Lycopene Market by Source (Synthetic and Natural), Application (Dietary Supplements, Food, Pharmaceuticals, and Personal Care Products), Form (Beadlets, Oil Suspension, Emulsifiers, and Powder), Property, and Region - Global Forecast to 2025

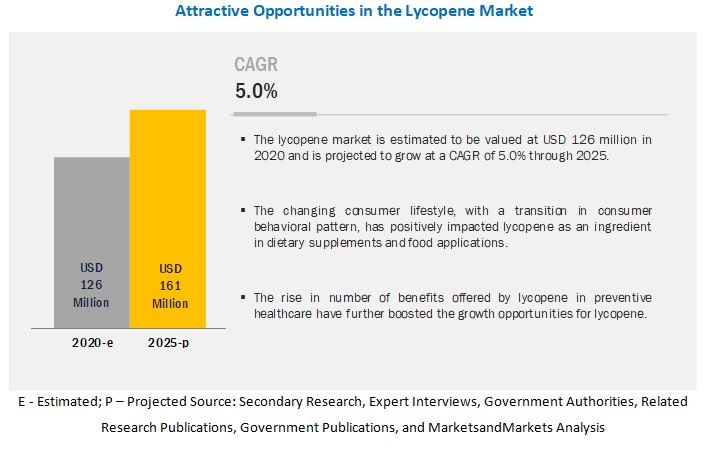

The global lycopene market is projected to reach USD 161 million by 2025, recording a CAGR of 5.0% during the forecast period. The market is primarily driven by the increasing number of benefits offered by lycopene in preventive healthcare and its rising applications in an array of industries, globally.

Rising consumption of lycopene in an array of industries due to its functions as a health ingredient and coloring agent

Lycopene is witnessing a rise in consumption in an array of industries including dietary supplements, food, personal care & cosmetics, and pharmaceuticals. It is experiencing this growth due to its properties that mainly includes being a health ingredient, followed by being a coloring agent. The majority of the market share in the global lycopene market was accounted for by the health ingredient property. The coloring agent property has a comparatively smaller share in the global market for lycopene. This is a result of the limited application of lycopene as a coloring agent in the food industry. Also, applications of lycopene as a health ingredient are expanding, which is further expected to boost the growth of lycopene in the global market.

Dietary supplements to record the highest CAGR during the forecast period

The demand for dietary supplements is on the rise in developed and developing countries among the millennial population. Lycopene constitutes to be a key ingredient in the dietary supplements consumed by an individual daily. Also, industry experts foresee the adoption rate for dietary supplements to increase the most in the next five years. Hence, lycopene’s key role in the dietary supplement application because of its distinct health benefits is expected to bolster the growth during the forecast period between 2020 and 2025.

Beadlets to be the most preferred form of lycopene in the global market

The beadlets form of lycopene accounted for the largest share in the lycopene market in 2019 and is projected to follow the same trend through the forecast year until 2025. Beadlets are the most commonly used form of lycopene by an array of industries globally, as it comprises the highest content of lycopene concentrate. Among all the other forms such as oil suspension, powder, and emulsion, the beadlet form is observed to be produced by most of the lycopene manufacturers, resulting in higher demand for it. Thus, demand and supply side, both favouring the beadlet form of lycopene, resulting in its dominance in the market during the forecast period.

In terms of source, synthetic lycopene accounted for the dominant share in the market

Synthetic source lycopene is targeted by most of the manufacturing companies due to a number of factors including lower cost of production, simpler processing, and its easy and wide applications in various industries. Furthermore, the synthetic source lycopene is widely available, resulting in its leading market share. However, the changing consumer trends toward healthier lifestyles result in higher demand for natural products cause of the health-related benefits offered. Hence, the natural source lycopene is projected to exhibit the highest CAGR in the lycopene market during the forecast period.

