Industrial Cloud Platform Market for Factory Automation by Solution (MES, PLM), Platform (Asset Management, Data Processing and Analytics), Service (System Integration, Consulting), End User Industry, and Geography - Global Forecast to 2022

The Industrial Cloud Platform Market for Factory Automation was valued at USD 121.2 Million in 2015 and is expected to reach USD 747.1 Million by 2022, at a CAGR of 31.05% during the forecast period. The base year considered for the study is 2015 and the forecast for the market size is provided for the period between 2016 and 2022. The main objectives of this study are as follows:

- To define, describe, and forecast the industrial cloud platform market for factory automation on the basis of solution, platform, professional service, end-user industry, and geography

- To provide market statistics with detailed classification and split in terms of value

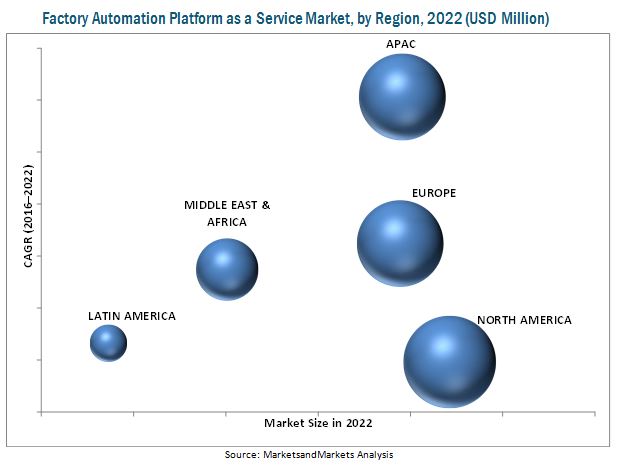

- To forecast the size of Industrial Cloud Platform market segments with respect to five major regions: North America, Europe, Asia-Pacific (APAC), Middle East and Africa, and Latin America

- To provide detailed information regarding the major factors influencing the growth of the industrial cloud platform market for factory automation (drivers, restraints, opportunities, and challenges)

- To provide detailed insights based on the Porter's analysis and value chain analysis for the industrial cloud platform market for factory automation

- To strategically profile the key players and comprehensively analyze their market share and core competencies along with detailing the competitive landscape for market leaders

- To analyze competitive developments such as joint ventures, mergers and acquisitions, new product developments, and research and development in the industrial cloud platform market for factory automation

The Industrial Cloud Platform Market for Factory Automation is expected to be worth USD 747.1 Million by 2022, at a CAGR of 31.05% during the forecast period. The performance and characteristics of the industrial cloud platforms depend largely upon the platform and professional services offered. Industrial cloud platforms are adopted by several process based industries due to the ease and flexibility of services offered.

Industrial cloud platform market for factory automation has been segmented on the basis of solution into supervisory control and data acquisition (SCADA), distributed control system (DCS), manufacturing execution system (MES), human–machine interface (HMI), and product lifecycle management (PLM), among others. The market for other solutions includes manufacturing operation management (MOM) and industrial information management (IIM). Of these, the market for manufacturing execution system (MES) is expected to grow at the highest CAGR during the forecast period because manufacturers are increasingly adopting this solution owing to its ability to save costs, for facilitate operations, and deliver high performance for production assets across the supply chain.

Industrial cloud platform market for factory automation has been segmented on the basis of platform and professional services. The platform processes high volumes of data in real time and provides meaningful analytics that are essential for achieving business objectives, which is one of the major factors driving this market. The market for platform is further segmented into asset management, remote monitoring, data processing and analytics, application development and management, and security management. The market for data processing and analytics is expected to grow at the highest CAGR during the forecast period.

Industrial cloud platform market for factory automation, on the basis of professional service, has been segmented into consulting and planning; system integration; and training, support, and maintenance. The market for consulting and planning service is expected to grow at the highest CAGR during the forecast period. The growing usage of professional services to manage industrial cloud platforms is attributed to its ability to ensure the optimization of factory automation systems as it manages the consulting, support and maintenance, and integration of the entire system.

Industrial cloud platform market for factory automation, on the basis of end-user industry, has been segmented into oil and gas, electric power generation, chemicals, water and wastewater management, food and beverages, mining and metal, pulp and paper, pharmaceutical, and others. The market for the electric power generation industry is expected to grow at a high rate, followed by the food and beverages industry.

