Metal Coatings Market by Type (Polyester, Plastisol, Siliconized Polyster, Fluropolymer, Polyurethane), Process (Coil, Extrusion, Hot Dip Galvanizing), Technology (Liquid, Powder), End Use Industry, and Region - Global Forecast to 2026

The global metal coatings market is estimated to be valued at USD 10.52 Billion in 2016 and is projected to reach USD 14.34 Billion by 2026, at a CAGR of 6.1% from 2016 to 2026. In this study, 2015 has been considered the base year to estimate the market size. The report provides the short term forecast from 2016 to 2021, and the long term forecast from 2016 to 2026. This report aims to estimate the market size and future growth potential of the global metal coatings market across different segments such as type, technology, process application, and region. Factors influencing market growth such as drivers, restraints, opportunities, and industry-specific challenges have been studied in the report. The report analyzes the opportunities in the market for stakeholders and presents the competitive landscape for the market leaders.

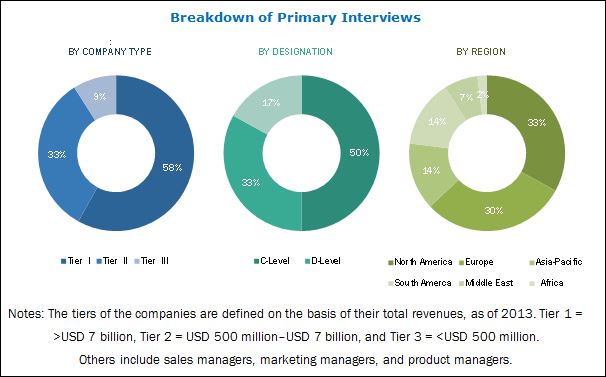

The top-down and bottom-up approaches have been used to estimate and validate the size of the global metal coatings market and estimate the sizes of various other dependent submarkets. The research study involved the use of extensive secondary sources, directories and databases such as Hoovers, Bloomberg, Chemical Weekly, Factiva, and other government associations. Private & company websites have also been used to identify and collect information useful for the technical, market-oriented, and commercial study of the global metal coatings market. After arriving at the total market size, the overall market has been split into several segments and subsegments. The figure given below provides a breakdown of the primaries conducted during the research study, on the basis of company type, designation, and region.

To know about the assumptions considered for the study, download the pdf brochure

The value chain for metal coatings begins with raw material manufacturers of environment-friendly as well as petroleum-based chemicals. These raw materials are procured by resin manufacturers and petrochemical companies. They manufacture different types of basic chemicals, additives, and pigments, which are then sold to metal coatings manufacturers. The resin is then procured by resin manufacturers, who sell their products to, coatings and composites manufacturers. The converted product manufacturers then market their products to molders and end-user companies after receiving the regulatory approvals. The maximum value is added at the manufacturing stage, as the basic chemicals are mixed and processed with other chemicals to achieve the desired coatings for specific applications.

Key metal coatings manufacturers are E.I. du Pont de Nemours and Company (U.S.), PPG Industries (U.S.), Axalta Coating Systems. (U.S.), AkzoNobel N.V. (Netherland), Nippon Paint Holdings Co., Ltd. (Japan), Henkel AG & Co., KGaA (Germany), The Sherwin-Williams Company (U.S.), The Valspar Corporation (U.S.), BASF SE (Germany), Kansai Paint Co., Ltd.(Japan), Wacker Chemie AG (Germany), and The Becker Group, Ltd. (US). The value chain includes the manufacture of metal coatings and the delivery of products to the end-users such as manufacturers of paints & coatings.

Key Target Audience:

- Metal coatings manufacturers

- Raw material suppliers

- Traders, distributors, and suppliers of metal coatings

- Government and regional agencies and research organizations

- Investment research firms

Scope of the report:

This research report categorizes the global metal coatings market on the basis of type, process, technology, end-use industry, and region.

On the basis of Resin Type:

- Polyester

- Plastisol

- Siliconized Polyster

- Fluoropolymer

- Polyurethane

- Others

On the basis of Process:

- Coil Coating

- Extrusion Coating

- Hot-Dip Galvanizing

On the basis of Technology:

- Liquid Coating

- Powder Coating

On the basis of End-Use Industry:

- Building & Construction

- Automotive & Transportation

- Consumer Goods & Appliances

- Marine and Protective Coatings

- Others

On the basis of Region:

- Asia-Pacific

- Europe

- North-America

- Middle East

- South America

- Africa

The market is further analyzed for the key countries in each of these regions.

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to the companys specific needs. The following customization options are available for the report:

Regional Analysis:

- Country-level analysis of the global metal coatings market by application.

Company Information:

- Detailed analysis and profiles of additional market players.

The global metal coatings market is projected to reach USD 14.34 Billion by 2026, at a CAGR of 6.1% from 2016 to 2026. Metal coatings are used by various end-users such as building & construction, automotive & transportation, consumer goods & appliances, marine and protective coatings industries. Metal coatings are used in order to add specific surface properties, such as corrosion or oxidation resistance, color, attractive appearance, wear resistance, optical properties, electrical resistance, or thermal protection.

