Low-Carbon Propulsion Market by Fuel Type (CNG, LNG, Ethanol, Electric and Hydrogen), Mode (Rail and Road), Vehicle Type (Heavy-Duty and Light-Duty), Rail Application (Passenger and Freight), Electric Vehicle, and Region - Global Forecast to 2027

Low-Carbon Propulsion Market

The governments of several countries are taking initiatives to promote clean sources of energy by implementing stringent emission norms. Alternative fuel driven vehicles will help meet these stringent emission regulations. Manufacturers are seeking viable solutions to fulfil future demand for ultra-low emissions in urban areas. They are attaining it primarily though combustion of alternative fuels such as compressed natural gas (CNG), liquefied natural gas (LNG), ethanol, electric, and hydrogen.

Key Drivers

- Increasing demand for emission-free vehicles and energy-efficient transport

- Vehicle conversions and fluctuations in fuel prices

Key Restraints

- High cost involved with technologies and components

- Infrastructure for alternate fuel vehicles

Top Players

- Tesla (US)

- BYD (China)

- Yutong (China)

- Proterra (US)

- Nissan (Japan)

- Bombardier (Canada)

- Siemens (Germany)

- Alstom (France)

- Toyota (Japan)

- Honda (Japan)

- Hyundai (South Korea)

- MAN SE (Germany)

- Tesla – Tesla was established in 2003 with its headquarters in California. The company operates in two business segments: Automotive and Energy Generation and Storage. In the Automotive segment, Tesla designs and manufactures electric vehicles, electric components, and systems. Vehicle bodies, chassis, interiors, and low voltage electrical systems are produced in-house. In March 2019, Tesla unveiled V3, a completely new architecture for Supercharging. With V3, Tesla will enable its vehicles to charge faster than any other electric vehicle in the market.

- BYD – BYD (Build Your Dreams) specializes in manufacturing electric vehicles. It was established in 1995 and is headquartered in Shenzhen, China. The company is the largest electric vehicle manufacturer in the world. In April 2019, BYD announced the launch of the K12A, the world's first 27-meter pure electric bus. With a passenger capacity of 250 people, it is the longest pure electric bus in the world and can travel at a maximum speed of 70 km/h. Additionally, it is also the world's first electric bus equipped with a distributed 4WD system, which can switch between 2WD and 4WD smoothly to meet the demands of different terrains, while also lowering the vehicle's overall energy consumption.

- Yutong – Yutong is a bus manufacturer and a leader in the Chinese market. The company was founded in 1993 and is headquartered in Zhengzhou, China. The company claims to have delivered 63,526 bus units in 2018, out of which 24,748 were electric. It is leading the Chinese bus market in terms of sales with more than 32% of market share and has around 15% market share in the global bus market. In November 2018, In the Euro Bus Expo 2018, held at the National Exhibition Center in Birmingham, UK, Yutong exhibited its major products for this area, including newly-launched high-end tourism coach T122 with right hand drive, 10-meter full electric city bus E10, and ZK6398HQ that has 70% share in the segment market.

Low Carbon Propulsion Market and Key Application/ Technology/ Industry

- Fuel cell for heavy load transportation – Currently, fuel cells are used in passenger cars, industrial vehicles, and commercial vehicles. With increasing R&D in the field of fuel cell technology, the cost of a fuel cell is expected to decrease, allowing the use of fuel cells in other segments of transportation. In the coming years, fuel cells are expected to be used in heavy load transportation such as passenger ships, trains, trams, and as synthetic fuel (synfuel) in freight ships and airplanes. Initiatives have been taken for using fuel cells in heavy load transportation. For instance, Germany launched the world’s first fuel cell-powered train in September 2018 named ‘Coradia iLint.’ The train has a driving range of 1,000 km (621 miles) and maximum speed of 140 km/hr.

- Electric propulsion in trains – All electrically powered vehicles have significant emission benefits over conventional ICE vehicles. These vehicles can directly draw electricity from the grid or other off-board electrical power sources and store it in batteries. Because of the advantages electric propulsion offers, governments and OEMs across the globe have shifted their focus on electrifying all the mediums of transportation. For instance, Bombardier transportation introduced the new Electro-Hybrid Train Talent 3 in September 2018. This train does not generate any exhaust and sets standards for smart mobility with peak values of 90% in the areas of efficiency and recyclability. It is also around 50% quieter than modern diesel trains.

- CNG Propulsion – CNG is natural gas under pressure which is clear, odorless, and non-corrosive. CNG is a cost effective and green fuel alternative to petrol and diesel fuels for vehicles. The fuel is stored in a compressed gaseous state at a pressure of up to 3,600 pounds PSI for utilization in vehicles. CNG as an alternative to fuels is used in light- and heavy-duty vehicles.

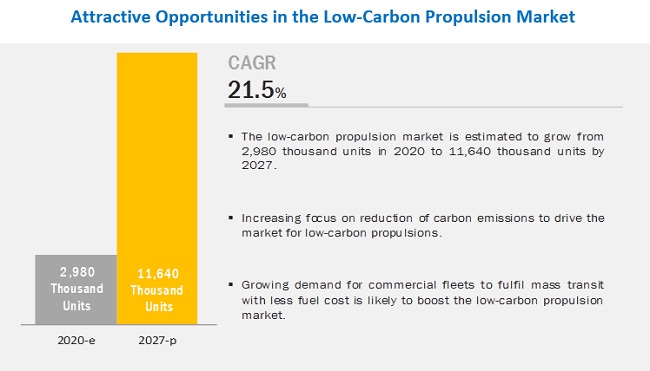

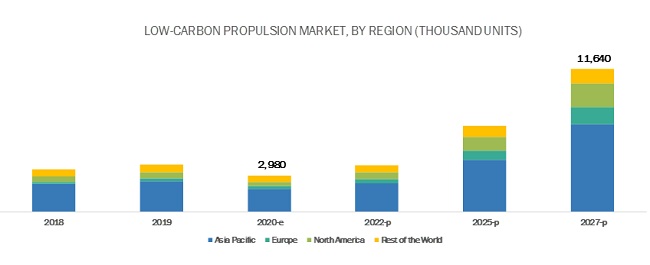

[225 Pages Report] The global low-carbon propulsion market size is estimated to be 2,980 thousand units in 2020. It is projected to grow at a CAGR of 21.5% to reach 11,640 thousand units by 2027. Technological advancements to improve the emission standards by conventional conversions of vehicles and proposed range extensions with fuel efficiency by alternative fuels in commercial vehicles are a propelling factor for low-carbon propulsions.

The electric passenger car segment is expected to have the largest market in, by electric vehicle type, during the forecast period.

Countries such as China have a lower waiting period for electric vehicles than ICE vehicles. Due to the growing stringency of emission norms, European countries such as Germany are planning to have 1 million electric vehicles on the road by the end of 2020. China dominates the market for electric passenger cars, followed by the US.

