Metallic Powder Coatings Market by Process Type (Bonding, Blending, Extrusion),Pigment Type (Aluminum, Mica), Resin Type (Polyester, Hybrid, Epoxy, Polyurethane, Others), End-use Industry, and Region - Global Forecast to 2025

Updated on : August 25, 2025

Metallic Powder Coatings Market

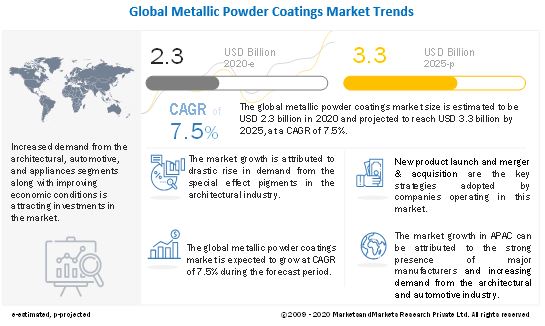

The global metallic powder coatings market was valued at USD 2.3 billion in 2020 and is projected to reach USD 3.3 billion by 2025, growing at 7.5% cagr from 2020 to 2025. The market trend is attributed to the continued growth of the architectural industry, which is the largest consumer of metallic powder coatings.

To know about the assumptions considered for the study, download the pdf brochure

COVID-19 Impact on the Global Metallic Powder Coatings Market

The outbreak of COVID-19 has disrupted the production of raw materials used in paints and coatings manufacturing. Asian countries such as India, China, Japan, Singapore, and Thailand are the hubs for paints and coatings manufacturing and are major suppliers of these raw materials. The outbreak of the novel coronavirus in APAC has affected the supply of these raw materials. For instance, China is one of the major suppliers of resins and exports a million tons of resins in the global market. The break in the supplies of raw materials has reduced the production of paints and coatings products.

In April 2020, all private buildings and construction sites, government constructions, and refinish automotive businesses were hit drastically. Retailors are also canceling already placed bulk orders of paint and coatings products due to the shutdown of the market. End-use consumers are not buying expensive coating technologies such as polyurea and polyurethanes from distributors and retailers due to COVID-19. Overall, the sales of paints and coatings products are hampered at the distributors’ level due to the suspension of construction and building activities.

Metallic Powder Coatings Market Dynamics

Driver: Increasing demand for metallic pigments from architectural and automotive industries

Metallic powder coatings find major applications in the architectural industry due to their phenomenal weathering properties with excellent color and gloss retention. Their corrosion resistance and excellent weatherability make them extremely popular for exterior architectural applications, such as façade, curtain wall, windows, doors and aluminum profiles, sheet metal, cladding, and others. Growing consumer demand for specialty and attractive products has made metallic pigments an option for the automotive industry. The increased acceptance of aluminum pigments in the automotive sector has been instrumental in driving the growth of the market. The growing awareness regarding the use of products with low carbon footprints is expected to drive the demand for metallic pigments in eco-friendly paints and coatings products. Hence, the use of metallic pigments in powder coatings is increasing at a rapid pace as they provide a wider range of color products to the consumers.

Restraint: High priced product in a price-competitive market

Metallic powders are more expensive than solids, especially if it is a bonded metallic powder coating. The reason is the extra processes involved in creating a bonded metallic powder. Also, some metallics require a clear top-coat, and others require a base coat. Even if the metallic needs one of those requirements, it is an extra step in the manufacturing process and therefore cost added onto a job. Metallic powders can be more difficult to spray than solid color powders. Essentially, the electrostatics, among other things, have an effect on the way the metallic flakes in the powder orient. A small change in flake orientation can change the color of the coating, especially when there is a large contrast between the base color and the color of the metallic flake.

Opportunity: Advanced materials and new compositions in wheels

The automotive industry has seen constant innovation in the development of lightweight materials. The average percentage of carbon fiber reinforced composites and aluminum used in automobiles has been increasing consistently over the years. Given the growing demand for lighter, faster, and better performing vehicles and rising fuel costs, aftermarket players have been focusing on developing light-weighting technologies. In an endeavor to offer pleasing reding, aftermarket players are using innovative materials/composites for making wheels that provide a better grip with high performance and strength. The developers and manufacturers are innovating with new materials for making wheels that are cost-efficient and feasible in practical life.

Challenge: Application of metallic powder coatings

Metallic powder coatings are denser than other powder materials. This makes it harder to fluidize and deliver the metal flake materials. Challenges such as uneven film thickness (varying deposition of effect pigments gives rise to color or effect change) arise during application. To make it easier to fluidize, it should be ensured that the air supply is properly dry. It is usually recommended that the air should be around 38°F (3.3°C) dew point or lower. Also, a feed hopper needs to be used, not a box feed system. A box system may work, but it is more challenging to control the distribution of the powder by particle size and pigmentation. In some cases, it can be helpful to have additional inlets into the plenum to add more air volume. Additional pressure alone may not provide good fluidization, where additional air volume (CFM) without additional pressure (PSI) can be helpful.

Metallic Powder Coatings Market Ecosystem

Polyester resin segment accounted for the largest share of the metallic powder coatings market in 2020.

Polyester resin segment accounts for the largest share in the metallic powder coatings market. A powder coating based on a polyester resin system blended with suitable metallic pigments. Polyester-based metallic powder coatings are designed where the user requires a superior decorative finish for exterior use, as they offer excellent flow and toughness. Other attributes such as enhanced mar resistance from metal rubbing, and fingerprint resistance, Tribo-safe also can be achieved. A range of substrates may be coated with the help of polyester based metallic powder coatings.

Architectural is projected to witness the fastest growth of metallic powder coatings market during the forecast period.

Architectural is projected to witness the fastest growth of metallic powder coatings market during the forecast period, in terms of volume. Metallic powder coatings for architectural applications include interior and exterior coatings such as facade panels, metal constructions, railings, and window and door frames. These coatings are primarily used in residential and commercial buildings and applied by paint professionals and do-it-yourself consumers. They are used to coat aluminum and steel, both for interior and exterior applications.

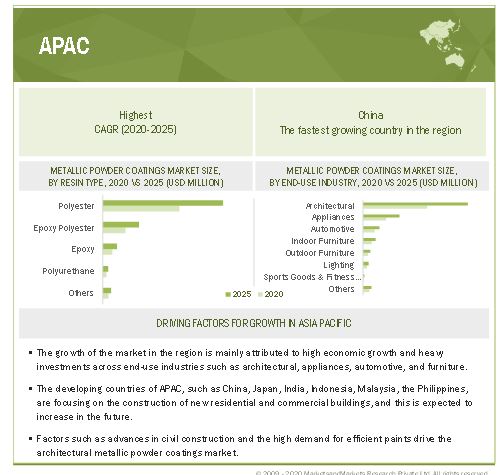

APAC is the largest metallic powder coatings market in the forecast period

APAC has emerged as one of the leading producers as well as consumers of metallic powder coatings. The developing countries of APAC, such as China, Japan, India, Indonesia, Malaysia, the Philippines, are focusing on the construction of new residential and commercial buildings, and this is expected to increase in the future. Factors such as advances in civil construction and the high demand for efficient paints drive the architectural metallic powder coatings market. The shifting of the end-use industries such as automotive, appliances, and furniture to cost-competitive countries, such as Indonesia and Vietnam, is driving the metallic powder coatings market in countries.

