Low Dielectric Materials Market by Type, Material Type (Fluoropolymers, Modified Polyphenylene Ether, Polyimide, Cyclic Olefin Copolymer, Cyanate Ester, Liquid Crystal Polymer),Application and region - Global Forecast to 2027

Updated on : September 02, 2025

Low Dielectric Materials Market

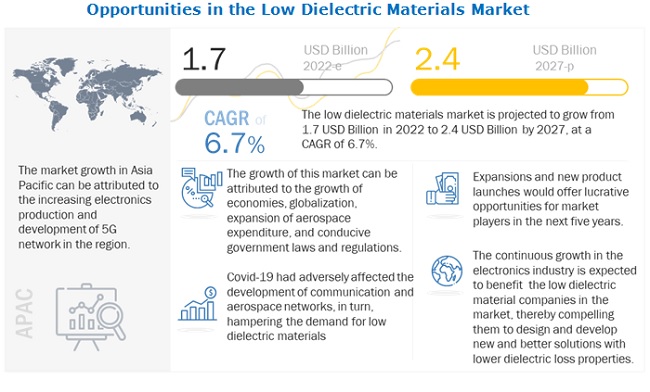

The global low dielectric materials market was valued at USD 1.7 billion in 2022 and is projected to reach USD 2.4 billion by 2027, growing at 6.7% cagr from 2022 to 2027. High-performance resins with low dielectric constant and low dielectric loss are required in high-speed communication devices. With the development of the 5G network, resins with low dielectric constants are gaining impetus in such applications. Resins showing low dielectric loss are potentially attractive materials for designing of antenna interlayers, cables, and communication devices. Due to these properties, the demand for various low dielectric constant resins and ceramics are expected to gain traction in the low dielectric materials market.

To know about the assumptions considered for the study, Request for Free Sample Report

The Thermoset resins segment is expected to grow at the highest rate during the forecast period.

The demand for thermosets is increasing considerably, mainly due to its ability to easily form a stable shape with excellent resistance to deformation during heat application. These resins also offer considerable strength, toughness, and electrical resistance, making them especially suitable for the manufacturing of printed wiring boards. On the other hand, with the trend of sustainability gaining traction across the globe, easily recyclable thermoplastics are also being utilized on a large scale.

Fluoropolymers are the most prominent low dielectric material type used in the manufacturing of PCBs and electronic components

Demand for wire & cables, PCBs, microelectronics, and antenna have expanded exponentially in past few years with rising demand for electronics such as mobiles, TVs, and other appliances. Fluoropolymers prove to be an excellent material for manufacturing these components due to their low cost, excellent resistance to heat and low dielectric constants. PTFE is predominantly employed to manufacture PCBs while other fluoropolymers such ETFE and PFA are employed mainly to manufacture wire & cables and microelectronics. Due to these reasons, the fluoropolymer segment holds the largest share in the global market.

PCBs accounts for the largest share of the overall market

By Applications, low dielectric materials market is segmented into PCBs, antenna, microelectronics, wire & cable, radome, and others. PCBs currently is the largest end use application of the low dielectric materials. Low dielectric materials are used as the interconnecting insulator material between the terminal of PCB, allowing low loss of signal and reduced crosstalk. With the demand for PCBs gaining traction across the globe, the demand for low dielectric materials is expected to increase significantly during the forecast period.

To know about the assumptions considered for the study, download the pdf brochure

Asia Pacific is expected to account for the largest global market share during the forecast period.

Based on the region, the low dielectric materials market has been segmented into Europe, North America, APAC, and RoW. APAC is the most significant and fastest-growing low dielectric materials market due to the increasing demand for these materials in manufacturing electronic components such as PCBs and microelectronics. Furthermore, the increase in air traffic have expanded the demand for antenna and radomes in the region, further driving the demand for low dielectric materials to newer heights.

Low Dielectric Materials Market Players

The major vendors in the low dielectric materials market are Huntsman Corporation (U.S.), Arxada (Switzerland), SABIC (Saudi Arabia), Asahi Kasei (Japan), Topas Advanced Polymers (Germany), Zeon Corp. (Japan), Chemours Company LLC (U.S.), DIC Corporation (Japan), Arkema (France), Mitsubishi Corporation (Japan), Showa Denko (Japan), Dow (U.S.), Shin Etsu Chemical Co. Ltd. (Japan), Olin Corporation (U.S.), Celanese Corporation (U.S.), and Solvay (Belgium).

The major companies are undertaking product development and expansions to improve their shares in this market. Companies including Arkema (France), Shin-Etsu Chemical Co., Ltd. (Japan), Arxada (France) and Huntsman Corporation (U.S.) have adopted various strategies, such as collaborations, acquisitions, and product development between 2019 and 2022. The companies also expanded their plant capacities to increase their production capacities and meet the growing demand for low dielectric materials in various applications.

Low Dielectric Materials Market Report Scope

|

Report Metric |

Details |

|

Market Size Value in 2022 |

USD 1.7 billion |

|

Revenue Forecast in 2027 |

USD 2.4 billion |

|

CAGR |

6.7% |

|

Market size available for years |

2019–2027 |

|

Base year considered |

2021 |

|

Forecast period |

2022–2027 |

|

Forecast units |

Value (USD Billion and Million) and Volume (Kilotons) |

|

Segments covered |

Type, Material Type, Application, and Region |

|

Geographies covered |

North America, Asia Pacific, Europe, Rest of the World |

|

Companies covered |

Huntsman Corporation (U.S.), Solvay (Belgium), SABIC (Saudi Arabia), Showa Denko (Japan), Chemours Company LLC (U.S.), Asahi Kasei (Japan), and others. Total 26 major players covered. |

This research report categorizes the low dielectric materials market based on type, material type, application, and region.

Based on type, the low dielectric materials market has been segmented as follows:

- Thermoplastic

- Thermoset

- Ceramics

Based on material type, the low dielectric materials market has been segmented as follows:

-

Fluoropolymer

- PTFE

- Others (ETFE, FEP, and PFA)

- Modified Polyphenylene Ether

- Polyimide

- Cyclic Olefin Copolymer

- Cyanate Ester

- Liquid Crystal Polymer

- Others (Ceramics, BCB, SiLK, SLK, PEEK)

Based on application, the low dielectric materials market has been segmented as follows:

- PCBs

- Antenna

- Microelectronics

- Wire & Cable

- Radome

- Others (CMOS Devices, and Sensor Devices)

Based on the region, the low dielectric materials market has been segmented as follows:

- APAC

- Europe

- North America

- Rest of World

Recent Developments

- In November 2021, Arkema designed 3 new ultra-low loss materials for RF applications, PRO14729, PRO14730 and PRO14731. These new materials were developed to cater the increasing demand for very low dielectric constant and low dissipation factor materials in advanced electronic applications.

- In February 2021, Zeon Corporation launched a new form of cyclic olefin copolymer with stereoregular characteristics with unprecedented heat, chemical and bending resistances. The new product is expected to cater the demands from local electronic component manufacturers in Asia Pacific.

- In September 2021, Topas Advanced Polymers announced a collaboration with Borealis, a leading manufacturer of polyolefin solutions, for the development of a new class of engineered materials for capacitor film applications. These new products are expected to close the gap between standard polymers and high-end plastics. The products will be developed using the know-how of the two companies on cyclic olefin copolymer and PP capacitor offerings.

Frequently Asked Questions (FAQ):

What are the upcoming hot bets for the low dielectric materials market?

Rising airplane traffic is expected to increase the demand for components such as antennas and radome. This shall be one hot bet wherein low dielectric material suppliers could target with their offerings.

How are the market dynamics changing for different types of low dielectric materials?

Fluropolymers are expected to slowly be replaced with advanced polymers such as polyimide, cyanate ester and liquid crystal polymers considering better electric handling and heat resistance properties.

How are the market dynamics changing for different applications of low dielectric materials?

Increase in demand for 5G enabled mobiles is expected to create additional demand for PCBs, thus driving the market for low dielectric materials in this application.

Who are the major manufacturers of low dielectric materials?

Solvay, Huntsman Corporation, SABIC, Arkema and Chemours Company LLC are few of the major manufacturers of these materials

How are the market dynamics changing for different regions of low dielectric materials?

