Gunshot Detection Systems Market by Installation (Fixed Installation, Vehicle Mounted, Soldier Mounted System), Solution (System, Subscription-based Gunshot Detection Services), Application, End User, and Region - Global Forecast to 2027

Updated on : Nov 25, 2024

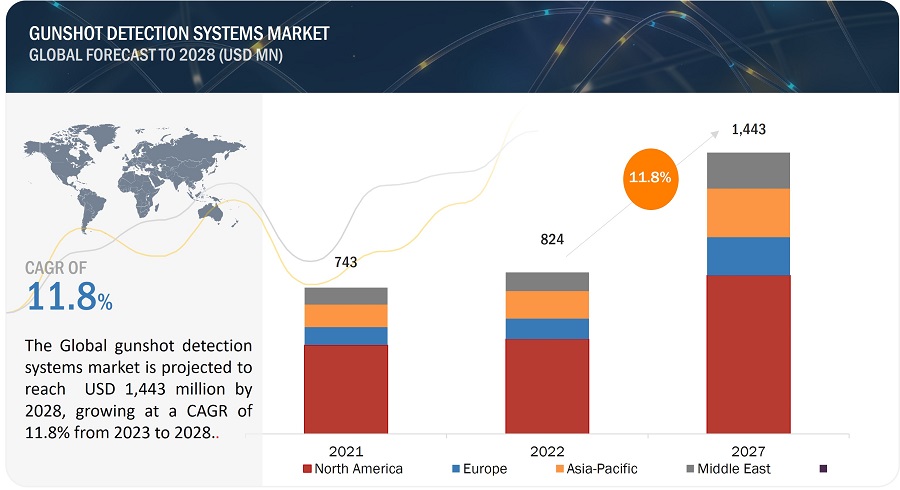

[186 Pages Report] The Gunshot Detection Systems Market is projected to grow from USD 824 million in 2022 to USD 1,443 million by 2027, at a CAGR of 11.8% from 2022 to 2027. A gunshot detection system is a combination of sensors that detect/locate gunshot firing in an area. Acoustic system-based gunshot detection systems use sensor networks deployed in the surveillance area. Sensors can differentiate other acoustic interferences in the environment by using acoustic pattern analysis. Another technology substituting gunshot detection are electro-optic detection, which uses thermal imaging to track the location of enemy snipers. Gunshot detection systems are being increasingly adopted by various countries. The US is the fastest-growing market for gunshot detection systems. Growth in gun ownership in the US and illegal arms sales have contributed to the threat of gunfire-related incidents. The rise in deaths or homicide incidents due to the use of guns is a major concern.

Gunshot Detection Systems Market Forecast to 2028

To know about the assumptions considered for the study, Request for Free Sample Report

Gunshot Detection Systems Market Dynamics

Driver: Need to track shooters and protect defense establishments effectively

Gunshot incidents are more frequent in contested environments wherein the defense forces need to track down the origin of a gunshot and apprehend the culprit or strategize an appropriate response. Gunshot detection systems are vital in determining the origin of gunfire and preparing soldiers for a counterattack. Several defense agencies worldwide have integrated such systems into their platoons to minimize the risk of casualty to the deployed troops. For instance, the US Army has purchased wearable sniper detector systems from QinetiQ Group plc (UK) for its troops stationed in Iraq and Afghanistan. These systems identify the distance and direction of shots fired within a tenth of a second. The US Army plans to integrate gunshot detection technology with its Land Warrior and Nett Warrior systems for future applications. These systems have network-situational-awareness capabilities, including a helmet-mounted display screen that uses the Global Positioning System (GPS) digital mapping display technology designed to provide enhanced tactical awareness to dismounted soldiers.

The increasing demand for such systems has also encouraged manufacturers to design several gunshot detection technologies whose capabilities and functioning parameters can be modified as per the engagement scenario. For instance, Raytheon Technologies Corporation’s (US) Boomerang uses a fixed array of microphones mounted on a High Mobility Multipurpose Wheeled Vehicle (HMMWV) to locate the position of the shooter. The Boomerang automatically provides an immediate indication of hostile fire or sniper attack and localizes the shooter’s position, allowing for a rapid, informed, and coordinated response. Another system prominently used in the European region is Pilar by the ACOEM Group (France). This system can be vehicle-mounted for sniper localization.

Restraint: High installation cost

Gunshot detection systems are widely used in homeland security applications. These systems require the installation of several spatially distributed sensors over a large area and are, thus, expensive. Maintaining these systems is an additional expense. The average installation cost varies between USD 0.2 million and USD 0.4 million for a 3-square mile area in a subscription period of 3 years (ShotSpotter Inc.). Maintenance and replacement of faulty sensors may increase the life-cycle cost of these systems, which leads to an increase in the tax rates for citizens. The high cost associated with the installation and maintenance of gunshot detection systems is one of the restraining factors for the market.

Opportunity: Focus of law enforcement agencies to suppress gun-related crimes

With digital technologies becoming more prevalent, law enforcement agencies are increasingly looking to external experts to help them with digital transformation. They are partnering with external managed service providers to upgrade existing systems and increase the coverage currently provided by gunshot detection technologies. According to a Forbes report published in 2018, the smart cities market has the potential to grow to USD 1.5 trillion by 2025. Futuristic smart cities are expected to employ high-end technologies to enhance security. Gunshot detection is one of the technologies playing an important role in improving civilian security services. It is being adopted by various cities across US, including Fresno, California, and Peoria, Illinois. In December 2020, ShotSpotter Inc. (US) announced new contracts with seven US cities, all with populations less than 50,000, to deploy its flagship gunshot detection solution called ShotSpotter Respond as part of an increasing trend of small cities adopting big city tools for preventing and reducing gun violence.

These systems provide law enforcement agencies and security firms with forensic evidence for investigations of gunshot events. Gunshot detectors use digital microphones installed on buildings and streets that record evidence of gunshots, provide near instantaneous notification, triangulate the location of shooters and the direction of a shot, detect the type of gun, and ultimately aid in catching fleeing suspects and solving crimes.

Challenge: High rate of false alarms

[187 Pages Report] Gunshot detection systems sense specific characteristics of ammunition leaving the gun chamber. The sensing modalities of such systems include both sound and visual elements. Thus, loud sounds, including fireworks, power tools, and helicopters, can all trigger the system, causing false alarms. Numerous false triggers have raised serious reliability concerns over the installed base of gunshot detection systems. In August 2021, a critical report issued by the City of Chicago’s Inspector General (IG) highlighted four major problems caused due to gunshot detection systems by ShotStopper. It stated that the false alarms result in 60 or more trips for law enforcement agencies into communities for no reason and on high alert, expecting to potentially confront a dangerous situation.

The methodology used by ShotSpotter to provide evidence against defendants in criminal cases is not transparent. It has not been peer-reviewed or otherwise independently evaluated. These sensors automatically send audio files to human analysts when those sensors detect gunshot-like sounds. These analysts then decide whether the sounds are gunshots or other loud noises such as firecrackers, car backfires, or construction noises. They also triangulate the timing of when sounds reach different microphones to establish a location for the noise. If it is believed to be the sound of a gunshot, they try to figure out how many shots were fired and what kind of gun is involved (such as a pistol versus a fully automatic weapon).

