Instant Adhesive Market by Chemistry (Cyanoacrylate, Epoxy-based), Curing Process (Conventional, Light Cured), Application (Industrial, Woodworking, Transportation, Consumer, Medical, Electronics), and Region - Global Forecasts to 2022

[158 Pages Report] The Instant Adhesive Market is projected to grow from USD 1.57 Billion in 2017 to USD 2.38 Billion by 2022, at a CAGR of 8.75% during the forecast period. In this study, 2016 has been considered as the base year to estimate the size of the instant adhesives market. The report provides the short-term forecast from 2017 to 2022. It aims at estimating the size and future growth potential of the instant adhesives market across different segments, such as curing process, chemistry, application, and region. Factors such as drivers, restraints, opportunities, and industry-specific challenges influencing the growth of the instant adhesives market have also been studied in this report. The report analyzes the opportunities in the instant adhesives market for stakeholders and presents a competitive landscape of the market.

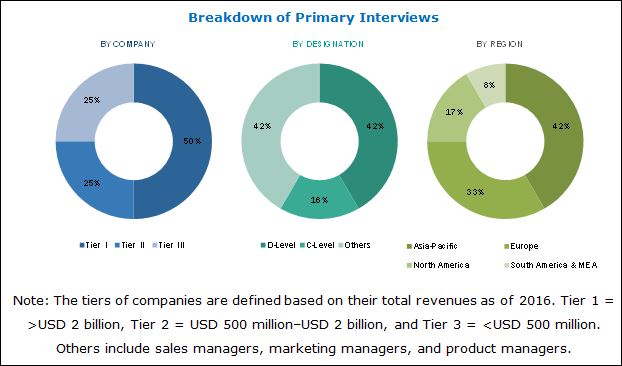

Both top-down and bottom-up approaches have been used to estimate and validate the size of the instant adhesive market and to estimate the sizes of various other dependent submarkets. This research study involved extensive use of secondary sources, directories, and databases, such as Hoovers, Bloomberg, Chemical Weekly, Factiva, and other government associations. Moreover, private websites and company websites have also been used to identify and collect information useful for this technical, market-oriented, and commercial study of the instant adhesives market. After arriving at the total market size, the overall market has been split into several segments and subsegments. The figure given below provides a breakdown of the primaries conducted during the research study, based on company type, designation, and region.

To know about the assumptions considered for the study, download the pdf brochure

The acrylic adhesives market has a diversified and established ecosystem of upstream players such as raw material suppliers and downstream stakeholders such as manufacturers, vendors, end users, and government organizations. Leading players in the instant adhesives market, which include Henkel AG & Co. KGaA (Germany), H.B. Fuller (U.S.), Huntsman Corporation (U.S.), 3M Company (U.S.), Bostik SA (France), Toagosei Co., Ltd. (Japan), and Pidilite Industries (India), among others, have been profiled in this report.

Key Target Audience:

- Manufacturers of Instant adhesives

- Manufacturers of Adhesives

- Government Agencies or Organizations

- Research Institutions and Organizations

- Various Applications (Industrial, Woodworking, Transportation, Consumer, Medical, Electronics)

- Traders, Distributors, and Suppliers of Technology and Adhesives

- Regional Adhesives Manufacturers Associations

Scope of the Report:

This research report categorizes the instant adhesive market based on curing process, chemistry, application, and region.

Instant Adhesives Market, By Curing Process:

- Conventional

- Light-cured

Instant Adhesives Market, By Chemistry:

- Cyanoacrylate

- Epoxy-based

Instant Adhesives Market, By Application:

- Industrial

- Woodworking

- Transportation

- Consumer

- Medical

- Electronics

Instant Adhesives Market, By Region:

- North America

- Europe

- Asia-Pacific

- Middle East & Africa

- South America

The market is further analyzed for key countries in each of these regions.