Asia Pacific being a hub for electronics manufacturing, is projected to further grow at fastest rate with governments of China and India focusing on development of 5G network to the far corners of their countries. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 34)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION

TABLE 1 PROPERTY COMPARISON OF LOW DIELECTRIC MATERIALS

1.3 STUDY SCOPE

FIGURE 1 LOW DIELECTRIC MATERIALS MARKET SEGMENTATION

1.3.1 REGIONAL SCOPE

1.3.2 YEARS CONSIDERED

1.4 CURRENCY

1.5 UNIT CONSIDERED

1.6 STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 38)

2.1 RESEARCH DATA

FIGURE 2 LOW DIELECTRIC MATERIALS MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Key data from primary sources

2.1.2.2 Key market insights

2.1.2.3 Breakdown of primary interviews

2.2 MARKET SIZE ESTIMATION

2.2.1 BOTTOM-UP APPROACH

FIGURE 3 LOW DIELECTRIC MATERIALS MARKET: BOTTOM-UP APPROACH

2.2.2 TOP-DOWN APPROACH

FIGURE 4 LOW DIELECTRIC MATERIALS MARKET: TOP-DOWN APPROACH

2.2.3 MARKET SIZE ESTIMATION APPROACH

2.2.3.1 Approach 1 (Based on application area, by region)

2.2.3.2 Approach 2 (Based on demand-side consumption)

2.3 DATA TRIANGULATION

FIGURE 5 LOW DIELECTRIC MATERIALS MARKET: DATA TRIANGULATION

2.4 RESEARCH ASSUMPTIONS & LIMITATIONS

2.4.1 ASSUMPTIONS

2.4.2 LIMITATIONS

2.5 INCLUSIONS/EXCLUSIONS

3 EXECUTIVE SUMMARY (Page No. - 47)

FIGURE 6 PCBS TO LEAD MARKET DURING FORECAST PERIOD

FIGURE 7 ASIA PACIFIC DOMINATED MARKET IN 2021

4 PREMIUM INSIGHTS (Page No. - 50)

4.1 ASIA PACIFIC TO WITNESS HIGH DEMAND FOR LOW DIELECTRIC MATERIALS

FIGURE 8 EMERGING ECONOMIES OFFER ATTRACTIVE OPPORTUNITIES IN LOW DIELECTRIC MATERIALS MARKET

4.2 LOW DIELECTRIC MATERIALS MARKET, BY TYPE

FIGURE 9 THERMOPLASTIC TO LEAD MARKET FOR LOW DIELECTRIC MATERIALS THROUGH 2027

4.3 LOW DIELECTRIC MATERIALS MARKET, BY MATERIAL TYPE

FIGURE 10 CYANATE ESTER TO GROW AT FASTEST RATE IN LOW DIELECTRIC MATERIALS MARKET DURING FORECAST PERIOD

4.4 LOW DIELECTRIC MATERIALS MARKET, BY APPLICATION

FIGURE 11 PCBS TO BE LARGEST APPLICATION OF LOW DIELECTRIC MATERIALS DURING FORECAST PERIOD

4.5 ASIA PACIFIC LOW DIELECTRIC MATERIALS MARKET, BY APPLICATION AND BY COUNTRY, 2021

FIGURE 12 PCBS SEGMENT AND CHINA ACCOUNTED FOR LARGEST SHARES

4.6 LOW DIELECTRIC MATERIALS MARKET, BY KEY COUNTRIES

FIGURE 13 MARKET IN INDIA TO GROW AT HIGHEST CAGR BETWEEN 2022 AND 2027

5 MARKET OVERVIEW (Page No. - 53)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 14 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN LOW DIELECTRIC MATERIALS MARKET