APAC is expected to be the fastest-growing market followed by Europe during the forecast period. The availability of skilled labor at affordable costs, development of infrastructure, technological capabilities, and the willingness of government to harness the market opportunities have contributed to the growth of the markets in APAC. Also, developing countries such as Singapore, South Korea, and Indonesia are expected to witness a high growth in the market because of the growing adoption of cloud technology in these countries, which creates the need for more advanced technologies as well as ease of operation for better productivity and less maintenance.

The key players in this market focus on strategic partnerships, acquisitions, agreements, and new product launches to increase their revenue. For instance in September, 2016 Microsoft (U.S.) launched Azure Services, becoming the first public cloud provider in India by establishing three data centers in Mumbai, Pune, and Chennai. These local data centers would be responsible for increasing flexibility and scalability and reducing the time to market for partners and customers.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 15)

1.1 Study Objective

1.2 Market Definition

1.3 Study Scope

1.3.1 Market Covered

1.3.2 Years Considered for Study

1.4 Currency & Pricing

1.5 Limitations

1.6 Stakeholders

2 Research Methodology (Page No. - 18)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Source

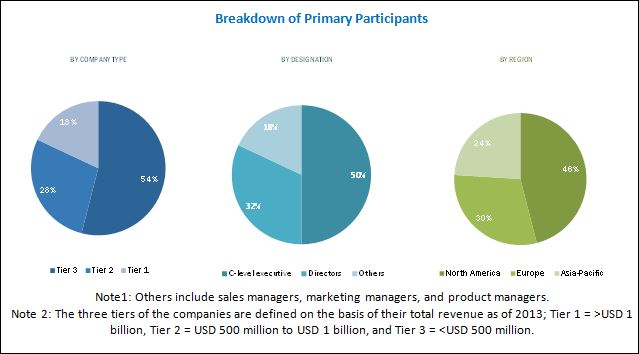

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

2.1.2.3 Breakdown of Primaries

2.2 Market Size Estimation

2.3 Market Breakdown and Data Triangulation

2.4 Research Assumption

3 Executive Summary (Page No. - 26)

4 Premium Insights (Page No. - 31)

4.1 Attractive Opportunities in the Factory Automation Platform as A Service (FA PaaS) Market

4.2 Factory Automation Platform as A Service Market, By Solution

4.3 FA PaaS Market in APAC

4.4 Factory Automation Platform as A Service: Geographic Snapshot for the Forecast Period

4.5 FA PaaS Market, By End-User Industry

5 Market Overview (Page No. - 34)

5.1 Introduction

5.2 Market Segmentation

5.2.1 By Solution

5.2.2 By Platform and Professional Service

5.2.2.1 By Platform

5.2.2.2 By Professional Service

5.2.3 By End-User Industry

5.2.4 By Geography

5.3 Market Dynamics

5.3.1 Drivers

5.3.1.1 Increased Focus on Energy Efficiency, Resource Optimization and Cost of Production

5.3.1.2 Advancement in Cloud Computing Technology

5.3.2 Restraints

5.3.2.1 Lack of Skilled Technical Workforce

5.3.3 Opportunities

5.3.3.1 New Opportunities Offered By Industry 4.0

5.3.3.2 Convenience of Platform-Based Deployment/Service-Based Platform

5.3.3.3 Strategic Partnerships and Collaborations

5.3.4 Challenges

5.3.4.1 Data Security and Privacy

6 Industry Trends (Page No. - 41)

6.1 Introduction

6.2 Value Chain Analysis

6.3 Porter’s Five Forces Analysis

6.3.1 Threat of New Entrants

6.3.2 Threat of Substitutes

6.3.3 Bargaining Power of Suppliers

6.3.4 Bargaining Power of Buyers

6.3.5 Intensity of Competitive Rivalry

7 Factory Automation Platform as A Service Market, By Solution (Page No. - 49)

7.1 Introduction

7.2 Supervisory Control and Data Acquisition (SCADA)

7.3 Distributed Control System (DCS)

7.4 Manufacturing Execution System (MES)

7.5 Human–Machine Interface (HMI)

7.6 Product Lifecycle Management (PLM)

7.7 Others

8 Factory Automation Platform as A Service Market, By Platform and Professional Service (Page No. - 57)

