Marine Lighting Market by Ship (Passenger, Commercial, Yachts), Technology (LED, Fluorescent, Halogen, Xenon), Application (Navigation, Dome, C&U, Reading, Docking, Safety, Decorative), Type (Functional, Decorative), and Region - Global Forecast to 2027

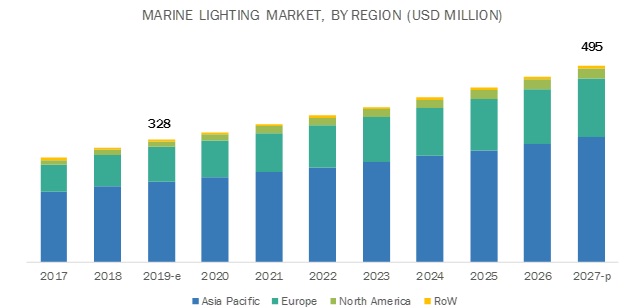

The global marine lighting market in terms of revenue was estimated to be worth USD 328 billion in 2019 and is poised to reach USD 495 billion by 2027, growing at a CAGR of 5.3% from 2019 to 2027. The increasing demand for marine lighting is driven by the growth in the usage of LEDs and the stringent regulations for the marine industry with regards to safety lights.

Functional lighting is expected to be the largest segment of the global market, by type, during the forecast period

Functional lighting is projected to be the largest market in the global market by 2027. Navigation lights, compartment & utility lights, docking lights, and safety lights are categorized as functional lights. The external functional lights are made to last in extreme weather conditions. Increasing demand for commercial ships in countries such as China, Indonesia, Japan, South Korea, Russia, and Greece is a significant factor for the increasing demand for functional lighting.

LEDs are the fastest-growing segment in the lighting market for marine, by Technology

Light-emitting diodes (LEDs) are estimated to hold a significant share in this market. They last longer as compared with other types of lighting technologies. Not only do they consume less space but also offer a broad spectrum of colors to choose from. Moreover, LED’s do not emit heat radiations, making them safer for marine applications. Shipyards across major ports are replacing other lighting technologies with LEDs due to the host of benefits they offer. Hence, LEDs are projected to be the fastest-growing segment by technology.

In the application segment, compartment and utility lights are projected to be the largest segment, during the forecast period.

Compartment & utility lights are projected to be the largest market for marine lighting by application. These lights are functional and mandated by regulations to be made of explosion-proof materials. Commercial ships such as bulk cargo, oil tankers, general cargo, and container ships are the major users of compartment & utility lights. It is the most significant application in all commercial vessels. Passenger ships are supplemented with decorative lights to provide passengers with an enhanced cruise experience. Hence, it is projected to be the largest contributor in global market by application.

Asia Pacific is expected to account for the largest market size during the forecast period.

Asia Pacific is projected to hold the largest market share, by value, during the forecast period. Factors such as rising global trade and maritime regulations have triggered the demand for commercial ships which has, in turn, has led to increasing demand for marine lighting in the region. China is expected to account for the largest share of this market owing to the high demand of for commercial ships including tankers and bulk cargo ships. With increasing demand, it is expected to remain the largest market in Asia Pacific.

Some of the key players in the marine lighting market are Signify (Netherlands), Hella (Germany), Koito (Japan), Osram (Germany), West Marine (US), Lumishore (UK), Foresti & Saurdi (Italy). Hella (Germany) is identified as the leading player in the global market. The company is one of the established players and a globally renowned supplier of lighting products for various industries including marine. The company follows the strategy of new product developments and supply contracts/partnerships to gain a competitive edge in this market. In June 2018, Hella launched the Dual Color Sea Hawk-XL lights that use three rows of bright LEDs to provide multiple color options in a single lamp, significantly reducing clutter onboard.

Recent Developments

- In February 2019, Hella Marine Lighting secured a contract to fit Haines Hunter SP725 with Navi LED Compact port/starboard navigation lamps, Navi LED Compact 20” fold-down anchor pole light, Sea Hawk-470 LED Floodlight, Euro LED Touch 130 interior lights, and the Red LED Round Courtesy Lamps.