5.2.1 DRIVERS

5.2.1.1 Development of 5G communication

5.2.1.2 Increase in delivery of airplanes and automobile production

5.2.1.3 Increasing use of engineering resin substitutes for ultra-thin components

5.2.1.4 Use of low-dielectric-constant materials for high-speed communication networks

5.2.2 RESTRAINTS

5.2.2.1 High processing and manufacturing costs

5.2.3 OPPORTUNITIES

5.2.3.1 Growing use of PCB in telecommunications industry

5.2.3.2 Growing use of eco-friendly m-PPE resin

5.2.3.3 Shift from epoxy and bismaleimide resins to novel low dielectric materials

5.2.4 CHALLENGES

5.2.4.1 Challenges in processing low dielectric resin

5.2.4.2 Intense price competition from Chinese manufacturers

5.3 PORTER’S FIVE FORCES ANALYSIS

FIGURE 15 LOW DIELECTRIC MATERIALS MARKET: PORTER’S FIVE FORCES ANALYSIS

5.3.1 THREAT OF NEW ENTRANTS

5.3.2 BARGAINING POWER OF SUPPLIERS

5.3.3 THREAT OF SUBSTITUTES

5.3.4 BARGAINING POWER OF BUYERS

5.3.5 INTENSITY OF COMPETITIVE RIVALRY

5.4 TECHNOLOGY ANALYSIS

5.4.1 5G CONNECTIVITY AND LOW DIELECTRIC MATERIALS

5.4.2 ADVANCEMENTS IN ELECTRONIC DESIGN AND LOW DIELECTRIC MATERIALS

5.4.3 SELF-DRIVING VEHICLES AND LOW DIELECTRIC MATERIALS

5.5 MACROECONOMIC INDICATORS

5.5.1 GLOBAL GDP TRENDS AND FORECAST FOR MAJOR ECONOMIES

TABLE 2 PROJECTED REAL GDP GROWTH (ANNUAL PERCENTAGE CHANGE) OF KEY COUNTRIES, 2019–2025

5.5.2 AUTOMOBILE PRODUCTION TRENDS

TABLE 3 AUTOMOBILE PRODUCTION IN KEY COUNTRIES, 2019–2021

5.5.3 SMARTPHONE NETWORK TRENDS

TABLE 4 NETWORK TECHNOLOGY MIX, 2021 VS. 2025

5.5.4 EXPORTS STATISTICS OF ELECTRONICS INDUSTRY, 2019

TABLE 5 CHANGE IN ELECTRONIC CIRCUIT EXPORTS, 2019 VS. 2020

5.6 IMPACT OF COVID-19: SUPPLIER ANALYSIS

5.6.1 TEIJIN LIMITED

FIGURE 16 TEIJIN LIMITED: IMPACT OF COVID-19 ON NET SALES

5.6.2 U.S. SILICA

FIGURE 17 U.S. SILICA: IMPACT OF COVID-19 ON NET SALES

5.7 IMPACT OF COVID-19: CONSUMER ANALYSIS

5.7.1 UNIMICRON

FIGURE 18 UNIMICRON: REVENUE TREND DURING COVID-19 PANDEMIC

5.7.2 SUZHOU DONGSHAN PRECISION MANUFACTURING CO., LTD.

FIGURE 19 SUZHOU DONGSHAN PRECISION MANUFACTURING CO., LTD.: REVENUE TREND DURING COVID-19 PANDEMIC

6 INDUSTRY TRENDS (Page No. - 66)

6.1 SUPPLY CHAIN

FIGURE 20 SUPPLY CHAIN OF LOW DIELECTRIC MATERIALS MARKET

6.1.1 RAW MATERIAL SUPPLIERS

6.1.2 LOW DIELECTRIC MATERIAL MANUFACTURERS AND DISTRIBUTORS

6.1.3 COMPONENT MANUFACTURERS

6.1.4 END USERS

6.2 TRENDS/DISRUPTIONS IMPACTING CUSTOMER’S BUSINESS

6.2.1 SHIFT FROM 4G TO 5G NETWORK IN NORTH AMERICA AND ASIA PACIFIC

FIGURE 21 SHIFT FROM 4G TO 5G BETWEEN 2021 AND 2025

6.2.2 REVENUE SHIFTS & REVENUE POCKETS FOR LOW DIELECTRIC MATERIAL MANUFACTURERS

FIGURE 22 REVENUE SHIFT IN LOW DIELECTRIC MATERIALS MARKET

6.3 CONNECTED MARKETS: ECOSYSTEM FOR LOW DIELECTRIC MATERIALS MARKET

FIGURE 23 ECOSYSTEM MAP FOR LOW DIELECTRIC MATERIALS MARKET

TABLE 6 LOW DIELECTRIC MATERIALS MARKET: ECOSYSTEM

6.4 CASE STUDY ANALYSIS

6.4.1 PTFE APPLICATION IN AEROSPACE COMPONENTS

6.4.2 KOLON’S COLORLESS POLYIMIDE (CPI) TECHNOLOGY USED BY XIAOMI AND LENOVO

6.4.3 TAPEWORKS DEVELOPS CUSTOM-ENGINEERED SOLUTION FOR ELECTRONIC CIRCUIT BOARD MANUFACTURERS

6.5 AVERAGE SELLING PRICE

FIGURE 24 AVERAGE PRICE OF LOW DIELECTRIC MATERIALS, BY REGION, 2019–2027

FIGURE 25 AVERAGE PRICE OF LOW DIELECTRIC MATERIALS, BY MATERIAL TYPE, 2019–2027

6.6 REGULATORY LANDSCAPE

6.6.1 REGULATIONS ON CATEGORIZATION OF RESINS INTO POLYMER OF LOW CONCERN (PLC)

TABLE 7 OVERVIEW OF POLYMER REGISTRATIONS AND PLC DEFINITION

6.6.2 GUIDE TO US ELECTRICAL AND ELECTRONIC EQUIPMENT COMPLIANCE REQUIREMENTS

TABLE 8 FEDERAL AGENCIES RESPONSIBLE FOR REGULATING ELECTRICAL AND ELECTRONIC PRODUCTS IN US

6.6.3 ASTM STANDARDS AND TEST METHODS FOR ELECTRICAL AND ELECTRONIC EQUIPMENT

TABLE 9 ASTM VOLUNTARY ELECTRICAL AND ELECTRONIC STANDARDS FOR DIELECTRIC MATERIALS

6.7 PATENT ANALYSIS

6.7.1 METHODOLOGY

6.7.2 DOCUMENT TYPE

TABLE 10 GRANTED PATENTS WERE 9% OF TOTAL PATENT COUNT IN LAST 10 YEARS

FIGURE 26 PATENTS REGISTERED FOR LOW DIELECTRIC MATERIALS, 2011–2021

6.7.3 PUBLICATION TRENDS OF PATENTS ON LOW DIELECTRIC MATERIALS, LAST 10 YEARS

FIGURE 27 PUBLICATION TRENDS, LAST 10 YEARS

6.7.4 LEGAL STATUS OF PATENTS

FIGURE 28 LEGAL STATUS OF PATENTS, 2021

6.7.5 JURISDICTION ANALYSIS

FIGURE 29 MAXIMUM PATENTS FILED IN CHINA

6.7.6 TOP APPLICANTS

FIGURE 30 TOP 10 PATENT APPLICANTS

TABLE 11 TOP 10 PATENT OWNERS IN US, 2011–2021

7 LOW DIELECTRIC MATERIALS MARKET, BY TYPE (Page No. - 86)

7.1 INTRODUCTION

FIGURE 31 THERMOSET TO GAIN SIGNIFICANT MARKET SHARE DURING FORECAST PERIOD

TABLE 12 LOW DIELECTRIC MATERIALS MARKET SIZE, BY TYPE, 2019–2021 (KILOTON)

TABLE 13 LOW DIELECTRIC MATERIALS MARKET SIZE, BY TYPE, 2022–2027 (KILOTON)

TABLE 14 LOW DIELECTRIC MATERIALS MARKET SIZE, BY TYPE, 2019–2021 (USD MILLION)

TABLE 15 LOW DIELECTRIC MATERIALS MARKET SIZE, BY TYPE, 2022–2027 (USD MILLION)

7.2 THERMOSET

7.2.1 ADOPTION OF THERMOSET RESINS IN ELECTRONIC COMPONENTS INFLATING MARKET

7.3 THERMOPLASTIC

7.3.1 DEMAND FOR FLEXIBLE PRINTED BOARDS IN 5G-ENABLED SMARTPHONES DRIVING DEMAND FOR THERMOPLASTICS

7.4 CERAMICS

7.4.1 DEMAND FOR CERAMICS IN CAPACITOR APPLICATIONS TO DRIVE THIS SEGMENT

8 LOW DIELECTRIC MATERIALS MARKET, BY MATERIAL TYPE (Page No. - 90)

8.1 INTRODUCTION

FIGURE 32 FLUOROPOLYMERS TO BE LARGEST MATERIAL TYPE IN OVERALL LOW DIELECTRIC MATERIALS MARKET

TABLE 16 LOW DIELECTRIC MATERIALS MARKET SIZE, BY MATERIAL TYPE, 2019–2021 (KILOTON)

TABLE 17 LOW DIELECTRIC MATERIALS MARKET SIZE, BY MATERIAL TYPE, 2022–2027 (KILOTON)

TABLE 18 LOW DIELECTRIC MATERIALS MARKET SIZE, BY MATERIAL TYPE, 2019–2021 (USD MILLION)

TABLE 19 LOW DIELECTRIC MATERIALS MARKET SIZE, BY MATERIAL TYPE, 2022–2027 (USD MILLION)

8.2 FLUOROPOLYMERS

TABLE 20 LOW DIELECTRIC MATERIALS MARKET SIZE, BY FLUOROPOLYMERS, 2019–2021 (KILOTON)

TABLE 21 LOW DIELECTRIC MATERIALS MARKET SIZE, BY FLUOROPOLYMERS, 2022–2027 (KILOTON)

TABLE 22 LOW DIELECTRIC MATERIALS MARKET SIZE, BY FLUOROPOLYMERS, 2019–2021 (USD MILLION)

TABLE 23 LOW DIELECTRIC MATERIALS MARKET SIZE, BY FLUOROPOLYMERS, 2022–2027 (USD MILLION)

8.2.1 POLYTETRAFLUOROETHYLENE (PTFE)

8.2.2 OTHER FLUOROPOLYMERS (ETFE, FEP, AND PFA)

8.3 MODIFIED POLYPHENYLENE ETHER

8.4 POLYIMIDE

8.5 CYANATE ESTER (CE)

8.6 LIQUID CRYSTAL POLYMER (LCP)

8.7 CYCLIC OLEFIN COPOLYMER (COC)

9 LOW DIELECTRIC MATERIALS MARKET, BY APPLICATION (Page No. - 98)

9.1 INTRODUCTION

FIGURE 33 PCBS TO LEAD LOW DIELECTRIC MATERIALS MARKET, BY APPLICATION

TABLE 24 LOW DIELECTRIC MATERIALS MARKET SIZE, BY APPLICATION, 2019–2021 (KILOTON)

TABLE 25 LOW DIELECTRIC MATERIALS MARKET SIZE, BY APPLICATION, 2022–2027 (KILOTON)

TABLE 26 LOW DIELECTRIC MATERIALS MARKET SIZE, BY APPLICATION, 2019–2021 (USD MILLION)

TABLE 27 LOW DIELECTRIC MATERIALS MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

9.2 PRINTED CIRCUIT BOARDS (PCBS)

9.3 ANTENNA

9.4 MICROELECTRONICS

9.5 WIRE & CABLE

9.6 RADOMES

10 LOW DIELECTRIC MATERIALS MARKET, BY REGION (Page No. - 103)

10.1 INTRODUCTION

FIGURE 34 ASIA PACIFIC TO LEAD LOW DIELECTRIC MATERIALS MARKET BETWEEN 2022 AND 2027

TABLE 28 LOW DIELECTRIC MATERIALS MARKET SIZE, BY REGION, 2019–2021 (KILOTON)

TABLE 29 LOW DIELECTRIC MATERIALS MARKET SIZE, BY REGION, 2022–2027 (KILOTON)

TABLE 30 LOW DIELECTRIC MATERIALS MARKET SIZE, BY REGION, 2019–2021 (USD MILLION)

TABLE 31 LOW DIELECTRIC MATERIALS MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

10.2 ASIA PACIFIC

FIGURE 35 ASIA PACIFIC: LOW DIELECTRIC MATERIALS MARKET SNAPSHOT

10.2.1 ASIA PACIFIC: LOW DIELECTRIC MATERIALS MARKET, BY TYPE

TABLE 32 ASIA PACIFIC: LOW DIELECTRIC MATERIALS MARKET SIZE, BY TYPE, 2019–2021 (KILOTON)

