Liquid Crystal Polymers Market by Application(Electrical & Electronics, Consumer Goods, Automotive, Lighting, Medical), and Region (APAC, North America, Europe, South America, Middle East & Africa) - Global Forecast to 2026

Updated on : September 02, 2025

Liquid Crystal Polymers Market

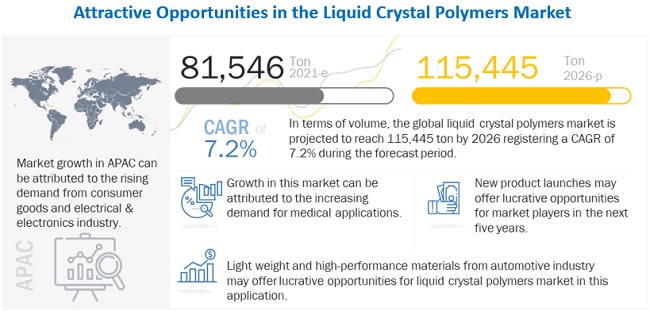

The global liquid crystal polymers market was valued at USD 1.2 billion in 2021 and is projected to reach USD 1.8 billion by 2026, growing at 8.2% cagr from 2021 to 2026. Liquid crystalline polymers (LCP) an exceptional combination of high temperature resistance, high stiffness, and high flow makes them particularly well suited to the growing trend of miniaturization in the electrical & electronics industry and the increasing acceptance in microinjection molding. Applications such as connectors with high pin density have been driving the notable growth in liquid crystal polymers consumption. Several factors directly or indirectly affect the liquid crystal polymers market such as high temperature resistance and excellent mechanical strength, chemical resistance, and high dimensional stability, growth of the electrical & electronics industry, increasing engineering resin substitutes for ultra-thin components, increasing demand for lightweight, high-performance materials from the automotive industry, growth potential in consumer goods and medical application, high manufacturing costs.

To know about the assumptions considered for the study, Request for Free Sample Report

Impact of COVID-19 on Liquid Crystal Polymers Market

COVID-19 has led the industrial and manufacturing sectors into an unknown operating environment globally. Government restrictions on the number of people that can gather at one place have severely impacted the sector. For example, the component manufacturing sector is heavily hit by the impact of the virus. The production and factory operations in the automotive, electronics, and aerospace are on halt. Most of the industries are dependent on China for raw material supply. Hence, supply chain disruptions also have a major impact on industrial output. The global economy is contracting due to the pandemic. The pandemic has also reduced global demand for oil by about 29 million barrels a day from about 100 million barrels per day in 2019, as per the World Economic Forum. OPEC and other producers agreed to reduce production by 9.7 million barrels a day. The impact of COVID-19 on all industries will continue till the pandemic lasts. Factors such as loss in investments, liquidity shortage, labour shortage, supply chain constraints, and the overall global economic uncertainty are all severely affecting the industrial sector.

Liquid crystal polymers manufacturers have also experienced a negative impact of COVID-19 on sales volume in the first and second quarters of 2020. Major players in the market are mitigating the risk through a strong focus on local management and on market opportunities.

Liquid Crystal Polymers Market Dynamics

Driver: Emergence of new generation technologies

Next generation technologies such as 5G and 3D printing are key drivers in growing demand for liquid crystal polymers. The demand for liquid crystal polymers is growing at a very rapid pace with a multitude of applications, ranging from electrical & electronics and automotive to consumer goods, sports, leisure, and medical devices. Furthermore, increasing application of liquid crystal polymers films in flexible solar cells, owing to its exceptional heat resistance and low water absorbency are also underpinning gains for the market. Moreover, fast-growing technologies, such as 5G communication and 3D printing hold high stakes of growth for the liquid crystal polymers market. In the emerging 5G communication, liquid crystal polymers are being viewed on a large scale as a novel material with an optimistic outlook for mobile phone antennas.

Restraints: High manufacturing costs of liquid crystal polymers

High production cost of liquid crystal polymers is one of the major restraints that affect growth of the Liquid crystal polymers market. The cost of Liquid crystal polymers is higher than traditional high-performance polymers. This makes Liquid crystal polymers less competitive in with their inexpensive rivals such PPA, ABS, and nylon. Generic nylon and ABS prices are approximately one-fifth of the price of Liquid crystal polymers, which gives cost advantage in electrical & electronics of the applications where high performance polymers require while filling walls down to 0.25 mm at most. The manufacturing of Liquid crystal polymers requires considerably high investments, as the process is complex than that of other group of plastics, such as PE, PP, and others. To manufacture Liquid crystal polymers, products with high temperature function and high level of technical expertise are required. Therefore, both the manufacturing process and the final liquid crystal polymer products are expensive. The high price of Liquid crystal polymers limits their use to high-end application areas, thus restricting the market growth. The high cost of production also prevents the entry of mid- and small-scale market players, which in turn reduces the market size of Liquid crystal polymers.

Opportunities: Emerging market for thermoplastic polymers

Thermoplastics are polymers that have the property to become liquid when heated and return to the solid state when cooled. The cycle of melting and freezing can be recurrent. This would enable the plastic to be reshaped by heating it. Liquid crystal polymers are the major thermoplastics used for extreme temperature applications in various end-use industries, such as transportation, electrical & electronics, medical, and others. They are useful for a wide range of applications, including consumer goods, machine parts, medical equipment, and packaging and storage materials. Owing to their properties, thermoplastic polymers are gaining importance as an alternative for traditional materials, such as steel, aluminium, and wood. In comparison to other traditional materials, thermoplastics have higher chemical and impact resistance, higher strength-to-weight ratios, and greater design flexibility. Therefore, the thermoplastics market is expected to grow rapidly during the forecast period. Thermoplastics are expected to have many emerging applications in the near future, which will further enhance the growth prospects for Liquid crystal polymers, globally.

“Electrical & electronics to hold the largest share in liquid crystal polymers market between 2021 and 2026.”

Electrical & electronics accounted for the largest size of the liquid crystal polymers market, in terms of value in 2020. The market size was estimated to be USD 1,152 million in 2020 and is projected to register a CAGR of 8.2% between 2021 and 2026, in terms of value. Medical application of liquid crystal polymers is projected to witness the highest CAGR of 9.6% between 2021 and 2026. The demand for liquid crystal polymers in medical application is increasing on account of the replacing traditional metals and plastic devices and equipment with high performance materials devices and equipment and the effect of COVID-19 on this segment is less comparatively.

