Integration Platform as a Service Market by Service Type (API Management, B2B Integration, Data Integration), Deployment Model (Public and Private Cloud), Organization Size, Vertical and Region (2022 - 2026)

Integration Platform as a Service Market Size & Forecast

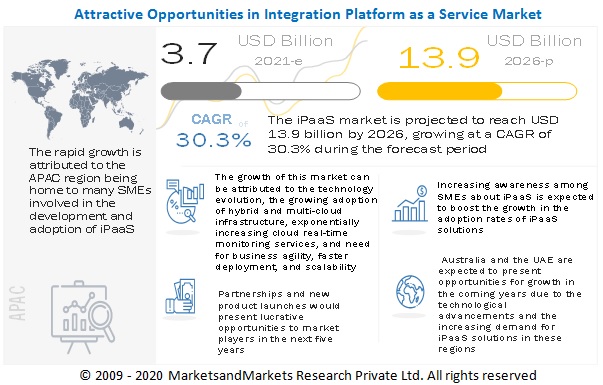

The global Integration Platform as a Service Market size was valued at USD 3.7 billion in 2021 and is expected to grow at a CAGR of 30.3% from 2021 to 2026. The revenue forecast for 2026 is projected to reach $13.9 billion. The base year for estimation is 2020, and the historical data spans from 2021 to 2026.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 Impact Analysis

The COVID-19 pandemic has boosted iPaaS solution adoption across industry verticals as the users move to leverage iPaaS solutions advantages, such as expansions and less cost. Despite the global economic slowdown, around 50% of subscription companies are expanding at a similar pace without any negative influence due to the COVID-19 pandemic.

Due to the COVID 19 outbreak, organizations across the globe are experiencing huge changes in the way products and services are bought and sold. Many studies and survey organizations, including large enterprises and SMEs, have increased their marketing spend during and after the COVID-19 lockdown situation. The COVID-19 pandemic has affected every segment of the society, including individuals and businesses. The technological ecosystem has been playing a pivotal role across the globe. The impact of the COVID-19 pandemic on the iPaaS market has been analyzed. The emphasis is substantially on the positive effects of the pandemic on market growth. Mandatory containment measures and health safety compliances have put huge pressure on remote operations in various industry verticals, such as BFSI, energy and utilities, government and public sector, healthcare and life sciences, manufacturing. For instance, several auto manufacturers, such as Ford, GM, and Fiat Chrysler, had shut down their centers across North America and Europe. This has led to the demand for iPaaS solutions to support remote monitoring across these industry verticals.

Technologies such as IoT and 5G, along with iPaaS, make it possible for the organization to tackle COVID-19-related risks and customer expectations. Software applications, telemedicine programs, and diagnostic devices using patient data can enable medical professionals to reach their patients quickly and efficiently. At the end of 2020, global companies witnessed rising investments in cloud solutions to facilitate easy remote working. Hence, due to the rising adoption of cloud solutions and platforms in all organizations, it is expected to accelerate the demand for platform integration services, which fuels the integration platform as a service market growth.

Integration Platform as a Service Market Growth Dynamics

Drivers: Growing Adoption of Hybrid and Multi-cloud Infrastructure

It is anticipated that, in the coming years, various organizations will adopt hybrid and multi-cloud strategies, as these systems are trending in the relevant sectors. Organizations are expected to opt for these strategies as they are reluctant to depend on a single cloud vendor. According to IBM Corp., 98% of organizations are planning to utilize multiple hybrid clouds by 2021. Hybrid cloud provides the benefits of both public and private clouds, by enhancing flexibility to work between both the cloud solutions. Further, it enables organizations to protect their confidential data by storing it in the private cloud and simultaneously using the public cloud for storing public data. The requirements of specific applications and functions will differ with the increase in specialized services. This, in turn, encourages business managers to opt for multi-cloud and hybrid solutions to run the system effectively and efficiently. Moreover, it is cost-effective, and it mitigates the risk of business loss. The adoption of hybrid cloud will also influence the integration platform as a service (IPaaS) market growth. The hybrid model will require proper integration to ensure smooth business functioning over time, thereby contributing to the market growth.

Restraints: Interoperability issues

iPaaS offers a platform to integrate with applications, data, and process integration projects that involve cloud-based applications, APIs, and on-premises systems. However, such integrations are not possible with the existing traditional machines which are highly interoperable. The traditional applications that manage critical data such as consumer details and employee details are not interoperable with the latest cloud integration system, which requires the need to replace the existing system with the new updated system to integrate with iPaaS. These issues with interoperability make it difficult for enterprises to adopt iPaaS.

Challenges: Intense competition among major vendors

The emerging iPaaS market includes both established and specialized vendors. The large vendors have advanced through data integration to iPaaS, whereas SMEs have unrolled themselves with the extension to the middleware portfolio. So, most iPaaS vendors are fragmented, and vendors are expanding the integration solutions by focusing beyond core competencies to improve positioning as well as cloud-based application and integration process. Most iPaaS vendors are struggling to establish themselves in the fragmented market. For instance, major vendors such as Boomi, Informatica, MuleSoft, and SnapLogic contribute the largest market share around the globe. Hence, there is stiff competition among the major players, which hinders the growth of SMEs. So, these vendors are finding it difficult to compete with the major iPaaS vendors.

Opportunities:Growing demand among enterprises to streamline business processes

Despite having challenges and restraints in implementing iPaaS, enterprises prefer it as a standalone cloud-based and on-premises service platform for integrating applications as it offers better control on integration flows, cost efficiency, faster delivery, and reliability. In addition, the integration of SaaS and iPaaS platform can be done with the help of cloud enterprises that offer enterprises to share data and processes from anywhere for streamlining the business. The iPaaS market is emerging, and it has the potential to boost enterprises during the forecast period. Therefore, iPaaS will likely boost the market among enterprises to streamline the business processes.

Integration Platform as a Service Market Ecosystem

To know about the assumptions considered for the study, download the pdf brochure

Based on service type, API Management to be a larger contributor to the iPaaS market growth during the forecast period

As a growing number of consumers and businesses incorporate web and mobile apps into their daily routines, businesses are discovering valuable new uses for previously isolated data sources. APIs (application programming interfaces) are tools that allow businesses to put that data to use by inspiring innovative developers to create new business opportunities and improve existing products, systems, and operations. APIs are a method for integrating enterprise systems and are often the vehicle that enables iPaaS solutions. API management is the process of overseeing and managing those APIs across their lifecycle, from designing, publishing, documenting, analyzing, and beyond. Solutions that manage the full API lifecycle provide a means of creating and deploying the API as well as the ability to govern, secure, and manage those APIs. API management solutions ensure visibility into APIs across the organization and that each API is secured properly, as well as serviced and troubleshot when errors arise. These solutions also provide a way for APIs to be easily accessed and discovered across the organization to be reused for other projects. API management solutions offer various features such as API design studios, API analytics, can serve as an API gateway, and even API stores.

Based on deployment model, the public cloud deployment be a larger contributor to the iPaaS market during the forecast period

The public cloud refers to the cloud computing model in which the resources are accessible to multiple users in sharing through the internet. It is a standard model that enables service providers to grant access to resources such as applications and storage, available to the public over the internet. Public cloud services may be offered free of cost or on a pay-per-use model, depending on the requirements of the end users. The reason for the high adoption of public cloud among cloud storage providers is the ease of access and faster deployment. The public cloud deployment model offers various benefits to the enterprises, such as scalability, reliability, flexibility, and remote location access. It is more preferred by the enterprises that have fewer regulatory hurdles and are willing to outsource their storage facilities either fully or partially. The major concern with the public cloud is data security, due to which many enterprises are shifting to private and hybrid cloud storage solutions. However, the public cloud is expected to hold the largest market share in the iPaaS market. It is the most common type of cloud computing deployment. A third-party cloud service provider owns and operates the cloud resources (such as servers and storage) distributed over the internet. A cloud provider owns and manages all hardware, software, and other supporting infrastructure in a public cloud. Furthermore, it provides a wide range of data recovery options and infrastructures, such as hardware, operating systems, software, and middleware servers, to run applications across several platforms. Enterprises prefer to adopt public cloud services as they are simple to implement.

