Modular Trailer Market by Type (Multi-Axle, Telescopic/Extendable, and Lowboy Trailer), Axles (2 Axles and >2 Axles), Application (Construction & Infrastructure, Mining, Wind & Energy and Heavy Engineering), and Region - Global Forecast to 2027

Modular Trailer Market

Modular trailer is an unpowered unit used for transportation of freight when combined with a tractor unit through fifth wheel coupling. It is also called specialty trailer, heavy truck trailer/special vehicle truck trailer, special transporter, or heavy haulage trailer. It is mostly used for transportation of over dimensional cargo (ODC) for industries such as construction & infrastructure, mining, wind & energy, and heavy engineering.

Key Drivers:

- Expanding wind energy industry

- Growing construction and mining industries

Key Restraints and Challenges:

- Growing presence of local/regional players

- Increase in government regulations

Top 10 Players:

- Goldhofer: Goldhofer was founded in 1705 and is headquartered in Memmingen, Germany. The company manufactures vehicles (trailers) for heavy-duty transport and special cargo haulage. The company caters its products to transport and airport segments. The products offered under the transport segment are trailers, semi-trailer, heavy-duty modules, and special applications. In January 2019, Goldhofer announced long term investments in a modern production facility, relocating the production facility from Ostfildern to nearby Nürtingen for more space and advanced technologies.

- Nooteboom Trailers: Nooteboom Trailers was founded in 1881 and is headquartered in Wijchen, Netherlands. The company designs and builds trailers for ODC and extraordinary transport. The markets catered by the company are construction machinery, industrial goods, crane component, wind turbines, access platform and telescopic handlers, road construction machinery, steel structures and concrete elements, and other loads. In December 2018, Nooteboom Trailers launched the NOVAB 3.0 Cloud. This product helps calculate the optimal load positions for all vehicle combinations to prevent exceeding the maximum axle loads.

- Faymonville Group: Faymonville Group was founded in 1954 and is headquartered in Borgo San Dalmazzo, Italy. The company manufactures special vehicles for heavy load and special transport. The products manufactured by the company are semi-trailers, low-loaders, modular vehicles (trailers), and self-propelled vehicles. Various brands under the Faymonville Group include MAX Trailer, Faymonville, Cometto, MAX Rental, and Faymonville Trade & Services. Modular trailers are offered under the MAX Trailer, Faymonville, and Cometto brands. In March 2019, Faymonville Group launched a blade lifter with the name BladeMAX. This blade lifter has a huge load capacity of 716.5 tons. It helps transport mega wind turbine blades safely and efficiently in wooded or built-up areas, narrow streets, or mountainous regions.

- VMT Industries: VMT Industries was founded in 2005 and is headquartered in New Delhi, India. The products offered by the company are transportation trailers, transportation carrier vehicles (container carrier, precast beam carrier, precast slabs carrier), chassis carrier, container bodies, drop deck, hydraulic axles, tippers, trailer for precast slabs, wind mill, wind mill blade trailer, and wind turbine. The services offered by the company are customized fabrication, fabrication job work, fabrication services, and MS fabrication.

- K-Line Trailers: K-Line Trailers was founded in 1991 and is headquartered in British Columbia, Canada. The company designs and manufactures transport. Some of the products offered by the company are dump bodies, low-beds and multi-axle heavy haul trailers, side and end dump trailers, specialty transport trailers, wind blade trailers, and mining equipment. The services offered by the company are repairs and custom cutting and forming. The company caters to mining, heavy haul, aggregate, and wind energy, among various other industries and applications.

- Tratec Engineers

- Anster

- Doll Fahrzeugbau AG

- TII Group

- Demarko Trailers

-

Other Regional Players:

- Tantri

- Tidd Ross Todd Limited

- Shandong Titan Vehicle

- VAK

- Pacton Trailers Bv

- Broshuis Bv

- Trail King Industries

- Raglan Industries

Modular Trailer Market & Key Application:

- Construction & Infrastructure - Modular trailers are used for the construction of bridges, large buildings, and roads. Big bridge segments, large girders, and concrete beans are placed on modular trailers and transported to the construction sites. The construction companies usually have projects located in different areas. Modular trailers help in transportation of the already built sections to places where they will be installed and at the same time shift materials and equipment from one project to another.