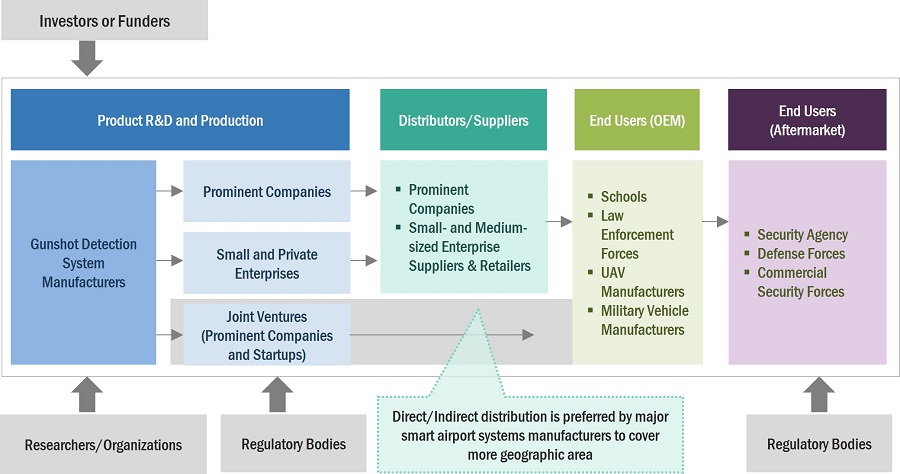

Gunshot Detection Systems Market Ecosystem

Prominent companies in this market include well-established, financially stable manufacturers of gunshot detection systems. These companies have been operating in the market for several years and possess a diversified product portfolio, state-of-the-art technologies, and strong global sales and marketing networks. Prominent companies include SoundThinking Inc. (Previously ShotStopper Inc.,) (US) and Shooter Detection Systems LLC (US), Raytheon Technologies Corporation (US), QinetiQ Group (US), ACOEM Group (France), Thales Group (France), and Elta Systems Ltd. (Israel), among others.

Fixed Installation segment to have second largest market share during the forecast period

Based on Installation, the Gunshot Detection Systems market has been segmented into fixed installation, vehicle installation and soldier mounted. The fixed installation segment is expected to increase significantly in the upcoming years. The increase in segment remuneration can be attributed to improvements in the safety systems of present school, university, and military infrastructures. Fixed gunshot detection systems track a gunshot occurrence using acoustic sensor node technology. These systems are put on walls, poles, or border crossings for military purposes.

Defense and Government segment to lead the market for Gunshot Detection Systems during the forecast period

Based on End User, the Gunshot Detection Systems market has been segmented into Commercial, Defense and Government Segment. Gunshot detection systems in the defense and government sector are either platform-mounted or fixed installations deployed at defense and government establishments. An increase in open fire incidents and a rise in criminal activities have led to increased spending by government authorities of various countries to install gunshot detection systems. Additionally, the US government is installing gunshot detection systems in government offices and buildings to enhance safety.

System segment to witness higher demand during the forecast period

Based on Solution, the Gunshot Detection Systems market has been classified into System and Subscription based gunshot detection services. The system comprises all of the hardware needed to detect gunshots using sensors. Acoustic sensors and display systems, among others, are employed in gunshot detection systems. Increasing gunfire incidents across the globe are leading to the increased demand for the gunshot detection system.

Outdoor segment to acquire the largest market share during the forecast period

Based on Application, the Gunshot Detection Systems market has been classified into Indoor and outdoor segment. These systems are also used at international crossings, as well as on armoured vehicles and air platforms like UAVs and helicopter gunships. The outdoor category is expected to be the largest in 2022 and to maintain its dominance throughout the forecast period. The increased value is due to the greater coverage area and improved precision. The cross-border conflicts are the primary factor for the utilization of gunshot detection systems for outdoor applications.

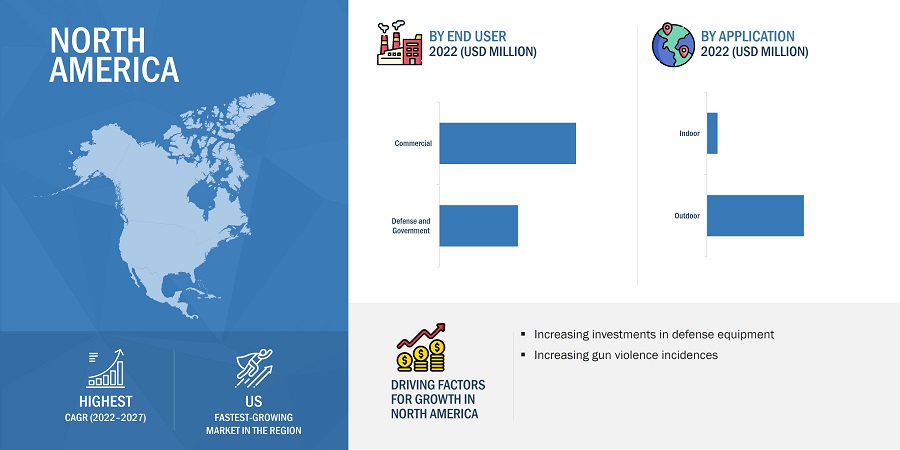

Nort America is projected to witness the highest market share during the forecast period

North Ameica leads the Gunshot Detection Systems market. Because of the high rates of shooting or gunshots near schools, colleges, and universities, as educational facilities within the area, North America dominates the Gunshot Detection Systems market. The rising rate of gun violence, combined with the growing need for sophisticated gunshot detection systems, will drive market growth in the next years. The United States has seen a rise in gun crime in recent years, prompting law enforcement to deploy gunshot detection devices.

Gunshot Detection Systems Market by Region

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

Major players operating in the Gunshot Detection Systems market include Shot spotter, Inc., (US) and Shooter Detection Systems LLC (US), Raytheon Technologies Corporation (US), QinetiQ Group (US), ACOEM Group (France), THALES (France), and Elta Systems Ltd. (Israel), and among others.

Scope of the Report

|

Report Metric |

Details |

|

Market size available for years |

2018-2027 |

|

Base year considered |

2021 |

|

Forecast period |

2022-2027 |

|

Forecast units |

Value (USD Million/Billion) |

|

Segments Covered |

By Installation, By End User, By Solution, By Application, By Region |

|

Geographies Covered |

North America, Asia Pacific, Europe, Middle East, Rest of the World |

|

Companies Covered |

Shot spotter, Inc., (US) Shooter Detection Systems LLC (US), Raytheon Technologies Corporation (US), QinetiQ Group (US), Acoem Group (France), THALES (France), Databuoy Corporation (US), and Elta Systems Ltd. (Israel), among others. |

Gunshot Detection Systems Market Highlights

This research report categorizes the Gunshot detection system Market based on Component, Type, End User, Platform, Application and Region.

|

Aspect |

Details |

|

By Application |

|

|

By Solution |

|

|

By End User |

|

|

By Installation |

|

|

By Region |

|

Recent Developments

- In September 2022, 3xLOGIC, Inc., a supplier of integrated, intelligent security systems, introduced a new variety of deployment choices for users seeking to secure smaller areas in active shooter scenarios with the new Single Sensor Gunshot Detection solution. The 3xLOGIC 8-sensor device is intended for bigger places, such as a gymnasium, cafeteria, library, or pole installed outside to cover wider regions.

- In December 2021, Shooter Detection System, LLC signed the partnership agreement with Siemens Smart Infrastructure (US). The coupling of the Guardian Indoor Active Shooter Detection System and Surveillance Video system software will allow organizations to automatically alert building security by activating alarms, correlate live video feeds with real-time monitoring of recognized shots on building floor plans, and take other automated steps when gunfire is detected within a building.

- In September 2021, Shooter Detection System, LLC signed the partnership agreement with Genesys Inc. (US). The partnership will provide multi-channel active shooter warnings and enhanced critical event management.

- In June 2021, Shooter Detection System, LLC signed the partnership agreement with Singlewire Software, LLC (US). The companies have incorporated technology to improve public safety in the case of an active shooter. In response to a shooting in a building, companies employing both systems will be able to instantly disseminate emergency notifications to people in danger via several channels at the same time, including audio broadcast systems, digital signs, desktop alerts, mobile devices, and email.