The market for the building & construction end-use industry was the largest in terms of volume in 2015. As metal coatings are widely used for protective coatings due to the superior properties, such as high adhesion, corrosion or oxidation resistance, color, wear resistance, optical properties. The coil coating process accounted for the largest market share in 2015. The global coil coating industry is witnessing high growth because of its increasing applications, and technological advancements. The liquid coating technology accounted for the largest market share in 2015 in terms of volume and value. Liquid coatings include a variety of custom formulations, ranging from solvent-based to high-solid/low-bake, waterborne finishes, and UV-curable technology, all designed to increase applied cost efficiency and help manufacturers to achieve better quality. Polyester resin type accounted for the largest market share in 2015 in terms of volume. Polyester resin based metal coatings have uniform properties, such as good bendability, hardness, gloss, and resistance to UV, chemicals, scratching, and light.

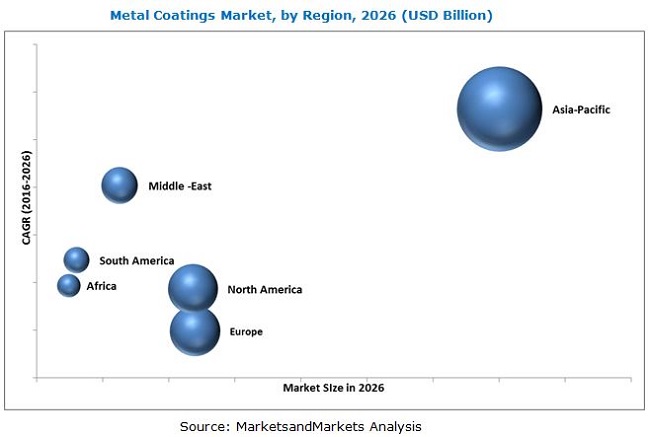

The Asia-Pacific region is expected to grow at the highest rate in the global metal coatings market, in terms of value and volume, from 2016 to 2021. The increasing demand from emerging economies, such as China and India, and the increased mega construction projects and the sales of high-end vehicles and consumer goods & appliances are expected to drive the growth of the Asia-Pacific metal coatings market.

Currently, China is the worlds largest consumer of metal coatings in terms of volume. Growth of the metal coatings market in China is driven by foreign investments, cost-effective labor, and the availability of inexpensive raw materials. The consumer goods & appliances industry is the largest industry in the country with double-digit growth, annually.

Though the metal coatings market is gaining importance, a few factors act as restraints to its growth in the global market. The volatility in raw material prices and restrictions on the use of hazardous chemicals, composite materials replacing painted aluminum and steel sheets in the building & construction industry, restricts the metal coatings market for the building & construction industry.

Companies such E.I. du Pont de Nemours and Company (U.S.), PPG Industries (U.S.), Axalta Coating Systems. (U.S.), AkzoNobel N.V. (Netherland), Nippon Paint Holdings Co., Ltd. (Japan), Henkel AG & Co., KGaA (Germany), The Sherwin-Williams Company (U.S.), The Valspar Corporation (U.S.), BASF SE (Germany), Kansai Paint Co., Ltd.(Japan), Wacker Chemie AG (Germany), The Becker Group, Ltd. (US), are the key players in the global metal coatings market.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction

