Food Additives Market by Type (Emulsifiers, Hydrocolloids, Preservatives, Dietary Fibers, Enzymes, Sweeteners, Flavors), Source, Form, Application (Food, Beverages), by Functionality (Thickening, Stabilizing, Binding, Emulsifying, Other Functionalities), and Region - Global Forecast to 2028

Food Additives Market Overview

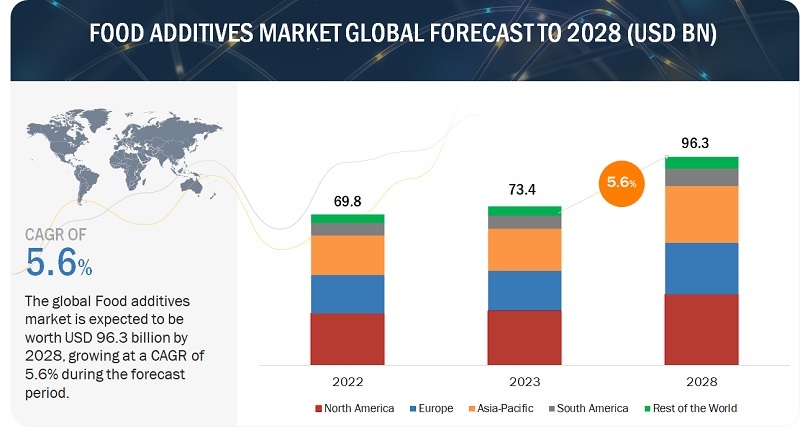

The global food additives market size valued at USD 69.8 billion in 2022 and projected to grow from USD 73.4 billion in 2023 to USD 96.3 billion by 2028, recording a CAGR of 5.6%. This growth is primarily attributed to the increasing demand for processed and convenience foods. As consumers seek longer shelf life, enhanced taste, and appealing visual attributes, the food industry relies on additives. Their multifunctional roles in improving texture, flavor, and preservation contribute significantly to this expansion.

The expanding business has offered lucrative business opportunities to the players who are operating in the market segments. For instance, in April 2023, IFF launched BCLEAR, which empowers breweries to effortlessly preserve the clarity of their beers through a smarter, streamlined process. With BCLEAR, breweries can enjoy enhanced cost efficiency and a robust stabilization method that outshines other enzymatic solutions in the market. Other key players like CP Kelco have capitalized on this by making strategic partnerships. For instance, CP Kelco partnered with Shiru, Inc., a food startup, to advance sustainable food with precision fermentation. Leveraging nearly 90 years of expertise, CP Kelco collaborates with global food leaders to create innovative products meeting texture and consumer preferences, including clean labels. This reinforces its commitment to sustainable ingredient innovation in the global market.

The overall Food additives market is classified as a competitive market, with the key players, namely ADM (US), Cargill Incorporated (US), IFF (US), Ingredion Incorporated (US), and Givaudan (Switzerland) occupying 35-40% of the market share.

To know about the assumptions considered for the study, Request for Free Sample Report

To know about the assumptions considered for the study, download the pdf brochure

Food Additives Market Dynamics

Drivers: Expansion of convenient and processed food products to catalyze demand

The demand for processed foods is increasing due to the growing need for convenient and ready-to-eat food products. As people lead busy lives, they seek options that are quick and easy to prepare. Processed foods, which are easy to cook and have a long shelf life, have become an essential part of modern dietary habits. To meet this demand, food additives are used to enhance the quality, safety and overall appeal of these products. Additives such as preservatives, flavor enhancers, and stabilizers are used to maintain the freshness and taste of these products, meeting consumer expectations for both convenience and sensory satisfaction. This preference for processed foods also extends to a growing appetite for diverse and exotic flavors, textures, and appearances, driving innovation within the food additives sector. As the inclination toward processed foods continues to thrive, the role of food additives in meeting consumer demands for convenience and quality remains pivotal in shaping the industry’s trajectory.

Restraints: Limited raw material availability and price fluctuations

The prices of essential raw materials used in food additive formulations can greatly impact production costs and ultimately, the pricing of end products. The food additives market relies on a diverse range of raw materials, including preservatives, emulsifiers, flavors, and sugar substitutes, making it vulnerable to global economic shifts, weather patterns affecting agriculture, and geopolitical factors that impact the supply chain. This creates a scenario where manufacturers must navigate unpredictable market conditions, adjusting their pricing strategies in response to the ever-changing costs of inputs. To maintain their competitiveness, companies need to have strategic foresight and adaptability to ensure product affordability for consumers while grappling with the broader economic landscape.

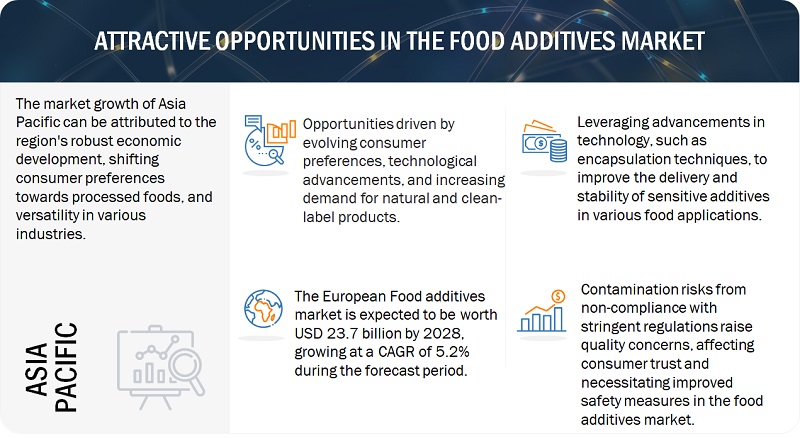

Opportunities: Advancements in food processing technologies

Advancements in food processing technologies have had a significant impact on the food additives market. The evolution of food processing has enabled the purposeful inclusion of food additives and preservatives in minute quantities to serve specific technological or sensory functions. These functions range from enhancing shelf life and maintaining color to preserving nutritive value and improving flavor. While conventional additives have played a vital role in processing and storage, concerns regarding safety and health have led to a shift towards natural sources such as phytochemicals and plant essential oils as antioxidants and preservatives. The use of metallic nanoparticles as antimicrobial agents and innovative techniques like nanoencapsulation have opened new avenues for developing novel food ingredients. The exploration of non-conventional cell disruption technologies for extracting potential food additives and nutraceuticals from microalgae, along with the use of encapsulated natural compounds as antimicrobial additives in food packaging, exemplifies the industry’s commitment to technological advancements.

Challenges: Widespread negative perception of food additives among consumers

Food additives play an important role in enhancing food quality, safety, and shelf life. However, some consumers perceive them unfavorably due to concerns about the potential health effects associated with certain additives, coupled with a lack of understanding about their various functions. This poses a challenge for companies operating in this market, as they need to address and overturn these negative perceptions. To do so, companies can use consumer education and transparent communication to dispel myths and foster a better understanding of the purpose and safety of various food additives. They can also emphasize natural and familiar ingredients through clean-label initiatives to align their products with evolving consumer preferences for simpler and more recognizable formulations.

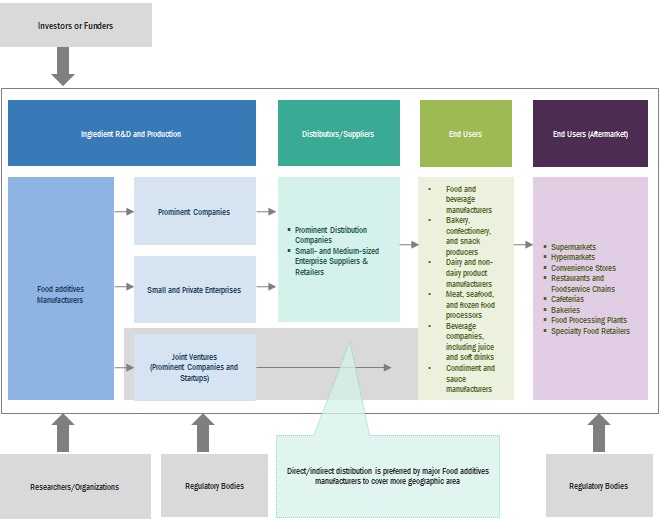

Food Additives Market Ecosystem

By Type, the Dietary Fibers segment is projected to grow with the highest CAGR in the food additives market during the forecast period.

As more consumers prioritize well-being, there's a growing demand for functional foods containing dietary fibers known for promoting digestive health and aiding weight management. The rising prevalence of lifestyle-related health issues is driving the incorporation of dietary fibers in various food products, including baked goods, cereals, and snacks. Additionally, the trend towards clean-label products aligns with the natural origin of many dietary fibers, further boosting their adoption. Regulatory support emphasizing the health benefits of dietary fibers adds impetus to their growth. With consumers actively seeking fiber-rich options for improved nutrition, the dietary fibers segment is positioned to dominate the market, contributing significantly to the overall expansion of food additives.

By Source, the Natural segment is projected to grow with the highest CAGR in the food additives market during the forecast period.

Growing health consciousness has led consumers to seek clean-label and minimally processed products, fueling the demand for natural additives sourced from fruits, vegetables, and plants. Increasing concerns about synthetic additives and their potential health impacts further propel the growth of the natural segment. Industry players are responding with innovations in natural additives, aligning with the ongoing trend towards healthier and more sustainable food choices. As regulatory scrutiny intensifies, the natural segment gains prominence, offering not only consumer-desired transparency but also functional benefits, contributing significantly to the overall expansion of the food additives market.

By Form, the liquid segment accounts for the second-highest market share in the food additives market.

The liquid segment secures the second-highest market share in the food additives industry due to its versatile applications and consumer preferences. The demand for liquid additives stems from their convenience in incorporation across various food and beverage products. Liquid forms offer ease of handling, precise dosing, and efficient blending during the manufacturing process. Additionally, in products like beverages, sauces, and dressings, liquid additives seamlessly integrate, enhancing sensory attributes and ensuring homogenous distribution. The shift towards innovative and exotic flavor profiles in liquid-based formulations, including beverages and condiments, fuels the popularity of liquid additives. With consumers gravitating towards diverse taste experiences and the industry's continuous pursuit of formulation efficiency, the liquid segment plays a pivotal role, contributing significantly to the overall market share of food additives.