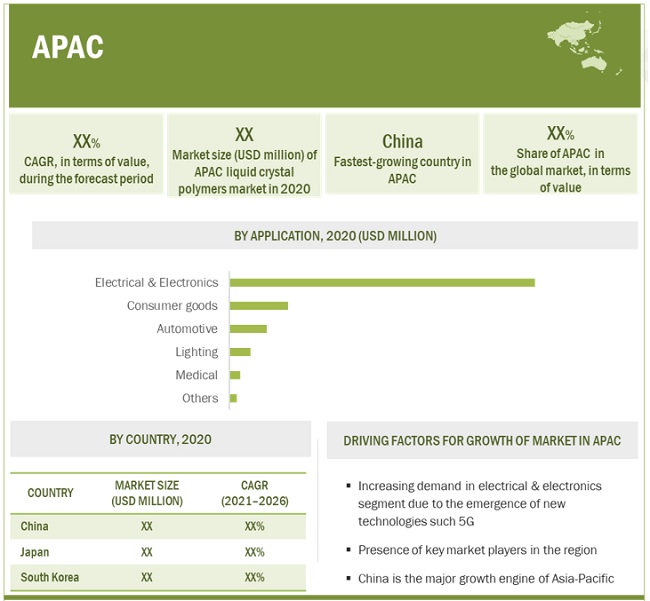

“APAC to hold the largest market share in liquid crystal polymers market, in terms of value and volume during the forecast period.”

The largest market for liquid crystal polymers is APAC at a CAGR of 8.6% during the same period. The growth of the liquid crystal polymers market in APAC is due to rapid expansion of the electrical & electronics industry. The increasing domestic demand, coupled with affordable manufacturing facilities, is expected to continue driving the demand for liquid crystal polymers from various applications in APAC. The increasing population and demands, accompanied with initiatives for new technologies and products are projected to make this region an ideal destination for the liquid crystal polymers market to grow. The growing electrical & electronics, automobile, and consumer goods industries are triggering the demand of liquid crystal polymers in the region.

To know about the assumptions considered for the study, download the pdf brochure

Liquid Crystal Polymers Market Players

The key players in the market are focusing on strategies, such as new product launches, partnerships & agreements, acquisitions, and expansions, to expand their businesses globally. The major players in the Liquid crystal polymers market are and Polyplastics Co., Ltd (Japan), Celanese Corporation (U.S.), Solvay S.A. (Belgium), Toray Industries, Inc. (Japan), and Sumitomo Chemicals Co. Ltd. (Japan).

Liquid Crystal Polymers Market Report Scope

|

Report Metric |

Details |

|

Years considered for the study |

2021-2026 |

|

Base Year |

2020 |

|

Forecast period |

2021-2026 |

|

Units considered |

Value (USD million) |

|

Segments |

Application, Region |

|

Regions |

APAC, North America, Europe, South America, Middle East & Africa |

|

Companies |

The key players in this market are Polyplastics Co., Ltd (Japan), Celanese Corporation (U.S.), Solvay S.A. (Belgium), Toray Industries, Inc. (Japan), and Sumitomo Chemicals Co. Ltd. (Japan). |

This report categorizes the global liquid crystal polymers market based on application and region.

On the basis of application, the liquid crystal polymers market has been segmented as follows:

- Electrical & electronics

- Consumer goods

- Automotive

- Lighting

- Medical

- Others

On the basis of region, the liquid crystal polymers market has been segmented as follows:

- APAC

- North America

- Europe

- South America

- Middle East & Africa

Recent Developments in Liquid Crystal Polymers Market

|

Company |

Date |

Deal Type |

Description |

|

Polyplastics Co. Ltd. |

October 2020 |

Acquisition |

Polyplastics Co. Ltd completes acquisition of total shares of Polyplastics Co. Ltd from Celanese. |

|

Polyplastics Co. Ltd. |

February 2019 |

Merger |

Polyplastics Co. Ltd completed a merger with Wintech Polymer Ltd. to integrate LCP business with operations by Polyplastics Co. Ltd. |

Frequently Asked Questions (FAQ):

What are the factors influencing the growth of liquid crystal polymers market?

Emergence of new generation technologies

What are different type of applications in liquid crystal polymers market?

It is classified as electrical & electronics, automotive, consumer goods, medical, lighting

What is the biggest Restraint for liquid crystal polymers market?

High manufacturing costs of liquid crystal polymers .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 26)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.2.1 LIQUID CRYSTAL POLYMERS MARKET: INCLUSIONS AND EXCLUSIONS

1.2.2 LIQUID CRYSTAL POLYMERS MARKET DEFINITION AND INCLUSIONS, BY APPLICATION

1.3 MARKET SCOPE

1.3.1 LIQUID CRYSTAL POLYMERS MARKET SEGMENTATION

1.3.2 REGIONS COVERED

1.3.3 YEARS CONSIDERED FOR THE STUDY

1.4 CURRENCY

1.5 UNITS CONSIDERED

1.6 STAKEHOLDERS

1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 31)

2.1 RESEARCH DATA

FIGURE 1 LIQUID CRYSTAL POLYMERS MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.2 PRIMARY DATA

2.1.2.1 Primary interviews –demand and supply sides

2.1.2.2 Key industry insights

2.1.2.3 Breakdown of primary interviews

2.2 MARKET SIZE ESTIMATION

2.2.1 BOTTOM-UP APPROACH

FIGURE 2 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 1 (SUPPLY-SIDE)

FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 2 –BOTTOM-UP (DEMAND-SIDE)

2.2.2 TOP-DOWN APPROACH

FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 3 –TOP-DOWN

2.3 DATA TRIANGULATION

FIGURE 5 LIQUID CRYSTAL POLYMERS MARKET: DATA TRIANGULATION

2.4 GROWTH RATE ASSUMPTIONS/GROWTH FORECAST

2.4.1 SUPPLY-SIDE

FIGURE 6 MARKET CAGR PROJECTIONS FROM SUPPLY-SIDE

2.4.2 DEMAND-SIDE

FIGURE 7 MARKET GROWTH PROJECTIONS FROM DEMAND-SIDE DRIVERS AND OPPORTUNITIES

2.5 FACTOR ANALYSIS

2.6 ASSUMPTIONS

2.7 LIMITATIONS

2.8 RISK ASSESSMENT

TABLE 1 LIQUID CRYSTAL POLYMERS MARKET: RISK ASSESSMENT

3 EXECUTIVE SUMMARY (Page No. - 42)

FIGURE 8 MEDICAL APPLICATION TO BE THE FASTEST-GROWING SEGMENT OF THE LIQUID CRYSTAL POLYMERS MARKET DURING THE FORECAST PERIOD

FIGURE 9 ELECTRICAL & ELECTRONICS APPLICATION TO HOLD THE LARGEST SHARE IN THE LIQUID CRYSTAL POLYMERS MARKET DURING THE FORECAST PERIOD