1.1 Objectives of the Study

1.2 Market Definition

1.3 Scope of the Study

1.3.1 Markets Covered

1.3.2 Years Considered in the Report

1.4 Currency & Pricing

1.5 Package Size

1.6 Limitations

1.7 Stake Holders

2 Research Methodology

2.1 Research Data

2.1.1 Metal Coatings Market: Research Data

2.1.2 Breakdown of Primary Interviews

2.1.3 Key Industry Insights

2.1.4 Market Size Estimation: Top-Down Approach

2.1.5 Market Size Estimation: Bottom-Up Approach

2.1.6 Key Data From Primary Sources

2.1.7 Data Triangulation

2.1.8 Assumption

3 Executive Summary

3.1 Key Findings

4 Premium Insights

4.1 Opportunities in the Metal Coatings Market

4.2 Coil Coating Process Estimated to Register Highest CAGR (2016-2021)

4.3 Surge in Demand for Metal Coating Products in Developing Countries Presents Opportunities

4.4 Metal Coatings Market, Developing vs Developed Countries

5 Market Overview

5.1 Introduction

5.2 Market Segmentation

5.3 Market Dynamics

5.3.1 Drivers

5.3.1.1 Growing Building & Construction, Automotive, and Appliances Industries

5.3.1.2 High Demand for Metal Coatings From the Asia-Pacific Region

5.3.1.3 Demand for Fluoropolymer Resin Type Continues to Grow in the Building & Construction Market

5.3.2 Restraints

5.3.2.1 Volatility in Raw Material Prices

5.3.2.2 Composite Material Replacing Painted Aluminum, Steel Sheets in the Building & Construction Industry

5.3.3 Opportunities

5.3.3.1 Opportunities for Steel and Aluminum Protected Skyscrapers in the Middle-East Countries

5.3.3.2 Major European Players are Shifting in Emerging Countries Such as India & Saudi Arabia

5.3.3.3 Growing Automotive Market in Asia-Pacific and in the Middle-East

5.3.4 Challenges

5.3.4.1 Stringent and Time-Consuming Regulatory Policies

5.3.4.2 Major Hurdle for New Entrants in the Coil Coatings Market

6 Industry Trends

6.1 Value Chain Analysis

6.2 Porters Five Forces Analysis

7 Patent Details

7.1 Introduction

7.2 Patent Details

8 Metal Coatings Market, By Technology

8.1 Introduction

8.2 Market Size & Projection

8.2.1 Liquid Coating

8.2.1.1 Water-Based

8.2.1.2 Solvent-Based

8.2.2 Powder Coating

9 Metal Coatings Market, By Process

9.1 Introduction

9.2 Market Size & Projection

9.2.1 Coil Coatings

9.2.2 Extrusion Coatings

9.2.3 Hot Dip Galvanized

10 Metal Coatings Market, By Resin Type

10.1 Introduction

10.2 Market Size & Projection

10.2.1 Polyester

10.2.2 Plastisol

10.2.3 Siliconized Polyester

10.2.4 Fluropolymer

10.2.5 Polyurethane

10.2.6 Others (Acrylic & Epoxy)

11 Metal Coatings Market, By End-Use Industry

11.1 Introduction

11.1.1 Building & Construction

11.1.1.1 Interior

11.1.1.1.1 HVAC

11.1.1.1.2 Trim

11.1.1.1.3 Ceiling Grids

11.1.1.1.4 Blinds

11.1.1.1.5 Purlins

11.1.1.1.6 Railing

11.1.1.2 Exterior

11.1.1.2.1 Roof & Wall Panels

11.1.1.2.2 Doors

11.1.1.2.3 Panels

11.1.1.2.4 Windows

11.1.1.2.5 Soffit

11.1.1.2.6 Curtain Walls

11.1.2 Automotive & Transportation

11.1.2.1 Interior

11.1.2.1.1 Trim

11.1.2.1.2 Hitches

11.1.2.1.3 Blinds

11.1.2.1.4 Panels

11.1.2.1.5 Oil Filters

11.1.2.2 Exterior

11.1.2.2.1 Wheel Trim

11.1.2.2.2 Door Handle

11.1.2.2.3 Windshield Wipers

11.1.2.2.4 Roof Racks

11.1.2.2.5 Bumper

11.1.3 Consumer Goods & Appliances

11.1.3.1 Washing Machines

11.1.3.2 Refrigerators

11.1.3.3 Microwave Ovens

11.1.3.4 Air Conditioners

11.1.3.5 Fans

11.1.3.6 Cookers

11.1.4 Marine and Protective Coatings

11.1.4.1 Marine

11.1.4.1.1 Tanks

11.1.4.1.2 Barges

11.1.4.1.3 Hulls

11.1.4.1.4 Engine Rooms

11.1.4.1.5 Sbm

11.1.4.2 Oil & Gas

11.1.4.2.1 Pipeline

11.1.4.2.2 Tubing

11.1.4.2.3 Turbine

11.1.4.2.4 Chimneys

11.1.5 Others

11.1.5.1 Wind Industry

11.1.5.1.1 Turbine

11.1.5.1.2 Blades

11.1.5.2 Solar Industry

11.1.5.2.1 Panels

11.1.5.2.2 Mirror

11.1.5.3 Packaging

11.1.5.3.1 Food

11.1.5.3.2 Beverages

11.1.5.3.3 Line Cans

12 Metal Coatings Market, By Region

12.1 Introduction

12.2 Asia-Pacific

12.2.1 China

12.2.2 India

12.2.3 Japan

12.2.4 South Korea

12.2.5 Thailand

12.2.6 Indonesia

12.2.7 Vietnam

12.2.8 Rest of Asia-Pacific Countries

12.3 North America

12.3.1 U.S.

11.3.2 Canada

11.3.3 Mexico

12.4 Europe

12.4.1 Germany

12.4.2 U.K.

12.4.3 France

12.4.4 Russia

12.4.5 Italy

12.4.6 Turkey

12.4.7 Spain

12.4.8 Rest of European Countries

12.5 Middle East

12.5.1 Saudi Arabia

12.5.2 UAE

12.5.3 Rest of Middle East Countries

12.6 South America

12.6.1 Brazil

12.6.2 Rest of South American Countries

12.7 Africa

12.7.1 South Africa

12.7.2 Rest of South African Countries

13 Competitive Landscape

13.1 Overview

13.2 Market Share Analysis

13.3 Most Adopted Growth Strategy

13.4 Competitive Situation & Trends

13.5 Competitive Benchmarking

14 Company Profiles

14.1 PPG Industries Inc.

14.2 E. I. Du Pont De Nemours and Company

14.3 Akzonobel N.V.

14.4 The Valspar Corporation

14.5 The Sherwin-Williams Company

14.6 BASF SE

14.7 Axalta Coating Systems

14.8 Kansai Coating System

14.9 The Beckers Group

14.10 Henkel AG & Co. KGaA

14.11 Nippon Paint Holdings Co., Ltd.

14.12 Other Key Players/Companies Considered in the Report

14.12.1 Nof Metal Coatings

14.12.2 United Metal Coating LLC

14.12.3 AFP Metal Products

14.12.4 ICI Paints

14.12.5 Alucoil LLC

14.12.6 Jinhu Color Powder Coating Co., Ltd.

14.12.7 Magni Industries, Inc.

14.12.8 Guangzhou Cm Paint & Coating Co., Ltd.

14.12.9 3A Composites

14.12.10 Fameline Products Co., Ltd.

15 Appendix

15.1 Experts From Industry

15.2 Discussion Guide

15.3 Introducing RT: Real Time Market Intelligence

15.4 Available Customizations

15.5 Related Reports

List of Tables (187 Tables)

