UV Adhesives Market by Resin Type (Acrylic, Cyanoacrylate, Epoxy, Silicone, Polyurethane), Application (Medical, Electronics, Glass Bonding, Packaging, Transportation, Industrial Assembly) and Region - Global Forecast to 2021

[270 Pages Report] The UV adhesives market is expected to reach USD 1,222.5 Million by 2021, at a CAGR of 9.15% between 2016 and 2021. In this study, 2015 has been considered as the base year for estimating the market size. This report aims to estimate the market size and future growth potential of the UV adhesives market across different segments such as resin type, application, and region. Factors influencing the market growth, such as drivers, restraints, opportunities, and industry-specific challenges have been studied in the report. Furthermore, the report analyzes the opportunities in the market for stakeholders and presents the competitive landscape for market leaders.

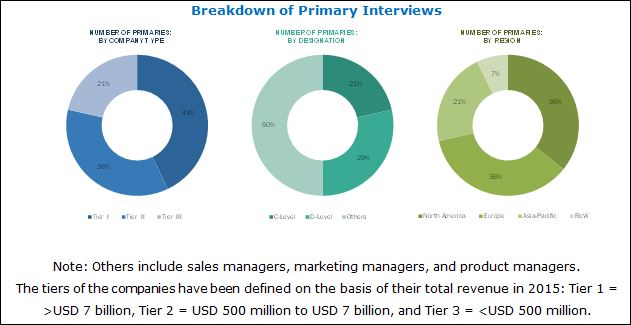

Top-down and bottom-up approaches have been used to estimate and validate the size of the global market and estimate the sizes of various other dependent submarkets in the UV adhesives market. The research study involved extensive use of secondary sources; directories; and databases, such as Hoovers, Bloomberg, Chemical Weekly, Factiva, Composites World, Related Associations/Institutes, and other government associations. Company websites were also used to identify and collect information useful for the technical, market-oriented, and commercial study of the global UV adhesives market. After arriving at the total market size, the overall market has been split into several segments and subsegments. The figure given below provides a breakdown of primaries conducted during the research study, on the basis of company type, designation, and region.

To know about the assumptions considered for the study, download the pdf brochure

The UV adhesives market has a diversified and established ecosystem of its upstream companies, including raw material suppliers and downstream stakeholders, such as manufacturers, vendors, end users, and government organizations. In the UV adhesives value chain, the design and prototype phase is carried out according to the end user specifications and requirements. These specifications and requirements are different across diverse application industries.

Key companies operational in the UV adhesives market include Henkel AG & Co. KGaA (Germany), H.B. Fuller (U.S.), Ashland Inc. (U.S.), Dymax Corporation (U.S.), The 3M Company (U.S.), Permabond Engineering Adhesives (U.K.), Master Bond Inc. (U.S.), Panacol-Elosol GmbH (Germany), and Epoxy Technology, Inc. (U.S.).

Key Target Audience:

- UV Adhesives Manufacturers

- Raw Material Suppliers

- Traders, Distributors, and Suppliers of UV Adhesives

- Regional Manufacturers and Associations Government and Regional Agencies and Research Organizations

- Investment Research Firms

Scope of the Report:

This research report categorizes the global UV adhesives market on the basis of resin type, application, and region.

On the basis of Resin Type:

- Acrylic

- Cyanoacrylate

- Epoxy

- Silicone

- Polyurethane

- Others

On the basis of Application:

- Medical

- Electronics

- Glass Bonding

- Packaging

- Transportation

- Industrial Assembly

- Others

On the basis of Region:

- North America

- Europe

- Asia-Pacific

- Middle East & Africa

- Rest of the World

Available Customizations:

Along with the given market data, MarketsandMarkets offers customizations according to the companys specific needs. The following customization options are available for the report:

Regional Analysis:

- Country-level analysis of the UV adhesives market by application

Company Information:

- Detailed analysis and profiling of additional market players

The UV adhesives market is projected to reach USD 1,222.5 Million by 2021, at a CAGR of 9.15% between 2016 and 2021. Increasing demand for solvent-free adhesives in medical, glass bonding, transportation, and electronics applications is expected to lead to the growth of the UV adhesives market.

Medical was the largest application segment of the UV adhesives market in 2015. Increasing aging population and innovation in medical procedures are expected to lead to increased demand for medical devices, such as IV delivery systems, catheters, syringes, hearing aids, silicone rubber components, among others. Since UV adhesives are increasingly being used in the manufacturing of these devices, the rise in the demand of the devices is expected to consequently lead to the growth of UV adhesives market.

Silicone is expected to be the fastest-growing segment of the UV adhesives market, segmented by resin type. This growth can be attributed to the fact that silicone-based UV adhesives are widely used across several end-use industries for different applications, due to their low surface tension, high chemical & temperature resistance, and hydrophobic nature.

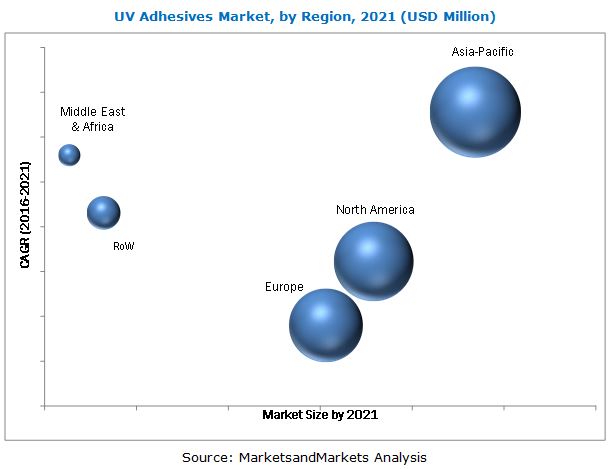

Asia-Pacific is expected to be the largest market for UV adhesives. The demand for solvent free and eco-friendly adhesives has increased in medical and electronics applications, which is expected to drive the demand for UV adhesives in the region.