TABLE 33 ASIA PACIFIC: LOW DIELECTRIC MATERIALS MARKET SIZE, BY TYPE, 2022–2027 (KILOTON)

TABLE 34 ASIA PACIFIC: LOW DIELECTRIC MATERIALS MARKET SIZE, BY TYPE, 2019–2021 (USD MILLION)

TABLE 35 ASIA PACIFIC: LOW DIELECTRIC MATERIALS MARKET SIZE, BY TYPE, 2022–2027 (USD MILLION)

10.2.2 ASIA PACIFIC: LOW DIELECTRIC MATERIALS MARKET, BY MATERIAL TYPE

TABLE 36 ASIA PACIFIC: LOW DIELECTRIC MATERIALS MARKET SIZE, BY MATERIAL TYPE, 2019–2021 (KILOTON)

TABLE 37 ASIA PACIFIC: LOW DIELECTRIC MATERIALS MARKET SIZE, BY MATERIAL TYPE, 2022–2027 (KILOTON)

TABLE 38 ASIA PACIFIC: LOW DIELECTRIC MATERIALS MARKET SIZE, BY MATERIAL TYPE, BY FLUOROPOLYMERS, 2019–2021 (KILOTON)

TABLE 39 ASIA PACIFIC: LOW DIELECTRIC MATERIALS MARKET SIZE, BY MATERIAL TYPE, BY FLUOROPOLYMERS, 2022–2027 (KILOTON)

TABLE 40 ASIA PACIFIC: LOW DIELECTRIC MATERIALS MARKET SIZE, BY MATERIAL TYPE, 2019–2021 (USD MILLION)

TABLE 41 ASIA PACIFIC: LOW DIELECTRIC MATERIALS MARKET SIZE, BY MATERIAL TYPE, 2022–2027 (USD MILLION)

TABLE 42 ASIA PACIFIC: LOW DIELECTRIC MATERIALS MARKET SIZE, BY MATERIAL TYPE, BY FLUOROPOLYMERS, 2019–2021 (USD MILLION)

TABLE 43 ASIA PACIFIC: LOW DIELECTRIC MATERIALS MARKET SIZE, BY MATERIAL TYPE, BY FLUOROPOLYMERS, 2022–2027 (USD MILLION)

10.2.3 ASIA PACIFIC: LOW DIELECTRIC MATERIALS MARKET, BY APPLICATION

TABLE 44 ASIA PACIFIC: LOW DIELECTRIC MATERIALS MARKET SIZE, BY APPLICATION, 2019–2021 (KILOTON)

TABLE 45 ASIA PACIFIC: LOW DIELECTRIC MATERIALS MARKET SIZE, BY APPLICATION, 2022–2027 (KILOTON)

TABLE 46 ASIA PACIFIC: LOW DIELECTRIC MATERIALS MARKET SIZE, BY APPLICATION, 2019–2021 (USD MILLION)

TABLE 47 ASIA PACIFIC: LOW DIELECTRIC MATERIALS MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

10.2.4 ASIA PACIFIC LOW DIELECTRIC MATERIALS MARKET, BY COUNTRY

TABLE 48 ASIA PACIFIC: LOW DIELECTRIC MATERIALS MARKET SIZE, BY COUNTRY, 2019–2021 (KILOTON)

TABLE 49 ASIA PACIFIC: LOW DIELECTRIC MATERIALS MARKET SIZE, BY COUNTRY, 2022–2027 (KILOTON)

TABLE 50 ASIA PACIFIC: LOW DIELECTRIC MATERIALS MARKET SIZE, BY COUNTRY, 2019–2021 (USD MILLION)

TABLE 51 ASIA PACIFIC: LOW DIELECTRIC MATERIALS MARKET SIZE, BY COUNTRY, 2022–2027 (USD MILLION)

10.2.4.1 China

10.2.4.1.1 Largest Asia Pacific low dielectric materials market

TABLE 52 CHINA: LOW DIELECTRIC MATERIALS MARKET SIZE, BY APPLICATION, 2019–2021 (KILOTON)

TABLE 53 CHINA: LOW DIELECTRIC MATERIALS MARKET SIZE, BY APPLICATION, 2022–2027 (KILOTON)

TABLE 54 CHINA: LOW DIELECTRIC MATERIALS MARKET SIZE, BY APPLICATION, 2019–2021 (USD MILLION)

TABLE 55 CHINA: LOW DIELECTRIC MATERIALS MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

10.2.4.2 Japan

10.2.4.2.1 Presence of key manufacturers to drive market

TABLE 56 JAPAN: LOW DIELECTRIC MATERIALS MARKET SIZE, BY APPLICATION, 2019–2021 (KILOTON)

TABLE 57 JAPAN: LOW DIELECTRIC MATERIALS MARKET SIZE, BY APPLICATION, 2022–2027 (KILOTON)

TABLE 58 JAPAN: LOW DIELECTRIC MATERIALS MARKET SIZE, BY APPLICATION, 2019–2021 (USD MILLION)

TABLE 59 JAPAN: LOW DIELECTRIC MATERIALS MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

10.2.4.3 South Korea

10.2.4.3.1 Growing demand for electronics to drive market

TABLE 60 SOUTH KOREA: LOW DIELECTRIC MATERIALS MARKET SIZE, BY APPLICATION, 2019–2021 (KILOTON)

TABLE 61 SOUTH KOREA: LOW DIELECTRIC MATERIALS MARKET SIZE, BY APPLICATION, 2022–2027 (KILOTON)

TABLE 62 SOUTH KOREA: LOW DIELECTRIC MATERIALS MARKET SIZE, BY APPLICATION, 2019–2021 (USD MILLION)

TABLE 63 SOUTH KOREA: LOW DIELECTRIC MATERIALS MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

10.2.4.4 India

10.2.4.4.1 Development of 5G infrastructure escalating demand for low dielectric materials

TABLE 64 INDIA: LOW DIELECTRIC MATERIALS MARKET SIZE, BY APPLICATION, 2019–2021 (KILOTON)

TABLE 65 INDIA: LOW DIELECTRIC MATERIALS MARKET SIZE, BY APPLICATION, 2022–2027 (KILOTON)

TABLE 66 INDIA: LOW DIELECTRIC MATERIALS MARKET SIZE, BY APPLICATION, 2019–2021 (USD MILLION)

TABLE 67 INDIA: LOW DIELECTRIC MATERIALS MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

10.2.4.5 Taiwan

10.2.4.5.1 Support of government for growth of microelectronics manufacturing industry to favor market growth

TABLE 68 TAIWAN: LOW DIELECTRIC MATERIALS MARKET SIZE, BY APPLICATION, 2019–2021 (KILOTON)

TABLE 69 TAIWAN: LOW DIELECTRIC MATERIALS MARKET SIZE, BY APPLICATION, 2022–2027 (KILOTON)

TABLE 70 TAIWAN: LOW DIELECTRIC MATERIALS MARKET SIZE, BY APPLICATION, 2019–2021 (USD MILLION)

TABLE 71 TAIWAN: LOW DIELECTRIC MATERIALS MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

10.2.4.6 Rest of Asia Pacific

TABLE 72 REST OF ASIA PACIFIC: LOW DIELECTRIC MATERIALS MARKET SIZE, BY APPLICATION, 2019–2021 (KILOTON)

TABLE 73 REST OF ASIA PACIFIC: LOW DIELECTRIC MATERIALS MARKET SIZE, BY APPLICATION, 2022–2027 (KILOTON)

TABLE 74 REST OF ASIA PACIFIC: LOW DIELECTRIC MATERIALS MARKET SIZE, BY APPLICATION, 2019–2021 (USD MILLION)

TABLE 75 REST OF ASIA PACIFIC: LOW DIELECTRIC MATERIALS MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

10.3 NORTH AMERICA

FIGURE 36 NORTH AMERICA: LOW DIELECTRIC MATERIALS MARKET SNAPSHOT

10.3.1 NORTH AMERICA: LOW DIELECTRIC MATERIALS MARKET, BY TYPE

TABLE 76 NORTH AMERICA: LOW DIELECTRIC MATERIALS MARKET SIZE, BY TYPE, 2019–2021 (KILOTON)

