Instrumentation Valves and Fittings Market with COVID-19 Impact Analysis by Product (Valves, Fittings, and Actuators), Industry (Oil & Gas, Food & Beverages, Chemicals, Healthcare, Pulp & Paper, and Energy & Power), and Region - Global Forecast to 2025

Updated on : October 07, 2024

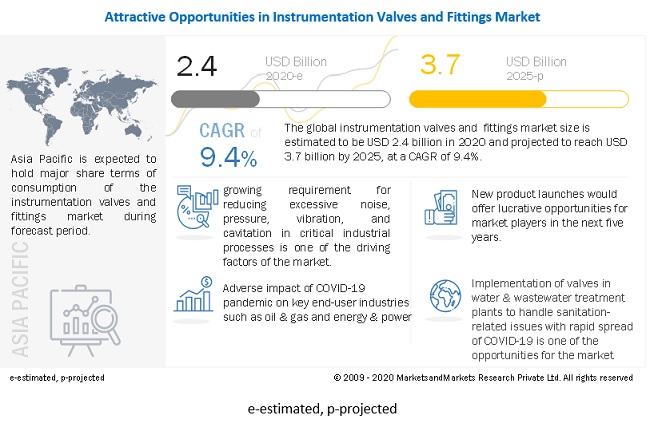

The instrumentation valves and fittings market size was valued at USD 2.4 billion in 2020 and is projected to reach USD 3.7 billion by 2025, growing at a CAGR of 9.4% during the forecast period.

Surging demand for valves from healthcare and pharmaceuticals industries due to outbreak of COVID-19 pandemic, growing requirement for reducing excessive noise, pressure, vibration, and cavitation in critical industrial processes, increasing industrialization and urbanization, along with growing number of smart city initiatives, and rising need for connected networks to maintain and monitor varieties of equipment in plants are the key driving factors for the market.

To know about the assumptions considered for the study, Request for Free Sample Report

Instrumentation Valves and Fittings Market Dynamics:

Driver: Surging demand for valves from healthcare and pharmaceuticals industries due to outbreak of COVID-19 pandemic

With the rapid spread of the coronavirus, healthcare and pharmaceuticals industries are at the forefront of combating COVID-19. There is a rise in the production of all the critical medical devices required to cure COVID patients. Instrumentation valves play an important role in the manufacturing of different types of medical devices, and several key industry players have grabbed the opportunity to fight against the deadly coronavirus pandemic. Companies are increasingly investing in research and development activities pertaining to automatic components such as solenoid valves that are supplied to the pharmaceuticals industry. Likewise, pharmaceutical companies seek to develop sophisticated fluid handling systems, such as automatic sanitizer dispensers and liquid soap dispensers, which, in turn, is creating the need for valves. Thus, the growing production of healthcare devices and increasing R&D investments in the pharma field boost the growth of the instrumentation valves and fittings market.

Restraint: Lack of standardization of certification and policies

Instrumentation valves and fittings are used in several industries such as oil & gas, food & beverages, pharmaceuticals, energy & power, chemicals, and pulp & paper. Certain regions have different certification and regulatory policies with respect to valve manufacturing, and valve manufacturers must adhere to these norms and regulations. However these norms keep on changing after certain period, thereby creating heterogeneity in demand. This restricts market growth as industry players are strictly required to manufacture products that adhere to regional policies, thereby making it difficult for industry players to achieve low-cost fabrication as manufacturers are required to set up a manufacturing unit based on stringent regional standards, which requires high capital. Hence, even if manufacturers focus on setting up their facilities in other countries, it requires additional investments.

Opportunity: Implementation of valves in water & wastewater treatment plants to handle sanitation-related issues with rapid spread of COVID-19

In the COVID-19 pandemic situation, water utilities are under close observation to provide safe drinking water and sanitation. The outbreak of coronavirus has created insecurity among people. Water & wastewater treatment is among the essential services, and hence, the plants are operational for all residential services. The pandemic has made people more concerned about sanitation and clean water. Thus, investments in establishing water treatment plants are expected to propel the growth of the instrumentation valves and fittings market. Additionally, the aging infrastructure in the water & wastewater treatment industry is the primary concern in several countries. Valves used in old infrastructure are also on the verge of replacement as they have surpassed their operational life. Hence, it is important to replace such valves for improved performance and better worker safety. Thus, the rising concern of people for better sanitation and increasing fresh investments in water supply and sanitation projects create significant opportunities for the providers of valves having applications in the water & wastewater treatment industry.

Challenge: Minimization of lead time

Lead time is time between the request generation of valves by end-user industries and manufacturing, installation, and documentation of valves. One of the factors influencing the valve industry is the lead time. A significant number of weeks are consumed for the delivery of valves. On an average, the lead time for a valve is 18 weeks, which may vary, depending upon the valve type, valve material, and its application. This average lead time may be longer for customized valves. Thus, the longer lead time is the biggest challenge faced by valve manufacturers. To overcome this challenge, industry players need to develop innovative technologies or establish strong business relations with value chain entities. A few Chinese valve manufacturers use shorter lead time as a differentiation factor and offer advanced and specialty/customized valves in around 10 weeks.