By Application, the beverages segment accounts significant market share in the food additives market.

The beverages segment claims a significant market share in the food additives industry, driven by ongoing trends and evolving consumer preferences. One prominent factor is the rising demand for functional and enhanced beverages, where additives play a crucial role in improving taste, texture, and nutritional profiles. The surge in health-conscious consumers has led to a growing preference for fortified and natural beverages, prompting the use of additives to address formulation challenges and deliver desired attributes. Additionally, the popularity of ready-to-drink products and the continual innovation in beverage formulations, such as plant-based and functional drinks, further propel the demand for additives. As consumers seek diverse and novel taste experiences, the beverages segment remains a focal point for additive applications, contributing significantly to the overall market share.

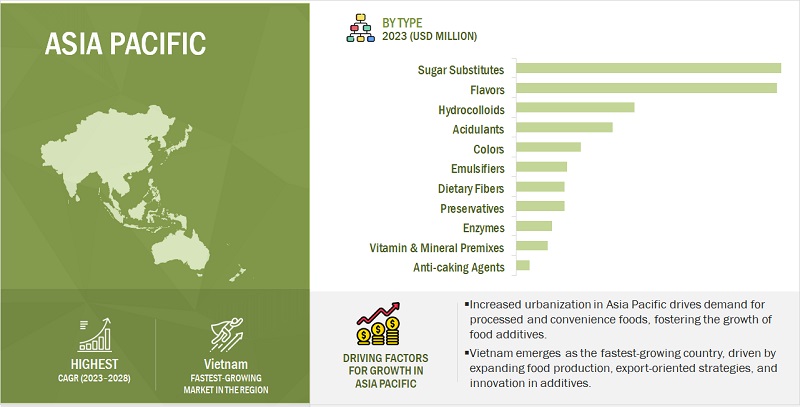

Asia Pacific is poised to experience the highest CAGR in the Food additives market during the forecast period.

The region's remarkable economic growth has led to increased consumer purchasing power, which, in turn, has boosted demand for processed foods and beverages. Food additives play a crucial role in this sector as thickeners, preservatives, stabilizers, and texture enhancers, driving their growth. Additionally, The region's escalating demand for clean-label products has spurred a surge in the adoption of natural and minimally processed additives, aligning with the global movement towards healthier options. Innovations in plant-based food additives cater to the growing popularity of vegetarian and sustainable dietary choices. The emphasis on health and wellness has elevated the demand for functional additives, addressing specific health concerns and contributing to the region's overall market growth. Furthermore, the rich tapestry of ethnic and authentic flavors in the Asia Pacific fuels a need for additives that enhance and preserve the unique tastes of regional cuisines. Stringent regulatory compliance and a focus on food safety underscore the importance of compliant and safe food additive solutions in this rapidly growing market.

Asia Pacific: Food Additives Market Snapshot

Key Food Additives Market Players

Key players in this market include Cargill, Incorporated (US), BASF SE (Germany), ADM (US), IFF (US), Kerry Group PLC (Ireland), Ingredion (US), Tate & Lyle (UK), Givaudan (Switzerland), Darling Ingredients Inc. (US), Chr. Hansen Holding A/S (Denmark), Novozymes (Denmark), Ashland (US), Cp Kelco (US), Glanbia PLC (US), and Sensient Technologies Corporation (US).

Other prominent players in the market also include Ajinomoto Co., Inc. (Japan), Biospringer (France), Palsgaard (Denmark), Lonza (Switzerland), Fooding Group Limited (China), Evonik Industries AG (Germany), Kalsec Inc. (US), Dohler Group (Germany), Lallemand Inc. (Canada), AB Mauri (UK), and Laffort (France).

Scope of the report

|

Report Metric |

Details |

|

Market size estimation |

2023–2028 |

|

Base year considered |

2022 |

|

Forecast period considered |

2023–2028 |

|

Companies studied |

|

Food Additives Market Segmentation:

By Type

- Emulsifiers

- Hydrocolloids

- Preservatives

- Enzymes

- Flavors

- Anti-caking Agents

- Colors

- Sugar Substitutes

- Dietary Fibers

- Vitamin & Mineral Premixes

- Acidulants

By Source

- Natural

- Synthetic

By Form

- Dry

- Liquid

By Application

-

Food

- Dairy & Non-Dairy Products

- Bakery & Confectionery Products

- Supplements & Sports Nutrition

- Meat & Seafood and Meat Alternative Products

- Cereal, Savory, & Snacks

- Soups, Sauces, Dressing & Condiments

- Other Food Applications

-

Beverages

- Juice & Juice Concentrates

- Functional Drinks

- Alcoholic Drinks

- Carbonated Soft Drinks

- Powdered Drinks

- Other Beverages

By Functionality (Qualitative)

- Thickening

- Stabilizing

- Binding

- Emulsifying

- Other Functionalities

By Region

- North America

- Europe

- Asia Pacific

- South America

- Rest of the World

Food Additives Industry Developments

- In November 2023, Chr. Hansen introduces NEER Poly and NEER Punch strains, expanding SmartBev NEER technology for non-alcoholic brewing. Enhancing flavor diversity, reducing costs, and accelerating production, this innovation aligns with market trends, positioning Chr. Hansen as a leader in providing top-notch solutions for the food additives market.

- In October 2023, Cargill is poised for double-digit growth in 2023, focusing on South India expansion, investing USD 35 million in a Nellore manufacturing facility. Cargill emphasizes quality and supply chain resilience to navigate inflationary pressures and drive long-term sustainable growth in India's evolving food market.

- In June 2023, CP Kelco partnered with Shiru, Inc., a food startup, to advance sustainable food with precision fermentation. Leveraging nearly 90 years of expertise, CP Kelco collaborates with global food leaders to create innovative products meeting texture and consumer preferences, including clean labels. This reinforces their commitment to sustainable ingredient innovation in the food additives market.

Frequently Asked Questions (FAQ):

What are the key applications considered in the study for major food additives, and which segments within North America's beverage application are projected to experience promising growth?

The study focuses on two major applications: food and beverages. Within North America's beverage application, the subsegment of carbonated soft drinks emerges as the dominant category, showcasing promising growth potential in the projected market trends.

Is there customizable information available specific to the South America beverage market within the food additives study, and if so, what details are provided?

Yes, customization for the South America market for various segments can be provided on various aspects, including market size, market trends, forecast, competitive landscape, and company profiles. Exclusive insights on below Asia Pacific countries below will be provided:

- Brazil

- Argentina

- Colombia

- Chile

- Peru

- Rest of South America (Uruguay, Ecuador, Venezuela Paraguay, and other South American countries)

Could you highlight the opportunities identified in the study that are expected to fuel the future growth of the food additives market?

The global Food additives market is characterized by the following opportunities:

Advancements in Food Processing Technologies:

The study recognizes the opportunity for future growth in the food additives market through ongoing advancements in food processing technologies. These innovations enhance efficiency, product quality, and the overall capability to meet evolving consumer demands, fostering a dynamic landscape for additive applications.

Custom Food Additives for Personalized Nutrition:

A notable opportunity lies in the development of custom food additives tailored to individual nutrition and health goals. As consumers increasingly seek personalized dietary solutions, the ability to customize additives aligns with this trend, offering unique formulations that cater to diverse nutritional preferences and well-being objectives.

Among the regions studied, which one is anticipated to exhibit the CAGR for the food additives market?

Asia Pacific is anticipated to exhibit the highest CAGR for the food additives market at 6.1%. This projection is attributed to factors such as robust economic growth, a large and diverse population, shifting dietary preferences, and an increasing demand for processed and convenience foods in the region.

What is the expected CAGR range projected for the food additives market during the period 2023-2028, as outlined in the study?

The Food additives market is expected to record a CAGR of 5.6 % during the period 2023-2028. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MACROECONOMIC INDICATORSINCREASE IN RETAIL SALESGROWTH OPPORTUNITIES IN ASIA PACIFIC AND SOUTH AMERICA

-

5.3 MARKET DYNAMICSDRIVERS- Expansion of convenient and processed food products to catalyze demand- Rising demand for clean-label, natural additives with transparent ingredient lists- Growing demand for products with extended shelf lifeRESTRAINTS- Limited raw material availability and price fluctuations- Strict regulatory requirements and standards regarding use of additives to limit their application in certain regionsOPPORTUNITIES- Advancements in food processing technologies- Custom food additives for personalized nutrition and health goalsCHALLENGES- Lack of regulatory harmonization- Widespread negative perception of food additives among consumers

- 6.1 INTRODUCTION

-

6.2 VALUE CHAIN ANALYSISRESEARCH AND PRODUCT DEVELOPMENTRAW MATERIAL SOURCINGPROCESSING AND MANUFACTURINGDISTRIBUTIONMARKETING & SALES

-

6.3 TECHNOLOGY ANALYSISNANOTECHNOLOGY INTEGRATION IN FOOD ADDITIVESPRECISION FERMENTATION IN FOOD ADDITIVES INNOVATION

-

6.4 PRICING ANALYSISAVERAGE SELLING PRICE TREND, BY TYPE

-

6.5 MARKET MAP AND ECOSYSTEM OF FOOD ADDITIVESDEMAND SIDESUPPLY SIDE

-

6.6 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS’ BUSINESSES

-

6.7 PATENT ANALYSIS

-

6.8 TRADE ANALYSISFOOD ADDITIVES

- 6.9 KEY CONFERENCES AND EVENTS

-

6.10 TARIFF AND REGULATORY LANDSCAPENORTH AMERICA- US- CanadaEUROPEAN UNIONASIA PACIFIC- Japan- IndiaSOUTH AMERICA- Brazil- Colombia

-

6.11 PORTER’S FIVE FORCES ANALYSISINTENSITY OF COMPETITIVE RIVALRYBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSTHREAT OF SUBSTITUTESTHREAT OF NEW ENTRANTS

-

6.12 KEY STAKEHOLDERS AND BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

-

6.13 CASE STUDIESINTERNATIONAL FLAVORS & FRAGRANCES INC.: LAUNCH OF SEAFLOURNOVOZYMES: REVOLUTIONIZING PLANT-BASED MEAT WITH TEXTURE INNOVATION