Based on organization size, the SMEs segment to be a larger contributor to the iPaaS market growth during the forecast period

Cost-effectiveness is an important factor for SMEs, as they always have tight budgets, leaving them with limited ways to market themselves and gain visibility. The intensely competitive market scenario has encouraged SMEs to invest in IPaaS solutions to reach their desired target audience. The implementation of cloud storage would result in increased revenue, desired outcomes, and improved business efficiency for SMEs. However, SMEs face challenges in managing capital, hiring a skilled workforce, and scalability. To overcome these challenges, SMEs adopt the pay-as-you-go model to manage IT costs and improve flexibility and scalability. SMEs adopt iPaaS solutions to improve business performance, informed decision-making, and manage the overall integration process at a reduced cost. Small businesses will take a fit-to-business scale approach when looking for an ideal iPaaS solution.

Based on verticals, the BFSI vertical to be a larger contributor to the iPaaS market growth during the forecast period

The BFSI industry has been booming with technological advancements revolutionizing the user experience for customers and businesses. BFSI has been disrupting the market with new applications and innovations to a point where individuals are using a bunch of applications to manage their finances. It can automate routine data entry, enable SaaS and on-premises systems to share data, and automate workflows between systems for greater efficiency and productivity. The BFSI sector provides substantial opportunities for the growth of the iPaaS market due to the complex integration between cloud services and on-premises systems. Banks are investing in iPaaS as a key enabler of centralized management of all integrated processes and improved cost efficiencies to support their business strategies. Companies such as Dell Boomi, Oracle, IBM, and Informatica are the major players in this vertical.

APAC to grow at the highest CAGR during the forecast period

APAC is expected to grow at a significant rate during the forecast period. This growth is driven by the rising adoption of cloud and mobility trends in China, Australia and New Zealand (ANZ), India, and Japan. Government initiatives to promote the digital infrastructure are also driving the adoption of iPaaS in the region. The APAC region is expected to have major traction toward iPaaS modules due to the rising demand for local manufacturing and high energy demand. The increasing proliferation of cloud and mobile technologies and changing work dynamics have led to the adoption across verticals, such as manufacturing, energy and utilities, retail and consumer goods, BFSI, and telecommunications of iPaaS in countries such as China, Japan, Singapore, and Australia. Companies such as Boomi, SAP, Oracle, Microsoft, and IBM are the top players focusing on serving the APAC iPaaS market.

Asia Pacific’s rapid growth rate is attributed to the region being home to many SMEs, which are highly involved in the development and adoption of iPaaS. China is one of the largest e-commerce markets in the world. The expansion in the sector is a significant driver for the adoption of iPaaS solutions. The rapid rise of e-commerce that is dealing in B2B and B2C platforms has demanded businesses to handle multiple areas such as online selling, placing orders, and inventory management, among others. IPaaS solutions can provide a seamless e-commerce integration solution to merge the back-end processes, ERP systems, and the website. Moreover, these integration tools enable the free flow of data across front-end and back-end systems while significantly reducing IT outlays.

Key Market Players

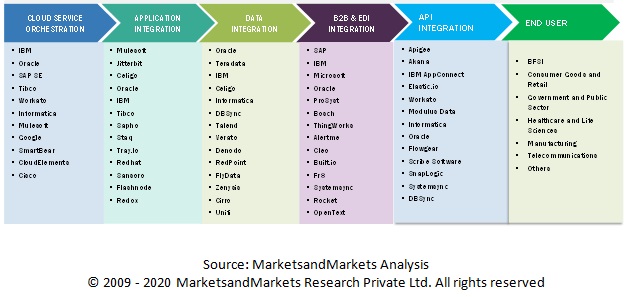

The Integration Platform as a Service Market is dominated by companies such as Informatica (US), Boomi Inc. (US), SAP SE (Germany), Oracle Corporation (US), MuleSoft LLC (US), Jitterbit Inc. (US), Workato Inc. (US), SnapLogic Inc. (US), Software AG (Germany), IBM Corporation (US), Microsoft Corporation (US), Tibco (US), Celigo (US), and Zapier (US). These vendors have a large customer base and strong geographic footprint along with organized distribution channels, which helps them to increase revenues.

Scope of the Report

|

Report Metrics |

Details |

|

Market Size Value in 2021 |

US$ 3.7 billion |

|

Revenue Forecast Size Value in 2026 |

US$ 13.9 billion |

|

Growth Rate |

30.3% CAGR |

|

Market size available for years |

2016-2026 |

|

Base year considered |

2020 |

|

Forecast period |

2021-2026 |

|

Key Market Drivers |

|

|

Key Market Opportunities |

|

|

Segments covered |

Service Type, Deployment Model, Organization Size, Verticals, and Regions |

|

Regions covered |

North America, Europe, APAC, MEA, and Latin America |

|

Companies covered |

Informatica Inc. (US), Boomi Inc. (US), SAP SE (Germany), Oracle Corporation (US), MuleSoft LLC (US), Jitterbit Inc. (US), Workato Inc. (US), SnapLogic Inc. (US), Software AG (Germany), IBM Corporation (US), Microsoft Corporation (US), Tibco (US), Celigo (US), and Zapier (US). |

This research report categorizes the Integration Platform as a Service Market to forecast revenue and analyze trends in each of the following submarkets:

Based on the service type:

- API Management

- B2B Integration

- Data Integration

- Cloud Integration

- Application Integration

- Other Services (EDI Integration and Cloud Service Orchestration)

Based on the deployment model:

- Public Cloud

- Private Cloud

Based on the Organization Size

- Large Enterprises

- SMEs

Based on the verticals:

- Banking, Financial Services, and Insurance (BFSI)

- Energy and Utilities

- Government and Public Sector

- Healthcare and Life Sciences

- Manufacturing

- Retail and Consumer Goods

- Telecommunications

- Others

Based on regions:

-

North America

- US

- Canada

-

Europe

- UK

- Germany

- France

- Rest of Europe

-

APAC

- China

- Japan

- Australia

- Rest of APAC

-

Middle East

- UAE

- Saudi Arabia

- Rest of MEA

-

Latin America

- Brazil

- Rest of Latin America

Recent Developments

- In October 2021, Boomi launched a new charitable donation program, led by its Boomiverse user community, that will give a total of $100,000 to nonprofit organizations dedicated to causes such as alleviating homelessness, increasing diversity in STEM, international aid, and more.

- In October 2021, Propel, developer of the only unified quality management (QMS) and product lifecycle management (PLM) solution built on Salesforce, and Jitterbit, the API transformation company have made a strategic partnership to standardize and simplify connections between Propel and enterprise resource planning (ERP) systems. Jitterbit becomes Propel’s preferred solution for integrations with ERP providers catering to small, medium, and mid-market manufacturers, including NetSuite, Infor, and Microsoft Dynamics.

- In September 2021,SnapLogic has released the latest version of its breakthrough new SnapLogic Flows solution. SnapLogic Flows makes it easy for teams in departments such as sales, marketing, finance, and HR to build new integrations and automation themselves that support their daily operations, solve their most pressing business needs, and speed up time-to-market and results.

- In August 2021, SnapLogic and Schneider Electric has introduced a new citizen developer approach to application and data integration. With SnapLogic’s self-service, low-code platform as the foundation for Schneider Electric’s new operating model, the multinational energy provider has empowered nearly 150 citizen developers to integrate more than 100 cloud and on-premises systems across the company, driving up employee productivity and resulting in faster innovation and greater business impact.

