IoT Device Management Market by Solution (Real-Time Streaming Analysis, Security Solutions, Data Management, Remote Monitoring, Network Bandwidth Management), Service, Application Area, Deployment Model, and Organization Size - Global Forecast to 2022

[157 Pages Report] The Internet of Things (IoT) device management market size is expected to grow from USD 693.4 Million in 2017 to USD 2,559.6 Million by 2022, at a Compound Annual Growth Rate (CAGR) of 29.8% from 2017 to 2022.

Objectives of the Study

The main objective of this report is to define, describe, and forecast the IoT device management market on the basis of solutions, services, organization sizes, and deployment models, along with applications, and regions. The report provides detailed information regarding the major factors influencing the growth of the market (drivers, restraints, opportunities, and industry-specific challenges). The report also attempts to forecast the market size with respect to 5 main regions, namely, North America, Europe, Asia Pacific (APAC), Middle East and Africa (MEA), and Latin America. It profiles key players and comprehensively analyzes their core competencies. This report also tracks and analyzes competitive developments, such as joint ventures, mergers and acquisitions, and new product developments in the market.

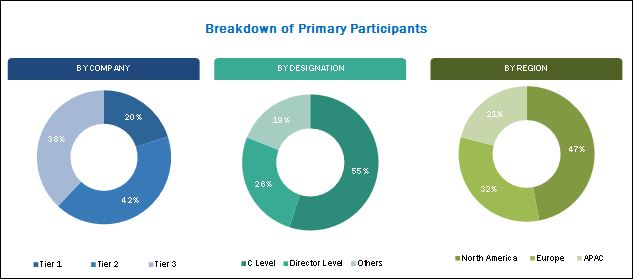

The research methodology used to estimate and forecast the IoT device management market begins with collection and analysis of data on key vendor revenues through secondary research, such as annual reports and press releases, investor presentations of companies, conferences and associations, such as Institute of Electrical and Electronic Engineers (IEEE): Conferences on Network And Device Management, EAI International Conference on Interoperability in IoT, technology journals, certified publications, and articles from recognized authors, directories, and databases. The vendor offerings have also been taken into consideration to determine the market segmentation. The bottom-up procedure was employed to arrive at the overall market size of the market from the revenue of key players (companies) and their shares in this market. The market spending across all regions, along with the geographical split in the various verticals, using various solutions and associated services was considered to arrive at the overall market size. After arriving at the overall market size, the total market was split into several segments and subsegments, which were then verified through primary research by conducting extensive interviews with key people, such as Chief Executive Officers (CEOs), Vice Presidents (VPs), directors, and executives. The data triangulation and market breakdown procedures were employed to complete the overall market engineering process and arrive at the exact statistics for all the segments and subsegments. The breakdown of profiles of primary is depicted in the below figure:

To know about the assumptions considered for the study, download the pdf brochure

The IoT device management ecosystem comprises vendors providing IoT device management solutions to their commercial clients across the globe. Companies, such as Microsoft Corporation (US), PTC Incorporation (US), Telit Communications PLC (UK), IBM Corporation (US), Oracle Corporation (US), Smith Micro Software, Inc. (US), Advantech Co. Ltd. (China), Aeris (US), and Zentri (US) have adopted new partnerships, agreements, and collaborations as their key strategies to enhance their market reach. This strategy accounted for the largest share of the total strategies adopted by the market players. These IoT Device Management Solutions Vendors are rated and listed by us on the basis of product quality, reliability, and their business strategy.

Key Target Audience For IoT Device Management Market

- IoT device management solution vendors

- Third-party system integrators

- IoT device management professionals and consultants

- Managed service providers and middleware companies

- Machine-to-Machine (M2M), IoT, and telecommunication companies

- Consultancy firms/advisory firms

- Regulatory agencies

- Investors and venture capitalists

Study answers several questions for the stakeholders, primarily which market segments to focus in next two to five years for prioritizing the efforts and investments.