- In April 2021, Shooter Detection System, LLC signed the partnership agreement with VS Energy, Inc. for the integration of the Guardian Indoor Active Shooter Detection System with the Lightway. The technological integration combines quick, precise gunshot detection with an overhead lighting system that illuminates the path to safety for building occupants and directs first responders to the danger area.

Frequently Asked Questions (FAQs) Addressed by the Report

What are your views on the growth prospect of the Gunshot Detection Systems market?

The Gunshot Detection Systems market is being driven by the installation on the advanced Gunshot Detection Systems in the schools, colleges, theater, public areas to enhance the public safety. The Systems helps in sharing real-time information that increases the possibility of saving lives in the event of a shooting incident. Other establishments, such as banks and financial organizations, also have a significant demand for these systems, as do high-security prisons and defence installations. Additionally the growth of the market has been pushed by the rising need for advancement in border surveillance systems and perimeter security.

What are the key sustainability strategies adopted by leading players operating in the Gunshot Detection Systems market?

Key players have adopted various organic and inorganic strategies to strengthen their position in the Gunshot Detection Systems market. The major players include Shot spotter, Inc., (US) and Shooter Detection Systems LLC (US), Raytheon Technologies Corporation (US), QinetiQ Group (US), ACOEM Group (France), THALES (France), and Elta Systems Ltd. (Israel), and among others. These players have adopted various strategies, such as acquisitions, contracts, expansions, new product launches, and partnerships & agreements, to expand their presence in the market.

What are the new emerging technologies and use cases disrupting the Gunshot Detection Systems market?

Some of the major emerging technologies and use cases disrupting the market include the Utilization of Optical Detection Systems, Infrared Cameras, Laser Range Finders, and GPS with Gunshot Detection Systems.

Who are the key players and innovators in the ecosystem of the Gunshot Detection Systems market?

The key players in the Gunshot Detection Systems market include Shot spotter, Inc. (US) and Shooter Detection Systems LLC (US), Raytheon Technologies Corporation (US), QinetiQ Group (US), ACOEM Group (France), THALES (France), and Elta Systems Ltd. (Israel).

Which region is expected to hold the highest market share in the Gunshot Detection Systems market?

The Gunshot Detection Systems market in North America is projected to hold the highest market share during the forecast period due open fire arm incidents occurring in the region and owing to the upgradation of security systems in existing infrastructure, such as universities, public banks, and corporate offices. More than 120 departments in US have installed gunfire detection systems on rooftops and light poles that use a web of wirelessly connected acoustic sensors to provide gunshot alerts.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Increasing gun-related violence in public- Need to track shooters and protect defense establishments effectivelyRESTRAINTS- High installation costOPPORTUNITIES- Focus of law enforcement agencies to suppress gun-related crimesCHALLENGES- High rate of false alarms

-

5.3 TRENDS/DISRUPTION IMPACTING CUSTOMERS’ BUSINESSESREVENUE SHIFT AND NEW REVENUE POCKETS FOR GUNSHOT DETECTION SYSTEM MANUFACTURERS

- 5.4 TRADE ANALYSIS

- 5.5 PRICING ANALYSIS

-

5.6 MARKET ECOSYSTEMPROMINENT COMPANIESPRIVATE AND SMALL ENTERPRISESEND USERS

- 5.7 VALUE CHAIN ANALYSIS

-

5.8 RECESSION IMPACT ANALYSISUNCERTAINTY ANALYSISFACTORS IMPACTING GUNSHOT DETECTION SYSTEMS MARKET 2022–2023PROBABLE SCENARIO IMPACT OF GUNSHOT DETECTION SYSTEMS MARKET

- 5.9 TECHNOLOGY ANALYSIS

-

5.10 PORTER’S FIVE FORCES MODELTHREAT OF NEW ENTRANTSTHREAT OF SUBSTITUTESBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSINTENSITY OF COMPETITIVE RIVALRY

-

5.11 KEY STAKEHOLDERS AND BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

- 5.12 KEY CONFERENCES AND EVENTS IN 2022–2023

- 5.13 TARIFF REGULATORY LANDSCAPE FOR AEROSPACE & DEFENSE INDUSTRY

- 6.1 INTRODUCTION

- 6.2 SUPPLY CHAIN ANALYSIS

-

6.3 TECHNOLOGY TRENDSEDGE COMPUTING

-

6.4 USE CASES: GUNSHOT DETECTION SYSTEMSUSE CASE 1: GUNSHOT DETECTION SYSTEM INSTALLATION IN CHICAGO CITYUSE CASE 2: GUNSHOT DETECTION SYSTEM INSTALLATION IN LOS ANGELES CITYUSE CASE 3: INDOOR GUNSHOT DETECTION SYSTEM INSTALLATIONS IN OFFICES OF GILBANE BUILDING COMPANY (US)USE CASE 4: ACOUSTIC DETECTION SYSTEM INSTALLATION ON ARMORED VEHICLES

- 6.5 IMPACT OF MEGATRENDS

-

6.6 GUNSHOT DETECTION SYSTEMS MARKET: PATENT ANALYSIS

- 7.1 INTRODUCTION

-

7.2 FIXED INSTALLATIONINCREASED ADOPTION IN SCHOOLS

-

7.3 VEHICLE INSTALLATIONARMORED VEHICLES- Increased defense budget to drive marketOTHER COMMERCIAL VEHICLES- Utilized for public security

-

7.4 SOLIDER MOUNTED SYSTEMSUTILIZATION OF TECHNOLOGY BY VARIOUS DEFENSE FORCES

- 8.1 INTRODUCTION

-

8.2 COMMERCIALADOPTION BY VARIOUS COMMERCIAL STAKEHOLDERSTRANSPORTATION- Incorporation of advanced technologiesEDUCATION- Increased open-arm fire incidents in educational institutesSPORTS AND ENTERTAINMENT- Used in security solutions at different zones

-

8.3 DEFENSE AND GOVERNMENTADOPTION BY GOVERNMENTS AND DEFENSE TO CONTROL OPENFIRE INCIDENTSGOVERNMENT FACILITIES- Deployment at different government agenciesHOMELAND SECURITY- Enforce stringent security measuresDEFENSE AND MILITARY- Increasing demand for armored vehicles owing to cross-border conflicts

- 9.1 INTRODUCTION

-

9.2 SYSTEMSADOPTION BY VARIOUS COMMERCIAL STAKEHOLDERSSENSORS- Important component in gunshot detection systems- Acoustic sensors- Electro-optic sensors- Air pressure sensorsMICROPHONES- Capture gunfire shotsCOMMUNICATION MODULES- Translates real-time informationUSER INTERFACE MODULES- Large user interface modules cover wide area

-

9.3 SUBSCRIPTION-BASED GUNSHOT DETECTION SERVICES (SAAS)INCREASING OPENFIRE INCIDENTS TO DRIVE MARKET

- 10.1 INTRODUCTION

-

10.2 INDOORINCREASING DEMAND FROM EDUCATIONAL INSTITUTES

-

10.3 OUTDOORINCREASED ADOPTION IN DEFENSE OPERATIONS

-

11.1 INTRODUCTIONREGIONAL RECESSION ANALYSIS

-

11.2 NORTH AMERICAPESTLE ANALYSIS: NORTH AMERICAUS- Lucrative market for gunshot detection systemsCANADA- Adoption of advanced gunshot detection systems for public safety

-

11.3 EUROPEPESTLE ANALYSIS: EUROPEUK- CPNI utilizes gunshot detection systems to enhance securityFRANCE- Increased adoption in commercial marketGERMANY- Adoption in universities and schoolsITALY- Increasing prevalence of gun violence incidentsRUSSIA- Adoption by law enforcement agenciesREST OF EUROPE- Growing public safety concern

