Airborne Countermeasure Systems Market by Application (Jammers, Missile Defence, and Counter Countermeasure), Platform (Military Aircraft, Military Helicopters, and Unmanned systems), Product and Region (2021-2026)

Airborne Countermeasure Systems Market Size & Growth

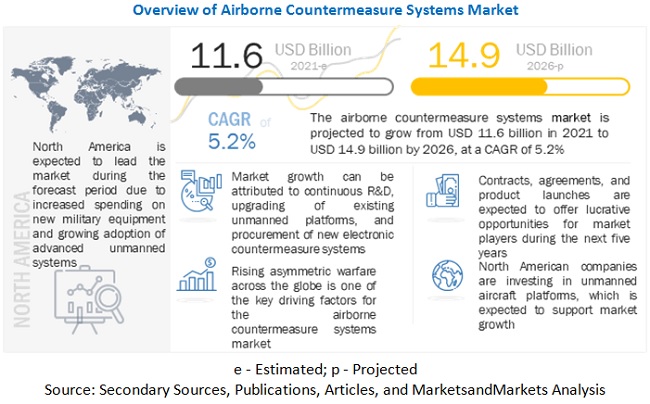

[302 Pages Report] The Global Airborne Countermeasure Systems Market Size was valued at USD 11.6 billion in 2021 and is estimated to reach USD 14.9 billion by 2026, growing at a CAGR of 5.2% during the forecast period. It is witnessing significant growth due to increasing new technologies and demand of going Airborne Countermeasure Systems. The North American region will dominate, due to the growing investments in Airborne Countermeasure Systems Industry.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 Impact on market

The COVID-19 impact has been analyzed for three scenarios: realistic, optimistic, and pessimistic. The realistic scenario has been considered for further calculations.

The Airborne Countermeasure Systems market includes major players such as Lockheed Martin Corporation (US), Israel Aerospace Industries Ltd. (Israel), Northrop Grumman Corporation (US), Saab AB (Sweden), L3Harris Technologies, Inc. (US), Leonardo SPA (Italy), BAE Systems (UK), Aselsan AS (Turkey), and Textron Systems (US). These players have spread their business across various countries includes North America, Europe, Asia Pacific, Middle East & Africa, and Latin America. COVID-19 has impacted their businesses as well.

R&D in airborne countermeasure systems are constantly evolving, considering the current scenario and the countries cutting down their defense budget in might be a hindrance to the growth of this technology The manufacturing activities have faced operational and running activities due to the import and export regulations. Currently, control of the COVID-19 outbreak is an international concern and has become a crucial challenge in many countries.

Airborne Countermeasure System Market Trends

Driver: Increased acquisition of unmanned warfare systems because to rising transnational and regional insecurity

The rising frequency of bilateral armed confrontations between nations is advancing at a rapid rate, necessitating a greater requirement for countries' defense forces to enhance their security measures. To meet the demands of battle, new weaponry and fighting systems are being created. With the development of digital battlefields, electronic warfare technology has been integrated into unmanned systems. These technologies have led to a shift in nations' purchase priorities to stay in sync with growing military demands.

For example, political instability and terrorism in Iraq and Syria in the Middle East have resulted in military confrontations since 2014, with numerous terrorist organizations increasingly employing high-tech weaponry. Countries in this area are boosting defense spending to incorporate modern systems to protect their borders from these weapons. Saudi Arabia, the UAE, and Qatar have boosted their investments in radar and air defense systems in this region. Saudi Arabia, for example, intends to purchase S-400 air defense systems from Russia in the future.

Over the period of 2015-2019, China and Pakistan conducted multiple incursions into India, resulting in hostilities between these countries. The Turkish government authorities announced the purchase of Russian S-400 air defense systems in October 2019. Rising conflicts in the South China Sea between China and its neighbors, including Vietnam, Indonesia, Taiwan, Malaysia, and the Philippines, have prompted these nations to raise their defense budgets. Because of the tensions between Russia and NATO, nations such as Romania, Poland, and Ukraine have increased their spending on air defense systems. Russia intends to upgrade and improve its airborne countermeasure capabilities as well. These initiatives for military capabilities upgrading will fuel the market for airborne countermeasure systems.

Restraints: Concerns over error possibilities in complex combat situations

With various governments adopting AI-powered systems for surveillance and automation, concerns are being raised, stating that human control over robots is necessary to ensure control and humanitarian protection. There is also concern among humanitarian organizations like Human Rights Watch regarding whether governments are secretly developing “Automated Killer Robots” to top the AI arms race. This compels governments to publicly declare their current capabilities and refrain from developing autonomous weapons and fully automated robots, as these will be incapable of meeting the standards of International Humanitarian Law.

Additionally, the possibility of errors is also high with AI systems. Since they make quick decisions, they may not be able to adapt to the inevitable complexities of war. As a result, these systems might not accurately distinguish between combatants and non-combatants or threats and system anomalies and ultimately be less accurate and precise than human operators. These problems could be magnified if systems are fielded before being adequately tested or if adversaries succeed in spoofing or hacking into them.

Opportunities: Enhanced system reliability and efficiency by adopting traveling wave tube-based solutions

Various countries are demanding mission-critical systems with maximum reliability. The introduction of Traveling-Wave Tube (TWT)-based solutions has resulted in improved efficiency of electronic countermeasure systems. TWT is a dedicated vacuum tube used in electronics to amplify radiofrequency. TWT-based solutions can provide the widest range of capabilities such as efficient broadband performance and high output power. However, the adoption of TWT-based solutions is negatively impacted by the increased use of GaN technology. Hence, TWT manufacturers are making efforts to increase the bandwidth and frequency of TWT-based solutions. The rise in defense funding programs for GaN devices, such as advanced active electronically scanned array (AESA) radar and next-generation jammer (NGJ) technology, is projected to drive the adoption of GaN technology, thereby acting as a threat to manufacturers of TWT-based solutions. Manufacturers of TWT are working on improvements in tube technology, which has led to the increased reliability, power output, frequency, and lifespan of these tubes. Thus, the integration of TWT-based solutions with electronic countermeasure systems to improve system reliability and efficiency is providing growth opportunities to developers of unmanned electronic countermeasure systems.

Challenges: High deployment costs

The increasing importance of unmanned electronic warfare in tactical and strategic roles in modern warfare environments has propelled the need for new, effective, and affordable electronic warfare systems. These systems use electromagnetic radiations to ensure secure transmission of data. Unmanned electronic warfare systems encompass multiple capabilities such as electronic attack, electronic protection, and electronic support. These systems are required to perform various essential functions in diverse threat environments. They must identify all emitters in an area of interest using SIGINT techniques to determine their geographic locations or ranges of mobility, characterize their signals, and determine the strategy of enemy conflict. Achieving the performance levels expected for the next generation unmanned electronic warfare systems becomes a formidable task due to the complexity of these systems. These systems require complex designs to serve in high-magnitude signal environments. One of the key challenges faced by manufacturers of unmanned electronic warfare systems is modifying and programming these systems. Advanced EW technologies are required to operate in a crowded electromagnetic (EM) environment, and a cost-effective open system approach will help achieve challenging design goals. The electronic warfare systems market is expected to be cost-dependent due to the requirement of heavy R&D investments, which serves as a challenge for manufacturers.

Airborne Countermeasure System Market Segments

Based on platform, the military aircraft segment is projected to grow at the highest CAGR during the forecast period.

The growth in the Airborne Countermeasure Systems market is expected to drive the growth of the three platforms proportionately. The requirement of military aircraft in battlefield for surveillance and threat detection capabilities is expected to drive the market during the forecast period.

Based on product, the Self-Protection EW Suite segment is projected to grow at the highest CAGR during the forecast period.

Based on product, Self-Protection EW Suite segment is projected to grow at the highest CAGR during the forecast period. The requirement of electronic suites helps in protecting the aircraft by shielding and reducing human loss and increasing capabilities, and investments in R&D towards these systems are helping the growth of the market for Airborne Countermeasure Systems.

Based on application, the Counter Countermeasure Systems equipment segment is projected to grow at the highest CAGR during the forecast period

Growing demand for counter countermeasure systems due to their high demand for antijamming and deception techniques in countermeasure applications are projected to increase the growth of the Airborne Countermeasure Systems market.

To know about the assumptions considered for the study, download the pdf brochure

Airborne Countermeasure System Market Regions

The North America region is estimated to lead the Airborne Countermeasure Systems market in the forecast period

The North American region is estimated to lead the Airborne Countermeasure Systems market in the forecast period. The growth of the North America Airborne Countermeasure Systems market is primarily driven by increasing focus on increasing investments in Airborne Countermeasure Systems technologies by countries in this region. In addition, factors including increasing geopolitical tensions and increased defense-related expenditure are expected to drive the demand for Airborne Countermeasure Systems market in the region.