8.1 Introduction

8.2 By Platform

8.2.1 Asset Management

8.2.2 Remote Monitoring

8.2.3 Data Processing and Analytics

8.2.4 Application Development and Management

8.2.5 Security Management

8.3 By Professional Service

8.3.1 Consulting and Planning

8.3.2 System Integration

8.3.3 Training, Support, and Maintenance

9 Factory Automation Platform as A Service Market, By End User Industry (Page No. - 69)

9.1 Introduction

9.2 Oil and Gas

9.3 Electric Power Generation

9.4 Chemicals

9.5 Water and Wastewater Management

9.6 Food and Beverages

9.7 Mining and Metal

9.8 Paper and Pulp

9.9 Pharmaceutical

9.10 Others

10 Geographic Analysis (Page No. - 79)

10.1 Introduction

10.2 North America

10.2.1 U.S.

10.2.2 Canada

10.2.3 Rest of N.A.

10.3 Europe

10.3.1 Germany

10.3.2 United Kingdom (U.K.)

10.3.3 France

10.3.4 Rest of Europe

10.4 Asia-Pacific (APAC)

10.4.1 China

10.4.2 Japan

10.4.3 India

10.4.4 Rest of APAC

10.5 Middle East and Africa

10.6 Latin America

11 Competitive Landscape (Page No. - 105)

11.1 Overview

11.2 Market Ranking Analysis

11.3 Competitive Situation and Trends

11.3.1 New Product Launches

11.3.2 Mergers, Acquisitions, and Collaboration

11.3.3 Contracts, Partnerships, and Agreements

11.3.4 Expansions

12 Company Profiles (Page No. - 112)

12.1 Introduction

(Business Overview, Products & Services, Key Insights, Recent Developments, SWOT Analysis, Ratio Analysis, MnM View)*

12.2 General Electric Company

12.3 Siemens AG

12.4 Microsoft Corporation

12.5 Honeywell International Inc.

12.6 Hitachi Data Systems Corporation (Hitachi Ltd.)

12.7 Schneider Electric Se

12.8 Rockwell Automation, Inc.

12.9 Telit

12.10 Advantech Co., Ltd

12.11 PTC

12.12 International Business Machines Corporation

*Details on Business Overview, Products & Services, Key Insights, Recent Developments, SWOT Analysis, MnM View Might Not Be Captured in Case of Unlisted Companies.

13 Appendix (Page No. - 143)

13.1 Insights of Industry Experts

13.2 Discussion Guide

13.3 Knowledge Store: Marketsandmarkets’ Subscription Portal

13.4 Introducing RT: Real-Time Market Intelligence

13.5 Available Customizations

13.6 Related Reports

13.7 Author Details

List of Tables (64 Tables)

Table 1 Industrial Cloud Platform Market, By Solution, 2015–2022 (USD Million)

Table 2 Market for Supervisory Control and Data Acquisition (SCADA), By Region, 2015–2022 (USD Million)

Table 3 Market for Distributed Control System (DCS), By Region, 2015–2022 (USD Million)

Table 4 Market for Manufacturing Execution System (MES) , By Region, 2015–2022 (USD Million)

Table 5 Market for Human–Machine Interface (HMI), By Region, 2015–2022 (USD Million)

Table 6 Market for Product Lifecycle Management (PLM), By Region, 2015–2022 (USD Million)

Table 7 Market for Other Solutions, By Region, 2015–2022 (USD Million)

Table 8 Market, By Platform and Professional Service, 2015–2022 (USD Million)

Table 9 Market, By Platform, 2015–2022 (USD Million)

Table 10 Market for Platform, By Region, 2015–2022 (USD Million)

Table 11 Market for Asset Management, By Region, 2015–2022 (USD Million)

Table 12 Market for Remote Monitoring, By Region, 2015–2022 (USD Million)

Table 13 Market for Data Processing and Analytics, By Region, 2015–2022 (USD Million)

Table 14 Market for Application Development and Management, By Region, 2015–2022 (USD Million)

Table 15 Market for Security Management, By Region, 2015–2022 (USD Million)

Table 16 Market, By Professional Service, 2015–2022 (USD Million)