The spread of the coronavirus started in China in early January 2020. Within a small period, the spread in other Asian countries such as Japan, South Korea, and Thailand resulted in the pandemic situation, with numerous positive cases and deaths. This situation led national governments across APAC to announce lockdowns, leading to a decrease in traffic, construction & mining activities, manufacturing industries, and so on. Since China is a global manufacturing hub, the impact of COVID-19 is anticipated to be much higher in the country. Considering the above factors, the metallic powder coatings market is expected to decline in APAC in 2020.

Metallic Powder Coatings Market Players

The key players operating in the market are AkzoNobel N.V. (Netherlands), Axalta Coating Systems, LLC (US), Jotun A/S (Norway), PPG Industries (US), The Sherwin-Williams Company (US), and Tiger Coatings GmbH & Co. KG (Austria).

Scope of the report

Metallic Powder Coatings Market Report Scope

|

Report Metric |

Details |

|

Years considered for the study |

2018-2025 |

|

Base year |

2019 |

|

Forecast period |

2020–2025 |

|

Units considered |

Value (USD) and Volume (Kiloton) |

|

Segments |

By Process Type |

|

Regions covered |

APAC, Europe, North America, South America, and Middle East & Africa |

|

Companies profiled |

The major market players AkzoNobel N.V. (Netherlands), Axalta Coating Systems, LLC (US), Jotun A/S (Norway), PPG Industries (US), The Sherwin-Williams Company (US), and Tiger Coatings GmbH & Co. KG (Austria). (Total of 26 companies) |

This research report categorizes the metallic powder coatings market based on process type, pigment type, resin type, end-use industry, and region.

By Process Type:

- Bonding/Bonded

- Blending

- Extrusion

By Pigment Type:

- Aluminum

- Mica

- Others

By Resin Type:

- Polyester

- Hybrid

- Epoxy

- Polyurethane

- Others

By End-use Industry:

- Architectural

- Automotive

- Appliances

- Furniture

- Sports Goods & Fitness Equipment

- Lighting

- Others

By Region:

- APAC

- Europe

- North America

- South America

- Middle East & Africa

Recent Developments

- In July 2019, AkzoNobel announced plans to add three new production lines at its Changzhou powder coatings plant in China—the company’s largest facility of its kind in the world. The USD 3.3 million investment will support additional supplies of acrylic powder coatings, metallic powder coatings, and powder primers for the automotive sector, strengthening AkzoNobel’s ability to deliver more locally produced premium products.

- In December 2019, Axalta strengthened its position in the global powder market by investing in bonding capabilities for metallic effect powder coatings. The investment will enhance Axalta's new bonding production line in Landshut, Germany, and upgrade bonding equipment and capabilities in Houston, Texas, US and Shanghai, China, to enable customers to purchase best-in-class metallic effect powder coatings more easily from Axalta's locations worldwide.

Frequently Asked Questions (FAQ):

What is the current size of the global metallic powder coatings market?

The global metallic powder coatings market is estimated to be USD 2.3 billion n 2020 and projected to reach USD 3.3 billion by 2025, at a CAGR of 7.5%

Who are the major players of the metallic powder coatings market?

Companies such as AkzoNobel N.V. (Netherlands), Axalta Coating Systems, LLC (US), Jotun A/S (Norway), PPG Industries (US), The Sherwin-Williams Company (US), and Tiger Coatings GmbH & Co. KG (Austria) are the major players in the market.

Where will all these developments take the industry in the mid-to-long term?

Continuous developments in the market, including new product launches, mergers & acquisitions, and investments & expansions are expected to help the market grow. New product launch and merger & acquisition are the key strategies adopted by companies operating in this market.

Which segment has the potential to register the highest market share for metallic powder coatings?

Architectural was the largest end-use industry of metallic powder coatings, in terms of both volume and value, in 2019. The consumption of powder coatings in the architectural segment is growing because of its excellent durability and availability of a variety of finishes and colors. Architectural metallic powder coatings are factory applied, high quality, and durable in nature. Such coatings designed specifically keeping architectural applications in mind.

Which is the fastest-growing region in the market?

APAC is expected to be the largest and fastest-growing market for metallic powder coatings due to the high demand from end-use industries such as architectural, appliances, and automotive. The developing countries of APAC, such as China, Japan, India, Indonesia, Malaysia, the Philippines, are focusing on the construction of new residential and commercial buildings, and this is expected to increase in the future. Factors such as advances in civil construction and the high demand for efficient paints drive the metallic powder coatings market. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 27)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.2.1 MARKET INCLUSIONS

1.2.2 MARKET EXCLUSIONS

1.3 MARKET SCOPE

FIGURE 1 MARKET SEGMENTATION: METALLIC POWDER COATINGS

1.3.1 REGIONS COVERED

1.3.2 YEARS CONSIDERED FOR THE STUDY

1.4 CURRENCY

1.5 UNITS CONSIDERED

1.6 STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 31)

2.1 RESEARCH DATA

FIGURE 2 METALLIC POWDER COATINGS MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Primary data sources