Airborne Countermeasure System Companies: Top Key Market Players

The Airborne Countermeasure System Companies are dominated by globally established players such as:

- Lockheed Martin Corporation (US)

- Israel Aerospace Industries Ltd. (Israel)

- Bae Systems Plc. (UK)

- L3Harris Technologies, Inc. (US)

- Raytheon Technologies Corporation (US)

Scope of the Report

|

Report Metric |

Details |

|

Estimated Market Size |

USD 11.6 billion in 2021 |

|

Projected Market Size |

USD 14.9 billion by 2026 |

|

Growth Rate (CAGR) |

5.2% |

|

Market size available for years |

2018–2026 |

|

Base year considered |

2020 |

|

Forecast period |

2021-2026 |

|

Forecast units |

Value (USD Million) |

|

Segments covered |

By Platform, By Product, By Operation, By Capability |

|

Geographies covered |

North America, Europe, Asia Pacific, Middle East & Africa and Latin America |

|

Companies covered |

Lockheed Martin Corporation (US), Northrop Grumman Corporation (US), Thales Group (France), Israel Aerospace Industries Ltd.(Israel), Raytheon Technologies Corporation (US), BAE Systems (UK), Saab AB (Sweden), Elbit Systems (Israel) and L3Harris Technologies (US). and others. Total 25 Market Players |

The study categorizes the Airborne Countermeasure Systems market based on platform, capability, product, and operation, along with region.

By Platform

- Military Aircraft

- Military Helicopters

- Unmanned Systems

By Application

- Jamming

- Missile Defence

- Counter Countermeasure

By Product

- Jammers

- Self-protection EW Suites

- Directed Energy Weapons

- Infrared Countermeasures

- Identification Friend or Foe (IFF) Systems

- Missile Approach Warning Systems

- Laser Warning Systems

- Radar Warning Receivers

- Electronic Counter Countermeasure Systems

By Region

- North America

- Europe

- Asia Pacific

- Middle East & Africa

- Latin America

Recent Developments

- In July 2021, BAE Systems received a contract from the US Army to deliver the next-generation 2-Color Advanced Warning System (2CAWS). The system provides aircrews with advanced threat detection capabilities, improving survivability and mission effectiveness in contested environments.

- In June 2021, L3Harris Technologies’ ESI-500 Electronic Standby Instrument was selected for standard production on the Bristell B23 aircraft made by Czech Republic-headquartered BRM AERO, which depicts 3D terrain and obstacles to reflect topography and hazards with impact alerts shaded to increase situational awareness.

- In June 2021, IAI signed a contract with an undisclosed Asian country to provide support services for the Heron UAV

- In April 2021, Boeing Defence Australia (BDA) and Northrop Grumman Australia partnered to develop a solution for the Joint Interface Control System to integrate data coming in from multiple and independent secure networks to create a single operational view for improved situational awareness.

Frequently Asked Questions (FAQ):

Which are the major systems considered in this study and which segments are projected to have a promising market share in future?

The Airborne Countermeasure Systems include jammers, laser warning systems, missile warning systems, and radar warning systems which are projected to fuel the growth of the market

What are some of the drivers fuelling the growth of Airborne Countermeasure Systems market?

Global Airborne Countermeasure Systems market is characterized by following drivers:

Increasing need for missile detection systems

Advancements in missile technology have led to the development of intercontinental ballistic missiles capable of reaching a speed of Mach 5.0, underlining the need for the upgrade of missile detection and defense systems. The BrahMos-II hypersonic cruise missile, currently under joint development between Russia and India, is estimated to reach a speed of Mach 7.0. Other countries are also expected to upgrade their missile arsenal to enable similar capabilities. Most missile defense systems are ground or naval-based and use missiles to counter incoming threats. Radar and airborne ISR systems should ideally be able to track the location of the incoming missile in 3D to accurately judge the distance, range, and elevation of threats. The need for powerful airborne countermeasure systems that can reliably track such missiles approaching at hypersonic speeds is expected to boost the demand for airborne countermeasure systems for missile defense applications.

For instance, in July 2021, the US Army awarded BAE Systems a USD 62 million contract for its 2-Color Advanced Warning System (2CAWS), a next-generation missile warning system for aircraft protection.

Upgrading existing fighter jets and procurement of advanced fighter and transport aircraft

The upgrade of existing fighter jets is one of the major factors driving the global adoption of decoy flares such as in a recent Royal Thai Air Force white paper, the organization mentioned various plans such as the upgrade of the Saab Early Warning System, replacement of F-16 fighter jets and L-39s trainers, and procurement of various transport, helicopters, and unmanned aircraft. Similarly, in July 2020, the Defense Acquisition Council (DAC) approved defense deals worth USD 523.67 billion, including the purchase of 21 MiG-29 fighter jets for the Indian Air Force (IAF), the upgrade of 59 existing MiG-29 jets from the IAF inventory, and the purchase of 12 Su-30MKI aircraft from Russia. Such strategies and transactions by major market competitors are expected to propel market expansion at a rapid pace in the coming years.

I am interested in understanding the research methodology on how you arrived at the market size and segmental splits before making a purchase decision. Can you provide me with an explanation on the same?

Yes, a detailed explanation of research methodology can be provided over a scheduled call, it will also enable us to explain all your queries in detail. For a brief overview and knowledge: Multiple approaches have been adopted to understand the holistic view of this market including:

- Top-down approach (Based on the global market)

- Primary interviews with industry experts

- Data triangulation

What kind of information is provided in the competitive landscape section?

For the list of below-mentioned players, company profiles provide insights such as business overview covering information on the company’s business segments, financials, geographic presence and revenue mix and business revenue mix. The company profiles section also provides information on product offerings, key developments associated with the company, SWOT analysis and MnM view to elaborate analyst view on the company. Some of the key players in the market are Lockheed Martin Corporation (US), Northrop Grumman Corporation (US), Israel Aerospace Industries Ltd. (Israel), Raytheon Technologies Corporation (US), Thales Group (France), L3Harris Technologies, Inc. (US), BAE Systems (UK), and Saab Ab (Sweden). .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 34)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 STUDY SCOPE

1.3.1 AIRBORNE COUNTERMEASURE SYSTEM MARKET SEGMENTATION

1.3.2 REGIONAL SCOPE

1.3.3 YEARS CONSIDERED FOR THE STUDY

1.4 CURRENCY

1.4.1 USD EXCHANGE RATES

1.5 INCLUSIONS AND EXCLUSIONS

1.6 LIMITATIONS

1.7 MARKET STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 39)

2.1 RESEARCH DATA

FIGURE 1 REPORT PROCESS FLOW

FIGURE 2 AIRBORNE COUNTERMEASURE SYSTEM MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Key data from primary sources

2.1.2.2 Breakdown of primaries

2.1.2.3 Key insights from primary respondents

2.2 FACTOR ANALYSIS

2.2.1 INTRODUCTION

2.2.2 DEMAND-SIDE INDICATORS

2.2.2.1 Increased military spending of emerging countries

2.2.2.2 Growth of military expenditure on sensor-based autonomous defense systems

FIGURE 3 MILITARY EXPENDITURE, 2019–2020 (USD BILLION)

2.2.2.3 Rising incidences of regional disputes, terrorism, and political conflicts

2.2.3 SUPPLY-SIDE INDICATORS

2.2.3.1 Major US defense contractors’ financial trends

2.3 MARKET SIZE ESTIMATION

2.3.1 MARKET DEFINITION & SCOPE

2.4 RESEARCH APPROACH & METHODOLOGY

2.4.1 BOTTOM-UP APPROACH

FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

2.4.2 TOP-DOWN APPROACH

FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

2.4.2.1 COVID-19 impact on airborne countermeasure system market

2.5 DATA TRIANGULATION

FIGURE 6 DATA TRIANGULATION

2.6 ASSUMPTIONS

2.7 RISK ANALYSIS

3 EXECUTIVE SUMMARY (Page No. - 50)

FIGURE 7 MILITARY AIRCRAFT SEGMENT TO EXHIBIT HIGHEST CAGR DURING FORECAST PERIOD

FIGURE 8 NORTH AMERICA ESTIMATED TO LEAD AIRBORNE COUNTERMEASURE MARKET IN 2021

4 PREMIUM INSIGHTS (Page No. - 53)

4.1 ATTRACTIVE OPPORTUNITIES IN AIRBORNE COUNTERMEASURE SYSTEM MARKET

FIGURE 9 INCREASING ADOPTION OF COUNTER COUNTERMEASURE SYSTEMS TO DRIVE MARKET GROWTH

4.2 AIRBORNE COUNTERMEASURE SYSTEM MARKET, BY PLATFORM

FIGURE 10 MILITARY AIRCRAFT SEGMENT ESTIMATED TO ACCOUNT FOR LARGEST SHARE OF MARKET IN 2021

4.3 AIRBORNE COUNTERMEASURE SYSTEM MARKET, BY APPLICATION

FIGURE 11 COUNTER COUNTERMEASURE SEGMENT TO LEAD THE MARKET DURING FORECAST PERIOD

4.4 AIRBORNE COUNTERMEASURE SYSTEM MARKET, BY PRODUCT

FIGURE 12 SELF-PROTECTION EW SUITES SEGMENT ESTIMATED TO LEAD THE MARKET DURING FORECAST PERIOD

4.5 AIRBORNE COUNTERMEASURE SYSTEM MARKET, BY COUNTRY

FIGURE 13 BRAZIL TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

5 MARKET OVERVIEW (Page No. - 56)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 14 AIRBORNE COUNTERMEASURE SYSTEM MARKET: DRIVERS, OPPORTUNITIES, AND CHALLENGES

