Insulating Glass Window Market by Product Type, Glazing Type (double glazed, triple glazed), Spacer Type, Sealant Type (silicone, polysulfide, hot melt butyl, polyurethane), End-Use Industry, and Region - Global Forecast to 2026

Insulating Glass Window Market

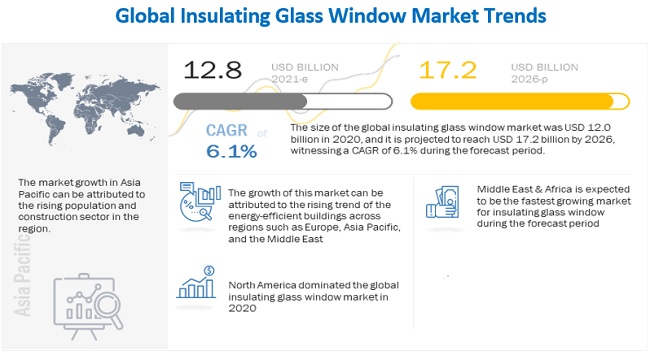

The global insulating glass window market was valued at USD 12.8 billion in 2021 and is projected to reach USD 17.2 billion by 2026, growing at a cagr 6.1% from 2021 to 2026. Insulating glass windows increase the thermal efficiency of buildings by minimizing the transfer of heat/cold from within the building environment to the outside environment.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 Impact on the global insulating glass window market

The pandemic is estimated to have an impact on various factors of the value chain of the insulating glass window market, which is expected to reflect during the forecast period, especially in the year 2020. The impact of COVID-19 is as follows:

In 2020, COVID-19 disrupted the global operations of the glass industry, with some companies being more exposed to the effects of shutdowns than others, resulting in them coming under severe financial pressure. The supply chain of insulating glass manufacturing was significantly disrupted in 2020. Various restrictions on cross-border movements as well as inside borders disrupted the supply chain of global insulating glass window market during 2020. A majority of the production plants for insulating glass windows have either been closed or were operating with limited capacity in Europe and North America during 2020. The insulating glass window market is mainly driven by the rising trend of energy-efficient building construction. Due to the COVID-19 pandemic, various building construction activities such as new and existing projects, onsite productivity, and contract value, were estimated to have slowed by 24% in 2020, when compared to 2019. However, there has been a rebound in activity during 2021.

Insulating Glass Window Market Dynamics

Driver: Optimal energy-saving performance

The high energy consumption in buildings is propelling the demand for energy-efficient building materials such as insulating glass windows. The usage of insulating glass windows can help reduce energy losses and result in lower energy consumption, which is a crucial requirement. The heat and light transferred through the glass directly impact the comfort level of the people in the room, apart from affecting the energy costs. Switching to insulating glass windows makes a huge difference in the overall energy consumption. The use of insulating glass windows in residential and commercial buildings can reduce power consumption by almost 50%, thereby proving to be an effective technology for power optimization. Also, the growing trend of rating systems in various countries, such as LEED (Leadership in Energy & Environmental Design) in the US, IGBC Green Ratings in India, and others are likely to contribute to the growth of the insulating glass window market.

Opportunity: Growing trend of lightweight vehicles to drive market growth

With the increasing global concern on climate change and energy security, automobile manufacturers are facing increasing pressure to improve fuel efficiency on their fleet. Automobile manufacturers are turning to aluminum and composite materials as a building platform for vehicles. Both aluminum and composite materials are more expensive than steel. Therefore, the automobile industry are also looking at areas where they can use adhesive tapes instead of rivets and bolts to reduce costs. Structural adhesive tapes are engineered for multi-material bonding and joining and are the excellent adhesive solution for lightweight and high-performance designs.

Challenge: High fuel consumption in glass manufacturing

In the glass manufacturing process, a large amount of fuel is consumed for melting raw materials. This also leads to the emission of harmful gases such as CO2. There is a demand to devise new manufacturing processes to cut down on fuel consumption. Companies such as Saint-Gobain (France) and Nippon Sheet Glass (Japan), which are the major players in the insulating glass window market, are formulating new ways to reduce fuel consumption, which will not only reduce their production costs but also help in complying with many carbon credit regulations. This would help these companies achieve sustainable growth.

By product type, gas-filled insulating glass segment is expected to grow at the highest CAGR from 2021 to 2026

The gas-filled insulating glass segment is projected to grow at the highest CAGR during the forecast period. The performance of an insulating glass unit can be enhanced by filling the space between the panes with a noble gas such as argon or krypton. These gases are denser than air and reduce the amount of heat transfer through the insulating glass. Hence, better insulation properties offered by gas-filled insulating glass is expected to drive this segment.

By glazing type, double-glazed insulating glass windows is expected to lead the insulating glass window market from 2021 to 2026

Double-glazed windows considerably reduce heat loss and improve the energy conservation rate. These windows found application in both the residential and commercial sectors. Low-emissivity (Low-e) glass is used in double-glazed windows to improve thermal efficiency. Such properties are driving the growth of this segment.

By sealant type, silicone segment is expected to lead the insulating glass window market during 2021 to 2026

Silicone sealants are widely used for glass bonding in insulating glass windows as they have the ability to bond materials together with enormous power or exceptional lightness and are designed for both permanent and temporary adhesion applications. Various properties of silicone, such as high elongation, high-temperature resistance, durability, and others are expected to drive this segment.

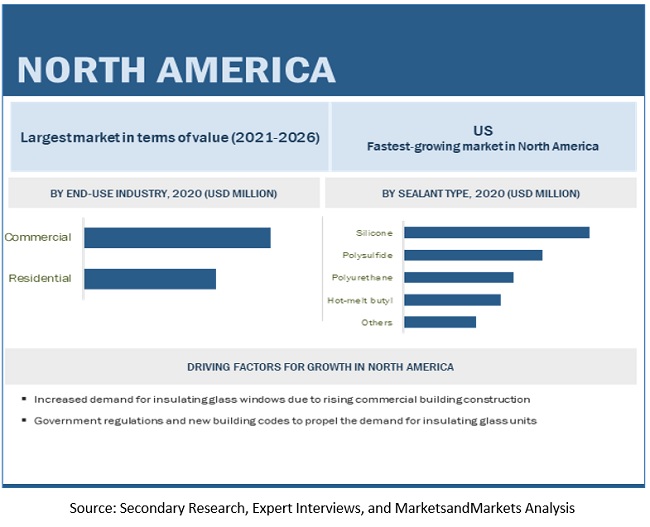

North America is expected to dominate the insulating glass window market during 2021 to 2026

North America is projected to be the largest regional market for insulating glass windows. The market in North America is driven by moderate growth in the construction industry. Glass insulation is considered a viable option for making buildings energy-efficient. Also, factors such as the high quality of infrastructural construction, reduced environmental impact, climatic conditions, and government regulations are fueling the growth of energy-efficient windows in North America.

To know about the assumptions considered for the study, download the pdf brochure

Insulating Glass Window Market Players

The key market players include AGC Inc. (Japan), Central Glass Co., Ltd. (Japan), Compagnie de Saint-Gobain SA (France), Dymax (US), Glaston Corporation (Finland), Guardian Glass (US), H.B. Fuller Company (US), Henkel AG & Co. KGaA (Germany), Internorm (Austria), Scheuten (Netherlands), Nippon Sheet Glass Co., Ltd. (Japan), Sika AG (Switzerland), 3M (US), Viracon (US). These players have adopted product launches, acquisitions, expansions, agreements, contracts, partnerships, investments, collaborations, and divestments as their growth strategies .

Insulating Glass Window Market Report Scope

|

Report Metric |

Details |

|

Market Size Value in 2021 |

USD 12.8 billion |

|

Revenue Forecast in 2026 |

USD 17.2 billion |

|

CAGR |

6.1% |

|

Market Size Available for Years |

2019–2026 |

|

Base Year Considered |

2020 |

|

Forecast Period |

2021–2026 |

|

Forecast Units |

Value (USD Billion) |

|

Segments Covered |

Product Type, Glazing Type, Spacer Type, Sealant Type, End-Use Industry, and Region |

|

Geographies Covered |

North America, Europe, Asia Pacific, Middle East & Africa, and South America |

|

Companies Covered |

AGC Inc. (Japan), Central Glass Co., Ltd. (Japan), Compagnie de Saint-Gobain SA (France), Dymax (US), Glaston Corporation (Finland), Guardian Glass (US), H.B. Fuller Company (US), Henkel AG & Co. KGaA (Germany), Internorm (Austria), Scheuten (Netherlands), Nippon Sheet Glass Co., Ltd. (Japan), Sika AG (Switzerland), 3M (US), Viracon (US), Beijing Hanjiang Automatic Glass Machinery Equipment Co., Ltd. (China), Cardinal Glass Industries, Inc (US), Eco Glass, Inc (US), Ittihad Insulating Glass Co. (Jordan), Qingdao Migo Glass Co., Ltd. (China), OYADE Sealant (China), Shenzhen Jimy Glass Co., Ltd. (China), Strathclyde Insulating Glass Ltd. (Scotland), Vitro Architectural Glass (US), Yongan Adhesive Industry Co., Ltd. (China), and Fuso (India). |

This research report categorizes the insulating glass window market based on product type, glazing type, spacer type, sealant type, end-use industry, and region.