- Mining - Mining requires heavy machinery for drilling and transportation of materials, including crude oils and minerals. Such heavy machinery is assembled offsite and then transported to mining sites. As mining machinery is the heaviest cargo, transportation from one point to another challenging. It is not possible to move it with the use of normal trucks and conventional semi-trailers. Therefore, modular trailers are preferred over semi-trailers.

- Wind & Energy - Improvements in cost and performance of wind power technologies; yielding low-priced wind energy for utility, corporate, and other power purchasers; expectations for low natural gas prices; and modest electricity demand are the driving factors for the wind & energy industry. To optimize cost and performance of wind power projects, the average turbine capacity, rotor diameter, and hub height have been increased.

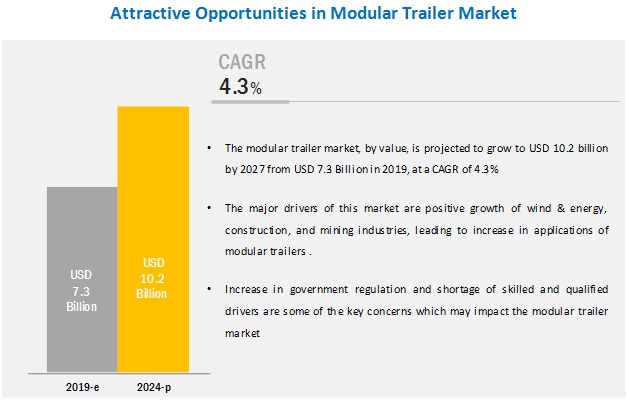

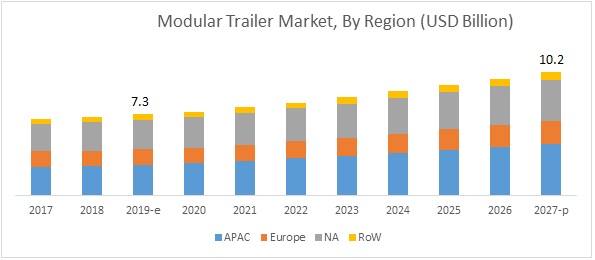

[104 Pages Report] The modular trailer market by value is projected to grow to USD 10.2 billion by 2027 from USD 7.3 billion in 2019, at a CAGR of 4.3%. The modular trailer market growth is driven by growing end-user industries such as construction & infrastructure, mining, wind & energy, and heavy engineering.

Multi-axle trailer is expected to be the largest segment, by trailer type

The major driving factor for multi-axle trailers is the demand from end-user industries. The demand for resource exploration and mining activities in developing countries is rising. Positive economic outlook and expansion of the wind & energy and construction industries are creating opportunities for modular trailer manufacturers.

Multi-axle trailer is estimated to account for the largest market share during the forecast period. It can load over dimension cargo (ODC) by the addition of axle lines as per requirement. As the axle lines can be attached and detached, a multi-axle trailer can be used for various applications. The payload capacity of per axle line starts from 15 tons. Also, it offers maximum agility, good stability and maneuverability, and safety.

2-axle line trailer is projected to be the fastest growing segment

The 2-axle line trailers are available in a wide range of size and weight carrying capacities. Per axle line load carrying capacity starts from 10 tons and goes up to 1000 tons. 2-axle line trailers are quite popular for transportation of large equipment.

Asia Pacific and North America together account for a higher number of 2-axle line trailers. According to the Indian Construction Equipment Manufacturer Association (ICEMA), the demand for earth moving and mining equipment during FY 2017–18 was significant, recording an increase of 23%. The rising demand for such equipment creates the need for freight transportation for supply chain operations. This, in turn, will create a positive outlook for the modular trailer market.

