IoT Data Management Market by Solution (Data Integration, Data Analytics and Visualization, Metadata Management, Data Security), Service, Deployment Type, Organization Size, Application Area, and Region - Global Forecast to 2022

[165 Pages Report] Internet of Things (IoT) data management market projected to grow from $23.8 Billion in 2016 to reach $66.44 Billion by 2022, at a Compound Annual Growth Rate (CAGR) of 19.3%.

Objectives of the Study:

The main objective of the report is to define, describe, and forecast the IoT data management market size on the basis of components (solutions and services), deployment types, organization size, application areas, and regions. The report provides detailed information on the major factors (drivers, restraints, opportunities, and challenges) influencing the growth of the market. The report attempts to forecast the market size of the 5 main regions, namely, North America, Europe, Asia Pacific (APAC), Middle East and Africa (MEA), and Latin America. The report strategically profiles the key market players and comprehensively analyzes their core competencies. It also tracks and analyzes the competitive developments, such as joint ventures, mergers and acquisitions, and new product developments, in the market.The research methodology used to estimate and forecast the market size began with collection and analysis of data on the key vendor revenues through secondary sources, including annual reports and press releases, investor presentations, technology journals, certified publications, articles from recognized authors, directories, and databases. IoT Data & AI Summit, IoT Business Summit, IoT Evolution Expo, IEEEs World Forum on IoT, and IoT M2M Council were also referred to. The vendor offerings were also been taken into consideration to determine the market segmentations.

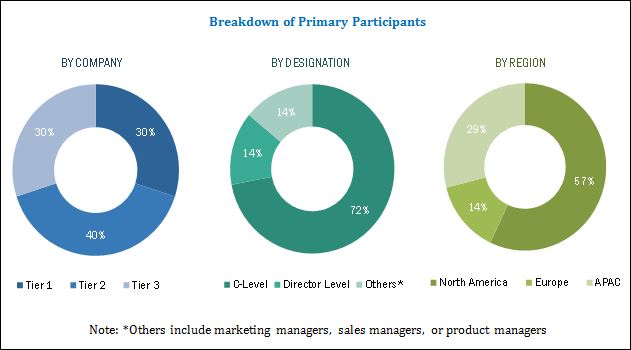

The bottom-up procedure was employed to arrive at the overall market size of the market from the revenue of the key players and their market shares. The IoT data management market spending across all regions along with the geographical split in various verticals was considered to arrive at the overall market size. After arriving at the overall market size, the total market was split into several segments and subsegments, which were then verified through primary research by conducting extensive interviews with key people, such as Chief Executive Officers (CEOs), Vice Presidents (VPs), directors, and executives. The data triangulation and market breakdown procedures were employed to complete the overall market engineering process and arrive at the exact statistics for all the segments and subsegments. The breakdown of the profiles of the primary participants is depicted in the below figure:

To know about the assumptions considered for the study, download the pdf brochure

The IoT data management market includes various vendors providing IoT data management solutions inclusive of data integration, data analytics and visualization, metadata management, data security, data migration, data quality, data governance, and data orchestration. Companies such as International Business Machines (IBM) Corporation (US), PTC Inc. (US), Teradata Corporation (US), Dell Technologies, Inc. (US), Cisco Systems, Inc. (US), SAS Institute Inc. (US), Hewlett Packard Enterprise (HPE) Company (US), Fujitsu Limited (Japan), Oracle Corporation (US), Google Inc. (US), and SAP SE (Germany) have adopted various growth strategies, including partnerships, agreements, and collaborations, to enhance their market presence. These Internet of Things (IoT) Data Management Solutions Vendors are rated and listed by us on the basis of product quality, reliability, and their business strategy. Please visit 360Quadrants to see the vendor listing of Internet of Things (IoT) Data Management Solutions.

Key Target Audience for IoT Data Management Market

The study answers several questions for the stakeholders, primarily, which market segments to focus on in the next 2 to 5 years for prioritizing efforts and investments.