-

11.4 ASIA PACIFICPESTLE ANALYSIS: ASIA PACIFICCHINA- Increased border disputes and regulationsINDIA- Increased instances of gun-related violence in public areasJAPAN- Increased budget for homeland securityAUSTRALIA- Enhanced national strategySOUTH KOREA- Procurement of advanced armored vehiclesREST OF ASIA PACIFIC- Increased emphasis on upgrading military capabilities

-

11.5 MIDDLE EASTPESTLE ANALYSIS: MIDDLE EASTSAUDI ARABIA- Utilization by various defense and homeland forcesTURKEY- Increased focus on homeland securityISRAEL- Joint program by government and private firms to develop technologyREST OF MIDDLE EAST- Expansion of market due to rising tourist industry

-

11.6 REST OF THE WORLDPESTLE ANALYSIS: REST OF THE WORLDLATIN AMERICA- Increased public safetyAFRICA- Adoption by government agencies

- 12.1 INTRODUCTION

- 12.2 MARKET SHARE ANALYSIS OF KEY PLAYERS, 2021

- 12.3 TOP FIVE PLAYERS RANKING ANALYSIS, 2021

- 12.4 REVENUE ANALYSIS OF TOP FIVE MARKET PLAYERS, 2021

- 12.5 COMPETITIVE BENCHMARKING

-

12.6 COMPANY EVALUATION QUADRANTSTARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTS

-

12.7 STARTUP/SME EVALUATION QUADRANTPROGRESSIVE COMPANIESRESPONSIVE COMPANIESSTARTING BLOCKSDYNAMIC COMPANIES

-

12.8 COMPETITIVE SCENARIOMARKET EVALUATION FRAMEWORKPRODUCT LAUNCHES/DEVELOPMENTSDEALS

- 13.1 INTRODUCTION

-

13.2 KEY PLAYERSSOUND THINKING INC. (PREVIOUSLY SHOTSPOTTER, INC.)- Business overview- Products/Solutions/Services offered- MnM viewSHOOTER DETECTION SYSTEMS, LLC- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewRAYTHEON TECHNOLOGIES CORPORATION- Business overview- Products/Solutions/Services offered- MnM viewQINETIQ GROUP- Business overview- Products/Solutions/Services offered- MnM viewACOEM GROUP- Business overview- Products/Solutions/Services offered- MnM viewDATABUOY CORPORATION- Business overview- Products/Solutions/Services offered- Recent developmentsELTA SYSTEMS LTD.- Business overview- Products/Solutions/Services offered- Recent developmentsCOMPAGNIE INDUSTRIELLE DES LASERS (CIILAS)- Business overview- Products/Solutions/Services offeredDIVERSIFIED DATA SYSTEMS, INC.- Business overview- Products/Solutions/Services offeredMICROFLOWN AVISA- Business overview- Products/Solutions/Services offeredINFORMATION SYSTEM TECHNOLOGIES, INC.- Business overview- Products/Solutions/Services offeredTHALES- Business overview- Products/Solutions/Services offeredRHEINMETALL AG- Business overview- Products/Solutions/Services offeredAMBERBOX, INC.- Business overview- Products/Solutions/Services offeredEAGL TECHNOLOGY, INC.- Business overview- Products/Solutions/Services offeredC-DAC (CENTRE FOR DEVELOPMENT OF ADVANCED COMPUTING)- Business overview- Products/Solutions/Services offeredSAFE ZONE TECHNOLOGIES, INC.- Business overview- Products/Solutions/Services offeredASELSAN A.S.- Business overview- Products/Solutions/Services offered3XLOGIC, INC.- Business overview- Products/Solutions/Services offeredHERRINGS TECHNOLOGY- Business overview- Products/Solutions/Services offeredIMS TECHNOLOGY & SECURITY- Business overview- Products/Solutions/Services offered

- 14.1 DISCUSSION GUIDE

- 14.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 14.3 CUSTOMIZATION OPTIONS

- 14.4 RELATED REPORTS

- 14.5 AUTHOR DETAILS

- TABLE 1 USD EXCHANGE RATES

- TABLE 2 GUNSHOT DETECTION SYSTEMS MARKET: INCLUSIONS AND EXCLUSIONS

- TABLE 3 SEGMENTS AND SUBSEGMENTS

- TABLE 4 GUNSHOT DETECTION SYSTEM INSTALLATIONS IN US CITIES

- TABLE 5 IMPORTED VALUE OF ARMORED VEHICLES, USD MILLION (2015–2020)

- TABLE 6 AVERAGE SELLING PRICE RANGE: GUNSHOT DETECTION SYSTEMS MARKET (BY APPLICATION)

- TABLE 7 GUNSHOT DETECTION SYSTEMS MARKET ECOSYSTEM

- TABLE 8 TECHNOLOGICAL DEVELOPMENTS IN GUNSHOT DETECTION SYSTEMS MARKET

- TABLE 9 GUNSHOT DETECTION SYSTEMS MARKET: PORTER’S FIVE FORCES ANALYSIS

- TABLE 10 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR GUNSHOT DETECTION TECHNOLOGIES (%)

- TABLE 11 KEY BUYING CRITERIA FOR GUNSHOT DETECTION TECHNOLOGIES

- TABLE 12 GUNSHOT DETECTION SYSTEMS MARKET: CONFERENCES AND EVENTS

- TABLE 13 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 14 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 15 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 16 MIDDLE EAST: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 17 REST OF THE WORLD: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 18 KEY PATENTS, 2016–2022

- TABLE 19 GUNSHOT DETECTION SYSTEMS MARKET, BY INSTALLATION, 2018–2021 (USD MILLION)

- TABLE 20 GUNSHOT DETECTION SYSTEMS MARKET, BY INSTALLATION, 2022–2027 (USD MILLION)

- TABLE 21 GUNSHOT DETECTION SYSTEMS MARKET, BY END USER, 2018–2021 (USD MILLION)

- TABLE 22 GUNSHOT DETECTION SYSTEMS MARKET, BY END USER, 2022–2027 (USD MILLION)

- TABLE 23 GUNSHOT DETECTION SYSTEMS MARKET, BY SOLUTION, 2018–2021 (USD MILLION)

- TABLE 24 GUNSHOT DETECTION SYSTEMS MARKET, BY SOLUTION, 2022–2027 (USD MILLION)

- TABLE 25 GUNSHOT DETECTION SYSTEMS MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

- TABLE 26 GUNSHOT DETECTION SYSTEMS MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 27 GUNSHOT DETECTION SYSTEMS MARKET, BY REGION, 2018–2021 (USD MILLION)

- TABLE 28 GUNSHOT DETECTION SYSTEMS MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 29 NORTH AMERICA: GUNSHOT DETECTION SYSTEMS MARKET, BY INSTALLATION, 2018–2021 (USD MILLION)

- TABLE 30 NORTH AMERICA: GUNSHOT DETECTION SYSTEMS MARKET, BY INSTALLATION, 2022–2027 (USD MILLION)

- TABLE 31 NORTH AMERICA: GUNSHOT DETECTION SYSTEMS MARKET, BY END USER, 2018–2021 (USD MILLION)

- TABLE 32 NORTH AMERICA: GUNSHOT DETECTION SYSTEMS MARKET, BY END USER, 2022–2027 (USD MILLION)

- TABLE 33 NORTH AMERICA: GUNSHOT DETECTION SYSTEMS MARKET, BY SOLUTION, 2018–2021 (USD MILLION)

- TABLE 34 NORTH AMERICA: GUNSHOT DETECTION SYSTEMS MARKET, BY SOLUTION, 2022–2027 (USD MILLION)

- TABLE 35 NORTH AMERICA: GUNSHOT DETECTION SYSTEMS MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

- TABLE 36 NORTH AMERICA: GUNSHOT DETECTION SYSTEMS MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 37 NORTH AMERICA: GUNSHOT DETECTION SYSTEMS MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

