Mine Detection System Market by Application (Defence and Homeland Security), Deployment (Vehicle Mounted, Ship Mounted, Airborne Mounted and Handheld), Technology, Upgradation (OEMs and MROs), and Region (2021-2026)

Updated on : Nov 06, 2024

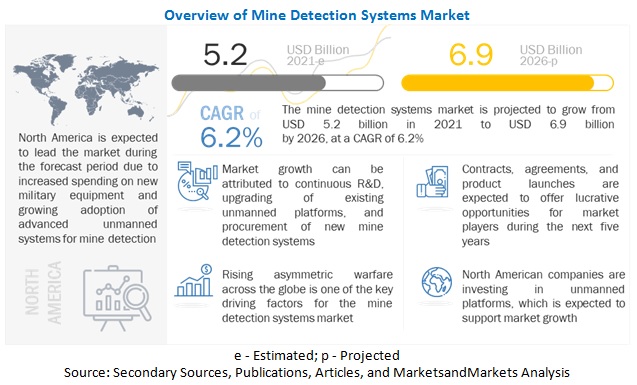

[216 Pages Report] According to MarketsandMarkets Mine detection Systems Market size is projected to grow from an estimated USD 5.2 billion in 2021 to USD 6.9 billion by 2026, at a CAGR of 6.2% in terms of value during the forecasted period. It is witnessing significant growth due to increasing asymmetric warfare which refers to warfare wherein opposite parties or countries have imbalanced or unequal military resources, and weaker opponents use unconventional weapons and tactics to exploit the vulnerabilities of their enemies. There has been a significant rise in asymmetric warfare across the globe over the past decade owing to political, religious, economic instability, and socio-cultural factors.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 Impact on market

The COVID-19 impact has been analyzed for three scenarios: realistic, optimistic, and pessimistic. The realistic scenario has been considered for further calculations.

The Mine Detection Systems market includes major players such as Lockheed Martin Corporation (US), Israel Aerospace Industries Ltd. (Israel), Northrop Grumman Corporation (US),L3Harris Technologies, Inc. (US), Leonardo SPA (Italy), BAE Systems (UK), Elbit Systems (Israel), and Textron Systems (US). These players have spread their business across various countries including North America, Europe, Asia Pacific, Middle East& Africa, and Latin America. COVID-19 has impacted their businesses as well.

R&D in mine detection systemsare constantly evolving, considering the current scenario and the countries cutting down their defense budget in might be a hindrance to the growth of this technology The manufacturing activities have faced operational and running activities due to the import and export regulations. Currently, control of the COVID-19 outbreak is an international concern and has become a crucial challenge in many countries.

Market Dynamics

Driver: Increasingterrorist activities worldwide

Terrorist organizations worldwide are using IEDs as an unconventional explosive weapons that can take any form and be activated in a variety of ways. IEDs can cause casualties. Recent IED blasts in India, the U.K., France, Pakistan, Turkey, Iran, and Brussels have caused serious damage to people and their assets.

The Afghanistan war has led the US to invest immensely in defeating IEDs. According to our world data, in 2017, terrorism activities killed an estimated 26,445 individuals worldwide. Over the previous decade, the average yearly mortality rate was 21,000 people. There can, however, be substantial year-to-year variation. Over the course of this decade, the worldwide mortality toll varied from 7,827 in 2010 to 44,490 in 2014. Several terrorist organizations have attempted to expand their regional presence in Afghanistan, Iraq, Syria, and Africa in recent years. Terrorist havens pose a danger to the international community. They are hotbeds of fear and tyranny for local communities, as well as hubs for the spread of deadly ideology. Many terrorist attacks against local communities and other countries have been planned and organized from these safer places. Countries are investing in detecting and neutralizing IEDs as well as identifying and disrupting the networks supporting threats associated with these devices and preparing&protecting forces.

Restraints:Regulatoryconstraints in the transfer of technology

Import-export control regimes, exchange controls, the Foreign Corrupt Practices Act, and the Export Administration Act are some of the federal and legislative rules and regulations that state-owned defense organizations across the globe must comply with. In Japan, Germany, Canada, and South Korea, manufacturers of military equipment are prohibited from exporting their products, thereby decreasing their chances of serving international customers. This hinders the manufacturers of mine detection systems from accessing the international market. The strict rules and regulations related to the transfer of associated technologies to eliminate the access of terrorist organizations to advanced technologies are also expected to act as restraints to the growth of the Mine Detection System Industry during the forecast period.

Opportunities: Increasing demand from homeland security agencies

Terrorists are targeting civilians and public assets using IEDs and restricting them is a major challenge for homeland security forces and agencies. Hence, homeland security is one of the major end users of counter-IED. Countries such as India, the U.K., France, Turkey, Iran, and others are facing immense threats from IED blasts. Homeland security agencies of these countries are increasingly procuring advanced IED detection and countermeasure equipment’s. Similarly, U.S. Joint Improvised-Threat Defeat Organization trains homeland security personnel’s and assists them in handling and procurement of counter-IED.

The demand for IED from the homeland security segment is increasing and is especially from terrorism affected countries, such as India, Israel, and others. For instance, India is continuously investing in counter-IED technologies and procuring MRAP vehicles with counter-IED capabilities for its state forces who are dealing with IED attacks in terrorist affected regions.

Challenges: High cost of development

The increasing importance of unmanned systems in tactical and strategic roles in modern warfare environments has propelled the need for new, effective, and affordable warfare systems reducing the error and human loss. These systems use electromagnetic radiations to ensure secure transmission of data. These systems are required to perform various essential functions in diverse threat environments. They must identify all emitters in an area of interest using SIGINT techniques to determine their geographic locations or ranges of mobility, characterize their signals, and determine the location of mine using thermal imaging. Achieving the performance levels expected for the next generation unmanned electronic warfare systems becomes a formidable task due to the complexity of these systems. These systems require complex designs to serve in high-magnitude signal environments. One of the key challenges faced by manufacturers of unmanned systems is modifying and programming these systems. Advanced technologies are required to operate in a crowded electromagnetic (EM) environment, and a cost-effective open system approach will help achieve challenging design goals. The integration of AI in unmanned systems market is expected to be cost-dependent due to the requirement of heavy R&D investments, which serves as a challenge for manufacturers.

Based on Deployment, the ship mounted segment is projected to grow at the highest CAGR during the forecast period.

Based on deployment, the mine detection system market has been segmented into vehicle-mounted, ship-mounted, airborne-mounted, and handheld. Mine detection systems are used extensively on land vehicles. Mine detection systems mounted on vehicles vary in size, weight, range, capability, function, and operation. These vehicles are manned as well as unmanned depending on the operation. Vehicle-mounted mine detection systems are further sub-segmented into armored vehicles and unmanned ground vehicles.Mines are a major threat to commercial shipping and maritime military forces. The usage of these devices is a growing concern for governments and agencies. Mines can be placed either externally on the ship’s side and/or hull or placed internally by infiltrators that can cause a combination of onboard bombings and specific assaults. Mine detection systems are very much mandatory to install on all naval platforms for these attacks.

Based on upgrade, the OEMs segment is projected to grow at the highest CAGR during the forecast period.

Based on upgrades, the mine detection system market has been segmented into OEMs and MROs. Upgrading the existing mine detection systems is an ongoing process, especially in countries that already have well-established mine detection systems for their platforms.An increase in vehicle-mounted mine detection systems globally is one of the significant factors driving the growth of the mine detection system market. In addition, the rise in the use of dual-band radar is among the technological factors expected to fuel the growth of the mine detection system market soon. In the defense industry, mine detection systems are mounted over ships, vehicles, and aircraft and delivered to the military forces. OEMs handle the installation of mine detection systems. The OEM component providers also offer the line-fit option, thereby saving the time consumed in the installation of mine detection systems post-delivery.

Based on technology, the Sonar based Systems segment is projected to grow at the highest CAGR during the forecast period

Sonar is a technology for navigating, measuring distances (range), communicating with, and detecting mine-like objects on or beneath the surface of the water, such as other boats, using sound propagation (typically underwater, as in submarine navigation). The sonar technology utilized in mine detecting systems is expected to be driven by growing navy ship procurement and upgrade operations, as well as rising commercial and combat ship deliveries throughout the world.