Valves to account for a larger share of the instrumentation valves market by 2025

The instrumentation valves market for valves is expected to hold the largest share during the forecast period. Valves are used to regulate the flow of media including gases and liquids. These valves are also used in situations where tight shutoff is required. Valves are popular for their reliable bubble-tight sealing. These valves are quick opening and closing valves that can throttle gases or vapors; hence, these valves are preferred in low-flow, low-pressure, or shutoff applications in transmission, storage, and gas processing across all industries. Moreover, Increasing use of instrumentation valves and fittings in energy & power, chemicals, and oil & gas industries is the major factor that drives the growth of the market for instrumentation valves and fittings. Due to the high level of resistance to corrosion and sturdiness of instrumentation valves and fittings, these products account for a small share of the market for the retrofit application.

Oil & Gas accounted for the largest market share in 2019

The oil & gas industry accounted for the largest share of the instrumentation valves and fittings market in 2019 owing to the growing transportation sector, increasing energy demand, and rising drilling activities in the Gulf Cooperation Council (GCC) countries. Pre-COVID-19 pandemic, the growing production of oil and shale gas has fuelled the demand for instrumentation valves and fittings in North America. Instrumentation valves and fittings are used in the oil & gas industry in offshore rigs, refinery plants, and gas handling systems. Valves and fittings used in the oil & gas industry should be able to withstand harsh environmental conditions. As a result, maintenance, repair, and overhaul (MRO) activities are highly crucial for the valves used in the oil & gas industry. However, the oil & gas industry has been hit strongly in the first 2 quarters of 2020 due to the outbreak of the COVID-19 pandemic and the oil price war. The setback of the oil & gas industry has affected the instrumentation valves and fittings market as well. Various companies are planning to reduce their capital expenditure because of the pandemic.

North America to witness the highest CAGR in instrumentation valves and fittings market during the forecast period

North America is a large consumer and a producer of natural gas, and the market in this region is dominated by the US supply and demand dynamics. The US was the world’s largest producer and consumer of natural gas in 2019. This factor, along with the shale gas boom in North America, contributed to the significant growth of the oil & gas industry in the region until 2019. However, right from the beginning of 2020, the entire world has been strongly hit by the COVID-19 pandemic and a health and an economic crisis. The US is among the most affected countries in the world. The COVID-19 pandemic has plummeted the oil demand drastically. The manufacturing market in North America has mostly been affected due to the shutdown of major manufacturing facilities and the superseding of the North American Free Trade Agreement (NAFTA) by the United States–Mexico–Canada Agreement (USMCA). This has been done to restrict the trade of non-essential goods and travels across the borders to limit the spread of COVID-19.

To know about the assumptions considered for the study, download the pdf brochure

Instrumentation Valves and Fittings Market Key Players

Parker Hannifin (US), CIRCOR International (US), Swagelok (US), Hy-Lok Corporation (South Korea), and Ham-Let (US) are among the major players in the instrumentation valves and fittings market.

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Instrumentation Valves and Fittings Market Report Scope

|

Report Metric |

Details |

|

Market Size Availability for Years |

2016–2025 |

|

Base Year |

2019 |

|

Forecast Period |

2020–2025 |

|

Forecast Units |

Value (USD) |

|

Segments Covered |

By product, material, valve type, industry, and region |

|

Geographies Covered |

North America, Europe, APAC, and RoW |

|

Companies Covered |

Parker Hannifin (US), CIRCOR International (US), Swagelok (US), Safelok (UK), Hy-Lok Corporation (South Korea), and Ham-Let (US), AS-Schneider (Germany), Hex Valve (US), Bray International (US), Fuijikin Incorporated (Japan), Dwyer Instruments (US), SSP Fittings Corporation (US). |

This research report categorizes the instrumentation valves and fittings market, by product, industry, and region

Instrumentation Valves Market Based on Material:

- Valves

- Stainless Steel

- Alloy Based

- Cast Iron

- Others

Instrumentation Valves and Fittings Market Based on Product:

-

Valves

- Ball Valves

- Needle Valves

- Check Valves

- Plug Valves

- Other Valves

-

Fittings

- Single Ferrule

- Double Ferrule

- Pipe Fittings

- Flare Fittings

- Pneumatic Actuators

- Others (Gaskets, Manifolds, Glands, in Line Filters)

Based on Industry:

- Oil & Gas

- Food & Beverages

- Chemicals

- Healthcare

- Paper and Pulp

- Energy & Power

- Others

Based on the Region

- North America

- Europe

- APAC

- RoW (South America, Middle East & Africa)

Recent Developments in Instrumentation Valves and Fittings Industry

- In July 2020, AS-Schneider released new Double Block & Bleed valves, specifically designed for instrumentation piping.

