Lipase Market by Source (Microbial Lipases, Animal Lipases), Application (Animal Feed, Dairy, Bakery, Confectionery, Others), & by Geography (North America, Europe, Asia-Pacific, Latin America, RoW) - Global Forecast to 2020

Lipase is one of the rapidly growing markets in the industrial enzymes market, mainly due to its numerous health and industrial benefits. It helps in the digestion of fats by breaking them down into fatty acids and glycerol. It also helps in controlling appetite and regulates cholesterol levels in the body. Furthermore, lipase performs several functions, such as texturants, flavorants, cleaning agents, and shelf life enhancers and has a range of applications in food & non-food industries.

The global market has been categorized into source, application, and geography. On the basis of source, the lipase market has been segmented into microbial lipases and animal lipases. On the basis of application, the segmentation includes animal feed, dairy, bakery, confectionery, and others. The market has also been segmented on the basis of regions into North America, Europe, Asia-Pacific, Latin America, and Rest of the World (RoW).

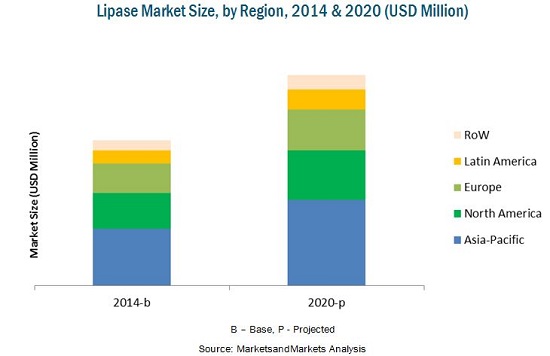

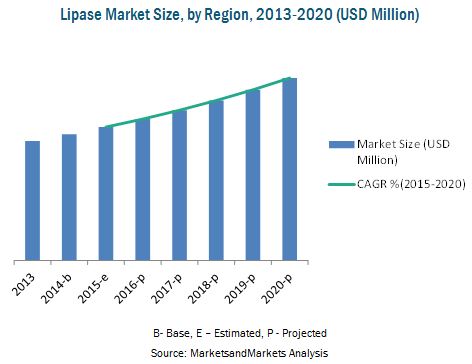

The global market is projected to reach $590.5 Million by 2020, at a CAGR of 6.5% between 2015 and 2020. In 2014, the market was dominated by Asia-Pacific, followed by North America. The Asia-Pacific market is projected to grow at the highest CAGR, with rapid growth in the lipase market in developing countries such as China and India. The growing awareness about animal health and the rising consumption of meat and processed milk products are the major factors anticipated to drive the growth the market in this region.

This report includes market sizes in terms of value (USD Million) and volume (MT). Both top-down and bottom-up approaches were used to arrive at the market sizes and obtain the market forecast. Extensive secondary research was conducted to understand the market insights and trends, which was further validated through primary interviews. The report provides both, qualitative and quantitative analysis of the lipase market, the competitive landscape, and the preferred development strategies of key players.

The key players were observed to prefer new product launches & developments, acquisitions, agreements, and expansions as strategies to capture a larger share in the market. The report also analyzes the market dynamics, winning imperatives, and issues faced by leading players.

Scope of the Report

The research study has categorized the market on the basis of source, application, and geography.

On the basis of source, the market has been segmented as follows:

- Microbial Lipases

- Animal Lipases

On the basis of application, the market has been segmented as follows:

- Animal Feed

- Dairy

- Bakery

- Confectionery

- Others

On the basis of geography, the market has been segmented as follows:

- North America

- Europe

- Asia-Pacific

- Latin America

- RoW

The growth of the lipase market is fueled by the growing awareness about animal health and rising consumption of meat and processed milk products. Numerous health benefits of lipases to improve health of the livestock have led to a large-scale adoption of lipase in various animal feeds in the global market. As an ingredient in food industry, it helps improving food quality and enhances the flavor of certain food items, improves their texture, prolongs shelf life, and increases the softness in some food products. The increasing demand for improved quality of meat and processed dairy products is driving the demand for lipases in animal feed and dairy application segments. Lipases are largely used in the animal feed, dairy, bakery, and confectionery industries.

