Marine Fuel Injection System Market by Application (Inland Waterways, Commercial Vessels and Offshore Support Vessels), by Component (Fuel Injector, Fuel Valves, Fuel Pump and Others), by HP Range and by Region - Trend and Forecasts to 2021

[148 Pages Report] The global marine fuel injection market was valued at USD 4.21 Billion in 2015, and is expected to grow at a CAGR of 3.9% from 2016 to 2021. The marine fuel injection market has been segmented based on its application, component, power rating (HP Range), and region. The years considered for the study are:

- Base Year – 2015

- Estimated Year – 2016

- Projected Year – 2021

- Forecast Period – 2016 to 2021

The year 2015 has been considered for company profiles in the report. Where information is unavailable for the base year, the prior year has been considered. The report describes and forecasts the global marine fuel injection market on the basis of application, component, HP range, and region.

It strategically analyzes the marine fuel injection market with respect to individual growth trends of manufacturers and service providers, their future expansions, and contribution to the market.

Research Methodology

This research study involves extensive usage of secondary sources, directories, and databases to identify and collect information useful for this technical, market-oriented, and commercial study of the marine fuel injection technology. The flow of the research methodology is explained below.

- Analysis of the shipbuilding industry and new vessel order book for each type of vessel

- Analysis of country-wise demand for new marine engines and fuel injection components on the basis of number of shipbuilding yards and their ship building capabilities in each country

- Analysis of demand for marine fuel injection; key manufacturing industries supplying marine fuel injection systems

- Analyzing market trends in various regions/ countries supported by the on-going shipbuilding order book in each region/ country

- Overall market size has been finalized by triangulation with the supply-side data, which include product developments, supply chain, and annual completion of number of ships across the globe

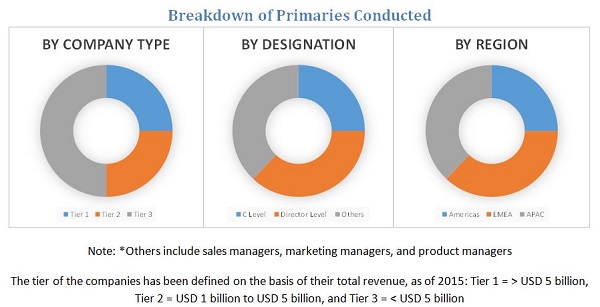

After arriving at the overall market size, the total market has been split into several segments and subsegments. The figure below shows the breakdown of the primaries on the basis of company type, designation, and region, conducted during the research study.

Market Ecosystem

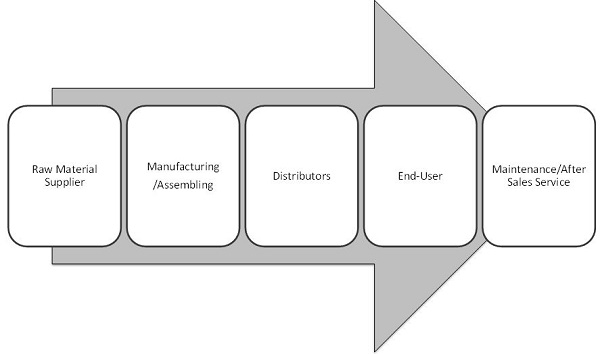

The marine fuel injection market starts with raw material suppliers, which include cast iron, steel, and aluminum & copper suppliers. This is then designed, molded, and assembled by the marine fuel injection manufacturers. The manufactured system in then supplied to the end-users (marine engine manufacturers) through distributors. The marine fuel injection manufacturers include Robert Bosch (U.S.), Rolls-Royce (L’Orange) (U.K.), Woodward (U.S.), and Yanmar (Japan) among others. The end-users include marine engine manufacturers such as Cummins (U.S.), Caterpillar (U.S.), and Rolls-Royce (U.K.).