- In June 2020, Swagelok expanded its manufacturing operations and created a new business organization in APAC to support the growing demand from the region. The new office is located in Singapore, and the manufacturing plant is in China.

- In June 2020, CIRCOR International announced that its subsidiary—CIRCOR Energy Products LLC (CEP)—signed a definitive agreement to dispose of its loss-making short-cycle upstream oil and gas business, Distributed Valves, to MS Valves GmbH.

- In June 2020, The company extended its portfolio of ball valve offerings for extended operations in a harsh environment at working pressure of 415 bar.

- In October 2019, Parker Hannifin completed its acquisition of LORD Corporation, a leading manufacturer of advanced adhesives and coatings, as well as vibration and motion control technologies. The strategic transaction creates a combined organization with strong materials science capabilities, electrification, and aerospace product offerings that are highly complementary.

Frequently Asked Questions (FAQ):

Which are the major companies in the instrumentation valves and fittings market? What are their major strategies to strengthen their market presence?

The major companies in the instrumentation valves and fittings market are - Parker Hannifin (US), CIRCOR International (US), AS-Schneider (Germany), Hex Valve (US), Bray International (US), Fuijikin Incorporated (Japan), Dwyer Instruments (US), SSP Fittings Corporation (US), Swagelok (US), Safelok (UK), Hy-Lok Corporation (South Korea), and Ham-Let (US). Players in this market have adopted product launches and developments, expansions, acquisitions, and agreements strategies to increase their market share.

Which is the potential market for instrumentation valves and fittings market in terms of the region?

The instrumentation valves and fittings market in APAC is expected to hold major share of the market during the forecast period. Rapid population growth and urbanization in developing economies, such as China and India, have prompted speedy development of industries including energy & power, chemicals, pharmaceuticals, and oil & gas.

What are the opportunities for new market entrants?

There are significant opportunities in the instrumentation valves and fittigs market such as integration of IIoT-enabled instrumentation valves to minimize unexpected downtime, focus of valve manufacturers to offer improved customer services,and implementation of valves in water & wastewater treatment plants to handle sanitation-related issues with rapid spread of COVID-19

Which end-user industries are expected to drive the growth of the market in the next five years?

In the chemicals industry, instrumentation valves and fittings are used in applications such as backflow leakage prevention, acid/caustic/water flow control, pressure reduction and control, as well as regulating the pressure of media flowing from different pipelines. Instrumentation valves and fittings need to comply with stringent standards of safety and reliability as these devices are exposed to highly toxic substances during electrolysis and production of acids and fertilizers. As a result, the fabrication costs of instrumentation valves and fittings that are used in the chemicals industry are higher than those that are used in other industries.

Which products is expected to hold the largest share of the market by 2025?

The instrumentation valves market for valves is expected to hold the largest share during the forecast period. Valves are used to regulate the flow of media including gases and liquids. These valves are also used in situations where tight shutoff is required. Valves are popular for their reliable bubble-tight sealing. These valves are quick opening and closing valves that can throttle gases or vapors; hence, these valves are preferred in low-flow, low-pressure, or shutoff applications in transmission, storage, and gas processing across all industries. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION AND SCOPE

TABLE 1 INCLUSION AND EXCLUSION

1.3 STUDY SCOPE

FIGURE 1 MARKET SEGMENTATION

FIGURE 2 MARKET SEGMENTATION

FIGURE 3 YEARS CONSIDERED

1.4 CURRENCY

1.5 STAKEHOLDERS

1.6 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

2.1 RESEARCH DATA

FIGURE 4 RESEARCH DESIGN

2.1.1 SECONDARY DATA AND PRIMARY RESEARCH

FIGURE 5 RESEARCH APPROACH

2.1.2 SECONDARY DATA

FIGURE 6 KEY DATA FROM SECONDARY SOURCES

2.1.3 PRIMARY DATA

FIGURE 7 KEY DATA FROM PRIMARY SOURCES

2.2 MARKET SIZE ESTIMATION

FIGURE 8 SUPPLY SIDE ANALYSIS

2.2.1 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 1 (SUPPLY SIDE)

2.2.2 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 2 (DEMAND SIDE)

FIGURE 9 BOTTOM-UP APPROACH

FIGURE 10 TOP-DOWN APPROACH

2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 11 MARKET BREAKDOWN

2.4 RESEARCH STUDY ASSUMPTIONS

FIGURE 12 RESEARCH STUDY ASSUMPTIONS

3 EXECUTIVE SUMMARY

FIGURE 13 INSTRUMENTATION VALVES AND FITTINGS MARKET, 2016–2025 (USD BILLION)

FIGURE 14 INSTRUMENTATION VALVES AND FITTINGS MARKET: OPTIMISTIC, REALISTIC, PESSIMISTIC, AND PRE-COVID-19 SCENARIO ANALYSIS (2017–2025)

FIGURE 15 MARKET, BY INDUSTRY, 2020 & 2025 (USD MILLION)

FIGURE 16 MARKET, BY PRODUCT, 2020 & 2025 (USD MILLION)

