Internet of Things (IoT) Managed Services Market by Service Type (Infrastructure Management, Security Management, Network Management, Data Management, Device Management), Vertical, and Region - Global Forecast to 2021

[112 Pages Report] The IoT managed services market estimated to grow from $21.85 billion in 2016 to $79.60 billion by 2021, at a Compound Annual Growth Rate (CAGR) of 29.5% during the period 20162021. IoT managed services is a portfolio of services and capabilities that help in managing the entire IoT environment. It defines an appropriate strategy for business for digital transformation and empowers the organizations, to bring together, the right mix of IoT products and solutions. The complexity involved during the integration of IoT technology with the existing legacy systems and process is the major pain point for organizations planning for a digital transformation.

IoT Managed Services Market Dynamics

Drivers

- MSPs enable operational effectiveness and high-performance work systems in organizations

- Increasing momentum of managed cloud services

- Declining profits from service revenues shifting focus to MSPs

- Growing inclination toward cost-effective managed services

- Inability of MSPs to cope up with IoT complexities

- MSPs in IoT space lack scalability and flexibility in their service offering

Opportunities

- Proliferation of connected devices will generate demand for market

- Recurring revenue opportunity for IoT managed services

- IoT managed services experience enable MSPs to enhance their service offerings portfolio

Challenges

- Constant security threats in the IoT environment

- MSPs are using legacy support process for service delivery

- Lack of long term successful partnership between MSPs and organizations

Increasing momentum of managed cloud services is expected to drive the global IoT managed services market

The IT industry is transitioning from traditional hosting to cloud hosting. This fuels the rise of managed cloud services. Many organizations are still unware and not able to exploit the full potential of cloud. Therefore, they opt for a third party managed cloud service provider for the same. This need is fueling the managed cloud services. Cloud service is a major trend in the outsourcing services market. Managed Anything as a Service (XaaS) is the major focus areas for MSPs, as they tend to offer their service offerings over cloud. Cloud and IoT are highly correlated, as the IoT components are not designed to have a self-storage element and therefore the data generated must be stored over cloud. Precisely, IoT managed services are adopting cloud platform to deliver their managed IoT services to the organizations.

The following are the major objectives of the study

- To define, describe, and forecast the market on the basis of types and verticals.

- To provide detailed information regarding the major factors influencing the growth of the market (drivers, restraints, opportunities, and industry specific challenges).

- To strategically analyze sub-segments with respect to individual growth trends, future prospects, and contribution to the total market.

- To analyze opportunities in the market for stakeholders, provide company profiles of the key players in the market, to comprehensively analyze core competencies1, and to illustrate the competitive landscape of the market.

- To forecast the market size of the sub-segments with respect to regions, namely, North America, Europe, Asia-Pacific, the Middle East, and Latin America.

- To track and analyze competitive developments such as joint ventures, mergers & acquisitions, new product developments, and research & development in the market

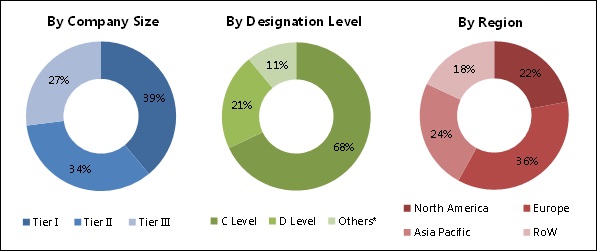

The research methodology used to estimate and forecast the IoT managed services market begins with capturing data on key vendor revenues and the market size of the individual segments through secondary sources such as industry associations such as IoT M2M Council, IoT Alliance and Consortium, and Industrial Internet Consortium (IIC), trade journals such as IEEE Internet of Things Journal, Journal of Internet Services and Applications, and International Journal of Internet of Things and Web Services, etc. The vendor offerings are also taken into consideration to determine market segmentation. The bottom-up procedure was employed to arrive at the overall market size of the market from the individual technology segment. After arriving at the overall market size, the total market was split into several segments and sub segments, which were then verified through primary research by conducting extensive interviews with key industry personnel, such as CEOs, VPs, directors, and executives. The data triangulation and market breakdown procedures were employed to complete the overall market engineering process and arrive at the exact statistics for all segments and sub segments. The breakdown of profiles of primary discussion participants is depicted in the below figure:

