AC Drives Market by Voltage (Low and Medium), Power Rating (Low, Medium, and High Power), Application (Pumps, Fans, Compressors, Conveyors, Extruders), End-Use Industry and Region - Global Trends & Forecast to 2021

[161 Pages Report] The AC drives market was valued at USD 14.68 Billion in 2015, and is expected to grow at a CAGR of 7.0% from 2016 to 2021. Increasing urbanization & industrialization, rising need for energy efficiency, and regulations on energy efficiency are major factors driving the AC drives market.

The years considered for the study are as follows:

- Base Year 2015

- Estimated Year 2016

- Projected Year 2021

- Forecast Period 2016 to 2021

2015 has been considered as the base year for company profiles. Whenever information was unavailable for the base year, the prior year has been considered.

Objectives of the Study

- To define and segment the global AC drives market

- To estimate the market size, in terms of value, of the global AC drives market

- To analyse the market with respect to end-use industry, application, voltage, power rating, and region

- To provide a detailed information on major factors influencing the growth of the market (drivers, restraints, opportunities, and industry-specific challenges)

- To analyse the major stakeholders of the global AC drives market and provide details of the competitive landscape for key market leaders

- To study industrial trends and forecast the North American, European, Asia-Pacific, South American, the Middle East, and African markets

- To track and analyse competitive developments such as contract agreements, mergers and acquisitions, new product developments, and Research and Development (R&D) in the AC drives market

Research Methodology

This research study involved the use of extensive secondary sources, directories, and databases such as Hoovers, Bloomberg Businessweek, Factiva, and OneSource to identify and collect information useful for a technical, market-oriented, and commercial study of the global AC drives market. Primary sources are mainly industry experts from core and related industries, preferred suppliers, manufacturers, distributors, service providers, technology developers, standard and certification organizations of companies, and organizations related to all the segments of this industrys value chain. The points given below explain the research methodology.

- Study of annual revenue and market developments of major players providing AC drives

- Analysis of major applications of and demand for AC drives from end-use industries

- Assessment of future trends and industrial growth of end-use industries

- Assessment of AC drives market with respect to the voltage used for different applications

- Study of market trends in various regions/countries supported by application of AC drives in the power electronics, alternative energy, industrial, transportation, telecom and other industries

- Study of contracts and developments related to AC drives, for key players, across different regions

- Finalization of overall market sizes by triangulating the supply-side data, which includes product developments, supply chain, and annual revenues of companies manufacturing AC drives across the globe

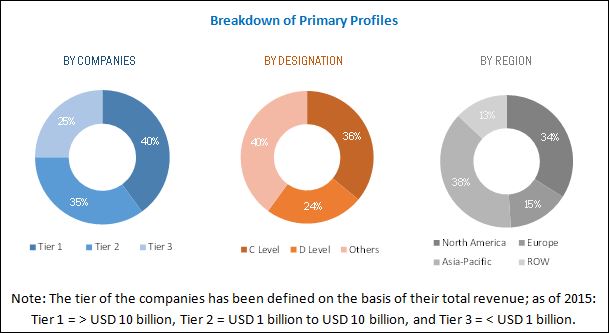

After arriving at the overall market size, the total market has been split into several segments and subsegments. The figure given below shows the breakdown of primaries on the basis of company type, designation, and region, conducted during the research study.

To know about the assumptions considered for the study, download the pdf brochure

Market Ecosystem:

The ecosystem of the global AC drives market starts with suppliers of basic components such as transistors, inverters, and DC circuit & rectifier units. The manufactured parts are then assembled by the OEM (original equipment manufacturer) to form an AC drive set, which is then tested. This stage is followed by the distribution stage, following which the product is provided to the end-users. Distribution is the next stage of the supply chain. The top players of the industry market their products through self-operated sales offices located near target markets, while regional players rely on distribution partnerships to access diverse markets. Some of the major players in AC drives market are ABB Ltd. (Switzerland), Siemens AG (Germany), Danfoss Group (Denmark), Schneider Electric SE (France), Rockwell Automation, Inc. (U.S.), Mitsubishi Electric Co. (Japan), and Yaskawa Electric Corporation (Japan) , among others.