5.2.1 DRIVERS

5.2.1.1 Increased acquisition of unmanned systems because of rising transnational and regional insecurity

5.2.1.2 Upgrading existing fighter jets and procurement of advanced fighter and transport aircraft

5.2.1.3 Increasing need for missile detection systems

5.2.1.4 Increasing demand for military helicopters

TABLE 1 INCREASING MILITARY EXPENDITURE BY EMERGING ECONOMIES, 2014-2020 (USD BILLION)

5.2.1.5 Electronic warfare capabilities deployed on unmanned systems

5.2.1.6 Growing popularity of modern warfare methods

5.2.1.7 Technological advancements in airborne warfare systems

5.2.2 RESTRAINTS

5.2.2.1 Concerns over possibility of errors in complex combat situations

5.2.2.2 Regulatory constraints in transfer of technology

5.2.2.3 Lack of accuracy and operational complexities in airborne countermeasure

5.2.2.4 Lack of standards and protocols for use of AI in military applications

5.2.2.5 Lack of infrastructure for advanced communication technologies

5.2.3 OPPORTUNITIES

5.2.3.1 Enhanced system reliability and efficiency of TWT-based solutions

5.2.4 CHALLENGES

5.2.4.1 High cost of deployment

5.2.4.2 Inability to address multiple/diverse threats

5.2.4.3 Sensitive nature of military data

5.2.4.4 Minimizing weight and size of devices while maintaining advanced features

5.2.4.5 Complexity in designs

5.3 RANGES AND SCENARIOS

FIGURE 15 IMPACT OF COVID-19 ON THE MARKET: GLOBAL SCENARIOS

5.4 IMPACT OF COVID-19 ON AIRBORNE COUNTERMEASURE SYSTEM MARKET

FIGURE 16 IMPACT OF COVID-19 ON AIRBORNE COUNTERMEASURE SYSTEM MARKET

5.4.1 DEMAND-SIDE IMPACT

5.4.1.1 Key developments from January 2020 to June 2021

TABLE 2 KEY DEVELOPMENTS IN THE AIRBORNE COUNTERMEASURE SYSTEM MARKET 2020-2021

5.4.2 SUPPLY-SIDE IMPACT

5.4.2.1 Key developments from January 2020 to March 2021

TABLE 3 KEY DEVELOPMENTS IN THE AIRBORNE COUNTERMEASURE SYSTEM MARKET, JANUARY 2020 TO DECEMBER 2020

5.5 TRENDS/DISRUPTIONS IMPACTING CUSTOMER'S BUSINESS

5.5.1 REVENUE SHIFT AND NEW REVENUE POCKETS FOR AIRBORNE COUNTERMEASURE SYSTEMS MANUFACTURERS

FIGURE 17 REVENUE SHIFT IN AIRBORNE COUNTERMEASURE SYSTEM MARKET

5.6 AVERAGE SELLING PRICE ANALYSIS, 2020

5.7 AIRBORNE COUNTERMEASURE SYSTEM MARKET ECOSYSTEM

5.7.1 PROMINENT COMPANIES

5.7.2 PRIVATE AND SMALL ENTERPRISES

5.7.3 END USERS

FIGURE 18 AIRBORNE COUNTERMEASURE SYSTEM MARKET ECOSYSTEM MAP

TABLE 4 AIRBORNE COUNTERMEASURE SYSTEM MARKET ECOSYSTEM

5.8 TECHNOLOGY ANALYSIS

5.8.1 DUAL COLOR MISSILE APPROACH WARNING SYSTEM (DCMAWS) FOR FIGHTER AIRCRAFT

5.8.2 NEXT-GENERATION JAMMERS (NGJ)

5.8.3 AI ACROSS BATTLEFIELD

5.9 USE CASE ANALYSIS

5.9.1 USE CASE: UAS SENSOR

5.9.2 USE CASE: UAV RADARS

5.9.3 USE CASE: SMART SENSOR NETWORK TO REDIRECT MISSILE

5.9.4 USE CASE: COMBAT AIR PATROL AND AIRBORNE EARLY WARNING PLATFORM

5.9.5 USE CASE: ACTIVE AIR DEFENSE SYSTEM

5.10 VALUE CHAIN ANALYSIS OF AIRBORNE COUNTERMEASURE SYSTEM MARKET

FIGURE 19 VALUE CHAIN ANALYSIS

5.11 PORTER’S FIVE FORCES ANALYSIS

TABLE 5 KEY AIRBORNE COUNTERMEASURE SYSTEM MARKET: PORTER’S FIVE FORCE ANALYSIS

FIGURE 20 KEY AIRBORNE COUNTERMEASURE SYSTEM MARKET: PORTER’S FIVE FORCE ANALYSIS

5.11.1 THREAT OF NEW ENTRANTS

5.11.2 THREAT OF SUBSTITUTES

5.11.3 BARGAINING POWER OF SUPPLIERS

5.11.4 BARGAINING POWER OF BUYERS

5.11.5 DEGREE OF COMPETITION

5.12 TARIFF AND REGULATORY LANDSCAPE

5.12.1 NORTH AMERICA

5.12.2 EUROPE

5.12.3 ASIA PACIFIC

5.12.4 MIDDLE EAST

5.13 TRADE ANALYSIS

TABLE 6 NAVIGATIONAL INSTRUMENTS: COUNTRY-WISE IMPORTS, 2019-2020 (USD THOUSAND)

TABLE 7 NAVIGATIONAL INSTRUMENTS: COUNTRY-WISE EXPORTS, 2019-2020 (USD THOUSAND)

TABLE 8 COUNTRY-WISE EXPORTS, 2019-2020 (USD THOUSAND)

TABLE 9 COUNTRY-WISE IMPORTS, 2019-2020 (USD THOUSAND)

6 INDUSTRY TRENDS (Page No. - 89)

6.1 INTRODUCTION

6.2 TECHNOLOGY TRENDS

6.2.1 SOFTWARE-DEFINED AIRBORNE COUNTERMEASURE SYSTEM

6.2.2 INVERSE SYNTHETIC APERTURE RADAR (ISAR)

6.2.3 LIDAR TECHNOLOGY

6.2.4 ADAPTIVE RADAR COUNTERMEASURES (ARC) TECHNOLOGY

6.2.5 NEXT-GENERATION SENSOR SYSTEMS

6.2.6 ELECTRONIC COUNTER COUNTERMEASURE SYSTEMS

6.2.6.1 ECM detection and radiation homing weapons

6.2.6.2 Frequency hopping spread-spectrum (FHSS)

6.2.6.3 Pulse compression

6.3 SUPPLY CHAIN ANALYSIS

FIGURE 21 SUPPLY CHAIN ANALYSIS

6.4 IMPACT OF MEGATRENDS

6.4.1 AI AND COGNITIVE APPLICATIONS

6.4.2 MACHINE LEARNING

6.4.3 DEEP LEARNING

6.4.4 BIG DATA

6.5 INNOVATIONS AND PATENT REGISTRATIONS

TABLE 10 INNOVATION & PATENT REGISTRATIONS (2018-2021)

7 AIRBORNE COUNTERMEASURE SYSTEM MARKET, BY PRODUCT (Page No. - 98)

7.1 INTRODUCTION

FIGURE 22 SELF-PROTECTION EW SUITE PROJECTED TO LEAD AIRBORNE COUNTERMEASURE SYSTEM MARKET DURING FORECAST PERIOD

TABLE 11 AIRBORNE COUNTERMEASURE SYSTEM MARKET, BY PRODUCT, 2018–2026 (USD MILLION)

7.2 JAMMERS

7.2.1 INCREASING USE OF JAMMERS IN INTERFERING WITH ENEMY RADIOFREQUENCY

TABLE 12 JAMMERS: AIRBORNE COUNTERMEASURE SYSTEM MARKET, BY TYPE, 2018–2026 (USD MILLION)

7.2.2 RADAR JAMMERS

7.2.2.1 Emission of radiofrequency waves and false waves to distract enemies

TABLE 13 RADAR JAMMERS: AIRBORNE COUNTERMEASURE SYSTEM MARKET, BY TYPE, 2018–2026 (USD MILLION)