BREAKDOWN OF PRIMARY PROFILES

To know about the assumptions considered for the study, download the pdf brochure

The IoT managed services market ecosystem includes technology vendors such as Cisco Systems, Inc. (California, U.S.), Cognizant Technology Solutions Corporation (New Jersey, U.S.), HCL Technologies Limited ( Uttar Pradesh, India), Harman International Industries, Inc. (Connecticut, U.S.), Infosys Limited (Karnataka, India), Virtusa Corporation (Massachusetts, U.S.), Tieto Corporation (Helsinki, Finland), Tata Consultancy Services Limited (Maharashtra, India), Tech Mahindra Limited (Maharashtra, India), and Wipro Limited (Karnataka, India).

IoT Managed Services Market Developments

- In November 2016, Reliance Group, India's leading private sector business house partnered with Cisco Jasper for the launch of a new venture, UNLIMIT, exclusively dedicated to provide IoT services to enterprise customers throughout India.

- In November 2016, Tech Mahindra launched Connected Service Experience Solution. This will enable the manufacturing industry to integrate connected devices with end-to-end business processes. This solution offers organizations with increased efficiency and better customer experiences, by capitalizing on IIoT.

- In February 2016, Harman International partnered Interdigital, a leading mobile technology R&D company, to deliver a suite of oneM2M and 3GPP compliant end-to-end IoT solutions to the IoT managed services industry. This will provide customers a unique way to accelerate the definition & deployment of tailored, scalable, and interoperable IoT solutions aimed to maximize business results.

- Managed Service Providers (MSPs)

- Cloud Service Providers (CSPs)

- IT service providers

- Investors and venture capitalists

- Consultants/consultancies/advisory firms

- IoT technology vendors

- Academic and research institutes

- Network management service providers

- Support and maintenance service providers

- Infrastructure service providers

- Government associations

Scope of the IoT Managed Services Market Research Report

|

Report Metrics |

Details |

|

Market size available for years |

2016-2021 |

|

Estimated year considered |

2016 |

|

Forecast period |

2016-2021 |

|

Forecast units |

Value (USD) |

|

Segments covered |

Service Type, Vertical and Region |

|

Geographies covered |

North America, Europe, Asia Pacific, Middle East & Africa, Latin America |

|

Companies covered |

Cisco Systems, Inc. (California, U.S.), Cognizant Technology Solutions Corporation (New Jersey, U.S.), HCL Technologies Limited ( Uttar Pradesh, India), Harman International Industries, Inc. (Connecticut, U.S.), Infosys Limited (Karnataka, India), Virtusa Corporation (Massachusetts, U.S.), Tieto Corporation (Helsinki, Finland), Tata Consultancy Services Limited (Maharashtra, India), Tech Mahindra Limited (Maharashtra, India), and Wipro Limited (Karnataka, India) |

The research report categorizes the market to forecast the revenues and analyze the trends in each of the following sub segments:

IoT managed services market By Service Type

- Infrastructure management services

- Security management services

- Network management services

- Data management services

- Device management services

- Smart manufacturing

- Smart metal

- IT & telecom

- Smart transportation

- Smart energy & utilities

- Smart buildings

- Others (smart healthcare and smart education)

- North America

- Europe

- Asia-Pacific (APAC)

- Middle East and Africa (MEA)

- Latin America

With the given market data, MarketsandMarkets offers customization as per the companys specific requirements. The following customization options are available for the report:

