Aluminum Casting Market by Process (Die Casting, Permanent Mold Casting, Sand Casting), End-use Sector (Transportation, Industrial, Building & Construction), and Region (APAC, Europe, North America, South America, MEA) - Global Forecast to 2026

Updated on : September 03, 2025

Aluminum Casting Market

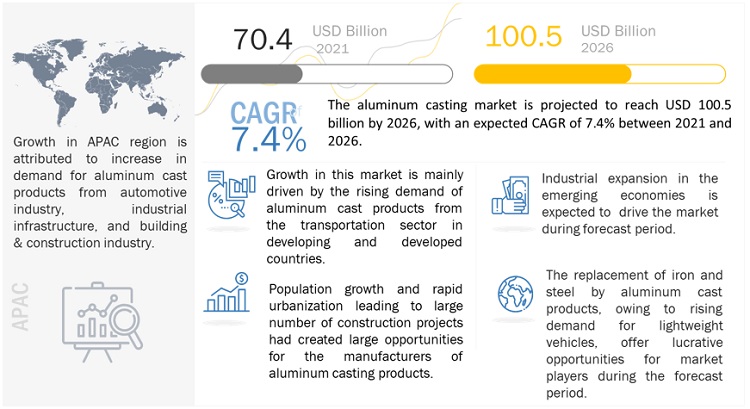

The global aluminum casting market was valued at USD 70.4 billion in 2021 and is projected to reach USD 100.5 billion by 2026, growing at 7.4% cagr from 2021 to 2026. The market is witnessing considerable growth due to advancement in technology and high efficiency of aluminum cast products. Growing demand in the automobile and consumer applications, rising military investment in lightweight weaponry, and industrial expansion in emerging economies are the key factors fueling the growth of the aluminum casting market. These are the key factors driving the demand for aluminum casting during the forecast period.

Due to its application in passenger cars, motorcycles, aerospace, trains, shipbuilding, commercial vehicles, heavy machinery, building & construction hardware, power & hand tools, and telecom, aluminium casting has seen substantial expansion in the market. The need for lightweight cars and other vehicles is growing along with new sectors, which is opening up opportunities for the aluminium casting market. The ongoing growth of manufacturing facilities across all industries in the nation is being driven by economic development coupled with the cheap supply of labour and raw materials, particularly in China.

Global Aluminum Casting Market Trends

To know about the assumptions considered for the study, Request for Free Sample Report

Aluminum Casting Market Dynamics

Driver: Industrial expansion in emerging economies

With the emergence of new industries, the need for lightweight vehicles and automobiles is also increasing; this is creating scope for the aluminum casting market. Emerging economies have been focusing on rapid industrialization over the last few decades. Countries such as China, India, Indonesia, South Africa, Brazil, and Argentina are transforming their economies from being agricultural-based to being based on manufacturing and other industries. It is used in passenger cars, motorbikes, aerospace, railways, shipbuilding, commercial vehicles, heavy machinery, building & construction hardware, power & hand tools, and telecom. The growth of these industries depends on various macro-economic factors such as GDP growth, employment rate, and standard of living. As cast aluminum is used in almost every industry, the demand is projected to grow significantly with the expansion of facilities.

Restraint: Switch to alternative materials from aluminium alloy

The use of lightweight materials is on the rise in a variety of industries, including automotive, aerospace, building and construction, body armour and protection, sports equipment, and consumer products. The rapid industrial growth has increased the need for materials that are both lighter and stronger. Magnesium alloys may satisfy the current demand for more dependable and lightweight construction. Magnesium alloys have the potential to replace steel and aluminium alloys because to their same specific stiffness, increased specific strength, and energy absorption. Magnesium alloys are especially helpful in situations where materials are subjected to changing or dynamic stresses, such as during car and plane crashes, bullet penetration resistance in buildings, etc. The developments in magnesium alloys and composites are restraining the growth of the aluminum casting market.

Opportunity: Growing electric vehicles market

The growth of electric vehicles is constantly increasing in Europe and North America. Several European countries have strict regulations regarding CO2 emission, which is driving the demand for high-strength aluminum alloys as they provide superior strength that is a key requirement in electric vehicles. Electric vehicles run on battery power, and the batteries weigh approximately 25% of the overall car weight. A study by the Aluminum Association demonstrated that by utilizing an advanced aluminum body structure instead of traditional steel, a vehicle’s stored energy requirements can be cut by around 10%, which could save up to USD 3,000 per vehicle as less power is required to move a lighter vehicle. With the increasing demand for electric vehicles, the automotive aluminum casting market is also expected to witness growth. The rising demand for lightweight vehicles, metal replacement, and environmental concerns are influencing the market for cast aluminum.

Challenges: High capital investment requirement

The trend of using finished aluminum cast parts, high raw material costs, and complexities in foundry installation are heavily capital-intensive and require high initial investment. This investment incudes processes such as establishing production, smelting, refining, and metal recovery. The process of transforming raw bauxite into cast aluminum is energy-intensive and requires high amounts of electricity, water, and other resources. According to North American Die Casting Association, the equipment used in die casting have high costs, among the highest of any production process. Further, the cost adding factors include the fluctuating price of raw material (aluminum) and trimming and finishing tool cost. These factors add cost to the initial capital requirement to start manufacturing of casted aluminum products.

Die Casting process segment dominate the aluminum casting market

The die casting process segment is the fastest-growing process segment. Die-casting alloys made of aluminum are thin and light, and they have great dimensional stability for parts with intricate geometries and thin walls. Aluminum is an excellent alloy for die casting because of its strong thermal and electrical conductivity, superior mechanical qualities, and corrosion resistance. Metals made of low-density aluminum are necessary for the die casting sector. Cold chamber machines are necessary because the aluminium die casting process maintains a lasting strength at extremely high temperatures. A furnace is used to melt the molten metal to the required temperature while it is still confined in an open holding pot. Due to these high temperatures, the open holding pot is maintained apart from the die casting machine, and the molten metal is ladled from the pot for each casting. Die casting is extensively used in the automobile sector for parts such as engine blocks, wheel spacers, valve covers, and others.

The transportation sector segment holds the largest share of aluminum casting market

The lightweight feature of aluminum helps in better fuel efficiency of vehicles. Due to high fuel efficiency, aluminum parts are widely used in trains, boats, cars, and aircraft. Cast products make up more than half of the aluminum used in cars. In aircraft manufacturing, aluminum is used for frames, exteriors, wiring, and electrical systems. Car parts such as valve covers, wheel spacer bars, wheel transmission housings, hoods, suspension components, and engine blocks are usually built of aluminum cast products. The transportation sector is the largest user of permanent mold cast and die cast aluminum products.

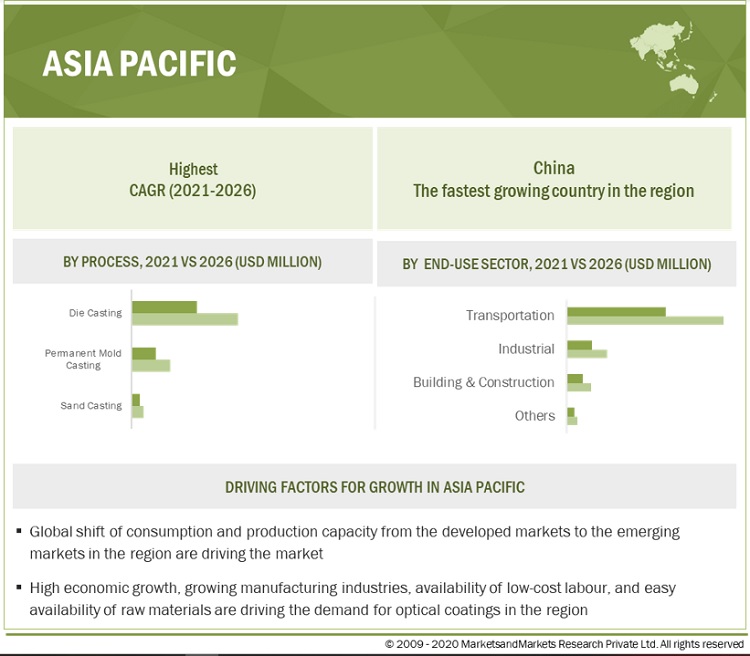

APAC is expected to have highest CAGR during the forecast period

The APAC region represents the largest and fastest-growing aluminum casting market. Countries covered in this region include India, China, Japan, South Korea, and others. China's industrial segment experienced a production growth of 9.8% in April 2021. The substantial rise is mostly due to a considerable reduction in industrial production and the accompanying low base from the previous year's similar period. Industrial production grew by 14.1% in April 2019, or 6.8% yearly. The car industry in China has been propelled by the fast expansion of the local market. Japan was the third-largest economy in the world in 2020. It had a GDP of USD 5,048.69 billion and a share of 5.7% in the world GDP. The country is the second-largest market for aluminum casting in the APAC region. It accounted for an 11.1% share of the region’s aluminum casting market in 2020, in terms of value.

