Higher Education Market by Component (Solutions and Services), Solution (Student Information Management System, Content Collaboration, Data Security and Compliance, Campus Management), Deployment Type, Vertical, and Region - Global Forecast to 2025

Higher Education Market Size, Share, Industry Growth, Latest Trends, Forecast - 2025

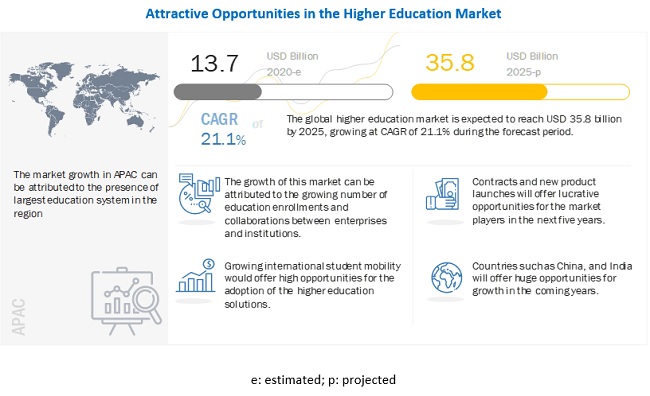

[196 Pages Report] MarketsandMarkets estimates the global higher education market size to grow from USD 13.7 billion in 2020 to USD 35.8 billion by 2025, at a Compound Annual Growth Rate (CAGR) of 21.1% during the forecast period. The growing number of higher education enrollments has emerged as one of the strongest factors for higher education tools and services adoption across regions. Factors such as growing international student mobility and increasing government initiatives and funding are expected to create ample opportunities for higher education vendors.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 impact

Huge demand for online education with nearly 1.7 billion learners unable to attend their educational institutes and are in need of online education to continue with the tuition for the current academic year 2020-21. Industry experts forecast the adoption of eLearning technologies to gain traction during the COVID-19 outbreak and would gradually increase in the post-COVID-19 as well, to be prepared to tackle a similar lockdown situation in the future. Additionally, several higher education solution providers are making their products free during the pandemic to boost the adoption of higher education solutions further. The International Monetary Fund (IMF) has projected the recession much worse than the global financial crisis in 2008. However, this may positively impact the market as a recession could lead to the increased demand for re-skilling and extended time in education.

Market Dynamics

Driver: Growing number of higher education enrollments

With the changing technological landscape, enterprises are constantly looking for individuals that can be at the forefront of this change and can adapt to such technological changes rapidly. The lack of skilled workers has become one of the major challenges for enterprises, which has resulted in individuals turning to specialized higher education courses that could benefit students in the long run.

Globalization and the advent of the internet have opened up new opportunities for individuals to increase their skillset from top-notch universities that are spread across the globe. Individuals are opting for these courses as they are in line with the technological advancements that are happening all across the globe. This is expected to be one of the top factors that will drive the adoption of higher education software adoption across institutions.

Restraint: Data privacy concerns

As the education vertical is opting for digital transformation, the vertical has been a sweet spot for hackers where hackers are implementing phishing attacks, ransomware, malware, and other types of attacks. Hackers are targeting the higher education vertical as it has personal information of users and teachers. The vertical has also witnessed a shift in the crowd due to fresh enrollments happening and students graduating. These factors have made it difficult to implement a robust security solution. The restraint also has been cited across major publications, where according to the Verizon Data Brach investigation report, the number of breaches in the last three years has grown at approximately 46%.

Opportunity: Growing international student mobility

With the advent of globalization and the growing number of students traveling to various countries for education purposes, the creation of huge opportunities for higher education providers can be expected. According to a report published report by the British Council, China, India, and South Korea are expected to have the largest outbound of students with major destinations being the US, the UK, Australia, Canada, and Germany. This huge traffic flow is expected to create immense opportunities for higher education solution vendors as institutions will have to manage these huge volumes of data, which in turn would open up new revenue streams for higher education software providers.

Challenge: Technological readiness among faculties

As technology has become an inseparable part of today’s education system, the success of the technology is highly dependent on the tech-savviness of the faculty or instructors. The adoption of techniques, such as course design, assignment development, assessment and evaluation, online content delivery, and collaboration, pose challenges to a majority of instructors that have adopted traditional methods to deliver lectures.

The factor is not limited to any particular country or region and is a challenge that is faced by educational institutes and faculties worldwide. According to the Educause Horizon report 2019, technological adoption was one of the major challenges faces by education institutions.

Solutions segment to hold a larger market size during the forecast period

The higher education solutions provide a complete application development environment for IT developers, with which they design, develop, deploy, and execute applications as per the requirements. These solutions offer features to integrate structured and unstructured data across various technologies. On the other hand, they also enable higher education institutes to increase their market shares, generate more revenue, and focus on catering to the specific needs of higher education institutes. Thus, higher education solutions support institutions in making informed decisions and gaining profits.

Cloud segment to hold a larger market size during the forecast period in the higher education market

Cloud-based higher education tools and services provide cost-saving benefits, which improve the operational efficiency of organizations and reduce the overall operational costs. Lower maintenance costs and low workforce requirements are expected to drive cloud-based higher education solutions and services.

State universities vertical to hold a majority of the market share during the forecast period

State universities need to consider their traditional approach toward geography, time, and quality. In the coming years, long-standing traditional models of higher education will be supplemented by models, including innovation, responsivity, and adaptation. Hence, state universities need to adopt higher education solutions and stay ahead of the competition.

To know about the assumptions considered for the study, download the pdf brochure

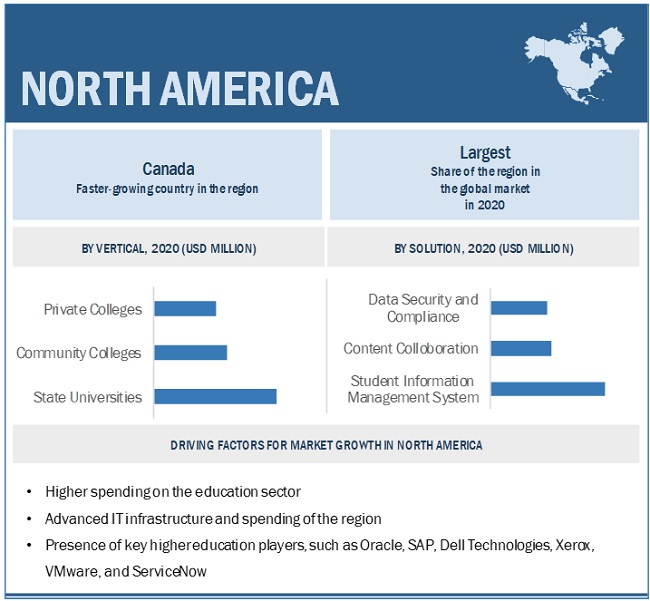

North America to account for the largest market size during the forecast period

The global higher education market by region covers five major geographic regions, namely, North America, Asia Pacific (APAC), Europe, Middle East & Africa (MEA), and Latin America. North America is expected to account for the largest market size during the forecast period. The increasing adoption of Bring Your Own Device (BYOD) among students and faculty, as well as more focus on enhancing student acquisition and retention rates, are further expected to fuel the adoption of higher education solutions in the North America region.