Scope of the Report

|

Report Metric |

Details |

|

Market Size Available for Years |

2019–2027 |

|

Base Year Considered |

2018 |

|

Forecast Period |

2019–2027 |

|

Forecast Units |

Value (USD thousand) and Volume (Thousand units) |

|

Segments Covered |

Ship type, technology, application, type, and region |

|

Geographies Covered |

Asia Oceania, Europe, North America, and the RoW |

|

Companies Covered |

The key players in the global market are Signify (Netherlands), Hella(Germany), Koito (Japan), Osram (Germany), West Marine (US), Lumishore (UK) and Foresti & Saurdi (Italy) |

This research report categorizes the marine lighting based on ship type, technology, application, type, and region.

By Ship Type

- Passenger Ships

- Commercial Ships

- Yachts

By Technology

- LED

- Fluorescent

- Halogen

- Xenon

By Application

- Navigation lights

- Dome lights

- Compartment & Utility lights

- Reading lights

- Docking lights

- Safety lights

- Decorative lights

By Type

- Functional lights

- Decorative lights

By Region

- Asia Oceania

- Europe

- North America

- RoW

Key Questions addressed by the report

- Which application will lead the marine lighting in the future?

- How are the government regulations going to impact the market for marine lighting globally?

- What would be the trend of lighting technologies in the marine industry in the next five years?

- What would be the share of passenger ships, commercial ships, and yachts in this market?

- How are regulations shaping up the global market?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 16)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Years Considered For the Study

1.4 Currency

1.5 Package Size

1.6 Limitations

2 Research Methodology (Page No. - 19)

2.1 Research Data

2.2 Secondary Data

2.3 Primary Data

2.3.1 Sampling Techniques & Data Collection Methods

2.3.2 Primary Participants

2.4 Market Estimation

2.4.1 Bottom-Up Approach

2.5 Market Breakdown & Data Triangulation

2.6 Assumptions

3 Executive Summary (Page No. - 26)

4 Premium Insights (Page No. - 29)

4.1 Attractive Opportunities in Marine Lighting Market

4.2 Market, By Region and Ship Type

4.3 Market, By Country

4.4 Market, By Ship Type

4.5 Market, By Technology

4.6 Market, By Application

4.7 Market, By Type

5 Market Overview (Page No. - 33)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Increased Demand For Luxury Cruises and Yachts

5.2.1.2 Lighting Regulations Providing an Impetus For Innovation

5.2.2 Restraints

5.2.2.1 Heavy Investments in R&D and Complex Lighting Systems

5.2.2.2 Fluctuating Prices of Raw Materials

5.2.3 Opportunities

5.2.3.1 Organic Light Emitting Diodes

5.2.3.2 Replacement of Traditional Lighting With Led

5.2.4 Challenges

5.2.4.1 High Initial Costs Associated With Leds

6 Global Market, By Ship Type (Page No. - 37)

Note: This Chapter has Been Further Segmented By Region Into Asia Oceania, Europe, North America and RoW

6.1 Introduction

6.1.1 Research Methodology

6.1.2 Assumptions/Limitations

6.1.3 By Ship Type: Industry Insights

6.2 Passenger Ship

6.2.1 North America is the Fastest Growing Market For Passenger Ship Lighting Due to Increasing Demand For Passenger Ships

6.3 Commercial Ship

6.3.1 Europe is the Fastest Growing Market For Commercial Ship Lighting Due to Increasing Regional Trade

6.4 Yacht

6.4.1 Asia Pacific is the Largest Market For Yacht Lighting Due to Increasing Demand For Recreational Boats

7 Global Market, By Technology (Page No. - 44)

Note: This Chapter has Been Further Segmented By Ship Type Into Passenger Ships, Commercial Ships and Yachts