To know about the assumptions considered for the study, download the pdf brochure

Aluminum Casting Market Players

Alcoa Corporation (US), Ryobi Limited (Japan), Aluminum Corporation of China Limited (China), Rio Tinto (UK), United Company RUSAL (Russia) are the key players operating in the aluminum casting market.

These companies have adopted several growth strategies to strengthen their position in the market. Expansion, new product development, merger & acquisition, and collaboration are the key growth strategies adopted by these players to enhance their product offering & regional presence to meet the growing demand for to aluminum casting from emerging economies.

Aluminum Casting Market Report Scope

|

Report Metric |

Details |

|

Market Size Value in 2021 |

USD 70.4 billion |

|

Revenue Forecast in 2026 |

USD 100.5 billion |

|

CAGR |

7.4% |

|

Market size available for years |

2019–2026 |

|

Base year |

2020 |

|

Forecast period |

2021–2026 |

|

Units considered |

Value (USD Million) |

|

Segments |

Process, End-use Sector and Region |

|

Regions |

APAC, Europe, North America, South America, and Middle East & Africa |

|

Companies |

Alcoa Corporation (US), Ryobi Limited (Japan), Aluminum Corporation of China Limited (China), Rio Tinto (UK), United Company RUSAL (Russia) |

This research report categorizes the aluminum casting market based on type, application, technology and region.

Aluminum Casting Market by Process

- Die Casting

- Sand Casting

- Permanent Mold Casting

Aluminum Casting Market by End-use

- Transportation sector

- Building & Construction sector

- Industrial sector

- Others (household appliances, engineering tools, and telecom sector)

Aluminum Casting Market by Region

- APAC

- Europe

- North America

- South America

- Middle East & Africa

Recent Developments

- In June 2021, Rio Tinto has partnered with Comptech to introduce new aluminum alloys to the market, which can be used in advanced technologies such as electric vehicles and 5G antennas. This partnership was done to be able to allow Rio Tinto to deliver a new range of specialized alloys designed to deliver high-performance, lower-cost solutions for advanced applications like electric vehicles and 5G antennas.

- In May 2021, China Hongqiao Group Limited is doing a joint project along with Germany's Scholz Recycling. As a result of this joint venture, recycled aluminum production line will be put into operation in Shandong at the end of 2021. China Hongqiao Group Limited aims to use more scrap and tap cleaner power sources to make the smelting process more energy-intensive to cut down its own environmental footprint and reduce emissions. As the company’s sustainable initiative, the company will also process mixed scrap metal and end-of-life vehicles starting from June 2022.

- In April 2021, RUSAL has completely acquired Aluminium Rheinfelden GmbH after the approval by the German Federal Cartel Office and the German Federal Ministry for Economic Affairs and Energy. As a result of this acquisition, the position of United Company RUSAL has strengthened as a supplier to match its customer’s requirements and deliver commercial synergies by matching Aluminium Rheinfelden’s high end, niche product focus with RUSAL’s global scale low-carbon aluminum alloy production. United Company RUSAL will deliver sustainable aluminum solutions.

- In September 2020, Alcoa Corporation announced the expansion of its Sustana line with the introduction of EcoLum aluminum, which will perform 3.5 times better than the industry average and is offered in a full range of primary products, including billet, foundry, slab, unalloyed high purity, and P1020. With this, the company was able to extend its product portfolio.

- In February 2021, Arconic Inc. has announced to make an investment to expand its hot mill capability along with adding downstream equipment capabilities to manufacture industrial and automotive aluminum products in its Alcoa, Tennessee facility. This project started in early 2019 and was complete at the end of 2020.

- In November 2020, Kaiser Aluminum Corporation entered into an agreement to purchase Alcoa Warrick LLC, containing all the assets of the Warrick Rolling Mill (“Warrick”), from Alcoa Corporation (“Alcoa”) for USD 670 million Alcoa will retain ownership of the related smelting assets, power plant, and land. As part of the transaction, Kaiser Aluminum entered a market-based molten aluminum supply agreement, and a long-term ground lease that includes provisions for utility services. This agreement has helped the company to ensure an uninterrupted supply of molten aluminum, which will aid the company to timely deliver the products to its customers.

Frequently Asked Questions (FAQ):

What are the upcoming hot bets for the aluminum casting market?

Rise in demand for aluminum casting from emerging economies and growing popularity of growing demand from automotive, construction and manufacturing sectors are hot bets for the market.

What are the market dynamics for the different type of aluminum casting?

On the basis of process, the die casting process segment accounted for a larger market share. Die Casting provides flexibility of design, wide range of alloys and properties available, lowest tooling cost, shortest lead time, long tool life, high production rates for large range of parts, ease of product modification, least sensitive gating, feeding and heat removal system in mass production. When a large number of simple or complicated castings are required, the die casting method of aluminum casting is appropriate

What are the market dynamics for the different end-uses of aluminum casting?

The transportation sector segment led the market in terms of both value and volume. It is attributed to the use of aluminum casting into small and big applications in the automotive industry.

Who are the major manufacturers of the aluminum casting market?

Alcoa Corporation (US), Ryobi Limited (Japan), Aluminum Corporation of China Limited (China), Rio Tinto (UK), United Company RUSAL (Russia) are the key players operating in the aluminum casting market.

What are the major factors which will impact market growth during the forecast period?

Stringent government regulations will be a restraint to the growth of the market during the forecast period. Governments worldwide are addressing this issue by imposing strict laws, which results in the aluminum casting market being subjected to governance .

What is aluminum casting?

Aluminum casting is a process for creating high-quality, high-tolerance items by pouring molten aluminium into a properly built die, mould, or form. The layer of aluminium oxide that forms as soon as the item is taken from the mould is a benefit of casting aluminium.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 38)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.2.1 ALUMINUM CASTING: MARKET DEFINITION