7.2.2.2 Electronic jammers

7.2.2.2.1 Increased adoption of electronic warfare technologies and integrating with jamming systems

TABLE 14 ELECTRONIC JAMMERS: AIRBORNE COUNTERMEASURE SYSTEM MARKET, BY TYPE, 2018–2026 (USD MILLION)

7.2.2.2.2 Barrage jammers

7.2.2.2.3 Sweep jammers

7.2.2.2.4 Spot jammers

7.2.2.2.5 Pulse jammers

7.2.2.2.6 Digital radiofrequency memory (DRFM) jammers

7.2.2.3 Mechanical jammers

7.2.2.3.1 Protecting the aircraft from emerging missile threats through decoy systems

TABLE 15 MECHANICAL JAMMERS: AIRBORNE COUNTERMEASURE SYSTEM MARKET, BY TYPE, 2018–2026 (USD MILLION)

7.2.2.3.2 Corner reflectors

7.2.2.3.3 Decoys

TABLE 16 DECOYS: AIRBORNE COUNTERMEASURE SYSTEM MARKET, BY TYPE, 2018–2026 (USD MILLION)

7.2.2.3.3.1 Towed decoys

7.2.2.3.3.2 Active decoys

7.2.2.3.3.3 Drone decoys

7.2.2.3.3.4 Flare dispensers

7.2.2.3.3.5 Chaff dispensers

7.2.3 COMMUNICATION JAMMERS

7.2.3.1 Use of electromagnetic energy in preventing radio communications

7.2.4 REMOTE-CONTROLLED IMPROVISED EXPLOSIVE DEVICE (RCIED) JAMMERS

7.2.4.1 Countering wireless command IEDs through jamming to protect civilians and military personnel

7.3 SELF-PROTECTION EW SUITE

7.3.1 INCREASING PERFORMANCE OF ELECTRONIC SYSTEMS INFLUENCED BY ELECTRONIC COUNTERMEASURE SYSTEMS

7.4 INFRARED COUNTERMEASURE SYSTEMS

7.4.1 PROTECTION OF AIRCRAFT FROM HEAT-SEEKING GROUND TO AIR MISSILES

7.4.2 DIRECTIONAL INFRARED COUNTERMEASURES (DIRCM)

7.4.2.1 Increasing adoption of optronic countermeasure

7.4.3 COMMON INFRARED COUNTERMEASURES (CIRCM)

7.4.3.1 Employing both threat tracking and defensive measure capabilities against missiles

7.5 IDENTIFICATION FRIEND OR FOE (IFF) SYSTEMS

7.5.1 PREVENTING MILITARY FRIENDLY FIRE INCIDENTS AND AIDING IN DETECTING POTENTIAL ADVERSARY INCURSIONS

7.6 MISSILE APPROACH WARNING SYSTEMS (MWS)

7.6.1 ADOPTION OF ADVANCED ELECTRONICS AIDING IN THREAT DETECTION AND TRACKING CAPABILITIES

7.6.2 IR MISSILE WARNING SYSTEMS

7.6.2.1 Increasing use of IR sensors in missile warning systems

7.6.3 PULSE-DOPPLER MISSILE WARNING SYSTEMS

7.6.3.1 Identification of approaching missiles

7.6.4 ULTRAVIOLET MISSILE WARNING SYSTEMS

7.6.4.1 High probability of warning in high clutter background environments.

7.7 LASER WARNING SYSTEMS (LWS)

7.7.1 DETECTION OF THREATS AGAINST LASER-GUIDED MISSILES

7.8 RADAR WARNING RECEIVERS (RWR)

7.8.1 ALERTING PILOTS REGARDING HOSTILE RADAR ACTIVITY

TABLE 17 TYPES OF RADAR WARNING RECEIVERS IN SERVICE ACROSS COUNTRIES

7.9 ELECTRONIC COUNTER COUNTERMEASURE SYSTEMS

7.9.1 ADOPTION OF ANTI-JAMMING TECHNIQUES TO COUNTER THE COUNTERMEASURES

8 AIRBORNE COUNTERMEASURE SYSTEM MARKET, BY PLATFORM (Page No. - 110)

8.1 INTRODUCTION

FIGURE 23 AIRBORNE COUNTERMEASURE SYSTEM MARKET, BY PLATFORM, 2021–2026 (USD MILLION)

TABLE 18 AIRBORNE COUNTERMEASURE SYSTEM MARKET, BY PLATFORM, 2018–2026 (USD MILLION)

8.2 MILITARY AIRCRAFT

TABLE 19 MILITARY AIRCRAFT: AIRBORNE COUNTERMEASURE SYSTEM MARKET, BY TYPE, 2018–2026 (USD MILLION)

TABLE 20 MILITARY AIRCRAFT: AIRBORNE COUNTERMEASURE SYSTEM MARKET, BY REGION, 2018–2026 (USD MILLION)

8.2.1 FIGHTER AIRCRAFT

8.2.1.1 Fighter aircraft use various countermeasure systems like radar to navigate, acquire targets, and engage them

8.2.2 TRANSPORT AIRCRAFT

8.2.2.1 Transport aircraft are fitted with modern countermeasure systems to enhance situational awareness

8.2.3 TRAINER AIRCRAFT

8.2.3.1 Trainer aircraft are fitted with missile warning systems to offer student pilots hands-on experience

8.2.4 SPECIAL MISSION AIRCRAFT

8.2.4.1 Increasing need to detect cross-border infiltrations to drive demand

8.3 MILITARY HELICOPTERS

8.3.1 MILITARY HELICOPTERS LOCATE AND TRACK FRIENDLY & ENEMY FORCES BY CARRYING OUT AIR-TO-AIR & AIR-TO-GROUND SURVEILLANCE

TABLE 21 MILITARY HELICOPTERS: AIRBORNE COUNTERMEASURE SYSTEM MARKET, BY REGION, 2018–2026 (USD MILLION)

8.4 UNMANNED SYSTEMS

TABLE 22 UNMANNED SYSTEMS: AIRBORNE COUNTERMEASURE SYSTEM MARKET, BY TYPE, 2018–2026 (USD MILLION)

TABLE 23 UNMANNED SYSTEMS: AIRBORNE COUNTERMEASURE SYSTEM MARKET, BY REGION, 2018–2026 (USD MILLION)

8.4.1 SMALL UAVS

8.4.1.1 Small UAVs offer anti-jamming capabilities in areas that may be hardly approachable by humans

8.4.2 TACTICAL UAVS

8.4.2.1 Technological advancements in unmanned battlefield surveillance systems to drive demand

8.4.3 STRATEGIC UAVS

8.4.3.1 Strategic UAVs are versatile as they offer mine detection and combat capabilities

TABLE 24 STRATEGIC UAVS: AIRBORNE COUNTERMEASURE SYSTEM MARKET, BY TYPE, 2018–2026 (USD MILLION)

8.4.3.2 Medium-altitude long-endurance (MALE) UAVs

8.4.3.3 High-altitude long-endurance (HALE) UAVs

8.4.4 SPECIAL PURPOSE UAVS

8.4.4.1 Special purpose UAVs perform multiple missions like reconnaissance, operations, and battle damage assessment

8.4.5 AEROSTATS

8.4.5.1 Need for surveillance to monitor border disputes and drug trafficking to drive demand

9 AIRBORNE COUNTERMEASURE SYSTEM MARKET, BY APPLICATION (Page No. - 119)

9.1 INTRODUCTION

TABLE 25 AIRBORNE COUNTERMEASURE SYSTEM MARKET, BY APPLICATION, BY REGION, 2018–2026 (USD MILLION)

TABLE 26 APPLICATION: AIRBORNE COUNTERMEASURE SYSTEM MARKET, 2018–2026 (USD MILLION)

FIGURE 24 COUNTER COUNTERMEASURE SYSTEM PROJECTED TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

9.2 JAMMING

9.2.1 INCREASED ADOPTION OF JAMMERS IN CONFOUNDING ENEMY RADAR AND COMMUNICATION SYSTEMS

TABLE 27 JAMMING: AIRBORNE COUNTERMEASURE SYSTEM MARKET, BY REGION, 2018–2026 (USD MILLION)

9.3 MISSILE DEFENSE

9.3.1 THREAT DETECTION AGAINST MISSILE SYSTEMS

TABLE 28 MISSILE DEFENSE: AIRBORNE COUNTERMEASURE SYSTEM MARKET, BY REGION, 2018–2026 (USD MILLION)

9.4 COUNTER COUNTERMEASURE

9.4.1 ELIMINATING EFFECTS OF ELECTRONIC COUNTERMEASURES

TABLE 29 COUNTER COUNTERMEASURE: AIRBORNE COUNTERMEASURE SYSTEM MARKET, BY REGION, 2018–2026 (USD MILLION)