TABLE 77 NORTH AMERICA: LOW DIELECTRIC MATERIALS MARKET SIZE, BY TYPE, 2022–2027 (KILOTON)

TABLE 78 NORTH AMERICA: LOW DIELECTRIC MATERIALS MARKET SIZE, BY TYPE, 2019–2021 (USD MILLION)

TABLE 79 NORTH AMERICA: LOW DIELECTRIC MATERIALS MARKET SIZE, BY TYPE, 2022–2027 (USD MILLION)

10.3.2 NORTH AMERICA: LOW DIELECTRIC MATERIALS MARKET, BY MATERIAL TYPE

TABLE 80 NORTH AMERICA: LOW DIELECTRIC MATERIALS MARKET SIZE, BY MATERIAL TYPE, 2019–2021 (KILOTON)

TABLE 81 NORTH AMERICA: LOW DIELECTRIC MATERIALS MARKET SIZE, BY MATERIAL TYPE, 2022–2027 (KILOTON)

TABLE 82 NORTH AMERICA: LOW DIELECTRIC MATERIALS MARKET SIZE, BY MATERIAL TYPE, BY FLUOROPOLYMERS, 2019–2021 (KILOTON)

TABLE 83 NORTH AMERICA: LOW DIELECTRIC MATERIALS MARKET SIZE, BY MATERIAL TYPE, BY FLUOROPOLYMERS, 2022–2027 (KILOTON)

TABLE 84 NORTH AMERICA: LOW DIELECTRIC MATERIALS MARKET SIZE, BY MATERIAL TYPE, 2019–2021 (USD MILLION)

TABLE 85 NORTH AMERICA: LOW DIELECTRIC MATERIALS MARKET SIZE, BY MATERIAL TYPE, 2022–2027 (USD MILLION)

TABLE 86 NORTH AMERICA: LOW DIELECTRIC MATERIALS MARKET SIZE, BY MATERIAL TYPE, BY FLUOROPOLYMERS, 2019–2021 (USD MILLION)

TABLE 87 NORTH AMERICA: LOW DIELECTRIC MATERIALS MARKET SIZE, BY MATERIAL TYPE, BY FLUOROPOLYMERS, 2022–2027 (USD MILLION)

10.3.3 NORTH AMERICA: LOW DIELECTRIC MATERIALS MARKET, BY APPLICATION

TABLE 88 NORTH AMERICA: LOW DIELECTRIC MATERIALS MARKET SIZE, BY APPLICATION, 2019–2021 (KILOTON)

TABLE 89 NORTH AMERICA: LOW DIELECTRIC MATERIALS MARKET SIZE, BY APPLICATION, 2022–2027 (KILOTON)

TABLE 90 NORTH AMERICA: LOW DIELECTRIC MATERIALS MARKET SIZE, BY APPLICATION, 2019–2021 (USD MILLION)

TABLE 91 NORTH AMERICA: LOW DIELECTRIC MATERIALS MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

10.3.4 NORTH AMERICA: LOW DIELECTRIC MATERIALS MARKET, BY COUNTRY

TABLE 92 NORTH AMERICA: LOW DIELECTRIC MATERIALS MARKET SIZE, BY COUNTRY, 2019–2021 (KILOTON)

TABLE 93 NORTH AMERICA: LOW DIELECTRIC MATERIALS MARKET SIZE, BY COUNTRY, 2022–2027 (KILOTON)

TABLE 94 NORTH AMERICA: LOW DIELECTRIC MATERIALS MARKET SIZE, BY COUNTRY, 2019–2021 (USD MILLION)

TABLE 95 NORTH AMERICA: LOW DIELECTRIC MATERIALS MARKET SIZE, BY COUNTRY, 2022–2027 (USD MILLION)

10.3.4.1 US

10.3.4.1.1 Large aerospace industry driving market

TABLE 96 US: LOW DIELECTRIC MATERIALS MARKET SIZE, BY APPLICATION, 2019–2021 (KILOTON)

TABLE 97 US: LOW DIELECTRIC MATERIALS MARKET SIZE, BY APPLICATION, 2022–2027 (KILOTON)

TABLE 98 US: LOW DIELECTRIC MATERIALS MARKET SIZE, BY APPLICATION, 2019–2021 (USD MILLION)

TABLE 99 US: LOW DIELECTRIC MATERIALS MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

10.3.4.2 Canada

10.3.4.2.1 Increasing manufacturing of electronics contributing to market growth

TABLE 100 CANADA: LOW DIELECTRIC MATERIALS MARKET SIZE, BY APPLICATION, 2019–2021 (KILOTON)

TABLE 101 CANADA: LOW DIELECTRIC MATERIALS MARKET SIZE, BY APPLICATION, 2022–2027 (KILOTON)

TABLE 102 CANADA: LOW DIELECTRIC MATERIALS MARKET SIZE, BY APPLICATION, 2019–2021 (USD MILLION)

TABLE 103 CANADA: LOW DIELECTRIC MATERIALS MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

10.3.4.3 Mexico

10.3.4.3.1 Expansion of electronics industry to trigger demand for low dielectric materials

TABLE 104 MEXICO: LOW DIELECTRIC MATERIALS MARKET SIZE, BY APPLICATION, 2019–2021 (KILOTON)

TABLE 105 MEXICO: LOW DIELECTRIC MATERIALS MARKET SIZE, BY APPLICATION, 2022–2027 (KILOTON)

TABLE 106 MEXICO: LOW DIELECTRIC MATERIALS MARKET SIZE, APPLICATION, 2019–2021 (USD MILLION)

TABLE 107 MEXICO: LOW DIELECTRIC MATERIALS MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

10.4 EUROPE

FIGURE 37 EUROPE: LOW DIELECTRIC MATERIALS MARKET SNAPSHOT

10.4.1 EUROPE: LOW DIELECTRIC MATERIALS MARKET, BY TYPE

TABLE 108 EUROPE: LOW DIELECTRIC MATERIALS MARKET SIZE, BY TYPE, 2019–2021 (KILOTON)

TABLE 109 EUROPE: LOW DIELECTRIC MATERIALS MARKET SIZE, BY TYPE, 2022–2027 (KILOTON)

TABLE 110 EUROPE: LOW DIELECTRIC MATERIALS MARKET SIZE, BY TYPE, 2019–2021 (USD MILLION)

TABLE 111 EUROPE: LOW DIELECTRIC MATERIALS MARKET SIZE, BY TYPE, 2022–2027 (USD MILLION)

10.4.2 EUROPE: LOW DIELECTRIC MATERIALS MARKET, BY MATERIAL TYPE

TABLE 112 EUROPE: LOW DIELECTRIC MATERIALS MARKET SIZE, BY MATERIAL TYPE, 2019–2021 (KILOTON)

TABLE 113 EUROPE: LOW DIELECTRIC MATERIALS MARKET SIZE, BY MATERIAL TYPE, 2022–2027 (KILOTON)

TABLE 114 EUROPE: LOW DIELECTRIC MATERIALS MARKET SIZE, BY MATERIAL TYPE, BY FLUOROPOLYMERS, 2019–2021 (KILOTON)

TABLE 115 EUROPE: LOW DIELECTRIC MATERIALS MARKET SIZE, BY MATERIAL TYPE, BY FLUOROPOLYMERS, 2022–2027 (KILOTON)

TABLE 116 EUROPE: LOW DIELECTRIC MATERIALS MARKET SIZE, BY MATERIAL TYPE, 2019–2021 (USD MILLION)

TABLE 117 EUROPE: LOW DIELECTRIC MATERIALS MARKET SIZE, BY MATERIAL TYPE, 2022–2027 (USD MILLION)

TABLE 118 EUROPE: LOW DIELECTRIC MATERIALS MARKET SIZE, BY MATERIAL TYPE, BY FLUOROPOLYMERS, 2019–2021 (USD MILLION)

TABLE 119 EUROPE: LOW DIELECTRIC MATERIALS MARKET SIZE, BY MATERIAL TYPE, BY FLUOROPOLYMERS, 2022–2027 (USD MILLION)

10.4.3 EUROPE: LOW DIELECTRIC MATERIALS MARKET, BY APPLICATION

TABLE 120 EUROPE: LOW DIELECTRIC MATERIALS MARKET SIZE, BY APPLICATION, 2019–2021 (KILOTON)

