Feldspar Market by Type (Plagioclase Feldspar, and K-Feldspar), End-Use (Glass, Ceramics, Fillers), and Region (Europe, North America, South America, Asia-Pacific, and Middle East & Africa) - Global Forecast to 2022

[92 Pages Report] The global feldspar market was valued at USD 517.0 million in 2016 and is projected to reach USD 745.7 million by 2022, at a CAGR of 6.4%, in terms of value, during the forecast period. Feldspar is widely used in glass and ceramic manufacturing, with the glass industry being the major end user. The superior properties of feldspar, such as resistance to heat, chemical inertness, and low melting point, have contributed to the growth of the feldspars market. The base year considered for the study is 2016 and the forecast period is from 2017 to 2022.

Market Dynamics

Drivers

- Increasing demand for ceramic tiles

- Increasing use of feldspar in automotive glass

Restraints

- Recycling of glass and ceramics

Opportunities

- Rising investment in commercial and residential construction

Increasing demand for ceramic tiles

Ceramic tile is one of the most important materials consumed in the construction industry. Therefore, the growth of the ceramic tiles market is dependent on the rising construction expenditure, globally. The construction sector is significantly growing, mainly in APAC countries, such as China, India, and Malaysia. In 2015, Chinas construction spending was approximately USD 1.7 trillion. Therefore, the demand for ceramic tiles is increasing with the growth in the construction sector. According to the ceramic industry report, as of 2013, China was the worlds largest tiles producer, consumer, and exporter. Its output was about 5.7 billion square meters which is 47.8% of the world production of ceramic tiles. Brazil and India are also the largest manufacturers of ceramic tiles. The feldspar market is expected to grow in these countries as well. Feldspar, kaolin, bentonite, and silica sand are the major raw materials used in manufacturing ceramic tiles.

Objectives of the Study

- To estimate and forecast the size of the feldspars market, in terms of value and volume

- To provide detailed information regarding the key factors (drivers, restraints, challenges, and opportunities) influencing the growth of the market

- To define, describe, and forecast the market on the basis of type and end-use

- To forecast the market size with respect to five main regions, namely, North America, Europe, Asia Pacific (APAC), the Middle East & Africa, and South America

- To analyze competitive developments, such as acquisitions, new product launches, expansions, collaborations, and investments in the market

- To analyze market opportunities for stakeholders and provide a competitive landscape for market leaders

- To strategically profile the key players and comprehensively analyze their market share and core competencies1

Note 1: Core competencies of the companies are captured in terms of key developments and key strategies adopted by them to maintain their position in the market.

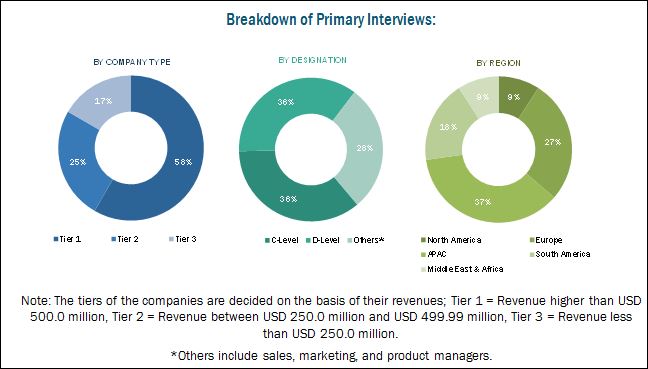

Both the top-down and bottom-up approaches have been used to estimate and validate the size of the global feldspar market and to estimate the size of various other dependent submarkets. This study involved the use of extensive secondary sources, directories, and databases, such as Hoovers, Bloomberg, Chemical Weekly, Factiva, Commonwealth Scientific and Industrial Research Organization (CSIRO), Securities and Exchange Commission (SEC), American National Standards Institute (ANSI), Organization for Economic Co-operation and Development (OECD), and other sources, to identify and collect information useful for the technical, market-oriented, and commercial study of the feldspar market.

To know about the assumptions considered for the study, download the pdf brochure

The key players in the feldspar market include Eczacibasi Esan (Turkey), Micronized Group (South Africa), Imerys Minerals (UK), Sibelco Nordic (Norway), and The Quartz Corp. (France). These companies focus on expanding their reach in the emerging markets of APAC and South America.