The COVID-19 impact on electric passenger cars can show a positive response as citizens worldwide would prefer private cars over public transportation. For instance, ever since China lifted its lockdown, the number of private cars on roads in Beijing and other cities has almost doubled, and there has been an increase in new car dealerships. In Chinese cities, many residents have shown the intention of new car purchases.

The hydrogen segment is expected to be the fastest-growing market in the low-carbon propulsion market, by fuel type, during the forecast period.

Hydrogen as a fuel is an emission-free alternative that can be obtained from various sources such as fossil fuels, natural gas, and water, among others. It can be produced from various techniques such as the thermochemical process, electrolytic process, direct solar water splitting process, and biological processes. Hydrogen is produced with the help of heat and chemical reactions in a thermochemical process. Resources such as natural gas, coal, or biomass are used for hydrogen production in the thermochemical process. Light energy is used in the direct solar process to split hydrogen and oxygen atoms in water. Currently, the process is in a developing stage but offers long-term benefits of low environmental impact and potential sustainable hydrogen production process.

North America is expected to lead the market since the US is prone to high air pollution levels. Consumption of gasoline is maximum in the region, which leads to the emission of nitrogen oxides (NOx), hydrocarbons (HC), and particulate matter (PM). Hydrogen-powered fuel cell vehicles emit no harmful substances since they release only water and warm air. The environmental and health precautions required in the US are expected to drive hydrogen production to achieve low or zero-emission goals.

Europe is expected to account for the fastest market during the forecast period.

Europe has been at the forefront of improving the safety and fuel efficiency of commercial vehicles, for which the EU institutions have announced their plans to replace gasoline and diesel stations with CNG, LNG, electric, and other biofuels. Though electric vehicles present a clearer path to decarbonization in transport, biomethane as a fuel remains a favored option for heavy-duty vehicles. Thus, CNG and LNG represent a major source of renewable fuels for low-carbon propulsion in Europe.

Europe's targets for 2021 are the most stringent in the world. The 2021 targets for the European fleet are far tougher to achieve than those in the US, China, or Japan (US: 121g, Japan: 117g, China: 119g). Thus, auto manufacturers, distributors, and fuel providers are taking measures to fulfill the targets.

Key Market Players

The major players in the low-carbon market include Tesla (US), BYD (China), Nissan Motor (Japan), Yutong (China), and Proterra (US).

BYD is another key player in the low-carbon propulsion market. Moreover, BYD designs and assembles a wide range of electric buses. The company has a presence in various regions, including China, the US, Europe, and India. BYD has collaborated with many city transport authorities across the world, providing electric buses of different specifications and sizes. For instance, in February 2019, 25 electric buses developed by BYD were introduced for public transport in Pune, India.

Scope of the Report

|

Report Metric |

Details |

|

Market Size Available for Years |

2018–2027 |

|

Base Year Considered |

2018 |

|

Forecast Period |

2020–2027 |

|

Forecast Units |

Volume (Thousand Units) |

|

Segments Covered |

Fuel type, mode, vehicle type, electric vehicle, rail application, and region. |

|

Geographies Covered |

Asia Pacific, Europe, North America, and the Rest of the World. |

|

Companies Covered |

Tesla (US), BYD (China), Nissan (Japan), Yutong (China), and Proterra (US). |

This research report categorizes the low-carbon propulsion market based on fuel type, mode, vehicle type, electric vehicle, rail application, and region.

By Fuel Type

- Compressed Natural Gas (CNG)

- Liquefied Natural Gas (LNG)

- Ethanol

- Hydrogen

- Electric

By Mode

- Rail

- Road

By Vehicle Type

- Heavy-Duty

- Light-Duty

By Rail Application

- Passenger

- Freight

By Electric Vehicle

- Electric Passenger Car

- Electric Bus

- Electric Two-Wheeler

- Electric Off-Highway

By Region

- Asia Pacific

- Europe

- North America

- RoW

Key questions addressed by the report

- Where will all these developments take the industry in the mid- to long-term?

- How is the increasing adoption of alternative fuel vehicles and changing environmental norms affecting the low-carbon propulsion market?

- What are the upcoming models in commercial vehicles driven by renewable fuels?

- Who are the key players in the market, and how intense is the competition?

- How will the combination of low-carbon emission technology and high-speed range will work on a road and rail transport modes?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENT

