Flame Arrestors Market by Type (In-Line and End-of-Line), Application (Storage Tank, Pipeline, Incinerator, Ventilation System), End-user (Oil & Gas, Chemical, Pharmaceutical, Waste-to-Energy Plant), and Region - Global Forecast to 2023

[116 Pages Report] The global flame arrestors market was valued at USD 677.1 million in 2017 and is projected to reach USD 924.7 million by 2023, at a CAGR of 5.31% during the forecast period. Stringent industrial safety norms and regulations and increasing oil & gas activities in North America are driving the flame arrestors market globally. The years considered for the study are as follows:

- Base Year: 2017

- Estimated Year: 2018

- Projected Year: 2023

- Forecast Period: 20182023

The base year considered for company profiles is 2017. Whenever information was unavailable for the base year, the prior year has been considered.

Objectives of the Study

- To define, describe, and forecast the flame arrestors market by type, application, end-user, and region

- To provide detailed information about the major factors influencing the growth of the market (drivers, restraints, opportunities, and industry-specific challenges)

- To strategically analyze the market with respect to individual growth trends, future projections, and the contribution of each segment to the market

- To track and analyze competitive developments such as contracts & agreements, new product launches, investments and expansions, mergers & acquisitions, and partnerships and collaborations in the market

- To profile key players and comprehensively analyze their market ranking and core competencies

Research Methodology

This research study involved the use of extensive secondary sources, directories, and databases, such as Hoovers, Bloomberg Businessweek, Factiva, and OneSource to identify and collect information useful for a technical, market-oriented, and commercial study of the flame arrestors market. Primary sources are mainly industry experts from the core and related industries, preferred suppliers, manufacturers, distributors, service providers, technology developers, standards and certification organizations of companies, and organizations related to all the segments of this industrys value chain. The points given below explain the research methodology.

- Study of the annual revenue and market developments of major players that provide flame arrestors

- Assessment of future trends and growth of end-users

- Assessment of the market with respect to the type of module used by different end-users

- Study of contracts and other developments related to the market by key players across different regions

- Finalization of overall market sizes by triangulating the supply-side data, which includes product developments, supply chain, and annual revenues of companies offering flame arrestors across the globe

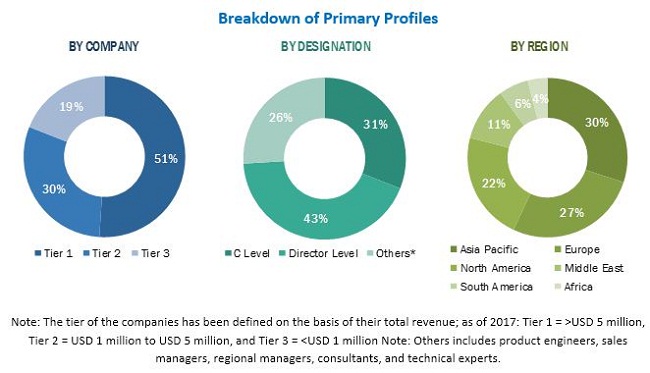

After arriving at the overall market size, the total market has been split into several segments and subsegments. The figure given below illustrates the breakdown of primaries conducted during the research study, on the basis of company type, designation, and region.

To know about the assumptions considered for the study, download the pdf brochure

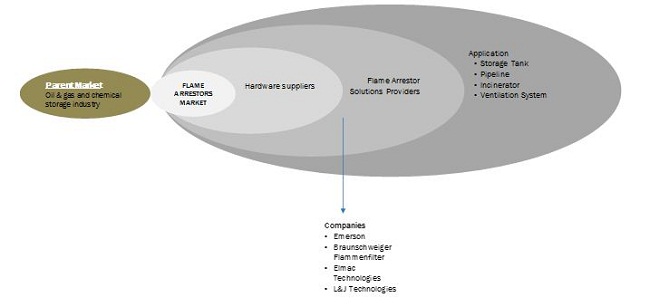

Market Ecosystem

The ecosystem of the flame arrestors market comprises companies such are Emerson (US), Braunschweiger Flammenfilter (Germany), Protectoseal (US), L&J Technologies (US), and Elmac Technologies (UK).