Construction & infrastructure is projected to be the largest segment, by application

Construction companies usually have projects located in different arears. Modular trailers help in the transportation of the already built sections to places where they will be installed and at the same time shift materials and equipment from one project to another. These trailers are used to transport large bridge segments, large girders, concrete beans, and construction machinery, among others. Spending on capital-intensive projects and infrastructure is expected to grow significantly in the next decade, thereby driving the need for transportation of constructing equipment and materials.

Asia Pacific is expected to account for the largest market size during the forecast period

Positive outlook for construction, mining, and wind & energy are fueling the modular trailer market in Asia Pacific. The industrial expansion in countries like India and China has led to the increased demand for freight transportation in these countries. Asia Pacific has also experienced growth in construction & infrastructure projects. According to the forecast of Global Wind Energy Council (GWEC), the wind power market is expected to reach 341.4 GW by 2022 with Asia Pacific dominating the market. Globally, China is expected to be the leading wind power market. All these factors would contribute to an increase in demand for modular trailers during the forecast period.

Key Market Players

Some of the key players in the modular trailer market are Goldhofer (Germany), Nooteboom Trailers (Netherlands), Faymonville Group (Italy), TII Group (Germany), and VMT Industries (India), K-Line Trailers (Canada), Tratec Engineers (India), Anster (China), Doll Fahrzeugbau AG (Germany), and Demarko Trailers (Poland). Goldhofer adopted the strategies of expansion and partnership to retain its leading position in the market, whereas Faymonville adopted new product development as a key strategy to sustain its market position

Scope of the Report

|

Report Metric |

Details |

|

Market Size Available for Years |

2017–2027 |

|

Base Year Considered |

2018 |

|

Forecast Period |

2019–2027 |

|

Forecast Units |

Value (USD Million) and Volume (Units) |

|

Segments Covered |

Type, Application, Number of Axles, and Region |

|

Geographies Covered |

Asia Pacific, Europe, North America, and RoW |

|

Companies Covered |

Key players in the modular trailer market are Goldhofer (Germany), Nooteboom (Netherlands), Faymonville (Italy), VMT Industries (India), and TII Group (Germany) Additionally, the report covers 15 other players. |

This research report categorizes the modular trailer market based on type, application, number of axles, and region.

Modular Trailer Market, by Type

- Multi-axle

- Telescopic/Extendable

- Lowboy

Modular Trailer Market, by Application

- Construction & Infrastructure

- Mining

- Wind & Energy

- Heavy Engineering

Modular Trailer Market, by Number of Axles

- 2 axles

- >2 axles

Modular Trailer Market, by Region

- Asia Pacific

- Europe

- North America

- RoW

Key Questions Addressed by the Report

- What would be the regional demand for modular trailers during the forecast years?

- What would be the industry-wise demand for modular trailers in coming years?

- How will government regulations impact the modular trailer market?

- How would the trend of self-propelled modular trailer (SPMT) impact the market over the next 5 years?

The report also features an exclusive competitive leadership mapping of key players represented in a four-quadrant box, representing the visionary leaders as well as dynamic differentiators

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 13)