The lipase market has been segmented based on source into microbial lipases and animal lipases. Based on application, the market has been segmented into animal feed, dairy, bakery, confectionery, and others. The market has also been segmented on the basis of regions, into North America, Europe, Asia-Pacific, Latin America, and Rest of the World (RoW), and has been further segmented on the basis of their key countries. This report includes market sizes in terms of value (USD Million) and volume (MT).

The global market size of lipase is projected to reach $590.5 Million by 2020, at a CAGR of 6.5% between 2015 and 2020, with the increasing use of lipase in numerous feeds for livestock. Furthermore, the rising opportunities in emerging markets such as India, China, and Brazil are anticipated to augment the market size of lipases over the forecast period. In 2014, Asia-Pacific was the largest market for lipase. The Asia-Pacific market is projected to grow at the highest CAGR during the forecast period.

The lipase market is oligopolistic & competitive in nature, with few players dominating the market and many small players operating at regional and local levels. The key players in the market adopted new product launches and expansions as their preferred strategies. Key players such as Novozymes A/S (Denmark), E. I. du Pont de Nemours and Company (Genencor) (U.S.), Koninklijke DSM N.V. (Netherlands), and Chr. Hansen Holdings A/S (Denmark) have been profiled in the report.

Table of Contents

1 Introduction (Page No. - 14)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Markets Scope

1.3.1 Years Considered in the Report

1.3.2 Currency & Pricing

1.4 Stakeholders

2 Research Methodology (Page No. - 17)

2.1 Market Share Estimation

2.1.1 Secondary Data

2.1.2 Primary Data

2.1.2.1 Key Industry Insights

2.1.2.2 Breakdown of Primaries

2.2 Market Size Estimation

2.3 Market Breakdown & Data Triangulation

2.3.1 Assumptions

3 Executive Summary (Page No. - 26)

4 Premium Insights (Page No. - 29)

4.1 Attractive Market Opportunity for Lipase Manufacturers

4.2 Lipase Market Growing at A Fast Pace

4.3 Lipase Market in Asia-Pacific

4.4 Global Lipase Market, By Type: Value & Volume

4.5 Lipase Market Attractiveness

5 Market Overview (Page No. - 33)

5.1 Introduction

5.2 Market Segmentation

5.2.1 By Source

5.2.2 By Application

5.3 Market Dynamics

5.3.1 Drivers

5.3.1.1 Increasing Awareness About Animal Health

5.3.1.2 Rise in Global EMC & EMDI Consumption

5.3.1.3 Increased Demand for Quality Animal Produce

5.3.1.4 Multiple Health Benefits

5.3.2 Restraints

5.3.2.1 Lack of Transparency in Patent Protection Laws

5.3.3 Opportunities

5.3.3.1 Large Number of Emerging Applications

5.3.4 Challenges

5.3.4.1 Creating Awareness About Benefits of Lipases

6 Regulatory Environment Analysis (Page No. - 39)

6.1 North America: Regulatory Framework

6.2 Europe: Regulatory Framework

6.3 Asia-Pacific: Regulatory Framework

6.4 Latin America: Regulatory Framework

7 Industry Trends (Page No. - 42)

7.1 Introduction

7.2 Value Chain Analysis

7.3 Global Lipase Market : Porters Five Forces Analysis

7.3.1 Intensity of Competitive Rivalry

7.3.2 Bargaining Power of Suppliers

7.3.3 Bargaining Power of Buyers

7.3.4 Threat of Substitutes

7.3.5 Threat of New Entrants

8 Lipase Market, By Source (Page No. - 47)

8.1 Introduction

8.2 Microbial Lipases

8.3 Animal Lipases

9 Lipase Market, By Application (Page No. - 53)

9.1 Introduction

9.2 Lipase in Animal Feed

9.3 Lipase in Dairy

9.4 Lipase in Bakery

9.5 Lipase in Confectionery

9.6 Lipase in Others

