Mobile Learning Market by Solution (Mobile Content Authoring, E-books, Portable LMS, Mobile and Video-based Courseware, Interactive Assessments, Content Development, M-Enablement), by Applications, by User Type, & by Region - Global Forecast to 2020

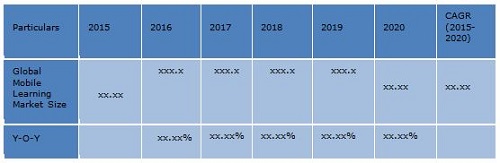

[180 Pages Report] MarketsandMarkets expects the total mobile learning market to grow from $7.98 billion in 2015 to $37.60 billion by 2020 at a Compound Annual Growth Rate (CAGR) of 36.3% during the forecast period.

In the recent years, there has been a substantial growth in mobile learning market. Education institutions and corporate users have become more receptive towards the adoption of technological components. Technology in the mobile learning industry has played a significant role in enabling students and educators to interact with the upcoming learning opportunities, thus enabling them to have a richer learning experience.

Technological advancements in the fields of computers, mobiles and Information technology have revolutionized the education sector to a great extent. The education system is moving forward from paper books and pencils to E-solutions. One such solution, which is gaining immense popularity in terms of efficiency and cost effectiveness is the mobile learning or M-learning system. With mobile phones become an inseparable tool in one’s daily life, mobile learning provides the ultimate solution to enhance the overall learning experience, by providing them with utmost convenience in exchanging information and collaborating from diverse locations. In addition, mobile learning solutions have helped the mobile users to interact and communicate over their mobile devices.

Mobile learning system refers to the interactive and simulative process of teaching and learning with the use of mobile devices and applications, instead of the traditional classroom method. M-learning integrates the techniques and knowledge of the classroom with the flexibility and scalability of advanced mobile technology to create a unique, fruitful and efficient learning experience.

Furthermore, M-learning bypasses all time and distance constraints as features such as video lectures, VOIP and others can be used to impart knowledge across the mobile device. The mobile learning market provides solutions for enterprises to complement their on-job training process.

The international mobile learning market has emerged in the last ten years and is now rapidly growing than ever before. The amount of players in this market is escalating too, with private and public higher education institutions, education and testing companies, ministries of education, and quality assertion and authorization agencies. Moreover, the provision of enhanced flexibility among the mobile learning services offers new opportunities to the mobile learning service providers. While, diversified regulations and policies present across various regions still stands as a challenge faced by the vendors.

The mobile learning market consists of large players like Net Dimensions, Sap AG, Dell, Upside Learning, Skillsoft and others, which offer services and solutions in this market. The market has seen these players grab high amount of market share.

The report is a comprehensive study of the market for Mobile learning solutions and associated services. This report analyzes global adoption trends, key drivers, restraints, opportunities, and best practices in the mobile learning market. The research report also examines growth potential, market sizes, and revenue forecasts across different regions as well as industry verticals.

The report spans the overall structure of the mobile learning market and provides premium insights that can help mobile learning service providers such as MNOs, software providers, content developers, service providers, and device manufacturers to identify the needs of the customers and mobile subscribers.

The report forecasts the market sizes and trends for mobile learning market, which is broadly classified as software, applications, user type and regions. For more detailed analysis the market is further segmented into the following sub-markets:

On the basis of Software Solution:

- Mobile Content Authoring

- e-Books

- Portable LMS

- Mobile and video based courseware

- Interactive Assessments

- Content Development

- m-Enablement

On the basis of Application:

- In-Class Learning

- Simulation-Based Learning

- Corporate Learning

- Online-on-the job training

On the basis of End User types:

- Academic

- Corporate

On the basis of regions:

- North America (NA)

- Europe

- Asia-Pacific (APAC)

- Middle-East and Africa (MEA)

- Latin America (LA)

Mobile learning is innovative approach of learning across multiple frameworks that empower both social and content interactions using individual devices such as smartphones, netbooks, and tablets. The mobile learning market is a booming industry, which has experienced several waves of innovation in last five years. Imparting education through simulated classrooms is a new conception that is becoming prevalent not only in traditional educational institutions, but also in training centers with vocational courses. The advent of mobile learning has brought about a significant change in the education sector, by connecting people, and things around the world, across business and personal lives.