7.1 Introduction

7.1.1 Research Methodology

7.1.2 Assumptions/Limitations

7.1.3 By Technology: Industry Insights

7.2 Led

7.2.1 Commercial Ship is the Largest Segment Due to Lower Energy Consumption

7.3 Fluorescent

7.3.1 Passenger Ship is the Fastest Growing Market For Fluorescent Marine Lights

7.4 Halogen

7.4.1 Commercial Ship is the Largest Market For Halogen Marine Lights as they are Required For Safety Applications

7.5 Xenon

7.5.1 Commercial Ship is the Largest Market For Xenon Marine Lights

8 Global Market, By Application (Page No. - 52)

Note: This Chapter has Been Further Segmented By Region Into Asia Oceania, Europe, North America and RoW

8.1 Introduction

8.1.1 Research Methodology

8.1.2 Assumptions/Limitations

8.1.3 By Application: Industry Insights

8.2 Navigation Lights

8.2.1 Europe is the Fastest Growing Market For Navigation Lights Due to Increasing Demand For Passenger Ships and Yachts

8.3 Dome Lights

8.3.1 Asia Pacific is the Largest Market For Dome Lights Due to Increasing Requirement of Passenger Ships

8.4 Compartment and Utility Lights

8.4.1 North America is the Second Fastest Growing Market For Compartment and Utility Lights Due to Increasing Demand For Luxury Cruises

8.5 Reading Lights

8.5.1 Asia Pacific is the Largest Market For Reading Lights Due to Increasing Demand For Passenger Ships

8.6 Docking Lights

8.6.1 Europe is the Fastest Growing Market For Docking Lights Due to Stringent Regulations For Marine Industry

8.7 Safety Lights

8.7.1 Asia Pacific is the Largest Market For Safety Lights Due to Large-Scale Registration of Commercial Ships

8.8 Decorative Lights

8.8.1 Europe is the Fastest Growing Market For Decorative Lights Due to Increasing Demand For Passenger Ships and Yachts

9 Global Market, By Type (Page No. - 63)

Note: This Chapter has Been Further Segmented By Region Into Asia Oceania, Europe, North America and RoW

9.1 Introduction

9.1.1 Research Methodology

9.1.2 Assumptions/Limitations

9.1.3 By Type: Industry Insights

9.2 Functional Lights

9.2.1 Asia Pacific is the Largest Market For Functional Lights Due to Increasing Commercial Ship Registration

9.3 Decorative Lights

9.3.1 Europe is the Fastest Growing Market For Decorative Lights Due to Increasing Registration of Passenger Ships and Yachts

10 Global Market, By Region (Page No. - 68)

Note: This Chapter has Been Further Segmented By Material Type (Led, Fluorescent, Halogen and Xenon)

10.1 Introduction

10.1.1 Research Methodology

10.1.2 Assumptions/Limitations

10.1.3 By Technology: Industry Insights

10.2 Asia Pacific

10.2.1 China

10.2.1.1 Led is the Fastest Growing Technology in Owing to Increasing Demand For Commercial Ships

10.2.2 India

10.2.2.1 Led is the Fastest Growing Technology Due to Increasing Commercial Ship Requirement

10.2.3 Japan

10.2.3.1 Led is the Fastest Growing Technology Due to Increasing Requirement in Passenger Ships

10.2.4 South Korea

10.2.4.1 Fluorescent Light is the Second Largest Technology Segment Due to Its Longevity

10.2.5 Indonesia

10.2.5.1 Led is the Fastest Growing Marine Lighting Technology Due to Increasing Passenger and Commercial Ship Requirements