10 Regional Analysis (Page No. - 75)

10.1 Introduction

10.2 North America

10.2.1 North America Lipase Market, By Application

10.2.2 North America Lipase Market, By Source

10.2.3 U.S. Lipase Market, By Application

10.2.4 Canada Lipase Market, By Application

10.2.5 Mexico Lipase Market, By Application

10.3 Europe

10.3.1 Europe Lipase Market, By Application

10.3.2 Europe Lipase Market, By Source

10.3.3 Germany Lipase Market, By Application

10.3.4 U.K. Lipase Market, By Application

10.3.5 France Lipase Market, By Application

10.3.6 Spain Lipase Market, By Application

10.3.7 Russia Lipase Market, By Application

10.4 Asia-Pacific

10.4.1 Asia-Pacific Lipase Market, By Application

10.4.2 Asia-Pacific Lipase Market, By Source

10.4.3 China Lipase Market, By Application

10.4.4 India Lipase Market, By Application

10.4.5 Indonesia Lipase Market, By Application

10.4.6 Japan Lipase Market, By Application

10.4.7 Australia Lipase Market, By Application

10.5 Latin America

10.5.1 Latin America Lipase Market, By Application

10.5.2 Latin America Lipase Market, By Source

10.5.3 Brazil Lipase Market, By Application

10.5.4 Argentina Lipase Market, By Application

10.6 RoW

10.6.1 RoW Lipase Market, By Application

10.6.2 RoW Lipase Market, By Source

10.6.3 South Africa Lipase Market, By Application

11 Competitive Landscape (Page No. - 137)

11.1 Overview

11.2 Developments, By Region

11.3 Developments, By Year

11.4 Market Share, By Key Players

11.5 Competitive Situation and Trends

11.5.1 New Product Launch

11.5.2 Expansions and Investments

11.5.3 Mergers & Acquisitions

11.5.4 Agreements and Joint Ventures

12 Company Profiles (Page No. - 143)

(Company at A Glance, Recent Financials, Products & Services, Strategies & Insights, & Recent Developments)*

12.1 Introduction

12.2 Novozymes A/S

12.3 Koninklijke DSM N.V.

12.4 Chr. Hansen Holdings A/S

12.5 Amano Enzymes Inc.

12.6 Associated British Foods PLC

12.7 E. I. Du Pont De Nemours and Company (Genencor)

12.8 Advanced Enzymes

12.9 Clerici-Sacco Group

12.10 Renco New Zealand

12.11 Enzyme Development Corporation

*Details on Company at A Glance, Recent Financials, Products & Services, Strategies & Insights, & Recent Developments Might Not Be Captured in Case of Unlisted Companies.

13 Appendix (Page No. - 166)

13.1 Discussion Guide

13.2 Company Developments

13.2.1 New Product Launch

13.2.2 Expansions and Investments

13.2.3 Mergers & Acquisitions

13.3 Introducing RT: Real Time Market Intelligence

13.4 Available Customization

13.5 Related Reports

List of Tables (122 Tables)

Table 1 Potential Impact of Opportunities on the Lipase Market

Table 2 Lipase Market Size, By Source, 2013-2020 (USD Million)

Table 3 Lipase Market Size, By Source, 2013-2020 (MT)

Table 4 Microbial Lipases Market Size, By Geography, 2013-2020 (USD Million)

Table 5 Microbial Lipases Market Size, By Geography, 2013-2020 (MT)

Table 6 Animal Lipases Market Size, By Geography, 2013-2020 (USD Million)

Table 7 Animal Lipases Market Size, By Geography, 2013-2020 (MT)

Table 8 Lipase Market Size, By Application, 2013-2020 (USD Million)

Table 9 Lipase Market Size, By Application, 2013-2020 (MT)

Table 10 Lipase in Animal Feed Market Size, By Geography, 2013-2020 (USD Million)

Table 11 Lipase in Animal Feed Market Size, By Geography, 2013-2020 (MT)

Table 12 Lipase in Poultry Feed Market Size, By Geography, 2013-2020 (USD Million)

Table 13 Lipase in Poultry Feed Market Size, By Geography, 2013-2020 (MT)

Table 14 Lipase in Aqua Feed Market Size, By Geography, 2013-2020 (USD Million)