Higher education leaders aim at improving institutional efficiency by implementing various higher education solutions. Several educational institutes have formed a consortium to improve the industry-wide collaboration, and enterprises operating in the region have adopted higher education solutions to track employee performance and provide the necessary training to boost productivity. North America is segmented further into the US and Canada. The US is expected to be one of the major revenue contributors to the growth of the higher education market in North America. After the US, Canada is expected to present major growth opportunities for higher education solutions and service providers.

Key Market Players

The higher education vendors have implemented various types of organic as well as inorganic growth strategies, such as new product launches, product upgradations, partnerships and agreements, business expansions, and mergers and acquisitions, to strengthen their offerings in the market. The major vendors offering higher education software and services globally are Oracle (US), SAP (Germany), Dell Technologies (US), VMware (US), Xerox (US), ServiceNow (US), Unifyed (US), Ellucian (US), Hyland Software (US), Blackbaud (US), Cisco (US), Verizon (US), Blackboard (US), Civitas Learning (US), Remind (US), Instructure (US) and Anthology (US).

The study includes an in-depth competitive analysis of key players in the higher education market with their company profiles, recent developments, COVID-19 developments, and key market strategies.

Scope of the report

|

Report Metric |

Details |

|

Market size available for years |

2014–2025 |

|

Base year considered |

2019 |

|

Forecast period |

2020–2025 |

|

Forecast units |

Billion (USD) |

|

Segments covered |

Component, Solutions, Services, Professional Services, Deployment Type, Vertical, and Region |

|

Geographies covered |

North America, APAC, Europe, MEA, and Latin America |

|

Companies covered |

Oracle (US), SAP (Germany), Dell Technologies (US), VMware (US), Xerox (US), ServiceNow (US), Unifyed (US), Ellucian (US), Hyland Software (US), Blackbaud (US), Cisco (US), Verizon (US), Blackboard (US), Civitas Learning (US), Remind (US), Instructure (US) and Anthology (US). |

This research report categorizes the higher education market based on component, deployment type, vertical, and region.

Based on the component:

-

Solutions

- Student Information Management System

- Content Collaboration

- Data Security and Compliance

- Campus Management

- Others (Workflow Management, Administration, and Analytics)

-

Services

- Managed Services

-

Professional Services

- Support and Maintenance

- Consulting

- Implementation and Integration

Based on the deployment type:

- On-premises

- Cloud

Based on the vertical

- State Universities

- Community Colleges

- Private Colleges

Based on the region:

-

North America

- US

- Canada

-

Europe

- UK

- Germany

- Rest of Europe

-

APAC

- China

- India

- Rest of APAC

-

MEA

- KSA

- South Africa

- Rest of MEA

-

Latin America

- Brazil

- Rest of Latin America

Recent Developments

- In July 2020, VMware introduced education services in India. The new services include training on the VMware Cloud on AWS infrastructure in India. After the introduction of the AWS APAC (Mumbai) Region, VMware Cloud on AWS is available in 14 regions across the globe. The new services will help its customers in adopting best practices for implementing the hybrid cloud platform.

- In June 2020, SAP announced the availability of the student edition of SAP Learning Hub. The enhanced version was launched in partnership with the SAP University Alliances and the SAP Next-Gen programs. The enhanced SAP Learning Hub will help SAP in strengthening its collaboration with universities and research organizations.

- In June 2020, Dell Technologies signed a contract with the University of Cambridge, Cardiff University, and the University of Pisa to enhance its data-centric research. It launched the Open Exascale Lab in collaboration with Intel and the University of Cambridge to study innovative and emerging exascale technologies.

Frequently Asked Questions (FAQ):

What is higher education?

Higher education solutions and services aim at enabling higher educational institutes to streamline their day-to-day processes. Major components of higher education software include student information system, content collaboration, data security and compliance, campus management, and others. The education vertical is undergoing a digital transformation where the vertical is adopting technologies, such as security and data governance, to cater to the needs of the end user.

Who are the top vendors in the higher education market?

The major vendors operating in the higher education market include Oracle, SAP, Dell Technologies, VMware, and Xerox. These vendors have adopted different types of organic and inorganic growth strategies such as new product launches, product enhancements, partnerships, and contracts.

Which countries are considered in the European region?

The report includes an analysis of the UK, Germany, and other European countries from the Europe region.

What are the major higher education solutions considered in the study?

Major higher education solutions included in the study are the student information management system, content collaboration, data security and compliance, campus management, and others.

Does this report include the impact of COVID-19 on the higher education market?

Yes, the report includes the impact of COVID-19 on the higher education market. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 22)

1.1 INTRODUCTION TO COVID-19

1.2 COVID-19 HEALTH ASSESSMENT

FIGURE 1 COVID-19: THE GLOBAL PROPAGATION

FIGURE 2 COVID-19 PROPAGATION: SELECT COUNTRIES

1.3 COVID-19 ECONOMIC ASSESSMENT

FIGURE 3 REVISED GROSS DOMESTIC PRODUCT FORECASTS FOR SELECT G20 COUNTRIES IN 2020

1.3.1 COVID-19 ECONOMIC IMPACT—SCENARIO ASSESSMENT

FIGURE 4 CRITERIA IMPACTING THE GLOBAL ECONOMY

FIGURE 5 SCENARIOS IN TERMS OF RECOVERY OF THE GLOBAL ECONOMY

1.4 OBJECTIVES OF THE STUDY

1.5 MARKET DEFINITION

1.5.1 INCLUSIONS AND EXCLUSIONS

1.6 MARKET SCOPE

1.6.1 MARKET SEGMENTATION

1.6.2 REGIONS COVERED

1.6.3 YEARS CONSIDERED FOR THE STUDY

1.7 CURRENCY CONSIDERED

TABLE 1 UNITED STATES DOLLAR EXCHANGE RATE, 2017–2019

1.8 STAKEHOLDERS

1.9 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 32)

2.1 RESEARCH DATA

FIGURE 6 HIGHER EDUCATION MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.2 PRIMARY DATA