To know about the assumptions considered for the study, download the pdf brochure

The North American region is estimated to lead theMine Detection Systemsmarket in the forecast period

The North American region is estimated to lead the Mine Detection Systems market in the forecast period. The US is recognized as one of the key manufacturers, exporters, and users of mine detection systems worldwide and is known to have the largest market share. Key manufacturers of mine detection systems in the US include Lockheed Martin Corporation, Northrop Grumman Corporation, L3Harris Technologies, Inc., and Raytheon Technologies Corporation. The new defense strategy of the US indicates an increase in spending on unmanned systems to include advanced capabilities in existing defense systems of the US Army to detect the presence of planted mines.

Key Market Players:

The Mine Detection System Companies are dominated by a few globally established players such as Lockheed Martin Corporation (US), Israel Aerospace Industries Ltd. (Israel), Bae Systems Plc. (UK), L3Harris Technologies, Inc. (US), and Raytheon Technologies Corporation (US).

Scope Of The Report

|

Report Metric |

Details |

|

Market size available for years |

2018–2026 |

|

Base year considered |

2020 |

|

Forecast period |

2021-2026 |

|

Forecast units |

Value (USD Million) |

|

Segments covered |

By Deployment, By Upgrade, By Application, By Technology |

|

Geographies covered |

North America, Europe, Asia Pacific, Middle East & Africa, and Latin America |

|

Companies covered |

Lockheed Martin Corporation (US), Northrop Grumman Corporation (US), Thales Group (France), Israel Aerospace Industries Ltd.(Israel), Raytheon Technologies Corporation (US), BAE Systems (UK), Elbit Systems (Israel) and L3Harris Technologies (US). and others. Total 25 Market Players |

The study categorizes the mine detection Systems market based on platform, capability, product, and operation, along with region.

By Deployment

- Vehicle Mounted

- Ship Mounted

- Airborne Mounted

- Handheld

By Application

- Defence

- Homeland Security

By Technology

- Radar Based

- Laser Based

- Sonar Based

By Upgrade

- OEMs

- MROs

By Region

- North America

- Europe

- Asia Pacific

- Middle East & Africa

- Latin America

Recent Developments

- In May 2021, General Dynamics Mission Systems Inc. of Quincy, Massachusetts, has been awarded a contract by US Navy for the conversion of five Surface Mine Countermeasure Unmanned Undersea Vehicle systems to the Block I configuration and engineering support services.

- In May 2021, Germany's Rheinmetall won a contract to provide British Armed Forces with mission masters. In order to study potential future capabilities, the British military will purchase four additional Mission Masters, this time with a fire support module. Other than logistics, it may also be used for surveillance, security, casualty evacuation, and CBRN detection, among other things. Additionally, the Mission Master may be used as a mobile radio relay station.

- In April 2021, Raytheon Technologies has been granted a contract by the US Navy to update certain AQS-20A towed sonars to the AQS-20C version. Raytheon was granted a firm fixed-price contract by the Naval Sea Systems Command to convert 10 vintage AQS-20A mine hunting sonars to the AN/AQS-20C configuration through engineering, design, development, manufacturing, integration, and testing.

Frequently Asked Questions (FAQ):

Which are the major systems considered in this study and which segments are projected to have a promising market share in future?

The Mine Detection Systems include laser based, sonar based and radar based mine detection systems which are deployed in various platforms such as land vehicles, ships, aircrafts and hand held devices which are projected to fuel the growth of the market

What are some of the drivers fuelling the growth of Mine Detection Systems market?

Global Mine Detection Systems market is characterized by following drivers:

Increased acquisition of unmanned systems because of rising transnational and regional insecurity

The rising frequency of bilateral armed confrontations between nations is advancing at a rapid rate, necessitating a greater requirement for countries' defence forces to enhance their security measures. To meet the demands of battle, new weaponry and fighting systems are being created. With the development of digital battlefields, electronic warfare technology has been integrated into unmanned systems. These technologies have led to a shift in nations' purchase priorities to stay in sync with growing military demands.

For example, political instability and terrorism in Iraq and Syria in the Middle East have resulted in military confrontations since 2014, with numerous terrorist organizations increasingly employing high-tech weaponry. Countries in this area are boosting defence spending to incorporate modern systems to protect their borders from these weapons. Saudi Arabia, the UAE, and Qatar have boosted their investments in radar and air defence systems in this region. Saudi Arabia, for example, intends to purchase S-400 air defence systems from Russia in the future.

Over the period of 2015-2019, China and Pakistan conducted multiple incursions into India, resulting in hostilities between these countries. The Turkish government authorities announced the purchase of Russian S-400 air defence systems in October 2019. Rising conflicts in the South China Sea between China and its neighbours, including Vietnam, Indonesia, Taiwan, Malaysia, and the Philippines, have prompted these nations to raise their defence budgets. Because of the tensions between Russia and NATO, nations such as Romania, Poland, and Ukraine have increased their spending on air defence systems. Ukraine intends to upgrade and improve its mine detection capabilities as well. These initiatives for military capabilities upgrading will fuel the market for mine detection systems.

Proliferation of asymmetric warfare around the world

Asymmetric warfare refers to warfare wherein opposite parties or countries have imbalanced or unequal military resources, and weaker opponents use unconventional weapons and tactics to exploit vulnerabilities of their enemies. There has been a significant rise in asymmetric warfare across the globe over the past decade owing to political, religious, economic instability, and socio-cultural factors.

There is increasing evidence of asymmetrical warfare becoming a strategy of choice for extremist and dissident groups. This can cause a threat to national and international security in the coming years. Government agencies across the world are increasingly adopting digital battlefield products, services and solutions for self-protection and defense against terrorist or insurgent attacks. Operating in covert and small groups, asymmetrical combatants are also engaging in lethal and violent activities to shield unrecognized sovereign territory. The rising incidence of asymmetric warfare tactics and operations is also forcing defense forces to adopt new technologies and solutions to tackle such situations. Thus, rising instances of asymmetric warfare are expected to lead to increased procurement of defense products, globally, thereby driving the growth of the digital battlefield market over the projected period.

I am interested in understanding the research methodology on how you arrived at the market size and segmental splits before making a purchase decision. Can you provide me with an explanation on the same?

Yes, a detailed explanation of research methodology can be provided over a scheduled call, it will also enable us to explain all your queries in detail. For a brief overview and knowledge: Multiple approaches have been adopted to understand the holistic view of this market including:

- Top-down approach (Based on the global market)

- Primary interviews with industry experts

- Data triangulation

What kind of information is provided in the competitive landscape section?

For the list of below-mentioned players, company profiles provide insights such as business overview covering information on the company’s business segments, financials, geographic presence and revenue mix and business revenue mix. The company profiles section also provides information on product offerings, key developments associated with the company, SWOT analysis and MnM view to elaborate analyst view on the company. Some of the key players in the market are Lockheed Martin Corporation (US), Northrop Grumman Corporation (US), Israel Aerospace Industries Ltd. (Israel), Raytheon Technologies Corporation (US), Thales Group (France), L3Harris Technologies, Inc. (US), BAE Systems (UK), and Elbit Systems (Israel). .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 33)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 STUDY SCOPE

FIGURE 1 MINE DETECTION SYSTEM MARKET SEGMENTATION

1.3.1 REGIONAL SCOPE

FIGURE 2 REGIONAL SCOPE: MINE DETECTION SYSTEM MARKET

1.3.2 YEARS CONSIDERED FOR THE STUDY

1.4 CURRENCY & PRICING

1.5 USD EXCHANGE RATES

1.6 LIMITATIONS

1.7 INCLUSIONS & EXCLUSIONS

1.8 MARKET STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 37)

2.1 RESEARCH DATA

FIGURE 3 REPORT PROCESS FLOW

FIGURE 4 MINE DETECTION SYSTEM MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Key data from primary sources