- 7.1 INTRODUCTION

-

7.2 EMULSIFIERSVERSATILE EMULSIFIERS TO DRIVE FOOD ADDITIVES MARKET, ENHANCING TEXTURE, STABILITY, AND SHELF LIFE ACROSS APPLICATIONSMONO- & DI-GLYCERIDES AND THEIR DERIVATIVES- WIDE RANGE OF FUNCTIONALITIES TO BOOST APPLICATIONSLECITHIN (OILED & DE-OILED)- Lecithins’ crucial role in enhancing functionality of bakery & confectionery items to fuel market demandSORBITAN ESTERS- Aeration property of sorbitan esters to widen scope of application and drive growthPOLYGLYCEROL ESTERS- Cost-efficiency associated with usage of polyglycerol esters to drive market growthSTEAROYL LACTYLATES- Dough strengthening and foaming properties to widen usage of stearoyl lactylates in bakery industryOTHER EMULSIFIERS

-

7.3 HYDROCOLLOIDSRISE IN DEMAND FOR ENHANCED TEXTURE, EXTENDED SHELF LIFE, AND QUALITY IMPROVEMENT TO FUEL SEGMENT GROWTHGELATIN- Plant-based substitutes such as agar and carrageenan to drive market demandPECTIN- Distinct characteristics such as being natural vegan hydrocolloid and potential to generate diverse viscoelastic solutions to fuel segmentCARRAGEENAN- Texture-enhancing properties to propel carrageenan demand in food additivesXANTHAN GUM- Versatility in enhancing texture, stability, and quality to drive demand for xanthan gumAGAR- Natural origin, versatile gelling, and plant-based trend to drive agar demandGUM ARABIC- Gum arabic to act as stabilizer to extend product’s shelf lifeLBG- Locust bean gum to decrease blood sugar and blood fat levelsCMC- Increase in demand for natural, functional ingredients to propel demand for cellulose gumALGINATES- Application of alginate to coat fruits & vegetables as microbial and viral protection products to drive demandGUAR GUM- Clean label, gluten-free demand to fuel growth of guar gum in food additivesMCC- Clean label demand and versatile applications to propel demand for MCC in food

-

7.4 PRESERVATIVESEXTENDED SHELF LIFE AND MAINTAINED PRODUCT QUALITY TO PROPEL DEMAND FOR PRESERVATIVESNATURAL- High consumer awareness and preference for natural food ingredients to drive marketSYNTHETIC- Cost-effectiveness and easy availability to drive market growth

-

7.5 DIETARY FIBERSCONSUMER DEMAND FOR DIVERSE, CONVENIENT, AND PROCESSED FOODS TO DRIVE DEMAND FOR DIETARY FIBERS IN FOOD APPLICATIONSSOLUBLE- Changing lifestyles and functional food demand propel growth of soluble dietary fibersINSOLUBLE- Health-conscious consumers to drive demand for products with insoluble dietary fiber

-

7.6 VITAMIN & MINERAL PREMIXESGREATER AWARENESS REGARDING NUTRITIONAL DEFICIENCIES TO FUEL DEMAND FOR FORTIFIED PRODUCTSVITAMIN & MINERAL COMBINATION- Proactive response to consumer demand for nutritionally enriched products to drive demandVITAMIN- Health-conscious consumers to propel demand for vitamin-enhanced food & beveragesMINERAL- Nutritional fortification and health-conscious consumer preferences to propel mineral additives demand

-

7.7 ENZYMESCONSUMER DEMAND FOR DIVERSE, CONVENIENT, AND PROCESSED FOODS TO DRIVE DEMAND FOR ENZYMES IN FOOD APPLICATIONSCARBOHYDRASES- Amylase- Cellulase- Lactase- Pectinase- Other carbohydrasesPROTEASES- Extensive presence of proteins and diverse functionalities of proteases to fuel market in food industryLIPASES- Lipases to extend shelf-life of baking products with diversified enzymatic propertiesPOLYMERASES & NUCLEASES- Polymerases & nucleases essential in nucleic acid processesOTHER ENZYMES

-

7.8 FLAVORSINNOVATIVE TECHNOLOGIES TO ENHANCE TASTE TO PROPEL DEMAND FOR FOOD FLAVORSCHOCOLATE & BROWN- Rise in spending on confectionery products and implementation of sustainable cocoa farming practices to fuel market demandVANILLA- High culinary value of natural vanilla and demand for more authentic flavors to propel vanilla’s dominanceFRUITS- Increase in popularity of natural and diverse fruit flavors to fuel market growthDAIRY- Growth in demand for authentic and innovative dairy flavors to propel market expansionSPICES & SAVORY- Growing consumer preference for bold and variegated taste profiles to drive spices marketMINT- Increase in inclusion in confections to drive demand for mint flavorsOTHER FLAVORS

-

7.9 ANTI-CAKING AGENTSENHANCED PRODUCT QUALITY AND EXTENDED SHELF LIFE TO PROPEL DEMAND FOR ANTI-CAKING AGENTSCALCIUM COMPOUNDS- High moisture absorption properties of calcium compounds to drive market for anti-caking agentsSODIUM COMPOUNDS- Coloring, flavoring, and texture enhancing to be key properties of sodium compounds along with anti-cakingSILICON DIOXIDE- Availability of natural and synthetic forms of silica as anti-caking agent to fuel demandMAGNESIUM COMPOUNDS- Salt and confectioner’s sugar to be key application areas for magnesium compoundsMICROCRYSTALLINE CELLULOSE- Wood to be key source for microcrystalline celluloseOTHER ANTI-CAKING AGENTS

-

7.10 COLORSCONSUMER APPEAL AND VISUAL AESTHETICS TO MAKE FOOD COLORS INFLUENCING FACTORNATURAL COLORS- Rise in demand for natural safe-to-use food colors to fuel growthSYNTHETIC- Demand for visually appealing colors in food productsNATURE-IDENTICAL- Low costs of nature-identical colors to drive their demand

-

7.11 SUGAR SUBSTITUTESINCREASE IN HEALTH AWARENESS AND DEMAND FOR REDUCED-CALORIE AND SUGAR-FREE FOOD OPTIONS TO DRIVE DEMANDHIGH-FRUCTOSE SYRUP- Increase in demand for candies and soft drinks to fuel marketHIGH-INTENSITY SWEETENERS- Rise in adoption of zero-calorie and sugar-free food & beverage to drive demandLOW-INTENSITY SWEETENERS- Rise in metabolic diseases to propel demand for low-intensity sweeteners

-

7.12 ACIDULANTSUSAGE OF ACIDULANTS IN BEVERAGES, CONFECTIONERY, AND PROCESSED FOODS TO SHOWCASE VERSATILITY

- 8.1 INTRODUCTION

-

8.2 FOODCONSUMER DEMAND FOR DIVERSE, CONVENIENT, AND PROCESSED FOODS TO DRIVE FOOD ADDITIVES USAGE IN FOOD APPLICATIONSDAIRY & NON-DAIRY PRODUCTS- Growing demand for diverse textures and flavors in dairy and non-dairy products to boost food additives marketBAKERY & CONFECTIONERY PRODUCTS- Versatility of bakery additives in enhancing texture, adding freshness, and increasing shelf life to fuel demandSUPPLEMENTS & SPORTS NUTRITION- Consumer demand for health, driven by clean labels and adherence to regulations, to be met by food additivesMEAT & SEAFOOD AND MEAT ALTERNATIVE PRODUCTS- Enhanced taste, texture, and nutritional profile of plant-based meat to propel demand for food additivesCEREAL, SAVORY, AND SNACKS- Changes in food preferences in cereal, savory, and snacks to fuel market growthSOUPS, SAUCES, DRESSING, AND CONDIMENTS- Shelf life extension and demand for convenience to drive segmentOTHER FOOD APPLICATIONS

-

8.3 BEVERAGESINNOVATION FROM KEY PLAYERS AND CONSUMER INTEREST IN NEW FLAVORS TO DRIVE BEVERAGE ADDITIVES MARKETJUICE & JUICE CONCENTRATES- Need for consistency in organoleptic qualities to drive juice and concentrates segmentFUNCTIONAL DRINKS- Nutritional enhancement and consumer wellness to drive food additives demand in functional drinksALCOHOLIC DRINKS- Diverse additives that enhance flavor, stability, and quality to drive alcoholic drinks segmentCARBONATED SOFT DRINKS- Flavor enhancement, preservation, and stability to drive food additives market in carbonated soft drinks applicationPOWDERED DRINKS- On-the-go convenience offered by powdered drinks, contributing to their popularity among busy consumersOTHER BEVERAGES

- 9.1 INTRODUCTION

-

9.2 NATURALCONSUMER DEMAND FOR TRANSPARENCY IN INGREDIENTS USED AND NUTRITIONAL BENEFITS TO DRIVE DEMAND FOR NATURAL ADDITIVES

-

9.3 SYNTHETICGROWING DEMAND FOR PROCESSED AND CONVENIENT FOODS TO FUEL GROWTH OF SYNTHETIC ADDITIVES

- 10.1 INTRODUCTION

-

10.2 DRYENHANCED STABILITY AND EXTENDED SHELF LIFE TO DRIVE DEMAND FOR DRY FORM

-

10.3 LIQUIDEASE OF HANDLING AND DISPENSING LIQUID ADDITIVES TO ENHANCE MANUFACTURING EFFICIENCY

- 11.1 INTRODUCTION

-

11.2 STABILIZINGDEMAND FOR NATURAL INGREDIENTS AND VEGAN FOOD TO LEAD TO GROWING MARKET FOR NATURALLY SOURCED STABILIZERS

-

11.3 THICKENINGCONSUMER PREFERENCES TO EVOLVE TOWARD DIVERSE AND CONVENIENT FOOD OPTIONS, THEREBY FUELING DEMAND

-

11.4 GELLINGTEXTURE DIVERSITY IN FOOD TO ENHANCE EXPERIENCE TO PROPEL DEMAND FOR GELLING FUNCTIONALITY

-

11.5 EMULSIFYINGEMULSIFYING DEMAND TO WITNESS INCREASE WITH CONSUMER PREFERENCES FOR PRESERVED, QUALITY, AND ORGANIC FOODS

