Cellular Glass Market by Product Type (Blocks And Shells, And Foam Glass Gravels), Application (Construction, Industrial, and Consumer Abrasive), and Region (North America, Europe, Asia-Pacific, Rest of World) - Global Forecast to 2025

Updated on : June 18, 2024

Cellular Glass Market

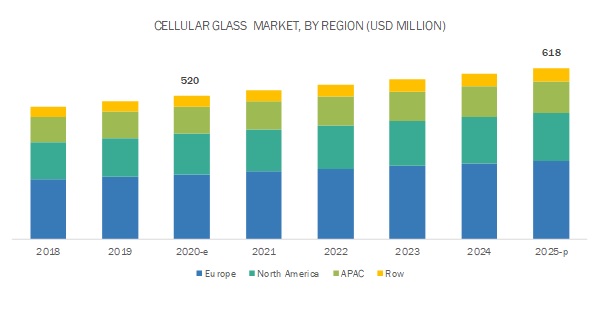

The global cellular glass market is projected to reach USD 618 million by 2025, at a cagr 3.5%. High-quality insulation for industrial purposes and protection against fire and long life are the driving factors for the growth of the cellular glass industry. Also, environmental regulations and new application areas are projected to boost the demand for cellular glass in the coming years.

Blocks & shells led the cellular glass market, by type, in 2019.

The blocks & shells product type led the cellular glass industry in 2019 due to the growth in the construction and industrial sectors. This trend is anticipated continuing during the forecast period.

Blocks & shells are used in storage tank insulation, pipelines, and roof insulations. Blocks can be cut into the desired form and can be installed accordingly. Thus, the flexibility of its usage is another factor driving its demand.

Construction led the cellular glass market, by application, in 2019.

The construction application accounted for the largest share of the market in 2019. The presence of stringent building codes and increasing use of thermal insulation material with high load-bearing capacity in the construction of buildings and other structures will continue driving the market growth. As both blocks and shells, as well as foam glass gravel, are used in the cellular glass market, this drives its demand. In addition, its usage in the residential, commercial, and civil construction drove the market.

Europe led the global cellular glass market in 2019.

Europe led the global cellular glass industry in 2019. The increasing use of cellular glass in construction projects in several European countries is driving market growth.The trend toward energy efficiency persists and stringent building codes, which increases the use of insulation in this region.

In addition, the presence of major manufacturers of cellular glass such as Misapor AG (Switzerland), POLYDROS, S.A. (Spain), REFAGLASS s.r.o. (Czech Republic), Uusioaines Oy(Finland), Steinbach Schaumglas GmbH & Co. KG (Germany), GEOCELL Schaumglas GmbH (Germany), STES-Vladimir (Russia), German Geo Construction GmbH (Germany), Benarx (Norway), and Liaver GmbH & Co. KG (Germany) in the region, is another factor driving its demand. In countries like Germany, the driving factor is the renovation of old buildings.

Cellular Glass Market Players

Owens Corning (US), Misapor AG (Switzerland), POLYDROS,S.A. (Spain), REFAGLASS s.r.o. (Czech Republic), Zhejiang Zhenshen Thermal Technology Co., Ltd. (China), Zhejiang Dehe Insulation Technology Co., Ltd. (China), Uusioaines Oy (Finland), Steinbach Schaumglas GmbH & Co. KG (Germany), Earthstone International LLC (US), GEOCELL Schaumglas GmbH (Germany), STES-Vladimir (Russia), German Geo Construction GmbH (Germany), Benarx (Norway), GLAVEL, Inc. (US), Anhui Huichang New Material Co., Ltd.(China), Jahan Ayegh Pars Company (Iran), and Liaver GmbH & Co. KG (Germany) are the leading manufacturers of cellular glass. They have also adopted strategies such as acquisitions to increase their market reach and strengthen their market position.

Owens Corning is the largest manufacturers of cellular glass. It acquired the company, Pittsburgh Corning, in July 2017 that manufactured and sold cellular glass under the name FOAMGLAS. The company focuses on strategies such as acquisition to remain competitive in the market.