2.1.2.1 Breakup of primaries

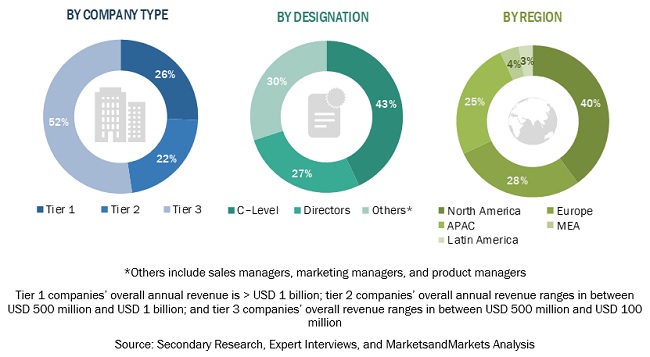

FIGURE 7 BREAKUP OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

2.1.2.2 Key industry insights

2.2 DATA TRIANGULATION

2.3 MARKET SIZE ESTIMATION

FIGURE 8 HIGHER EDUCATION MARKET: TOP-DOWN AND BOTTOM-UP APPROACHES

2.3.1 TOP-DOWN APPROACH

FIGURE 9 MARKET SIZE ESTIMATION METHODOLOGY ? APPROACH 1 (TOP-DOWN): REVENUE OF VENDORS OFFERING HIGHER EDUCATION SOLUTIONS AND SERVICES

2.3.2 BOTTOM-UP APPROACH

FIGURE 10 MARKET SIZE ESTIMATION METHODOLOGY ? APPROACH 2 (BOTTOM-UP): REVENUE OF VENDORS FROM SOLUTIONS

2.4 COMPANY EVALUATION MATRIX

FIGURE 11 COMPANY EVALUATION MATRIX: CRITERIA WEIGHTAGE

2.5 RESEARCH ASSUMPTIONS

TABLE 2 ASSUMPTIONS FOR THE STUDY

2.5.1 SUPPLY SIDE

FIGURE 12 MARKET CAGR PROJECTIONS FROM SUPPLY SIDE

2.6 LIMITATIONS OF THE STUDY

3 EXECUTIVE SUMMARY (Page No. - 43)

FIGURE 13 CLOUD SEGMENT TO HOLD A HIGHER MARKET SHARE IN THE HIGHER EDUCATION MARKET IN 2020

FIGURE 14 NORTH AMERICA TO ACCOUNT FOR THE HIGHEST SHARE IN 2020

FIGURE 15 SOLUTIONS SEGMENT TO HOLD A HIGHER MARKET SHARE IN THE MARKET IN 2020

4 PREMIUM INSIGHTS (Page No. - 47)

4.1 ATTRACTIVE OPPORTUNITIES IN THE HIGHER EDUCATION MARKET

FIGURE 16 GROWING USE OF ADVANCED TECHNOLOGIES TO DRIVE THE GROWTH OF THE MARKET DURING THE FORECAST PERIOD

4.2 MARKET, BY COMPONENT, 2020 VS 2025

FIGURE 17 SOLUTIONS SEGMENT TO HOLD A HIGHER MARKET SHARE DURING THE FORECAST PERIOD

4.3 MARKET, BY VERTICAL, 2020 VS 2025

FIGURE 18 STATE UNIVERSITIES SEGMENT TO HOLD THE HIGHEST MARKET SHARE BY 2025

4.4 MARKET INVESTMENT SCENARIO, 2020–2025

FIGURE 19 ASIA PACIFIC TO EMERGE AS THE BEST MARKET FOR INVESTMENTS IN NEXT FIVE YEARS

5 MARKET OVERVIEW (Page No. - 49)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 20 HIGHER EDUCATION MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.2.1 DRIVERS

5.2.1.1 Growing number of higher education enrollments

FIGURE 21 HIGHER EDUCATION ENROLMENTS

5.2.1.2 Growing use of advanced technologies

5.2.1.3 Collaborations between enterprises and institutions

5.2.2 RESTRAINTS

5.2.2.1 Data privacy concerns

FIGURE 22 DATA BREACHES IN EDUCATION SECTOR

5.2.3 OPPORTUNITIES

5.2.3.1 Growing international student mobility

5.2.3.2 Increasing government initiatives and funding

FIGURE 23 EDUCATION SPENDING AS PERCENTAGE OF THE GROSS DOMESTIC PRODUCT, UNITED STATES 2011-2020

5.2.4 CHALLENGES

5.2.4.1 Technological readiness among faculties

5.3 INDUSTRY TRENDS

5.3.1 CASE STUDY ANALYSIS

5.3.1.1 Case study 1: Public University

5.3.1.2 Case study 2: Private University

5.4 AVERAGE SELLING PRICE: HIGHER EDUCATION MARKET

5.5 VALUE CHAIN ANALYSIS

FIGURE 24 MARKET: VALUE CHAIN ANALYSIS

5.6 TECHNOLOGY ANALYSIS

5.7 COVID-19 IMPACT: MARKET

5.7.1 ASSUMPTIONS: COVID-19 IMPACT ON MARKET

5.7.2 OPERATIONAL DRIVERS: MARKET

5.7.3 CUMULATIVE GROWTH ANALYSIS

TABLE 3 MARKET: CUMULATIVE GROWTH ANALYSIS

6 HIGHER EDUCATION MARKET, BY COMPONENT (Page No. - 57)

6.1 INTRODUCTION

6.1.1 COMPONENT: MARKET DRIVERS

6.1.2 COMPONENT: COVID-19 IMPACT

FIGURE 25 SERVICES SEGMENT TO GROW AT A HIGHER CAGR DURING THE FORECAST PERIOD

TABLE 4 MARKET SIZE, BY COMPONENT, 2014–2018 (USD MILLION)

TABLE 5 MARKET SIZE, BY COMPONENT, 2019–2025 (USD MILLION)

6.2 SOLUTIONS

FIGURE 26 DATA SECURITY AND COMPLIANCE SEGMENT TO GROW AT THE HIGHEST CAGR DURING THE FORECAST PERIOD

TABLE 6 SOLUTIONS: MARKET SIZE, BY TYPE, 2014–2018 (USD MILLION)

TABLE 7 SOLUTIONS: MARKET SIZE, BY TYPE, 2019–2025 (USD MILLION)

TABLE 8 SOLUTIONS: MARKET SIZE, BY REGION, 2014–2018 (USD MILLION)

TABLE 9 SOLUTIONS: HIGHER EDUCATION MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

6.2.1 STUDENT INFORMATION MANAGEMENT SYSTEM

TABLE 10 STUDENT INFORMATION MANAGEMENT SYSTEM MARKET SIZE, BY REGION, 2014–2018 (USD MILLION)

TABLE 11 STUDENT INFORMATION MANAGEMENT SYSTEM MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

6.2.2 CONTENT COLLABORATION

TABLE 12 CONTENT COLLABORATION MARKET SIZE, BY REGION, 2014–2018 (USD MILLION)

TABLE 13 CONTENT COLLABORATION MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

6.2.3 DATA SECURITY AND COMPLIANCE

TABLE 14 DATA SECURITY AND COMPLIANCE MARKET SIZE, BY REGION, 2014–2018 (USD MILLION)

TABLE 15 DATA SECURITY AND COMPLIANCE MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

6.2.4 CAMPUS MANAGEMENT

TABLE 16 CAMPUS MANAGEMENT MARKET SIZE, BY REGION, 2014–2018 (USD MILLION)