- In May 2021,Jitterbit has acquired eBridge Connections, a leading integration Platform as a Service (iPaaS) provider that enables data to seamlessly flow between on-premises or cloud e-commerce, EDI, ERP, and CRM systems. A strong complement to Jitterbit’s award-winning Harmony API integration platform, the combined offerings will provide one of the industry’s most comprehensive sets of integration solutions around e-commerce integration and EDI integration on the market, helping customers accelerate their digital transformations and reap massive time efficiencies.

- In May 2021,Boomi and Solace, a leading provider of event streaming and management capabilities, today announced that the European retail distributor, The Mousquetaires Group, has chosen both companies to support its digital transformation and the adoption of a hybrid integration platform.

- In May 2021,Francisco Partners, a leading global investment firm that specializes in partnering with technology businesses, and TPG Capital, the private equity platform of global alternative asset firm TPG, have entered into a definitive agreement with Dell Technologies to acquire Boomi, a leading provider of cloud-based integration platform as a service (iPaaS). The cash transaction is valued at $4 billion and is expected to close by the end of 2021, subject to customary closing conditions. Terms of the agreement were not disclosed.

Frequently Asked Questions (FAQ):

What is the projected market value of the iPaaS market?

What are the iPaaS Market Trends?

- Continued growth

- Emphasis on security

- Expansion of capabilities

- Increasing adoption by small and medium-sized businesses

- Competition and consolidation

Which region has the highest market share in the iPaaS market?

Which service type is expected to witness high adoption in the coming years?

Which are the major vendors in the iPaaS market?

Which countries are considered in the European region?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 26)

1.1 INTRODUCTION TO COVID-19

1.2 COVID-19 HEALTH ASSESSMENT

FIGURE 1 COVID-19: GLOBAL PROPAGATION

FIGURE 2 COVID-19 PROPAGATION: SELECT COUNTRIES

1.3 COVID-19 ECONOMIC ASSESSMENT

FIGURE 3 REVISED GROSS DOMESTIC PRODUCT FORECASTS FOR SELECT G20 COUNTRIES IN 2020

1.3.1 COVID-19 ECONOMIC IMPACT—SCENARIO ASSESSMENT

FIGURE 4 CRITERIA IMPACTING THE GLOBAL ECONOMY

FIGURE 5 SCENARIOS IN TERMS OF RECOVERY OF THE GLOBAL ECONOMY

1.4 OBJECTIVES OF THE STUDY

1.5 MARKET DEFINITION

1.5.1 INCLUSIONS AND EXCLUSIONS

1.6 MARKET SCOPE

1.6.1 MARKET SEGMENTATION

1.6.2 REGIONS COVERED

1.6.3 YEARS CONSIDERED FOR THE STUDY

1.7 CURRENCY CONSIDERED

TABLE 1 UNITED STATES DOLLAR EXCHANGE RATE, 2018–2020

1.8 STAKEHOLDERS

1.9 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 36)

2.1 RESEARCH DATA

FIGURE 6 INTEGRATION PLATFORM AS A SERVICE MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.2 PRIMARY DATA

2.1.2.1 Breakup of primary profiles

FIGURE 7 BREAKUP OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

TABLE 2 PRIMARY RESPONDENTS: MARKET

2.1.2.2 Key industry insights

2.2 MARKET BREAKUP AND DATA TRIANGULATION

FIGURE 8 DATA TRIANGULATION

2.3 MARKET SIZE ESTIMATION

FIGURE 9 INTEGRATION PLATFORM AS A SERVICE MARKET: TOP-DOWN AND BOTTOM-UP APPROACHES

FIGURE 10 MARKET SIZE ESTIMATION METHODOLOGY – APPROACH 1 (SUPPLY SIDE): REVENUE OF IPAAS FROM VENDORS

FIGURE 11 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH (SUPPLY SIDE): COLLECTIVE REVENUE OF IPAAS VENDORS

FIGURE 12 MARKET SIZE ESTIMATION METHODOLOGY - APPROACH 2 (DEMAND SIDE): IPAAS MARKET

FIGURE 13 MARKET SIZE ESTIMATION METHODOLOGY – (SUPPLY SIDE): ILLUSTRATION OF VENDOR REVENUE ESTIMATION

FIGURE 14 MARKET SIZE ESTIMATION METHODOLOGY – APPROACH 2 (DEMAND SIDE): REVENUE GENERATED FROM COMPONENT (1/2)

2.4 ASSUMPTIONS FOR THE STUDY

2.5 LIMITATIONS OF THE STUDY

3 EXECUTIVE SUMMARY (Page No. - 47)

FIGURE 15 INTEGRATION PLATFORM AS A SERVICE MARKET: GLOBAL SNAPSHOT, 2019-2026

FIGURE 16 TOP-GROWING SEGMENTS IN THE MARKET

FIGURE 17 API MANAGEMENT EXPECTED TO ACCOUNT FOR THE LARGEST MARKET SIZE DURING THE FORECAST PERIOD

FIGURE 18 PUBLIC CLOUD EXPECTED TO ACCOUNT FOR A LARGER MARKET SIZE DURING THE FORECAST PERIOD

FIGURE 19 SMES EXPECTED TO ACCOUNT FOR A LARGER MARKET SIZE DURING THE FORECAST PERIOD

FIGURE 20 TOP VERTICALS IN THE MARKET, 2019–2026 (USD MILLION)

FIGURE 21 NORTH AMERICA EXPECTED TO ACCOUNT FOR THE LARGEST MARKET SIZE DURING THE FORECAST PERIOD

4 PREMIUM INSIGHTS (Page No. - 54)

4.1 BRIEF OVERVIEW OF THE INTEGRATION PLATFORM AS A SERVICE MARKET

FIGURE 22 ADOPTION OF HYBRID AND MULTI-CLOUD INFRASTRUCTURE AND INCREASING CLOUD REAL-TIME MONITORING SERVICES TO DRIVE THE MARKET GROWTH

4.2 MARKET, BY SERVICE TYPE, 2021 VS. 2026

FIGURE 23 API MANAGEMENT EXPECTED TO ACCOUNT FOR THE LARGEST MARKET SHARE BY 2026

4.3 MARKET, BY DEPLOYMENT MODEL, 2021 VS. 2026

FIGURE 24 PUBLIC CLOUD SEGMENT EXPECTED TO ACCOUNT FOR A LARGER SHARE BY 2026

4.4 MARKET, BY ORGANIZATION SIZE, 2021 VS. 2026

FIGURE 25 LARGE ENTERPRISES EXPECTED TO ACCOUNT FOR A LARGER MARKET SHARE BY 2026

4.5 MARKET, BY VERTICAL, 2021 VS. 2026

FIGURE 26 BFSI SEGMENT EXPECTED TO ACCOUNT FOR THE LARGEST MARKET SHARE BY 2026

4.6 INTEGRATION PLATFORM AS A SERVICE MARKET INVESTMENT SCENARIO

FIGURE 27 ASIA PACIFIC TO EMERGE AS THE BEST MARKET FOR INVESTMENTS IN THE NEXT FIVE YEARS

5 MARKET OVERVIEW AND INDUSTRY TRENDS (Page No. - 58)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 28 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES: INTEGRATED PLATFORM AS A SERVICE MARKET

