Microbial Lipase Market by Application (Cleaning Agents, Animal Feed, Dairy Products, Bakery Products, and Confectionery Products), Form (Powder and Liquid), Source (Fungi and Bacteria), and Region - Global Forecast to 2023

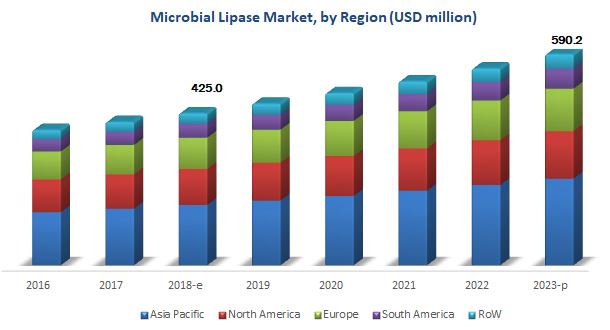

[162 Pages Report] The microbial lipase market was valued at USD 400.6 Million in 2017 and is projected to reach USD 590.2 Million by 2023, growing at a CAGR of 6.8% from 2018, in terms of value. The objectives of this study are to define, segment, and project the size of the microbial lipase market based on application, form, source, and key regions.

For more details on this research, Request Free Sample Report

- To understand the structure of the microbial lipase market by identifying its various subsegments

- To provide detailed information about the key factors influencing the growth of the market (drivers, restraints, opportunities, and industry-specific challenges)

- To analyze the micromarkets with respect to individual growth trends, future prospects, and their contribution to the total market

- To project the size of the market and its submarkets, in terms of value and volume, with respect to five regions (along with their respective key countries)

- To profile the key players and comprehensively analyze their core competencies

-

To provide a comparative analysis of the market leaders on the basis of the following:

- Product offerings

- Business strategies

- Strengths and weaknesses

- Key financials

- To understand the competitive landscape and identifying major growth strategies adopted by the players across the key regions

- To analyze the competitive developments such as expansions, new product launches, mergers & acquisitions, agreements, partnerships, and investments in the market for microbial lipase.

The years and periodization considered for the study are as follows:

- Base year: 2017

- Beginning of the projection period: 2018

- End of the projection period: 2023

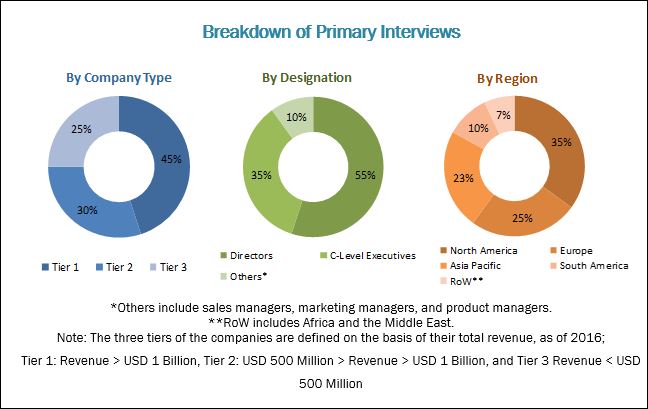

This report includes the estimation of the market size for value (USD million) and volume (metric tons). Both, top-down and bottom-up approaches have been used to estimate and validate the size of the microbial lipase market and to estimate the size of various other dependent submarkets in the overall market. Key players in the market have been identified through secondary research (FAO, Bloomberg Businessweek, Factiva, and companies’ annual reports), and their market shares have been determined through primary and secondary research. All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

To know about the assumptions considered for the study, download the pdf brochure

Market Ecosystem

The various contributors involved in the value chain of microbial lipases include manufacturers, suppliers, distributors, intermediaries, and customers. The key players in the microbial lipase market include Novozymes (Denmark), DSM (Netherlands), Chr. Hansen (Denmark), Amano Enzymes (Japan), Associated British Foods (UK), DowDuPont (US), Advanced Enzymes (India), Enzyme Development Corporation (US), Aumgene Biosciences (India), Biocatalysts (UK), Meito Sangyo Co., Ltd (Japan), and Creative Enzymes (US).