FIGURE 10 APAC ACCOUNTED FOR THE LARGEST SHARE OF THE LIQUID CRYSTAL POLYMERS MARKET IN 2020

4 PREMIUM INSIGHTS (Page No. - 46)

4.1 ATTRACTIVE OPPORTUNITIES IN THE LIQUID CRYSTAL POLYMERS MARKET

FIGURE 11 GROWING ELECTRICAL & ELECTRONICS APPLICATION SEGMENT TO DRIVE THE MARKET DURING THE FORECAST PERIOD

4.2 LIQUID CRYSTAL POLYMERS MARKET SIZE, BY REGION

FIGURE 12 APAC TO BE THE LARGEST MARKET FOR LIQUID CRYSTAL POLYMERS DURING THE FORECAST PERIOD

4.3 APAC: LIQUID CRYSTAL POLYMERS MARKET, BY APPLICATION AND COUNTRY, 2020

FIGURE 13 CHINA AND ELECTRICAL & ELECTRONICS SEGMENT ACCOUNTED FOR THE LARGEST SHARES

4.4 LIQUID CRYSTAL POLYMERS MARKET SIZE, BY APPLICATION

FIGURE 14 ELECTRICAL & ELECTRONICS TO BE THE LARGEST APPLICATION OF LIQUID CRYSTAL POLYMERS DURING THE FORECAST PERIOD

4.5 LIQUID CRYSTAL POLYMERS MARKET SIZE, APPLICATION VS. REGION

FIGURE 15 ELECTRICAL & ELECTRONICS TO BE THE DOMINANT APPLICATION OF LIQUID CRYSTAL POLYMERS ACROSS REGIONS

4.6 LIQUID CRYSTAL POLYMERS MARKET, BY KEY REGIONS/COUNTRIES

FIGURE 16 SOUTH AMERICA TO REGISTER THE HIGHEST CAGR BETWEEN 2021 AND 2026

5 MARKET OVERVIEW AND INDUSTRY TRENDS (Page No. - 49)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 17 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN THE LIQUID CRYSTAL POLYMERS MARKET

5.2.1 DRIVERS

5.2.1.1 Next-generation technologies such as 5G and 3D printing

5.2.1.2 Replacement of conventional materials by liquid crystal polymers

5.2.1.3 Increasing engineering resin substitutes for ultra-thin components

5.2.1.4 Rising demand for lightweight and high-performance materials from the automotive industry

TABLE 2 AUTOMOBILE PRODUCTION IN KEY COUNTRIES, 2015-2019, (UNITS)

5.2.2 RESTRAINTS

5.2.2.1 High manufacturing costs of liquid crystal polymers

5.2.3 OPPORTUNITIES

5.2.3.1 Emerging market for thermoplastic polymers

5.2.3.2 Growth potential in consumer goods and medical applications

5.2.4 CHALLENGES

5.2.4.1 Challenges in processing liquid crystal polymers

5.3 PORTER’S FIVE FORCES ANALYSIS

FIGURE 18 PORTER’S FIVE FORCES ANALYSIS OF LIQUID CRYSTAL POLYMERS MARKET

TABLE 3 LIQUID CRYSTAL POLYMERS MARKET: PORTER’S FIVE FORCES ANALYSIS

5.3.1 THREAT OF NEW ENTRANTS

5.3.2 THREAT OF SUBSTITUTES

5.3.3 BARGAINING POWER OF SUPPLIERS

5.3.4 BARGAINING POWER OF BUYERS

5.3.5 INTENSITY OF COMPETITIVE RIVALRY

5.4 SUPPLY CHAIN ANALYSIS

FIGURE 19 LIQUID CRYSTAL POLYMERS MARKET: SUPPLY CHAIN

5.4.1 RAW MATERIALS

5.4.2 LIQUID CRYSTAL POLYMER MANUFACTURERS AND DISTRIBUTORS

5.4.3 END-USE INDUSTRIES

5.5 TECHNOLOGY ANALYSIS

5.5.1 5G CONNECTIVITY AND LIQUID CRYSTAL POLYMERS

5.5.2 ELECTRIC VEHICLES AND LIQUID CRYSTAL POLYMERS

5.5.3 ADVANCEMENTS IN ELECTRONIC DESIGNS AND LIQUID CRYSTAL POLYMERS

5.6 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS’ BUSINESS

5.6.1 REVENUE SHIFTS & REVENUE POCKETS FOR LIQUID CRYSTAL POLYMER MANUFACTURERS

FIGURE 20 REVENUE SHIFT FOR LIQUID CRYSTAL POLYMERS MARKET

5.7 ECOSYSTEM/ MARKET MAP

FIGURE 21 LIQUID CRYSTAL POLYMERS MARKET: ECOSYSTEM

TABLE 4 LIQUID CRYSTAL POLYMERS MARKET: ECOSYSTEM

5.8 CASE STUDIES

5.8.1 AIR FROHLICH USING TEFLON FILM FOR HEAT EXCHANGERS

5.8.2 PTFE COATINGS FOR AEROSPACE COMPONENTS

5.9 LIQUID CRYSTAL POLYMERS MARKET: REALISTIC, PESSIMISTIC, OPTIMISTIC, AND NON-COVID-19 SCENARIOS

FIGURE 22 MARKET SIZE UNDER THE REALISTIC, PESSIMISTIC, OPTIMISTIC, AND NON-COVID-19 SCENARIOS

TABLE 5 LIQUID CRYSTAL POLYMERS MARKET FORECAST SCENARIO, 2019-2026 (USD MILLION)

5.9.1 NON-COVID-19 SCENARIO

5.9.2 OPTIMISTIC SCENARIO

5.9.3 PESSIMISTIC SCENARIO

5.9.4 REALISTIC SCENARIO

5.10 AVERAGE SELLING PRICE

FIGURE 23 AVERAGE SELLING PRICE OF LIQUID CRYSTAL POLYMERS, BY REGION (USD/KG)

TABLE 6 AVERAGE SELLING PRICE OF LIQUID CRYSTAL POLYMERS, BY REGION (USD/KG)

5.11 TARIFF AND REGULATORY LANDSCAPE

5.11.1 REGULATIONS IN MEDICAL DEVICES

TABLE 7 REGULATORY ANALYSIS OF MEDICAL DEVICES

5.12 TRADE ANALYSIS

5.12.1 IMPORT SCENARIO OF LIQUID CRYSTAL POLYMERS

FIGURE 24 IMPORT OF LIQUID CRYSTAL POLYMERS, BY KEY COUNTRIES, 2016-2020

TABLE 8 IMPORT OF LIQUID CRYSTAL POLYMERS, BY REGION, 2016-2020 (USD MILLION)

5.12.2 EXPORT SCENARIO OF LIQUID CRYSTAL POLYMERS

FIGURE 25 EXPORT OF LIQUID CRYSTAL POLYMERS, BY KEY COUNTRIES, 2016-2020

TABLE 9 EXPORT OF LIQUID CRYSTAL POLYMERS, BY REGION, 2016-2020 (USD MILLION)