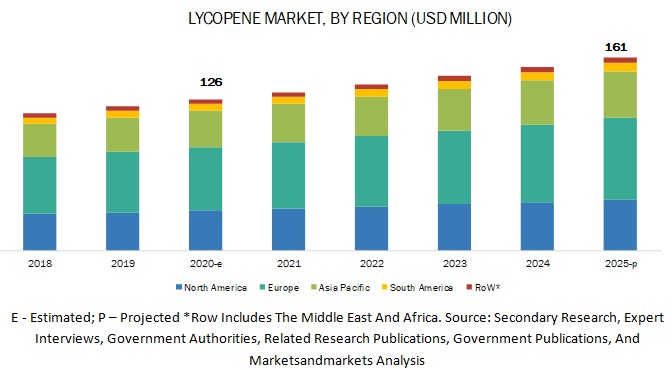

The lycopene market in the Asia Pacific region is projected to grow at the highest CAGR from 2019 to 2025

Factors driving the growth of the Asia Pacific market include the presence of the lycopene manufacturing companies in this region. In addition, the production of tomatoes is the highest among all the regions, globally resulting in lower cost for procuring raw material. Hence, the development of technologies and abundant raw material leading the manufacturers to produce and supply lycopene to an array of industries at a competitive price and gaining an advantage over the competitors in the other regions. Furthermore, the rising awareness on benefits of lycopene in food, dietary supplement, and personal care & cosmetic applications is expected to boost the demand for lycopene, also resulting in higher exports from the surplus production of lycopene in this region, which will further boost the market share of this region in the global lycopene market.

Top Companies in the Lycopene Market

Many domestic and global players provide lycopene as an ingredient across the world, making it a fragmented market. Major players have their presence in the Asia Pacific region, primarily in Chinese and Indian countries. Key players operating in this market include Allied Biotech Corporation (China), Lycored (Israel), DSM (Netherlands), Wellgreen Technology Co Ltd (China), Divi’s Laboratories (India), San-Ei Gen F.F.I., Inc (Japan), Dangshang Sannuo Limited (China), DDW (US), Döhler (Germany), Farbest Brands (US), Zhejiang NHU CO. Ltd (China), EID Parry (India), Shaanxi Kingsci Biotechnology Co. Ltd (China), Vidya Herbs (India), Xi'an Pincredit Biotech Co Ltd (China), Hunan Sunshine Bio-Tech Co.Ltd (China), Xi'an Natural Field Bio-Technology Co.,Ltd (China), Plantnat (China), SV AgroFoods (India), and Plamed Green Science Group (China).

Scope of the Report

|

Report Metric |

Details |

|

Lycopene Market size value in 2020 |

USD 126 million |

|

Lycopene Market Revenue forecast in 2025 |

USD 161 million |

|

Growth Rate |

CAGR of 5.0% from 2020 to 2025 |

|

Market size estimation |

2018-2025 |

|

Base year considered |

2019 |

|

Forecast period considered |

2020–2025 |

|

Units considered |

Value (USD Million) and Volume (Tons) |

|

Segments covered |

|

|

Regions covered |

|

|

Key Companies Profiled |

|

Target Audience

- Supply-side: Lycopene manufacturers, raw material suppliers, tomato producers, carotenoid manufacturers, importers, and exporters

- Demand-side: Lycopene-based product manufacturers, retailers, distributors, and wholesalers of lycopene and lycopene-based products

- Regulatory side: Concerned government authorities, commercial research & development (R&D) institutions, and other regulatory bodies

- Associations and industry bodies: Food and Agriculture Organization (FAO), United States Department of Agriculture (USDA), European Food Safety Authority (EFSA), World Cancer Research Fund International (WCRF), World Health Organization (WHO), All India Food Processing Association (AIFPA), National Center for Biotechnology Information (NCBI), National Library of Medicine (NLM), National Institutes of Health (NIH), Center for Food Safety (CFS), World Bank, and Organisation for Economic Co-operation and Development (OECD).

Lycopene Market Scope

Source

- Synthetic

- Natural

Application

- Dietary supplements

- Food & beverages

- Personal care products

- Pharmaceuticals

Form:

- Beadlets

- Oil suspension

- Powder

- Emulsion

Property:

- Health ingredient

- Coloring agent

Region

- Europe

- North America

- Asia Pacific

- South America

- Rest of the World (RoW)

Recent Developments

- In January 2018, E.I.D. Parry (India) entered into a partnership with Synthite Industries Ltd to synergize the company’s marketing strength in its human nutrition segment

- In September 2018, E.I.D. Parry (India) acquired Alimtec S.A. (Chile), which is a part of Bayer Group (Germany), to strengthen its nutraceutical business.