Misapor AG (Switzerland), Steinbach Schaumglas GmbH & Co. KG (Germany) and GEOCELL Schaumglas GmbH(Germany) are few of the largest manufacturers for foam glass gravels. Most of the companies producing foam glass gravels are majorly in the countries of Europe.

Cellular Glass Market Report Scope

|

Report Metric |

Details |

|

Years considered for the study |

2018–2025 |

|

Base year considered |

2019 |

|

Forecast period |

2020–2025 |

|

Units considered |

Value (USD million) |

|

Segments covered |

Product type, application, region |

|

Regions covered |

Europe, North America, APAC and Rest of the World |

|

Companies profiled |

Owens Corning (US), Misapor AG(Switzerland), Zhejiang Zhenshen Thermal Technology Co., Ltd. (China), Zhejiang Dehe Insulation Technology Co., Ltd. (China), Jahan Ayegh Pars Company (Iran), POLYDROS, S.A. (Spain), REFAGLASS sro (Czech Republic), Uusioaines Oy (Finland), Steinbach Schaumglas GmbH & Co. KG (Germany), Earthstone International LLC (US), GEOCELL Schaumglas GmbH (Germany), STES-Vladimir (Russia), German Geo Construction GmbH (Germany), Benarx (Norway), Anhui Huichang New Material Co., Ltd. (China), Liaver GmbH & Co. KG (Germany), and GLAVEL, Inc. (US), among others. A total of 25 players are profiled in the report.

|

This report categorizes the global cellular glass market based on product type, application, and region.

Based on product type:

- Blocks & Shells

- Foam Glass Gravels

Based on the application:

- Construction

- Industrial

- Others

Based on the region:

- Europe

- North America

- APAC

- Rest of World

Recent Developments

- In June 2019, Uusioaines’ parent company, Partnera Glass Recycling, acquired Hasopor. Hasopor is located in Hammar, Sweden’s glass recycling center, and the company is now the only cellular glass manufacturer in the country – in much the same way as Uusioaines, the Group’s company in Finland. The acquisition brings Forssa-based Uusioaines into the extensive Baltic fold of glass recycling business and foam glass production. Uusioaines and Hasopor joined forces to achieve strong growth and internationalization, transforming the circular economy into a profitable business and riding the popularity of their established product brands.

- In November 2017, Owens Corning acquired Pittsburgh Corning, which is the world’s leading producer of cellular glass insulation systems for commercial and industrial markets. This helped the company become the world’s leading provider of insulation solutions with fiberglass, foam, mineral fiber, and cellular glass.

Key Questions addressed by the report

- What are the significant developments impacting the cellular glass market?

- Where will all the developments take the industry in the mid to long term?

- What are the emerging applications of cellular glass?

- What are the major factors expected to impact cellular glass market growth during the forecast period?

- How is the demand for various product types?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 12)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 MARKET SCOPE

1.3.1 YEARS CONSIDERED FOR THE STUDY

1.4 CURRENCY

1.5 LIMITATIONS

1.6 STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 16)

2.1 RESEARCH DATA

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Key data from primary sources