10 REGIONAL ANALYSIS (Page No. - 124)

10.1 INTRODUCTION

FIGURE 25 AIRBORNE COUNTERMEASURE SYSTEM MARKET IN NORTH AMERICA PROJECTED TO GROW AT HIGHEST CAGR

TABLE 30 AIRBORNE COUNTERMEASURE SYSTEM MARKET, BY REGION, 2018–2026 (USD MILLION)

TABLE 31 AIRBORNE COUNTERMEASURE SYSTEM MARKET, BY PLATFORM, 2018–2026 (USD MILLION)

TABLE 32 AIRBORNE COUNTERMEASURE SYSTEM MARKET, BY PRODUCT, 2018–2026 (USD MILLION)

TABLE 33 AIRBORNE COUNTERMEASURE SYSTEM MARKET, BY PRODUCT, BY JAMMERS 2018–2026 (USD MILLION)

TABLE 34 AIRBORNE COUNTERMEASURE SYSTEM MARKET, BY APPLICATION, 2018–2026 (USD MILLION)

10.2 NORTH AMERICA

10.2.1 COVID-19 IMPACT ON NORTH AMERICA

10.2.2 PESTLE ANALYSIS: NORTH AMERICA

FIGURE 26 NORTH AMERICA: AIRBORNE COUNTERMEASURE SYSTEM MARKET SNAPSHOT

TABLE 35 NORTH AMERICA: AIRBORNE COUNTERMEASURE SYSTEM MARKET, BY COUNTRY, 2018–2026 (USD MILLION)

TABLE 36 NORTH AMERICA: AIRBORNE COUNTERMEASURE SYSTEM MARKET, BY PLATFORM, 2018–2026 (USD MILLION)

TABLE 37 NORTH AMERICA: AIRBORNE COUNTERMEASURE SYSTEM MARKET, BY PRODUCT, 2018–2026 (USD MILLION)

TABLE 38 NORTH AMERICA: AIRBORNE COUNTERMEASURE SYSTEM MARKET, BY PRODUCT, BY JAMMERS 2018–2026 (USD MILLION)

TABLE 39 NORTH AMERICA: AIRBORNE COUNTERMEASURE SYSTEM MARKET, BY APPLICATION, 2018–2026 (USD MILLION)

10.2.3 US

10.2.3.1 Development programs related to unmanned systems to drive the market

FIGURE 27 US: MILITARY SPENDING, 2010–2020 (USD BILLION)

TABLE 40 US: AIRBORNE COUNTERMEASURE SYSTEM MARKET, BY PLATFORM, 2018–2026 (USD MILLION)

TABLE 41 US: AIRBORNE COUNTERMEASURE SYSTEM MARKET, BY PRODUCT, 2018–2026 (USD MILLION)

TABLE 42 US: AIRBORNE COUNTERMEASURE SYSTEM MARKET, BY PRODUCT, BY JAMMERS 2018–2026 (USD MILLION)

TABLE 43 US: AIRBORNE COUNTERMEASURE SYSTEM MARKET, BY APPLICATION, 2018–2026 (USD MILLION)

10.2.4 CANADA

10.2.4.1 Increasing R&D investments to drive the market

FIGURE 28 CANADA: MILITARY SPENDING, 2010–2020 (USD BILLION)

TABLE 44 CANADA: AIRBORNE COUNTERMEASURE SYSTEM MARKET, BY PLATFORM, 2018–2026 (USD MILLION)

TABLE 45 CANADA: AIRBORNE COUNTERMEASURE SYSTEM MARKET, BY PRODUCT, 2018–2026 (USD MILLION)

TABLE 46 CANADA: AIRBORNE COUNTERMEASURE SYSTEM MARKET, BY PRODUCT, BY JAMMERS 2018–2026 (USD MILLION)

TABLE 47 CANADA: AIRBORNE COUNTERMEASURE SYSTEM MARKET, BY APPLICATION, 2018–2026 (USD MILLION)

10.3 EUROPE

10.3.1 COVID-19 IMPACT ON EUROPE

10.3.2 PESTLE ANALYSIS: EUROPE

FIGURE 29 EUROPE: MARKET SNAPSHOT

TABLE 48 EUROPE: MARKET, BY COUNTRY, 2018–2026 (USD MILLION)

TABLE 49 EUROPE: MARKET, BY PLATFORM, 2018–2026 (USD MILLION)

TABLE 50 EUROPE: MARKET, BY PRODUCT, 2018–2026 (USD MILLION)

TABLE 51 EUROPE: MARKET, BY PRODUCT, BY JAMMERS 2018–2026 (USD MILLION)

TABLE 52 EUROPE: MARKET, BY APPLICATION, 2018–2026 (USD MILLION)

10.3.3 UK

10.3.3.1 Upgrading existing fleets expected to drive the market

FIGURE 30 UK: MILITARY SPENDING, 2010–2020 (USD BILLION)

TABLE 53 UK: MARKET, BY PLATFORM, 2018–2026 (USD MILLION)

TABLE 54 UK: MARKET, BY PRODUCT, 2018–2026 (USD MILLION)

TABLE 55 UK: MARKET, BY PRODUCT, BY JAMMERS 2018–2026 (USD MILLION)

TABLE 56 UK: MARKET, BY APPLICATION, 2018–2026 (USD MILLION)

10.3.4 FRANCE

10.3.4.1 Technological advancements in UAV platforms to drive the market

FIGURE 31 FRANCE: MILITARY SPENDING, 2010–2020 (USD BILLION)

TABLE 57 FRANCE: MARKET, BY PLATFORM, 2018–2026 (USD MILLION)

TABLE 58 FRANCE: MARKET, BY PRODUCT, 2018–2026 (USD MILLION)

TABLE 59 FRANCE: MARKET, BY PRODUCT, BY JAMMERS 2018–2026 (USD MILLION)

TABLE 60 FRANCE: MARKET, BY APPLICATION, 2018–2026 (USD MILLION)

10.3.5 GERMANY

10.3.5.1 Integration of airborne platforms with advanced countermeasure system to drive the market

FIGURE 32 GERMANY: MILITARY SPENDING, 2010–2020 (USD BILLION)

TABLE 61 GERMANY: MARKET, BY PLATFORM, 2018–2026 (USD MILLION)

TABLE 62 GERMANY: MARKET, BY PRODUCT, 2018–2026 (USD MILLION)

TABLE 63 GERMANY: MARKET, BY PRODUCT, BY JAMMERS 2018–2026 (USD MILLION)

TABLE 64 GERMANY: MARKET, BY APPLICATION, 2018–2026 (USD MILLION)

10.3.6 RUSSIA

10.3.6.1 Growing investments in digitizing VHF and UHF radar systems to drive the market

FIGURE 33 RUSSIA: MILITARY SPENDING, 2010–2020 (USD BILLION)

TABLE 65 RUSSIA: MARKET, BY PLATFORM, 2018–2026 (USD MILLION)

TABLE 66 RUSSIA: MARKET, BY PRODUCT, 2018–2026 (USD MILLION)

TABLE 67 RUSSIA: MARKET, BY PRODUCT, BY JAMMERS 2018–2026 (USD MILLION)

TABLE 68 RUSSIA: MARKET, BY APPLICATION, 2018–2026 (USD MILLION)

10.3.7 ITALY

10.3.7.1 Plans to renew airborne fleet expected to drive the market

FIGURE 34 ITALY: MILITARY SPENDING, 2010–2020 (USD BILLION)

TABLE 69 ITALY: MARKET, BY PLATFORM, 2018–2026 (USD MILLION)

TABLE 70 ITALY: MARKET, BY PRODUCT, 2018–2026 (USD MILLION)

TABLE 71 ITALY: MARKET, BY PRODUCT, BY JAMMERS 2018–2026 (USD MILLION)

TABLE 72 ITALY: MARKET, BY APPLICATION, 2018–2026 (USD MILLION)

10.3.8 REST OF EUROPE

TABLE 73 REST OF EUROPE: MARKET, BY PLATFORM, 2018–2026 (USD MILLION)

TABLE 74 REST OF EUROPE: MARKET, BY PRODUCT, 2018–2026 (USD MILLION)

TABLE 75 REST OF EUROPE: MARKET, BY PRODUCT, BY JAMMERS 2018–2026 (USD MILLION)

TABLE 76 REST OF EUROPE: MARKET, BY APPLICATION, 2018–2026 (USD MILLION)

10.4 ASIA PACIFIC

10.4.1 PESTLE ANALYSIS: ASIA PACIFIC

FIGURE 35 ASIA PACIFIC MARKET SNAPSHOT

TABLE 77 ASIA PACIFIC: MARKET, BY COUNTRY, 2018–2026 (USD MILLION)

TABLE 78 ASIA PACIFIC: MARKET, BY PLATFORM, 2018–2026 (USD MILLION)

TABLE 79 ASIA PACIFIC: MARKET, BY PRODUCT, 2018–2026 (USD MILLION)