10.2.6 Rest of Asia Pacific

10.2.6.1 Halogen is the Second Fastest Growing Technology Due to Extensive Usage in Safety Applications

10.3 Europe

10.3.1 France

10.3.1.1 Led is the Fastest Growing Technology Due to Increasing Commercial Ship Requirement

10.3.2 Spain

10.3.2.1 Halogen is the Second Fastest Growing Technology Due to Widespread Use in Safety Applications

10.3.3 Turkey

10.3.3.1 Fluorescent Light is the Second Largest Technology Segment Due to Its Longevity

10.3.4 Norway

10.3.4.1 Led is the Largest Technology Segment Due to Increasing Passenger and Commercial Ship Requirements

10.3.5 Greece

10.3.5.1 Led is the Fastest Growing Technology Due to Increasing Demand For Passenger Ships

10.3.6 Russia

10.3.6.1 Led is the Largest Technology Segment Due to Growing Demand For Commercial and Passenger Ships

10.3.7 Rest of Europe

10.3.7.1 Halogen is the Second Fastest Growing Technology Due to Extensive Usage in Safety Applications

10.4 North America

10.4.1 US

10.4.1.1 Led is the Largest Technology Segment Due to Increasing Demand For Commercial Ships

10.4.2 Canada

10.4.2.1 Led is the Largest Technology Segment Due to Increasing Demand For Commercial Ships

10.4.3 Mexico

10.4.3.1 Led is the Fastest Growing Technology Due to Increasing Commercial Ship Registrations

10.5 RoW

10.5.1 Iran

10.5.1.1 Led is the Largest Technology Segment Due to Large-Scale Commercial Ship Registrations

10.5.2 Brazil

10.5.2.1 Halogen is the Second Fastest Growing Technology Due to Widespread Use in Safety Applications

10.5.3 Rest of RoW

10.5.3.1 Led is the Fastest Growing Technology Due to Widespread Use in Commercial Ships

11 Competitive Landscape (Page No. - 97)

11.1 Overview

11.2 Market Ranking Analysis

11.3 Competitive Scenario

11.3.1 Partnerships/Agreements/Supply Contracts/Collaborations/Joint Ventures

11.4 Competitive Leadership Mapping

11.4.1 Visionary Leaders

11.4.2 Innovators

11.4.3 Dynamic Differentiators

11.4.4 Emerging Companies

11.5 Strength of Product Portfolio

11.6 Business Strategy Excellence

12 Company Profiles (Page No. - 105)

(Business Overview, Products Offered, Recent Developments & SWOT Analysis)*

12.1 Signify

12.2 Hella

12.3 Koito

12.4 Osram GmbH

12.5 West Marine

12.6 Lumishore

12.7 Lumitec

12.8 Foresti & Saurdi

12.9 NJZ Lighting Technology

12.1 Taco Marine

12.11 Additional Companies

12.11.1 North America

12.11.1.1 Itc Marine

12.11.1.2 Britmar Marine

12.11.1.3 Myotek

12.11.1.4 Techno Marine Corporation

12.11.2 Europe

12.11.2.1 Ensto

12.11.2.2 Led Flex

12.11.2.3 Savage Marine

12.11.2.4 Palagi

12.11.3 Asia Pacific

12.11.3.1 Ushio Lighting

12.11.3.2 Deyuan Marine

12.11.3.3 Ajmera Electrotech

*Details on Business Overview, Products Offered, Recent Developments & SWOT Analysis Might Not Be Captured in Case of Unlisted Companies.

13 Appendix (Page No. - 127)

13.1 Insights of Industry Experts

13.2 Discussion Guide

13.3 Knowledge Store: Marketsandmarkets’ Subscription Portal

13.4 Available Customizations

13.4.1 Global Market, By Passenger Ship, By Application

13.4.1.1 Navigation Lights

13.4.1.2 Dome Lights

13.4.1.3 Compartment and Utility Lights

13.4.1.4 Reading Lights

13.4.1.5 Docking Lights

13.4.1.6 Safety Lights

13.4.1.7 Decorative Lights

13.4.2 Global Market, By Commercial Ship, By Application

13.4.2.1 Navigation Lights

13.4.2.2 Compartment and Utility Lights

13.4.2.3 Docking Lights

13.4.2.4 Safety Lights

13.4.2.5 Pickup Truck

13.5 Related Reports

13.6 Author Details

List of Tables (96 Tables)

Table 1 Currency Exchange Rates (W.R.T. USD)

Table 2 Marine Lighting Applications By Ship Type

Table 3 Global Market, By Ship Type, 2017–2027 (Thousand Units)

Table 4 Global Market, By Ship Type, 2017–2027 (USD Thousand)

Table 5 Passenger Ship Lighting Market, By Region, 2017–2027 (Thousand Units)

Table 6 Passenger Ship Lighting Market, By Region, 2017–2027 (USD Thousand)

Table 7 Commercial Ship Lighting Market, By Region, 2017–2027 (Thousand Units)