5.13 COVID-19 IMPACT

5.13.1 INTRODUCTION

5.13.2 COVID-19 HEALTH ASSESSMENT

FIGURE 26 COUNTRY-WISE SPREAD OF COVID-19

5.13.3 COVID-19 ECONOMIC ASSESSMENT

FIGURE 27 REVISED GDP FORECASTS FOR SELECT G20 COUNTRIES IN 2021

5.13.3.1 COVID-19 Impact on the Economy—Scenario Assessment

FIGURE 28 FACTORS IMPACTING THE GLOBAL ECONOMY

FIGURE 29 SCENARIOS OF COVID-19 IMPACT

5.14 IMPACT OF COVID-19: CUSTOMER ANALYSIS

5.15 PATENT ANALYSIS

5.15.1 APPROACH

5.15.2 DOCUMENT TYPE

FIGURE 30 PATENTS REGISTERED FOR LIQUID CRYSTAL POLYMERS, 2010–2020

FIGURE 31 PATENT PUBLICATION TRENDS FOR LIQUID CRYSTAL POLYMERS, 2010–2020

5.15.3 LEGAL STATUS OF PATENTS

5.15.4 JURISDICTION ANALYSIS

FIGURE 32 MAXIMUM PATENTS FILED BY COMPANIES IN CHINA

5.15.5 TOP APPLICANTS

FIGURE 33 SICPA HOLDING SA REGISTERED THE MAXIMUM NUMBER OF PATENTS BETWEEN 2010 AND 2020

TABLE 10 TOP 10 PATENT OWNERS IN THE US, 2010–2020

6 LIQUID CRYSTAL POLYMERS MARKET, BY APPLICATION (Page No. - 81)

6.1 INTRODUCTION

FIGURE 34 ELECTRICAL & ELECTRONICS IS THE LEADING APPLICATION SEGMENT IN THE LIQUID CRYSTAL POLYMERS MARKET

TABLE 11 LIQUID CRYSTAL POLYMERS MARKET SIZE, BY APPLICATION, 2016–2019 (TON)

TABLE 12 LIQUID CRYSTAL POLYMER MARKET SIZE, BY APPLICATION, 2020–2026 (TON)

TABLE 13 LIQUID CRYSTAL POLYMERS MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 14 LIQUID CRYSTAL POLYMER MARKET SIZE, BY APPLICATION, 2020–2026 (USD MILLION)

6.2 ELECTRICAL & ELECTRONICS

6.2.1 APAC TO BE THE KEY DRIVER FOR THE MARKET IN THE ELECTRICAL & ELECTRONICS APPLICATION

FIGURE 35 APAC TO BE THE LARGEST LIQUID CRYSTAL POLYMERS MARKET FOR ELECTRICAL & ELECTRONICS APPLICATION DURING THE FORECAST PERIOD

TABLE 15 LIQUID CRYSTAL POLYMERS MARKET SIZE IN ELECTRICAL & ELECTRONICS, BY REGION, 2016–2019 (TON)

TABLE 16 LIQUID CRYSTAL POLYMER MARKET SIZE IN ELECTRICAL & ELECTRONICS, BY REGION, 2020–2026 (TON)

TABLE 17 LIQUID CRYSTAL POLYMERS MARKET SIZE IN ELECTRICAL & ELECTRONICS, BY REGION, 2016–2019 (USD MILLION)

TABLE 18 LIQUID CRYSTAL POLYMER MARKET SIZE IN ELECTRICAL & ELECTRONICS, BY REGION, 2020–2026 (USD MILLION)

6.2.2 CONSUMER ELECTRICAL & ELECTRONICS

6.2.3 INDUSTRIAL ELECTRICAL & ELECTRONICS

6.3 CONSUMER GOODS

6.3.1 HIGH-PERFORMANCE LIQUID CRYSTAL POLYMERS ARE USED IN MANY CONSUMER GOODS

FIGURE 36 APAC TO BE THE LARGEST LIQUID CRYSTAL POLYMERS MARKET IN CONSUMER GOODS APPLICATION

TABLE 19 LIQUID CRYSTAL POLYMERS MARKET SIZE IN CONSUMER GOODS, BY REGION, 2016–2019 (TON)

TABLE 20 LIQUID CRYSTAL POLYMER MARKET SIZE IN CONSUMER GOODS, BY REGION, 2020–2026 (TON)

TABLE 21 LIQUID CRYSTAL POLYMERS MARKET SIZE IN CONSUMER GOODS, BY REGION, 2016–2019 (USD MILLION)

TABLE 22 LIQUID CRYSTAL POLYMERS MARKET SIZE IN CONSUMER GOODS, BY REGION, 2020–2026 (USD MILLION)

6.4 AUTOMOTIVE

6.4.1 RISING DEMAND FOR LIGHT-WEIGHT VEHICLES IN THE AUTOMOTIVE INDUSTRY DRIVING THE MARKET IN THIS SEGMENT

FIGURE 37 APAC TO BE THE LARGEST LIQUID CRYSTAL POLYMERS MARKET IN AUTOMOTIVE APPLICATION DURING THE FORECAST PERIOD

TABLE 23 LIQUID CRYSTAL POLYMERS MARKET SIZE IN AUTOMOTIVE, BY REGION, 2016–2019 (TON)

TABLE 24 LIQUID CRYSTAL POLYMER MARKET SIZE IN AUTOMOTIVE, BY REGION, 2020–2026 (TON)

TABLE 25 LIQUID CRYSTAL POLYMERS MARKET SIZE IN AUTOMOTIVE, BY REGION, 2016–2019 (USD MILLION)

TABLE 26 LIQUID CRYSTAL POLYMER MARKET SIZE IN AUTOMOTIVE, BY REGION, 2020–2026 (USD MILLION)

6.5 LIGHTING

6.5.1 INCREASED USE OF LED LAMPS BOOSTING THE LIGHTING APPLICATIONS OF LIQUID CRYSTAL POLYMERS

FIGURE 38 MIDDLE EAST & AFRICA TO BE THE EMERGING LIQUID CRYSTAL POLYMERS MARKET IN LIGHTING APPLICATION DURING THE FORECAST PERIOD

TABLE 27 LIQUID CRYSTAL POLYMERS MARKET SIZE IN LIGHTING, BY REGION, 2016–2019 (TON)

TABLE 28 LIQUID CRYSTAL POLYMER MARKET SIZE IN LIGHTING, BY REGION, 2020–2026 (TON)

TABLE 29 LIQUID CRYSTAL POLYMERS MARKET SIZE IN LIGHTING, BY REGION, 2016–2019 (USD MILLION)

TABLE 30 LIQUID CRYSTAL POLYMER MARKET SIZE IN LIGHTING, BY REGION, 2020–2026 (USD MILLION)

6.6 MEDICAL

6.6.1 APAC AND NORTH AMERICA TO OFFER BIG GROWTH POTENTIAL FOR THE LIQUID CRYSTAL POLYMERS MARKET

FIGURE 39 MIDDLE EAST & AFRICA TO REGISTER THE HIGHEST CAGR IN THE MEDICAL APPLICATION DURING THE FORECAST PERIOD

TABLE 31 LIQUID CRYSTAL POLYMERS MARKET SIZE IN MEDICAL, BY REGION, 2016–2019 (TON)

TABLE 32 LIQUID CRYSTAL POLYMER MARKET SIZE IN MEDICAL, BY REGION, 2020–2026 (TON)

TABLE 33 LIQUID CRYSTAL POLYMERS MARKET SIZE IN MEDICAL, BY REGION, 2016–2019 (USD MILLION)

TABLE 34 LIQUID CRYSTAL POLYMER MARKET SIZE IN MEDICAL, BY REGION, 2020–2026 (USD MILLION)