FIGURE 17 MARKET, BY REGION

4 PREMIUM INSIGHTS

4.1 ATTRACTIVE OPPORTUNITIES IN MARKET

FIGURE 18 INCREASING DEMAND FOR VALVES FROM HEALTHCARE AND PHARMACEUTICALS INDUSTRIES DUE TO OUTBREAK OF COVID-19 PANDEMIC DRIVING GROWTH OF MARKET

4.2 INSTRUMENTATION VALVES AND FITTINGS MARKET, BY INDUSTRY

FIGURE 19 OIL & GAS INDUSTRY TO CONTINUE TO HOLD LARGEST SIZE OF MARKET DURING FORECAST PERIOD

4.3 INSTRUMENTATION VALVES AND FITTINGS MARKET, BY PRODUCT

FIGURE 20 VALVES TO LEAD INSTRUMENTATION VALVES AND FITTINGS MARKET, BY PRODUCT, DURING FORECAST PERIOD

4.4 MARKET IN APAC, BY COUNTRY AND INDUSTRY

FIGURE 21 OIL & GAS INDUSTRY HELD LARGEST SHARE OF MARKET IN APAC IN 2019

4.5 INSTRUMENTATION VALVES AND FITTINGS MARKET, BY COUNTRY

FIGURE 22 INDIA TO WITNESS HIGHEST CAGR IN MARKET DURING FORECAST PERIOD

5 MARKET OVERVIEW

5.1 MARKET DYNAMICS

FIGURE 23 INSTRUMENTATION VALVES AND FITTINGS MARKET DYNAMICS

5.1.1 DRIVERS

FIGURE 24 IMPACT ANALYSIS OF DRIVERS

5.1.2 RESTRAINTS

FIGURE 25 IMPACT ANALYSIS OF RESTRAINTS

5.1.3 OPPORTUNITIES

FIGURE 26 IMPACT ANALYSIS OF OPPORTUNITIES

5.1.4 CHALLENGES

FIGURE 27 IMPACT ANALYSIS OF CHALLENGES

5.2 INDUSTRY TRENDS

5.2.1 VALUE CHAIN ANALYSIS

FIGURE 28 VALUE CHAIN OF INSTRUMENTATION VALVES AND FITTINGS ECOSYSTEM

5.2.2 INDUSTRY TRENDS

6 INSTRUMENTATION VALVES MARKET, BY MATERIAL

6.1 INTRODUCTION

FIGURE 29 INSTRUMENTATION VALVES MARKET, BY MATERIAL, 2016–2025 (USD MILLION)

6.2 STAINLESS STEEL VALVES

FIGURE 30 STAINLESS STEEL INSTRUMENTATION VALVES MARKET, 2016–2025 (USD MILLION)

6.3 ALLOY-BASED VALVES

FIGURE 31 ALLOY-BASED INSTRUMENTATION VALVES MARKET, 2016–2025 (USD MILLION)

6.4 CAST IRON VALVES

FIGURE 32 CAST IRON INSTRUMENTATION VALVES MARKET, 2016–2025 (USD MILLION)

6.5 VALVES MADE UP OF OTHER MATERIALS

FIGURE 33 INSTRUMENTATION VALVES MARKET FOR OTHER MATERIALS, 2016–2025 (USD MILLION)

7 INSTRUMENTATION VALVES AND FITTINGS MARKET, BY PRODUCT

7.1 INTRODUCTION

FIGURE 34 INSTRUMENTATION VALVES AND FITTINGS MARKET, BY PRODUCT, 2016–2025 (USD MILLION)

7.2 VALVES

FIGURE 35 INSTRUMENTATION VALVES MARKET, BY VALVE TYPE, 2016–2025 (USD MILLION)

7.2.1 BALL AND NEEDLE VALVES

FIGURE 36 BALL VALVES MARKET, 2016–2025 (USD MILLION)

FIGURE 37 NEEDLE VALVES MARKET, 2016–2025 (USD MILLION)

7.2.2 CHECK AND PLUG VALVES

FIGURE 38 CHECK VALVES MARKET, 2016–2025 (USD MILLION)

FIGURE 39 PLUG VALVES MARKET, 2016–2025 (USD MILLION)

7.2.3 OTHER VALVES

FIGURE 40 OTHER INSTRUMENTATION VALVES MARKET, 2016–2025 (USD MILLION)

7.3 FITTINGS

FIGURE 41 INSTRUMENTATION FITTINGS MARKET, BY TYPE, 2016–2025 (USD MILLION)

8 INSTRUMENTATION VALVES AND FITTINGS MARKET, BY INDUSTRY

8.1 INTRODUCTION

FIGURE 42 INSTRUMENTATION VALVES AND FITTINGS MARKET, BY INDUSTRY, 2016–2025 (USD MILLION)

8.2 OIL & GAS

FIGURE 43 MARKET FOR OIL & GAS INDUSTRY, BY REGION, 2016–2025 (USD MILLION)