Key Target Audience:

- Feldspar Extractors

- Feldspar Traders, Distributors, and Suppliers

- Mineral Suppliers

- Government and Research Organizations

- Regulatory Bodies

- Associations and Industry Bodies

This study answers several questions for the stakeholders, primarily which market segments they should focus upon during the next two to five years to prioritize their efforts and investments.

Scope of the Report:

This research report categorizes the feldspar market by type, end-use, and region.

Based on Type:

- Plagioclase feldspar

- K-feldspar

Based on End-use:

- Glass

- Ceramics

- Fillers

- Others

Based on Region:

- North America

- Europe

- APAC

- Middle East & Africa

- South America

- The market is further analyzed for the key countries in each of these regions.

Critical questions which the report answers

- What is the market size for Feldspar in different application across developing nations?

- Which are the key players in the market and how intense is the competition?

Available Customizations:

- With the given market data, MarketsandMarkets offers customizations according to the companys specific needs. The following customization options are available for the report:

Regional Analysis:

- Regional and country-level analysis of the feldspar market, by end-use.

Company Information:

- Detailed analysis and profiles of additional market players.

The feldspar market is estimated to be USD 547.0 million in 2017 and is projected to reach USD 745.7 million by 2022, at a CAGR of 6.4%, in terms of value, between 2017 and 2022. The use of feldspar as a fluxing agent in glass and ceramic manufacturing industries is expected to drive the feldspars market during the forecast period.

The feldspar market has been segmented based on type into plagioclase feldspar and K-feldspar. These two types are categorized based on the inorganic minerals present in them. Sodium and potassium are the main minerals differentiating the two types. The plagioclase feldspar segment is expected to dominate the feldspars market during the forecast period due to its abundant presence as well as low cost, which will help catalyze its demand from glass and ceramic manufacturers.

Feldspar is one of the most important materials used in the manufacturing of various types of glass. The use of feldspar, which acts as a fluxing agent, reduces the melting temperature of quartz and helps in controlling the viscosity of glass. Based on end-use, the glass segment is projected to dominate the feldspar market during the forecast period. However, the ceramics segment is expected to witness the highest growth rate during the forecast period due to the increased production of ceramic floor tiles on account of the growing construction of several residential and commercial buildings.

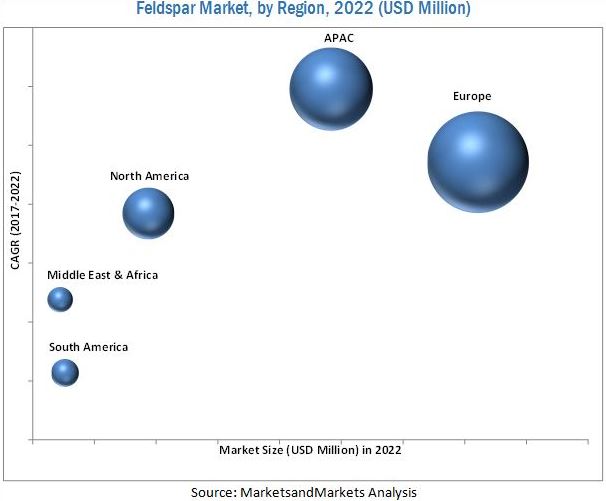

APAC is estimated to be the fastest-growing market for feldspar during the forecast period due to rising demand for feldspars from the regions glass and ceramics industries. China is the largest and the fastest-growing feldspar market in this region. India, Thailand, South Korea, and Malaysia are the other key feldspars markets in APAC. Increasing population, growing urbanization, and rising investments in infrastructure projects are expected to drive the regions overall industrial growth, thereby increasing the demand for feldspars. The Make in India initiative of the Indian government will also catalyze the demand for feldspar from local glass and ceramic manufacturing industries.

Feldspar is majorly used as a fluxing agent during the manufacturing of glass and ceramics from quartz. However, the recycling of glass and ceramics has limited the growth of the feldspar market.

Feldspar is an essential mineral in igneous, metamorphic, and sedimentary rocks. The classification of a number of rocks is based upon the presence of feldspar. Feldspar is one of the most abundant terrestrial rocks, which occurs in the form of crystals. It is widely used in many everyday life products such as drinking glass, protection glass, fiberglass, floor tiles, shower, basins, and tableware.