Target Audience:

The reports target audience includes:

- AC drives manufacturers, dealers, and suppliers

- AC drives equipment manufacturing companies

- Government and research organizations

- Environmental and industrial associations

- Banks, venture capitalists, financial institutions, and other investors

- Market research and consulting firms

Scope of the Report:

- By Voltage

- Low Voltage

- Medium Voltage

- By Application

- Pumps

- Fans

- Compressor

- Conveyors

- Extruders

- Other application

- By EndUse Industry

- Oil & Gas

- Water & wastewater

- Power generation

- Building Automation

- Food & Beverage

- Metals & Mining

- Chemicals & Petrochemicals

- Other industries

- By Power Rating

- Low Power Drives (< 40 kW)

- Medium Power Drives (41 200 kW)

- High Power Drives (> 200 kW)

- By Region

- North America

- Europe

- Asia-Pacific

- South America

- Middle East & Africa

Available Customizations:

With the given market data, MarketsandMarkets offers customizations as per the clients specific needs. The following customization options are available for this report:

Regional Analysis

Further breakdown of region/country-specific analysis

Company Information

Detailed analysis and profiling of additional market players (Up to five)

The global AC drives market is projected to grow at a CAGR of 7.0% from 2016 to 2021, to reach a market size of USD 22.07 Billion by 2021. This growth is attributed to the increasing urbanization & industrialization, rising need for energy efficiency, and regulations on energy efficiency.

The report segments the AC drives market based on end-user industries into oil & gas, water & wastewater, power generation, building automation, food & beverage, metals & mining, chemicals & petrochemicals, and other industries. Oil & gas segment is the largest end-user of AC drives as it offers good speed controls & high energy savings. Based on voltage, the AC drives market has been segmented in low voltage and medium voltage AC drives. The low voltage AC drives segment is expected to dominate the AC drives market during the forecast period. The AC drives market has also been segmented based on power rating into three segments: low (below 40 kW), medium (41 200 kW), and high (above 200 kW). Demand from building automation, food & beverage, oil & gas, construction, and pulp & paper industries will drive the low power AC drives market during the forecast period. The report segments the AC drives market based on applications into pump, fan, compressors, conveyors, extruders, and others. Increased demand for HVAC applications offered by pumps is expected to dominate the AC drives market.

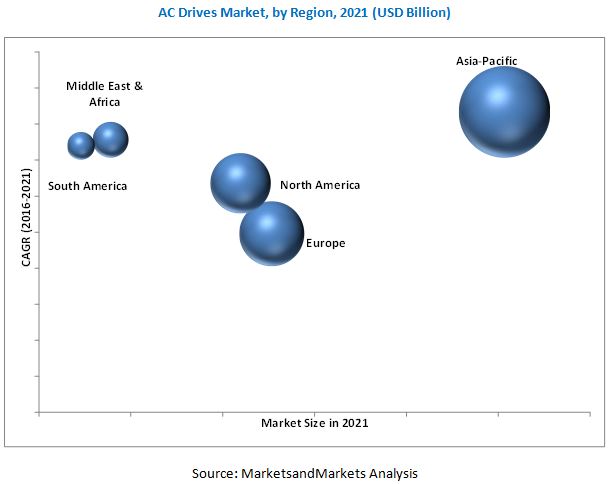

In this report, the AC drives market has been analysed with respect to five regions, namely, North America, Europe, Asia-Pacific, South America, and the Middle East & Africa. Asia-Pacific is expected to dominate the global AC drives market during the forecast period. Asia-Pacific is also projected to grow at the fastest CAGR from 2016 to 2021, owing to rising need for energy efficiency and industrialization in the region.

The decrease in Greenfield investment owing to continuous fall in oil prices is expected to slow down the demand for AC drives for the forecast period. However, AC drives have huge opportunity in replacement sector. In addition, industrial internet of things (IIoT) is also an opportunity for AC drives market. Some of the leading players in the AC drives market include ABB Ltd. (Switzerland), Siemens AG (Germany), Danfoss Group (Denmark), Schneider Electric SE (France), Rockwell Automation, Inc. (U.S.), Mitsubishi Electric Co. (Japan), and Yaskawa Electric Corporation (Japan). New product development was the strategy most commonly adopted by top players in the market, constituting 26.5% of the total developments from 2012 to 2016. It was followed by investment & expansion, contracts & agreements, and mergers & acquisitions.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 14)