Target Audience

- Raw material suppliers

- Enzyme manufacturers and suppliers

- Regulatory bodies, including government agencies and NGOs

- Commercial research & development (R&D) institutions

- Importers and exporters of microbial lipases

- Microbial lipase traders, distributors, and suppliers

- Government organizations, research organizations, and consulting firms

- Trade associations and industry bodies

- End-use industries

Scope of the Report

The microbial lipase market is segmented as follows:

On the basis of Application:

- Cleaning agents

- Animal feed

- Dairy products

- Bakery products

- Confectionery products

- Others (bio-fuels and pulp & paper)

On the basis of Form:

- Powder

- Liquid

On the basis of Source:

- Fungi

- Bacteria

On the basis of Region:

- North America

- Europe

- Asia Pacific

- South America

- RoW (South Africa and other countries in RoW)

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the client-specific needs.

The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Regional Analysis

- Further breakdown of the Rest of Asia Pacific market for microbial lipase on the basis of the key contributing countries

- Further breakdown of the Rest of the World market for microbial lipase on the basis of the key South American countries

Company Information

- Detailed analysis and profiling of additional market players (up to five)

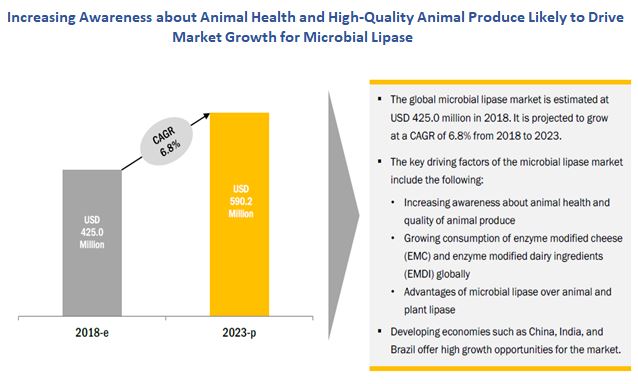

The microbial lipase market is estimated to be USD 425.0 Million in 2018. It is projected to reach USD 590.2 Million by 2023, growing at a CAGR of 6.8% from 2018, in terms of value. The market has been largely driven by increasing awareness about animal health and quality of animal produce, and increasing consumption of enzyme-modified cheese (EMC) and enzyme-modified dairy ingredients (EMDI). The advantages of microbial lipases over animal and plant lipases are also driving the market growth. The demand for lipase, particularly from microbial sources, is expected to witness significant growth in the near future, due to their numerous applications in a wide range of food processes.

The cleaning agents segment is projected to dominate the microbial lipase market through the forecast period. Innovation in the detergents industry is the key factor that drives the growth of industrial microbial lipases, replacing harsh chlorine bleach with lipase.

The powder form of microbial lipases is estimated to dominate the microbial lipase market as it is preferred by the consumers, as it is relatively stable, easy to handle, and easier for packaging & transportation. They are widely used in various application industries such as food & beverage, animal feed, cleaning, and biofuel.

For more details on this research, Request Free Sample Report

The Asia Pacific region dominated the microbial lipase market in 2017 and is projected to grow at the highest CAGR from 2018 to 2023. The presence of leading microbial lipase manufacturers who operate on a global level and the rise in adoption of lipase enzymes drive the demand for microbial lipases in the region. Further, the changing dietary patterns have led to increased consumption of dairy products in the region; increase in concerns about greater hygiene, increase in awareness of personal hygiene, growing concerns about the spread of infectious diseases, and sterilizing household industrial surfaces are driving also the use of washing and cleaning products, and demands of end consumers for better quality feed for livestock, leading to enhanced scope for future growth of microbial lipases in food, cleaning agents, and feed segments respectively.

In the North American region, the US dominate the microbial lipase market. This is due to an increase in the use of enzymes in animal feed, along with dairy products, cleaning agents, and toiletries is anticipated to drive the growth of the market in the country. Additionally, big food chains have led to an increase in demand for cheese and other dairy products. Thus, the increased consumption of cheese in this country is expected to consequently lead to the growth of the microbial lipase market.

The lack of transparency in the patent protection laws of lipase in several countries and absence of a uniform regulatory structure restrain the growth of market for microbial lipase.