2.1.2.2 Key industry insights

2.1.2.3 Breakdown of primary interviews

2.2 MARKET SIZE ESTIMATION

2.2.1 BOTTOM-UP APPROACH

2.2.2 TOP-DOWN APPROACH

2.2.3 MARKET FORECAST CALCULATION METHODOLOGY

2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

2.4 ASSUMPTIONS

3 EXECUTIVE SUMMARY (Page No. - 23)

4 PREMIUM INSIGHTS (Page No. - 26)

4.1 ATTRACTIVE OPPORTUNITIES IN THE CELLULAR GLASS MARKET

4.2 CELLULAR GLASS MARKET, BY REGION

4.3 CELLULAR GLASS MARKET, BY APPLICATION

4.4 EUROPEAN CELLULAR GLASS MARKET, BY COUNTRY AND APPLICATION (2019)

4.5 CELLULAR GLASS MARKET, BY COUNTRY

5 MARKET OVERVIEW (Page No. - 29)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

5.2.1 DRIVERS

5.2.1.1 Demand for high-quality insulation for industrial purposes

5.2.1.2 Protection against fire and longer life

5.2.2 RESTRAINTS

5.2.2.1 Fragile and susceptible to vibration-induced damage

5.2.2.2 Lack of marketing of cellular glass

5.2.3 OPPORTUNITIES

5.2.3.1 Environmental regulations driving growth of cellular glass

5.2.3.2 New application areas providing opportunities

5.2.4 CHALLENGES

5.2.4.1 High cost of cellular glass

5.2.4.2 Lack of awareness

5.3 PORTER’S FIVE FORCES

5.3.1 THREAT OF NEW ENTRANTS (MODERATE)

5.3.2 THREAT OF SUBSTITUTE (MODERATE)

5.3.3 BARGAINING POWER OF SUPPLIER (LOW)

5.3.4 BARGAINING POWER OF BUYER (MODERATE)

5.3.5 INTENSITY OF COMPETITIVE RIVALRY (MODERATE-TO-HIGH)

5.4 MACROECONOMIC INDICATORS

5.4.1 GDP TRENDS AND FORECAST OF MAJOR REGIONS

5.4.2 GROSS VALUE ADDED BY CONSTRUCTION SECTOR IN MAJOR ECONOMIES (USD MILLION)

6 CELLULAR GLASS MARKET, BY PRODUCT TYPE (Page No. - 37)

6.1 INTRODUCTION

6.2 BLOCKS & SHELLS

6.2.1 INCREASING DRILLING RIGS IN US WILL FUEL DEMAND FOR CELLULAR GLASS BLOCKS & SHELLS

6.3 FOAM GLASS GRAVELS

6.3.1 CHEAPER COST AND CONVENIENT TRANSPORTATION SIGNIFICANTLY DRIVING THE MARKET FOR FOAM GLASS GRAVELS IN BUILDING AND CONSTRUCTION