1.1 Objectives of The Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Years Considered for The Study

1.4 Currency

1.5 Limitation

1.6 Stakeholders

2 Research Methodology (Page No. - 18)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Breakdown of Primaries

2.2 Market Size Estimation

2.3 Market Breakdown & Data Triangulation

2.4 Research Assumptions

2.4.1 Assumptions

3 Executive Summary (Page No. - 25)

3.1 Historical Backdrop

3.2 Current Scenario

3.3 Future Outlook

3.4 Conclusion

4 Premium Insights (Page No. - 31)

4.1 Attractive Opportunities in The AC Drives Market, 20162021

4.2 Asia-Pacific Accounted for The Largest Market Share in 2015

4.3 AC Drives Market, By Application, 20142021

4.4 AC Drives Market in The Asia-Pacific Region

4.5 Low Voltage AC Drives Segment is Expected to Dominate The Global Market During The Forecast Period

4.6 Life Cycle Analysis, By Region

5 Market Overview (Page No. - 37)

5.1 Introduction

5.2 AC Drives: Market Segmentation

5.2.1 By Voltage

5.2.2 By Application

5.2.3 By Power Rating

5.2.4 By Industry

5.2.5 By Region

5.3 Market Dynamics

5.3.1 Drivers

5.3.1.1 Increasing Urbanization & Industrialization

5.3.1.2 Rising Need for Energy Efficiency

5.3.1.3 Regulations on Energy Efficiency

5.3.2 Restraints

5.3.2.1 Decrease in Greenfield Investment

5.3.3 Opportunities

5.3.3.1 Huge Opportunity in The Replacement Sector

5.3.3.2 Industrial Internet of Things (IIoT)

5.3.4 Challenges

5.3.4.1 Regional Level Competition From Local Players

6 AC Drives Market, By Voltage (Page No. - 46)

6.1 Introduction

6.2 Low Voltage

6.3 Medium Voltage

7 AC Drives Market, By Power Rating (Page No. - 51)

7.1 Introduction

7.2 Low Power

7.3 Medium Power

7.4 High Power

8 AC Drives Market, By End-Use Industry (Page No. - 58)

8.1 Introduction

8.2 Oil & Gas

8.3 Water & Wastewater

8.4 Power Generation

8.5 Building Automation

8.6 Food & Beverage

8.7 Metals & Mining

8.8 Chemicals & Petrochemicals

8.9 Others

9 AC Drives Market, By Application (Page No. - 67)

9.1 Introduction

9.2 Pumps

9.3 Fans

9.4 Compressors

9.5 Conveyors

9.6 Extruders

9.7 Others

10 AC Drives Market, By Region (Page No. - 74)

10.1 Introduction

10.2 Asia-Pacific

10.2.1 By Voltage

10.2.2 By Application

10.2.3 By Power Rating

10.2.4 By End-Use Industry

10.2.5 By Country

10.2.5.1 China

10.2.5.2 Japan

10.2.5.3 India

10.2.5.4 Australia

10.2.5.5 Rest of Asia-Pacific

10.3 Europe

10.3.1 By Voltage

10.3.2 By Application

10.3.3 By Power Rating

10.3.4 By End-Use Industry

10.3.5 By Country

10.3.5.1 Germany

10.3.5.2 France

10.3.5.3 Russia

10.3.5.4 U.K.

10.3.5.5 Italy

10.3.5.6 Rest of Europe

10.4 North America

10.4.1 By Voltage

10.4.2 By Application

10.4.3 By Power Rating

10.4.4 By End-Use Industry

10.4.5 By Country

10.4.5.1 U.S.

10.4.5.2 Canada

10.4.5.3 Mexico

10.5 Middle East & Africa

10.5.1 By Voltage

10.5.2 By Application

10.5.3 By Power Rating

10.5.4 By End-Use Industry

10.5.5 By Country

10.5.5.1 Saudi Arabia

10.5.5.2 Uae

10.5.5.3 South Africa

10.5.5.4 Rest of The Middle East & Africa

10.6 South America

10.6.1 By Voltage

10.6.2 By Application

10.6.3 By Power Rating

10.6.4 By End-Use Industry

10.6.5 By Country

10.6.5.1 Brazil

10.6.5.2 Argentina

10.6.5.3 Rest of South America

11 Competitive Landscape (Page No. - 103)

11.1 Overview

11.2 Competitive Situations & Trends

11.2.1 New Product Developments

11.2.2 Investments & Expansions

11.2.3 Contracts & Agreements

11.2.4 Mergers & Acquisitions

11.2.5 Other Developments

12 Company Profiles (Page No. - 110)

(Overview, Products & Services, Strategies & Insights, Developments and MnM View)*

