Mobile Apps and Web Analytics Market by Component (Solutions & Services), Solution (Data Analytics, Data Discovery), Application (Content Marketing, Marketing Automation), Deployment Mode, Organization Size, Vertical and Region - Global Forecast to 2027

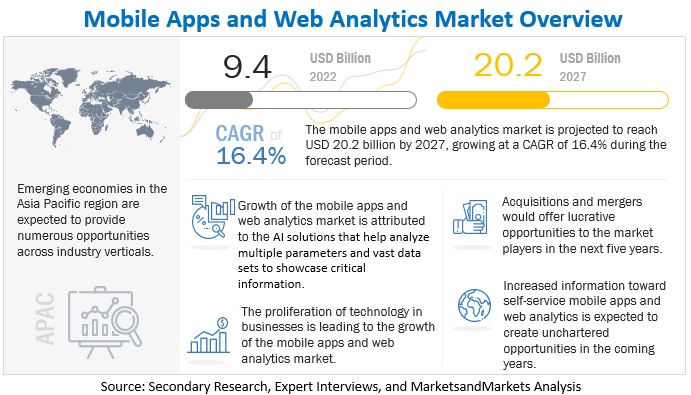

[313 Pages Report] The global Mobile Apps and Web Analytics market is projected to grow from USD 9.4 billion in 2022 to USD 20.2 billion by 2027, at a CAGR of 16.4% during the forecast period. SME initiatives in the area are focused on cloud services, which would speed up artificial intelligence and business analytics. Cloud will play a crucial role in enabling new platforms, services, and facilities that governments and businesses want to enable as digitalization occurs throughout the area. The Mobile Apps and Web Analytics market is segmented based on components, applications, deployment modes, organization sizes, verticals, and regions.

To know about the assumptions considered for the study, Request for Free Sample Report

Market Dynamics

Driver: Growing trend of digitalization

The rapid growth of the internet has changed the way customers shop. Many customers are using various mobile apps and websites for online shopping, and this trend is growing exponentially. With the growing use of smartphones, the use of the internet is also growing, which has created vast scope for retailers to sell their products online. During the past decade, the adoption of mobile devices, cloud solutions, and social media platforms has grown tremendously, which has created the business potential for mobile apps and web analytics. Middle Eastern customers prioritize their mobile devices above other channels and largely choose mobile apps.

Restraint: Data security and compliance issues

The Middle East public mobile app and web analytics market is expected to have slow development due to security and privacy concerns with data loss, breaches, unforeseen crises, application vulnerabilities, and cyber-attacks related to cloud-based solutions. Authorization management, access control, data aggregation and encryption, and communication security are just a few cloud-based security services available to address information security and data confidentiality issues. Major cloud providers are establishing data centers and commercial activities in this nation to meet the limitations in the Middle East mobile app and web analytics market due to the expanded client potential and growing digital transformation ambitions.

Opportunity: Government initiatives toward digitization

The governments of Middle Eastern nations are launching several programs, including Dubai Internet City (DIC) and the KSA Vision 2030, all of which have the same goal of making their nations fully digitally connected, from smart homes and smart cities to smart transportation systems. Because of these endeavors, the Middle East is on the verge of a significant digital upheaval. Blockchain and loT are the only technologies used in this digitalization. Due to the extensive land usage, there will be plenty of areas for future cyberattacks, making cybersecurity solutions and services necessary. The need to defend networks, endpoints, data, and other entities, such as autonomous automobiles, and smart homes, would also necessitate constant surveillance of possible cyberattacks after digitalization has made significant progress in the Middle East. Therefore, programs, such as DIC and KSA 2030 are anticipated to provide profitable prospects for Middle Eastern mobile apps and web analytics market players.

Challenge: High cost involved in disrupting existing infrastructure

Due to the many cutting-edge benefits that smart cities may provide, the notion of smart cities has been gaining popularity. However, several obstacles are preventing the industry from expanding. The large initial expenses of disrupting a city's infrastructure might impede market expansion. The sheer volume of financial responsibilities required for the projects has significantly contributed to the slowdown in market growth. The existing situation, however, is anticipated to change in the upcoming years due to the rise in popularity of several different investment strategies, including build transfer (B.T.), build operate transfer (B.O.T.), build own operate (B.O.O.), and public-private partnerships.

Healthcare & Life sciences vertical to register at the highest CAGR during the forecast period

The Mobile Apps and Web Analytics market by vertical is segmented into: BFSI, telecom, healthcare and life sciences, retail and e-commerce, government and defense, manufacturing, IT and ITeS, energy and utilities, transportation and logistics, and others (media and entertainment, travel and hospitality, and education and research). Among vertical, the healthcare & life sciences vertical registered to grow at a highest CAGR during the forecast period. The Mobile Apps and Web Analytics market is witnessing increased growth opportunities in the healthcare and life sciences vertical. The explosion of healthcare data in recent years is largely attributable to wearable and mobile devices that capture heart rate, blood pressure, physical activity, and other data. To guide better medical procedures, experts want to see data analytics used in clinical trials. Hospitals and other health institutions adopt mobile apps and web analytics solutions in their business applications to improve patients' overall experience. The solutions potentially speed up the detection of disease outbreaks, increase the time it takes for new pharmaceuticals to reach the market, tailor treatment based on a patient's DNA, and simplify the insurance and payment systems.

Mobile Advertising and Marketing Analytics segments register to account for the largest market size during the forecast period

Mobile advertising and marketing analytics can help organizations make better, quicker decisions by demystifying complex data and providing a unified view of campaign performance. It is more effective to measure the ROI of mobile marketing through consumer response rates. Knowing and choosing the best tracking solution is the first step in mobile advertising and marketing analytics. The main factor in optimizing mobile advertising campaigns and achieving KPIs is analytics. In addition to data demonstrating trends in user acquisition and retention, qualitative analysis enables one to delve deeper into the why of the conversion rates.

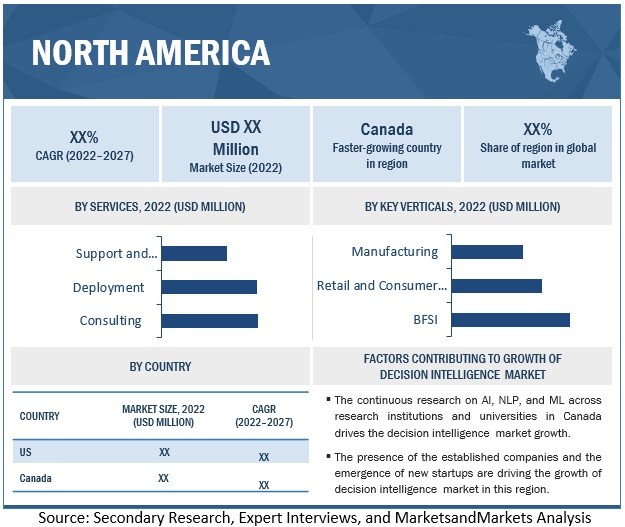

North America to account for the largest market size during the forecast period

North America is expected to have the largest market share in the Mobile Apps and Web Analytics market. The region has a well-established economy and has seen large-scale investments in AI-enabled infrastructure; because of this, both startups and well-established companies emphasize developing innovative AI-enabled solutions to cater to various industry verticals. The region has witnessed favorable conditions for market growth due to the implementation of data management technologies, government regulations, established player presence, and interest from enterprises to apply ML and BI solutions. Leading technology players such as Google, AWS, Salesforce, Microsoft, and IBM have been investing significantly in R&D activities for developing new AI-based solutions. These companies target higher revenue due to the increasing competition across North America. Apart from these established players, startups also receive funding from various bodies for their innovative ideas and products.

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

The Mobile Apps and Web Analytics vendors have implemented various types of organic and inorganic growth strategies, such as new product launches, product upgradations, partnerships and agreements, business expansions, and mergers and acquisitions to strengthen their offerings in the market. The major vendors in the global Mobile Apps and Web Analytics market include Microsoft (US), Google (US), Oracle (US), SAP (US), AWS, IBM (US), Teradata (US), Adobe (US), SAS Institute (US), Micro Focus (US), comScore (US), Salesforce (US), Splunk (US), Microstrategy (US), AT Internet (US), Webtrends (US), Tibco Software (US), Mixpanel (US), Upland Localytics (US), Amplitude Analytics (France), Qlik (US), Flurry (US), Cooldata (US), Countly (UK), Mobilebridge (Netherlands), Appsflyer (US), Uxcam (US), Incubasys (UAE), Datamatics Technologies (UAE), Alpha Byte (UAE), Celadon (UAE), Singular (Israel), Matomo (New Zealand), Plausible (Estonia), and Fathom (US).