1.1 Objectives

1.2 Market Definition

1.3 Market Scope

1.4 Limitations

1.5 Stakeholders

2 Research Methodology (Page No. - 16)

2.1 Research Data

2.2 Secondary Data

2.2.1 Key Secondary Sources for Base Numbers (Semi-Trailer & Modular Trailer)

2.2.2 Key Secondary Sources for Market Sizing

2.2.3 Key Data From Secondary Sources

2.3 Primary Data

2.3.1 Sampling Techniques & Data Collection Methods

2.3.2 Primary Participants

2.4 Market Size Estimation

2.4.1 Data Triangulation Approach

2.4.2 Top-Down Approach

2.5 Market Breakdown

2.6 Assumptions and Risk Assessment & Ranges

3 Executive Summary (Page No. - 25)

4 Premium Insights (Page No. - 27)

4.1 Modular Trailer Market: Trend, Forecast, Opportunity

4.2 Market, By Region

4.3 Market, By Type

4.4 Market, By Application

4.5 Market, By Number of Axles

5 Market Overview (Page No. - 30)

5.1 Introduction

5.2 Years Considered for the Study

5.3 Currency & Pricing

5.4 Market Dynamics

5.4.1 Drivers

5.4.1.1 Expanding Wind Energy Industry

5.4.1.2 Growing Construction and Mining Industries

5.4.2 Revenue Shift in the Modular Trailer Market

5.4.3 Restraints

5.4.3.1 Growing Presence of Local/Regional Players

5.4.4 Opportunities

5.4.4.1 Increasing Demand for Self-Propelled Modular Trailers

5.4.5 Challenges

5.4.5.1 Increase in Government Regulations

5.4.5.2 Shortage of Skilled and Qualified Drivers

5.5 Revenue Missed: Opportunities for Modular Trailer Manufacturers

5.6 Modular Trailer Market: Scenarios

5.6.1 Market: Most Likely Scenario

5.6.2 Market: Optimistic Scenario

5.6.3 Market: Pessimistic Scenario

6 Modular Trailer Market, By Type (Page No. - 39)

The Chapter is Further Segmented at Regional Level and Considered Regions are Asia Pacific, Europe, North America and RoW

6.1 Introduction

6.1.1 Research Methodology

6.1.2 Assumptions

6.1.3 Industry Insights

6.2 Operational Data

6.2.1 Global Infrastructure Spending

6.2.2 Asia Infrastructure Spending, By Country

6.3 Multi-Axle Trailer

6.3.1 Growth of Construction Industry Will Drive the Multi-Axle Trailer Market

6.4 Lowboy Trailer

6.4.1 Regulatory Ban on Lowboy Trailers Makes the Market Stagnant for This Trailer Type

6.5 Extendable/Telescopic Trailer

6.5.1 Developments in Wind & Energy Sector to Drive the Extendable/Telescopic Trailer Market

6.6 Market Leaders

7 Modular Trailer Market, By Number of Axles (Page No. - 47)

The Chapter is Further Segmented at Regional Level and Considered Regions are Asia Pacific, Europe, North America and RoW

7.1 Introduction

7.1.1 Research Methodology

7.1.2 Assumptions

7.1.3 Industry Insights

7.2 2 Axles

7.2.1 Asia Pacific Leads the Market for 2-Axle Trailers

7.3 >2 Axles

7.3.1 Extendable/Telescopic Trailer Accounts for Majority Share in Asia Pacific

7.4 Market Leaders

8 Modular Trailer Market, By Application (Page No. - 53)

The Chapter is Further Segmented at Regional Level and Considered Regions are Asia Pacific, Europe, North America and RoW

8.1 Introduction

8.1.1 Research Methodology

8.1.2 Assumptions

8.1.3 Industry Insights

8.2 Operational Data

8.2.1 Global Airport Construction Projects, By Country

8.2.2 Smart Cities Projects, By Country

8.2.3 Per Capita Electric Power Consumption

8.2.4 Electricity Production From Renewable Sources

8.2.5 Offshore Wind Capacity Scenarios Per Country

8.3 Construction & Infrastructure

8.3.1 Growth in Construction & Infrastructure Activities in Asia Pacific and North America to Drive the Market

8.4 Mining

8.4.1 Positive Outlook of Mining Industry to Drive the Market

8.5 Wind & Energy

8.5.1 Increase in Capacity and Length of Equipment in Wind & Energy Sector to Drive Modular Trailer Demand

8.6 Heavy Engineering

8.6.1 Increase in Nuclear Power Plant Projects Will Boost the Modular Trailer Market

8.7 Market Leaders

9 Modular Trailer Market, By Region (Page No. - 63)

The Chapter is Further Segmented at Regional Level and Considered Regions are Asia Pacific, Europe, North America and RoW