Based on Product Type, the insulating glass window market has been segmented as follows:

- Vacuum insulating glass (VIG)

- Gas filled insulating glass

- Air filled insulating glass

Based on Glazing Type, the insulating glass window market has been segmented as follows:

- Double glazed

- Triple glazed

- Others (quadruple glazing, heat-absorbing tints, reflective coatings, and spectrally selective coatings)

Based on Spacer Type, the insulating glass window market has been segmented as follows:

- Cold edge spacer

- Warm edge spacer

Based on Sealant Type, the insulating glass window market has been segmented as follows:

- Silicone

- Polysulfide

- Hot melt butyl

- Polyurethane

- Others (polyisobutylene (PIB) and epoxy-based sealants)

Based on End-Use Industry, the insulating glass window market has been segmented as follows:

- Residential

- Commercial

Based on Region, the insulating glass window market has been segmented as follows:

- North America

- Europe

- Asia Pacific

- Middle East & Africa

- South America

Recent Developments

- In December 2020, 3M launched 2480 3M Hi-Tack silicone adhesive tapes. The products provide sheer performance, stronger adhesion, and longer-wear time.

- In July 2020, Guardian Glass has launched a new glass coater in Czestochowa Poland, which transforms normal float glass into high-performance, value-added glass using modern technology. This will help to increase the production of low-emissivity (low-E) solar control glass for both residential and commercial applications.

Frequently Asked Questions (FAQ):

What is the current size of the global insulating glass window market?

The insulating glass window market size was USD 12.0 billion in 2020 and is projected to reach USD 17.2 billion by 2026; it is expected to grow at a CAGR of 6.1% from 2021 to 2026.

Who are the leading players in the global insulating glass window market?

The leading companies in the insulating glass window market include AGC Inc. (Japan), Central Glass Co., Ltd. (Japan), Compagnie de Saint-Gobain SA (France), Dymax (US), Glaston Corporation (Finland), Guardian Glass (US), H.B. Fuller Company (US), Henkel AG & Co. KGaA (Germany), Internorm (Austria), Scheuten (Netherlands), Nippon Sheet Glass Co., Ltd. (Japan), Sika AG (Switzerland), 3M (US), Viracon (US). .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 39)

1.1 OBJECTIVES OF THE STUDY

1.2 PRODUCT DEFINITION

1.3 INCLUSIONS & EXCLUSIONS

1.4 MARKET SCOPE

1.4.1 INSULATING GLASS WINDOW MARKET SEGMENTATION

1.4.2 REGIONS COVERED

1.4.3 YEARS CONSIDERED FOR THE STUDY

1.5 CURRENCY

1.6 STAKEHOLDERS

1.7 SUMMARY OF CHANGES

1.8 LIMITATIONS

2 RESEARCH METHODOLOGY (Page No. - 43)

2.1 RESEARCH DATA

FIGURE 1 INSULATING GLASS WINDOW MARKET: RESEARCH DESIGN

2.2 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 2 DATA TRIANGULATION

2.2.1 SECONDARY DATA

2.2.1.1 Key data from secondary sources

2.2.2 PRIMARY DATA

2.2.2.1 Key data from primary sources

2.2.2.2 Breakdown of primaries

2.3 MATRIX CONSIDERED FOR DEMAND-SIDE

FIGURE 3 MAIN MATRIX CONSIDERED WHILE CONSTRUCTING AND ASSESSING DEMAND FOR INSULATING GLASS WINDOWS

2.4 MARKET SIZE ESTIMATION

FIGURE 4 METHODOLOGY FOR THE SIZING OF GLOBAL INSULATING GLASS WINDOW MARKET: DEMAND-SIDE APPROACH

2.4.1 CALCULATION FOR DEMAND-SIDE ANALYSIS

2.4.2 KEY ASSUMPTIONS FOR CALCULATING THE DEMAND-SIDE MARKET SIZE

2.4.3 LIMITATIONS

FIGURE 5 METHODOLOGY FOR ASSESSING SUPPLY OF INSULATING GLASS WINDOWS

2.4.3.1 Calculations for supply-side analysis

FIGURE 6 INSULATING GLASS WINDOW MARKET: SUPPLY-SIDE ANALYSIS

2.4.3.2 Forecast

2.5 GROWTH RATE ASSUMPTIONS/GROWTH FORECAST

2.6 MARKET CAGR PROJECTIONS FROM GLASS INSULATION MARKET (PARENT MARKET) ACROSS REGIONS

2.6.1 RISK ANALYSIS

3 EXECUTIVE SUMMARY (Page No. - 52)

FIGURE 7 COMMERCIAL END-USE INDUSTRY TO ACCOUNT FOR LARGER SHARE OF THE INSULATING GLASS WINDOW MARKET

FIGURE 8 SILICONE SEGMENT LED THE MARKET IN 2020

FIGURE 9 NORTH AMERICA WAS THE LARGEST MARKET IN 2020

4 PREMIUM INSIGHTS (Page No. - 55)

4.1 ATTRACTIVE OPPORTUNITIES IN THE INSULATING GLASS WINDOW MARKET

FIGURE 10 INCREASING TREND OF ENERGY-EFFICIENT BUILDINGS TO BOOST THE MARKET

4.2 INSULATING GLASS WINDOW MARKET, BY PRODUCT TYPE

FIGURE 11 AIR FILLED TO BE THE LARGEST SEGMENT OF THE MARKET

4.3 INSULATING GLASS WINDOW MARKET, BY GLAZING TYPE

FIGURE 12 DOUBLE GLAZED TO BE THE LARGEST SEGMENT OF THE MARKET

4.4 INSULATING GLASS WINDOW MARKET, BY REGION

FIGURE 13 NORTH AMERICA TO LEAD THE INSULATING GLASS WINDOW MARKET DURING THE FORECAST PERIOD

4.5 NORTH AMERICA: INSULATING GLASS WINDOW MARKET, BY END-USE INDUSTRY AND COUNTRY, 2020

FIGURE 14 US AND THE COMMERCIAL SEGMENT ACCOUNTED FOR THE LARGEST SHARES

5 MARKET OVERVIEW (Page No. - 58)

5.1 INTRODUCTION

FIGURE 15 GLOBAL SHARE OF BUILDINGS AND CONSTRUCTION IN FINAL ENERGY CONSUMPTION, 2019

5.2 MARKET DYNAMICS

FIGURE 16 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN THE INSULATING GLASS WINDOW MARKET

5.2.1 DRIVERS

5.2.1.1 Optimal energy-saving performance

5.2.1.2 Rising demand for value-added glass products

5.2.1.3 COVID-19 influencing the demand for energy-efficient buildings

FIGURE 17 IMPACT OF DRIVERS ON INSULATING GLASS WINDOW MARKET

5.2.2 RESTRAINTS

5.2.2.1 Higher cost of glass bonding adhesives than conventional adhesives

FIGURE 18 PRICE COMPARISON: CONVENTIONAL ADHESIVES VS. GLASS BONDING ADHESIVES

5.2.2.2 Lack of awareness about insulation products

FIGURE 19 IMPACT OF RESTRAINTS ON INSULATING GLASS WINDOW MARKET

5.2.3 OPPORTUNITIES

5.2.3.1 Increasing support for energy management in buildings from public and private sectors

TABLE 1 US DEPARTMENT OF ENERGY (FY-2021) FEDERAL FUNDING FOR ENERGY EFFICIENCY IN BUILDINGS

5.2.3.2 Rapid urbanization

TABLE 2 ASIA PACIFIC URBANIZATION TREND, 2014 AND 2050

FIGURE 20 IMPACT OF OPPORTUNITIES ON INSULATING GLASS WINDOW MARKET

5.2.4 CHALLENGES

5.2.4.1 High fuel consumption in glass manufacturing

FIGURE 21 IMPACT OF CHALLENGES ON INSULATING GLASS WINDOW MARKET

5.3 PORTER’S FIVE FORCES ANALYSIS

TABLE 3 INSULATING GLASS WINDOW MARKET: PORTER’S FIVE FORCES ANALYSIS

5.3.1 THREAT OF NEW ENTRANTS

5.3.2 THREAT OF SUBSTITUTES

5.3.3 BARGAINING POWER OF BUYERS

5.3.4 BARGAINING POWER OF SUPPLIERS

5.3.5 INTENSITY OF COMPETITIVE RIVALRY

5.4 MANUFACTURING PROCESS OF INSULATED GLASS UNITS

5.5 ECOSYSTEM/MARKET MAP

FIGURE 22 INSULATING GLASS WINDOW MARKET: ECOSYSTEM/MARKET MAP

TABLE 4 ECOSYSTEM/MARKET MAP

5.6 REVENUE SHIFT & NEW REVENUE POCKETS FOR PROVIDERS

FIGURE 23 REVENUE SHIFT FOR INSULATING GLASS WINDOW MARKET

5.6.1 YC, YCC DRIVERS FOR INSULATING GLASS WINDOW

5.6.1.1 Benefits offered by insulating glass windows

5.7 PATENT ANALYSIS

5.7.1 DOCUMENT TYPE

FIGURE 24 PATENTS, BY DOCUMENT TYPE - LAST 10 YEARS

5.7.2 PATENT PUBLICATION TREND

FIGURE 25 PATENT PUBLICATION TREND - LAST 10 YEARS

5.7.3 JURISDICTION ANALYSIS

FIGURE 26 JURISDICTION ANALYSIS – TOP REGIONS (2010-2020)

