Kaolin Market

Kaolin Market by Type (Synthetic, Natural), Process (Water-washed, Airfloat, Calcined, Delaminated, Surface-modified & Unprocessed), End-use Industry (Paper, Ceramics & Sanitaryware, Fiberglass, Paints & Coatings, Rubber, Plastic), and Region - Forecast to 2030

KAOLIN MARKET OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The global kaolin market is estimated at USD 5.8 billion in 2025 and is projected to reach USD 8.3 billion by 2030, at a CAGR of 7.5% from 2025 to 2030. Global kaolin demand is growing steadily due to its rising usage across diverse applications such as ceramics, paper coating, paints and coatings, rubber, and cable insulation. Market growth is further driven by increasing infrastructure development, the shift toward sustainable packaging, advancements in construction materials, and technological improvements in processing techniques, making kaolin more adaptable across industrial sectors.

KEY TAKEAWAYS

-

BY TYPEThe kaolin market comprises natural and synthetic kaolin. Natural kaolin dominates the market and is projected to grow at a CAGR of 7.4%. Synthetic kaolin serves as a cost-effective alternative to titanium dioxide in paint applications. However, market preference leans toward natural kaolin due to its superior purity and performance characteristics.

-

BY PROCESSKey process types include water-washed, airfloat, calcined, delaminated, and surface-modified & unprocessed. Paper applications require high-brightness, low abrasion and delaminated kaolins for enhanced gloss and ink receptivity. Calcined kaolin is predominantly used in paper manufacturing for smoothness and brightness, and in ceramics for thermal resistance. Surface-modified kaolin provides enhanced opacity, gloss, and suspension properties in ceramic glazes. Water-washed variants command premium pricing due to superior quality.

-

BY END-USE INDUSTRYKey end-use industries of kaolin span the paper, ceramic & sanitaryware, fiberglass, paints & coatings, rubber, and plastic segments. The paper industry accounts for the largest market share, followed by ceramics. Growing demand is driven by sustainable packaging, lightweight materials, and eco-friendly mining practices. In paper coatings, kaolin accounts for 25% of the paper's mass, enhancing printability and reducing environmental impact.

-

BY REGIONThe kaolin market covers Europe, North America, Asia Pacific, South America, the Middle East, and Africa. Asia Pacific is the largest market for kaolin and is home to several prominent kaolin companies. The market for kaolin is influenced by several primary factors, such as the existence of numerous manufacturers, government support, and increased kaolin production. The demand for kaolin is rising in various end-use industries due to increased adoption of kaolin in medical and cosmetic formulations, extensive use of bright and high-quality paper in academic institutions, offices, and printing industries, and innovative kaolin-based products, such as high-performance coatings and advanced ceramics in the ceramic and paints & coatings industry.

-

COMPETITIVE LANDSCAPEMajor market players have adopted both organic and inorganic strategies, including partnerships and investments. For instance, Imerys S.A. (France), 20 Microns (India), KaMin LLC (US), Ashapura Group (India), SCR-Sibelco (Belgium), and Thiele Kaolin Company (US) have entered into a number of agreements and partnerships to cater to the growing demand for kaolin across innovative applications.

Key factors driving the kaolin market include the increasing demand from the ceramics, paper, and paint industries and the growing need for infrastructure and packaging. Technological advancements in processing and product customization are broadening the applications of kaolin. There are also opportunities in high-growth sectors such as electrical insulation, engineered plastics, and sustainable packaging solutions.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The impact on consumers' business emerges from customer trends or disruptions. Hotbets are clients of kaolin manufacturers, and target applications are clients of kaolin manufacturers. Shifts, which are changing trends or disruptions, will impact the revenues of end users. The revenue impact on end users will affect the revenue of hotbets, which will further affect the revenues of kaolin manufacturers.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Growing demand from paper and packaging industries for improved print quality and surface smoothness

-

Increasing use in ceramics and construction materials due to urbanization and infrastructure development

Level

-

Environmental regulations limiting mining operations and processing activities in key kaolin-producing regions

-

High transportation costs due to bulk nature of kaolin affecting profit margins for distant markets

Level

-

Rising demand for high-purity kaolin in advanced applications like pharmaceuticals and cosmetics

-

Expansion of paint and coatings industry in emerging markets driving kaolin consumption

Level

-

Competition from alternative fillers and extenders offering similar properties at lower costs

-

Depletion of high-quality kaolin reserves requiring investment in beneficiation technologies

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Growing demand from paper and packaging industries for improved print quality and surface smoothness.