Scope of the report

|

Report Metric |

Details |

|

Market size available for years |

20172022 |

|

Base year considered |

2016 |

|

Forecast period |

20172022 |

|

Forecast units |

Billion (USD) |

|

Segments covered |

Components, Deployment type, Organization size, application areas and regions. |

|

Geographies covered |

North America, Europe, APAC, Latin America, and MEA |

|

Companies covered |

IBM Corporation (US), PTC Inc. (US), Teradata Corporation (US), Dell Technologies, Inc. (US), Cisco Systems, Inc. (US), SAS Institute Inc. (US), Hewlett Packard Enterprise (HPE) Company (US), Fujitsu Limited (Japan), Oracle Corporation (US), Google Inc. (US), and SAP SE (Germany) |

The research report segments the IoT data management market into the following submarkets:

IoT Data Management Market By Component:

- Solutions

- Services

IoT Data Management Market By Solution

- Data integration

- Data analytics and visualization

- Metadata management

- Data security

- Data migration

- Others (data governance, data quality, and data orchestration)

IoT Data Management Market By Service:

- Managed services

- Consulting services

- Support and maintenance services

Market By Deployment Type:

- Public cloud

- Private cloud

- Hybrid cloud

IoT Data Management Market By Organization Size:

- Small and Medium-sized Enterprises (SMEs)

- Large enterprises

Market By Application Area:

- Smart energy and utilities

- Smart manufacturing

- Building and home automation

- Smart healthcare

- Smart retail

- Smart mobility and transportation

- Connected logistics

- Others (connected agriculture, media and entertainment, and smart education)

IoT Data Management Market By Region:

- North America

- Europe

- APAC

- MEA

- Latin America

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the companys specific needs. The following customization options are available for the IoT Data Management Market report:

Geographic Analysis

- Further breakdown of the North American market into the US and Canada

- Further breakdown of the European market into the UK, Germany, and France

Company Information

- Detailed analysis and profiling of additional market players

#

MarketsandMarkets forecasts the global IoT data management market size to grow from USD 27.54 Billion in 2017 to USD 66.44 Billion by 2022, at a Compound Annual Growth Rate (CAGR) of 19.3%.

The IoT data management market is segmented on the basis of components (solutions and services), deployment types, organization size, application areas, and regions. The solutions segment is segmented into data integration, data analytics and visualization, metadata management, data security, data migration, and others (data governance, data quality, and data orchestration).

The metadata management solution is expected to grow at the highest CAGR during the forecast period, as enterprises need to continuously manage the data generated by sensor types, functions, locations, manufacturers, and serial numbers. Metadata management also includes the searching of the interpreted data, attributes, types, owner information, and reading values. It is helpful for viewing device IDs, life cycle status, permissions, sensor readings, and forecasts.

The services segment is segmented into managed, consulting, and support and maintenance services. The deployment type segment is categorized into public cloud, private cloud, and hybrid cloud. The organization size segment is categorized into Small and Medium-sized Enterprises (SMEs) and large enterprises. The application area segment is categorized into smart energy and utilities, smart manufacturing, building and home automation, smart healthcare, smart retail, smart mobility and transportation, connected logistics, and others (connected agriculture, media and entertainment, and smart education).

The IoT data management market is gaining traction, due to widespread adoption of end-to-end data management platforms for capitalizing IoT data more efficiently and flexibly across organizations. The major factors driving the growth of the market include the modernization of data warehouse architecture, increasing adoption of data encryption for IoT device security, and rising need for data security and data traffic management. Opportunities such as the adoption of mature content models in enterprises, emerging unified metadata services, and efficient processes for increased Return on Investment (ROI) have boosted the adoption rate of IoT data management solutions.

The trending technologies, such as data analytics, blockchain, machine learning, and artificial intelligence, play a vital role in IoT data management. These technologies enable an enterprise to manage and share data with ease, remove single points of failure, and reduce costs. The emerging semantic interoperability of IoT data management solutions enables the interpretation and integration of large volumes of data formats using meta-tagged data.