9.1 Introduction

9.1.1 Research Methodology

9.1.2 Assumptions/Limitations

9.1.3 Industry Insights

9.2 Asia Pacific

9.2.1 Lowboy Trailer Market Accounts for Lowest Market Share

9.3 Europe

9.3.1 Positive Outlook of Wind Power Industry Creates Opportunity for Telescopic/Extendable Trailers

9.4 North America

9.4.1 Multi-Axle Trailer is the Fastest Growing Market in North America

9.5 Rest of the World (RoW)

9.5.1 Multi-Axle Trailer is the Largest Market

9.6 Market Leaders

10 Competitive Landscape (Page No. - 71)

10.1 Overview

10.2 Modular Trailer: Market Ranking Analysis

10.3 Product Comparison Mapping, By Key Competitors

10.4 Competitive Leadership Mapping

10.4.1 Terminology

10.4.1.1 Visionary Leaders

10.4.1.2 Innovators

10.4.1.3 Dynamic Differentiators

10.4.1.4 Emerging Companies

10.4.2 Strength of Product Portfolio

10.4.3 Business Strategy Excellence

10.5 Winners vs Tail Enders

10.6 Competitive Scenario

10.6.1 New Product Developments

10.6.2 Expansion

10.6.3 Acquisitions

10.6.4 Supply Contract/Partnerships

11 Company Profiles (Page No. - 81)

(Business Overview, Products Offered, Recent Developments & SWOT Analysis) *

11.1 Goldhofer

11.1.1 Business Overview

11.1.2 Products Offered

11.1.3 Recent Developments

11.1.4 SWOT Analysis

11.1.5 MnM View

11.2 Nooteboom Trailers

11.2.1 Business Overview

11.2.2 Products Offered

11.2.3 Recent Developments

11.2.4 SWOT Analysis

11.2.5 MnM View

11.3 Faymonville Group

11.3.1 Business Overview

11.3.2 Products Offered

11.3.3 Recent Developments

11.3.4 SWOT Analysis

11.3.5 MnM View

11.4 VMT Industries

11.4.1 Business Overview

11.4.2 Products Offered

11.4.3 SWOT Analysis

11.4.4 MnM View

11.5 K-Line Trailers

11.5.1 Business Overview

11.5.2 Products Offered

11.6 Tratec Engineers

11.6.1 Business Overview

11.6.2 Products Offered

11.7 Anster

11.7.1 Business Overview

11.7.2 Products Offered

11.8 Doll Fahrzeugbau AG

11.8.1 Business Overview

11.8.2 Products Offered

11.9 TII Group

11.9.1 Business Overview

11.9.2 Products Offered

11.9.3 Recent Developments

11.10 Demarko Trailers

11.10.1 Business Overview

11.10.2 Products Offered

11.11 Additional Companies

11.11.1 Asia Oceania

11.11.1.1 Tantri

11.11.1.2 Tidd Ross Todd Limited

11.11.1.3 Shandong Titan Vehicle

11.11.1.4 Hugeiron Tech

11.11.2 Europe

11.11.2.1 VAK

11.11.2.2 Pacton Trailers Bv

11.11.2.3 Broshuis Bv

11.11.3 North Americas

11.11.3.1 Trail King Industries

11.11.3.2 Raglan Industries

11.11.3.3 Talbert Industries

*Details on Business Overview, Products Offered, Recent Developments & SWOT Analysis Might Not Be Captured in Case of Unlisted Companies.