6.7 OTHERS

FIGURE 40 APAC TO ACCOUNT FOR THE LARGEST MARKET SHARE IN OTHER APPLICATIONS

TABLE 35 LIQUID CRYSTAL POLYMERS MARKET SIZE IN OTHER APPLICATIONS, BY REGION, 2016–2019 (TON)

TABLE 36 LIQUID CRYSTAL POLYMER MARKET SIZE IN OTHER APPLICATIONS, BY REGION, 2020–2026 (TON)

TABLE 37 LIQUID CRYSTAL POLYMERS MARKET SIZE IN OTHER APPLICATIONS, BY REGION, 2016–2019 (USD MILLION)

TABLE 38 LIQUID CRYSTAL POLYMER MARKET SIZE IN OTHER APPLICATIONS, BY REGION, 2020–2026 (USD MILLION)

7 LIQUID CRYSTAL POLYMERS MARKET, BY REGION (Page No. - 98)

7.1 INTRODUCTION

FIGURE 41 APAC TO LEAD THE LIQUID CRYSTAL POLYMERS MARKET BETWEEN 2021 AND 2026

TABLE 39 LIQUID CRYSTAL POLYMERS MARKET SIZE, BY REGION, 2016–2019 (TON)

TABLE 40 LIQUID CRYSTAL POLYMER MARKET SIZE, BY REGION, 2020–2026 (TON)

TABLE 41 LIQUID CRYSTAL POLYMERS MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 42 LIQUID CRYSTAL POLYMER MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

7.2 APAC

FIGURE 42 APAC: LIQUID CRYSTAL POLYMERS MARKET SNAPSHOT

7.2.1 APAC: LIQUID CRYSTAL POLYMER MARKET, BY APPLICATION

TABLE 43 APAC: MARKET SIZE, BY APPLICATION, 2016–2019 (TON)

TABLE 44 APAC: MARKET SIZE, BY APPLICATION, 2020–2026 (TON)

TABLE 45 APAC: MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 46 APAC: MARKET SIZE, BY APPLICATION, 2020–2026 (USD MILLION)

7.2.2 APAC LIQUID CRYSTAL POLYMERS MARKET, BY COUNTRY

TABLE 47 APAC: LIQUID CRYSTAL POLYMER MARKET SIZE, BY COUNTRY, 2016–2019 (TON)

TABLE 48 APAC: MARKET SIZE, BY COUNTRY, 2020–2026 (TON)

TABLE 49 APAC: MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 50 APAC: MARKET SIZE, BY COUNTRY, 2020–2026 (USD MILLION)

7.2.2.1 China

7.2.2.1.1 China holds the largest share of the APAC liquid crystal polymers market

TABLE 51 CHINA: LIQUID CRYSTAL POLYMERS MARKET SIZE, BY APPLICATION, 2016–2019 (TON)

TABLE 52 CHINA: MARKET SIZE, BY APPLICATION, 2020–2026 (TON)

TABLE 53 CHINA: MARKET SIZE, BY APPLICATION, 2016–2019 (USD THOUSAND)

TABLE 54 CHINA: MARKET SIZE, BY APPLICATION, 2020–2026 (USD THOUSAND)

7.2.2.2 Japan

7.2.2.2.1 Presence of key manufacturers to drive the market

TABLE 55 JAPAN: LIQUID CRYSTAL POLYMERS MARKET SIZE, BY APPLICATION, 2016–2019 (TON)

TABLE 56 JAPAN: LIQUID CRYSTAL POLYMER MARKET SIZE, BY APPLICATION, 2020–2026 (TON)

TABLE 57 JAPAN: MARKET SIZE, BY APPLICATION, 2016–2019 (USD THOUSAND)

TABLE 58 JAPAN: MARKET SIZE, BY APPLICATION, 2020–2026 (USD THOUSAND)

7.2.2.3 South Korea

7.2.2.3.1 Growing demand for automobiles in the country to drive the market

TABLE 59 SOUTH KOREA: LIQUID CRYSTAL POLYMERS MARKET SIZE, BY APPLICATION, 2016–2019 (TON)

TABLE 60 SOUTH KOREA: MARKET SIZE, BY APPLICATION, 2020–2026 (TON)

TABLE 61 SOUTH KOREA: MARKET SIZE, BY APPLICATION, 2016–2019 (USD THOUSAND)

TABLE 62 SOUTH KOREA: MARKET SIZE, BY APPLICATION, 2020–2026 (USD THOUSAND)

7.2.2.4 Rest of APAC

TABLE 63 REST OF APAC: LIQUID CRYSTAL POLYMERS MARKET SIZE, BY APPLICATION, 2016–2019 (TON)

TABLE 64 REST OF APAC: MARKET SIZE, BY APPLICATION, 2020–2026 (TON)

TABLE 65 REST OF APAC: MARKET SIZE, BY APPLICATION, 2016–2019 (USD THOUSAND)

TABLE 66 REST OF APAC: LIQUID CRYSTAL POLYMER MARKET SIZE, BY APPLICATION, 2020–2026 (USD THOUSAND)

7.3 NORTH AMERICA

FIGURE 43 NORTH AMERICA: LIQUID CRYSTAL POLYMERS MARKET SNAPSHOT

7.3.1 NORTH AMERICA: LIQUID CRYSTAL POLYMER MARKET, BY APPLICATION

TABLE 67 NORTH AMERICA: MARKET SIZE, BY APPLICATION, 2016–2019 (TON)

TABLE 68 NORTH AMERICA: MARKET SIZE, BY APPLICATION, 2020–2026 (TON)

TABLE 69 NORTH AMERICA: MARKET SIZE, APPLICATION, 2016–2019 (USD MILLION)

TABLE 70 NORTH AMERICA: MARKET SIZE, BY APPLICATION, 2020–2026 (USD MILLION)

7.3.2 NORTH AMERICA: MARKET, BY COUNTRY

TABLE 71 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2016–2019 (TON)

TABLE 72 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2020–2026 (TON)

TABLE 73 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 74 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2020–2026 (USD MILLION)

7.3.2.1 US

7.3.2.1.1 Large automotive industry driving the liquid crystal polymers market in the US

TABLE 75 US: LIQUID CRYSTAL POLYMERS MARKET SIZE, BY APPLICATION, 2016–2019 (TON)

TABLE 76 US: MARKET SIZE, BY APPLICATION, 2020–2026 (TON)

TABLE 77 US: MARKET SIZE, BY APPLICATION, 2016–2019 (USD THOUSAND)

TABLE 78 US: MARKET SIZE, BY APPLICATION, 2020–2026 (USD THOUSAND)

7.3.2.2 Rest of North America

TABLE 79 REST OF NORTH AMERICA: LIQUID CRYSTAL POLYMERS MARKET SIZE, BY APPLICATION, 2016–2019 (TON)

TABLE 80 REST OF NORTH AMERICA: LIQUID CRYSTAL POLYMER MARKET SIZE, BY APPLICATION, 2020–2026 (TON)

TABLE 81 REST OF NORTH AMERICA: MARKET SIZE, APPLICATION, 2016–2019 (USD THOUSAND)

TABLE 82 REST OF NORTH AMERICA: MARKET SIZE, BY APPLICATION, 2020–2026 (USD THOUSAND)