Scope of the Report

|

Report Metrics |

Details |

|

Market size available for years |

2016–2027 |

|

Base year considered |

2022 |

|

Forecast period |

2022–2027 |

|

Forecast units |

USD Billion |

|

Segments covered |

Component, Application, Deployment Mode, Organization Size, Industry Vertical, and Region |

|

Geographies covered |

North America, Europe, Asia Pacific, Middle East & Africa, and Latin America |

|

Companies covered |

Microsoft (US), Google (US), Oracle (US), SAP (US), AWS, IBM (US), Teradata (US), Adobe (US), SAS Institute (US), Micro Focus (US), comScore (US), Salesforce (US), Splunk (US), Microstrategy (US), AT Internet (US), Webtrends (US), Tibco Software (US), Mixpanel (US), Upland Localytics (US), Amplitude Analytics (France), Qlik (US), Flurry (US), Cooldata (US), Countly (UK), Mobilebridge (Netherlands), Appsflyer (US), Uxcam (US), Incubasys (UAE), Datamatics Technologies (UAE), Alpha Byte (UAE), Celadon (UAE), Singular (Israel), Matomo (New Zealand), Plausible (Estonia), and Fathom (US). |

This research report categorizes the Mobile Apps and Web Analytics market based on components, solutions, application, deployment mode, organization size, vertical, and regions.

By Component:

- Solutions

- Services

By Solutions:

- Data Analytics

- Data Discovery

- Data Management

- Data Visualization

By Services:

- Consulting

- Support & Maintenance

- Integration & Deployment

By Deployment Mode:

- Cloud

- On-premises

By Organization Size:

- Large Enterprises

- SMEs

By Vertical:

- BFSI

- Retail & eCommerce

- Healthcare & Life Sciences

- Government & Public Sector

- Media & Entertainment

- Energy & Utilities

- Telecom

- IT and ITeS

- Manufacturing

- Transportation & Logistics

- Travel & Hospitality

- Other Verticals

By Region:

-

North America

- US

- Canada

-

Europe

- UK

- Germany

- France

- Rest of Europe

-

Asia Pacific

- China

- Japan

- India

- Australia & New Zealand

- Rest of Asia Pacific

-

Middle East & Africa

- UAE

- Kingdom of Saudi Arabia

- Israel

- Turkey

- Qatar

- South Africa

- Rest of Middle East & Africa

-

Latin America

- Brazil

- Mexico

- Rest of Latin America

Recent Developments:

- In December 2022, Splunk announced a five-year extension of its Strategic Collaboration Agreement (SCA) with Amazon Web Services (AWS).

- In November 2022, IBM (introduced new software to assist organizations in breaking down data and analytics silos to make data-driven choices fast and navigate unanticipated disruptions.

- In August 2022, Micro Focus announced a partnership with Google Cloud to enable the impending release of BigQuery remote functions.

- In May 2021, Google launched three new services, named “Dataplex, Analytics hub, and Datastream,” to empower customers with a unified data cloud platform.

- In January 2021, Information Builders’ purchase by TIBCO was announced. With this purchase, ibi’s data management and analytics capabilities have been added to the sophisticated TIBCO Connected Intelligence platform.

- In February 2020, Upland Software, one of the leading companies in enterprise work management software, acquired Localytics, a leading provider of mobile apps personalization and analytics solutions.

Frequently Asked Questions (FAQ):

What is a Mobile Apps and Web Analytics?

Mobile analytics solutions deal with the metrics specific to mobile websites and applications, analyzing visitor behavior in terms of engagement, conversion, and retention. This style of analytics looks at mobile web activities, including mobile apps, smartphone data, SMS messaging bots, QR codes, and other interactions on mobile devices.

Which countries are considered in the European region?

The report includes an analysis of the UK, Germany, and France in the European region.

Which are key verticals adopting Mobile Apps and Web Analytics solutions and services?

Key verticals adopting Mobile Apps and Web Analytics and services include BFSI, Retail & eCommerce, Healthcare & Life Sciences, Energy & Utilities, Telecom, IT & ITeS, Manufacturing, Transportation & Logistics, Travel & Hospitality and Other Verticals includes education, forestry & fishing and construction & real estate.

Which are the key drivers supporting the growth of the Mobile Apps and Web Analytics market?

The key drivers supporting the growth of the Mobile Apps and Web Analytics market include rising demand for AI and Machine Learning, widespread adoption of SME cloud storage and Growing trend of digitalization.

Who are the key vendors in the Mobile Apps and Web Analytics market?

The key vendors in the global Mobile Apps and Web Analytics market include Microsoft (US), Google (US), Oracle (US), SAP (US), AWS, IBM (US), Teradata (US), Adobe (US), SAS Institute (US), Micro Focus (US), comScore (US), Salesforce (US), Splunk (US), Microstrategy (US), AT Internet (US), Webtrends (US), Tibco Software (US), Mixpanel (US), Upland Localytics (US), Amplitude Analytics (France), Qlik (US), Flurry (US), Cooldata (US), Countly (UK), Mobilebridge (Netherlands), Appsflyer (US), Uxcam (US), Incubasys (UAE), Datamatics Technologies (UAE), Alpha Byte (UAE), Celadon (UAE), Singular (Israel), Matomo (New Zealand), Plausible (Estonia), and Fathom (US).

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Increasing focus on enhancing customer experience- Rising need for competitive differentiation- Growing demand for AI and machine learningRESTRAINTS- Complexity of data synchronizationOPPORTUNITIES- Increasing need to analyze large data- Growing use of mobile apps due to COVID-19CHALLENGES- Privacy and security concerns due to disconnect between consumers and businesses

-

5.3 ECOSYSTEM ANALYSIS

-

5.4 CASE STUDY ANALYSISBANKING, FINANCIAL SERVICES, AND INSURANCE- Case Study 1: FinServe increased its app adoption ratings by leveraging Upland Localytics’ digital expertiseMANUFACTURING- Case Study 2: CORT adopted Adobe’s analytics solutions to reach key demographic customersIT & TELECOM- Case Study 3: G2 gained actionable insights into user behavior with AmplitudeRETAIL & ECOMMERCE- Case Study 4: Leading consumer goods company built actionable media mix using Vetro’s productsENERGY & UTILITIES- Case Study 5: Teradata helped PG&E cater to diverse customers with specific needs

-

5.5 TECHNOLOGY ANALYSISSMART WEARABLESIOT AND SMART OBJECTSM-COMMERCEMOTION AND LOCATION SENSINGARTIFICIAL INTELLIGENCE AND MACHINE LEARNINGCHATBOTSAUGMENT REALITY AND VIRTUAL REALITYBEACON TECHNOLOGYWIRELESS 5G NETWORKCLOUD PLATFORM STORAGE/CLOUD COMPUTINGENTERPRISE APPSEDGE COMPUTING

- 5.6 VALUE CHAIN ANALYSIS

-

5.7 PORTER’S FIVE FORCES ANALYSISTHREAT FROM NEW ENTRANTSTHREAT FROM SUBSTITUTESBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSINTENSITY OF COMPETITIVE RIVALRY

- 5.8 PRICING MODEL ANALYSIS

-

5.9 PATENT ANALYSISMETHODOLOGYDOCUMENT TYPEINNOVATION AND PATENT APPLICATIONS- Top applicants

- 5.10 KEY CONFERENCES & EVENTS, 2022–2023

-

5.11 TARIFF AND REGULATORY LANDSCAPEREGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONSNORTH AMERICA: REGULATIONS- Personal Information Protection and Electronic Documents Act (PIPEDA)- Gramm-Leach-Bliley (GLB) Act- Health Insurance Portability and Accountability Act (HIPAA) of 1996- Federal Information Security Management Act (FISMA)- Federal Information Processing Standards (FIPS)- California Consumer Privacy Act (CSPA)EUROPE: TARIFFS AND REGULATIONS- GDPR 2016/679- General Data Protection Regulation- European Committee for Standardization (CEN)- European Technical Standards Institute (ETSI)

-

5.12 KEY STAKEHOLDERS AND BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

- 6.1 INTRODUCTION

- 6.2 COMPONENTS: MOBILE APPS AND WEB ANALYTICS MARKET DRIVERS

-

6.3 SOLUTIONSGROWING NEED TO LEVERAGE MOBILE APPS AND WEB ANALYTICS TO MANAGE DATA PROLIFERATIONDATA ANALYTICSDATA DISCOVERYDATA VISUALIZATIONDATA MANAGEMENT

-

6.4 SERVICESADOPTION OF MOBILE APPS AND WEB ANALYTICS TO FACILITATE GROWTHMANAGED SERVICESPROFESSIONAL SERVICES- Consulting- Support & maintenance- Deployment & integration

-

7.1 INTRODUCTIONDEPLOYMENT MODES: MOBILE APPS AND WEB ANALYTICS MARKET DRIVERS

-

7.2 ON-PREMISESSTRINGENT PRIVACY LAWS TO DRIVE GROWTH OF ON-PREMISES SOLUTIONS

-

7.3 CLOUDRISING FOCUS ON REDUCING OPERATIONAL COSTS AND INCREASING DATA ACCESSIBILITY

-

8.1 INTRODUCTIONORGANIZATION SIZES: MOBILE APPS AND WEB ANALYTICS MARKET DRIVERS

-

8.2 SMALL AND MEDIUM-SIZED ENTERPRISESGROWING NEED TO ANALYZE TARGET AUDIENCE

-

8.3 LARGE ENTERPRISESINCREASING FOCUS ON MAKING DATA-DRIVEN DECISIONS

- 9.1 INTRODUCTION

- 9.2 APPLICATIONS: MOBILE APPS AND WEB ANALYTICS MARKET DRIVERS

-

9.3 MOBILE ADVERTISING & MARKETING ANALYTICSMAJOR USE OF MARKETING ANALYTICS IN CUSTOMER RETENTION

-

9.4 SEARCH ENGINE TRACKING & RANKINGKEYWORD RANKINGS HELP INCREASE SALES

-

9.5 HEAT MAP ANALYTICSGROWING DEMAND TO LEVERAGE HEAT MAP ANALYTICS

-

9.6 IN-APP & WEB BEHAVIORAL ANALYSISGROWING NEED TO GAUGE USER BEHAVIOR TO TRACK ACHIEVEMENT

-

9.7 APPLICATION PERFORMANCE & ADVERTISING OPTIMIZATIONRECORDING PERFORMANCE AND IDENTIFYING ANOMALIES TO BOOST BROWSING EXPERIENCE