- TABLE 38 NORTH AMERICA: GUNSHOT DETECTION SYSTEMS MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

- TABLE 39 US: GUNSHOT DETECTION SYSTEMS MARKET, BY INSTALLATION, 2018–2021 (USD MILLION)

- TABLE 40 US: GUNSHOT DETECTION SYSTEMS MARKET, BY INSTALLATION, 2022–2027 (USD MILLION)

- TABLE 41 US: GUNSHOT DETECTION SYSTEMS MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

- TABLE 42 US: GUNSHOT DETECTION SYSTEMS MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 43 CANADA: GUNSHOT DETECTION SYSTEMS MARKET, BY INSTALLATION, 2018–2021 (USD MILLION)

- TABLE 44 CANADA: GUNSHOT DETECTION SYSTEMS MARKET, BY INSTALLATION, 2022–2027 (USD MILLION)

- TABLE 45 CANADA: GUNSHOT DETECTION SYSTEMS MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

- TABLE 46 CANADA: GUNSHOT DETECTION SYSTEMS MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 47 EUROPE: GUNSHOT DETECTION SYSTEMS MARKET, BY INSTALLATION, 2018–2021 (USD MILLION)

- TABLE 48 EUROPE: GUNSHOT DETECTION SYSTEMS MARKET, BY INSTALLATION, 2022–2027 (USD MILLION)

- TABLE 49 EUROPE: GUNSHOT DETECTION SYSTEMS MARKET, BY END USER, 2018–2021 (USD MILLION)

- TABLE 50 EUROPE: GUNSHOT DETECTION SYSTEMS MARKET, BY END USER, 2022–2027 (USD MILLION)

- TABLE 51 EUROPE: GUNSHOT DETECTION SYSTEMS MARKET, BY SOLUTION, 2018–2021 (USD MILLION)

- TABLE 52 EUROPE: GUNSHOT DETECTION SYSTEMS MARKET, BY SOLUTION, 2022–2027 (USD MILLION)

- TABLE 53 EUROPE: GUNSHOT DETECTION SYSTEMS MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

- TABLE 54 EUROPE: GUNSHOT DETECTION SYSTEMS MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 55 EUROPE: GUNSHOT DETECTION SYSTEMS MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

- TABLE 56 EUROPE: GUNSHOT DETECTION SYSTEMS MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

- TABLE 57 UK: GUNSHOT DETECTION SYSTEMS MARKET, BY INSTALLATION, 2018–2021 (USD MILLION)

- TABLE 58 UK: GUNSHOT DETECTION SYSTEMS MARKET, BY INSTALLATION, 2022–2027 (USD MILLION)

- TABLE 59 UK: GUNSHOT DETECTION SYSTEMS MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

- TABLE 60 UK: GUNSHOT DETECTION SYSTEMS MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 61 FRANCE: GUNSHOT DETECTION SYSTEMS MARKET, BY INSTALLATION, 2018–2021 (USD MILLION)

- TABLE 62 FRANCE: GUNSHOT DETECTION SYSTEMS MARKET, BY INSTALLATION, 2022–2027 (USD MILLION)

- TABLE 63 FRANCE: GUNSHOT DETECTION SYSTEMS MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

- TABLE 64 FRANCE: GUNSHOT DETECTION SYSTEMS MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 65 GERMANY: GUNSHOT DETECTION SYSTEMS MARKET, BY INSTALLATION, 2018–2021 (USD MILLION)

- TABLE 66 GERMANY: GUNSHOT DETECTION SYSTEMS MARKET, BY INSTALLATION, 2022–2027 (USD MILLION)

- TABLE 67 GERMANY: GUNSHOT DETECTION SYSTEMS MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

- TABLE 68 GERMANY: GUNSHOT DETECTION SYSTEMS MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 69 ITALY: GUNSHOT DETECTION SYSTEMS MARKET, BY INSTALLATION, 2018–2021 (USD MILLION)

- TABLE 70 ITALY: GUNSHOT DETECTION SYSTEMS MARKET, BY INSTALLATION, 2022–2027 (USD MILLION)

- TABLE 71 ITALY: GUNSHOT DETECTION SYSTEMS MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

- TABLE 72 ITALY: GUNSHOT DETECTION SYSTEMS MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 73 RUSSIA: GUNSHOT DETECTION SYSTEMS MARKET, BY INSTALLATION, 2018–2021 (USD MILLION)

- TABLE 74 RUSSIA: GUNSHOT DETECTION SYSTEMS MARKET, BY INSTALLATION, 2022–2027 (USD MILLION)

- TABLE 75 RUSSIA: GUNSHOT DETECTION SYSTEMS MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

- TABLE 76 RUSSIA: GUNSHOT DETECTION SYSTEMS MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 77 REST OF EUROPE: GUNSHOT DETECTION SYSTEMS MARKET, BY INSTALLATION, 2018–2021 (USD MILLION)

- TABLE 78 REST OF EUROPE: GUNSHOT DETECTION SYSTEMS MARKET, BY INSTALLATION, 2022–2027 (USD MILLION)

- TABLE 79 REST OF EUROPE: GUNSHOT DETECTION SYSTEMS MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

- TABLE 80 REST OF EUROPE: GUNSHOT DETECTION SYSTEMS MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 81 ASIA PACIFIC: GUNSHOT DETECTION SYSTEMS MARKET, BY INSTALLATION, 2018–2021 (USD MILLION)

- TABLE 82 ASIA PACIFIC: GUNSHOT DETECTION SYSTEMS MARKET, BY INSTALLATION, 2022–2027 (USD MILLION)

- TABLE 83 ASIA PACIFIC: GUNSHOT DETECTION SYSTEMS MARKET, BY END USER, 2018–2021 (USD MILLION)

- TABLE 84 ASIA PACIFIC: GUNSHOT DETECTION SYSTEMS MARKET, BY END USER, 2022–2027 (USD MILLION)

- TABLE 85 ASIA PACIFIC: GUNSHOT DETECTION SYSTEMS MARKET, BY SOLUTION, 2018–2021 (USD MILLION)

- TABLE 86 ASIA PACIFIC: GUNSHOT DETECTION SYSTEMS MARKET, BY SOLUTION, 2022–2027 (USD MILLION)

- TABLE 87 ASIA PACIFIC: GUNSHOT DETECTION SYSTEMS MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

- TABLE 88 ASIA PACIFIC: GUNSHOT DETECTION SYSTEMS MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 89 ASIA PACIFIC: GUNSHOT DETECTION SYSTEMS MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

- TABLE 90 ASIA PACIFIC: GUNSHOT DETECTION SYSTEMS MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

- TABLE 91 CHINA: GUNSHOT DETECTION SYSTEMS MARKET, BY INSTALLATION, 2018–2021 (USD MILLION)

- TABLE 92 CHINA: GUNSHOT DETECTION SYSTEMS MARKET, BY INSTALLATION, 2022–2027 (USD MILLION)

- TABLE 93 CHINA: GUNSHOT DETECTION SYSTEMS MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

- TABLE 94 CHINA: GUNSHOT DETECTION SYSTEMS MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 95 INDIA: GUNSHOT DETECTION SYSTEMS MARKET, BY INSTALLATION, 2018–2021 (USD MILLION)

- TABLE 96 INDIA: GUNSHOT DETECTION SYSTEMS MARKET, BY INSTALLATION, 2022–2027 (USD MILLION)

- TABLE 97 INDIA: GUNSHOT DETECTION SYSTEMS MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

- TABLE 98 INDIA: GUNSHOT DETECTION SYSTEMS MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 99 JAPAN: GUNSHOT DETECTION SYSTEMS MARKET, BY INSTALLATION, 2018–2021 (USD MILLION)