Table 1 Global Metal Coatings Market Overview (2016-2021)

Table 2 Metal Coatings Market, By Resin Type

Table 3 Metal Coatings Market, By Process

Table 4 Metal Coatings Market, By Technology

Table 5 Metal Coatings Market, By Application

Table 6 Patent Analysis, 2014 2015

Table 7 Metal Coatings Market Size, By Technology, 20142026 (Million Gallon)

Table 8 Metal Coatings Markets Size, By Technology, 20142026 (USD Million)

Table 9 Liquid Metal Coatings Market Size, By Technology, 20142026 (Million Gallon)

Table 10 Liquid Metal Coatings Market Size, By Technology, 20142026 (USD Million)

Table 11 Solvent-Based Liquid Metal Coatings Market Size, By Technology, 20142026 (Million Gallon)

Table 12 Solvent-Based Liquid Metal Coatings Market Size, By Technology, 20142026 (USD Million)

Table 13 Water-Based Liquid Metal Coatings Market Size, By Technology, 20142026 (Million Gallon)

Table 14 Water-Based Liquid Metal Coatings Market Size, By Technology, 20142026 (USD Million)

Table 15 Powder Metal Coatings Market Size, By Technology, 20142026 (Million Gallon)

Table 16 Powder Metal Coatings Market Size, By Technology, 20142026 (USD Million)

Table 17 Metal Coatings Market Size, By Process, 20142026 (Million Gallon)

Table 18 Metal Coatings Market Size, By Process, 20142026 (USD Million)

Table 19 Coil Coating Process Market Size, By Region, 20142026 (Million Gallon)

Table 20 Coil Coating Process Market Size, By Region, 20142026 (USD Million)

Table 21 Extrusion Coating Process Market Size, By Region, 20142026 (Million Gallon)

Table 22 Extrusion Coating Process Market Size, By Region, 20142026 (USD Million)

Table 23 Hot-Dip Galvanizing Process Market Size, By Region, 20142026 (Million Gallon)

Table 24 Hot-Dip Galvanizing Process Market Size, By Region, 20142026 (USD Million)

Table 25 Metal Coatings Market Size, By Resin Type, 2014-2026 (Million Gallon)

Table 26 Metal Coatings Market Size, By Resin Type, 2014-2026 (USD Million)

Table 27 Polyester Resin Metal Coatings Market Size, By Region, 2014-2026 (Million Gallon)

Table 28 Polyester Resin Metal Coatings Market Size, By Region, 2014-2026 (USD Million)

Table 29 Plastisol Resin Metal Coatings Market Size, By Region, 2014-2026 (Million Gallon)

Table 30 Plastisol Resin Metal Coatings Market Size, By Region, 2014-2026 (USD Million)

Table 31 Siliconized Polyester Resin Metal Coatings Market Size, By Region 2014-2026 (Million Gallon)

Table 32 Siliconized Polyester Resin Metal Coatings Market Size, By Region, 2014-2026 (USD Million)

Table 33 Fluoropolymer Resin Metal Coatings Market Size, By Region , 2014-2026 (Million Gallon)

Table 34 Fluoropolymer Resin Metal Coatings Market Size, By Region, 2014-2026 (USD Million)

Table 35 Polyurethane Resin Metal Coatings Market Size, By Region , 2014-2026 (Million Gallon)

Table 36 Polyurethane Resin Metal Coatings Market Size, By Region, 2014-2026 (USD Million)

Table 37 Other Resin Metal Coatings Market Size, By Region, 2014-2026 (Million Gallon)

Table 38 Other Resin Metal Coatings Market Size, By Region, 2014-2026 (USD Million)

Table 39 Metal Coatings Market Size, By End-Use Industry, 20142026 (Million Gallon)

Table 40 Metal Coatings Market Size, By End-Use Industry, 20142026 (USD Million)

Table 41 Metal Coatings Market Size in Building & Construction Ndustry, By Region, 20142026 (Million Gallon)

Table 42 Metal Coatings Market Size in Building & Construction Industry, By Region, 20142026 (USD Million)

Table 43 Metal Coatings Market Size in Automotive & Transporation Industry By Region 20142026 (Million Gallon)

Table 44 Metal Coatings Market Size in Automotive & Transporation Industry By Region 20142026 (USD Million )

Table 45 Metal Coatings Market Size in Consumer Goods & Appliances Industry By Region 20142026 (Million Gallon)

Table 46 Metal Coatings Market Size in Consumer Goods & Appliances Industry By Region 20142026 (USD Million )

Table 47 Metal Coatings Market Size in Marine & Protective Coatings Industry, By Region 20142026 (Million Gallon)

Table 48 Metal Coatings Market Size in Marine &Protective Coatings Industry, By Region 20142026 (USD Million)

Table 49 Metal Coatings Market Size in Other End Use Industry, By Region 20142026 (Million Gallon)

Table 50 Metal Coatings Market Size in Other End Use Industry, By Region 20142026 (USD Million )

Table 51 Top Economies By GDP in Ppp Terms, 2010 & 2020 (USD Trillion)

Table 52 Asia-Pacific: Metal Coatings Market Size, By Country, 20142026 (Million Gallon)

Table 53 Asia-Pacific: Metal Coatings Market Size, By Country, 20142021 (USD Million)