- 11.6 OTHER FUNCTIONALITIES

- 12.1 INTRODUCTION

-

12.2 NORTH AMERICANORTH AMERICA: RECESSION IMPACT ANALYSISUS- Presence of key players in US to fuel food additives market growthCANADA- Canadian food additives market to witness surges owing to shifting consumer preferencesMEXICO- Regulatory reforms promoting nutritional transparency to drive Mexico’s food additives market

-

12.3 EUROPERECESSION IMPACT ANALYSISGERMANY- Increasing consumer demand for diverse and premium bakery products to drive need for innovative food texturizersFRANCE- Growing consumer preference for clean label products to push manufacturers to adopt natural additivesUK- UK’s position as leading manufacturer in food & drink sector to amplify demand for additives to meet production needsITALY- Rising awareness of balanced nutrition to foster demand for additives in healthier Italian food optionsSPAIN- Demand for healthier processed food to drive market for natural food additivesTURKEY- Fast-growing bakery & confectionery industry to fuel market growth for food additives in TurkeyPOLAND- Poland’s food additives market to witness surge due to clean-label demand and innovationNETHERLANDS- Clean-label trend and regulatory compliance to drive Dutch food additives marketREST OF EUROPE

-

12.4 ASIA PACIFICASIA PACIFIC: RECESSION IMPACT ANALYSISCHINA- Rising demand for sugar substitutes as consumers seek healthier alternatives leading to increase in demandINDIA- Greater demand for healthy processed food products to boost demand for food additivesJAPAN- Popularity of ready-to-eat and convenience foods in Japan to increase demand for texturizers for enhanced taste and textureSOUTH KOREA- Adapting to changing lifestyles and health priorities to influence South Korea’s food additives marketAUSTRALIA & NEW ZEALAND- Consumption of beverages to increase opportunities for different preservative manufacturersINDONESIA- Palm oil production surge to propel Indonesia’s food additives market growthMALAYSIA- Growing demand for innovative food products to fuel Malaysia’s additives marketPHILIPPINES- Regulatory revisions to drive transparency, safety, and growth in Philippine marketTHAILAND- Popularity of ready-to-eat and convenience foods in Thailand to fuel demand for texturizersVIETNAM- Rapid urbanization, changing lifestyles, and rising disposable income to drive market growth in VietnamREST OF ASIA PACIFIC

-

12.5 SOUTH AMERICASOUTH AMERICA: RECESSION IMPACT ANALYSISBRAZIL- Increasing health consciousness among Brazilians to encourage use of additives to create healthier, low-fat, and low-sugar alternativesARGENTINA- Consumer demand for processed foods to drive Argentina’s food additives marketCOLOMBIA- Higher demand for diverse and innovative food additives, driven by changing consumer preferences, to foster growthCHILE- Changing consumer preferences and robust food industry in Chile to drive growthPERU- Peru’s food additives market growth to be fueled by demand for convenienceREST OF SOUTH AMERICA

-

12.6 REST OF THE WORLD (ROW)ROW: RECESSION IMPACT ANALYSISAFRICA- Evolving consumer preferences, increasing demand for processed foods, and rich biodiversity to drive market growth in Africa- South Africa- Morocco- Algeria- Kenya- Rest of AfricaMIDDLE EAST- Rising demand for nutritional labeling to increase demand for natural food additives in Middle East- Saudi Arabia- Rest of Middle East

- 13.1 OVERVIEW

- 13.2 MARKET SHARE ANALYSIS

- 13.3 KEY PLAYER STRATEGIES/RIGHT TO WIN

- 13.4 SEGMENTAL REVENUE ANALYSIS

- 13.5 KEY PLAYERS’ ANNUAL REVENUE VS. GROWTH

- 13.6 KEY PLAYERS’ EBITDA

- 13.7 GLOBAL SNAPSHOT OF KEY MARKET PARTICIPANTS

-

13.8 COMPANY EVALUATION MATRIX (KEY PLAYERS)STARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTSCOMPETITIVE FOOTPRINT (KEY PLAYERS)

-

13.9 STARTUP/SME EVALUATION MATRIXPROGRESSIVE COMPANIESRESPONSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKSCOMPETITIVE BENCHMARKING

-

13.10 COMPETITIVE SCENARIO AND TRENDSPRODUCT LAUNCHESDEALSOTHERS

-

14.1 KEY COMPANIESCARGILL, INCORPORATED- Business overview- Products/Services/Solutions offered- Recent developments- MnM viewBASF SE- Business overview- Products/Services/Solutions offered- Recent developments- MnM viewADM- Business overview- Products/Services/Solutions offered- Recent developments- MnM viewINTERNATIONAL FLAVORS & FRAGRANCES INC.- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewINGREDION INCORPORATED- Business overview- Products/Services/Solutions offered- Recent developments- MnM viewKERRY GROUP PLC- Business overview- Products/Services/Solutions offered- Recent developments- MnM viewTATE & LYLE- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewGIVAUDAN- Business overview- Products offered- Recent developments- MnM viewDARLING INGREDIENTS INC.- Business overview- Products/Services/Solutions offered- Recent developments- MnM viewCHR. HANSEN- Business overview- Products/Services/Solutions offered- Recent developments- MnM viewNOVOZYMES- Business overview- Products/Services/Solutions offered- Recent developments- MnM viewASHLAND- Business overview- Products/Services/Solutions offered- Recent developments- MnM viewCP KELCO U.S., INC.- Business overview- Products/Services/Solutions offered- Recent developments- MnM viewGLANBIA PLC- Business overview- Products/Services/Solutions offered- Recent developments- MnM viewSENSIENT TECHNOLOGIES CORPORATION- Business overview- Products/Services/Solutions offered- Recent developments- MnM viewROQUETTE FRÈRES- Business overview- Products/Services/Solutions offered- Recent developments- MnM viewCORBION- Business overview- Products/Services/Solutions offered- Recent developments- MnM viewFOODCHEM INTERNATIONAL CORPORATION- Business overview- Products/Services/Solutions offered- Recent developments- MnM viewAMANO ENZYME INC.- Business overview- Products/Services/Solutions offered- Recent developments- MnM viewENZYME SUPPLIES- Business overview- Products/Services/Solutions offered- Recent developments- MnM view

-

14.2 OTHER PLAYERSACE INGREDIENTS CO., LTD.FDL LTDMANE (EN)NEXIRABELL FLAVORS & FRAGRANCES

- 15.1 INTRODUCTION

- 15.2 RESEARCH LIMITATIONS

-

15.3 GLOBAL HYDROCOLLOIDS MARKETMARKET DEFINITIONMARKET OVERVIEW

-

15.4 FOOD TEXTURE MARKETMARKET DEFINITIONMARKET OVERVIEW

- 16.1 DISCUSSION GUIDE

- 16.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 16.3 CUSTOMIZATION OPTIONS

- 16.4 RELATED REPORTS

- 16.5 AUTHOR DETAILS

- TABLE 1 USD EXCHANGE RATES CONSIDERED, 2019–2022

- TABLE 2 FOOD ADDITIVES MARKET SNAPSHOT, 2023 VS. 2028

- TABLE 3 FOOD ADDITIVES MARKET: AVERAGE SELLING PRICE TREND, BY TYPE, 2019–2022 (USD/TON)

- TABLE 4 EMULSIFIERS: AVERAGE SELLING PRICE TREND, BY REGION, 2020–2022 (USD/TON)

- TABLE 5 HYDROCOLLOIDS: AVERAGE SELLING PRICE TREND, BY REGION, 2020–2022 (USD/TON)

- TABLE 6 PRESERVATIVES: AVERAGE SELLING PRICE TREND, BY REGION, 2020–2022 (USD/TON)

- TABLE 7 ENZYMES: AVERAGE SELLING PRICE TREND, BY REGION, 2020–2022 (USD/TON)

- TABLE 8 FLAVORS: AVERAGE SELLING PRICE TREND, BY REGION, 2020–2022 (USD/TON)

- TABLE 9 ANTI-CAKING AGENTS: AVERAGE SELLING PRICE TREND, BY REGION, 2020–2022 (USD/TON)

- TABLE 10 COLORS: AVERAGE SELLING PRICE TREND, BY REGION, 2020–2022 (USD/TON)

- TABLE 11 SUGAR SUBSTITUTES: AVERAGE SELLING PRICE TREND, BY REGION, 2020–2022 (USD/TON)

- TABLE 12 DIETARY FIBERS: AVERAGE SELLING PRICE TREND, BY REGION, 2020–2022 (USD/TON)

- TABLE 13 VITAMIN & MINERAL PREMIXES: AVERAGE SELLING PRICE TREND, BY REGION, 2020–2022 (USD/TON)

- TABLE 14 ACIDULANTS: AVERAGE SELLING PRICE TREND, BY REGION, 2020–2022 (USD/TON)

- TABLE 15 FOOD ADDITIVES MARKET: SUPPLY CHAIN (ECOSYSTEM)

- TABLE 16 PATENTS PERTAINING TO FOOD ADDITIVES, 2022–2023

- TABLE 17 TOP 10 IMPORTERS AND EXPORTERS OF FOOD ADDITIVES, 2022 (USD THOUSAND)

- TABLE 18 KEY CONFERENCES AND EVENTS IN FOOD ADDITIVES MARKET, 2023–2024

- TABLE 19 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 20 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 21 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 22 FOOD ADDITIVES MARKET: PORTER’S FIVE FORCES ANALYSIS

- TABLE 23 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR SOURCES OF FOOD ADDITIVES

- TABLE 24 KEY CRITERIA FOR SELECTING SUPPLIER/VENDOR

- TABLE 25 FOOD ADDITIVES MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 26 MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 27 MARKET, BY TYPE, 2019–2022 (KT)

- TABLE 28 MARKET, BY TYPE, 2023–2028 (KT)

- TABLE 29 EMULSIFIERS: MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 30 EMULSIFIERS: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 31 EMULSIFIERS: MARKET, BY REGION, 2019–2022 (KT)

- TABLE 32 EMULSIFIERS: MARKET, BY REGION, 2023–2028 (KT)