TABLE 80 ASIA PACIFIC: MARKET, BY PRODUCT, BY JAMMERS 2018–2026 (USD MILLION)

TABLE 81 ASIA PACIFIC: MARKET, BY APPLICATION, 2018–2026 (USD MILLION)

10.4.2 CHINA

10.4.2.1 Increasing R&D expenditure to drive the market

FIGURE 36 CHINA: MILITARY SPENDING, 2010–2020 (USD BILLION)

TABLE 82 CHINA: MARKET, BY PLATFORM, 2018–2026 (USD MILLION)

TABLE 83 CHINA: MARKET, BY PRODUCT, 2018–2026 (USD MILLION)

TABLE 84 CHINA: MARKET, BY PRODUCT, BY JAMMERS 2018–2026 (USD MILLION)

TABLE 85 CHINA: MARKET SIZE, BY APPLICATION, 2018–2026 (USD MILLION)

10.4.3 INDIA

10.4.3.1 Ongoing modernization of defense capabilities to drive the market

FIGURE 37 INDIA: MILITARY SPENDING, 2010–2020 (USD BILLION)

TABLE 86 INDIA: MARKET, BY PLATFORM, 2018–2026 (USD MILLION)

TABLE 87 INDIA: MARKET, BY PRODUCT, 2018–2026 (USD MILLION)

TABLE 88 INDIA: MARKET, BY PRODUCT, BY JAMMERS 2018–2026 (USD MILLION)

TABLE 89 INDIA: MARKET, BY APPLICATION, 2018–2026 (USD MILLION)

10.4.4 JAPAN

10.4.4.1 Uplifting of self-imposed defense equipment export ban to drive the market

FIGURE 38 JAPAN: MILITARY SPENDING, 2010–2020 (USD BILLION)

TABLE 90 JAPAN: MARKET, BY PLATFORM, 2018–2026 (USD MILLION)

TABLE 91 JAPAN: MARKET, BY PRODUCT, 2018–2026 (USD MILLION)

TABLE 92 JAPAN: MARKET, BY PRODUCT, BY JAMMERS 2018–2026 (USD MILLION)

TABLE 93 JAPAN: MARKET, BY APPLICATION, 2018–2026 (USD MILLION)

10.4.5 AUSTRALIA

10.4.5.1 High demand for advanced technologies in military equipment to drive the market

FIGURE 39 AUSTRALIA: MILITARY SPENDING, 2010–2020 (USD BILLION)

TABLE 94 AUSTRALIA: MARKET, BY PLATFORM, 2018–2026 (USD MILLION)

TABLE 95 AUSTRALIA: MARKET, BY PRODUCT, 2018–2026 (USD MILLION)

TABLE 96 AUSTRALIA: MARKET, BY PRODUCT, BY JAMMERS 2018–2026 (USD MILLION)

TABLE 97 AUSTRALIA: MARKET, BY APPLICATION, 2018–2026 (USD MILLION)

10.4.6 SOUTH KOREA

10.4.6.1 Need for stronger ISR to drive the market

FIGURE 40 SOUTH KOREA: MILITARY SPENDING, 2010–2020 (USD BILLION)

TABLE 98 SOUTH KOREA: MARKET, BY PLATFORM, 2018–2026 (USD MILLION)

TABLE 99 SOUTH KOREA: MARKET, BY PRODUCT, 2018–2026 (USD MILLION)

TABLE 100 SOUTH KOREA: MARKET, BY PRODUCT, BY JAMMERS 2018–2026 (USD MILLION)

TABLE 101 SOUTH KOREA: MARKET, BY APPLICATION, 2018–2026 (USD MILLION)

10.4.7 REST OF ASIA PACIFIC

TABLE 102 REST OF ASIA PACIFIC: MARKET, BY PLATFORM, 2018–2026 (USD MILLION)

TABLE 103 REST OF ASIA PACIFIC: MARKET, BY PRODUCT, 2018–2026 (USD MILLION)

TABLE 104 REST OF ASIA PACIFIC: MARKET, BY PRODUCT, BY JAMMERS 2018–2026 (USD MILLION)

TABLE 105 REST OF ASIA PACIFIC: MARKET, BY APPLICATION, 2018–2026 (USD MILLION)

10.5 MIDDLE EAST & AFRICA

10.5.1 PESTLE ANALYSIS

FIGURE 41 MIDDLE EAST & AFRICA: AIRBORNE COUNTERMEASURE SYSTEMS MARKET SNAPSHOT

TABLE 106 MIDDLE EAST & AFRICA: AIRBORNE COUNTERMEASURE SYSTEMS MARKET, BY REGION, 2018–2026 (USD MILLION)

TABLE 107 MIDDLE EAST & AFRICA: AIRBORNE COUNTERMEASURE SYSTEMS MARKET, BY PLATFORM, 2018–2026 (USD MILLION)

TABLE 108 MIDDLE EAST & AFRICA: AIRBORNE COUNTERMEASURE SYSTEMS MARKET, BY PRODUCT, 2018–2026 (USD MILLION)

TABLE 109 MIDDLE EAST & AFRICA: AIRBORNE COUNTERMEASURE SYSTEMS MARKET, BY PRODUCT, BY JAMMERS 2018–2026 (USD MILLION)

TABLE 110 MIDDLE EAST & AFRICA: AIRBORNE COUNTERMEASURE SYSTEMS MARKET, BY APPLICATION, 2018–2026 (USD MILLION)

10.5.2 ISRAEL

10.5.2.1 Strong bilateral relationship with the US to drive the market

FIGURE 42 ISRAEL: MILITARY SPENDING, 2010–2020 (USD BILLION)

TABLE 111 ISRAEL: AIRBORNE COUNTERMEASURE SYSTEMS MARKET, BY PLATFORM, 2018–2026 (USD MILLION)

TABLE 112 ISRAEL: AIRBORNE COUNTERMEASURE SYSTEMS MARKET, BY PRODUCT, 2018–2026 (USD MILLION)

TABLE 113 ISRAEL: AIRBORNE COUNTERMEASURE SYSTEMS MARKET, BY PRODUCT, BY JAMMERS 2018–2026 (USD MILLION)

TABLE 114 ISRAEL: AIRBORNE COUNTERMEASURE SYSTEMS MARKET, BY APPLICATION, 2018–2026 (USD MILLION)

10.5.3 TURKEY

10.5.3.1 Focus on strengthening defense capability to drive the market

FIGURE 43 TURKEY: MILITARY SPENDING, 2010–2020 (USD BILLION)

TABLE 115 TURKEY: AIRBORNE COUNTERMEASURE SYSTEMS MARKET, BY PLATFORM, 2018–2026 (USD MILLION)

TABLE 116 TURKEY: AIRBORNE COUNTERMEASURE SYSTEMS MARKET, BY PRODUCT, 2018–2026 (USD MILLION)

TABLE 117 TURKEY: AIRBORNE COUNTERMEASURE SYSTEMS MARKET, BY PRODUCT, BY JAMMERS 2018–2026 (USD MILLION)

TABLE 118 TURKEY: AIRBORNE COUNTERMEASURE SYSTEMS MARKET, BY APPLICATION, 2018–2026 (USD MILLION)

10.5.4 SAUDI ARABIA

10.5.4.1 Increased military expenditure to drive the market

FIGURE 44 SAUDI ARABIA: MILITARY SPENDING, 2010–2020 (USD BILLION)

TABLE 119 SAUDI ARABIA: AIRBORNE COUNTERMEASURE SYSTEMS MARKET, BY PLATFORM, 2018–2026 (USD MILLION)

TABLE 120 SAUDI ARABIA: AIRBORNE COUNTERMEASURE SYSTEMS MARKET, BY PRODUCT, 2018–2026 (USD MILLION)

TABLE 121 SAUDI ARABIA: AIRBORNE COUNTERMEASURE SYSTEMS MARKET, BY PRODUCT, BY JAMMERS 2018–2026 (USD MILLION)

TABLE 122 SAUDI ARABIA: AIRBORNE COUNTERMEASURE SYSTEMS MARKET, BY APPLICATION, 2018–2026 (USD MILLION)

10.5.5 SOUTH AFRICA

10.5.5.1 Replacement of aging military equipment to drive the market

FIGURE 45 SOUTH AFRICA: MILITARY SPENDING, 2010–2020 (USD BILLION)

TABLE 123 SOUTH AFRICA: AIRBORNE COUNTERMEASURE SYSTEMS MARKET, BY PLATFORM, 2018–2026 (USD MILLION)

TABLE 124 SOUTH AFRICA: AIRBORNE COUNTERMEASURE SYSTEMS MARKET, BY PRODUCT, 2018–2026 (USD MILLION)

TABLE 125 SOUTH AFRICA: AIRBORNE COUNTERMEASURE SYSTEMS MARKET, BY PRODUCT, BY JAMMERS 2018–2026 (USD MILLION)