12.1 Introduction

12.2 ABB Ltd.

12.3 Danfoss Group

12.4 Schneider Electric Se

12.5 Siemens AG

12.6 Mitsubishi Electrical Corporation

12.7 Fuji Electric Co. Ltd.

12.8 Emerson Electric Co.

12.9 Hitachi Ltd.

12.10 Parker Hannifin Corporation

12.11 Rockwell Automation, Inc.

12.12 Toshiba International Corporation

12.13 WEG SA

12.14 Yaskawa Electric Corporation

*Details on Overview, Products & Services, Strategies & Insights, Developments and MnM View Might Not Be Captured in Case of Unlisted Companies.

13 Appendix (Page No. - 151)

13.1 Insights of Industry Experts

13.2 Discussion Guide

13.3 Knowledge Store: Marketsandmarkets Subscription Portal

13.4 Introducing RT: Real Time Market Intelligence

13.5 Available Customizations

13.6 Related Reports

13.7 Author Details

List of Tables (76 Tables)

Table 1 AC Drives Market Size, By Voltage, 20142021 (USD Million)

Table 2 Low Voltage: AC Drives Market Size, By Region, 20142021 (USD Million)

Table 3 Medium Voltage AC Drives Used By Different End-Use Industries

Table 4 Medium Voltage: AC Drives Market Size, By Region, 20142021 (USD Million)

Table 5 AC Drives Market Size, By Power Rating, 20142021 (USD Million)

Table 6 Low Power: AC Drives Market Size, By Region, 20142021 (USD Million)

Table 7 Medium Power: AC Drives Market Size, By Region, 20142021 (USD Million)

Table 8 High Power: AC Drives Market Size, By Region, 20142021 (USD Million)

Table 9 AC Drives Market Size, By End-Use Industry, 20142021 (USD Million)

Table 10 Oil & Gas: AC Drives Market Size, By Region, 20142021 (USD Million)

Table 11 Water & Wastewater: AC Drives Market Size, By Region, 20142021 (USD Million)

Table 12 Power Generation: AC Drives Market Size, By Region, 20142021 (USD Million)

Table 13 Building Automation: AC Drives Market Size, By Region, 20142021 (USD Million)

Table 14 Food & Beverage: AC Drives Market Size, By Region, 20142021 (USD Million)

Table 15 Metals & Mining: AC Drives Market Size, By Region, 20142021 (USD Million)

Table 16 Chemicals & Petrochemicals: AC Drives Market Size, By Region, 20142021 (USD Million)

Table 17 Others: AC Drives Market Size, By Region, 20142021 (USD Million)

Table 18 AC Drives Market Size, By Application, 20142021 (USD Million)

Table 19 Pumps: AC Drives Market Size, By Region, 20142021 (USD Million)

Table 20 Fans: AC Drives Market Size, By Region, 20142021 (USD Million)

Table 21 Compressors: AC Drives Market Size, By Region, 20142021 (USD Million)

Table 22 Conveyors: AC Drives Market Size, By Region, 20142021 (USD Million)

Table 23 Extruders: AC Drives Market Size, By Region, 20142021 (USD Million)

Table 24 Others: AC Drives Market Size, By Region, 20142021 (USD Million)

Table 25 AC Drives Market Size, By Region, 20142021 (USD Million)

Table 26 Asia-Pacific: AC Drives Market Size, By Voltage, 20142021 (USD Million)

Table 27 Asia-Pacific: AC Drives Market Size, By Application, 20142021 (USD Million)

Table 28 Asia-Pacific: AC Drives Market Size, By Power Rating, 20142021 (USD Million)

Table 29 Asia-Pacific: AC Drives Market Size, By End-Use Industry, 20142021 (USD Million)

Table 30 Asia-Pacific: AC Drives Market Size, By Country, 20142021 (USD Million)

Table 31 China: AC Drives Market Size, By Voltage, 20142021 (USD Million)

Table 32 Japan: AC Drives Market Size, By Voltage, 20142021 (USD Million)

Table 33 India: AC Drives Market Size, By Voltage, 20142021 (USD Million)

Table 34 Australia: AC Drives Market Size, By Voltage, 20142021 (USD Million)

