Marine and Marine Management Software Market by Component (Software and Services), Location (Onboard and Onshore), Application (Crew Management, Port Management, and Reservation Management), Deployment Mode, End User, and Region - Global Forecast to 2026

Updated on : May 15, 2023

Marine and Marine Management Software Market Research

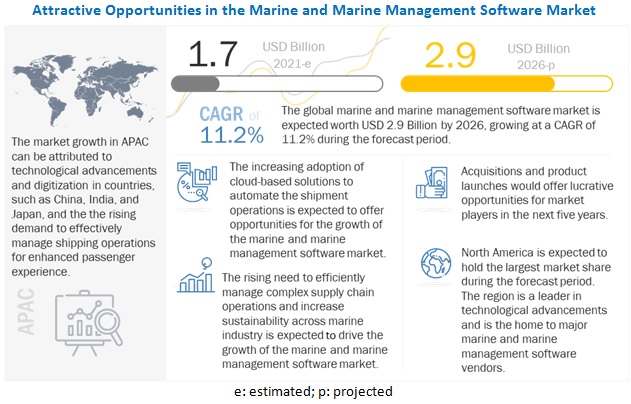

[278 Pages Report] The global marine and marine management software market size is expected to increase from USD 1.7 billion in 2021 to USD 2.9 billion by 2026, at a Compound Annual Growth Rate (CAGR) of 11.2% from 2021 to 2026. Factors such as rising need to efficiently manage complex supply chain operations, increase sustainability across marine software industry, and increasing demand for centralized administrative of big data to reduce overall shipment costs and enhance shipyard productivity are driving the adoption of the marine and marine management software market across the globe.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 impact

COVID-19 is disrupting the world, businesses, and economies, thus impacting on the livelihood of people live, their interaction, and the way they manage their businesses. The ability to sustain has become the new normal for enterprises as they shift their focus from growth opportunities and concentrate on implementing drastic measures to mitigate the impact of the COVID-19 pandemic. The competition among major marine software companies is expected to be furious as most upcoming projects are kept on hold due to the pandemic. Hence, several companies will fight to gain a single project. Businesses have already started their efforts to return back to normal and are facing multiple challenges on the customer as well as operational side.

In a short time, the COVID-19 outbreak has caused the shipping and maritime industry to face the nastiest circumstances as the workforce in these sectors has been shut down for the safety and prevention of the increase of the pandemic. This impediment has also been affected due to the standstill of all kinds of cargos via water or air during this isolation period as the transportation of such cargos in ships or through the air can be possibly carrying with it the virus from one port to another affecting overall crew management process. All the trade chains, including the major import and export trade, is in the face with a breakdown. Moreover, a ban has also been imposed by various countries on the entry of containers and vessels that are being operated from other ports, especially those that are transported from China. Such obstructed operations have hampered with the logistics and operations of the maritime industry. The maritime, transport and shipping industry is coated with foremost challenges during these pandemic times.

Marine and Marine Management Software Market Dynamics

Driver: Rising need to efficiently manage complex supply chain operations and increase sustainability across the marine industry

The marine industry has to cope with dynamic market conditions and complex processes to operate. The industry is in the surge to implement digital technologies to shipping logistics as an opportunity to streamline operations, create smarter ships and fleets, and better prepare to capitalize on global growth. Global supply chains are rising and becoming more complex as consumer demand increases. The greater need for products, ingredients and raw materials directly transforms into increased environmental impact. In today’s highly competitive market, it is imperative that marine industries implement new ways to streamline their supply chain and optimize productivity.

Marine software integrated with innovative technologies such as AI, Big Data and Analytics enables end users to organize inventory data digitally, monitor and manage shipping and tracking information, and create electronic invoices with ease. Marine software companies can reduce the time spent shipping, receiving, tracking, and compiling order data, saving both time and money. Moreover, more stringent environmental requirements continue to shape the maritime transport sector as transporters need to maintain service levels and reduce costs, and at the same time ensure sustainability in operations.

Restraint: Interoperability issues and risk associated with cyber threats

Increased cyber attacks in shipping during the COVID-19 crisis were aggravated by the limited ability of companies to sufficiently safeguard themselves by keeping limitations in traveling and maintaining social distancing. With ships and ports becoming better connected and further integrated into IT networks, the implementation and strengthening of cybersecurity measures are becoming essential priorities. Marine software in ships worldwide increases the risks of cyber threats as these ships follow satellite routes during their voyages.

The use of Big Data analytics for the development of smart ships is expected to enhance the operational efficiency and safety of the vessels. With instances of online threats and potential attacks increasing across the globe, the Maritime Safety Committee (MSC) of the International Maritime Organization (IMO) has introduced temporary guidelines to prevent cyberattacks on ships’ systems. Cybersecurity risks are likely to continue to grow significantly as a result of greater reliance on electronic trading and an increasing shift to virtual interactions at all levels. This expands vulnerabilities across the globe, with the potential to produce crippling effects on critical supply chains and services across marine industries.

Opportunity: Increasing adoption of cloud-based marine management solutions to automate the shipment operations

The impact of technology on the marine industry will grow in the coming years as companies increasingly implementing cloud-based marina software and apps such as port and crew management in their businesses. From crewing and training to procurement and bunkering, marine management includes all support services that enable marinas to operate at sea. Companies are now opening up to the innumerable benefits offered by different technologies, and one such technology is cloud computing. Cloud computing technology makes operations, communications, and collaborations easier for workforces across the globe.

The cloud-based solutions offer the latest versions, newest features, and rapid support across the globe. Cloud-based marine software offers clients the ability to focus on their business, tackle any incoming issues immediately, automate the software version upgrades, and provide strict security measures. Few vendors, such as Chetu, RMS, Scribble Software and Harba offer cloud-based marina management software, digitalizing repetitive and time-consuming marina management processes. Hence, development in the cloud computing technology in the marine industry is expected to dominate the adoption of marine management software in the coming years.

Challenge: Limited workforce and halt in the production units during the pandemic to adversely affect the marine industry

The epidemic has caused the shipping and maritime industry to face the worst circumstances as the workforce in these sectors has been shut down for the safety and prevention of the escalation of COVID-19. According to European Maritime Safety Agency (EMSA), there were 53,035 ship calls at EU ports, and in January 2021, there were 49,908 ship calls. The number of calls decreased by 6% in comparison with 2019. Moreover, an estimation by UNCTAD, global maritime trade will drop by 4.1% in 2020 due to the unprecedented disruption caused by COVID-19 mentioned in the Review of Maritime Transport 2020. The pandemic has sent shockwaves through supply chains, shipping networks, and ports, leading to plummeting cargo volumes and foiling growth prospects. To deal with pandemic-related disruptions, players in the maritime sector adjusted their operations, finances, and sanitary and safety protocols, as well as working practices and procedures.

In addition, several governments, through their border agencies, port authorities, and customs administrations, made reforms to keep trade flowing while keeping people safe. With the growing digitalization and ongoing pandemic, there is an increase in cybersecurity risks coupled with disruption in supply chains and services across global maritime sector. Many countries have responded to the pandemic by imposing lockdown or restricting movement. Some ports remain open but have reduced workforce, which exacerbates the cargo congestion. This causes disruption of the supply chain, including the movement of essential goods and foodstuffs. The cargo lying uncollected at ports creates congestion and takes up space, reducing capacity for incoming cargo and containers.

The software segment is expected to account for a larger market size during the forecast period

The component segment has been further divided into software and services. The software segment is expected to account for a larger market size during the forecast period. Marine software adoption is becoming crucial for the shipping industry, as it enables shipping companies to automate and track vessel performance and enhance overall productivity. The marine software enables administrators to track orders, generate shipping manifests, gain insights into performance reports, and identify new business opportunities on a centralized dashboard.

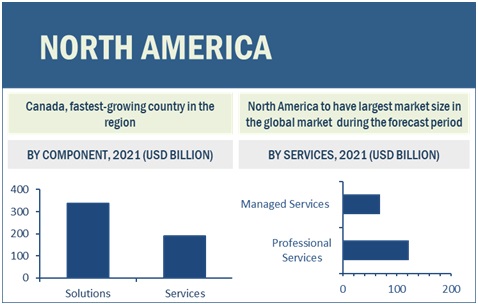

North America to account for largest market size during the forecast period

North America is expected to have the largest market share in the marine and marine management software market. Key factors favoring the growth of the marine software market in North America include the increasing technological advancements in the region. The growing number of marine software players across regions is expected to further drive the market growth.

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

The major vendors in the global marine and marine management software market include Oracle (US), ABB (Switzerland), DockMaster (US), Marina Master (Slovenia), Marinacloud (Croatia), Lloyd's Register (UK), TIMEZERO (France), Scribble Software (US), MarineCFO (US), Chetu (US), MESPAS (Switzerland), Dockwa (US), Swell Advantage (Canada), Marina Ahoy (Estonia), Harba (Denmark), Harbour Assist (UK), Havenstar (England), Gestalt Systems (Germany), Seahub (US), BlueShell (Switzerland), Raymarine (UK), Ayden Marine (Turkey), OceanManager (US), Innovez One (Singapore), RMS (Australia), Nautical Software (US), and CorVant (US).