Stakeholders

The stakeholders for this report are:

- Fuel injection component manufacturers

- Automotive fuel injection manufacturers

- Marine engine manufacturers

- Government and research organizations

- Consulting companies in the marine sector

- Marine engine manufacturers associations

- Environmental associations

- Investment banks

Scope of the Report:

- This study estimates the global marine fuel injection market, in terms of USD till 2021

- It offers a detailed qualitative and quantitative analysis of the market

- It provides a comprehensive review of major market drivers, restraints, opportunities, challenges, and technological trends of the market

- It covers various important aspects of the market. These include analysis of supply chain along with Porter’s five forces model, competitive landscape, market dynamics, market estimates in terms of value, and future trends in the marine fuel injection market.

The market has been segmented into -

On the basis of Application

- Commercial Vessels

- Inland Waterways transport vessel

- Offshore Support Vessels (OSV)

On the basis of Power Rating (HP Range)

- 0 HP–2,000 HP

- 2,000 HP–10,000 HP

- 10,000 HP–20,000 HP

- 20,000HP–50,000 HP

- 50,000 HP–80,000 HP

- Above 80,000 HP

(Above ranges define the total engine capacity of a vessel/ship)

On the basis of Component

- Fuel Injector

- Electronic Control Unit (ECU)

- Fuel Pump

- Fuel Valves

- Others

On the basis of Region

- Asia-Pacific

- Europe

- North America

- South America

- Middle East & Africa

Available Customization

With the market data provided above, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

- Detailed analysis and profiling of additional market players (Up to 5)

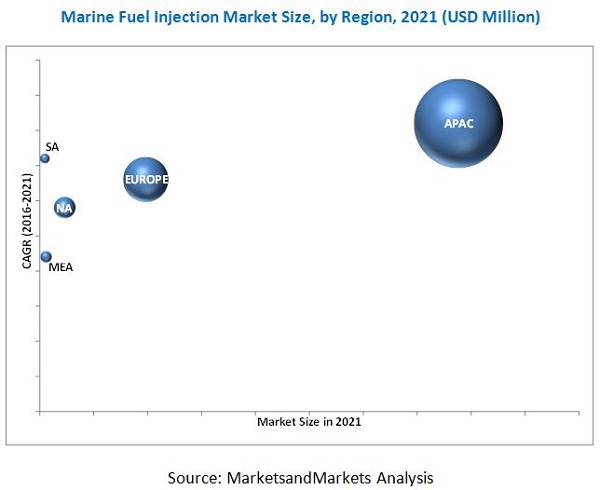

The global marine fuel injection market is expected to reach USD 5.20 Billion by 2021, at a CAGR of 3.9% from 2016 to 2021. The growth is attributed to increase in international seaborne trade, growth of the shipbuilding industry, and stringent marine emission regulations across the globe.

Fuel injection system is a collective term used for fuel injector, fuel pump, fuel valves, Electronic Control Unit (ECU), and other components such as fuel rail and fuel pressure regulators. The marine fuel injection is used to attain faster throttle response, better fuel flow, precise control of exhaust system, and equal distribution of fuel. With marine emission norms getting stringent, the demand for new fuel injection systems is also increasing. In addition, the advent of the electronic fuel injection technology is also driving the market for marine fuel injection.

The report segments the marine fuel injection market on the basis of its application, power rating (HP range), component, and region. Fuel injector is the only component in marine fuel injection system which is changed frequently, thus it dominated the marine fuel injection market, by component, in 2015.

The commercial vessel segment is expected to dominate the marine fuel injection market, by application. The inland waterways segment is also a potential market for marine fuel injection as its demand has increased in Africa, South America, and Europe. Hence, commercial vessel and inland waterways are the key applications to demand marine fuel injection systems. Meanwhile, Asia-Pacific was the leading market for marine fuel injection in 2015, as the region houses several major shipbuilding countries such as China, Japan, South Korea, Malaysia, and India. Furthermore, factors favoring this include low labor and manufacturing cost. Hence, the Asia-Pacific region dominated the marine fuel injection market in 2015. China is estimated to be the largest market, growing at a decent rate during the forecast period, whereas countries such as South Korea, Japan, Brazil, and India are potential markets to demand marine fuel injection during the same duration.