TABLE 17 CAMPUS MANAGEMENT MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

6.2.5 OTHER SOLUTIONS

TABLE 18 OTHER SOLUTIONS MARKET SIZE, BY REGION, 2014–2018 (USD MILLION)

TABLE 19 OTHER SOLUTIONS MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

6.3 SERVICES

FIGURE 27 MANAGED SERVICES SEGMENT TO GROW AT A HIGHER CAGR DURING THE FORECAST PERIOD

TABLE 20 SERVICES: HIGHER EDUCATION MARKET SIZE, BY TYPE, 2014–2018 (USD MILLION)

TABLE 21 SERVICES: MARKET SIZE, BY TYPE, 2019–2025 (USD MILLION)

TABLE 22 SERVICES: MARKET SIZE, BY REGION, 2014–2018 (USD MILLION)

TABLE 23 SERVICES: MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

6.3.1 PROFESSIONAL SERVICES

FIGURE 28 CONSULTING SERVICES SEGMENT TO GROW AT THE HIGHEST CAGR DURING THE FORECAST PERIOD

TABLE 24 PROFESSIONAL SERVICES: MARKET SIZE, BY TYPE, 2014–2018 (USD MILLION)

TABLE 25 PROFESSIONAL SERVICES: MARKET SIZE, BY TYPE, 2019–2025 (USD MILLION)

6.3.1.1 Integration and implementation

TABLE 26 INTEGRATION AND IMPLEMENTATION MARKET SIZE, BY REGION, 2014–2018 (USD MILLION)

TABLE 27 INTEGRATION AND IMPLEMENTATION MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

6.3.1.2 Support and maintenance

TABLE 28 SUPPORT AND MAINTENANCE MARKET SIZE, BY REGION, 2014–2018 (USD MILLION)

TABLE 29 SUPPORT AND MAINTENANCE MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

6.3.1.3 Consulting services

TABLE 30 CONSULTING SERVICES MARKET SIZE, BY REGION, 2014–2018 (USD MILLION)

TABLE 31 CONSULTING SERVICES MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

6.3.2 MANAGED SERVICES

7 HIGHER EDUCATION MARKET, BY DEPLOYMENT TYPE (Page No. - 73)

7.1 INTRODUCTION

7.1.1 DEPLOYMENT TYPE: MARKET DRIVERS

7.1.2 DEPLOYMENT TYPE: COVID-19 IMPACT

FIGURE 29 CLOUD DEPLOYMENT TYPE TO GROW AT A HIGHER CAGR DURING THE FORECAST PERIOD

TABLE 32 MARKET SIZE, BY DEPLOYMENT TYPE, 2014–2018 (USD MILLION)

TABLE 33 MARKET SIZE, BY DEPLOYMENT TYPE, 2019–2025 (USD MILLION)

7.1.3 ON-PREMISES

TABLE 34 ON-PREMISES: MARKET SIZE, BY REGION, 2014–2018 (USD MILLION)

TABLE 35 ON-PREMISES: MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

7.1.4 CLOUD

TABLE 36 CLOUD: MARKET SIZE, BY REGION, 2014–2018 (USD MILLION)

TABLE 37 CLOUD: MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

8 HIGHER EDUCATION MARKET, BY VERTICAL (Page No. - 78)

8.1 INTRODUCTION

8.1.1 VERTICAL: MARKET DRIVERS

8.1.2 VERTICAL: COVID-19 IMPACT

FIGURE 30 PRIVATE COLLEGES VERTICAL TO GROW AT THE HIGHEST CAGR DURING THE FORECAST PERIOD

TABLE 38 MARKET SIZE, BY VERTICAL, 2014–2018 (USD MILLION)

TABLE 39 MARKET SIZE, BY VERTICAL, 2019–2025 (USD MILLION)

8.2 STATE UNIVERSITIES

TABLE 40 STATE UNIVERSITIES: MARKET SIZE, BY REGION, 2014–2018 (USD MILLION)

TABLE 41 STATE UNIVERSITIES: MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

8.3 COMMUNITY COLLEGES

TABLE 42 COMMUNITY COLLEGES: MARKET SIZE, BY REGION, 2014–2018 (USD MILLION)

TABLE 43 COMMUNITY COLLEGES: MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

8.4 PRIVATE COLLEGES

TABLE 44 PRIVATE COLLEGES: MARKET SIZE, BY REGION, 2014–2018 (USD MILLION)

TABLE 45 PRIVATE COLLEGES: MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

9 HIGHER EDUCATION MARKET, BY REGION (Page No. - 84)

9.1 INTRODUCTION

FIGURE 31 NORTH AMERICA TO HOLD THE LARGEST MARKET SIZE DURING THE FORECAST PERIOD

TABLE 46 MARKET SIZE, BY REGION, 2014–2018 (USD MILLION)

TABLE 47 MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

9.2 NORTH AMERICA

9.2.1 NORTH AMERICA: COVID-19 IMPACT

9.2.2 NORTH AMERICA: MARKET DRIVERS

9.2.3 NORTH AMERICA: REGULATORY LANDSCAPE

FIGURE 32 NORTH AMERICA: MARKET SNAPSHOT

TABLE 48 NORTH AMERICA: HIGHER EDUCATION MARKET SIZE, BY COMPONENT, 2014–2018 (USD MILLION)

TABLE 49 NORTH AMERICA: MARKET SIZE, BY COMPONENT, 2019–2025 (USD MILLION)

TABLE 50 NORTH AMERICA: MARKET SIZE, BY SOLUTION, 2014–2018 (USD MILLION)

TABLE 51 NORTH AMERICA: MARKET SIZE, BY SOLUTION, 2019–2025 (USD MILLION)

TABLE 52 NORTH AMERICA: MARKET SIZE, BY SERVICE, 2014–2018 (USD MILLION)

TABLE 53 NORTH AMERICA: MARKET SIZE, BY SERVICE, 2019–2025 (USD MILLION)

TABLE 54 NORTH AMERICA: MARKET SIZE, BY PROFESSIONAL SERVICE, 2014–2018 (USD MILLION)

TABLE 55 NORTH AMERICA: MARKET SIZE, BY PROFESSIONAL SERVICE, 2019–2025 (USD MILLION)

TABLE 56 NORTH AMERICA: MARKET SIZE, BY DEPLOYMENT TYPE, 2014–2018 (USD MILLION)

TABLE 57 NORTH AMERICA: MARKET SIZE, BY DEPLOYMENT TYPE, 2019–2025 (USD MILLION)

TABLE 58 NORTH AMERICA: MARKET SIZE, BY VERTICAL, 2014–2018 (USD MILLION)

TABLE 59 NORTH AMERICA: MARKET SIZE, BY VERTICAL, 2019–2025 (USD MILLION)

TABLE 60 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2014–2018 (USD MILLION)

TABLE 61 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2019–2025 (USD MILLION)