- TABLE 33 EMULSIFIERS: MARKET, BY SUBTYPE, 2019–2022 (USD MILLION)

- TABLE 34 EMULSIFIERS: MARKET, BY SUBTYPE, 2023–2028 (USD MILLION)

- TABLE 35 HYDROCOLLOIDS: FOOD ADDITIVES MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 36 HYDROCOLLOIDS: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 37 HYDROCOLLOIDS: MARKET, BY REGION, 2019–2022 (KT)

- TABLE 38 HYDROCOLLOIDS: MARKET, BY REGION, 2023–2028 (KT)

- TABLE 39 HYDROCOLLOIDS: MARKET, BY SUBTYPE, 2019–2022 (USD MILLION)

- TABLE 40 HYDROCOLLOIDS: MARKET, BY SUBTYPE, 2023–2028 (USD MILLION)

- TABLE 41 FOOD PRESERVATIVES MARKET: FUNCTIONS AND PERMISSIBLE LIMITS IN FOOD PRODUCTS

- TABLE 42 PRESERVATIVES: FOOD ADDITIVES MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 43 PRESERVATIVES: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 44 PRESERVATIVES: MARKET, BY REGION, 2019–2022 (KT)

- TABLE 45 PRESERVATIVES: MARKET, BY REGION, 2023–2028 (KT)

- TABLE 46 PRESERVATIVES: MARKET, BY SUBTYPE, 2019–2022 (USD MILLION)

- TABLE 47 PRESERVATIVES: MARKET, BY SUBTYPE, 2023–2028 (USD MILLION)

- TABLE 48 DIETARY FIBERS: MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 49 DIETARY FIBERS: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 50 DIETARY FIBERS: MARKET, BY REGION, 2019–2022 (KT)

- TABLE 51 DIETARY FIBERS: MARKET, BY REGION, 2023–2028 (KT)

- TABLE 52 DIETARY FIBERS: MARKET, BY SUBTYPE, 2019–2022 (USD MILLION)

- TABLE 53 DIETARY FIBERS: MARKET, BY SUBTYPE, 2023–2028 (USD MILLION)

- TABLE 54 VITAMIN & MINERAL PREMIXES: FOOD ADDITIVES MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 55 VITAMIN & MINERAL PREMIXES: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 56 VITAMIN & MINERAL PREMIXES: MARKET, BY REGION, 2019–2022 (KT)

- TABLE 57 VITAMIN & MINERAL PREMIXES: MARKET, BY REGION, 2023–2028 (KT)

- TABLE 58 VITAMIN & MINERAL PREMIXES: MARKET, BY SUBTYPE, 2019–2022 (USD MILLION)

- TABLE 59 VITAMIN & MINERAL PREMIXES: MARKET, BY SUBTYPE, 2023–2028 (USD MILLION)

- TABLE 60 TYPES OF FOOD ENZYMES AND THEIR FUNCTIONS IN FOOD & BEVERAGE INDUSTRY

- TABLE 61 ENZYMES: FOOD ADDITIVES MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 62 ENZYMES: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 63 ENZYMES: MARKET, BY REGION, 2019–2022 (KT)

- TABLE 64 ENZYMES: MARKET, BY REGION, 2023–2028 (KT)

- TABLE 65 TYPES, SOURCES, AND FUNCTIONS OF LIPASES

- TABLE 66 FLAVORS: FOOD ADDITIVES MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 67 FLAVORS: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 68 FLAVORS: MARKET, BY REGION, 2019–2022 (KT)

- TABLE 69 FLAVORS: MARKET, BY REGION, 2023–2028 (KT)

- TABLE 70 FLAVORS: MARKET, BY SUBTYPE, 2019–2022 (USD MILLION)

- TABLE 71 FLAVORS: MARKET, BY SUBTYPE, 2023–2028 (USD MILLION)

- TABLE 72 ANTI-CAKING AGENTS: FOOD ADDITIVES MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 73 ANTI-CAKING AGENTS: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 74 ANTI-CAKING AGENTS: MARKET, BY REGION, 2019–2022 (KT)

- TABLE 75 ANTI-CAKING AGENTS: MARKET, BY REGION, 2023–2028 (KT)

- TABLE 76 ANTI-CAKING AGENTS: MARKET, BY SUBTYPE, 2019–2022 (USD MILLION)

- TABLE 77 ANTI-CAKING AGENTS: MARKET, BY SUBTYPE, 2023–2028 (USD MILLION)

- TABLE 78 CALCIUM COMPOUNDS: PERMISSIBLE LIMITS & FOOD APPLICATIONS

- TABLE 79 SODIUM COMPOUNDS: PERMISSIBLE LIMITS & FOOD APPLICATIONS

- TABLE 80 SILICON DIOXIDE: PERMISSIBLE LIMITS & FOOD APPLICATIONS

- TABLE 81 MAGNESIUM COMPOUNDS: PERMISSIBLE LIMITS & FOOD APPLICATIONS

- TABLE 82 MICROCRYSTALLINE CELLULOSE: PERMISSIBLE LIMITS & FOOD APPLICATIONS

- TABLE 83 COLORS: FOOD ADDITIVES MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 84 COLORS: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 85 COLORS: MARKET, BY REGION, 2019–2022 (KT)

- TABLE 86 COLORS: MARKET, BY REGION, 2023–2028 (KT)

- TABLE 87 COLORS: MARKET, BY SUBTYPE, 2019–2022 (USD MILLION)

- TABLE 88 COLORS: MARKET, BY SUBTYPE, 2023–2028 (USD MILLION)

- TABLE 89 SUGAR SUBSTITUTE: FOOD ADDITIVES MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 90 SUGAR SUBSTITUTE: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 91 SUGAR SUBSTITUTE: MARKET, BY REGION, 2019–2022 (KT)

- TABLE 92 SUGAR SUBSTITUTE: MARKET, BY REGION, 2023–2028 (KT)

- TABLE 93 SUGAR SUBSTITUTE: MARKET, BY SUBTYPE, 2019–2022 (USD MILLION)

- TABLE 94 SUGAR SUBSTITUTE: MARKET, BY SUBTYPE, 2023–2028 (USD MILLION)

- TABLE 95 ACIDULANTS: FOOD ADDITIVES MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 96 ACIDULANTS: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 97 ACIDULANTS: MARKET, BY REGION, 2019–2022 (KT)

- TABLE 98 ACIDULANTS: MARKET, BY REGION, 2023–2028 (KT)

- TABLE 99 FOOD ADDITIVES MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 100 MARKET FOR FOOD ADDITIVES, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 101 FOOD: MARKET FOR FOOD ADDITIVES, BY REGION, 2019–2022 (USD MILLION)

- TABLE 102 FOOD: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 103 BEVERAGES: MARKET FOR FOOD ADDITIVES, BY REGION, 2019–2022 (USD MILLION)

- TABLE 104 BEVERAGES: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 105 FOOD ADDITIVES MARKET, BY SOURCE, 2019–2022 (USD MILLION)

- TABLE 106 MARKET, BY SOURCE, 2023–2028 (USD MILLION)

- TABLE 107 NATURAL: MARKET FOR FOOD ADDITIVES, BY REGION, 2019–2022 (USD MILLION)

- TABLE 108 NATURAL: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 109 SYNTHETIC: MARKET FOR FOOD ADDITIVES, BY REGION, 2019–2022 (USD MILLION)

- TABLE 110 SYNTHETIC: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 111 FOOD ADDITIVES MARKET, BY FORM, 2019–2022 (USD MILLION)

- TABLE 112 MARKET, BY FORM, 2023–2028 (USD MILLION)

- TABLE 113 DRY: MARKET FOR FOOD ADDITIVES, BY REGION, 2019–2022 (USD MILLION)

- TABLE 114 DRY: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 115 LIQUID: MARKET FOR FOOD ADDITIVES, BY REGION, 2019–2022 (USD MILLION)

- TABLE 116 LIQUID: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 117 FOOD ADDITIVES MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 118 MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 119 MARKET, BY REGION, 2019–2022 (KT)

- TABLE 120 MARKET, BY REGION, 2023–2028 (KT)

- TABLE 121 NORTH AMERICA: FOOD ADDITIVES MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 122 NORTH AMERICA: MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 123 NORTH AMERICA: MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 124 NORTH AMERICA: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 125 NORTH AMERICA: MARKET, BY TYPE, 2019–2022 (KT)

- TABLE 126 NORTH AMERICA: MARKET, BY TYPE, 2023–2028 (KT)

- TABLE 127 NORTH AMERICA: MARKET, BY SOURCE, 2019–2022 (USD MILLION)

- TABLE 128 NORTH AMERICA: MARKET, BY SOURCE, 2023–2028 (USD MILLION)

- TABLE 129 NORTH AMERICA: MARKET, BY FORM, 2019–2022 (USD MILLION)

- TABLE 130 NORTH AMERICA: MARKET, BY FORM, 2023–2028 (USD MILLION)

- TABLE 131 NORTH AMERICA: MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 132 NORTH AMERICA: MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 133 US: FOOD ADDITIVES MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 134 US: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 135 CANADA: MARKET FOR FOOD ADDITIVES, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 136 CANADA: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 137 MEXICO: MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 138 MEXICO: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 139 EUROPE: MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 140 EUROPE: MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 141 EUROPE: MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 142 EUROPE: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 143 EUROPE: MARKET, BY TYPE, 2019–2022 (KT)

- TABLE 144 EUROPE: MARKET, BY TYPE, 2023–2028 (KT)

- TABLE 145 EUROPE: MARKET, BY SOURCE, 2019–2022 (USD MILLION)

- TABLE 146 EUROPE: MARKET, BY SOURCE, 2023–2028 (USD MILLION)

- TABLE 147 EUROPE: MARKET, BY FORM, 2019–2022 (USD MILLION)

- TABLE 148 EUROPE: FOOD ADDITIVES MARKET, BY FORM, 2023–2028 (USD MILLION)