The kaolin market is primarily driven by the growing demand from paper and packaging industries, where kaolin serves as a critical coating pigment and filler that significantly enhances print quality and surface smoothness. As e-commerce continues to expand globally, the demand for packaging materials has surged, creating a robust market for kaolin-coated papers that offer superior printability, brightness, and opacity. Premium printing applications, including magazines, brochures, and high-end packaging, specifically require high-quality kaolin grades that can deliver exceptional surface characteristics and ink receptivity.

Restraint: Environmental regulations limiting mining operations and processing activities in key kaolin-producing regions

The kaolin industry faces significant constraints from increasingly stringent environmental regulations that limit mining operations and processing activities in key producing regions. These environmental compliance requirements have substantially increased operational costs, as companies must invest in advanced waste management systems, water treatment facilities, and land restoration programs. The mine permitting process has become more complex and time-consuming, often involving extensive environmental impact assessments and community consultations that can delay project development by several years.

Opportunity: Rising demand for high-purity kaolin in advanced applications like pharmaceuticals and cosmetics

The market presents substantial opportunities through rising demand for high-purity kaolin in advanced applications, particularly in pharmaceuticals and cosmetics industries. Pharmaceutical-grade kaolin is increasingly used in antidiarrheal medications and as an excipient in drug delivery systems, commanding premium prices compared to traditional industrial grades. The cosmetics industry has embraced kaolin for face masks, skin care products, and color cosmetics, driven by growing consumer awareness of natural ingredients and the global wellness trend that favors mineral-based beauty products.

Challenge: Competition from alternative fillers and extenders offering similar properties at lower costs

Competition from alternative fillers and extenders poses a persistent challenge to the kaolin industry, as materials like precipitated calcium carbonate (PCC) and ground calcium carbonate offer similar properties at potentially lower costs in certain applications. Technological advancements have made these alternatives increasingly viable, particularly in paper manufacturing where PCC can provide comparable opacity and printability benefits. Synthetic alternatives are also gaining traction in specialized ceramic applications, forcing kaolin suppliers to continuously demonstrate superior value propositions and develop application-specific grades.

Kaolin Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

High-grade kaolin as a coating pigment in premium printing papers and magazines | Enhanced print quality, improved brightness and opacity, superior ink receptivity, and reduced show-through |

|

Calcined kaolin as a functional filler in architectural paints and industrial coatings | Improved scrub resistance, enhanced opacity and hiding power, reduced titanium dioxide usage, and cost optimization |

|

Purified kaolin in personal care products, including facial masks and cosmetics | Gentle oil absorption, natural detoxification properties, improved skin texture, and enhanced product stability |

|

Kaolin as key ingredient in ceramic tile manufacturing and sanitaryware production | Enhanced plasticity and workability, improved fired strength, reduced shrinkage, and superior surface finish |

|

Pharmaceutical-grade kaolin in antidiarrheal medications and drug delivery systems | Safe and effective adsorption properties, regulatory compliance, improved bioavailability, and extended shelf life |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The kaolin market ecosystem comprises a well-integrated value chain starting from raw material extraction, where major players like Imerys S.A., KaMin LLC, and Thiele Kaolin mine and supply crude kaolin. This is followed by manufacturers such as Sibelco and Ashapura Group that refine kaolin into hydrous, calcined, and surface-treated grades for various industrial uses. Distributors and logistics providers like Minerals Technologies Inc. and regional suppliers facilitate the movement of processed kaolin to end users. The end-use industries span ceramics, paper & pulp, paints & coatings, rubber & plastics, and construction, with key consumers, including Kohler, UPM-Kymmene, PPG Industries, and Bridgestone. The ecosystem is supported by regulatory bodies, technology providers, and research institutions focusing on environmental standards, mining innovations, and product development, making the kaolin value chain dynamic and increasingly sustainability-driven.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