Table 35 Rest of Asia-Pacific: AC Drives Market Size, By Voltage, 20142021 (USD Million)

Table 36 Europe: AC Drives Market Size, By Voltage, 20142021 (USD Million)

Table 37 Europe: AC Drives Market Size, By Application, 20142021 (USD Million)

Table 38 Europe: AC Drives Market Size, By Power Rating, 20142021 (USD Million)

Table 39 Europe: AC Drives Market Size, By End-Use Industry, 20142021 (USD Million)

Table 40 Europe: AC Drives Market Size, By Country, 20142021 (USD Million)

Table 41 Germany: AC Drives Market Size, By Voltage, 20142021 (USD Million)

Table 42 France: AC Drives Market Size, By Voltage, 20142021 (USD Million)

Table 43 Russia: AC Drives Market Size, By Voltage, 20142021 (USD Million)

Table 44 U.K.: AC Drives Market Size, By Voltage, 20142021 (USD Million)

Table 45 Italy: AC Drives Market Size, By Voltage, 20142021 (USD Million)

Table 46 Rest of Europe: AC Drives Market Size, By Voltage, 20142021 (USD Million)

Table 47 North America: AC Drives Market Size, By Voltage, 20142021 (USD Million)

Table 48 North America: AC Drives Market Size, By Application, 20142021 (USD Million)

Table 49 North America: AC Drives Market Size, By Power Rating, 20142021 (USD Million)

Table 50 North America: AC Drives Market Size, By End-Use Industry, 20142021 (USD Million)

Table 51 North America: AC Drives Market Size, By Country, 20142021 (USD Million)

Table 52 U.S.: AC Drives Market Size, By Voltage, 20142021 (USD Million)

Table 53 Canada: AC Drives Market Size, By Voltage, 20142021 (USD Million)

Table 54 Mexico: AC Drives Market Size, By Voltage, 20142021 (USD Million)

Table 55 Middle East & Africa: AC Drives Market Size, By Voltage, 20142021 (USD Million)

Table 56 Middle East & Africa: AC Drives Market Size, By Application, 20142021 (USD Million)

Table 57 Middle East & Africa: AC Drives Market Size, By Power Rating, 20142021 (USD Million)

Table 58 Middle East & Africa: AC Drives Market Size, By End-Use Industry, 20142021 (USD Million)

Table 59 Middle East & Africa: AC Drives Market Size, By Country, 20142021 (USD Million)

Table 60 Saudi Arabia: AC Drives Market Size, By Voltage, 20142021 (USD Million)

Table 61 Uae: AC Drives Market Size, By Voltage, 20142021 (USD Million)

Table 62 South Africa: AC Drives Market Size, By Voltage, 20142021 (USD Million)

Table 63 Rest of The Middle East & Africa: AC Drives Market Size, By Voltage, 20142021 (USD Million)

Table 64 South America: AC Drives Market Size, By Voltage, 20142021 (USD Million)

Table 65 South America: AC Drives Market Size, By Application, 20142021 (USD Million)

Table 66 South America: AC Drives Market Size, By Power Rating, 20142021 (USD Million)

Table 67 South America: AC Drives Market Size, By End-Use Industry, 20142021 (USD Million)

Table 68 South America: AC Drives Market Size, By Country, 20142021 (USD Million)

Table 69 Brazil: AC Drives Market Size, By Voltage, 20142021 (USD Million)

Table 70 Argentina: AC Drives Market Size, By Voltage, 20142021 (USD Million)

Table 71 Rest of South America: AC Drives Market Size, By Voltage, 20142021 (USD Million)

Table 72 New Product Developments, 20152016

Table 73 Investments & Expansions, 20142016

Table 74 Contracts & Agreements, 20152016

Table 75 Merger & Acquisitions, 20142016

Table 76 Other Developments, 20152016

List of Figures (60 Figures)

Figure 1 AC Drives: Market Segmentation

Figure 2 AC Drives Market: Country-Wise Scope

Figure 3 AC Drives Market: Research Design

Figure 4 Breakdown of Primary Interviews: By Company Type, Designation, & Region

Figure 5 Market Size Estimation Methodology: Bottom-Up Approach

Figure 6 Market Size Estimation Methodology: Top-Down Approach

Figure 7 Data Triangulation Methodology

Figure 8 Asia-Pacific Occupied The Largest Market Share (Value) in 2015

Figure 9 AC Drives Market Share (By Value), By Voltage, 2016 & 2021 (USD Million)