TABLE 2 MARKET IN NORTH AMERICA FOR OIL & GAS INDUSTRY, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 3 MARKET IN NORTH AMERICA FOR OIL & GAS INDUSTRY, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 4 MARKET IN EUROPE FOR OIL & GAS INDUSTRY, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 5 MARKET IN EUROPE FOR OIL & GAS INDUSTRY, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 6 MARKET IN APAC FOR OIL & GAS INDUSTRY, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 7 MARKET IN APAC FOR OIL & GAS INDUSTRY, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 8 MARKET IN ROW FOR OIL & GAS INDUSTRY, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 9 MARKET IN ROW FOR OIL & GAS INDUSTRY, BY COUNTRY, 2020–2025 (USD MILLION)

8.3 FOOD & BEVERAGES

FIGURE 44 INSTRUMENTATION VALVES AND FITTINGS MARKET FOR FOOD & BEVERAGES INDUSTRY, BY REGION, 2016–2025 (USD MILLION)

TABLE 10 MARKET IN NORTH AMERICA FOR FOOD & BEVERAGES INDUSTRY, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 11 MARKET IN NORTH AMERICA FOR FOOD & BEVERAGES INDUSTRY, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 12 MARKET IN EUROPE FOR FOOD & BEVERAGES INDUSTRY, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 13 MARKET IN EUROPE FOR FOOD & BEVERAGES INDUSTRY, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 14 MARKET IN APAC FOR FOOD & BEVERAGES INDUSTRY, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 15 MARKET IN APAC FOR FOOD & BEVERAGES INDUSTRY, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 16 MARKET IN ROW FOR FOOD & BEVERAGES INDUSTRY, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 17 MARKET IN ROW FOR FOOD & BEVERAGES INDUSTRY, BY COUNTRY, 2020–2025 (USD MILLION)

8.4 CHEMICALS

FIGURE 45 INSTRUMENTATION VALVES AND FITTINGS MARKET FOR CHEMICALS INDUSTRY, BY REGION, 2016–2025 (USD MILLION)

TABLE 18 MARKET IN NORTH AMERICA FOR CHEMICALS INDUSTRY, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 19 MARKET IN NORTH AMERICA FOR CHEMICALS INDUSTRY, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 20 MARKET IN EUROPE FOR CHEMICALS INDUSTRY, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 21 MARKET IN EUROPE FOR CHEMICALS INDUSTRY, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 22 MARKET IN APAC FOR CHEMICALS INDUSTRY, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 23 MARKET IN APAC FOR CHEMICALS INDUSTRY, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 24 MARKET IN ROW FOR CHEMICALS INDUSTRY, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 25 INSTRUMENTATION VALVES AND FITTINGS MARKET IN ROW FOR CHEMICALS INDUSTRY, BY COUNTRY, 2020–2025 (USD MILLION)

8.5 HEALTHCARE

FIGURE 46 INSTRUMENTATION VALVES AND FITTINGS MARKET FOR HEALTHCARE INDUSTRY, BY REGION, 2016–2025 (USD MILLION)

TABLE 26 MARKET IN NORTH AMERICA FOR HEALTHCARE INDUSTRY, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 27 MARKET IN NORTH AMERICA FOR HEALTHCARE INDUSTRY, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 28 MARKET IN EUROPE FOR HEALTHCARE INDUSTRY, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 29 MARKET IN EUROPE FOR HEALTHCARE INDUSTRY, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 30 MARKET IN APAC FOR HEALTHCARE INDUSTRY, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 31 MARKET IN APAC FOR HEALTHCARE INDUSTRY, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 32 MARKET IN ROW FOR HEALTHCARE INDUSTRY, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 33 INSTRUMENTATION VALVES AND FITTINGS MARKET IN ROW FOR HEALTHCARE INDUSTRY, BY COUNTRY, 2020–2025 (USD MILLION)

8.6 PULP & PAPER

FIGURE 47 INSTRUMENTATION VALVES AND FITTINGS MARKET FOR PULP & PAPER INDUSTRY, BY REGION, 2016–2025 (USD MILLION)

TABLE 34 MARKET IN NORTH AMERICA FOR PULP & PAPER INDUSTRY, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 35 MARKET IN NORTH AMERICA FOR PULP & PAPER INDUSTRY, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 36 MARKET IN EUROPE FOR PULP & PAPER INDUSTRY, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 37 MARKET IN EUROPE FOR PULP & PAPER INDUSTRY, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 38 MARKET IN APAC FOR PULP & PAPER INDUSTRY, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 39 MARKET IN APAC FOR PULP & PAPER INDUSTRY, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 40 MARKET IN ROW FOR PULP & PAPER INDUSTRY, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 41 INSTRUMENTATION VALVES AND FITTINGS MARKET IN ROW FOR PULP & PAPER INDUSTRY, BY COUNTRY, 2020–2025 (USD MILLION)