Target Audience:

The reports target audience includes:

- Flame arrestors companies

- Oil & gas storage terminals

- Refineries

- Health, Environment & Safety (HSE) consultants

- Engineering and procurement companies in the oil & gas and chemical sector

- Government and research organizations

- Consulting companies

Scope of the Report:

By Type

- In-line

- End-of-line

By Application

- Storage Tank

- Pipeline

- Incinerator

- Ventilation System

- Others

By End-user

- Oil & Gas

- Chemical

- Metals & Mining

- Pharmaceutical

- Waste-to-energy Plant

- Others

By Region

- North America

- Europe

- Asia Pacific

- South America

- Middle East

- Africa

Available Customizations:

With the given market data, MarketsandMarkets offers customizations as per the clients specific needs. The following customization options are available for the report:

Regional Analysis

- Further breakdown of region/country-specific analyses

Company Information

- Detailed analyses and profiling of additional market players (up to 5)

Drivers

Safety guidelines and regulations for industries

Safety regulations and norms are mandatory for all industries, particularly oil & gas and chemical, and every country has its own safety regulations, norms, and guidelines in place for various industries. Globally, every industry such as oil & gas, mining, chemical, and pharmaceuticals are required to comply with industrial safety regulation norms as prescribed by organizations such as US Coast Guard, International Electrotechnical Commission (IEC) and European Committee for Electrotechnical Standardization (CENELEC). For the compliance of these norms, it is mandatory for industries to install effective and efficient hazardous control systems such as safety valves, gas blanketing equipment, and flame arrestors.

Shale gas and tight oil boom in North America and China

The oil & gas industry is the largest segment of the flame arrestors market. The ecologically sensitive nature of the oil & gas industry makes the installation of hazard prevention equipment a necessity. The recent shale gas and tight oil boom in the US and Canada is an important driver for the market. With the production cost decreasing as newer technology emerges, the shale gas and tight oil production has been rapidly increasing. The US Energy Information Administration (EIA) estimates that natural gas production driven by the shale gas boom will reach a production capacity of 84.21 bcf/day in 2018, from the 2016 average of 77.82 bcf/day. The stringent regulations for the environment, health and safety in North America, are the major driving factors for the growth of hazardous environment control systems.

Restraints

Lack of efficient government monitoring for industrial safety in developing economies

Most countries have a special regulatory body formed for regulating and guiding industries about safety norms and other protocols to be followed for the safety of the environment and human resources. Developed countries such as the US, Canada, and the European countries such as Germany and the UK have strict norms with regular follow-ups and monitoring mechanisms to ensure that these regulations are followed.

Mergers & Acquisitions, 20142018

|

Date |

Company Name |

Development |

|

January 2014 |

Emerson |

Emerson acquired the flame arrestors and tank safety equipment manufacturer Enardo LLC for USD 65 million. The acquisition enables Emerson to enter the flame arrestors market. |

Contracts & Agreements, 20142018

|

Date |

Company Name |

Development |

|

June 2018 |

Elmac Technologies |

Elmac Technologies supplied 7 in-line UCA detonation flame arrestors to Belgiums largest fuel storage facility with the objective to supply assistance with the vapor recovery lines of two new jetties. The installation has helped reduce the overall project costs by reducing the line size from 8 inches to 6 inches. |

|

May 2018 |

Elmac Technologies |

Elmac Technologies supplied 3 in-line detonation flame arrestors and 1 in-line deflagration arrestor to Akzo Nobels paint plant in Northumberland, England. The flame arrestors were installed in the tank vent lines to prevent the propagation of flames within the tank. |

The global flame arrestors market is estimated to be USD 713.8 million in 2018 and is projected to reach USD 924.7 million by 2023, at a CAGR of 5.31%. Stringent safety norms and regulations in industries and the growing demand for shale gas and tight oil are expected to the drive the growth of the market.