Table 17 Market for Professional Service, By Region, 2015–2022 (USD Million)

Table 18 Market for Consulting and Planning, By Region, 2015–2022 (USD Million)

Table 19 Market for System Integration, By Region, 2015–2022 (USD Million)

Table 20 Market for Training, Support, and Maintenance, By Region, 2015–2022 (USD Million)

Table 21 Market, By End-User Industry, 2015–2022 (USD Million)

Table 22 Market Size for Oil and Gas, By Region, 2015–2022 (USD Million)

Table 23 Market for Electric Power Generation, By Region, 2015–2022 (USD Million)

Table 24 Factory Automation PaaS Market for Chemicals, By Region, 2015–2022 (USD Million)

Table 25 FA PaaS Market for Water and Wastewater Management, By Region, 2015–2022 (USD Million)

Table 26 Market for Food and Beverages, By Region, 2015–2022 (USD Million)

Table 27 Market for Mining and Metal, By Region, 2015–2022 (USD Million)

Table 28 Market for Paper and Pulp, By Region, 2015–2022 (USD Million)

Table 29 Market for Pharmaceutical, By Region, 2015–2022 (USD Million)

Table 30 Market for Other End-User Industries, By Region, 2015–2022 (USD Million)

Table 31 Market, By Region, 2015–2022 (USD Million)

Table 32 Market in North America, By Country, 2015–2022 (USD Million)

Table 33 Market in North America, By Solution, 2015–2022 (USD Million)

Table 34 Market in North America, By Platform and Professional Service, 2015–2022 (USD Million)

Table 35 Market in North America, By Platform, 2015–2022 (USD Million)

Table 36 Market in North America, By Professional Service, 2015–2022 (USD Million)

Table 37 Market in North America, By End-User Industry, 2015–2022 (USD Million)

Table 38 Market in Europe, By Country, 2015–2022 (USD Million)

Table 39 Market in Europe, By Solution, 2015–2022 (USD Million)

Table 40 Market in Europe, By Platform and Professional Service, 2015–2022 (USD Million)

Table 41 Market in Europe, By Platform, 2015–2022 (USD Million)

Table 42 Market in Europe, By Professional Service, 2015–2022 (USD Million)

Table 43 Market in Europe, By End-User Industry, 2015–2022 (USD Million)

Table 44 Market in APAC, By Country, 2015–2022 (USD Million)

Table 45 Market in APAC, By Solution, 2015–2022 (USD Million)

Table 46 Market in APAC, By Platform and Professional Service, 2015–2022 (USD Million)

Table 47 Market in APAC, By Platform, 2015–2022 (USD Million)

Table 48 Market in APAC, By Professional Service, 2015–2022 (USD Million)

Table 49 FA PaaS Market in APAC, By End-User Industry, 2015–2022 (USD Million)

Table 50 FA PaaS Market in MEA, 2015–2022 (USD Million)

Table 51 FA PaaS Market in MEA, By Solution 2015–2022 (USD Million)

Table 52 FA PaaS Market in MEA, By Platform and Professional Service 2015–2022 (USD Million)

Table 53 FA PaaS Market in MEA, By Platform, 2015–2022 (USD Million)

Table 54 FA PaaS Market in MEA, By Professional Service, 2015-2022 (USD Million)

Table 55 FA PaaS Market in MEA, By End–User Industry, 2015–2022 (USD Million)

Table 56 FA PaaS Market in LA, By Solution 2015–2022 (USD Million)

Table 57 FA PaaS Market in LA, By Platform and Professional Service 2015-2022 (USD Million)

Table 58 FA PaaS Market in LA ,By Platform, 2015–2022 (USD Million)

Table 59 FA PaaS Market in LA, By Professional Service, 2015–2022 (USD Million)

Table 60 FA PaaS Market in LA, By End–User Industry, 2015-2022 (USD Million)

Table 61 Market Ranking, 2015

Table 62 New Product Launches, 2014–2016

Table 63 Mergers, Acquisitions, and Collaboration 2014–2016

Table 64 Contracts, Partnerships, and Agreements 2014–2016

List of Figures (68 Figures)

Figure 1 Factory Automation Platform as A Service (FA PaaS) Market: Research Design