1 INTRODUCTION (Page No. - 20)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.2.1 INCLUSIONS & EXCLUSIONS

1.3 MARKET SCOPE

1.3.1 YEARS CONSIDERED FOR THE STUDY

1.4 PACKAGE SIZE

1.5 LIMITATIONS

1.6 STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 23)

2.1 RESEARCH DATA

2.2 SECONDARY DATA

2.2.1 KEY SECONDARY SOURCES

2.2.2 KEY DATA FROM SECONDARY SOURCES

2.3 PRIMARY DATA

2.3.1 SAMPLING TECHNIQUES & DATA COLLECTION METHODS

2.3.2 PRIMARY PARTICIPANTS

2.4 MARKET SIZE ESTIMATION

2.4.1 BOTTOM-UP APPROACH

2.4.2 TOP-DOWN APPROACH

2.5 MARKET BREAKDOWN AND DATA TRIANGULATION

2.6 ASSUMPTIONS

3 EXECUTIVE SUMMARY (Page No. - 33)

4 PREMIUM INSIGHTS (Page No. - 38)

4.1 LOW-CARBON PROPULSION MARKET TO GROW AT A SIGNIFICANT RATE DURING THE FORECAST PERIOD (2020–2027)

4.2 ASIA PACIFIC IS ESTIMATED TO LEAD THE MARKET IN 2020

4.3 MARKET, BY VEHICLE TYPE AND MODE

4.4 MARKET, BY FUEL TYPE

4.5 MARKET, BY VEHICLE TYPE

4.6 MARKET, BY MODE

4.7 MARKET, BY RAIL APPLICATION

4.8 MARKET, BY ELECTRIC VEHICLE TYPE

5 MARKET OVERVIEW (Page No. - 46)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

5.2.1 DRIVERS

5.2.1.1 Increasing demand for emission-free vehicles and energy efficient transport

5.2.1.2 Vehicle conversions and fluctuations in fuel prices

5.2.2 RESTRAINTS

5.2.2.1 High cost involved with technologies and components

5.2.3 OPPORTUNITIES

5.2.3.1 Availability of alternative fuel engine solutions for commercial vehicles

5.2.3.2 Government support for zero emission technologies

5.2.4 CHALLENGES

5.2.4.1 Infrastructure for alternative fuel vehicles

5.3 LOW-CARBON PROPULSION MARKET SCENARIOS (2020–2027)

5.3.1 MOST LIKELY SCENARIO

5.3.2 OPTIMISTIC SCENARIO

5.3.3 PESSIMISTIC SCENARIO

6 INTRODUCTION (COVID-19) (Page No. - 53)

6.1 COVID-19 HEALTH ASSESSMENT

6.2 COVID-19 ECONOMIC ASSESSMENT

6.2.1 COVID-19 ECONOMIC IMPACT—SCENARIO ASSESSMENT

7 INDUSTRY TRENDS (Page No. - 59)

7.1 INTRODUCTION

7.2 PORTER’S 5 FORCES ANALYSIS

7.3 VALUE CHAIN ANALYSIS

7.4 TECHNOLOGICAL ANALYSIS

7.4.1 BI-FUEL PROPANE VEHICLES

7.4.2 INNOVATIVE CHARGING SOLUTIONS

7.4.2.1 Off-board top-down pantograph charging system

7.4.2.2 On-board bottom-up-pantograph charging system

7.4.3 USE OF FUEL CELL FOR HEAVY LOAD TRANSPORTATION

7.4.4 HYDROGEN PRODUCTION

7.4.5 LNG TECHNOLOGY AND FUTURE MARKET POTENTIAL

7.5 KEY MARKETS FOR EXPORT/IMPORT

7.5.1 EUROPE (GERMANY AND SWEDEN)

7.5.2 JAPAN

7.5.3 CHINA

7.5.4 US

7.6 PATENT ANALYSIS

7.6.1 METHODOLOGY

7.6.2 DOCUMENT TYPE

7.6.3 PATENTS FILED

7.6.4 INSIGHT

7.7 CASE STUDY

7.7.1 AUTONOMOUS ELECTRIC CARS

7.8 REGULATORY OVERVIEW

7.8.1 CANADA

7.8.2 CHINA

7.8.3 FRANCE

7.8.4 AUSTRIA

7.8.5 GERMANY

7.8.6 SPAIN

7.9 NATURAL GAS VEHICLES

7.9.1 EUROPE

7.9.2 ITALY

7.9.3 US

7.9.4 CHINA

7.9.5 INDIA

8 MNM INSIGHTS ON ALTERNATIVE FUEL VEHICLES (Page No. - 79)

8.1 ETHANOL

8.1.1 US FUEL ETHANOL BIO-REFINERIES BY STATE

8.1.2 US ETHANOL EXPORTS & IMPORTS

8.1.3 TOP DESTINATIONS FOR US ETHANOL EXPORTS IN 2018

8.1.4 GLOBAL FUEL ETHANOL PRODUCTION BY COUNTRY

8.1.5 US RETAIL STATIONS OFFERING E15

8.1.6 OEM MODEL WISE DATA

8.1.7 NATIONAL AVERAGE RETAIL PRICES FOR E10 & E85

8.1.8 US RETAIL STATIONS OFFERING E85 AND OTHER FLEX FUELS

8.1.9 ETHANOL-FUEL MIXTURE IN THE WORLD

8.2 NATURAL GAS VEHICLES

8.2.1 NGV PASSENGER CAR MODELS FOR EUROPE

8.2.2 LIGHT COMMERCIAL VEHICLE MODELS FOR EUROPE

8.2.3 BUSES MODELS FOR EUROPE

8.2.4 TRUCKS MODELS FOR EUROPE

8.2.5 CNG & LNG STATIONS IN EUROPE

8.2.6 TOP 5 MOST NGVS (CNG+LNG) SOLD IN EUROPE

8.3 ELECTRIC & HYDROGEN VEHICLES

8.3.1 AVERAGE CO2 EMISSIONS OF NEW CARS, BY COUNTRY

8.3.2 CHARGING POINTS FOR ECVS PER COUNTRY, PLUS PERCENTAGE OF EU TOTAL

8.3.3 FUEL CELL VEHICLES (HYDROGEN)

9 LOW-CARBON PROPULSION MARKET, BY RAIL APPLICATION (Page No. - 96)

9.1 INTRODUCTION

9.2 OPERATIONAL DATA

9.2.1 ASSUMPTIONS

9.2.2 RESEARCH METHODOLOGY

9.3 PASSENGER

9.3.1 GROWING DEMAND FOR ENERGY-EFFICIENT MODES OF TRANSPORTATION TO BOOST THE MARKET

9.4 FREIGHT

9.4.1 DEMAND FOR EMISSION-FREE FREIGHT TRANSPORT HAS INCREASED GLOBALLY

9.5 KEY INDUSTRY INSIGHTS

10 LOW-CARBON PROPULSION MARKET, BY FUEL TYPE (Page No. - 102)

10.1 INTRODUCTION

10.2 OPERATIONAL DATA

10.2.1 ASSUMPTIONS

10.2.2 RESEARCH METHODOLOGY

10.3 COMPRESSED NATURAL GAS (CNG)

10.3.1 LOW COST OF CNG WILL BOOST ITS DEMAND

10.4 LIQUEFIED NATURAL GAS (LNG)

10.4.1 LONGER RANGE AND SAFER TRANSPORT PROVIDED BY LNG WILL DRIVE THE MARKET

10.5 ETHANOL

10.5.1 VARIETY OF ETHANOL AS AN ALTERNATIVE FUEL WILL BOOST THE DEMAND

10.6 HYDROGEN

10.6.1 GOVERNMENT INITIATIVES TOWARD FUEL CELL VEHICLES WILL DRIVE THE MARKET

10.7 ELECTRIC

10.7.1 AVAILABILITY OF TECHNOLOGY AND INFRASTRUCTURE FOR ELECTRIC VEHICLES WILL BOOST THE MARKET

10.8 KEY INDUSTRY INSIGHTS

11 LOW-CARBON PROPULSION MARKET, BY ELECTRIC VEHICLE (Page No. - 112)

11.1 INTRODUCTION

11.2 OPERATIONAL DATA

11.2.1 ASSUMPTIONS

11.2.2 RESEARCH METHODOLOGY

11.3 PASSENGER CAR

11.3.1 GOVERNMENT MANDATES REGARDING EMISSION CONTROL WILL DRIVE THE MARKET

11.4 ELECTRIC TWO-WHEELER

11.4.1 USAGE OF ALTERNATIVE FUELS FOR INCREASED POWER IN WILL DRIVE THE MARKET

11.4.2 ELECTRIC MOTORCYCLE

11.4.3 ELECTRIC SCOOTER/MOPED

11.5 ELECTRIC BUS

11.5.1 GOVERNMENT MANDATES AND INCREASING INVESTMENTS IN EMISSION-FREE PUBLIC TRANSPORT WILL BOOST THE MARKET

11.6 ELECTRIC OFF-HIGHWAY VEHICLE

11.6.1 HIGH EFFICIENCY AND GREATER DRIVING RANGE OF ALTERNATIVE FUELS WILL DRIVE THE MARKET

11.6.2 MINING

11.6.3 CONSTRUCTION

11.6.4 AGRICULTURE

11.7 KEY INDUSTRY INSIGHTS

12 LOW-CARBON PROPULSION MARKET, BY MODE (Page No. - 122)

12.1 INTRODUCTION

12.2 OPERATIONAL DATA

12.2.1 ASSUMPTIONS

12.2.2 RESEARCH METHODOLOGY

12.3 ROAD

12.3.1 DEMAND FOR EMISSION-FREE COMMERCIAL VEHICLES AND RISING ADOPTION OF ELECTRIC VEHICLES IN THE LOGISTICS INDUSTRY WILL FUEL THE MARKET