The microbial lipase market is concentrated, with leading companies driving the market growth. This report provides a qualitative analysis of the prominent market players and their preferred development strategies. Key players such as Novozymes (Denmark), DSM (Netherlands), Chr. Hansen (Denmark), Amano Enzymes (Japan), Associated British Foods (UK), and DowDuPont (US) have been profiled in the report. These leading players have adopted various strategies such as expansions, mergers & acquisitions, new product launches, agreements, partnerships, and investments to explore new and untapped markets, expanding in local areas of emerging markets, and developing a new customer base for long-term client relationships. This has not only enabled the key players to expand their geographical reach, but has also reinforced their market position by gaining a larger share in terms of revenue and product portfolios.

Small-scale players have also adopted these strategies to expand their businesses globally by investing in the establishment of manufacturing facilities and technical service centers in various regions. This inorganic growth strategy enables them to improve their technical expertise through intensive R&D infrastructure offered by bigger players.

Frequently Asked Questions (FAQ):

What is the leading application in the microbial lipase market?

The cleaning agents segment was the highest revenue contributor to the market, with USD 124.1 million in 2017, and is estimated to reach USD 181.1 million by 2023, with a CAGR of 6.6%. The animal feed segment is estimated to reach USD 123.2 million by 2023, at a significant CAGR of 6.8% during the forecast period.

What is the estimated industry size of microbial lipase?

The global microbial lipase market was valued at USD 400.6 million in 2017, and is projected to reach USD 590.2 million by 2023, registering a CAGR of 6.8% from 2018 to 2023.

What is the leading form of microbial lipase market?

The powder segment was the highest revenue contributor to the market, with USD 319.4 million in 2017, and is estimated to reach USD 469.1 million by 2023, with a CAGR of 6.7%. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 15)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Study Scope

1.4 Periodization Considered

1.5 Currency Considered

1.6 Unit Considered

1.7 Stakeholders

2 Research Methodology (Page No. - 19)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

2.1.2.3 Breakdown of Primary Interviews

2.2 Market Size Estimation

2.3 Market Breakdown & Data Triangulation

2.4 Research Assumptions & Limitations

3 Executive Summary (Page No. - 28)

4 Premium Insights (Page No. - 32)

4.1 Attractive Opportunities in the Microbial Lipases Market

4.2 Microbial Lipases Market, By Application

4.3 Microbial Lipases Market, By Form & Region

4.4 Microbial Lipases Market, By Source & Region, 2017

4.5 Asia Pacific: Microbial Lipases Market, By Application & Country

4.6 Microbial Lipases Market, By Region

5 Market Overview (Page No. - 37)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Advantages of Microbial Lipases Over Animal and Plant Lipases