TABLE 121 EUROPE: LOW DIELECTRIC MATERIALS MARKET SIZE, BY APPLICATION, 2022–2027 (KILOTON)

TABLE 122 EUROPE: LOW DIELECTRIC MATERIALS MARKET SIZE, BY APPLICATION, 2019–2021 (USD MILLION)

TABLE 123 EUROPE: LOW DIELECTRIC MATERIALS MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

10.4.4 EUROPE: LOW DIELECTRIC MATERIALS MARKET, BY COUNTRY

TABLE 124 EUROPE: LOW DIELECTRIC MATERIALS MARKET SIZE, BY COUNTRY, 2019–2021 (KILOTON)

TABLE 125 EUROPE: LOW DIELECTRIC MATERIALS MARKET SIZE, BY COUNTRY, 2022–2027 (KILOTON)

TABLE 126 EUROPE: LOW DIELECTRIC MATERIALS MARKET SIZE, BY COUNTRY, 2019–2021 (USD MILLION)

TABLE 127 EUROPE: LOW DIELECTRIC MATERIALS MARKET SIZE, BY COUNTRY, 2022–2027 (USD MILLION)

10.4.4.1 Germany

10.4.4.1.1 Electrical & electronics segment driving market

TABLE 128 GERMANY: LOW DIELECTRIC MATERIALS MARKET SIZE, BY APPLICATION, 2019–2021 (KILOTON)

TABLE 129 GERMANY: LOW DIELECTRIC MATERIALS MARKET SIZE, BY APPLICATION, 2022–2027 (KILOTON)

TABLE 130 GERMANY: LOW DIELECTRIC MATERIALS MARKET SIZE, BY APPLICATION, 2019–2021 (USD MILLION)

TABLE 131 GERMANY: LOW DIELECTRIC MATERIALS MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

10.4.4.2 UK

10.4.4.2.1 Rise in demand from electrical & electronics industry to boost market

TABLE 132 UK: LOW DIELECTRIC MATERIALS MARKET SIZE, BY APPLICATION, 2019–2021 (KILOTON)

TABLE 133 UK: LOW DIELECTRIC MATERIALS MARKET SIZE, BY APPLICATION, 2022–2027 (KILOTON)

TABLE 134 UK: LOW DIELECTRIC MATERIALS MARKET SIZE, BY APPLICATION, 2019–2021 (USD MILLION)

TABLE 135 UK: LOW DIELECTRIC MATERIALS MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

10.4.4.3 France

10.4.4.3.1 Profitable trade with other countries in Europe propelling market in France

TABLE 136 FRANCE: LOW DIELECTRIC MATERIALS MARKET SIZE, BY APPLICATION, 2019–2021 (KILOTON)

TABLE 137 FRANCE: LOW DIELECTRIC MATERIALS MARKET SIZE, BY APPLICATION, 2022–2027 (KILOTON)

TABLE 138 FRANCE: LOW DIELECTRIC MATERIALS MARKET SIZE, BY APPLICATION, 2019–2021 (USD MILLION)

TABLE 139 FRANCE: LOW DIELECTRIC MATERIALS MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

10.4.4.4 Spain

10.4.4.4.1 Growth in manufacturing sector pushing demand for new electronic devices and machinery

TABLE 140 SPAIN: LOW DIELECTRIC MATERIALS MARKET SIZE, BY APPLICATION, 2019–2021 (KILOTON)

TABLE 141 SPAIN: LOW DIELECTRIC MATERIALS MARKET SIZE, BY APPLICATION, 2022–2027 (KILOTON)

TABLE 142 SPAIN: LOW DIELECTRIC MATERIALS MARKET SIZE, BY APPLICATION, 2019–2021 (USD MILLION)

TABLE 143 SPAIN: LOW DIELECTRIC MATERIALS MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

10.4.4.5 Russia

10.4.4.5.1 War against Ukraine to delay expansion of market in Russia

TABLE 144 RUSSIA: LOW DIELECTRIC MATERIALS MARKET SIZE, BY APPLICATION, 2019–2021 (KILOTON)

TABLE 145 RUSSIA: LOW DIELECTRIC MATERIALS MARKET SIZE, BY APPLICATION, 2022–2027 (KILOTON)

TABLE 146 RUSSIA: LOW DIELECTRIC MATERIALS MARKET SIZE, BY APPLICATION, 2019–2021 (USD MILLION)

TABLE 147 RUSSIA: LOW DIELECTRIC MATERIALS MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

10.4.4.6 Italy

10.4.4.6.1 Presence of manufacturers developing electric and self-driving vehicles driving market

TABLE 148 ITALY: LOW DIELECTRIC MATERIALS MARKET SIZE, BY APPLICATION, 2019–2021 (KILOTON)

TABLE 149 ITALY: LOW DIELECTRIC MATERIALS MARKET SIZE, BY APPLICATION, 2022–2027 (KILOTON)

TABLE 150 ITALY: LOW DIELECTRIC MATERIALS MARKET SIZE, BY APPLICATION, 2019–2021 (USD MILLION)

TABLE 151 ITALY: LOW DIELECTRIC MATERIALS MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

10.4.4.7 Rest of Europe

TABLE 152 REST OF EUROPE: LOW DIELECTRIC MATERIALS MARKET SIZE, BY APPLICATION, 2019–2021 (KILOTON)

TABLE 153 REST OF EUROPE: LOW DIELECTRIC MATERIALS MARKET SIZE, BY APPLICATION, 2022–2027 (KILOTON)

TABLE 154 REST OF EUROPE: LOW DIELECTRIC MATERIALS MARKET SIZE, BY APPLICATION, 2019–2021 (USD MILLION)

TABLE 155 REST OF EUROPE: LOW DIELECTRIC MATERIALS MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

10.5 REST OF WORLD

10.5.1 REST OF WORLD: LOW DIELECTRIC MATERIALS MARKET, BY TYPE

TABLE 156 REST OF WORLD: LOW DIELECTRIC MATERIALS MARKET SIZE, BY TYPE, 2019–2021 (KILOTON)

TABLE 157 REST OF WORLD: LOW DIELECTRIC MATERIALS MARKET SIZE, BY TYPE, 2022–2027 (KILOTON)

TABLE 158 REST OF WORLD: LOW DIELECTRIC MATERIALS MARKET SIZE, BY TYPE, 2019–2021 (USD MILLION)

TABLE 159 REST OF WORLD: LOW DIELECTRIC MATERIALS MARKET SIZE, BY TYPE, 2022–2027 (USD MILLION)

10.5.2 REST OF WORLD: LOW DIELECTRIC MATERIALS MARKET, BY MATERIAL TYPE

TABLE 160 REST OF WORLD: LOW DIELECTRIC MATERIALS MARKET SIZE, BY MATERIAL TYPE, 2019–2021 (KILOTON)

TABLE 161 REST OF WORLD: LOW DIELECTRIC MATERIALS MARKET SIZE, BY MATERIAL TYPE, 2022–2027 (KILOTON)

TABLE 162 REST OF WORLD: LOW DIELECTRIC MATERIALS MARKET SIZE, BY MATERIAL TYPE, BY FLUOROPOLYMERS, 2019–2021 (KILOTON)

TABLE 163 REST OF WORLD: LOW DIELECTRIC MATERIALS MARKET SIZE, BY MATERIAL TYPE, BY FLUOROPOLYMERS, 2022–2027 (KILOTON)

TABLE 164 REST OF WORLD: LOW DIELECTRIC MATERIALS MARKET SIZE, BY MATERIAL TYPE, 2019–2021 (USD MILLION)

TABLE 165 REST OF WORLD: LOW DIELECTRIC MATERIALS MARKET SIZE, BY MATERIAL TYPE, 2022–2027 (USD MILLION)

TABLE 166 REST OF WORLD: LOW DIELECTRIC MATERIALS MARKET SIZE, BY MATERIAL TYPE, BY FLUOROPOLYMERS, 2019–2021 (USD MILLION)

TABLE 167 REST OF WORLD: LOW DIELECTRIC MATERIALS MARKET SIZE, BY MATERIAL TYPE, BY FLUOROPOLYMERS, 2022–2027 (USD MILLION)