5.7.4 TOP COMPANIES/APPLICANTS

FIGURE 27 TOP 10 APPLICANTS/COMPANIES WITH THE HIGHEST NUMBER OF PATENTS

5.7.5 LIST OF PATENTS

5.8 CASE STUDY

5.9 TRADE DATA STATISTICS

TABLE 5 COUNTRY-WISE IMPORT OF HS CODE 700530 (GLASS, FLOAT GLASS, AND SURFACE GROUND OR POLISHED GLASS, IN SHEETS, WIRED GLASS, WHETHER OR NOT HAVING AN ABSORBENT OR REFLECTING LAYER) IN 2019

TABLE 6 COUNTRY-WISE IMPORT OF HS CODE 700530 (GLASS, FLOAT GLASS, AND SURFACE GROUND OR POLISHED GLASS, IN SHEETS, WIRED GLASS, WHETHER OR NOT HAVING AN ABSORBENT OR REFLECTING LAYER) IN 2020

TABLE 7 COUNTRY-WISE EXPORT OF HS CODE 700530 (GLASS, FLOAT GLASS, AND SURFACE GROUND OR POLISHED GLASS, IN SHEETS, WIRED GLASS, WHETHER OR NOT HAVING AN ABSORBENT OR REFLECTING LAYER) IN 2019

TABLE 8 COUNTRY-WISE EXPORT OF HS CODE 700530 (GLASS, FLOAT GLASS, AND SURFACE GROUND OR POLISHED GLASS, IN SHEETS, WIRED GLASS, WHETHER OR NOT HAVING AN ABSORBENT OR REFLECTING LAYER) IN 2020

5.10 REGULATORY LANDSCAPE

5.10.1 ENERGY PERFORMANCE TESTING, CERTIFICATION, AND LABELLING OF INSULATING GLASS WINDOWS

5.10.2 GLASS STANDARDS AND GUIDELINES, AS PER FENESTRATION & GLAZING INDUSTRY ALLIANCE (FGIA)

5.10.3 GLASS STANDARDS AND GUIDELINES, AS PER FENESTRATION & GLAZING INDUSTRY ALLIANCE (FGIA)

5.11 PRICING ANALYSIS

TABLE 9 AVERAGE PRICE OF GLASS (PER SQUARE FOOT), BY TYPE

TABLE 10 WINDOW GLASS REPLACEMENT COST, BY WINDOW TYPE

6 COVID-19 IMPACT ON THE INSULATING GLASS WINDOW MARKET (Page No. - 85)

6.1 INTRODUCTION

6.2 IMPACT ON GLASS RAW MATERIALS/COMPONENTS OF INSULATING GLASS UNITS

6.2.1 FLOAT GLASS

6.2.1.1 US

6.2.1.2 Israel

6.3 IMPACT ON INSULATING GLASS WINDOW MANUFACTURING

6.3.1 EUROPE AND THE AMERICAS

6.3.2 ASIA PACIFIC

6.4 IMPACT ON CONSTRUCTION INDUSTRY

TABLE 11 EUROCONSTRUCT (EC-19) COUNTRIES GDP VS CONSTRUCTION OUTPUT, Y-O-Y CHANGE, % GROWTH, BY COUNTRY, 2016–2022 (%)

FIGURE 28 EUROCONSTRUCT (EC-19) COUNTRIES GDP VS. CONSTRUCTION OUTPUT, Y-O-Y CHANGE, % GROWTH, BY COUNTRY, 2016–2022 (%)

7 INSULATING GLASS WINDOW MARKET, BY PRODUCT TYPE (Page No. - 88)

7.1 INTRODUCTION

FIGURE 29 AIR-FILLED INSULATING GLASS TO LEAD THE MARKET DURING THE FORECAST PERIOD

TABLE 12 INSULATING GLASS WINDOW MARKET SIZE, BY PRODUCT TYPE, 2018–2020 (USD MILLION)

TABLE 13 INSULATING GLASS WINDOW MARKET SIZE, BY PRODUCT TYPE, 2021–2026 (USD MILLION)

7.2 GAS-FILLED INSULATING GLASS

7.2.1 BETTER INSULATION THAN AIR-FILLED TO ENCOURAGE THE DEMAND FOR GAS-FILLED INSULATING GLASS

7.3 AIR-FILLED INSULATING GLASS

7.3.1 LOW COST TO DRIVE THIS SEGMENT DURING THE FORECAST PERIOD

7.4 VACUUM INSULATING GLASS (VIG)

7.4.1 LIGHTWEIGHT AND BETTER THERMAL INSULATION TO ENHANCE THE MARKET FOR THE SEGMENT

8 INSULATING GLASS WINDOW MARKET, BY GLAZING TYPE (Page No. - 92)

8.1 INTRODUCTION

TABLE 14 COMMON APPLICATIONS OF DOUBLE- AND TRIPLE-GLAZED WINDOWS

FIGURE 30 DOUBLE GLAZED SEGMENT TO LEAD THE INSULATING GLASS WINDOW MARKET DURING THE FORECAST PERIOD

TABLE 15 INSULATING GLASS WINDOW MARKET SIZE, BY GLAZING TYPE, 2018–2020 (USD MILLION)

TABLE 16 INSULATING GLASS WINDOW MARKET SIZE, BY GLAZING TYPE, 2021–2026 (USD MILLION)

8.2 DOUBLE GLAZED

8.2.1 PROPERTIES SUCH AS LOW COST AND EASY INSTALLATION COMPARED TO TRIPLE GLAZED WINDOWS IS DRIVING THIS SEGMENT

TABLE 17 PROS OF DOUBLE-GLAZED WINDOWS

TABLE 18 CONS OF DOUBLE-GLAZED WINDOWS

TABLE 19 DOUBLE GLAZED: INSULATING GLASS WINDOW MARKET SIZE, BY REGION, 2018–2020 (USD MILLION)

TABLE 20 DOUBLE GLAZED: INSULATING GLASS WINDOW MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

8.3 TRIPLE GLAZED

8.3.1 HIGH DEMAND FROM COUNTRIES HAVING COLD CLIMATES DRIVING THIS SEGMENT

TABLE 21 PROS OF TRIPLE GLAZED WINDOWS

TABLE 22 CONS OF TRIPLE GLAZED WINDOWS

TABLE 23 TRIPLE GLAZED: INSULATING GLASS WINDOW MARKET SIZE, BY REGION, 2018–2020 (USD MILLION)

TABLE 24 TRIPLE GLAZED: INSULATING GLASS WINDOW MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

8.4 OTHERS

TABLE 25 OTHERS: INSULATING GLASS WINDOW MARKET SIZE, BY REGION, 2018–2020 (USD MILLION)

TABLE 26 OTHERS: INSULATING GLASS WINDOW MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

9 INSULATING GLASS WINDOW MARKET, BY SEALANT TYPE (Page No. - 99)

9.1 INTRODUCTION

TABLE 27 RELATIVE INSULATING GLASS SEAL DURABILITY

TABLE 28 OVERALL ARGON GAS PERMEABILITIES OF DUAL EDGE-SEALED INSULATING GLASS WINDOWS

FIGURE 31 SILICONE SEGMENT TO LEAD THE INSULATING GLASS WINDOW MARKET DURING THE FORECAST PERIOD

TABLE 29 INSULATING GLASS WINDOW MARKET SIZE, BY SEALANT TYPE, 2018–2020 (USD MILLION)

TABLE 30 INSULATING GLASS WINDOW MARKET SIZE, BY SEALANT TYPE, 2021–2026 (USD MILLION)

9.2 SILICONE

9.2.1 CHEMICAL STRUCTURE OF SILOXAME POLYMER IN SILICONE SEALANTS TO DRIVE THE MARKET

9.3 POLYSULFIDE

9.3.1 RESIDENTIAL SECTOR TO DRIVE THE DEMAND

TABLE 31 SEALANT ARGON PERMEABILITY RATES AT ROOM TEMPERATURES

9.4 HOT-MELT BUTYL

9.4.1 LOW MVTR HAS MADE HOT-MELT BUTYL A PREFERRED SEALANT IN INSULATING GLASS WINDOWS

9.5 POLYURETHANE

9.5.1 ASIA PACIFIC TO DRIVE THE MARKET IN THIS SEGMENT

9.6 OTHERS

10 INSULATING GLASS WINDOW MARKET, BY SPACER TYPE (Page No. - 105)

10.1 INTRODUCTION

FIGURE 32 PLASTIC-METAL HYBRID WARM EDGE SPACER TO REGISTER THE HIGHEST CAGR DURING THE FORECAST PERIOD

TABLE 32 INSULATING GLASS WINDOW MARKET SIZE, BY SPACER TYPE, 2018–2020 (USD MILLION)

TABLE 33 INSULATING GLASS WINDOW MARKET SIZE, BY SPACER TYPE, 2021–2026 (USD MILLION)

10.2 COLD EDGE SPACER (ALUMINUM SPACER)

10.2.1 HIGH CONDUCTIVITY OF COLD EDGE (ALUMINUM) SPACERS TO REDUCE THEIR CONSUMPTION IN INSULATING GLASS WINDOWS

10.3 WARM EDGE SPACER

10.3.1 IMPROVED THERMAL EFFICIENCY AND CONDENSATION RESISTANCE DRIVING THE MARKET IN THIS SEGMENT

10.3.2 STAINLESS STEEL WARM EDGE SPACER

10.3.3 PLASTIC-METAL HYBRID WARM EDGE SPACER

10.3.4 FLEXIBLE WARM EDGE SPACER

11 INSULATING GLASS WINDOW MARKET, BY END-USE INDUSTRY (Page No. - 110)

11.1 INTRODUCTION

FIGURE 33 COMMERCIAL SEGMENT TO BE THE LARGER END-USE INDUSTRY

TABLE 34 INSULATING GLASS WINDOW MARKET, BY END-USE INDUSTRY, 2018–2020 (USD MILLION)