kaolin Market, by Type

Natural kaolin accounted for the largest share of the Kaolin market due to its abundance, versatility across various end-use industries, and environmentally friendly properties. Natural kaolin is widely found in sedimentary rocks that form under ambient geological conditions, making it readily accessible and economically attractive for large-scale mining and use. Its physical characteristics such as fine particle size, high whiteness, chemical inertness, and plasticity makes it a highly desirable material for industries like paper, ceramics, paints, coatings, cosmetics, and others. The paper industry, in particular, relies on kaolin as a vital coating and filler material that enhances paper brightness, printability, and surface smoothness, which are crucial for high-quality packaging and print media.

kaolin Market, by Process

In the kaolin market, the water-washed process segment is expected to register the highest CAGR as it is one of the most popular procedures for transforming raw kaolin into its finished products. It is also known as wet processing, as it utilizes water extensively at various stages, including screening, grinding, centrifuging, slurring, blunging, and chemical treatment to separate, purify, and process kaolin. It forms a stable chemical composition and strong adsorption capacity of kaolin, which contributes to its effectiveness in high-performance and specialty applications. The market is expanding as a result of rising demand, especially from the building and construction sector. The water-washed process is widely used in the production of hydrous kaolin, as the process helps to retain water in the clay for about 12–14%.

kaolin Market, by End-use Industry

The paper industry is projected to register the highest growth rate in the kaolin market. Kaolin is extensively used as both a filler and coating pigment in paper production, enhancing essential qualities such as gloss, printability, brightness, opacity, smoothness, and ink absorption. The continued expansion of e-commerce and online shopping is fueling a surge in demand for paper-based packaging materials, where kaolin plays a crucial role in improving packaging paper quality and visual appeal. The industry's shift toward sustainable and eco-friendly materials also drives the demand for Kaolin, as it is naturally biodegradable and non-toxic.

REGION

Asia Pacific to be fastest-growing region in global kaolin market during forecast period

Asia Pacific dominates the kaolin market due to region's substantial natural reserves, rapid industrialization, and broad-based demand across wide range of end-use industries. Countries like China, India, Japan, South Korea, and Australia drive the market with their large kaolin deposits and position as major producers of ceramics, paper, and construction materials. The market for kaolin in the Asia Pacific is characterized by capacity expansions, joint ventures, and agreements between various leading market players. Kaolin’s extensive use in the ceramics industry in the production of ceramics, including tableware, sanitaryware, construction tiles, and decorative items, is a major factor driving the demand for kaolin in the region. An increasing number of ceramic manufacturing companies in China have contributed to the growth of the kaolin market in recent years.

Kaolin Market: COMPANY EVALUATION MATRIX

In the kaolin market matrix, Imerys S.A. (Star) leads with a strong market share and extensive product footprint, driven by its advanced kaolin materials widely adopted in the paper and construction sectors. EICL Limited (Emerging Leader) is increasing its visibility with its kaolin product, which is used in paper and board as well as the paint industry. The company is solidifying its position through innovation and specialized product offerings. While Imerys S.A. dominates the market due to its scale and diverse portfolio, EICL Limited has significant potential to advance into the leaders’ quadrant as the demand for fine kaolin material continues to rise.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 5.3 Billion |

| Market Forecast in 2030 (Value) | USD 8.3 Billion |

| Growth Rate | CAGR of 7.5% from 2025-2030 |

| Years Considered | 2021-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million/Billion), Volume (Kiloton) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regions Covered | North America, Asia Pacific, Europe, South America, and Middle East & Africa |

WHAT IS IN IT FOR YOU: Kaolin Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Paper Mill Operator |

|

|

| Ceramic Manufacturer |

|

|

| Paint & Coatings Producer |

|

|

| Mining Company |

|

|

| Pharmaceutical Company |

|

|

RECENT DEVELOPMENTS

- June 2025 : In June 2025, LB MINERALS, LTD. (Czech Republic) plans to increase production of highly pure enriched kaolin to 120,000 tons. This will take place in a processing plant in Western Australia and involve the hiring of over 50 new permanent staff.