North America is expected to have the largest market share and dominate the IoT data management market during the forecast period. The region is witnessing increasing adoption of smart connected devices and is adopting emerging trends, such as Bring Your Own Device (BYOD). North America has always topped the list of the most affected region in terms of data analytics, metadata management, data integration, and data security. The region has the largest number of IoT data management vendors. Moreover, the increased budgets and grants have invited various reputed players to make significant investments in this region. These are some of the important factors driving the growth of the market in North America. Furthermore, the advent of SMEs and startup culture in North America is growing at a faster pace as compared to the other regions.

Asia Pacific (APAC) has witnessed advanced and dynamic adoption of new technologies, and it has always been a lucrative market. The region is expected to grow at the highest CAGR during the forecast period in the IoT data management market, owing to the rapid development in IT infrastructures; adoption of new technologies, such as big data and analytics, Industrial Internet of Things (IIoT), remote asset management, and cloud; and increased investments in large-scale infrastructure projects by vendors in the APAC region.

Lack of industrial interoperability standards and deficiency of skills and expertise are some of the restraining factors for the market. However, the recent developments, new product launches, and acquisitions undertaken by the major market players are boosting the growth of the market.

The study measures and evaluates the offerings and key strategies of the major IoT Data Management Market players, including International Business Machines (IBM) Corporation, PTC Inc., Teradata Corporation, Dell Technologies, Inc., Cisco Systems, Inc., SAS Institute Inc., Hewlett Packard Enterprise (HPE) Company, Fujitsu Limited, Oracle Corporation, Google Inc., and SAP SE. These companies have been at the forefront in offering reliable IoT data management solutions to their commercial clients across the globe.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 15)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.4 Years Considered for the Study

1.5 Currency

1.6 Stakeholders

2 Research Methodology (Page No. - 18)

2.1 Research Data

2.1.1 Secondary Data

2.1.2 Primary Data

2.1.2.1 Breakdown of Primaries

2.1.2.2 Key Industry Insights

2.2 Market Size Estimation

2.3 Microquadrant Research Methodology

2.3.1 Microquadrant: Weightage Criteria

2.3.2 Quadrant Description

2.4 Research Assumptions

2.5 Limitations

3 Executive Summary (Page No. - 26)

4 Premium Insights (Page No. - 29)

4.1 Attractive Market Opportunities in the market

4.2 Market By Region (2017 vs 2022)

4.3 Market Investment Scenario

4.4 Market By Deployment Type, 20172022

4.5 Market Share of the Top 3 Application Areas and Regions, 2017

4.6 Lifecycle Analysis, By Region, 2017

5 IoT Data Management Market Overview and Trends (Page No. - 33)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Modernization of Data Warehouse Architecture