The study includes an in-depth competitive analysis of these key players in the marine and marine management software market with their company profiles, recent developments, and key market strategies. The marine and marine management software vendors have implemented various types of organic and inorganic growth strategies, such as new product launches, product upgradations, partnerships and agreements, business expansions, and mergers and acquisitions to strengthen their offerings in the market.

Scope of the Report

|

Report Metrics |

Details |

|

Market size value in 2021 |

USD 1.7 billion |

|

Revenue forecast for 2026 |

USD 2.9 billion |

|

Growth Rate |

11.2% CAGR |

|

Forecast units |

USD Billion |

|

Segments covered |

Component, Deployment Mode, Organization Size, Location, Application, End User, And Region |

|

Key Market Drivers |

|

|

Key Market Opportunities |

|

|

Geographies covered |

North America, Europe, APAC, Latin America and MEA |

|

Top Companies covered |

Oracle (US), ABB (Switzerland), DockMaster (US), Marina Master (Slovenia), Marinacloud (Croatia), Lloyd's Register (UK), TIMEZERO (France), Scribble Software (US), MarineCFO (US), Chetu (US), MESPAS (Switzerland) |

This research report categorizes the marine and marine management software market based on components, deployment mode, organization size, location, application, end user, and regions.

By Component:

-

Software

- Tracking and Monitoring

- Navigation and Routing

- Supply Chain and Logistics

- Finance and Accounting

- System Testing

- Other Software Type (communication, and voyage and operations)

-

Services

- Professional Services

- Managed Services

By Deployment Mode:

- Cloud

- On-premises

By Organization Size:

- Large enterprises

- Small and medium-sized enterprises (SMEs)

By Location

- Onboard

- Onshore

By Application

- Crew Management

- Port Management

- Harbor Management

- Reservation Management

- Cruise and Yacht Management

By End User

- Commercial

- Defense

By Region:

-

North America

- US

- Canada

-

Europe

- UK

- Germany

- France

- Rest of Europe

-

APAC

- China

- Singapore

- India

- Rest of APAC

-

MEA

- KSA

- UAE

- South Africa

- Rest of MEA

-

Latin America

- Brazil

- Mexico

- Rest of Latin America

Recent Developments:

- In April 2021, Lloyd's Register partnered with the innovation leader in operational AI, Falkonry, to combine its predictive digital twins with asset performance and risk management solutions for heavy industry, including chemicals and oil and gas.

- In February 2021, ABB announced to expand its Marine and Ports business unit in Turkey and Saudi Arabia. The expansion will strengthen ABB Marine & Ports’ ability to work closely with its growing client base in each country and reinforce efforts to enhance efficiency and sustainability in the shipping, ports, and offshore sectors in both locations.

- In February 2021, Marina Master enables a contactless faster payment facility. Payment is made through a link. This solution is derived as a result of FreedomPay integration.

- In February 2021, Marina Master partnered with FreedomPay, a leading payment gateway provider, to enhance the online payment process. The partnership would enable faster and convenient automated contactless online payment in fewer steps.

- In September 2020, Lloyd's Register partnered with STC Global to use AI to unlock the insight from the vast amounts of incident data captured by HSE functions but left untapped. Leveraging complementary expertise, the partnership will raise the game for HSE professionals by integrating NLP and root cause analysis technologies for the first time.

- In May 2020, ABB partnered with Crate.io to offer powerful purpose-built Industrial Internet of Things (IIoT) database (CrateDB) as part of its ABB ability platform ecosystem to support its digital solutions.

- In February 2020, Oracle and Microsoft expanded their cloud collaboration with a new cloud interconnect location in Amsterdam, Netherlands. The new interconnect would enable these businesses to share data across applications running in Microsoft Azure and Oracle Cloud.

Frequently Asked Questions (FAQ):

How big is the marine and marine management software market?

What is growth rate of the marine and marine management software market?

What are the applications in marine and marine management software market?

Who are the key players in marine and marine management software market?

Who will be the leading hub for marine and marine management software market?

What is the marine and marine management software market segmentation?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 29)

1.1 INTRODUCTION TO COVID–19

1.2 COVID–19 HEALTH ASSESSMENT

FIGURE 1 COVID–19: GLOBAL PROPAGATION

FIGURE 2 COVID–19 PROPAGATION: SELECT COUNTRIES

1.3 COVID–19 ECONOMIC ASSESSMENT

FIGURE 3 REVISED GROSS DOMESTIC PRODUCT FORECASTS FOR SELECT G20 COUNTRIES IN 2020

1.3.1 COVID–19 ECONOMIC IMPACT—SCENARIO ASSESSMENT

FIGURE 4 CRITERIA IMPACTING THE GLOBAL ECONOMY

FIGURE 5 SCENARIOS IN TERMS OF RECOVERY OF THE GLOBAL ECONOMY

1.4 OBJECTIVES OF THE STUDY

1.5 MARKET DEFINITION

1.5.1 INCLUSIONS AND EXCLUSIONS

1.6 MARKET SCOPE

1.6.1 MARKET SEGMENTATION

1.6.2 REGIONS COVERED

1.6.3 YEARS CONSIDERED FOR THE STUDY

1.7 CURRENCY CONSIDERED

TABLE 1 UNITED STATES DOLLAR EXCHANGE RATE, 2018–2020

1.8 STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 38)

2.1 RESEARCH DATA

FIGURE 6 MARINE AND MARINE MANAGEMENT SOFTWARE MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.2 PRIMARY DATA

TABLE 2 PRIMARY INTERVIEWS

2.1.2.1 Breakup of primary profiles

2.1.2.2 Key industry insights

2.2 MARKET BREAKUP AND DATA TRIANGULATION

FIGURE 7 DATA TRIANGULATION

2.3 MARKET SIZE ESTIMATION

FIGURE 8 MARKET: TOP–DOWN AND BOTTOM–UP APPROACHES

2.3.1 TOP-DOWN APPROACH

2.3.2 BOTTOM-UP APPROACH

FIGURE 9 MARKET SIZE ESTIMATION METHODOLOGY – APPROACH 1 (SUPPLY-SIDE): REVENUE FROM SOLUTIONS/SERVICES OF THE MARKET

FIGURE 10 MARKET SIZE ESTIMATION METHODOLOGY – APPROACH 2, BOTTOM-UP (SUPPLY–SIDE): COLLECTIVE REVENUE FROM ALL SOLUTIONS/SERVICES OF THE MARINE AND MARINE MANAGEMENT SOFTWARE MARKET

FIGURE 11 MARKET SIZE ESTIMATION METHODOLOGY – APPROACH 3, BOTTOM-UP (SUPPLY–SIDE): COLLECTIVE REVENUE FROM ALL SOLUTIONS/SERVICES OF THE MARKET

FIGURE 12 MARKET SIZE ESTIMATION METHODOLOGY – APPROACH 4, BOTTOM–UP (DEMAND–SIDE): SHARE OF QUEUE MANAGEMENT SYSTEM THROUGH OVERALL MARINE AND MARINE MANAGEMENT SOFTWARE SPENDING

2.4 MARKET FORECAST

TABLE 3 FACTOR ANALYSIS

2.5 COMPANY EVALUATION MATRIX METHODOLOGY

FIGURE 13 COMPANY EVALUATION MATRIX: CRITERIA WEIGHTAGE

2.6 STARTUP/SME EVALUATION MATRIX METHODOLOGY

FIGURE 14 STARTUP/SME EVALUATION MATRIX: CRITERIA WEIGHTAGE

2.7 ASSUMPTIONS FOR THE STUDY

2.8 LIMITATIONS OF THE STUDY

2.9 IMPLICATIONS OF COVID–19 ON THE MARKET

FIGURE 15 QUARTERLY IMPACT OF COVID–19 DURING 2020–2021

3 EXECUTIVE SUMMARY (Page No. - 54)

TABLE 4 GLOBAL MARINE AND MARINE MANAGEMENT SOFTWARE MARKET SIZE AND GROWTH RATE, 2017–2020 (USD MILLION, Y–O–Y %)

TABLE 5 GLOBAL MARKET SIZE AND GROWTH RATE, 2021–2026 (USD MILLION, Y–O–Y %)

