Mobile Enterprise Application Market by Software (Accounting & Finance, ERP, Communication & Collaboration, and CRM), Operating System (Android, iOS, and Windows), Type of App, Organization Size, Industry Vertical, and Region - Global Forecast to 2021

[165 Pages Report] The mobile enterprise application market expected to grow from USD 48.24 Billion in 2016 to USD 98.03 Billion by 2021, at a Compound Annual Growth Rate (CAGR) of 15.24% from 2016 to 2021.

Request for Customization to get the mobile enterprise application market forecasts to 2021

Mobile enterprise application is a broad term that refer to the enterprise software application designed to run on mobile devices such as smartphones and tablets. Mobile enterprise application enables organizations to mobilize their business processes and to extend their brands for greater interaction with employees and clients.

The objectives of the report are to define, describe, and forecast the mobile enterprise application market on the basis of software, type of app, operating system, organization size, industry verticals, and regions, to provide detailed information regarding the key factors influencing the market growth (drivers, restraints, opportunities, and challenges). It also aims to track and analyze the market scenario on the basis of technological developments, product launches, and mergers & acquisitions, and to forecast the market size of market segments with respect to five main regions, namely, North America (NA), Europe, Asia-Pacific (APAC), Middle East & Africa (MEA), and Latin America. The base year considered for the study is 2015 and the forecast period has been determined from 2016 to 2021.

This research study involves extensive usage of secondary sources, directories, and databases (such as Hoovers, Bloomberg Businessweek, Factiva, and OneSource) to identify and collect information useful for this technical, market-oriented, and commercial aspects of the mobile enterprise application market. The below points explain the research methodology:

- Analysis of market begins with capturing data on key vendor revenues through secondary research sources such as ITU union, MSME, World Bank & GSMA, and GEMA associations.

- Market coverage includes large traditional software vendors such as IBM, HCL, AT&T, Oracle, and Accenture. A few of them are changing their offerings to meet new customer expectations, and for mid-sized or small mobile enterprise app development service providers.

- Insights through in-depth interviews with the top management and thought leaders of the organization are taken into account.

- The vendor offerings are also taken into consideration to determine the market segmentation.

- The bottom-up procedure was employed to arrive at the overall market size of the global mobile enterprise application market from the revenue of the key players in the market.

- Analyzing market trends in various regions/countries supported by enterprises and enterprise app store spending in respective regions/countries.

- Overall market size values are finalized by triangulation with the supply side data, which includes product developments, supply chain, and value chain of mobile enterprise applications across the globe.

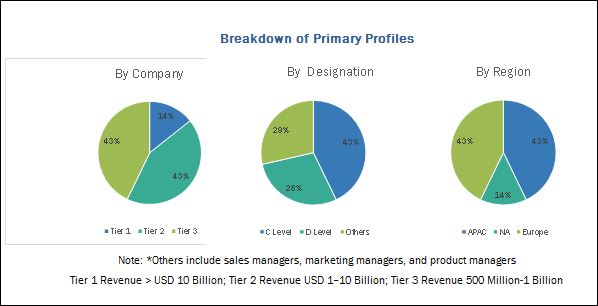

After arriving at the overall market size, the total market has been split into several segments and subsegments. The figure below shows the break-down of the primary profiles on the basis of company, designation, and region, conducted during the research study:

To know about the assumptions considered for the study, download the pdf brochure

The major vendors in the mobile enterprise application market are AT&T (U.S.), IBM Corporation (U.S.), BlackBerry Limited (Canada), Tata Consultancy Services (India), Infosys Limited (India), SAP SE (Germany), Salesforce.com, Inc. (U.S.), Oracle Corporation (U.S.), Accenture (U.S.), Capgemini (France), HCL Technologies (India), and Deloitte (U.S.). Further, the report also includes key innovators such as MobileIron (U.S.), SOTI (Canada), and Pegasystems (U.S.), who provide mobile enterprise application services and solutions to end users to cater to their requirements and communications needs.