Figure 10 Oil & Gas and Water & Wastewater Segments are Expected to Account for The Maximum Share During The Forecast Period

Figure 11 AC Drives Market Snapshot: Asia-Pacific is Expected to Exhibit The Highest Growth Rate in The Next 5 Years

Figure 12 Pumps Segment Was The Largest Application in 2016 and is Projected to Remain So Till 2021

Figure 13 Top Market Development (20142015)

Figure 14 Increasing Urbanization, Industrialization, & Need for Energy Saving are Expected to Drive The Demand for AC Drives

Figure 15 The Asia-Pacific and The Middle East & Africa Markets are Expected to Grow at A Fast Pace During The Forecast Period

Figure 16 Pumps Segment is Expected to Hold The Largest Share During The Forecast Period

Figure 17 The Chinese AC Drives Market is Projected to Hold The Largest Share in Asia-Pacific During The Forecast Period

Figure 18 Low Voltage Segment Accounted for The Largest Market Share in 2015

Figure 19 The Asia-Pacific Market is Expected to Grow at The Highest Rate During The Forecast Period

Figure 20 AC Drives Market Segmentation By Voltage, Application, Power Rating, End-Use Industry, & Region

Figure 21 Market Dynamics of AC Drives

Figure 22 Urbanization Trend

Figure 23 Industrial Electricity Prices, Europe, 20112014

Figure 24 Motor Efficiency Regulations: A Timeline

Figure 25 Decline in Brent Crude Oil Prices Since January 2014

Figure 26 Comparison Between Energy Saving Obtained By Using Dc Drives & AC Drives

Figure 27 Low Voltage AC Drives Segment Held The Largest Market Share (By Value) in 2015

Figure 28 Medium Voltage Segment is Expected to Grow at The Highest CAGR During The Forecast Period

Figure 29 Low Power Segment Held The Largest Market Share (By Value) in 2015

Figure 30 Asia-Pacific is Expected to Be Fastest Growing Region in Low Power AC Drives Market During The Forecast Period

Figure 31 Medium Power AC Drives Market Share (By Value), By Region, 2015

Figure 32 High Power AC Drives Market Share (By Value), By Region, 2015

Figure 33 Application vs Industry Matrix

Figure 34 Oil & Gas Segment is Expected to Account for The Largest Market Share in 2016

Figure 35 Global Snapshot: Pumps Segment is Expected to Dominate The AC Drives Market During The Forecast Period

Figure 36 Asia-Pacific to Drive The AC Drives Market, By Region, 20162021

Figure 37 Regional SnapshotGrowth Rate of AC Drives Market in Important Countries, 20162021

Figure 38 Asia-Pacific AC Drives Market Overview (2015)

Figure 39 Europe AC Drives Market Overview (2015)

Figure 40 Companies Adopted Investments & Expansions and New Product Developments to Capture The Market, 20122016

Figure 41 Market Evaluation Framework: New Product Developments, Contracts & Agreements, and Investments & Expansions Have Fueled The Growth of Companies, 20122016

Figure 42 Region-Wise Revenue Mix of The Top 5 Market Players

Figure 43 ABB Ltd.: Company Snapshot

Figure 44 ABB Ltd.: SWOT Analysis

Figure 45 Danfoss Group: Company Snapshot

Figure 46 Danfoss Group : SWOT Analysis

Figure 47 Schneider Electric Se: Company Snapshot

Figure 48 Schneider Electric Se: SWOT Analysis

Figure 49 Siemens AG: Company Snapshot

Figure 50 Siemens AG: SWOT Analysis

Figure 51 Mitsubishi Electrical Corporation: Company Snapshot

Figure 52 Mitsubishi Electrical Corporation : SWOT Analysis

Figure 53 Fuji Electric Co. Ltd.: Company Snapshot

Figure 54 Emerson Electric Co.: Company Snapshot

Figure 55 Hitachi Ltd.: Company Snapshot

Figure 56 Parker Hannifin Corporation: Company Snapshot

Figure 57 Rockwell Automation, Inc.: Company Snapshot

Figure 58 Toshiba International Corporation: Company Snapshot

Figure 59 WEG SA: Company Snapshot

Figure 60 Yaskawa Electric Corporation: Company Snapshot

Growth opportunities and latent adjacency in AC Drives Market