FIGURE 16 SOFTWARE SEGMENT TO HOLD A LARGER MARKET SIZE IN THE MARKET IN 2021

FIGURE 17 ONBOARD LOCATION SEGMENT TO HOLD A LARGER MARKET SHARE IN THE MARKET IN 2021

FIGURE 18 PROFESSIONAL SERVICES SEGMENT TO HOLD A LARGER MARKET SIZE IN THE MARKET IN 2021

FIGURE 19 SYSTEM INTEGRATION AND IMPLEMENTATION SEGMENT TO HOLD THE LARGEST MARKET SHARE IN THE MARKET IN 2021

FIGURE 20 CREW MANAGEMENT SEGMENT TO HOLD THE LARGEST MARKET SIZE IN THE MARKET IN 2021

FIGURE 21 TRACKING AND MONITORING SEGMENT TO HOLD THE LARGEST MARKET SHARE IN 2021

FIGURE 22 CLOUD SEGMENT TO HOLD A LARGER MARKET SHARE IN 2021

FIGURE 23 LARGE ENTERPRISES SEGMENT TO HOLD A LARGER MARKET SIZE IN 2021

FIGURE 24 COMMERCIAL END USER SEGMENT TO HOLD A LARGER MARKET SHARE IN 2021

FIGURE 25 NORTH AMERICA TO HOLD THE LARGEST MARKET SHARE AND ASIA PACIFIC TO GROW AT THE HIGHEST CAGR IN THE MARKET IN 2021

4 PREMIUM INSIGHTS (Page No. - 61)

4.1 ATTRACTIVE OPPORTUNITIES IN THE MARINE AND MARINE MANAGEMENT SOFTWARE MARKET

FIGURE 26 RISING NEED TO EFFICIENTLY MANAGE COMPLEX SUPPLY CHAIN OPERATIONS AND INCREASE SUSTAINABILITY ACROSS THE MARINE INDUSTRY TO DRIVE THE GROWTH OF THE MARKET

4.2 MARKET, TOP THREE APPLICATIONS

FIGURE 27 RESERVATION MANAGEMENT APPLICATION SEGMENT TO GROW AT THE HIGHEST CAGR DURING THE FORECAST PERIOD

4.3 MARKET, BY COMPONENT AND TOP THREE APPLICATIONS

FIGURE 28 SOFTWARE AND CREW MANAGEMENT SEGMENT TO HOLD HIGHEST MARKET SHARES IN 2021

4.4 MARKET, BY REGION

FIGURE 29 NORTH AMERICA TO HOLD THE LARGEST MARKET SHARE IN 2021

5 MARKET OVERVIEW AND INDUSTRY TRENDS (Page No. - 64)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 30 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES: MARINE AND MARINE MANAGEMENT SOFTWARE MARKET

5.2.1 DRIVERS

5.2.1.1 Rising need to efficiently manage complex supply chain operations and increase sustainability across the marine industry

5.2.1.2 Increasing demand for centralized administration of data to reduce overall shipment costs and enhance shipyard productivity

5.2.2 RESTRAINTS

5.2.2.1 Interoperability issues and risk associated with cyber threats

5.2.2.2 Stringent environmental regulations and compliance issues

5.2.3 OPPORTUNITIES

5.2.3.1 Increasing adoption of cloud-based marine management solutions to automate the shipment operations

5.2.3.2 Exponential growth of smartphone users during COVID–19 to lead the increased proliferation of mobile-based marine management software

5.2.4 CHALLENGES

5.2.4.1 Limited workforce and halt in the production units during the pandemic to adversely affect the marine industry

5.2.4.2 Lack of technical expertise to manage complex software

5.2.5 CUMULATIVE GROWTH ANALYSIS

5.3 MARINE AND MARINE MANAGEMENT SOFTWARE: ECOSYSTEM

FIGURE 31 ECOSYSTEM OF MARINE AND MARINE MANAGEMENT SOFTWARE MARKET

5.4 CASE STUDY ANALYSIS

5.4.1 PETER DOHLE GROUP USED THE CLOUD-BASED PLATFORM BY MAXSEA TO COMMUNICATE AND SHARE DATA

5.4.2 PACC OFFSHORE SERVICES HOLDING USED INNOVEZ ONE–BASED AI MODEL TO MANAGE RESOURCES AND FINANCIAL MANAGEMENT TARIFFS

5.4.3 STOCK ISLAND MARINA VILLAGE INCREASED ITS REVENUE BY IMPROVING CUSTOMER EXPERIENCE WITH CLOUD-BASED SOFTWARE AND SEO BY DOCKWA

5.4.4 EDGARTOWN HARBOR USED A CLOUD-BASED SOFTWARE TO OPTIMIZE THE RESERVATION PROCESS ON MARINA

5.4.5 HERRINGTON HARBOUR USED A CLOUD-BASED PLATFORM FOR TRANSACTIONS AND OPTIMIZATION OF BOOKING PROCESSES AT MULTIPLE LOCATIONS

5.4.6 SEA SHEPHERD GLOBAL IMPLEMENTED CLOUD-BASED MARINE SOFTWARE TO SCHEDULE AND TRACK FLUID

5.4.7 CORROBOREE IMPLEMENTED MAINTENANCE MANAGEMENT SOFTWARE TO TRACK AND SCHEDULE MAINTENANCE ACTIVITIES

5.4.8 ROBBIN’S MARITIME V365 SOLUTION BY MARINACFO TO STREAMLINE OPERATIONS

5.4.9 PORT HARBOR MARINE NEEDED A CLOUD-BASED MARINE SOLUTION TO OPTIMIZE ITS OPERATION

5.4.10 M&P USED REPORTING AND ANALYTICS TOOLS TO TRACK PERFORMANCE

5.5 MARINE AND MARINE MANAGEMENT SOFTWARE MARKET: COVID–19 IMPACT

FIGURE 32 MARKET TO WITNESS MINIMAL SLOWDOWN IN GROWTH IN 2020

5.6 PATENT ANALYSIS

5.6.1 METHODOLOGY

5.6.2 DOCUMENT TYPE

TABLE 6 PATENTS FILED

5.6.3 INNOVATION AND PATENT APPLICATIONS

FIGURE 33 TOTAL NUMBER OF PATENTS GRANTED IN A YEAR, 2010–2021

5.6.3.1 Top Applicants

FIGURE 34 TOP 12 COMPANIES WITH THE HIGHEST NUMBER OF PATENT APPLICATIONS, 2010–2021

TABLE 7 TOP 10 PATENT OWNERS (US) IN THE MARKET, 2010–2021

5.7 SUPPLY CHAIN ANALYSIS

FIGURE 35 SUPPLY CHAIN ANALYSIS: MARINE AND MARINE MANAGEMENT SOFTWARE MARKET

5.8 PRICING MODEL ANALYSIS

TABLE 8 PRICING MODEL OF MARINE AND MARINE MANAGEMENT SOFTWARE PLAYERS: 2019-2020

5.9 PORTER’S FIVE FORCES ANALYSIS

TABLE 9 IMPACT OF EACH FORCE ON THE MARINE AND MARINE MANAGEMENT SOFTWARE

FIGURE 36 PORTER’S FIVE FORCES ANALYSIS

5.9.1 THREAT OF NEW ENTRANTS

5.9.2 THREAT OF SUBSTITUTES

5.9.3 BARGAINING POWER OF SUPPLIERS

5.9.4 BARGAINING POWER OF BUYERS

5.9.5 INTENSITY OF COMPETITIVE RIVALRY

5.10 SCENARIO

TABLE 10 CRITICAL FACTORS TO IMPACT THE GROWTH OF THE MARINE MARKET

6 MARINE AND MARINE MANAGEMENT SOFTWARE MARKET, BY COMPONENT (Page No. - 85)

6.1 INTRODUCTION

6.1.1 COMPONENTS: COVID–19 IMPACT

FIGURE 37 SERVICES SEGMENT TO REGISTER A HIGHER CAGR DURING THE FORECAST PERIOD

TABLE 11 MARKET SIZE, BY COMPONENT, 2017–2020 (USD MILLION)

TABLE 12 MARKET SIZE, BY COMPONENT, 2021–2026 (USD MILLION)

6.2 SOFTWARE

FIGURE 38 FINANCE AND ACCOUNTING SEGMENT TO REGISTER THE HIGHEST CAGR DURING THE FORECAST PERIOD

TABLE 13 SOFTWARE: MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 14 SOFTWARE: MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

TABLE 15 SOFTWARE: MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 16 SOFTWARE: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

6.2.1 TRACKING AND MONITORING

6.2.1.1 With the growing need to monitor crew and assets related to marines to boost the demand for operations monitoring solutions in the market

TABLE 17 TRACKING AND MONITORING: MARINE AND MARINE MANAGEMENT SOFTWARE MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 18 TRACKING AND MONITORING: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

6.2.2 SUPPLY CHAIN AND LOGISTICS

6.2.2.1 The need to optimize logistics operations to reduce administrative workloads to drive the growth of supply chain and logistics solutions in the market

TABLE 19 SUPPLY CHAIN AND LOGISTICS: MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 20 SUPPLY CHAIN AND LOGISTICS: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

6.2.3 SYSTEM TESTING

6.2.3.1 The rising need to enable end users to effectively handle and track errors in the marine and marine management system to drive the adoption of system testing software type

TABLE 21 SYSTEM TESTING: MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 22 SYSTEM TESTING: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

6.2.4 NAVIGATION AND ROUTING

6.2.4.1 The need to optimize fuel consumption and forecast weather condition in real time to boost the demand FOR navigation and routing solutions in the market