1.2.2 INCLUSIONS AND EXCLUSIONS

1.3 MARKET SCOPE

FIGURE 1 MARKET SEGMENTATION

1.4 REGIONS COVERED

1.4.1 YEARS CONSIDERED FOR THE STUDY

1.5 CURRENCY

1.6 UNIT CONSIDERED

1.7 LIMITATIONS

1.8 STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 43)

2.1 RESEARCH DATA

FIGURE 2 ALUMINUM CASTING MARKET: RESEARCH DESIGN

2.1.1 KEY INDUSTRY INSIGHTS

2.1.1.1 Data validation from primary experts

TABLE 1 LIST OF STAKEHOLDERS INVOLVED

2.1.1.2 Breakdown of primary interviews

2.2 BASE NUMBER CALCULATION

2.2.1 SUPPLY-SIDE APPROACH – 1

FIGURE 3 ALUMINUM CASTING MARKET: SUPPLY-SIDE APPROACH – 1

2.2.2 SUPPLY-SIDE APPROACH – 2

FIGURE 4 ALUMINUM CASTING MARKET: SUPPLY-SIDE APPROACH – 2

2.2.3 DEMAND-SIDE APPROACH – 1

FIGURE 5 ALUMINUM CASTING MARKET: DEMAND-SIDE APPROACH – 1

2.2.4 DEMAND-SIDE APPROACH – 2

FIGURE 6 ALUMINUM CASTING MARKET: DEMAND-SIDE APPROACH – 2

2.3 MARKET SIZE ESTIMATION

2.3.1 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

2.3.2 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

2.4 DATA TRIANGULATION

FIGURE 7 DATA TRIANGULATION

2.4.1 SECONDARY DATA

2.4.2 PRIMARY DATA

2.5 RESEARCH ASSUMPTIONS & LIMITATIONS

2.5.1 ASSUMPTIONS

2.5.2 RISK ASSESSMENT

TABLE 2 LIMITATIONS & ASSOCIATED RISKS

3 EXECUTIVE SUMMARY (Page No. - 51)

FIGURE 8 DIE CASTING TO ACCOUNT FOR THE LARGEST SHARE IN THE ALUMINUM CASTING MARKET THROUGH 2026

FIGURE 9 TRANSPORTATION SECTOR TO LEAD THE MARKET FOR ALUMINUM CASTING THROUGH 2026

FIGURE 10 APAC DOMINATED THE ALUMINUM CASTING MARKET IN 2020

4 PREMIUM INSIGHTS (Page No. - 54)

4.1 ATTRACTIVE MARKET OPPORTUNITIES IN THE ALUMINUM CASTING MARKET

FIGURE 11 ALUMINUM CASTING MARKET IN APAC TO OFFER ATTRACTIVE OPPORTUNITIES DURING THE FORECAST PERIOD

4.2 ALUMINUM CASTING MARKET, BY REGION

FIGURE 12 APAC TO BE THE FASTEST-GROWING REGION DURING THE FORECAST PERIOD

4.3 ALUMINUM CASTING MARKET, BY PROCESS

FIGURE 13 DIE CASTING TO BE THE LARGEST PROCESS SEGMENT DURING THE FORECAST PERIOD

4.4 ALUMINUM CASTING MARKET, BY END-USE SECTOR

FIGURE 14 INDUSTRIAL TO BE THE FASTEST-GROWING END-USE SECTOR DURING THE FORECAST PERIOD

4.5 ALUMINUM CASTING MARKET: EMERGING VS. MATURE MARKETS

FIGURE 15 CHINA TO EMERGE AS THE MOST LUCRATIVE MARKET BETWEEN 2021 AND 2026

4.6 ALUMINUM CASTING MARKET IN APAC, 2020

FIGURE 16 TRANSPORTATION SECTOR ACCOUNTED FOR THE LARGEST SHARE OF THE APAC ALUMINUM CASTING MARKET

4.7 ALUMINUM CASTING MARKET: REGIONAL SNAPSHOT

FIGURE 17 MARKET IN CHINA TO GROW AT THE HIGHEST RATE FROM 2021 TO 2026

5 MARKET OVERVIEW (Page No. - 58)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 18 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN THE ALUMINUM CASTING MARKET

5.2.1 DRIVERS

5.2.1.1 Growing demand in the automobile industry

TABLE 3 CARS: MOTOR VEHICLE PRODUCTION, BY COUNTRY, 2016–2020

TABLE 4 COMMERCIAL VEHICLES: MOTOR VEHICLE PRODUCTION, BY COUNTRY, 2016–2020

5.2.1.2 Rising military investment in lightweight weapon systems

FIGURE 19 COUNTRY-WISE MILITARY SPENDING, 2019

5.2.1.3 Industrial expansion in emerging economies

5.2.2 RESTRAINTS

5.2.2.1 Replacement of aluminum alloys with other materials

5.2.3 OPPORTUNITIES

5.2.3.1 Replacement of iron and steel with aluminum in the automobile industry

5.2.3.2 Growing electric vehicles market

5.2.3.3 Population growth and rapid urbanization leading to a large number of construction projects

TABLE 5 APAC: URBANIZATION TRENDS, BY COUNTRY, 1990–2050

5.2.4 CHALLENGES

5.2.4.1 Environmental effect of aluminum cast production

5.2.4.2 High capital investment requirement

5.3 PORTER’S FIVE FORCES ANALYSIS

FIGURE 20 PORTER’S FIVE FORCES ANALYSIS

TABLE 6 ALUMINUM CASTINGS MARKET: PORTER’S FIVE FORCES ANALYSIS

5.3.1 THREAT OF NEW ENTRANTS

5.3.2 THREAT OF SUBSTITUTES

5.3.3 BARGAINING POWER OF SUPPLIERS

5.3.4 BARGAINING POWER OF BUYERS

5.3.5 INTENSITY OF COMPETITIVE RIVALRY

5.4 RANGE SCENARIO ANALYSIS

FIGURE 21 RANGE SCENARIO FOR THE ALUMINUM CASTING MARKET

5.4.1 OPTIMISTIC SCENARIO

5.4.2 PESSIMISTIC SCENARIO

5.4.3 REALISTIC SCENARIO

5.5 SUPPLY CHAIN ANALYSIS

FIGURE 22 ALUMINUM CASTING MARKET: SUPPLY CHAIN

5.6 YC-YCC DRIVERS

FIGURE 23 YC-YCC DRIVERS

5.7 MARKET MAPPING/ECOSYSTEM MAP

FIGURE 24 ECOSYSTEM MAP

5.8 PATENT ANALYSIS

5.8.1 INTRODUCTION

5.8.2 METHODOLOGY

5.8.3 DOCUMENT TYPE

TABLE 7 ALUMINUM CASTING MARKET: REGISTERED PATENTS

FIGURE 25 ALUMINUM CASTING MARKET: REGISTERED PATENTS

5.8.4 PATENT PUBLICATION TRENDS

FIGURE 26 ALUMINUM CASTING MARKET: PATENT PUBLICATION TRENDS, 2010–2020

5.8.5 INSIGHT

5.8.6 JURISDICTION ANALYSIS

FIGURE 27 ALUMINUM CASTING MARKET: JURISDICTION ANALYSIS

5.8.7 TOP PATENT APPLICANTS

FIGURE 28 ALUMINUM CASTING MARKET: TOP PATENT APPLICANTS

5.8.8 LIST OF CRITICAL PATENTS

TABLE 8 ALUMINUM CASTING: LIST OF PATENTS

5.8.9 DISCLAIMER

5.9 REGULATORY ANALYSIS

5.10 TECHNOLOGY ANALYSIS

5.10.1 OIL-COOLANT MODULE

5.10.2 HOUSING FOR HV BOOSTER

5.10.3 HYBRID BATTERY HOUSING CAST

5.10.4 DIE LUBRICANT

5.11 TRADE ANALYSIS

5.11.1 IMPORT-EXPORT SCENARIO OF ALUMINUM CASTING MARKET

5.11.2 EXPORT SCENARIO OF ALUMINUM CASTING MARKET

FIGURE 29 ALUMINUM CASTING MARKET: EXPORTING COUNTRIES

5.11.3 IMPORT SCENARIO OF ALUMINUM CASTING MARKET

FIGURE 30 ALUMINUM CASTING MARKET: IMPORTING COUNTRIES

TABLE 9 TOP ALUMINUM EXPORTERS, BY COUNTRY (2020)

TABLE 10 TOP ALUMINUM IMPORTERS, BY COUNTRY (2020

5.12 AVERAGE SELLING PRICE ANALYSIS

TABLE 11 AVERAGE PRICES OF ALUMINUM CASTING, BY REGION (USD/KG), 2020

5.13 CASE STUDY ANALYSIS

5.13.1 MODERN CASTING

5.13.2 EAGLE GROUP MANUFACTURING

6 IMPACT OF COVID-19 ON THE ALUMINUM CASTING MARKET (Page No. - 83)

6.1 INTRODUCTION

6.2 IMPACT OF COVID-19 ON THE ALUMINUM CASTING MARKET

6.2.1 END-USE SECTOR

6.2.1.1 Impact of COVID-19 on the building & construction industry

6.2.1.2 Impact of COVID-19 on the automotive industry

7 ALUMINUM CASTING MARKET, BY PROCESS (Page No. - 85)

7.1 INTRODUCTION

FIGURE 31 DIE CASTING SEGMENT TO REGISTER THE HIGHEST GROWTH RATE THROUGH 2026

TABLE 12 MARKET SIZE, BY PROCESS, 2019–2026 (USD MILLION)

TABLE 13 MARKET SIZE, BY PROCESS, 2015–2018 (USD MILLION)

TABLE 14 MARKET SIZE, BY PROCESS, 2019–2026 (KILOTON)

TABLE 15 MARKET SIZE, BY PROCESS, 2015–2018 (KILOTON)

7.2 DIE CASTING

7.3 PERMANENT MOLD CASTING

7.4 SAND CASTING

8 ALUMINUM CASTING MARKET, BY END-USE SECTOR (Page No. - 89)

8.1 INTRODUCTION

FIGURE 32 TRANSPORTATION SECTOR TO RECORD THE LARGEST DEMAND FOR ALUMINUM CASTING THROUGH 2026

TABLE 16 ALUMINUM CASTING MARKET SIZE, BY END-USE SECTOR, 2019–2026 (USD MILLION)

TABLE 17 MARKET SIZE, BY END-USE SECTOR, 2015–2018 (USD MILLION)

TABLE 18 MARKET SIZE, BY END-USE SECTOR 2019–2026 (KILOTON)

TABLE 19 MARKET SIZE, BY END-USE SECTOR 2015–2018 (KILOTON)

8.2 TRANSPORTATION SECTOR

8.3 BUILDING & CONSTRUCTION SECTOR

8.4 INDUSTRIAL SECTOR

8.5 OTHERS

9 ALUMINUM CASTING MARKET, BY REGION (Page No. - 93)

9.1 INTRODUCTION

FIGURE 33 APAC TO RECORD THE FASTEST GROWTH DURING THE FORECAST PERIOD

TABLE 20 MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

TABLE 21 MARKET SIZE, BY REGION, 2015–2018 (USD MILLION)

TABLE 22 MARKET SIZE, BY REGION, 2019–2026 (KILOTON)