The introduction of mobile learning and connectivity has given way to new practices of instruction and learning that eventually will improve the performance and results whilst at the same time open up new markets for mobile operators across the world.

The current propagation and dissemination of mobile devices along with the affordability and approachability of mobile products is currently driving the mobile learning market in various sectors. This approach not only reduces the cost to produce and acquire mobile learning applications, but also makes it easy to connect and collaborate from any location.

Even though mobile learning is being executed across developed nations, the rate of adoption is still slow in emerging nations. One of the main reasons of the slow adoption is the intricate informative practices, which are often not associated to the organization’s vision, mission and culture. Educational applications are an area of substantial growth, with useful content offered in a thought-provoking way with memory aids and puzzles to consolidate learning.

Furthermore, mobile learning is an exciting new opportunity for educators, as proper training and the right skills help to explore high-tech gadgets that allow teachers, learners and educators to collaborate with these devices in the classroom on a regular basis. Tablets are proving to be real and viable devices for the adoption of mobile learning in the workplace and are expected to witness rapid increase in the adoption of devices within organizations. The implementation of mobile learning facilitates augmentation of the learning process through real-time interchange of information and involvement of best practices across all the major regions.

The report analyzes the significance of implementing mobile learning that would help educators to develop a virtual setup wherein learners can collaborate and share the desired information. The global mobile learning market has been segmented on the basis of software solutions, applications, user type, and regions.

MarketsandMarkets expects the total mobile learning market to grow from $7.98 billion in 2015 to $37.60 billion by 2020 at a Compound Annual Growth Rate (CAGR) of 36.3% during the forecast period.

The overall size of the mobile learning market is the revenues generated by academic and corporate users on the implementation of mobile learning.

Global Mobile Learning Market Size, 2015 - 2020 ($Billion)