2.1.2.2 Breakdown of primaries

2.1.2.3 Key insights from primary respondents

TABLE 1 PRIMARY INTERVIEWEES DETAILS

2.2 FACTOR ANALYSIS

2.2.1 INTRODUCTION

2.2.2 DEMAND-SIDE INDICATORS

2.2.2.1 Increased military spending of emerging countries

2.2.2.2 Growth of military expenditure on sensor-based autonomous defense systems

FIGURE 5 MILITARY EXPENDITURE, 2019–2020 (USD BILLION)

2.2.2.3 Rising incidences of regional disputes, terrorism, and political conflicts

2.2.3 SUPPLY-SIDE INDICATORS

2.2.3.1 Major US defense contractors’ financial trends

2.3 MARKET SIZE ESTIMATION

2.4 SCOPE

2.5 RESEARCH APPROACH & METHODOLOGY

2.5.1 BOTTOM-UP APPROACH

FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

2.5.2 TOP-DOWN APPROACH

FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

2.5.2.1 COVID-19 impact on mine detection system market

2.6 DATA TRIANGULATION

FIGURE 8 DATA TRIANGULATION

2.7 GROWTH RATE ASSUMPTIONS

2.8 ASSUMPTIONS

2.9 RISK ANALYSIS

3 EXECUTIVE SUMMARY (Page No. - 47)

FIGURE 9 VEHICLE-MOUNTED SEGMENT PROJECTED TO DOMINATE MARKET DURING FORECAST PERIOD

FIGURE 10 RADAR-BASED SEGMENT PROJECTED TO DOMINATE MARKET DURING FORECAST PERIOD

FIGURE 11 DEFENSE SEGMENT PROJECTED TO DOMINATE MARKET DURING FORECAST PERIOD

4 PREMIUM INSIGHTS (Page No. - 49)

4.1 ATTRACTIVE OPPORTUNITIES IN MINE DETECTION SYSTEM MARKET

FIGURE 12 INCREASING ADOPTION OF UNMANNED SYSTEMS FOR MINE DETECTION TO DRIVE MARKET GROWTH

4.2 MINE DETECTION SYSTEM MARKET, BY TECHNOLOGY

FIGURE 13 RADAR-BASED SEGMENT ESTIMATED TO ACCOUNT FOR LARGEST SHARE OF MARKET IN 2021

4.3 MINE DETECTION SYSTEM MARKET, BY APPLICATION

FIGURE 14 DEFENSE SEGMENT TO LEAD THE MARKET DURING FORECAST PERIOD

4.4 MINE DETECTION SYSTEM MARKET, BY COUNTRY

FIGURE 15 BRAZIL TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

5 MARKET OVERVIEW (Page No. - 51)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 16 MINE DETECTION SYSTEMS MARKET: DRIVERS, OPPORTUNITIES, AND CHALLENGES

5.2.1 DRIVERS

5.2.1.1 Increasing terrorist activities worldwide

5.2.1.2 Increased acquisition of unmanned systems

5.2.1.3 Proliferation of asymmetric warfare around the world

5.2.2 RESTRAINTS

5.2.2.1 Regulatory constraints in transfer of technology

5.2.2.2 Lack of accuracy and operational complexities in airborne mine detection

5.2.3 OPPORTUNITIES

5.2.3.1 Increasing demand from emerging countries towards the procurement of advanced mine detection systems

5.2.3.2 Increasing demand from homeland security agencies

5.2.4 CHALLENGES

5.2.4.1 High cost of development

5.2.4.2 Minimizing weight and size of devices while maintaining advanced features

5.2.4.3 Complexity of design closure constraints has led manufacturing process to be expensive

5.3 RANGES AND SCENARIOS

FIGURE 17 IMPACT OF COVID-19 ON THE MARKET: GLOBAL SCENARIOS

5.4 IMPACT OF COVID-19 ON MINE DETECTION SYSTEM MARKET

FIGURE 18 IMPACT OF COVID-19 ON MINE DETECTION SYSTEMS MARKET

5.4.1 DEMAND-SIDE IMPACT

5.4.1.1 Key developments from January 2020 to June 2021

TABLE 2 KEY DEVELOPMENTS IN MINE DETECTION SYSTEM MARKET 2020-2021

5.4.2 SUPPLY-SIDE IMPACT

5.4.2.1 Key developments from January 2020 to June 2021

TABLE 3 KEY DEVELOPMENTS IN MINE DETECTION SYSTEM MARKET 2020-2021

5.5 TRENDS/DISRUPTIONS IMPACTING CUSTOMER'S BUSINESS

5.5.1 REVENUE SHIFT AND NEW REVENUE POCKETS FOR MINE DETECTION SYSTEM MANUFACTURERS

FIGURE 19 REVENUE SHIFT IN MINE DETECTION SYSTEM MARKET

5.6 AVERAGE SELLING PRICE ANALYSIS OF MINE DETECTION SYSTEMS, 2020

TABLE 4 AVERAGE SELLING PRICE ANALYSIS OF MINE DETECTION SYSTEMS AND SUBSYSTEMS IN 2020

5.7 MINE DETECTION SYSTEM MARKET ECOSYSTEM

5.7.1 PROMINENT COMPANIES

5.7.2 PRIVATE AND SMALL ENTERPRISES

5.7.3 END USERS

FIGURE 20 MINE DETECTION SYSTEM MARKET ECOSYSTEM MAP

TABLE 5 MINE DETECTION SYSTEM MARKET ECOSYSTEM

5.8 TECHNOLOGY ANALYSIS

5.8.1 SENSOR TECHNOLOGIES

5.8.1.1 Infrared (IR) sensors

5.8.1.2 Ultrasound sensors

5.8.1.3 Explosive detection vapor technique

5.8.1.4 Acoustic/seismic sensors

5.8.2 GROUND PENETRATION RADAR

5.9 USE CASE ANALYSIS

5.9.1 USE CASE: ADVANCED SIGNAL PROCESSING AND SIGNATURE MODELING

5.9.2 USE CASE: LAND MINE DETECTION USING ROCKER BOGIE SYSTEM

5.9.3 USE CASE: IMAGING

5.9.4 USE CASE: SPECTRAL MINE DETECTION

5.10 VALUE CHAIN ANALYSIS OF MINE DETECTION SYSTEM MARKET

FIGURE 21 VALUE CHAIN ANALYSIS

5.11 PORTER’S FIVE FORCES ANALYSIS

FIGURE 22 KEY MINE DETECTION SYSTEM MARKET: PORTER’S FIVE FORCE ANALYSIS

5.11.1 THREAT OF NEW ENTRANTS

5.11.2 THREAT OF SUBSTITUTES

5.11.3 BARGAINING POWER OF SUPPLIERS

5.11.4 BARGAINING POWER OF BUYERS

5.11.5 DEGREE OF COMPETITION

5.12 TARIFF AND REGULATORY LANDSCAPE

5.12.1 NORTH AMERICA

5.12.2 EUROPE

5.12.3 ASIA PACIFIC

5.12.4 MIDDLE EAST

5.13 TRADE ANALYSIS

TABLE 6 RADAR APPARATUS: COUNTRY-WISE EXPORTS, 2019-2020 (USD THOUSAND)

TABLE 7 RADAR APPARATUS: COUNTRY-WISE IMPORTS, 2019-2020 (USD THOUSAND)

TABLE 8 SIGNALING APPARATUS: COUNTRY-WISE EXPORTS, 2019-2020 (USD THOUSAND)

TABLE 9 SIGNALING APPARATUS: COUNTRY-WISE IMPORTS, 2019-2020 (USD THOUSAND)

6 INDUSTRY TRENDS (Page No. - 76)

6.1 INTRODUCTION

6.2 TECHNOLOGY TRENDS

6.2.1 LIDAR TECHNOLOGY

6.2.2 ELECTRICAL IMPEDANCE TOMOGRAPHY (EIT)

6.2.3 INFRARED/HYPERSPECTRAL SYSTEMS

6.2.4 NEXT-GENERATION SENSOR SYSTEMS

6.3 SUPPLY CHAIN ANALYSIS

FIGURE 23 SUPPLY CHAIN ANALYSIS

6.4 IMPACT OF MEGATRENDS

6.4.1 AI AND COGNITIVE APPLICATIONS

6.4.2 MACHINE LEARNING

6.4.3 DEEP LEARNING

6.4.4 BIG DATA

6.5 INNOVATIONS AND PATENT REGISTRATIONS

TABLE 10 INNOVATION & PATENT REGISTRATIONS (2018-2021)