9.2.4 UNITED STATES

TABLE 62 UNITED STATES: HIGHER EDUCATION MARKET SIZE, BY COMPONENT, 2014–2018 (USD MILLION)

TABLE 63 UNITED STATES: MARKET SIZE, BY COMPONENT, 2019–2025 (USD MILLION)

TABLE 64 UNITED STATES: MARKET SIZE, BY DEPLOYMENT TYPE, 2014–2018 (USD MILLION)

TABLE 65 UNITED STATES: MARKET SIZE, BY DEPLOYMENT TYPE, 2019–2025 (USD MILLION)

9.2.5 CANADA

TABLE 66 CANADA: MARKET SIZE, BY COMPONENT, 2014–2018 (USD MILLION)

TABLE 67 CANADA: MARKET SIZE, BY COMPONENT, 2019–2025 (USD MILLION)

TABLE 68 CANADA: MARKET SIZE, BY DEPLOYMENT TYPE, 2014–2018 (USD MILLION)

TABLE 69 CANADA: MARKET SIZE, BY DEPLOYMENT TYPE, 2019–2025 (USD MILLION)

9.3 EUROPE

9.3.1 EUROPE: COVID-19 IMPACT

9.3.2 EUROPE: HIGHER EDUCATION MARKET DRIVERS

9.3.3 EUROPE: REGULATORY LANDSCAPE

TABLE 70 EUROPE: MARKET SIZE, BY COMPONENT, 2014–2018 (USD MILLION)

TABLE 71 EUROPE: MARKET SIZE, BY COMPONENT, 2019–2025 (USD MILLION)

TABLE 72 EUROPE: MARKET SIZE, BY SOLUTION, 2014–2018 (USD MILLION)

TABLE 73 EUROPE: MARKET SIZE, BY SOLUTION, 2019–2025 (USD MILLION)

TABLE 74 EUROPE: MARKET SIZE, BY SERVICE, 2014–2018 (USD MILLION)

TABLE 75 EUROPE: MARKET SIZE, BY SERVICE, 2019–2025 (USD MILLION)

TABLE 76 EUROPE: MARKET SIZE, BY PROFESSIONAL SERVICE, 2014–2018 (USD MILLION)

TABLE 77 EUROPE: MARKET SIZE, BY PROFESSIONAL SERVICE, 2019–2025 (USD MILLION)

TABLE 78 EUROPE: MARKET SIZE, BY DEPLOYMENT TYPE, 2014–2018 (USD MILLION)

TABLE 79 EUROPE: MARKET SIZE, BY DEPLOYMENT TYPE, 2019–2025 (USD MILLION)

TABLE 80 EUROPE: MARKET SIZE, BY VERTICAL, 2014–2018 (USD MILLION)

TABLE 81 EUROPE: MARKET SIZE, BY VERTICAL, 2019–2025 (USD MILLION)

TABLE 82 EUROPE: MARKET SIZE, BY COUNTRY, 2014–2018 (USD MILLION)

TABLE 83 EUROPE: MARKET SIZE, BY COUNTRY, 2019–2025 (USD MILLION)

9.3.4 UNITED KINGDOM

TABLE 84 UNITED KINGDOM: HIGHER EDUCATION MARKET SIZE, BY COMPONENT, 2014–2018 (USD MILLION)

TABLE 85 UNITED KINGDOM: MARKET SIZE, BY COMPONENT, 2019–2025 (USD MILLION)

TABLE 86 UNITED KINGDOM: MARKET SIZE, BY DEPLOYMENT TYPE, 2014–2018 (USD MILLION)

TABLE 87 UNITED KINGDOM: MARKET SIZE, BY DEPLOYMENT TYPE, 2019–2025 (USD MILLION)

9.3.5 GERMANY

TABLE 88 GERMANY: MARKET SIZE, BY COMPONENT, 2014–2018 (USD MILLION)

TABLE 89 GERMANY: MARKET SIZE, BY COMPONENT, 2019–2025 (USD MILLION)

TABLE 90 GERMANY: MARKET SIZE, BY DEPLOYMENT TYPE, 2014–2018 (USD MILLION)

TABLE 91 GERMANY: MARKET SIZE, BY DEPLOYMENT TYPE, 2019–2025 (USD MILLION)

9.3.6 REST OF EUROPE

TABLE 92 REST OF EUROPE: HIGHER EDUCATION MARKET SIZE, BY COMPONENT, 2014–2018 (USD MILLION)

TABLE 93 REST OF EUROPE: MARKET SIZE, BY COMPONENT, 2019–2025 (USD MILLION)

TABLE 94 REST OF EUROPE: MARKET SIZE, BY DEPLOYMENT TYPE, 2014–2018 (USD MILLION)

TABLE 95 REST OF EUROPE: MARKET SIZE, BY DEPLOYMENT TYPE, 2019–2025 (USD MILLION)

9.4 ASIA PACIFIC

9.4.1 ASIA PACIFIC: COVID-19 IMPACT

9.4.2 ASIA PACIFIC: MARKET DRIVERS

9.4.3 ASIA PACIFIC: REGULATORY LANDSCAPE

FIGURE 33 ASIA PACIFIC: MARKET SNAPSHOT

TABLE 96 ASIA PACIFIC: HIGHER EDUCATION MARKET SIZE, BY COMPONENT, 2014–2018 (USD MILLION)

TABLE 97 ASIA PACIFIC: MARKET SIZE, BY COMPONENT, 2019–2025 (USD MILLION)

TABLE 98 ASIA PACIFIC: MARKET SIZE, BY SOLUTION, 2014–2018 (USD MILLION)

TABLE 99 ASIA PACIFIC: MARKET SIZE, BY SOLUTION, 2019–2025 (USD MILLION)

TABLE 100 ASIA PACIFIC: MARKET SIZE, BY SERVICE, 2014–2018 (USD MILLION)

TABLE 101 ASIA PACIFIC: MARKET SIZE, BY SERVICE, 2019–2025 (USD MILLION)

TABLE 102 ASIA PACIFIC: MARKET SIZE, BY PROFESSIONAL SERVICE, 2014–2018 (USD MILLION)

TABLE 103 ASIA PACIFIC: MARKET SIZE, BY PROFESSIONAL SERVICE, 2019–2025 (USD MILLION)

TABLE 104 ASIA PACIFIC: MARKET SIZE, BY DEPLOYMENT TYPE, 2014–2018 (USD MILLION)

TABLE 105 ASIA PACIFIC: MARKET SIZE, BY DEPLOYMENT TYPE, 2019–2025 (USD MILLION)

TABLE 106 ASIA PACIFIC: MARKET SIZE, BY VERTICAL, 2014–2018 (USD MILLION)

TABLE 107 ASIA PACIFIC: MARKET SIZE, BY VERTICAL, 2019–2025 (USD MILLION)

TABLE 108 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2014–2018 (USD MILLION)

TABLE 109 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2019–2025 (USD MILLION)