Key Target Audience

- Mobile Enterprise Application Platform Developers

- Enterprise Application Store Providers

- Mobile Engagement Providers

- Enterprise Mobile Migration and Integration

- Enterprise Mobile Application Testers

- Enterprise Mobile Application Support and Maintenance Providers

- Network Providers

- Telecom Service Providers

Scope of the Report:

The mobile enterprise application market report is broadly segmented into the following software, type of app, operating system, organization size, industry vertical, and region:

Market, By Software

- Accounting and Finance

- Enterprise Resource Planning

- Communication and Collaboration

- Customer Relationship Management

- mCommerce

- Business Analytics

- M Learning

- Supply Chain Management

- Productivity Tools

- Human Capital Management

- Others (business process, IT management, and Sales force automation)

Market, By Type of App

- Native

- Hybrid

- Web

Mobile Enterprise Application Market, By Operating System

- Android

- iOS

- Windows

- Others (Blackberry and Symbian)

Market, By Organization size

- Small and Medium Enterprise

- Large Enterprise

Mobile Enterprise Application Market, By Industry Vertical

- BFSI

- Government

- Media and Entertainment

- Transport and Logistics

- Retail

- Healthcare and Life Sciences

- Education

- Manufacturing and Automotive

- Energy and Utilities

- Others (oil & gas, real estate, and IT & telecom)

Market, By Region

- North America

- Europe

- APAC

- MEA

- Latin America

Available Customizations

With the given market data, MarketsandMarkets offers customizations based on company-specific needs. The following customization options are available for the report:

Geographic Analysis

- Further breakdown of the APAC market into countries contributing 75% to the regional market size

- Further breakdown of the North American market into countries contributing 75% to the regional market size

- Further breakdown of the Latin American market into countries contributing 75% to the regional market size

- Further breakdown of the MEA market into countries contributing 75% to the regional market size

- Further breakdown of the European market into countries contributing 75% to the regional market size

Company Information

- Detailed analysis and profiling of additional market players (up to 5).

MarketsandMarkets estimates the mobile enterprise application market size to grow from USD 48.24 Billion in 2016 to USD 98.03 Billion by 2021, at a Compound Annual Growth Rate (CAGR) of 15.24% from 2016 to 2021. Increase in smartphone penetration, enhancement in connectivity & productivity of both employees and organizations, growing demand for real-time information capture, and organizations continued focus to make their business processes mobile-ready due to increase in mobile workforce are some of the driving forces in the market.

The scope of this report covers the mobile enterprise application market by software, type of app, operating system, organization size, industry vertical, and region. Enterprise Resource Planning (ERP) software is expected to hold the largest market share, because it helps enterprises increase their operational efficiencies, improves communication & collaboration, anytime access to information, instant access to work center, and improves workforce productivity.

Among the type of app, the hybrid app is expected to hold the largest market share during the forecast period. Hybrid apps have a suite of features, such as they can integrate with device file systems & web-based services, and they have embedded browsers to improve access to online content. Hybrid apps also have capability to support cross-platforms, which effectively reduces the development cost of developers. In the mobile enterprise application market, hybrid apps dominate the market share due to their robust functionalities, such as cross-platform support, access to devices, and ease of development.

Among the organization size, Small and Medium Enterprises (SMEs) segment is expected to dominate the mobile enterprise application market and holds the largest market share. The mobile enterprise application helps SMEs improve their overall business efficiency and provides concise information with a faster response. Mobile enterprise application deployment in SMEs is also useful in case of office relocations, heritage building, and temporary locations.

Among the verticals, the Banking, Financial Services, and Insurance (BFSI), vertical is expected to hold the largest market share during the forecast period 2016 to 2021. Banks, insurances, and financial organizations use mobile enterprise apps to improve their employees productivity and boost connectivity with clients and customers.

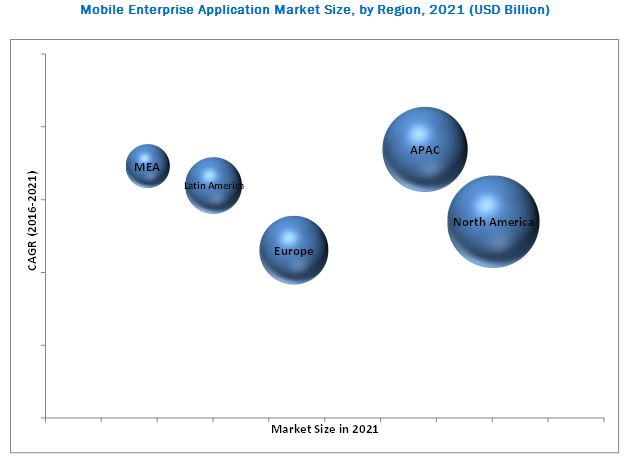

Asia-Pacific (APAC) is expected to grow at the highest rate in the mobile enterprise application market during the forecast period. This is because of large scale acceptance of mobile enterprise application services and solutions by enterprises. There are several factors driving the impressive growth in the APAC region, such as rapid economic developments, globalization & foreign direct investments, increasing penetration of smartphones, and internet adoptions in workforce.