- In June 2019, DDW (US) The Color House acquired the natural color business from DuPont’s Nutrition & Biosciences division to expand its global reach and also to add manufacturing and technical attributes in new natural colors.

Key questions addressed by the lycopene market report:

- Which region will account for the largest share in the lycopene market?

- What are the trends and factors responsible for influencing the adoption rate of lycopene in key emerging countries?

- What is the level of support offered by governments across these countries to the ingredient manufacturers for lycopene?

- Which are the key players in the market, and how intense is the competition?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 16)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 MARKET SEGMENTATION

1.4 REGIONS COVERED

1.5 PERIODIZATION CONSIDERED FOR THE STUDY

1.6 CURRENCY CONSIDERED

1.7 UNITS CONSIDERED

1.8 STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 20)

2.1 RESEARCH DATA

2.1.1 SECONDARY DATA

2.1.1.1 Key Data from Secondary Sources

2.1.2 PRIMARY DATA

2.1.2.1 Breakdown of Primaries

2.2 MARKET SIZE ESTIMATION

2.3 DATA TRIANGULATION

2.4 ASSUMPTIONS/HYPOTHESIS FOR THE STUDY

2.5 LIMITATIONS OF THE STUDY

3 EXECUTIVE SUMMARY (Page No. - 26)

4 PREMIUM INSIGHTS (Page No. - 30)

4.1 ATTRACTIVE OPPORTUNITIES IN THE LYCOPENE MARKET

4.2 EUROPE: LYCOPENE MARKET, BY KEY APPLICATION & COUNTRY

4.3 LYCOPENE MARKET, BY FORMULATION

4.4 LYCOPENE MARKET, BY SOURCE & REGION

4.5 LYCOPENE MARKET: HIGH-GROWTH COUNTRIES

5 LYCOPENE MARKET OVERVIEW (Page No. - 33)

5.1 INTRODUCTION

5.2 LYCOPENE MARKET DYNAMICS

5.2.1 DRIVERS

5.2.1.1 Benefits of lycopene in preventive healthcare

5.2.1.2 Increasing usage of lycopene as a food colorant

5.2.2 RESTRAINTS

5.2.2.1 Stringent regulatory norms hampering the market growth

5.2.2.2 Lack of R&D in underdeveloped countries

5.2.3 OPPORTUNITIES

5.2.3.1 Growing demand in the pharmaceutical industry

5.2.3.2 Growing demand for naturally sourced lycopene

5.2.4 CHALLENGES

5.2.4.1 Difficulty in meeting requisite quality standards

5.3 REGULATIONS

5.3.1 US FDA

5.3.2 EPA

5.3.3 EU AND NORDIC GUIDELINES

5.3.4 FOOD SAFETY AND STANDARDS AUTHORITY OF INDIA (FSSAI)

6 LYCOPENE MARKET, BY SOURCE (Page No. - 39)

6.1 INTRODUCTION

6.2 NATURAL LYCOPENE

6.2.1 REGULATIONS BY GOVERNMENTS TO AVOID USING SYNTHETIC LYCOPENE IN VARIOUS REGIONS EXPECTED TO DRIVE THE MARKET FOR NATURAL LYCOPENE

6.3 SYNTHETIC LYCOPENE

6.3.1 LOW PRICE OF SYNTHETIC LYCOPENE IS DRIVING ITS MARKET GROWTH

7 LYCOPENE MARKET, BY PROPERTY (Page No. - 43)

7.1 INTRODUCTION

7.2 HEALTH INGREDIENT

7.2.1 HEALTH INGREDIENT PROPERTY OF LYCOPENE HAS HELPED BROADEN ITS APPLICATION SPECTRUM

7.3 COLORING AGENT

7.3.1 GROWTH IN THE CONVENIENCE FOOD SECTOR HAS BEEN PROVIDING OPPORTUNITIES FOR LYCOPENE APPLICATION AS A COLORING AGENT