TABLE 23 NAVIGATION AND ROUTING: MARINE AND MARINE MANAGEMENT SOFTWARE MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 24 NAVIGATION AND ROUTING: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

6.2.5 FINANCE AND ACCOUNTING

6.2.5.1 The necessity to handle shipping transactions and payment processing in real time to drive the demand for finance and accounting software type in the market

TABLE 25 FINANCE AND ACCOUNTING: MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 26 FINANCE AND ACCOUNTING: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

6.2.6 OTHER SOFTWARE TYPES

TABLE 27 OTHER SOFTWARE TYPES: MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 28 OTHER SOFTWARE TYPES: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

6.3 SERVICES

FIGURE 39 MANAGED SERVICES SEGMENT TO GROW AT A HIGHER CAGR DURING THE FORECAST PERIOD

TABLE 29 SERVICES: MARINE AND MARINE MANAGEMENT SOFTWARE MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 30 SERVICES: MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

TABLE 31 SERVICES: MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 32 SERVICES: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

6.3.1 PROFESSIONAL SERVICES

FIGURE 40 TRAINING AND CONSULTING SEGMENT TO REGISTER THE HIGHEST CAGR DURING THE FORECAST PERIOD

TABLE 33 PROFESSIONAL SERVICES: MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 34 PROFESSIONAL SERVICES: MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

TABLE 35 PROFESSIONAL SERVICES: MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 36 PROFESSIONAL SERVICES: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

6.3.1.1 Training and Consulting

6.3.1.1.1 Training and consulting services enable companies to lower risk, reduce complexity, and increase RoI to deliver maximum product assurance

TABLE 37 TRAINING AND CONSULTING SERVICES: MARINE AND MARINE MANAGEMENT SOFTWARE MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 38 TRAINING AND CONSULTING SERVICES: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

6.3.1.2 Support and maintenance

6.3.1.2.1 Support and maintenance services help customers in providing enhancements to solutions and assistance for solving solution–related issues.

TABLE 39 SUPPORT AND MAINTENANCE SERVICES: MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 40 SUPPORT AND MAINTENANCE SERVICES: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

6.3.1.3 System Integration and Implementation

6.3.1.3.1 Companies’ need to ensure minimum risks and reduced cost optimization to drive the demand for system integration and implementation services

TABLE 41 SYSTEM INTEGRATION AND IMPLEMENTATION SERVICES: MARINE AND MARINE MANAGEMENT SOFTWARE MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 42 SYSTEM INTEGRATION AND IMPLEMENTATION SERVICES: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

6.3.2 MANAGED SERVICES

6.3.2.1 With the growing concern of companies to lower labor costs and eliminate the cost of hiring and training new IT staff to drive the company to outsource managed service providers

TABLE 43 MANAGED SERVICES: MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 44 MANAGED SERVICES: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

7 MARINE AND MARINE MANAGEMENT MARKET, BY ORGANIZATION SIZE (Page No. - 106)

7.1 INTRODUCTION

7.1.1 ORGANIZATION SIZE: COVID–19 IMPACT

FIGURE 41 SMALL AND MEDIUM-SIZED ENTERPRISES SEGMENT TO REGISTER A HIGHER CAGR DURING THE FORECAST PERIOD

TABLE 45 MARINE AND MARINE MANAGEMENT SOFTWARE MARKET SIZE, BY ORGANIZATION SIZE, 2017–2020 (USD MILLION)

TABLE 46 MARKET SIZE, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

7.2 LARGE ENTERPRISES

7.2.1 THE INCREASED COMPETITION AMONG LARGE ENTERPRISES TO TRACK AND IMPROVE SHIPPING EXPERIENCE TO DRIVE THE DEMAND FOR MARINE AND MARINE MANAGEMENT SOFTWARE

TABLE 47 LARGE ENTERPRISES: MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 48 LARGE ENTERPRISES: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

7.3 SMALL AND MEDIUM-SIZED ENTERPRISES

7.3.1 CONCERN TO DELIVER OMNICHANNEL CUSTOMER EXPERIENCES AND ENABLE ORGANIZATIONS TO HANDLE SHIPPING OPERATIONS TO DRIVE THE DEMAND FOR MARINE AND MARINE MANAGEMENT SOFTWARE

TABLE 49 SMALL AND MEDIUM-SIZED ENTERPRISES: MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 50 SMALL AND MEDIUM-SIZED ENTERPRISES: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

8 MARINE AND MARINE MANAGEMENT SOFTWARE MARKET, BY DEPLOYMENT MODE (Page No. - 112)

8.1 INTRODUCTION

8.1.1 DEPLOYMENT MODE: COVID–19 IMPACT

FIGURE 42 ON-PREMISES SEGMENT TO REGISTER A HIGHER CAGR DURING THE FORECAST PERIOD

TABLE 51 MARKET SIZE, BY DEPLOYMENT MODE, 2017–2020 (USD MILLION)

TABLE 52 MARKET SIZE, BY DEPLOYMENT MODE, 2021–2026 (USD MILLION)

8.2 ON-PREMISES

8.2.1 ENHANCED CONTROL OVER DATA ACCESSIBILITY ACROSS THE NETWORK OF ON-PREMISES TO DRIVE THE ADOPTION OF MARINE AND MARINE MANAGEMENT SOFTWARE

TABLE 53 ON-PREMISES: MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 54 ON-PREMISES: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

8.3 CLOUD

8.3.1 COST-EFFECTIVENESS, EASY ACCESS, AND SCALABILITY TO BOOST THE ADOPTION OF CLOUD MARINE AND MARINE MANAGEMENT SOFTWARE

TABLE 55 CLOUD: MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 56 CLOUD: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

9 MARINE AND MARINE MANAGEMENT SOFTWARE MARKET, BY LOCATION (Page No. - 117)

9.1 INTRODUCTION

9.1.1 LOCATION: COVID–19 IMPACT

FIGURE 43 ONSHORE SEGMENT TO REGISTER A HIGHER CAGR DURING THE FORECAST PERIOD

TABLE 57 MARKET SIZE, BY LOCATION, 2017–2020 (USD MILLION)

TABLE 58 MARKET SIZE, BY LOCATION, 2021–2026 (USD MILLION)

9.2 ONBOARD

9.2.1 GROWING NEED TO TRACK THE PERFORMANCE OF DIFFERENT DEPARTMENTS TO DRIVE THE ADOPTION OF MARINE AND MARINE MANAGEMENT SOFTWARE IN ONBOARD LOCATION

TABLE 59 ONBOARD: MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 60 ONBOARD: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

9.3 ONSHORE

9.3.1 NEED TO HANDLE VESSEL OPERATIONS AND CREW PERFORMANCE TO BOOST THE ADOPTION OF ONSHORE MARINE AND MARINE MANAGEMENT SOFTWARE

TABLE 61 ONSHORE: MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 62 ONSHORE: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

10 MARINE AND MARINE MANAGEMENT SOFTWARE MARKET, BY APPLICATION (Page No. - 122)

10.1 INTRODUCTION

10.1.1 APPLICATIONS: COVID–19 IMPACT

FIGURE 44 CREW MANAGEMENT SEGMENT TO RECORD THE LARGEST MARKET SIZE DURING THE FORECAST PERIOD

TABLE 63 MARKET SIZE, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 64 MARKET SIZE, BY APPLICATION, 2021–2026 (USD MILLION)

10.2 CREW MANAGEMENT

10.2.1 GROWING CONCERN OF MARINE COMPANIES TO TRACK PERFORMANCE OF THE CREW TO DRIVE THE ADOPTION OF CREW MANAGEMENT IN THE MARKET

TABLE 65 CREW MANAGEMENT: MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 66 CREW MANAGEMENT: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

10.3 PORT MANAGEMENT

10.3.1 GROWING NEED TO MONITOR THE ARRIVAL AND DEPARTURE OF SHIPS, BOATS, AND VESSELS TO BOOST THE DEMAND FOR PORT MANAGEMENT APPLICATIONS IN THE MARKET

TABLE 67 PORT MANAGEMENT: MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 68 PORT MANAGEMENT: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

10.4 HARBOR MANAGEMENT

10.4.1 THE RISING FOCUS OF SHIPPING COMPANIES TO MANAGE HIGH VOLUME ARRIVALS AND DEPARTURES TO DRIVE THE DEMAND FOR HARBOR MANAGEMENT

TABLE 69 HARBOR MANAGEMENT: MARINE AND MARINE MANAGEMENT SOFTWARE MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 70 HARBOR MANAGEMENT: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

10.5 RESERVATION MANAGEMENT

10.5.1 THE RISING FOCUS OF SHIPPING COMPANIES TO STREAMLINE TRANSIENT RESERVATION PROCESS TO DRIVE THE DEMAND FOR RESERVATION MANAGEMENT

TABLE 71 RESERVATION MANAGEMENT: MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 72 RESERVATION MANAGEMENT: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