2.1.2.2 Key data from primary sources

2.1.2.3 Key industry insights

2.1.2.4 Breakdown of primary interviews

2.2 MARKET SIZE ESTIMATION

FIGURE 3 MARKET SIZE ESTIMATION: TOP-DOWN APPROACH

FIGURE 4 METALLIC POWDER COATINGS MARKET ESTIMATION, BY REGION

2.3 MARKET FORECAST APPROACH

2.3.1 SUPPLY-SIDE FORECAST PROJECTION:

2.3.2 DEMAND-SIDE FORECAST PROJECTION:

2.4 DATA TRIANGULATION

FIGURE 5 METALLIC POWDER COATINGS MARKET: DATA TRIANGULATION

2.5 ASSUMPTIONS

2.6 LIMITATIONS

3 EXECUTIVE SUMMARY (Page No. - 40)

TABLE 1 METALLIC POWDER COATINGS MARKET SNAPSHOT, 2020 VS. 2025

FIGURE 6 POLYESTER METALLIC POWDER COATINGS DOMINATED THE MARKET IN 2019

FIGURE 7 BONDING METALLIC POWDER COATINGS DOMINATED THE MARKET IN 2019

FIGURE 8 ALUMINUM PIGMENT-BASED METALLIC POWDER COATINGS DOMINATED THE MARKET IN 2019

FIGURE 9 APAC ACCOUNTED FOR LARGEST MARKET SHARE IN 2019

4 PREMIUM INSIGHTS (Page No. - 45)

4.1 ATTRACTIVE OPPORTUNITIES IN METALLIC POWDER COATINGS MARKET

FIGURE 10 HIGH DEMAND FROM ARCHITECTURAL INDUSTRY TO DRIVE THE MARKET

4.2 METALLIC POWDER COATINGS MARKET, BY RESIN TYPE

FIGURE 11 POLYESTER BASED TO DOMINATE OVERALL METALLIC POWDER COATINGS MARKET

4.3 METALLIC POWDER COATINGS MARKET, DEVELOPED VS. DEVELOPING COUNTRIES

FIGURE 12 DEVELOPING COUNTRIES TO GROW FASTER THAN DEVELOPED COUNTRIES

4.4 APAC METALLIC POWDER COATINGS MARKET, BY END-USE INDUSTRY AND COUNTRY

FIGURE 13 ARCHITECTURAL SEGMENT ACCOUNTED FOR LARGEST MARKET SHARE

4.5 METALLIC POWDER COATINGS MARKET, BY KEY COUNTRIES

FIGURE 14 CHINA TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

5 MARKET OVERVIEW (Page No. - 48)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 15 OVERVIEW OF FACTORS GOVERNING THE METALLIC POWDER COATINGS MARKET