-

9.8 MARKETING AUTOMATIONINCREASED ADOPTION OF TECHNOLOGIES TO DESIGN CUSTOMER-CENTRIC BRANDS

-

9.9 CONTENT MARKETINGRISING NEED TO DETERMINE EFFECTIVENESS OF MARKETING CAMPAIGNS

-

9.10 SOCIAL MEDIA MANAGEMENTINCREASED USE OF SOCIAL MEDIA TO ENHANCE BRAND PRESENCE

- 9.11 OTHER APPLICATIONS

-

10.1 INTRODUCTIONVERTICALS: MOBILE APPS AND WEB ANALYTICS MARKET DRIVERS

-

10.2 BANKING, FINANCIAL SERVICES, AND INSURANCE (BFSI)RISING NEED TO IMPROVE BUSINESS PERFORMANCE AND OPERATIONAL EFFICIENCY

-

10.3 HEALTHCARE & LIFE SCIENCESINCREASED USE OF AI MODELS IN CRITICAL DECISION-MAKING

-

10.4 RETAIL & ECOMMERCERISING DEMAND FOR PERSONALIZED CUSTOMER EXPERIENCE

-

10.5 GOVERNMENT & PUBLIC SECTORMOBILE APPS AND WEB ANALYTICS PROVIDE ROBUST ENVIRONMENT

-

10.6 MEDIA & ENTERTAINMENTRAPID SPREAD OF DIGITAL TECHNOLOGY AND RISE OF INTERNET

-

10.7 TELECOMMUNICATIONSRISING NEED TO INCREASE CUSTOMER LIFETIME VALUE BY TRACKING NETWORK RELIABILITY

-

10.8 TRANSPORTATION & LOGISTICSGROWING NEED FOR TECHNOLOGICAL ADVANCEMENTS TO DRIVE GOOD CONSUMER EXPERIENCE

-

10.9 MANUFACTURINGGROWING NEED TO OPTIMIZE PLANT PRODUCTION

-

10.10 ENERGY & UTILITIESMOBILE APPS AND WEB ANALYTICS HELP MEET ENVIRONMENTAL GOALS

-

10.11 TRAVEL & HOSPITALITYENHANCED TRAVELING EXPERIENCE POSSIBLE THROUGH MOBILE APPS AND ANALYTICS

- 10.12 OTHER VERTICALS

-

11.1 INTRODUCTIONMOBILE APPS AND WEB ANALYTICS MARKET: IMPACT OF RECESSION

-

11.2 NORTH AMERICANORTH AMERICA: MOBILE APPS AND WEB ANALYTICS MARKET DRIVERSUS- Growing need for robust infrastructure, innovation, and initiativesCANADA- Advent of digital economy powered by IoT

-

11.3 EUROPEEUROPE: MOBILE APPS AND WEB ANALYTICS MARKET DRIVERSUK- Rising competition in retail industryGERMANY- Increased demand for technological development from various companiesFRANCE- Rising adoption of technology solutions for quick predictive resultsREST OF EUROPE

-

11.4 ASIA PACIFICASIA PACIFIC: MOBILE APPS AND WEB ANALYTICS MARKET DRIVERSCHINA- Rising investments by governmentJAPAN- Federal support for cutting-edge technologies and strong organic growth capabilitiesINDIA- Growing adoption of Social, Mobile, Analytics, and Cloud (SMAC) among SMEsREST OF ASIA PACIFIC

-

11.5 MIDDLE EAST & AFRICAMIDDLE EAST & AFRICA: MOBILE APPS & WEB ANALYTICS MARKET DRIVERSUAE- Increasing focus on ensuring comprehensive protection from online risksSAUDI ARABIA- Rising adoption of mobile apps and web analytics to boost digitizationISRAEL- Growing investments in advanced technologies by governmentTURKEY- Growing competitiveness among technology playersQATAR- Growing use of technology to reshape corporate operationsSOUTH AFRICA- Growing urgency to implement advanced, easy-to-use mobile appsREST OF THE MIDDLE EAST & AFRICA

-

11.6 LATIN AMERICALATIN AMERICA: MOBILE APPS AND WEB ANALYTICS MARKET DRIVERSBRAZIL- Rising focus on shaping technological landscapeMEXICO- Increasing government initiatives to support cloud-based solutionsREST OF LATIN AMERICA

- 12.1 OVERVIEW

- 12.2 STRATEGIES ADOPTED BY KEY PLAYERS

- 12.3 REVENUE ANALYSIS

- 12.4 MARKET SHARE ANALYSIS

-

12.5 EVALUATION QUADRANT FOR KEY PLAYERS, 2022STARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTS

-

12.6 EVALUATION MATRIX FOR STARTUPS/SMES, 2022PROGRESSIVE COMPANIESRESPONSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKS

- 12.7 COMPETITIVE BENCHMARKING

-

12.8 COMPETITIVE SCENARIOPRODUCT LAUNCHESDEALSOTHERS

-

13.1 MAJOR PLAYERSMICROSOFT- Business overview- Products offered- Recent developments- MnM viewSAP- Business overview- Products offered- MnM viewIBM- Business overview- Products offered- Recent developments- MnM viewSAS INSTITUTE- Business overview- Products/Solutions offered- Recent developments- MnM viewGOOGLE- Business overview- Products offered- Recent developmentsORACLE- Business overview- Products offered- Recent developmentsAWS- Business overview- Solutions offered- Recent developmentsTERADATA- Business overview- Products/Solutions offered- Recent developmentsADOBE- Business overview- Solutions offered- Recent developmentsMICRO FOCUS- Business overview- Products offered- Recent developmentsCOMSCORE- Business overview- Products offered- Recent developmentsSALESFORCE- Business overview- Products offered- Recent developmentsSPLUNK- Business overview- Products offered- Recent developmentsMICROSTRATEGY- Business overview- Products/Solutions offered- Recent developmentsAT INTERNET- Business overview- Solutions offered- Recent developmentsWEBTRENDS- Business overview- Solutions offeredUPLAND LOCALYTICS- Business overview- Solutions offered- Recent developmentsQLIK- Business overview- Solutions offered- Recent developmentsTIBCO SOFTWARE- Business overview- Solutions offered- Recent developmentsMIXPANEL- Business overview- Solutions offered- Recent developmentsAMPLITUDE ANALYTICS

-

13.2 STARTUPS/SMES.FLURRYMEDALLIACOUNTLYMOBILEBRIDGEAPPSFLYERUXCAMMATOMOPLAUSIBLEFATHOMINCUBASYSDATAMATICSCELADONALPHA BYTESINGULAR

-

14.1 PREDICTIVE ANALYTICS MARKETMARKET DEFINITIONMARKET OVERVIEW- Predictive analytics market, by component- Predictive analytics market, by solution- Predictive analytics market, by service- Predictive analytics market, by deployment mode- Predictive analytics market, by organization size- Predictive analytics market, by vertical- Predictive analytics market, by region

-

14.2 BIG DATA MARKETMARKET DEFINITIONMARKET OVERVIEW- Big data market, by component- Big data market, by deployment mode- Big data market, by organization size- Big data market, by business function- Big data market, by industry vertical- Big data market, by region

- 15.1 DISCUSSION GUIDE

- 15.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 15.3 CUSTOMIZATION OPTIONS

- 15.4 RELATED REPORTS

- 15.5 AUTHOR DETAILS

- TABLE 1 UNITED STATES DOLLAR EXCHANGE RATE, 2019–2021

- TABLE 2 BREAKUP OF PRIMARY INTERVIEWS

- TABLE 3 FACTOR ANALYSIS

- TABLE 4 MOBILE APPS AND WEB ANALYTICS MARKET SIZE AND GROWTH RATE, 2016–2021 (USD MILLION, Y-O-Y%)

- TABLE 5 MOBILE APPS AND WEB ANALYTICS MARKET SIZE AND GROWTH RATE, 2022–2027 (USD MILLION, Y-O-Y%)

- TABLE 6 ECOSYSTEM ANALYSIS

- TABLE 7 PORTER’S FIVE FORCES ANALYSIS

- TABLE 8 PRICING LEVELS

- TABLE 9 PATENTS FILED, 2018–2021

- TABLE 10 TOP TEN PATENT OWNERS, 2018–2021

- TABLE 11 KEY CONFERENCES & EVENTS, 2022–2023

- TABLE 12 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 13 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 14 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 15 MIDDLE EAST & AFRICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 16 LATIN AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 17 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE APPLICATIONS (%)