5.2.1.2 Rising Need for Data Security and Data Traffic Management

5.2.1.3 Increasing Adoption of Data Encryption for IoT Device Security

5.2.1.4 Lack of Skilled Personnel for Secure Implementation of IoT

5.2.2 Restraints

5.2.2.1 Lack of Industrial Interoperability Standards

5.2.3 Opportunities

5.2.3.1 Adoption of Content Maturity Model in Enterprises

5.2.3.2 Efficient Processes, Cost Savings, and Increased Return on Investments

5.2.3.3 Emerging Unified Metadata Services

5.2.4 Challenges

5.2.4.1 Need to Improvise Database Management Systems

5.2.4.2 Handling the Mass Data Deluge

5.3 Innovation Spotlight

5.4 IoT Data Management Use Cases

5.4.1 Smart Manufacturing

5.4.1.1 Cisco Systems, Inc.

5.4.1.2 Hewlett Packard Enterprise Company

5.4.2 Smart Energy and Utilities

5.4.2.1 Cisco Systems, Inc.

5.4.2.2 IBM Corporation

5.4.3 Smart Retail

5.4.3.1 Kaa IoT Technologies, LLC

5.4.3.2 Fujitsu Limited

5.4.4 Smart Healthcare

5.4.4.1 Fujitsu Limited

5.4.4.2 Microsoft Corporation

6 Market Analysis, By Component (Page No. - 41)

6.1 Introduction

6.2 Solutions

6.3 Services

7 IoT Data Management Market Analysis By Solution (Page No. - 45)

7.1 Introduction

7.2 Data Integration

7.3 Data Analytics and Visualization

7.4 Metadata Management

7.5 Data Security

7.6 Data Migration

7.7 Others

8 IoT Data Management Market Analysis, By Service (Page No. - 54)

8.1 Introduction

8.2 Managed Services

8.3 Consulting Services

8.4 Support and Maintenance Services

9 Market Analysis By Deployment Type (Page No. - 58)

9.1 Introduction

9.2 Public Cloud

9.3 Private Cloud

9.4 Hybrid Cloud

10 IoT Data Management Market Analysis By Organization Size (Page No. - 63)

10.1 Introduction

10.2 Small and Medium-Sized Enterprises

10.3 Large Enterprises

11 Market Analysis, By Application Area (Page No. - 67)

11.1 Introduction

11.2 Smart Energy and Utilities

11.3 Smart Manufacturing

11.4 Building and Home Automation

11.5 Smart Healthcare

11.6 Smart Retail

11.7 Smart Mobility and Transportation

11.8 Connected Logistics

11.9 Others

12 Geographic Analysis (Page No. - 76)

12.1 Introduction

12.2 North America

12.3 Europe

12.4 Asia Pacific

12.5 Middle East and Africa

12.6 Latin America

13 Competitive Landscape (Page No. - 99)

13.1 Microquadrant Overview

13.1.1 Visionary Leaders

13.1.2 Innovators

13.1.3 Dynamic Differentiators

13.1.4 Emerging Companies

13.2 Competitive Benchmarking

13.2.1 Strength of Product Portfolio Adopted By Major Players in the IoT Data Management Market

13.2.2 Business Strategy Excellence Adopted By Major Players in the Market

14 Company Profiles (Page No. - 103)

(Overview, Strength of Product Portfolio, Business Strategy Excellence, and Recent Developments)*

14.1 International Business Machines Corporation

14.2 PTC Inc.

14.3 Teradata Corporation

14.4 Dell Technologies, Inc.

14.5 Cisco Systems, Inc.

14.6 SAS Institute Inc.

14.7 Hewlett Packard Enterprise Company

14.8 Oracle Corporation

14.9 Fujitsu Limited

14.10 SAP SE

14.11 Google Inc.

14.12 Logmein, Inc.

*Details on Overview, Strength of Product Portfolio, Business Strategy Excellence, and Recent Developments Might Not Be Captured in Case of Unlisted Companies.

14.13 Key Innovators

14.13.1 Mulesoft, Inc.

14.13.2 Striim, Inc.

14.13.3 Zebra Technologies Corporation

14.13.4 Logfuze Inc.

14.13.5 Influxdata, Inc.

14.13.6 Trustwave Holdings, Inc.

15 Appendix (Page No. - 156)

15.1 Industry Experts

15.2 Discussion Guide

15.3 Knowledge Store: Marketsandmarkets Subscription Portal

15.4 Introducing RT: Real-Time Market Intelligence

15.5 Available Customizations

15.6 Related Reports

15.7 Author Details

List of Tables (60 Tables)

Table 1 IoT Data Management Market Size, By Component, 20152022 (USD Million)

Table 2 Market Size, By Solution, 20152022 (USD Million)

Table 3 Data Integration: IoT Data Mangement Market Size, By Region, 20152022 (USD Million)

Table 4 Data Analytics and Visualization: Market Size, By Region, 20152022 (USD Million)

Table 5 Metadata Management: Market Size, By Region, 20152022 (USD Million)

Table 6 Data Security: Market Size, By Region, 20152022 (USD Million)

Table 7 Data Migration: Market Size, By Region, 20152022 (USD Million)

Table 8 Others: Market Size, By Region, 20152022 (USD Million)

Table 9 IoT Data Management Market Size, By Service, 20152022 (USD Million)

Table 10 Managed Services: Market Size, By Region, 20152022 (USD Million)

Table 11 Consulting Services: Market Size, By Region, 20152022 (USD Million)

Table 12 Support and Maintenance Services: Market Size, By Region, 20152022 (USD Million)

Table 13 Market Size, By Deployment Type, 20152022 (USD Million)