7 MINE DETECTION SYSTEM MARKET, BY APPLICATION (Page No. - 83)

7.1 INTRODUCTION

FIGURE 24 DEFENSE SEGMENT PROJECTED TO DOMINATE MARKET DURING FORECAST PERIOD

TABLE 11 BY APPLICATION: MINE DETECTION SYSTEMS MARKET, 2018–2026 (USD MILLION)

7.2 HOMELAND SECURITY

7.2.1 INCREASING THREATS TO CRITICAL INFRASTRUCTURE TO DRIVE DEMAND

7.3 DEFENSE

7.3.1 GEOPOLITICAL TENSIONS TO DRIVE DEMAND

8 MINE DETECTION SYSTEM MARKET, BY DEPLOYMENT (Page No. - 86)

8.1 INTRODUCTION

FIGURE 25 VEHICLE-MOUNTED SEGMENT PROJECTED TO DOMINATE MARKET DURING FORECAST PERIOD

TABLE 12 BY DEPLOYMENT: MINE DETECTION SYSTEMS MARKET, 2018–2026 (USD MILLION)

8.2 VEHICLE-MOUNTED

8.2.1 ARMORED VEHICLES

8.2.1.1 Easy installation on combat vehicles to drive demand

8.2.2 UNMANNED GROUND VEHICLES

8.2.2.1 Developments by armed forces to drive demand

8.3 SHIP-MOUNTED

8.3.1 COMBAT SHIPS

8.3.1.1 Need for precise and accurate attack naval weapons to drive demand

8.3.2 SUBMARINE

8.3.2.1 Ability to penetrate below water surface without attenuation to drive demand

8.3.3 UNMANNED MARITIME VEHICLE (UMV)

8.3.3.1 Adoption of UMVs for defense applications to drive demand

8.4 AIRBORNE-MOUNTED

8.4.1 FIXED WING AIRCRAFT

8.4.1.1 Increasing number of combat and defense mission aircraft to drive demand

8.4.2 HELICOPTER

8.4.2.1 Low cost of engagement and easy installation to drive demand

8.4.3 UNMANNED AERIAL VEHICLE (UAV)

8.4.3.1 Need for UAVs with combat capabilities to drive demand

8.5 HANDHELD

8.5.1 COMPACT, LIGHT, AND ENERGY-EFFICIENT HANDHELD METAL DETECTORS TO DRIVE DEMAND

9 MINE DETECTION SYSTEM MARKET, BY UPGRADE (Page No. - 91)

9.1 INTRODUCTION

FIGURE 26 OEM SEGMENT PROJECTED TO DOMINATE MARKET DURING FORECAST PERIOD

TABLE 13 BY UPGRADE: MINE DETECTION SYSTEMS MARKET, 2018–2026 (USD MILLION)

9.2 OEM

9.2.1 INCREASE IN VEHICLE-MOUNTED MINE DETECTION SYSTEMS TO DRIVE DEMAND

9.3 MRO

9.3.1 TECHNOLOGICAL ADVANCEMENTS TO DRIVE DEMAND

10 MINE DETECTION SYSTEM MARKET, BY TECHNOLOGY (Page No. - 94)

10.1 INTRODUCTION

FIGURE 27 RADAR-BASED SEGMENT PROJECTED TO DOMINATE MARKET DURING FORECAST PERIOD

TABLE 14 BY TECHNOLOGY: MINE DETECTION SYSTEMS MARKET, 2018–2026 (USD MILLION)

10.2 LASER-BASED

10.2.1 RISING UNDERSEA WARFARE TO DRIVE DEMAND

10.3 RADAR-BASED

10.3.1 INCREASING GROUND-BASED THREATS TO DRIVE DEMAND

10.4 SONAR-BASED

10.4.1 INCREASING PROCUREMENT OF SHIPS TO DRIVE DEMAND

11 REGIONAL ANALYSIS (Page No. - 97)

11.1 INTRODUCTION

FIGURE 28 MINE DETECTION SYSTEM MARKET IN NORTH AMERICA PROJECTED TO GROW AT HIGHEST CAGR

11.2 IMPACT OF COVID-19

FIGURE 29 IMPACT OF COVID-19 ON MINE DETECTION SYSTEM MARKET

TABLE 15 MINE DETECTION SYSTEM MARKET, BY REGION, 2018–2026 (USD MILLION)

TABLE 16 MINE DETECTION SYSTEM MARKET, BY DEPLOYMENT, 2018–2026 (USD MILLION)

TABLE 17 MINE DETECTION SYSTEM MARKET, BY UPGRADE, 2018–2026 (USD MILLION)

TABLE 18 MINE DETECTION SYSTEM MARKET, BY APPLICATION, 2018–2026 (USD MILLION)

TABLE 19 MINE DETECTION SYSTEM MARKET, BY TECHNOLOGY, 2018–2026 (USD MILLION)

11.3 NORTH AMERICA

11.3.1 COVID-19 IMPACT ON NORTH AMERICA

11.3.2 PESTLE ANALYSIS: NORTH AMERICA

FIGURE 30 NORTH AMERICA: MINE DETECTION SYSTEM MARKET SNAPSHOT

TABLE 20 NORTH AMERICA: MINE DETECTION SYSTEM MARKET, BY COUNTRY, 2018–2026 (USD MILLION)

TABLE 21 NORTH AMERICA: MINE DETECTION SYSTEM MARKET, BY DEPLOYMENT, 2018–2026 (USD MILLION)

TABLE 22 NORTH AMERICA: MINE DETECTION SYSTEM MARKET, BY UPGRADE, 2018–2026 (USD MILLION)

TABLE 23 NORTH AMERICA: MINE DETECTION SYSTEM MARKET, BY APPLICATION, 2018–2026 (USD MILLION)

TABLE 24 NORTH AMERICA: MINE DETECTION SYSTEM MARKET, BY TECHNOLOGY, 2018–2026 (USD MILLION)

11.3.3 US

11.3.3.1 Development programs related to unmanned systems to drive the market

FIGURE 31 US: MILITARY SPENDING, 2010–2020 (USD BILLION)

TABLE 25 US: MINE DETECTION SYSTEM MARKET, BY DEPLOYMENT, 2018–2026 (USD MILLION)

TABLE 26 US: MINE DETECTION SYSTEM MARKET, BY UPGRADE, 2018–2026 (USD MILLION)

TABLE 27 US: MINE DETECTION SYSTEM MARKET, BY APPLICATION, 2018–2026 (USD MILLION)

TABLE 28 US: MINE DETECTION SYSTEM MARKET, BY TECHNOLOGY, 2018–2026 (USD MILLION)

11.3.4 CANADA

11.3.4.1 Increasing R&D investments to drive the market

FIGURE 32 CANADA: MILITARY SPENDING, 2010–2020 (USD BILLION)

TABLE 29 CANADA: MINE DETECTION SYSTEM MARKET, BY DEPLOYMENT, 2018–2026 (USD MILLION)

TABLE 30 CANADA: MINE DETECTION SYSTEM MARKET, BY UPGRADE, 2018–2026 (USD MILLION)

TABLE 31 CANADA: MINE DETECTION SYSTEM MARKET, BY APPLICATION, 2018–2026 (USD MILLION)

TABLE 32 CANADA: MINE DETECTION SYSTEM MARKET, BY TECHNOLOGY, 2018–2026 (USD MILLION)

11.4 EUROPE

11.4.1 COVID-19 IMPACT ON EUROPE

11.4.2 PESTLE ANALYSIS: EUROPE

FIGURE 33 EUROPE: MINE DETECTION SYSTEM MARKET SNAPSHOT

TABLE 33 EUROPE: MINE DETECTION SYSTEM MARKETS MARKET, BY COUNTRY, 2018–2026 (USD MILLION)