The flame arrestors market has been segmented, by type, into in-line and end-of-line. The in-line segment is expected to be the largest because of the rising demand for detonation arrestors for pipelines and ventilation systems of storage terminals in the oil & gas industry.

The flame arrestors market has been segmented, by application, into storage tank, pipeline, incinerator, ventilation system, and others. The others segment includes generator, vacuum pump, and compressor. The storage tank segment is estimated to hold the largest share of the market during the forecast period. The growth in the oil & gas terminals as a result of increased investments in refineries and petrochemical industries are driving the growth for the storage tank segment.

The flame arrestors market has been segmented, by end-user, into oil & gas, chemical, metals & mining, pharmaceutical, waste-to-energy plant, and others. The others segment includes food & beverage, marine, and primary non-metallic industries. The oil & gas segment is estimated to hold the largest market share by 2023. The shale gas and tight oil boom in North America and the Asia Pacific is the driving factor for the growth of the oil & gas segment in the market.

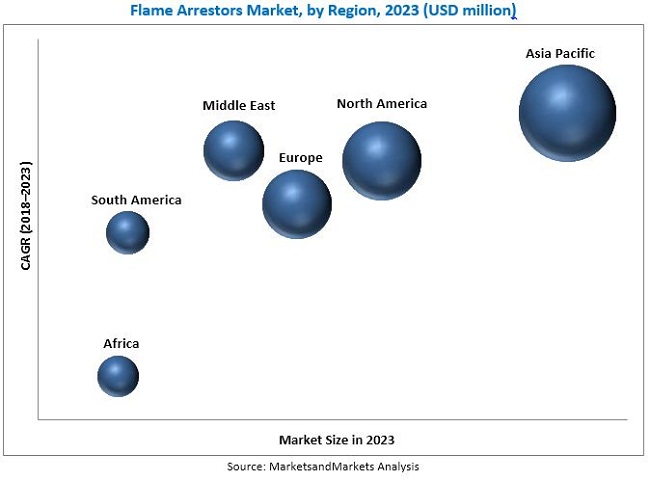

The flame arrestors market has been analyzed with respect to 6 regions, namely, North America, Europe, the Asia Pacific, South America, the Middle East, and Africa. The Asia Pacific is expected to dominate the market during the forecast period. Continued investments in refinery expansion and construction of storage terminals and tank farms in the region are driving the growth of flame arrestors in the Asia Pacific. The rapidly growing pharmaceutical and chemical industries in the region are further contributing to the growth.

The major factor restraining the growth of the flame arrestors market is the lack of effective monitoring of safety instrumentation in emerging economies. This restraining factor is particularly prevalent in the Asia Pacific region, especially in China, India, and Indonesia where small and mid-sized manufacturers opt for hazard prevention equipment like gas blanketing systems to save costs rather than installing hazard protection equipment like flame arrestors.

Some of the leading players in the flame arrestors market include Emerson (US), Braunschweiger Flammenfilter (Germany), Elmac Technologies (UK), Protectoseal (US), and Tornado Combustion Technologies (US). Contracts & agreements were the most commonly adopted strategy by the top players in the market from 2014 to 2018. It was followed by new product developments.

Opportunities

Rapid growth of manufacturing sector in the Asia Pacific region

The growth of the manufacturing sector in the Asia Pacific region is one of the biggest opportunities for the flame arrestors market. Countries such as China, India, and Indonesia are witnessing rapid growth in the manufacturing sector, especially, petrochemical, pharmaceutical, textiles, and heavy industries. China, the largest economy of the region, has a robust manufacturing sector, which contributed almost 30% toward the countrys GDP in 2016. The International Monetary Fund (IMF), in 2017, upgraded Chinas economic growth rate to 6.5%, from an earlier estimate of 6.2%. The growth of the manufacturing sector in these regions provides tremendous opportunities for the hazard protection equipment such as flame arrestors, particularly in the pharmaceutical and chemical industries.