TABLE 35 INSULATING GLASS WINDOW MARKET, BY END- USE INDUSTRY, 2021–2026 (USD MILLION)

11.2 RESIDENTIAL

11.2.1 GROWING DEMAND FOR GREEN BUILDINGS TO DRIVE THE MARKET DURING THE FORECAST PERIOD

11.3 COMMERCIAL

11.3.1 NORTH AMERICA TO DOMINATE THE COMMERCIAL END-USE INDUSTRY SEGMENT DURING THE FORECAST PERIOD

12 INSULATING GLASS WINDOW MARKET, BY REGION (Page No. - 114)

12.1 INTRODUCTION

FIGURE 34 GLOBAL INSULATING GLASS WINDOW MARKET SNAPSHOT

TABLE 36 INSULATING GLASS WINDOW MARKET SIZE, BY REGION, 2018–2020 (USD MILLION)

TABLE 37 INSULATING GLASS WINDOW MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

12.2 NORTH AMERICA

FIGURE 35 NORTH AMERICA: INSULATING GLASS WINDOW MARKET SNAPSHOT

TABLE 38 NORTH AMERICA: INSULATING GLASS WINDOW MARKET SIZE, BY COUNTRY, 2018–2020 (USD MILLION)

TABLE 39 NORTH AMERICA: INSULATING GLASS WINDOW MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 40 NORTH AMERICA: INSULATING GLASS WINDOW MARKET SIZE, BY SPACER TYPE, 2018–2020 (USD MILLION)

TABLE 41 NORTH AMERICA: INSULATING GLASS WINDOW MARKET SIZE, BY SPACER TYPE, 2021–2026 (USD MILLION)

TABLE 42 NORTH AMERICA: INSULATING GLASS WINDOW MARKET SIZE, BY SEALANT TYPE, 2018–2020 (USD MILLION)

TABLE 43 NORTH AMERICA: INSULATING GLASS WINDOW MARKET SIZE, BY SEALANT TYPE, 2021–2026 (USD MILLION)

TABLE 44 NORTH AMERICA: INSULATING GLASS WINDOW MARKET SIZE, BY PRODUCT TYPE, 2018–2020 (USD MILLION)

TABLE 45 NORTH AMERICA: INSULATING GLASS WINDOW MARKET SIZE, BY PRODUCT TYPE, 2021–2026 (USD MILLION)

TABLE 46 NORTH AMERICA: INSULATING GLASS WINDOW MARKET SIZE, BY GLAZING TYPE, 2018–2020 (USD MILLION)

TABLE 47 NORTH AMERICA: INSULATING GLASS WINDOW MARKET SIZE, BY GLAZING TYPE, 2021–2026 (USD MILLION)

TABLE 48 NORTH AMERICA: INSULATING GLASS WINDOW MARKET SIZE, BY END-USE INDUSTRY, 2018–2020 (USD MILLION)

TABLE 49 NORTH AMERICA: INSULATING GLASS WINDOW MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (USD MILLION)

12.2.1 US

12.2.1.1 Commercial construction to drive the demand

TABLE 50 US: INSULATING GLASS WINDOW MARKET SIZE, BY END-USE INDUSTRY, 2018–2020 (USD MILLION)

TABLE 51 US: INSULATING GLASS WINDOW MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (USD MILLION)

TABLE 52 US: INSULATING GLASS WINDOW MARKET SIZE, BY SPACER TYPE, 2018–2020 (USD MILLION)

TABLE 53 US: INSULATING GLASS WINDOW MARKET SIZE, BY SPACER TYPE, 2021–2026 (USD MILLION)

TABLE 54 US: INSULATING GLASS WINDOW MARKET SIZE, BY SEALANT TYPE, 2018–2020 (USD MILLION)

TABLE 55 US: INSULATING GLASS WINDOW MARKET SIZE, BY SEALANT TYPE, 2021–2026 (USD MILLION)

12.2.2 CANADA

12.2.2.1 Government incentives for construction to propel the market

TABLE 56 CANADA: INSULATING GLASS WINDOW MARKET SIZE, BY END-USE INDUSTRY, 2018–2020 (USD MILLION)

TABLE 57 CANADA: INSULATING GLASS WINDOW MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (USD MILLION)

TABLE 58 CANADA: INSULATING GLASS WINDOW MARKET SIZE, BY SPACER TYPE, 2018–2020 (USD MILLION)

TABLE 59 CANADA: INSULATING GLASS WINDOW MARKET SIZE, BY SPACER TYPE, 2021–2026 (USD MILLION)

TABLE 60 CANADA: INSULATING GLASS WINDOW MARKET SIZE, BY SEALANT TYPE, 2018–2020 (USD MILLION)

TABLE 61 CANADA: INSULATING GLASS WINDOW MARKET SIZE, BY SEALANT TYPE, 2021–2026 (USD MILLION)

12.2.3 MEXICO

12.2.3.1 Commercial segment to dominate the market in Mexico

TABLE 62 MEXICO: INSULATING GLASS WINDOW MARKET SIZE, BY END-USE INDUSTRY, 2018–2020 (USD MILLION)

TABLE 63 MEXICO: INSULATING GLASS WINDOW MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (USD MILLION)

TABLE 64 MEXICO: INSULATING GLASS WINDOW MARKET SIZE, BY SPACER TYPE, 2018–2020(USD MILLION)

TABLE 65 MEXICO: INSULATING GLASS WINDOW MARKET SIZE, BY SPACER TYPE, 2021–2026 (USD MILLION)

TABLE 66 MEXICO: INSULATING GLASS WINDOW MARKET SIZE, BY SEALANT TYPE, 2018–2020 (USD MILLION)

TABLE 67 MEXICO: INSULATING GLASS WINDOW MARKET SIZE, BY SEALANT TYPE, 2021–2026 (USD MILLION)

12.3 EUROPE

FIGURE 36 EUROPE: INSULATING GLASS WINDOW MARKET SNAPSHOT

TABLE 68 EUROPE: INSULATING GLASS WINDOW MARKET SIZE, BY COUNTRY, 2018–2020 (USD MILLION)

TABLE 69 EUROPE: INSULATING GLASS WINDOW MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 70 EUROPE: INSULATING GLASS WINDOW MARKET SIZE, BY SPACER TYPE, 2018–2020 (USD MILLION)

TABLE 71 EUROPE: INSULATING GLASS WINDOW MARKET SIZE, BY SPACER TYPE, 2021–2026 (USD MILLION)

TABLE 72 EUROPE: INSULATING GLASS WINDOW MARKET SIZE, BY SEALANT TYPE, 2018–2020 (USD MILLION)

TABLE 73 EUROPE: INSULATING GLASS WINDOW MARKET SIZE, BY SEALANT TYPE, 2021–2026 (USD MILLION)

TABLE 74 EUROPE: INSULATING GLASS WINDOW MARKET SIZE, BY PRODUCT TYPE, 2018–2020 (USD MILLION)

TABLE 75 EUROPE: INSULATING GLASS WINDOW MARKET SIZE, BY PRODUCT TYPE, 2021–2026 (USD MILLION)

TABLE 76 EUROPE: INSULATING GLASS WINDOW MARKET SIZE, BY GLAZING TYPE, 2018–2020 (USD MILLION)

TABLE 77 EUROPE: INSULATING GLASS WINDOW MARKET SIZE, BY GLAZING TYPE, 2021–2026 (USD MILLION)

TABLE 78 EUROPE: INSULATING GLASS WINDOW MARKET SIZE, BY END-USE INDUSTRY, 2018–2020 (USD MILLION)

TABLE 79 EUROPE: INSULATING GLASS WINDOW MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (USD MILLION)

12.3.1 GERMANY

12.3.1.1 Federal government policies to drive the construction of energy-efficient buildings in the country

TABLE 80 GERMANY: INSULATING GLASS WINDOW MARKET SIZE, BY END-USE INDUSTRY, 2018–2020 (USD MILLION)

TABLE 81 GERMANY: INSULATING GLASS WINDOW MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (USD MILLION)

TABLE 82 GERMANY: INSULATING GLASS WINDOW MARKET SIZE, BY SPACER TYPE, 2018–2020 (USD MILLION)

TABLE 83 GERMANY: INSULATING GLASS WINDOW MARKET SIZE, BY SPACER TYPE, 2021–2026 (USD MILLION)

TABLE 84 GERMANY: INSULATING GLASS WINDOW MARKET SIZE, BY SEALANT TYPE, 2018–2020 (USD MILLION)

TABLE 85 GERMANY: INSULATING GLASS WINDOW MARKET SIZE, BY SEALANT TYPE, 2021–2026 (USD MILLION)

12.3.2 UK

12.3.2.1 Various government initiatives to support Net Zero building construction

TABLE 86 UK: INSULATING GLASS WINDOW MARKET SIZE, BY END-USE INDUSTRY, 2018–2020 (USD MILLION)

TABLE 87 UK: INSULATING GLASS WINDOW MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (USD MILLION)

TABLE 88 UK: INSULATING GLASS WINDOW MARKET SIZE, BY SPACER TYPE, 2018–2020 (USD MILLION)

TABLE 89 UK: INSULATING GLASS WINDOW MARKET SIZE, BY SPACER TYPE, 2021–2026 (USD MILLION)