- TABLE 18 KEY BUYING CRITERIA FOR TOP THREE VERTICALS

- TABLE 19 MOBILE APPS AND WEB ANALYTICS MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

- TABLE 20 MOBILE APPS AND WEB ANALYTICS MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

- TABLE 21 MOBILE APPS AND WEB ANALYTICS MARKET, BY SOLUTION, 2016–2021 (USD MILLION)

- TABLE 22 MOBILE APPS AND WEB ANALYTICS MARKET, BY SOLUTION, 2022–2027 (USD MILLION)

- TABLE 23 SOLUTIONS: MOBILE APPS AND WEB ANALYTICS MARKET, BY REGION, 2016–2021 (USD MILLION)

- TABLE 24 SOLUTIONS: MOBILE APPS AND WEB ANALYTICS MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 25 DATA ANALYTICS: MOBILE APPS AND WEB ANALYTICS MARKET, BY REGION, 2016–2021 (USD MILLION)

- TABLE 26 DATA ANALYTICS: MOBILE APPS AND WEB ANALYTICS MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 27 DATA DISCOVERY: MOBILE APPS AND WEB ANALYTICS MARKET, BY REGION, 2016–2021 (USD MILLION)

- TABLE 28 DATA DISCOVERY: MOBILE APPS AND WEB ANALYTICS MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 29 DATA VISUALIZATION: MOBILE APPS AND WEB ANALYTICS MARKET, BY REGION, 2016–2021 (USD MILLION)

- TABLE 30 DATA VISUALIZATION: MOBILE APPS AND WEB ANALYTICS MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 31 DATA MANAGEMENT: MOBILE APPS AND WEB ANALYTICS MARKET, BY REGION, 2016–2021 (USD MILLION)

- TABLE 32 DATA MANAGEMENT: MOBILE APPS AND WEB ANALYTICS MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 33 SERVICES: MOBILE APPS AND WEB ANALYTICS MARKET, BY TYPE, 2016–2021 (USD MILLION)

- TABLE 34 SERVICES: MOBILE APPS AND WEB ANALYTICS MARKET, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 35 SERVICES: MOBILE APPS AND WEB ANALYTICS MARKET, BY REGION, 2016–2021 (USD MILLION)

- TABLE 36 SERVICES: MOBILE APPS AND WEB ANALYTICS MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 37 MANAGED SERVICES: MOBILE APPS AND WEB ANALYTICS MARKET, BY REGION, 2016–2021 (USD MILLION)

- TABLE 38 MANAGED SERVICES: MOBILE APPS AND WEB ANALYTICS MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 39 PROFESSIONAL SERVICES: MOBILE APPS AND WEB ANALYTICS MARKET, BY REGION, 2016–2021 (USD MILLION)

- TABLE 40 PROFESSIONAL SERVICES: MOBILE APPS AND WEB ANALYTICS MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 41 MOBILE APPS AND WEB ANALYTICS MARKET, BY DEPLOYMENT MODE, 2016–2021 (USD MILLION)

- TABLE 42 MOBILE APPS AND WEB ANALYTICS MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

- TABLE 43 ON-PREMISES: MOBILE APPS AND WEB ANALYTICS MARKET, BY REGION, 2016–2021 (USD MILLION)

- TABLE 44 ON-PREMISES: MOBILE APPS AND WEB ANALYTICS MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 45 CLOUD: MOBILE APPS AND WEB ANALYTICS MARKET, BY REGION, 2016–2021 (USD MILLION)

- TABLE 46 CLOUD: MOBILE APPS AND WEB ANALYTICS MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 47 MOBILE APPS AND WEB ANALYTICS MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

- TABLE 48 MOBILE APPS AND WEB ANALYTICS MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

- TABLE 49 SMES: MOBILE APPS AND WEB ANALYTICS MARKET, BY REGION, 2016–2021 (USD MILLION)

- TABLE 50 SMES: MOBILE APPS AND WEB ANALYTICS MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 51 LARGE ENTERPRISES: MOBILE APPS AND WEB ANALYTICS MARKET, BY REGION, 2016–2021 (USD MILLION)

- TABLE 52 LARGE ENTERPRISES: MOBILE APPS AND WEB ANALYTICS MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 53 MOBILE APPS AND WEB ANALYTICS MARKET, BY APPLICATION, 2016–2021 (USD MILLION)

- TABLE 54 MOBILE APPS AND WEB ANALYTICS MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 55 MOBILE ADVERTISING & MARKETING ANALYTICS: MOBILE APPS AND WEB ANALYTICS MARKET, BY REGION, 2016–2021 (USD MILLION)

- TABLE 56 MOBILE ADVERTISING & MARKETING ANALYTICS: MOBILE APPS AND WEB ANALYTICS MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 57 SEARCH ENGINE TRACKING & RANKING: MOBILE APPS AND WEB ANALYTICS MARKET, BY REGION, 2016–2021 (USD MILLION)

- TABLE 58 SEARCH ENGINE TRACKING & RANKING: MOBILE APPS AND WEB ANALYTICS MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 59 HEAT MAP ANALYTICS: MOBILE APPS AND WEB ANALYTICS MARKET, BY REGION, 2016–2021 (USD MILLION)

- TABLE 60 HEAT MAP ANALYTICS: MOBILE APPS AND WEB ANALYTICS MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 61 IN-APP & WEB BEHAVIOR ANALYSIS: MOBILE APPS AND WEB ANALYTICS MARKET, BY REGION, 2016–2021 (USD MILLION)

- TABLE 62 IN-APP & WEB BEHAVIOR ANALYSIS: MOBILE APPS AND WEB ANALYTICS MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 63 APPLICATION PERFORMANCE & ADVERTISING OPTIMIZATION: MOBILE APPS AND WEB ANALYTICS MARKET, BY REGION, 2016–2021 (USD MILLION)

- TABLE 64 APPLICATION PERFORMANCE & ADVERTISING OPTIMIZATION: MOBILE APPS AND WEB ANALYTICS MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 65 MARKETING AUTOMATION: MOBILE APPS AND WEB ANALYTICS MARKET, BY REGION, 2016–2021 (USD MILLION)

- TABLE 66 MARKETING AUTOMATION: MOBILE APPS AND WEB ANALYTICS MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 67 CONTENT MARKETING: MOBILE APPS AND WEB ANALYTICS MARKET, BY REGION, 2016–2021 (USD MILLION)

- TABLE 68 CONTENT MARKETING: MOBILE APPS AND WEB ANALYTICS MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 69 SOCIAL MEDIA MANAGEMENT: MOBILE APPS AND WEB ANALYTICS MARKET, BY REGION, 2016–2021 (USD MILLION)

- TABLE 70 SOCIAL MEDIA MANAGEMENT: MOBILE APPS AND WEB ANALYTICS MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 71 OTHER APPLICATIONS: MOBILE APPS AND WEB ANALYTICS MARKET, BY REGION, 2016–2021 (USD MILLION)

- TABLE 72 OTHER APPLICATIONS: MOBILE APPS AND WEB ANALYTICS MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 73 MOBILE APPS AND WEB ANALYTICS MARKET, BY VERTICAL, 2016–2021 (USD MILLION)

- TABLE 74 MOBILE APPS AND WEB ANALYTICS MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

- TABLE 75 BFSI: MOBILE APPS AND WEB ANALYTICS MARKET, BY REGION, 2016–2021 (USD MILLION)

- TABLE 76 BFSI: MOBILE APPS AND WEB ANALYTICS MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 77 HEALTHCARE & LIFE SCIENCES: MOBILE APPS AND WEB ANALYTICS MARKET, BY REGION, 2016–2021 (USD MILLION)

- TABLE 78 HEALTHCARE & LIFE SCIENCES: MOBILE APPS AND WEB ANALYTICS MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 79 RETAIL & ECOMMMERCE: MOBILE APPS AND WEB ANALYTICS MARKET, BY REGION, 2016–2021 (USD MILLION)

- TABLE 80 RETAIL & ECOMMMERCE: MOBILE APPS AND WEB ANALYTICS MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 81 GOVERNMENT & PUBLIC SECTOR: MOBILE APPS AND WEB ANALYTICS MARKET, BY REGION, 2016–2021 (USD MILLION)

- TABLE 82 GOVERNMENT & PUBLIC SECTOR: MOBILE APPS AND WEB ANALYTICS MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 83 MEDIA & ENTERTAINMENT: MOBILE APPS AND WEB ANALYTICS MARKET, BY REGION, 2016–2021 (USD MILLION)

- TABLE 84 MEDIA & ENTERTAINMENT: MOBILE APPS AND WEB ANALYTICS MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 85 TELECOMMUNICATIONS: MOBILE APPS AND WEB ANALYTICS MARKET, BY REGION, 2016–2021 (USD MILLION)

- TABLE 86 TELECOMMUNICATIONS: MOBILE APPS AND WEB ANALYTICS MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 87 TRANSPORTATION & LOGISTICS: MOBILE APPS AND WEB ANALYTICS MARKET, BY REGION, 2016–2021 (USD MILLION)