5.2.1 DRIVERS

5.2.1.1 Growing Adoption of Hybrid and Multi-cloud Infrastructure

5.2.1.2 Exponentially increasing cloud real-time monitoring services

5.2.1.3 Need for business agility, faster deployment, and scalability

5.2.2 RESTRAINTS

5.2.2.1 Interoperability issues

5.2.2.2 High initial investments

5.2.3 OPPORTUNITIES

5.2.3.1 Growing demand among enterprises to streamline business processes

5.2.3.2 Accelerate hybrid cloud and big data integration of enterprises

5.2.4 CHALLENGES

5.2.4.1 Intense competition among major vendors

5.2.4.2 Usage of Enterprise Service Bus (ESB) technology as an alternative

5.3 COVID-19-DRIVEN MARKET DYNAMICS

5.3.1 DRIVERS AND OPPORTUNITIES

5.3.2 RESTRAINTS AND CHALLENGES

5.4 CASE STUDY ANALYSIS

5.4.1 CASE STUDY 1: BERKLEE BRINGS HARMONY TO CONNECTED STUDENT MANAGEMENT

5.4.2 CASE STUDY 2: BRASKEM ENHANCES PETROCHEMICAL FACTORY EFFICIENCY

5.4.3 CASE STUDY 3: NSW HEALTH PATHOLOGY EFFICIENTLY INTEGRATES HEALTHCARE DATA TO DELIVER A BETTER PATIENT EXPERIENCE

5.4.4 CASE STUDY 4: ALTUS FINANCIAL USES ENTERPRISE AUTOMATION TO ENSURE DATA INTEGRITY

5.4.5 CASE STUDY 5: INTEGRATING FUN WITH CRUISING

5.5 ECOSYSTEM

FIGURE 29 INTEGRATED PLATFORM AS A SERVICE MARKET: ECOSYSTEM

5.6 VALUE CHAIN ANALYSIS

FIGURE 30 INTEGRATED PLATFORM AS A SERVICE MARKET: VALUE CHAIN

5.7 PRICING ANALYSIS

5.8 PATENT ANALYSIS

FIGURE 31 NUMBER OF PATENTS PUBLISHED

FIGURE 32 TOP FIVE PATENT OWNERS (GLOBAL)

TABLE 3 TOP TEN PATENT OWNERS

TABLE 4 PATENTS GRANTED TO VENDORS IN THE INTEGRATED PLATFORM AS A SERVICE MARKET

5.9 TECHNOLOGY ANALYSIS

5.9.1 CLOUD COMPUTING

5.9.2 AI/ML

5.9.3 BIG DATA

5.9.4 IOT

5.9.5 BLOCKCHAIN

5.10 PORTER’S FIVE FORCES ANALYSIS

FIGURE 33 INTEGRATED PLATFORM AS A SERVICE MARKET: PORTER’S FIVE FORCES ANALYSIS

TABLE 5 INTEGRATED PLATFORM AS A SERVICE MARKET: PORTER’S FIVE FORCES ANALYSIS

5.10.1 THREAT OF NEW ENTRANTS

5.10.2 THREAT OF SUBSTITUTES

5.10.3 BARGAINING POWER OF SUPPLIERS

5.10.4 BARGAINING POWER OF BUYERS

5.10.5 INTENSITY OF COMPETITIVE RIVALRY

5.11 REGULATIONS

5.11.1 NORTH AMERICA

5.11.2 EUROPE

5.11.3 ASIA PACIFIC

5.11.4 MIDDLE EAST AND AFRICA

5.11.5 LATIN AMERICA

6 INTEGRATION PLATFORM AS A SERVICE MARKET, BY SERVICE TYPE (Page No. - 79)

6.1 INTRODUCTION

6.1.1 SERVICE TYPE: MARKET DRIVERS

6.1.2 SERVICE TYPE: COVID-19 IMPACT

FIGURE 34 APPLICATION INTEGRATION SEGMENT EXPECTED TO GROW AT THE HIGHEST CAGR DURING THE FORECAST PERIOD

TABLE 6 MARKET SIZE, BY SERVICE TYPE, 2016–2020 (USD MILLION)

TABLE 7 MARKET SIZE, BY SERVICE TYPE, 2021–2026 (USD MILLION)

6.2 API MANAGEMENT

TABLE 8 API MANAGEMENT: MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 9 API MANAGEMENT: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

6.3 B2B INTEGRATION

TABLE 10 B2B INTEGRATION: MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 11 B2B INTEGRATION: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

6.4 DATA INTEGRATION

TABLE 12 DATA INTEGRATION: MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 13 DATA INTEGRATION: INTEGRATION PLATFORM AS A SERVICE MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

6.5 CLOUD INTEGRATION

TABLE 14 CLOUD INTEGRATION: MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 15 CLOUD INTEGRATION: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

6.6 APPLICATION INTEGRATION

TABLE 16 APPLICATION INTEGRATION: MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 17 APPLICATION INTEGRATION: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

6.7 OTHER SERVICES (EDI INTEGRATION, CLOUD SERVICE ORCHESTRATION)

TABLE 18 OTHER SERVICES: MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 19 OTHER SERVICES: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

7 INTEGRATION PLATFORM AS A SERVICE MARKET, BY DEPLOYMENT MODEL (Page No. - 89)

7.1 INTRODUCTION

7.1.1 DEPLOYMENT MODEL: MARKET DRIVERS

7.1.2 DEPLOYMENT MODEL: COVID-19 IMPACT

FIGURE 35 PRIVATE CLOUD SEGMENT EXPECTED TO GROW AT A HIGHER CAGR DURING THE FORECAST PERIOD

TABLE 20 MARKET SIZE, BY DEPLOYMENT MODEL, 2016–2020 (USD MILLION)

TABLE 21 MARKET SIZE, BY DEPLOYMENT MODEL, 2021–2026 (USD MILLION)

7.2 PUBLIC CLOUD

TABLE 22 PUBLIC CLOUD: MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 23 PUBLIC CLOUD: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

7.3 PRIVATE CLOUD

TABLE 24 PRIVATE CLOUD: MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 25 PRIVATE CLOUD: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

8 INTEGRATION PLATFORM AS A SERVICE MARKET, BY ORGANIZATION SIZE (Page No. - 94)

8.1 INTRODUCTION

FIGURE 36 LARGE ENTERPRISES TO GROW AT A HIGHER CAGR DURING THE FORECAST PERIOD

TABLE 26 MARKET SIZE, BY ORGANIZATION SIZE, 2016–2020 (USD MILLION)

TABLE 27 MARKET SIZE, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

8.1.1 ORGANIZATION SIZE: MARKET DRIVERS

8.1.2 ORGANIZATION SIZE: COVID-19 IMPACT

8.2 SMALL AND MEDIUM-SIZED ENTERPRISES

TABLE 28 SMALL AND MEDIUM-SIZED ENTERPRISES: MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 29 SMALL AND MEDIUM-SIZED ENTERPRISES: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

8.3 LARGE ENTERPRISES

TABLE 30 LARGE ENTERPRISES: MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 31 LARGE ENTERPRISES: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

9 INTEGRATION PLATFORM AS A SERVICE MARKET, BY VERTICAL (Page No. - 99)

9.1 INTRODUCTION

FIGURE 37 RETAIL AND CONSUMER GOODS VERTICAL IS EXPECTED TO GROW AT THE HIGHEST CAGR DURING THE FORECAST PERIOD

TABLE 32 MARKET SIZE, BY VERTICAL, 2016–2020 (USD MILLION)

TABLE 33 MARKET SIZE, BY VERTICAL, 2021–2026 (USD MILLION)

9.1.1 VERTICAL: MARKET DRIVERS

9.1.2 VERTICAL: COVID-19 IMPACT

9.2 BANKING, FINANCIAL SERVICES, AND INSURANCE

TABLE 34 BFSI: MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 35 BFSI: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

9.3 ENERGY AND UTILITIES

TABLE 36 ENERGY AND UTILITIES: MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 37 ENERGY AND UTILITIES: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