Different regions have different marine environmental regulations for emission of NOx and use of sulfur content in fuel. Hence, marine fuel injection manufacturers would have a challenging task to provide different fuel injection systems for different regions. However, factors such as huge investments required in R&D and high capital required would restraint the marine fuel injection market. Meanwhile, several fuel injection manufacturers are coming up with new technologies, such as methanol fuel injection, in order to cope with stringent environment regulations.

Major players in the global marine fuel injection market include Cummins Inc. (U.S.), Liebherr International AG (Switzerland), Robert Bosch GmbH (Germany), Rolls-Royce Holding PLC. (U.K.), Caterpillar Inc. (U.S.), Yanmar Co. Ltd. (Japan), Woodward Inc. (U.S.), and Denso Corporation (Japan), among others. In order to acquire majority of the market share, marine fuel injection manufacturers have invested in developing new technologies.

Table of Contents

1 Introduction (Page No. - 15)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Markets Covered

1.3.2 Years Considered for the Study

1.4 Currency

1.5 Limitations

1.6 Stakeholders

2 Research Methodology (Page No. - 18)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

2.1.2.3 Breakdown of Primaries

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

2.3 Data Triangulation

2.4 Research Assumptions & Limitations

2.4.1 Assumptions

2.4.2 Limitations

3 Executive Summary (Page No. - 27)

3.1 Introduction

3.2 Current Scenario

3.3 Future Trends

3.4 Conclusion

4 Premium Insights (Page No. - 32)

4.1 Asia-Pacific: the Largest Market During the Forecast Period

4.2 Marine Fuel Injection System Market Size, By Component, 2021

4.3 Marine Fuel Injection System Market, By Application, 2021

4.4 Life Cycle Analysis, By Region

5 Market Overview (Page No. - 37)

5.1 Introduction

5.2 Marine Fuel Injection System: Market Segmentation

5.2.1 By Application

5.2.2 By Component

5.2.3 By HP Range

5.2.4 By Region

5.3 Market Dynamics

5.3.1 Drivers

5.3.1.1 Growth of the Shipbuilding Industry

5.3.1.1.1 Development of Fleet Size

5.3.1.1.2 Ship Demolition

5.3.1.2 Marine Emission Regulations

5.3.1.3 Increase in Global Maritime Trade & Tourism

5.3.1.3.1 Rise in Seaborne Trade

5.3.1.3.2 Growth of Maritime Tourism

5.3.2 Restraints

5.3.2.1 Technical Design Complexity Increases R&D Cost

5.3.2.2 Fluctuating Price of Raw Materials

5.3.3 Opportunities

5.3.3.1 Advanced Fuel Injection Systems

5.3.3.1.1 Methanol Fuel Injection Systems

5.3.3.2 Increase in Demand for Inland Water & Luxury Boats

5.3.3.2.1 Growth of Inland Water Boats

5.3.3.2.2 Rise in Luxury Boat Market

5.3.4 Challenges

5.3.4.1 Coping With Country-Wise Emission Norms

5.4 Technical Overview

6 Industry Trends (Page No. - 49)

6.1 Introduction

6.2 Supply Chain Analysis

6.2.1 Raw Material Suppliers

6.2.2 Manufacturers

6.2.3 Distributors

6.2.4 End-Users/ Engine Manufacturers

6.3 Porter’s Five Forces Analysis

6.3.1 Threat of Substitutes

6.3.2 Threat of New Entrants

6.3.3 Bargaining Power of Buyers

6.3.4 Bargaining Power of Suppliers

6.3.5 Intensity of Competitive Rivalry

7 Marine Fuel Injection System Market, By Application (Page No. - 54)