8.7 ENERGY & POWER

FIGURE 48 INSTRUMENTATION VALVES AND FITTINGS MARKET FOR ENERGY & POWER INDUSTRY, BY REGION, 2016–2025 (USD MILLION)

TABLE 42 MARKET IN NORTH AMERICA FOR ENERGY & POWER INDUSTRY, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 43 MARKET IN NORTH AMERICA FOR ENERGY & POWER INDUSTRY, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 44 MARKET IN EUROPE FOR ENERGY & POWER INDUSTRY, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 45 MARKET IN EUROPE FOR ENERGY & POWER INDUSTRY, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 46 MARKET IN APAC FOR ENERGY & POWER INDUSTRY, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 47 MARKET IN APAC FOR ENERGY & POWER INDUSTRY, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 48 MARKET IN ROW FOR ENERGY & POWER INDUSTRY, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 49 MARKET IN ROW FOR ENERGY & POWER INDUSTRY, BY COUNTRY, 2020–2025 (USD MILLION)

8.8 OTHERS

FIGURE 49 INSTRUMENTATION VALVES AND FITTINGS MARKET FOR OTHER INDUSTRIES, BY REGION, 2016–2025 (USD MILLION)

TABLE 50 MARKET IN NORTH AMERICA FOR OTHER INDUSTRIES, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 51 MARKET IN NORTH AMERICA FOR OTHER INDUSTRIES, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 52 MARKET IN EUROPE FOR OTHER INDUSTRIES, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 53 MARKET IN EUROPE FOR OTHER INDUSTRIES, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 54 MARKET IN APAC FOR OTHER INDUSTRIES, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 55 MARKET IN APAC FOR OTHER INDUSTRIES, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 56 MARKET IN ROW FOR OTHER INDUSTRIES, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 57 INSTRUMENTATION VALVES AND FITTINGS MARKET IN ROW FOR OTHER INDUSTRIES, BY COUNTRY, 2020–2025 (USD MILLION)

9 INSTRUMENTATION VALVES AND FITTINGS MARKET, BY REGION

9.1 GEOGRAPHIC SNAPSHOT

FIGURE 50 INSTRUMENTATION VALVES AND FITTINGS MARKET, BY REGION

FIGURE 51 INSTRUMENTATION VALVES AND FITTINGS MARKET, BY REGION, 2016–2025 (USD MILLION)

9.2 NORTH AMERICA

FIGURE 52 MARKET IN NORTH AMERICA,BY COUNTRY, 2016–2025 (USD MILLION)

FIGURE 53 MARKET IN NORTH AMERICA,BY INDUSTRY, 2016–2025 (USD MILLION)

TABLE 58 MARKET IN US, BY INDUSTRY, 2016–2019 (USD MILLION)

TABLE 59 MARKET IN US, BY INDUSTRY, 2020–2025 (USD MILLION)

TABLE 60 MARKET IN CANADA, BY INDUSTRY, 2016–2019 (USD MILLION)

TABLE 61 MARKET IN CANADA,BY INDUSTRY, 2020–2025 (USD MILLION)

TABLE 62 MARKET IN MEXICO, BY INDUSTRY, 2016–2019 (USD MILLION)

TABLE 63 MARKET IN MEXICO, BY INDUSTRY, 2020–2025 (USD MILLION)

9.3 EUROPE

FIGURE 54 INSTRUMENTATION VALVES AND FITTINGS MARKET IN EUROPE, BY COUNTRY, 2016–2025 (USD MILLION)

FIGURE 55 MARKET IN EUROPE, BY INDUSTRY, 2016–2025 (USD MILLION)

TABLE 64 MARKET IN GERMANY, BY INDUSTRY, 2016–2019 (USD MILLION)

TABLE 65 MARKET IN GERMANY, BY INDUSTRY, 2020–2025 (USD MILLION)

TABLE 66 MARKET IN UK, BY INDUSTRY, 2016–2019 (USD MILLION)

TABLE 67 MARKET IN UK, BY INDUSTRY, 2020–2025 (USD MILLION)

TABLE 68 MARKET IN FRANCE, BY INDUSTRY, 2016–2019 (USD MILLION)

TABLE 69 MARKET IN FRANCE, BY INDUSTRY, 2020–2025 (USD MILLION)

TABLE 70 MARKET IN ITALY, BY INDUSTRY, 2016–2019 (USD MILLION)

TABLE 71 MARKET IN ITALY, BY INDUSTRY, 2020–2025 (USD MILLION)

TABLE 72 MARKET IN REST OF EUROPE, BY INDUSTRY, 2016–2019 (USD MILLION)

TABLE 73 MARKET IN REST OF EUROPE, BY INDUSTRY, 2020–2025 (USD MILLION)

9.4 ASIA-PACIFIC

FIGURE 56 INSTRUMENTATION VALVES AND FITTINGS MARKET IN APAC, BY COUNTRY, 2016–2025 (USD MILLION)

FIGURE 57 MARKET IN APAC, BY INDUSTRY, 2016–2025 (USD MILLION)