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to specific needs of the companies. The following customization options are available for the report:

Regional Analysis:

- Country-level analysis of the instant adhesives market, by application

Company Information:

- Detailed analysis and profiles of additional market players

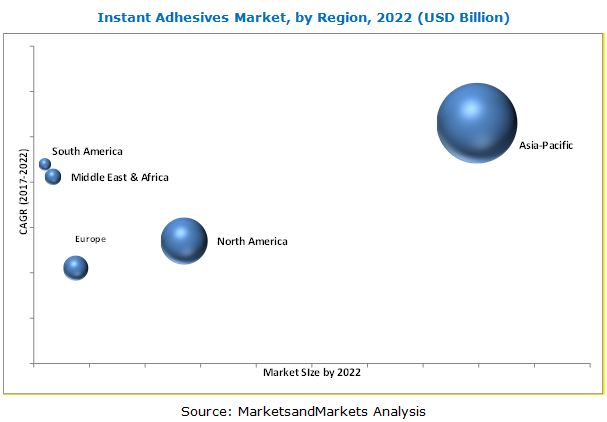

The instant adhesives market is projected to reach USD 2.38 Billion by 2022, at a CAGR 8.75% from 2017 to 2022. Instant adhesives are mostly one-part solvent-free adhesives, which cure at room temperature. They offer excellent bonding strength to most of the substrates such as metal, glass, composites, and wood, among others. These adhesives cure instantly when pressed between two similar or different substrates to form a rigid thermoplastic. The market is largely driven by the increased demand from various applications, such as industrial, woodworking, transportation, consumer, medical, and electronics. The growth of the instant adhesives market can also be attributed to the increased investments by key market players to launch efficient and cost-effective products. High growth in the end-use industries of Asia-Pacific and miniaturization and automation in the electronics industry are fueling the demand for instant adhesives. The instant adhesives market has been segmented based on curing process, chemistry, application, and region.

The demand for instant adhesives has increased in the recent years in the Asia-Pacific region. This increased demand can be attributed to the growing automotive and electronics industry. This, in turn, has contributed to the growth of the market for instant adhesives in the region. The market is highly competitive as innovative products that comply with tough safety standards and improved efficiencies attract customers.

The Asia-Pacific region is the largest market for instant adhesive in terms of both volume and value. Companies such as Henkel AG & Co. KGaA (Germany), H.B. Fuller (U.S.), Huntsman Corporation (U.S.), 3M Company (U.S.), Bostik SA (France), Toagosei Co., Ltd. (Japan), and Pidilite Industries (India), among others, are the key manufacturers of instant adhesives that have expanded their presence across the Asia-Pacific region and enhanced their production capacities to cater the increased demand for instant adhesive from this region.

Low durability and high cost of instant adhesives as compared to other types of adhesives are restricting the growth of the global instant adhesives market.

Key players operating in the instant adhesive market include Henkel AG & Co. KGaA (Germany), H.B. Fuller (U.S.), Huntsman Corporation (U.S.), 3M Company (U.S.), Bostik SA (France), Toagosei Co., Ltd. (Japan), and Pidilite Industries (India), among others.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 17)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Years Considered for the Study

1.4 Currency

1.5 Package Size

1.6 Stakeholders

2 Research Methodology (Page No. - 20)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

2.1.2.3 Breakdown of Primary Interviews

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

2.3 Data Triangulation

2.4 Assumptions and Limitations

2.4.1 Assumptions

2.4.2 Limitations

3 Executive Summary (Page No. - 28)

4 Premium Insights (Page No. - 32)

4.1 Attractive Opportunities in the Instant Adhesives Market

4.2 Instant Adhesives Market, By Chemistry

4.3 Instant Adhesives Market, By Application and Countries in Asia-Pacific

4.4 Instant Adhesives Market, By Country

4.5 Instant Adhesives Market, Developed vs Developing Countries

5 Market Overview (Page No. - 35)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 High Growth in the End-Use Industries of Asia-Pacific