9.4 GOVERNMENT AND PUBLIC SECTOR

TABLE 38 GOVERNMENT AND PUBLIC SECTOR: INTEGRATION PLATFORM AS A SERVICE MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 39 GOVERNMENT AND PUBLIC SECTOR: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

9.5 HEALTHCARE AND LIFE SCIENCES

TABLE 40 HEALTHCARE AND LIFE SCIENCES: MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 41 HEALTHCARE AND LIFE SCIENCES: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

9.6 MANUFACTURING

TABLE 42 MANUFACTURING: MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 43 MANUFACTURING: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

9.7 RETAIL AND CONSUMER GOODS

TABLE 44 RETAIL AND CONSUMER GOODS: MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 45 RETAIL AND CONSUMER GOODS: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

9.8 TELECOMMUNICATIONS

TABLE 46 TELECOMMUNICATIONS: INTEGRATION PLATFORM AS A SERVICE MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 47 TELECOMMUNICATIONS: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

9.9 OTHERS

TABLE 48 OTHERS: MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 49 OTHERS: MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

10 GEOGRAPHIC ANALYSIS (Page No. - 112)

10.1 INTRODUCTION

FIGURE 38 ASIA PACIFIC TO WITNESS SIGNIFICANT GROWTH DURING THE FORECAST PERIOD

TABLE 50 MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 51 MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

10.2 NORTH AMERICA

10.2.1 NORTH AMERICA: INTEGRATION PLATFORM AS A SERVICE MARKET DRIVERS

10.2.2 NORTH AMERICA: COVID-19 IMPACT

FIGURE 39 NORTH AMERICA: MARKET SNAPSHOT

TABLE 52 NORTH AMERICA: MARKET SIZE, BY SERVICE TYPE, 2016–2020 (USD MILLION)

TABLE 53 NORTH AMERICA: MARKET SIZE, BY SERVICE TYPE, 2021–2026 (USD MILLION)

TABLE 54 NORTH AMERICA: MARKET SIZE, BY DEPLOYMENT MODEL, 2016–2020 (USD MILLION)

TABLE 55 NORTH AMERICA: MARKET SIZE, BY DEPLOYMENT MODEL, 2021–2026 (USD MILLION)

TABLE 56 NORTH AMERICA: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2020 (USD MILLION)

TABLE 57 NORTH AMERICA: MARKET SIZE, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

TABLE 58 NORTH AMERICA: MARKET SIZE, BY VERTICAL, 2016–2020 (USD MILLION)

TABLE 59 NORTH AMERICA: MARKET SIZE, BY VERTICAL, 2021–2026 (USD MILLION)

TABLE 60 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2016–2020 (USD MILLION)

TABLE 61 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

10.2.3 UNITED STATES

TABLE 62 UNITED STATES: INTEGRATION PLATFORM AS A SERVICE MARKET SIZE, BY DEPLOYMENT MODEL, 2016–2020 (USD MILLION)

TABLE 63 UNITED STATES: MARKET SIZE, BY DEPLOYMENT MODEL, 2021–2026 (USD MILLION)

TABLE 64 UNITED STATES: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2020 (USD MILLION)

TABLE 65 UNITED STATES: MARKET SIZE, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

10.2.4 CANADA

TABLE 66 CANADA: MARKET SIZE, BY DEPLOYMENT MODEL, 2016–2020 (USD MILLION)

TABLE 67 CANADA: MARKET SIZE, BY DEPLOYMENT MODEL, 2021–2026 (USD MILLION)

TABLE 68 CANADA: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2020 (USD MILLION)

TABLE 69 CANADA: MARKET SIZE, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

10.3 EUROPE

10.3.1 EUROPE: INTEGRATION PLATFORM AS A SERVICE MARKET DRIVERS

10.3.2 EUROPE: COVID-19 IMPACT

TABLE 70 EUROPE: MARKET SIZE, BY SERVICE TYPE, 2016–2020 (USD MILLION)

TABLE 71 EUROPE: MARKET SIZE, BY SERVICE TYPE, 2021–2026 (USD MILLION)

TABLE 72 EUROPE: MARKET SIZE, BY DEPLOYMENT MODEL, 2016–2020 (USD MILLION)

TABLE 73 EUROPE: MARKET SIZE, BY DEPLOYMENT MODEL, 2021–2026 (USD MILLION)

TABLE 74 EUROPE: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2020 (USD MILLION)

TABLE 75 EUROPE: MARKET SIZE, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

TABLE 76 EUROPE: MARKET SIZE, BY VERTICAL, 2016–2020 (USD MILLION)

TABLE 77 EUROPE: MARKET SIZE, BY VERTICAL, 2021–2026 (USD MILLION)

TABLE 78 EUROPE: MARKET SIZE, BY COUNTRY, 2016–2020 (USD MILLION)

TABLE 79 EUROPE: MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

10.3.3 UNITED KINGDOM

TABLE 80 UK: INTEGRATION PLATFORM AS A SERVICE MARKET SIZE, BY DEPLOYMENT MODEL, 2016–2020 (USD MILLION)

TABLE 81 UK: MARKET SIZE, BY DEPLOYMENT MODEL, 2021–2026 (USD MILLION)

TABLE 82 UK: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2020 (USD MILLION)

TABLE 83 UK: MARKET SIZE, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

10.3.4 GERMANY

TABLE 84 GERMANY: MARKET SIZE, BY DEPLOYMENT MODEL, 2016–2020 (USD MILLION)

TABLE 85 GERMANY: MARKET SIZE, BY DEPLOYMENT MODEL, 2021–2026 (USD MILLION)

TABLE 86 GERMANY: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2020 (USD MILLION)

TABLE 87 GERMANY: MARKET SIZE, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

10.3.5 FRANCE

TABLE 88 FRANCE: INTEGRATION PLATFORM AS A SERVICE MARKET SIZE, BY DEPLOYMENT MODEL, 2016–2020 (USD MILLION)

TABLE 89 FRANCE: MARKET SIZE, BY DEPLOYMENT MODEL, 2021–2026 (USD MILLION)

TABLE 90 FRANCE: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2020 (USD MILLION)

TABLE 91 FRANCE: MARKET SIZE, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

10.3.6 REST OF EUROPE

TABLE 92 REST OF EUROPE: MARKET SIZE, BY DEPLOYMENT MODEL, 2016–2020 (USD MILLION)

TABLE 93 REST OF EUROPE: MARKET SIZE, BY DEPLOYMENT MODEL, 2021–2026 (USD MILLION)

TABLE 94 REST OF EUROPE: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2020 (USD MILLION)

TABLE 95 REST OF EUROPE: MARKET SIZE, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

10.4 ASIA PACIFIC

10.4.1 ASIA PACIFIC: INTEGRATION PLATFORM AS A SERVICE MARKET DRIVERS

10.4.2 ASIA PACIFIC: COVID-19 IMPACT

FIGURE 40 ASIA PACIFIC: MARKET SNAPSHOT

TABLE 96 ASIA PACIFIC: MARKET SIZE, BY SERVICE TYPE, 2016–2020 (USD MILLION)

TABLE 97 ASIA PACIFIC: MARKET SIZE, BY SERVICE TYPE, 2021–2026 (USD MILLION)

TABLE 98 ASIA PACIFIC: MARKET SIZE, BY DEPLOYMENT MODEL, 2016–2020 (USD MILLION)

TABLE 99 ASIA PACIFIC: MARKET SIZE, BY DEPLOYMENT MODEL, 2021–2026 (USD MILLION)

TABLE 100 ASIA PACIFIC: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2020 (USD MILLION)

TABLE 101 ASIA PACIFIC: MARKET SIZE, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

TABLE 102 ASIA PACIFIC: MARKET SIZE, BY VERTICAL, 2016–2020 (USD MILLION)