However, the adoption of technology by ground level workforce across the globe and interoperability & complexity of the solution to implement in cross-platform operating systems would be the restraining factors for the market.

The major vendors in the mobile enterprise application market include AT&T (U.S.), IBM Corporation (U.S.), BlackBerry Limited (Canada), Tata Consultancy Services (India), Infosys Limited (India), SAP SE (Germany), Salesforce.com, Inc. (U.S.), Oracle Corporation (U.S.), Accenture (U.S.), Capgemini (France), HCL Technologies (India), and Deloitte (U.S.). These players have adopted various strategies, such as new product launches, partnerships, agreements, collaborations, mergers & acquisitions, and business expansions to cater to the needs of their customers. The report also includes key innovators in the market, such as MobileIron (U.S.), Soti (Canada), Inc., and Pegasystems (U.S.).

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 14)

1.1 Objectives of the Report

1.2 Market Definition

1.3 Market Scope

1.3.1 Markets Covered

1.3.2 Years Considered in the Report

1.4 Currency

1.5 Limitations

1.6 Stakeholders

2 Research Methodology (Page No. - 19)

2.1 Introduction

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

2.1.2.3 Breakdown of Primaries

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

2.3 Market Breakdown and Data Triangulation

2.4 Research Assumptions

2.4.1 Assumptions

3 Executive Summary (Page No. - 28)

4 Premium Insights (Page No. - 33)

4.1 Attractive Market Opportunities in the Mobile Enterprise Application Market

4.2 Market, By Region, 2016 vs 2021

4.3 Market, By Software, 20162021

4.4 Market, By Vertical and Region, 2016

4.5 Lifecycle Analysis, By Region, 20162021

5 Market Overview (Page No. - 37)

5.1 Introduction

5.2 Market Segmentation

5.2.1 By Software

5.2.2 By Type of App

5.2.3 By Operating System

5.2.4 By Organization Size

5.2.5 By Vertical

5.2.6 By Region

5.3 Market Dynamics

5.3.1 Drivers

5.3.1.1 Increase in Smartphone Penetration With Variant Operating Systems

5.3.1.2 Increased Productivity of Both Employees and Enterprises

5.3.1.3 Increasing Demand for Real-Time Information Capture

5.3.1.4 Increase in Mobile Workforce

5.3.2 Restraints

5.3.2.1 Difficulties in Adoption of Technology By Ground Level Workforce

5.3.2.2 Complexities in Interoperability and Cross-Platform Implementation

5.3.3 Opportunities

5.3.3.1 Advancements in Cloud Technologies to Serve Various Business Needs

5.3.3.2 Increase in New Offerings Such as M2m and Iot By Telcos

5.3.4 Challenges

5.3.4.1 Cost of Implementing the Solution

5.3.4.2 Security Constraints in Safeguarding Potential Information

6 Industry Trends (Page No. - 47)

6.1 Introduction

6.2 Value Chain Analysis

6.3 Strategic Benchmarking

7 Mobile Enterprise Application Market Analysis, By Software (Page No. - 50)

7.1 Introduction

7.2 Accounting and Finance

7.3 Enterprise Resource Planning

7.4 Communication and Collaboration

7.5 Customer Relationship Management

7.6 Mcommerce

7.7 Business Analytics

7.8 Mobile Learning

7.9 Supply Chain Management

7.10 Productivity Tools

7.11 Human Capital Management

7.12 Others

8 Market Analysis, By Type of App (Page No. - 62)

8.1 Introduction

8.2 Native App

8.3 Hybrid App

8.4 Web App

9 Mobile Enterprise Application Market Analysis, By Operating System (Page No. - 66)

9.1 Introduction

9.2 Android

9.3 Ios

9.4 Windows

9.5 Others

10 Market Analysis, By Organization Size (Page No. - 72)

10.1 Introduction

10.2 Small and Medium Enterprises

10.3 Large Enterprises