Source: MarketsandMarkets Analysis

Table of Contents

1 Introduction (Page No. - 17)

1.1 Objectives of the Study

1.2 Mobile Learning Market Definition

1.3 Market Scope

1.3.1 Markets Covered

1.3.2 Year

1.4 Currency

1.5 Stakeholders

2 Research Methodology (Page No. - 22)

2.1 Mobile Learning Market Size Estimation

2.2 Market Breakdown and Data Triangulation

2.3 Market Share Estimation

2.3.1 Key Data Taken From Secondary Sources

2.3.2 Key Data Taken From Primary Sources

2.3.3 Assumptions

2.3.4 Key Industry Insights

3 Executive Summary (Page No. - 31)

4 Premium Insights (Page No. - 36)

4.1 Attractive Market Opportunities

4.2 Top Three Industry Verticals

4.3 Global Mobile Learning Market

4.4 Market Potential

4.5 Mobile Learning User Type Market (2020)

4.6 Mobile Learning Regional Market

4.7 Global Mobile Learning Market, By Solution (2015-2020)

4.8 Solutions Growth Matrix

4.9 Lifecycle Analysis, By Region 2015

5 Mobile Learning Market Overview (Page No. - 44)

5.1 Introduction

5.2 Evolution

5.3 Market Segmentation

5.3.1 Mobile Learning Market, By Software Solution

5.3.2 Market, By Application

5.3.3 Market, By User Type

5.3.4 Market, By Region

5.4 Mobile Learning Market Dynamics

5.4.1 Drivers

5.4.1.1 Growing Mobile and Smartphone Penetration Rates

5.4.1.2 Improved Integration Between Device Makers and Content Suppliers

5.4.1.3 Rise in Deployments of Tablets in Educational Institutions

5.4.1.4 Increasing Demand for Digital Education

5.4.2 Restraints

5.4.2.1 Increasing Cost Associated With Equipment, Connectivity and Maintenance

5.4.2.2 Lack of Digital Clarity Among End Users

5.4.3 Opportunities

5.4.3.1 Evolving New Opportunities for Traditional Educational Institutions

5.4.3.2 Increasing Prospective in Emerging Nations

5.4.3.3 Collaborations With Mobile Banking and Mobile Health Initiatives

5.4.4 Challenges

5.4.4.1 Budget Constraints Related to Technology Infrastructure

5.4.5 Burning Issue

5.4.5.1 Lack of Technical Skills Among Instructors and Learners

6 Industry Trends (Page No. - 56)

6.1 Introduction

6.2 Value Chain Analysis

6.3 Pest Analysis

6.3.1 Political Factors

6.3.2 Economic Factors

6.3.3 Social Factors

6.3.4 Technological Factors

6.4 Porter’s Five Forces Analysis

6.4.1 Threat From New Entrants

6.4.2 Threat From Substitutes

6.4.3 Bargaining Power of Suppliers

6.4.4 Bargaining Power of Buyers

6.4.5 Intensity of Competitive Rivarly

7 Mobile Learning Market Size, By Software Solutions (Page No. - 65)

7.1 Introduction

7.2 Mobile Content Authoring

7.3 E-Books

7.4 Portable LMS

7.5 Mobile and Video-Based Courseware

7.6 Interactive Assessments

7.7 Content Development

7.8 M-Enablement

8 Mobile Learning Market, By Application (Page No. - 80)

8.1 Introduction

8.2 In-Class Learning

8.3 Simulation Based Learning

8.4 Corporate Training

8.5 Online On-The-Job Training

9 Mobile Learning Market, By User Type (Page No. - 94)

9.1 Introduction

9.2 Academic

9.2.1 K-12

9.2.2 Higher Education

9.3 Corporate

9.3.1 SMB

9.3.2 Large Enterprise

9.3.3 Verticals

9.3.3.1 BFSI

9.3.3.2 Healthcare

9.3.3.3 Government

9.3.3.4 Professional Services

9.3.3.5 IT and Telecom

9.3.3.6 Others

10 Geographic Analysis (Page No. - 117)

10.1 Introduction

10.2 North America

10.3 Europe

10.4 Asia Pacific

10.5 Middle East and Africa

10.6 Latin America

11 Competitive Landscape (Page No. - 136)

11.1 Overview

11.2 Competitive Situation and Trends

11.2.1 New Product Developments

11.2.2 Agreements, Partnerships, and Collaborations

11.2.3 Mergers and Acquisitions

11.2.4 Expansion

11.2.5 Venture Capital(VC) Funding

12 Company Profiles (Page No. - 146)

12.1 Introduction

12.2 Netdimensions

12.2.1 Business Overview

12.2.2 Products & Services

12.2.3 Key Strategies

12.2.4 Recent Developments

12.2.5 MNM View

12.3 SAP AG

12.3.1 Business Overview

12.3.2 Solutions

12.3.3 Key Strategies

12.3.4 Recent Developments

12.3.5 SWOT Analysis

12.3.6 MNM View

12.4 Promethean

12.4.1 Business Overview

12.4.2 Solutions

12.4.3 Key Strategies

12.4.4 Recent Developments

12.4.5 Promethean: SWOT Analysis

12.4.6 MNM View

12.5 Upside Learning

12.5.1 Business Overview

12.5.2 Solutions & Services

12.5.3 Key Strategies

12.5.4 Recent Developments

12.5.5 MNM View

12.6 Skillsoft

12.6.1 Business Overview

12.6.2 Solutions and Services

12.6.3 Key Strategies

12.6.4 Recent Developments

12.6.5 MNM View

12.7 CISCO Systems, Inc.

12.7.1 Business Overview

12.7.2 Solutions and Services

12.7.3 Key Strategies

12.7.4 Recent Developments

12.7.5 CISCO: SWOT Analysis

12.7.6 MNM View

12.8 AT&T

12.8.1 Business Overview

12.8.2 Solutions

12.8.3 Key Strategies

12.8.4 Recent Developments

12.8.5 SWOT Analysis

12.8.6 MNM View

12.9 Dell

12.9.1 Business Overview

12.9.2 Services

12.9.3 Key Strategies

12.9.4 Recent Developments

12.9.5 MNM View

12.10 Citrix Systems Inc,

12.10.1 Business Overview

12.10.2 Solutions

12.10.3 Key Strategies

12.10.4 Recent Developments

12.10.5 MNM View

12.11 IBM Corporation

12.11.1 Business Overview

12.11.2 Solutions

12.11.3 Key Strategies

12.11.4 SWOT Analysis

12.11.5 Recent Developments

12.11.6 MNM View

13 Appendix (Page No. - 176)

13.1 Industry Excerpts

13.2 Discussion Guide

13.3 Introducing RT: Real Time Market Intelligence

13.4 Available Customizations

List of Tables (81 Tables)