5.2.1 DRIVERS

5.2.1.1 Increasing demand for metallic pigments from architectural and automotive industries

5.2.1.2 Large organized and unorganized aftermarkets for wheels

5.2.2 RESTRAINTS

5.2.2.1 Metallic liquid coatings being major substitute for metallic powder coatings

5.2.2.2 High-priced product in price-competitive market

5.2.2.3 Requires storage of metallics at a particular temperature

5.2.3 OPPORTUNITIES

5.2.3.1 Continuous advances in the metallic powder coatings market

5.2.3.2 Technological advancements

5.2.3.3 Advanced materials and new compositions in wheels

5.2.4 CHALLENGES

5.2.4.1 Application of metallic powder coatings

5.2.4.2 Volatile resin prices

5.3 PORTER’S FIVE FORCES ANALYSIS

FIGURE 16 METALLIC POWDER COATINGS MARKET: PORTER’S FIVE FORCES ANALYSIS

TABLE 2 METALLIC POWER COATING: PORTER’S FIVE FORCES

5.3.1 THREAT OF SUBSTITUTES

5.3.2 BARGAINING POWER OF BUYERS

5.3.3 THREAT OF NEW ENTRANTS

5.3.4 BARGAINING POWER OF SUPPLIERS

5.3.5 INTENSITY OF COMPETITIVE RIVALRY

5.4 COVID-19 IMPACT

5.5 COVID-19 ECONOMIC ASSESSMENT

FIGURE 17 LATEST WORLD ECONOMIC OUTLOOK GROWTH PROJECTIONS

5.5.1 COVID-19 ECONOMIC IMPACT – SCENARIO ASSESSMENT

FIGURE 18 FACTORS IMPACTING ECONOMY OF SELECT G20 COUNTRIES IN 2020

FIGURE 19 SCENARIO-BASED ANALYSIS OF IMPACT OF COVID-19 ON BUSINESSES

5.6 VALUE CHAIN ANALYSIS

FIGURE 20 METALLIC POWDER COATING: VALUE CHAIN ANALYSIS

5.7 VALUE CHAIN OF PAINTS & COATINGS INDUSTRY

FIGURE 21 PAINTS & COATINGS VALUE CHAIN

FIGURE 22 IMPACT OF COVID-19 ON VALUE CHAIN NODES

FIGURE 23 IMPACT OF COVID-19 ON PAINTS & COATINGS MARKET

5.8 IMPACT ON VALUE CHAIN

5.8.1 RAW MATERIALS/SUPPLIERS

5.8.2 PAINTS AND COATINGS FORMULATORS

5.8.3 APPLICATORS

5.8.4 DISTRIBUTORS

TABLE 3 DISTRIBUTORS: OFFERINGS AND SERVICES

5.8.5 END-USE INDUSTRIES

5.9 CUSTOMER ANALYSIS

5.9.1 SHIFT IN AUTOMOTIVE INDUSTRY

5.9.2 IMPACT ON CUSTOMERS’ OUTPUT & STRATEGIES TO RESUME/IMPROVE PRODUCTION

5.9.2.1 Impact on customers’ revenues

5.9.2.2 Most impacted regions

5.9.2.2.1 Short-term strategies to manage cost structure and supply chains

5.9.2.3 New market opportunities/growth opportunities

5.9.2.4 Customers’ perspective on the growth outlook

5.10 SHIFT IN AEROSPACE INDUSTRY

5.10.1 DISRUPTION IN THE INDUSTRY

5.10.2 IMPACT ON CUSTOMERS’ OUTPUT & STRATEGIES TO RESUME/IMPROVE PRODUCTION

5.10.3 IMPACT ON CUSTOMERS’ REVENUES

5.10.3.1 Most impacted regions

5.10.3.2 Short-term strategies to manage cost structure and supply chains

5.10.4 NEW MARKET OPPORTUNITIES/GROWTH OPPORTUNITIES

5.10.4.1 Measures taken by customers

5.10.4.2 Customers’ perspective on growth outlook

5.11 SHIFT IN CONSTRUCTION INDUSTRY

5.11.1 DISRUPTION IN THE INDUSTRY

5.11.2 IMPACT ON CUSTOMERS’ OUTPUT & STRATEGIES TO RESUME/IMPROVE PRODUCTION

5.11.3 IMPACT ON CUSTOMERS’ REVENUES

5.11.3.1 Customer’s most impacted regions

5.11.3.2 Short-term strategies to manage cost structure and supply chains

5.11.4 NEW MARKET OPPORTUNITIES/GROWTH OPPORTUNITIES

5.11.4.1 Measures taken by customers

5.11.4.2 Customers’ perspective on growth outlook

5.12 PRICING ANALYSIS

FIGURE 24 AVERAGE PRICE COMPETITIVENESS IN METALLIC POWDER COATINGS MARKET, BY REGION

FIGURE 25 AVERAGE PRICE COMPETITIVENESS IN METALLIC POWDER COATINGS MARKET, BY RESIN TYPE

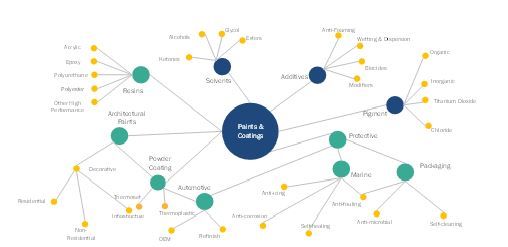

5.13 PAINTS & COATINGS ECOSYSTEM AND INTERCONNECTED MARKET

TABLE 4 METALLIC POWDER COATINGS: ECOSYSTEM

5.14 REVENUE SHIFT AND NEW REVENUE POCKETS FOR POWDER COATING MANUFACTURERS

FIGURE 26 REVENUE SHIFT IN POWDER COATINGS MARKET

5.15 EXPORT-IMPORT TRADE STATISTICS

TABLE 5 COUNTRY-WISE EXPORT DATA, EPOXIDE RESINS, 2017-2019

TABLE 6 COUNTRY-WISE EXPORT DATA, UNSATURATED POLYESTER RESINS, 2017-2019

TABLE 7 COUNTRY-WISE EXPORT DATA, SATURATED POLYESTER RESINS, 2017-2019

TABLE 8 COUNTRY-WISE IMPORT DATA, EPOXIDE RESINS, 2017-2019

TABLE 9 COUNTRY-WISE IMPORT DATA, UNSATURATED POLYESTER RESINS, 2017-2019

TABLE 10 COUNTRY-WISE IMPORT DATA, SATURATED POLYESTER RESINS, 2017-2019

5.16 REGULATIONS

5.16.1 AMERICAN COATINGS ASSOCIATION

5.16.2 ASTM INTERNATIONAL STANDARD WORLDWIDE

5.17 PATENT ANALYSIS

5.17.1 METHODOLOGY

5.17.2 PUBLICATION TRENDS

FIGURE 27 NUMBER OF PATENTS PUBLISHED, 2016-2020

5.17.3 TOP JURISDICTION

FIGURE 28 PATENTS PUBLISHED BY JURISDICTION, 2016-2020

5.17.4 TOP APPLICANTS

FIGURE 29 PATENTS PUBLISHED BY MAJOR PLAYERS, 2015-2020

TABLE 11 RECENT PATENTS BY COMPANIES

5.18 CASE STUDY ANALYSIS

5.19 TECHNOLOGY ANALYSIS

6 METALLIC POWDER COATINGS MARKET, BY PROCESS TYPE (Page No. - 109)

6.1 INTRODUCTION

FIGURE 30 BONDING TO BE THE LARGEST PROCESS TYPE FOR METALLIC POWDER COATINGS

TABLE 12 METALLIC POWDER COATINGS MARKET SIZE, BY PROCESS TYPE, 2018–2025 (KILOTON)

TABLE 13 METALLIC POWDER COATINGS MARKET SIZE, BY PROCESS TYPE, 2018–2025 (USD MILLION)

6.2 BONDING/BONDED

6.2.1 IMPROVED APPLICATION, BROADER RANGE OF APPEARANCES, AND CAN BE RECLAIMED SUCCESSFULLY

TABLE 14 BONDED METALLIC POWDER COATINGS MARKET SIZE, BY REGION, 2018–2025 (KILOTON)

TABLE 15 BONDED METALLIC POWDER COATINGS MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

6.3 BLENDING

6.3.1 POSSIBILITY OF FREE METALLIC HAVING A TENDENCY TO BUILD UP ON THE GUN TIP, CAUSING SPITTING OF THE COATING

TABLE 16 BLENDED METALLIC POWDER COATINGS MARKET SIZE, BY REGION, 2018–2025 (KILOTON)

TABLE 17 BLENDED METALLIC POWDER COATINGS MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

6.3.2 POST BLEND WITH UNCOATED ALUMINUM FLAKE

6.3.3 POST BLEND WITH COATED ALUMINUM FLAKE

6.4 EXTRUSION

6.4.1 INABILITY TO ACHIEVE CERTAIN LOOKS AND APPEARANCES

TABLE 18 EXTRUDED METALLIC POWDER COATINGS MARKET SIZE, BY REGION, 2018–2025 (KILOTON)

TABLE 19 EXTRUDED METALLIC POWDER COATINGS MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

7 METALLIC POWDER COATINGS MARKET, BY PIGMENT TYPE (Page No. - 115)

7.1 INTRODUCTION

FIGURE 31 ALUMINUM METALLIC POWDER COATINGS TO BE THE LARGEST PIGMENT TYPE

TABLE 20 METALLIC POWDER COATINGS MARKET SIZE, BY PIGMENT TYPE, 2018–2025 (KILOTON)

TABLE 21 METALLIC POWDER COATINGS MARKET SIZE, BY PIGMENT TYPE, 2018–2025 (USD MILLION)

7.2 ALUMINUM

7.2.1 LEAFING ALUMINUM PIGMENTS

7.2.2 NON-LEAFING ALUMINUM PIGMENTS

TABLE 22 ALUMINUM BASED METALLIC POWDER COATINGS MARKET SIZE, BY REGION, 2018–2025 (KILOTON)

TABLE 23 ALUMINUM BASED METALLIC POWDER COATINGS MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

7.3 MICA

TABLE 24 MICA-BASED METALLIC POWDER COATINGS MARKET SIZE, BY REGION, 2018–2025 (KILOTON)

TABLE 25 MICA-BASED METALLIC POWDER COATINGS MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

7.4 OTHERS

TABLE 26 OTHER PIGMENT BASED METALLIC POWDER COATINGS MARKET SIZE, BY REGION, 2018–2025 (KILOTON)

TABLE 27 OTHER PIGMENT BASED METALLIC POWDER COATINGS MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

8 METALLIC POWDER COATINGS MARKET, BY RESIN TYPE (Page No. - 120)

8.1 INTRODUCTION

FIGURE 32 POLYESTER TO BE LARGEST RESIN TYPE FOR METALLIC POWDER COATINGS

TABLE 28 METALLIC POWDER COATINGS MARKET SIZE, BY RESIN TYPE, 2018–2025 (KILOTON)

TABLE 29 METALLIC POWDER COATINGS MARKET SIZE, BY RESIN TYPE, 2018–2025 (USD MILLION)

8.2 POLYESTER

8.2.1 EXCELLENT WEATHER AND CORROSION RESISTANCE TO DRIVE DEMAND FOR POLYESTER RESIN

8.3 HYBRID

8.3.1 DEMAND FOR HYBRID RESINS FOR INDOOR APPLICATIONS FOR DURABILITY AND SUPERIOR COLOR STABILITY

8.4 EPOXY

8.4.1 RARE USE OF EPOXY-BASED METALLIC POWDER COATINGS FOR OUTDOOR APPLICATIONS

8.5 POLYURETHANE

8.5.1 POLYURETHANE-BASED METALLIC POWDER COATINGS ARE RARELY USED FOR OUTDOOR APPLICATIONS

8.6 OTHERS

9 METALLIC POWDER COATINGS MARKET, BY END-USE INDUSTRY (Page No. - 124)

9.1 INTRODUCTION

FIGURE 33 ARCHITECTURAL TO BE LARGEST END-USE INDUSTRY OF METALLIC POWDER COATINGS

TABLE 30 METALLIC POWDER COATINGS MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (KILOTON)

TABLE 31 METALLIC POWDER COATINGS MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (USD MILLION)

9.2 ARCHITECTURAL

9.2.1 EXCELLENT DURABILITY AND AVAILABILITY FUELING CONSUMPTION OF METALLIC POWDER COATINGS

TABLE 32 METALLIC POWDER COATINGS MARKET SIZE IN ARCHITECTURAL END-USE INDUSTRY, 2018–2025 (KILOTON)