7.1 Introduction

7.2 Commercial Vessels

7.3 Inland Waterways

7.4 Offshore Support Vessels

8 Marine Fuel Injection System Market, By HP Range (Page No. - 62)

8.1 Introduction

8.2 By HP Range, 2,001 HP–10,000 HP

8.3 By HP Range, 20,001 HP–50,000 HP

8.4 By HP Range, 10,001 HP–20,000 HP

8.5 By HP Range, 0 HP–2,000 HP

8.6 By HP Range, 50,001 HP–80,000 HP

8.7 By HP Range, Above 80,000 HP

9 Marine Fuel Injection System Market, By Component (Page No. - 69)

9.1 Introduction

9.2 Fuel Injector

9.3 Electronic Control Unit (ECU)

9.4 Fuel Pump

9.5 Fuel Valves

9.6 Others

10 Marine Fuel Injection System Market, By Region (Page No. - 78)

10.1 Introduction

10.2 Asia-Pacific

10.2.1 By Application

10.2.2 By Component

10.2.3 By HP Range

10.2.4 By Country

10.2.4.1 China

10.2.4.2 South Korea

10.2.4.3 Japan

10.2.4.4 Indonesia

10.2.4.5 Rest of Asia-Pacific

10.3 Europe

10.3.1 By Application

10.3.2 By Component

10.3.3 By HP Range

10.3.4 By Country

10.3.4.1 Russia

10.3.4.2 Norway

10.3.4.3 Germany

10.3.4.4 Italy

10.3.4.5 Rest of Europe

10.4 North America

10.4.1 By Application

10.4.2 By Component

10.4.3 By HP Range

10.4.4 By Country

10.4.4.1 U.S.

10.4.4.2 Canada

10.4.4.3 Rest of North America

10.5 Middle East & Africa

10.5.1 By Application

10.5.2 By Component

10.5.3 By HP Range

10.5.4 By Country

10.5.4.1 Egypt

10.5.4.2 South Africa

10.5.4.3 UAE

10.5.4.4 Rest of Middle East & Africa

10.6 South America

10.6.1 By Application

10.6.2 By Component

10.6.3 By HP Range

10.6.4 By Country

10.6.4.1 Brazil

10.6.4.2 Uruguay

10.6.4.3 Rest of South America

11 Competitive Landscape (Page No. - 110)

11.1 Overview

11.2 Market Share Analysis, By Key Players

11.3 Competitive Situations & Trends

11.3.1 Investments & Expansions

11.3.2 New Product Developments

11.3.3 Contracts & Agreements

11.3.4 Other Developments

11.3.5 Mergers & Acquisitions

12 Company Profiles (Page No. - 117)

(Company at A Glance, Recent Financials, Products & Services, Strategies & Insights, & Recent Developments)*

12.1 Introduction

12.2 Caterpillar Inc.

12.3 Cummins Inc.

12.4 Robert Bosch GmbH

12.5 Rolls-Royce Holdings PLC.

12.6 Liebherr International AG

12.7 Yanmar Co. Ltd.

12.8 Woodward Inc.

12.9 Denso Corporation

12.10 Delphi Automotive PLC.

12.11 MAN SE

*Details on Company at A Glance, Recent Financials, Products & Services, Strategies & Insights, & Recent Developments Might Not Be Captured in Case of Unlisted Companies.

13 Appendix (Page No. - 142)

13.1 Insights From Industry Experts

13.2 Discussion Guide

13.3 Knowledge Store: Marketsandmarkets’ Subscription Portal

13.4 Introducing RT: Real-Time Market Intelligence

13.5 Available Customizations

13.6 Related Reports

List of Tables (74 Tables)

Table 1 Nox Emission Control: Marpol Annexure Vi

Table 2 Marine Fuel Injection System Market Size, By Application, 2014–2021 (USD Million)

Table 3 Commercial Vessels: Marine Fuel Injection Systems Market Size, By Region, 2014–2021 (USD Million)

Table 4 Commercial Vessels: Marine Fuel Injection Systems Market Size, By Top Countries, 2016-2021 (USD Million)

Table 5 Inland Waterways: Marine Fuel Injection Systems Market Size, By Region, 2014–2021 (USD Million)