Table 8 Commercial Ship Lighting Market, By Region, 2017–2027 (USD Thousand)

Table 9 Yacht Lighting Market, By Region, 2017–2027 (Thousand Units)

Table 10 Yacht Lighting Market, By Region, 2017–2027 (USD Thousand)

Table 11 Global Market, By Technology, 2017–2027 (Thousand Units)

Table 12 Global Market, By Technology, 2017–2027 (USD Thousand)

Table 13 Led Lights Lighting Market, By Ship Type, 2017–2027 (Thousand Units)

Table 14 Led Lights Lighting Market, By Ship Type, 2017–2027 (USD Thousand)

Table 15 Fluorescent Lights Lighting Market, By Ship Type, 2017–2027 (Thousand Units)

Table 16 Fluorescent Lights Lighting Market, By Ship Type, 2017–2027 (USD Thousand)

Table 17 Halogen Lights Lighting Market, By Ship Type, 2017–2027 (Thousand Units)

Table 18 Halogen Lights Lighting Market, By Ship Type, 2017–2027 (USD Thousand)

Table 19 Xenon Lights Lighting Market, By Ship Type, 2017–2027 (Thousand Units)

Table 20 Xenon Lights Lighting Market, By Ship Type, 2017–2027 (USD Thousand)

Table 21 Global Market, By Application, 2017–2027 (Thousand Units)

Table 22 Global Market, By Application, 2017–2027 (USD Thousand)

Table 23 Navigation Lights Lighting Market, By Region, 2017–2027 (Thousand Units)

Table 24 Navigation Lights Lighting Market, By Region, 2017–2027 (USD Thousand)

Table 25 Dome Lights Lighting Market, By Region, 2017–2027 (Thousand Units)

Table 26 Dome Lights Lighting Market, By Region, 2017–2027 (USD Thousand)

Table 27 Compartment and Utility Lights Lighting Market, By Region, 2017–2027 (Thousand Units)

Table 28 Compartment and Utility Lights Lighting Market, By Region, 2017–2027 (USD Thousand)

Table 29 Reading Lights Lighting Market, By Region, 2017–2027 (Thousand Units)

Table 30 Reading Lights Lighting Market, By Region, 2017–2027 (USD Thousand)

Table 31 Docking Lights Lighting Market, By Region, 2017–2027 (Thousand Units)

Table 32 Docking Lights Lighting Market, By Region, 2017–2027 (USD Thousand)

Table 33 Safety Lights Lighting Market, By Region, 2017–2027 (Thousand Units)

Table 34 Safety Lights Lighting Market, By Region, 2017–2027 (USD Thousand)

Table 35 Decorative Lights Lighting Market, By Region, 2017–2027 (Thousand Units)

Table 36 Decorative Lights Lighting Market, By Region, 2017–2027 (USD Thousand)

Table 37 Global Market, By Type, 2017–2027 (Thousand Units)

Table 38 Global Market, By Type, 2017–2027 (USD Thousand)

Table 39 Functional Lights Lighting Market, By Region, 2017–2027 (Thousand Units)

Table 40 Functional Lights Lighting Market, By Region, 2017–2027 (USD Thousand)

Table 41 Decorative Lights Lighting Market, By Region, 2017–2027 (Thousand Units)

Table 42 Decorative Lights Lighting Market, By Region, 2017–2027 (USD Thousand)

Table 43 Global Market, By Region, 2017–2027 (Thousand Units)

Table 44 Global Market, By Region, 2017–2027 (USD Thousand)

Table 45 Asia Pacific Lighting Market, By Country, 2017–2027 (Thousand Units)

Table 46 Asia Pacific Lighting Market, By Country, 2017–2027 (USD Thousand)

Table 47 Asia Pacific Commercial Ship Registration, By Country, 2015-2018 (Units)

Table 48 China Lighting Market, By Technology, 2017–2027 (Thousand Units)

Table 49 China Lighting Market, By Technology, 2017–2027 (USD Thousand)

Table 50 India Lighting Market, By Technology, 2017–2027 (Thousand Units)

Table 51 India Lighting Market, By Technology, 2017–2027 (USD Thousand)