TABLE 126 SOUTH AFRICA: AIRBORNE COUNTERMEASURE SYSTEMS MARKET, BY APPLICATION, 2018–2026 (USD MILLION)

10.6 LATIN AMERICA

10.6.1 COVID-19 IMPACT ON LATIN AMERICA

10.6.2 PESTLE ANALYSIS: LATIN AMERICA

FIGURE 46 LATIN AMERICA: AIRBORNE COUNTERMEASURE SYSTEMS MARKET SNAPSHOT

TABLE 127 LATIN AMERICA: AIRBORNE COUNTERMEASURE SYSTEMS MARKET, BY COUNTRY, 2018–2026 (USD MILLION)

TABLE 128 LATIN AMERICA: AIRBORNE COUNTERMEASURE SYSTEMS MARKET, BY PLATFORM, 2018–2026 (USD MILLION)

TABLE 129 LATIN AMERICA: AIRBORNE COUNTERMEASURE SYSTEMS MARKET, BY PRODUCT, 2018–2026 (USD MILLION)

TABLE 130 LATIN AMERICA: AIRBORNE COUNTERMEASURE SYSTEMS MARKET, BY PRODUCT, BY JAMMERS 2018–2026 (USD MILLION)

TABLE 131 LATIN AMERICA: AIRBORNE COUNTERMEASURE SYSTEMS MARKET, BY APPLICATION, 2018–2026 (USD MILLION)

10.6.3 BRAZIL

10.6.3.1 Modernization of armed forces to drive the market

FIGURE 47 BRAZIL: MILITARY SPENDING, 2010–2020 (USD BILLION)

TABLE 132 BRAZIL: AIRBORNE COUNTERMEASURE SYSTEMS MARKET, BY PLATFORM, 2018–2026 (USD MILLION)

TABLE 133 BRAZIL: AIRBORNE COUNTERMEASURE SYSTEMS MARKET, BY PRODUCT, 2018–2026 (USD MILLION)

TABLE 134 BRAZIL: AIRBORNE COUNTERMEASURE SYSTEMS MARKET, BY PRODUCT, BY JAMMERS 2018–2026 (USD MILLION)

TABLE 135 BRAZIL: AIRBORNE COUNTERMEASURE SYSTEMS MARKET, BY APPLICATION, 2018–2026 (USD MILLION)

10.6.4 MEXICO

10.6.4.1 Focus on strengthening ISR capabilities to drive the market

FIGURE 48 MEXICO: MILITARY SPENDING, 2010–2020 (USD BILLION)

TABLE 136 MEXICO: AIRBORNE COUNTERMEASURE SYSTEMS MARKET, BY PLATFORM, 2018–2026 (USD MILLION)

TABLE 137 MEXICO: AIRBORNE COUNTERMEASURE SYSTEMS MARKET, BY PRODUCT, 2018–2026 (USD MILLION)

TABLE 138 MEXICO: AIRBORNE COUNTERMEASURE SYSTEMS MARKET, BY PRODUCT, BY JAMMERS 2018–2026 (USD MILLION)

TABLE 139 MEXICO: AIRBORNE COUNTERMEASURE SYSTEMS MARKET, BY APPLICATION, 2018–2026 (USD MILLION)

11 COMPETITIVE LANDSCAPE (Page No. - 189)

11.1 INTRODUCTION

TABLE 140 KEY DEVELOPMENTS BY LEADING PLAYERS IN AIRBORNE COUNTERMEASURE SYSTEMS MARKET BETWEEN 2018 AND 2021

11.2 RANKING ANALYSIS OF KEY MARKET PLAYERS, 2020

FIGURE 49 REVENUE ANALYSIS FOR KEY COMPANIES IN PAST 5 YEARS

11.3 MARKET SHARE ANALYSIS

TABLE 141 AIRBORNE COUNTERMEASURE SYSTEMS MARKET: DEGREE OF COMPETITION

11.4 COMPANY EVALUATION QUADRANT

11.4.1 AIRBORNE COUNTERMEASURE SYSTEMS MARKET COMPETITIVE LEADERSHIP MAPPING

11.4.1.1 Star

11.4.1.2 Pervasive

11.4.1.3 Emerging leader

11.4.1.4 Participant

FIGURE 50 AIRBORNE COUNTERMEASURE SYSTEMS MARKET (GLOBAL) COMPANY EVALUATION MATRIX, 2020

11.4.2 AIRBORNE COUNTERMEASURE SYSTEMS MARKET COMPETITIVE LEADERSHIP MAPPING (SME)

11.4.2.1 Progressive companies

11.4.2.2 Responsive companies

11.4.2.3 Starting blocks

11.4.2.4 Dynamic companies

FIGURE 51 AIRBORNE COUNTERMEASURE SYSTEMS MARKET (SME) COMPETITIVE LEADERSHIP MAPPING, 2020

11.4.2.5 Competitive benchmarking

TABLE 142 COMPANY PRODUCT FOOTPRINT (25 COMPANIES)

TABLE 143 COMPANY PLATFORM FOOTPRINT

TABLE 144 COMPANY APPLICATION FOOTPRINT

TABLE 145 COMPANY REGION FOOTPRINT

11.5 COMPETITIVE SCENARIO AND TRENDS

11.5.1 PRODUCT LAUNCHES

TABLE 146 AIRBORNE COUNTERMEASURE SYSTEMS MARKET: PRODUCT LAUNCHES, 2018–2021

11.5.2 DEALS

TABLE 147 AIRBORNE COUNTERMEASURE SYSTEMS MARKET: DEALS, 2018–2021

12 COMPANY PROFILES (Page No. - 217)

(Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View)*

12.1 INTRODUCTION

12.2 KEY PROFILES

12.2.1 L3HARRIS TECHNOLOGIES, INC.

TABLE 148 L3HARRIS TECHNOLOGIES, INC.: BUSINESS OVERVIEW

FIGURE 52 L3HARRIS TECHNOLOGIES, INC.: COMPANY SNAPSHOT

TABLE 149 L3HARRIS TECHNOLOGIES, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 150 L3HARRIS TECHNOLOGIES: PRODUCT LAUNCHES

TABLE 151 L3HARRIS TECHNOLOGIES, INC.: DEALS

12.2.2 RAYTHEON TECHNOLOGIES CORPORATION

TABLE 152 RAYTHEON TECHNOLOGIES CORPORATION: BUSINESS OVERVIEW

FIGURE 53 RAYTHEON TECHNOLOGIES CORPORATION: COMPANY SNAPSHOT

TABLE 153 RAYTHEON TECHNOLOGIES CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 154 RAYTHEON TECHNOLOGIES CORPORATION: DEALS

12.2.3 ISRAEL AEROSPACE INDUSTRIES LTD. (IAI)

TABLE 155 ISRAEL AEROSPACE INDUSTRIES LTD.: BUSINESS OVERVIEW

FIGURE 54 ISRAEL AEROSPACE INDUSTRIES LTD. (IAI): COMPANY SNAPSHOT

TABLE 156 ISRAEL AEROSPACE INDUSTRIES LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 157 ISRAEL AEROSPACE INDUSTRIES LTD.: PRODUCT LAUNCHES

TABLE 158 ISRAEL AEROSPACE INDUSTRIES LTD.: DEALS

12.2.4 LOCKHEED MARTIN CORPORATION

TABLE 159 LOCKHEED MARTIN CORPORATION: BUSINESS OVERVIEW

FIGURE 55 LOCKHEED MARTIN CORPORATION: COMPANY SNAPSHOT

TABLE 160 LOCKHEED MARTIN CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 161 LOCKHEED MARTIN: PRODUCT LAUNCHES

TABLE 162 LOCKHEED MARTIN CORPORATION: DEALS

12.2.5 BAE SYSTEMS PLC

TABLE 163 BAE SYSTEMS: BUSINESS OVERVIEW

FIGURE 56 BAE SYSTEMS PLC: COMPANY SNAPSHOT

TABLE 164 BAE SYSTEMS PLC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 165 BAE SYSTEM PLC: PRODUCT LAUNCHES

TABLE 166 BAE SYSTEM PLC: DEALS

12.2.6 NORTHROP GRUMMAN CORPORATION

TABLE 167 NORTHROP GRUMMAN CORPORATION: BUSINESS OVERVIEW

FIGURE 57 NORTHROP GRUMMAN CORPORATION: COMPANY SNAPSHOT

TABLE 168 NORTHROP GRUMMAN CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 169 NORTHROP GRUMMAN CORPORATION: PRODUCT LAUNCHES

TABLE 170 NORTHROP GRUMMAN CORPORATION: DEALS

TABLE 171 SAAB AB: BUSINESS OVERVIEW

FIGURE 58 SAAB AB: COMPANY SNAPSHOT

TABLE 172 SAAB AB: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 173 SAAB AB: PRODUCT LAUNCHES