Figure 2 Market Size Estimation Methodology: Bottom-Up Approach

Figure 3 Market Size Estimation Methodology: Top–Down Approach

Figure 4 Data Triangulation

Figure 5 Manufacturing Execution System (MES) Market for FA PaaS Expected to Grow at the Highest Rate During the Forecast Period

Figure 6 Platform to Lead the FA PaaS Market During the Forecast Period

Figure 7 Asset Management Expected to Be the Largest Segment of the Factory Automation Platform as A Service Market During the Forecast Period

Figure 8 System Integration to Lead the FA PaaS Market During the Forecast Period

Figure 9 Electric Power Generation of the Factory Automation Platform to Be the Best Market to Invest in During the Forecast Period

Figure 10 North America to Hold the Largest Share of the Factory Automation Platform as A Service Market in 2016

Figure 11 Demand for Factory Automation Platform as A Service Expected to Rise Gradually During the Forecast Period

Figure 12 Distributed Control System (DCS) to Hold the Largest Market Share During the Forecast Period

Figure 13 China to Hold the Largest Share of the FA PaaS Market in APAC During the Forecast Period

Figure 14 India Expected to Witness A Significant Growth Rate During the Forecast Period

Figure 15 Oil and Gas Industry Expected to Lead the FA PaaS Market During the Forecast Period

Figure 16 Market Segmentation: By Solution

Figure 17 Market Segmentation: By Platform

Figure 18 Market Segmentation: By Professional Service

Figure 19 Market Segmentation: By End-User Industry

Figure 20 Market Segmentation: By Region

Figure 21 FA PaaS Market: Drivers, Restraints, Opportunities, and Challenges

Figure 22 Industry 4.0 – Technologies Help to Transform Factory Automation

Figure 23 Value Chain Analysis: Major Value is Added During Platform as A Service Providing Phase

Figure 24 Porter’s Five Forces Analysis (2015)

Figure 25 Low Threat of Substitutes Due to Small Number of Players

Figure 26 Medium Impact of Threat of New Entrants on the FA PaaS Market

Figure 27 Low Impact of Threat of Substitutes on the FA PaaS Market

Figure 28 High Impact of Bargaining Power of Suppliers on the FA PaaS Market

Figure 29 Medium Impact of Bargaining Power of Buyers on the FA PaaS Market

Figure 30 Medium Impact of Intensity of Competitive Rivalry on the FA PaaS Market

Figure 31 FA PaaS Market Segmentation, By Solution

Figure 32 Manufacturing Execution System (MES) Expected to Witness the Highest Growth Rate During the Forecast Period

Figure 33 Factory Automation Platform as A Service Market Segmentation, By Platform and Professional Service

Figure 34 Platform Segment to Dominate the FA PaaS Market During the Forecast Period

Figure 35 FA PaaS Market, By Platform

Figure 36 Asset Management Platform Segment Market to Dominate the Market During Forecast Period

Figure 37 FA PaaS Market, By Professional Service

Figure 38 System Integration Segment of FA PaaS Market to Dominate During the Forecast Period

Figure 39 FA PaaS Market Segmentation, By End-User Industry

Figure 40 Electric Power Generation Industry to Witness the Highest Growth Rate in the FA PaaS Market During the Forecast Period

Figure 41 FA PaaS Market Segmentation, By Region

Figure 42 India Expected to Witness the Highest Growth Rate During the Forecast Period

Figure 43 North America: Factory Automation Platform as A Service Market Snapshot