7 CELLULAR GLASS MARKET, BY APPLICATION (Page No. - 41)

7.1 INTRODUCTION

7.2 CONSTRUCTION

7.2.1 STRINGENT BUILDING CODES AND GROWING DEMAND FOR HIGH LOAD-BEARING MATERIAL TO DRIVE THE MARKET

7.2.2 RESIDENTIAL AND COMMERCIAL CONSTRUCTION

7.2.3 CIVIL CONSTRUCTION

7.2.4 SPECIAL CONSTRUCTION

7.3 INDUSTRIAL

7.3.1 APAC IS LARGEST MARKET FOR CELLULAR GLASS IN INDUSTRIAL SEGMENT

7.4 OTHERS

8 CELLULAR GLASS MARKET, BY REGION (Page No. - 49)

8.1 INTRODUCTION

8.2 EUROPE

8.2.1 GERMANY

8.2.1.1 Renovation of existing buildings to drive demand for cellular glass in Germany

8.2.2 UK

8.2.2.1 Presence of stringent regulatory policies to drive the demand for cellular glass

8.2.3 RUSSIA

8.2.3.1 Growing construction activity to drive the demand for cellular glass in Russia

8.2.4 FRANCE

8.2.4.1 Strong industrial base in France to drive growth of cellular glass market

8.2.5 REST OF EUROPE

8.3 NORTH AMERICA

8.3.1 US

8.3.1.1 Presence of major oil & gas giants in drive the market in the US

8.3.2 CANADA

8.3.2.1 Increasing oil & gas exploration to drive the demand for cellular glass in Canada

8.3.3 MEXICO

8.3.3.1 Booming industrialization and growth in upstream sector to drive the demand for cellular glass

8.4 APAC

8.4.1 CHINA

8.4.1.1 Government policy to drive consumption of cellular glass in the country

8.4.2 JAPAN

8.4.2.1 Growing construction of energy-efficient buildings to drive the cellular glass market

8.4.3 INDIA

8.4.3.1 Growing energy sector to drive the demand for cellular glass

8.4.4 REST OF APAC

8.5 REST OF WORLD

8.5.1 MIDDLE EAST & AFRICA

8.5.1.1 Increase in glass recycling plant and oil & gas production in the region is estimated to drive the market

8.5.2 SOUTH AMERICA

8.5.2.1 Government regulations to drive the cellular glass market

9 COMPETITIVE LANDSCAPE (Page No. - 76)

9.1 OVERVIEW

9.2 COMPETITIVE LEADERSHIP MAPPING, 2019

9.2.1 VISIONARY LEADERS

9.2.2 INNOVATORS

9.2.3 EMERGING COMPANIES

9.3 STRENGTH OF PRODUCT PORTFOLIO

9.4 BUSINESS STRATEGY EXCELLENCE

9.5 MARKET SHARE OF CELLULAR GLASS MANUFACTURERS

9.6 COMPETITIVE SITUATION AND TRENDS

9.6.1 PARTNERSHIP

9.6.2 ACQUISITION

10 COMPANY PROFILES (Page No. - 82)

(Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View)*

10.1 OWENS CORNING

10.2 ZHEJIANG ZHENSHEN THERMAL TECHNOLOGY CO. LTD.

10.3 ZHEJIANG DEHE INSULATION TECHNOLOGY CO., LTD.

10.4 GLAPOR WERK MITTERTEICH GMBH

10.5 MISAPOR AG

10.6 POLYDROS, S.A.

10.7 EARTHSTONE INTERNATIONAL LLC

10.8 REFAGLASS S.R.O.

10.9 UUSIOAINES OY

10.1 ANHUI HUICHANG NEW MATERIAL CO., LTD.

10.11 GEOCELL SCHAUMGLAS GMBH

10.12 STES-VLADIMIR

10.13 OTHER MARKET PLAYERS

10.13.1 PINOSKLO CELLULAR GLASS

10.13.2 NINGBO YOYO FOAM GLASS CO., LTD.

10.13.3 STIKLOPORAS

10.13.4 AEROAGGREGATES OF NORTH AMERICA,LLC

10.13.5 VERISO GMBH

10.13.6 STEINBACH SCHAUMGLAS GMBH & CO. KG

10.13.7 GERMAN GEO CONSTRUCTION GMBH

10.13.8 BENARX

10.13.9 LIAVER GMBH & CO. KG

10.13.10 LANGFANG CHAOCHEN THERMAL INSULATION MATERIAL CO., LTD.

10.13.11 ZHEJIANG YAHONG INDUSTRIAL CO., LTD.

10.13.12 GLAVEL, INC.

10.13.13 JAHAN AYEGH PARS COMPANY

*Details on Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View might not be captured in case of unlisted companies.

11 APPENDIX (Page No. - 103)

11.1 DISCUSSION GUIDE

11.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

11.3 AVAILABLE CUSTOMIZATIONS

11.4 RELATED REPORTS

11.5 AUTHOR DETAILS

LIST OF TABLES (64 Tables)

TABLE 1 TRENDS AND FORECAST OF GDP IN NORTH AMERICA, 2017-2024 (USD BILLION)

TABLE 2 TRENDS AND FORECAST OF GDP IN APAC, 2017–2024 (USD BILLION)

TABLE 3 TRENDS AND FORECAST OF GDP IN EUROPE, 2017–2024 (USD BILLION)

TABLE 4 TRENDS AND FORECAST OF GDP IN MIDDLE EAST, 2017–2024 (USD BILLION)

TABLE 5 TRENDS AND FORECAST OF GDP IN SOUTH AMERICA, 2017–2024 (USD BILLION)

TABLE 6 TRENDS IN CONSTRUCTION SECTOR OF APAC, 2015–2028 (USD MILLION)

TABLE 7 TRENDS IN CONSTRUCTION SECTOR OF EUROPE, 2015–2028 (USD MILLION)

TABLE 8 TRENDS IN CONSTRUCTION SECTOR OF NORTH AMERICA, 2015–2028 (USD MILLION)

TABLE 9 CELLULAR GLASS MARKET SIZE , BY PRODUCT TYPE, 2018–2025 ( USD MILLION)