10.6 CRUISE AND YACHT MANAGEMENT

10.6.1 THE INCREASING NEED TO PROVIDE ENHANCED TRAVELLING EXPERIENCE TO THE PASSENGERS VIA CRUISE AND YACHT TO DRIVE THE DEMAND FOR CRUISE AND YACHT MANAGEMENT

TABLE 73 CRUISE AND YACHT MANAGEMENT: MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 74 CRUISE AND YACHT MANAGEMENT: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

11 MARINE AND MARINE MANAGEMENT SOFTWARE MARKET, BY END USER (Page No. - 131)

11.1 INTRODUCTION

11.1.1 END USERS: COVID–19 IMPACT

FIGURE 45 DEFENSE SEGMENT TO REGISTER A HIGHER CAGR DURING THE FORECAST PERIOD

TABLE 75 MARKET SIZE, BY END USER, 2017–2020 (USD MILLION)

TABLE 76 MARKET SIZE, BY END USER, 2021–2026 (USD MILLION)

11.2 COMMERCIAL

11.2.1 THE EVER-INCREASING NEED TO PROVIDE SEAMLESS EXPERIENCE TO PASSENGERS TO BOOST THE ADOPTION OF MARINE AND MARINE MANAGEMENT SOFTWARE AMONG COMMERCIAL END USERS

TABLE 77 COMMERCIAL: MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 78 COMMERCIAL: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

11.3 DEFENSE

11.3.1 THE EVER-INCREASING CYBERATTACK AND ENHANCED PERFORMANCE TO BOOST THE ADOPTION OF MARINE AND MARINE MANAGEMENT SOFTWARE AMID DEFENSE END USERS

TABLE 79 DEFENSE: MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 80 DEFENSE: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

12 MARINE AND MARINE MANAGEMENT SOFTWARE MARKET, BY REGION (Page No. - 136)

12.1 INTRODUCTION

FIGURE 46 INDIA TO REGISTER THE HIGHEST CAGR DURING THE FORECAST PERIOD

FIGURE 47 ASIA PACIFIC TO WITNESS THE HIGHEST CAGR DURING THE FORECAST PERIOD

TABLE 81 MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 82 MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

12.2 NORTH AMERICA

12.2.1 NORTH AMERICA: COVID–19 IMPACT

12.2.2 NORTH AMERICA: REGULATIONS

12.2.2.1 Health Insurance Portability and Accountability Act of 1996

12.2.2.2 California Consumer Privacy Act

12.2.2.3 Gramm–Leach–Bliley Act

12.2.2.4 Health Information Technology for Economic and Clinical Health Act

12.2.2.5 Sarbanes Oxley Act

12.2.2.6 Federal Information Security Management Act

12.2.2.7 Payment Card Industry Data Security Standard

12.2.2.8 Federal Information Processing Standards

FIGURE 48 NORTH AMERICA: MARKET SNAPSHOT

TABLE 83 NORTH AMERICA: MARINE AND MARINE MANAGEMENT SOFTWARE MARKET SIZE, BY COMPONENT, 2017–2020 (USD MILLION)

TABLE 84 NORTH AMERICA: MARKET SIZE, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 85 NORTH AMERICA: MARKET SIZE, BY LOCATION, 2017–2020 (USD MILLION)

TABLE 86 NORTH AMERICA: MARKET SIZE, BY LOCATION, 2021–2026 (USD MILLION)

TABLE 87 NORTH AMERICA: MARKET SIZE, BY SERVICE, 2017–2020 (USD MILLION)

TABLE 88 NORTH AMERICA: MARKET SIZE, BY SERVICE, 2021–2026 (USD MILLION)

TABLE 89 NORTH AMERICA: MARKET SIZE, BY PROFESSIONAL SERVICE, 2017–2020 (USD MILLION)

TABLE 90 NORTH AMERICA: MARKET SIZE, BY PROFESSIONAL SERVICE, 2021–2026 (USD MILLION)

TABLE 91 NORTH AMERICA: MARKET SIZE, BY ORGANIZATION SIZE, 2017–2020 (USD MILLION)

TABLE 92 NORTH AMERICA: MARKET SIZE, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

TABLE 93 NORTH AMERICA: MARINE AND MARINE MANAGEMENT SOFTWARE MARKET SIZE, BY DEPLOYMENT MODE, 2017–2020 (USD MILLION)

TABLE 94 NORTH AMERICA: MARKET SIZE, BY DEPLOYMENT MODE, 2021–2026 (USD MILLION)

TABLE 95 NORTH AMERICA: MARKET SIZE, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 96 NORTH AMERICA: MARKET SIZE, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 97 NORTH AMERICA: MARKET SIZE, BY SOFTWARE, 2017–2020 (USD MILLION)

TABLE 98 NORTH AMERICA: MARKET SIZE, BY SOFTWARE TYPE, 2021–2026 (USD MILLION)

TABLE 99 NORTH AMERICA: MARKET SIZE, BY END USER, 2017–2020 (USD MILLION)

TABLE 100 NORTH AMERICA: MARKET SIZE, BY END USER, 2021–2026 (USD MILLION)

TABLE 101 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 102 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

12.2.3 UNITED STATES

12.2.3.1 With increasing demand for advanced shipping operations, companies in the US to implement cloud-based marine and marine management software to optimize vessel performance and costs

12.2.4 CANADA

12.2.4.1 Increase in investments by the government in various digital initiatives and growing trade data to grow the marine and marine management software market in Canada

12.3 EUROPE

12.3.1 EUROPE: COVID–19 IMPACT

12.3.2 EUROPE: REGULATIONS

12.3.2.1 General Data Protection Regulation

12.3.2.2 European Committee for Standardization

12.3.2.3 European Technical Standards Institute

TABLE 103 EUROPE: MARKET SIZE, BY COMPONENT, 2017–2020 (USD MILLION)

TABLE 104 EUROPE: MARKET SIZE, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 105 EUROPE: MARKET SIZE, BY LOCATION, 2017–2020 (USD MILLION)

TABLE 106 EUROPE: MARKET SIZE, BY LOCATION, 2021–2026 (USD MILLION)

TABLE 107 EUROPE: MARKET SIZE, BY SERVICE, 2017–2020 (USD MILLION)

TABLE 108 EUROPE: MARKET SIZE, BY SERVICE, 2021–2026 (USD MILLION)

TABLE 109 EUROPE: MARKET SIZE, BY PROFESSIONAL SERVICE, 2017–2020 (USD MILLION)

TABLE 110 EUROPE: MARKET SIZE, BY PROFESSIONAL SERVICE, 2021–2026 (USD MILLION)

TABLE 111 EUROPE: MARKET SIZE, BY ORGANIZATION SIZE, 2017–2020 (USD MILLION)

TABLE 112 EUROPE: MARKET SIZE, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

TABLE 113 EUROPE: MARKET SIZE, BY DEPLOYMENT MODE, 2017–2020 (USD MILLION)

TABLE 114 EUROPE: MARKET SIZE, BY DEPLOYMENT MODE, 2021–2026 (USD MILLION)

TABLE 115 EUROPE: MARINE AND MARINE MANAGEMENT SOFTWARE MARKET SIZE, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 116 EUROPE: MARKET SIZE, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 117 EUROPE: MARKET SIZE, BY SOFTWARE, 2017–2020 (USD MILLION)

TABLE 118 EUROPE: MARKET SIZE, BY SOFTWARE TYPE, 2021–2026 (USD MILLION)

TABLE 119 EUROPE: MARKET SIZE, BY END USER, 2017–2020 (USD MILLION)

TABLE 120 EUROPE: MARKET SIZE, BY END USER, 2021–2026 (USD MILLION)

TABLE 121 EUROPE: MARKET SIZE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 122 EUROPE: MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

12.3.3 UNITED KINGDOM

12.3.3.1 Increase in the usage of mobile-based marine software to lead shipping companies to manage crew performance to drive the adoption of marine and marine management software and services across the UK

12.3.4 GERMANY

12.3.4.1 Increase in the usage of smartphones and digital spending to drive the growth of the marine and marine management software market in Germany

12.3.5 FRANCE

12.3.5.1 Growing concern of shipping companies to effectively manage crew and enhance productivity to drive the demand for marine and marine management software in France

12.3.6 REST OF EUROPE

12.4 ASIA PACIFIC

12.4.1 ASIA PACIFIC: COVID–19 IMPACT

12.4.2 ASIA PACIFIC: REGULATIONS

12.4.2.1 Privacy Commissioner for Personal Data

12.4.2.2 Act on the Protection of Personal Information

12.4.2.3 Critical Information Infrastructure

12.4.2.4 International Organization for Standardization 27001

12.4.2.5 Personal Data Protection Act

FIGURE 49 ASIA PACIFIC: MARKET SNAPSHOT

TABLE 123 ASIA PACIFIC: MARINE AND MARINE MANAGEMENT SOFTWARE MARKET SIZE, BY COMPONENT, 2017–2020 (USD MILLION)

TABLE 124 ASIA PACIFIC: MARKET SIZE, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 125 ASIA PACIFIC: MARKET SIZE, BY LOCATION, 2017–2020 (USD MILLION)