5.2.1.2 Properties of Instant Adhesives Such as Fast Curing and Excellent Bonding Strength

5.2.1.3 Increasing Demand for Miniaturization and Automation in the Electronics Industry

5.2.2 Restraints

5.2.2.1 Durability of Instant Adhesives is Low

5.2.2.2 Too Costly Compared to Other Adhesives

5.2.3 Opportunities

5.2.3.1 Innovation in Green Adhesives Technology

5.2.3.2 Surging Demand in the Developing Nations

5.2.4 Challenges

5.2.4.1 Increasing Competition From the Chinese Market

6 Industry Trends (Page No. - 40)

6.1 Introduction

6.2 Porters Five Forces Analysis

6.2.1 Intensity of Competitive Rivalry

6.2.2 Bargaining Power of Buyers

6.2.3 Bargaining Power of Suppliers

6.2.4 Threat of Substitutes

6.2.5 Threat of New Entrants

6.3 Patent Details

6.3.1 Introduction

6.3.2 Patent Details

6.4 Macroeconomic Overview and Key Trends

6.4.1 Introduction

6.4.2 Trends and Forecast of GDP

6.4.3 Production Statistics of the Automotive Industry

7 Instant Adhesives Market, By Substrate (Page No. - 46)

7.1 Introduction

7.1.1 Metal

7.1.2 Wood

7.1.3 Plastic

7.1.4 Glass

7.1.5 Composites

8 Instant Adhesives Market, By Curing Process (Page No. - 48)

8.1 Introduction

8.2 Conventional Instant Adhesives

8.3 Light-Cured Instant Adhesives

9 Instant Adhesives Market, By Chemistry & Sub-Chemistry (Page No. - 52)

9.1 Introduction

9.2 Cyanoacrylate Instant Adhesives

9.2.1 Ethyl Cyanoacrylate

9.2.2 Methyl Cyanoacrylate

9.2.3 Others

9.2.3.1 N-Butyl Cyanoacrylate

9.2.3.2 2-Octyl Cyanoacrylate

9.3 Epoxy-Based Instant Adhesives

9.3.1 One-Part

9.3.2 Two-Part

10 Instant Adhesives Market, By Application (Page No. - 62)

10.1 Introduction

10.2 Industrial

10.3 Woodworking

10.4 Transportation

10.5 Medical

10.6 Electronics

10.7 Consumer

10.8 Other Applications

10.8.1 Signage & Graphics

10.8.2 Sporting Goods

11 Instant Adhesives Market, By Region (Page No. - 73)

11.1 Introduction

11.2 North America

11.2.1 Country-Wise Key Insights

11.2.1.1 U.S.

11.2.1.2 Canada

11.2.1.3 Mexico

11.3 Europe

11.3.1 Country-Wise Key Insights

11.3.1.1 Germany

11.3.1.2 France

11.3.1.3 U.K.

11.3.1.4 Russia

11.3.1.5 Italy

11.3.1.6 Turkey

11.3.1.7 Netherlands

11.3.1.8 Spain

11.3.1.9 Rest of Europe

11.4 Asia-Pacific

11.4.1 Country-Wise Key Insights

11.4.1.1 China

11.4.1.2 India

11.4.1.3 Japan

11.4.1.4 South Korea

11.4.1.5 Taiwan

11.4.1.6 Malaysia

11.4.1.7 Indonesia

11.4.1.8 Rest of Asia-Pacific

11.5 South America

11.5.1 Country-Wise Key Insights

11.5.1.1 Brazil

11.5.1.2 Argentina

11.5.1.3 Colombia

11.5.1.4 Other South American Countries

11.6 Middle East & Africa

11.6.1 Country-Wise Key Insights

11.6.1.1 UAE

11.6.1.2 Saudi Arabia

11.6.1.3 South Africa

12 Competitive Landscape (Page No. - 107)

12.1 Introduction

12.2 Dive Analysis for Instant Adhesives

12.2.1 Vanguards

12.2.2 Innovators

12.2.3 Dynamic

12.2.4 Emerging

12.3 Competitive Benchmarking

12.3.1 Product Offerings

12.3.2 Business Strategy

13 Company Profiles (Page No. - 111)

(Overview, Financials, Products & Services, Strategy, and Developments)*

13.1 Henkel AG & Company

13.2 H.B. Fuller

13.3 3M Company

13.4 Sika AG

13.5 Toagosei Co., Ltd.

13.6 Illinois Tool Works Incorporation (ITW)

13.7 Bostik SA

13.8 Huntsman Corporation

13.9 Pidilite Industries Limited

13.10 Permabond LLC.

13.11 Royal Adhesives & Sealants, LLC

13.12 Franklin International

13.13 Lord Corporation

13.14 Masterbond

13.15 Parson Adhesives Inc.

13.16 Delo Industrial Adhesives LLC.

13.17 Dymax Corporation

13.18 Loxeal Engineering Adhesives

13.19 Hernon Manufacturing, Inc.

13.20 Chemence Limited

*Details on Overview, Financials, Product & Services, Strategy, and Developments Might Not Be Captured in Case of Unlisted Companies.