TABLE 10 BLOCKS & SHELLS MARKET SIZE , BY APPLICATION, 2018–2025 ( USD MILLION)

TABLE 11 FOAM GLASS GRAVELS MARKET SIZE , BY APPLICATION, 2018–2025 ( USD MILLION)

TABLE 12 CELLULAR GLASS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 13 LIST OF SOME RESIDENTIAL AND COMMERCIAL CONSTRUCTION APPLICATIONS

TABLE 14 LIST OF SOME CIVIL CONSTRUCTION APPLICATIONS

TABLE 15 CELLULAR GLASS MARKET SIZE IN CONSTRUCTION, BY REGION, 2018–2025 (USD MILLION)

TABLE 16 CELLULAR GLASS MARKET SIZE IN CONSTRUCTION, BY PRODUCT TYPE, 2018–2025 (USD MILLION)

TABLE 17 CELLULAR GLASS MARKET SIZE IN INDUSTRIAL, BY REGION, 2018–2025 (USD MILLION)

TABLE 18 CELLULAR GLASS MARKET SIZE IN INDUSTRIAL, BY PRODUCT TYPE, 2018–2025 (USD MILLION)

TABLE 19 CELLULAR GLASS MARKET SIZE IN OTHER APPLICATIONS, BY REGION, 2018–2025 (USD MILLION)

TABLE 20 CELLULAR GLASS MARKET SIZE IN OTHER APPLICATIONS, BY PRODUCT TYPE, 2018–2025 (USD MILLION)

TABLE 21 CELLULAR GLASS MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 22 EUROPE: CELLULAR GLASS MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 23 EUROPE: CELLULAR GLASS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 24 GERMANY: PROJECTS BY STEINBACH SCHAUMGLAS GMBH & CO. KG

TABLE 25 GERMANY: PROJECTS BY GLAPOR WERK MITTERTEICH GMBH

TABLE 26 GERMANY: PROJECTS BY GEOCELL SCHAUMGLAS GMBH

TABLE 27 GERMANY: NUMBER OF PROJECTS, BY COMPANY

TABLE 28 GERMANY: CELLULAR GLASS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 29 UK: NUMBER OF PROJECTS, BY COMPANY

TABLE 30 UK: CELLULAR GLASS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 31 RUSSIA: CELLULAR GLASS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 32 FRANCE: NUMBER OF PROJECTS, BY COMPANY