8 LYCOPENE MARKET, BY APPLICATION (Page No. - 48)

8.1 INTRODUCTION

8.2 FOOD & BEVERAGES

8.2.1 CHANGING LIFESTYLE OF PEOPLE HAS LED TO AN INCREASE IN DEMAND FOR PROCESSED FOOD & BEVERAGES, WHICH IS DRIVING THE GROWTH OF THE LYCOPENE MARKET

8.3 PERSONAL CARE PRODUCTS

8.3.1 EFFECTIVE ANTIOXIDANT AND ANTI-AGING PROPERTIES OF LYCOPENE ARE PROJECTED TO DRIVE ITS DEMAND IN PERSONAL CARE PRODUCTS

8.4 DIETARY SUPPLEMENTS

8.4.1 INCREASE IN BENEFITS OF LYCOPENE TO DRIVE ITS MARKET IN THE DIETARY SUPPLEMENTS SECTOR

8.5 PHARMACEUTICALS

8.5.1 ROLE OF LYCOPENE IN THE PREVENTION OF CANCER TO DRIVE ITS MARKET GROWTH IN PHARMACEUTICAL PRODUCTS

9 LYCOPENE MARKET, BY FORMULATION (Page No. - 55)

9.1 INTRODUCTION

9.2 BEADLETS

9.2.1 HIGH STABILITY OF LYCOPENE IN THE BEADLETS FORM DRIVING MARKET GROWTH

9.3 POWDER

9.3.1 INSTABILITY OF THE POWDER FORM OF LYCOPENE RESTRAINING MARKET GROWTH

9.4 OIL SUSPENSION

9.4.1 GROWING APPLICATIONS OF LYCOPENE IN OIL SUSPENSION ACROSS THE FOOD & BEVERAGE INDUSTRY

9.5 EMULSION

9.5.1 IMPROPER FORM OF EMULSIONS LEADS TO CRACKING, WHICH RESTRAINS MARKET GROWTH

10 LYCOPENE MARKET, BY REGION (Page No. - 61)

10.1 INTRODUCTION

10.2 NORTH AMERICA

10.2.1 US

10.2.1.1 Rise in demand for dietary supplements due to the increase in the number of aged people in the country is driving the market for lycopene

10.2.2 CANADA

10.2.2.1 Government regulations for the limited usage of food additives are restraining the market growth for lycopene

10.2.3 MEXICO

10.2.3.1 Increase in consumer preference for processed food & beverages to drive the market growth for lycopene

10.3 EUROPE

10.3.1 GERMANY

10.3.1.1 Potential market for manufacturers to expand with rising production of tomatoes

10.3.2 FRANCE

10.3.2.1 Dietary Supplements to Steadily Drive the Growth for Lycopene

10.3.3 UK

10.3.3.1 Lucrative market due to less competition in the country and a higher demand for dietary supplements

10.3.4 ITALY

10.3.4.1 High industrial applications in the processed and dietary food and cosmetic industries

10.3.5 SPAIN

10.3.5.1 Organic lycopene as a food additive & colorant to drive the growth of this market

10.3.6 RUSSIA

10.3.6.1 Antioxidant properties of tomato are driving the demand in various applications

10.3.7 NETHERLANDS

10.3.7.1 Entry of new players is expected to increase market demand in the Netherlands

10.3.8 REST OF EUROPE

10.4 ASIA PACIFIC

10.4.1 CHINA

10.4.1.1 Leading tomato producing country that offers manufacturers a competitive advantage over other players in the market

10.4.2 JAPAN

10.4.2.1 Dynamic changes in consumer diets to drive the growth of the lycopene market

10.4.3 INDIA

10.4.3.1 Increased health awareness and rising number of skin-related issues to drive the growth of the lycopene market in the country

10.4.4 INDONESIA

10.4.4.1 Increase in the aging population to drive the growth of the lycopene market

10.4.5 THAILAND

10.4.5.1 The dietary supplement segment is projected to drive the market growth and provide high potential for manufacturers to expand their business

10.4.6 REST OF ASIA PACIFIC

10.5 SOUTH AMERICA

10.5.1 BRAZIL

10.5.1.1 High demand for personal care products is driving the market for lycopene

10.5.2 ARGENTINA

10.5.2.1 Rising health awareness is driving the market for dietary supplements which in turn is fueling the market for lycopene