13.21 Other Key Companies

14 Appendix (Page No. - 152)

14.1 Discussion Guide

14.2 Knowledge Store: Marketsandmarkets Subscription Portal

14.3 Introducing RT: Real-Time Market Intelligence

14.4 Available Customizations

14.5 Related Reports

14.6 Author Details

List of Tables (109 Tables)

Table 1 Instant Adhesives: Market Snapshot

Table 2 Trends and Forecast of GDP, (Annual Percent Change)

Table 3 North America: Production Statistics of the Automotive* Industry, By Country, 20152016 (Unit)

Table 4 Europe: Production Statistics of the Automotive* Industry, By Country, 20152016 (Unit)

Table 5 Asia-Pacific: Production Statistics of Automotive* Industry, By Country, 20152016 (Unit)

Table 6 Instant Adhesives Market Size, By Curing Process, 20152022 (USD Million)

Table 7 Instant Adhesives Market Size, By Curing Process, 20152022 (Ton)

Table 8 Conventional Instant Adhesives Market Size, By Region, 20152022 (USD Million)

Table 9 Conventional Instant Adhesives Market Size, By Region, 20152022 (Ton)

Table 10 Light-Cured Instant Adhesives Market Size, By Region, 20152022 (USD Million)

Table 11 Light-Cured Instant Adhesives Market Size, By Region, 20152022 (Ton)

Table 12 Instant Adhesives Market Size, By Chemistry, 20152022 (USD Million)

Table 13 Instant Adhesives Market Size, By Chemistry, 20152022 (Ton)

Table 14 Cyanoacrylate Instant Adhesives Market Size, By Sub-Chemistry, 20152022 (USD Million)

Table 15 Cyanoacrylate Instant Adhesives Market Size, By Sub-Chemistry, 20152022 (Ton)

Table 16 Epoxy-Based Instant Adhesives Market Size, By Sub-Chemistry, 20152022 (USD Million)

Table 17 Epoxy-Based Instant Adhesives Market Size, By Sub-Chemistry, 20152022 (Ton)

Table 18 Cyanoacrylate Instant Adhesives Market Size, By Region, 20152022 (USD Million)

Table 19 Cyanoacrylate Instant Adhesives Market Size, By Region, 20152022 (Ton)

Table 20 Ethyl Cyanoacrylate Instant Adhesives Market Size, By Region, 20152022 (USD Million)

Table 21 Ethyl Cyanoacrylate Instant Adhesives Market Size, By Region, 20152022 (Ton)

Table 22 Methyl Cyanoacrylate Instant Adhesives Market Size, By Region, 20152022 (USD Million)

Table 23 Methyl Cyanoacrylate Instant Adhesives Market Size, By Region, 20152022 (Ton)

Table 24 Other Cyanoacrylate Instant Adhesives Market Size, By Region, 20152022 (USD Million)

Table 25 Other Cyanoacrylate Instant Adhesives Market Size, By Region, 20152022 (Ton)

Table 26 Epoxy-Based Instant Adhesives Market Size, By Region, 20152022 (USD Million)

Table 27 Epoxy-Based Instant Adhesives Market Size, By Region, 20152022 (Ton)

Table 28 One-Part Epoxy-Based Instant Adhesives Market Size, By Region, 20152022 (USD Million)

Table 29 One-Part Epoxy-Based Instant Adhesives Market Size, By Region, 20152022 (Ton)

Table 30 Two-Part Epoxy-Based Instant Adhesives Market Size, By Region, 20152022 (USD Million)

Table 31 Two-Part Epoxy-Based Instant Adhesives Market Size, By Region, 20152022 (Ton)

Table 32 Instant Adhesives Market Size, By Application, 20152022 (USD Million)

Table 33 Instant Adhesives Market Size, By Application, 20152022 (Ton)

Table 34 Instant Adhesives Market Size in Industrial Application, By Region, 20152022 (USD Million)