- November 2023 : Sibelco announced a planned USD 500 million greenfield expansion from 2024 to 2027, aimed at increasing production capacity, including clays, to meet anticipated future market growth.

- September 2022 : KaMin LLC has successfully acquired BASF SE’s Kaolin business. This division, which focuses on kaolin minerals, employs around 440 people across North America, Europe, and Asia. This acquisition is expected to significantly enhance the company's operations, technical capabilities, and talent pool, ultimately providing greater value to customers, distributors, and brand owners worldwide.

- July 2021 : Thiele has announced its plan to acquire mineral resources and certain manufacturing assets from Imerys Performance Minerals. This acquisition will primarily support hydrous kaolin production, while also including some calcination capabilities. The mineral and manufacturing assets are located in central Georgia, strategically positioned near other Thiele assets. Imerys will retain its assets in Sandersville, Georgia, and remains committed to the mining community and its business in the middle Georgia region.

Table of Contents

Methodology

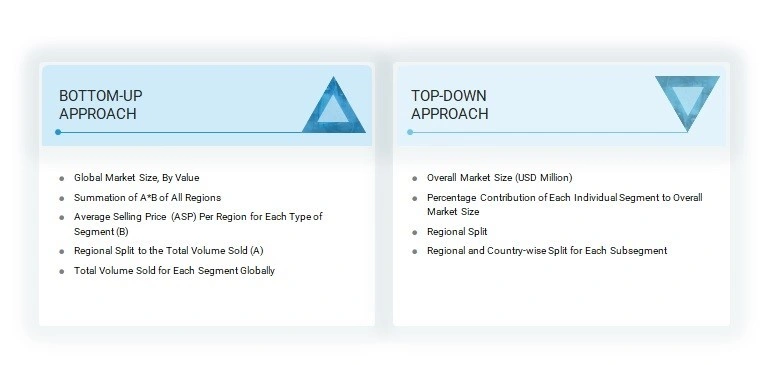

The study to estimate the current size of the kaolin market involved two key steps. First, comprehensive secondary research was conducted to gather data on the market and related and parent markets. This was followed by primary research, where insights, assumptions, and market estimates were validated through interviews with industry experts across the value chain. Both top-down and bottom-up methodologies were applied to determine the overall market size. Finally, the market was segmented, and data triangulation techniques were used to refine and validate the estimates for each segment and subsegment.

Secondary Research

Secondary sources consulted for this research included financial reports of kaolin manufacturers, along with data from trade organizations, business publications, and professional associations. The secondary research provided essential insights into the industry's value chain, identified key players, and helped classify and segment the market based on prevailing industry trends at regional and sub-regional levels. The information gathered was thoroughly analyzed to estimate the overall size of the kaolin market, which was then validated through primary research with industry experts.

Primary Research

Extensive primary research was carried out after collecting market insights through secondary research to validate the kaolin market scenario. Several interviews were conducted with industry experts from the demand and supply sides across North America, Europe, Asia Pacific, the Middle East & Africa, and South America. Primary data was gathered through structured questionnaires, emails, and telephonic interviews. On the supply side, respondents included industry professionals such as CXOs, vice presidents, directors, product innovation teams, system integrators, component suppliers, distributors, and other key opinion leaders. These interviews provided valuable insights into market statistics, revenue data, segmentation, size estimations, and forecasts, and enabled data triangulation. On the demand side, stakeholders such as CIOs, CTOs, CSOs, and installation teams from end-user companies were consulted to better understand customer perspectives, current usage patterns, supplier evaluations, and the outlook for kaolin.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The research methodology used to estimate the size of the kaolin market primarily focused on a demand-side approach. Market sizing was conducted by analyzing procurement activities and modernization efforts involving kaolin products across various applications at the regional level. These procurement trends offered valuable insights into the demand patterns within the kaolin industry for each application segment. All relevant segments were thoroughly mapped and integrated to provide a comprehensive view of the market structure and size across different end-use applications.