TABLE 33 METALLIC POWDER COATINGS MARKET SIZE IN ARCHITECTURAL END-USE INDUSTRY, 2018–2025 (USD MILLION)

9.3 AUTOMOTIVE

9.3.1 METALLIC POWDER COATINGS FULFIL APPEARANCE AND QUALITY REQUIREMENTS OF ALUMINUM WHEELS

TABLE 34 METALLIC POWDER COATINGS MARKET SIZE IN AUTOMOTIVE, BY REGION, 2018–2025 (KILOTON)

TABLE 35 METALLIC POWDER COATINGS MARKET SIZE IN AUTOMOTIVE, BY REGION, 2018–2025 (USD MILLION)

9.4 APPLIANCES

9.4.1 INCREASING PER CAPITA INCOME AND CONSUMER SPENDING ON APPLIANCES TO DRIVE MARKET

TABLE 36 METALLIC POWDER COATINGS MARKET SIZE IN APPLIANCES, BY REGION, 2018–2025 (KILOTON)

TABLE 37 METALLIC POWDER COATINGS MARKET SIZE IN APPLIANCES, BY REGION, 2018–2025 (USD MILLION)

9.5 FURNITURE

9.5.1 CHANGING CUSTOMER PREFERENCE AND IMPROVED STANDARD OF LIVING DRIVING THE DEMAND

9.5.2 INDOOR FURNITURE

TABLE 38 METALLIC POWDER COATINGS MARKET SIZE IN INDOOR FURNITURE, BY REGION, 2018–2025 (KILOTON)

TABLE 39 METALLIC POWDER COATINGS MARKET SIZE IN INDOOR FURNITURE, BY REGION, 2018–2025 (USD MILLION)

9.5.3 OUTDOOR FURNITURE

TABLE 40 METALLIC POWDER COATINGS MARKET SIZE IN OUTDOOR FURNITURE, BY REGION, 2018–2025 (KILOTON)

TABLE 41 METALLIC POWDER COATINGS MARKET SIZE IN OUTDOOR FURNITURE, BY REGION, 2018–2025 (USD MILLION)

9.6 SPORTS GOODS & FITNESS EQUIPMENT

9.6.1 STABILIZING ECONOMIC PROSPERITY AMONG CITIZENS OF APAC COUNTRIES DRIVING DEMAND

TABLE 42 METALLIC POWDER COATINGS MARKET SIZE IN SPORTS GOODS & FITNESS EQUIPMENT, BY REGION, 2018–2025 (KILOTON)

TABLE 43 METALLIC POWDER COATINGS MARKET SIZE IN SPORTS GOODS & FITNESS EQUIPMENT, BY REGION, 2018–2025 (USD MILLION)

9.7 LIGHTING

9.7.1 INCREASING USE OF INDOOR & OUTDOOR LIGHTING TO FUEL THE METALLIC POWDER COATINGS MARKET

TABLE 44 METALLIC POWDER COATINGS MARKET SIZE IN LIGHTING, BY REGION, 2018–2025 (KILOTON)

TABLE 45 METALLIC POWDER COATINGS MARKET SIZE IN LIGHTING, BY REGION, 2018–2025 (USD MILLION)

9.8 OTHERS

TABLE 46 METALLIC POWDER COATINGS MARKET SIZE IN OTHER END-USE INDUSTRIES, BY REGION, 2018–2025 (KILOTON)

TABLE 47 METALLIC POWDER COATINGS MARKET SIZE IN OTHER END-USE INDUSTRIES, BY REGION, 2018–2025 (USD MILLION)

10 METALLIC POWDER COATINGS MARKET, BY REGION (Page No. - 135)

10.1 INTRODUCTION

FIGURE 34 APAC TO BE FASTEST-GROWING METALLIC POWDER COATINGS MARKET

TABLE 48 METALLIC POWDER COATINGS MARKET SIZE, BY REGION, 2018–2025 (KILOTON)

TABLE 49 METALLIC POWDER COATINGS MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

10.2 APAC

FIGURE 35 APAC: METALLIC POWDER COATINGS MARKET SNAPSHOT

TABLE 50 APAC: GDP GROWTH RATE, BY COUNTRY

TABLE 51 APAC: METALLIC POWDER COATINGS MARKET SIZE, BY PROCESS TYPE, 2018–2025 (KILOTON)

TABLE 52 APAC: METALLIC POWDER COATINGS MARKET SIZE, BY PROCESS TYPE, 2018–2025 (USD MILLION)

TABLE 53 APAC: METALLIC POWDER COATINGS MARKET SIZE, BY PIGMENT TYPE, 2018–2025 (KILOTON)

TABLE 54 APAC: METALLIC POWDER COATINGS MARKET SIZE, BY PIGMENT TYPE, 2018–2025 (USD MILLION)

TABLE 55 APAC: METALLIC POWDER COATINGS MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (KILOTON)

TABLE 56 APAC: METALLIC POWDER COATINGS MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (USD MILLION)

10.2.1 CHINA

10.2.1.1 Strong recovery from the repercussion of COVID-19 to support market recovery

TABLE 57 CHINA: METALLIC POWDER COATINGS MARKET SIZE, 2018–2025 (KILOTON & USD MILLION)

10.2.2 JAPAN

10.2.2.1 Stringent government regulations in building & construction sector to support market growth

TABLE 58 JAPAN: METALLIC POWDER COATINGS MARKET SIZE, 2018–2025 (KILOTON & USD MILLION)

10.2.3 INDIA

10.2.3.1 Growing FDI in the construction and manufacturing industries to favor market growth

TABLE 59 INDIA: METALLIC POWDER COATINGS MARKET SIZE, 2018–2025 (KILOTON & USD MILLION)

10.2.4 SOUTH KOREA

10.2.4.1 Automotive industry is key driver for growth of metallic powder coatings market

TABLE 60 SOUTH KOREA: METALLIC POWDER COATINGS MARKET SIZE, 2018–2025 (KILOTON & USD MILLION)

10.2.5 INDONESIA

10.2.5.1 High economic growth and high-tech industrialized economy boosting growth

TABLE 61 INDONESIA: METALLIC POWDER COATINGS MARKET SIZE, 2018–2025 (KILOTON & USD MILLION)

10.2.6 MALAYSIA

10.2.6.1 Recovery of manufacturing sector from impact of COVID-19 to boost market

TABLE 62 MALAYSIA: METALLIC POWDER COATINGS MARKET SIZE, 2018–2025 (KILOTON & USD MILLION)

10.2.7 REST OF APAC

TABLE 63 REST OF APAC: METALLIC POWDER COATINGS MARKET SIZE, 2018–2025 (KILOTON & USD MILLION)

10.3 EUROPE

FIGURE 36 EUROPE: METALLIC POWDER COATINGS MARKET SNAPSHOT

TABLE 64 EUROPE: GDP GROWTH RATE, BY COUNTRY

TABLE 65 EUROPE: METALLIC POWDER COATINGS MARKET SIZE, BY PROCESS TYPE, 2018–2025 (KILOTON)