Table 35 Instant Adhesives Market Size in Industrial Application, By Region, 20152022 (Ton)

Table 36 Instant Adhesives Market Size in Woodworking Application, By Region, 20152022 (USD Million)

Table 37 Instant Adhesives Market Size in Woodworking Application, By Region, 20152022 (Ton)

Table 38 Instant Adhesives Market Size in Transportation Application, By Region, 20152022 (USD Million)

Table 39 Instant Adhesives Market Size in Transportation Application, By Region, 20152022 (Ton)

Table 40 Instant Adhesives Market Size in Medical Application, By Region, 20152022 (USD Million)

Table 41 Instant Adhesives Market Size in Medical Application, By Region, 20152022 (Ton)

Table 42 Instant Adhesives Market Size in Electronics Application, By Region, 20152022 (USD Million)

Table 43 Instant Adhesives Market Size in Electronics Application, By Region, 20152022 (Ton)

Table 44 Instant Adhesives Market Size in Consumer Application, By Region, 20152022 (USD Million)

Table 45 Instant Adhesives Market Size in Consumer Application, By Region, 20152022 (Ton)

Table 46 Instant Adhesives Market Size in Other Applications, By Region, 20152022 (USD Million)

Table 47 Instant Adhesives Market Size in Other Applications, By Region, 20152022 (Ton)

Table 48 Instant Adhesives Market Size, By Region, 20152022 (USD Million)

Table 49 Instant Adhesives Market Size, By Region, 20152022 (Ton)

Table 50 North America: Instant Adhesives Market Size, By Country, 20152022 (USD Million)

Table 51 North America: Instant Adhesives Market Size, By Country, 20152022 (Ton)

Table 52 North America: Instant Adhesives Market Size, By Chemistry, 20152022 (USD Million)

Table 53 North America: Instant Adhesives Market Size, By Chemistry, 20152022 (Ton)

Table 54 North America: Cyanoacrylate Instant Adhesives Market Size, By Sub-Chemistry, 20152022 (USD Million)

Table 55 North America: Cyanoacrylate Instant Adhesives Market Size, By Sub-Chemistry, 20152022 (Ton)

Table 56 North America: Epoxy-Based Instant Adhesives Market Size, By Sub-Chemistry, 20152022 (USD Million)

Table 57 North America: Epoxy-Based Instant Adhesives Market Size, By Sub-Chemistry, 20152022 (Ton)

Table 58 North America: Instant Adhesives Market Size, By Curing Process, 20152022 (USD Million)

Table 59 North America: Instant Adhesives Market Size, By Curing Process, 20152022 (Ton)

Table 60 North America: Instant Adhesives Market Size, By Application, 20152022 (USD Million)

Table 61 North America: Instant Adhesives Market Size, By Application, 20152022 (Ton)

Table 62 Europe: Instant Adhesives Market Size, By Country, 20152022 (USD Million)

Table 63 Europe: Instant Adhesives Market Size, By Country, 20152022 (Ton)

Table 64 Europe: Instant Adhesives Market Size, By Chemistry, 20152022 (USD Million)

Table 65 Europe: Instant Adhesives Market Size, By Chemistry, 20152022 (Ton)

Table 66 Europe: Cyanoacrylate Instant Adhesives Market Size, By Sub-Chemistry, 20152022 (USD Million)

Table 67 Europe: Cyanoacrylate Instant Adhesives Market Size, By Sub-Chemistry, 20152022 (Ton)

Table 68 Europe: Epoxy-Based Instant Adhesives Market Size, By Sub-Chemistry, 20152022 (USD Million)

Table 69 Europe: Epoxy-Based Instant Adhesives Market Size, By Sub-Chemistry, 20152022 (Ton)

Table 70 Europe: Instant Adhesives Market Size, By Curing Process, 20152022 (USD Million)

Table 71 Europe: Instant Adhesives Market Size, By Curing Process, 20152022 (Ton)

Table 72 Europe: Instant Adhesives Market Size, By Application, 20152022 (USD Million)

Table 73 Europe: Instant Adhesives Market Size, By Application, 20152022 (Ton)

Table 74 Asia-Pacific: Instant Adhesives Market Size, By Country, 20152022 (USD Million)