TABLE 34 EUROPE: MINE DETECTION SYSTEM MARKET, BY DEPLOYMENT, 2018–2026 (USD MILLION)

TABLE 35 EUROPE: MINE DETECTION SYSTEM MARKET, BY UPGRADE, 2018–2026 (USD MILLION)

TABLE 36 EUROPE: MINE DETECTION SYSTEM MARKET, BY APPLICATION, 2018–2026 (USD MILLION)

TABLE 37 EUROPE: MINE DETECTION SYSTEM MARKET, BY TECHNOLOGY, 2018–2026 (USD MILLION)

11.4.3 UK

11.4.3.1 Increasing terrorist activities and countermeasures for explosive devices to drive the market

FIGURE 34 UK: MILITARY SPENDING, 2010–2020 (USD BILLION)

TABLE 38 UK: MINE DETECTION SYSTEM MARKET, BY DEPLOYMENT, 2018–2026 (USD MILLION)

TABLE 39 UK: MINE DETECTION SYSTEM MARKET, BY UPGRADE, 2018–2026 (USD MILLION)

TABLE 40 UK: MINE DETECTION SYSTEM MARKET, BY APPLICATION, 2018–2026 (USD MILLION)

TABLE 41 UK: MINE DETECTION SYSTEM MARKET, BY TECHNOLOGY, 2018–2026 (USD MILLION)

11.4.4 FRANCE

11.4.4.1 Technological advancements in unmanned platforms to drive the market

FIGURE 35 FRANCE: MILITARY SPENDING, 2010–2020 (USD BILLION)

TABLE 42 FRANCE: MINE DETECTION SYSTEM MARKET, BY DEPLOYMENT, 2018–2026 (USD MILLION)

TABLE 43 FRANCE: MINE DETECTION SYSTEM MARKET, BY UPGRADE, 2018–2026 (USD MILLION)

TABLE 44 FRANCE: MINE DETECTION SYSTEM MARKET, BY APPLICATION, 2018–2026 (USD MILLION)

TABLE 45 FRANCE: MINE DETECTION SYSTEM MARKET, BY TECHNOLOGY, 2018–2026 (USD MILLION)

11.4.5 GERMANY

11.4.5.1 Procurement of handheld metal systems to drive the market

FIGURE 36 GERMANY: MILITARY SPENDING, 2010–2020 (USD BILLION)

TABLE 46 GERMANY: MINE DETECTION SYSTEM MARKET, BY DEPLOYMENT, 2018–2026 (USD MILLION)

TABLE 47 GERMANY: MINE DETECTION SYSTEM MARKET, BY UPGRADE, 2018–2026 (USD MILLION)

TABLE 48 GERMANY: MINE DETECTION SYSTEM MARKET, BY APPLICATION, 2018–2026 (USD MILLION)

TABLE 49 GERMANY: MINE DETECTION SYSTEM MARKET, BY TECHNOLOGY, 2018–2026 (USD MILLION)

11.4.6 RUSSIA

11.4.6.1 Growing investments in digitizing radar-based systems to drive the market

FIGURE 37 RUSSIA: MILITARY SPENDING, 2010–2020 (USD BILLION)

TABLE 50 RUSSIA: MINE DETECTION SYSTEM MARKET, BY DEPLOYMENT, 2018–2026 (USD MILLION)

TABLE 51 RUSSIA: MINE DETECTION SYSTEM MARKET, BY UPGRADE, 2018–2026 (USD MILLION)

TABLE 52 RUSSIA: MINE DETECTION SYSTEM MARKET, BY APPLICATION, 2018–2026 (USD MILLION)

TABLE 53 RUSSIA: MINE DETECTION SYSTEM MARKET, BY TECHNOLOGY, 2018–2026 (USD MILLION)

11.4.7 ITALY

11.4.7.1 Plans to renew mine detection systems to drive the market

FIGURE 38 ITALY: MILITARY SPENDING, 2010–2020 (USD BILLION)

TABLE 54 ITALY: MINE DETECTION SYSTEM MARKET, BY DEPLOYMENT, 2018–2026 (USD MILLION)

TABLE 55 ITALY: MINE DETECTION SYSTEM MARKET, BY UPGRADE, 2018–2026 (USD MILLION)

TABLE 56 ITALY: MINE DETECTION SYSTEM MARKET, BY APPLICATION, 2018–2026 (USD MILLION)

TABLE 57 ITALY: MINE DETECTION SYSTEM MARKET, BY TECHNOLOGY, 2018–2026 (USD MILLION)

11.4.8 REST OF EUROPE

TABLE 58 REST OF EUROPE: MINE DETECTION SYSTEM MARKET, BY DEPLOYMENT, 2018–2026 (USD MILLION)

TABLE 59 REST OF EUROPE: MINE DETECTION SYSTEM MARKET, BY UPGRADE, 2018–2026 (USD MILLION)

TABLE 60 REST OF EUROPE: MINE DETECTION SYSTEM MARKET, BY APPLICATION, 2018–2026 (USD MILLION)

TABLE 61 REST OF EUROPE: MINE DETECTION SYSTEM MARKET, BY TECHNOLOGY, 2018–2026 (USD MILLION)

11.5 ASIA PACIFIC

11.5.1 COVID-19 IMPACT ON ASIA PACIFIC

11.5.2 PESTLE ANALYSIS: ASIA PACIFIC

FIGURE 39 ASIA PACIFIC: MINE DETECTION SYSTEM MARKET SNAPSHOT

TABLE 62 ASIA PACIFIC: MINE DETECTION SYSTEM MARKET, BY COUNTRY, 2018–2026 (USD MILLION)

TABLE 63 ASIA PACIFIC: MINE DETECTION SYSTEM MARKET, BY DEPLOYMENT, 2018–2026 (USD MILLION)

TABLE 64 ASIA PACIFIC: MINE DETECTION SYSTEM MARKET, BY UPGRADE, 2018–2026 (USD MILLION)

TABLE 65 ASIA PACIFIC: MINE DETECTION SYSTEM MARKET, BY APPLICATION, 2018–2026 (USD MILLION)

TABLE 66 ASIA PACIFIC: MINE DETECTION SYSTEM MARKET, BY TECHNOLOGY, 2018–2026 (USD MILLION)

11.5.3 CHINA

11.5.3.1 Increasing R&D expenditure to drive the market

FIGURE 40 CHINA: MILITARY SPENDING, 2010–2020 (USD BILLION)

TABLE 67 CHINA: MINE DETECTION SYSTEM MARKET, BY DEPLOYMENT, 2018–2026 (USD MILLION)

TABLE 68 CHINA: MINE DETECTION SYSTEM MARKET, BY UPGRADE, 2018–2026 (USD MILLION)

TABLE 69 CHINA: MINE DETECTION SYSTEM MARKET, BY APPLICATION, 2018–2026 (USD MILLION)

TABLE 70 CHINA: MINE DETECTION SYSTEM MARKET, BY TECHNOLOGY, 2018–2026 (USD MILLION)

11.5.4 INDIA

11.5.4.1 Ongoing modernization of defense capabilities to drive the market

FIGURE 41 INDIA: MILITARY SPENDING, 2010–2020 (USD BILLION)

TABLE 71 INDIA: MINE DETECTION SYSTEM MARKET, BY DEPLOYMENT, 2018–2026 (USD MILLION)

TABLE 72 INDIA: MINE DETECTION SYSTEM MARKET, BY UPGRADE, 2018–2026 (USD MILLION)

TABLE 73 INDIA: MINE DETECTION SYSTEM MARKET, BY APPLICATION, 2018–2026 (USD MILLION)

TABLE 74 INDIA: MINE DETECTION SYSTEM MARKET, BY TECHNOLOGY, 2018–2026 (USD MILLION)

11.5.5 JAPAN

11.5.5.1 Uplifting of self-imposed defense equipment export ban to drive the market

FIGURE 42 JAPAN: MILITARY SPENDING, 2010–2020 (USD BILLION)