10.5.3 REST OF SOUTH AMERICA

10.6 REST OF THE WORLD (ROW)

10.6.1 MIDDLE EAST

10.6.1.1 Rising consumer trends toward dietary supplements present potential growth for lycopene

10.6.2 AFRICA

10.6.2.1 Growing consumer demand for diversified food products to drive the market in Africa

11 COMPETITIVE LANDSCAPE (Page No. - 105)

11.1 INTRODUCTION

11.2 COMPETITIVE LEADERSHIP MAPPING

11.2.1 VISIONARY LEADERS

11.2.2 DYNAMIC DIFFERENTIATORS

11.2.3 INNOVATORS

11.2.4 EMERGING COMPANIES

11.3 COMPETITIVE SCENARIO

11.3.1 NEW PRODUCT/TECHNOLOGY LAUNCHES

11.3.2 ACQUISITIONS

11.3.3 AGREEMENTS

12 COMPANY PROFILES (Page No. - 109)

(Business overview, Products offered, Recent Developments, SWOT analysis, MNM view)*

12.1 DSM

12.2 ALLIED BIOTECH CORPORATION

12.3 ZHEJIANG NHU CO. LTD

12.4 E.I.D. PARRY

12.5 DIVI’S LABORATORIES LIMITED

12.6 LYCORED

12.7 WELLGREEN TECHNOLOGY CO. LTD

12.8 SAN-EI GEN F.F.I., INC

12.9 DANGSHAN SINOJUICE FOOD CO LTD

12.10 DDW THE COLOR HOUSE

12.11 DÖHLER GROUP

12.12 FARBEST - TALLMAN FOODS CORPORATION

12.13 XI’AN PINCREDIT BIOTECH CO LTD

12.14 VIDYA HERBS

12.15 SHAANXI KINGSCI BIOTECHNOLOGY CO. LTD

12.16 HUNAN SUNSHINE BIO-TECH CO., LTD

12.18 PLANTNAT

12.19 PLAMED GREEN SCIENCE GROUP

12.20 S.V. AGRO

*Details on Business overview, Products offered, Recent Developments, SWOT analysis, MNM view might not be captured in case of unlisted companies.

13 APPENDIX (Page No. - 134)

13.1 DISCUSSION GUIDE

13.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

13.3 AVAILABLE CUSTOMIZATIONS

13.4 RELATED REPORTS

13.5 AUTHOR DETAILS

LIST OF TABLES (104 Tables)

TABLE 1 US DOLLAR EXCHANGE RATES CONSIDERED, 2015–2018

TABLE 2 LYCOPENE MARKET SIZE, BY SOURCE, 2018–2025 (USD MILLION)

TABLE 3 NATURAL LYCOPENE MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 4 LYCOPENE MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 5 LYCOPENE MARKET SIZE, BY PROPERTY, 2018–2025 (USD MILLION)

TABLE 6 HEALTH INGREDIENT: MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 7 COLORING AGENT: MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 8 LYCOPENE MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 9 LYCOPENE MARKET SIZE, BY APPLICATION, 2018–2025 (TONS)

TABLE 10 FOOD & BEVERAGES: MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 11 FOOD & BEVERAGES: MARKET SIZE, BY REGION, 2018–2025 (TONS)

TABLE 12 PERSONAL CARE PRODUCTS: MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 13 PERSONAL CARE PRODUCTS: MARKET SIZE, BY REGION, 2018–2025 (TONS)

TABLE 14 DIETARY SUPPLEMENTS: MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 15 DIETARY SUPPLEMENTS: MARKET SIZE, BY REGION, 2018–2025 (TONS)

TABLE 16 PHARMACEUTICALS: MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 17 PHARMACEUTICALS: MARKET SIZE, BY REGION, 2018–2025 (TONS)

TABLE 18 LYCOPENE MARKET SIZE, BY FORMULATION, 2018–2025 (USD MILLION)

TABLE 19 BEADLETS: LYCOPENE MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 20 POWDER: MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 21 OIL SUSPENSION: MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 22 EMULSION: LYCOPENE MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 23 MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 24 MARKET SIZE, BY REGION, 2018–2025 (TONS)

TABLE 25 NORTH AMERICA: LYCOPENE MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 26 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2018–2025 (TONS)