Table 1 Global Mobile Learning Market Size and Growth Rate, 2013-2020 ($Million, Y-O-Y %)

Table 2 Rise in Deployments of Tablets in Educational Institutions will Boost the M-Learning Market

Table 3 Increasing Cost Associated With Equipment, Connectivity and Maintenance Will Restrain the Growth of the Market

Table 4 Collaborations With Mobile Banking and Mobile Health Initiatives Will Act as an Opportunity for Mobile Learning

Table 5 To Overcome Budget Constraints Related to Technology Infrastructure Will Be the Major Challenge for Software Providers

Table 6 Mobile Learning Market Size, By Solution, 2013-2020 ($Million)

Table 7 Mobile Content Authoring Market Size, By User Type, 2013-2020 ($Million)

Table 8 Mobile Content Authoring Market Size, By Region, 2013-2020 ($Million)

Table 9 E-Books Market Size, By User Type, 2013-2020 ($Million)

Table 10 E-Books Market Size, By Region, 2013-2020 ($Million)

Table 11 Portable LMS Market Size, By User Type, 2013-2020 ($Million)

Table 12 Portable LMS Market Size, By Region, 2013-2020 ($Million)

Table 13 Mobile and Video-Based Courseware Market Size, By User Type, 2013-2020 ($Million)

Table 14 Mobile and Video-Based Courseware market Size, By Region, 2013-2020 ($Million)

Table 15 Interactive Assessments Market Size, By User Type, 2013-2020 ($Million)

Table 16 Interactive Assessments Market Size, By Region, 2013-2020 ($Million)

Table 17 Content Development Market Size, By User Type, 2013-2020 ($Million)

Table 18 Content Development Market Size, By Region, 2013-2020 ($Million)

Table 19 M-Enablement Market Size, By User Type, 2013-2020 ($Million)

Table 20 M-Enablement Market Size, By Region, 2013-2020 ($Million)

Table 21 Mobile Learning Market Size, By Application, 2013-2020 ($Million)

Table 22 In-Class Learning Market Size, By User Type, 2013-2020 ($Million)

Table 23 In-Class Learning Market Size, By Academic User, 2013-2020 ($Million)

Table 24 In-Class Learning Market Size, By Corporate User, 2013-2020 ($Million)

Table 25 In-Class Learning Market Size, By Region, 2013-2020 ($Million)

Table 26 Simulation Based Learning Market Size, By User Type, 2013-2020 ($Million)

Table 27 Simulation Based Learning Market Size, By Academic User, 2013-2020 ($Million)

Table 28 Simulation Based Learning Market Size, By Corporate User, 2013-2020 ($Million)

Table 29 Simulation Based Learning Market Size, By Region, 2013-2020 ($Million)

Table 30 Corporate Training Market Size, By User Type, 2013-2020 ($Million)

Table 31 Corporate Training Market Size, By Academic User, 2013-2020 ($Million)

Table 32 Corporate Training Market Size, By Corporate User, 2013-2020 ($Million)

Table 33 Corporate Training Market Size, By Region, 2013-2020 ($Million)

Table 34 Online On-The-Job Training Market Size, By User Type, 2013-2020 ($Million)

Table 35 Online On-The-Job Training Market Size, By Academic User, 2013-2020 ($Million)

Table 36 Online On-The-Job Training Market Size, By Corporate User, 2013-2020 ($Million)

Table 37 Online On-The-Job Training Market Size, By Region, 2013-2020 ($Million)

Table 38 Mobile Learning Market Size, By User Type, 2013-2020 ($Million)

Table 39 Academic Market Size, By Solution, 2013-2020 ($Million)

Table 40 Academic Market Size, By Application, 2013-2020 ($Million)

Table 41 Academic Market Size, By Sub User Type, 2013-2020 ($Million)

Table 42 Academic Market Size, By Region, 2013-2020 ($Million)

Table 43 K-12 Market Size, By Solution, 2013-2020 ($Million)