9.4.4 CHINA

TABLE 110 CHINA: HIGHER EDUCATION MARKET SIZE, BY COMPONENT, 2014–2018 (USD MILLION)

TABLE 111 CHINA: MARKET SIZE, BY COMPONENT, 2019–2025 (USD MILLION)

TABLE 112 CHINA: MARKET SIZE, BY DEPLOYMENT TYPE, 2014–2018 (USD MILLION)

TABLE 113 CHINA: MARKET SIZE, BY DEPLOYMENT TYPE, 2019–2025 (USD MILLION)

9.4.5 INDIA

TABLE 114 INDIA: MARKET SIZE, BY COMPONENT, 2014–2018 (USD MILLION)

TABLE 115 INDIA: MARKET SIZE, BY COMPONENT, 2019–2025 (USD MILLION)

TABLE 116 INDIA: MARKET SIZE, BY DEPLOYMENT TYPE, 2014–2018 (USD MILLION)

TABLE 117 INDIA: MARKET SIZE, BY DEPLOYMENT TYPE, 2019–2025 (USD MILLION)

9.4.6 REST OF ASIA PACIFIC

TABLE 118 REST OF ASIA PACIFIC: HIGHER EDUCATION MARKET SIZE, BY COMPONENT, 2014–2018 (USD MILLION)

TABLE 119 REST OF ASIA PACIFIC: MARKET SIZE, BY COMPONENT, 2019–2025 (USD MILLION)

TABLE 120 REST OF ASIA PACIFIC: MARKET SIZE, BY DEPLOYMENT TYPE, 2014–2018 (USD MILLION)

TABLE 121 REST OF ASIA PACIFIC: MARKET SIZE, BY DEPLOYMENT TYPE, 2019–2025 (USD MILLION)

9.5 MIDDLE EAST AND AFRICA

9.5.1 MIDDLE EAST AND AFRICA: COVID-19 IMPACT

9.5.2 MIDDLE EAST AND AFRICA: MARKET DRIVERS

9.5.3 MIDDLE EAST AND AFRICA: REGULATORY LANDSCAPE

TABLE 122 MIDDLE EAST AND AFRICA: HIGHER EDUCATION MARKET SIZE, BY COMPONENT, 2014–2018 (USD MILLION)

TABLE 123 MIDDLE EAST AND AFRICA: MARKET SIZE, BY COMPONENT, 2019–2025 (USD MILLION)

TABLE 124 MIDDLE EAST AND AFRICA: MARKET SIZE, BY SOLUTION, 2014–2018 (USD MILLION)

TABLE 125 MIDDLE EAST AND AFRICA: MARKET SIZE, BY SOLUTION, 2019–2025 (USD MILLION)

TABLE 126 MIDDLE EAST AND AFRICA: MARKET SIZE, BY SERVICE, 2014–2018 (USD MILLION)

TABLE 127 MIDDLE EAST AND AFRICA: MARKET SIZE, BY SERVICE, 2019–2025 (USD MILLION)

TABLE 128 MIDDLE EAST AND AFRICA: MARKET SIZE, BY PROFESSIONAL SERVICE, 2014–2018 (USD MILLION)

TABLE 129 MIDDLE EAST AND AFRICA: MARKET SIZE, BY PROFESSIONAL SERVICE, 2019–2025 (USD MILLION)

TABLE 130 MIDDLE EAST AND AFRICA: MARKET SIZE, BY DEPLOYMENT TYPE, 2014–2018 (USD MILLION)

TABLE 131 MIDDLE EAST AND AFRICA: MARKET SIZE, BY DEPLOYMENT TYPE, 2019–2025 (USD MILLION)

TABLE 132 MIDDLE EAST AND AFRICA: MARKET SIZE, BY VERTICAL, 2014–2018 (USD MILLION)

TABLE 133 MIDDLE EAST AND AFRICA: MARKET SIZE, BY VERTICAL, 2019–2025 (USD MILLION)

TABLE 134 MIDDLE EAST AND AFRICA: MARKET SIZE, BY COUNTRY, 2014–2018 (USD MILLION)

TABLE 135 MIDDLE EAST AND AFRICA: MARKET SIZE, BY COUNTRY, 2019–2025 (USD MILLION)

9.5.4 KINGDOM OF SAUDI ARABIA

TABLE 136 KINGDOM OF SAUDI ARABIA: HIGHER EDUCATION MARKET SIZE, BY COMPONENT, 2014–2018 (USD MILLION)

TABLE 137 KINGDOM OF SAUDI ARABIA: MARKET SIZE, BY COMPONENT, 2019–2025 (USD MILLION)

TABLE 138 KINGDOM OF SAUDI ARABIA: MARKET SIZE, BY DEPLOYMENT TYPE, 2014–2018 (USD MILLION)

TABLE 139 KINGDOM OF SAUDI ARABIA: MARKET SIZE, BY DEPLOYMENT TYPE, 2019–2025 (USD MILLION)

9.5.5 SOUTH AFRICA

TABLE 140 SOUTH AFRICA: MARKET SIZE, BY COMPONENT, 2014–2018 (USD MILLION)

TABLE 141 SOUTH AFRICA: MARKET SIZE, BY COMPONENT, 2019–2025 (USD MILLION)

TABLE 142 SOUTH AFRICA: MARKET SIZE, BY DEPLOYMENT TYPE, 2014–2018 (USD MILLION)

TABLE 143 SOUTH AFRICA: MARKET SIZE, BY DEPLOYMENT TYPE, 2019–2025 (USD MILLION)

9.5.6 REST OF MIDDLE EAST AND AFRICA

TABLE 144 REST OF MIDDLE EAST AND AFRICA: HIGHER EDUCATION MARKET SIZE, BY COMPONENT, 2014–2018 (USD MILLION)

TABLE 145 REST OF MIDDLE EAST AND AFRICA: MARKET SIZE, BY COMPONENT, 2019–2025 (USD MILLION)

TABLE 146 REST OF MIDDLE EAST AND AFRICA: MARKET SIZE, BY DEPLOYMENT TYPE, 2014–2018 (USD MILLION)

TABLE 147 REST OF MIDDLE EAST AND AFRICA: MARKET SIZE, BY DEPLOYMENT TYPE, 2019–2025 (USD MILLION)

9.6 LATIN AMERICA

9.6.1 LATIN AMERICA: COVID-19 IMPACT

9.6.2 LATIN AMERICA: MARKET DRIVERS

9.6.3 LATIN AMERICA: REGULATORY LANDSCAPE

TABLE 148 LATIN AMERICA: HIGHER EDUCATION MARKET SIZE, BY COMPONENT, 2014–2018 (USD MILLION)

TABLE 149 LATIN AMERICA: MARKET SIZE, BY COMPONENT, 2019–2025 (USD MILLION)

TABLE 150 LATIN AMERICA: MARKET SIZE, BY SOLUTION, 2014–2018 (USD MILLION)

TABLE 151 LATIN AMERICA: MARKET SIZE, BY SOLUTION, 2019–2025 (USD MILLION)