Table 52 Japan Lighting Market, By Technology, 2017–2027 (Thousand Units)

Table 53 Japan Lighting Market, By Technology, 2017–2027 (USD Thousand)

Table 54 South Korea Lighting Market, By Technology, 2017–2027 (Thousand Units)

Table 55 South Korea Lighting Market, By Technology, 2017–2027 (USD Thousand)

Table 56 Indonesia Lighting Market, By Technology, 2017–2027 (Thousand Units)

Table 57 Indonesia Lighting Market, By Technology, 2017–2027 (USD Thousand)

Table 58 Rest of Asia Pacific Lighting Market, By Technology, 2017–2027 (Thousand Units)

Table 59 Rest of Asia Pacific Lighting Market, By Technology, 2017–2027 (USD Thousand)

Table 60 Europe: Market, By Country, 2017–2027 (Thousand Units)

Table 61 Europe: Market, By Country, 2017–2027 (USD Thousand)

Table 62 Europe Commercial Ship Registration, By Country, 2015-2018 (Units)

Table 63 France Lighting Market, By Technology, 2017–2027 (Thousand Units)

Table 64 France Lighting Market, By Technology, 2017–2027 (USD Thousand)

Table 65 Spain Lighting Market, By Technology, 2017–2027 (Thousand Units)

Table 66 Spain Lighting Market, By Technology, 2017–2027 (USD Thousand)

Table 67 Turkey Lighting Market, By Technology, 2017–2027 (Thousand Units)

Table 68 Turkey Lighting Market, By Technology, 2017–2027 (USD Thousand)

Table 69 Norway Lighting Market, By Technology, 2017–2027 (Thousand Units)

Table 70 Norway Lighting Market, By Technology, 2017–2027 (USD Thousand)

Table 71 Greece Lighting Market, By Technology, 2017–2027 (Thousand Units)

Table 72 Greece Lighting Market, By Technology, 2017–2027 (USD Thousand)

Table 73 Russia Lighting Market, By Technology, 2017–2027 (Thousand Units)

Table 74 Russia Lighting Market, By Technology, 2017–2027 (USD Thousand)

Table 75 Rest of Europe Lighting Market, By Technology, 2017–2027 (Thousand Units)

Table 76 Rest of Europe Lighting Market, By Technology, 2017–2027 (USD Thousand)

Table 77 North America: Market, By Country, 2017–2027 (Thousand Units)

Table 78 North America: Market, By Country, 2017–2027 (USD Thousand)

Table 79 North America Commercial Ship Registration, By Country, 2015-2018 (Units)

Table 80 US Lighting Market, By Technology, 2017–2027 (Thousand Units)

Table 81 US Lighting Market, By Technology, 2017–2027 (USD Thousand)

Table 82 Canada Lighting Market, By Technology, 2017–2027 (Thousand Units)

Table 83 Canada Lighting Market, By Technology, 2017–2027 (USD Thousand)

Table 84 Mexico Lighting Market, By Technology, 2017–2027 (Thousand Units)

Table 85 Mexico Lighting Market, By Technology, 2017–2027 (USD Thousand)

Table 86 RoW: Market, By Country, 2017–2027 (Thousand Units)

Table 87 RoW: Market, By Country, 2017–2027 (USD Thousand)

Table 88 RoW Commercial Ship Registration, By Country, 2015-2018 (Units)

Table 89 Iran Lighting Market, By Technology, 2017–2027 (Thousand Units)

Table 90 Iran Lighting Market, By Technology, 2017–2027 (USD Thousand)

Table 91 Brazil Lighting Market, By Technology, 2017–2027 (Thousand Units)

Table 92 Brazil Lighting Market, By Technology, 2017–2027 (USD Thousand)

Table 93 Rest of RoW Lighting Market, By Technology, 2017–2027 (Thousand Units)

Table 94 Rest of RoW Lighting Market, By Technology, 2017–2027 (USD Thousand)

Table 95 New Product Developments, 2019

Table 96 Partnerships/Agreements/Supply Contracts/Collaborations/Joint Ventures, 2015–2017

List of Figures (41 Figures)