TABLE 23 MARKET SIZE, BY REGION, 2015–2018 (KILOTON)

9.2 APAC

FIGURE 34 APAC: ALUMINUM CASTING MARKET SNAPSHOT

TABLE 24 APAC: MARKET SIZE, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 25 APAC: MARKET SIZE, BY COUNTRY, 2015–2018 (USD MILLION)

TABLE 26 APAC: MARKET SIZE, BY COUNTRY, 2019–2026 (KILOTON)

TABLE 27 APAC: MARKET SIZE, BY COUNTRY, 2015–2018 (KILOTON)

TABLE 28 APAC: MARKET SIZE, BY PROCESS, 2019–2026 (USD MILLION)

TABLE 29 APAC: MARKET SIZE, BY PROCESS, 2015–2018 (USD MILLION)

TABLE 30 APAC: MARKET SIZE, BY PROCESS, 2019–2026 (KILOTON)

TABLE 31 APAC: MARKET SIZE, BY PROCESS, 2015–2018 (KILOTON)

TABLE 32 APAC: MARKET SIZE, BY END-USE SECTOR, 2019–2026 (USD MILLION)

TABLE 33 APAC: MARKET SIZE, BY END-USE SECTOR, 2015–2018 (USD MILLION)

TABLE 34 APAC: MARKET SIZE, BY END-USE SECTOR, 2019–2026 (KILOTON)

TABLE 35 APAC: MARKET SIZE, BY END-USE SECTOR, 2015–2018 (KILOTON)

9.2.1 CHINA

9.2.1.1 Stable and advancing industries, along with presence of significant manufacturers, to drive the market

TABLE 36 CHINA: MARKET SIZE, BY PROCESS, 2019–2026 (USD MILLION)

TABLE 37 CHINA: MARKET SIZE, BY PROCESS, 2015–2018 (USD MILLION)

TABLE 38 CHINA: MARKET SIZE, BY PROCESS, 2019–2026 (KILOTON)

TABLE 39 CHINA: MARKET SIZE, BY PROCESS, 2015–2018 (KILOTON)

TABLE 40 CHINA: MARKET SIZE, BY END-USE SECTOR, 2019–2026 (USD MILLION)

TABLE 41 CHINA: MARKET SIZE, BY END-USE SECTOR, 2015–2018 (USD MILLION)

TABLE 42 CHINA: MARKET SIZE, BY END-USE SECTOR, 2019–2026 (KILOTON)

TABLE 43 CHINA: MARKET SIZE, BY END-USE SECTOR, 2015–2018 (KILOTON)

9.2.2 JAPAN

9.2.2.1 Automotive and construction industries to drive moderate growth during the forecast period

TABLE 44 JAPAN: MARKET SIZE, BY PROCESS, 2019–2026 (USD MILLION)

TABLE 45 JAPAN: MARKET SIZE, BY PROCESS, 2015–2018 (USD MILLION)

TABLE 46 JAPAN: MARKET SIZE, BY PROCESS, 2019–2026 (KILOTON)

TABLE 47 JAPAN: MARKET SIZE, BY PROCESS, 2015–2018 (KILOTON)

TABLE 48 JAPAN: MARKET SIZE, BY END-USE SECTOR, 2019–2026 (USD MILLION)

TABLE 49 JAPAN: MARKET SIZE, BY END-USE SECTOR, 2015–2018 (USD MILLION)

TABLE 50 JAPAN: MARKET SIZE, BY END-USE SECTOR, 2019–2026 (KILOTON)

TABLE 51 JAPAN: MARKET SIZE, BY END-USE SECTOR, 2015–2018 (KILOTON)

9.2.3 INDIA

9.2.3.1 Huge investment in different industries and advancements in the building & construction sector are driving the market

TABLE 52 INDIA: MARKET SIZE, BY PROCESS, 2019–2026 (USD MILLION)

TABLE 53 INDIA: MARKET SIZE, BY PROCESS, 2015–2018 (USD MILLION)

TABLE 54 INDIA: MARKET SIZE, BY PROCESS, 2019–2026 (KILOTON)

TABLE 55 INDIA: MARKET SIZE, BY PROCESS, 2015–2018 (KILOTON)

TABLE 56 INDIA: MARKET SIZE, BY END-USE SECTOR, 2019–2026 (USD MILLION)

TABLE 57 INDIA: MARKET SIZE, BY END-USE SECTOR, 2015–2018 (USD MILLION)

TABLE 58 INDIA: MARKET SIZE, BY END-USE SECTOR, 2019–2026 (KILOTON)

TABLE 59 INDIA: MARKET SIZE, BY END-USE SECTOR, 2015–2018 (KILOTON)

9.2.4 SOUTH KOREA

9.2.4.1 Growing industries and commercial construction projects to support the market

TABLE 60 SOUTH KOREA: ALUMINUM CASTING MARKET SIZE, BY PROCESS, 2019–2026 (USD MILLION)

TABLE 61 SOUTH KOREA: MARKET SIZE, BY PROCESS, 2015–2018 (USD MILLION)

TABLE 62 SOUTH KOREA: MARKET SIZE, BY PROCESS, 2019–2026 (KILOTON)

TABLE 63 SOUTH KOREA: MARKET SIZE, BY PROCESS, 2015–2018 (KILOTON)

TABLE 64 SOUTH KOREA: MARKET SIZE, BY END-USE SECTOR, 2019–2026 (USD MILLION)

TABLE 65 SOUTH KOREA: MARKET SIZE, BY END-USE SECTOR, 2015–2018 (USD MILLION)

TABLE 66 SOUTH KOREA: MARKET SIZE, BY END-USE SECTOR, 2019–2026 (KILOTON)

TABLE 67 SOUTH KOREA: MARKET SIZE, BY END-USE SECTOR, 2015–2018 (KILOTON)

9.2.5 REST OF APAC

TABLE 68 REST OF APAC: MARKET SIZE, BY PROCESS, 2019–2026 (USD MILLION)

TABLE 69 REST OF APAC: MARKET SIZE, BY PROCESS, 2015–2018 (USD MILLION)

TABLE 70 REST OF APAC: MARKET SIZE, BY PROCESS, 2019–2026 (KILOTON)

TABLE 71 REST OF APAC: MARKET SIZE, BY PROCESS, 2015–2018 (KILOTON)

TABLE 72 REST OF APAC: MARKET SIZE, BY END-USE SECTOR, 2019–2026 (USD MILLION)

TABLE 73 REST OF APAC: MARKET SIZE, BY END-USE SECTOR, 2015–2018 (USD MILLION)

TABLE 74 REST OF APAC: MARKET SIZE, BY END-USE SECTOR, 2019–2026 (KILOTON)

TABLE 75 REST OF APAC: MARKET SIZE, BY END-USE SECTOR, 2015–2018 (KILOTON)

9.3 EUROPE

FIGURE 35 EUROPE: MARKET SNAPSHOT

TABLE 76 EUROPE: MARKET SIZE, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 77 EUROPE: MARKET SIZE, BY COUNTRY, 2015–2018 (USD MILLION)

TABLE 78 EUROPE: MARKET SIZE, BY COUNTRY, 2019–2026 (KILOTON)

TABLE 79 EUROPE: MARKET SIZE, BY COUNTRY, 2015–2018 (KILOTON)

TABLE 80 EUROPE: MARKET SIZE, BY PROCESS, 2019–2026 (USD MILLION)

TABLE 81 EUROPE: MARKET SIZE, BY PROCESS, 2015–2018 (USD MILLION)

TABLE 82 EUROPE: MARKET SIZE, BY PROCESS, 2019–2026 (KILOTON)

TABLE 83 EUROPE: MARKET SIZE, BY PROCESS, 2015–2018 (KILOTON)

TABLE 84 EUROPE: MARKET SIZE, BY END-USE SECTOR, 2019–2026 (USD MILLION)

TABLE 85 EUROPE: MARKET SIZE, BY END-USE SECTOR, 2015–2018 (USD MILLION)

TABLE 86 EUROPE: MARKET SIZE, BY END-USE SECTOR, 2019–2026 (KILOTON)

TABLE 87 EUROPE: MARKET SIZE, BY END-USE SECTOR, 2015–2018 (KILOTON)

9.3.1 GERMANY

9.3.1.1 Demand in industrial and automotive & transportation segments to drive the aluminum casting market

TABLE 88 GERMANY: MARKET SIZE, BY PROCESS, 2019–2026 (USD MILLION)

TABLE 89 GERMANY: MARKET SIZE, BY PROCESS, 2015–2018 (USD MILLION)

TABLE 90 GERMANY: MARKET SIZE, BY PROCESS, 2019–2026 (KILOTON)

TABLE 91 GERMANY: MARKET SIZE, BY PROCESS, 2015–2018 (KILOTON)