Glass

Feldspar is one of the most important elements used in manufacturing various types of glass. It is an important raw material because it acts as a fluxing agent. The use of feldspar reduces the melting temperature of quartz and helps in controlling the viscosity of glass. The alkali component in feldspar acts as a fluxing agent, which, in turn, lowers the temperature of the glass, thus making it a great melting agent.

Ceramics

In the ceramic industry, feldspar and clay are the most widely used raw materials. Feldspar tends to have varying melting points, and thus it melts at different temperature levels. This helps in modulations and modifications of ceramic products during the manufacturing of ceramic products such as tiles, sanitary ware, and tableware. Feldspar improves the physical appearance, strength, toughness, and durability of the ceramic product. This makes it one of the most widely used raw materials, especially in sanitary ware and tile making.

Fillers

Feldspar is also being used as fillers, mainly in the paint, plastic, and rubber applications. This is due to the properties such as good dispersibility, chemical inertness, stable pH, resistance to abrasion and frosting, and low viscosity. The feldspar used as fillers is fine-milled and processed. Plagioclase feldspar, mainly white feldspar is used as fillers. Fillers are used for glazing effect in paints, coatings, plastics, and other materials.

Some of the key players in the feldspar market include Eczacibasi Esan (Turkey), Micronized Group (South Africa), Imerys Minerals (UK), Sibelco Nordic (Norway), and The Quartz Corp. (France). These companies focus on increasing the mining of feldspars and their export to other countries where their demand in glass and ceramics manufacturing is high due to the rising construction activities. These companies also have existing supply contracts with glass and ceramics manufacturers.

Table of Contents

1 Introduction (Page No. - 11)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Years Considered for the Study

1.4 Currency

1.5 Units Considered

1.6 Limitations

1.7 Stakeholders

2 Research Methodology (Page No. - 14)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

2.1.2.3 Breakdown of Primaries

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

2.3 Data Triangulation

2.4 Assumptions

3 Executive Summary (Page No. - 21)

4 Premium Insights (Page No. - 25)

4.1 Attractive Opportunities in the Feldspar Market

4.2 Feldspar Market, By Type

4.3 Feldspars Market, By End Use

4.4 Europe Feldspar Market, By End Use and Country

4.5 Feldspars Market Attractiveness

5 Market Overview (Page No. - 29)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Increasing Demand for Ceramic Tiles

5.2.1.2 Increasing Use of Feldspar in Automotive Glass

5.2.2 Restraints

5.2.2.1 Reduction in Feldspar Usage Due to Recycling of Glass and Ceramics

5.2.3 Opportunities

5.2.3.1 Rising Investment in Commercial and Residential Construction

5.3 Porters Five Forces Analysis

5.3.1 Bargaining Power of Suppliers

5.3.2 Bargaining Power of Buyers

5.3.3 Threat of Substitutes

5.3.4 Threat of New Entrants

5.3.5 Intensity of Competitive Rivalry

6 Feldspar Market, By Type (Page No. - 34)

6.1 Introduction

6.2 Plagioclase Feldspar

6.3 K-Feldspar

7 Feldspar Market, By End Use (Page No. - 38)

7.1 Introduction

7.2 Glass

7.3 Ceramics

7.4 Fillers

7.5 Others

8 Feldspar Market, By Region (Page No. - 41)

8.1 Introduction

8.2 Europe

8.2.1 Germany

8.2.2 Italy

8.2.3 Spain

8.2.4 Russia

8.2.5 Rest of Europe

8.3 APAC

8.3.1 China

8.3.2 India

8.3.3 Thailand

8.3.4 South Korea

8.3.5 Malaysia

8.3.6 Rest of APAC

8.4 North America

8.4.1 US

8.4.2 Mexico

8.5 Middle East & Africa

8.5.1 Iran

8.5.2 Egypt

8.5.3 South Africa

8.5.4 Rest of Middle East & Africa

8.6 South America

8.6.1 Brazil

8.6.2 Argentina

8.6.3 Colombia

8.6.4 Rest of South America

9 Company Profile (Page No. - 72)

9.1 Ranking of Key Players

(Overview, Financial*, Products & Services, Strategy, and Developments)