Table 54 Asia-Pacific: Metal Coatings Market Size, By Process, 20142026 (Million Gallon)

Table 55 Asia-Pacific: Metal Coatings Market Size, By Process, 20142026 (USD Million)

Table 56 Asia-Pacific: Metal Coatings Market Size, By Resin Type, 20142026 (Million Gallon)

Table 57 Asia-Pacific: Metal Coatings Market Size, By Resin Type, 20142026 (USD Million)

Table 58 Asia-Pacific: Metal Coatings Market Size, By Technology, 20142026 (Million Gallon)

Table 59 Asia-Pacific: Metal Coatings Market Size, By Technology, 20142026 (USD Million)

Table 60 Asia-Pacific: Metal Coatings Market Size, By End-Use Industry, 20142026 (Million Gallon)

Table 61 Asia-Pacific: Metal Coatings Market Size, By End-Use Industry, 20142026 (USD Million)

Table 62 China: Macro Economic Indicators

Table 63 China: Metal Coatings Market Size, By End-Use Industry, 20142026 (Million Gallon)

Table 64 China: Metal Coatings Market Size, By End-Use Industry, 2014-2026 (USD Million)

Table 65 India: Macro Economic Indicators

Table 66 India: Metal Coatings Market Size, By End-Use Industry, 20142026 (Million Gallon)

Table 67 India: Metal Coatings Market Size, By End-Use Industry, 20142026 (USD Million)

Table 68 Japan: Macro Economic Indicators

Table 69 Japan: Metal Coatings Market Size, By End-Use Industry, 20142026 (Million Gallon)

Table 70 Japan: Metal Coatings Market Size, By End-Use Industry, 20142026 (USD Million)

Table 71 South Korea: Macro Economic Indicators

Table 72 South Korea: Metal Coatings Market Size, By End-Use Industry, 20142026 (Million Gallon)

Table 73 South Korea: Metal Coatings Market Size, By End-Use Industry, 20142026 (USD Million)

Table 74 Thailand: Macro Economic Indicators

Table 75 Thailand: Metal Coatings Market Size, By End-Use Industry, 20142026 (Million Gallon)

Table 76 Thailand: Metal Coatings Market, By End-Use Industry , 2014-2021 (USD Million)

Table 77 Indonesia: Metal Coatings Market Share (Volume), By End-Use Industry, 2015

Table 78 Indonesia: Macro Economic Indicators

Table 79 Indonesia: Metal Coatings Market Size, By End-Use Industry, 20142026 (Million Gallon)

Table 80 Indonesia: Metal Coatings Market Size, By End-Use Industry, 20142026 (USD Million)

Table 81 Vietnam: Metal Coatings Market Size, By End-Use Industry, 20142026 (Million Gallon)

Table 82 Vietnam: Metal Coatings Market Size, By End-Use Industry, 20142026 (USD Million)

Table 83 Rest of Asia-Pacific: Metal Coatings Market Size, By End-Use Industry, 20142026 (Million Gallons)

Table 84 Rest of Asia-Pacific: Metal Coatings Market Size, By End-Use Industry, 20142026 (USD Million)

Table 85 Europe: Metal Coatings Market Size, By Country, 20142026 (Million Gallon)

Table 86 Europe: Metal Coatings Market Size, By Country, 20142026 (USD Million)

Table 87 Europe: Metal Coatings Market Size, By Process, 20142026 (Million Gallon)

Table 88 Europe: Metal Coatings Market Size, By Process, 20142026 (USD Million)

Table 89 Europe: Metal Coatings Market Size, By Resin Type, 20142026 (Million Gallon)

Table 90 Europe: Metal Coatings Market Size, By Resin Type, 20142026 (USD Million)

Table 91 Europe: Metal Coatings Market Size, By Technology, 20142026 (Million Gallon)

Table 92 Europe: Metal Coatings Market Size, By Technology, 20142026 (USD Million)

Table 93 Europe: Metal Coatings Market Size, By End-Use Industry, 20142026 (Million Gallon)

Table 94 Europe: Metal Coatings Market Size, By End-Use Industry, 20142026 (USD Million)

Table 95 Russia: Metal Coatings Market Size, By End-Use Industry, 20142026 (Million Gallon)

Table 96 Russia: Metal Coatings Market Size, By End-Use Industry, 20142026 (USD Million)

Table 97 France: Macroeconomic Indicators

Table 98 France: Metal Coatings Market Size, By End-Use Industry, 20142026 (Million Gallon)

Table 99 France: Metal Coatings Market Size, By End-Use Industry, 20142026 (USD Million)

Table 100 Germany: Macroeconomic Indicators

Table 101 Germany: Metal Coatings Market Size, By End-Use Industry, 20142026 (Million Gallon)

Table 102 Germany: Metal Coatings Market Size, By End-Use Industry, 20142026 (USD Million)

Table 103 U.K.: Macroeconomic Indicators

Table 104 U.K.: Metal Coatings Market Size, By End-Use Industry, 20142026 (Million Gallon)

Table 105 U.K.: Metal Coatings Market Size, By End-Use Industry, 20142026 (USD Million)

Table 106 Spain: Macroeconomic Indicators

Table 107 Spain: Metal Coatings Market Size, By End-Use Industry, 20142026 (Million Gallon)