TABLE 75 JAPAN: MINE DETECTION SYSTEM MARKET, BY DEPLOYMENT, 2018–2026 (USD MILLION)

TABLE 76 JAPAN: MINE DETECTION SYSTEM MARKET, BY UPGRADE, 2018–2026 (USD MILLION)

TABLE 77 JAPAN: MINE DETECTION SYSTEM MARKET, BY APPLICATION, 2018–2026 (USD MILLION)

TABLE 78 JAPAN: MINE DETECTION SYSTEM MARKET, BY TECHNOLOGY, 2018–2026 (USD MILLION)

11.5.6 AUSTRALIA

11.5.6.1 High demand for advanced technologies in military equipment to drive the market

FIGURE 43 AUSTRALIA: MILITARY SPENDING, 2010–2020 (USD BILLION)

TABLE 79 AUSTRALIA: MINE DETECTION SYSTEM MARKET, BY DEPLOYMENT, 2018–2026 (USD MILLION)

TABLE 80 AUSTRALIA: MINE DETECTION SYSTEM MARKET, BY UPGRADE, 2018–2026 (USD MILLION)

TABLE 81 AUSTRALIA: MINE DETECTION SYSTEM MARKET, BY APPLICATION, 2018–2026 (USD MILLION)

TABLE 82 AUSTRALIA: MINE DETECTION SYSTEM MARKET, BY TECHNOLOGY, 2018–2026 (USD MILLION)

11.5.7 SOUTH KOREA

11.5.7.1 Need for stronger high-end radar-based systems to drive the market

FIGURE 44 SOUTH KOREA: MILITARY SPENDING, 2010–2020 (USD BILLION)

TABLE 83 SOUTH KOREA: MINE DETECTION SYSTEM MARKET, BY DEPLOYMENT, 2018–2026 (USD MILLION)

TABLE 84 SOUTH KOREA: MINE DETECTION SYSTEM MARKET, BY UPGRADE, 2018–2026 (USD MILLION)

TABLE 85 SOUTH KOREA: MINE DETECTION SYSTEM MARKET, BY APPLICATION, 2018–2026 (USD MILLION)

TABLE 86 SOUTH KOREA: MINE DETECTION SYSTEM MARKET, BY TECHNOLOGY, 2018–2026 (USD MILLION)

11.5.8 REST OF ASIA PACIFIC

TABLE 87 REST OF ASIA PACIFIC: MINE DETECTION SYSTEM MARKET, BY DEPLOYMENT, 2018–2026 (USD MILLION)

TABLE 88 REST OF ASIA PACIFIC: MINE DETECTION SYSTEM MARKET, BY UPGRADE, 2018–2026 (USD MILLION)

TABLE 89 REST OF ASIA PACIFIC: MINE DETECTION SYSTEM MARKET, BY APPLICATION, 2018–2026 (USD MILLION)

TABLE 90 REST OF ASIA PACIFIC: MINE DETECTION SYSTEM MARKET, BY TECHNOLOGY, 2018–2026 (USD MILLION)

11.6 MIDDLE EAST & AFRICA

11.6.1 COVID-19 IMPACT ON MIDDLE EAST & AFRICA

11.6.2 PESTLE ANALYSIS

FIGURE 45 MIDDLE EAST & AFRICA: MINE DETECTION SYSTEM MARKET SNAPSHOT

TABLE 91 MIDDLE EAST & AFRICA: MINE DETECTION SYSTEM MARKET, BY COUNTRY, 2018–2026 (USD MILLION)

TABLE 92 MIDDLE EAST & AFRICA: MINE DETECTION SYSTEM MARKET, BY DEPLOYMENT, 2018–2026 (USD MILLION)

TABLE 93 MIDDLE EAST & AFRICA: MINE DETECTION SYSTEM MARKET, BY UPGRADE, 2018–2026 (USD MILLION)

TABLE 94 MIDDLE EAST & AFRICA: MINE DETECTION SYSTEM MARKET, BY APPLICATION, 2018–2026 (USD MILLION)

TABLE 95 MIDDLE EAST & AFRICA: MINE DETECTION SYSTEM MARKET, BY TECHNOLOGY, 2018–2026 (USD MILLION)

11.6.3 ISRAEL

11.6.3.1 Strong bilateral relationship with the US to drive the market

FIGURE 46 ISRAEL: MILITARY SPENDING, 2010–2020 (USD BILLION)

TABLE 96 ISRAEL: MINE DETECTION SYSTEM MARKET, BY DEPLOYMENT, 2018–2026 (USD MILLION)

TABLE 97 ISRAEL: MINE DETECTION SYSTEM MARKET, BY UPGRADE, 2018–2026 (USD MILLION)

TABLE 98 ISRAEL: MINE DETECTION SYSTEM MARKET, BY APPLICATION, 2018–2026 (USD MILLION)

TABLE 99 ISRAEL: MINE DETECTION SYSTEM MARKET, BY TECHNOLOGY, 2018–2026 (USD MILLION)

11.6.4 TURKEY

11.6.4.1 Focus on strengthening defense capabilities to drive the market

FIGURE 47 TURKEY: MILITARY SPENDING, 2010–2020 (USD BILLION)

TABLE 100 TURKEY: MINE DETECTION SYSTEM MARKET, BY DEPLOYMENT, 2018–2026 (USD MILLION)

TABLE 101 TURKEY: MINE DETECTION SYSTEM MARKET, BY UPGRADE, 2018–2026 (USD MILLION)

TABLE 102 TURKEY: MINE DETECTION SYSTEM MARKET, BY APPLICATION, 2018–2026 (USD MILLION)

TABLE 103 TURKEY: MINE DETECTION SYSTEM MARKET, BY TECHNOLOGY, 2018–2026 (USD MILLION)

11.6.5 SAUDI ARABIA

11.6.5.1 Increased military expenditure to drive the market

FIGURE 48 SAUDI ARABIA: MILITARY SPENDING, 2010–2020 (USD BILLION)

TABLE 104 SAUDI ARABIA: MINE DETECTION SYSTEM MARKET, BY DEPLOYMENT, 2018–2026 (USD MILLION)

TABLE 105 SAUDI ARABIA: MINE DETECTION SYSTEM MARKET, BY UPGRADE, 2018–2026 (USD MILLION)

TABLE 106 SAUDI ARABIA: MINE DETECTION SYSTEM MARKET, BY APPLICATION, 2018–2026 (USD MILLION)

TABLE 107 SAUDI ARABIA: MINE DETECTION SYSTEM MARKET, BY TECHNOLOGY, 2018–2026 (USD MILLION)

11.6.6 SOUTH AFRICA

11.6.6.1 Upgrade of aging military equipment with new systems to drive the market

FIGURE 49 SOUTH AFRICA: MILITARY SPENDING, 2010–2020 (USD BILLION)

TABLE 108 SOUTH AFRICA: MINE DETECTION SYSTEM MARKET, BY DEPLOYMENT, 2018–2026 (USD MILLION)

TABLE 109 SOUTH AFRICA: MINE DETECTION SYSTEM MARKET, BY UPGRADE, 2018–2026 (USD MILLION)

TABLE 110 SOUTH AFRICA: MINE DETECTION SYSTEM MARKET, BY APPLICATION, 2018–2026 (USD MILLION)

TABLE 111 SOUTH AFRICA: MINE DETECTION SYSTEM MARKET, BY TECHNOLOGY, 2018–2026 (USD MILLION)

11.7 LATIN AMERICA

11.7.1 COVID-19 IMPACT ON LATIN AMERICA

11.7.2 PESTLE ANALYSIS: LATIN AMERICA

FIGURE 50 LATIN AMERICA: MINE DETECTION SYSTEM MARKET SNAPSHOT

TABLE 112 LATIN AMERICA: MINE DETECTION SYSTEM MARKET, BY COUNTRY, 2018–2026 (USD MILLION)

TABLE 113 LATIN AMERICA: MINE DETECTION SYSTEM MARKET, BY DEPLOYMENT, 2018–2026 (USD MILLION)