7.4 EUROPE

FIGURE 44 EUROPE: LIQUID CRYSTAL POLYMERS MARKET SNAPSHOT

7.4.1 EUROPE: LIQUID CRYSTAL POLYMER MARKET, BY APPLICATION

TABLE 83 EUROPE: MARKET SIZE, BY APPLICATION, 2016–2019 (TON)

TABLE 84 EUROPE: MARKET SIZE, BY APPLICATION, 2020–2026 (TON)

TABLE 85 EUROPE: MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 86 EUROPE: MARKET SIZE, BY APPLICATION, 2020–2026 (USD MILLION)

7.4.2 EUROPE: MARKET, BY COUNTRY

TABLE 87 EUROPE: MARKET SIZE, BY COUNTRY, 2016–2019 (TON)

TABLE 88 EUROPE: MARKET SIZE, BY COUNTRY, 2020–2026 (TON)

TABLE 89 EUROPE: MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 90 EUROPE: MARKET SIZE, BY COUNTRY, 2020–2026 (USD MILLION)

7.4.2.1 Germany

7.4.2.1.1 Electrical & electronics segment driving the country’s liquid crystal polymers market

TABLE 91 GERMANY: LIQUID CRYSTAL POLYMERS MARKET SIZE, BY APPLICATION, 2016–2019 (TON)

TABLE 92 GERMANY: LIQUID CRYSTAL POLYMER MARKET SIZE, BY APPLICATION, 2020–2026 (TON)

TABLE 93 GERMANY: MARKET SIZE, BY APPLICATION, 2016–2019 (USD THOUSAND)

TABLE 94 GERMANY: MARKET SIZE, BY APPLICATION, 2020–2026 (USD THOUSAND)

7.4.2.2 UK

7.4.2.2.1 Rise in demand from the electrical & electronics industry to drive the market

TABLE 95 UK: LIQUID CRYSTAL POLYMERS MARKET SIZE, BY APPLICATION, 2016–2019 (TON)

TABLE 96 UK: LIQUID CRYSTAL POLYMER MARKET SIZE, BY APPLICATION, 2020–2026 (TON)

TABLE 97 UK: MARKET SIZE, BY APPLICATION, 2016–2019 (USD THOUSAND)

TABLE 98 UK: MARKET SIZE, BY APPLICATION, 2020–2026 (USD THOUSAND)

7.4.2.3 France

7.4.2.3.1 Profi TABLE trade with other countries in Europe driving the liquid crystal polymers market in France

TABLE 99 FRANCE: LIQUID CRYSTAL POLYMERS MARKET SIZE, BY APPLICATION, 2016–2019 (TON)

TABLE 100 FRANCE: LIQUID CRYSTAL POLYMER MARKET SIZE, BY APPLICATION, 2020–2026 (TON)

TABLE 101 FRANCE: MARKET SIZE, BY APPLICATION, 2016–2019 (USD THOUSAND)

TABLE 102 FRANCE: MARKET SIZE, BY APPLICATION, 2020–2026 (USD THOUSAND)

7.4.2.4 Rest of Europe

TABLE 103 REST OF EUROPE: LIQUID CRYSTAL POLYMERS MARKET SIZE, BY APPLICATION, 2016–2019 (TON)

TABLE 104 REST OF EUROPE: LIQUID CRYSTAL POLYMER MARKET SIZE, BY APPLICATION, 2020–2026 (TON)

TABLE 105 REST OF EUROPE: MARKET SIZE, BY APPLICATION, 2016–2019 (USD THOUSAND)

TABLE 106 REST OF EUROPE: MARKET SIZE, BY APPLICATION, 2020–2026 (USD THOUSAND)

7.5 SOUTH AMERICA

7.5.1 INCREASE IN DEMAND FROM VARIOUS APPLICATIONS TO DRIVE THE LIQUID CRYSTAL POLYMERS MARKET IN SOUTH AMERICA

7.5.2 SOUTH AMERICA: LIQUID CRYSTAL POLYMERS MARKET, BY APPLICATION

TABLE 107 SOUTH AMERICA: LIQUID CRYSTAL POLYMER MARKET SIZE, BY APPLICATION, 2016–2019 (TON)

TABLE 108 SOUTH AMERICA: MARKET SIZE, BY APPLICATION, 2020–2026 (TON)

TABLE 109 SOUTH AMERICA: MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 110 SOUTH AMERICA: MARKET SIZE, BY APPLICATION, 2020–2026 (USD MILLION)

7.6 MIDDLE EAST & AFRICA

7.6.1 HIGH CONSUMER DEMAND IN THE REGION TO DRIVE THE LIQUID CRYSTAL POLYMERS MARKET

7.6.2 MIDDLE EAST & AFRICA: LIQUID CRYSTAL POLYMERS MARKET, BY APPLICATION

TABLE 111 MIDDLE EAST & AFRICA: LIQUID CRYSTAL POLYMER MARKET SIZE, BY APPLICATION, 2016–2019 (TON)

TABLE 112 MIDDLE EAST & AFRICA: MARKET SIZE, BY APPLICATION, 2020–2026 (TON)

TABLE 113 MIDDLE EAST & AFRICA: MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 114 MIDDLE EAST & AFRICA: MARKET SIZE, BY APPLICATION, 2020–2026 (USD MILLION)

8 COMPETITIVE LANDSCAPE (Page No. - 136)

8.1 INTRODUCTION

8.2 STRATEGIES ADOPTED BY KEY PLAYERS

8.2.1 OVERVIEW OF STRATEGIES ADOPTED BY KEY LIQUID CRYSTAL POLYMER MANUFACTURERS

8.3 MARKET SHARE ANALYSIS

8.3.1 RANKING OF KEY MARKET PLAYERS, 2020

FIGURE 45 RANKING OF TOP FIVE PLAYERS IN LIQUID CRYSTAL POLYMERS MARKET, 2020

8.3.2 MARKET SHARE OF KEY PLAYERS

TABLE 115 LIQUID CRYSTAL POLYMERS MARKET: DEGREE OF COMPETITION

FIGURE 46 POLYPLASTICS CO. LTD. IS THE LEADING PLAYER IN THE LIQUID CRYSTAL POLYMERS MARKET

8.3.2.1 Polyplastics Co. Ltd.

8.3.2.2 Celanese Corporation

8.3.2.3 Sumitomo Chemicals Co. Ltd.

8.3.2.4 Solvay S.A.

8.3.2.5 Toray Industries, Inc.

8.4 REVENUE ANALYSIS OF TOP FIVE PLAYERS

FIGURE 47 REVENUE ANALYSIS OF KEY COMPANIES IN PAST FIVE YEARS

8.5 COMPANY PRODUCT FOOTPRINT ANALYSIS

FIGURE 48 LIQUID CRYSTAL POLYMERS MARKET: COMPANY FOOTPRINT

TABLLE 116 LIQUID CRYSTAL POLYMER MARKET: APPLICATION FOOTPRINT

TABLLE 117 LIQUID CRYSTAL POLYMERS MARKET: COMPANY REGION FOOTPRINT

8.6 COMPANY EVALUATION QUADRANT

8.6.1 STARS

8.6.2 EMERGING LEADERS

FIGURE 49 COMPANY EVALUATION QUADRANT FOR LIQUID CRYSTAL POLYMERS MARKET

8.7 START-UP/SMES EVALUATION QUADRANT

8.7.1 PROGRESSIVE COMPANIES

8.7.2 RESPONSIVE COMPANIES

8.7.3 STARTING BLOCKS

FIGURE 50 START-UP/SMES EVALUATION QUADRANT FOR LIQUID CRYSTAL POLYMERS MARKET

8.8 COMPETITIVE SITUATION AND TRENDS

8.8.1 NEW PRODUCT LAUNCHES

TABLE 118 LIQUID CRYSTAL POLYMERS MARKET: NEW PRODUCT LAUNCHES (2018- 2021)