Figure 1 Market Segmentation

Figure 2 Research Design

Figure 3 Research Design Model

Figure 4 Breakdown of Primary Interviews: By Company Type, Designation, and Region

Figure 5 Market Size Estimation Methodology: Bottom-Up Approach

Figure 6 Data Triangulation

Figure 7 Global Market Outlook

Figure 8 Global Market, By Region, 2019 vs. 2027 (USD Million)

Figure 9 Increasing Commercial Ship Demand to Drive the Marine Lighting Market

Figure 10 Commercial Ship and Yacht Segments Accounted For the Largest Shares in Asia Pacific Market, By Ship Type, 2019 (USD Million)

Figure 11 Greece, Mexico, Spain, and Canada are Expected to Grow at the Highest Rates During the Forecast Period

Figure 12 Commercial Ship is Expected to Hold the Largest Share of this Market, 2019 vs. 2027 (USD Million)

Figure 13 LED is Expected to Lead the Global Market, By Technology, 2019 vs. 2027 (USD Million)

Figure 14 Compartment and Utility Application to Hold the Largest Share in this Market, By Application, 2019 vs. 2027 (USD Million) 32

Figure 15 Functional Lighting to Hold the Largest Share in this Market, By Type, 2019 vs. 2027 (USD Million)

Figure 16 Global Market Dynamics

Figure 17 Global GDP Per Capita (USD), 2015–2018

Figure 18 Market, By Ship Type, 2019 vs. 2027 (USD Million)

Figure 19 Market, By Technology, 2019 vs. 2027 (USD Million)

Figure 20 Market, By Application, 2019 vs. 2027 (USD Million)

Figure 21 Market, By Type, 2019 vs. 2027 (USD Million)

Figure 22 Market, By Region 2019 vs. 2027 (USD Million)

Figure 23 Asia Pacific: Market Snapshot

Figure 24 Europe: Market Snapshot

Figure 25 North America: Market, By Country, 2019 vs. 2027 (USD Million)

Figure 26 RoW: Market, By Country 2019 vs. 2027 (USD Million)

Figure 27 Market Ranking, For Key Players, 2018

Figure 28 Companies Adopted Partnerships and Supply Contracts as A Key Growth Strategy

Figure 29 Marine Lighting Manufacturers (Global): Competitive Leadership Mapping, 2018

Figure 30 Signify: Company Snapshot

Figure 31 Signify: SWOT Analysis

Figure 32 Hella: Company Snapshot

Figure 33 Hella: SWOT Analysis

Figure 34 Koito: Company Snapshot

Figure 35 Koito: SWOT Analysis

Figure 36 Osram GmbH: Company Snapshot

Figure 37 Osram: SWOT Analysis

Figure 38 West Marine: Company Snapshot

Figure 39 West Marine: SWOT Analysis

Figure 40 Lumishore: Company Snapshot

Figure 41 Foresti & Saurdi: Company Snapshot

The study involves four main activities to estimate the current size of the marine lighting market. Exhaustive secondary research was done to collect information on the market, such as the lighting types, upcoming technologies, and upcoming regulations. The next step was to validate these findings, assumptions, and market analysis with industry experts across value chains through primary research. A mix of bottom-up and top-down approach was employed to estimate the complete market size for different segments considered under this study.

Secondary Research

The secondary sources referred for this research study include marine organizations such as the Marine Traffic Association, United Nations Conference on Trade Development, corporate filings (such as annual reports, investor presentations, and financial statements), Factiva, CrunchBase, Bloomberg and trade, business, and other shipping associations. Secondary data has been collected and analyzed to arrive at the overall market size, which is further validated by multiple industry experts.