TABLE 152 LATIN AMERICA: MARKET SIZE, BY SERVICE, 2014–2018 (USD MILLION)

TABLE 153 LATIN AMERICA: MARKET SIZE, BY SERVICE, 2019–2025 (USD MILLION)

TABLE 154 LATIN AMERICA: MARKET SIZE, BY PROFESSIONAL SERVICE, 2014–2018 (USD MILLION)

TABLE 155 LATIN AMERICA: MARKET SIZE, BY PROFESSIONAL SERVICE, 2019–2025 (USD MILLION)

TABLE 156 LATIN AMERICA: MARKET SIZE, BY DEPLOYMENT TYPE, 2014–2018 (USD MILLION)

TABLE 157 LATIN AMERICA: MARKET SIZE, BY DEPLOYMENT TYPE, 2019–2025 (USD MILLION)

TABLE 158 LATIN AMERICA: MARKET SIZE, BY VERTICAL, 2014–2018 (USD MILLION)

TABLE 159 LATIN AMERICA: MARKET SIZE, BY VERTICAL, 2019–2025 (USD MILLION)

TABLE 160 LATIN AMERICA: MARKET SIZE, BY COUNTRY, 2014–2018 (USD MILLION)

TABLE 161 LATIN AMERICA: MARKET SIZE, BY COUNTRY, 2019–2025 (USD MILLION)

9.6.4 BRAZIL

TABLE 162 BRAZIL: HIGHER EDUCATION MARKET SIZE, BY COMPONENT, 2014–2018 (USD MILLION)

TABLE 163 BRAZIL: MARKET SIZE, BY COMPONENT, 2019–2025 (USD MILLION)

TABLE 164 BRAZIL: MARKET SIZE, BY DEPLOYMENT TYPE, 2014–2018 (USD MILLION)

TABLE 165 BRAZIL: MARKET SIZE, BY DEPLOYMENT TYPE, 2019–2025 (USD MILLION)

9.6.5 REST OF LATIN AMERICA

TABLE 166 REST OF LATIN AMERICA: MARKET SIZE, BY COMPONENT, 2014–2018 (USD MILLION)

TABLE 167 REST OF LATIN AMERICA: MARKET SIZE, BY COMPONENT, 2019–2025 (USD MILLION)

TABLE 168 REST OF LATIN AMERICA: MARKET SIZE, BY DEPLOYMENT TYPE, 2014–2018 (USD MILLION)

TABLE 169 REST OF LATIN AMERICA: MARKET SIZE, BY DEPLOYMENT TYPE, 2019–2025 (USD MILLION)

10 COMPETITIVE LANDSCAPE (Page No. - 130)

10.1 MARKET EVALUATION FRAMEWORK

FIGURE 34 MARKET EVALUATION FRAMEWORK

10.2 MARKET SHARE ANALYSIS

FIGURE 35 MARKET SHARE ANALYSIS OF COMPANIES IN THE HIGHER EDUCATION MARKET

10.3 MARKET RANKING

FIGURE 36 MARKET RANKING IN 2020

10.4 HISTORICAL REVENUE ANALYSIS OF LEADING PLAYERS

FIGURE 37 HISTORICAL FIVE-YEAR REVENUE ANALYSIS OF LEADING PLAYERS IN THE MARKET, 2015-2019

10.5 KEY MARKET DEVELOPMENTS

FIGURE 38 KEY DEVELOPMENTS IN THE HIGHER EDUCATION MARKET DURING 2018– 2020

10.5.1 NEW PRODUCT LAUNCHES, PRODUCT ENHANCEMENTS, AND BUSINESS EXPANSIONS

TABLE 170 NEW PRODUCT LAUNCHES, PRODUCT ENHANCEMENTS, AND BUSINESS EXPANSIONS

10.5.2 CONTRACTS

TABLE 171 CONTRACTS

10.5.3 PARTNERSHIPS AND AGREEMENTS

TABLE 172 PARTNERSHIPS AND AGREEMENTS

10.6 COMPANY EVALUATION MATRIX

10.6.1 STAR

10.6.2 EMERGING LEADERS

10.6.3 PERVASIVE

10.6.4 PARTICIPANT

FIGURE 39 HIGHER EDUCATION MARKET (GLOBAL), COMPANY EVALUATION MATRIX

10.7 STARTUP/SME EVALUATION MATRIX,2020

10.7.1 PROGRESSIVE COMPANIES

10.7.2 RESPONSIVE COMPANIES

10.7.3 DYNAMIC COMPANIES

10.7.4 STARTING BLOCKS

FIGURE 40 HIGHER EDUCATION MARKET (GLOBAL), STARTUP/SME EVALUATION MATRIX, 2020

11 COMPANY PROFILES (Page No. - 141)

(Business Overview, Solutions, Products & Services, Key Insights, Recent Developments, SWOT Analysis, MnM View)*

11.1 ORACLE

FIGURE 41 ORACLE: COMPANY SNAPSHOT

FIGURE 42 ORACLE: SWOT ANALYSIS

11.2 DELL TECHNOLOGIES

FIGURE 43 DELL TECHNOLOGIES: COMPANY SNAPSHOT

FIGURE 44 DELL TECHNOLOGIES: SWOT ANALYSIS

11.3 SAP

FIGURE 45 SAP: COMPANY SNAPSHOT

FIGURE 46 SAP: SWOT ANALYSIS

11.4 VMWARE

FIGURE 47 VMWARE: COMPANY SNAPSHOT

FIGURE 48 VMWARE: SWOT ANALYSIS

11.5 SERVICENOW

FIGURE 49 SERVICENOW: COMPANY SNAPSHOT

11.6 XEROX

FIGURE 50 XEROX: COMPANY SNAPSHOT

FIGURE 51 XEROX: SWOT ANALYSIS

11.7 UNIFYED

11.8 ELLUCIAN

11.9 HYLAND SOFTWARE

11.10 BLACKBAUD

FIGURE 52 BLACKBAUD: COMPANY SNAPSHOT

11.11 CISCO

FIGURE 53 CISCO: COMPANY SNAPSHOT

11.12 VERIZON

FIGURE 54 VERIZON: COMPANY SNAPSHOT

11.13 BLACKBOARD

11.14 CIVTAS LEARNING

11.15 INSTRUCTURE

11.16 ANTHOLOGY

11.17 REMIND

*Details on Business Overview, Solutions, Products & Services, Key Insights, Recent Developments, SWOT Analysis, MnM View might not be captured in case of unlisted companies.