Table 15 Lipase in Aqua Feed Market Size, By Geography, 2013-2020 (MT)

Table 16 Lipase in Swine Feed Market Size, By Geography, 2013-2020 (USD Million)

Table 17 Lipase in Swine Feed Market Size, By Geography, 2013-2020 (MT)

Table 18 Lipase in Ruminant Feed Market Size, By Geography, 2013-2020 (USD Million)

Table 19 Lipase in Ruminant Feed Market Size, By Geography, 2013-2020 (MT)

Table 20 Lipase in Dairy Market Size, By Geography, 2013-2020 (USD Million)

Table 21 Lipase in Dairy Market Size, By Geography, 2013-2020 (MT)

Table 22 Lipase in Cheese/ EMC Market Size, By Geography, 2013-2020 (USD Million)

Table 23 Lipase in Cheese/EMC Market Size, By Geography, 2013-2020 (MT)

Table 24 Lipase in EMDI Market Size, By Geography, 2013-2020 (USD Million)

Table 25 Lipase in EMDI Market Size, By Geography, 2013-2020 (MT)

Table 26 Lipase in Bakery Market Size, By Geography, 2013-2020 (USD Million)

Table 27 Lipase in Bakery Market Size, By Geography, 2013-2020 (MT)

Table 28 Lipase in Confectionery Market Size, By Geography, 2013-2020 (USD Million)

Table 29 Lipase in Confectionery Market Size, By Geography, 2013-2020 (MT)

Table 30 Lipase in Others Market Size, By Geography, 2013-2020 (USD Million)

Table 31 Lipase in Others Market Size, By Geography, 2013-2020 (MT)

Table 32 Lipase Market Size, By Geography, 2013-2020 (USD Million)

Table 33 Lipase Market Size, By Geography, 2013-2020 (MT)

Table 34 North America: Lipase Market Size, By Geography 2013-2020 (USD Million)

Table 35 North America: Market Size, By Geography 2013-2020 (MT)

Table 36 North America: Market Size, By Application, 2013-2020 (USD Million)

Table 37 North America: Market Size, By Application, 2013-2020 (MT)

Table 38 Lipase in Animal Feed in North America, 2013-2020 (USD Mn)

Table 39 Lipase in Animal Feed in North America, 2013-2020 (MT)

Table 40 Lipase in Dairy in North America, 2013-2020 (USD Mn)

Table 41 Lipase in Dairy in North America, 2013-2020 (MT)

Table 42 North America: Lipase Market Size, By Application, 2013-2020 (USD Million)

Table 43 North America: Market Size, By Application, 2013-2020 (MT)

Table 44 U.S.: Lipase Market Size, By Application, 2013-2020 (USD Million)

Table 45 U.S.: Market Size, By Application, 2013-2020 (MT)

Table 46 Canada: Lipase Market Size, By Application, 2013-2020 (USD Million)

Table 47 Canada: Market Size, By Application, 2013-2020 (MT)

Table 48 Mexico: Lipase Market Size, By Application, 2013-2020 (USD Million)

Table 49 Mexico: Market Size, By Application, 2013-2020 (MT)

Table 50 Europe: Lipase Market Size, By Geography 2013-2020 (USD Million)

Table 51 Europe: Market Size, By Geography, 2013-2020 (MT)

Table 52 Europe: Market Size, By Application, 2013-2020 (USD Million)

Table 53 Europe: Market Size, By Application, 2013-2020 (MT)

Table 54 Europe: Lipase Market in Animal Feed, 2013-2020 (USD Mn)

Table 55 Europe: Market in Animal Feed, 2013-2020 (MT)

Table 56 Europe: Lipase Market in Dairy in Europe, 2013-2020 (USD Mn)

Table 57 Europe: Market in Dairy, 2013-2020 (MT)

Table 58 Europe: Lipase Market Size, By Source, 2013-2020 (USD Million)

Table 59 Europe: Market Size, By Source, 2013-2020 (MT)

Table 60 Germany: Lipase Market Size, By Application, 2013-2020 (USD Million)

Table 61 Germany: Market Size, By Application, 2013-2020 (MT)