- TABLE 100 JAPAN: GUNSHOT DETECTION SYSTEMS MARKET, BY INSTALLATION, 2022–2027 (USD MILLION)

- TABLE 101 JAPAN: GUNSHOT DETECTION SYSTEMS MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

- TABLE 102 JAPAN: GUNSHOT DETECTION SYSTEMS MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 103 AUSTRALIA: GUNSHOT DETECTION SYSTEMS MARKET, BY INSTALLATION, 2018–2021 (USD MILLION)

- TABLE 104 AUSTRALIA: GUNSHOT DETECTION SYSTEMS MARKET, BY INSTALLATION, 2022–2027 (USD MILLION)

- TABLE 105 AUSTRALIA: GUNSHOT DETECTION SYSTEMS MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

- TABLE 106 AUSTRALIA: GUNSHOT DETECTION SYSTEMS MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 107 SOUTH KOREA: GUNSHOT DETECTION SYSTEMS MARKET, BY INSTALLATION, 2018–2021 (USD MILLION)

- TABLE 108 SOUTH KOREA: GUNSHOT DETECTION SYSTEMS MARKET, BY INSTALLATION, 2022–2027 (USD MILLION)

- TABLE 109 SOUTH KOREA: GUNSHOT DETECTION SYSTEMS MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

- TABLE 110 SOUTH KOREA: GUNSHOT DETECTION SYSTEMS MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 111 REST OF ASIA PACIFIC: GUNSHOT DETECTION SYSTEMS MARKET, BY INSTALLATION, 2018–2021 (USD MILLION)

- TABLE 112 REST OF ASIA PACIFIC: GUNSHOT DETECTION SYSTEMS MARKET, BY INSTALLATION, 2022–2027 (USD MILLION)

- TABLE 113 REST OF ASIA PACIFIC: GUNSHOT DETECTION SYSTEMS MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

- TABLE 114 REST OF ASIA PACIFIC: GUNSHOT DETECTION SYSTEMS MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 115 MIDDLE EAST: GUNSHOT DETECTION SYSTEMS MARKET, BY INSTALLATION, 2018–2021 (USD MILLION)

- TABLE 116 MIDDLE EAST: GUNSHOT DETECTION SYSTEMS MARKET, BY INSTALLATION, 2022–2027 (USD MILLION)

- TABLE 117 MIDDLE EAST: GUNSHOT DETECTION SYSTEMS MARKET, BY END USER, 2018–2021 (USD MILLION)

- TABLE 118 MIDDLE EAST: GUNSHOT DETECTION SYSTEMS MARKET, BY END USER, 2022–2027 (USD MILLION)

- TABLE 119 MIDDLE EAST: GUNSHOT DETECTION SYSTEMS MARKET, BY SOLUTION, 2018–2021 (USD MILLION)

- TABLE 120 MIDDLE EAST: GUNSHOT DETECTION SYSTEMS MARKET, BY SOLUTION, 2022–2027 (USD MILLION)

- TABLE 121 MIDDLE EAST: GUNSHOT DETECTION SYSTEMS MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

- TABLE 122 MIDDLE EAST: GUNSHOT DETECTION SYSTEMS MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 123 MIDDLE EAST: GUNSHOT DETECTION SYSTEMS MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

- TABLE 124 MIDDLE EAST: GUNSHOT DETECTION SYSTEMS MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

- TABLE 125 SAUDI ARABIA: GUNSHOT DETECTION SYSTEMS MARKET, BY INSTALLATION, 2018–2021 (USD MILLION)

- TABLE 126 SAUDI ARABIA: GUNSHOT DETECTION SYSTEMS MARKET, BY INSTALLATION, 2022–2027 (USD MILLION)

- TABLE 127 SAUDI ARABIA: GUNSHOT DETECTION SYSTEMS MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

- TABLE 128 SAUDI ARABIA: GUNSHOT DETECTION SYSTEMS MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 129 TURKEY: GUNSHOT DETECTION SYSTEMS MARKET, BY INSTALLATION, 2018–2021 (USD MILLION)

- TABLE 130 TURKEY: GUNSHOT DETECTION SYSTEMS MARKET, BY INSTALLATION, 2022–2027 (USD MILLION)

- TABLE 131 TURKEY: GUNSHOT DETECTION SYSTEMS MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

- TABLE 132 TURKEY: GUNSHOT DETECTION SYSTEMS MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 133 ISRAEL: GUNSHOT DETECTION SYSTEMS MARKET, BY INSTALLATION, 2018–2021 (USD MILLION)

- TABLE 134 ISRAEL: GUNSHOT DETECTION SYSTEMS MARKET, BY INSTALLATION, 2022–2027 (USD MILLION)

- TABLE 135 ISRAEL: GUNSHOT DETECTION SYSTEMS MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

- TABLE 136 ISRAEL: GUNSHOT DETECTION SYSTEMS MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 137 REST OF MIDDLE EAST: GUNSHOT DETECTION SYSTEMS MARKET, BY INSTALLATION, 2018–2021 (USD MILLION)

- TABLE 138 REST OF MIDDLE EAST: GUNSHOT DETECTION SYSTEMS MARKET, BY INSTALLATION, 2022–2027 (USD MILLION)

- TABLE 139 REST OF MIDDLE EAST: GUNSHOT DETECTION SYSTEMS MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

- TABLE 140 REST OF MIDDLE EAST: GUNSHOT DETECTION SYSTEMS MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 141 REST OF THE WORLD: GUNSHOT DETECTION SYSTEMS MARKET, BY INSTALLATION, 2018–2021 (USD MILLION)

- TABLE 142 REST OF THE WORLD: GUNSHOT DETECTION SYSTEMS MARKET, BY INSTALLATION, 2022–2027 (USD MILLION)

- TABLE 143 REST OF THE WORLD: GUNSHOT DETECTION SYSTEMS MARKET, BY END USER, 2018–2021 (USD MILLION)

- TABLE 144 REST OF THE WORLD: GUNSHOT DETECTION SYSTEMS MARKET, BY END USER, 2022–2027 (USD MILLION)

- TABLE 145 REST OF THE WORLD: GUNSHOT DETECTION SYSTEMS MARKET, BY SOLUTION, 2018–2021 (USD MILLION)

- TABLE 146 REST OF THE WORLD: GUNSHOT DETECTION SYSTEMS MARKET, BY SOLUTION, 2022–2027 (USD MILLION)

- TABLE 147 REST OF THE WORLD: GUNSHOT DETECTION SYSTEMS MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

- TABLE 148 REST OF THE WORLD: GUNSHOT DETECTION SYSTEMS MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 149 REST OF THE WORLD: GUNSHOT DETECTION SYSTEMS MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

- TABLE 150 REST OF THE WORLD: GUNSHOT DETECTION SYSTEMS MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

- TABLE 151 LATIN AMERICA: GUNSHOT DETECTION SYSTEMS MARKET, BY INSTALLATION, 2018–2021 (USD MILLION)

- TABLE 152 LATIN AMERICA: GUNSHOT DETECTION SYSTEMS MARKET, BY INSTALLATION, 2022–2027 (USD MILLION)

- TABLE 153 LATIN AMERICA: GUNSHOT DETECTION SYSTEMS MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

- TABLE 154 LATIN AMERICA: GUNSHOT DETECTION SYSTEMS MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 155 AFRICA: GUNSHOT DETECTION SYSTEMS MARKET, BY INSTALLATION, 2018–2021 (USD MILLION)

- TABLE 156 AFRICA: GUNSHOT DETECTION SYSTEMS MARKET, BY INSTALLATION, 2022–2027 (USD MILLION)

- TABLE 157 AFRICA: GUNSHOT DETECTION SYSTEMS MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

- TABLE 158 AFRICA: GUNSHOT DETECTION SYSTEMS MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 159 GUNSHOT DETECTION SYSTEM S MARKET: DEGREE OF COMPETITION