5.2.1.2 Increasing Awareness About Animal Health and Quality of Animal Produce

5.2.1.3 Increasing Consumption of Enzyme Modified Cheese (EMC) and Enzyme Modified Dairy Ingredients (EMDI)

5.2.1.4 Growing Demand From Emerging Economies

5.2.2 Restraints

5.2.2.1 Lack of Transparency in Patent Protection Laws

5.2.2.2 Absence of Uniform Regulatory Structure

5.2.3 Opportunities

5.2.3.1 Growing Demand From Emerging Application Industries

5.2.4 Challenges

5.2.4.1 Possible Side-Effects of Microbial Lipases and Lack of Awareness About Their Benefits

5.3 Regulatory Analysis

5.3.1 North America

5.3.2 Europe

5.3.3 Asia Pacific

5.3.4 South America

5.4 Value Chain Analysis

6 Microbial Lipase Market, By Application (Page No. - 46)

6.1 Introduction

6.2 Cleaning Agents

6.3 Animal Feed

6.4 Dairy Products

6.5 Bakery Products

6.6 Confectionery Products

6.7 Others

7 Microbial Lipase Market, By Form (Page No. - 61)

7.1 Introduction

7.2 Powder

7.3 Liquid

8 Microbial Lipase Market, By Source (Page No. - 66)

8.1 Introduction

8.2 Fungi

8.3 Bacteria

9 Microbial Lipase Market, By Region (Page No. - 71)

9.1 Introduction

9.2 North America

9.2.1 US

9.2.2 Canada

9.2.3 Mexico

9.3 Europe

9.3.1 Germany

9.3.2 France

9.3.3 UK

9.3.4 Spain

9.3.5 Russia

9.3.6 Rest of Europe

9.4 Asia Pacific

9.4.1 China

9.4.2 Japan

9.4.3 India

9.4.4 Australia & New Zealand

9.4.5 Rest of Asia Pacific

9.5 South America

9.5.1 Brazil

9.5.2 Argentina

9.5.3 Rest of South America

9.6 Rest of the World (RoW)

9.6.1 South Africa

9.6.2 Others in RoW

10 Competitive Landscape (Page No. - 124)

10.1 Overview

10.2 Competitive Scenario

10.3 Market Share Analysis

10.4 Expansions

10.5 Mergers & Acquisitions

10.6 New Product Launches

10.7 Agreements, Partnerships, and Investments

11 Company Profiles (Page No. - 129)

(Business Overview, Products Offered, Recent Developments, SWOT Analysis & MnM View)*

11.1 Novozymes

11.2 DSM

11.3 Chr. Hansen

11.4 Amano Enzymes Inc.

11.5 Associated British Foods

11.6 Dowdupont

11.7 Advanced Enzymes

11.8 Enzyme Development Corporation

11.9 Aumgene Biosciences

11.10 Biocatalysts

11.11 Meito Sangyo Co., Ltd.

11.12 Creative Enzymes

*Details on Business Overview, Products Offered, Recent Developments, SWOT Analysis & MnM View Might Not Be Captured in Case of Unlisted Companies.

12 Appendix (Page No. - 154)

12.1 Discussion Guide

12.2 Knowledge Store: Marketsandmarkets’ Subscription Portal

12.3 Introducing RT: Real-Time Market Intelligence

12.4 Available Customizations

12.5 Related Reports

12.6 Author Details

List of Tables (113 Tables)

Table 1 US Dollar Exchange Rate, 2014–2017

Table 2 Global Animal Feed Production, 2016 (Million Metric Ton)

Table 3 Microbial Lipase Market Size, By Application, 2016–2023 (USD Million)

Table 4 Size of Market For Microbial Lipase, By Application, 2016–2023 (MT)

Table 5 Microbial Lipase Market Size for Cleaning Agents, By Region, 2016–2023 (USD Million)

Table 6 Size of Market For Microbial Lipase for Cleaning Agents, By Region, 2016–2023 (MT)

Table 7 Microbial Lipase Market Size for Animal Feed, By Region, 2016–2023 (USD Million)

Table 8 Size of Market For Microbial Lipase for Animal Feed, By Region, 2016–2023 (MT)

Table 9 Global Dairy Production and Consumption in (Ktpw)

Table 10 Microbial Lipase Market Size for Dairy Products, By Region, 2016–2023 (USD Million)

Table 11 Size of Market For Microbial Lipase for Dairy Products, By Region, 2016–2023 (MT)

Table 12 Microbial Lipase Market Size for Bakery Products, By Region, 2016–2023 (USD Million)

Table 13 Size of Market For Microbial Lipase for Bakery Products, By Region, 2016–2023 (MT)

Table 14 Microbial Lipase Market Size for Confectionery Products, By Region, 2016–2023 (USD Million)

Table 15 Size of Market For Microbial Lipase for Confectionery Products, By Region, 2016–2023 (MT)

Table 16 Microbial Lipase Market Size for Other Applications, By Region, 2016–2023 (USD Million)

Table 17 Size of Market For Microbial Lipase for Other Applications, By Region, 2016–2023 (MT)

Table 18 Microbial Lipase Market Size, By Form, 2016–2023 (USD Million)

Table 19 Size of Market For Microbial Lipase, By Form, 2016–2023 (MT)

Table 20 Powdered Microbial Lipase Market Size, By Region, 2016–2023 (USD Million)

Table 21 Size of Market For Powdered Microbial Lipase, By Region, 2016–2023 (MT)

Table 22 Liquid Microbial Lipase Market Size, By Region, 2016–2023 (USD Million)

Table 23 Size of Market For Liquid Microbial Lipase, By Region, 2016–2023 (MT)

Table 24 Microbial Lipase Market Size, By Source, 2016–2023 (USD Million)