11 Mobile Enterprise Application Market Analysis, By Vertical (Page No. - 76)

11.1 Introduction

11.2 Banking, Financial Services, and Insurance

11.3 Government

11.4 Media and Entertainment

11.5 Transportation and Logistics

11.6 Retail

11.7 Healthcare and Life Sciences

11.8 Education

11.9 Manufacturing and Automotive

11.10 Energy and Utilities

11.11 Others

12 Geographic Analysis (Page No. - 87)

12.1 Introduction

12.2 North America

12.3 Europe

12.4 Asia-Pacific

12.5 Middle East and Africa

12.6 Latin America

13 Competitive Landscape (Page No. - 107)

13.1 Overview

13.2 Portfolio Comparison

13.3 Competitive Situation and Trends

13.3.1 Agreements, Partnerships, and Collaborations

13.3.2 New Product/Service Developments

13.3.3 Mergers and Acquisitions

14 Company Profiles (Page No. - 113)

(Overview, Products and Services, Financials, Strategy & Development)*

14.1 Introduction

14.2 AT&T, Inc.

14.3 Tata Consultancy Services Limited

14.4 Infosys Limited

14.5 IBM Corporation

14.6 Blackberry Limited

14.7 SAP SE

14.8 Salesforce.Com, Inc.

14.9 Capgemini

14.10 Oracle Corporation

14.11 Accenture

14.12 HCL Technologies Limited

14.13 Deloitte Touche Tohmatsu Limited

*Details on Overview, Products and Services, Financials, Strategy & Development Might Not Be Captured in Case of Unlisted Companies.

15 Key Innovator Profiles (Page No. - 145)

15.1 Pegasystems, Inc.

15.1.1 Business Overview

15.2 Soti, Inc.

15.2.1 Business Overview

15.3 Mobileiron, Inc.

15.3.1 Business Overview

16 Appendix (Page No. - 148)

16.1 Key Insights

16.2 Other Developments

16.3 Discussion Guide

16.4 Knowledge Store: Marketsandmarkets Subscription Portal

16.5 Introducing RT: Real-Time Market Intelligence

16.6 Available Customizations

16.7 Related Reports

16.8 Author Details

List of Tables (73 Tables)

Table 1 Global Mobile Enterprise Application Market Size and Growth Rate, 2014-2021 (USD Billion, Yoy %)

Table 2 Market Size, By Software, 20142021 (USD Billion)

Table 3 Accounting and Finance: Market Size, By Region, 20142021 (USD Million)

Table 4 Enterprise Resource Planning: Market Size, By Region, 20142021 (USD Billion)

Table 5 Communication and Collaboration: Market Size, By Region, 20142021 (USD Billion)

Table 6 Customer Relationship Management: Market Size, By Region, 20142021 (USD Billion)

Table 7 Mcommerce: Market Size, By Region, 20142021 (USD Million)

Table 8 Business Analytics: Market Size, By Region, 20142021 (USD Million)

Table 9 Mobile Learning: Market Size, By Region, 20142021 (USD Million)

Table 10 Supply Chain Management: Market Size, By Region, 20142021 (USD Million)

Table 11 Productivity Tools: Market Size, By Region, 20142021 (USD Million)

Table 12 Human Capital Management: Mobile Enterprise Application Market Size, By Region, 20142021 (USD Million)

Table 13 Others: Market Size, By Region, 20142021 (USD Million)

Table 14 Market Size, By Type of App, 20142021 (USD Billion)

Table 15 Native App: Market Size, By Region, 20142021 (USD Billion)

Table 16 Hybrid App: Market Size, By Region, 20142021 (USD Billion)

Table 17 Web App: Market Size, By Region, 20142021 (USD Billion)

Table 18 Market Size, By Operating System, 20142021 (USD Billion)

Table 19 Android: Market Size, By Region, 20142021 (USD Billion)

Table 20 Ios: Market Size, By Region, 20142021 (USD Billion)

Table 21 Windows: Market Size, By Region, 20142021 (USD Million)

Table 22 Others: Market Size, By Region, 20142021 (USD Million)

Table 23 Market Size, By Organization Size, 20142021 (USD Billion)

Table 24 Small and Medium Enterprises: Market Size, By Region, 20142021 (USD Billion)