Scope of the Report

The research report segments the market into the following submarkets:

IoT Device Management Market By Component

- Solution

- Service

By Solution

- Real-Time streaming analytics

- Security solution

- Data management

- Remote monitoring

- Network bandwidth management

By Service

- Professional services

- Managed services

By Organization Size

- Large Enterprises

- Small and Medium-Sized Enterprises (SMEs)

By Deployment

- Public cloud

- Private cloud

- Hybrid cloud

By Application Area

- Smart retail

- Connected health

- Connected logistics

- Smart utilities

- Smart manufacturing

- Others

By Region

- North America

- Europe

- APAC

- MEA

- Latin America

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the companys specific needs. The following customization options are available for the report:

Geographic Analysis

- Further breakdown of the North American market into the US and Canada

- Further breakdown of the European market into the UK, Germany, and France

Company Information

- Detailed analysis and profiling of additional market players

MarketsandMarkets forecasts the IoT device management market size to grow from USD 693.4 Million in 2017 to USD 2,559.6 Million by 2022, at a Compound Annual Growth Rate (CAGR) of 29.8%. The growing proliferation of connected devices, advent of sensors, and need for a convergent IoT device management platform are some of the driving factors for the growth of Internet of Things (IoT) device management market.

The IoT device management market is segmented by solution, service, organization size, deployment model, application area, and region. The service segment is expected to grow at a higher CAGR during the forecast period, because services help organizations to easily deploy the software on cloud. The services segment is further categorized into professional services and managed services. Furthermore, the professional services segment is classified into consulting service, support and maintenance, and integration services. The integration service segment is growing at a rapid pace as compared to the other professional service segments, owing to the lack of standardization and increase in diverse protocols, and connectivity technologies and devices.

The security solution is the fastest growing in the IoT device management market, as security concerns are increasing among clients who are deploying IoT solutions. As numerus devices are connected to each other in an IoT system, the security of data becomes complex due to the non-standardization and non-compatibility of devices. Additionally, it is easier for hackers/attackers to perform malicious activities due to such varied protocols, applications, and devices. Thus, IoT solution vendors are investing large capitals in Research and Development (R&D) of security solutions, as security is also one of the major challenges faced by organizations while deploying IoT solutions.

The hybrid cloud deployment model is expected to grow at the highest CAGR during the forecast period. It helps reduce the overall cost, while providing highly flexible and scalable access to the clients. The vendors are providing hybrid cloud-based deployment model to reduce the infrastructure cost for the clients. Security remains a critical issue that restricts its adoption; however, this issue is gradually being eradicated through rigorous security tests of highest standards by third parties.

The Small and Medium-Sized Enterprises (SMEs) segment is expected to grow at the highest CAGR in the IoT device management market during the forecast period. Organizations with an employee range between 100 and 1,000 are categorized under SMEs. SMEs face some specific challenges, such as requirement of domain-specific technical personnel and skilled workforce, budget constraint, and limited economies of scale. The increasing competition has prompted SMEs to invest in this disruptive technology and adopt go-to-market strategies to make efficient decisions for the business growth.

The application area segment is categorized into smart manufacturing, connected logistics, smart utilities, connected health, smart retail, and other segments. The IoT device management solutions are widely used in production, procurement, and storage of goods/materials, owing to which, the smart manufacturing application area is expected to dominate the IoT device management market.

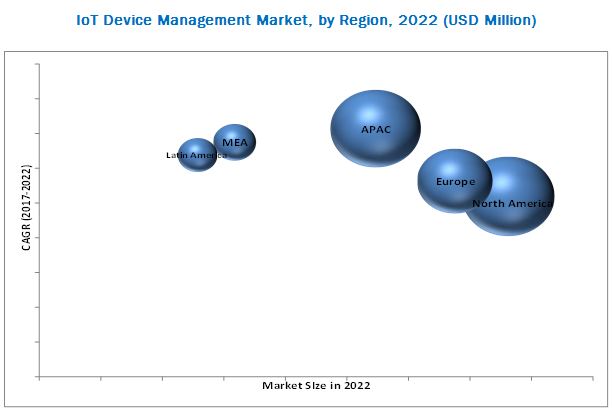

North America is expected to hold the largest market share and Asia Pacific (APAC) is growing at the highest CAGR in the market, however Middle East and Africa (MEA) and Latin America are still in their initial phase of introduction. The lack of Information Technology (IT) infrastructure and finance are some of the major factors restraining the growth of IoT device management in these regions.