TABLE 74 MARKET IN CHINA, BY INDUSTRY, 2016–2019 (USD MILLION)

TABLE 75 MARKET IN CHINA, BY INDUSTRY, 2020–2025 (USD MILLION)

TABLE 76 MARKET IN JAPAN, BY INDUSTRY, 2016–2019 (USD MILLION)

TABLE 77 MARKET IN JAPAN, BY INDUSTRY, 2020–2025 (USD MILLION)

TABLE 78 MARKET IN SOUTH KOREA, BY INDUSTRY, 2016–2019 (USD MILLION)

TABLE 79 MARKET IN SOUTH KOREA, BY INDUSTRY, 2020–2025 (USD MILLION)

TABLE 80 MARKET IN INDIA, BY INDUSTRY, 2016–2019 (USD MILLION)

TABLE 81 MARKET IN INDIA, BY INDUSTRY, 2020–2025 (USD MILLION)

TABLE 82 MARKET IN REST OF APAC, BY INDUSTRY, 2016–2019 (USD MILLION)

TABLE 83 MARKET IN REST OF APAC, BY INDUSTRY, 2020–2025 (USD MILLION)

9.5 ROW

FIGURE 58 INSTRUMENTATION VALVES AND FITTINGS MARKET IN ROW, BY COUNTRY, 2016–2025 (USD MILLION)

FIGURE 59 MARKET IN ROW, BY INDUSTRY, 2016–2025 (USD MILLION)

TABLE 84 MARKET IN SOUTH AMERICA, BY INDUSTRY, 2016–2019 (USD MILLION)

TABLE 85 MARKET IN SOUTH AMERICA, BY INDUSTRY, 2020–2025 (USD MILLION)

TABLE 86 MARKET IN MIDDLE EAST, BY INDUSTRY, 2016–2019 (USD MILLION)

TABLE 87 MARKET IN MIDDLE EAST, BY INDUSTRY, 2020–2025 (USD MILLION)

TABLE 88 MARKET IN AFRICA, BY INDUSTRY, 2016–2019 (USD MILLION)

TABLE 89 INSTRUMENTATION VALVES AND FITTINGS MARKET IN AFRICA, BY INDUSTRY, 2020–2025 (USD MILLION)

10 COMPETITIVE LANDSCAPE

10.1 LEADING MARKET PLAYER

FIGURE 60 INSTRUMENTATION VALVES AND FITTINGS MARKET: LEADING PLAYERS (2019)

10.2 MARKET SHARE ANALYSIS – TOP 5 COMPANIES

TABLE 90 MARKET SHARE ANALYSIS – TOP 5 COMPANIES

10.3 COMPETITIVE SITUATION AND TRENDS

FIGURE 61 GLOBAL INSTRUMENTATION VALVES AND FITTINGS MARKET: COMPETITIVE SITUATIONS AND TRENDS

10.4 COMPETITIVE LEADERSHIP MAPPING

10.4.1 VISIONARY LEADERS

10.4.2 DYNAMIC DIFFERENTIATORS

10.4.3 INNOVATORS

10.4.4 EMERGING COMPANIES

FIGURE 62 INSTRUMENTATION VALVES AND FITTINGS MARKET (GLOBAL) COMPETITIVE LEADERSHIP MAPPING, 2019

11 COMPANY PROFILE

(Business Overview, Products Offered, Recent Developments, SWOT Analysis, and MnM View)*

11.1 SWAGELOK

FIGURE 63 SWAGELOK: COMPANY OVERVIEW

11.2 PARKER HANNIFIN

FIGURE 64 PARKER HANNIFIN: COMPANY OVERVIEW

11.3 CIRCOR INTERNATIONAL

FIGURE 65 CIRCOR INTERNATIONAL: COMPANY OVERVIEW

11.4 HAM-LET

FIGURE 66 HAM-LET: COMPANY OVERVIEW

11.5 HY-LOK CORPORATION

FIGURE 67 HY-LOK CORPORATION: COMPANY OVERVIEW

11.6 BRAY INTERNATIONAL

FIGURE 68 BRAY INTERNATIONAL: COMPANY OVERVIEW

11.7 AS-SCHNEIDER

FIGURE 69 AS-SCHNEIDER: COMPANY OVERVIEW

11.8 OLIVER VALVES

FIGURE 70 OLIVER VALVES: COMPANY OVERVIEW

11.9 SSP CORPORATION

FIGURE 71 SSP CORPORATION: COMPANY OVERVIEW

11.10 FUJIKIN

FIGURE 72 FUJIKIN: COMPANY OVERVIEW

11.11 HEX VALVE

FIGURE 73 HEX VALVE: COMPANY OVERVIEW

11.12 SAFELOK

FIGURE 74 SAFELOK: COMPANY OVERVIEW

11.13 DWYER INSTRUMENTS

FIGURE 75 DWYER INSTRUMENTS: COMPANY OVERVIEW

11.14 FITOK

FIGURE 76 FITOK: COMPANY OVERVIEW

11.15 RIGHT-TO-WIN (KEY MARKET PLAYERS)

TABLE 91 RIGHT-TO-WIN (KEY MARKET PLAYERS)

11.16 OTHER KEY PLAYERS

11.16.1 TYLOK INTERNATIONAL

11.16.2 WALTER STAUFFENBERG GMBH & CO (STAUFF)

11.16.3 ALCO VALVES GROUP

11.16.4 BRENNEN INDUSTRIES

11.16.5 WAVERLEY BROWNALL

*Details on Business Overview, Products Offered, Recent Developments, SWOT Analysis, and MnM View might not be captured in case of unlisted companies.