TABLE 66 EUROPE: METALLIC POWDER COATINGS MARKET SIZE, BY PROCESS TYPE, 2018–2025 (USD MILLION)

TABLE 67 EUROPE: METALLIC POWDER COATINGS MARKET SIZE, BY PIGMENT TYPE, 2018–2025 (KILOTON)

TABLE 68 EUROPE: METALLIC POWDER COATINGS MARKET SIZE, BY PIGMENT TYPE, 2018–2025 (USD MILLION)

TABLE 69 EUROPE: METALLIC POWDER COATINGS MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (KILOTON)

TABLE 70 EUROPE: METALLIC POWDER COATINGS MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (USD MILLION)

10.3.1 GERMANY

TABLE 71 GERMANY: METALLIC POWDER COATINGS MARKET SIZE, 2018–2025 (KILOTON & USD MILLION)

10.3.2 SPAIN

10.3.2.1 Focus on revival of economy to support market growth

TABLE 72 SPAIN: METALLIC POWDER COATINGS MARKET SIZE, 2018–2025 (KILOTON & USD MILLION)

10.3.3 RUSSIA

10.3.3.1 Continuous growth in construction industry to increase demand for metallic powder coatings

TABLE 73 RUSSIA: METALLIC POWDER COATINGS MARKET SIZE, 2018–2025 (KILOTON & USD MILLION)

10.3.4 FRANCE

10.3.4.1 Expected growth opportunities in construction sector to influence market trend

TABLE 74 FRANCE: METALLIC POWDER COATINGS MARKET SIZE, 2018–2025 (KILOTON & USD MILLION)

10.3.5 UK

10.3.5.1 Economic growth, increase in consumer spending, and changing consumer preference driving demand

TABLE 75 UK: METALLIC POWDER COATINGS MARKET SIZE, 2018–2025 (KILOTON & USD MILLION)

10.3.6 TURKEY

10.3.6.1 Growing housing sector to create strong demand for coatings

TABLE 76 TURKEY: METALLIC POWDER COATINGS MARKET SIZE, 2018–2025 (KILOTON & USD MILLION)

10.3.7 ITALY

10.3.7.1 Construction industry playing a major role in growth of metallic powder coatings market

TABLE 77 ITALY: METALLIC POWDER COATINGS MARKET SIZE, 2018–2025 (KILOTON & USD MILLION)

10.3.8 POLAND

10.3.8.1 Residential buildings and other infrastructure expected to drive metallic powder coatings market

TABLE 78 POLAND: METALLIC POWDER COATINGS MARKET SIZE, 2018–2025 (KILOTON & USD MILLION)

10.3.9 BELGIUM

10.3.9.1 Institutional construction will increase demand for powder coatings

TABLE 79 BELGIUM: METALLIC POWDER COATINGS MARKET SIZE, 2018–2025 (KILOTON & USD MILLION)

10.3.10 SWEDEN

10.3.10.1 New infrastructural projects to drive the market for metallic powder coatings

TABLE 80 SWEDEN: METALLIC POWDER COATINGS MARKET SIZE, 2018–2025 (KILOTON & USD MILLION)

10.3.11 AUSTRIA

10.3.11.1 Construction activities in the country to drive the metallic powder coatings market

TABLE 81 AUSTRIA: METALLIC POWDER COATINGS MARKET SIZE, 2018–2025 (KILOTON & USD MILLION)

10.3.12 REST OF EUROPE

TABLE 82 REST OF EUROPE: METALLIC POWDER COATINGS MARKET SIZE, 2018–2025 (KILOTON & USD MILLION)

10.4 NORTH AMERICA

FIGURE 37 NORTH AMERICA: METALLIC POWDER COATINGS MARKET SNAPSHOT

TABLE 83 NORTH AMERICA: GDP GROWTH RATE, BY COUNTRY

TABLE 84 NORTH AMERICA: METALLIC POWDER COATINGS MARKET SIZE, BY PROCESS TYPE, 2018–2025 (KILOTON)

TABLE 85 NORTH AMERICA: METALLIC POWDER COATINGS MARKET SIZE, BY PROCESS TYPE, 2018–2025 (USD MILLION)

TABLE 86 NORTH AMERICA: METALLIC POWDER COATINGS MARKET SIZE, BY PIGMENT TYPE, 2018–2025 (KILOTON)

TABLE 87 NORTH AMERICA: METALLIC POWDER COATINGS MARKET SIZE, BY PIGMENT TYPE, 2018–2025 (USD MILLION)

TABLE 88 NORTH AMERICA: METALLIC POWDER COATINGS MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (KILOTON)

TABLE 89 NORTH AMERICA: METALLIC POWDER COATINGS MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (USD MILLION)

10.4.1 US

10.4.1.1 Turmoil in the manufacturing sector and COVID-19 impact on construction sector

TABLE 90 US: METALLIC POWDER COATINGS MARKET SIZE, 2018–2025 (KILOTON & USD MILLION)

10.4.2 CANADA

10.4.2.1 Proximity to the US supporting market growth

TABLE 91 CANADA: METALLIC POWDER COATINGS MARKET SIZE, 2018–2025 (KILOTON & USD MILLION)

10.4.3 MEXICO

10.4.3.1 Construction industry to be driven by investment in infrastructure and commercial projects

TABLE 92 MEXICO: METALLIC POWDER COATINGS MARKET SIZE, 2018–2025 (KILOTON & USD MILLION)

10.5 MIDDLE EAST & AFRICA

TABLE 93 MIDDLE EAST & AFRICA: GDP GROWTH RATE, BY COUNTRY

TABLE 94 MIDDLE EAST & AFRICA: METALLIC POWDER COATINGS MARKET SIZE, BY PROCESS TYPE, 2018–2025 (KILOTON)

TABLE 95 MIDDLE EAST & AFRICA: METALLIC POWDER COATINGS MARKET SIZE, BY PROCESS TYPE, 2018–2025 (USD MILLION)

TABLE 96 MIDDLE EAST & AFRICA: METALLIC POWDER COATINGS MARKET SIZE, BY PIGMENT TYPE, 2018–2025 (KILOTON)

TABLE 97 MIDDLE EAST & AFRICA: METALLIC POWDER COATINGS MARKET SIZE, BY PIGMENT TYPE, 2018–2025 (USD MILLION)

TABLE 98 MIDDLE EAST & AFRICA: METALLIC POWDER COATINGS MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (KILOTON)

TABLE 99 MIDDLE EAST & AFRICA: METALLIC POWDER COATINGS MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (USD MILLION)

10.5.1 SAUDI ARABIA

10.5.1.1 Architectural industry to drive metallic powder coatings market

TABLE 100 SAUDI ARABIA: METALLIC POWDER COATINGS MARKET SIZE, 2018–2025 (KILOTON & USD MILLION)

10.5.2 UAE

10.5.2.1 Developments in ongoing projects to increase demand for metallic powder coatings

TABLE 101 UAE: METALLIC POWDER COATINGS MARKET SIZE, 2018–2025 (KILOTON & USD MILLION)