- TABLE 149 EUROPE: MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 150 EUROPE: MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 151 GERMANY: MARKET FOR FOOD ADDITIVES, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 152 GERMANY: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 153 FRANCE: MARKET FOR FOOD ADDITIVES, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 154 FRANCE: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 155 UK: FOOD ADDITIVES MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 156 UK: ARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 157 ITALY: MARKET FOR FOOD ADDITIVES, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 158 ITALY: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 159 SPAIN: MARKET FOR FOOD ADDITIVES, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 160 SPAIN: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 161 TURKEY: MARKET FOR FOOD ADDITIVES, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 162 TURKEY: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 163 POLAND: FOOD ADDITIVES MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 164 POLAND: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 165 NETHERLANDS: MARKET FOR FOOD ADDITIVES, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 166 NETHERLANDS: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 167 REST OF EUROPE: MARKET FOR FOOD ADDITIVES, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 168 REST OF EUROPE: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 169 ASIA PACIFIC: FOOD ADDITIVES MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 170 ASIA PACIFIC: MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 171 ASIA PACIFIC: MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 172 ASIA PACIFIC: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 173 ASIA PACIFIC: MARKET, BY TYPE, 2019–2022 (KT)

- TABLE 174 ASIA PACIFIC: MARKET, BY TYPE, 2023–2028 (KT)

- TABLE 175 ASIA PACIFIC: MARKET, BY SOURCE, 2019–2022 (USD MILLION)

- TABLE 176 ASIA PACIFIC: MARKET, BY SOURCE, 2023–2028 (USD MILLION)

- TABLE 177 ASIA PACIFIC: MARKET, BY FORM, 2019–2022 (USD MILLION)

- TABLE 178 ASIA PACIFIC: MARKET, BY FORM, 2023–2028 (USD MILLION)

- TABLE 179 ASIA PACIFIC: MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 180 ASIA PACIFIC: MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 181 CHINA: MARKET FOR FOOD ADDITIVES, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 182 CHINA: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 183 INDIA: MARKET FOR FOOD ADDITIVES, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 184 INDIA: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 185 JAPAN: FOOD ADDITIVES MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 186 JAPAN: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 187 SOUTH KOREA: MARKET FOR FOOD ADDITIVES, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 188 SOUTH KOREA: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 189 AUSTRALIA & NEW ZEALAND: FOOD ADDITIVES MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 190 AUSTRALIA & NEW ZEALAND: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 191 INDONESIA: MARKET FOR FOOD ADDITIVES BY TYPE, 2019–2022 (USD MILLION)

- TABLE 192 INDONESIA: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 193 MALAYSIA: MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 194 MALAYSIA: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 195 PHILIPPINES: FOOD ADDITIVES MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 196 PHILIPPINES: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 197 THAILAND: MARKET FOR FOOD ADDITIVES, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 198 THAILAND: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 199 VIETNAM: MARKET FOR FOOD ADDITIVES, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 200 VIETNAM: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 201 REST OF ASIA PACIFIC: MARKET FOR FOOD ADDITIVES, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 202 REST OF ASIA PACIFIC: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 203 SOUTH AMERICA: FOOD ADDITIVES MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 204 SOUTH AMERICA: MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 205 SOUTH AMERICA: MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 206 SOUTH AMERICA: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 207 SOUTH AMERICA: MARKET, BY TYPE, 2019–2022 (KT)

- TABLE 208 SOUTH AMERICA: MARKET, BY TYPE, 2023–2028 (KT)

- TABLE 209 SOUTH AMERICA: MARKET, BY SOURCE, 2019–2022 (USD MILLION)

- TABLE 210 SOUTH AMERICA: MARKET, BY SOURCE, 2023–2028 (USD MILLION)

- TABLE 211 SOUTH AMERICA: MARKET, BY FORM, 2019–2022 (USD MILLION)

- TABLE 212 SOUTH AMERICA: MARKET, BY FORM, 2023–2028 (USD MILLION)

- TABLE 213 SOUTH AMERICA: MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 214 SOUTH AMERICA: MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 215 BRAZIL: FOOD ADDITIVES MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 216 BRAZIL: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 217 ARGENTINA: MARKET FOR FOOD ADDITIVES, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 218 ARGENTINA: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 219 COLOMBIA: MARKET FOR FOOD ADDITIVES, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 220 COLOMBIA: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 221 CHILE: MARKET FOR FOOD ADDITIVES, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 222 CHILE: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 223 PERU: MARKET FOR FOOD ADDITIVES, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 224 PERU: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 225 REST OF SOUTH AMERICA: FOOD ADDITIVES MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 226 REST OF SOUTH AMERICA: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 227 ROW: FOOD ADDITIVES MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 228 ROW: MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 229 ROW: MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 230 ROW: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 231 ROW: MARKET, BY TYPE, 2019–2022 (KT)

- TABLE 232 ROW: MARKET, BY TYPE, 2023–2028 (KT)

- TABLE 233 ROW: MARKET, BY SOURCE, 2019–2022 (USD MILLION)

- TABLE 234 ROW: MARKET, BY SOURCE, 2023–2028 (USD MILLION)

- TABLE 235 ROW: MARKET, BY FORM, 2019–2022 (USD MILLION)

- TABLE 236 ROW: MARKET, BY FORM, 2023–2028 (USD MILLION)

- TABLE 237 ROW: MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 238 ROW: MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 239 AFRICA: FOOD ADDITIVES MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 240 AFRICA: MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 241 SOUTH AFRICA: MARKET FOR FOOD ADDITIVES, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 242 SOUTH AFRICA: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 243 MOROCCO: MARKET FOR FOOD ADDITIVES, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 244 MOROCCO: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 245 ALGERIA: MARKET FOR FOOD ADDITIVES, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 246 ALGERIA: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 247 KENYA: MARKET FOR FOOD ADDITIVES, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 248 KENYA: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 249 REST OF AFRICA: MARKET FOR FOOD ADDITIVES, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 250 REST OF AFRICA: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 251 MIDDLE EAST: FOOD ADDITIVES MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 252 MIDDLE EAST: MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 253 SAUDI ARABIA: MARKET FOR FOOD ADDITIVES, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 254 SAUDI ARABIA: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 255 REST OF MIDDLE EAST: MARKET FOR FOOD ADDITIVES, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 256 REST OF MIDDLE EAST: MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 257 GLOBAL FOOD ADDITIVES MARKET: DEGREE OF COMPETITION

- TABLE 258 STRATEGIES ADOPTED BY KEY FOOD ADDITIVE MANUFACTURERS

- TABLE 259 COMPANY FOOTPRINT, BY TYPE (KEY PLAYERS)

- TABLE 260 COMPANY FOOTPRINT, BY FORM (KEY PLAYERS)

- TABLE 261 COMPANY FOOTPRINT, BY APPLICATION (KEY PLAYERS)

- TABLE 262 COMPANY FOOTPRINT, BY REGION (KEY PLAYERS)

- TABLE 263 OVERALL FOOTPRINT (KEY PLAYERS)

- TABLE 264 GLOBAL FOOD ADDITIVES MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 265 MARKET FOR FOOD ADDITIVES: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES (1/2)

- TABLE 266 MARKET FOR FOOD ADDITIVES: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES (2/2)

- TABLE 267 MARKET FOR FOOD ADDITIVES: NEW PRODUCT LAUNCHES, 2019–2023

- TABLE 268 MARKET FOR FOOD ADDITIVES: DEALS, 2019–2023

- TABLE 269 MARKET FOR FOOD ADDITIVES: OTHERS, 2019–2023

- TABLE 270 CARGILL, INCORPORATED: BUSINESS OVERVIEW

- TABLE 271 CARGILL, INCORPORATED: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 272 CARGILL, INCORPORATED: PRODUCT LAUNCHES

- TABLE 273 CARGILL, INCORPORATED: DEALS

- TABLE 274 CARGILL, INCORPORATED: OTHERS

- TABLE 275 BASF SE: BUSINESS OVERVIEW

- TABLE 276 BASF SE: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 277 BASF SE: DEALS

- TABLE 278 BASF SE: OTHERS

- TABLE 279 ADM: BUSINESS OVERVIEW

- TABLE 280 ADM: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 281 ADM: DEALS

- TABLE 282 ADM: OTHERS

- TABLE 283 INTERNATIONAL FLAVORS & FRAGRANCES INC.: BUSINESS OVERVIEW

- TABLE 284 INTERNATIONAL FLAVORS & FRAGRANCES INC.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 285 INTERNATIONAL FLAVORS & FRAGRANCES INC.: PRODUCT LAUNCHES

- TABLE 286 INTERNATIONAL FLAVORS & FRAGRANCES INC.: DEALS

- TABLE 287 INTERNATIONAL FLAVORS & FRAGRANCES INC.: OTHERS

- TABLE 288 INGREDION INCORPORATED: BUSINESS OVERVIEW

- TABLE 289 INGREDION INCORPORATED: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 290 INGREDION INCORPORATED: PRODUCT LAUNCHES

- TABLE 291 INGREDION INCORPORATED: DEALS

- TABLE 292 KERRY GROUP PLC: BUSINESS OVERVIEW

- TABLE 293 KERRY GROUP PLC: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 294 KERRY GROUP PLC: PRODUCT LAUNCHES

- TABLE 295 KERRY GROUP PLC: DEALS

- TABLE 296 KERRY GROUP PLC: OTHERS

- TABLE 297 TATE & LYLE: BUSINESS OVERVIEW

- TABLE 298 TATE & LYLE: PRODUCT LAUNCHES

- TABLE 299 TATE & LYLE: DEALS

- TABLE 300 TATE & LYLE: OTHERS

- TABLE 301 GIVAUDAN: BUSINESS OVERVIEW

- TABLE 302 GIVAUDAN: PRODUCT LAUNCHES

- TABLE 303 GIVAUDAN: DEALS

- TABLE 304 DARLING INGREDIENTS INC.: BUSINESS OVERVIEW

- TABLE 305 DARLING INGREDIENTS INC.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 306 DARLING INGREDIENTS INC.: DEALS

- TABLE 307 DARLING INGREDIENTS INC.: OTHERS

- TABLE 308 CHR. HANSEN: BUSINESS OVERVIEW

- TABLE 309 CHR. HANSEN: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 310 CHR. HANSEN: PRODUCT LAUNCHES

- TABLE 311 CHR. HANSEN: DEALS

- TABLE 312 CHR. HANSEN: OTHERS

- TABLE 313 NOVOZYMES: BUSINESS OVERVIEW

- TABLE 314 NOVOZYMES: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 315 NOVOZYMES: DEALS