TABLE 103 ASIA PACIFIC: MARKET SIZE, BY VERTICAL, 2021–2026 (USD MILLION)

TABLE 104 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2016–2020 (USD MILLION)

TABLE 105 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

10.4.3 CHINA

TABLE 106 CHINA: INTEGRATION PLATFORM AS A SERVICE MARKET SIZE, BY DEPLOYMENT MODEL, 2016–2020 (USD MILLION)

TABLE 107 CHINA: MARKET SIZE, BY DEPLOYMENT MODEL, 2021–2026 (USD MILLION)

TABLE 108 CHINA: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2020 (USD MILLION)

TABLE 109 CHINA: MARKET SIZE, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

10.4.4 JAPAN

TABLE 110 JAPAN: MARKET SIZE, BY DEPLOYMENT MODEL, 2016–2020 (USD MILLION)

TABLE 111 JAPAN: MARKET SIZE, BY DEPLOYMENT MODEL, 2021–2026 (USD MILLION)

TABLE 112 JAPAN: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2020 (USD MILLION)

TABLE 113 JAPAN: MARKET SIZE, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

10.4.5 AUSTRALIA

TABLE 114 AUSTRALIA: INTEGRATION PLATFORM AS A SERVICE MARKET SIZE, BY DEPLOYMENT MODEL, 2016–2020 (USD MILLION)

TABLE 115 AUSTRALIA: MARKET SIZE, BY DEPLOYMENT MODEL, 2021–2026 (USD MILLION)

TABLE 116 AUSTRALIA: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2020 (USD MILLION)

TABLE 117 AUSTRALIA: MARKET SIZE, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

10.4.6 REST OF ASIA PACIFIC

TABLE 118 REST OF ASIA PACIFIC: MARKET SIZE, BY DEPLOYMENT MODEL, 2016–2020 (USD MILLION)

TABLE 119 REST OF ASIA PACIFIC: MARKET SIZE, BY DEPLOYMENT MODEL, 2021–2026 (USD MILLION)

TABLE 120 REST OF APAC: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2020 (USD MILLION)

TABLE 121 REST OF APAC: MARKET SIZE, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

10.5 MIDDLE EAST & AFRICA

10.5.1 MIDDLE EAST & AFRICA: INTEGRATION PLATFORM AS A SERVICE MARKET DRIVERS

10.5.2 MIDDLE EAST & AFRICA: COVID-19 IMPACT

TABLE 122 MIDDLE EAST AND AFRICA: MARKET SIZE, BY SERVICE TYPE, 2016–2020 (USD MILLION)

TABLE 123 MIDDLE EAST AND AFRICA: MARKET SIZE, BY SERVICE TYPE, 2021–2026 (USD MILLION)

TABLE 124 MIDDLE EAST AND AFRICA: MARKET SIZE, BY DEPLOYMENT MODEL, 2016–2020 (USD MILLION)

TABLE 125 MIDDLE EAST AND AFRICA: MARKET SIZE, BY DEPLOYMENT MODEL, 2021–2026 (USD MILLION)

TABLE 126 MIDDLE EAST AND AFRICA: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2020 (USD MILLION)

TABLE 127 MIDDLE EAST AND AFRICA: MARKET SIZE, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

TABLE 128 MIDDLE EAST AND AFRICA: MARKET SIZE, BY VERTICAL, 2016–2020 (USD MILLION)

TABLE 129 MIDDLE EAST AND AFRICA: MARKET SIZE, BY VERTICAL, 2021–2026 (USD MILLION)

TABLE 130 MIDDLE EAST AND AFRICA: MARKET SIZE, BY COUNTRY, 2016–2020 (USD MILLION)

TABLE 131 MIDDLE EAST AND AFRICA: MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

10.5.3 SAUDI ARABIA

TABLE 132 SAUDI ARABIA: INTEGRATION PLATFORM AS A SERVICE MARKET SIZE, BY DEPLOYMENT MODEL, 2016–2020 (USD MILLION)

TABLE 133 SAUDI ARABIA: MARKET SIZE, BY DEPLOYMENT MODEL, 2021–2026 (USD MILLION)

TABLE 134 SAUDI ARABIA: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2020 (USD MILLION)

TABLE 135 SAUDI ARABIA: MARKET SIZE, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

10.5.4 UNITED ARAB EMIRATES

TABLE 136 UNITED ARAB EMIRATES: MARKET SIZE, BY DEPLOYMENT MODEL, 2016–2020 (USD MILLION)

TABLE 137 UNITED ARAB EMIRATES: MARKET SIZE, BY DEPLOYMENT MODEL, 2021–2026 (USD MILLION)

TABLE 138 UNITED ARAB EMIRATES: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2020 (USD MILLION)

TABLE 139 UNITED ARAB EMIRATES: MARKET SIZE, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

10.5.5 REST OF MIDDLE EAST & AFRICA

TABLE 140 REST OF MIDDLE EAST & AFRICA: INTEGRATION PLATFORM AS A SERVICE MARKET SIZE, BY DEPLOYMENT MODEL, 2016–2020 (USD MILLION)

TABLE 141 REST OF MIDDLE EAST & AFRICA: MARKET SIZE, BY DEPLOYMENT MODEL, 2021–2026 (USD MILLION)

TABLE 142 REST OF MEA: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2020 (USD MILLION)

TABLE 143 REST OF MEA: MARKET SIZE, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

10.6 LATIN AMERICA

10.6.1 LATIN AMERICA: MARKET DRIVERS

10.6.2 LATIN AMERICA: COVID-19 IMPACT

TABLE 144 LATIN AMERICA: INTEGRATION PLATFORM AS A SERVICE MARKET SIZE, BY SERVICE TYPE, 2016–2020 (USD MILLION)

TABLE 145 LATIN AMERICA: MARKET SIZE, BY SERVICE TYPE, 2021–2026 (USD MILLION)

TABLE 146 LATIN AMERICA: MARKET SIZE, BY DEPLOYMENT MODEL, 2016–2020 (USD MILLION)

TABLE 147 LATIN AMERICA: MARKET SIZE, BY DEPLOYMENT MODEL, 2021–2026 (USD MILLION)

TABLE 148 LATIN AMERICA: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2020 (USD MILLION)

TABLE 149 LATIN AMERICA: MARKET SIZE, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

TABLE 150 LATIN AMERICA: MARKET SIZE, BY VERTICAL, 2016–2020 (USD MILLION)

TABLE 151 LATIN AMERICA: MARKET SIZE, BY VERTICAL, 2021–2026 (USD MILLION)

TABLE 152 LATIN AMERICA: MARKET SIZE, BY COUNTRY, 2016–2020 (USD MILLION)

TABLE 153 LATIN AMERICA: MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

10.6.3 BRAZIL

TABLE 154 BRAZIL: INTEGRATION PLATFORM AS A SERVICE MARKET SIZE, BY DEPLOYMENT MODEL, 2016–2020 (USD MILLION)

TABLE 155 BRAZIL: MARKET SIZE, BY DEPLOYMENT MODEL, 2021–2026 (USD MILLION)

TABLE 156 BRAZIL: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2020 (USD MILLION)

TABLE 157 BRAZIL: MARKET SIZE, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

10.6.4 REST OF LATIN AMERICA

TABLE 158 REST OF LATIN AMERICA: MARKET SIZE, BY DEPLOYMENT MODEL, 2016–2020 (USD MILLION)

TABLE 159 REST OF LATIN AMERICA: MARKET SIZE, BY DEPLOYMENT MODEL, 2021–2026 (USD MILLION)

TABLE 160 REST OF LATIN AMERICA: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2020 (USD MILLION)

TABLE 161 REST OF LATIN AMERICA: MARKET SIZE, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