TABLE 114 LATIN AMERICA: MINE DETECTION SYSTEM MARKET, BY UPGRADE, 2018–2026 (USD MILLION)

TABLE 115 LATIN AMERICA: MINE DETECTION SYSTEM MARKET, BY APPLICATION, 2018–2026 (USD MILLION)

TABLE 116 LATIN AMERICA: MINE DETECTION SYSTEM MARKET, BY TECHNOLOGY, 2018–2026 (USD MILLION)

11.7.3 BRAZIL

11.7.3.1 Modernization of armed forces to drive the market

FIGURE 51 BRAZIL: MILITARY SPENDING, 2010–2020 (USD BILLION)

TABLE 117 BRAZIL: MINE DETECTION SYSTEM MARKET, BY DEPLOYMENT, 2018–2026 (USD MILLION)

TABLE 118 BRAZIL: MINE DETECTION SYSTEM MARKET, BY UPGRADE, 2018–2026 (USD MILLION)

TABLE 119 BRAZIL: MINE DETECTION SYSTEM MARKET, BY APPLICATION, 2018–2026 (USD MILLION)

TABLE 120 BRAZIL: MINE DETECTION SYSTEM MARKET, BY TECHNOLOGY, 2018–2026 (USD MILLION)

11.7.4 MEXICO

11.7.4.1 Focus on strengthening ISR capabilities to drive the market

FIGURE 52 MEXICO: MILITARY SPENDING, 2010–2020 (USD BILLION)

TABLE 121 MEXICO: MINE DETECTION SYSTEM MARKET, BY DEPLOYMENT, 2018–2026 (USD MILLION)

TABLE 122 MEXICO: MINE DETECTION SYSTEM MARKET, BY UPGRADE, 2018–2026 (USD MILLION)

TABLE 123 MEXICO: MINE DETECTION SYSTEM MARKET, BY APPLICATION, 2018–2026 (USD MILLION)

TABLE 124 MEXICO: MINE DETECTION SYSTEM MARKET, BY TECHNOLOGY, 2018–2026 (USD MILLION)

12 COMPETITIVE LANDSCAPE (Page No. - 152)

12.1 INTRODUCTION

TABLE 125 KEY DEVELOPMENTS BY LEADING PLAYERS IN MINE DETECTION SYSTEM MARKET BETWEEN 2018 AND 2020

12.2 REVENUE ANALYSIS OF TOP 5 MARKET PLAYERS, 2020

FIGURE 53 REVENUE ANALYSIS OF LEADING PLAYERS IN MINE DETECTION SYSTEM MARKET, 2020

12.3 MARKET SHARE ANALYSIS OF LEADING PLAYERS, 2020

FIGURE 54 MARKET SHARE ANALYSIS OF LEADING PLAYERS IN MINE DETECTION SYSTEM MARKET, 2020

TABLE 126 MINE DETECTION SYSTEM MARKET: DEGREE OF COMPETITION

12.4 COMPANY EVALUATION QUADRANT

12.4.1 MINE DETECTION SYSTEM MARKET COMPETITIVE LEADERSHIP MAPPING

12.4.1.1 Star

12.4.1.2 Emerging Leader

12.4.1.3 Pervasive

12.4.1.4 Participant

FIGURE 55 MINE DETECTION SYSTEM MARKET (GLOBAL) COMPANY EVALUATION MATRIX, 2020

12.4.2 MINE DETECTION SYSTEMS MARKET COMPETITIVE LEADERSHIP MAPPING (SME)

12.4.2.1 Progressive companies

12.4.2.2 Responsive companies

12.4.2.3 Starting blocks

12.4.2.4 Dynamic companies

FIGURE 56 MINE DETECTION SYSTEMS MARKET (SME) COMPETITIVE LEADERSHIP MAPPING, 2020

12.5 COMPANY PRODUCT FOOTPRINT ANALYSIS

TABLE 127 COMPANY PRODUCT FOOTPRINT

TABLE 128 COMPANY APPLICATION FOOTPRINT

TABLE 129 COMPANY REGION FOOTPRINT

12.6 COMPETITIVE SCENARIO AND TRENDS

12.6.1 DEALS

TABLE 130 MINE DETECTION SYSTEM MARKET, DEALS, 2017–2021

12.6.2 PRODUCT LAUNCHES

TABLE 131 MINE DETECTION SYSTEM MARKET, PRODUCT LAUNCHES, 2017–2021

13 COMPANY PROFILES (Page No. - 165)

13.1 INTRODUCTION

13.2 KEY PLAYERS

(Business overview, Products/solutions/services offered, MNM view, Key strengths/Right to win, Strategic choices made, and Weaknesses and competitive threats)*

13.2.1 L3HARRIS TECHNOLOGIES, INC.

TABLE 132 L3HARRIS TECHNOLOGIES, INC.: BUSINESS OVERVIEW

FIGURE 57 L3HARRIS TECHNOLOGIES, INC.: COMPANY SNAPSHOT

TABLE 133 L3HARRIS TECHNOLOGIES, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

13.2.2 NORTHROP GRUMMAN CORPORATION

TABLE 134 NORTHROP GRUMMAN CORPORATION: BUSINESS OVERVIEW

FIGURE 58 NORTHROP GRUMMAN CORPORATION: COMPANY SNAPSHOT

TABLE 135 NORTHROP GRUMMAN CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

13.2.3 BAE SYSTEMS

TABLE 136 BAE SYSTEMS: BUSINESS OVERVIEW

FIGURE 59 BAE SYSTEMS: COMPANY SNAPSHOT

TABLE 137 BAE SYSTEMS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

13.2.4 RAYTHEON TECHNOLOGIES CORPORATION

TABLE 138 RAYTHEON TECHNOLOGIES CORPORATION: BUSINESS OVERVIEW

FIGURE 60 RAYTHEON TECHNOLOGIES CORPORATION: COMPANY SNAPSHOT

TABLE 139 RAYTHEON TECHNOLOGIES CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 140 RAYTHEON TECHNOLOGIES CORPORATION: DEALS

13.2.5 ISRAEL AEROSPACE INDUSTRIES

TABLE 141 ISRAEL AEROSPACE INDUSTRIES: BUSINESS OVERVIEW

FIGURE 61 ISRAEL AEROSPACE INDUSTRIES: COMPANY SNAPSHOT

TABLE 142 ISRAEL AEROSPACE INDUSTRIES: PRODUCTS/SOLUTIONS/SERVICES OFFERED

13.2.6 LOCKHEED MARTIN CORPORATION

TABLE 143 LOCKHEED MARTIN CORPORATION: BUSINESS OVERVIEWS

FIGURE 62 LOCKHEED MARTIN CORPORATION: COMPANY SNAPSHOT

TABLE 144 LOCKHEED MARTIN CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

13.2.7 THALES GROUP

TABLE 145 THALES GROUP: BUSINESS OVERVIEW

FIGURE 63 THALES GROUP: COMPANY SNAPSHOT

TABLE 146 THALES GROUP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 147 THALES GROUP: DEALS

13.2.8 ELBIT SYSTEMS LTD.

TABLE 148 ELBIT SYSTEMS LTD.: BUSINESS OVERVIEW

FIGURE 64 ELBIT SYSTEMS LTD.: COMPANY SNAPSHOT

TABLE 149 ELBIT SYSTEMS LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 150 ELBIT SYSTEMS LTD: PRODUCT DEVELOPMENT

TABLE 151 ELBIT SYSTEMS LTD: DEAL

13.2.9 GENERAL DYNAMIC CORPORATION

TABLE 152 GENERAL DYNAMICS CORPORATION: BUSINESS OVERVIEW

FIGURE 65 GENERAL DYNAMICS CORPORATION: COMPANY SNAPSHOT

TABLE 153 GENERAL DYNAMICS CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 154 GENERAL DYNAMICS CORPORATION: DEAL

13.2.10 LEONARDO

TABLE 155 LEONARDO: BUSINESS OVERVIEW

FIGURE 66 LEONARDO: COMPANY SNAPSHOT

TABLE 156 LEONARDO: PRODUCTS/SOLUTIONS/SERVICES OFFERED

13.2.11 CHEMRING GROUP PLC

TABLE 157 CHEMRING GROUP PLC: BUSINESS OVERVIEW

FIGURE 67 CHEMRING GROUP PLC: COMPANY SNAPSHOT

TABLE 158 CHEMRING GROUP PLC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 159 CHEMRING GROUP PLC: DEALS

13.2.12 SCHIEBEL

TABLE 160 SCHIEBEL: BUSINESS OVERVIEW

TABLE 161 SCHIEBEL: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 162 SCHIEBEL: DEALS