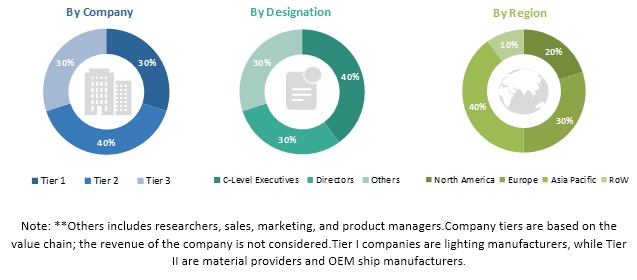

Primary Research

Extensive primary research has been conducted to understand the Marine lighting scenario through secondary research. Several primary interviews have been conducted with market experts from both the demand- (Ship manufacturers) and supply-side (lighting manufacturers) across major regions, namely, North America, Europe, Asia Oceania, and the Rest of the World. Primary data has been collected through questionnaires, emails, and telephonic interviews. In the canvassing of primaries, we have strived to cover various departments within organizations, such as sales, operations, vehicle planning, production, and administration, to provide a holistic viewpoint in our report.

After interacting with industry experts, we also conducted brief sessions with highly experienced independent consultants to reinforce the findings from our primaries. This, along with the in-house subject matter experts’ opinions, has led us to the findings as described in the remainder of this report.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The bottom-up approach has been used to estimate and validate the size of the global market by technology. To determine the market size, in terms of volume, by application and ship type, the country-level registration numbers of each ship type have been multiplied by technology-level penetration of light type (halogen, LED, xenon, and fluorescent). The regional-level market size, in terms of volume, of each ship type is added to derive the global market, by region.

The country-level market by volume is multiplied with the average selling price at country level of each technology under different applications, which results in the country-level market size. The further summation of country-level markets gives the regional level market, by value. It is consolidated to form the global market by value.

All percentage shares, splits, and breakdowns have been determined using secondary paid and unpaid sources and verified through primary research. All parameters that are said to affect the markets covered in this research study have been accounted for, reviewed in extensive detail, verified through primary research, and analyzed to get the final quantitative and qualitative data. The data has been consolidated and enhanced with detailed inputs and analysis from MarketsandMarkets and presented in this report.

Data Triangulation

All percentage shares, splits, and breakdowns have been determined using secondary sources and verified by primary sources. All parameters that are said to affect the markets covered in this research study have been accounted for, viewed in extensive detail, and analyzed to obtain the final quantitative and qualitative data. This data has been consolidated, enhanced with detailed inputs and analysis from MarketsandMarkets, and presented in the report. The data was triangulated by studying various factors and trends from both the demand and supply sides in this market.

Report Objectives

- To define, segment, analyze, and forecast (2019–2027) the marine lighting size, in terms of volume (housand tons) and value (USD million/thousand)

- To segment and forecast the market size, by volume and value, based on ship type (passenger ship, commercial ship, and yachts)

- To segment and forecast the market size, by volume and value, based on application (navigation lights, dome lights, reading lights, compartment lights, docking lights, safety lights, decorative lights)

- To segment and forecast the market size, by volume and value, based on usage (functional and decorative)

- To segment and forecast the market size, by volume and value, based on technology (halogen, LED, xenon, and fluorescent)

- To segment and forecast the market size, by volume and value, based on region {North America, Europe, Asia Oceania, and the Rest of the World (RoW)}

- To analyze the competitive leadership mapping for key market players based on their product offerings and business strategies to find the dynamic differentiators, innovators, visionary leaders, and emerging companies in the Marine lighting

- To identify the market dynamics (drivers, restraints, opportunities, and challenges) and analyze their impact on the Marine lighting

- To track and analyze recent developments, collaborations, joint ventures, product innovations, and mergers & acquisitions in the Marine lighting

Available Customizations

With the given market data, MarketsandMarkets offers customizations in accordance with the company’s specific needs.

Passenger Ship Market for Marine Lighting, by Application

- Navigation lights

- Dome lights

- Compartment & Utility lights

- Reading lights

- Docking lights

- Safety lights

- Decorative lights

Commercial Ship Market for Marine Lighting , by Application

- Navigation lights

- Compartment & Utility lights

- Docking lights

- Safety lights

Note: The countries would be covered: Asia Oceania (China, South Korea, Indonesia, India, Japan and Rest of Asia), Europe (France, Spain, Turkey, Norway, Greece, Russia, and Rest of Europe), North America (US, Canada, and Mexico), and the Rest of World (Iran, Brazil, Rest of RoW)

Growth opportunities and latent adjacency in Marine Lighting Market