TABLE 92 GERMANY: MARKET SIZE, BY END-USE SECTOR, 2019–2026 (USD MILLION)

TABLE 93 GERMANY: MARKET SIZE, BY END-USE SECTOR, 2015–2018 (USD MILLION)

TABLE 94 GERMANY: MARKET SIZE, BY END-USE SECTOR, 2019–2026 (KILOTON)

TABLE 95 GERMANY: MARKET SIZE, BY END-USE SECTOR, 2015–2018 (KILOTON)

9.3.2 FRANCE

9.3.2.1 Industrialization of the country to drive the demand for aluminum casting

TABLE 96 FRANCE: MARKET SIZE, BY PROCESS, 2019–2026 (USD MILLION)

TABLE 97 FRANCE: MARKET SIZE, BY PROCESS, 2015–2018 (USD MILLION)

TABLE 98 FRANCE: MARKET SIZE, BY PROCESS, 2019–2026 (KILOTON)

TABLE 99 FRANCE: MARKET SIZE, BY PROCESS, 2015–2018 (KILOTON)

TABLE 100 FRANCE: MARKET SIZE, BY END-USE SECTOR, 2019–2026 (USD MILLION)

TABLE 101 FRANCE: MARKET SIZE, BY END-USE SECTOR, 2015–2018 (USD MILLION)

TABLE 102 FRANCE: MARKET SIZE, BY END-USE SECTOR, 2019–2026 (KILOTON)

TABLE 103 FRANCE: MARKET SIZE, BY END-USE SECTOR, 2015–2018 (KILOTON)

9.3.3 UK

9.3.3.1 Energy, automobile, and construction industries to drive the demand

TABLE 104 UK: MARKET SIZE, BY PROCESS, 2019–2026 (USD MILLION)

TABLE 105 UK: MARKET SIZE, BY PROCESS, 2015–2018 (USD MILLION)

TABLE 106 UK: MARKET SIZE, BY PROCESS, 2019–2026 (KILOTON)

TABLE 107 UK: MARKET SIZE, BY PROCESS, 2015–2018 (KILOTON)

TABLE 108 UK: MARKET SIZE, BY END-USE SECTOR, 2019–2026 (USD MILLION)

TABLE 109 UK: MARKET SIZE, BY END-USE SECTOR, 2015–2018 (USD MILLION)

TABLE 110 UK: MARKET SIZE, BY END-USE SECTOR, 2019–2026 (KILOTON)

TABLE 111 UK: MARKET SIZE, BY END-USE SECTOR, 2015–2018 (KILOTON)

9.3.4 ITALY

9.3.4.1 Rapid urbanization & infrastructural development to drive the demand

TABLE 112 ITALY: MARKET SIZE, BY PROCESS, 2019–2026 (USD MILLION)

TABLE 113 ITALY: MARKET SIZE, BY PROCESS, 2015–2018 (USD MILLION)

TABLE 114 ITALY: MARKET SIZE, BY PROCESS, 2019–2026 (KILOTON)

TABLE 115 ITALY: MARKET SIZE, BY PROCESS, 2015–2018 (KILOTON)

TABLE 116 ITALY: MARKET SIZE, BY END-USE SECTOR, 2019–2026 (USD MILLION)

TABLE 117 ITALY: MARKET SIZE, BY END-USE SECTOR, 2015–2018 (USD MILLION)

TABLE 118 ITALY: MARKET SIZE, BY END-USE SECTOR, 2019–2026 (KILOTON)

TABLE 119 ITALY: MARKET SIZE, BY END-USE SECTOR, 2015–2018 (KILOTON)

9.3.5 SPAIN

9.3.5.1 Strong industrial presence and steady construction and automobile industry growth to drive the market

TABLE 120 SPAIN: MARKET SIZE, BY PROCESS, 2019–2026 (USD MILLION)

TABLE 121 SPAIN: MARKET SIZE, BY PROCESS, 2015–2018 (USD MILLION)

TABLE 122 SPAIN: MARKET SIZE, BY PROCESS, 2019–2026 (KILOTON)

TABLE 123 SPAIN: MARKET SIZE, BY PROCESS, 2015–2018 (KILOTON)

TABLE 124 SPAIN: MARKET SIZE, BY END-USE SECTOR, 2019–2026 (USD MILLION)

TABLE 125 SPAIN: MARKET SIZE, BY END-USE SECTOR, 2015–2018 (USD MILLION)

TABLE 126 SPAIN: MARKET SIZE, BY END-USE SECTOR, 2019–2026 (KILOTON)

TABLE 127 SPAIN: MARKET SIZE, BY END-USE SECTOR, 2015–2018 (KILOTON)

9.3.6 RUSSIA

9.3.6.1 Machine construction, industrial growth, and rise in construction activities to drive the market growth

TABLE 128 RUSSIA: MARKET SIZE, BY PROCESS, 2019–2026 (USD MILLION)

TABLE 129 RUSSIA: MARKET SIZE, BY PROCESS, 2015–2018 (USD MILLION)

TABLE 130 RUSSIA: MARKET SIZE, BY PROCESS, 2019–2026 (KILOTON)

TABLE 131 RUSSIA: MARKET SIZE, BY PROCESS, 2015–2018 (KILOTON)

TABLE 132 RUSSIA: MARKET SIZE, BY END-USE SECTOR, 2019–2026 (USD MILLION)

TABLE 133 RUSSIA: MARKET SIZE, BY END-USE SECTOR, 2015–2018 (USD MILLION)

TABLE 134 RUSSIA: MARKET SIZE, BY END-USE SECTOR, 2019–2026 (KILOTON)

TABLE 135 RUSSIA: MARKET SIZE, BY END-USE SECTOR, 2015–2018 (KILOTON)

9.3.7 REST OF EUROPE

TABLE 136 REST OF EUROPE: MARKET SIZE, BY PROCESS, 2019–2026 (USD MILLION)

TABLE 137 REST OF EUROPE: MARKET SIZE, BY PROCESS, 2015–2018 (USD MILLION)

TABLE 138 REST OF EUROPE: MARKET SIZE, BY PROCESS, 2019–2026 (KILOTON)

TABLE 139 REST OF EUROPE: MARKET SIZE, BY PROCESS, 2015–2018 (KILOTON)

TABLE 140 REST OF EUROPE: MARKET SIZE, BY END-USE SECTOR, 2019–2026 (USD MILLION)

TABLE 141 REST OF EUROPE: MARKET SIZE, BY END-USE SECTOR, 2015–2018 (USD MILLION)

TABLE 142 REST OF EUROPE: MARKET SIZE, BY END-USE SECTOR, 2019–2026 (KILOTON)

TABLE 143 REST OF EUROPE: MARKET SIZE, BY END-USE SECTOR, 2015–2018 (KILOTON)

9.4 NORTH AMERICA

FIGURE 36 NORTH AMERICA: MARKET SNAPSHOT

TABLE 144 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 145 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2015–2018 (USD MILLION)

TABLE 146 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2019–2026 (KILOTON)

TABLE 147 NORTH AMERICA: MARKET SIZE, BY COUNTRY,2015–2018 (KILOTON)

TABLE 148 NORTH AMERICA: MARKET SIZE, BY PROCESS,2019–2026 (USD MILLION)

TABLE 149 NORTH AMERICA: MARKET SIZE, BY PROCESS, 2015–2018 (USD MILLION)

TABLE 150 NORTH AMERICA: MARKET SIZE, BY PROCESS, 2019–2026 (KILOTON)

TABLE 151 NORTH AMERICA: MARKET SIZE, BY PROCESS, 2015–2018 (KILOTON)

TABLE 152 NORTH AMERICA: MARKET SIZE, BY END-USE SECTOR, 2019–2026 (USD MILLION)

TABLE 153 NORTH AMERICA: MARKET SIZE, BY END-USE SECTOR, 2015–2018 (USD MILLION)

TABLE 154 NORTH AMERICA: MARKET SIZE, BY END-USE SECTOR, 2019–2026 (KILOTON)

TABLE 155 NORTH AMERICA: MARKET SIZE, BY END-USE SECTOR, 2015–2018 (KILOTON)

9.4.1 US

9.4.1.1 Developments in the automotive industry and growth in the building & construction industry to drive the market

TABLE 156 US: MARKET SIZE, BY PROCESS, 2019–2026 (USD MILLION)

TABLE 157 US: MARKET SIZE, BY PROCESS, 2015–2018 (USD MILLION)

TABLE 158 US: MARKET SIZE, BY PROCESS, 2019–2026 (KILOTON)

TABLE 159 US: MARKET SIZE, BY PROCESS, 2015–2018 (KILOTON)