- TABLE 88 TRANSPORTATION & LOGISTICS: MOBILE APPS AND WEB ANALYTICS MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 89 MANUFACTURING: MOBILE APPS AND WEB ANALYTICS MARKET, BY REGION, 2016–2021 (USD MILLION

- TABLE 90 MANUFACTURING: MOBILE APPS AND WEB ANALYTICS MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 91 ENERGY & UTILITIES: MOBILE APPS AND WEB ANALYTICS MARKET, BY REGION, 2016–2021 (USD MILLION)

- TABLE 92 ENERGY & UTILITIES: MOBILE APPS AND WEB ANALYTICS MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 93 TRAVEL & HOSPITALITY: MOBILE APPS AND WEB ANALYTICS MARKET, BY REGION, 2016–2021 (USD MILLION)

- TABLE 94 TRAVEL & HOSPITALITY: MOBILE APPS AND WEB ANALYTICS MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 95 OTHER VERTICALS: MOBILE APPS AND WEB ANALYTICS MARKET, BY REGION, 2016–2021 (USD MILLION)

- TABLE 96 OTHER VERTICALS: MOBILE APPS AND WEB ANALYTICS MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 97 MOBILE APPS AND WEB ANALYTICS MARKET, BY REGION, 2016–2021 (USD MILLION)

- TABLE 98 MOBILE APPS AND WEB ANALYTICS MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 99 NORTH AMERICA: MOBILE APPS AND WEB ANALYTICS MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

- TABLE 100 NORTH AMERICA: MOBILE APPS AND WEB ANALYTICS MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

- TABLE 101 NORTH AMERICA: MOBILE APPS AND WEB ANALYTICS MARKET, BY SOLUTION, 2016–2021 (USD MILLION)

- TABLE 102 NORTH AMERICA: MOBILE APPS AND WEB ANALYTICS MARKET, BY SOLUTION, 2022–2027 (USD MILLION)

- TABLE 103 NORTH AMERICA: MOBILE APPS AND WEB ANALYTICS MARKET, BY SERVICE, 2016–2021 (USD MILLION)

- TABLE 104 NORTH AMERICA: MOBILE APPS AND WEB ANALYTICS MARKET, BY SERVICE, 2022–2027 (USD MILLION)

- TABLE 105 NORTH AMERICA: MOBILE APPS AND WEB ANALYTICS MARKET, BY DEPLOYMENT MODE, 2016–2021 (USD MILLION)

- TABLE 106 NORTH AMERICA: MOBILE APPS AND WEB ANALYTICS MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

- TABLE 107 NORTH AMERICA: MOBILE APPS AND WEB ANALYTICS MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

- TABLE 108 NORTH AMERICA: MOBILE APPS AND WEB ANALYTICS MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

- TABLE 109 NORTH AMERICA: MOBILE APPS AND WEB ANALYTICS MARKET, BY APPLICATION, 2016–2021 (USD MILLION)

- TABLE 110 NORTH AMERICA: MOBILE APPS AND WEB ANALYTICS MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 111 NORTH AMERICA: MOBILE APPS AND WEB ANALYTICS MARKET, BY VERTICAL, 2016–2021 (USD MILLION)

- TABLE 112 NORTH AMERICA: MOBILE APPS AND WEB ANALYTICS MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

- TABLE 113 NORTH AMERICA: MOBILE APPS AND WEB ANALYTICS MARKET, BY COUNTRY, 2016–2021 (USD MILLION)

- TABLE 114 NORTH AMERICA: MOBILE APPS AND WEB ANALYTICS MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

- TABLE 115 US: MOBILE APPS AND WEB ANALYTICS MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

- TABLE 116 US: MOBILE APPS AND WEB ANALYTICS MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

- TABLE 117 US: MOBILE APPS AND WEB ANALYTICS MARKET, BY SOLUTION, 2016–2021 (USD MILLION)

- TABLE 118 US: MOBILE APPS AND WEB ANALYTICS MARKET, BY SOLUTION, 2022–2027 (USD MILLION)

- TABLE 119 EUROPE: MOBILE APPS AND WEB ANALYTICS MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

- TABLE 120 EUROPE: MOBILE APPS AND WEB ANALYTICS MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

- TABLE 121 EUROPE: MOBILE APPS AND WEB ANALYTICS MARKET, BY SOLUTION, 2016–2021 (USD MILLION)

- TABLE 122 EUROPE: MOBILE APPS AND WEB ANALYTICS MARKET, BY SOLUTION, 2022–2027 (USD MILLION)

- TABLE 123 EUROPE: MOBILE APPS AND WEB ANALYTICS MARKET, BY SERVICE, 2016–2021 (USD MILLION)

- TABLE 124 EUROPE: MOBILE APPS AND WEB ANALYTICS MARKET, BY SERVICE, 2022–2027 (USD MILLION)

- TABLE 125 EUROPE: MOBILE APPS AND WEB ANALYTICS MARKET, BY DEPLOYMENT MODE, 2016–2021 (USD MILLION)

- TABLE 126 EUROPE: MOBILE APPS AND WEB ANALYTICS MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

- TABLE 127 EUROPE: MOBILE APPS AND WEB ANALYTICS MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

- TABLE 128 EUROPE: MOBILE APPS AND WEB ANALYTICS MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

- TABLE 129 EUROPE: MOBILE APPS AND WEB ANALYTICS MARKET, BY APPLICATION, 2016–2021 (USD MILLION)

- TABLE 130 EUROPE: MOBILE APPS AND WEB ANALYTICS MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 131 EUROPE: MOBILE APPS AND WEB ANALYTICS MARKET, BY VERTICAL, 2016–2021 (USD MILLION)

- TABLE 132 EUROPE: MOBILE APPS AND WEB ANALYTICS MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

- TABLE 133 EUROPE: MOBILE APPS AND WEB ANALYTICS MARKET, BY COUNTRY, 2016–2021 (USD MILLION)

- TABLE 134 EUROPE: MOBILE APPS AND WEB ANALYTICS MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

- TABLE 135 UK: MOBILE APPS AND WEB ANALYTICS MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

- TABLE 136 UK: MOBILE APPS AND WEB ANALYTICS MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

- TABLE 137 UK: MOBILE APPS AND WEB ANALYTICS MARKET, BY SOLUTION, 2016–2021 (USD MILLION)

- TABLE 138 UK: MOBILE APPS AND WEB ANALYTICS MARKET, BY SOLUTION, 2022–2027 (USD MILLION)

- TABLE 139 ASIA PACIFIC: MOBILE APPS AND WEB ANALYTICS MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

- TABLE 140 ASIA PACIFIC: MOBILE APPS AND WEB ANALYTICS MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

- TABLE 141 ASIA PACIFIC: MOBILE APPS AND WEB ANALYTICS MARKET, BY SOLUTION, 2016–2021 (USD MILLION)

- TABLE 142 ASIA PACIFIC: MOBILE APPS AND WEB ANALYTICS MARKET, BY SOLUTION, 2022–2027 (USD MILLION)

- TABLE 143 ASIA PACIFIC: MOBILE APPS AND WEB ANALYTICS MARKET, BY SERVICE, 2016–2021 (USD MILLION)

- TABLE 144 ASIA PACIFIC: MOBILE APPS AND WEB ANALYTICS MARKET, BY SERVICE, 2022–2027 (USD MILLION)

- TABLE 145 ASIA PACIFIC: MOBILE APPS AND WEB ANALYTICS MARKET, BY DEPLOYMENT MODE, 2016–2021 (USD MILLION)

- TABLE 146 ASIA PACIFIC: MOBILE APPS AND WEB ANALYTICS MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

- TABLE 147 ASIA PACIFIC: MOBILE APPS AND WEB ANALYTICS MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

- TABLE 148 ASIA PACIFIC: MOBILE APPS AND WEB ANALYTICS MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

- TABLE 149 ASIA PACIFIC: MOBILE APPS AND WEB ANALYTICS MARKET, BY APPLICATION, 2016–2021 (USD MILLION)

- TABLE 150 ASIA PACIFIC: MOBILE APPS AND WEB ANALYTICS MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 151 ASIA PACIFIC: MOBILE APPS AND WEB ANALYTICS MARKET, BY VERTICAL, 2016–2021 (USD MILLION)

- TABLE 152 ASIA PACIFIC: MOBILE APPS AND WEB ANALYTICS MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

- TABLE 153 ASIA PACIFIC: MOBILE APPS AND WEB ANALYTICS MARKET, BY COUNTRY, 2016–2021 (USD MILLION)

- TABLE 154 ASIA PACIFIC: MOBILE APPS AND WEB ANALYTICS MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

- TABLE 155 CHINA: MOBILE APPS AND WEB ANALYTICS MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

- TABLE 156 CHINA: MOBILE APPS AND WEB ANALYTICS MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

- TABLE 157 CHINA: MOBILE APPS AND WEB ANALYTICS MARKET, BY SOLUTION, 2016–2021 (USD MILLION)

- TABLE 158 CHINA: MOBILE APPS AND WEB ANALYTICS MARKET, BY SOLUTION, 2022–2027 (USD MILLION)