8.8.2 DEALS

TABLE 119 LIQUID CRYSTAL POLYMER MARKET: DEALS (2018- 2021)

8.8.3 OTHER DEVELOPMENTS

TABLE 120 LIQUID CRYSTAL POLYMERS MARKET: EXPANSIONS, INVESTMENTS, AND INNOVATIONS (2018-2021)

9 COMPANY PROFILES (Page No. - 150)

(Business Overview, Products Offered, Recent Developments, MnM View Right to win, Strategic choices made, Weaknesses and competitive threats) *

9.1 MAJOR PLAYERS

9.1.1 POLYPLASTICS CO. LTD (DIACEL CORPORATION)

FIGURE 51 POLYPLASTICS CO. LTD: COMPANY SNAPSHOT

9.1.2 SOLVAY S.A.

FIGURE 52 SOLVAY S.A.: COMPANY SNAPSHOT

9.1.3 CELANESE CORPORATION

FIGURE 53 CELANESE CORPORATION: COMPANY SNAPSHOT

9.1.4 SUMITOMO CHEMICAL CO. LTD

FIGURE 54 SUMITOMO CHEMICAL CO. LTD: COMPANY SNAPSHOT

9.1.5 TORAY INDUSTRIES, INC.

FIGURE 55 TORAY INDUSTRIES, INC.: COMPANY SNAPSHOT

9.1.6 KURARAY CO. LTD

FIGURE 56 KURARAY CO. LTD: COMPANY SNAPSHOT

9.1.7 SHANGHAI PRET COMPOSITES CO. LTD.

9.1.8 UENO FINE CHEMICALS INDUSTRY LTD.

9.1.9 RTP COMPANY

9.1.10 ZEUS INDUSTRIAL PRODUCTS, INC.

9.1.11 CHANG CHUN PLASTICS CO. LTD

9.2 OTHER KEY MARKET PLAYERS

9.2.1 ASIA INTERNATIONAL ENTERPRISES (HK) LTD.

TABLE 121 ASIA INTERNATIONAL ENTERPRISES (HK) LTD.: COMPANY OVERVIEW

9.2.2 LOTTE FINE CHEMICALS CO. LTD

TABLLE 122 LOTTE FINE CHEMICALS CO. LTD: COMPANY OVERVIEW

9.2.3 MITSUI CHEMICALS

TABLLE 123 MITSUI CHEMICALS: COMPANY OVERVIEW

9.2.4 AVIENT CORPORATION

TABLLE 124 AVIENT CORPORATION: COMPANY OVERVIEW

9.2.5 SHENZHEN WOTE ADVANCED MATERIALS CO. LTD

TABLLE 125 SHENZHEN WOTE ADVANCED MATERIALS CO. LTD: COMPANY OVERVIEW

9.2.6 SABIC INNOVATIVE PLASTICS LTD.

TABLLE 126 SABIC INNOVATIVE PLASTICS LTD.: COMPANY OVERVIEW

9.2.7 POLYCLEAN TECHNOLOGIES, INC.

TABLLE 127 POLYCLEAN TECHNOLOGIES, INC.: COMPANY OVERVIEW

9.2.8 EVONIK INDUSTRIES

TABLLE 128 EVONIK INDUSTRIES: COMPANY OVERVIEW

9.2.9 ASHLAND INC.

TABLLE 129 ASHLAND INC.: COMPANY OVERVIEW

9.2.10 BARLOG PLASTICS GMBH

TABLLE 130 BARLOG PLASTICS GMBH: COMPANY OVERVIEW

9.2.11 ABTEC INC.

TABLLE 131 ABTEC INC.: COMPANY OVERVIEW

9.2.12 VICTREX

TABLLE 132 VICTREX: COMPANY OVERVIEW

9.2.13 NANJING QINGYAN POLYMER NEW MATERIALS LTD.

TABLLE 133 NANJING QINGYAN POLYMER NEW MATERIALS LTD.: COMPANY OVERVIEW

9.2.14 DAIKIN INDUSTRIES LTD.

TABLLE 134 DAIKIN INDUSTRIES LTD. COMPANY OVERVIEW

*Details on Business Overview, Products Offered, Recent Developments, MnM View, Right to win, Strategic choices made, Weaknesses and competitive threats might not be captured in case of unlisted companies.

10 ADJACENT AND RELATED MARKETS (Page No. - 178)

10.1 INTRODUCTION

10.2 LIMITATIONS

10.3 HIGH-PERFORMANCE POLYMERS MARKET

10.3.1 MARKET DEFINITION

10.3.2 MARKET OVERVIEW

10.4 HIGH-PERFORMANCE POLYMERS MARKET, BY END-USE INDUSTRY

TABLE 135 HIGH-PERFORMANCE POLYMERS MARKET SIZE, BY END-USE INDUSTRY, 2014–2026 (KILOTON)

TABLLE 136 HIGH-PERFORMANCE POLYMERS MARKET SIZE, BY END-USE INDUSTRY, 2014–2026 (USD BILLION)

10.5 HIGH-PERFORMANCE POLYMERS MARKET, BY REGION

TABLLE 137 HIGH-PERFORMANCE POLYMERS MARKET SIZE, BY REGION, 2014–2026 (KILOTON)

TABLLE 138 HIGH-PERFORMANCE POLYMERS MARKET SIZE, BY REGION, 2014–2026 (USD BILLION)

10.5.1 APAC: HIGH-PERFORMANCE POLYMERS MARKET SIZE, BY COUNTRY, 2014-2026 (KILOTON)

TABLE 139 APAC: HIGH-PERFORMANCE POLYMERS MARKET SIZE, BY COUNTRY, 2014–2026 (KILOTON)

TABLE 140 APAC: HIGH-PERFORMANCE POLYMERS MARKET SIZE, BY COUNTRY, 2014–2026 (USD MILLION)

TABLE 141 APAC: HIGH-PERFORMANCE POLYMERS MARKET SIZE, BY END-USE INDUSTRY, 2014–2026 (KILOTON)

TABLE 142 APAC: HIGH-PERFORMANCE POLYMERS MARKET SIZE, BY END-USE INDUSTRY, 2014–2026 (USD MILLION)