IoT managed services market by Geographic Analysis

- Further country level breakdown of the North American market

- Further country level breakdown of the European market

- Further country level breakdown of the APAC market

- Further country level breakdown of the MEA market

- Further country level breakdown of the Latin American market

- Detailed analysis and profiling of additional market players

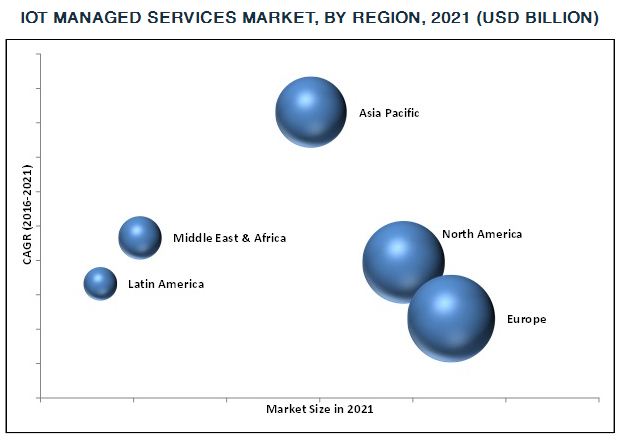

The IoT managed services market size is expected to grow from USD 21.85 billion in 2016 to USD 79.60 billion by 2021, at a Compound Annual Growth Rate (CAGR) of 29.5% during the period 20162021. The major driver for the increase in the demand for market is the growing momentum of managed cloud services, the as industry is shifting from traditional hosting to cloud hosting. Managed Service Providers (MSPs) offer the organizations the desired level of performance and effectiveness and it aids them to planning of the financial budget.

The scope of this report covers the market analysis by service type, vertical, and region. The device management services segment is expected to grow at the highest CAGR during the forecast period. Device management services help to achieve better data security, perform analyses to gain valuable insights from the granular data coming out from these services, and ensure a great customer experience.

Network management services is expected to have the largest market share in the IoT managed services market. Network management deals with the entire network chain of an organization. It is essential to optimize the network to make the best use of the available resources. Network management services assists in analyzing the amount of data transferring over a network and automatically routes it, to avoid congestion that can result in a network crash. Opting for a MSP that offers network management services in the IoT ecosystem can aid organizations in terms of reduced downtime, better network connectivity, safety, security, automatic device discovery, scalability, and seamless operation of the business process.

Smart transportation segment is expected to grow at the highest CAGR during the forecast period. Smart transportation is all about integrating advanced technologies with the existing transportation infrastructure, delivering real-time online information about the traffic flow, tracking of the assets, and passengers/commuters. IoT managed services help the transportation vendors to manage and monitor the complex IoT ecosystem. The increasing requirement for managing analytics, security, devices & sensors, data, and high volume networking, along with the rise in the overall operations and responsiveness, drives the smart transportation vertical in the market.

As per the geographic analysis, North America is expected to have the largest market share. North America is likely to benefit from its rapid digitization across industry verticals, increasing adoption of smart connected devices, and technological advancements, followed by robust network infrastructure and presence of major IoT managed services that offers specialized managed services. The need for better operational efficiency and business process at a low operating cost is expected to drive continuous growth in the IoT managed services market.

Smart Building

The IoT Managed Services Market give wide range of services to manage and monitor the smart building operations. The services included in the smart buildings vertical are Heating, Ventilation, and Air Conditioning (HVAC); lighting; shading; vertical transport; IP access control; smart security surveillance; intelligent infrastructure management; hybrid Wi-Fi; smartphone & VoIP access; network services; managed security services; device management services; data center management services; and energy management services. The benefits of employing IoT managed services are improved building performance, reduced energy, and reduced OPEX.

Smart Manufacturing

IoT managed services enable manufacturers to focus on its core business and process. These services complement technical skills that are required to maintain and update the IoT ecosystem of an organization. The IoT Managed Services offer various services that ranges from network management to infrastructure management. Moreover, the IoT managed service providers support and monitor services and also remotely manage the infrastructure, security, and data of the manufacturing industries.