Table 14 Public Cloud: Market Size, By Region, 20152022 (USD Million)

Table 15 Private Cloud: Market Size, By Region, 20152022 (USD Million)

Table 16 Hybrid Cloud: Market Size, By Region, 20152022 (USD Million)

Table 17 IoT Data Management Market Size, By Organization Size, 20152022 (USD Million)

Table 18 Small and Medium-Sized Enterprises: Market Size, By Region, 20152022 (USD Million)

Table 19 Large Enterprises: Market Size, By Region, 20152022 (USD Million)

Table 20 Market Size, By Application Area, 20152022 (USD Million)

Table 21 Smart Energy and Utilities: Market Size, By Region, 20152022 (USD Million)

Table 22 Smart Manufacturing: Market Size, By Region, 20152022 (USD Million)

Table 23 Building and Home Automation: Market Size, By Region, 20152022 (USD Million)

Table 24 Smart Healthcare: IoT Data Management Market Size, By Region, 20152022 (USD Million)

Table 25 Smart Retail: Market Size, By Region, 20152022 (USD Million)

Table 26 Smart Mobility and Transportation: Market Size, By Region, 20152022 (USD Million)

Table 27 Connected Logistics: Market Size, By Region, 20152022 (USD Million)

Table 28 Others: Market Size, By Region, 20152022 (USD Million)

Table 29 Market Size By Region, 20152022 (USD Million)

Table 30 North America: IoT Data Management Market Size, By Component, 20152022 (USD Million)

Table 31 North America: Market Size, By Solution, 20152022 (USD Million)

Table 32 North America: Market Size, By Service, 20152022 (USD Million)

Table 33 North America: Market Size, By Deployment Type, 20152022 (USD Million)

Table 34 North America: Market Size, By Organization Size, 20152022 (USD Million)

Table 35 North America: Market Size, By Application Area, 20152022 (USD Million)

Table 36 Europe: IoT Data Management Market Size, By Component, 20152022 (USD Million)

Table 37 Europe: Market Size, By Solution, 20152022 (USD Million)

Table 38 Europe: Market Size, By Service, 20152022 (USD Million)

Table 39 Europe: Market Size, By Deployment Type, 20152022 (USD Million)

Table 40 Europe: Market Size, By Organization Size, 20152022 (USD Million)

Table 41 Europe: Market Size, By Application Area, 20152022 (USD Million)

Table 42 Asia Pacific: IoT Data Management Market Size, By Component, 20152022 (USD Million)

Table 43 Asia Pacific: Market Size, By Solution, 20152022 (USD Million)

Table 44 Asia Pacific: Market Size, By Service, 20152022 (USD Million)

Table 45 Asia Pacific: Market Size, By Deployment Type, 20152022 (USD Million)

Table 46 Asia Pacific: Market Size, By Organization Size, 20152022 (USD Million)

Table 47 Asia Pacific: Market Size, By Application Area, 20152022 (USD Million)

Table 48 Middle East and Africa: Market Size, By Component, 20152022 (USD Million)

Table 49 Middle East and Africa: Market Size, By Solution, 20152022 (USD Million)

Table 50 Middle East and Africa: Market Size, By Service, 20152022 (USD Million)

Table 51 Middle East and Africa: Market Size, By Deployment Type, 20152022 (USD Million)

Table 52 Middle East and Africa: Market Size, By Organization Size, 20152022 (USD Million)

Table 53 Middle East and Africa: Market Size, By Application Area, 20152022 (USD Million)

Table 54 Latin America: IoT Data Management Market Size, By Component, 20152022 (USD Million)

Table 55 Latin America: Market Size, By Solution, 20152022 (USD Million)

Table 56 Latin America: Market Size, By Service, 20152022 (USD Million)

Table 57 Latin America: Market Size, By Deployment Type, 20152022 (USD Million)

Table 58 Latin America: Market Size, By Organization Size, 20152022 (USD Million)

Table 59 Latin America: Market Size, By Application Area, 20152022 (USD Million)

Table 60 Market Ranking for the Market, 2017

List of Figures (48 Figures)