Table 108 Spain: Metal Coatings Market Size, By End-Use Industry, 20142026 (USD Million)

Table 109 Italy: Metal Coatings Market Size, By End-Use Industry, 20142026 (Million Gallon)

Table 110 Italy: Metal Coatings Market Size, By End-Use Industry, 20142026 (USD Million)

Table 111 Turkey: Macroeconomic Indicators

Table 112 Turkey: Metal Coatings Market Size, By End-Use Industry, 20142026 (Million Gallon)

Table 113 Turkey: Metal Coatings Market Size, By End-Use Industry, 20142026 (USD Million)

Table 114 Rest of Europe: Metal Coatings Market Size, By End-Use Industry, 20142026 (Million Gallon)

Table 115 Rest of Europe: Metal Coatings Market Size, By End-Use Industry, 20142026 (USD Million)

Table 116 North America: Metal Coatings Market Size, By Country, 2014-2026 (Million Gallon)

Table 117 North America: Metal Coatings Market Size, By Country, 2014-2026 (USD Million)

Table 118 North America: Metal Coatings Market Size, By Process, 2014-2026 (Million Gallon)

Table 119 North America: Metal Coatings Market Size, By Process, 2014-2026 (USD Million)

Table 120 North America: Metal Coatings Market Size, By Resin Type, 2014-2026 (Million Gallon)

Table 121 North America: Metal Coatings Market Size, By Resin Type, 2014-2026 (USD Million)

Table 122 North America: Metal Coatings Market Size, By Technology, 2014-2026 (Million Gallon)

Table 123 North America: Metal Coatings Market Size, By Technology, 2014-2026 (USD Million)

Table 124 North America: Metal Coatings Market Size, By End-Use Industry, 2014-2026 (Million Gallon)

Table 125 North America: Metal Coatings Market Size, By End-Use Industry, 2014-2026 (USD Million)

Table 126 U.S.Macro Economic Indicators

Table 127 U.S.: Metal Coatings Market Size, By End-Use Industry, 2014-2026 (Million Gallon)

Table 128 U.S.: Metal Coatings Market Size, By End-Use Industry, 2014-2026 (USD Million)

Table 129 Canada.Macro Economic Indicators

Table 130 Canada: Metal Coatings Market Size, By End-Use Industry, 2014-2026 (Million Gallon)

Table 131 Canada: Metal Coatings Market Size, By End-Use Industry, 2014-2026 (USD Million)

Table 132 Mexico Economic Indicators

Table 133 Mexico: Metal Coatings Market Size, By End-Use Industry, 2014-2026 (Million Gallon)

Table 134 Mexico: Metal Coatings Market Size, By End-Use Industry, 2014-2026 (USD Million)

Table 135 Middle East: Metal Coatings Market Size, By Country, 2014-2026 (Million Gallon)

Table 136 Middle East: Metal Coatings Market Size, By Country, 2014-2026 (USD Million)

Table 137 Middle East: Metal Coatings Market Size, By Process, 2014-2026 (Million Gallon)

Table 138 Middle East: Metal Coatings Market Size, By Process, 2014-2026 (USD Million)

Table 139 Middle East: Metal Coatings Market Size, By Resin Type, 2014-2026 (Million Gallon)

Table 140 Middle East: Metal Coatings Market Size, By Resin Type, 2014-2026 (USD Million)

Table 141 Middle East: Metal Coatings Market Size, By Technology, 2014-2026 (Million Gallons)

Table 142 Middle East: Metal Coatings Market Size, By Technology, 2014-2026 (USD Million)

Table 143 Middle East: Metal Coatings Market Size, By End-Use Industry, 2014-2026 (Million Gallon)

Table 144 Middle East: Metal Coatings Market Size, By End-Use Industry, 2014-2026 (USD Million)

Table 145 Saudi Arabia: Metal Coatings Market Size, By End-Use Industry, 2014-2026 (Million Gallon)

Table 146 Saudi Arabia: Metal Coatings Market Size, By End-Use Industry, 2014-2026 (USD Million)

Table 147 UAE: Metal Coatings Market Size, By End-Use Industry, 2014-2026 (Million Gallon)

Table 148 UAE: Metal Coatings Market Size, By End-Use Industry, 2014-2026 (USD Million)

Table 149 Qatar: Metal Coatings Market Size, By End-Use Industry, 2014-2026 (Million Gallon)

Table 150 Qatar: Metal Coatings Market Size, By End-Use Industry, 2014-2026 (USD Million)

Table 151 Yemen: Metal Coatings Market Size, By End-Use Industry, 2014-2026 (Million Gallon)

Table 152 Yemen: Metal Coatings Market Size, By End-Use Industry, 2014-2026 (USD Million)

Table 153 Rest of the Middle East: Metal Coatings Market Size, By End-Use Industry, 2014-2026 (Million Gallon)

Table 154 Rest of the Middle East: Metal Coatings Market Size, By End-Use Industry, 2014-2026 (USD Million)

Table 155 South America- Macro Economic Indicators

Table 156 South America: Metal Coatings Market, By Country, 2014-2026 (Million Gallon)

Table 157 South America: Metal Coatings Market, By Country, 2014-2026 (USD Million)

Table 158 South America: Metal Coatings Market, By Process, 2014-2026 (Million Gallon)

Table 159 South America: Metal Coatings Market, By Process, 2014-2026 (USD Million)