TABLE 33 FRANCE: PROJECTS BY STEINBACH SCHAUMGLAS GMBH & CO. KG

TABLE 34 FRANCE: CELLULAR GLASS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 35 SWEDEN: PROJECTS BY HASOPOR AB

TABLE 36 SWITZERLAND: PROJECTS BY STEINBACH SCHAUMGLAS GMBH & CO. KG

TABLE 37 SWITZERLAND: NUMBER OF PROJECTS, BY COMPANY

TABLE 38 SWITZERLAND: PROJECTS BY GLAPOR WERK MITTERTEICH GMBH

TABLE 39 LUXEMBOURG: PROJECTS BY STEINBACH SCHAUMGLAS GMBH & CO. KG

TABLE 40 NETHERLANDS: PROJECTS BY STEINBACH SCHAUMGLAS GMBH & CO. KG

TABLE 41 ITALY: PROJECTS BY STEINBACH SCHAUMGLAS GMBH & CO. KG

TABLE 42 CROATIA: PROJECTS BY STEINBACH SCHAUMGLAS GMBH & CO. KG

TABLE 43 SLOVENIA: PROJECTS BY STEINBACH SCHAUMGLAS GMBH & CO. KG

TABLE 44 AUSTRIA: PROJECTS BY STEINBACH SCHAUMGLAS GMBH & CO. KG

TABLE 45 AUSTRIA: PROJECTS BY GLAPOR WERK MITTERTEICH GMBH

TABLE 46 AUSTRIA: PROJECTS BY GEOCELL SCHAUMGLAS GMBH

TABLE 47 DENMARK: PROJECTS BY GLAPOR WERK MITTERTEICH GMBH

TABLE 48 POLAND: PROJECTS BY GLAPOR WERK MITTERTEICH GMBH

TABLE 49 REST OF EUROPE: NUMBER OF PROJECTS BY OWENS CORNING

TABLE 50 REST OF EUROPE: NUMBER OF PROJECTS BY GEOCELL SCHAUMGLAS GMBH

TABLE 51 REST OF EUROPE: CELLULAR GLASS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 52 NORTH AMERICA: CELLULAR GLASS MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 53 NORTH AMERICA: CELLULAR GLASS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 54 US: CELLULAR GLASS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 55 CANADA: CELLULAR GLASS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 56 MEXICO: CELLULAR GLASS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 57 APAC: CELLULAR GLASS MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 58 CHINA: CELLULAR GLASS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 59 JAPAN: CELLULAR GLASS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 60 INDIA: CELLULAR GLASS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 61 REST OF APAC: CELLULAR GLASS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 62 REST OF WORLD: CELLULAR GLASS MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 63 PARTNERSHIP, 2017–2019

TABLE 64 ACQUISITION, 2017–2019

LIST OF FIGURES (35 Figures)