Smart Transportation

Smart transportation has a complex ecosystem of IoT that includes sensors, data, network infrastructure, and security. There is a definite need of the IoT managed service providers to check on the entire ecosystems. These services ensure data security and maximum up-time for devices, equipment, sensors, networks, and bandwidth in the smart transportation vertical. Furthermore, IoT managed services vendors also provide the 24/7/365 monitoring, support, and maintenance services.

Critical questions the report answers:

- Where will all these developments take the industry in the mid to long term?

- What are the future opportunities available in the IoT managed services market?

A few of the restraining factors that affect the growth of the market include lack of the scalability & flexibility in MSP service offerings and the inability of MSPs to cope up with IoT complexities. The IoT managed services vendors profiled in the report include Cisco Systems, Inc. (California, U.S.), Cognizant Technology Solutions Corporation (New Jersey, U.S.), HCL Technologies Limited (Uttar Pradesh, India), Harman International Industries, Inc. (Connecticut, U.S.), Infosys Limited (Karnataka, India), Virtusa Corporation (Massachusetts, U.S.), Tieto Corporation (Helsinki, Finland), Tata Consultancy Services Limited (Maharashtra, India), Tech Mahindra Limited (Maharashtra, India), and Wipro Limited (Karnataka, India).

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 13)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Markets Covered