10.5.3 SOUTH AFRICA

10.5.3.1 Country’s low production costs and access to new markets

TABLE 102 SOUTH AFRICA: METALLIC POWDER COATINGS MARKET SIZE, 2018–2025 (KILOTON & USD MILLION)

10.5.4 IRAN

10.5.4.1 Appliance market to support growth of metallic powder coatings

TABLE 103 IRAN: METALLIC POWDER COATINGS MARKET SIZE, 2018–2025 (KILOTON & USD MILLION)

10.5.5 REST OF MIDDLE EAST & AFRICA

TABLE 104 REST OF MIDDLE EAST & AFRICA: METALLIC POWDER COATINGS MARKET SIZE, 2018–2025 (KILOTON & USD MILLION)

10.6 SOUTH AMERICA

TABLE 105 SOUTH AMERICA: GDP GROWTH RATE, BY COUNTRY

TABLE 106 SOUTH AMERICA: METALLIC POWDER COATINGS MARKET SIZE, BY PROCESS TYPE, 2018–2025 (KILOTON)

TABLE 107 SOUTH AMERICA: METALLIC POWDER COATINGS MARKET SIZE, BY PROCESS TYPE, 2018–2025 (USD MILLION)

TABLE 108 SOUTH AMERICA: METALLIC POWDER COATINGS MARKET SIZE, BY PIGMENT TYPE, 2018–2025 (KILOTON)

TABLE 109 SOUTH AMERICA: METALLIC POWDER COATINGS MARKET SIZE, BY PIGMENT TYPE, 2018–2025 (USD MILLION)

TABLE 110 SOUTH AMERICA: METALLIC POWDER COATINGS MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (KILOTON)

TABLE 111 SOUTH AMERICA: METALLIC POWDER COATINGS MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (USD MILLION)

10.6.1 BRAZIL

10.6.1.1 Automotive market to support growth of metallic powder coatings

TABLE 112 BRAZIL: METALLIC POWDER COATINGS MARKET SIZE, 2018–2025 (KILOTON & USD MILLION)

10.6.2 ARGENTINA

10.6.2.1 Increasing population and improved economic conditions expected to fuel demand

TABLE 113 ARGENTINA: METALLIC POWDER COATINGS MARKET SIZE, 2018–2025 (KILOTON & USD MILLION)

10.6.3 REST OF SOUTH AMERICA

TABLE 114 REST OF SOUTH AMERICA: METALLIC POWDER COATINGS MARKET SIZE, 2018–2025 (KILOTON & USD MILLION)

11 COMPETITIVE LANDSCAPE (Page No. - 177)

11.1 OVERVIEW

FIGURE 38 KEY GROWTH STRATEGIES ADOPTED BY THE LEADING PLAYERS BETWEEN 2016 AND 2020

11.2 COMPANY EVALUATION QUADRANT MATRIX: DEFINITIONS AND METHODOLOGY, 2019

11.2.1 VISIONARY LEADERS

11.2.2 INNOVATORS

11.2.3 DYNAMIC DIFFERENTIATORS

11.2.4 EMERGING COMPANIES

FIGURE 39 METALLIC POWDER COATINGS MARKET (GLOBAL): COMPETITIVE LEADERSHIP MAPPING, 2019

11.3 STRENGTH OF PRODUCT PORTFOLIO

FIGURE 40 PRODUCT PORTFOLIO ANALYSIS OF TOP PLAYERS IN METALLIC POWDER COATINGS MARKET

11.4 BUSINESS STRATEGY EXCELLENCE

FIGURE 41 BUSINESS STRATEGY EXCELLENCE OF TOP PLAYERS IN METALLIC POWDER COATINGS MARKET

11.5 METALLIC POWDER COATINGS MARKET RANKING ANALYSIS: COMPETITIVE MARKET

11.6 COMPANY REVENUE ANALYSIS

FIGURE 42 COMPANY REVENUE ANALYSIS, 2015-2019

11.6.1 AKZONOBEL N.V.

11.6.2 PPG INDUSTRIES

11.6.3 THE SHERWIN-WILLIAMS COMPANY

11.6.4 AXALTA COATING SYSTEMS, LLC.

11.6.5 RPM INTERNATIONAL INC.

11.7 MARKET EVALUATION MATRIX

TABLE 115 COMPANY PRODUCT FOOTPRINT

TABLE 116 COMPANY APPLICATION FOOTPRINT

TABLE 117 COMPANY INDUSTRY FOOTPRINT

TABLE 118 COMPANY REGION FOOTPRINT

TABLE 119 STRATEGIC DEVELOPMENTS, BY COMPANY

TABLE 120 MOST FOLLOWED STRATEGY

TABLE 121 GROWTH STRATEGIES ADOPTED, BY KEY COMPANIES

11.7.1 METALLIC POWDER COATINGS MARKET: PRODUCT LAUNCHES, 2016-2020

11.7.2 METALLIC POWDER COATINGS MARKET: DEALS, 2016-2020

12 COMPANY PROFILES (Page No. - 196)

(Business Overview, Impact of COVID-19 on business segments, Products Offered, Recent Developments, SWOT Analysis, right to win)*

12.1 PPG INDUSTRIES

FIGURE 43 PPG INDUSTRIES: COMPANY SNAPSHOT

FIGURE 44 PPG INDUSTRIES, INC.: SWOT ANALYSIS

12.2 THE SHERWIN-WILLIAMS COMPANY

FIGURE 45 THE SHERWIN-WILLIAMS COMPANY: COMPANY SNAPSHOT

FIGURE 46 THE SHERWIN-WILLIAMS COMPANY: SWOT ANALYSIS

12.3 AKZONOBEL N.V.

FIGURE 47 AKZONOBEL N.V.: COMPANY SNAPSHOT

FIGURE 48 AKZONOBEL N.V.: SWOT ANALYSIS

12.4 AXALTA COATING SYSTEMS, LLC

FIGURE 49 AXALTA COATING SYSTEMS, LLC: COMPANY SNAPSHOT

FIGURE 50 AXALTA COATING SYSTEMS, LLC: SWOT ANALYSIS

12.5 JOTUN A/S

FIGURE 51 JOTUN A/S: COMPANY SNAPSHOT

FIGURE 52 JOTUN A/S: SWOT ANALYSIS

12.6 TIGER COATINGS GMBH & CO. KG

FIGURE 53 TIGER COATINGS GMBH: SWOT ANALYSIS

12.7 ASIAN PAINTS LIMITED

FIGURE 54 ASIAN PAINTS LIMITED: COMPANY SNAPSHOT

FIGURE 55 ASIAN PAINTS LIMITED: SWOT ANALYSIS

12.8 DULUXGROUP LTD.

FIGURE 56 DULUXGROUP LTD.: COMPANY SNAPSHOT

FIGURE 57 DULUXGROUP LTD.: SWOT ANALYSIS

12.9 RPM INTERNATIONAL INC.

FIGURE 58 RPM INTERNATIONAL INC.: COMPANY SNAPSHOT

FIGURE 59 RPM INTERNATIONAL INC.: SWOT ANALYSIS

12.10 AMERICAN POWDER COATINGS, INC.

12.11 OTHER COMPANIES

12.11.1 CARDINAL

12.11.2 DIAMOND VOGEL

12.11.3 IFS COATINGS

12.11.4 ERIE POWDER COATINGS INC.

12.11.5 IGP PULVERTECHNIK AG

12.11.6 PRIMATEK COATINGS OÜ

12.11.7 VITRACOAT

12.11.8 WEG

12.11.9 PULVERIT S.P.A.

12.11.10 ST POWDER COATINGS S.P.A.

12.11.11 ÝBA KIMYA A.Þ.