- TABLE 316 ASHLAND: BUSINESS OVERVIEW

- TABLE 317 ASHLAND: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 318 ASHLAND: PRODUCT LAUNCHES

- TABLE 319 CP KELCO U.S., INC.: BUSINESS OVERVIEW

- TABLE 320 CP KELCO U.S., INC.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 321 CP KELCO U.S., INC.: PRODUCT LAUNCHES

- TABLE 322 CP KELCO U.S., INC.: DEALS

- TABLE 323 CP KELCO U.S., INC.: OTHERS

- TABLE 324 GLANBIA PLC: BUSINESS OVERVIEW

- TABLE 325 GLANBIA PLC: PRODUCTS OFFERED

- TABLE 326 GLANBIA PLC: DEALS

- TABLE 327 SENSIENT TECHNOLOGIES CORPORATION: BUSINESS OVERVIEW

- TABLE 328 SENSIENT TECHNOLOGIES CORPORATION: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 329 SENSIENT TECHNOLOGIES CORPORATION: DEALS

- TABLE 330 ROQUETTE FRÈRES: BUSINESS OVERVIEW

- TABLE 331 ROQUETTE FRÈRES: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 332 CORBION: BUSINESS OVERVIEW

- TABLE 333 CORBION: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 334 CORBION: PRODUCT LAUNCHES

- TABLE 335 CORBION: DEALS

- TABLE 336 CORBION: OTHERS

- TABLE 337 FOODCHEM INTERNATIONAL CORPORATION: BUSINESS OVERVIEW

- TABLE 338 FOODCHEM INTERNATIONAL CORPORATION: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 339 AMANO ENZYME INC.: BUSINESS OVERVIEW

- TABLE 340 AMANO ENZYMES INC.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 341 AMANO ENZYME INC.: PRODUCT LAUNCHES

- TABLE 342 AMANO ENZYME INC.: OTHERS

- TABLE 343 ENZYME SUPPLIES: BUSINESS OVERVIEW

- TABLE 344 ENZYME SUPPLIES: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 345 ACE INGREDIENTS CO., LTD.: COMPANY OVERVIEW

- TABLE 346 FDL LTD: COMPANY OVERVIEW

- TABLE 347 MANE (EN): COMPANY OVERVIEW

- TABLE 348 NEXIRA: COMPANY OVERVIEW

- TABLE 349 BELL FLAVORS & FRAGRANCES: COMPANY OVERVIEW

- TABLE 350 ADJACENT MARKETS

- TABLE 351 HYDROCOLLOIDS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 352 FOOD TEXTURE MARKET, BY TYPE, 2023–2028 (USD MILLION)

- FIGURE 1 FOOD ADDITIVES MARKET: RESEARCH DESIGN

- FIGURE 2 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

- FIGURE 3 FOOD ADDITIVES MARKET: DEMAND-SIDE CALCULATION

- FIGURE 4 FOOD ADDITIVES MARKET SIZE ESTIMATION STEPS AND RESPECTIVE SOURCES: SUPPLY SIDE

- FIGURE 5 SUPPLY-SIDE ANALYSIS: FOOD ADDITIVES MARKET

- FIGURE 6 DATA TRIANGULATION

- FIGURE 7 INDICATORS OF RECESSION

- FIGURE 8 GLOBAL INFLATION RATE, 2011–2021

- FIGURE 9 GLOBAL GDP, 2011–2021 (USD TRILLION)

- FIGURE 10 RECESSION INDICATORS AND THEIR IMPACT ON FOOD ADDITIVES MARKET

- FIGURE 11 FOOD ADDITIVES MARKET: EARLIER FORECAST VS. RECESSION FORECAST

- FIGURE 12 MARKET, BY TYPE, 2023 VS. 2028 (USD MILLION)

- FIGURE 13 MARKET, BY SOURCE, 2023 VS. 2028 (USD MILLION)

- FIGURE 14 MARKET, BY FORM, 2023 VS. 2028 (USD MILLION)

- FIGURE 15 MARKET, BY APPLICATION, 2023 VS. 2028 (USD MILLION)

- FIGURE 16 MARKET SHARE (VALUE), BY REGION, 2022

- FIGURE 17 INCREASE IN DEMAND FOR NATURAL, CLEAN-LABEL PRODUCTS TO PROPEL MARKET FOR FOOD ADDITIVES

- FIGURE 18 US TO BE LARGEST COUNTRY-LEVEL/SUB-REGIONAL MARKET IN 2023

- FIGURE 19 NATURAL SEGMENT AND US ACCOUNTED FOR LARGEST SHARES IN NORTH AMERICAN MARKET IN 2022

- FIGURE 20 SUGAR SUBSTITUTES TO LEAD MARKET AMONG TYPES DURING FORECAST PERIOD

- FIGURE 21 NATURAL ADDITIVES TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 22 DRY ADDITIVES TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 23 FOOD SEGMENT TO BE LARGER THAN BEVERAGES DURING FORECAST PERIOD

- FIGURE 24 US: RETAIL AND FOOD SERVICE SALES, 2016–2021 (USD BILLION)

- FIGURE 25 ANNUAL GDP GROWTH RATE IN ASIAN COUNTRIES, 2022

- FIGURE 26 FOOD ADDITIVES MARKET DYNAMICS

- FIGURE 27 MAJOR FOOD INDUSTRY SEGMENTS (% OF TOTAL EUROPEAN FOOD INDUSTRY TURNOVER)

- FIGURE 28 VALUE CHAIN ANALYSIS OF FOOD ADDITIVES MARKET

- FIGURE 29 GLOBAL AVERAGE SELLING PRICE TREND, BY TYPE (USD/TON)

- FIGURE 30 FOOD ADDITIVES MARKET: MARKET MAP

- FIGURE 31 FOOD ADDITIVES: ECOSYSTEM MAPPING

- FIGURE 32 REVENUE SHIFT FOR FOOD ADDITIVES MARKET

- FIGURE 33 NUMBER OF PATENTS GRANTED BETWEEN 2013 AND 2022

- FIGURE 34 TOP 10 INVENTORS WITH HIGHEST NUMBER OF PATENT DOCUMENTS

- FIGURE 35 LEADING APPLICANTS WITH HIGHEST NUMBER OF PATENT DOCUMENTS

- FIGURE 36 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR KEY SOURCES

- FIGURE 37 KEY CRITERIA FOR SELECTING SUPPLIER/VENDOR

- FIGURE 38 FOOD ADDITIVES MARKET, BY TYPE, 2023 VS. 2028 (USD MILLION)

- FIGURE 39 FOOD SEGMENT TO BE LARGER FOOD ADDITIVES MARKET DURING PROJECTED PERIOD

- FIGURE 40 BAKERY & CONFECTIONERY PRODUCTS TO DOMINATE FOOD APPLICATION IN FOOD ADDITIVES MARKET THROUGH 2028

- FIGURE 41 CARBONATED SOFT DRINKS TO LEAD AMONG BEVERAGE APPLICATIONS OF FOOD ADDITIVES THROUGH 2028

- FIGURE 42 MARKET FOR FOOD ADDITIVES, BY SOURCE, 2023 VS. 2028 (USD MILLION)

- FIGURE 43 DRY FORM TO LEAD FOOD ADDITIVES MARKET DURING PROJECTED PERIOD

- FIGURE 44 FOOD ADDITIVES MARKET SHARE (VALUE), BY FUNCTIONALITY, 2022

- FIGURE 45 MARKET: GEOGRAPHIC GROWTH OPPORTUNITIES

- FIGURE 46 NORTH AMERICA: INFLATION, BY COUNTRY, 2018–2021

- FIGURE 47 NORTH AMERICAN FOOD ADDITIVES MARKET: RECESSION IMPACT ANALYSIS

- FIGURE 48 NORTH AMERICA: MARKET FOR FOOD ADDITIVES SNAPSHOT

- FIGURE 49 EUROPE: INFLATION, BY COUNTRY, 2018–2021

- FIGURE 50 EUROPE: MARKET FOR FOOD ADDITIVES: RECESSION IMPACT ANALYSIS

- FIGURE 51 ASIA PACIFIC: INFLATION, BY COUNTRY, 2018–2021

- FIGURE 52 ASIA PACIFIC FOOD ADDITIVES MARKET: RECESSION IMPACT ANALYSIS

- FIGURE 53 ASIA PACIFIC: MARKET FOR FOOD ADDITIVES SNAPSHOT

- FIGURE 54 SOUTH AMERICA: INFLATION, BY COUNTRY, 2018–2021

- FIGURE 55 SOUTH AMERICAN FOOD ADDITIVES MARKET: RECESSION IMPACT ANALYSIS

- FIGURE 56 SUB-SAHARAN AFRICA: INFLATION DATA, 2018–2021

- FIGURE 57 ROW FOOD ADDITIVES MARKET: RECESSION IMPACT ANALYSIS

- FIGURE 58 SEGMENTAL REVENUE ANALYSIS OF KEY PLAYERS, 2018–2022 (USD BILLION)

- FIGURE 59 ANNUAL REVENUE, 2022 (USD BILLION) VS. REVENUE GROWTH, 2020–2022 (%)

- FIGURE 60 EBITDA, 2022 (USD BILLION)

- FIGURE 61 FOOD ADDITIVES: GLOBAL SNAPSHOT OF KEY PARTICIPANTS, 2022

- FIGURE 62 COMPANY EVALUATION MATRIX, 2022 (KEY PLAYERS)