- TABLE 159 MIDDLE EAST & AFRICA: MOBILE APPS AND WEB ANALYTICS MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

- TABLE 160 MIDDLE EAST & AFRICA: MOBILE APPS AND WEB ANALYTICS MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

- TABLE 161 MIDDLE EAST & AFRICA: MOBILE APPS AND WEB ANALYTICS MARKET, BY SOLUTION, 2016–2021 (USD MILLION)

- TABLE 162 MIDDLE EAST & AFRICA: MOBILE APPS AND WEB ANALYTICS MARKET, BY SOLUTION, 2022–2027 (USD MILLION)

- TABLE 163 MIDDLE EAST & AFRICA: MOBILE APPS AND WEB ANALYTICS MARKET, BY SERVICE, 2016–2021 (USD MILLION)

- TABLE 164 MIDDLE EAST & AFRICA: MOBILE APPS AND WEB ANALYTICS MARKET, BY SERVICE, 2022–2027 (USD MILLION)

- TABLE 165 MIDDLE EAST & AFRICA: MOBILE APPS AND WEB ANALYTICS MARKET, BY DEPLOYMENT MODE, 2016–2021 (USD MILLION)

- TABLE 166 MIDDLE EAST & AFRICA: MOBILE APPS AND WEB ANALYTICS MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

- TABLE 167 MIDDLE EAST & AFRICA: MOBILE APPS AND WEB ANALYTICS MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

- TABLE 168 MIDDLE EAST & AFRICA: MOBILE APPS AND WEB ANALYTICS MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

- TABLE 169 MIDDLE EAST & AFRICA: MOBILE APPS AND WEB ANALYTICS MARKET, BY APPLICATION, 2016–2021 (USD MILLION)

- TABLE 170 MIDDLE EAST & AFRICA: MOBILE APPS AND WEB ANALYTICS MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 171 MIDDLE EAST & AFRICA: MOBILE APPS AND WEB ANALYTICS MARKET, BY VERTICAL, 2016–2021 (USD MILLION)

- TABLE 172 MIDDLE EAST & AFRICA: MOBILE APPS AND WEB ANALYTICS MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

- TABLE 173 MIDDLE EAST & AFRICA: MOBILE APPS AND WEB ANALYTICS MARKET, BY COUNTRY, 2016–2021 (USD MILLION)

- TABLE 174 MIDDLE EAST & AFRICA: MOBILE APPS AND WEB ANALYTICS MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

- TABLE 175 LATIN AMERICA: MOBILE APPS AND WEB ANALYTICS MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

- TABLE 176 LATIN AMERICA: MOBILE APPS AND WEB ANALYTICS MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

- TABLE 177 LATIN AMERICA: MOBILE APPS AND WEB ANALYTICS MARKET, BY SERVICE, 2016–2021 (USD MILLION)

- TABLE 178 LATIN AMERICA: MOBILE APPS AND WEB ANALYTICS MARKET, BY SERVICE, 2022–2027 (USD MILLION)

- TABLE 179 LATIN AMERICA: MOBILE APPS AND WEB ANALYTICS MARKET, BY SOLUTION, 2016–2021 (USD MILLION)

- TABLE 180 LATIN AMERICA: MOBILE APPS AND WEB ANALYTICS MARKET, BY SOLUTION, 2022–2027 (USD MILLION)

- TABLE 181 LATIN AMERICA: MOBILE APPS AND WEB ANALYTICS MARKET, BY DEPLOYMENT MODE, 2016–2021 (USD MILLION)

- TABLE 182 LATIN AMERICA: MOBILE APPS AND WEB ANALYTICS MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

- TABLE 183 LATIN AMERICA: MOBILE APPS AND WEB ANALYTICS MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

- TABLE 184 LATIN AMERICA: MOBILE APPS AND WEB ANALYTICS MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

- TABLE 185 LATIN AMERICA: MOBILE APPS AND WEB ANALYTICS MARKET, BY APPLICATION, 2016–2021 (USD MILLION)

- TABLE 186 LATIN AMERICA: MOBILE APPS AND WEB ANALYTICS MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 187 LATIN AMERICA: MOBILE APPS AND WEB ANALYTICS MARKET, BY VERTICAL, 2016–2021 (USD MILLION)

- TABLE 188 LATIN AMERICA: MOBILE APPS AND WEB ANALYTICS MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

- TABLE 189 LATIN AMERICA: MOBILE APPS AND WEB ANALYTICS MARKET, BY COUNTRY, 2016–2021 (USD MILLION)

- TABLE 190 LATIN AMERICA: MOBILE APPS AND WEB ANALYTICS MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

- TABLE 191 STRATEGIES ADOPTED BY KEY PLAYERS

- TABLE 192 INTENSITY OF COMPETITIVE RIVALRY

- TABLE 193 COMPETITIVE BENCHMARKING OF KEY PLAYERS, 2022

- TABLE 194 LIST OF KEY STARTUPS/SMES

- TABLE 195 COMPETITIVE BENCHMARKING OF STARTUPS/SMES

- TABLE 196 PRODUCT LAUNCHES, 2018–2022

- TABLE 197 DEALS, 2018–2022

- TABLE 198 OTHERS, 2018–2022

- TABLE 199 MICROSOFT: BUSINESS OVERVIEW

- TABLE 200 MICROSOFT: PRODUCTS OFFERED

- TABLE 201 MICROSOFT: PRODUCT LAUNCHES

- TABLE 202 MICROSOFT: DEALS

- TABLE 203 SAP: BUSINESS OVERVIEW

- TABLE 204 SAP: PRODUCTS OFFERED

- TABLE 205 SAP: DEALS

- TABLE 206 IBM: BUSINESS OVERVIEW

- TABLE 207 IBM: PRODUCTS OFFERED

- TABLE 208 IBM: PRODUCT LAUNCHES

- TABLE 209 IBM: DEALS

- TABLE 210 SAS INSTITUTE: BUSINESS OVERVIEW

- TABLE 211 SAS INSTITUTE: PRODUCTS OFFERED

- TABLE 212 SAS INSTITUTE: DEALS

- TABLE 213 SAS INSTITUTE: OTHERS

- TABLE 214 GOOGLE: BUSINESS OVERVIEW

- TABLE 215 GOOGLE: PRODUCTS OFFERED

- TABLE 216 GOOGLE: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 217 GOOGLE: DEALS

- TABLE 218 ORACLE: BUSINESS OVERVIEW

- TABLE 219 ORACLE: PRODUCTS OFFERED

- TABLE 220 ORACLE: PRODUCT LAUNCHES

- TABLE 221 ORACLE: DEALS

- TABLE 222 AWS: BUSINESS OVERVIEW

- TABLE 223 AWS: PRODUCTS OFFERED

- TABLE 224 AWS: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 225 AWS: DEALS

- TABLE 226 AWS: OTHERS

- TABLE 227 TERADATA: BUSINESS OVERVIEW

- TABLE 228 TERADATA: PRODUCTS OFFERED

- TABLE 229 TERADATA: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 230 TERADATA: DEALS

- TABLE 231 ADOBE: BUSINESS OVERVIEW

- TABLE 232 ADOBE: PRODUCTS OFFERED

- TABLE 233 ADOBE: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 234 ADOBE: DEALS

- TABLE 235 MICRO FOCUS: BUSINESS OVERVIEW

- TABLE 236 MICRO FOCUS: PRODUCTS OFFERED

- TABLE 237 MICRO FOCUS: PRODUCT LAUNCHES

- TABLE 238 MICRO FOCUS: DEALS

- TABLE 239 COMSCORE: BUSINESS OVERVIEW

- TABLE 240 COMSCORE: PRODUCTS OFFERED

- TABLE 241 COMSCORE: PRODUCT LAUNCHES

- TABLE 242 COMSCORE: DEALS

- TABLE 243 COMSCORE: OTHERS

- TABLE 244 SALESFORCE: BUSINESS OVERVIEW

- TABLE 245 SALESFORCE: PRODUCTS OFFERED

- TABLE 246 SALESFORCE: PRODUCT LAUNCHES

- TABLE 247 SALESFORCE: DEALS

- TABLE 248 SPLUNK: BUSINESS OVERVIEW

- TABLE 249 SPLUNK: PRODUCTS OFFERED

- TABLE 250 SPLUNK: PRODUCT LAUNCHES

- TABLE 251 SPLUNK: DEALS

- TABLE 252 MICROSTRATEGY: BUSINESS OVERVIEW

- TABLE 253 MICROSTRATEGY: PRODUCTS OFFERED

- TABLE 254 MICROSTRATEGY: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 255 MICROSTRATEGY: DEALS

- TABLE 256 AT INTERNET: BUSINESS OVERVIEW

- TABLE 257 AT INTERNET: PRODUCTS OFFERED

- TABLE 258 AT INTERNET: DEALS

- TABLE 259 WEBTRENDS: BUSINESS OVERVIEW

- TABLE 260 WEBTRENDS: SOLUTIONS OFFERED

- TABLE 261 WEBTRENDS: OTHERS

- TABLE 262 UPLAND LOCALYTICS: BUSINESS OVERVIEW

- TABLE 263 UPLAND LOCALYTICS: SOLUTIONS OFFERED

- TABLE 264 UPLAND LOCALYTICS: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 265 UPLAND LOCALYTICS: DEALS

- TABLE 266 QLIK: BUSINESS OVERVIEW

- TABLE 267 QLIK: SOLUTIONS OFFERED

- TABLE 268 QLIK: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 269 QLIK: DEALS