Replacement of legacy equipment in industries

The replacement of outdated flame arrestors in industries provides a growth opportunity for the flame arrestors market. The flame arrestor technology has evolved over the years with better protection technology and high-quality flame quenching element used in the equipment. Industries that had flame arrestors installed in the 1980s and the 1990s used older technology and thus are opting for the replacement of equipment with newer technology. Also, in cases where the flame arrestors installed were not in compliance with the hazardous area classificati

Challenges

Approval from regulatory and certification authority

Equipment used in hazardous environment are required to be certified by authorities that are responsible for approving electrical equipment. Since different countries have different regulations and specifications for the certification of equipment, it becomes a challenge for the manufacturers of flame arrestors to expand into different regions. Also, the cost for customization of product specification becomes an additional cost for meeting the compliance of a particular country. The testing and certification process also needs to be done for each country and incurs additional costs, thus creating competitive pricing challenges.

New Product Developments, 20142018

|

Date |

Company Name |

|

Development |

|

February 2018 |

Elmac Technologies |

|

Elmac Technologies launched a new range of end-of-line flame arrestors, the EHB series. The new series offers a size range from 15 mm to 600 mm, with extended operating temperatures of up to 150 ℃. |

|

January 2018 |

Elmac Technologies |

|

Elmac Technologies launched new end-of-line flame arrestors, the LCA and LEA series. The new products offer protection in the explosion groups IIA1 and IIA and range from 15 mm to 300 mm size in diameter. |

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 13)

1.1 Objectives of the Study

1.2 Definition

1.3 Market Scope

1.3.1 Markets Covered

1.3.2 Years Considered for the Study

1.4 Currency

1.5 Limitations

1.6 Stakeholders

2 Research Methodology (Page No. - 16)

2.1 Introduction

2.2 Research Data

2.2.1 Secondary Data

2.2.2 Primary Data

2.2.2.1 Key Data From Primary Sources

2.2.2.2 Key Industry Insights

2.2.2.3 Breakdown of Primary Interviews

2.3 Market Size Estimation

2.4 Market Breakdown & Data Triangulation

2.5 Research Assumptions

3 Executive Summary (Page No. - 24)

4 Premium Insights (Page No. - 28)

4.1 Attractive Opportunities in the Flame Arrestors Market During the Forecast Period

4.2 Flame Arrestors Market, By Type

4.3 Flame Arrestors Market, By Application

4.4 Flame Arrestors Market, By End-User

4.5 Flame Arrestors Market, By Region

5 Market Overview (Page No. - 31)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Safety Guidelines and Regulations for Industries