12.4 RAIL

12.4.1 BENEFIT OF MASS TRANSIT OVER LONG DISTANCES TO DRIVE THE MARKET

12.5 KEY INDUSTRY INSIGHTS

13 LOW-CARBON PROPULSION MARKET, BY VEHICLE TYPE (Page No. - 128)

13.1 INTRODUCTION

13.2 OPERATIONAL DATA

13.2.1 ASSUMPTIONS

13.2.2 RESEARCH METHODOLOGY

13.3 HEAVY-DUTY VEHICLE

13.3.1 GOVERNMENT FUNDED PROJECTS AND TARGETS TO REPLACE COMMERCIAL FLEET WITH ZERO EMISSION FLEET WILL DRIVE THE MARKET

13.4 LIGHT-DUTY VEHICLE

13.4.1 DEMAND FOR LAST MILE DELIVERY TO BOOST THE SEGMENT

13.5 KEY INDUSTRY INSIGHTS

14 LOW-CARBON PROPULSION MARKET, BY REGION (Page No. - 136)

14.1 INTRODUCTION

14.2 EUROPE

14.2.1 GERMANY

14.2.1.1 Government emission norms will fuel the German market

14.2.2 ITALY

14.2.2.1 Growing alternative fuel vehicle infrastructure will drive the Italian market

14.2.3 UK

14.2.3.1 Increasing promotion for electric and hydrogen fuel vehicles will drive the UK market

14.2.4 SPAIN

14.2.4.1 Increasing adoption of electric fleet with fuel the Spanish market

14.2.5 FRANCE

14.2.5.1 Bio-fuel adoption for commercial vehicles with boost the French market

14.2.6 RUSSIA

14.2.6.1 Presence of renowned OEMs with fuel the Russia market

14.2.7 TURKEY

14.2.7.1 Skilled workforce and automotive production will fuel the Turkish market

14.3 NORTH AMERICA

14.3.1 US

14.3.1.1 Increasing efforts from government for adoption of alternative fuel vehicles will drive the US market

14.3.2 CANADA

14.3.2.1 Fuel cell and electric vehicle technologies adopted by the industry will boost the Canadian market

14.3.3 MEXICO

14.3.3.1 ZEV standards adopted by the country will drive the Mexican market

14.4 ASIA PACIFIC

14.4.1 CHINA

14.4.1.1 Increasing sales of electric commercial vehicles will fuel the Chinese market

14.4.2 JAPAN

14.4.2.1 Increasing demand for road and rail vehicles driven by alternative fuels will drive the Japanese market

14.4.3 INDIA

14.4.3.1 Focus on reduced vehicle emissions will drive the Indian market

14.4.4 SOUTH KOREA

14.4.4.1 Presence of key players will fuel the South Korean market

14.4.5 THAILAND

14.4.5.1 Renewable energy agenda to meet emission targets will drive the Thai market

14.4.6 INDONESIA

14.4.6.1 Shift from ICE vehicles to EVs will fuel the Indonesian market

14.5 REST OF THE WORLD (ROW)

14.5.1 BRAZIL

14.5.1.1 Low cost of labor and demand for heavy-duty trucks will drive the Brazilian market

14.5.2 SOUTH AFRICA

14.5.2.1 Concerns over CO2 emissions from vehicles will boost the South African market

14.5.3 IRAN

14.5.3.1 Partnerships between global and domestic OEMs with drive the Iranian market

14.5.4 ARGENTINA

14.5.4.1 New NGV regulations will drive the Argentinian market

15 COMPETITIVE LANDSCAPE (Page No. - 166)

15.1 OVERVIEW

15.2 MARKET RANKING ANALYSIS

15.3 COMPETITIVE LEADERSHIP MAPPING

15.3.1 VISIONARY LEADERS

15.3.2 INNOVATORS

15.3.3 DYNAMIC DIFFERENTIATORS

15.3.4 EMERGING COMPANIES

15.4 STRENGTH OF PRODUCT PORTFOLIO

15.5 BUSINESS STRATEGY EXCELLENCE

15.6 WINNERS VS. TAIL-ENDERS

15.7 COMPETITIVE SCENARIO

15.7.1 NEW PRODUCT DEVELOPMENTS

15.7.2 JOINT VENTURE/PARTNERSHIPS/COLLABORATIONS

15.7.3 AGREEMENTS

15.7.4 EXPANSIONS, 2018–2019

16 COMPANY PROFILES (Page No. - 177)

(Business overview, Products offered, Recent Developments, SWOT analysis, MNM view)*

16.1 TESLA, INC.

16.2 BYD

16.3 YUTONG

16.4 PROTERRA

16.5 NISSAN

16.6 BOMBARDIER

16.7 SIEMENS

16.8 ALSTOM

16.9 TOYOTA

16.10 HONDA

16.11 HYUNDAI

16.12 MAN SE

*Details on Business overview, Products offered, Recent Developments, SWOT analysis, MNM view might not be captured in case of unlisted companies.

16.13 OTHER MAJOR PLAYERS

16.13.1 NORTH AMERICA

16.13.1.1 General Electric (GE)

16.13.1.2 NFI Group

16.13.1.3 Cummins Inc.

16.13.1.4 Nikola Motor Company

16.13.1.5 Zenith Motors

16.13.2 EUROPE

16.13.2.1 Volkswagen

16.13.2.2 AB Volvo

16.13.2.3 VDL Groep

16.13.2.4 Daimler AG

16.13.2.5 CAF

16.13.2.6 Scania

16.13.3 ASIA PACIFIC

16.13.3.1 Hyundai Rotem

16.13.3.2 Toshiba

16.13.3.3 King Long

16.13.3.4 Ankai

16.13.3.5 Tata Motors

17 RECOMMENDATIONS BY MARKETSANDMARKETS (Page No. - 217)

17.1 ASIA PACIFIC WILL BE THE LEADING LOW-CARBON PROPULSION MARKET

17.2 ELECTRIC VEHICLES HOLD THE KEY FOR LOW-CARBON PROPULSION MARKET IN COMING YEARS

17.3 CONCLUSION

18 APPENDIX (Page No. - 219)

18.1 KEY INSIGHTS OF INDUSTRY EXPERTS

18.2 DISCUSSION GUIDE

18.3 KNOWLEDGE STORE: MARKETSANDMARKETS SUBSCRIPTION PORTAL

18.4 AVAILABLE CUSTOMIZATIONS

18.5 RELATED REPORTS

18.6 AUTHOR DETAILS

LIST OF TABLES (123 TABLES)