- TABLE 270 QLIK: OTHERS

- TABLE 271 TIBCO SOFTWARE: BUSINESS OVERVIEW

- TABLE 272 TIBCO SOFTWARE: SOLUTIONS OFFERED

- TABLE 273 TIBCO SOFTWARE: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 274 TIBCO SOFTWARE: DEALS

- TABLE 275 MIXPANEL: BUSINESS OVERVIEW

- TABLE 276 MIXPANEL: SOLUTIONS OFFERED

- TABLE 277 MIXPANEL: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 278 MIXPANEL: DEALS

- TABLE 279 MIXPANEL: OTHERS

- TABLE 280 GLOBAL PREDICTIVE ANALYTICS MARKET SIZE AND GROWTH RATE, 2015–2020 (USD MILLION AND Y-O-Y%)

- TABLE 281 GLOBAL PREDICTIVE ANALYTICS MARKET SIZE AND GROWTH RATE, 2021–2026 (USD MILLION, Y-O-Y%)

- TABLE 282 PREDICTIVE ANALYTICS MARKET, BY COMPONENT, 2015–2020 (USD MILLION)

- TABLE 283 PREDICTIVE ANALYTICS MARKET, BY COMPONENT, 2021–2026 (USD MILLION)

- TABLE 284 PREDICTIVE ANALYTICS MARKET, BY SOLUTION, 2015–2020 (USD MILLION)

- TABLE 285 PREDICTIVE ANALYTICS MARKET, BY SOLUTION, 2021–2026 (USD MILLION)

- TABLE 286 PREDICTIVE ANALYTICS MARKET, BY SERVICE, 2015–2020 (USD MILLION)

- TABLE 287 PREDICTIVE ANALYTICS MARKET, BY SERVICE, 2021–2026 (USD MILLION)

- TABLE 288 PREDICTIVE ANALYTICS MARKET, BY DEPLOYMENT MODE, 2015–2020 (USD MILLION)

- TABLE 289 PREDICTIVE ANALYTICS MARKET, BY DEPLOYMENT MODE, 2021–2026 (USD MILLION)

- TABLE 290 PREDICTIVE ANALYTICS MARKET, BY ORGANIZATION SIZE, 2015–2020 (USD MILLION)

- TABLE 291 PREDICTIVE ANALYTICS MARKET, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

- TABLE 292 PREDICTIVE ANALYTICS MARKET, BY VERTICAL, 2015–2020 (USD MILLION)

- TABLE 293 PREDICTIVE ANALYTICS MARKET, BY VERTICAL, 2021–2026 (USD MILLION)

- TABLE 294 PREDICTIVE ANALYTICS MARKET, BY REGION, 2015–2020 (USD MILLION)

- TABLE 295 PREDICTIVE ANALYTICS MARKET, BY REGION, 2021–2026 (USD MILLION)

- TABLE 296 BIG DATA MARKET, BY COMPONENT, 2016–2020 (USD MILLION)

- TABLE 297 BIG DATA MARKET, BY COMPONENT, 2021–2026 (USD MILLION)

- TABLE 298 BIG DATA MARKET, BY SOLUTION, 2016–2020 (USD MILLION)

- TABLE 299 BIG DATA MARKET, BY SOLUTION, 2021–2026 (USD MILLION)

- TABLE 300 BIG DATA MARKET, BY SERVICE, 2016–2020 (USD MILLION)

- TABLE 301 BIG DATA MARKET, BY SERVICE, 2021–2026 (USD MILLION)

- TABLE 302 PROFESSIONAL BIG DATA SERVICES MARKET, BY TYPE, 2016–2020 (USD MILLION)

- TABLE 303 PROFESSIONAL BIG DATA SERVICES MARKET, BY TYPE, 2021–2026 (USD MILLION)

- TABLE 304 BIG DATA MARKET, BY DEPLOYMENT MODE, 2016–2020 (USD MILLION)

- TABLE 305 BIG DATA MARKET, BY DEPLOYMENT MODE, 2021–2026 (USD MILLION)

- TABLE 306 CLOUD DEPLOYMENT MARKET, BY TYPE, 2016–2020 (USD MILLION)

- TABLE 307 CLOUD DEPLOYMENT MARKET, BY TYPE, 2021–2026 (USD MILLION)

- TABLE 308 BIG DATA MARKET, BY ORGANIZATION SIZE, 2016–2020 (USD MILLION)

- TABLE 309 BIG DATA MARKET, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

- TABLE 310 BIG DATA MARKET, BY BUSINESS FUNCTION, 2016–2020 (USD MILLION)

- TABLE 311 BIG DATA MARKET, BY BUSINESS FUNCTION, 2021–2026 (USD MILLION)

- TABLE 312 BIG DATA MARKET, BY INDUSTRY VERTICAL, 2016–2020 (USD MILLION)

- TABLE 313 BIG DATA MARKET, BY INDUSTRY VERTICAL, 2021–2026 (USD MILLION)

- TABLE 314 BIG DATA MARKET, BY REGION, 2016–2020 (USD MILLION)

- TABLE 315 BIG DATA MARKET, BY REGION, 2021–2026 (USD MILLION)

- FIGURE 1 MOBILE APPS AND WEB ANALYTICS MARKET: RESEARCH DESIGN

- FIGURE 2 DATA TRIANGULATION

- FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY, APPROACH 1 (SUPPLY SIDE): REVENUE FROM MOBILE APPS AND WEB ANALYTICS SOLUTIONS AND SERVICES

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY, APPROACH 2, BOTTOM-UP (SUPPLY SIDE): REVENUE FROM MOBILE APPS AND WEB ANALYTICS SOLUTIONS AND SERVICES

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY, APPROACH 3, BOTTOM-UP (DEMAND SIDE): SHARE OF MOBILE APPS AND WEB ANALYTIC SOLUTIONS

- FIGURE 6 MOBILE APPS AND WEB ANALYTICS MARKET: TOP-DOWN AND BOTTOM-UP APPROACHES

- FIGURE 7 SOLUTIONS SEGMENT TO LEAD MARKET IN 2022

- FIGURE 8 PROFESSIONAL SERVICES SEGMENT TO ACCOUNT FOR LARGER SHARE IN 2022

- FIGURE 9 DATA ANALYTICS SEGMENT TO LEAD MARKET IN 2022

- FIGURE 10 CLOUD SEGMENT TO LEAD MARKET IN 2022

- FIGURE 11 LARGE ENTERPRISES SEGMENT TO ACCOUNT FOR LARGER SHARE IN 2022

- FIGURE 12 SEARCH ENGINE TRACKING & RANKING SEGMENT TO LEAD MARKET IN 2022

- FIGURE 13 BANKING, FINANCIAL SERVICES, & INSURANCE VERTICAL TO LEAD MARKET IN 2022

- FIGURE 14 NORTH AMERICA TO ACHIEVE HIGHEST GROWTH BY 2027

- FIGURE 15 RISING NEED FOR ANALYTICS SOLUTIONS TO TRANSFER DATA FROM ON-PREMISES TO CLOUD

- FIGURE 16 MEDIA & ENTERTAINMENT SEGMENT TO LEAD MARKET BY 2027

- FIGURE 17 NORTH AMERICA TO ACCOUNT FOR LARGEST SHARE BY 2022

- FIGURE 18 MANAGED SERVICES AND MEDIA & ENTERTAINMENT SEGMENTS TO ACCOUNT FOR SIGNIFICANT SHARE IN 2022

- FIGURE 19 MOBILE APPS AND WEB ANALYTICS MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 20 ECOSYSTEM ANALYSIS

- FIGURE 21 VALUE CHAIN ANALYSIS

- FIGURE 22 PORTER’S FIVE FORCES ANALYSIS

- FIGURE 23 TOTAL NUMBER OF PATENTS GRANTED, 2018–2021

- FIGURE 24 TOP TEN COMPANIES WITH HIGHEST NUMBER OF PATENT APPLICATIONS, 2018–2021

- FIGURE 25 SERVICES SEGMENT TO REGISTER HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 26 DATA ANALYTICS SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 27 MANAGED SERVICES SEGMENT TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 28 CLOUD SEGMENT TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 29 LARGE ENTERPRISES SEGMENT TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 30 MARKETING AUTOMATION SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 31 BANKING, FINANCIAL SERVICES, & INSURANCE SEGMENT TO ACCOUNT FOR LARGEST SHARE BY 2027

- FIGURE 32 INDIA TO ACCOUNT FOR HIGHEST COUNTRY-LEVEL CAGR DURING FORECAST PERIOD

- FIGURE 33 ASIA PACIFIC TO ACCOUNT FOR HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 34 NORTH AMERICA: MARKET SNAPSHOT

- FIGURE 35 ASIA PACIFIC: MARKET SNAPSHOT

- FIGURE 36 REVENUE ANALYSIS FOR KEY PLAYERS, 2017–2021 (USD MILLION)