TABLE 126 ASIA PACIFIC: MARKET SIZE, BY LOCATION, 2021–2026 (USD MILLION)

TABLE 127 ASIA PACIFIC: MARKET SIZE, BY SERVICE, 2017–2020 (USD MILLION)

TABLE 128 ASIA PACIFIC: MARKET SIZE, BY SERVICE, 2021–2026 (USD MILLION)

TABLE 129 ASIA PACIFIC: MARKET SIZE, BY PROFESSIONAL SERVICE, 2017–2020 (USD MILLION)

TABLE 130 ASIA PACIFIC: MARKET SIZE, BY PROFESSIONAL SERVICE, 2021–2026 (USD MILLION)

TABLE 131 ASIA PACIFIC: MARKET SIZE, BY ORGANIZATION SIZE, 2017–2020 (USD MILLION)

TABLE 132 ASIA PACIFIC: MARKET SIZE, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

TABLE 133 ASIA PACIFIC: MARKET SIZE, BY DEPLOYMENT MODE, 2017–2020 (USD MILLION)

TABLE 134 ASIA PACIFIC: MARKET SIZE, BY DEPLOYMENT MODE, 2021–2026 (USD MILLION)

TABLE 135 ASIA PACIFIC: MARINE AND MARINE MANAGEMENT SOFTWARE MARKET SIZE, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 136 ASIA PACIFIC: MARKET SIZE, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 137 ASIA PACIFIC: MARKET SIZE, BY SOFTWARE TYPE, 2017–2020 (USD MILLION)

TABLE 138 ASIA PACIFIC: MARKET SIZE, BY SOFTWARE TYPE, 2021–2026 (USD MILLION)

TABLE 139 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 140 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

12.4.3 CHINA

12.4.3.1 Growing concern of Chinese vendors to track and monitor vessel performance and ship locations to drive the demand for marine and marine management software

12.4.4 SINGAPORE

12.4.4.1 Increasing use of smartphones to drive the adoption of mobile-based marine and marine management software in Singapore to better enhance crew performance and track ship locations in real time

12.4.5 INDIA

12.4.5.1 The growing concern of companies across India to effectively handle crew performance and have better shipping experience to drive the demand for marine and marine management software

12.4.6 REST OF ASIA PACIFIC

12.5 MIDDLE EAST AND AFRICA

12.5.1 MIDDLE EAST AND AFRICA: COVID–19 IMPACT

12.5.2 MIDDLE EAST AND AFRICA: REGULATIONS

12.5.2.1 Israeli Privacy Protection Regulations (Data Security), 5777–2017

12.5.2.2 Cloud Computing Framework

12.5.2.3 GDPR Applicability in the Kingdom of Saudi Arabia (KSA)

12.5.2.4 Protection of Personal Information Act

TABLE 141 MIDDLE EAST AND AFRICA: MARINE AND MARINE MANAGEMENT SOFTWARE MARKET SIZE, BY COMPONENT, 2017–2020 (USD MILLION)

TABLE 142 MIDDLE EAST AND AFRICA: MARKET SIZE, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 143 MIDDLE EAST AND AFRICA: MARKET SIZE, BY LOCATION, 2017–2020 (USD MILLION)

TABLE 144 MIDDLE EAST AND AFRICA: MARKET SIZE, BY LOCATION, 2021–2026 (USD MILLION)

TABLE 145 MIDDLE EAST AND AFRICA: MARKET SIZE, BY SERVICE, 2017–2020 (USD MILLION)

TABLE 146 MIDDLE EAST AND AFRICA: MARKET SIZE, BY SERVICE, 2021–2026 (USD MILLION)

TABLE 147 MIDDLE EAST AND AFRICA: MARKET SIZE, BY PROFESSIONAL SERVICE, 2017–2020 (USD MILLION)

TABLE 148 MIDDLE EAST AND AFRICA: MARKET SIZE, BY PROFESSIONAL SERVICE, 2021–2026 (USD MILLION)

TABLE 149 MIDDLE EAST AND AFRICA: MARKET SIZE, BY ORGANIZATION SIZE, 2017–2020 (USD MILLION)

TABLE 150 MIDDLE EAST AND AFRICA: MARKET SIZE, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

TABLE 151 MIDDLE EAST AND AFRICA: MARKET SIZE, BY DEPLOYMENT MODE, 2017–2020 (USD MILLION)

TABLE 152 MIDDLE EAST AND AFRICA: MARKET SIZE, BY DEPLOYMENT MODE, 2021–2026 (USD MILLION)

TABLE 153 MIDDLE EAST AND AFRICA: MARINE AND MARINE MANAGEMENT SOFTWARE MARKET SIZE, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 154 MIDDLE EAST AND AFRICA: MARKET SIZE, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 155 MIDDLE EAST AND AFRICA: MARKET SIZE, BY SOFTWARE TYPE, 2017–2020 (USD MILLION)

TABLE 156 MIDDLE EAST AND AFRICA: MARKET SIZE, BY SOFTWARE TYPE, 2021–2026 (USD MILLION)

TABLE 157 MIDDLE EAST AND AFRICA: MARKET SIZE, BY END USER, 2017–2020 (USD MILLION)

TABLE 158 MIDDLE EAST AND AFRICA: MARKET SIZE, BY END USER, 2021–2026 (USD MILLION)

TABLE 159 MIDDLE EAST AND AFRICA: MARKET SIZE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 160 MIDDLE EAST AND AFRICA: MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

12.5.3 KINGDOM OF SAUDI ARABIA

12.5.3.1 Growing need of companies across KSA to achieve marine industry-specific regulatory compliance, provide personalized digital experience, and improve vessel performance to drive the demand for marine and marine management software

12.5.4 UNITED ARAB EMIRATES

12.5.4.1 Increase in government support and digitalization and the adoption of technological advancements to drive the demand for marine and marine management software across UAE

12.5.5 SOUTH AFRICA

12.5.5.1 Increasing awareness of shipping companies to effectively manage complex shipping operations to drive the demand for marine and marine management software across South Africa

12.5.6 REST OF THE MIDDLE EAST AND AFRICA

12.6 LATIN AMERICA

12.6.1 LATIN AMERICA: COVID–19 IMPACT

12.6.2 LATIN AMERICA: REGULATIONS

12.6.2.1 Brazil Data Protection Law

12.6.2.2 Argentina Personal Data Protection Law No. 25.326

TABLE 161 LATIN AMERICA: MARINE AND MARINE MANAGEMENT SOFTWARE MARKET SIZE, BY COMPONENT, 2017–2020 (USD MILLION)

TABLE 162 LATIN AMERICA: MARKET SIZE, BY COMPONENT, 2021–2026 (USD MILLION)

TABLE 163 LATIN AMERICA: MARKET SIZE, BY LOCATION, 2017–2020 (USD MILLION)

TABLE 164 LATIN AMERICA: MARKET SIZE, BY LOCATION, 2021–2026 (USD MILLION)

TABLE 165 LATIN AMERICA: MARKET SIZE, BY SERVICE, 2017–2020 (USD MILLION)

TABLE 166 LATIN AMERICA: MARKET SIZE, BY SERVICE, 2021–2026 (USD MILLION)

TABLE 167 LATIN AMERICA: MARKET SIZE, BY PROFESSIONAL SERVICE, 2017–2020 (USD MILLION)

TABLE 168 LATIN AMERICA: MARKET SIZE, BY PROFESSIONAL SERVICE, 2021–2026 (USD MILLION)

TABLE 169 LATIN AMERICA: MARKET SIZE, BY ORGANIZATION SIZE, 2017–2020 (USD MILLION)

TABLE 170 LATIN AMERICA: MARKET SIZE, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

TABLE 171 LATIN AMERICA: MARKET SIZE, BY DEPLOYMENT MODE, 2017–2020 (USD MILLION)

TABLE 172 LATIN AMERICA: MARKET SIZE, BY DEPLOYMENT MODE, 2021–2026 (USD MILLION)

TABLE 173 LATIN AMERICA: MARKET SIZE, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 174 LATIN AMERICA: MARINE AND MARINE MANAGEMENT SOFTWARE MARKET SIZE, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 175 LATIN AMERICA: MARKET SIZE, BY SOFTWARE TYPE, 2017–2020 (USD MILLION)

TABLE 176 LATIN AMERICA: MARKET SIZE, BY SOFTWARE TYPE, 2021–2026 (USD MILLION)

TABLE 177 LATIN AMERICA: MARKET SIZE, BY END USER, 2017–2020 (USD MILLION)

TABLE 178 LATIN AMERICA: MARKET SIZE, BY END USER, 2021–2026 (USD MILLION)

TABLE 179 LATIN AMERICA: MARKET SIZE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 180 LATIN AMERICA: MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

12.6.3 BRAZIL

12.6.3.1 The evolution of smartphone penetration across shipping companies to drive the need for mobile-based marine and marine management software in brazil