TABLE 1 INCLUSIONS & EXCLUSIONS FOR LOW-CARBON PROPULSION MARKET

TABLE 2 NATIONAL AVERAGE RETAIL FUEL PRICES OF CONVENTIONAL AND ALTERNATIVE FUELS, JANUARY 2020

TABLE 3 DIESEL VS. CNG VS. LNG

TABLE 4 GOVERNMENT PROGRAMS FOR PROMOTION OF ELECTRIC COMMERCIAL VEHICLE SALES

TABLE 5 MARKET (MOST LIKELY), BY REGION, 2020–2027 (THOUSAND UNITS)

TABLE 6 LOW-CARBON PROPULSION MARKET (OPTIMISTIC), BY REGION, 2020–2027 (THOUSAND UNITS)

TABLE 7 LOW-CARBON PROPULSION (PESSIMISTIC), BY REGION, 2020–2027 (THOUSAND UNITS)

TABLE 8 SUMMARY OF FCEV ATTRIBUTES COMPARED TO THOSE OF ADVANCED BEV FOR 200-MILE AND 300-MILE RANGE

TABLE 9 TOTAL IMPORT/EXPORT OF VEHICLES IN EUROPE, UNITS

TABLE 10 TOTAL IMPORT/EXPORT OF VEHICLES IN JAPAN, UNITS

TABLE 11 TOTAL IMPORT/EXPORT OF VEHICLES IN CHINA, UNITS

TABLE 12 TOTAL IMPORT/EXPORT OF VEHICLES IN US, UNITS

TABLE 13 EXISTING SUBSIDIES AND TAX STRUCTURE, CANADA, 2018

TABLE 14 EXISTING CHARGING STATION STANDARDS IN CHINA

TABLE 15 EXISTING SUBSIDIES AND TAX STRUCTURE, CHINA, 2018

TABLE 16 EXISTING SUBSIDIES AND TAX STRUCTURE, FRANCE, 2018

TABLE 17 EXISTING SUBSIDIES AND TAX STRUCTURE, AUSTRIA, 2018

TABLE 18 EXISTING SUBSIDIES AND TAX STRUCTURE, GERMANY, 2018

TABLE 19 EXISTING SUBSIDIES AND TAX STRUCTURE, SPAIN, 2018

TABLE 20 WORLDWIDE NGV COUNTRIES, 2018

TABLE 21 AVERAGE CONSUMPTION IN GALLONS OF GASOLINE EQUIVALENT (GGE)

TABLE 22 EXAMPLES OF DEPLOYMENT OF HYDROGEN BUS PROJECTS

TABLE 23 CLEAN ENERGY FUELS - RETAIL SALES DATA, 2015–2018

TABLE 24 ANNUAL WORLD FUEL ETHANOL PRODUCTION (MIL. GAL.)

TABLE 25 ANNUAL U.S. FUEL ETHANOL PRODUCTION

TABLE 26 TOP 5 MOST ECVS SOLD IN EUROPE

TABLE 27 TOP 5 MOST FCEVS SOLD IN EUROPE

TABLE 28 LOW-CARBON PROPULSION MARKET, BY RAIL APPLICATION, 2018–2027 (UNITS)

TABLE 29 WORLDWIDE CNG, LNG, AND BIOMETHANE STATIONS ,2018

TABLE 30 PASSENGER: MARKET, BY REGION, 2018–2027 (UNITS)

TABLE 31 RAIL TRANSPORT ACTIVITY BY FUEL TYPE, 1995–2016

TABLE 32 FREIGHT: MARKET, BY REGION, 2020–2027 (UNITS)

TABLE 33 WORLDWIDE CNG, LNG AND BIOMETHANE STATIONS , 2018

TABLE 34 MARKET, BY FUEL TYPE, 2018–2027 (THOUSAND UNITS)

TABLE 35 CNG+LNG REFUELING STATIONS IN EUROPE, 2018

TABLE 36 COMPRESSED NATURAL GAS (CNG): LOW-CARBON PROPULSION MARKET, BY REGION, 2018–2027 (THOUSAND UNITS)

TABLE 37 LIQUEFIED NATURAL GAS (LNG): MARKET, BY REGION, 2018–2027 (THOUSAND UNITS)

TABLE 38 ETHANOL: MARKET, BY REGION, 2018–2027 (THOUSAND UNITS)

TABLE 39 HYDROGEN: MARKET, BY REGION, 2018–2027 (THOUSAND UNITS)

TABLE 40 ELECTRIC: MARKET, BY REGION, 2018–2027 (THOUSAND UNITS)

TABLE 41 ELECTRIC CAR DEPLOYMENT IN SELECTED COUNTRIES, 2013–2018 (MILLION UNITS)

TABLE 42 ELECTRIC COMMERCIAL VEHICLE DATA BASED ON POWER OUTPUT

TABLE 43 TOP 5 COUNTRIES USING ALTERNATIVE FUEL CARS IN 2019

TABLE 44 PASSENGER CAR: MARKET, 2018–2027 (THOUSAND UNITS)

TABLE 45 ELECTRIC TWO-WHEELER: MARKET, 2018–2027 (THOUSAND UNITS)

TABLE 46 ELECTRIC BUSES: MARKET, 2018–2027 (THOUSAND UNITS)

TABLE 47 ELECTRIC OFF-HIGHWAY: MARKET, 2018–2027 (THOUSAND UNITS)

TABLE 48 LOW-CARBON PROPULSION MARKET, BY MODE, 2018–2027 (THOUSAND UNITS)

TABLE 49 SCENARIO FOR ENERGY DEMAND IN FUTURE FROM RAIL MODE

TABLE 50 ROAD: MARKET, BY REGION, 2018–2027 (THOUSAND UNITS)

TABLE 51 RAIL: MARKET, BY REGION, 2018–2027 (THOUSAND UNITS)

TABLE 52 MARKET, BY VEHICLE TYPE, 2018–2027 (THOUSAND UNITS)

TABLE 53 US TIER III EVAPORATIVE EMISSIONS TESTS AND LIMITS FOR GASOLINE LIGHT-DUTY VEHICLES

TABLE 54 EXAMPLES OF DEPLOYMENT BUS PROJECTS

TABLE 55 HEAVY-DUTY VEHICLE: MARKET, BY REGION, 2018–2027 (THOUSAND UNITS)