- FIGURE 37 MARKET SHARE ANALYSIS FOR KEY PLAYERS, 2022

- FIGURE 38 EVALUATION MATRIX FOR KEY PLAYERS, 2022

- FIGURE 39 EVALUATION MATRIX FOR STARTUPS/SMES, 2022

- FIGURE 40 MICROSOFT: COMPANY SNAPSHOT

- FIGURE 41 SAP: COMPANY SNAPSHOT

- FIGURE 42 IBM: COMPANY SNAPSHOT

- FIGURE 43 SAS INSTITUTE: COMPANY SNAPSHOT

- FIGURE 44 GOOGLE: COMPANY SNAPSHOT

- FIGURE 45 ORACLE: COMPANY SNAPSHOT

- FIGURE 46 AWS: COMPANY SNAPSHOT

- FIGURE 47 TERADATA: COMPANY SNAPSHOT

- FIGURE 48 ADOBE: COMPANY SNAPSHOT

- FIGURE 49 MICRO FOCUS: COMPANY SNAPSHOT

- FIGURE 50 COMSCORE: COMPANY SNAPSHOT

- FIGURE 51 SALESFORCE: COMPANY SNAPSHOT

- FIGURE 52 SPLUNK: COMPANY SNAPSHOT

- FIGURE 53 MICROSTRATEGY: COMPANY SNAPSHOT

The research study for the Mobile Apps and Web Analytics involved the use of extensive secondary sources, directories, and several magazines and journals, including International Research Journal of Engineering and Technology (IRJET), Journal of Big Data, Journal of Pipeline Science and Engineering - KeAi Publishing, and Active intelligence Magazine, and publications, such as IEEE Conference Publication and design to omni-channel logistics: A literature review and research agenda, Annals of Mathematics and Multichannel Order Management. 0.778 Impact Factor 2019, and International Journal of Information Systems and Supply Chain Management (IJISSCM), to identify and collect information useful for this comprehensive market research study. Primary sources were mainly industry experts from the core and related industries, preferred Mobile Apps and Web Analytics providers, third-party service providers, consulting service providers, end users, and other commercial enterprises. In-depth interviews were conducted with various primary respondents, including key industry participants and subject matter experts, to obtain and verify critical qualitative and quantitative information, and assess the market’s prospects.

Secondary Research

The market size of companies offering Mobile Apps and Web Analytics solutions and services was arrived at based on secondary data available through paid and unpaid sources. It was also arrived at by analyzing the product portfolios of major companies and rating the companies based on their performance and quality.

In the secondary research process, various sources were referred to for identifying and collecting information for this study. Secondary sources included annual reports, press releases, and investor presentations of companies; white papers, journals, and certified publications; and articles from recognized authors, directories, and databases. The data was also collected from other secondary sources, such as Omni-channel management in the new retailing era: A systematic review and future research agenda Journals and magazines, and Journal/Forums for Machine Learning (ML), AI India magazine, Customer Experience magazine, and other magazines. The Mobile Apps and Web Analytics spending of various countries was extracted from respective sources. Secondary research was mainly used to obtain key information about the industry’s value chain and supply chain to identify key players based on solutions; services; market classification, and segmentation according to offerings of major players; industry trends related to solutions, services, deployment modes, applications, verticals, and regions; and key developments from both market and technology-oriented perspectives.

Primary Research

In the primary research process, various primary sources from both supply and demand sides were interviewed to obtain qualitative and quantitative information on the market. The primary sources from the supply side included various industry experts, including Chief Experience Officers (CXOs); Vice Presidents (VPs); directors from business development, marketing, product development/innovation teams; related key executives from Mobile Apps and Web Analytics solution vendors, SIs, professional service providers, and industry associations; and key opinion leaders.

Primary interviews were conducted to gather insights, such as market statistics, revenue data collected from solutions and services, market breakups, market size estimations, market forecasts, and data triangulation. Primary research also helped in understanding various trends related to technologies, applications, deployments, and regions. Stakeholders from the demand side, such as Chief Information Officers (CIOs), Chief Technology Officers (CTOs), Chief Strategy Officers (CSOs), and end users using Mobile Apps and Web Analytics solutions, were interviewed to understand the buyer’s perspective on suppliers, products, service providers, and their current usage of Mobile Apps and Web Analytics solutions and services, which would impact the overall Mobile Apps and Web Analytics.

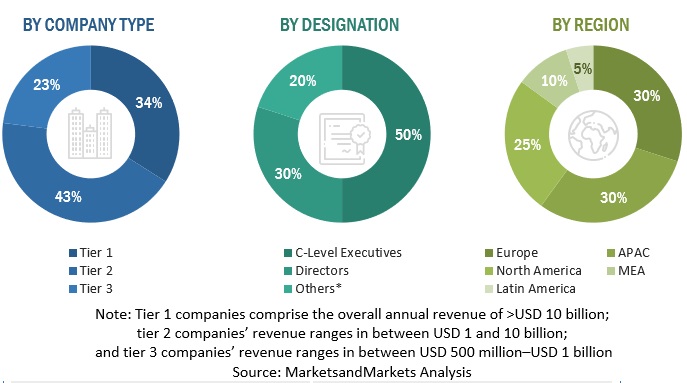

The following is the breakup of primary profiles:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Top-down and bottom-up approaches were used to estimate and validate the size of the global Mobile Apps and Web Analytics market and various other dependent subsegments. In the top-down approach, an exhaustive list of all the vendors offering tools and services in the Mobile Apps and Web Analytics was prepared. The revenue contribution of the market vendors was estimated through annual reports, press releases, funding, investor presentations, paid databases, and primary interviews. Each vendor's offerings were evaluated based on breadth of solutions and services, deployment modes, applications, and verticals. The aggregate of all the companies’ revenue was extrapolated to reach the overall market size. Each subsegment was studied and analyzed for its global market size and regional penetration. The markets were triangulated through both primary and secondary research. The primary procedure included extensive interviews for key insights from industry leaders, such as CIOs, CEOs, VPs, directors, and marketing executives. The market numbers were further triangulated with the existing MarketsandMarkets’ repository for validation. In the bottom-up approach, the adoption rate of Mobile Apps and Web Analytics solutions among different end users in key countries with respect to their regions that contribute the most to the market share was identified. For cross-validation, the adoption of Mobile Apps and Web Analytics solutions and services among industries, along with different use cases with respect to their regions, was identified and extrapolated. Weightage was given to use cases identified in different regions for the market size calculation.

All the possible parameters that affect the market covered in the research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the final quantitative and qualitative data. The data is consolidated and added with detailed inputs and analysis from MarketsandMarkets.

- The pricing trend is assumed to vary over time.

- All the forecasts are made with the standard assumption that the accepted currency is USD.

- For the conversion of various currencies to USD, average historical exchange rates are used according to the year specified. For all the historical and current exchange rates required for calculations and currency conversions, the US Internal Revenue Service's website is used.

- All the forecasts are made under the standard assumption that the globally accepted currency USD remains constant during the next five years.

- Vendor-side analysis: The market size estimates of associated solutions and services are factored in from the vendor side by assuming an average of licensing and subscription-based models of leading and innovative vendors in the market.

- Demand/end-user analysis: End users operating in verticals across regions are analyzed in terms of market spending on Mobile Apps and Web Analytics solutions based on some of the key use cases. These factors for the Mobile Apps and Web Analytics tool industry per region are separately analyzed, and the average spending was extrapolated with an approximation based on assumed weightage. This factor is derived by averaging various market influencers, including recent developments, regulations, mergers and acquisitions, enterprise/SME adoption, startup ecosystem, IT spending, technology propensity and maturity, use cases, and the estimated number of organizations per region.

Data Triangulation

After arriving at the overall market size using the market size estimation processes as explained above, the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation, and market breakup procedures were employed, wherever applicable. The overall market size was then used in the top-down procedure to estimate the size of other individual markets via percentage splits of the market segmentation.

Report Objectives

- To define, describe, and predict the Mobile Apps and Web Analytics by component (solutions and services), application, deployment mode, organization size, vertical, and region.

- To provide detailed information about major factors (drivers, restraints, opportunities, and challenges) influencing the market growth

- To analyze opportunities in the market and provide details of the competitive landscape for stakeholders and market leaders.

- To forecast the market size of segments with respect to five main regions: North America, Europe, Asia Pacific (APAC), Middle East & Africa (MEA), and Latin America

- To profile key players and comprehensively analyze their market rankings and core competencies

- To analyze competitive developments, such as partnerships, new product launches, and mergers and acquisitions, in the Mobile Apps and Web Analytics

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

- Product matrix provides a detailed comparison of the product portfolio of each company

Geographic Analysis

- Further breakup of the North American Mobile Apps and Web Analytics market

- Further breakup of the European Mobile Apps and Web Analytics market

- Further breakup of the Asia Pacific Mobile Apps and Web Analytics market

- Further breakup of the Latin American Mobile Apps and Web Analytics market

- Further breakup of the Middle East & Africa Mobile Apps and Web Analytics market

Company Information

- Detailed analysis and profiling of additional market players up to 5

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Mobile Apps and Web Analytics Market