11 COMPETITIVE LANDSCAPE (Page No. - 158)

11.1 INTRODUCTION

FIGURE 41 MARKET EVALUATION FRAMEWORK

11.2 MARKET SHARE OF TOP VENDORS

TABLE 162 INTEGRATION PLATFORM AS A SERVICE: DEGREE OF COMPETITION

FIGURE 42 INTEGRATION PLATFORM AS A SERVICE MARKET: VENDOR SHARE ANALYSIS

11.3 HISTORICAL REVENUE ANALYSIS OF TOP VENDORS

FIGURE 43 HISTORICAL REVENUE ANALYSIS, 2016–2020

11.4 KEY MARKET DEVELOPMENTS

11.4.1 NEW LAUNCHES

TABLE 163 NEW LAUNCHES, 2019-2021

11.4.2 DEALS

TABLE 164 DEALS, 2018- 2021

11.4.3 OTHERS

TABLE 165 OTHERS, 2020- 2021

11.5 COMPANY EVALUATION QUADRANT

11.5.1 STARS

11.5.2 EMERGING LEADERS

11.5.3 PERVASIVE PLAYERS

11.5.4 PARTICIPANTS

FIGURE 44 INTEGRATION PLATFORM AS A SERVICE MARKET (GLOBAL): COMPANY EVALUATION QUADRANT, 2020

TABLE 166 COMPANY SOLUTION FOOTPRINT

TABLE 167 COMPANY VERTICAL FOOTPRINT

TABLE 168 COMPANY REGION FOOTPRINT

TABLE 169 COMPANY FOOTPRINT

11.6 SME EVALUATION QUADRANT

FIGURE 45 STARTUP/SME EVALUATION MATRIX: CRITERIA WEIGHTAGE

11.6.1 RESPONSIVE VENDORS

11.6.2 PROGRESSIVE VENDORS

11.6.3 DYNAMIC VENDORS

11.6.4 PARTICIPANTS

TABLE 170 SMES COMPANY FOOTPRINT

FIGURE 46 INTEGRATION PLATFORM AS A SERVICE MARKET (SMES): COMPANY EVALUATION QUADRANT, 2020

12 COMPANY PROFILES (Page No. - 174)

12.1 INTRODUCTION

(Business overview, Products/solutions offered, Recent developments & MnM View)*

12.2 INFORMATICA

TABLE 171 INFORMATICA: BUSINESS OVERVIEW

FIGURE 47 INFORMATICA: COMPANY SNAPSHOT

TABLE 172 INFORMATICA: PRODUCTS/SOLUTIONS OFFERED

TABLE 173 INFORMATICA: PRODUCT LAUNCH

TABLE 174 INFORMATICA: DEALS

12.3 BOOMI

TABLE 175 BOOMI: BUSINESS OVERVIEW

TABLE 176 BOOMI: PRODUCTS/SERVICES OFFERED

TABLE 177 BOOMI: PRODUCT LAUNCHES

TABLE 178 BOOMI: DEALS

12.4 SAP

TABLE 179 SAP: BUSINESS OVERVIEW

FIGURE 48 SAP: COMPANY SNAPSHOT

TABLE 180 SAP: PRODUCTS OFFERED

12.5 ORACLE

TABLE 181 ORACLE: BUSINESS OVERVIEW

FIGURE 49 ORACLE: COMPANY SNAPSHOT

TABLE 182 ORACLE: PRODUCTS/SERVICES OFFERED

TABLE 183 ORACLE: PRODUCT LAUNCHES

12.6 MULESOFT

TABLE 184 MULESOFT: BUSINESS OVERVIEW

TABLE 185 MULESOFT: PRODUCTS OFFERED

TABLE 186 MULESOFT: PRODUCT LAUNCHES

TABLE 187 MULESOFT: DEALS

12.7 JITTERBIT

TABLE 188 JITTERBIT: BUSINESS OVERVIEW

TABLE 189 JITTERBIT: PRODUCTS OFFERED

TABLE 190 JITTERBIT: PRODUCT LAUNCHES

TABLE 191 JITTERBIT: DEALS

12.8 WORKATO

TABLE 192 WORKATO: BUSINESS OVERVIEW

TABLE 193 WORKATO: PRODUCTS AND SERVICES OFFERED

TABLE 194 WORKATO: PRODUCT LAUNCHES

TABLE 195 WORKATO: DEALS

12.9 SNAPLOGIC

TABLE 196 SNAPLOGIC: BUSINESS OVERVIEW

TABLE 197 SNAPLOGIC: PRODUCTS AND SERVICES OFFERED

TABLE 198 SNAPLOGIC: PRODUCT LAUNCHES

TABLE 199 SNAPLOGIC: DEALS

12.10 SOFTWARE AG

TABLE 200 SOFTWARE AG: BUSINESS OVERVIEW

FIGURE 50 SOFTWARE AG: COMPANY SNAPSHOT

TABLE 201 SOFTWARE AG: PRODUCTS AND SERVICES OFFERED

TABLE 202 SOFTWARE AG: PRODUCT LAUNCHES

TABLE 203 SOFTWARE AG: DEALS

12.11 IBM

TABLE 204 IBM: BUSINESS OVERVIEW

FIGURE 51 IBM: COMPANY SNAPSHOT

TABLE 205 IBM: PRODUCTS/SERVICES OFFERED

TABLE 206 IBM: PRODUCT LAUNCHES

TABLE 207 IBM: DEALS

12.12 MICROSOFT

TABLE 208 MICROSOFT: BUSINESS OVERVIEW

FIGURE 52 MICROSOFT: COMPANY SNAPSHOT

TABLE 209 MICROSOFT: PRODUCTS/SERVICES OFFERED

TABLE 210 MICROSOFT: PRODUCT LAUNCHES

12.13 TIBCO

12.14 CELIGO

12.15 ZAPIER

12.16 SYNCARI

12.17 ACTIAN CORPORATION

12.18 ELASTIC.IO

12.19 TRAY.IO

12.2 TALEND

12.21 FLOWGEAR

*Details on Business overview, Products/solutions offered, Recent developments & MnM View might not be captured in case of unlisted companies.

13 ADJACENT/RELATED MARKETS (Page No. - 230)

13.1 INTRODUCTION

13.1.1 RELATED MARKETS

13.1.2 LIMITATIONS

13.2 CLOUD MIGRATION SERVICES MARKET

13.2.1 CLOUD MIGRATION SERVICES MARKET, BY VERTICAL

13.2.1.1 Introduction

TABLE 211 BFSI: CLOUD MIGRATION SERVICES MARKET SIZE, BY REGION, 2015–2022 (USD MILLION)

TABLE 212 HEALTHCARE AND LIFE SCIENCES: CLOUD MIGRATION SERVICES MARKET SIZE, BY REGION, 2015–2022 (USD MILLION)

TABLE 213 TELECOMMUNICATIONS AND ITES: CLOUD MIGRATION SERVICES MARKET SIZE, BY REGION, 2015–2022 (USD MILLION)

TABLE 214 GOVERNMENT AND PUBLIC SECTOR: CLOUD MIGRATION SERVICES MARKET SIZE, BY REGION, 2015–2022 (USD MILLION)

TABLE 215 MANUFACTURING: CLOUD MIGRATION SERVICES MARKET SIZE, BY REGION, 2015–2022 (USD MILLION)

TABLE 216 CONSUMER GOODS AND RETAIL: CLOUD MIGRATION SERVICES MARKET SIZE, BY REGION, 2015–2022 (USD MILLION)

TABLE 217 MEDIA AND ENTERTAINMENT: CLOUD MIGRATION SERVICES MARKET SIZE, BY REGION, 2015–2022 (USD MILLION)

TABLE 218 OTHERS: CLOUD MIGRATION SERVICES MARKET SIZE, BY REGION, 2015–2022 (USD MILLION)