Table 25 Size of Market For Microbial Lipase, By Source, 2016–2023 (MT)

Table 26 Fungi: Microbial Lipase Market Size, By Region, 2016–2023 (USD Million)

Table 27 Fungi: Size of Market For Microbial Lipase, By Region, 2016–2023 (MT)

Table 28 Bacteria: Microbial Lipase Market Size, By Region, 2016–2023 (USD Million)

Table 29 Bacteria: Size of Market For Microbial Lipase, By Region, 2016–2023 (MT)

Table 30 Microbial Lipase Market Size, By Region, 2016–2023 (USD Million)

Table 31 Size of Market For Microbial Lipase, By Region, 2016–2023 (MT)

Table 32 North America: Microbial Lipase Market Size, By Country, 2016–2023 (USD Million)

Table 33 North America: Size of Market For Microbial Lipase, By Country, 2016–2023 (MT)

Table 34 North America: Size of Market For Microbial Lipase, By Application, 2016–2023 (USD Million)

Table 35 North America: Size of Market For Microbial Lipase, By Application, 2016–2023 (MT)

Table 36 North America: Size of Market For Microbial Lipase, By Form, 2016–2023 (USD Million)

Table 37 North America: Size of Market For Microbial Lipase, By Form, 2016–2023 (MT)

Table 38 North America: Size of Market For Microbial Lipase, By Source, 2016–2023 (USD Million)

Table 39 North America: Size of Market For Microbial Lipase, By Source, 2016–2023 (MT)

Table 40 US: Microbial Lipase Market Size, By Application, 2016–2023 (USD Million)

Table 41 US: Size of Market For Microbial Lipase, By Application, 2016–2023 (MT)

Table 42 Canada: Microbial Lipase Market Size, By Application, 2016–2023 (USD Million)

Table 43 Canada: Size of Market For Microbial Lipase, By Application, 2016–2023 (MT)

Table 44 Mexico: Microbial Lipase Market Size, By Application, 2016–2023 (USD Million)

Table 45 Mexico: Size of Market For Microbial Lipase, By Application, 2016–2023 (MT)

Table 46 Europe: Microbial Lipase Market Size, By Country, 2016–2023 (USD Million)

Table 47 Europe: Size of Market For Microbial Lipase, By Country, 2016–2023 (MT)

Table 48 Europe: Size of Market For Microbial Lipase, By Application, 2016–2023 (USD Million)

Table 49 Europe: Size of Market For Microbial Lipase, By Application, 2016–2023 (MT)

Table 50 Europe: Size of Market For Microbial Lipase, By Form, 2016–2023 (USD Million)

Table 51 Europe: Size of Market For Microbial Lipase, By Form, 2016–2023 (MT)

Table 52 Europe: Size of Market For Microbial Lipase, By Source, 2016–2023 (USD Million)

Table 53 Europe: Size of Market For Microbial Lipase, By Source, 2016–2023 (MT)

Table 54 Germany: Microbial Lipase Market Size, By Application, 2016–2023 (USD Million)

Table 55 Germany: Size of Market For Microbial Lipase, By Application, 2016–2023 (MT)

Table 56 France: Microbial Lipase Market Size, By Application, 2016–2023 (USD Million)

Table 57 France: Size of Market For Microbial Lipase, By Application, 2016–2023 (MT)

Table 58 UK: Microbial Lipase Market Size, By Application, 2016–2023 (USD Million)

Table 59 UK: Size of Market For Microbial Lipase, By Application, 2016–2023 (MT)

Table 60 Spain: Microbial Lipase Market Size, By Application, 2016–2023 (USD Million)

Table 61 Spain: Size of Market For Microbial Lipase, By Application, 2016–2023 (MT)

Table 62 Russia: Microbial Lipase Market Size, By Application, 2016–2023 (USD Million)

Table 63 Russia: Size of Market For Microbial Lipase, By Application, 2016–2023 (MT)

Table 64 Rest of Europe: Microbial Lipase Market Size, By Application, 2016–2023 (USD Million)

Table 65 Rest of Europe: Size of Market For Microbial Lipase, By Application, 2016–2023 (MT)

Table 66 Asia Pacific: Microbial Lipase Market Size, By Country, 2016–2023 (USD Million)