- TABLE 160 KEY DEVELOPMENTS BY LEADING PLAYERS IN GUNSHOT DETECTION SYSTEMS MARKET, 2021

- TABLE 161 SOLUTION STRENGTH

- TABLE 162 PRODUCT AND REGION FOOTPRINT

- TABLE 163 COMPANY REGION FOOTPRINT

- TABLE 164 GUNSHOT DETECTION SYSTEM S MARKET: KEY STARTUPS/SMES

- TABLE 165 GUNSHOT DETECTION SYSTEMS MARKET: PRODUCT LAUNCHES/DEVELOPMENTS, SEPTEMBER 2019–JUNE 2022

- TABLE 166 GUNSHOT DETECTION SYSTEMS MARKET: DEALS, APRIL 2019–DECEMBER 2021

- TABLE 167 SHOTSPOTTER, INC.: BUSINESS OVERVIEW

- TABLE 168 SHOOTER DETECTION SYSTEMS, LLC: BUSINESS OVERVIEW

- TABLE 169 SHOOTER DETECTION SYSTEMS, LLC: PRODUCT LAUNCHES

- TABLE 170 SHOOTER DETECTION SYSTEMS, LLC: DEALS

- TABLE 171 RAYTHEON TECHNOLOGIES CORPORATION: COMPANY OVERVIEW

- TABLE 172 QINETIQ GROUP: BUSINESS OVERVIEW

- TABLE 173 ACOEM GROUP: BUSINESS OVERVIEW

- TABLE 174 DATABUOY CORPORATION: BUSINESS OVERVIEW

- TABLE 175 DATABUOY CORPORATION: DEALS

- TABLE 176 ELTA SYSTEMS LTD.: BUSINESS OVERVIEW

- TABLE 177 ELTA SYSTEMS LTD.: PRODUCT LAUNCHES

- TABLE 178 COMPAGNIE INDUSTRIELLE DES LASERS (CILAS): BUSINESS OVERVIEW

- TABLE 179 DIVERSIFIED DATA SYSTEMS, INC.: BUSINESS OVERVIEW

- TABLE 180 MICROFLOWN AVISA: BUSINESS OVERVIEW

- TABLE 181 INFORMATION SYSTEM TECHNOLOGIES, INC.: BUSINESS OVERVIEW

- TABLE 182 THALES: COMPANY OVERVIEW

- TABLE 183 RHEINMETALL AG: COMPANY OVERVIEW

- TABLE 184 AMBERBOX, INC.: COMPANY OVERVIEW

- TABLE 185 EAGL TECHNOLOGY, INC.: COMPANY OVERVIEW

- TABLE 186 C-DAC: BUSINESS OVERVIEW

- TABLE 187 SAFE ZONE TECHNOLOGIES, INC.: BUSINESS OVERVIEW

- TABLE 188 ASELSAN A.S.: BUSINESS OVERVIEW

- TABLE 189 3XLOGIC, INC.: BUSINESS OVERVIEW

- TABLE 190 HERRINGS TECHNOLOGY: BUSINESS OVERVIEW

- TABLE 191 IMS TECHNOLOGY & SECURITY: BUSINESS OVERVIEW

- FIGURE 1 RESEARCH PROCESS FLOW

- FIGURE 2 GUNSHOT DETECTION SYSTEMS MARKET: RESEARCH DESIGN

- FIGURE 3 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

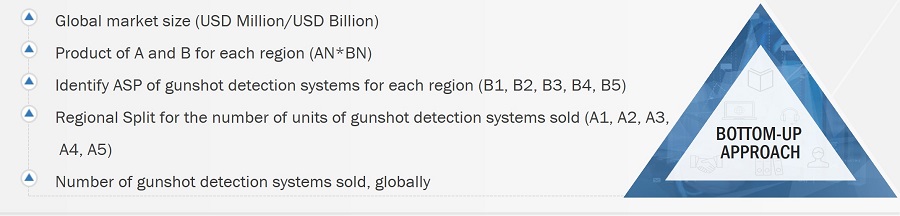

- FIGURE 4 MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH (DEMAND-SIDE)

- FIGURE 5 MARKET SIZE ESTIMATION: TOP-DOWN APPROACH (SUPPLY-SIDE)

- FIGURE 6 DATA TRIANGULATION METHODOLOGY

- FIGURE 7 GUNSHOT DETECTION SYSTEMS MARKET: BUDGET OF US DEPARTMENT OF HOMELAND SECURITY, 2018–2022 (USD BILLION)

- FIGURE 8 GUNSHOT DETECTION SYSTEMS MARKET: FUNDING DISTRIBUTION OF US DEPARTMENT OF HOMELAND SECURITY FOR FY 22 (USD BILLION)

- FIGURE 9 PARAMETRIC ASSUMPTIONS FOR MARKET FORECAST

- FIGURE 10 COMMERCIAL SEGMENT TO LEAD GUNSHOT DETECTION SYSTEMS MARKET DURING FORECAST PERIOD

- FIGURE 11 OUTDOOR SEGMENT TO REGISTER HIGHEST GROWTH RATE DURING FORECAST PERIOD

- FIGURE 12 NORTH AMERICA TO ACCOUNT FOR LARGEST MARKET SHARE IN 2022

- FIGURE 13 TECHNOLOGICAL ADVANCEMENTS AND NEED TO STRENGTHEN HOMELAND SECURITY TO DRIVE MARKET

- FIGURE 14 SOLDIER MOUNTED SYSTEMS SEGMENT TO HOLD DOMINANT SHARE DURING FORECAST PERIOD

- FIGURE 15 SYSTEMS SEGMENT TO LEAD MARKET FROM 2022 TO 2027

- FIGURE 16 DEFENSE AND GOVERNMENT SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 17 GUNSHOT DETECTION SYSTEMS MARKET: MARKET DYNAMICS