TABLE 90 UK: INSULATING GLASS WINDOW MARKET SIZE, BY SEALANT TYPE, 2018–2020 (USD MILLION)

TABLE 91 UK: INSULATING GLASS WINDOW MARKET SIZE, BY SEALANT TYPE, 2021–2026 (USD MILLION)

12.3.3 FRANCE

12.3.3.1 Presence of leading insulating glass window manufacturers to support market growth

TABLE 92 FRANCE: INSULATING GLASS WINDOW MARKET SIZE, BY END-USE INDUSTRY, 2018–2020 (USD MILLION)

TABLE 93 FRANCE: INSULATING GLASS WINDOW MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (USD MILLION)

TABLE 94 FRANCE: INSULATING GLASS WINDOW MARKET SIZE, BY SPACER TYPE, 2018–2020 (USD MILLION)

TABLE 95 FRANCE: INSULATING GLASS WINDOW MARKET SIZE, BY SPACER TYPE, 2021–2026 (USD MILLION)

TABLE 96 FRANCE: INSULATING GLASS WINDOW MARKET SIZE, BY SEALANT TYPE, 2018–2020 (USD MILLION)

TABLE 97 FRANCE: INSULATING GLASS WINDOW MARKET SIZE, BY SEALANT TYPE, 2021–2026 (USD MILLION)

12.3.4 ITALY

12.3.4.1 Government incentives programs for energy-efficient buildings to spur the market growth

TABLE 98 ITALY: INSULATING GLASS WINDOW MARKET SIZE, BY END-USE INDUSTRY, 2018–2020 (USD MILLION)

TABLE 99 ITALY: INSULATING GLASS WINDOW MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (USD MILLION)

TABLE 100 ITALY: INSULATING GLASS WINDOW MARKET SIZE, BY SPACER TYPE, 2018–2020 (USD MILLION)

TABLE 101 ITALY: INSULATING GLASS WINDOW MARKET SIZE, BY SPACER TYPE, 2021–2026 (USD MILLION)

TABLE 102 ITALY: INSULATING GLASS WINDOW MARKET SIZE, BY SEALANT TYPE, 2018–2020 (USD MILLION)

TABLE 103 ITALY: INSULATING GLASS WINDOW MARKET SIZE, BY SEALANT TYPE, 2021–2026 (USD MILLION)

12.3.5 SPAIN

12.3.5.1 Slow handling of building plans and applications to boost new building construction

TABLE 104 SPAIN: INSULATING GLASS WINDOW MARKET SIZE, BY END-USE INDUSTRY, 2018–2020 (USD MILLION)

TABLE 105 SPAIN: INSULATING GLASS WINDOW MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (USD MILLION)

TABLE 106 SPAIN: INSULATING GLASS WINDOW MARKET SIZE, BY SPACER TYPE, 2018–2020 (USD MILLION)

TABLE 107 SPAIN: INSULATING GLASS WINDOW MARKET SIZE, BY SPACER TYPE, 2021–2026 (USD MILLION)

TABLE 108 SPAIN: INSULATING GLASS WINDOW MARKET SIZE, BY SEALANT TYPE, 2018–2020 (USD MILLION)

TABLE 109 SPAIN: INSULATING GLASS WINDOW MARKET SIZE, BY SEALANT TYPE, 2021–2026 (USD MILLION)

12.3.6 REST OF EUROPE

TABLE 110 REST OF EUROPE: INSULATING GLASS WINDOW MARKET SIZE, BY END-USE INDUSTRY, 2018–2020 (USD MILLION)

TABLE 111 REST OF EUROPE: INSULATING GLASS WINDOW MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (USD MILLION)

TABLE 112 REST OF EUROPE: INSULATING GLASS WINDOW MARKET SIZE, BY SPACER TYPE, 2018–2020 (USD MILLION)

TABLE 113 REST OF EUROPE: INSULATING GLASS WINDOW MARKET SIZE, BY SPACER TYPE, 2021–2026 (USD MILLION)

TABLE 114 REST OF EUROPE: INSULATING GLASS WINDOW MARKET SIZE, BY SEALANT TYPE, 2018–2020 (USD MILLION)

TABLE 115 REST OF EUROPE: INSULATING GLASS WINDOW MARKET SIZE, BY SEALANT TYPE, 2021–2026 (USD MILLION)

12.4 ASIA PACIFIC

FIGURE 37 ASIA PACIFIC: INSULATING GLASS WINDOW MARKET SNAPSHOT

TABLE 116 ASIA PACIFIC: INSULATING GLASS WINDOW MARKET SIZE, BY COUNTRY, 2018–2020 (USD MILLION)

TABLE 117 ASIA PACIFIC: INSULATING GLASS WINDOW MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 118 ASIA PACIFIC: INSULATING GLASS WINDOW MARKET SIZE, BY SPACER TYPE, 2018–2020 (USD MILLION)

TABLE 119 ASIA PACIFIC: INSULATING GLASS WINDOW MARKET SIZE, BY SPACER TYPE, 2021–2026 (USD MILLION)

TABLE 120 ASIA PACIFIC: INSULATING GLASS WINDOW MARKET SIZE, BY SEALANT TYPE, 2018–2020 (USD MILLION)

TABLE 121 ASIA PACIFIC: INSULATING GLASS WINDOW MARKET SIZE, BY SEALANT TYPE, 2021–2026 (USD MILLION)

TABLE 122 ASIA PACIFIC: INSULATING GLASS WINDOW MARKET SIZE, BY PRODUCT TYPE, 2018–2020 (USD MILLION)

TABLE 123 ASIA PACIFIC: INSULATING GLASS WINDOW MARKET SIZE, BY PRODUCT TYPE, 2021–2026 (USD MILLION)

TABLE 124 ASIA PACIFIC: INSULATING GLASS WINDOW MARKET SIZE, BY GLAZING TYPE, 2018–2020 (USD MILLION)

TABLE 125 ASIA PACIFIC: INSULATING GLASS WINDOW MARKET SIZE, BY GLAZING TYPE, 2021–2026 (USD MILLION)

TABLE 126 ASIA PACIFIC: INSULATING GLASS WINDOW MARKET SIZE, BY END-USE INDUSTRY, 2018–2020 (USD MILLION)

TABLE 127 ASIA PACIFIC: INSULATING GLASS WINDOW MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (USD MILLION)

12.4.1 CHINA

12.4.1.1 Presence of leading insulating glass window manufacturers along with the growing urbanization to drive the market

TABLE 128 CHINA: INSULATING GLASS WINDOW MARKET SIZE, BY END-USE INDUSTRY, 2018–2020 (USD MILLION)

TABLE 129 CHINA: INSULATING GLASS WINDOW MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (USD MILLION)

TABLE 130 CHINA: INSULATING GLASS WINDOW MARKET SIZE, BY SPACER TYPE, 2018–2020 (USD MILLION)

TABLE 131 CHINA: INSULATING GLASS WINDOW MARKET SIZE, BY SPACER TYPE, 2021–2026 (USD MILLION)

TABLE 132 CHINA: INSULATING GLASS WINDOW MARKET SIZE, BY SEALANT TYPE, 2018–2020 (USD MILLION)

TABLE 133 CHINA: INSULATING GLASS WINDOW MARKET SIZE, BY SEALANT TYPE, 2021–2026 (USD MILLION)

12.4.2 JAPAN

12.4.2.1 Investment in various housing projects to drive the demand

TABLE 134 JAPAN: INSULATING GLASS WINDOW MARKET SIZE, BY END-USE INDUSTRY, 2018–2020 (USD MILLION)

TABLE 135 JAPAN: INSULATING GLASS WINDOW MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (USD MILLION)

TABLE 136 JAPAN: INSULATING GLASS WINDOW MARKET SIZE, BY SPACER TYPE, 2018–2020 (USD MILLION)

TABLE 137 JAPAN: INSULATING GLASS WINDOW MARKET SIZE, BY SPACER TYPE, 2021–2026 (USD MILLION)

TABLE 138 JAPAN: INSULATING GLASS WINDOW MARKET SIZE, BY SEALANT TYPE, 2018–2020 (USD MILLION)

TABLE 139 JAPAN: INSULATING GLASS WINDOW MARKET SIZE, BY SEALANT TYPE, 2021–2026 (USD MILLION)

12.4.3 INDIA

12.4.3.1 Government’s growing expenditure on the construction sector to drive the market

TABLE 140 INDIA: INSULATING GLASS WINDOW MARKET SIZE, BY END-USE INDUSTRY, 2018–2020 (USD MILLION)

TABLE 141 INDIA: INSULATING GLASS WINDOW MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (USD MILLION)

TABLE 142 INDIA: INSULATING GLASS WINDOW MARKET SIZE, BY SPACER TYPE, 2018–2020 (USD MILLION)

TABLE 143 INDIA: INSULATING GLASS WINDOW MARKET SIZE, BY SPACER TYPE, 2021–2026 (USD MILLION)

TABLE 144 INDIA: INSULATING GLASS WINDOW MARKET SIZE, BY SEALANT TYPE, 2018–2020 (USD MILLION)

TABLE 145 INDIA: INSULATING GLASS WINDOW MARKET SIZE, BY SEALANT TYPE, 2021–2026 (USD MILLION)

12.4.4 SOUTH KOREA

12.4.4.1 Growth in private and public investments in infrastructure will propel the demand

TABLE 146 SOUTH KOREA: INSULATING GLASS WINDOW MARKET SIZE, BY END-USE INDUSTRY, 2018–2020 (USD MILLION)

TABLE 147 SOUTH KOREA: INSULATING GLASS WINDOW MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (USD MILLION)