12 APPENDIX

12.1 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

12.2 MARKETSANDMARKETS KNOWLEDGE STORE: SNAPSHOT

12.3 RELATED REPORTS

12.4 AUTHOR DETAILS

The study has involved four major activities in estimating the size of the instrumentation valves and fittings market. Exhaustive secondary research has been done to collect information on the market, the peer market, and the parent market. To validate these findings, assumptions, and sizing with industry experts across the value chain through primary research has been the next step. Both top-down and bottom-up approaches have been employed to estimate the total market size. After that, market breakdown and data triangulation methods have been used to estimate the market for segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources such as Hoovers, Bloomberg BusinessWeek, and Factiva have been referred to identify and collect information for this study. These secondary sources included annual reports, press releases and investor presentations of companies, white papers, certified publications, articles by recognized authors, gold-standard and silver-standard websites, regulatory bodies, trade directories, and databases.

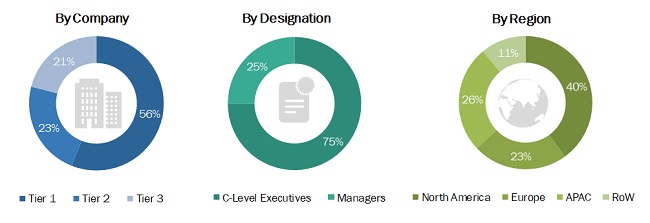

Primary Research

Extensive primary research has been conducted after understanding and analyzing the instrumentation valves and fittings market through secondary research. Several primary interviews have been conducted with key opinion leaders from both the demand-side and supply-side vendors across four major regions—North America, Europe, Asia Pacific (APAC), and Rest of the World (RoW). Various primary sources from both the supply and demand sides of the market have been interviewed to obtain qualitative and quantitative information. The breakdown of primary respondents is as follows

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches have been used to estimate and validate the total size of the instrumentation valves and fittings market. These methods have also been used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size is as follows:

- Key players in the industry and markets have been identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, have been determined through primary and secondary research processes.

- Revenue of various instrumentation valves and fittins manufacturers is considered to arrive at global numbers.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size from the estimation process explained earlier, the global market has been split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments, the data triangulation and market breakdown procedures have been employed, wherever applicable. The data has been triangulated by studying various factors and trends from both the demand and supply sides. Along with this, the instrumentation valves and fittings market has been validated using both the top-down and bottom-up approaches.

Report Objectives

- To forecast the instrumentation valves and fittings market, by product, industry, and geography, in terms of value

- To forecast the instrumentation valves and fittings market size for various segments with regard to 4 main regions—North America, Europe, APAC, and RoW, in terms of value

- To forecast the instrumentation valves market, by material and type, in terms of value

- To forecast the instrumentation fittings market, by type, in terms of value

- To provide brief information regarding drivers, restraints, opportunities, and challenges pertaining to the instrumentation valves and fittings market

- To study a complete value chain of the ecosystem of instrumentation valves and fittings and analyze current and future market trends

- To analyze opportunities in the market for stakeholders by identifying high-growth segments of the instrumentation valves and fittings market

- To strategically profile key players and comprehensively analyze their market position, in terms of ranking and core competencies2, along with detailing competitive landscape for market players

- To analyze strategic approaches such as product launches and developments, acquisitions and mergers, collaborations, contracts, expansions, and partnerships in the instrumentation valves and fittings market

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to the company’s specific needs. The following customization options are available for the report:

Company Information:

- Detailed analysis and profiling of additional market players based on various blocks of the value chain.

Growth opportunities and latent adjacency in Instrumentation Valves and Fittings Market

My focus area in knowing about the manufacturers in APAC specifically in China, Japan, South Korea, India

Have you included US market size for Instrument Valve Manifold for any Process Industry such as Oil and Gas, Petrochemical, Water and Waste Water management, Power, Food etc

Could you send me the sample report so that i get an idea about the deliverable. It would help me in deciding and telling the scope

I am looking for in-depth analysis of the instrumentation valves & fittings market. Can you help me with the scope of the instrumentation valves & fittings market? I would like to know more about the segments covered in the report. I would also like to understand the research methodology used to arrive at the market size.

I am Interested in undertanding the total global instrumentation valves & fittings market in terms of volume and size. I am also interested in understanding the competitive landscape of market players the key strategies adopted by them in this market.