12.6.4 MEXICO

12.6.4.1 The need to enhance vessel performance and overall productivity to drive the marine and marine management software market in Mexico

12.6.5 REST OF LATIN AMERICA

13 COMPETITIVE LANDSCAPE (Page No. - 192)

13.1 OVERVIEW

13.2 KEY PLAYER STRATEGIES

13.3 HISTORICAL REVENUE ANALYSIS OF KEY MARKET PLAYERS

FIGURE 50 REVENUE ANALYSIS OF KEY MARKET PLAYERS

13.4 COMPANY EVALUATION MATRIX DEFINITIONS AND METHODOLOGY

13.4.1 STAR

13.4.2 EMERGING LEADERS

13.4.3 PERVASIVE

13.4.4 PARTICIPANTS

FIGURE 51 MARINE AND MARINE MANAGEMENT SOFTWARE MARKET (GLOBAL), COMPANY EVALUATION MATRIX, 2020

13.5 STRENGTH OF PRODUCT PORTFOLIO

FIGURE 52 PRODUCT PORTFOLIO ANALYSIS OF TOP PLAYERS IN THE MARKET

13.6 BUSINESS STRATEGY EXCELLENCE

FIGURE 53 BUSINESS STRATEGY EXCELLENCE OF TOP PLAYERS IN THE MARKET

13.7 RANKING OF KEY MARKET PLAYERS IN THE MARKET, 2020

FIGURE 54 RANKING OF KEY PLAYERS, 2020

13.8 COMPANY (MAJOR PLAYERS) PRODUCT FOOTPRINT ANALYSIS

TABLE 181 COMPANY (MAJOR PLAYERS) PRODUCT FOOTPRINT

TABLE 182 COMPANY (MAJOR PLAYERS) REGION FOOTPRINT

13.9 STARTUP/SME EVALUATION MATRIX, 2020

13.9.1 PROGRESSIVE COMPANIES

13.9.2 RESPONSIVE COMPANIES

13.9.3 DYNAMIC COMPANIES

13.9.4 STARTING BLOCKS

FIGURE 55 MARINE AND MARINE MANAGEMENT SOFTWARE MARKET (GLOBAL), STARTUP/SME EVALUATION QUADRANT, 2020

13.10 STRENGTH OF PRODUCT PORTFOLIO (STARTUPS)

FIGURE 56 PRODUCT PORTFOLIO ANALYSIS OF TOP STARTUPS IN THE MARKET

13.11 BUSINESS STRATEGY EXCELLENCE (STARTUPS)

FIGURE 57 BUSINESS STRATEGY EXCELLENCE OF TOP STARTUPS IN THE MARKET

13.12 COMPANY (STARTUPS/-SMES) PRODUCT FOOTPRINT ANALYSIS

TABLE 183 COMPANY (STARTUPS/SMES) PRODUCT FOOTPRINT

TABLE 184 COMPANY (STARTUP/SME) REGION FOOTPRINT

13.13 COMPETITIVE SCENARIO

13.13.1 NEW SOLUTION LAUNCHES AND PRODUCT ENHANCEMENTS

TABLE 185 NEW SOLUTION LAUNCHES AND PRODUCT ENHANCEMENTS, 2018–2021

13.13.2 DEALS

TABLE 186 DEALS, 2019–2021

13.13.3 OTHERS

TABLE 187 OTHERS, 2020–2021

14 COMPANY PROFILES (Page No. - 209)

14.1 INTRODUCTION

14.2 MAJOR PLAYERS

(Business Overview, Products, Key Insights, Recent Developments, COVID-19 Developments, MnM View)*

14.2.1 ORACLE

TABLE 188 ORACLE: BUSINESS OVERVIEW

FIGURE 58 ORACLE: COMPANY SNAPSHOT

TABLE 189 ORACLE: SOLUTIONS/SERVICES OFFERED

TABLE 190 ORACLE: MARINE AND MARINE MANAGEMENT MARKET: SOLUTION LAUNCHES AND ENHANCEMENTS

TABLE 191 ORACLE: MARINE AND MARINE MANAGEMENT SOFTWARE MARKET: DEALS

14.2.2 ABB

TABLE 192 ABB: BUSINESS OVERVIEW

FIGURE 59 ABB: FINANCIAL OVERVIEW

TABLE 193 ABB: SOLUTIONS/SERVICES OFFERED

TABLE 194 ABB: MARKET: SOLUTION LAUNCHES AND ENHANCEMENTS

TABLE 195 ABB: MARKET: OTHERS

TABLE 196 ABB: WARE MARKET: DEALS

14.2.3 DOCKMASTER

TABLE 197 DOCKMASTER: BUSINESS OVERVIEW

TABLE 198 DOCKMASTER SOLUTIONS/SERVICES OFFERED

TABLE 199 DOCK MASTER: MARKET: SOLUTION LAUNCHES AND ENHANCEMENTS

TABLE 200 DOCKMASTER: MARKET: DEALS

14.2.4 MARINA MASTER

TABLE 201 MARINA MASTER: MARKET

TABLE 202 MARINA MASTER: SOLUTIONS/SERVICES OFFERED

TABLE 203 MARINA MASTER: MARKET: SOLUTION LAUNCHES AND ENHANCEMENTS

TABLE 204 MARINA MASTER: MARINE AND MARINE MANAGEMENT SOFTWARE MARKET: DEALS

14.2.5 MARINA CLOUD

TABLE 205 MARINA CLOUD: BUSINESS OVERVIEW

TABLE 206 MARINA CLOUD: SOLUTIONS/SERVICES OFFERED

TABLE 207 MARINA CLOUD: MARINE AND MARINE MANAGEMENT SOFTWARE MARKE: NEW PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 208 MARINA CLOUD: MARINA AND MARINA SOFTWARE MARKET: DEALS

14.2.6 LLOYD’S REGISTER

TABLE 209 LLOYD’S REGISTER: BUSINESS OVERVIEW

TABLE 210 LLOYD’S REGISTER: SOLUTIONS/SERVICES OFFERED

TABLE 211 LLYOD’S REGISTER: MARINE AND MARINE MANAGEMENT SOFTWARE MARKET: SOLUTION LAUNCHES AND ENHANCEMENTS

TABLE 212 LLYOD’S REGISTER: MARKET: DEALS

14.2.7 TIMEZERO

TABLE 213 TIMEZERO: BUSINESS OVERVIEW

TABLE 214 TIMEZERO: SOLUTIONS/SERVICES OFFERED

TABLE 215 TIMEZERO: MARKET: SOLUTION LAUNCHES AND ENHANCEMENTS

TABLE 216 TIMEZERO MARINE AND MARINE SOFTWARE MANAGEMENT SOFTWARE MARKET: DEALS

14.2.8 SCRIBBLE SOFTWARE

TABLE 217 SCRIBBLE SOFTWARE: BUSINESS OVERVIEW

TABLE 218 SCRIBBLE SOFTWARE: SOLUTIONS/SERVICES OFFERED

TABLE 219 SCRIBBLE SOFTWARE: MARKET: SOLUTION LAUNCHES AND ENHANCEMENTS

TABLE 220 SCRIBBLE OFFICE: MARKET: DEALS

14.2.9 MARINECFO

TABLE 221 MARINECFO: BUSINESS OVERVIEW

TABLE 222 MARINECFO: SOLUTIONS/SERVICES OFFERED

TABLE 223 MARINECFO: MARINE AND MARINE MANAGEMENT SOFTWARE MARKET: SOLUTION LAUNCHES AND ENHANCEMENTS

TABLE 224 MARINECFO: MARKET: DEALS

14.2.10 CHETU

TABLE 225 CHETU: BUSINESS OVERVIEW

TABLE 226 CHETU: SOLUTIONS/ SERVICES OFFERED

TABLE 227 CHETU: MARINE AND MARINE MANAGEMENT SOLUTION MARKET: OTHERS

TABLE 228 CHETU: MARKET: DEALS

14.2.11 MESPAS

TABLE 229 MESPAS: BUSINESS OVERVIEW

TABLE 230 MESPAS: SOLUTIONS/SERVICES OFFERED

TABLE 231 MESPAS: MARKET: SOLUTION LAUNCHES AND ENHANCEMENTS

TABLE 232 MESPAS: MARINE AND MARINE MANAGEMENT SOFTWARE MARKET: DEALS

14.2.12 RAYMARINE

14.2.13 AYDEN MARINE

14.2.14 OCEANMANAGER

14.2.15 INNOVEZ ONE

14.2.16 RMS

14.2.17 NAUTICAL SOFTWARE

14.2.18 CORVANT

*Details on Business Overview, Products, Key Insights, Recent Developments,COVID-19 Developments MnM View might not be captured in case of unlisted companies.