Table 67 Asia Pacific: Size of Market For Microbial Lipase, By Country, 2016–2023 (MT)

Table 68 Asia Pacific: Size of Market For Microbial Lipase, By Application, 2016–2023 (USD Million)

Table 69 Asia Pacific: Size of Market For Microbial Lipase, By Application, 2016–2023 (MT)

Table 70 Asia Pacific: Size of Market For Microbial Lipase, By Form, 2016–2023 (USD Million)

Table 71 Asia Pacific: Size of Market For Microbial Lipase, By Form, 2016–2023 (MT)

Table 72 Asia Pacific: Size of Market For Microbial Lipase, By Source, 2016–2023 (USD Million)

Table 73 Asia Pacific: Size of Market For Microbial Lipase, By Source, 2016–2023 (MT)

Table 74 China: Microbial Lipase Market Size, By Application, 2016–2023 (USD Million)

Table 75 China: Size of Market For Microbial Lipase, By Application, 2016–2023 (MT)

Table 76 Japan: Microbial Lipase Market Size, By Application, 2016–2023 (USD Million)

Table 77 Japan: Size of Market For Microbial Lipase, By Application, 2016–2023 (MT)

Table 78 India: Microbial Lipase Market Size, By Application, 2016–2023 (USD Million)

Table 79 India: Size of Market For Microbial Lipase, By Application, 2016–2023 (MT)

Table 80 Australia & New Zealand: Microbial Lipase Market Size, By Application, 2016–2023 (USD Million)

Table 81 Australia & New Zealand: Size of Market For Microbial Lipase, By Application, 2016–2023 (MT)

Table 82 Rest of Asia Pacific: Microbial Lipase Market Size, By Application, 2016–2023 (USD Million)

Table 83 Rest of Asia Pacific: Size of Market For Microbial Lipase, By Application, 2016–2023 (MT)

Table 84 South America: Microbial Lipase Market Size, By Country, 2016–2023 (USD Million)

Table 85 South America: Size of Market For Microbial Lipase, By Country, 2016–2023 (MT)

Table 86 South America: Size of Market For Microbial Lipase, By Application, 2016–2023 (USD Million)

Table 87 South America: Size of Market For Microbial Lipase, By Application, 2016–2023 (MT)

Table 88 South America: Size of Market For Microbial Lipase, By Form, 2016–2023 (USD Million)

Table 89 South America: Size of Market For Microbial Lipase, By Form, 2016–2023 (MT)

Table 90 South America: Size of Market For Microbial Lipase, By Source, 2016–2023 (USD Million)

Table 91 South America: Size of Market For Microbial Lipase, By Source, 2016–2023 (MT)

Table 92 Brazil: Microbial Lipase Market Size, By Application, 2016–2023 (USD Million)

Table 93 Brazil: Size of Market For Microbial Lipase, By Application, 2016–2023 (MT)

Table 94 Argentina: Microbial Lipase Market Size, By Application, 2016–2023 (USD Million)

Table 95 Argentina: Size of Market For Microbial Lipase, By Application, 2016–2023 (USD Million)

Table 96 Rest of South America: Microbial Lipase Market Size, By Application, 2016–2023 (USD Million)

Table 97 Rest of South America: Size of Market For Microbial Lipase, By Application, 2016–2023 (USD Million)

Table 98 RoW: Microbial Lipase Market Size, By Region, 2016–2023 (USD Million)

Table 99 RoW: Size of Market For Microbial Lipase, By Region, 2016–2023 (MT)

Table 100 RoW: Size of Market For Microbial Lipase, By Application, 2016–2023 (USD Million)

Table 101 RoW: Size of Market For Microbial Lipase, By Application, 2016–2023 (MT)

Table 102 RoW: Size of Market For Microbial Lipase, By Form, 2016–2023 (USD Million)

Table 103 RoW: Size of Market For Microbial Lipase, By Form, 2016–2023 (MT)

Table 104 RoW: Size of Market For Microbial Lipase, By Source, 2016–2023 (USD Million)

Table 105 RoW: Size of Market For Microbial Lipase, By Source, 2016–2023 (MT)