TABLE 160 US: MARKET SIZE, BY END-USE SECTOR, 2019–2026 (USD MILLION)

TABLE 161 US: MARKET SIZE, BY END-USE SECTOR, 2015–2018 (USD MILLION)

TABLE 162 US: MARKET SIZE, BY END-USE SECTOR, 2019–2026 (KILOTON)

TABLE 163 US: MARKET SIZE, BY END-USE SECTOR, 2015–2018 (KILOTON)

9.4.2 CANADA

9.4.2.1 Construction and automobile industries of the country to drive the market

TABLE 164 CANADA: MARKET SIZE, BY PROCESS, 2019–2026 (USD MILLION)

TABLE 165 CANADA: MARKET SIZE, BY PROCESS, 2015–2018 (USD MILLION)

TABLE 166 CANADA: MARKET SIZE, BY PROCESS, 2019–2026 (KILOTON)

TABLE 167 CANADA: MARKET SIZE, BY PROCESS, 2015–2018 (KILOTON)

TABLE 168 CANADA: MARKET SIZE, BY END-USE SECTOR, 2019–2026 (USD MILLION)

TABLE 169 CANADA: MARKET SIZE, BY END-USE SECTOR, 2015–2018 (USD MILLION)

TABLE 170 CANADA: MARKET SIZE, BY END-USE SECTOR, 2019–2026 (KILOTON)

TABLE 171 CANADA: MARKET SIZE, BY END-USE SECTOR, 2015–2018 (KILOTON)

9.4.3 MEXICO

9.4.3.1 Focus on developing infrastructure and automotive industry innovations to drive the market

TABLE 172 MEXICO: MARKET SIZE, BY PROCESS,2019–2026 (USD MILLION)

TABLE 173 MEXICO: MARKET SIZE, BY PROCESS, 2015–2018 (USD MILLION)

TABLE 174 MEXICO: MARKET SIZE, BY PROCESS, 2019–2026 (KILOTON)

TABLE 175 MEXICO: MARKET SIZE, BY PROCESS, 2015–2018 (KILOTON)

TABLE 176 MEXICO: MARKET SIZE, BY END-USE SECTOR, 2019–2026 (USD MILLION)

TABLE 177 MEXICO: MARKET SIZE, BY END-USE SECTOR, 2015–2018 (USD MILLION)

TABLE 178 MEXICO: MARKET SIZE, BY END-USE SECTOR, 2019–2026 (KILOTON)

TABLE 179 MEXICO: MARKET SIZE, BY END-USE SECTOR, 2015–2018 (KILOTON)

9.5 MIDDLE EAST & AFRICA

TABLE 180 MIDDLE EAST & AFRICA: MARKET SIZE, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 181 MIDDLE EAST & AFRICA: MARKET SIZE, BY COUNTRY, 2015–2018 (USD MILLION)

TABLE 182 MIDDLE EAST & AFRICA: MARKET SIZE, BY COUNTRY, 2019–2026 (KILOTON)

TABLE 183 MIDDLE EAST & AFRICA: MARKET SIZE, BY COUNTRY, 2015–2018 (KILOTON)

TABLE 184 MIDDLE EAST & AFRICA: MARKET SIZE, BY PROCESS, 2019–2026 (USD MILLION)

TABLE 185 MIDDLE EAST & AFRICA: MARKET SIZE, BY PROCESS, 2015–2018 (USD MILLION)

TABLE 186 MIDDLE EAST & AFRICA: MARKET SIZE, BY PROCESS, 2019–2026 (KILOTON)

TABLE 187 MIDDLE EAST & AFRICA: MARKET SIZE, BY PROCESS, 2015–2018 (KILOTON)

TABLE 188 MIDDLE EAST & AFRICA: MARKET SIZE, BY END-USE SECTOR, 2019–2026 (USD MILLION)

TABLE 189 MIDDLE EAST & AFRICA: MARKET SIZE, BY END-USE SECTOR, 2015–2018 (USD MILLION)

TABLE 190 MIDDLE EAST & AFRICA: MARKET SIZE, BY END-USE SECTOR, 2019–2026 (KILOTON)

TABLE 191 MIDDLE EAST & AFRICA: MARKET SIZE, BY END-USE SECTOR, 2015–2018 (KILOTON)

9.5.1 TURKEY

9.5.1.1 Mega road projects and increasing automobile production in the country to drive the market

TABLE 192 TURKEY: MARKET SIZE, BY PROCESS, 2019–2026 (USD MILLION)

TABLE 193 TURKEY: MARKET SIZE, BY PROCESS, 2015–2018 (USD MILLION)

TABLE 194 TURKEY: MARKET SIZE, BY PROCESS, 2019–2026 (KILOTON)

TABLE 195 TURKEY: MARKET SIZE, BY PROCESS,2015–2018 (KILOTON)

TABLE 196 TURKEY: MARKET SIZE, BY END-USE SECTOR, 2019–2026 (USD MILLION)

TABLE 197 TURKEY: MARKET SIZE, BY END-USE SECTOR, 2015–2018 (USD MILLION)

TABLE 198 TURKEY: MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (KILOTON)

TABLE 199 TURKEY: MARKET SIZE, BY END-USE SECTOR, 2015–2018 (KILOTON)

9.5.2 SAUDI ARABIA

9.5.2.1 Mega construction projects and increasing automobile production in the country to drive the market

TABLE 200 SAUDI ARABIA: MARKET SIZE, BY PROCESS, 2019–2026 (USD MILLION)

TABLE 201 SAUDI ARABIA: MARKET SIZE, BY PROCESS, 2015–2018 (USD MILLION)

TABLE 202 SAUDI ARABIA: MARKET SIZE, BY PROCESS, 2019–2026 (KILOTON)

TABLE 203 SAUDI ARABIA: MARKET SIZE, BY PROCESS, 2015–2018 (KILOTON)

TABLE 204 SAUDI ARABIA: MARKET SIZE, BY END-USE SECTOR, 2019–2026 (USD MILLION)

TABLE 205 SAUDI ARABIA: MARKET SIZE, BY END-USE SECTOR, 2015–2018 (USD MILLION)

TABLE 206 SAUDI ARABIA: MARKET SIZE, BY END-USE SECTOR, 2019–2026 (KILOTON)

TABLE 207 SAUDI ARABIA: MARKET SIZE, BY END-USE SECTOR, 2015–2018 (KILOTON)

9.5.3 UAE

9.5.3.1 Exploring the potential in new markets in the country to drive the market

TABLE 208 UAE: ALUMINUM CASTING MARKET SIZE, BY PROCESS, 2019–2026 (USD MILLION)

TABLE 209 UAE: ALUMINUM CASTING MARKET SIZE, BY PROCESS, 2015–2018 (USD MILLION)

TABLE 210 UAE: ALUMINUM CASTING MARKET SIZE, BY PROCESS, 2019–2026 (KILOTON)

TABLE 211 UAE: ALUMINUM CASTING MARKET SIZE, BY PROCESS, 2015–2018 (KILOTON)

TABLE 212 UAE: ALUMINUM CASTING MARKET SIZE, BY END-USE SECTOR, 2019–2026 (USD MILLION)

TABLE 213 UAE: ALUMINUM CASTING MARKET SIZE, BY END-USE SECTOR, 2015–2018 (USD MILLION)

TABLE 214 UAE: ALUMINUM CASTING MARKET SIZE, BY END-USE SECTOR, 2019–2026 (KILOTON)

TABLE 215 UAE: ALUMINUM CASTING MARKET SIZE, BY END-USE SECTOR, 2015–2018 (KILOTON)

9.5.4 SOUTH AFRICA

9.5.4.1 Growing building & construction industry to drive the market

TABLE 216 SOUTH AFRICA: ALUMINUM CASTING MARKET SIZE, BY PROCESS, 2019–2026 (USD MILLION)

TABLE 217 SOUTH AFRICA: ALUMINUM CASTING MARKET SIZE, BY PROCESS, 2015–2018 (USD MILLION)

TABLE 218 SOUTH AFRICA: ALUMINUM CASTING MARKET SIZE, BY PROCESS, 2019–2026 (KILOTON)

TABLE 219 SOUTH AFRICA: ALUMINUM CASTING MARKET SIZE, BY PROCESS, 2015–2018 (KILOTON)

TABLE 220 SOUTH AFRICA: ALUMINUM CASTING MARKET SIZE, BY END-USE SECTOR, 2019–2026 (USD MILLION)

TABLE 221 SOUTH AFRICA: ALUMINUM CASTING MARKET SIZE, BY END-USE SECTOR, 2015–2018 (USD MILLION)

TABLE 222 SOUTH AFRICA: ALUMINUM CASTING MARKET SIZE, BY END-USE SECTOR, 2019–2026 (KILOTON)