Figure 1 IoT Data Management Market Segmentation

Figure 2 Market: Research Design

Figure 3 Breakdown of Primary Interviews: By Company, Designation, and Region

Figure 4 Data Triangulation

Figure 5 Market Size Estimation Methodology: Bottom-Up Approach

Figure 6 Market Size Estimation Methodology: Top-Down Approach

Figure 7 North America is Estimated to Hold the Largest Market Share in 2017

Figure 8 Segments Dominating the Global IoT Data Management Market

Figure 9 Large Enterprises Segment is Estimated to Hold A Major Market Share in 2017

Figure 10 Rising Need for Data Traffic Management and Growing Threat of Data Compromise are Driving the internet of things data management market

Figure 11 North America is Expected to Hold the Largest Market Size During the Forecast Period

Figure 12 Asia Pacific is Expected to Emerge as the Best Market for Investments in the Next 5 Years

Figure 13 Hybrid Deployment Type is Expected to Grow at the Highest CAGR During the Forecast Period

Figure 14 Smart Manufacturing and North America are Estimated to Have the Largest Market Shares in 2017

Figure 15 Asia Pacific is Expected to Grow at A Significant Pace During the Forecast Period (20172022)

Figure 16 IoT Data Management Market: Drivers, Restraints, Opportunities, and Challenges

Figure 17 Solutions Segment is Expected to Dominate the Market During the Forecast Period

Figure 18 North America is Expected to Dominate the Solutions Segment in the Market During the Forecast Period

Figure 19 North America is Expected to Have the Largest Market Size in the IoT Data Management Services Market During the Forecast Period

Figure 20 Metadata Management Segment is Expected to Grow at the Highest CAGR During the Forecast Period

Figure 21 North America is Expected to Dominate the Data Analytics and Visualization Segment During the Forecast Period

Figure 22 Asia Pacific is Expected to Grow at the Highest CAGR During the Forecast Period

Figure 23 Support and Maintenance Services Segment is Expected to Exhibit the Highest CAGR During the Forecast Period

Figure 24 Public Cloud is Expected to Hold the Largest Market Size During the Forecast Period

Figure 25 North America is Expected to Dominate the Public Cloud Segment in the IoT Data Management Market During the Forecast Period

Figure 26 Large Enterprises Segment is Expected to Have A Larger Market Size During the Forecast Period

Figure 27 Smart Manufacturing Segment is Expected to Have the Largest Market Size During the Forecast Period

Figure 28 North America is Expected to Have the Largest Market Size During the Forecast Period

Figure 29 Asia Pacific is Expected to Exhibit the Highest CAGR in the Market During the Forecast Period

Figure 30 North America: Market Snapshot

Figure 31 Metadata Management is Expected to Exhibit the Highest CAGR in the IoT Data Management Market During the Forecast Period

Figure 32 Metadata Management is Expected to Exhibit the Highest CAGR in the Market During the Forecast Period

Figure 33 Asia Pacific: Market Snapshot

Figure 34 Metadata Management is Expected to Exhibit the Highest CAGR in the Market During the Forecast Period

Figure 35 Metadata Management is Expected to Exhibit the Highest CAGR in the Market During the Forecast Period

Figure 36 Metadata Management is Expected to Exhibit the Highest CAGR in the Market During the Forecast Period

Figure 37 IoT Data Management Market (Global), Competitive Leadership Mapping, 2017

Figure 38 International Business Machines Corporation: Company Snapshot

Figure 39 PTC Inc.: Company Snapshot

Figure 40 Teradata Corporation: Company Snapshot

Figure 41 Cisco Systems, Inc.: Company Snapshot

Figure 42 SAS Institute Inc.: Company Snapshot

Figure 43 Hewlett Packard Enterprise Company: Company Snapshot

Figure 44 Oracle Corporation: Company Snapshot

Figure 45 Fujitsu Limited: Company Snapshot

Figure 46 SAP SE: Company Snapshot

Figure 47 Google Inc.: Company Snapshot

Figure 48 Logmein, Inc.: Company Snapshot

Growth opportunities and latent adjacency in IoT Data Management Market