TABLE 56 LIGHT-DUTY VEHICLE: MARKET, BY REGION, 2018–2027 (THOUSAND UNITS)

TABLE 57 LOW-CARBON PROPULSION MARKET, BY REGION, 2018–2027 (THOUSAND UNITS)

TABLE 58 PRODUCTION IMPACT OF THE CORONAVIRUS / COVID-19 CRISIS ON THE EUROPEAN AUTO INDUSTRY, 2020

TABLE 59 EUROPE: MARKET, BY COUNTRY, 2018–2027 (THOUSAND UNITS)

TABLE 60 GERMANY: AUTOMOTIVE FUEL CELL MARKET - ONGOING PROJECTS

TABLE 61 GERMANY: MARKET, BY VEHICLE TYPE, 2018–2027 (THOUSAND UNITS)

TABLE 62 ITALY: MARKET, BY VEHICLE TYPE, 2018–2027 (THOUSAND UNITS)

TABLE 63 UK: MARKET, BY VEHICLE TYPE, 2018–2027 (THOUSAND UNITS)

TABLE 64 SPAIN: MARKET, BY VEHICLE TYPE, 2018–2027 (THOUSAND UNITS)

TABLE 65 FRANCE: MARKET, BY VEHICLE TYPE, 2018–2027 (THOUSAND UNITS)

TABLE 66 RUSSIA: MARKET, BY VEHICLE TYPE, 2018–2027 (THOUSAND UNITS)

TABLE 67 TURKEY: MARKET, BY VEHICLE TYPE, 2018–2027 (THOUSAND UNITS)

TABLE 68 NORTH AMERICA: MARKET, BY COUNTRY, 2018–2027 (THOUSAND UNITS)

TABLE 69 US: LOW-CARBON PROPULSION MARKET, BY VEHICLE TYPE, 2018–2027 (THOUSAND UNITS)

TABLE 70 CANADA: MARKET, BY VEHICLE TYPE, 2018–2027 (THOUSAND UNITS)

TABLE 71 MEXICO: MARKET, BY VEHICLE TYPE, 2018–2027 (THOUSAND UNITS)

TABLE 72 ASIA PACIFIC: MARKET, BY COUNTRY, 2018–2027 (THOUSAND UNITS)

TABLE 73 CHINA: MARKET, BY VEHICLE TYPE, 2018–2027 (THOUSAND UNITS)

TABLE 74 JAPAN: MARKET, BY VEHICLE TYPE, 2018–2027 (THOUSAND UNITS)

TABLE 75 INDIA: MARKET, BY VEHICLE TYPE, 2018–2027 (THOUSAND UNITS)

TABLE 76 SOUTH KOREA: MARKET, BY VEHICLE TYPE, 2018–2027 (THOUSAND UNITS)

TABLE 77 THAILAND: MARKET, BY VEHICLE TYPE, 2018–2027 (THOUSAND UNITS)

TABLE 78 INDONESIA: MARKET, BY VEHICLE TYPE, 2018–2027 (THOUSAND UNITS)

TABLE 79 ROW: LOW-CARBON PROPULSION MARKET, BY COUNTRY, 2018–2027 (THOUSAND UNITS)

TABLE 80 BRAZIL: MARKET, BY VEHICLE TYPE, 2018–2027 (THOUSAND UNITS)

TABLE 81 SOUTH AFRICA: MARKET, BY VEHICLE TYPE, 2018–2027 (THOUSAND UNITS)

TABLE 82 IRAN: MARKET, BY VEHICLE TYPE, 2018–2027 (THOUSAND UNITS)

TABLE 83 ARGENTINA: MARKET, BY VEHICLE TYPE, 2018–2027 (THOUSAND UNITS)

TABLE 84 NEW PRODUCT DEVELOPMENTS, 2018–2019

TABLE 85 SUPPLY CONTRACTS, 2017–2019

TABLE 86 JOINT VENTURES/PARTNERSHIPS/COLLABORATIONS, 2018–2019

TABLE 87 AGREEMENTS, 2018–2019

TABLE 88 EXPANSIONS, 2018–2019

TABLE 89 TESLA, INC.: NEW PRODUCT DEVELOPMENT/EXPANSIONS

TABLE 90 TESLA, INC.: AUTOMOTIVE REVENUE SHARE OVER THE YEARS

TABLE 91 BYD: PRODUCT OFFERINGS

TABLE 92 BYD:NEW PRODUCT DEVELOPMENT/EXPANSIONS

TABLE 93 BYD: JOINT VENTURES/PARTNERSHIPS/COLLABORATIONS/AGREEMENTS/SUPPLY CONTRACT/ACQUISITION/MERGER/DEMONSTRATION

TABLE 94 BYD: AUTOMOTIVE REVENUE SHARE OVER THE YEARS

TABLE 95 YUTONG: PRODUCT OFFERINGS

TABLE 96 YUTONG: NEW PRODUCT DEVELOPMENT/EXPANSIONS

TABLE 97 YUTONG: JOINT VENTURES/PARTNERSHIPS/COLLABORATIONS/AGREEMENTS/SUPPLY CONTRACT/ACQUISITION/MERGER/DEMONSTRATION

TABLE 98 PROTERRA: PRODUCT OFFERINGS

TABLE 99 PROTERRA: NEW PRODUCT DEVELOPMENT/EXPANSIONS

TABLE 100 PROTERRA: JOINT VENTURES/PARTNERSHIPS/COLLABORATIONS/AGREEMENTS/SUPPLY CONTRACT/ACQUISITION/MERGER/DEMONSTRATION

TABLE 101 NISSAN MOTOR: PRODUCT OFFERINGS

TABLE 102 NISSAN: NEW PRODUCT DEVELOPMENT/EXPANSIONS

TABLE 103 NISSAN: JOINT VENTURES/PARTNERSHIPS/COLLABORATIONS/AGREEMENTS/SUPPLY CONTRACT/ACQUISITION/MERGER/DEMONSTRATION

TABLE 104 BOMBARDIER: PRODUCT OFFERINGS

TABLE 105 BOMBARDIER: NEW PRODUCT DEVELOPMENT/EXPANSIONS

TABLE 106 BOMBARDIER: JOINT VENTURES/PARTNERSHIPS/COLLABORATIONS/AGREEMENTS/SUPPLY CONTRACT/ACQUISITION/MERGER/DEMONSTRATION

TABLE 107 SIEMENS: PRODUCT OFFERINGS

TABLE 108 SIEMENS: NEW PRODUCT DEVELOPMENT/EXPANSIONS

TABLE 109 SIEMENS: JOINT VENTURES/PARTNERSHIPS/COLLABORATIONS/AGREEMENTS/SUPPLY CONTRACT/ACQUISITION/MERGER/DEMONSTRATION