12 Appendix (Page No. - 98)

12.1 Insights of Industry Experts

12.2 Discussion Guide

12.3 Knowledge Store: Marketsandmarkets Subscription Portal

12.5 Available Customizations

12.5.1 Self-Propelled Modular Trailer Market, By Application

12.5.1.1 Construction & Infrastructure

12.5.1.2 Mining

12.5.1.3 Wind & Energy

12.5.1.4 Heavy Engineering

12.5.2 Self-Propelled Modular Trailer Market, By Region

12.5.2.1 Asia Pacific

12.5.2.2 Europe

12.5.2.3 North America

12.5.2.4 RoW

12.6 Related Reports

12.7 Author Details

List of Tables (64 Tables)

Table 1 Market Definition

Table 2 Inclusions & Exclusions

Table 3 Assumptions and Risk Assessment & Ranges, By Trailer Type

Table 4 Assumptions and Risk Assessment & Ranges, By Number of Axles

Table 5 Assumptions and Risk Assessment & Ranges, By Application

Table 6 Assumptions and Risk Assessment & Ranges, By Region

Table 7 Currency Exchange Rates (Wrt Per USD)

Table 8 Local Players, By Region

Table 9 Modular Trailer Market (Most Likely), By Region, 2017–2027 (USD Million)

Table 10 Market (Optimistic), By Region, 2017–2027 (USD Million)

Table 11 Market (Pessimistic), By Region, 2017–2027 (USD Million)

Table 12 Market, By Type, 2017–2027 (Units)

Table 13 Market, By Type, 2017–2027 (USD Million)

Table 14 Multi-Axle Trailer Market, By Region, 2017–2017 (Units)

Table 15 Multi-Axle Trailer Market, By Region, 2017–2017 (USD Million)

Table 16 Lowboy Trailer Market, By Region, 2017–2017 (Units)

Table 17 Lowboy Trailer Market, By Region, 2017–2017 (USD Million)

Table 18 Extendable/Telescopic Trailer Market, By Region, 2017–2017 (Units)

Table 19 Extendable/Telescopic Trailer Market, By Region, 2017–2017 (USD Million)

Table 20 Recent Developments

Table 21 Market, By Number of Axles, 2017–2027 (Units)

Table 22 Market, By Number of Axles, 2017–2027 (USD Million)

Table 23 2 Axles Modular Trailer Market, By Region, 2017–2017 (Units)

Table 24 2 Axles Market, By Region, 2017–2017 (USD Million)

Table 25 >2 Axles Market, By Region, 2017–2017 (Units)

Table 26 >2 Axles Market, By Region, 2017–2017 (USD Million)

Table 27 Recent Developments

Table 28 Global Airport Construction Projects, By Country

Table 29 Smart Cities Projects, By Country

Table 30 Offshore Wind Capacity Scenarios Per Country (MW )

Table 31 Modular Trailer Market, By Application, 2017–2027 (Units)

Table 32 Market, By Application, 2017–2027 (USD Million)

Table 33 Construction & Infrastructure: Market, By Region, 2017–2017 (Units)

Table 34 Construction & Infrastructure: Market, By Region, 2017–2017 (USD Million)

Table 35 Mining: Market, By Region, 2017–2017 (Units)

Table 36 Mining: Market, By Region, 2017–2017 (USD Million)

Table 37 Wind & Energy: Market, By Region, 2017–2017 (Units)

Table 38 Wind & Energy: Market, By Region, 2017–2017 (USD Million)

Table 39 Heavy Engineering: Market, By Region, 2017–2017 (Units)

Table 40 Heavy Engineering: Market, By Region, 2017–2017 (USD Million)

Table 41 Recent Development

Table 42 Market, By Region, 2017–2027 (Units)

Table 43 Market, By Region, 2017–2027 (USD Million)

Table 44 Asia Pacific Market, By Trailer Type, 2017–2027 (Units)

Table 45 Asia Pacific Market, By Trailer Type, 2017–2027 (USD Million)

Table 46 Europe Market, By Trailer Type, 2017–2027 (Units)

Table 47 Europe Market, By Trailer Type, 2017–2027 (USD Million)

Table 48 North America Market, By Trailer Type, 2017–2027 (Units)