TABLE 148 SOUTH KOREA: INSULATING GLASS WINDOW MARKET SIZE, BY SPACER TYPE, 2018–2020 (USD MILLION)

TABLE 149 SOUTH KOREA: INSULATING GLASS WINDOW MARKET SIZE, BY SPACER TYPE, 2021–2026 (USD MILLION)

TABLE 150 SOUTH KOREA: INSULATING GLASS WINDOW MARKET SIZE, BY SEALANT TYPE, 2018–2020 (USD MILLION)

TABLE 151 SOUTH KOREA: INSULATING GLASS WINDOW MARKET SIZE, BY SEALANT TYPE, 2021–2026 (USD MILLION)

12.4.5 TAIWAN

12.4.5.1 Growing building permits to propel the construction and insulating glass window markets

TABLE 152 TAIWAN: INSULATING GLASS WINDOW MARKET SIZE, BY END-USE INDUSTRY, 2018–2020 (USD MILLION)

TABLE 153 TAIWAN: INSULATING GLASS WINDOW MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (USD MILLION)

TABLE 154 TAIWAN: INSULATING GLASS WINDOW MARKET SIZE, BY SPACER TYPE, 2018–2020 (USD MILLION)

TABLE 155 TAIWAN: INSULATING GLASS WINDOW MARKET SIZE, BY SPACER TYPE, 2021–2026 (USD MILLION)

TABLE 156 TAIWAN: INSULATING GLASS WINDOW MARKET SIZE, BY SEALANT TYPE, 2018–2020 (USD MILLION)

TABLE 157 TAIWAN: INSULATING GLASS WINDOW MARKET SIZE, BY SEALANT TYPE, 2021–2026 (USD MILLION)

12.4.6 REST OF ASIA PACIFIC

TABLE 158 REST OF ASIA PACIFIC: INSULATING GLASS WINDOW MARKET SIZE, BY END-USE INDUSTRY, 2018–2020 (USD MILLION)

TABLE 159 REST OF ASIA PACIFIC: INSULATING GLASS WINDOW MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (USD MILLION)

TABLE 160 REST OF ASIA PACIFIC: INSULATING GLASS WINDOW MARKET SIZE, BY SPACER TYPE, 2018–2020 (USD MILLION)

TABLE 161 REST OF ASIA PACIFIC: INSULATING GLASS WINDOW MARKET SIZE, BY SPACER TYPE, 2021–2026 (USD MILLION)

TABLE 162 REST OF ASIA PACIFIC: INSULATING GLASS WINDOW MARKET SIZE, BY SEALANT TYPE, 2018–2020 (USD MILLION)

TABLE 163 REST OF ASIA PACIFIC: INSULATING GLASS WINDOW MARKET SIZE, BY SEALANT TYPE, 2021–2026 (USD MILLION)

12.5 MIDDLE EAST & AFRICA

TABLE 164 MIDDLE EAST & AFRICA: INSULATING GLASS WINDOW MARKET SIZE, BY COUNTRY, 2018–2020 (USD MILLION)

TABLE 165 MIDDLE EAST & AFRICA: INSULATING GLASS WINDOW MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 166 MIDDLE EAST & AFRICA: INSULATING GLASS WINDOW MARKET SIZE, BY SPACER TYPE, 2018–2020 (USD MILLION)

TABLE 167 MIDDLE EAST & AFRICA: INSULATING GLASS WINDOW MARKET SIZE, BY SPACER TYPE, 2021–2026 (USD MILLION)

TABLE 168 MIDDLE EAST & AFRICA: INSULATING GLASS WINDOW MARKET SIZE, BY SEALANT TYPE, 2018–2020 (USD MILLION)

TABLE 169 MIDDLE EAST & AFRICA: INSULATING GLASS WINDOW MARKET SIZE, BY SEALANT TYPE, 2021–2026 (USD MILLION)

TABLE 170 MIDDLE EAST & AFRICA: INSULATING GLASS WINDOW MARKET SIZE, BY PRODUCT TYPE, 2018–2020 (USD MILLION)

TABLE 171 MIDDLE EAST & AFRICA: INSULATING GLASS WINDOW MARKET SIZE, BY PRODUCT TYPE, 2021–2026 (USD MILLION)

TABLE 172 MIDDLE EAST & AFRICA: INSULATING GLASS WINDOW MARKET SIZE, BY GLAZING TYPE, 2018–2020 (USD MILLION)

TABLE 173 MIDDLE EAST & AFRICA: INSULATING GLASS WINDOW MARKET SIZE, BY GLAZING TYPE 2021–2026 (USD MILLION)

TABLE 174 MIDDLE EAST & AFRICA: INSULATING GLASS WINDOW MARKET SIZE, BY END-USE INDUSTRY, 2018–2020 (USD MILLION)

TABLE 175 MIDDLE EAST & AFRICA: INSULATING GLASS WINDOW MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (USD MILLION)

12.5.1 SAUDI ARABIA

12.5.1.1 Vision 2030 to support the market growth in the country

TABLE 176 SAUDI ARABIA: INSULATING GLASS WINDOW MARKET SIZE, BY END-USE INDUSTRY, 2018–2020 (USD MILLION)

TABLE 177 SAUDI ARABIA: INSULATING GLASS WINDOW MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (USD MILLION)

TABLE 178 SAUDI ARABIA: INSULATING GLASS WINDOW MARKET SIZE, BY SPACER TYPE, 2018–2020 (USD MILLION)

TABLE 179 SAUDI ARABIA: INSULATING GLASS WINDOW MARKET SIZE, BY SPACER TYPE, 2021–2026 (USD MILLION)

TABLE 180 SAUDI ARABIA: INSULATING GLASS WINDOW MARKET SIZE, BY SEALANT TYPE, 2018–2020 (USD MILLION)

TABLE 181 SAUDI ARABIA: INSULATING GLASS WINDOW MARKET SIZE, BY SEALANT TYPE, 2021–2026 (USD MILLION)

12.5.2 SOUTH AFRICA

12.5.2.1 Rapid urbanization to boost the market

TABLE 182 SOUTH AFRICA: INSULATING GLASS WINDOW MARKET SIZE, BY END-USE INDUSTRY, 2018–2020 (USD MILLION)

TABLE 183 SOUTH AFRICA: INSULATING GLASS WINDOW MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (USD MILLION)

TABLE 184 SOUTH AFRICA: INSULATING GLASS WINDOW MARKET SIZE, BY SPACER TYPE, 2018–2020 (USD MILLION)

TABLE 185 SOUTH AFRICA: INSULATING GLASS WINDOW MARKET SIZE, BY SPACER TYPE, 2021–2026 (USD MILLION)

TABLE 186 SOUTH AFRICA: INSULATING GLASS WINDOW MARKET SIZE, BY SEALANT TYPE, 2018–2020 (USD MILLION)

TABLE 187 SOUTH AFRICA: INSULATING GLASS WINDOW MARKET SIZE, BY SEALANT TYPE, 2021–2026 (USD MILLION)

12.5.3 EGYPT

12.5.3.1 Increasing infrastructural development to propel the demand

TABLE 188 EGYPT: INSULATING GLASS WINDOW MARKET SIZE, BY END-USE INDUSTRY, 2018–2020 (USD MILLION)

TABLE 189 EGYPT: INSULATING GLASS WINDOW MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (USD MILLION)

TABLE 190 EGYPT: INSULATING GLASS WINDOW MARKET SIZE, BY SPACER TYPE, 2018–2020 (USD MILLION)

TABLE 191 EGYPT: INSULATING GLASS WINDOW MARKET SIZE, BY SPACER TYPE, 2021–2026 (USD MILLION)

TABLE 192 EGYPT: INSULATING GLASS WINDOW MARKET SIZE, BY SEALANT TYPE, 2018–2020 (USD MILLION)

TABLE 193 EGYPT: INSULATING GLASS WINDOW MARKET SIZE, BY SEALANT TYPE, 2021–2026 (USD MILLION)

12.5.4 REST OF MIDDLE EAST & AFRICA

TABLE 194 REST OF MIDDLE EAST & AFRICA: INSULATING GLASS WINDOW MARKET SIZE, BY END-USE INDUSTRY, 2018–2020 (USD MILLION)

TABLE 195 REST OF MIDDLE EAST & AFRICA: INSULATING GLASS WINDOW MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (USD MILLION)

TABLE 196 REST OF MIDDLE EAST & AFRICA: INSULATING GLASS WINDOW MARKET SIZE, BY SPACER TYPE, 2018–2020 (USD MILLION)

TABLE 197 REST OF MIDDLE EAST & AFRICA: INSULATING GLASS WINDOW MARKET SIZE, BY SPACER TYPE, 2021–2026 (USD MILLION)

TABLE 198 REST OF MIDDLE EAST & AFRICA: INSULATING GLASS WINDOW MARKET SIZE, BY SEALANT TYPE, 2018–2020 (USD MILLION)

TABLE 199 REST OF MIDDLE EAST & AFRICA: INSULATING GLASS WINDOW MARKET SIZE, BY SEALANT TYPE, 2021–2026 (USD MILLION)

12.6 SOUTH AMERICA

TABLE 200 SOUTH AMERICA: INSULATING GLASS WINDOW MARKET SIZE, BY COUNTRY, 2018–2020(USD MILLION)

TABLE 201 SOUTH AMERICA: INSULATING GLASS WINDOW MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 202 SOUTH AMERICA: INSULATING GLASS WINDOW MARKET SIZE, BY SPACER TYPE, 2018–2020 (USD MILLION)