5.2.1.2 Shale Gas and Tight Oil Boom in North America and China

5.2.2 Restraints

5.2.2.1 Lack of Efficient Government Monitoring for Industrial Safety in Developing Economies

5.2.3 Opportunities

5.2.3.1 Rapid Growth of Manufacturing Sector in the Asia Pacific Region

5.2.3.2 Replacement of Legacy Equipment in Industries

5.2.4 Challenges

5.2.4.1 Approval From Regulatory and Certification Authority

6 Market, By Type (Page No. - 35)

6.1 Introduction

6.2 In-Line

6.3 End-Of-Line

7 Market, By Application (Page No. - 39)

7.1 Introduction

7.2 Storage Tank

7.3 Pipeline

7.4 Incinerator

7.5 Ventilation System

7.6 Others

8 Market, By End-User (Page No. - 45)

8.1 Introduction

8.2 Oil & Gas

8.3 Chemical

8.4 Metals & Mining

8.5 Pharmaceutical

8.6 Waste-To-Energy Plant

8.7 Others

9 Market, By Region (Page No. - 54)

9.1 Introduction

9.2 Asia Pacific

9.2.1 By Type

9.2.2 By Application

9.2.3 By End-User

9.2.4 By Country

9.2.4.1 China

9.2.4.2 India

9.2.4.3 Japan

9.2.4.4 South Korea

9.2.4.5 Indonesia

9.2.4.6 Rest of Asia Pacific

9.3 North America

9.3.1 By Type

9.3.2 By Application

9.3.3 By End-User

9.3.4 By Country

9.3.4.1 Us

9.3.4.2 Canada

9.3.4.3 Mexico

9.4 Europe

9.4.1 By Type

9.4.2 By Application

9.4.3 By End-User

9.4.4 By Country

9.4.4.1 Russia

9.4.4.2 Germany

9.4.4.3 Spain

9.4.4.4 Italy

9.4.4.5 France

9.4.4.6 Rest of Europe

9.5 Middle East

9.5.1 By Type

9.5.2 By Application

9.5.3 By End-User

9.5.4 By Country

9.5.4.1 Saudi Arabia

9.5.4.2 Iran

9.5.4.3 UAE

9.5.4.4 Kuwait

9.5.4.5 Rest of Middle East

9.6 South America

9.6.1 By Type

9.6.2 By Application

9.6.3 By End-User

9.6.4 By Country

9.6.4.1 Brazil

9.6.4.2 Argentina

9.6.4.3 Rest of South America

9.7 Africa

9.7.1 By Type

9.7.2 By Application

9.7.3 By End-User

9.7.4 By Country

9.7.4.1 Algeria

9.7.4.2 Egypt

9.7.4.3 South Africa

9.7.4.4 Rest of Africa

10 Competitive Landscape (Page No. - 88)

10.1 Introduction

10.2 Market Ranking Analysis

10.3 Competitive Situation & Trends

11 Company Profile (Page No. - 91)

(Business Overview, Products Offered, and Recent Developments)*

11.1 Braunschweiger Flammenfilter

11.2 Elmac Technologies

11.3 Emerson

11.4 Morrison Bros. Co.

11.5 Groth Corporation

11.6 Westech Industrial

11.7 Tornado Combustion Technologies

11.8 Protectoseal

11.9 Ergil

11.10 Bs&B Safety Systems

11.11 L&J Technologies

11.12 Motherwell Tank Protection

*Details on Business Overview, Products Offered, and Recent Developments Might Not Be Captured in Case of Unlisted Companies.

12 Appendix (Page No. - 109)

12.1 Insights of Industry Experts

12.2 Discussion Guide

12.3 Knowledge Store: Marketsandmarkets Subscription Portal

12.4 Available Customizations

12.5 Related Reports

12.6 Author Details

List of Tables (80 Tables)

Table 1 Flame Arrestors Market Snapshot

Table 2 Safety Regulations and Norms Across Different Countries

Table 3 Flame Arrestors Market, By Type, 20162023 (USD Million)

Table 4 In-Line Market, By Configuration, 20162023 (USD Million)

Table 5 In-Line Market, By Region, 20162023 (USD Million)

Table 6 End-Of-Line Market, By Region, 20162023 (USD Million)

Table 7 Flame Arrestors Market, By Application, 20162023 (USD Million)

Table 8 Storage Tank: Market, By Region, 20162023 (USD Million)

Table 9 Pipeline: Market, By Region, 20162023 (USD Million)

Table 10 Incinerator: Flame Arrestors Market, By Region, 20162023 (USD Million)

Table 11 Ventilation System: Market, By Region, 20162023 (USD Million)

Table 12 Others: Flame Arrestors Market, By Region, 20162023 (USD Million)

Table 13 Flame Arrestors Market, By End-User, 20162023 (USD Million)

Table 14 Oil & Gas: Market, By Region, 2016-2023 (USD Million)

Table 15 Oil & Gas: Market, By Region, 2016-2023 (Thousand Units)

Table 16 Chemical: Flame Arrestors Market, By Region, 2016-2023 (USD Million)