Table 160 South America: Metal Coatings Market, By Resin Type, 2014-2026 (Million Gallon)

Table 161 South America: Metal Coatings Market, By Resin Type, 2014-2026 (USD Million)

Table 162 South America: Metal Coatings Market, By Technology, 2014-2026 (Million Gallon)

Table 163 South America: Metal Coatings Market, By Technology, 2014-2026 (USD Million)

Table 164 South America: Metal Coatings Market, By End-Use Industry, 2014-2026 (Million Gallon)

Table 165 South America: Metal Coatings Market, By End-Use Industry, 2014-2026 (USD Million)

Table 166 Brazil: Metal Coatings Market, By End-Use Industry, 2014-2026 (Million Gallon)

Table 167 Brazil: Metal Coatings Market, By End-Use Industry, 2014-2026 (USD Million)

Table 168 Rest of South America: Metal Coatings Market, By End-Use Industry, 2014-2026 (Million Gallon)

Table 169 Rest of South America : Metal Coatings Market, By End-Use Industry, 2014-2026 (USD Million)

Table 170 Africa: Metal Coatings Market, By Country, 2014-2026 (Million Gallon)

Table 171 Africa : Metal Coatings Market, By Country, 2014-2026 (USD Million)

Table 172 Africa: Metal Coatings Market, By Process, 2014-2026 (Million Gallon)

Table 173 Africa: Metal Coatings Market, By Process, 2014-2026 (USD Million)

Table 174 Africa: Metal Coatings Market, By Resin Type, 2014-2026 (Million Gallon)

Table 175 Africa: Metal Coatings Market, By Resin Type, 2014-2026 (USD Million)

Table 176 Africa: Metal Coatings Market, By Technology, 2014-2026 (Million Gallon)

Table 177 Africa: Metal Coatings Market, By Technology, 2014-2026 (USD Million)

Table 178 Africa: Metal Coatings Market, By End-Use Industry, 2014-2026 (Million Gallon)

Table 179 Africa: Metal Coatings Market, By End-Use Industry, 2014-2026 (USD Million)

Table 180 South Africa: Metal Coatings Market, By End-Use Industry, 2014-2026 (Million Gallon)

Table 181 South Africa: Metal Coatings Market, By End-Use Industry, 2014-2026 (USD Million)

Table 182 Rest of South Africa : Metal Coatings Market, By End-Use Industry, 2014-2026 (Million Gallon)

Table 183 Rest of South Africa: Metal Coatings Market, By End-Use Industry, 2014-2026 (USD Million)

Table 184 New Product Launches Growth Strategies : Metal Coatings Market

Table 185 Investment & Expansion Growth Strategies : Metal Coatings Market

Table 186 Merger & Acqusition Growth Strategies : Metal Coatings Market

Table 187 Joint Venture, Partnership and Agreement: Metal Coatings Market

List of Tables (92 Figures)

Figure 1 Breakdown of Primary Interviews

Figure 2 Asia-Pacific to Register Highest CAGR During 2016-2021

Figure 3 Fluoropolymer Resin to Register Highest During 2016-2021

Figure 4 Coil Coating Process to Register Highest CAGR During 2016-2021

Figure 5 Powder Coating to Register Higher CAGR During 2016- 2021

Figure 6 Building & Construction is Projected to Have the Highest CAGR2021

Figure 7 Surge in Demand for Metal Coating Products in Developing Countries Presents Opportunities

Figure 8 Coil Coating Process to Register the Highest CAGR Till 2021

Figure 9 Metal Coatings Market to Register High Growth in Developing Countries Between 2016 and 2021

Figure 10 India is Projected to Grow at the Fastest Rate Between 2016 and 2021

Figure 11 Metal Coatings Market, By Region

Figure 12 High Demand From Building & Construction End-Use Industry Will Drive the Metal Coatings Market in Asia-Pacific

Figure 13 Porters Five Forces Analysis

Figure 14 Patent Details

Figure 15 Japan Accounted for the Highest Number of Patents Filed Between 2014 and 2015

Figure 16 Kansai Paints Co Ltd Had the Highest Numbers of Patents Between 2014 and 2015

Figure 17 Metal Coatings Market Share, By Technology, 2015

Figure 18 Liquid Metal Coatings Market Share, By Region, 2015

Figure 19 Solvent-Based Metal Coatings Market Share , By Region, 2015

Figure 20 Water-Based Metal Coatings Market Share, By Region, 2015

Figure 21 Powder Metal Coatings Market Share, By Region, 2015

Figure 22 Metal Coatings Market Share, By Process, 2015

Figure 23 Coil Coating Market Share, By Region, 2015

Figure 24 Extrusion Coating Market Share, By Region, 2015

Figure 25 Hot-Dip Galvanizing Market Share, By Region, 2015

Figure 26 Metal Coatings Market Share, By Resin Type , 2015

Figure 27 Polyester Resin Metal Coatings Market Share, By Region, 2015

Figure 28 Plastisol Resin Metal Coatings Market Share, By Region, 2015

Figure 29 Siliconized Polyester Resin Metal Coatings Market Share, 2015

Figure 30 Fluoropolymer Resin Metal Coatings Market Share,, 2015

Figure 31 Polyurethane Resin Metal Coatings Market Share,, 2015

Figure 32 Other Resin Metal Coatings Market Share,, 2015

Figure 33 End-Use Industries Share, 2015

Figure 34 Metal Coatings Market Share in Building & Construction End-Use Industry By Region 2015