FIGURE 1 CELLULAR GLASS: MARKET DEFINITION

FIGURE 2 CELLULAR GLASS: MARKET SEGMENTATION

FIGURE 3 CELLULAR GLASS MARKET, BY REGION

FIGURE 4 CELLULAR GLASS MARKET: RESEARCH DESIGN

FIGURE 5 MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

FIGURE 6 MARKET SIZE ESTIMATION: TOP-DOWN APPROACH

FIGURE 7 CELLULAR GLASS MARKET: FORECAST CALCULATION METHODOLOGY

FIGURE 8 CELLULAR GLASS MARKET: BASE NUMBER CALCULATION, METHODOLOGY 1

FIGURE 9 CELLULAR GLASS MARKET: BASE NUMBER CALCULATION, METHODOLOGY 2

FIGURE 10 CELLULAR GLASS MARKET: DATA TRIANGULATION

FIGURE 11 CONSTRUCTION APPLICATION ACCOUNTED FOR LARGEST SHARE OF THE CELLULAR GLASS MARKET IN 2019

FIGURE 12 BLOCKS & SHELLS TO BE FASTEST-GROWING TYPE OF CELLULAR GLASS BETWEEN 2020 AND 2025

FIGURE 13 EUROPE TO BE FASTEST-GROWING MARKET FOR CELLULAR GLASS

FIGURE 14 INCREASING DEMAND FROM EUROPE TO DRIVE THE GLOBAL CELLULAR GLASS

FIGURE 15 EUROPE TO BE FASTEST-GROWING MARKET FOR CELLULAR GLASS

FIGURE 16 CONSTRUCTION WAS LARGEST APPLICATION OF CELLULAR GLASS IN 2019

FIGURE 17 GERMANY ACCOUNTED FOR LARGEST SHARE OF CELLULAR GLASS MARKET IN EUROPE

FIGURE 18 CANADA TO GROW AT THE HIGHEST RATE DURING THE FORECAST PERIOD

FIGURE 19 OVERVIEW OF FACTORS INFLUENCING THE CELLULAR GLASS MARKET

FIGURE 20 PORTERS FIVE FORCES: CELLULAR GLASS MARKET

FIGURE 21 BLOCKS & SHELLS SEGMENT TO LEAD THE CELLULAR GLASS MARKET

FIGURE 22 CONSTRUCTION APPLICATION TO LEAD THE CELLULAR GLASS MARKET DURING THE FORECAST PERIOD

FIGURE 23 EUROPE: CELLULAR GLASS MARKET SNAPSHOT

FIGURE 24 NORTH AMERICA: CELLULAR GLASS MARKET SNAPSHOT

FIGURE 25 APAC: CELLULAR GLASS MARKET SNAPSHOT

FIGURE 26 COMPETITIVE LEADERSHIP MAPPING, 2019

FIGURE 27 PRODUCT PORTFOLIO ANALYSIS OF TOP PLAYERS IN CELLULAR GLASS MARKET

FIGURE 28 BUSINESS STRATEGY EXCELLENCE OF TOP PLAYERS IN CELLULAR GLASS MARKET

FIGURE 29 ACQUISITION WAS KEY GROWTH STRATEGY ADOPTED BY MARKET PLAYERS BETWEEN 2017 AND 2019

FIGURE 30 MARKET SHARE ANALYSIS IN 2019

FIGURE 31 OWENS CORNING: COMPANY SNAPSHOT

FIGURE 32 OWENS CORNING: WINNING IMPERATIVES

FIGURE 33 OWENS CORNING: SWOT ANALYSIS

FIGURE 34 ZHEJIANG ZHENSHEN THERMAL TECHNOLOGY CO., LTD.: SWOT ANALYSIS

FIGURE 35 ZHEJIANG DEHE INSULATION TECHNOLOGY CO., LTD.: SWOT ANALYSIS

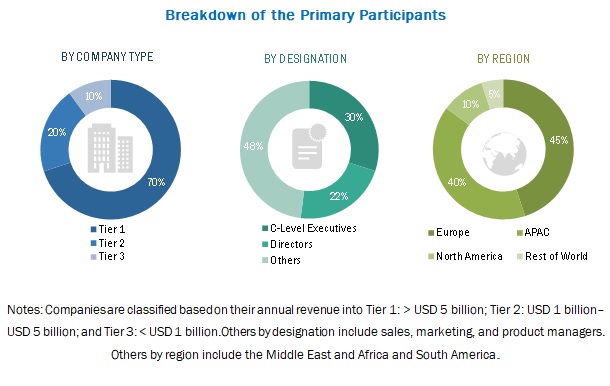

The study involved four major activities for estimating the size of the cellular glass market. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate the findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the total market size. After that, the market breakdown and data triangulation procedures were used to estimate the market size of the segments and sub-segments.

Secondary Research

Secondary sources used in the cellular glass market study includes annual reports, sustainability reports, press releases, and investor presentations of companies, white papers, certified publications, articles from recognized authors, gold standard and silver standard websites; such as Factiva, ICIS, Bloomberg, United Nations Statistical Commission and the United States International Trade Commission (USITC) the findings of this study were verified through primary research by conducting extensive interviews with key officials such as CEOs, VPs, directors, and other executives.

Primary Research

The cellular glass market comprises of several stakeholders, such as raw material suppliers, end-product manufacturers, and regulatory organizations in the supply chain. The demand side of this market is characterized by the development of construction, industrial, and other applications. The supply side is characterized by advancements in technology and diverse end-use applications. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information.

The breakdown of profiles of the primary interviewees is illustrated in the figure below:

To know about the assumptions considered for the study, download the pdf brochure

Market Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the total size of the cellular glass market. These methods were also used extensively to estimate the size of the market in each application. The research methodology used to estimate the market size includes the following:

The key players in the industry were identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, were determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size-using the cellular glass market size estimation processes as explained above-the market was split into several segments. To complete the overall market engineering process and arrive at the exact statistics of each segment, the data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Report Objectives

- To analyze and forecast the size of the cellular glass market in terms of value

- To provide detailed information regarding key factors such as drivers, restraints, challenges, and opportunities influencing the growth of the market

- To define, describe, and segment the cellular glass market based on product type, application, and region

- To forecast the size of the market for regions such as Europe, North America, APAC, and Rest of World

- To strategically analyze the segmented markets with respect to individual growth trends, prospects, and contribution to the overall market

- To identify and investigate opportunities for stakeholders in the cellular glass market

- To analyze competitive developments such as partnerships, and acquisitions in the market

- To strategically profile key players and comprehensively analyze their core competencies

Available Customizations

Along with the given market data, MarketsandMarkets offers customizations according to the company’s specific needs. The following customization options are available for the cellular glass market report:

Regional Analysis

- Further breakdown of a region with respect to a particular country or application

Company Information

- Detailed analysis and profiles of additional market players (up to five)

Growth opportunities and latent adjacency in Cellular Glass Market