Data Triangulation

After estimating the overall market size through the process explained above, the total market was further segmented into various segments and subsegments. To ensure accuracy, data triangulation and market breakdown techniques were applied wherever relevant, forming a key part of the overall market engineering process. This involved analyzing multiple factors and trends from both the demand and supply sides. Additionally, the final market size and segment-level figures were validated using a combination of top-down and bottom-up approaches to ensure precision and reliability of the statistical estimates.

Market Definition

Kaolin, also known as China clay, is a soft, white, and fine-textured clay composed of kaolinite, a hydrated aluminum silicate. Naturally occurring with a plate-like structure and fine particle size, kaolin is also synthetically producible. It is extracted and processed into various forms such as powder, semi-dry, and liquid slurry. Processed kaolin is widely used across the paper, ceramics & sanitaryware, fiberglass, paints & coatings, rubber, plastics, and cement industries. Its high purity and chemical inertness make it a preferred choice in formulations requiring consistent performance and stability.

Stakeholders

- Kaolin manufacturers

- Ceramic and cement manufacturers

- Universities, governments, and research organizations

- Kaolin associations and industrial bodies

- Research and consulting firms

- R&D institutions

- Environmental support agencies

Report Objectives

- To define, describe, segment, and forecast the size of the kaolin market, by type, process, end-use industry, and region, in terms of volume and value

- To forecast the size of market segments across five major regions (along with country-level data), namely North America, Europe, Asia Pacific, South America, and the Middle East & Africa

- To identify and analyze key drivers, restraints, opportunities, and challenges influencing market growth

- To strategically analyze micro markets with respect to individual growth trends, prospects, and contributions to the overall market

- To analyze opportunities for stakeholders in the market

- To assess recent developments and competitive strategies, such as acquisitions, agreements, contracts, and product developments/launches, to draw the competitive landscape

- To strategically profile the key market players and comprehensively analyze their core competencies

Customization Options

MarketsandMarkets offers the following customizations for this market report:

- Additional country-level analysis of the kaolin market

Product Analysis

- Product matrix, which provides a detailed comparison of the product portfolio of each company's market

Key Questions Addressed by the Report

Who are the major companies in the kaolin market?

Major companies include Imerys S.A. (France), 20 Microns (India), KaMin LLC (US), Ashapura Group (India), SCR-Sibelco (Belgium), Thiele Kaolin Company (US), LB MINERALS, LTD. (Hungary), EICL Limited (India), Quarzwerke GmbH (Germany), and Sedlecký Kaolin a.s. (Czech Republic), among others.

What are the drivers and opportunities for the kaolin market?

Key drivers include demand from ceramics, paper, and paints, infrastructure growth, and packaging industry expansion. Opportunities lie in electrical insulation, engineered plastics, and sustainable packaging.

Which region is expected to hold the highest market share?

Asia Pacific is expected to hold the highest market share due to strong manufacturing presence and ongoing mining projects.

What is the projected CAGR of the kaolin market during 2025–2030?

The market is expected to grow at a CAGR of 7.5% between 2025 and 2030.

How is the kaolin market structured and positioned in terms of key technologies, applications, and industry trends?

The market centers on advanced technologies like calcination and flotation, producing specialized grades for ceramics, paper, coatings, and electrical insulation. Trends include rising demand for sustainable packaging, lightweight materials, and eco-friendly mining practices.

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Kaolin Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Kaolin Market