12.11.12 NEOKEM S.A.

12.11.13 TEKNOS GROUP OY

12.11.14 ARSONSISI S.P.A.

12.11.15 EMIL FREI GMBH & CO. KG

12.11.16 PULVER KIMYA SAN. VE TIC. A.Þ.

*Details on Business Overview, Impact of COVID-19 on business segments, Products Offered, Recent Developments, SWOT Analysis, right to win might not be captured in case of unlisted companies.

13 ADJACENT/RELATED MARKETS (Page No. - 237)

13.1 INTRODUCTION

13.2 LIMITATIONS

13.3 PAINTS & COATINGS ECOSYSTEM AND INTERCONNECTED MARKET

13.4 POWDER COATING MARKET

13.4.1 MARKET DEFINITION

13.4.2 MARKET OVERVIEW

13.4.3 POWDER COATING MARKET, BY RESIN TYPE

TABLE 122 POWDER COATINGS MARKET SIZE, BY RESIN TYPE, 2016-2019 (KILOTON)

TABLE 123 POWDER COATINGS MARKET SIZE, BY RESIN TYPE, 2020-2025 (KILOTON)

TABLE 124 POWDER COATINGS MARKET SIZE, BY RESIN TYPE, 2016-2019 (USD MILLION)

TABLE 125 POWDER COATINGS MARKET SIZE, BY RESIN TYPE, 2020-2025 (USD MILLION)

13.4.4 POWDER COATING MARKET, BY END-USE INDUSTRY

TABLE 126 POWDER COATINGS MARKET SIZE, BY END-USE INDUSTRY, 2016-2019 (KILOTON)

TABLE 127 POWDER COATINGS MARKET SIZE, BY END-USE INDUSTRY, 2020-2025(KILOTON)

TABLE 128 POWDER COATINGS MARKET SIZE, BY END-USE INDUSTRY, 2016-2019 (USD MILLION)

TABLE 129 POWDER COATINGS MARKET SIZE, BY END-USE INDUSTRY, 2020-2025 (USD MILLION)

13.4.5 POWDER COATING MARKET, BY REGION

TABLE 130 POWDER COATINGS MARKET SIZE, BY REGION, 2016-2019 KILOTON

TABLE 131 POWDER COATINGS MARKET SIZE, BY REGION, 2020-2025 KILOTON

TABLE 132 POWDER COATINGS MARKET SIZE, BY REGION, 2016-2019 (USD MILLION)

TABLE 133 POWDER COATINGS MARKET SIZE, BY REGION, 2020-2025 (USD MILLION)

14 APPENDIX (Page No. - 244)

14.1 DISCUSSION GUIDE

14.2 KNOWLEDGE STORE: MARKETSANDMARKETS SUBSCRIPTION PORTAL

14.3 AVAILABLE CUSTOMIZATIONS

14.4 RELATED REPORTS

14.5 AUTHOR DETAILS

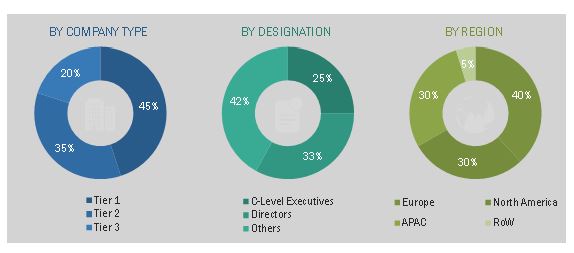

The study involves four major activities in estimating the current market size of metallic powder coatings. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both the top-down and bottom-up approaches were employed to estimate the complete market size. After that, the market breakdown and data triangulation methods were used to estimate the size of the segments and sub-segments of the overall market.

Secondary Research

In the secondary research process, various secondary sources, such as Hoovers, Bloomberg BusinessWeek, and Dun & Bradstreet, have been referred to identifying and collecting information for this study. These secondary sources also included annual reports, press releases & investor presentations of companies; white papers; certified publications; articles by recognized authors; gold standard & silver standard websites, regulatory bodies, trade directories, and databases.

Primary Research

The metallic powder coatings market comprises several stakeholders, such as raw material suppliers, processors, end-product manufacturers, and regulatory organizations. The demand side of this market is characterized by the development in applications, such as architectural, automotive, appliances, furniture, sports goods & fitness equipment, lighting, and others. The supply side is characterized by advancements in technology. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information.

Following is the breakdown of primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the total size of the metallic powder coatings market. These methods were also used extensively to estimate the sizes of various sub-segments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the market have been identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

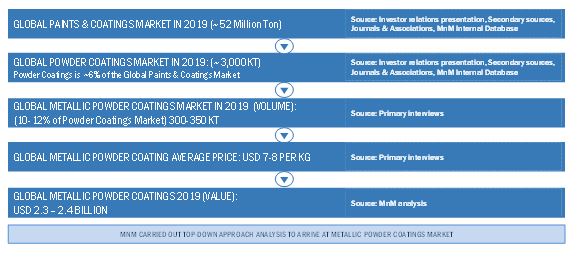

Global Metallic Powder Coatings Market Size: Top-Down Approach

Data Triangulation

After arriving at the overall market size-using the market size estimation processes as explained above-the market was split into several segments and sub-segments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and sub-segment, the data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Report Objectives

- To define, describe, and forecast the metallic powder coatings market in terms of value and volume

- To provide detailed information regarding the major factors (drivers, restraints, opportunities, and challenges) influencing the growth of the market

- To analyze and forecast the market based on resin type, process type, pigment type, end-use industry, and region

- To analyze and forecast the metallic powder coatings market in five major regions— Asia Pacific (APAC), Europe, North America, the Middle East & Africa, and South America, along with their key countries

- To analyze opportunities in the market for stakeholders and present a competitive landscape for market leaders

- To analyze recent developments such as new product developments, investments & expansions, and mergers & acquisitions in the metallic powder coatings market

- To strategically profile the key players in the market and to comprehensively analyze their core competencies1

Note: Core competencies1 of the companies are covered in terms of their key developments and key strategies adopted to sustain their position in the market..

Available Customizations

MarketsandMarkets offers customizations according to the specific needs of the companies with the given market data.

The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Regional Analysis

- Further breakdown of the metallic powder coatings market, by country

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Metallic Powder Coatings Market