TABLE 27 NORTH AMERICA: MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 28 NORTH AMERICA: MARKET SIZE, BY APPLICATION, 2018–2025 (TONS)

TABLE 29 NORTH AMERICA: MARKET SIZE, BY SOURCE, 2018–2025 (USD MILLION)

TABLE 30 NORTH AMERICA: MARKET SIZE, BY FORMULATION, 2018–2025 (USD MILLION)

TABLE 31 NORTH AMERICA: MARKET SIZE, BY PROPERTY, 2018–2025 (USD MILLION)

TABLE 32 NORTH AMERICA: DIETARY SUPPLEMENTS MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 33 NORTH AMERICA: FOOD & BEVERAGES MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 34 NORTH AMERICA: PERSONAL CARE PRODUCTS MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 35 NORTH AMERICA: PHARMACEUTICALS MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 36 US: MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 37 CANADA: MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 38 MEXICO: MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 39 EUROPE: MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 40 EUROPE: LYCOPENE MARKET SIZE, BY REGION, 2018–2025 (TONS)

TABLE 41 EUROPE: MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 42 EUROPE: MARKET SIZE, BY APPLICATION, 2018–2025 (TONS)

TABLE 43 EUROPE: MARKET SIZE, BY SOURCE, 2018–2025 (USD MILLION)

TABLE 44 EUROPE: MARKET SIZE, BY FORM, 2018–2025 (USD MILLION)

TABLE 45 EUROPE: MARKET SIZE, BY PROPERTY, 2018–2025 (USD MILLION)

TABLE 46 EUROPE: DIETARY SUPPLEMENTS MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 47 EUROPE: FOOD & BEVERAGES MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 48 EUROPE: PERSONAL CARE PRODUCTS MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 49 EUROPE: PHARMACEUTICALS MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 50 GERMANY: MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 51 FRANCE: MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 52 UK: MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 53 ITALY: MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 54 SPAIN: MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 55 RUSSIA: MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 56 NETHERLANDS: MARKET SIZE, BY APPLICATION,2018–2025 (USD MILLION)

TABLE 57 REST OF EUROPE: MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 58 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 59 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2018–2025 (TON)

TABLE 60 ASIA PACIFIC: MARKET SIZE, BY APPLICATION, 2018-2025 (USD MILLION)

TABLE 61 ASIA PACIFIC: MARKET SIZE, BY APPLICATION, 2018-2025 (TONS)

TABLE 62 ASIA PACIFIC: MARKET SIZE, BY SOURCE, 2018-2025 (USD MILLION)

TABLE 63 ASIA PACIFIC: MARKET SIZE, BY FORM, 2018–2025 (USD MILLION)

TABLE 64 ASIA PACIFIC: LYCOPENE MARKET SIZE, BY PROPERTY, 2018–2025 (USD MILLION)

TABLE 65 ASIA PACIFIC: DIETARY SUPPLEMENTS MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 66 ASIA PACIFIC: FOOD & BEVERAGES MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 67 ASIA PACIFIC: PERSONAL CARE PRODUCTS MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 68 ASIA PACIFIC: PHARMACEUTICALS MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 69 CHINA: MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 70 JAPAN: MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 71 INDIA: MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 72 INDONESIA: MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 73 THAILAND: MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 74 REST OF ASIA PACIFIC: MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 75 SOUTH AMERICA: LYCOPENE MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 76 SOUTH AMERICA: MARKET SIZE, BY REGION, 2018–2025 (TONS)

TABLE 77 SOUTH AMERICA: MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 78 SOUTH AMERICA: MARKET SIZE, BY APPLICATION, 2018–2025 (TONS)

TABLE 79 SOUTH AMERICA: MARKET SIZE, BY SOURCE, 2018–2025 (USD MILLION)

TABLE 80 SOUTH AMERICA: MARKET SIZE, BY FORMULATION, 2018–2025 (USD MILLION)

TABLE 81 SOUTH AMERICA: MARKET SIZE, BY PROPERTY, 2018-2025 (USD MILLION)