Table 62 U.K.: Lipase Market Size, By Application, 2013-2020 (USD Million)

Table 63 U.K.: Market Size, By Application, 2013-2020 (MT)

Table 64 France: Lipase Market Size, By Application, 2013-2020 (USD Million)

Table 65 France: Market Size, By Application, 2013-2020 (MT)

Table 66 Spain: Lipase Market Size, By Application, 2013-2020 (USD Million)

Table 67 Spain: Market Size, By Application, 2013-2020 (MT)

Table 68 Russia: Lipase Market Size, By Application, 2013-2020 (USD Million)

Table 69 Russia: Market Size, By Application, 2013-2020 (MT)

Table 70 Asia-Pacific: Lipase Market Size, By Geography 2013-2020 (USD Million)

Table 71 Asia-Pacific: Market Size, By Geography 2013-2020 (MT)

Table 72 Asia-Pacific: Market Size, By Application, 2013-2020 (USD Million)

Table 73 Asia-Pacific: Market Size, By Application, 2013-2020 (MT)

Table 74 Lipase in Animal Feed in Asia-Pacific, 2013-2020 (USD Mn)

Table 75 Lipase in Animal Feed in Asia-Pacific, 2013-2020 (MT)

Table 76 Lipase in Dairy in Asia-Pacific, 2013-2020 (USD Mn)

Table 77 Lipase in Dairy in Asia- Pacific, 2013-2020 (MT)

Table 78 Asia-Pacific: Lipase Market Size, By Source, 2013-2020 (USD Million)

Table 79 Asia-Pacific: Market Size, By Source, 2013-2020 (MT)

Table 80 China: Lipase Market Size, By Application, 2013-2020 (USD Million)

Table 81 China: Market Size, By Application, 2013-2020 (MT)

Table 82 India: Lipase Market Size, By Application, 2013-2020 (USD Million)

Table 83 India: Market Size, By Application, 2013-2020 (MT)

Table 84 Indonesia: Lipase Market Size, By Application, 2013-2020 (USD Million)

Table 85 Indonesia: Market Size, By Application, 2013-2020 (MT)

Table 86 Japan: Lipase Market Size, By Application, 2013-2020 (USD Million)

Table 87 Japan: Market Size, By Application, 2013-2020 (MT)

Table 88 Australia: Lipase Market Size, By Application, 2013-2020 (USD Million)

Table 89 Australia: Market Size, By Application, 2013-2020 (MT)

Table 90 Latin America Lipase: Market Size, By Geography 2013-2020 (USD Million)

Table 91 Latin America: Market Size, By Geography 2013-2020 (MT)

Table 92 Latin America: Market Size, By Application, 2013-2020 (USD Million)

Table 93 Latin America: Market Size, By Application, 2013-2020 (MT)

Table 94 Lipase in Animal Feed in Latin America, 2013-2020 (USD Mn)

Table 95 Lipase in Animal Feed in Latin America, 2013-2020 (MT)

Table 96 Lipase in Dairy in Latin America, 2013-2020 (USD Mn)

Table 97 Lipase in Dairy in Latin America, 2013-2020 (MT)

Table 98 Latin America Lipase Market Size, By Source, 2013-2020 (USD Million)

Table 99 Latin America Lipase Market Size, By Source, 2013-2020 (MT)

Table 100 Brazil: Lipase Market Size, By Application, 2013-2020 (USD Million)

Table 101 Brazil: Market Size, By Application, 2013-2020 (MT)

Table 102 Argentina: Lipase Market Size, By Application, 2013-2020 (USD Million)

Table 103 Argentina: Market Size, By Application, 2013-2020 (MT)

Table 104 RoW: Lipase Market Size, By Geography 2013-2020 (USD Million)

Table 105 RoW: Market Size, By Geography 2013-2020 (MT)

Table 106 RoW: Market Size, By Application, 2013-2020 (USD Million)

Table 107 RoW: Market Size, By Application, 2013-2020 (MT)

Table 108 Lipase in Animal Feed in RoW, 2013-2020 (USD Mn)

Table 109 Lipase in Animal Feed in RoW, 2013-2020 (MT)