TABLE 174 SAAB AB: DEALS

12.2.8 COBHAM PLC

TABLE 175 COBHAM PLC: BUSINESS OVERVIEW

FIGURE 59 COBHAM PLC: COMPANY SNAPSHOT

TABLE 176 COBHAM PLC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 177 COBHAM PLC: PRODUCT LAUNCHES

TABLE 178 COBHAM PLC: DEALS

12.2.9 LEONARDO S.P.A.

TABLE 179 LEONARDO S.P.A.: BUSINESS OVERVIEW

FIGURE 60 LEONARDO S.P.A.: COMPANY SNAPSHOT

TABLE 180 LEONARDO S.P.A.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 181 LEONARDO S.P.A.: DEALS

12.2.10 ELBIT SYSTEMS LTD.

TABLE 182 ELBIT SYSTEMS LTD.: BUSINESS OVERVIEW

FIGURE 61 ELBIT SYSTEMS LTD.: COMPANY SNAPSHOT

TABLE 183 ELBIT SYSTEMS LTD: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 184 ELBIT SYSTEMS LTD.: DEALS

12.2.11 THALES GROUP

TABLE 185 THALES GROUP: BUSINESS OVERVIEW

FIGURE 62 THALES GROUP: COMPANY SNAPSHOT

TABLE 186 THALES GROUP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 187 THALES GROUP: DEALS

12.2.12 RHEINMETALL AG

TABLE 188 RHEINMETALL AG: BUSINESS OVERVIEW

FIGURE 63 RHEINMETALL AG: COMPANY SNAPSHOT

TABLE 189 RHEINMETALL AG: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 190 RHEINMETALL AG: DEALS

12.2.13 ASELSAN A.S.

TABLE 191 ASELSAN A.S.: BUSINESS OVERVIEW

TABLE 192 ASELSAN A.S.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 193 ASELSAN A.S.: DEALS

12.2.14 FLIR SYSTEMS

TABLE 194 FLIR SYSTEMS: BUSINESS OVERVIEW

TABLE 195 FLIR SYSTEMS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 196 FLIR SYSTEMS: DEALS

12.2.15 TELEDYNE TECHNOLOGIES INTERNATIONAL CORP.

TABLE 197 TELEDYNE TECHNOLOGIES INTERNATIONAL CORP.: BUSINESS OVERVIEW

FIGURE 64 TELEDYNE TECHNOLOGIES INTERNATIONAL CORP.: COMPANY SNAPSHOT

TABLE 198 TELEDYNE TECHNOLOGIES INTERNATIONAL CORP.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 199 TELEDYNE TECHNOLOGIES INTERNATIONAL CORP.: DEALS

12.2.16 HENSOLDT AG

TABLE 200 HENSOLDT AG: BUSINESS OVERVIEW

TABLE 201 HENSOLDT AG: PRODUCTS/SOLUTIONS/SERVICES OFFERED

12.2.17 INDRA SISTEMAS SA

TABLE 202 INDRA SISTEMAS SA: BUSINESS OVERVIEW

FIGURE 65 INDRA SISTEMAS SA: COMPANY SNAPSHOT

TABLE 203 INDRA SISTEMAS SA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 204 INDRA SISTEMAS SA: DEALS

12.2.18 SAFRAN

TABLE 205 SAFRAN: BUSINESS OVERVIEW

FIGURE 66 SAFRAN: COMPANY SNAPSHOT

TABLE 206 SAFRAN: PRODUCTS/SOLUTIONS/SERVICES OFFERED

12.3 OTHER PLAYERS

12.3.1 COLLINS AEROSPACE

12.3.2 COHORT PLC

12.3.3 CURTISS-WRIGHT CORPORATION

12.3.4 TERMA AS

12.3.5 MAG AEROSPACE

12.3.6 LACROIX SA

12.3.7 CHEMRING COUNTERMEASURES

*Details on Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View might not be captured in case of unlisted companies.

13 APPENDIX (Page No. - 296)

13.1 DISCUSSION GUIDE

13.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

13.3 AVAILABLE CUSTOMIZATIONS

13.4 RELATED REPORTS

13.5 AUTHOR DETAILS

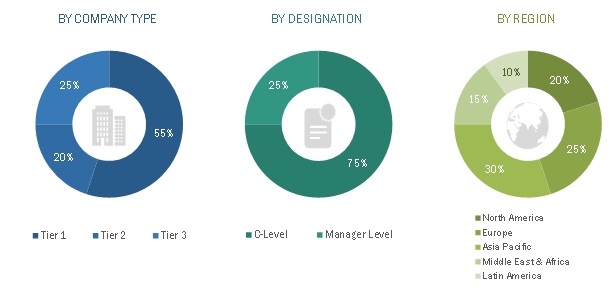

The study involved various activities in estimating the market size for Airborne Countermeasure Systems. Exhaustive secondary research was undertaken to collect information on the Airborne Countermeasure Systems market, its adjacent markets, and its parent market. The next step was to validate these findings, assumptions, and sizing with the industry experts across the value chain through primary research. Both demand- and supply-side analyses were carried out to estimate the overall size of the market. Thereafter, market breakdown and data triangulation procedures were used to estimate the sizes of different segments and subsegments of the Airborne Countermeasure Systems market.

Secondary Research

The market share of companies in the Airborne Countermeasure Systems market was determined by using the secondary data acquired through paid and unpaid sources and analyzing product portfolios of major companies operating in the market. These companies were rated based on the performance and quality of their products. These data points were further validated by primary sources.

Secondary sources referred for this research study on the Airborne Countermeasure Systems market included government sources, such as the US Department of Defense (DoD); federal and state governments of various countries; corporate filings, such as annual reports, investor presentations, and financial statements; and trade, business, and professional associations; among others. Secondary data was collected and analyzed to arrive at the overall size of the Airborne Countermeasure Systems market, which was further validated by primary respondents.

Primary Research

Extensive primary research was conducted after acquiring information about the current scenario of the Airborne Countermeasure Systems market through secondary research. Several primary interviews were conducted with market experts from both the demand and supply sides across major regions, namely, North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America. Primary data was collected through questionnaires, emails, and telephonic interviews.

To know about the assumptions considered for the study, download the pdf brochure

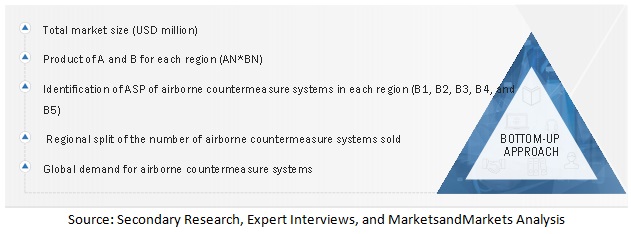

Market Size Estimation

Both, top-down and bottom-up approaches were used to estimate and validate the Airborne Countermeasure Systems market size. These methods were also used extensively to estimate the size of various segments and subsegments of the market. The research methodology used to estimate the market size included the following steps:

- Key players in the industry and market were identified through extensive secondary research of their product matrix and geographical presence and developments undertaken by them.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

Research Approach:

Both top-down and bottom-up approaches were used to estimate and validate the total size of the Airborne Countermeasure Systems market. These methods were also used extensively to estimate the size of various segments and subsegments of the market. The research methodology used to estimate the market size included the following:

- Key players in the industry and market were identified through extensive secondary research of their product matrix and geographical presence and developments undertaken by them.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

Global the Airborne Countermeasure Systems market Size: Bottom-Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall size of the Airborne Countermeasure Systems market using the market size estimation processes explained above, the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from demand as well as supply sides of the Airborne Countermeasure Systems market.

Objectives of the Report

- To define, describe, segment, and forecast the size of the Airborne Countermeasure Systems market based on Platform, product, application, and region

- To understand the structure of the market by identifying its various segments and subsegments

- To forecast the size of various segments of the market with respect to major regions, namely, North America, Europe, Asia Pacific, Middle East & Africa, and Latin America along with the major countries in each of these regions

- To identify and analyze key drivers, restraints, opportunities, and challenges that influence the growth of the Airborne Countermeasure Systems market

- To strategically analyze the micro-markets with respect to individual growth trends, prospects, and their contributions to the overall market

- To analyze the opportunities in the market for stakeholders by identifying key market trends

- To analyze competitive developments such as contracts, acquisitions, expansions, new product launches, and partnerships & agreements in the market

- To provide a detailed competitive landscape of the Airborne Countermeasure Systems market, along with an analysis of the business and corporate strategies adopted by leading players

Available Customizations

MarketsandMarkets offers the following customizations for this market report:

- Additional country-level analysis of the Airborne Countermeasure Systems market

- Profiling of additional market players (up to 5)

Product Analysis

- Product matrix, which provides a detailed comparison of the product portfolio of each company in the Airborne Countermeasure Systems market

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Airborne Countermeasure Systems Market