Table 6 Inland Water Ways: Marine Fuel Injection Systems Market Size, By Top Countries, 2016-2021 (USD Million)

Table 7 Offshore Support Vessels: Marine Fuel Injection Systems Market Size, By Region, 2014–2021 (USD Million)

Table 8 OSV: Marine Fuel Injection Systems Market Size, By Top Countries, 2014-2021 (USD Million)

Table 9 Marine Fuel Injection Systems Market Size, By HP Range, 2014–2021 (USD Million)

Table 10 2,001 HP–10,000 HP: Marine Fuel Injection Systems Market Size, By Region, 2014–2021 (USD Million)

Table 11 20,001 HP–50,000 HP: Marine Fuel Injection Systems Market Size, By Region, 2014–2021 (USD Million)

Table 12 10,001 HP–20,000 HP: Marine Fuel Injection Systems Market Size, By Region, 2014–2021 (USD Million)

Table 13 0 HP–2,000 HP: Marine Fuel Injection Systems Market Size, By Region, 2014–2021 (USD Million)

Table 14 50,001 HP–80,000 HP: Marine Fuel Injection Systems Market Size, By Region, 2014–2021 (USD Million)

Table 15 Above 80,000 HP: Marine Fuel Injection Systems Market Size, By Region, 2014–2021 (USD Million)

Table 16 Major Manufacturers of Marine Fuel Injection Systems Components

Table 17 Marine Fuel Injection Systems Market Size, By Component, 2014–2021 (USD Million)

Table 18 Fuel Injector: Marine Fuel Injection Systems Market Size, By Region, 2014–2021 (USD Million)

Table 19 Electronic Control Unit: Marine Fuel Injection Systems Market Size, By Region, 2014–2021 (USD Million)

Table 20 Fuel Pump: Marine Fuel Injection Systems Market Size, By Region, 2014–2021 (USD Million)

Table 21 Fuel Valves: Marine Fuel Injection Systems Market Size, By Region, 2014–2021 (USD Million)

Table 22 Others: Marine Fuel Injection System Market Size, By Region, 2014–2021 (USD Million)

Table 23 North America: Marine Fuel Injection Systems Market Size, By Component, 2014–2021 (USD Million)

Table 24 South America: Marine Fuel Injection Systems Market Size, By Component, 2014–2021 (USD Million)

Table 25 Asia-Pacific: Marine Fuel Injection Systems Market Size, By Component, 2014-2021 (USD Million)

Table 26 Europe: Marine Fuel Injection Systems Market Size, By Component, 2014–2021 (USD Million)

Table 27 Middle East & Africa: Marine Fuel Injection Systems Market Size, By Component, 2014–2021 (USD Million)

Table 28 Marine Fuel Injection Systems Market Size, By Region, 2014–2021 (USD Million)

Table 29 Asia-Pacific: Order Book, By Top Country, 2011–2015 (Number of Vessels, Gross Tonnage)

Table 30 Asia-Pacific: Marine Fuel Injection System Market Size, By Application, 2014–2021 (USD Million)

Table 31 Asia-Pacific: By Market Size, By Component, 2014–2021 (USD Million)

Table 32 Asia-Pacific: By Market Size, By HP Range, 2014–2021 (USD Million)

Table 33 Asia-Pacific: By Market Size, By Country, 2014–2021 (USD Million)

Table 34 China: Marine Fuel Injection Systems Market Size, By Application, 2014–2021 (USD Million)

Table 35 South Korea: Marine Fuel Injection Systems Market Size, By Application, 2014–2021 (USD Million)

Table 36 Japan : Marine Fuel Injection Systems Market Size, By Application, 2014–2021 (USD Million)

Table 37 Indonesia: Marine Fuel Injection System Market Size, By Application, 2014–2021 (USD Million)

Table 38 Rest of Asia-Pacific: Marine Fuel Injection System Market Size, By Application, 2014–2021 (USD Million)

Table 39 Europe: Marine Fuel Injection System Market Size, By Application, 2014–2021 (USD Million)

Table 40 Europe: By Market Size, By Component, 2014–2021 (USD Million)