Table 106 South Africa: Microbial Lipase Market Size, By Application, 2016–2023 (USD Million)

Table 107 South Africa: Size of Market For Microbial Lipase, By Application, 2016–2023 (MT)

Table 108 Others in RoW: Microbial Lipase Market Size, By Application, 2016–2023 (USD Million)

Table 109 Others in RoW: Size of Market For Microbial Lipase, By Application, 2016–2023 (MT)

Table 110 Expansions, 2015–2018

Table 111 Acquisitions, 2016–2017

Table 112 Product/Service/Technology Launches, 2016–2017

Table 113 Agreements, Partnerships, and Investments, 2015–2017

List of Figures (49 Figures)

Figure 1 Microbial Lipase Market Segmentation

Figure 2 Regional Scope

Figure 3 Microbial Lipase Market: Research Design

Figure 4 Breakdown of Primary Interviews: By Company Type, Designation, and Region

Figure 5 Market Size Estimation Methodology: Top-Down Approach

Figure 6 Market Size Estimation Methodology: Bottom-Up Approach

Figure 7 Market Breakdown & Data Triangulation

Figure 8 Research Assumptions

Figure 9 Research Limitations

Figure 10 Microbial Lipase Market Size, By Application, 2018 vs 2023

Figure 11 Size of Market For Microbial Lipase, By Form, 2018 vs 2023

Figure 12 Microbial Lipase Market Share (Value), By Source, 2017

Figure 13 Size of Market For Microbial Lipase, By Region, 2017

Figure 14 Increasing Awareness About Animal Health and High-Quality Animal Produce Likely to Drive Market Growth for Microbial Lipase

Figure 15 Confectionery Products to Grow at the Highest Rate Between 2018 & 2023

Figure 16 Powder Segment Estimated to Dominate the Market in Terms of Value in All Regions in 2018

Figure 17 Fungi Segment Dominated the Market in Terms of Value in 2017

Figure 18 China Dominated the Asia Pacific Market in 2017

Figure 19 Asia Pacific is Projected to Dominate the Market for Microbial Lipases Through 2023

Figure 20 Increasing Awareness About Animal Health to Drive the Microbial Lipase Market

Figure 21 Authorities & Regulations Regulating the Microbial Lipase Market

Figure 22 Microbial Lipase Production and Processing Adds Major Value to the Final Product

Figure 23 Confectionery Products Segment Projected to Grow at the Highest CAGR Between 2018 and 2023

Figure 24 Global Production of Animal Feed, 2012–2016 (Million Metric Tons)

Figure 25 Regional Production of Animal Feed, 2016 (Million Metric Tons)

Figure 26 Global Sales Percentage of Confectionery Products (2016)

Figure 27 Global Share of Biofuel Production (2016)

Figure 28 Leading Countries Producing Biofuels, 2016 (MT)

Figure 29 Global Share of Paper & Paperboard Production (2016)

Figure 30 Leading Countries Producing Paper & Paperboard, 2016 (MT)

Figure 31 Powder Segment is Projected to Dominate the Microbial Lipase Market Through 2023

Figure 32 Fungi Segment is Projected to Dominate the Microbial Lipase Market Through 2023

Figure 33 North America: Market Snapshot

Figure 34 Europe: Microbial Lipase Market Snapshot

Figure 35 Asia Pacific: Market Snapshot

Figure 36 Companies Adopted Expansions as Key Growth Strategy Between 2013 & 2018

Figure 37 Number of Developments Between 2015 and 2018

Figure 38 Market Share Analysis of Key Players in the Microbial Lipase Market

Figure 39 Novozymes A/S: Company Snapshot

Figure 40 Novozymes A/S: SWOT Analysis

Figure 41 DSM: Company Snapshot

Figure 42 DSM: SWOT Analysis

Figure 43 Chr. Hansen: Company Snapshot

Figure 44 Associated British Food: Company Snapshot

Figure 45 Associated British Food: SWOT Analysis

Figure 46 Dowdupont: Company Snapshot

Figure 47 Dowdupont: SWOT Analysis

Figure 48 Advanced Enzymes: Company Snapshot

Figure 49 Advanced Enzymes: SWOT Analysis

Growth opportunities and latent adjacency in Microbial Lipase Market