12 ADJACENT AND RELATED MARKETS (Page No. - 176)

12.1 INTRODUCTION

12.1.1 RELATED MARKETS

12.1.2 LIMITATIONS

12.2 ED TECH AND SMART CLASSROOMS MARKET

12.2.1 MARKET DEFINITION

12.2.2 MARKET OVERVIEW

12.2.3 INTRODUCTION

TABLE 173 EDTECH AND SMART CLASSROOM MARKET SIZE, BY EDUCATION TYPE, 2014–2018 (USD MILLION)

TABLE 174 EDTECH AND SMART CLASSROOM MARKET SIZE, BY EDUCATION TYPE, 2019–2025 (USD MILLION)

TABLE 175 LEARNING MANAGEMENT SYSTEM: EDTECH AND SMART CLASSROOM MARKET SIZE, BY REGION, 2014–2018 (USD MILLION)

TABLE 176 LEARNING MANAGEMENT SYSTEM: EDTECH AND SMART CLASSROOM MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

TABLE 177 STUDENT INFORMATION SYSTEM: EDTECH AND SMART CLASSROOM MARKET SIZE, BY REGION, 2014–2018 (USD MILLION)

TABLE 178 STUDENT INFORMATION SYSTEM: EDTECH AND SMART CLASSROOM MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

TABLE 179 CLASSROOM ASSESSMENT SYSTEM: EDTECH AND SMART CLASSROOM MARKET SIZE, BY REGION, 2014–2018 (USD MILLION)

TABLE 180 CLASSROOM ASSESSMENT SYSTEM: EDTECH AND SMART CLASSROOM MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

TABLE 181 CLASSROOM COLLABORATION SYSTEM: EDTECH AND SMART CLASSROOM MARKET SIZE, BY REGION, 2014–2018 (USD MILLION)

TABLE 182 CLASSROOM COLLABORATION SYSTEM: EDTECH AND SMART CLASSROOM MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

TABLE 183 CLASSROOM MANAGEMENT SYSTEM: EDTECH AND SMART CLASSROOM MARKET SIZE, BY REGION, 2014–2018 (USD MILLION)

TABLE 184 CLASSROOM MANAGEMENT SYSTEM: EDTECH AND SMART CLASSROOM MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

TABLE 185 DOCUMENT MANAGEMENT SYSTEM: EDTECH AND SMART CLASSROOM MARKET SIZE, BY REGION, 2014–2018 (USD MILLION)

TABLE 186 DOCUMENT MANAGEMENT SYSTEM: EDTECH AND SMART CLASSROOM MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

TABLE 187 STUDENT RESPONSE SYSTEM: EDTECH AND SMART CLASSROOM MARKET SIZE, BY REGION, 2014–2018 (USD MILLION)

TABLE 188 STUDENT RESPONSE SYSTEM: EDTECH AND SMART CLASSROOM MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

TABLE 189 TALENT MANAGEMENT SYSTEM: EDTECH AND SMART CLASSROOM MARKET SIZE, BY REGION, 2014–2018 (USD MILLION)

TABLE 190 TALENT MANAGEMENT SYSTEM: EDTECH AND SMART CLASSROOM MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

12.3 LEARNING MANAGEMENT SYSTEM MARKET

12.3.1 MARKET DEFINITION

12.3.2 MARKET OVERVIEW

12.3.3 INTRODUCTION

TABLE 191 LEARNING MANAGEMENT SYSTEM MARKET SIZE, BY COMPONENT, 2014–2019 (USD MILLION)

TABLE 192 LEARNING MANAGEMENT SYSTEM MARKET SIZE, BY COMPONENT, 2020–2025 (USD MILLION)

12.3.3.1 Solution

TABLE 193 SOLUTION: LEARNING MANAGEMENT SYSTEM MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 194 SOLUTION: LEARNING MANAGEMENT SYSTEM MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

12.3.3.2 Services

TABLE 195 SERVICES: LEARNING MANAGEMENT SYSTEM MARKET SIZE, BY TYPE, 2014–2019 (USD MILLION)

TABLE 196 SERVICES: LEARNING MANAGEMENT SYSTEM MARKET SIZE, BY TYPE, 2020–2025 (USD MILLION)

TABLE 197 SERVICES: LEARNING MANAGEMENT SYSTEM MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 198 SERVICES: LEARNING MANAGEMENT SYSTEM MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

TABLE 199 CONSULTING SERVICES MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 200 CONSULTING SERVICES MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

TABLE 201 IMPLEMENTATION SERVICES MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 202 IMPLEMENTATION SERVICES MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

TABLE 203 SUPPORT SERVICES MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 204 SUPPORT SERVICES MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

13 APPENDIX (Page No. - 189)

13.1 DISCUSSION GUIDE

13.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

13.3 AVAILABLE CUSTOMIZATIONS

13.4 RELATED REPORTS

13.5 AUTHOR DETAILS

The study involved four major activities in estimating the current size of the global higher education market. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the total higher education market size. After that, the market breakup and data triangulation techniques were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources, such as Bloomberg and BusinessWeek, have been referred to identify and collect information for this study. The secondary sources included annual reports, press releases, and investor presentations of companies; white papers; and journals, such as Linux Journal and Container Journal, and articles from recognized authors, directories, and databases.

Primary Research

Various primary sources from both supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. The primary sources from the supply side included industry experts, such as Chief Executive Officers (CEOs), Chief Marketing Officers (CMO), Vice Presidents (VPs), Managing Directors (MDs), technology and innovation directors, and related key executives from various key companies and organizations operating in the higher education market along with the associated service providers, and system integrators operating in the targeted regions. All possible parameters that affect the market covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the final quantitative and qualitative data. Following is the breakup of primary respondents.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

For making market estimates and forecasting the higher education market, and other dependent submarkets, the top-down and bottom-up approaches were used. The bottom-up procedure was used to arrive at the overall market size of the global higher education market using key companies’ revenue and their offerings in the market. The research methodology used to estimate the market size includes the following:

- The key players in the higher education market have been identified through extensive secondary research.

- The market size, in terms of value, has been determined through primary and secondary research processes.

- All percentage shares, splits, and breakups have been determined using secondary sources and verified through primary sources.

Data Triangulation

With data triangulation and validation through primary interviews, the exact value of the overall parent market size was determined and confirmed using this study. The overall market size was then used in the top-down procedure to estimate the size of other individual markets via percentage splits of the market segmentation.

Report Objectives

- To define, describe, and forecast the higher education market based on components (solutions and services), deployment types, verticals, and regions

- To provide detailed information about the major factors (drivers, restraints, opportunities, and industry-specific challenges) influencing the growth of the market

- To analyze the market with respect to individual growth trends in solutions and services, category prospects, and contribution to the overall market

- To analyze the impact of COVID-19 on the higher education market

- To forecast the market size of the five major regions: North America, Europe, Asia Pacific (APAC), Middle East and Africa (MEA), and Latin America

- To analyze the opportunities in the market for stakeholders by identifying the high-growth segments of the market

- To profile the key players in the market and comprehensively analyze their core competencies in each subsegment

- To track and analyze competitive developments, such as mergers and acquisitions, new product developments, and partnerships and collaborations, in the market

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Company Information

- Detailed analysis and profiling of an additional five market players

Growth opportunities and latent adjacency in Higher Education Market