- FIGURE 18 NUMBER OF ACTIVE SHOOTER INCIDENTS IN US BETWEEN 2016 AND 2020

- FIGURE 19 REVENUE SHIFT IN GUNSHOT DETECTION SYSTEMS MARKET

- FIGURE 20 MARKET ECOSYSTEM MAP: GUNSHOT DETECTION SYSTEMS

- FIGURE 21 VALUE CHAIN ANALYSIS: GUNSHOT DETECTION SYSTEMS MARKET

- FIGURE 22 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS OF GUNSHOT DETECTION TECHNOLOGIES

- FIGURE 23 KEY BUYING CRITERIA FOR GUNSHOT DETECTION TECHNOLOGIES

- FIGURE 24 SUPPLY CHAIN ANALYSIS OF GUNSHOT DETECTION SYSTEMS MARKET

- FIGURE 25 SOLDIER MOUNTED SYSTEMS SEGMENT TO HOLD MAJOR MARKET SHARE DURING FORECAST PERIOD

- FIGURE 26 DEFENSE AND GOVERNMENT SEGMENT TO HOLD MAJOR MARKET SHARE DURING FORECAST PERIOD

- FIGURE 27 SYSTEMS SEGMENT TO LEAD GUNSHOT DETECTION SYSTEM MARKET DURING FORECAST PERIOD

- FIGURE 28 OUTDOOR SEGMENT TO HOLD MAJOR MARKET SHARE DURING FORECAST PERIOD

- FIGURE 29 NORTH AMERICA TO ACCOUNT FOR LARGEST MARKET SHARE IN 2022

- FIGURE 30 NORTH AMERICA: GUNSHOT DETECTION SYSTEMS MARKET SNAPSHOT

- FIGURE 31 EUROPE: GUNSHOT DETECTION SYSTEMS MARKET SNAPSHOT

- FIGURE 32 ASIA PACIFIC: GUNSHOT DETECTION SYSTEMS MARKET SNAPSHOT

- FIGURE 33 MIDDLE EAST: GUNSHOT DETECTION SYSTEMS MARKET SNAPSHOT

- FIGURE 34 REST OF THE WORLD: GUNSHOT DETECTION SYSTEMS MARKET SNAPSHOT

- FIGURE 35 SHARE OF TOP PLAYERS IN GUNSHOT DETECTION SYSTEMS MARKET, 2021

- FIGURE 36 MARKET RANKING OF LEADING PLAYERS IN GUNSHOT DETECTION SYSTEMS MARKET, 2021

- FIGURE 37 MARKET RANKING OF PUBLIC PLAYERS IN GUNSHOT DETECTION SYSTEMS MARKET, 2021

- FIGURE 38 MARKET COMPETITIVE LEADERSHIP MAPPING, 2021

- FIGURE 39 GUNSHOT DETECTION SYSTEMS MARKET (STARTUPS) COMPETITIVE LEADERSHIP MAPPING, 2021

- FIGURE 40 SHOTSPOTTER, INC.: COMPANY SNAPSHOT

- FIGURE 41 RAYTHEON TECHNOLOGIES CORPORATION: COMPANY SNAPSHOT

- FIGURE 42 QINETIQ GROUP: COMPANY SNAPSHOT

- FIGURE 43 THALES: COMPANY SNAPSHOT

- FIGURE 44 RHEINMETALL AG: COMPANY SNAPSHOT

- FIGURE 45 ASELSAN A.S.: COMPANY SNAPSHOT

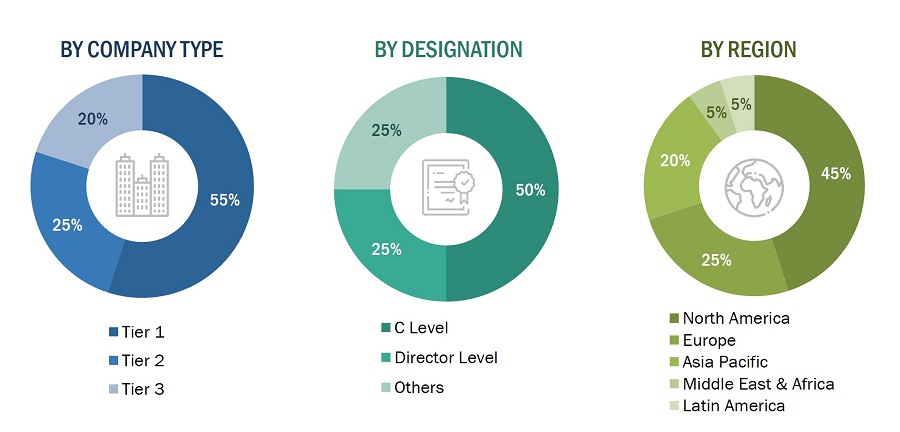

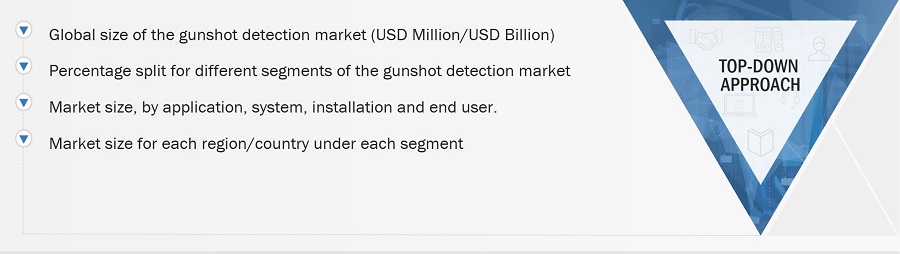

The study involved four major activities in estimating the current market size for the Gunshot detection system market. Exhaustive secondary research was conducted to collect information on the market, the peer markets, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation procedures were used to estimate the market size of segments and subsegments.

Secondary Research:

In the secondary research process, various secondary sources, such as D&B Hoovers, Bloomberg, BusinessWeek, and different magazines, were referred to identify and collect information for this study. Secondary sources also included annual reports, press releases & investor presentations of companies, certified publications, articles by recognized authors, and simulator databases.

Primary Research

The Gunshot detection system market comprises several stakeholders, such as raw material providers, Gunshot detection system manufacturers and suppliers, and regulatory organizations in the supply chain. While the demand side of this market is characterized by various end users, the supply side is characterized by technological advancements in actuator technologies. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. Following is the breakdown of primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the Gunshot detection system market. These methods were also used extensively to estimate the size of various subsegments of the market. The research methodology used to estimate the market size includes the following:

- Key players in the industry and markets were identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, were determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

Market size estimation methodology: Bottom-up approach

The bottom-up approach was employed to arrive at the overall size of the gunshot detection systems market from the demand for such systems and components by end users in each country, and the average cost of integration for both brownfield and greenfield. These calculations led to the estimation of the overall market size.

Market size estimation methodology: Top-down approach

In the top-down approach, the overall market size was used to estimate the size of the individual markets (mentioned in market segmentation) through percentage splits obtained from secondary and primary research.

The most appropriate and immediate parent market size was used to calculate the specific market segments to implement the top-down approach. The bottom-up approach was also implemented to validate the market segment revenues obtained.

A market share was then estimated for each company to verify the revenue share used earlier in the bottom-up approach. With data triangulation procedures and data validation through primaries, the overall parent market size and each market size were determined and confirmed in this study. The data triangulation procedure used for this study is explained in the market breakdown and triangulation section.

Data Triangulation

After arriving at the overall market size—using the market size estimation process explained above—the market was split into several segments and subsegments. Data triangulation and market breakdown procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment. The data was triangulated by studying various factors and trends from both the demand and supply sides of the Gunshot detection system market.

Market Definition-

A gunshot detection system is defined as an acoustic sensing system capable of identifying, discriminating, and reporting gunshots to the police within seconds of a shot being fired. In the commercial sector, gunshot detection systems are used for public safety and law enforcement, interior gunfire detection, and wildlife poaching. In the defense segment, a gunshot detection system identifies, isolates, and provides the location the gunshot is fired from. In this segment, gunshot detection systems are typically platforms installed on armored vehicles and military drones. Individual systems are also provided to soldiers to identify and track a gunshot location. According to law enforcement authorities, acoustic gunshot detection devices are frequently installed in high- crime areas. Gunshot detection systems are being widely incorporated in the public & defense sector as well as in public safety and law enforcement, interior gunfire detection, and wildlife poaching.

Key Stakeholders:

- Gunshot detection system equipment manufacturer

- Original Equipment Manufacturer (OEM)

- Software Solution Provider

- Component Supplier

- Infrastructure Security Service Provider

- Military Vehicle Manufacturers and Retrofitters

Report Objectives

- To identify and analyze key drivers, restraints, challenges, and opportunities influencing the growth of the Gunshot detection system market

- To analyze the impact of macro and micro indicators on the market

- To forecast the market size of segments for five regions, namely, North America, Europe, Asia Pacific, Middle East & Africa, along with major countries in each of these regions

- To strategically analyze micro markets with respect to individual technological trends, prospects, and their contribution to the overall market

- To strategically profile key market players and comprehensively analyze their market ranking and core competencies

- To provide a detailed competitive landscape of the market, along with an analysis of business and corporate strategies, such as contracts, agreements, partnerships, and expansions.

- To identify detailed financial positions, key products, unique selling points, and key developments of leading companies in the market

Available customizations

Along with the market data, MarketsandMarkets offers customizations as per the specific needs of companies. The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Regional Analysis

- Further breakdown of the market segments at country-level

Company Information

- Detailed analysis and profiling of additional market players (up to 2)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Gunshot Detection Systems Market

We are considering to invest in a new company that developed a gunshot detection solution. I would like to review the brochure first.