TABLE 110 SIEMENS: MOBILITY REVENUE SHARE OVER THE YEARS

TABLE 111 ALSTOM: PRODUCT OFFERINGS

TABLE 112 ALSTOM: NEW PRODUCT DEVELOPMENT/EXPANSIONS

TABLE 113 ALSTOM: JOINT VENTURES/PARTNERSHIPS/COLLABORATIONS/AGREEMENTS/SUPPLY CONTRACT/ACQUISITION/MERGER/DEMONSTRATION

TABLE 114 TOYOTA: PRODUCT OFFERINGS

TABLE 115 TOYOTA: NEW PRODUCT DEVELOPMENT/EXPANSIONS

TABLE 116 TOYOTA: JOINT VENTURES/PARTNERSHIPS/COLLABORATIONS/AGREEMENTS/SUPPLY CONTRACT/ACQUISITION/MERGER/DEMONSTRATION

TABLE 117 TOYOTA: AUTOMOTIVE REVENUE SHARE OVER THE YEARS

TABLE 118 HONDA: PRODUCT OFFERINGS

TABLE 119 HONDA: NEW PRODUCT DEVELOPMENT/EXPANSIONS

TABLE 120 HYUNDAI: PRODUCT OFFERINGS

TABLE 121 HYUNDAI: NEW PRODUCT DEVELOPMENT/EXPANSIONS

TABLE 122 HYUNDAI: JOINT VENTURES/PARTNERSHIPS/COLLABORATIONS/AGREEMENTS/SUPPLY CONTRACT/ACQUISITION/MERGER/DEMONSTRATION

TABLE 123 MAN SE: PRODUCT OFFERINGS

LIST OF FIGURES (71 FIGURES)

FIGURE 1 LOW-CARBON PROPULSION: MARKET SEGMENTATION

FIGURE 2 LOW-CARBON PROPULSION MARKET: RESEARCH DESIGN

FIGURE 3 RESEARCH METHODOLOGY MODEL

FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS

FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY FOR MARKET: BOTTOM-UP APPROACH

FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY FOR MARKET: TOP-DOWN APPROACH

FIGURE 7 DATA TRIANGULATION

FIGURE 8 REVENUE SHIFT IN THE MARKET

FIGURE 9 COVID-19 IMPACT ON MARKET

FIGURE 10 LOW-CARBON PROPULSION: MARKET DYNAMICS

FIGURE 11 LOW-CARBON PROPULSION MARKET, BY REGION, 2020–2027

FIGURE 12 LOW-CARBON PROPULSION, BY FUEL TYPE, 2020 VS 2027

FIGURE 13 INCREASING DEMAND FOR FUEL EFFICIENT VEHICLES IS LIKELY TO BOOST MARKET GROWTH

FIGURE 14 MARKET SHARE, BY REGION, 2020

FIGURE 15 LIGHT-DUTY AND ROAD MODE ACCOUNT FOR THE LARGEST SHARES OF THE MARKET IN 2020

FIGURE 16 ELECTRIC TYPE IS EXPECTED TO HOLD THE LARGEST MARKET SHARE, 2020 VS. 2027 (THOUSAND UNITS)

FIGURE 17 LIGHT-DUTY IS EXPECTED TO HOLD THE LARGEST MARKET SHARE, 2020 VS. 2027 (THOUSAND UNITS)

FIGURE 18 ROAD IS ESTIMATED TO HOLD THE LARGEST MARKET SHARE, 2020 VS. 2027 (THOUSAND UNITS)

FIGURE 19 PASSENGER IS ESTIMATED TO HOLD THE LARGEST MARKET SHARE, 2020 VS. 2027 (UNITS)

FIGURE 20 PASSENGER IS ESTIMATED TO HOLD THE LARGEST MARKET SHARE, 2020 VS. 2027 (THOUSAND UNITS)

FIGURE 21 GLOBAL FUEL ECONOMY AND CO2 EMISSION DATA (2016–2025)