Table 75 Asia-Pacific: Instant Adhesives Market Size, By Country, 20152022 (Ton)

Table 76 Asia-Pacific: Instant Adhesives Market Size, By Chemistry, 20152022 (USD Million)

Table 77 Asia-Pacific: Instant Adhesives Market Size, By Chemistry, 20152022 (Ton)

Table 78 Asia-Pacific: Cyanoacrylate Instant Adhesives Market Size, By Sub-Chemistry, 20152022 (USD Million)

Table 79 Asia-Pacific: Cyanoacrylate Instant Adhesives Market Size, By Sub-Chemistry, 20152022 (Ton)

Table 80 Asia-Pacific: Epoxy-Based Instant Adhesives Market Size, By Sub-Chemistry, 20152022 (USD Million)

Table 81 Asia-Pacific: Epoxy-Based Instant Adhesives Market Size, By Sub-Chemistry, 20152022 (Ton)

Table 82 Asia-Pacific: Instant Adhesives Market Size, By Curing Process, 20152022 (USD Million)

Table 83 Asia-Pacific: Instant Adhesives Market Size, By Curing Process, 20152022 (Ton)

Table 84 Asia-Pacific: Instant Adhesives Market Size, By Application, 20152022 (USD Million)

Table 85 Asia-Pacific: Instant Adhesives Market Size, By Application, 20152022 (Ton)

Table 86 South America: Instant Adhesives Market Size, By Country, 20152022 (USD Million)

Table 87 South America: Instant Adhesives Market Size, By Country, 20152022 (Ton)

Table 88 South America: Instant Adhesives Market Size, By Chemistry, 20152022 (USD Million)

Table 89 South America: Instant Adhesives Market Size, By Chemistry, 20152022 (Ton)

Table 90 South America: Cyanoacrylate Instant Adhesives Market Size, By Sub-Chemistry, 20152022 (USD Million)

Table 91 South America: Cyanoacrylate Instant Adhesives Market Size, By Sub-Chemistry, 20152022 (Ton)

Table 92 South America: Epoxy-Based Instant Adhesives Market Size, By Sub-Chemistry, 20152022 (USD Million)

Table 93 South America: Epoxy-Based Instant Adhesives Market Size, By Sub-Chemistry, 20152022 (Ton)

Table 94 South America: Instant Adhesives Market Size, By Curing Process, 20152022 (USD Million)

Table 95 South America: Instant Adhesives Market Size, By Curing Process, 20152022 (Ton)

Table 96 South America: Instant Adhesives Market Size, By Application, 20152022 (USD Million)

Table 97 South America: Instant Adhesives Market Size, By Application, 20152022 (Ton)

Table 98 Middle East & Africa: Instant Adhesives Market Size, By Country, 20152022 (USD Million)

Table 99 Middle East & Africa: Instant Adhesives Market Size, By Country, 20152022 (Ton)

Table 100 Middle East & Africa: Instant Adhesives Market Size, By Chemistry, 20152022 (USD Million)

Table 101 Middle East & Africa: Instant Adhesives Market Size, By Chemistry, 20152022 (Ton)

Table 102 Middle East & Africa: Cyanoacrylate Instant Adhesives Market Size, By Sub-Chemistry, 20152022 (USD Million)

Table 103 Middle East & Africa: Cyanoacrylate Instant Adhesives Market Size, By Sub-Chemistry, 20152022 (Ton)

Table 104 Middle East & Africa: Epoxy-Based Instant Adhesives Market Size, By Sub-Chemistry, 20152022 (USD Million)

Table 105 Middle East & Africa: Epoxy-Based Instant Adhesives Market Size, By Sub-Chemistry, 20152022 (Ton)

Table 106 Middle East & Africa: Instant Adhesives Market Size, By Curing Process, 20152022 (USD Million)

Table 107 Middle East & Africa: Instant Adhesives Market Size, By Curing Process, 20152022 (Ton)

Table 108 Middle East & Africa: Instant Adhesives Market Size, By Application, 20152022 (USD Million)

Table 109 Middle East & Africa: Instant Adhesives Market Size, By Application, 20152022 (Ton)

List of Figures (52 Figures)