Table 25 Large Enterprises: Mobile Enterprise Application Market Size, By Region, 20142021 (USD Billion)

Table 26 Market Size, By Vertical, 20142021 (USD Billion)

Table 27 Banking, Financial Services, and Insurance: Market Size, By Region, 20142021 (USD Billion)

Table 28 Government: Market Size, By Region, 20142021 (USD Billion)

Table 29 Media and Entertainment: Market Size, By Region, 20142021 (USD Million)

Table 30 Transporation and Logistics: Market Size, By Region, 20142021 (USD Million)

Table 31 Retail: Market Size, By Region, 20142021 (USD Million)

Table 32 Healthcare and Life Sciences: Market Size, By Region, 20142021 (USD Million)

Table 33 Education: Market Size, By Region, 20142021 (USD Million)

Table 34 Manufacturing and Automotive: Market Size, By Region, 20142021 (USD Million)

Table 35 Energy and Utilities: Market Size, By Region, 20142021 (USD Million)

Table 36 Others: Market Size, By Region, 20142021 (USD Million)

Table 37 Mobile Enterprise Application Market Size, By Region, 20142021 (USD Billion)

Table 38 North America: Market Size, By Country, 20142021 (USD Billion)

Table 39 North America: Market Size, By Software, 20142021(USD Million)

Table 40 North America: Market Size, By Operating System, 20142021 (USD Billion)

Table 41 North America: Market Size, By Organization Size, 20142021 (USD Billion)

Table 42 North America: Market Size, By Type of App, 20142021 (USD Billion)

Table 43 North America: Market Size, By Vertical, 20142021 (USD Billion)

Table 44 Europe: Market Size, By Country, 20142021 (USD Billion)

Table 45 Europe: Market Size, By Software, 20142021 (USD Million)

Table 46 Europe: Market Size, By Operating System, 20142021 (USD Million)

Table 47 Europe: Market Size, By Organization Size, 20142021 (USD Billion)

Table 48 Europe: Market Size, By Type of App, 20142021 (USD Billion)

Table 49 Europe: Mobile Enterprise Application Market Size, By Vertical, 20142021 (USD Million)

Table 50 Asia-Pacific: Market Size, By Country, 20142021 (USD Billion)

Table 51 Asia-Pacific: Market Size, By Software, 20142021 (USD Million)

Table 52 Asia-Pacific: Market Size, By Operating System, 20142021 (USD Billion)

Table 53 Asia-Pacific: Market Size, By Organization Size, 20142021 (USD Billion)

Table 54 Asia-Pacific: Market Size, By Type of App, 20142021 (USD Billion)

Table 55 Asia-Pacific: Market Size, By Vertical, 20142021 (USD Billion)

Table 56 Middle East and Africa: Market Size, By Country, 20142021 (USD Billion)

Table 57 Middle East and Africa: Market Size, By Software, 20142021 (USD Million)

Table 58 Middle East and Africa: Market Size, By Operating System, 20142021 (USD Billion)

Table 59 Middle East and Africa: Market Size, By Organization Size, 20142021 (USD Billion)

Table 60 Middle East and Africa: Market Size, By Type of App, 20142021 (USD Billion)

Table 61 Middle East and Africa: Mobile Enterprise Application Market Size, By Vertical, 20142021 (USD Million)

Table 62 Latin America: Market Size, By Country, 20142021 (USD Million)

Table 63 Latin America: Market Size, By Software, 20142021 (USD Million)

Table 64 Latin America: Market Size, By Operating System, 20142021 (USD Billion)

Table 65 Latin America: Market Size, By Organization Size, 20142021 (USD Billion)

Table 66 Latin America: Market Size, By Type of App, 20142021 (USD Billion)

Table 67 Latin America: Market Size, By Vertical, 20142021 (USD Million)

Table 68 Agreements, Partnerships, and Collaborations, 2016

Table 69 New Product/Service Developments, 2016

Table 70 Mergers and Acquisitions, 2016

Table 71 Agreements, Partnerships, and Collaborations, 2014-2016

Table 72 New Product Developments, 20142016

Table 73 Mergers and Acquisitions, 20152016

List of Figures (58 Figures)