TABLE 82 SOUTH AMERICA: DIETARY SUPPLEMENTS MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 83 SOUTH AMERICA: FOOD & BEVERAGES MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 84 SOUTH AMERICA: PERSONAL CARE PRODUCTS MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 85 SOUTH AMERICA: PHARMACEUTICALS MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 86 BRAZIL: MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 87 ARGENTINA: MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 88 REST OF SOUTH AMERICA: LYCOPENE MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 89 ROW: LYCOPENE MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 90 ROW: MARKET SIZE, REGION, 2018–2025 (TONS)

TABLE 91 ROW: MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 92 ROW: MARKET SIZE, BY APPLICATION, 2018–2025 (TONS)

TABLE 93 ROW: MARKET SIZE, BY SOURCE, 2018–2025 (USD MILLION)

TABLE 94 ROW: MARKET SIZE, BY FORMULATION, 2018–2025 (USD MILLION)

TABLE 95 ROW: MARKET SIZE, BY PROPERTY, 2018–2025 (USD MILLION)

TABLE 96 ROW: DIETARY SUPPLEMENTS MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 97 ROW: FOOD & BEVERAGES MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 98 ROW: PERSONAL CARE PRODUCTS MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 99 ROW: PHARMACEUTICALS MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 100 MIDDLE EAST: LYCOPENE MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 101 AFRICA: MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 102 NEW PRODUCT/ TECHNOLOGY LAUNCHES, 2017–2019

TABLE 103 ACQUISITIONS, 2017-2019

TABLE 104 AGREEMENTS, COLLABORATIONS & PARTNERSHIPS, 2017–2019

LIST OF FIGURES (29 Figures)

FIGURE 1 LYCOPENE MARKET: RESEARCH DESIGN

FIGURE 2 DATA TRIANGULATION METHODOLOGY

FIGURE 3 LYCOPENE MARKET, BY FORMULATION, 2020 VS. 2025 (USD MILLION)

FIGURE 4 LYCOPENE MARKET SIZE, BY SOURCE, 2020 (USD MILLION)

FIGURE 5 MARKET SIZE, BY APPLICATION, 2020 VS. 2025 (USD MILLION)

FIGURE 6 MARKET SIZE, BY PROPERTY, 2020–2025 (USD MILLION)

FIGURE 7 MARKET SHARE, BY REGION

FIGURE 8 GROWING PREMIUMIZATION OF FOOD PRODUCTS DUE TO CONSUMER DEMAND FOR HEALTH BENEFITS IN FOOD IS EXPECTED TO DRIVE THE MARKET

FIGURE 9 GERMANY AND DIETARY SUPPLEMENTS DOMINATED THEIR RESPECTIVE SEGMENTS IN 2019

FIGURE 10 THE MARKET FOR LYCOPENE BEADLETS IS PROJECTED TO DOMINATE DURING THE FORECAST PERIOD

FIGURE 11 EUROPE ACCOUNTED FOR THE LARGEST SHARE ACROSS ALL SOURCES OF LYCOPENE IN 2019

FIGURE 12 CHINA IS PROJECTED TO GROW AT THE HIGHEST CAGR DURING THE FORECAST PERIOD

FIGURE 13 LYCOPENE MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

FIGURE 14 MARKET SHARE (VALUE), BY SOURCE, 2020 VS. 2025

FIGURE 15 MARKET SHARE, BY PROPERTY, 2020 VS. 2025 (USD MILLION)

FIGURE 16 MARKET SHARE, BY APPLICATION, 2020 VS. 2025 (BY VALUE)

FIGURE 17 MARKET SIZE, BY FORMULATION, 2020 VS. 2025 (USD MILLION)