Table 17 Chemical: Market, By Region, 2016-2023 (Thousand Units)

Table 18 Metals & Mining: Flame Arrestors Market, By Region, 2016-2023 (USD Million)

Table 19 Metals & Mining: Market, By Region, 2016-2023 (Thousand Units)

Table 20 Pharmaceutical: Flame Arrestors Market, By Region, 2016-2023 (USD Million)

Table 21 Pharmaceutical: Market, By Region, 2016-2023 (Thousand Units)

Table 22 Waste-To-Energy Plant: Flame Arrestors Market, By Region, 2016-2023 (USD Million)

Table 23 Waste-To-Energy Plant: Market, By Region, 2016-2023 (Thousand Units)

Table 24 Others: Flame Arrestors Market, By Region, 2016-2023 (USD Million)

Table 25 Others: Market, By Region, 20162023 (Thousand Units)

Table 26 Flame Arrestors Market, By Region, 20162023 (USD Million)

Table 27 Asia Pacific: Market, By Type, 20162023 (USD Million)

Table 28 Asia Pacific: Market, By Application, 20162023 (USD Million)

Table 29 Asia Pacific: Market, By End-User, 20162023 (USD Million)

Table 30 Asia Pacific: Flame Arrestors Market, By Country, 20162023 (USD Million)

Table 31 China: Flame Arrestors Market Size, By End-User, 20162023 (USD Million)

Table 32 India: Flame Arrestors Market Size, By End-User, 20162023 (USD Million)

Table 33 Japan: Flame Arrestors Size, By End-User, 20162023 (USD Million)

Table 34 South Korea: Flame Arrestors Size, By End-User, 20162023 (USD Million)

Table 35 Indonesia: Flame Arrestors Market Size, By End-User, 20162023 (USD Million)

Table 36 Rest of Asia Pacific: Flame Arrestors Size, By End-User, 20162023 (USD Million)

Table 37 North America: Market, By Type, 20162023 (USD Million)

Table 38 North America: Market, By Application, 20162023 (USD Million)

Table 39 North America: Market, By End-User, 20162023 (USD Million)

Table 40 North America: Flame Arrestors Market, By Country, 20162023 (USD Million)

Table 41 US: Flame Arrestors Market Size, By End-User, 20162023 (USD Million)

Table 42 Canada: Flame Arrestors Size, By End-User, 20162023 (USD Million)

Table 43 Mexico: Flame Arrestors Size, By End-User, 20162023 (USD Million)

Table 44 Europe: Flame Arrestors Market, By Type, 20162023 (USD Million)

Table 45 Europe: Market, By Application, 20162023 (USD Million)

Table 46 Europe: Market, By End-User, 20162023 (USD Million)

Table 47 Europe: Flame Arrestors Market, By Country, 20162023 (USD Million)

Table 48 Russia: Flame Arrestors Size, By End-User, 20162023 (USD Million)

Table 49 Germany: Flame Arrestors Market Size, By End-User, 20162023 (USD Million)

Table 50 Spain: Flame Arrestors Size, By End-User, 20162023 (USD Million)

Table 51 Italy: Flame Arrestors Size, By End-User, 20162023 (USD Million)

Table 52 France: Flame Arrestors Size, By End-User, 20162023 (USD Million)

Table 53 Rest of Europe: Flame Arrestors Market Size, By End-User, 20162023 (USD Million)

Table 54 Middle East: Flame Arrestors Market, By Type, 20162023 (USD Million)

Table 55 Middle East: Market, By Application, 20162023 (USD Million)

Table 56 Middle East: Market, By End-User, 20162023 (USD Million)

Table 57 Middle East: Market, By Country, 20162023 (USD Million)

Table 58 Saudi Arabia: Flame Arrestors Market Size, By End-User, 20162023 (USD Million)

Table 59 Iran: Flame Arrestors Market Size, By End-User, 20162023 (USD Million)

Table 60 UAE: Flame Arrestors Size, By End-User, 20162023 (USD Million)