North America is estimated to hold the largest market share and expected to dominate the IoT device management market from 2017 to 2022. This region has the major dominance with sustainable and well-established economies, empowering the region to strongly invest in Research and Development (R&D) activities, thereby contributing to the development of new technologies in IoT security and analytics. Further, the governments support and heavy investments by various well-established organizations are driving the growth of the market in the North American region.

APAC has witnessed the highest CAGR in the IoT device management market, owing to the dynamic adoption of smart cities and the increasing investment by government toward IoT initiatives. Countries, such as Japan, China, Singapore, Australia, and India are gaining traction and taking various initiatives, in terms of R&D and supporting IoT deployments in utilities, and manufacturing and retail.

Despite the rapid adoption of IoT device management in various application areas, the continuous exposure to security issues and lack of standardization are some of the challenging factors for the growth of this market.

The IoT device management market is rapidly gaining traction, which is evident from the recent developments, new product launches, and acquisitions by the major market players, such as IBM Corporation, Microsoft Corporation, PTC Inc., Oracle Corporation, and Cumulocity GmBH. The market study also measures and evaluates the offerings of key vendors in the market, along with vendors who are offering highly innovative offerings, such as Xively, Particle, Einfochips, and Wind River Systems.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 14)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Size

1.4 Years Considered for the Study

1.5 Currency

1.6 Stakeholders

2 Research Methodology (Page No. - 17)

2.1 Research Data

2.1.1 Secondary Data

2.1.2 Primary Data

2.1.2.1 Breakdown of Primaries

2.1.2.2 Key Industry Insights

2.2 Market Size Estimation

2.3 Research Assumptions

2.4 Limitations

3 Executive Summary (Page No. - 23)

4 Premium Insights (Page No. - 26)

4.1 Attractive Growth Opportunities in IoT Device Management Market

4.2 IoT Device Management: Market Share of Top Three Solutions and Regions, 2017

4.3 Lifecycle Analysis, By Region 2017

4.4 Market Investment Scenario

4.5 Market Deployment Models, 20172022

5 Market Overview and Industrial Trends (Page No. - 30)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Proliferation of Intelligent Connected Devices