TABLE 223 SOUTH AFRICA: ALUMINUM CASTING MARKET SIZE, BY END-USE SECTOR, 2015–2018 (KILOTON)

9.5.5 REST OF MIDDLE EAST & AFRICA

TABLE 224 REST OF MIDDLE EAST & AFRICA: ALUMINUM CASTING MARKET SIZE, BY PROCESS, 2019–2026 (USD MILLION)

TABLE 225 REST OF MIDDLE EAST & AFRICA: ALUMINUM CASTING MARKET SIZE, BY PROCESS, 2015–2018 (USD MILLION)

TABLE 226 REST OF MIDDLE EAST & AFRICA: ALUMINUM CASTING MARKET SIZE, BY PROCESS, 2019–2026 (KILOTON)

TABLE 227 REST OF MIDDLE EAST & AFRICA: ALUMINUM CASTING MARKET SIZE, BY PROCESS, 2015–2018 (KILOTON)

TABLE 228 REST OF MIDDLE EAST & AFRICA: ALUMINUM CASTING MARKET SIZE, BY END-USE SECTOR, 2019–2026 (USD MILLION)

TABLE 229 REST OF MIDDLE EAST & AFRICA: ALUMINUM CASTING MARKET SIZE, BY END-USE SECTOR, 2015–2018 (USD MILLION)

TABLE 230 REST OF MIDDLE EAST & AFRICA: ALUMINUM CASTING MARKET SIZE, BY END-USE SECTOR, 2019–2026 (KILOTON)

TABLE 231 REST OF MIDDLE EAST & AFRICA: ALUMINUM CASTING MARKET SIZE, BY END-USE SECTOR, 2015–2018 (KILOTON)

9.6 SOUTH AMERICA

TABLE 232 SOUTH AMERICA: ALUMINUM CASTING MARKET SIZE, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 233 SOUTH AMERICA: ALUMINUM CASTING MARKET SIZE, BY COUNTRY, 2015–2018 (USD MILLION)

TABLE 234 SOUTH AMERICA: ALUMINUM CASTING MARKET SIZE, BY COUNTRY, 2019–2026 (KILOTON)

TABLE 235 AMERICA: ALUMINUM CASTING MARKET SIZE, BY COUNTRY, 2015–2018 (KILOTON)

TABLE 236 SOUTH AMERICA: ALUMINUM CASTING MARKET SIZE, BY PROCESS, 2019–2026 (USD MILLION)

TABLE 237 SOUTH AMERICA: ALUMINUM CASTING MARKET SIZE, BY PROCESS, 2015–2018 (USD MILLION)

TABLE 238 SOUTH AMERICA: ALUMINUM CASTING MARKET SIZE, BY PROCESS, 2019–2026 (KILOTON)

TABLE 239 SOUTH AMERICA: ALUMINUM CASTING MARKET SIZE, BY PROCESS, 2015–2018 (KILOTON)

TABLE 240 SOUTH AMERICA: ALUMINUM CASTING MARKET SIZE, BY END-USE SECTOR, 2019–2026 (USD MILLION)

TABLE 241 SOUTH AMERICA: ALUMINUM CASTING MARKET SIZE, BY END-USE SECTOR, 2015–2018 (USD MILLION)

TABLE 242 SOUTH AMERICA: ALUMINUM CASTING MARKET SIZE, BY END-USE SECTOR, 2019–2026 (KILOTON)

TABLE 243 SOUTH AMERICA: ALUMINUM CASTING MARKET SIZE, BY END-USE SECTOR, 2015–2018 (KILOTON)

9.6.1 BRAZIL

9.6.1.1 Brazil’s construction and manufacturing industries to dominate the aluminum casting market in South America

TABLE 244 BRAZIL: ALUMINUM CASTING MARKET SIZE, BY PROCESS, 2019–2026 (USD MILLION)

TABLE 245 BRAZIL: ALUMINUM CASTING MARKET SIZE, BY PROCESS, 2015–2018 (USD MILLION)

TABLE 246 BRAZIL: ALUMINUM CASTING MARKET SIZE, BY PROCESS, 2019–2026 (KILOTON)

TABLE 247 BRAZIL: ALUMINUM CASTING MARKET SIZE, BY PROCESS, 2015–2018 (KILOTON)

TABLE 248 BRAZIL: ALUMINUM CASTING MARKET SIZE, BY END-USE SECTOR, 2019–2026 (USD MILLION)

TABLE 249 BRAZIL: ALUMINUM CASTING MARKET SIZE, BY END-USE SECTOR, 2015–2018 (USD MILLION)

TABLE 250 BRAZIL: ALUMINUM CASTING MARKET SIZE, BY END-USE SECTOR, 2019–2026 (KILOTON)

TABLE 251 BRAZIL: ALUMINUM CASTING MARKET SIZE, BY END-USE SECTOR, 2015–2018 (KILOTON)

9.6.2 ARGENTINA

9.6.2.1 Flourishing automotive industry and construction activities to drive the market

TABLE 252 ARGENTINA: ALUMINUM CASTING MARKET SIZE, BY PROCESS, 2019–2026 (USD MILLION)

TABLE 253 ARGENTINA: ALUMINUM CASTING MARKET SIZE, BY PROCESS, 2015–2018 (USD MILLION)

TABLE 254 ARGENTINA: ALUMINUM CASTING MARKET SIZE, BY PROCESS, 2019–2026 (KILOTON)

TABLE 255 ARGENTINA: ALUMINUM CASTING MARKET SIZE, BY PROCESS, 2015–2018 (KILOTON)

TABLE 256 ARGENTINA: ALUMINUM CASTING MARKET SIZE, BY END-USE SECTOR, 2019–2026 (USD MILLION)

TABLE 257 ARGENTINA: ALUMINUM CASTING MARKET SIZE, BY END-USE SECTOR, 2015–2018 (USD MILLION)

TABLE 258 ARGENTINA: ALUMINUM CASTING MARKET SIZE, BY END-USE SECTOR, 2019–2026 (KILOTON)

TABLE 259 ARGENTINA: ALUMINUM CASTING MARKET SIZE, BY END-USE SECTOR, 2015–2018 (KILOTON)

9.6.3 REST OF SOUTH AMERICA

TABLE 260 REST OF SOUTH AMERICA: ALUMINUM CASTING MARKET SIZE, BY PROCESS, 2019–2026 (USD MILLION)

TABLE 261 REST OF SOUTH AMERICA: ALUMINUM CASTING MARKET SIZE, BY PROCESS, 2015–2018 (USD MILLION)

TABLE 262 REST OF SOUTH AMERICA: ALUMINUM CASTING MARKET SIZE, BY PROCESS, 2019–2026 (KILOTON)

TABLE 263 REST OF SOUTH AMERICA: ALUMINUM CASTING MARKET SIZE, BY PROCESS, 2015–2018 (KILOTON)

TABLE 264 REST OF SOUTH AMERICA: ALUMINUM CASTING MARKET SIZE, BY END-USE SECTOR, 2019–2026 (USD MILLION)

TABLE 265 REST OF SOUTH AMERICA: ALUMINUM CASTING MARKET SIZE, BY END-USE SECTOR, 2015–2018 (USD MILLION)

TABLE 266 REST OF SOUTH AMERICA: ALUMINUM CASTING MARKET SIZE, BY END-USE SECTOR, 2019–2026 (KILOTON)

TABLE 267 REST OF SOUTH AMERICA: ALUMINUM CASTING MARKET SIZE, BY END-USE SECTOR, 2015–2018 (KILOTON)