Table 61 Kuwait: Flame Arrestors Size, By End-User, 20162023 (USD Million)

Table 62 Rest of the Middle East: Flame Arrestors Market Size, By End-User, 20162023 (USD Million)

Table 63 South America: Flame Arrestors Market, By Type, 20162023 (USD Million)

Table 64 South America: Market, By Application, 20162023 (USD Million)

Table 65 South America: Market, By End-User, 20162023 (USD Million)

Table 66 South America: Flame Arrestors Market, By Country, 20162023 (USD Million)

Table 67 Brazil: Flame Arrestors Market Size, By End-User, 20162023 (USD Million)

Table 68 Argentina: Flame Arrestors Size, By End-User, 20162023 (USD Million)

Table 69 Rest of South America: Flame Arrestors Size, By End-User, 20162023 (USD Million)

Table 70 Africa: Flame Arrestors Market, By Type, 20162023 (USD Million)

Table 71 Africa: Market, By Application, 20162023 (USD Million)

Table 72 Africa: Flame Arrestors Market, By End-User, 20162023 (USD Million)

Table 73 Africa: Market, By Country, 20162023 (USD Million)

Table 74 Algeria: Flame Arrestors Size, By End-User, 20162023 (USD Million)

Table 75 Egypt: Flame Arrestors Market Size, By End-User, 20162023 (USD Million)

Table 76 South Africa: Flame Arrestors Size, By End-User, 20162023 (USD Million)

Table 77 Rest of Africa: Flame Arrestors Market Size, By End-User, 20162023 (USD Million)

Table 78 Mergers & Acquisitions, 20142018

Table 79 Contracts & Agreements, 20142018

Table 80 New Product Developments, 20142018

List of Figures (28 Figures)

Figure 1 Markets Covered: Flame Arrestors Market

Figure 2 Regional Scope: Market

Figure 3 Flame Arrestors Market: Research Design

Figure 4 Breakdown of Primary Interviews: By Company Type, Designation, & Region

Figure 5 Market Size Estimation Methodology: Bottom-Up Approach

Figure 6 Market Size Estimation Methodology: Top-Down Approach

Figure 7 Data Triangulation Methodology

Figure 8 In-Line Flame Arrestors Market is Expected to Grow at the Highest CAGR During the Forecast Period

Figure 9 Storage Tank Segment is Expected to Have the Maximum Market Share During the Forecast Period

Figure 10 Oil & Gas Segment is Expected to Lead the Market

Figure 11 Asia Pacific is Expected to Dominate the Flame Arrestors Market During the Forecast Period

Figure 12 Stringent Safety Norms and Regulations in Industries Create Opportunity for the Flame Arrestors Market, 20182023

Figure 13 In-Line Segment is Leading the Flame Arrestors Market, 20182023

Figure 14 Storage Tank Segment Led the Market in 2018

Figure 15 Oil & Gas Segment is Expected to Hold the Largest Share in the Market in 2018

Figure 16 Asia Pacific Region is Expected to Grow at the Fastest CAGR During the Forecast Period

Figure 17 Flame Arrestors Market Dynamics for the Market

Figure 18 Figure: Natural Gas Production in the US is Expected to Surge in 2018.

Figure 19 In-Line Flame Arrestors Segment Dominated the Market in 2017

Figure 20 Storage Tank Segment Dominated the Flame Arrestors Market in 2017

Figure 21 Oil & Gas Segment Dominated the Market, By End-User, in 2017

Figure 22 Asia Pacific is Estimated to Grow at the Highest CAGR During the Forecast Period

Figure 23 Asia Pacific Led the Market in 2017

Figure 24 Asia Pacific: Market Snapshot

Figure 25 North America: Market Snapshot

Figure 26 Key Developments in the Market, 20142018

Figure 27 Market Ranking, Market, 2017

Figure 28 Emerson: Company Snapshot

Growth opportunities and latent adjacency in Flame Arrestors Market