Table 49 North America Market, By Trailer Type, 2017–2027 (USD Million)

Table 50 RoW Market, By Trailer Type, 2017–2027 (Units)

Table 51 RoW Market, By Trailer Type, 2017–2027 (USD Million)

Table 52 Recent Developments

Table 53 Product Comparison Mapping, By Key Competitors

Table 54 Modular Trailer Manufacturers: Company-Wise Product Offering Analysis

Table 55 Modular Trailer Manufacturers: Company-Wise Product Business Strategy Analysis

Table 56 Winners, Key Strategy

Table 57 New Product Developments, 2018–2019

Table 58 Expansion, 2018

Table 59 Acquisition, 2019

Table 60 Supply Contract/Partnerships, 2017–2019

Table 61 Recent Developments, 2017–2019

Table 62 Recent Developments, 2018

Table 63 Recent Developments, 2017–2019

Table 64 Recent Developments, 2017–2019

List of Figures (33 Figures)

Figure 1 Market Segmentation: Modular Trailer Market

Figure 2 Market: Research Design

Figure 3 Research Design Model

Figure 4 Breakdown of Primary Interviews

Figure 5 Top-Down Approach: Market

Figure 6 Data Triangulation

Figure 7 Modular Trailer: Market Outlook

Figure 8 Market, By Trailer Type, 2019 vs 2027 (USD Million)

Figure 9 Expansion in Wind & Energy Industry to Offer Attractive Opportunities

Figure 10 Asia Pacific to Dominate the Market

Figure 11 Multi-Axle Modular Trailer Segment is Estimated to Hold the Largest Share in 2019

Figure 12 Heavy Engineering is the Fastest Growing Application Market

Figure 13 2-Axle Segment is Estimated to Hold the Largest Share in 2019

Figure 14 Market: Market Dynamics

Figure 15 Global Installed Wind Power Capacity Forecast, 2017–2022 (GW)

Figure 16 Global Installed Wind Power Capacity Forecast, By Region, 2017–2022 (GW)

Figure 17 Global Construction Market Outlook, 2019–2030 (USD Trillion)

Figure 18 Mining Equipment Market, By Region, 2018 vs 2025 (USD Billion)

Figure 19 Infrastructure Spending Across the Globe, 2006–2024

Figure 20 Infrastructure Spending in Asian Markets, 2013–2014

Figure 21 Modular Trailer Market, By Type, 2019 vs 2027 (USD Million)

Figure 22 Market, By Number of Axles, 2019 vs 2027 (USD Million)

Figure 23 Electric Power Consumption (Kwh Per Capita)

Figure 24 Electricity Production From Renewable Sources, Excluding Hydroelectric (TWH)

Figure 25 Market, By Application, 2019 vs 2027 (USD Million)

Figure 26 Market, By Region, 2019–2027 (USD Million)

Figure 27 Modular Trailer: Market Ranking Analysis, 2018

Figure 28 Modular Trailers Manufacturers: Competitive Leadership Mapping (2018)

Figure 29 Companies Adopted New Product Development & Partnerships/ Agreements/Supply Contracts/Collaborations/Joint Ventures as the Key Growth Strategy, 2017–2019

Figure 30 Goldhofer: SWOT Analysis

Figure 31 Nooteboom Trailers: SWOT Analysis

Figure 32 Faymonville Group: SWOT Analysis

Figure 33 VMT Industries: SWOT Analysis

The study involves four main activities to estimate the current size of the modular trailer market. Exhaustive secondary research was done to collect information such as modular trailer types, upcoming technologies, and upcoming modular trailer models. The next step was to validate these findings, assumptions, and market analysis with industry experts across value chains through primary research. The top-down approach was employed to estimate the market size of different segments considered under this study.