Table 44 K-12 Market Size, By Application, 2013-2020 ($Million)

Table 45 Higher Education Market Size, By Solution, 2013-2020 ($Million)

Table 46 Higher Education Market Size, By Application, 2013-2020 ($Million)

Table 47 Corporate Market Size, By Solution, 2013-2020 ($Million)

Table 48 Corporate Market Size, By Application, 2013-2020 ($Million)

Table 49 Corporate Market Size, By Sub User Type, 2013-2020 ($Million)

Table 50 Corporate Market Size, By Region, 2013-2020 ($Million)

Table 51 SMB Market Size, By Solution, 2013-2020 ($Million)

Table 52 SMB Market Size, By Application, 2013-2020 ($Million)

Table 53 Large Enterprise Market Size, By Solution, 2013-2020 ($Million)

Table 54 Large Enterprise Market Size, By Application, 2013-2020 ($Million)

Table 55 BFSI Market Size, By Region, 2013-2020 ($Million)

Table 56 Healthcare Market Size, By Region, 2013-2020 ($Million)

Table 57 Government Market Size, By Region, 2013-2020 ($Million)

Table 58 Professional Services Market Size, By Region, 2013-2020 ($Million)

Table 59 IT and Telecom Market Size, By Region, 2013-2020 ($Million)

Table 60 Others Market Size, By Region, 2013-2020 ($Million)

Table 61 Mobile Learning Market Size, By Region, 2013-2020 ($Million)

Table 62 North America Market Size, By Solution, 2013-2020 ($Million)

Table 63 North America Market Size, By Application, 2013-2020 ($Million)

Table 64 North America Market Size, By User Type, 2013-2020 ($Million)

Table 65 Europe Market Size, By Solution, 2013-2020 ($Million)

Table 66 Europe Market Size, By Application, 2013-2020 ($Million)

Table 67 Europe Market Size, By User Type, 2013-2020 ($Million)

Table 68 APAC Market Size, By Solution, 2013-2020 ($Million)

Table 69 APAC Market Size, By Application, 2013-2020 ($Million)

Table 70 APAC Market Size, By User Type, 2013-2020 ($Million)

Table 71 MEA Market Size, By Solution, 2013-2020 ($Million)

Table 72 MEA Market Size, By Application, 2013-2020 ($Million)

Table 73 MEA Market Size, By User Type, 2013-2020 ($Million)

Table 74 Latin America Market Size, By Solution, 2013-2020 ($Million)

Table 75 Latin America Market Size, By Application, 2013-2020 ($Million)

Table 76 Latin America Market Size, By User Type, 2013-2020 ($Million)

Table 77 New Product Developments, 2012–2014

Table 78 Agreements, Partnerships, and Collaborations, 2012–2015

Table 79 Mergers and Acquisitions, 2011–2014

Table 80 Expansion, 2012–2014

Table 81 VC Funding 2012-2013

List of Figures (66 Figures)

Figure 1 Markets Covered

Figure 2 Research Design

Figure 3 Market Size Estimation Methodology: Bottom-Up Approach

Figure 4 Market Size Estimation Methodology: Top-Down Approach

Figure 5 Breakdown of Primary Interview: By Company Type, Designation, and Region

Figure 6 Data Triangulation

Figure 7 Mobile Learning Market Size, User Type Snapshot (2015-2020): Market for Corporate is Expected to Double in the Next Five Years

Figure 8 Market Size, Solution Snapshot (2015-2020): Portable LMS Will Dominate the Market

Figure 9 Global Market Size, By Application, 2015-2020

Figure 10 Global Market Share, 2015 - North America Will Exhibit the Highest Market Share in 2015

Figure 11 Increasing Demand Among Organizations for Integrated Mobile Learning Suite

Figure 12 Healthcare, BFSI, and Professional Services Are the Top Three Industry Segments Gaining the Highest Traction in Terms of Market Size

Figure 13 North America Holds the Maximum Share in the Mobile Learning Market (2015)

Figure 14 Asia-Pacific is Expected to Have the Highest Market Growth Potential in the Years to Come

Figure 15 Corporate Sector Will Continue to Dominate the Market in the Next Five Years

Figure 16 Asia-Pacific Market to Grow Faster Than Europe and North America

Figure 17 3/4th of the Total Market Growth Will Come From Portable LMS in 2015-2020