5.2.1.2 Critical Need for Converged Device Management Platform

5.2.1.3 Advent of Intelligent Sensors and Adoption of Lwm2m

5.2.1.4 Adoption of Device and Vendor Agnostic Platforms

5.2.2 Restraints

5.2.2.1 Absence of Uniform IoT Standards for Interoperability

5.2.3 Opportunities

5.2.3.1 Rising Demand for Cloud-Based Device Management Platforms

5.2.3.2 Increasing Adoption of BYOD and CYOD Among Enterprises

5.2.4 Challenges

5.2.4.1 Real-Time Complexity, Dynamic Environment, and Lack of Compatibility and Connectivity

5.2.4.2 Data Security and Privacy Concerns

5.3 IoT Device Management: Features and Functionalities

5.4 Strategic Benchmarking

6 IoT Device Management Market Analysis By Component (Page No. - 39)

6.1 Introduction

7 Market Analysis, By Solution (Page No. - 41)

7.1 Introduction

7.2 Real-Time Streaming Analytics

7.3 Security Solution

7.4 Data Management

7.5 Remote Monitoring

7.6 Network Bandwidth Management

8 IoT Device Management Market Analysis By Service (Page No. - 48)

8.1 Introduction

8.2 Professional Services

8.2.1 Integration

8.2.2 Support and Maintenance

8.2.3 Consulting

8.3 Managed Services

9 Market Analysis, By Organization Size (Page No. - 55)

9.1 Introduction

9.2 Large Enterprises

9.3 Small and Medium-Sized Enterprises (SMES)

10 IoT Device Management Market Analysis By Deployment Model (Page No. - 59)

10.1 Introduction

10.2 Public Cloud

10.3 Private Cloud

10.4 Hybrid Cloud

11 Market Analysis, By Application Area (Page No. - 64)

11.1 Introduction

11.2 Smart Retail

11.3 Connected Health

11.4 Connected Logistics

11.5 Smart Utilities

11.6 Smart Manufacturing

11.7 Others

12 Geographic Analysis (Page No. - 71)

12.1 Introduction

12.2 North America

12.3 Europe

12.4 Asia Pacific (APAC)

12.5 Middle East and Africa (MEA)

12.6 Latin America

13 Vendor Dive Analysis (Page No. - 93)

13.1 Introduction

13.1.1 Vanguards

13.1.2 Innovators

13.1.3 Dynamic

13.1.4 Emerging

13.2 Competitive Benchmarking

13.2.1 Product Offerings

13.2.2 Business Strategies

14 Company Profiles (Page No. - 97)

14.1 Advantech Co., Ltd.

(Overview, Company Scorecard, Product Offerings, Business Strategies, and Recent Developments)

14.2 Aeris

14.3 Amplia Soluciones S.L.

14.4 Cumulocity GmbH

14.5 Enhanced Telecommunications Inc.

14.6 International Business Machines Corporation

14.7 Microsoft Corporation

14.8 Oracle Corporation

14.9 PTC Incorporation

14.10 Smith Micro Software, Inc.

14.11 Telit Communications PLC

14.12 Wind River

14.13 Xively

14.14 Zentri

*Details on Overview, Company Scorecard, Product Offerings, Business Strategies, and Recent Developments Might Not Be Captured in Case of Unlisted Companies.

15 Appendix (Page No. - 149)

15.1 Industry Experts

15.2 Discussion Guide

15.3 Knowledge Store: MarketsandMarkets Subscription Portal

15.4 Introducing RT: Real-Time Market Intelligence

15.5 Available Customizations

15.6 Related Reports

15.7 Author Details

List of Tables (69 Tables)

Table 1 IoT Device Management Market Size, By Component, 20152022 (USD Million)

Table 2 Market Size By Solution, 20152022 (USD Million)

Table 3 IoT Device Management Solution Market Size, By Region, 20152022 (USD Million)

Table 4 Real-Time Streaming Analytics: IoT Device Management Solution Market Size, By Region, 20152022 (USD Million)

Table 5 Security : IoT Device Management Solution Market Size, By Region, 20152022 (USD Million)

Table 6 Data Management: IoT Device Management Solution Market Size, By Region, 20152022 (USD Million)

Table 7 Remote Monitoring: IoT Device Management Solution Market Size, By Region, 20152022 (USD Million)

Table 8 Network Bandwidth Management: IoT Device Management Solution Market Size, By Region, 20152022 (USD Million)

Table 9 IoT Device Management Market Size, By Service, 20152022 (USD Million)

Table 10 Global IoT Device Management Services Market Size, By Region, 20152022 (USD Million)

Table 11 Professional Services: Market Size, 20152022 (USD Million)

Table 12 Professional Services: Market Size, By Region, 20152022 (USD Million)

Table 13 Integration: IoT Device Management Professional Services Market Size, By Region, 20152022 (USD Million)

Table 14 Support and Maintenance: IoT Device Management Professional Services Market Size, By Region, 20152022 (USD Million)

Table 15 Consulting: IoT Device Management Professional Services Market Size, By Region, 20152022 (USD Million)

Table 16 Managed Services: Market Size, By Region, 20152022 (USD Million)

Table 17 IoT Device Management Market Size, By Organization Size, 20152022 (USD Million)

Table 18 Organization Size: Market Size, By Region, 20152022 (USD Million)

Table 19 Large Enterprises: Market Size, By Region, 20152022 (USD Million)

Table 20 SMES: Market Size, By Region 20152022 (USD Million)

Table 21 Market Size By Deployment Model, 20152022 (USD Million)

Table 22 Deployment Model: Market Size, By Region, 20152022 (USD Million)

Table 23 Public Cloud Deployment: Market Size, By Region, 20152022 (USD Million)

Table 24 Private Cloud Deployment: Market Size, By Region, 20152022 (USD Million)

Table 25 Hybrid Cloud Deployment: Market Size, By Region, 20152022 (USD Million)

Table 26 IoT Device Management Market Size By Application Area, 20152022 (USD Million)

Table 27 Application Area: Market Size, By Region, 20152022 (USD Million)