1.3.2 Years Considered for the Study

1.4 Currency

1.5 Limitations

1.6 Stakeholders

2 Research Methodology (Page No. - 17)

2.1 Secondary Data

2.1.1 Key Data Points Taken From Secondary Sources

2.2 Primary Data

2.2.1 Key Data From Primary Sources

2.2.1.1 Key Industry Insights

2.2.1.2 Breakdown of Primaries

2.3 IoT Managed Services Market Size Estimation

2.3.1 Bottom-Up Approach

2.3.2 Top-Down Approach

2.4 Market Breakdown and Data Triangulation

2.5 Assumptions

3 Executive Summary (Page No. - 25)

4 Premium Insights (Page No. - 29)

4.1 Attractive Market Opportunities in the IoT Managed Services Market

4.2 Market By Region, 2016

4.3 Market By Service Type, 20162021

4.4 Market By Vertical, 20162021

4.5 Lifecycle Analysis, By Region

5 Market Overview (Page No. - 32)

5.1 Introduction

5.2 Market Segmentation

5.2.1 By Service Type

5.2.2 By Vertical Type

5.2.3 By Region Type

5.3 Market Dynamics

5.3.1 Drivers

5.3.1.1 MSPs Enable Operational Effectiveness and High-Performance Work Systems in Organizations

5.3.1.2 Increasing Momentum of Managed Cloud Services

5.3.1.3 Declining Profits From Service Revenues Shifting the Focus to MSPs

5.3.1.4 Growing Inclination Toward Cost-Efficient Managed Services

5.3.2 Restraints

5.3.2.1 Inability of MSPs to Cope Up With IoT Complexities

5.3.2.2 MSPs in IoT Space Lack Scalability and Flexibility in Their Service Offerings

5.3.3 Opportunities

5.3.3.1 Proliferation of Connected Devices Will Generate Demand for IoT Managed Services

5.3.3.2 Recurring Revenue Opportunity for IoT Managed Services Market

5.3.3.3 IoT Managed Services Experience Enables MSPs to Enhance Their Service Offerings Portfolio

5.3.4 Challenges

5.3.4.1 Constant Security Threats in the IoT Environment

5.3.4.2 MSPs are Using Legacy Support Processes for Service Delivery

5.3.4.3 Lack of Long-Term Successful Partnerships Between MSPs and Organizations

6 Industry Trends (Page No. - 40)

6.1 Introduction

6.2 Value Chain Analysis

6.3 Strategic Benchmarking

7 IoT Managed Services Market Analysis, By Service Type (Page No. - 42)

7.1 Introduction

7.2 Infrastructure Management Services

7.3 Security Management Services

7.4 Network Management Services

7.5 Data Management Services

7.6 Device Management Services

8 IoT Managed Services Market Analysis, By Vertical (Page No. - 49)

8.1 Introduction

8.2 Smart Manufacturing

8.3 Smart Retail

8.4 IT and Telecom

8.5 Smart Transportation

8.6 Smart Energy and Utilities

8.7 Smart Buildings

8.8 Others

9 Geographic Analysis (Page No. - 57)

9.1 Introduction

9.2 North America

9.3 Europe

9.4 Asia-Pacific

9.5 Latin America

9.6 Middle East and Africa

10 Competitive Landscape (Page No. - 72)

10.1 Overview

10.2 Competitive Situation and Trends

10.3 Partnerships and Collaborations, 20142016

10.4 Mergers and Acquisitions, 20142016

10.5 Business Expansions, 2016

10.6 New Service Launches, 20152016

11 Company Profiles (Page No. - 77)

(Overview, Financials, Products & Services, Strategy, and Developments)*

11.1 Cisco Systems, Inc.

11.2 Cognizant Technology Solutions Corporation

11.3 Happiest Minds Technologies

11.4 Harman International Industries, Inc.

11.5 Hcl Technologies Limited

11.6 Infosys Limited

11.7 Tata Consultancy Services

11.8 Tech Mahindra Limited

11.9 Tieto Corporation

11.10 Virtusa Corporation

11.11 Wipro Limited

*Details on Overview, Financials, Product & Services, Strategy, and Developments Might Not Be Captured in Case of Unlisted Companies.

11.12 Key Innovators

11.12.1 Aricent Inc.

11.12.2 Futurism Technologies Pvt. Ltd.

11.12.3 Ilink Systems Inc.

11.12.4 Scalable Systems, Inc.

11.12.5 Trustwave Holdings, Inc.

12 Appendix (Page No. - 102)

12.1 Discussion Guide

12.2 Knowledge Store: MarketsandMarkets Subscription Portal

12.3 Introducing RT: Real-Time Market Intelligence

12.4 Available Customization

12.5 References

12.6 Related Reports

12.7 Author Details

List of Tables (36 Tables)

Table 1 IoT Managed Services Market and Growth Rate, 2016-2021 (USD Billion, Y-O-Y%)

Table 2 Market: Strategic Benchmarking

Table 3 Market Size, By Service Type, 20162021 (USD Million)

Table 4 Infrastructure Management Services: Market Size, By Region, 20162021 (USD Million)

Table 5 Security Management Services: Market Size, By Region, 20162021 (USD Million)

Table 6 Network Management Services: Market Size, By Region, 20162021 (USD Million)

Table 7 Data Management Services: Market Size, By Region, 20162021 (USD Million)

Table 8 Device Management Services: Market Size, By Region, 20162021 (USD Million)

Table 9 IoT Managed Services Market Size, By Vertical, 20162021 (USD Million)

Table 10 Smart Manufacturing: Market Size, By Region, 20162021 (USD Million)

Table 11 Smart Retail: Market Size, By Region, 20162021 (USD Million)

Table 12 IT and Telecom: Market Size, By Region, 20162021 (USD Million)

Table 13 Smart Transportation: Market Size, By Region, 20162021 (USD Million)

Table 14 Smart Energy and Utilities: Market Size, By Region, 20162021 (USD Million)

Table 15 Smart Buildings: Market Size, By Region, 20162021 (USD Million)

Table 16 Others: Market Size, By Region, 20162021 (USD Million)

Table 17 Market Size, By Region, 20162021 (USD Million)

Table 18 North America: IoT Managed Services Market Size, 20162021 (USD Million, Y-O-Y %)

Table 19 North America: Market Size, By Service Type, 20162021 (USD Million)

Table 20 North America: Market Size, By Vertical, 20162021 (USD Million)

Table 21 Europe: IoT Managed Services Market Size, 20162021 (USD Million, Y-0-Y %)

Table 22 Europe: Market Size, By Service Type, 20162021 (USD Million)