Figure 1 Instant Adhesives: Market Segmentation

Figure 2 Instant Adhesives Market: Research Design

Figure 3 Market Size Estimation: Bottom-Up Approach

Figure 4 Market Size Estimation: Top-Down Approach

Figure 5 Instant Adhesives Market: Data Triangulation

Figure 6 Asia-Pacific to Dominate the Instant Adhesives Market Till 2022

Figure 7 Cyanoacrylate to Be the Larger Segment of the Instant Adhesives Market, 20172022

Figure 8 Medical to Be the Fastest-Growing Application of Instant Adhesives, 20172022

Figure 9 Asia-Pacific to Be the Fastest-Growing Market for Instant Adhesives By 2022

Figure 10 Emerging Economies Offer Attractive Opportunities to the Instant Adhesives Market

Figure 11 Cyanoacrylate Instant Adhesives Dominate the Instant Adhesives Market

Figure 12 Industrial Application Accounted for the Largest Share in the Emerging Asia-Pacific Market in 2016

Figure 13 India to Be the Fastest-Growing Market for Instant Adhesives

Figure 14 The Market in Developing Countries to Grow Faster Than That in Developed Countries, 20172022

Figure 15 Factors Governing the Instant Adhesives Market

Figure 16 Impact Analysis: Instant Adhesives Market

Figure 17 Instant Adhesives Market: Porters Five Forces Analysis

Figure 18 The U.S. Accounted for the Highest Number of Patents Between 2014 and 2017*

Figure 19 Henkel KGaA Ltd Registered the Highest Number of Patents Between 2014 and 2017*

Figure 20 Asia-Pacific Dominated the Instant Adhesives Market in 2016

Figure 21 Rising Prevalence of Major Application Industries to Drive the Market, 20172022

Figure 22 Medical to Be the Largest Application, 20172022

Figure 23 Growth in the Medical Device & Equipment Adhesives Market, 20142019

Figure 24 Growth in the Electronics Industry, 20142015

Figure 25 Geographic Snapshot: the Instant Adhesives Market in Asia-Pacific to Register the Highest Growth Rate

Figure 26 Asia-Pacific to Be the Fastest-Growing Instant Adhesives Market for Both the Chemistry Types

Figure 27 Asia-Pacific to Be the Fastest-Growing Application Market for Instant Adhesives

Figure 28 Asia-Pacific Dominated the Global Instant Adhesives Market in 2016

Figure 29 Asia-Pacific Accounted for the Largest Market Share in 2016

Figure 30 North American Instant Adhesives Market Snapshot: the U.S. Was the Largest Market in 2016

Figure 31 European Instant Adhesives Market Snapshot: Germany Was the Largest Market in 2016

Figure 32 Asia-Pacific Instant Adhesives Market Snapshot: China is the Most Lucrative Market

Figure 33 Instant Adhesives: Dive Chart

Figure 34 Henkel AG & Company: Company Snapshot

Figure 35 Henkel AG & Company: Strengths and Weaknesses Analysis

Figure 36 H.B. Fuller: Company Snapshot

Figure 37 H.B. Fuller: Strengths and Weaknesses Analysis

Figure 38 3M Company: Company Snapshot

Figure 39 3M Company: Strengths and Weaknesses Analysis

Figure 40 Sika AG: Company Snapshot

Figure 41 Sika AG: Strengths and Weaknesses Analysis

Figure 42 Toagosei Co., Ltd: Company Snapshot

Figure 43 Toagosei Co., Ltd: Strengths and Weaknesses Analysis

Figure 44 Illinois Tool Works Corporation: Company Snapshot

Figure 45 Illinois Tool Works Corporation: Strengths and Weaknesses Analysis

Figure 46 Bostik SA: Company Snapshot

Figure 47 Bostik SA: Strengths and Weaknesses Analysis

Figure 48 Huntsman Corporation: Company Snapshot

Figure 49 Huntsman Corporation: Strengths and Weaknesses Analysis

Figure 50 Pidilite Industries Limited: Company Snapshot

Figure 51 Pidilite Industries Limited: Strengths and Weaknesses Analysis

Figure 52 Permabond: Strengths and Weaknesses Analysis

Growth opportunities and latent adjacency in Instant Adhesive Market