FIGURE 18 LYCOPENE MARKET SHARE (BY VALUE), BY KEY COUNTRIES, 2019

FIGURE 19 EUROPE: REGIONAL SNAPSHOT

FIGURE 20 ASIA PACIFIC: REGIONAL SNAPSHOT

FIGURE 21 LYCOPENE MARKET: COMPETITIVE LEADERSHIP MAPPING, 2019

FIGURE 22 DSM: COMPANY SNAPSHOT

FIGURE 23 DSM: SWOT ANALYSIS

FIGURE 24 ALLIED BIOTECH CORPORATION: SWOT ANALYSIS

FIGURE 25 ZHEJIANG NHU CO. LTD: SWOT ANALYSIS

FIGURE 26 E.I.D. PARRY: COMPANY SNAPSHOT

FIGURE 27 E.I.D. PARRY: SWOT ANALYSIS

FIGURE 28 DIVI’S LABORATORIES LIMITED: COMPANY SNAPSHOT

FIGURE 29 DIVI’S LABORATORIES: SWOT ANALYSIS

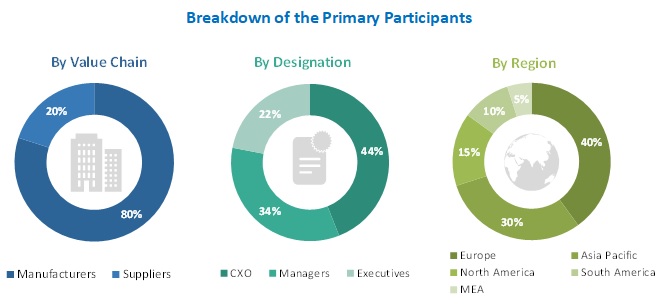

The study involved four major activities for estimating the global lycopene market size. Exhaustive secondary research was conducted to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both the top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation were used to estimate the market size of the segments and subsegments.

Secondary Research

In the secondary research process, various sources, such as the Food and Agriculture Organization (FAO), United States Department of Agriculture (USDA), European Food Safety Authority (EFSA), National Center for Biotechnology Information (NCBI), and company revenues, were referred to, to identify and collect information for this study. The secondary sources also include journals, press releases, investor presentations of companies, white papers, certified publications, articles by recognized authors and regulatory bodies, trade directories, and paid databases.

Secondary research was mainly conducted to obtain key information about the industry’s supply chain, the total pool of key players, market classification & segmentation according to the industry trends to the bottom-most level, and geographical markets. It was also used to obtain information about the key developments from a market-oriented perspective.

Primary Research

The market comprises several stakeholders in the supply chain, which include raw material suppliers and malt manufacturers. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. The primary interviewees from the supply-side include lycopene manufacturers. The primary sources from the demand-side include distributors, importers, exporters, and end users.

To know about the assumptions considered for the study, download the pdf brochure

Lycopene Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the total size of the lycopene market. These approaches were also used extensively to estimate the size of various subsegments in the market for the base year (2019) in terms of value. The research methodology used to estimate the market size includes the following:

- The key players in the industry and markets were identified through extensive secondary research.

- All possible parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

- The research included the study of reports, reviews, and newsletters of top market players, along with the extensive interviews for opinions from leaders such as CEOs, directors, and marketing executives.

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the total market was split into several segments and sub-segments. To estimate the overall lycopene market and arrive at the exact statistics for all segments and sub-segments, the data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from the demand and supply sides. Along with this, the market size was validated using both the top-down and bottom-up approaches.

Report Objectives

Market Intelligence

- Determining and projecting the size of the lycopene market, with respect to source, application, form, property, and regional markets, over a five-year period, ranging from 2020 to 2025

- Identifying the attractive opportunities in the market by determining the largest and fastest-growing segments across regions

- Providing detailed information about the key factors influencing the growth of the market (drivers, restraints, opportunities, and industry-specific challenges)

- Analyzing the micromarkets, with respect to individual growth trends, prospects, and their contribution to the total market

Competitive Intelligence

- Identifying and profiling the key market players in the lycopene market

- Providing a comparative analysis of market leaders on the basis of the following:

- Product offerings

- Business strategies

- Strengths and weaknesses

- Key financials

- Understanding the competitive landscape and identifying the major growth strategies adopted by players across the key regions

- Analyzing the value chain and products across the key regions and their impact on the prominent market players

- Providing insights into key product innovations and investments in the extruded snacks market

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to client-specific scientific needs.

The following customization options are available for the report:

Geographic Analysis

- Further breakdown of the Rest of Europe lycopene market, into Denmark, Poland, Belgium, and other EU and non-EU countries

- Further breakdown of Rest of Asia Pacific lycopene market into Australia & New Zealand, the Philippines, South Korea, and other South Asian countries

- Further breakdown of South America lycopene market into Chile, Peru, Columbia, and other South American countries

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Growth opportunities and latent adjacency in Lycopene Market