TABLE 203 SOUTH AMERICA: INSULATING GLASS WINDOW MARKET SIZE, BY SPACER TYPE, 2021–2026 (USD MILLION)

TABLE 204 SOUTH AMERICA: INSULATING GLASS WINDOW MARKET SIZE, BY SEALANT TYPE, 2018–2020 (USD MILLION)

TABLE 205 SOUTH AMERICA: INSULATING GLASS WINDOW MARKET SIZE, BY SEALANT TYPE, 2021–2026 (USD MILLION)

TABLE 206 SOUTH AMERICA: INSULATING GLASS WINDOW MARKET SIZE, BY PRODUCT TYPE, 2018–2020 (USD MILLION)

TABLE 207 SOUTH AMERICA: INSULATING GLASS WINDOW MARKET SIZE, BY PRODUCT TYPE, 2021–2026 (USD MILLION)

TABLE 208 SOUTH AMERICA: INSULATING GLASS WINDOW MARKET SIZE, BY GLAZING TYPE, 2018–2020 (USD MILLION)

TABLE 209 SOUTH AMERICA: INSULATING GLASS WINDOW MARKET SIZE, BY GLAZING TYPE, 2021–2026 (USD MILLION)

TABLE 210 SOUTH AMERICA: INSULATING GLASS WINDOW MARKET SIZE, BY END-USE INDUSTRY, 2018–2020 (USD MILLION)

TABLE 211 SOUTH AMERICA: INSULATING GLASS WINDOW MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (USD MILLION)

12.6.1 BRAZIL

12.6.1.1 Rising middle-class population to enhance the demand for insulating glass windows

TABLE 212 BRAZIL: INSULATING GLASS WINDOW MARKET SIZE, BY END-USE INDUSTRY, 2018–2020 (USD MILLION)

TABLE 213 BRAZIL: INSULATING GLASS WINDOW MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (USD MILLION)

TABLE 214 BRAZIL: INSULATING GLASS WINDOW MARKET SIZE, BY SPACER TYPE, 2018–2020 (USD MILLION)

TABLE 215 BRAZIL: INSULATING GLASS WINDOW MARKET SIZE, BY SPACER TYPE, 2021–2026 (USD MILLION)

TABLE 216 BRAZIL: INSULATING GLASS WINDOW MARKET SIZE, BY SEALANT TYPE, 2018–2020 (USD MILLION)

TABLE 217 BRAZIL: INSULATING GLASS WINDOW MARKET SIZE, BY SEALANT TYPE, 2021–2026 (USD MILLION)

12.6.2 ARGENTINA

12.6.2.1 Increasing public expenditure on commercial infrastructure to propel the market

TABLE 218 ARGENTINA: INSULATING GLASS WINDOW MARKET SIZE, BY END-USE INDUSTRY, 2018–2020 (USD MILLION)

TABLE 219 ARGENTINA: INSULATING GLASS WINDOW MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (USD MILLION)

TABLE 220 ARGENTINA: INSULATING GLASS WINDOW MARKET SIZE, BY SPACER TYPE, 2018–2020 (USD MILLION)

TABLE 221 ARGENTINA: INSULATING GLASS WINDOW MARKET SIZE, BY SPACER TYPE, 2021–2026 (USD MILLION)

TABLE 222 ARGENTINA: INSULATING GLASS WINDOW MARKET SIZE, BY SEALANT TYPE, 2018–2020 (USD MILLION)

TABLE 223 ARGENTINA: INSULATING GLASS WINDOW MARKET SIZE, BY SEALANT TYPE, 2021–2026 (USD MILLION)

12.6.3 REST OF SOUTH AMERICA

TABLE 224 REST OF SOUTH AMERICA: INSULATING GLASS WINDOW MARKET SIZE, BY END-USE INDUSTRY, 2018–2020 (USD MILLION)

TABLE 225 REST OF SOUTH AMERICA: INSULATING GLASS WINDOW MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (USD MILLION)

TABLE 226 REST OF SOUTH AMERICA: INSULATING GLASS WINDOW MARKET SIZE, BY SPACER TYPE, 2018–2020(USD MILLION)

TABLE 227 REST OF SOUTH AMERICA: INSULATING GLASS WINDOW MARKET SIZE, BY SPACER TYPE, 2021–2026 (USD MILLION)

TABLE 228 REST OF SOUTH AMERICA: INSULATING GLASS WINDOW MARKET SIZE, BY SEALANT TYPE, 2018–2020 (USD MILLION)

TABLE 229 REST OF SOUTH AMERICA: INSULATING GLASS WINDOW MARKET SIZE, BY SEALANT TYPE, 2021–2026 (USD MILLION)

13 COMPETITIVE LANDSCAPE (Page No. - 184)

13.1 KEY PLAYERS’ STRATEGIES

TABLE 230 OVERVIEW OF KEY STRATEGIES ADOPTED BY TOP PLAYERS, 2017–2021

13.2 REVENUE ANALYSIS

FIGURE 38 REVENUE SHARE ANALYSIS IN THE INSULATING GLASS WINDOW MARKET FOR TOP PLAYERS

13.3 MARKET SHARE ANALYSIS

FIGURE 39 INSULATING GLASS WINDOW MARKET SHARE ANALYSIS

TABLE 231 INSULATING GLASS WINDOW MARKET: DEGREE OF COMPETITION

13.4 COMPAGNIE DE SAINT-GOBAIN SA

13.5 AGC INC.

13.6 NIPPON SHEET GLASS CO., LTD.

13.7 GUARDIAN GLASS

13.8 CENTRAL GLASS CO., LTD.

TABLE 232 INSULATING GLASS WINDOW MARKET: PRODUCT FOOTPRINT

TABLE 233 INSULATING GLASS WINDOW MARKET: END-USE INDUSTRY FOOTPRINT

TABLE 234 INSULATING GLASS WINDOW MARKET: REGION FOOTPRINT

13.9 COMPANY EVALUATION QUADRANT

13.9.1 STAR

13.9.2 PERVASIVE

13.9.3 EMERGING LEADER

13.9.4 PARTICIPANT

FIGURE 40 INSULATING GLASS WINDOW MARKET (GLOBAL) COMPETITIVE LEADERSHIP MAPPING, 2020

13.10 COMPETITIVE LEADERSHIP MAPPING OF SME, 2020

13.10.1 PROGRESSIVE COMPANIES

13.10.2 RESPONSIVE COMPANIES

13.10.3 STARTING BLOCKS

13.10.4 DYNAMIC COMPANIES

FIGURE 41 OTHER ADDITIONAL PLAYERS/SMES EVALUATION MATRIX FOR INSULATING GLASS WINDOW MARKET

13.11 COMPETITIVE SCENARIO

TABLE 235 INSULATING GLASS WINDOW MARKET: PRODUCT LAUNCHES, 2017-2020

TABLE 236 INSULATING GLASS WINDOW MARKET: DEALS, 2017-2021

TABLE 237 INSULATING GLASS WINDOW MARKET: OTHER DEVELOPMENTS, 2017-2021

14 COMPANY PROFILES (Page No. - 201)

14.1 KEY PLAYERS

(Business Overview, Products/solutions/services offered, Recent Developments, Product launches, Deals, Others, MnM view, Key strengths/right to win, Strategic choice made, Weaknesses and competitive threats)*