Figure 35 Metal Coatings Market Share in Automotive & Transportation End- Use Industry, By Volume, By Region 2015

Figure 36 Metal Coatings Market Share in Consumer Goods & Appliances Industry, By Region 2015

Figure 37 Metal Coatings Market Share in Marine & Protective Coatings Industry, By Region 2015

Figure 38 Metal Coatings Market Share in Other End-Use Industry, By Region 2015

Figure 39 Metal Coatings Market Share, By Region, 2015

Figure 40 Metal Coatings Market Growth Rate, By Technology & Region (20162021)

Figure 41 Metal Coatings Market Growth Rate, By Process & Region (20162021)

Figure 42 Metal Coatings Growth Rate, By Resin Type & Region (20162021)

Figure 43 Metal Coatings Market Growth Rate, By End-Use Industry & Region (20162021)

Figure 44 Asia-Pacific: Metal Coatings Market Snapshot

Figure 45 China is Projected to Dominate the Metal Coatings Market Through 2021

Figure 46 China: Metal Coatings Market Share, By End-Use Industry, 2015

Figure 47 India: Metal Coatings Market Share By End-Use Industry, 2015

Figure 48 Japan: Metal Coatings Market Share, By End-Use Industry, 2015

Figure 49 South Korea: Metal Coatings Market Share, By End-Use Industry, 2015

Figure 50 Thailand: Metal Coatings Market Share, By End-Use Industry, 2015

Figure 51 Vietnam: Metal Coatings Market Share, By End-Use Industry, 2015

Figure 52 Rest of Asia-Pacific: Metal Coatings Market Share, By End-Use Industry, 2015

Figure 53 Europe: Metal Coatings Market Share, By Application, By 2015

Figure 54 Russia to Dominate the Metal Coatings Market in Europe

Figure 55 Russia: Metal Coatings Market Share, By End-Use Industry, 2015

Figure 56 France: Metal Coatings Market Share, By End-Use Industry, 2015

Figure 57 Germany: Metal Coatings Market Share By End-Use Industry, 2015

Figure 58 U.K.: Metal Coatings Market Share, By End-Use Industry, 2015

Figure 59 Spain: Metal Coatings Market Share, By End-Use Industry, 2015

Figure 60 Italy: Metal Coatings Market Share, By End-Use Industry, 2015

Figure 61 Turkey: Metal Coatings Market Share, By End-Use Industry, 2015

Figure 62 Rest of Europe: Metal Coatings Market Share, By End-Use Industry, 2015

Figure 63 North America: Metal Coatings Market Share,, 2015

Figure 64 U.S. to Dominate the Metal Coatings Market in North America Till 2021

Figure 65 U.S. Metal Coatings Market Share, By End-Use Industry, 2015

Figure 66 U.S. Metal Coatings Market Share, By End-Use Industry, 2015

Figure 67 Canada: Metal Coatings Market Share, By End-Use Industry, 2015

Figure 68 Mexico: Metal Coatings Market Share By End-Use Industry, 2015

Figure 69 Middle East: Metal Coatings Market Size By Application,, 2015

Figure 70 Saudi Arabia to Dominate the Middle East Metal Coatings Market

Figure 71 Saudi Arabia: Metal Coatings Market Share, By End-Use Industry, 2015

Figure 72 UAE: Metal Coatings Market Share, By End-Use Industry, 2015

Figure 73 Qatar: Metal Coatings Market Share, By End-Use Industry, 2015

Figure 74 Yemen: Metal Coatings Market Share, By End-Use Industry, 2015

Figure 75 Rest of the Middle East: Metal Coatings Market Share (Volume), By End-Use Industry, 2015

Figure 76 South America: Metal Coatings Market Size, By Application, 2015

Figure 77 Brazil to Dominate Metal Coatings Market in South America Till 2021

Figure 78 Brazil: Metal Coatings Market Share, By End-Use Industry, 2015

Figure 79 Rest of South America. Metal Coatings Market Share, By End-Use Industry, 2015

Figure 80 Africa: Metal Coatings Market Size, By Application,, 2015

Figure 81 South Africa to Dominate Metal Coatings Market in Africa,

Figure 82 South Africa: Metal Coatings Market Share,, By End-Use Industry, 2015

Figure 83 Rest of Africa: Metal Coatings Market Share, By End-Use Industry, 2015

Figure 84 Companies Organic and Inorganic Growth Strategies : Metal Coatings Market

Figure 85 Companies Adopted New Product Launch and Investment & Expansion Growth Strategies

Figure 86 Companies Organic and Inorganic Growth Strategies : Metal Coatings Market

Figure 87 New Product Launch and Investment & Expansion Strategy Were Adopted By the Players

Figure 88 Market Share Analysis: Metal Coatings Market

Figure 89 Akzonobel N.V., the Valspar Corporation, and PPG Industries Inc. Accounted Fort the Largest Market Share

Figure 90 Investment & Expansion Growth Strategies : Metal Coatings Market

Figure 91 Merger & Acqusition Growth Strategies : Metal Coatings Market

Figure 92 Joint Venture, Partnership and Agreement: Metal Coatings Market

Growth opportunities and latent adjacency in Metal Coatings Market