Figure 18 Mobile Learning Solutions, Growth Matrix

Figure 19 Regional Lifecycle - MEA Expected to Be in the Introduction Phase for the Year 2015

Figure 20 Mobile Application Developers to Play A Crucial Role in Mobile Learning Market

Figure 21 Mobile Learning Market Segmentation: By Software Solution

Figure 22 Market Segmentation: By Application

Figure 23 Market Segmentation: By User Type

Figure 24 Market Segmentation: By Region

Figure 25 Growing Mobile Phone and Smartphone Penetration Rates Will Drive the Market for Mobile Learning

Figure 26 Value Chain Analysis

Figure 27 Porter’s Five Forces Analysis (2014): Availability of Substitute Products Have Decreased the Value of the Mobile Learning Solutions

Figure 28 Mobile Content Authoring and Portable LMS is Leading the Solutions Market

Figure 29 E-Books is Expected to Show Considerable Growth in the European Region

Figure 30 Portable LMS Expected to Show Considerable Growth in All Regions

Figure 31 Portable LMS Will Continue to Grow at A Steady Rate

Figure 32 In-Class Learning Market Size is Expected to Double By 2020

Figure 33 In-Class Learning Expected to Show Considerable Growth in All Regions

Figure 34 Simulation-Based Learning Expected to Exhibit A Considerable Growth Rate in the Academic Segment

Figure 35 Corporate Training Expected to Exhibit A Considerable Growth Rate in APAC

Figure 36 Academic User Segment Exhibit the Fastest Growth Rate in the Mobile Learning Market During the Forecast Period

Figure 37 K-12 to Exhibit the Fastest Growth in the Academic Segment for the Forecast Period

Figure 38 Asia-Pacific Expected to Dominate the Academic User Segment

Figure 39 SMBS Are Expected to Exhibit the Highest Growth Rate in the Corporate User Segment for the Forecast Period

Figure 40 Asia-Pacific Expected to Be A Potential Region for the Corporate User Segment

Figure 41 Healthcare Vertical Expected to Show Considerable Growth in the European Region

Figure 42 Asia-Pacific Will Exhibit the Highest Growth Rate in the Mobile Learning Market

Figure 43 Geographic Snapshot – Asia-Pacific is Emerging as A New Hotspot

Figure 44 Asia-Pacific: One of the Attractive Destinations for Almost All Industry Verticals

Figure 45 Geographic Snapshot (2015-2020): Asia-Pacific is an Attractive Destination for the Overall Market

Figure 46 North America Market Snapshot: Portable LMS is Expected to Contribute Maximum to the Market Value in 2015

Figure 47 Asia-Pacific Market Snapshot – Mobile Content Authoring Expected to Gain Popularity By 2020

Figure 48 Asia-Pacific is One of the Fastest Growing Regions in the Mobile Learning Market

Figure 49 Companies Adopted Mergers and Acquisitions as the Key Growth Strategies Over the Last 4 Years

Figure 50 CISCO and At&T Grew With the Highest Rate Between 2011 and 2013

Figure 51 Mobile Learning Market Evaluation Framework

Figure 52 Battle for Market Share: Agreements, Partnerships and Collaborations Were the Key Strategy

Figure 53 Geographic Revenue Mix of Top 5 Market Players

Figure 54 Netdimensions: Company Snapshot

Figure 55 SAP AG: Company Snapshot

Figure 56 SAP AG: SWOT Analysis

Figure 57 Promethean: Company Snapshot

Figure 58 Upside Learning: Company Snapshot

Figure 59 Skillsoft: Company Snapshot

Figure 60 CISCO Systems, Inc.: Company Snapshot

Figure 61 At&T: Company Snapshot

Figure 62 At&T: SWOT Analysis

Figure 63 Dell: Company Snapshot

Figure 64 Citrix Systems, Inc.: Company Snapshot

Figure 65 IBM Corporation: Company Snapshot

Figure 66 IBM Corporation: SWOT Analysis

Growth opportunities and latent adjacency in Mobile Learning Market

Understanding the mobile device industry for emerging countries

Understanding the growth and market size for mobile and video games

Interested in mobile device industry