Table 110 Lipase in Dairy in RoW, 2013-2020 (USD Mn)

Table 111 Lipase in Dairy in RoW, 2013-2020 (MT)

Table 112 RoW: Lipase Market Size, By Source, 2013-2020 (USD Million)

Table 113 RoW: Market Size, By Source, 2013-2020 (MT)

Table 114 South Africa: Lipase Market Size, By Application, 2013-2020 (USD Million)

Table 115 South Africa: Market Size, By Application, 2013-2020 (MT)

Table 116 New Product Launches, 2011–2015

Table 117 Expansions and Investments, 2010–2015

Table 118 Mergers & Acquisitions, 2010–2015

Table 119 Agreements and Joint Ventures, 2010–2015

Table 120 New Product Launches, 2011–2015

Table 121 Expansions and Investments, 2010–2015

Table 122 Mergers & Acquisitions, 2010–2015

List of Figures (92 Figures)

Figure 1 Research Design

Figure 2 Key Data From Secondary Sources

Figure 3 Key Data From Primary Sources

Figure 4 Breakdown of Primary Interviews, By Company Type, Designation & Region

Figure 5 Market Size Estimation Methodology: Bottom-Up Approach

Figure 6 Market Size Estimation Methodology: Top-Down Approach

Figure 7 Market Breakdown & Data Triangulation

Figure 8 Animal Feed to Dominate the Application Segment of this Market

Figure 9 Microbial Lipases Segment to Register the Highest CAGR Between 2015 & 2020

Figure 10 Asia-Pacific is Estimated to Be the Largest Market for Lipase, in Terms of Volume (2015-2020)

Figure 11 Lipase Market is Lucrative for Enzyme Manufacturers

Figure 12 Asia Pacific to Witness the Highest Growth During the Forecast Period

Figure 13 China Emerges as the Largest Consumer of Lipase in Asia-Pacific

Figure 14 Microbial Lipases is Projected to Be the Faster-Growing Segment and Contribute A Major Market Share During the Forecast Period

Figure 15 Asia-Pacific to Command the Largest Share of this Market (2015)

Figure 16 Lipase Market Segmentation, By Source

Figure 17 Lipase Market Segmentation, By Application

Figure 18 Increased Animal Health Awareness and Rising Demand of EMC & EMDI to Lead the global market in Future

Figure 19 Authorities & Regulations for the Lipase Market

Figure 20 Lipase Production and Processing Adds Major Value to the Final Product

Figure 21 Global Lipase Market: Porters Five Forces Analysis

Figure 22 Lipase Market, By Type

Figure 23 Microbial Lipases to See the Fastest Growth, From 2015

Figure 24 Asia-Pacific to Grow at the Fastest Pace, From 2015

Figure 25 Asia-Pacific to Be the Largest Segment for Microbial Lipases (2015)

Figure 26 Lipase Market, By Application

Figure 27 Animal Feed to Be the Largest Segment By 2020

Figure 28 Asia-Pacific is the Largest Sub-Segment for the Animal Feed Application

Figure 29 Asia-Pacific Led the Lipase Market in Poultry Feed Application

Figure 30 Asia-Pacific is the Largest Sub-Segment for the Aqua Feed Application

Figure 31 Asia-Pacific to Witness the Fastest Growth in Lipase in Swine Feed Market, From 2015

Figure 32 Asia-Pacific to Lead Lipase in Ruminant Feed Market

Figure 33 Asia-Pacific Estimated to Be the Largest Market for Lipase in Diary Application

Figure 34 Asia-Pacific to Grow at the Fastest CAGR From 2015 to 2020

Figure 35 Asia-Pacific Estimated to Be the Largest Market for Lipase in Cheese/EMC Application, From 2014

Figure 36 Lipase Market in Bakery Segment to Witness Highest Growth in Asia-Pacific

Figure 37 Asia-Pacific is Projected to Be the Largest Market for Lipase in Confectionery Application Segment

Figure 38 Lipase Market in Confectionary Anticipated to Witness the Fastest Growth in Asia-Pacific

Figure 39 Lipase Market in Asia-Pacific Expected to Witness Significant Growth Due to Increasing Demand From Emerging Economies