Figure 44 North America: FA PaaS Market Segmentation

Figure 45 Europe: Factory Automation Platform as A Service Market Snapshot

Figure 46 Europe: FA PaaS Market Segmentation

Figure 47 APAC: FA PaaS Market Snapshot

Figure 48 APAC: FA PaaS Market Segmentation

Figure 49 Strategies Adopted By Companies in the FA PaaS Market

Figure 50 Battle for Market Share: New Product Launch Was the Key Strategy

Figure 51 Market Evaluation Framework

Figure 52 Geographic Revenue Mix of Top FA PaaS Market Players

Figure 53 General Electric Company: Company Snapshot

Figure 54 General Electric Company: SWOT Analysis

Figure 55 Siemens AG: Company Snapshot

Figure 56 Siemens AG: SWOT Analysis

Figure 57 Microsoft Corporation: Company Snapshot

Figure 58 Microsoft Corporation: SWOT Analysis

Figure 59 Honeywell International Inc.: Company Snapshot

Figure 60 Honeywell International Inc.: SWOT Analysis

Figure 61 Hitachi Data Systems Corporation (Hitachi Ltd.): Company Snapshot

Figure 62 Hitachi Data Systems Corporation (Hitachi Ltd.) : SWOT Analysis

Figure 63 Schneider Electric Se: Company Snapshot

Figure 64 Rockwell Automation, Inc.: Company Snapshot

Figure 65 Telit: Company Snapshot

Figure 66 Advantech Co., Ltd.: Company Snapshot

Figure 67 PTC: Company Snapshot

Figure 68 International Business Machines Corporation: Company Snapshot

The research methodology used to estimate and forecast the industrial cloud platform market for factory automation includes the use of extensive primary research and secondary research. The secondary sources referred for this study include directories; databases such as Hoovers, Bloomberg BusinessWeek, Factiva, and OneSource; and associations such as industrial internet consortium (IIC). The vendor offerings have been taken into consideration to determine the market segmentation. The top-down procedure has been employed to arrive at the overall Industrial Cloud Platform market size of the global industrial cloud platform market for factory automation. After arriving at the overall market size, the total market has been split into several segments and subsegments, which have then been verified through primary research by conducting extensive interviews with key people such as CEOs, VPs, directors, and executives. This data triangulation and market breakdown procedures have been employed to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments.

To know about the assumptions considered for the study, download the pdf brochure

This report provides valuable insights into the industrial cloud platform market for factory automation such as solutions provided, platforms used, professional service offered, and end-user industry segments. The major providers include Siemens AG (Germany), General Electric Company (U.S.), Schneider Electric SE (France), Honeywell International Inc. (U.S.), Rockwell Automation, Inc. (U.S.), Telit (U.K.), Microsoft (U.S.), PTC (U.S.), Hitachi Data Systems Corporation (Japan), Advantech Co., Ltd. (Taiwan), and IBM (U.S.), among others.

Target Audience:

- Original equipment manufacturers (OEMs)

- Automation software solution providers

- Data analytics and cloud platform providers

- Service Providers

- Associations, organizations, and alliances

- End users of across various industries such as electric power generation, paper and pulp, metals and mining, and oil and gas, among others

- Application developers and aggregators

- Machine-to-machine (M2M), IoT, and telecommunications companies

Scope of the Report:

In this research report, the global industrial cloud platform market for factory automation has been segmented on the basis of solution, platform and professional service, end-user industry, and geography.

Industrial Cloud Platform Market for Factory Automation, by Solution

- Supervisory Control and Data Acquisition (SCADA)

- Distributed Control System (DCS)

- Manufacturing Execution System (MES)

- Human–Machine Interface (HMI)

- Product Lifecycle Management (PLM)

-

Others

- Manufacturing Operation Management (MOM)

- Industrial Information Management (IIM)

Industrial Cloud Platform Market for Factory Automation, by Platform and Professional Service

-

By Platform

- Asset Management

- Remote Monitoring

- Data Processing and Analytics

- Application Development and Management

- Security Management

-

By Professional Service

- Consulting and Planning

- System Integration

- Training, Support, and Maintenance

Industrial Cloud Platform Market for Factory Automation, by End-User Industry

- Oil and Gas

- Electric Power generation

- Chemicals

- Water and Waste Water Management

- Food and Beverage

- Mining and Metal

- Pulp and Paper

- Pharmaceutical

-

Others

- Cement and Glass

- Petrochemical and Fertilizer

Industrial Cloud Platform Market for Factory Automation, by Region

- North America

- Europe

- APAC

- Middle East and Africa

- Latin America

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to the company’s specific needs. The following customization options are available for the report:

- Comprehensive coverage of regulations followed in each region (the North America, APAC, and Europe)

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Growth opportunities and latent adjacency in Industrial Cloud Platform Market

I would like to know more about the growth of IIoT and Cloud Business in the fabric Automation market specifically.

We are dealing as a security integrator so it's mostly my curiosity that drives this search, I feel I need to know a bit about integration of IoT with factory automation equipment and the challenges faced while integration.