10.5.3 REST OF WORLD: LOW DIELECTRIC MATERIALS MARKET, BY APPLICATION

TABLE 168 REST OF WORLD: LOW DIELECTRIC MATERIALS MARKET SIZE, BY APPLICATION, 2019–2021 (KILOTON)

TABLE 169 REST OF WORLD: LOW DIELECTRIC MATERIALS MARKET SIZE, BY APPLICATION, 2022–2027 (KILOTON)

TABLE 170 REST OF WORLD: LOW DIELECTRIC MATERIALS MARKET SIZE, BY APPLICATION, 2019–2021 (USD MILLION)

TABLE 171 REST OF WORLD: LOW DIELECTRIC MATERIALS MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

10.5.4 REST OF WORLD: LOW DIELECTRIC MATERIALS MARKET, BY COUNTRY

TABLE 172 REST OF WORLD: LOW DIELECTRIC MATERIALS MARKET SIZE, BY COUNTRY/SUB-REGION, 2019–2021 (KILOTON)

TABLE 173 REST OF WORLD: LOW DIELECTRIC MATERIALS MARKET SIZE, BY COUNTRY/SUB-REGION, 2022–2027 (KILOTON)

TABLE 174 REST OF WORLD: LOW DIELECTRIC MATERIALS MARKET SIZE, BY COUNTRY/SUB-REGION, 2019–2021 (USD MILLION)

TABLE 175 REST OF WORLD: LOW DIELECTRIC MATERIALS MARKET SIZE, BY COUNTRY/SUB-REGION, 2022–2027 (USD MILLION)

10.5.4.1 Israel

10.5.4.1.1 Utilization of low dielectric materials in radars and antennas spurring market growth

TABLE 176 ISRAEL: LOW DIELECTRIC MATERIALS MARKET SIZE, BY APPLICATION, 2019–2021 (KILOTON)

TABLE 177 ISRAEL: LOW DIELECTRIC MATERIALS MARKET SIZE, BY APPLICATION, 2022–2027 (KILOTON)

TABLE 178 ISRAEL: LOW DIELECTRIC MATERIALS MARKET SIZE, BY APPLICATION, 2019–2021 (USD MILLION)

TABLE 179 ISRAEL: LOW DIELECTRIC MATERIALS MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

10.5.4.2 GCC

10.5.4.2.1 Use of PCBs in oil drilling control units supporting market growth

TABLE 180 GCC: LOW DIELECTRIC MATERIALS MARKET SIZE, BY APPLICATION, 2019–2021 (KILOTON)

TABLE 181 GCC: LOW DIELECTRIC MATERIALS MARKET SIZE, BY APPLICATION, 2022–2027 (KILOTON)

TABLE 182 GCC: LOW DIELECTRIC MATERIALS MARKET SIZE, BY APPLICATION, 2019–2021 (USD MILLION)

TABLE 183 GCC: LOW DIELECTRIC MATERIALS MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

10.5.4.3 Others

TABLE 184 OTHERS: LOW DIELECTRIC MATERIALS MARKET SIZE, BY APPLICATION, 2019–2021 (KILOTON)

TABLE 185 OTHERS: LOW DIELECTRIC MATERIALS MARKET SIZE, BY APPLICATION, 2022–2027 (KILOTON)

TABLE 186 OTHERS: LOW DIELECTRIC MATERIALS MARKET SIZE, BY APPLICATION, 2019–2021 (USD MILLION)

TABLE 187 OTHERS: LOW DIELECTRIC MATERIALS MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

11 COMPETITIVE LANDSCAPE (Page No. - 172)

11.1 INTRODUCTION

TABLE 188 KEY DEVELOPMENTS IN LOW DIELECTRIC MATERIALS MARKET (2020–2022)

11.1.1 REVENUE ANALYSIS OF TOP COMPANIES

FIGURE 38 LOW DIELECTRIC MATERIALS MARKET: REVENUE ANALYSIS (2020)

11.2 MARKET SHARE ANALYSIS OF TOP PLAYERS, 2021

TABLE 189 LOW DIELECTRIC MATERIALS MARKET: DEGREE OF COMPETITION

11.3 COMPANY EVALUATION QUADRANT, 2022

11.3.1 STAR

11.3.2 EMERGING LEADER

11.3.3 PERVASIVE

11.3.4 PARTICIPANT

FIGURE 39 LOW DIELECTRIC MATERIALS MARKET (GLOBAL): COMPANY EVALUATION QUADRANT, 2022

11.4 SMALL AND MEDIUM-SIZED ENTERPRISES (SME) EVALUATION QUADRANT, 2022

11.4.1 PROGRESSIVE COMPANIES

11.4.2 RESPONSIVE COMPANIES

11.4.3 DYNAMIC COMPANIES

11.4.4 STARTING BLOCKS

FIGURE 40 LOW DIELECTRIC MATERIALS MARKET (GLOBAL): SME EVALUATION QUADRANT, 2022

11.4.5 LOW DIELECTRIC MATERIALS MARKET: START-UP MATRIX

TABLE 190 LOW DIELECTRIC MATERIALS MARKET: DETAILED LIST OF KEY START-UPS/SMES

TABLE 191 LOW DIELECTRIC MATERIALS MARKET: COMPETITIVE BENCHMARKING OF KEY START-UPS/SMES

TABLE 192 LOW DIELECTRIC MATERIALS MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES, BY APPLICATION

TABLE 193 LOW DIELECTRIC MATERIALS MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES BY TYPE AND BY REGION

11.4.6 LOW DIELECTRIC MATERIALS MARKET: COMPANY FOOTPRINT

TABLE 194 COMPANY FOOTPRINT: BY TYPE

TABLE 195 COMPANY FOOTPRINT: BY MATERIAL TYPE

TABLE 196 COMPANY FOOTPRINT: BY APPLICATION

TABLE 197 COMPANY FOOTPRINT: BY REGION

11.5 COMPETITIVE SCENARIO AND TRENDS

11.5.1 PRODUCT LAUNCHES

TABLE 198 LOW DIELECTRIC MATERIALS MARKET: PRODUCT LAUNCHES, FEBRUARY 2020–JANUARY 2022

11.5.2 DEALS

TABLE 199 LOW DIELECTRIC MATERIALS MARKET: DEALS, FEBRUARY 2020–JANUARY 2022

11.5.3 OTHERS

TABLE 200 LOW DIELECTRIC MATERIALS MARKET: OTHERS, FEBRUARY 2020–JANUARY 2022

12 COMPANY PROFILES (Page No. - 188)

(Business Overview, Business segment, Products/Solutions/Services offered, Recent Developments, Mnm view, right to win, Strategic choices, Weaknesses and competitive threats)*