14.3 STARTUP/SME PROFILES

14.3.1 DOCKWA

14.3.2 SWELL ADVANTAGE

14.3.3 MARINA AHOY

14.3.4 HARBA

14.3.5 HARBOUR ASSIST

14.3.6 HAVENSTAR

14.3.7 GESTALT SYSTEMS

14.3.8 SEAHUB

14.3.9 BLUESHELL

15 ADJACENT AND RELATED MARKETS (Page No. - 254)

15.1 INTRODUCTION

15.2 SUPPLY CHAIN ANALYTICS MARKET – GLOBAL FORECAST TO 2025

15.2.1 MARKET DEFINITION

15.2.2 MARKET OVERVIEW

TABLE 233 SUPPLY CHAIN ANALYTICS MARKET SIZE AND GROWTH RATE, 2014–2019 (USD MILLION, Y–O–Y %)

TABLE 234 SUPPLY CHAIN ANALYTICS MARKET SIZE AND GROWTH RATE, 2019–2025 (USD MILLION, Y–O–Y %)

15.2.3 SUPPLY CHAIN ANALYTICS MARKET, BY COMPONENT

TABLE 235 SUPPLY CHAIN ANALYTICS MARKET SIZE, BY COMPONENT, 2014–2019 (USD MILLION)

TABLE 236 SUPPLY CHAIN ANALYTICS MARKET SIZE, BY COMPONENT, 2019–2025 (USD MILLION)

15.2.4 SUPPLY CHAIN ANALYTICS MARKET, BY DEPLOYMENT MODEL

TABLE 237 SUPPLY CHAIN ANALYTICS MARKET SIZE, BY DEPLOYMENT MODEL, 2014–2019 (USD MILLION)

TABLE 238 SUPPLY CHAIN ANALYTICS MARKET SIZE, BY DEPLOYMENT MODE, 2019–2025 (USD MILLION)

15.2.5 SUPPLY CHAIN ANALYTICS MARKET, BY ORGANIZATION SIZE

TABLE 239 SUPPLY CHAIN ANALYTICS MARKET SIZE, BY ORGANIZATION SIZE, 2014–2019 (USD MILLION)

TABLE 240 SUPPLY CHAIN ANALYTICS MARKET SIZE, BY ORGANIZATION SIZE, 2019–2025 (USD MILLION)

15.2.6 SUPPLY CHAIN ANALYTICS MARKET, BY INDUSTRY VERTICAL

TABLE 241 SUPPLY CHAIN ANALYTICS MARKET SIZE, BY INDUSTRY VERTICAL, 2014–2019 (USD MILLION)

TABLE 242 SUPPLY CHAIN ANALYTICS MARKET SIZE, BY INDUSTRY VERTICAL, 2019–2025 (USD MILLION)

15.2.7 SUPPLY CHAIN ANALYTICS MARKET, BY REGION

TABLE 243 SUPPLY CHAIN ANALYTICS MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 244 SUPPLY CHAIN ANALYTICS MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

15.3 MOBILE APPS AND WEB ANALYTICS MARKET – GLOBAL FORECAST TO 2025

15.3.1 MARKET DEFINITION

15.3.2 MARKET OVERVIEW

TABLE 245 MOBILE APPS AND WEB ANALYTICS MARKET SIZE AND GROWTH RATE, 2016–2019 (USD MILLION, Y–O–Y %)

TABLE 246 MOBILE APPS AND WEB ANALYTICS MARKET SIZE AND GROWTH RATE, 2019–2025 (USD MILLION, Y–O–Y %)

15.3.3 MOBILE APPS AND WEB ANALYTICS MARKET, BY COMPONENT

TABLE 247 MOBILE APPS AND WEB ANALYTICS MARKET SIZE, BY COMPONENT, 2016–2019 (USD MILLION)

TABLE 248 MOBILE APPS AND WEB ANALYTICS MARKET SIZE, BY COMPONENT, 2019–2025 (USD MILLION)

15.3.4 MOBILE APPS AND WEB ANALYTICS MARKET, BY APPLICATION

TABLE 249 MOBILE APPS AND WEB ANALYTICS MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 250 MOBILE APPS AND WEB ANALYTICS MARKET SIZE, BY APPLICATION, 2019–2025 (USD MILLION)

15.3.5 MOBILE APPS AND WEB ANALYTICS MARKET, BY DEPLOYMENT MODE

TABLE 251 MOBILE APPS AND WEB ANALYTICS MARKET SIZE, BY DEPLOYMENT MODE, 2016–2019 (USD MILLION)

TABLE 252 MOBILE APPS AND WEB ANALYTICS MARKET SIZE, BY DEPLOYMENT MODE, 2019–2025 (USD MILLION)

15.3.6 MOBILE APPS AND WEB ANALYTICS MARKET, BY ORGANIZATION SIZE

TABLE 253 MOBILE APPS AND WEB ANALYTICS MARKET SIZE, BY ORGANIZATION SIZE, 2016–2019 (USD MILLION)

TABLE 254 MOBILE APPS AND WEB ANALYTICS MARKET SIZE, BY ORGANIZATION SIZE, 2019–2025 (USD MILLION)

15.3.7 MOBILE APPS AND WEB ANALYTICS MARKET, BY INDUSTRY VERTICAL

TABLE 255 MOBILE APPS AND WEB ANALYTICS MARKET SIZE, BY INDUSTRY VERTICAL, 2016–2019 (USD MILLION)

TABLE 256 MOBILE APPS AND WEB ANALYTICS MARKET SIZE, BY INDUSTRY VERTICAL, 2019–2025 (USD MILLION)

15.3.8 MOBILE APPS AND WEB ANALYTICS MARKET, BY REGION

TABLE 257 MOBILE APPS AND WEB ANALYTICS MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 258 MOBILE APPS AND WEB ANALYTICS MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

16 APPENDIX (Page No. - 267)

16.1 INDUSTRY EXPERTS

16.2 DISCUSSION GUIDE

16.3 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

16.4 AVAILABLE CUSTOMIZATIONS

16.5 RELATED REPORTS

16.6 AUTHOR DETAILS

The study involved four major activities in estimating the current market size of the marine and marine management software market. Extensive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were used to estimate the total market size. After that, the market breakup and data triangulation procedures were used to estimate the market size of the segments and subsegments of the marine software market.

Secondary Research

In the secondary research process, various sources were referred to for identifying and collecting information for the study. The secondary sources included annual reports, press releases, investor presentations of companies; white papers; journals; and certified publications and articles from recognized authors, directories, and databases.

Primary Research

Various primary sources from both supply and demand sides were interviewed to obtain qualitative and quantitative information on the market. The primary sources from the supply side included various industry experts, including Chief X Officers (CXOs); Vice Presidents (VPs); directors from business development, marketing, and product development/innovation teams; related key executives from marine software vendors, system integrators, professional service providers, industry associations, and consultants; and key opinion leaders. All possible parameters that affect the market covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the final quantitative and qualitative data.

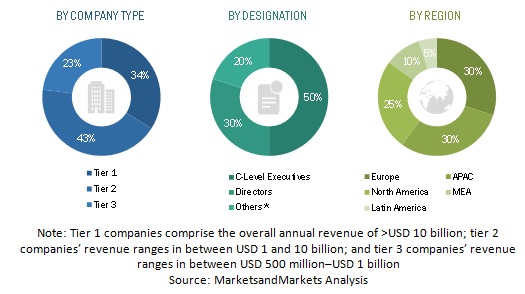

The following is the breakup of primary profiles:

To know about the assumptions considered for the study, download the pdf brochure

Marine and Marine Management Software Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the marine and marine management software market. The top-down approach was used to derive the revenue contribution of top vendors and their offerings in the marine and marine management software market. The bottom-up approach was used to arrive at the overall market size of the global marine and marine management software market using key companies’ revenue and their offerings in the market. The research methodology used to estimate the market size includes the following:

- The key players in the market were identified through extensive secondary research.

- The market size, in terms of value, was determined through primary and secondary research processes.

- All percentages, shares, and breakups were determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size using the market size estimation processes as explained above, the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation, and market breakup procedures were employed, wherever applicable. The overall market size was then used in the top-down procedure to estimate the size of other individual markets via percentage splits of the market segmentation.

Report Objectives

- To define, describe, and predict the marine and marine management software market by component (software and services), location, application, deployment mode, organization size, end user, and region

- To provide detailed information related to major factors (drivers, restraints, opportunities, and industry-specific challenges) influencing the market growth

- To analyze opportunities in the market and provide details of the competitive landscape for stakeholders and market leaders

- To forecast the market size of segments for five main regions: North America, Europe, Asia Pacific (APAC), Middle East and Africa (MEA), and Latin America

- To profile key players and comprehensively analyze their market rankings and core competencies

- To analyze competitive developments, such as partnerships, new product launches, and mergers and acquisitions, in the market

- To analyze the impact of the COVID-19 pandemic on the marine and marine management software market

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

- Product matrix provides a detailed comparison of the product portfolio of each company

Geographic Analysis

- Further breakup of the North American marine and marine management software market

- Further breakup of the European market

- Further breakup of the APAC market

- Further breakup of the Latin American market

- Further breakup of the MEA market

Company Information

- Detailed analysis and profiling of additional market players up to 5

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Marine and Marine Management Software Market