Table 23 Europe: Market Size, By Vertical, 20162021 (USD Million)

Table 24 Asia-Pacific: IoT Managed Services Market Size, 20162021 (USD Million, Y-O-Y %)

Table 25 Asia-Pacific: Market Size, By Service Type, 20162021 (USD Million)

Table 26 Asia-Pacific: Market Size, By Vertical, 20162021 (USD Million)

Table 27 Latin America: IoT Managed Services Market Size, 20162021 (USD Million, Y-O-Y %)

Table 28 Latin America: Market Size, By Service Type, 20162021 (USD Million)

Table 29 Latin America: Market Size, By Vertical, 20162021 (USD Million)

Table 30 Middle East and Africa: IoT Managed Services Market Size, 20162021 (USD Million, Y-O-Y %)

Table 31 Middle East and Africa: Market Size, By Service Type, 20162021 (USD Million)

Table 32 Middle East and Africa: Market Size, By Vertical, 20162021 (USD Million)

Table 33 Partnerships and Collaborations, 20142016

Table 34 Mergers and Acquisitions, 20142016

Table 35 Business Expansions, 2016

Table 36 New Service Launches, 20152016

List of Figures (36 Figures)

Figure 1 IoT Managed Services Market: Research Design

Figure 2 Breakdown of Primary Interviews: By Company Type, Designation, and Region

Figure 3 Market Size Estimation Methodology: Bottom-Up Approach

Figure 4 Market Size Estimation Methodology: Top-Down Approach

Figure 5 Data Triangulation Methodology

Figure 6 Market and Growth Rate, 20162021 (USD Billion, Y-O-Y %)

Figure 7 North America is Expected to Hold the Largest Market Share in 2016

Figure 8 IoT Managed Services Market: Segments Growing at the Highest CAGR During the Forecast Period

Figure 9 Emergence of IoT Technology Offers Attractive Market Opportunities

Figure 10 North America is Expected to Hold the Largest Market Share in 2016

Figure 11 Network Management Services Segment is Expected to Hold the Largest Market Share Among Service Types in 2016-2021

Figure 12 Smart Manufacturing is Expected to Lead the Market Share During the Forecast Period

Figure 13 IoT Managed Services Market Segmentation: By Service Type

Figure 14 Market Segmentation: By Vertical

Figure 15 Market Segmentation: By Region

Figure 16 Market : Drivers, Restraints, Opportunities, and Challenges

Figure 17 Market: Value Chain

Figure 18 Network Management Services Segment is Expected to Hold the Largest Market Size During the Forecast Period

Figure 19 Smart Manufacturing Vertical is Expected to Have the Largest Market Size During the Forecast Period

Figure 20 North America is the Leading Region in Terms of Market Size During the Forecast Period

Figure 21 Asia-Pacific: A Hotspot for the IoT Managed Services Market During the Forecast Period

Figure 22 North America Market Snapshot

Figure 23 Asia-Pacific Market Snapshot

Figure 24 Companies Have Widely Adopted Partnerships, Agreements & Collaboration as Growth Strategy

Figure 25 IoT Managed Services Market Evaluation Framework

Figure 26 Battle for Market Share: Partnerships and Collaborations is the Key Strategy

Figure 27 Cisco Systems, Inc.: Company Snapshot

Figure 28 Cognizant Technology Solutions Corporation: Company Snapshot

Figure 29 Harman International Industries, Inc.: Company Snapshot

Figure 30 HCL Technologies Limited: Company Snapshot

Figure 31 Infosys Limited: Company Snapshot

Figure 32 Tata Consultancy Services: Company Snapshot

Figure 33 Tech Mahindra: Company Snapshot

Figure 34 Tieto Corporation: Company Snapshot

Figure 35 Virtusa Corporation: Company Snapshot

Figure 36 Wipro Limited: Company Snapshot

Growth opportunities and latent adjacency in Internet of Things (IoT) Managed Services Market