9.2 Eczacibasi Esan

9.3 Micronized Group

9.4 Imerys Minerals

9.5 Sibelco Nordic

9.6 The Quartz Corp.

9.7 Asia Mineral Processing

9.8 EL Waha Mining & Fertilizers

9.9 EP Minerals, Inc.

9.10 Gimpex

9.11 I-Minerals

9.12 Other Companies

9.12.1 Mahavir Minerals

9.12.2 Minerali Industriali

9.12.3 Pacer Corporation

9.12.4 Sun Minerals

9.12.5 KMK Granit

*Details Might Not Be Captured in Case of Unlisted Companies

10 Appendix (Page No. - 85)

10.1 Discussion Guide

10.2 Knowledge Store: Marketsandmarkets Subscription Portal

10.3 Introducing RT: Real-Time Market Intelligence

10.4 Available Customizations

10.5 Related Reports

10.6 Author Details

List of Tables (69 Tables)

Table 1 Feldspar Market Size, By Type, 20152022 (USD Million)

Table 2 Feldspars Market Size, By Type, 20152022 (Kiloton)

Table 3 Plagioclase Feldspar Categories Based on Calcium Content

Table 4 Feldspar Market Size, By End Use, 20152022 (USD Million)

Table 5 Feldspars Market Size, By End Use, 20152022 (Kiloton)

Table 6 Feldspar Market Size, By Region, 20152022 (USD Million)

Table 7 Feldspars Market Size, By Region, 20152022 (Kiloton)

Table 8 Europe: Feldspar Market Size, By Country, 20152022 (USD Million)

Table 9 Europe: Feldspars Market Size, By Country, 20152022 (Kiloton)

Table 10 Europe: Feldspar Market Size, By End Use, 20152022 (USD Million)

Table 11 Europe: Feldspars Market Size, By End Use, 20152022 (Kiloton)

Table 12 Germany: Feldspar Market Size, By End Use, 20152022 (USD Million)

Table 13 Germany: Feldspars Market Size, By End Use, 20152022 (Kiloton)

Table 14 Italy: By Market Size, By End Use, 20152022 (USD Million)

Table 15 Italy: Feldspar Market Size, By End Use, 20152022 (Kiloton)

Table 16 Spain: Feldspar Market Size, By End Use, 20152022 (USD Million)

Table 17 Spain: Feldspars Market Size, By End Use, 20152022 (Kiloton)

Table 18 Russia: Feldspar Market Size, By End Use, 20152022 (USD Million)

Table 19 Russia: Feldspars Market Size, By End Use, 20152022 (Kiloton)

Table 20 Rest of Europe: By Market Size, By End Use, 20152022 (USD Million)

Table 21 Rest of Europe: By Market Size, By End Use, 20152022 (Kiloton)

Table 22 APAC: By Market Size, By Country, 20152022 (USD Million)

Table 23 APAC: By Market Size, By Country, 20152022 (Kiloton)

Table 24 APAC: By Market Size, By End Use, 20152022 (USD Million)

Table 25 APAC: By Market Size, By End Use, 20152022 (Kiloton)

Table 26 China: By Market Size, By End Use, 20152022 (USD Million)

Table 27 China: By Market Size, By End Use, 20152022 (Kiloton)

Table 28 India: By Market Size, By End Use, 20152022 (USD Million)

Table 29 India: By Market Size, By End Use, 20152022 (Kiloton)

Table 30 Thailand: By Market Size, By End Use, 20152022 (USD Million)

Table 31 Thailand: By Market Size, By End Use, 20152022 (Kiloton)

Table 32 South Korea: By Market Size, By End Use, 20152022 (USD Million)

Table 33 South Korea: By Market Size, By End Use, 20152022 (Kiloton)

Table 34 Malaysia: By Market Size, By End Use, 20152022 (USD Million)

Table 35 Malaysia: By Market Size, By End Use, 20152022 (Kiloton)

Table 36 Rest of APAC: Feldspar Market Size, By End Use, 20152022 (USD Million)

Table 37 Rest of APAC: By Market Size, By End Use, 20152022 (Kiloton)

Table 38 North America: By Market Size, By Country, 20152022 (USD Million)

Table 39 North America: By Market Size, By Country, 20152022 (Kiloton)