Table 28 Smart Retail Application: Market Size, By Region, 20152022 (USD Million)

Table 29 Connected Health: Market Size, By Region, 20152022 (USD Million)

Table 30 Connected Logistics: Market Size, By Region, 20152022 (USD Million)

Table 31 Smart Utilities: Market Size, By Region, 20152022 (USD Million)

Table 32 Smart Manufacturing: Market Size, By Region, 20152022 (USD Million)

Table 33 Others: Market Size, By Region, 20152022 (USD Million)

Table 34 IoT Device Management Market Size, By Region, 20152022 (USD Million)

Table 35 North America: Market Size, By Component, 20152022 (USD Million)

Table 36 North America: Market Size, By Solution, 20152022 (USD Million)

Table 37 North America: Market Size, By Service, 20152022 (USD Million)

Table 38 North America: Market Size, By Professional Services, 20152022 (USD Million)

Table 39 North America: Market Size, By Organization Size, 20152022 (USD Million)

Table 40 North America: Market Size, By Deployment Model, 20152022 (USD Million)

Table 41 North America: Market Size, By Application Area, 20152022 (USD Million)

Table 42 Europe: IoT Device Management Market Size By Component, 20152022 (USD Million)

Table 43 Europe: Market Size, By Solution, 20152022 (USD Million)

Table 44 Europe: Market Size, By Service, 20152022 (USD Million)

Table 45 Europe: Market Size, By Professional Services, 20152022 (USD Million)

Table 46 Europe: Market Size, By Organization Size, 20152022 (USD Million)

Table 47 Europe: Market Size, By Deployment Model, 20152022 (USD Million)

Table 48 Europe: Market Size, By Application Area, 20152022 (USD Million)

Table 49 APAC: IoT Device Management Market Size, By Component, 20152022 (USD Million)

Table 50 APAC: Market Size, By Solution, 20152022 (USD Million)

Table 51 APAC: Market Size, By Service, 20152022 (USD Million)

Table 52 APAC: Market Size, By Professional Services, 20152022 (USD Million)

Table 53 APAC: Market Size, By Organization Size, 20152022 (USD Million)

Table 54 APAC: Market Size, By Deployment Model, 20152022 (USD Million)

Table 55 APAC: Market Size, By Application Area, 20152022 (USD Million)

Table 56 MEA: IoT Device Management Market Size By Component, 20152022 (USD Million)

Table 57 MEA: Market Size, By Solution, 20152022 (USD Million)

Table 58 MEA: Market Size, By Service, 20152022 (USD Million)

Table 59 MEA: Market Size, By Professional Services, 20152022 (USD Million)

Table 60 MEA: Market Size, By Organization Size, 20152022 (USD Million)

Table 61 MEA: Market Size, By Deployment Model, 20152022 (USD Million)

Table 62 MEA: Market Size, By Application Area, 20152022 (USD Million)

Table 63 Latin America: IoT Device Management Market Size, By Component, 20152022 (USD Million)

Table 64 Latin America: Market Size, By Solution, 20152022 (USD Million)

Table 65 Latin America: Market Size, By Service, 20152022 (USD Million)

Table 66 Latin America: Market Size, By Professional Services, 20152022 (USD Million)

Table 67 Latin America: Market Size, By Organization Size, 20152022 (USD Million)

Table 68 Latin America: Market Size, By Deployment Model, 20152022 (USD Million)

Table 69 Latin America: Market Size, By Application Area, 20152022 (USD Million)

List of Figures (67 Figures)

Figure 1 IoT Device Management Market Segmentation

Figure 2 Market: Research Design

Figure 3 Breakdown of Primary Interviews: By Company, Designation, and Region

Figure 4 Data Triangulation

Figure 5 Market Size Estimation Methodology: Bottom-Up Approach

Figure 6 Market Size Estimation Methodology: Top-Down Approach

Figure 7 Market Assumptions

Figure 8 North America to Hold Largest Share of Global IoT Device Management Market in 2017

Figure 9 Fastest- Growing Segments of Market in 2017

Figure 10 Professional Services to Hold Major Market Share in 2017

Figure 11 Proliferation of Connected Devices and Advent of Intelligent Sensors to Drive Market Growth During Forecast Period