FIGURE 22 COVID-19: THE GLOBAL PROPAGATION

FIGURE 23 COVID-19 PROPAGATION: SELECT COUNTRIES

FIGURE 24 COUNTRIES BEGIN WITH A SIMILAR TRAJECTORY BUT THE CURVE DEVIATES BASED ON MEASURES TAKEN

FIGURE 25 REVISED GDP FORECASTS FOR SELECT G20 COUNTRIES IN 2020

FIGURE 26 CRITERIA IMPACTING THE GLOBAL ECONOMY

FIGURE 27 SCENARIOS IN TERMS OF RECOVERY OF THE GLOBAL ECONOMY

FIGURE 28 VALUE CHAIN ANALYSIS OF LOW-CARBON PROPULSION MARKET

FIGURE 29 TIMELINE OF FUEL CELL MASS MARKET ACCEPTABILITY IN TRANSPORTATION SECTOR, 2016–2050

FIGURE 30 LNG SATURATED FUEL TANK

FIGURE 31 PATENT APPLICATION TRENDS – LAST 5 YEARS

FIGURE 32 COUNTRY-WISE PATENT ANALYSIS

FIGURE 33 TOP PATENT APPLICANTS, 2010-2019

FIGURE 34 ALTERNATIVELY-POWERED VEHICLES: SHARE OF THE EU CAR FLEET

FIGURE 35 CO2 EMISSIONS OF NEW CARS

FIGURE 36 NATIONAL INCOME AND ELECTRICALLY-CHARGEABLE CARS

FIGURE 37 LOW-CARBON PROPULSION MARKET, BY RAIL APPLICATION, 2020 VS. 2027

FIGURE 38 FINAL ENERGY DEMAND IN RAIL TRANSPORT BY REGION AND TYPE, 2000-17

FIGURE 39 MARKET, BY FUEL TYPE, 2020 VS. 2027, THOUSAND UNITS

FIGURE 40 US IMPORT AND EXPORT LNG DATA

FIGURE 41 ETHANOL FUELING STATIONS IN US

FIGURE 42 MARKET, BY ELECTRIC VEHICLE, 2020 VS. 2027, THOUSAND UNITS

FIGURE 43 MARKET, BY MODE, 2020 VS. 2027, THOUSAND UNITS

FIGURE 44 MARKET, BY VEHICLE TYPE, 2020 VS. 2027, THOUSAND UNITS

FIGURE 45 ALTERNATIVE FUEL VEHICLES IN EUROPE

FIGURE 46 MARKET, BY REGION, 2020 VS. 2027

FIGURE 47 EUROPE: LOW-CARBON PROPULSION MARKET SNAPSHOT

FIGURE 48 FORECAST OF GREEN VEHICLE MARKET DEVELOPMENT IN RUSSIA BY 2030

FIGURE 49 NORTH AMERICA: MARKET SNAPSHOT

FIGURE 50 ASIA PACIFIC: MARKET SNAPSHOT

FIGURE 51 ROW: MARKET SNAPSHOT

FIGURE 52 LOW-CARBON PROPULSION (GLOBAL): COMPETITIVE LEADERSHIP MAPPING, 2020

FIGURE 53 PRODUCT PORTFOLIO ANALYSIS OF TOP PLAYERS IN MARKET

FIGURE 54 BUSINESS STRATEGY EXCELLENCE OF TOP PLAYERS IN LOW-CARBON PROPULSION MARKET

FIGURE 55 KEY DEVELOPMENTS BY LEADING PLAYERS IN THE MARKET, 2017–2020

FIGURE 56 TESLA, INC.: COMPANY SNAPSHOT

FIGURE 57 TESLA, INC.: SWOT ANALYSIS

FIGURE 58 BYD: COMPANY SNAPSHOT

FIGURE 59 BYD: SWOT ANALYSIS

FIGURE 60 YUTONG: COMPANY SNAPSHOT

FIGURE 61 YUTONG: SWOT ANALYSIS

FIGURE 62 PROTERRA: SWOT ANALYSIS

FIGURE 63 NISSAN: COMPANY SNAPSHOT

FIGURE 64 NISSAN: SWOT ANALYSIS

FIGURE 65 BOMBARDIER: COMPANY SNAPSHOT

FIGURE 66 SIEMENS: COMPANY SNAPSHOT

FIGURE 67 ALSTOM: COMPANY SNAPSHOT

FIGURE 68 TOYOTA: COMPANY SNAPSHOT

FIGURE 69 HONDA: COMPANY SNAPSHOT

FIGURE 70 HYUNDAI: COMPANY SNAPSHOT

FIGURE 71 MAN SE: COMPANY SNAPSHOT

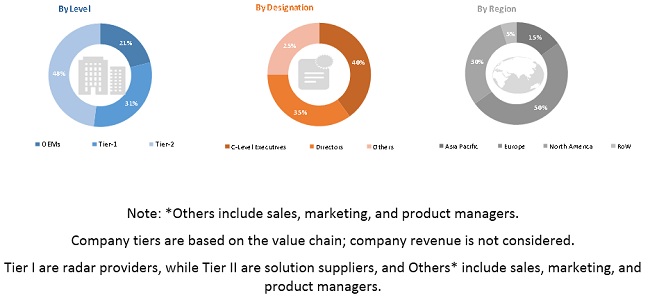

The study involves four main activities to estimate the current size of the global low-carbon propulsion market. Exhaustive secondary research was done to collect information on the market. The next step was to validate these findings, assumptions, and market analysis with industry experts across value chains through primary research. Both top-down and bottom-up approaches were employed to estimate the total market size of different segments considered in this study. After that, market breakdown and data triangulation were used to estimate the market size of the segments and subsegments.

Secondary Research

The secondary sources referred to for this research study include automotive industry organizations such as the Organisation Internationale des Constructeurs d'Automobiles (OICA), Alternative Fuels Data Center (AFDC), corporate filings (such as annual reports, investor presentations, and financial statements); and trade, business, and automotive associations. Secondary data has been collected and analyzed to arrive at the overall market size, which is further validated by primary research.

Primary Research

Extensive primary research has been conducted after acquiring an understanding of the low-carbon propulsion market scenario through secondary research. Several primary interviews have been conducted with market experts from both the demand-side (vehicle manufacturers, country-level government associations, and trade associations) and supply-side (OEMs and component manufacturers) across four major regions, namely, North America, Europe, Asia Pacific, and Rest of the World. Approximately 23% and 77% of primary interviews have been conducted from the demand and supply side, respectively. Primary data has been collected through questionnaires, emails, and telephonic interviews. In the canvassing of primaries, we have strived to cover various departments within organizations, such as sales, operations, and administration, to provide a holistic viewpoint in our report.

After interacting with industry experts, we have also conducted brief sessions with highly experienced independent consultants to reinforce the findings from our primaries. This, along with the in-house subject-matter experts’ opinions, has led us to the outcomes as described in the remainder of this report.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The bottom-up approach has been used to estimate and validate the size of the low-carbon propulsion market. In this approach, vehicle sales statistics for each vehicle type (light- and heavy-duty) have been considered at the country level.

To determine the market size, in terms of volume, a model mapping of the low carbon propulsion vehicles has been carried out for each country and vehicle type (light- and heavy-duty). The number of vehicle models varied from country to country. After analyzing the models, the segments have further been classified into fuel type, vehicle type, mode type, and region. Then the type of vehicle sold is identified, which gives us the volume of each segment type. The country-level data is summed up to arrive at the region-level data in terms of volume. The summation of the country-level market size gives the regional market size, and further summation of the regional market size provides the global low-carbon propulsion market size.

The top-down approach has been used to estimate and validate the size of the low-carbon propulsion market by application in terms of volume. In this approach, key applications of rail are identified at the country level. The penetration of each identified application (freight and passenger) is multiplied with the volume of rail vehicles at the regional level to derive the total volume. All regional-level data are summed up to obtain the global market by application type.

Data Triangulation

All percentage shares, splits, and breakdowns have been determined using secondary sources and verified by primary sources. All parameters that are said to affect the markets covered in this research study have been accounted for, viewed in extensive detail, and analyzed to obtain the final quantitative and qualitative data. This data has been consolidated, enhanced with detailed inputs and analysis from MarketsandMarkets, and presented in the report. The following figure is an illustrative representation of the overall market size estimation process employed for this study.

Report Objectives

- To segment and forecast the low-carbon propulsion market size, in terms of volume (thousand units)

- To define, describe, and forecast the market based on fuel type, mode, vehicle type, electric vehicle, rail application, and region.

- To segment and forecast the market size based on fuel type (CNG, LNG, ethanol, hydrogen, and electric)

- To segment and forecast the market size based on mode (rail and road)

- To segment and forecast the market size based on vehicle type (heavy duty and light duty)

- To segment and forecast the market size based on electric vehicle (electric passenger cars, electric two-wheeler, electric bus, and electric off-highway)

- To segment and forecast the market size based on rail application (passenger and freight)

- To forecast the market size with respect to key regions, namely, North America, Europe, Asia Pacific, and the Rest of the World

- To provide detailed information regarding the major factors influencing the low-carbon propulsion market growth (drivers, challenges, restraints, and opportunities)

- To strategically analyze markets with respect to individual growth trends, future prospects, and contribution to the total market

Available Customizations

With the given market data, MarketsandMarkets offers customizations in line with the company’s specific needs.

- Low-Carbon Propulsion Market, By Fuel type at country level (For countries covered in the report)

- Low-Carbon Propulsion Market, By Rail Application at country level (For countries covered in the report)

Company Information

- Profiling of Additional Market Players (Up to 5)

Growth opportunities and latent adjacency in Low-Carbon Propulsion Market