- FIGURE 63 STARTUP/SME EVALUATION MATRIX, 2022

- FIGURE 64 CARGILL, INCORPORATED: COMPANY SNAPSHOT

- FIGURE 65 BASF SE: COMPANY SNAPSHOT

- FIGURE 66 ADM: COMPANY SNAPSHOT

- FIGURE 67 INTERNATIONAL FLAVORS & FRAGRANCES INC.: COMPANY SNAPSHOT

- FIGURE 68 INGREDION INCORPORATED: COMPANY SNAPSHOT

- FIGURE 69 KERRY GROUP PLC: COMPANY SNAPSHOT

- FIGURE 70 TATE & LYLE: COMPANY SNAPSHOT

- FIGURE 71 GIVAUDAN: COMPANY SNAPSHOT

- FIGURE 72 DARLING INGREDIENTS INC.: COMPANY SNAPSHOT

- FIGURE 73 CHR. HANSEN: COMPANY SNAPSHOT

- FIGURE 74 NOVOZYMES: COMPANY SNAPSHOT

- FIGURE 75 ASHLAND: COMPANY SNAPSHOT

- FIGURE 76 GLANBIA PLC: COMPANY SNAPSHOT

- FIGURE 77 SENSIENT TECHNOLOGIES CORPORATION: COMPANY SNAPSHOT

- FIGURE 78 CORBION: COMPANY SNAPSHOT

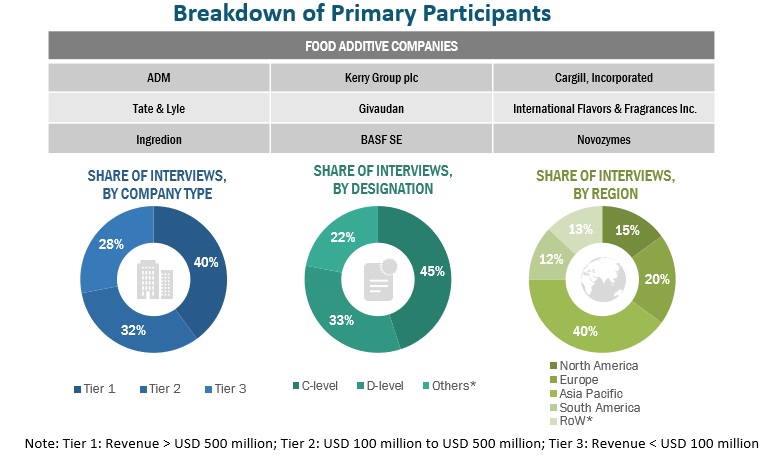

This research involves the extensive use of secondary sources; directories; and databases (Bloomberg and Factiva) to identify and collect information useful for a technical, market-oriented, and commercial study of the Food additives market. In-depth interviews were conducted with various primary respondents, such as key industry participants, Subject Matter Experts (SMEs), C-level executives of key market players, and industry consultants, to obtain and verify critical qualitative and quantitative information and to assess prospects.

Secondary Research

In the secondary research process, various sources, such as the Food and Agricultural Organization (FAO), United States Department of Agriculture (USDA), U.S. Food and Drug Administration (FDA) U.S. Food and Drug Administration (FDA), European Food Safety Authority (EFSA), World Health Organization (WHO), Consumer Healthcare Products Association (CHPA), European Federation of Associations of Health Product Manufacturers (EHPM), Canadian Health Food Association (CHFA), and Health Food Manufacturers' Association (HFMA), associations were referred to identify and collect information for this study. The secondary sources also include journals, press releases, investor presentations of companies, whitepapers, certified publications, articles by recognized authors and regulatory bodies, trade directories, and paid databases.

Primary Research

The Food additives market encompasses various stakeholders involved in the supply chain, raw material manufacturers, raw material suppliers, regulatory organizations, and research institutions. To gather comprehensive information, primary sources from both the supply and demand sides were engaged. Primary interviewees from the supply side consisted of manufacturers, distributors, importers, and technology providers involved in the production and distribution of Food Additives. On the demand side, key opinion leaders, executives, and CEOs of companies in the Food additives industry were approached through questionnaires, emails, and telephonic interviews. This approach ensured a comprehensive and well-rounded understanding of the Food additives market from various perspectives.

To know about the assumptions considered for the study, download the pdf brochure

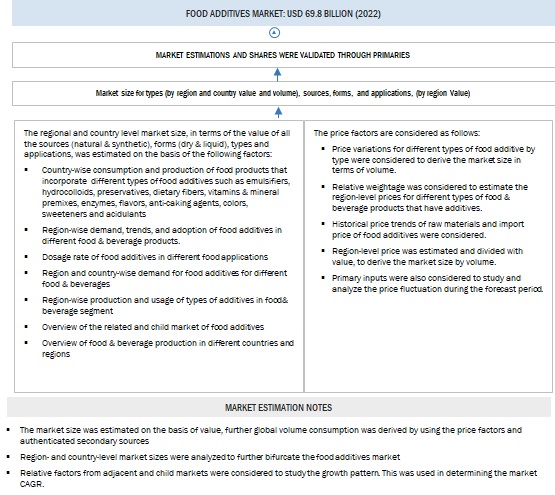

Food Additives Market Size Estimation

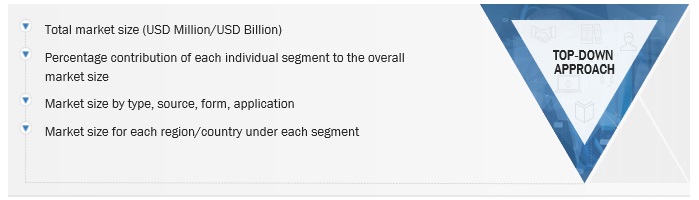

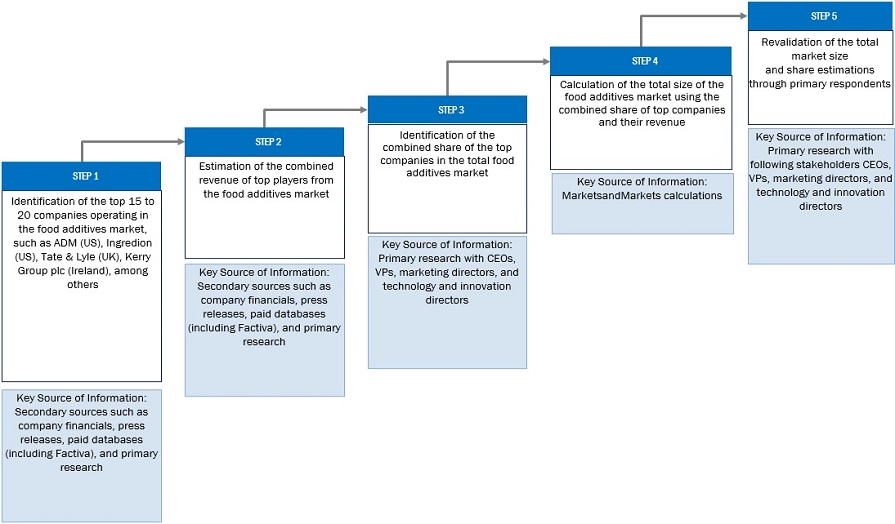

The top-down and bottom-up approaches were used to estimate and validate the market’s and various dependent submarkets’ size. The research methodology used to estimate the market size includes extensive secondary research of key players, reports, reviews, and newsletters of top market players, along with extensive interviews from leaders, such as CEOs, directors, and marketing executives.

Global Food additives Market Size: Bottom-Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Global Food additives market Size: Top-Down Approach

Global Food additives market size estimation: Supply Side

Data Triangulation

The data triangulation and market breakdown procedures explained above were implemented, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for various market segments and subsegments. The data was triangulated by studying various factors and trends from the demand and supply sides. Along with this, the market size was validated using both the top-down and bottom-up approaches.

Market Definition

The definition of food additives according to the European Commission is "any substance not normally consumed as a food in itself and not normally used as a characteristic ingredient of food, whether or not it has nutritive value."

Article 3.2 (a) of the European Council Regulation (EC) No. 1333/2008 (“Regulation 1333/2008”) legislation in the UK, defines food additives as "any substance not normally consumed as a food in itself and not normally used as a characteristic ingredient of food, whether or not it has nutritive value, the intentional addition of which to food for a technological purpose in the manufacture, processing, preparation, treatment, packaging, transport or storage of such food results, or may be reasonably expected to result, in it or its by-products becoming directly or indirectly a component of such foods."

Key Stakeholders

- Raw material suppliers of food additives

- Intermediate stakeholders, including distributors, retailers, associations, and regulatory bodies.

- Manufacturers and traders of food additives

- Manufacturers of food & beverage products

- Trade associations and industry bodies

- Government organizations, research organizations, and consulting firms

- Importers and exporters of food additives

-

Associations, regulatory bodies, and other industry-related bodies:

- Food and Agriculture Organization (FAO)

- Institute of Food and Agricultural Sciences (IFAS)

- Global Food & Beverage Association (GFBA)

- Food Export Association

- European Union (EU)

- The European Food Safety Authority (EFSA)

- United States Department of Agriculture (USDA)

- Organization for Economic Co-operation and Development (OECD)

Report Objectives

- To define, segment, and project the global market for Food additives on the basis of type, source, form, application, functionality (qualitative), and region

- To provide detailed information regarding the key factors influencing the growth of the market (drivers, restraints, opportunities, and industry-specific challenges)

- To strategically analyze the micro markets with respect to individual growth trends, future prospects, and their contribution to the total market

- To analyze the opportunities in the market for stakeholders and provide a competitive landscape of the market leaders

- To project the size of the market and its submarkets, in terms of value with respect to the regions (along with the key countries)

- To strategically profile the key players and comprehensively analyze their market position and core competencies

- To analyze competitive developments in the Food additives market, including joint ventures, mergers & acquisitions, new product developments, and research & development activities

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to company-specific scientific needs.

The following customization options are available for the report:

Product Analysis

- Product Matrix, which gives a detailed comparison of the product portfolio of each company

Geographic Analysis

With the given market data, MarketsandMarkets offers customizations according to company-specific scientific needs.

- Further breakdown of the Rest of the European Food additives market, by key country

- Further breakdown of the Rest of the Asia Pacific Food additives market, by key country

- Further breakdown of the Rest of South America Food additives market, by key country

Company Information

- Detailed analyses and profiling of additional market players such as Ajinomoto Co., Inc. (Japan), Biospringer (France), Palsgaard (Denmark), Lonza (Switzerland), Fooding Group Limited (China), Evonik Industries AG (Germany), Kalsec Inc. (US), Dohler Group (Germany), Lallemand Inc. (Canada), AB Mauri (UK), and Laffort (France).

Growth opportunities and latent adjacency in Food Additives Market