Figure 12 Data Management Solution to Hold Largest Market Share in 2017

Figure 13 Regional Lifecycle Analysis (2017): APAC to Grow at Significant Pace During Forecast Period

Figure 14 Market Investment Scenario: APAC to Emerge as the Worlds Best Market for Investments Over Next Five Years

Figure 15 Hybrid Cloud to Record Highest CAGR During Forecast Period (USD Million)

Figure 16 IoT Device Management Market: Drivers, Restraints, Opportunities, and Challenges

Figure 17 IoT Device Management Features

Figure 18 Provisioning and Authentication in Connected Healthcare Architecture

Figure 19 IoT Device Monitoring

Figure 20 IoT Device Management Market: Strategic Benchmarking

Figure 21 Services Segment to Record Higher CAGR During Forecast Period

Figure 22 Data Management to Dominate IoT Device Management Solutions Market During Forecast Period (USD Million)

Figure 23 Professional Services to Dominate IoT Device Management Services Market During Forecast Period (USD Million)

Figure 24 Integration Services to Record Highest CAGR During Forecast Period (USD Million)

Figure 25 Large Enterprises Segment to Dominate Market During Forecast Period (USD Million)

Figure 26 Hybrid Cloud Deployment Model to Record Highest CAGR During Forecast Period (USD Million)

Figure 27 Smart Manufacturing Application to Hold Largest Market Share During Forecast Period (USD Million)

Figure 28 APAC Region to Record Highest CAGR During Forecast Period (USD Million)

Figure 29 Global Market Snapshot: APAC to Remain an Attractive Destination During 20172022

Figure 30 North America: Market Snapshot

Figure 31 APAC: IoT Device Management Market Snapshot

Figure 32 Dive Chart

Figure 33 Advantech Co., Ltd.: Company Snapshot

Figure 34 Advantech Co., Ltd.: Product Offering Scorecard

Figure 35 Advantech Co., Ltd.: Business Strategy Scorecard

Figure 36 Aeris: Product Offering Scorecard

Figure 37 Aeris: Business Strategy Scorecard

Figure 38 Amplia Soluciones S.L.: Product Offering Scorecard

Figure 39 Amplia Soluciones S.L.: Business Strategy Scorecard

Figure 40 Cumulocity GmbH: Product Offering Scorecard

Figure 41 Cumulocity GmbH: Business Strategy Scorecard

Figure 42 Enhanced Telecommunications Inc.: Product Offering Scorecard

Figure 43 Enhanced Telecommunications Inc.: Business Strategy Scorecard

Figure 44 International Business Machines Corporation: Company Snapshot

Figure 45 International Business Machines Corporation: Product Offering

Figure 46 International Business Machines Corporation: Business Strategy

Figure 47 Microsoft Corporation: Company Snapshot

Figure 48 Microsoft Corporation: Product Offering Scorecard

Figure 49 Microsoft Corporation: Business Strategy Scorecard

Figure 50 Oracle Corporation: Company Snapshot

Figure 51 Oracle Corporation: Product Offering Scorecard

Figure 52 Oracle Corporation: Business Strategy Scorecard

Figure 53 PTC Incorporation: Company Snapshot

Figure 54 PTC Inc.: Product Offering Scorecard

Figure 55 PTC Inc.: Business Strategy Scorecard

Figure 56 Smith Micro Software, Inc.: Company Snapshot

Figure 57 Smith Micro Software, Inc.: Product Offering Scorecard

Figure 58 Smith Micro Software, Inc.: Business Strategy Scorecard

Figure 59 Telit Communications PLC: Company Snapshot

Figure 60 Telit Communications PLC: Product Offering Scorecard

Figure 61 Telit Communications PLC: Business Strategy Scorecard

Figure 62 Wind River: Product Offering Scorecard

Figure 63 Wind River: Business Strategy Scorecard

Figure 64 Xively: Product Offering Scorecard

Figure 65 Xively: Business Strategy Scorecard

Figure 66 Zentri: Product Offering Scorecard

Figure 67 Zentri: Business Strategy Scorecard

Growth opportunities and latent adjacency in IoT Device Management Market