Figure 40 Regional Snapshot: Asia-Pacific Driving the Growth in the Lipase Market

Figure 41 North America:Lipase Market Snapshot, (2014-2020)

Figure 42 U.S. Expected to Be the Largest Market for Lipase During the Forecast Period

Figure 43 Animal Feed Segment to Witness Fastest Growth in North American Lipase Market

Figure 44 Microbial Lipases to Remain the Largest Segment By 2020

Figure 45 Animal Feed Segment Leads the U.S. Lipase Market By Application

Figure 46 Animal Feed Segment Leads the Lipase Application Market in Canada,

Figure 47 Animal Feed Segment Leads the Lipase Market in Mexico,

Figure 48 Spain is Expected to Be the Fastest-Growing Market for Lipase in Europe

Figure 49 Animal Feed is the Largest Application for Lipase in Europe

Figure 50 Microbial Lipase Segment to Lead the European Lipase Market

Figure 51 Confectionery to See the Fastest Growth in Germany, From 2015

Figure 52 Confectionery to See the Fastest Growth in U.K., From 2015

Figure 53 Animal Feed to Lead the Lipase Application Market in France, From 2014

Figure 54 Animal Feed Segment to Lead the Lipase Application Market in France

Figure 55 Animal Feed to Lead the Lipase Application Market in Russia, From 2014

Figure 56 Asia-Pacific: Lipase Market Snapshot, (2014 – 2020)

Figure 57 Indonesia is Expected to Be the Fastest Growing Market for Lipase

Figure 58 Dairy Segment to Closely Follow Animal Feed in Asia-Pacific Lipase Market

Figure 59 Bio-Lipase Segment to Witness the Fastest Growth in Asia-Pacific

Figure 60 Confectionery Segment to Be the Fastest-Growing Segment of the Market in China

Figure 61 Bakery Application of Lipase to Witness the Fastest Growth in India

Figure 62 Animal Feed Segment to Lead the Lipase Market in the Indonesia

Figure 63 Animal Feed Segment to Lead the Lipase Market in the Japan

Figure 64 Animal Feed Application Segment to Lead the Lipase Market in Australia

Figure 65 Brazil is Expected to Be the Fastest-Growing Market for Lipase

Figure 66 Animal Feed to Be the Largest Application Segment for Lipase Market in Latin America

Figure 67 Microbial Lipases Segment to Witness the Fastest Growth in Latin America

Figure 68 Confectionery to Witness the Fastest Growth in Brazil

Figure 69 Animal Feed to Be the Largest Application Segment in Brazil

Figure 70 South Africa is Expected to Be the Largest Market for Lipase

Figure 71 Animal Feed to Be the Largest Application Segment of Lipase Market Growth in RoW

Figure 72 Microbial Lipase to Witness the Fastest Growth in RoW

Figure 73 Confectionery to Witness the Fastest Growth in South Africa

Figure 74 Companies Adopted New Product Launch as the Key Growth Strategy During the Studied Period (2010-2015)

Figure 75 Key Growth Strategies in Global Lipase Market, 2010-2015

Figure 76 New Product Launches in Europe has Made It the Most Active Region From 2012–2015

Figure 77 Maximum Developments Observed During the Year 2013

Figure 78 Novozymes A/S the Largest Player in the Market

Figure 79 Geographic Revenue Mix of Top 5 Market Players

Figure 80 Novozymes A/S: Company Snapshot

Figure 81 SWOT Analysis

Figure 82 Koninklijke DSM N.V.: Company Snapshot

Figure 83 SWOT Analysis

Figure 84 Chr. Hansen Holdings A/S: Company Snapshot

Figure 85 SWOT Analysis

Figure 86 Amano Enzymes Inc.: Key Financials

Figure 87 Associated British Food PLC: Company Snapshot

Figure 88 SWOT Analysis

Figure 89 E. I. Du Pont De Nemours and Company (Genencor): Company Snapshot

Figure 90 SWOT Analysis

Figure 91 Advanced Enzymes: Company Snapshot

Figure 92 SWOT Analysis

Growth opportunities and latent adjacency in Lipase Market