10 COMPETITIVE LANDSCAPE (Page No. - 174)

10.1 OVERVIEW

10.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

FIGURE 37 COMPANIES ADOPTED EXPANSION AS THE KEY GROWTH STRATEGY DURING 2016–202O

10.3 MARKET RANKING

FIGURE 38 MARKET RANKING OF KEY PLAYERS, 2020

10.3.1 ALCOA CORPORATION

10.3.2 RYOBI LIMITED

10.3.3 ALUMINUM CORPORATION OF CHINA LIMITED

10.3.4 RIO TINTO

10.3.5 UNITED COMPANY RUSAL

10.4 REVENUE ANALYSIS OF TOP MARKET PLAYERS

FIGURE 39 REVENUE ANALYSIS FOR KEY COMPANIES IN THE ALUMINUM CASTING MARKET

10.5 MARKET SHARE ANALYSIS

TABLE 268 ALUMINUM CASTING MARKET: SHARES OF KEY PLAYERS

FIGURE 40 SHARE OF LEADING COMPANIES IN THE ALUMINUM CASTING MARKET

10.6 COMPANY EVALUATION QUADRANT

FIGURE 41 COMPETITIVE LEADERSHIP MAPPING: ALUMINUM CASTING MARKET, 2020

10.6.1 STAR

10.6.2 PERVASIVE

10.6.3 EMERGING LEADER

10.6.4 PARTICIPANT

10.7 COMPETITIVE BENCHMARKING

10.7.1 STRENGTH OF PRODUCT PORTFOLIO

10.7.2 BUSINESS STRATEGY EXCELLENCE

TABLE 269 COMPANY PROCESS FOOTPRINT

TABLE 270 COMPANY END-USE FOOTPRINT

TABLE 271 COMPANY REGION FOOTPRINT

10.8 COMPETITIVE LEADERSHIP MAPPING OF SMES (SMALL AND MEDIUM-SIZED ENTERPRISES)

10.8.1 PROGRESSIVE COMPANIES

10.8.2 RESPONSIVE COMPANIES

10.8.3 STARTING BLOCKS

10.8.4 DYNAMIC COMPANIES

FIGURE 42 COMPETITIVE LEADERSHIP MAPPING OF SMES (SMALL AND MEDIUM-SIZED ENTERPRISES), 2020

10.9 COMPETITIVE SCENARIO AND TRENDS

10.9.1 DEALS

TABLE 272 ALUMINUM CASTING MARKET: DEALS, JANUARY 2016–NOVEMBER 2020

10.9.2 OTHERS

TABLE 273 ALUMINUM CASTING MARKET: OTHERS, JANUARY 2017–AUGUST 2021

11 COMPANY PROFILES (Page No. - 191)

11.1 MAJOR PLAYERS

(Business and financial overview, Products/Solutions/Services offered, Recent Developments, , MnM View, Key strengths/Right to win, Weaknesses and competitive threats)*

11.1.1 ALCOA CORPORATION

TABLE 274 ALCOA CORPORATION: COMPANY OVERVIEW

FIGURE 43 ALCOA CORPORATION: COMPANY SNAPSHOT

11.1.2 RYOBI LIMITED

TABLE 275 RYOBI LIMITED: COMPANY OVERVIEW

FIGURE 44 RYOBI LIMITED: COMPANY SNAPSHOT

11.1.3 ALUMINUM CORPORATION OF CHINA LIMITED (CHALCO)

TABLE 276 ALUMINUM CORPORATION OF CHINA LIMITED (CHALCO): COMPANY OVERVIEW

FIGURE 45 ALUMINUM CORPORATION OF CHINA LIMITED: COMPANY SNAPSHOT

TABLE 277 ALUMINUM CORPORATION OF CHINA LIMITED (CHALCO): DEALS

11.1.4 RIO TINTO

TABLE 278 RIO TINTO: COMPANY OVERVIEW

FIGURE 46 RIO TINTO: COMPANY SNAPSHOT

11.1.5 UNITED COMPANY RUSAL

TABLE 279 UNITED COMPANY RUSAL: COMPANY OVERVIEW

FIGURE 47 UNITED COMPANY RUSAL: COMPANY SNAPSHOT

11.1.6 CHINA HONGQIAO GROUP LIMITED

TABLE 280 CHINA HONGQIAO GROUP LIMITED: COMPANY OVERVIEW

FIGURE 48 CHINA HONGQIAO GROUP LIMITED: COMPANY SNAPSHOT

11.1.7 ARCONIC INC.

TABLE 281 ARCONIC INC.: COMPANY OVERVIEW

FIGURE 49 ARCONIC INC.: COMPANY SNAPSHOT

11.1.8 GIBBS DIE CASTING CORP

TABLE 282 GIBBS DIE CASTING CORP: COMPANY OVERVIEW

11.1.9 DYNACAST CHARLOTTE

TABLE 283 DYNACAST CHARLOTTE: COMPANY OVERVIEW

11.1.10 ENDURANCE TECHNOLOGIES LTD.

TABLE 284 ENDURANCE TECHNOLOGIES LTD.: COMPANY OVERVIEW

FIGURE 50 ENDURANCE TECHNOLOGIES LTD.: COMPANY SNAPSHOT

11.1.11 KAISER ALUMINUM CORPORATION

TABLE 285 KAISER ALUMINUM CORPORATION: COMPANY OVERVIEW

FIGURE 51 KAISER ALUMINUM CORPORATION: COMPANY SNAPSHOT

11.2 ADDITIONAL PLAYERS

11.2.1 ROCKMAN INDUSTRIES LTD

11.2.2 CONSOLIDATED METCO, INC.

11.2.3 ALCAST TECHNOLOGIES LTD.

11.2.4 EAGLE ALUMINUM CAST PRODUCTS

11.2.5 DRE CASTING

11.2.6 MARTINREA HONSEL

11.2.7 BODINE ALUMINUM INC.

11.2.8 NINGBO INNOVAW MECHANICAL CO., LTD.

11.2.9 KENWALT DIE CASTING

11.2.10 LA ALUMINUM CASTING COMPANY

11.2.11 FAIRFIELD ALUMINUM CASTING COMPANY (FALCO)

11.2.12 OLSON ALUMINUM CASTINGS

11.2.13 PACE INDUSTRIES, LLC

11.2.14 SHREENATH METALS

11.2.15 HARRISON CASTINGS LTD

*Details on Business Overview, Products/Solutions/Services offered, Recent Developments, MnM View, Key strengths/Right to win, Weaknesses and competitive threats might not be captured in case of unlisted companies.

12 APPENDIX (Page No. - 235)

12.1 DISCUSSION GUIDE

12.2 KNOWLEDGE STORE: MARKETSANDMARKETS SUBSCRIPTION PORTAL

12.3 AVAILABLE CUSTOMIZATIONS

12.4 RELATED REPORTS

12.5 AUTHOR DETAILS

Casting Market Overview

Casting Market Trends

1. 3D Printing of Castings

2. Lightweight Materials for Transportation

3. Renewable Energy Applications

4. Medical Devices

5. Aerospace and Defense

Top Companies in Casting Market

Casting Market Impact on Different Industries

1. Automotive Industry

2. Aerospace Industry

3. Construction Industry

4. Energy Industry

5. Medical Industry

Speak to our Analyst today to know more about Casting Market!

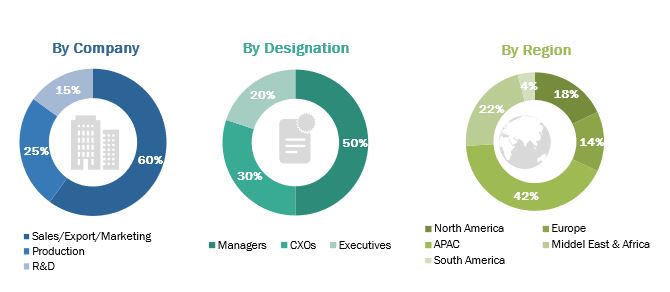

The study involved four major activities in estimating the current market size for the aluminum casting market. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, the market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources, such as Hoovers and Bloomberg BusinessWeek, were referred to for identifying and collecting information for this study. These secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, gold standard & silver standard websites, food safety organizations, regulatory bodies, and databases.

Primary Research

In the primary research process, various primary sources from both supply and demand sides were interviewed to obtain qualitative and quantitative information on the market. Primary interviews were conducted to gather insights, such as market statistics, data of revenue collected from the products & services, market breakdowns, market size estimations, market forecasting, and data triangulation. Primary research also helped in understanding various trends related to process, end-use sector, and region. Stakeholders from the demand side, such as automobile, industrial, building & construction companies, and other companies of the customer/end users who are using aluminum cast products were interviewed to understand the buyers’ perspective on suppliers, products, service providers, and their current use of aluminum casting and outlook of their business, which will affect the overall market.

Following is the breakdown of primary respondents—

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Top-down and bottom-up approaches were used to estimate and validate the total size of the aluminum casting market. These methods were also used extensively to estimate the size of the various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and markets were identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value and volume, were determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size-using the market size estimation processes as explained above-the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Report Objectives:

- To define, describe, and forecast the global aluminum casting market size, in terms of value and volume

- To provide detailed information regarding the key drivers, restraints, challenges, and opportunities influencing the market growth

- To analyze and forecast the aluminum casting market based on process and end-use

- To analyze and forecast the market size, based on five key regions, namely, Asia Pacific (APAC), Europe, North America, South America, and Middle East & Africa along with their key countries

- To analyze opportunities in the market for stakeholders and provide a competitive landscape for market leaders

- To analyze competitive developments, such as expansions, merger & acquisition, collaboration, and new product developments in the market

- To strategically identify and profile the key market players and analyze their core competencies in the market

Available Customizations:

- MarketsandMarkets offers customizations according to the specific requirements of companies with the given market data.

- The following customization options are available for the report

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Aluminum Casting Market