13.2.13 MBDA

TABLE 163 MBDA: BUSINESS OVERVIEW

TABLE 164 MBDA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

13.2.14 MINE KAFON

TABLE 165 MY KAFON: BUSINESS OVERVIEW

TABLE 166 MY KAFON: PRODUCTS/SOLUTIONS/SERVICES OFFERED

13.2.15 RHEINMETALL AG

TABLE 167 RHEINMETALL AG: BUSINESS OVERVIEW

FIGURE 68 RHEINMETALL AG: COMPANY SNAPSHOT

TABLE 168 RHEINMETALL AG: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 169 RHEINMETALL AG: DEALS

13.2.16 ARMTRAC LTD

TABLE 170 ARMTRAC LTD: BUSINESS OVERVIEW

TABLE 171 ARMTRAC LTD: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 172 ARMTRAC LTD: DEALS

13.2.17 CHAUDRONNERIE ET FORGES D'ALSACE

TABLE 173 CHAUDRONNERIE ET FORGES D'ALSACE: BUSINESS OVERVIEW

TABLE 174 CHAUDRONNERIE ET FORGES D'ALSACE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

13.2.18 PEARSON ENGINEERING

TABLE 175 PEARSON ENGINEERING: BUSINESS OVERVIEW

TABLE 176 PEARSON ENGINEERING: PRODUCTS/SOLUTIONS/SERVICES OFFERED

13.2.19 DCD GROUP

TABLE 177 DCD GROUP: BUSINESS OVERVIEW

TABLE 178 DCD GROUP PRODUCTS/SOLUTIONS/SERVICES OFFERED

13.3 OTHER PLAYERS

13.3.1 CSI

TABLE 179 CSI: BUSINESS OVERVIEW

TABLE 180 CSI PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 181 CSI: DEALS

13.3.2 MISTRAL

TABLE 182 MISTRAL: BUSINESS OVERVIEW

TABLE 183 MISTRAL: PRODUCTS/SOLUTIONS/SERVICES OFFERED

13.3.3 CDAC

TABLE 184 CDAC: BUSINESS OVERVIEW

TABLE 185 CDAC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

13.3.4 GEM SYSTEMS

TABLE 186 GEM SYSTEMS: BUSINESS OVERVIEW

TABLE 187 GEM SYSTEMS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

13.3.5 TÜBÝTAK BULTEN

TABLE 188 TUBITAK BULTEN: BUSINESS OVERVIEW

TABLE 189 TUBITAK BULTEN: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 190 TUBITAK BULTEN: DEALS

*Details on Business overview, Products/solutions/services offered, MNM view, Key strengths/Right to win, Strategic choices made, and Weaknesses and competitive threats might not be captured in case of unlisted companies.

14 APPENDIX (Page No. - 211)

14.1 DISCUSSION GUIDE

14.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

14.3 AVAILABLE CUSTOMIZATIONS

14.4 RELATED REPORTS

14.5 AUTHOR DETAILS

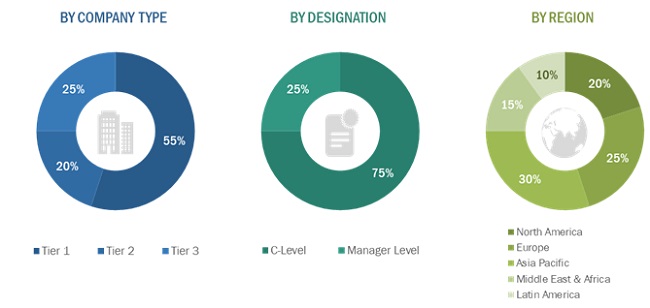

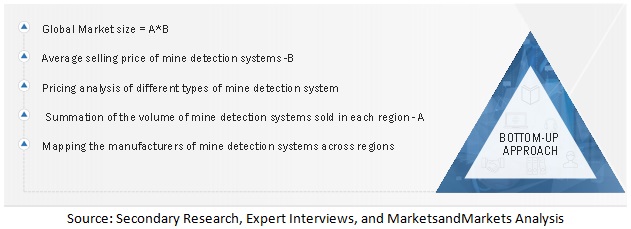

The study involved various activities in estimating the market size for Mine detection Systems. Exhaustive secondary research was undertaken to collect information on the mine detection Systems market, its adjacent markets, and its parent market. The next step was to validate these findings, assumptions, and sizing with the industry experts across the value chain through primary research. Both demand- and supply-side analyses were carried out to estimate the overall size of the market. Thereafter, market breakdown and data triangulation procedures were used to estimate the sizes of different segments and subsegments of the mine detection Systems market.

Secondary Research

The market share of companies in the mine detection Systems market was determined by using the secondary data acquired through paid and unpaid sources and analyzing product portfolios of major companies operating in the market. These companies were rated based on the performance and quality of their products. These data points were further validated by primary sources.

Secondary sources referred for this research study on the mine detection Systems market included government sources, such as the US Department of Defense (DoD); federal and state governments of various countries; corporate filings, such as annual reports, investor presentations, and financial statements; and trade, business, and professional associations; among others. Secondary data was collected and analyzed to arrive at the overall size of the mine detection Systems market, which was further validated by primary respondents.

Primary Research

Extensive primary research was conducted after acquiring information about the current scenario of the mine detection Systems market through secondary research. Several primary interviews were conducted with market experts from both the demand and supply sides across major regions, namely, North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America. Primary data was collected through questionnaires, emails, and telephonic interviews.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both, top-down and bottom-up approaches were used to estimate and validate the mine detection Systems market size. These methods were also used extensively to estimate the size of various segments and subsegments of the market. The research methodology used to estimate the market size included the following steps:

- Key players in the industry and market were identified through extensive secondary research of their product matrix and geographical presence and developments undertaken by them.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

Research Approach:

Both top-down and bottom-up approaches were used to estimate and validate the total size of the mine detection Systems market. These methods were also used extensively to estimate the size of various segments and subsegments of the market. The research methodology used to estimate the market size included the following:

- Key players in the industry and market were identified through extensive secondary research of their product matrix and geographical presence and developments undertaken by them.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

Global the mine detection Systems market Size: Bottom-Up Approach

Data Triangulation

After arriving at the overall size of the mine detection Systems market using the market size estimation processes explained above, the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from demand as well as supply sides of the mine detection systems market.

Objectives of the Report

- To define, describe, segment, and forecast the size of the mine detection Systems market based on deployment,upgrade, application, technology and region.

- To understand the structure of the market by identifying its various segments and subsegments

- To forecast the size of various segments of the market with respect to major regions, namely, North America, Europe, Asia Pacific, Middle East & Africa, and Latin America along with the major countries in each of these regions

- To identify and analyze key drivers, restraints, opportunities, and challenges that influence the growth of the mine detection Systems market

- To strategically analyze the micro-markets with respect to individual growth trends, prospects, and their contributions to the overall market

- To analyze the opportunities in the market for stakeholders by identifying key market trends

- To analyze competitive developments such as contracts, acquisitions, expansions, new product launches, and partnerships & agreements in the market

- To provide a detailed competitive landscape of the mine detection Systems market, along with an analysis of the business and corporate strategies adopted by leading players

Available Customizations

MarketsandMarkets offers the following customizations for this market report:

- Additional country-level analysis of the mine detection Systems market

- Profiling of additional market players (up to 5)

Product Analysis

- Product matrix, which provides a detailed comparison of the product portfolio of each company in the mine detection Systems market

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Mine Detection System Market