10.5.2 NORTH AMERICA: HIGH-PERFORMANCE POLYMERS MARKET SIZE, BY COUNTRY, 2014-2026, (KILOTON)

TABLE 143 NORTH AMERICA: HIGH-PERFORMANCE POLYMERS MARKET SIZE, BY COUNTRY, 2014–2026 (KILOTON)

TABLE 144 NORTH AMERICA: HIGH-PERFORMANCE POLYMERS MARKET SIZE, BY COUNTRY, 2014–2026 (USD MILLION)

TABLE 145 NORTH AMERICA: HIGH PERFORMANCE POLYMERS MARKET SIZE, BY END-USE INDUSTRY, 2014–2026 (KILOTON)

TABLE 146 NORTH AMERICA: HIGH-PERFORMANCE POLYMERS MARKET SIZE, BY END-USE INDUSTRY, 2014–2026 (USD MILLION)

10.5.3 EUROPE: HIGH-PERFORMANCE POLYMERS MARKET SIZE, BY COUNTRY, 2014-2026 (KILOTON)

TABLE 147 EUROPE: HIGH-PERFORMANCE POLYMERS MARKET SIZE, BY COUNTRY, 2014–2026 (USD MILLION)

TABLE 148 EUROPE: HIGH-PERFORMANCE POLYMERS MARKET SIZE, BY COUNTRY, 2014–2026 (KILOTON)

TABLE 149 EUROPE: HIGH-PERFORMANCE POLYMERS MARKET SIZE, BY END-USE INDUSTRY, 2014–2026 (USD MILLION)

TABLE 150 EUROPE: HIGH-PERFORMANCE POLYMERS MARKET SIZE, BY END-USE INDUSTRY, 2014–2026 (KILOTON)

10.5.4 MIDDLE EAST & AFRICA: HIGH-PERFORMANCE POLYMERS MARKET SIZE, BY COUNTRY, 2014-2026 (KILOTON)

TABLE 151 MIDDLE EAST & AFRICA: HIGH-PERFORMANCE POLYMERS MARKET SIZE, BY COUNTRY, 2014–2026 (KILOTON)

TABLE 152 MIDDLE EAST & AFRICA: HIGH-PERFORMANCE POLYMERS MARKET SIZE, BY COUNTRY, 2014–2026 (USD MILLION)

TABLE 153 MIDDLE EAST & AFRICA: HIGH-PERFORMANCE POLYMERS MARKET SIZE, BY END-USE INDUSTRY, 2014–2026 (KILOTON)

TABLE 154 MIDDLE EAST & AFRICA: HIGH-PERFORMANCE POLYMERS MARKET SIZE, BY END-USE INDUSTRY, 2014–2026 (USD MILLION)

10.5.5 SOUTH AMERICA: HIGH-PERFORMANCE POLYMERS MARKET SIZE, BY COUNTRY, 2014-2026 (KILOTON)

TABLE 155 SOUTH AMERICA: HIGH-PERFORMANCE POLYMERS MARKET SIZE, BY COUNTRY, 2014–2026 (KILOTON)

TABLE 156 SOUTH AMERICA: HIGH-PERFORMANCE POLYMERS MARKET SIZE, BY COUNTRY, 2014–2026 (USD MILLION)

TABLE 157 SOUTH AMERICA: HIGH-PERFORMANCE POLYMERS MARKET SIZE, BY END-USE INDUSTRY, 2014–2026 (KILOTON)

TABLE 158 SOUTH AMERICA: HIGH-PERFORMANCE POLYMERS MARKET SIZE, BY END-USE INDUSTRY, 2014–2026 (USD MILLION)

11 APPENDIX (Page No. - 190)

11.1 DISCUSSION GUIDE

11.2 KNOWLEDGE STORE: MARKETSANDMARKETS SUBSCRIPTION PORTAL

11.3 AVAILABLE CUSTOMIZATIONS

11.4 RELATED REPORTS

11.5 AUTHOR DETAILS

The study involved four major activities to estimate the market size of liquid crystal polymers market. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, the market breakdown and data triangulation procedures were used to estimate the market size of the segments and subsegments.

Liquid Crystal Polymers Market Secondary Research

Secondary sources used in this study included annual reports, press releases, and investor presentations of companies; white papers; certified publications; articles from recognized authors; and gold standard & silver standard websites such as Factiva, ICIS, Bloomberg, and others. Findings of this study were verified through primary research by conducting extensive interviews with key officials such as CEOs, VPs, directors, and other executives.

Liquid Crystal Polymers Market Primary Research

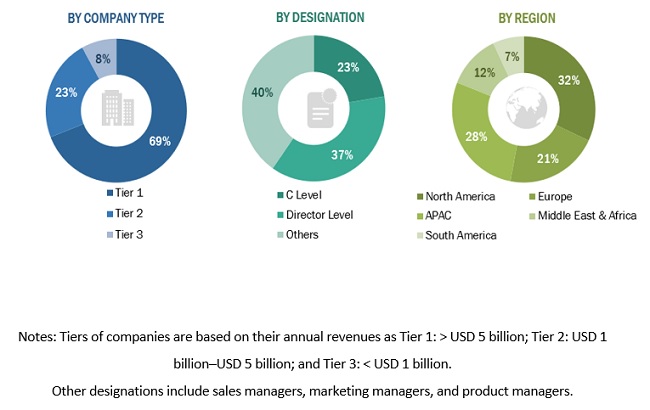

The liquid crystal polymers market comprises several stakeholders such as raw material suppliers, end-product manufacturers, end-users, and regulatory organizations in the supply chain. The demand side of this market is characterized by the development in end-use application such as packaging, consumer goods, construction and automotive. The supply side is characterized by advancements in technology and diverse application industries. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. The breakdown of profiles of the primary interviewees is illustrated in the figure below:

To know about the assumptions considered for the study, download the pdf brochure

Liquid Crystal Polymers Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the liquid crystal polymers market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

The key players in the industry have been identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, were determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

Liquid Crystal Polymers Market Report Data Triangulation

After arriving at the overall market size—using the market size estimation processes as explained above—the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Liquid Crystal Polymers Market Report Objectives

- To define, describe, and forecast the market for liquid crystal polymers in terms of volume and value

- To provide detailed information regarding the important factors (drivers, restraints, opportunities, and challenges) influencing the growth of the market

- To estimate and forecast the market by application and region

- To forecast the market based on key regions: North America, Europe, and Asia Pacific (APAC)

- To strategically analyze the market with respect to individual growth trends, prospects, and their contribution to the overall market

- To analyze opportunities for stakeholders in the market and provide a competitive landscape for the market leaders

- To strategically profile the key players and comprehensively analyze their core competencies*

Liquid Crystal Polymers Market Report Available Customizations

Along with the given market data, MarketsandMarkets offers customizations according to the company’s specific needs. The following customization options are available for the report:

Liquid Crystal Polymers Market Regional Analysis

- Further breakdown of a region with respect to a particular country or additional application

Liquid Crystal Polymers Market Company Information

- Detailed analysis and profiles of additional market players (up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Liquid Crystal Polymers Market