Secondary Research

The secondary sources referred for this research study include industry organizations such as the Canadian Transportation Equipment Association (CTEA), Heavy Transport Association (HTA), and European Association of Abnormal Road Transport and Mobile Cranes (ESTA); corporate filings (such as annual reports, investor presentations, and financial statements); databases such as Factiva, Crunchbase, Bloomberg; and trade, business, and automotive associations. Secondary data has been collected and analyzed to arrive at the overall market size, which is further validated by multiple industry experts.

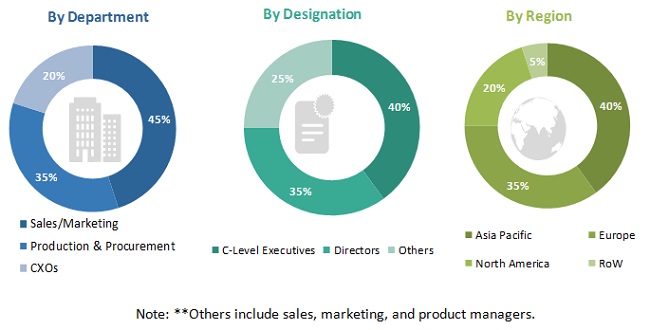

Primary Research

Extensive primary research has been conducted after acquiring an understanding of the modular trailer market scenario through secondary research. Several primary interviews have been conducted with market experts from both the demand- (users) and supply-side (modular trailer manufacturers) across four major regions, namely, North America, Europe, Asia Pacific, and the Rest of the World. Primary data has been collected through questionnaires, emails, and telephonic interviews. In the canvassing of primaries, we have strived to cover various departments within organizations, such as sales, operations, and administration, to provide a holistic viewpoint in our report.

After interacting with industry experts, we also conducted brief sessions with highly experienced independent consultants to reinforce the findings from our primaries. This, along with the in-house subject matter experts’ opinions, has led us to the findings as described in the remainder of this report.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The top-down approach has been used to estimate and validate the size of the modular trailer market. The market size, by volume, has been derived by secondary sources and studying various modular trailer models at the regional level. The market size, by value, is derived by multiplying the average selling price of modular trailers with the market volume for that specific country. The market size, by volume, of the semi-trailer market for different regions, is derived by identifying country-wise production rates.

Data Triangulation

All percentage shares, splits, and breakdowns have been determined using secondary sources and verified by primary sources. All parameters that are said to affect the markets covered in this research study have been accounted for, viewed in extensive detail, and analyzed to obtain the final quantitative and qualitative data. This data has been consolidated, enhanced with detailed inputs and analysis from MarketsandMarkets, and presented in the report. The data was triangulated by studying various factors and trends from both the demand and supply sides of the modular trailer market.

Report Objectives

- To define, describe, and forecast the global modular trailer market in terms of value (USD million) and volume (units)

- To define, describe, and forecast the market in terms of volume and value, by trailer type (multi-axle, extendable/telescopic, and lowboy) at regional level

- To define, describe, and forecast the market in terms of volume and value, by number of axles (2 axles and >2 axles) at regional level

- To define, describe, and forecast the market in terms of volume and value, by application (construction & infrastructure, mining, energy & power, and heavy engineering) at regional level

- To define, describe, and forecast the market in terms of volume and value, on the basis of region (Asia Pacific, Europe, North America, and RoW)

- To understand the market dynamics (drivers, restraints, opportunities, and challenges) of the market

- To analyze the market ranking of key players operating in the market

- To analyze the competitive landscape and prepare a competitive leadership mapping for the global players operating in the market

- To analyze recent developments, alliances, joint ventures, mergers & acquisitions, new product launches, and other activities carried out by key industry participants in the modular trailer market

Available Customizations

With the given market data, MarketsandMarkets offers customizations in accordance with the company’s specific needs.

Self-Propelled Modular Trailer Market, By Application

- Construction & Infrastructure

- Mining

- Wind & Energy

- Heavy Engineering

Self-Propelled Modular Trailer Market, By Region

- Asia Pacific

- Europe

- North America

- RoW

Growth opportunities and latent adjacency in Modular Trailer Market