14.1.1 COMPAGNIE DE SAINT-GOBAIN SA

TABLE 238 COMPAGNIE DE SAINT-GOBAIN SA: BUSINESS OVERVIEW

FIGURE 42 COMPAGNIE DE SAINT-GOBAIN SA: COMPANY SNAPSHOT

TABLE 239 COMPAGNIE DE SAINT-GOBAIN SA: PRODUCT OFFERINGS

TABLE 240 COMPAGNIE DE SAINT-GOBAIN SA: PRODUCT LAUNCHES

TABLE 241 COMPAGNIE DE SAINT-GOBAIN SA: DEALS

TABLE 242 COMPAGNIE DE SAINT-GOBAIN SA: OTHERS

14.1.2 AGC INC.

TABLE 243 AGC INC.: BUSINESS OVERVIEW

FIGURE 43 AGC INC.: COMPANY SNAPSHOT

TABLE 244 AGC INC.: PRODUCT OFFERINGS

TABLE 245 AGC INC.: DEALS

TABLE 246 AGC INC.: OTHERS

14.1.3 NIPPON SHEET GLASS CO., LTD.

TABLE 247 NIPPON SHEET GLASS CO., LTD.: BUSINESS OVERVIEW

FIGURE 44 NIPPON SHEET GLASS CO., LTD.: COMPANY SNAPSHOT

TABLE 248 NIPPON SHEET GLASS CO., LTD.: PRODUCT OFFERINGS

TABLE 249 NIPPON SHEET GLASS CO., LTD.: PRODUCT LAUNCHES

TABLE 250 NIPPON SHEET GLASS CO., LTD.: DEALS

14.1.4 GUARDIAN GLASS

TABLE 251 GUARDIAN GLASS: BUSINESS OVERVIEW

TABLE 252 GUARDIAN GLASS: PRODUCT OFFERINGS

TABLE 253 GUARDIAN GLASS: PRODUCT LAUNCHES

TABLE 254 GUARDIAN GLASS: OTHERS

14.1.5 CENTRAL GLASS CO., LTD.

TABLE 255 CENTRAL GLASS CO., LTD.: BUSINESS OVERVIEW

FIGURE 45 CENTRAL GLASS CO., LTD.: COMPANY SNAPSHOT

TABLE 256 CENTRAL GLASS CO., LTD.: PRODUCT OFFERINGS

14.1.6 DYMAX

TABLE 257 DYMAX: BUSINESS OVERVIEW

TABLE 258 DYMAX: PRODUCT OFFERINGS

14.1.7 GLASTON CORPORATION

TABLE 259 GLASTON CORPORATION: BUSINESS OVERVIEW

FIGURE 46 GLASTON CORPORATION: COMPANY SNAPSHOT

TABLE 260 GLASTON CORPORATION: PRODUCT OFFERINGS

TABLE 261 GLASTON CORPORATION: DEALS

14.1.8 H.B. FULLER COMPANY

TABLE 262 H.B. FULLER COMPANY: BUSINESS OVERVIEW

FIGURE 47 H.B. FULLER COMPANY: COMPANY SNAPSHOT

TABLE 263 H.B. FULLER COMPANY: PRODUCT OFFERINGS

TABLE 264 H.B. FULLER COMPANY: DEALS

TABLE 265 H.B. FULLER COMPANY: OTHERS

14.1.9 HENKEL AG & CO. KGAA

TABLE 266 HENKEL AG & CO. KGAA: BUSINESS OVERVIEW

FIGURE 48 HENKEL AG & CO. KGAA: COMPANY SNAPSHOT

TABLE 267 HENKEL AG & CO. KGAA: PRODUCT OFFERINGS

TABLE 268 HENKEL AG & CO. KGAA: OTHERS

14.1.10 INTERNORM

TABLE 269 INTERNORM: BUSINESS OVERVIEW

TABLE 270 INTERNORM: PRODUCT OFFERINGS

14.1.11 SCHEUTEN

TABLE 271 SCHEUTEN: BUSINESS OVERVIEW

TABLE 272 SCHEUTEN: PRODUCT OFFERINGS

TABLE 273 SCHEUTEN: DEALS

TABLE 274 SCHEUTEN: OTHERS

14.1.12 SIKA AG

TABLE 275 SIKA AG: BUSINESS OVERVIEW

FIGURE 49 SIKA AG: COMPANY SNAPSHOT

TABLE 276 SIKA AG: PRODUCT OFFERINGS

TABLE 277 SIKA AG: PRODUCT LAUNCHES

TABLE 278 SIKA AG: DEALS

TABLE 279 SIKA AG: OTHERS

14.1.13 3M

TABLE 280 3M: BUSINESS OVERVIEW

FIGURE 50 3M: COMPANY SNAPSHOT

TABLE 281 3M: PRODUCT OFFERINGS

TABLE 282 3M: PRODUCT LAUNCHES

14.1.14 VIRACON

TABLE 283 VIRACON: BUSINESS OVERVIEW

TABLE 284 VIRACON: PRODUCT OFFERINGS

14.2 OTHER COMPANIES

14.2.1 BEIJING HANJIANG AUTOMATIC GLASS MACHINERY EQUIPMENT CO., LTD.

TABLE 285 BEIJING HANJIANG AUTOMATIC GLASS MACHINERY EQUIPMENT CO., LTD.: COMPANY OVERVIEW

14.2.2 CARDINAL GLASS INDUSTRIES, INC

TABLE 286 CARDINAL GLASS INDUSTRIES, INC: COMPANY OVERVIEW

14.2.3 ECO GLASS, INC

TABLE 287 ECO GLASS: COMPANY OVERVIEW

14.2.4 ITTIHAD INSULATING GLASS COMPANY

TABLE 288 ITTIHAD INSULATING GLASS COMPANY: COMPANY OVERVIEW

14.2.5 QINGDAO MIGO GLASS CO.,LTD.

TABLE 289 QINGDAO MIGO GLASS CO.,LTD.: COMPANY OVERVIEW

14.2.6 OYADE SEALANT

TABLE 290 OYADE SEALANT: COMPANY OVERVIEW

14.2.7 SHENZHEN JIMY GLASS CO., LTD

TABLE 291 SHENZHEN JIMY GLASS CO., LTD: COMPANY OVERVIEW

14.2.8 STRATHCLYDE INSULATING GLASS LTD.

TABLE 292 STRATHCLYDE INSULATING GLASS LTD.: COMPANY OVERVIEW

14.2.9 VITRO ARCHITECTURAL GLASS

TABLE 293 VITRO ARCHITECTURAL GLASS: COMPANY OVERVIEW

14.2.10 YONGAN ADHESIVE INDUSTRY CO., LTD

TABLE 294 YONGAN ADHESIVE INDUSTRY CO., LTD: COMPANY OVERVIEW

14.2.11 FUSO

TABLE 295 FUSO: COMPANY OVERVIEW

*Details on Business Overview, Products/solutions/services offered, Recent Developments, Product launches, Deals, Others, MnM view, Key strengths/right to win, Strategic choice made, Weaknesses and competitive threats might not be captured in case of unlisted companies.

15 APPENDIX (Page No. - 258)

15.1 DISCUSSION GUIDE

15.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

15.3 AVAILABLE CUSTOMIZATIONS

15.4 RELATED REPORTS

15.5 AUTHOR DETAILS

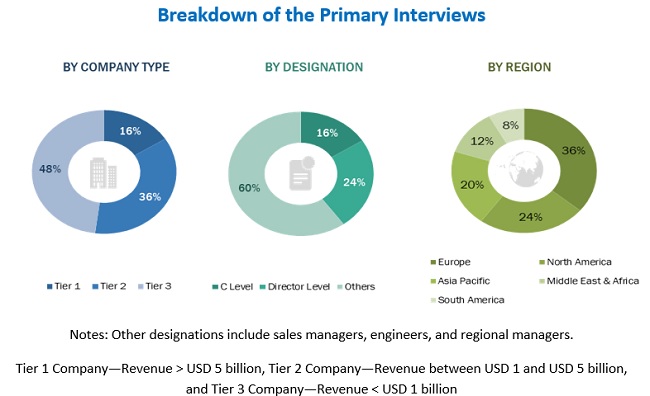

The study involved four major activities in estimating the current size of the insulating glass window market. Exhaustive secondary research was done to collect information on the market, peer markets, and parent market. The next step was to validate these findings, assumptions, and sizing with the industry experts across the insulating glass window market value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

Secondary sources referred to for this research study include annual reports, press releases, investor presentations of companies, white papers, certified publications, articles from recognized authors, and databases of various companies, regulatory bodies, and associations. The secondary research has been mainly used to obtain key information about the market classification and segmentation, use of insulating glass windows in residential and commercial buildings, cost of various components such as insulated glass, glass bonding adhesives and sealants, and spacers (warm edge and cold edge), regional market growth trend for insulating glass windows, and key developments from both the insulated glass manufacturing industry and overall construction industry perspectives.

Primary Research

The insulating glass window market comprises several stakeholders, such as glass suppliers, window systems suppliers, glass importers and exporters, energy-efficient glass-related technology investors, end users of insulated glass, glass insulation associations, government & regional agencies and research organizations.

In the primary research process, various primary sources from the supply and demand sides of the market have been interviewed to obtain qualitative and quantitative information. The primary interviewees from the supply side included side included industry experts such as CEOs, vice presidents, marketing directors, and related key executives from various companies and organizations operating in the insulating glass window market.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both the top-down and bottom-up approaches have been used to estimate and validate the total size of the insulating glass window market. These approaches have also been used extensively to estimate the size of various dependent subsegments of the market. The research methodology used to estimate the market size included the following:

The following segments provide details about the overall market size estimation process employed in this study:

- The key players in the market were identified through secondary research.

- The market shares in the respective regions were identified through both primary and secondary research.

- The value chain and market size of the insulating glass window market, in terms of value, were determined through primary and secondary research.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

- All possible parameters that affect the market covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

- The research included the study of annual and financial reports of the top market players and interviews with industry experts, such as CEOs, vice presidents, marketing directors, and related key executives, for key insights, both quantitative and qualitative.

Global Insulating Glass Window Market Size: Bottom-Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall market size from the estimation process explained below, the total market was split into several segments and subsegments. The data triangulation and market breakdown procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for all the segments and subsegments. The data was triangulated by studying various factors and trends from both the demand and supply sides. Along with this, the market was validated using both the top-down and bottom-up approaches.

Report Objectives

Market Intelligence

- To analyze and forecast the size of the insulating glass window market in terms of value

- To define, describe, and forecast the market size by component, technological solutions, application, vertical, and region

- To forecast the market size with respect to five main regions, namely, North America, Europe, Asia Pacific, the Middle East & Africa, and South America

- To provide detailed information about the key factors influencing the growth of the market (drivers, restraints, opportunities, and challenges)

- To strategically analyze the market segments with respect to individual growth trends, prospects, and their contribution to the market

- To analyze the opportunities in the market for stakeholders and provide a competitive landscape for market leaders

- To analyze competitive developments, such as product launches, acquisitions, expansions, agreements, contracts, partnerships, investments, collaborations, and divestments as in the insulating glass window market

Competitive Intelligence

- To identify and profile the key players in the insulating glass window market

- To determine the top players offering various products in the insulating glass window market

- To provide a comparative analysis of the market leaders based on the following:

- Product offerings

- Business strategies

- Strengths and weaknesses

- Key financials

- To understand the competitive landscape of the market and identify the key growth strategies adopted by the leading players across key regions

Available Customizations

MarketsandMarkets offers the following customizations for this market report:

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Insulating Glass Window Market