12.1 HUNTSMAN CORPORATION

TABLE 201 HUNTSMAN CORPORATION.: COMPANY OVERVIEW

FIGURE 41 HUNTSMAN CORPORATION: COMPANY SNAPSHOT

TABLE 202 HUNTSMAN CORPORATION.: PRODUCTS OFFERED

TABLE 203 HUNTSMAN CORPORATION.: DEALS

12.2 ARXADA

TABLE 204 ARXADA.: COMPANY OVERVIEW

TABLE 205 ARXADA.: PRODUCTS OFFERED

TABLE 206 ARXADA: DEALS

12.3 SABIC

TABLE 207 SABIC.: COMPANY OVERVIEW

FIGURE 42 SABIC: COMPANY SNAPSHOT

TABLE 208 SABIC.: PRODUCTS OFFERED

TABLE 209 SABIC.: PRODUCT LAUNCH

TABLE 210 SABIC.: DEAL

12.4 ASAHI KASEI

TABLE 211 ASAHI KASEI: COMPANY OVERVIEW

FIGURE 43 ASAHI KASEI: COMPANY SNAPSHOT

TABLE 212 ASAHI KASEI: PRODUCTS OFFERED

TABLE 213 ASAHI KASEI: DEALS

TABLE 214 ASAHI KASEI: OTHER DEVELOPMENTS

12.5 TOPAS ADVANCED POLYMERS

TABLE 215 TOPAS ADVANCED POLYMERS: COMPANY OVERVIEW

TABLE 216 TOPAS ADVANCED POLYMERS: PRODUCT OFFERED

TABLE 217 TOPAS ADVANCED POLYMERS: DEAL

TABLE 218 TOPAS ADVANCED POLYMERS: OTHER DEVELOPMENTS

12.6 ZEON CORP.

TABLE 219 ZEON CORP.: COMPANY OVERVIEW

FIGURE 44 ZEON CORP.: COMPANY SNAPSHOT

TABLE 220 ZEON CORP.: PRODUCTS OFFERED

TABLE 221 ZEON CORP.: EXPANSION

TABLE 222 ZEON CORP.: PRODUCT LAUNCH

12.7 THE CHEMOURS COMPANY

TABLE 223 THE CHEMOURS COMPANY: COMPANY OVERVIEW

FIGURE 45 THE CHEMOURS COMPANY: COMPANY SNAPSHOT

TABLE 224 THE CHEMOURS COMPANY: PRODUCTS OFFERED

12.8 DIC CORPORATION

TABLE 225 DIC CORPORATION: COMPANY OVERVIEW

FIGURE 46 DIC CORPORATION: COMPANY SNAPSHOT

TABLE 226 DIC CORPORATION: PRODUCTS OFFERED

12.9 ARKEMA

TABLE 227 ARKEMA: COMPANY OVERVIEW

FIGURE 47 ARKEMA: COMPANY SNAPSHOT

TABLE 228 ARKEMA: PRODUCTS OFFERED

TABLE 229 ARKEMA: DEAL

TABLE 230 ARKEMA: PRODUCT LAUNCH

12.10 MITSUBISHI CHEMICAL CORPORATION

TABLE 231 MITSUBISHI CHEMICAL CORPORATION: COMPANY OVERVIEW

FIGURE 48 MITSUBISHI CHEMICAL CORPORATION: COMPANY SNAPSHOT

TABLE 232 MITSUBISHI CHEMICAL CORPORATION: PRODUCTS OFFERED

12.11 SHOWA DENKO MATERIAL GROUP

TABLE 233 SHOWA DENKO MATERIAL GROUP: COMPANY OVERVIEW

FIGURE 49 SHOWA DENKO MATERIAL GROUP: COMPANY SNAPSHOT

TABLE 234 SHOWA DENKO MATERIAL GROUP: PRODUCTS OFFERED

12.12 DOW

TABLE 235 DOW: COMPANY OVERVIEW

FIGURE 50 DOW: COMPANY SNAPSHOT

TABLE 236 DOW: PRODUCTS OFFERED

12.13 SHIN-ETSU CHEMICAL CO., LTD.

TABLE 237 SHIN-ETSU CHEMICAL CO., LTD.: COMPANY OVERVIEW

FIGURE 51 SHIN-ETSU CHEMICAL CO., LTD.: COMPANY SNAPSHOT

TABLE 238 SHIN-ETSU CHEMICAL CO., LTD.: PRODUCTS OFFERED

TABLE 239 SHIN-ETSU CHEMICAL CO., LTD.: PRODUCT LAUNCH

TABLE 240 SHIN-ETSU CHEMICAL CO., LTD.: OTHER DEVELOPMENTS

12.14 OLIN CORPORATION

TABLE 241 OLIN CORPORATION: COMPANY OVERVIEW

FIGURE 52 OLIN CORPORATION: COMPANY SNAPSHOT

TABLE 242 OLIN CORPORATION: PRODUCTS OFFERED

TABLE 243 OLIN CORPORATION: DEAL

12.15 CELANESE CORPORATION

TABLE 244 CELANESE CORPORATION: COMPANY OVERVIEW

FIGURE 53 CELANESE CORPORATION: COMPANY SNAPSHOT

TABLE 245 CELANESE CORPORATION: PRODUCTS OFFERED

12.16 SOLVAY

TABLE 246 SOLVAY: COMPANY OVERVIEW

FIGURE 54 SOLVAY: COMPANY SNAPSHOT

TABLE 247 SOLVAY: PRODUCTS OFFERED

12.17 ADDITIONAL COMPANIES

12.17.1 FLUOROCARBON

12.17.2 CHENGUANG RESEARCH INSTITUTE OF CHEMICAL INDUSTRY

12.17.3 DAIKIN INDUSTRIES LTD

12.17.4 POLYONICS, INC.

12.17.5 CIRCUIT COMPONENTS SUPPLIES LTD

12.17.6 YUNDA ELECTRONIC MATERIALS CO., LTD.

12.17.7 LIYANG HUAJING ELECTRONIC MATERIAL CO., LTD.

12.17.8 POLYCLEAN TECHNOLOGIES, INC.

12.17.9 VICTREX

12.17.10 NANJING QINGYAN POLYMER NEW MATERIALS LTD.

*Details on Business Overview, Business segment, Products/Solutions/Services offered, Recent Developments, Mnm view, right to win, Strategic choices, Weaknesses and competitive threats might not be captured in case of unlisted companies.

13 APPENDIX (Page No. - 235)

13.1 DISCUSSION GUIDE

13.2 KNOWLEDGE STORE: MARKETSANDMARKETS SUBSCRIPTION PORTAL

13.3 AVAILABLE CUSTOMIZATIONS

13.4 RELATED REPORTS

13.5 AUTHOR DETAILS

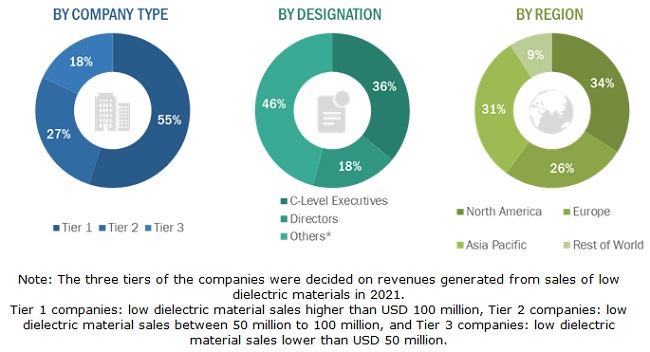

The study involved four major activities in estimating the current market size of low dielectric materials. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions and sizes with industry experts across the value chain of low dielectric materials through primary research. Both top-down and bottom-up approaches were employed to estimate the total market size.

Secondary Research

In the secondary research process, various secondary sources, such as Hoovers, Bloomberg BusinessWeek, Factiva, Dun & Bradstreet, World Bank, and Industry Journals, were referred to for identifying and collecting information for this study. These secondary sources included annual reports, press releases & investor presentations of companies; white papers; certified publications; articles by recognized authors; notifications by regulatory bodies; trade directories; and databases.

Primary Research

The low dielectric materials market comprises of several stakeholders, such as raw material suppliers, processors, end-product manufacturers, and regulatory organizations, in the supply chain. The demand side of this market is characterized by the development of PCBs, antennae, microelectronics, wires & cables, radome, and other applications. Advancements in technology describe the supply side. Key subject matter experts from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. Following is the breakdown of the primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the total size of the low dielectric materials market. These methods were also used extensively to determine the size of various sub-segments in the market. The research methodology used to estimate the market size included the following:

- The key players in the industry and markets were identified through extensive secondary research.

- In terms of value and volume, the industry’s supply chain and market size were determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size using the market size estimation processes as explained above, the market was split into several segments and sub-segments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation and market breakdown procedures were employed. The data was triangulated by studying various factors and trends from the demand and supply sides in the aerospace, automotive, electronics, and other industries.

Report Objectives:

- To analyze and forecast the market size of low dielectric materials in terms of volume and value

- To define, describe, and forecast the low dielectric materials market based on type, material type, application, and region

- To project the revenue of market segments with respect to four main regions, namely, North America, Europe, Asia Pacific (APAC), and the Rest of World

- To provide detailed information regarding the major factors influencing the growth of the market (drivers, restraints, opportunities, and industry-specific challenges)

- To analyze the opportunities in the market for stakeholders and details of a competitive landscape for market leaders

- To strategically analyze the micro-markets with respect to individual growth trends, growth prospects, and their contribution to the overall market

- To track and analyze the competitive developments, such as new product development, expansion, merger & acquisition, new product development, and contract & agreement, in the market

- To strategically profile the key players and comprehensively analyze their market shares and core competencies.

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to the client-specific needs.

The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Regional Analysis

- Further analysis of the low dielectric materials market for additional countries in Europe, APAC and RoW.

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Low Dielectric Materials Market