13.2.2 CLOUD MIGRATION SERVICES MARKET, BY REGION

13.2.2.1 Introduction

TABLE 219 NORTH AMERICA: CLOUD MIGRATION SERVICES MARKET SIZE, BY VERTICAL, 2015–2022 (USD MILLION)

TABLE 220 EUROPE: CLOUD MIGRATION SERVICES MARKET SIZE, BY VERTICAL, 2015–2022 (USD MILLION)

TABLE 221 ASIA PACIFIC: CLOUD MIGRATION SERVICES MARKET SIZE, BY VERTICAL, 2015–2022 (USD MILLION)

TABLE 222 MIDDLE EAST AND AFRICA: CLOUD MIGRATION SERVICES MARKET SIZE, BY VERTICAL, 2015–2022 (USD MILLION)

TABLE 223 LATIN AMERICA: CLOUD MIGRATION SERVICES MARKET SIZE, BY VERTICAL, 2015–2022 (USD MILLION)

13.3 CLOUD ORCHESTRATION MARKET

13.3.1 CLOUD ORCHESTRATION MARKET, BY VERTICAL

13.3.1.1 Introduction

TABLE 224 BANKING, FINANCIAL SERVICES, AND INSURANCE: CLOUD ORCHESTRATION MARKET SIZE, BY REGION, 2014–2021 (USD MILLION)

TABLE 225 CONSUMER GOODS AND RETAIL: CLOUD ORCHESTRATION MARKET SIZE, BY REGION, 2014–2021 (USD MILLION)

TABLE 226 EDUCATION: CLOUD ORCHESTRATION MARKET SIZE, BY REGION, 2014–2021 (USD MILLION)

TABLE 227 GOVERNMENT AND PUBLIC SECTOR: CLOUD ORCHESTRATION MARKET SIZE, BY REGION, 2014–2021 (USD MILLION)

TABLE 228 HEALTHCARE AND LIFE SCIENCES: CLOUD ORCHESTRATION MARKET SIZE, BY REGION, 2014–2021 (USD MILLION)

TABLE 229 MANUFACTURING: CLOUD ORCHESTRATION MARKET SIZE, BY REGION, 2014–2021 (USD MILLION)

TABLE 230 MEDIA AND ENTERTAINMENT: CLOUD ORCHESTRATION MARKET SIZE, BY REGION, 2014–2021 (USD MILLION)

TABLE 231 TELECOMMUNICATION AND ITES: CLOUD ORCHESTRATION MARKET SIZE, BY REGION, 2014–2021 (USD MILLION)

TABLE 232 OTHERS: CLOUD ORCHESTRATION MARKET SIZE, BY REGION, 2014–2021 (USD MILLION)

13.3.2 CLOUD ORCHESTRATION MARKET, BY REGION

13.3.2.1 Introduction

TABLE 233 NORTH AMERICA: CLOUD ORCHESTRATION MARKET SIZE, BY VERTICAL, 2014–2021 (USD MILLION)

TABLE 234 EUROPE: CLOUD ORCHESTRATION MARKET SIZE, BY VERTICAL, 2014–2021 (USD MILLION)

TABLE 235 ASIA PACIFIC: CLOUD ORCHESTRATION MARKET SIZE, BY VERTICAL, 2014–2021 (USD MILLION)

TABLE 236 MIDDLE EAST AND AFRICA: CLOUD ORCHESTRATION MARKET SIZE, BY VERTICAL, 2014–2021 (USD MILLION)

TABLE 237 LATIN AMERICA: CLOUD ORCHESTRATION MARKET SIZE, BY VERTICAL, 2014–2021 (USD MILLION)

14 APPENDIX (Page No. - 244)

14.1 DISCUSSION GUIDE

14.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

14.3 AVAILABLE CUSTOMIZATIONS

14.4 RELATED REPORTS

14.5 AUTHOR DETAILS

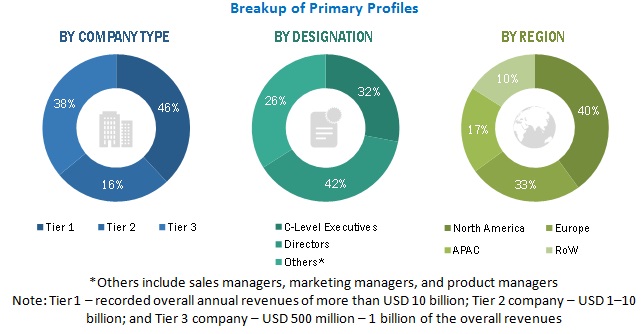

The study involved 4 major activities to estimate the current Integration Platform as a Service Market size. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, the market breakup and data triangulation procedures were used to estimate the market size of the segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources were referred to for identifying and collecting information for this study. The secondary sources included annual reports, press releases, and investor presentations of companies; whitepapers; certified publications; and articles from recognized associations, such as data center knowledge and government publishing sources. The research study involved the use of extensive secondary sources, directories, and databases, such as D&B Hoovers, DiscoverOrg, Factiva, Bloomberg BusinessWeek, Statista.com, Cloud Computing Association, OpenFog Consortium, Technology & Services Industry Association (TSIA), International Association of Business Communicators (IABC), World Economic Outlook (WEO), United Nations Economic and Social Commission for Asia and Pacific, Economic Commission for Latin America, Arab Information and Communication Technology Organization (AICTO), and Africa Information and Communication Technology Right (AIR) to identify and collect information useful for this technical, market-oriented, and commercial study of the Integration Platform as a Service Market. Secondary research was mainly used to obtain key information about the industry’s value chain, the total pool of key players, market classification and segmentation as per the industry trends to the bottom-most level, regional markets, and key developments from both market and technology-oriented perspectives.

Primary Research

In the primary research process, various primary sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. Primary sources from the supply-side included industry experts, such as Chief Executive Officers (CEOs), Vice Presidents (VPs), marketing directors, technology and innovation directors, and related key executives from various key companies and organizations providing iPaaS solutions. The primary sources from the demand side included the end-users of event management software solutions, which included Chief Information Officers (CIOs), IT technicians and technologists, and IT managers at public and investor-owned utilities.

The following figure depicts the breakup of the primary profiles:

To know about the assumptions considered for the study, download the pdf brochure

Integration Platform as a Service Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the Integration Platform as a Service Market. They were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and markets have been identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size—using the market size estimation processes as explained above—the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation and market breakup procedures were employed, wherever applicable. The data was triangulated by studying several factors and trends from both, the demand and supply sides, in the Integration Platform as a Service Market.

Report Objectives

- To describe and forecast the Global iPaaS service type, , deployment model, organization size, vertical, and region from 2021 to 2026, and analyze the various macro and microeconomic factors that affect the market growth

- To forecast the market size of regional segments: North America, Europe, Asia Pacific (APAC), Middle East and Africa (MEA), and Latin America

- To provide detailed information related to the major factors (drivers, restraints, opportunities, and challenges) influencing the growth of the Integration Platform as a Service Market

- To strategically analyze the market’s subsegments with respect to individual growth trends, prospects, and contribution to the total market

- To analyze opportunities in the market for stakeholders and provide details of the competitive landscape for major players

- To comprehensively analyze the core competencies of key players

- To track and analyze competitive developments, such as mergers and acquisitions, product developments, partnerships and collaborations, and business expansion activities, in the market

- To track and analyze COVID-19 and competitive developments, such as mergers and acquisitions, new product developments, and partnerships and collaborations, in the market.

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs and on best effort basis for profiling of additional market players.

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Integration Platform as a Service Market

To know about demand and supply structure of the Integration Platform as a Service (iPaaS) Industry

Thanks for the interesting iPaaS market analytics and forecasts. There is no doubt that the market will grow because iPaaS has a lot of advantages. They are discussed in detail in your study.