Table 40 North America: By Market Size, By End Use, 20152022 (USD Million)

Table 41 North America: By Market Size, By End Use, 20152022 (Kiloton)

Table 42 US: By Market Size, By End Use, 20152022 (USD Million)

Table 43 US: By Market Size, By End Use, 20152022 (Kiloton)

Table 44 Mexico: By Market Size, By End Use, 20152022 (USD Million)

Table 45 Mexico: By Market Size, By End Use, 20152022 (Kiloton)

Table 46 Middle East & Africa: By Market Size, By Country, 20152022 (USD Thousand)

Table 47 Middle East & Africa: By Market Size, By Country, 20152022 (Kiloton)

Table 48 Middle East & Africa: By Market Size, By End Use, 20152022 (USD Thousand)

Table 49 Middle East & Africa: By Market Size, By End Use, 20152022 (Kiloton)

Table 50 Iran: By Market Size, By End Use, 20152022 (USD Thousand)

Table 51 Iran: By Market Size, By End Use, 20152022 (Kiloton)

Table 52 Egypt: By Market Size, By End Use, 20152022 (USD Thousand)

Table 53 Egypt: By Market Size, By End Use, 20152022 (Kiloton)

Table 54 South Africa: By Market Size, By End Use, 20152022 (USD Thousand)

Table 55 South Africa: By Market Size, By End Use, 20152022 (Kiloton)

Table 56 Rest of Middle East & Africa: Feldspar Market Size, By End Use, 20152022 (USD Thousand)

Table 57 Rest of Middle East & Africa: Feldspars Market Size, By End Use, 20152022 (Kiloton)

Table 58 South America: By Market Size, By Country, 20152022 (USD Thousand)

Table 59 South America: By Market Size, By Country, 20152022 (Kiloton)

Table 60 South America: By Market Size, By End Use, 20152022 (USD Thousand)

Table 61 South America: By Market Size, By End Use, 20152022 (Kiloton)

Table 62 Brazil: Feldspar Market Size, By End Use, 20152022 (USD Thousand)

Table 63 Brazil: Feldspars Market Size, By End Use, 20152022 (Kiloton)

Table 64 Argentina: By Market Size, By End Use, 20152022 (USD Thousand)

Table 65 Argentina: By Market Size, By End Use, 20152022 (Kiloton)

Table 66 Colombia: By Market Size, By End Use, 20152022 (USD Thousand)

Table 67 Colombia: By Market Size, By End Use, 20152022 (Kiloton)

Table 68 Rest of South America: Feldspar Market Size, By End Use, 20152022 (USD Thousand)

Table 69 Rest of South America: Feldspars Market Size, By End Use, 20152022 (Kiloton)

List of Figures (19 Figures)

Figure 1 Feldspar Market: Research Design

Figure 2 Feldspars Market: Data Triangulation

Figure 3 Plagioclase Feldspar to Be the Largest Type Between 2017 and 2022

Figure 4 Glass to Be the Largest End Use of Feldspar Between 2017 and 2022

Figure 5 APAC to Be the Fastest-Growing Feldspar Market Between 2017 and 2022

Figure 6 Europe Led the Feldspars Market in All End Uses in 2016

Figure 7 The Feldspar Market to Witness Moderate Growth Between 2017 and 2022

Figure 8 K-Feldspar to Register the Highest CAGR Between 2017 and 2022

Figure 9 Glass End Use to Dominate the Feldspars Market Between 2017 and 2022

Figure 10 Germany Accounted for the Largest Market Share in 2016

Figure 11 APAC to Be the Fastest-Growing Market Between 2017 and 2022

Figure 12 Overview of Factors Governing the Feldspar Market

Figure 13 Feldspar Market: Porters Five Forces Analysis

Figure 14 Plagioclase Feldspar to Lead the Feldspars Market Between 2017 and 2022

Figure 15 Glass to Be the Largest End Use of Feldspar Between 2017 and 2022

Figure 16 Regional Snapshot: China to Be the Fastest-Growing Feldspar Market Between 2017 and 2022

Figure 17 European Feldspar Market Snapshot

Figure 18 APAC Feldspars Market Snapshot

Figure 19 Eczacibasi Esan is the Leading Feldspar Extractor

Growth opportunities and latent adjacency in Feldspar Market