Table 41 Europe: By Market Size, By HP Range, 2014–2021 (USD Million)

Table 42 Europe :By Market Size, By Country, 2014–2021 (USD Million)

Table 43 Russia: Marine Fuel Injection System Market Size, By Application, 2014–2021 (USD Million)

Table 44 Norway: Marine Fuel Injection System Market Size, By Application, 2014–2021 (USD Million)

Table 45 Germany: Marine Fuel Injection System Market Size, By Application, 2014–2021 (USD Million)

Table 46 Italy : Marine Fuel Injection System Market Size, By Application, 2014–2021 (USD Million)

Table 47 Rest of Europe: Marine Fuel Injection System Market Size, By Application, 2014–2021 (USD Million)

Table 48 North America: By Market Size, By Application, 2014-2021 (USD Million)

Table 49 North America: By Market Size, By Component, 2014-2021 (USD Million)

Table 50 North America: By Market Size, By HP Range, 2014-2021 (USD Million)

Table 51 North America: By Market Size, By Country, 2014-2021 (USD Million)

Table 52 U.S.: By Market Size, By Application, 2014-2021 (USD Million)

Table 53 Canada: By Market Size, By Application, 2014-2021 (USD Million)

Table 54 Rest of North America : By Market Size, By Application, 2014-2021 (USD Million)

Table 55 Middle East & Africa: By Market Size, By Application, 2014-2021 (USD Million)

Table 56 Middle East & Africa: By Market Size, By Component, 2014-2021 (USD Million)

Table 57 Middle East & Africa: By Market Size, By HP Range, 2014-2021 (USD Million)

Table 58 Middle East & Africa: By Market Size, By Country, 2014-2021 (USD Million)

Table 59 Egypt : By Market Size, By Application, 2014-2021 (USD Million)

Table 60 South Africa : By Market Size, By Application, 2014-2021 (USD Million)

Table 61 UAE :By Market Size, By Application, 2014-2021 (USD Million)

Table 62 Rest of Middle East & Africa : By Market Size, By Application, 2014-2021 (USD Million)

Table 63 South America: By Market Size, By Application, 2014-2021 (USD Million)

Table 64 South America: By Market Size, By Component, 2014-2021 (USD Million))

Table 65 South America: By Market Size, By HP Range, 2014-2021 (USD Million)

Table 66 South America: By Market Size, By Country, 2014-2021 (USD Million)

Table 67 Brazil: Marine Fuel Injection System Market Size, By Application, 2014-2021 (USD Million)

Table 68 Uruguay : Marine Fuel Injection System Market Size, By Application, 2014-2021 (USD Million)

Table 69 Rest of South America : Marine Fuel Injection System Market Size, By Application, 2014-2021 (USD Million)

Table 70 Investments & Expansions, 2013–2016

Table 71 New Product Developments, 2013–2015

Table 72 Contracts & Agreements, 2012–2016

Table 73 Other Developments, 2014–2016

Table 74 Mergers & Acquisitions, 2013

List of Figures (56 Figures)

Figure 1 Marine Fuel Injection System: Market Segmentation

Figure 2 Marine Fuel Injection System Market: Research Design

Figure 3 Bottom-Up Approach

Figure 4 Top-Down Approach

Figure 5 Data Triangulation Methodology

Figure 6 Assumptions of the Research Study

Figure 7 Limitations of the Research Study

Figure 8 Asia-Pacific Dominated the Marine Fuel Injection System Market in 2015

Figure 9 Commercial Vessels Segment Dominated the Fuel Injection System Market in 2015

Figure 10 Asia-Pacific is Expected to Be A Potential Market for Marine Fuel Injection System During the Forecast Period

Figure 11 Marine Engine With Power Rating of 2,001 HP–10,000 HP is Expected to Dominate the Fuel Injection System Market During the Forecast Period

Figure 12 Marine Fuel Injection System Market: A Potential Market to Invest During the Forecast Period