Figure 1 Mobile Enterprise Application Market: Research Design

Figure 2 Market Size Estimation Methodology: Bottom-Up Approach

Figure 3 Market Size Estimation Methodology: Top-Down Approach

Figure 4 Market Breakdown and Data Triangulation

Figure 5 Market Size, By Software: Accounting and Finance is Expected to Grow at the Highest CAGR During the Forecast Period

Figure 6 Market Size, By Type of App: Hybrid App Segment is Expected to Grow at the Highest CAGR During the Forecast Period

Figure 7 Market Size, By Operating System: Android is Expected to Grow at the Highest CAGR During the Forecast Period

Figure 8 Mobile Enterprise Application Market Size, By Vertical Snapshot (2016 vs 2021)

Figure 9 North America is Estimated to Hold the Largest Market Share in 2016

Figure 10 Increasing Demand Among Organizations for Integrated Mobile Enterprise Application Suite is Driving the Overall Growth of the Market

Figure 11 Asia-Pacific is Expected to Witness the Highest Growth Rate During the Forecast Period

Figure 12 Enterprise Resource Planning is Expected to Have the Largest Size in the Market

Figure 13 North America is Expected to Hold the Largest Market Share in the Market in 2016

Figure 14 Mobile Enterprise Application Regional Lifecycle: Asia-Pacific Exhibits the Highest Growth Potential During the Forecast Period

Figure 15 Market: Market Investment Scenario

Figure 16 Market Segmentation: By Software

Figure 17 Market Segmentation: By Type of App

Figure 18 Market Segmentation: By Operating System

Figure 19 Market Segmentation: By Organization Size

Figure 20 Mobile Enterprise Application Market Segmentation: By Vertical

Figure 21 Market Segmentation: By Region

Figure 22 Market: Drivers, Restraints, Opportunities, and Challenges

Figure 23 Global Unique Mobile Subscriptions (Billion)

Figure 24 Market Share By Operating Systems

Figure 25 Market: Ecosystem and Value Chain

Figure 26 Companies Adopted Different Strategies to Gain Competitive Advantage

Figure 27 Enterprise Resource Planning Software Exhibits the Largest Market Size in the Market During the Forecast Period

Figure 28 Hybrid App Exhibits the Highest Growth Rate in the Market During the Forecast Period

Figure 29 Android Exhibits the Highest Growth Rate in the Market, 20162021

Figure 30 Small and Medium Enterprises Segment is Estimated to Have the Largest Market Size During the Forecast Period

Figure 31 Banking, Financial Services, and Insurance Exhibits the Fastest Growth Rate in the Mobile Enterprise Application Market, 20162021

Figure 32 Middle East and Africa is Expected to Exhibit the Highest Growth Rate in the Market

Figure 33 North America Market Snapshot

Figure 34 Asia-Pacific Mobile Enterprise Application Market Snapshot

Figure 35 Companies Adopted Partnership and Agreement as the Key Growth Strategy During the Period 20142016

Figure 36 Market: Portfolio Comparison

Figure 37 Market Evaluation Framework

Figure 38 Battle for Market Share: Partnership and Agreement has Been the Key Strategy for Company Growth

Figure 39 Geographic Revenue Mix of Top 5 Market Players

Figure 40 AT&T, Inc.: Company Snapshot

Figure 41 AT&T, Inc.: SWOT Analysis

Figure 42 Tata Consultancy Services Limited: Company Snapshot

Figure 43 Tata Consultancy Services Limityed: SWOT Analysis

Figure 44 Infosys Limited: Company Snapshot

Figure 45 Infosys Limited: SWOT Analysis

Figure 46 IBM Corporation: Company Snapshot

Figure 47 IBM Corporation: SWOT Analysis

Figure 48 Blackberry Limited: Company Snapshot

Figure 49 Blackberry Limited: SWOT Analysis

Figure 50 SAP SE: Company Snapshot

Figure 51 Salesforce.Com, Inc.: Company Snapshot

Figure 52 Capgemini: Company Snapshot

Figure 53 Oracle Corporation: Company Snapshot

Figure 54 Accenture: Company Snapshot

Figure 55 HCL Technologies Limited: Company Snapshot

Figure 56 Deloitte Touche Tohmatsu Limited: Company Snapshot

Figure 57 Pegasystems, Inc.: Company Snapshot

Figure 58 Mobileiron, Inc.: Company Snapshot

Growth opportunities and latent adjacency in Mobile Enterprise Application Market