Figure 13 Asia-Pacific is Estimated to Hold the Largest Market Share (Value) By 2021

Figure 14 Fuel Injector Segment is Estimated to Hold the Largest Market Share (By Value) By 2021

Figure 15 Commercial Vessels Segment is Expected to Grow at the Highest CAGR During the Forecast Period

Figure 16 The Demand for Marine Fuel Injection System is Expected to Come From Marine Engine With HP Range of 2,001–10,000 By 2021

Figure 17 The Market in Asia-Pacific is Expected to Grow at the Highest Rate During the Forecast Period

Figure 18 Marine Fuel Injection System Market Segmentation: By Application, Component, Region, & HP Range

Figure 19 Growth of the Shipbuilding Industry & Strict Marine Regulations Would Drive the Marine Fuel Injection System Market

Figure 20 Shipbuilding Industry: New Order Fleet Count vs Fleet Size From 2009 to 2015

Figure 21 Development of Fleet Size in 000’ Gt, By Type of Vessel, 2012–2018

Figure 22 Emission Control Areas (ECA) Regulations as of 1st January 2015

Figure 23 Marine Fuel Injection System Market: Supply Chain Analysis

Figure 24 Marine Fuel Injection System Market: Porter’s Five Forces Analysis

Figure 25 Overview of Porter’s Five Forces Analysis

Figure 26 Commercial Vessel & Inland Waterways are Key Applications to Drive Marine Fuel Injection System Market By 2021

Figure 27 Asia-Pacific is A Potential Market to Invest for Commercial Vessels Fuel Injection Systems During the Forecast Period

Figure 28 Asia-Pacific is Expected to Dominate the Marine Fuel Injection System Market for the 2,001 HP–10,000 HP Category

Figure 29 Fuel Injector & ECU Accounted for More Than 50% of the Marine Fuel Injection System Market in 2015

Figure 30 Asia-Pacific & Europe are Potential Markets for ECU Components

Figure 31 Marine Fuel Injection System Market Share (By Value), By Region, 2015

Figure 32 Regional Snapshot: Growth Rate of the Marine Fuel Injection System Market in Major Countries, 2016–2021

Figure 33 Asia-Pacific: Marine Fuel Injection System Market Overview

Figure 34 Regional Snapshot: Growth Rate of the Marine Fuel Injection System Market in Major Countries, 2016–2021

Figure 35 Europe: Marine Fuel Injection System Market Overview

Figure 36 Russia is A Potential Market to Invest During the Forecast Period

Figure 37 Companies Adopted Investment& Expansion as the Key Growth Strategy, 2012–2016

Figure 38 Cummins Inc. Held the Largest Share in the Marine Fuel Injection System Market, 2015

Figure 39 Market Evaluation Framework: Investments & Expansions, Mergers & Acquisitions, and New Product Developments Fueled the Growth of Companies From 2013 to 2016

Figure 40 Regional Revenue Mix of the Top 5 Market Players

Figure 41 Caterpillar Inc.: Company Snapshot

Figure 42 Caterpillar Inc.: SWOT Analysis

Figure 43 Cummins Inc. : Company Snapshot

Figure 44 Cummins Inc.: SWOT Analysis

Figure 45 Robert Bosch GmbH : Company Snapshot

Figure 46 Robert Bosch GmbH : SWOT Analysis

Figure 47 Rolls-Royce Holdings PLC.: Company Snapshot

Figure 48 Rolls-Royce Holdings PLC : SWOT Analysis

Figure 49 Liebherr International AG : Company Snapshot

Figure 50 Liebherr International AG : SWOT Analysis

Figure 51 Yanmar Co. Ltd.: Company Snapshot

Figure 52 Yanmar Co. Ltd. : SWOT Analysis

Figure 53 Woodward Inc.: Company Snapshot

Figure 54 Denso Corporation : Company Snapshot

Figure 55 Delphi Automotive PLC.: Company Snapshot

Figure 56 MAN SE: Company Snapshot

Growth opportunities and latent adjacency in Marine Fuel Injection System Market