The high cost of UV adhesives, as compared to other conventional adhesives, such as thermal cure and moisture cure adhesives that are used in the medical, electronics, and glass bonding applications, may restrain the growth of the UV adhesives market in near future.

Companies such as Henkel AG & Co. KGaA (Germany), H.B. Fuller (U.S.), Ashland Inc. (U.S.), Dymax Corporation (U.S.), The 3M Company (U.S.), and Permabond Engineering Adhesives (U.K.) are the key players in the UV adhesives market. Diverse product portfolio, various R&D activities, and adoption of diverse development strategies are some of the factors that strengthen the position of these companies in the UV adhesives market. The companies have been adopting various organic and inorganic growth strategies to achieve growth in the market.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction

1.1 Objectives of the Study

1.2 Currency and Pricing

1.3 Market Definition

1.4 Market Scope

1.4.1 Market Covered

1.4.2 By Application

1.4.3 Stakeholders

2 Research Methodology

2.1 Research Data

2.2 UV Adhesives Market Research Data

2.2.1 Key Data From Secondary Source

2.2.2 Key Data From Primary Source

2.2.3 Key Industry Insights

2.3 Data Triangulation

2.4 Assumptions and Limitations

2.4.1 Assumption

2.4.2 Limitation

3 Executive Summary

4 Premium Insights

4.1 Opportunities in UV Adhesives Market

4.2 UV Adhesives Market Attractiveness

4.3 UV Adhesives Market: Developed vs Developing Countries

4.4 High Growth Potential in Asia-Pacific UV Adhesives Market, 20162021

5 UV Adhesives Market Overview

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.2 Restraints

5.2.3 Opportunities

5.2.4 Challenges

6 UV Adhesives Market Industry Trends

6.1 Value Chain of UV Adhesives Market

6.2 Porters Five Forces Analysis of UV Adhesives Market

6.2.1 Bargaining Power of Suppliers

6.2.2 Bargaining Power of Buyers

6.2.3 Threat of Substitutes

6.2.4 Threat of New Entrants

6.2.5 Intensity of Rivalry

6.3 Raw Material Analysis

6.4 Price Analysis

6.5 Advantages and Disadvantages

7 UV Adhesives Market, By Resin Type

7.1 Introduction

7.2 UV Adhesives Market, By Resin Type

7.2.1 Acrylic UV Adhesives Market

7.2.2 Cyanoacrylate UV Adhesives Market

7.2.3 Epoxy UV Adhesives Market

7.2.4 Silicone UV Adhesives Market

7.2.5 Polyurethane UV Adhesives Market

7.2.6 Others UV Adhesives Market

8 UV Adhesives Market, By Application

8.1 Introduction

8.2 Medical

8.3 Electronics

8.4 Glass Bonding

8.5 Packaging

8.6 Industrial Assembly

8.7 Transportation

8.8 Others

9 UV Adhesives Market, Regional Analysis

9.1 UV Adhesives Market, Regional Analysis

10 North America: UV Adhesives Market

10.1 North America

10.1.1 North American UV Adhesives Market: Overview

10.1.2 North America: Country-Level Overview

10.1.2.1 U.S.

10.1.2.2 Canada

10.1.2.3 Mexico

11 Europe: UV Adhesives Market

11.1 Europe

11.1.1 European UV Adhesives Market: Overview

11.1.2 Europe: Countries Overview

11.1.2.1 Germany

11.1.2.2 France

11.1.2.3 Netherlands

11.1.2.4 U.K.

11.1.2.5 Turkey

11.1.2.6 Spain

11.1.2.7 Belgium

11.1.2.8 Italy

11.1.2.9 Rest of Europe

12 Asia-Pacific: UV Adhesives Market

12.1 Asia-Pacific

12.1.1 Asia-Pacific Market: Overview

12.1.2 Asia-Pacific: Countries Overview

12.1.2.1 China

12.1.2.2 Japan

12.1.2.3 India

12.1.2.4 Southeast Asia

12.1.2.5 South Korea

12.1.2.6 Rest of Asia-Pacific

13 Middle East & Africa: UV Adhesives Market

13.1 Middle East & Africa

13.1.1 Middle East & Africa: Overview

13.1.2 Middle East & Africa: Countries Overview

13.1.2.1 Middle East

13.1.2.2 Africa

14 RoW: UV Adhesives Market

14.1 RoW

14.1.1 RoW Market: Overview

14.1.2 RoW: Countries Overview

14.1.2.1 Russia

14.1.2.2 Brazil

14.1.2.3 South American Countries

15 Market Share Analysis

15.1 Market Share Estimation

16 Competitive Landscape: UV Adhesives Market

16.1 Introduction

16.2 UV Adhesives Market, Key Growth Strategies

16.3 UV Adhesives Market, Major Developments

16.4 UV Adhesives Market: Key Developments, By Company

17 Recent Developments, 20122016

17.1 Recent Developments

18 Company Profiles UV Adhesives Market

18.1 Henkel AG & Co. KGAA

18.2 H.B. Fuller

18.3 3M Company

18.4 Ashland Inc.

18.5 Dymax Corporation

18.6 Permabond Engineering Adhesives

18.7 Threebond Holdings Co., Ltd.

18.8 Masterbond Inc.

18.9 Epoxy Technology Inc.

18.10 Microcoat Technology

18.11 Norland Products Inc.

18.12 Delo Industrial Adhesives LLC

18.13 Panacol-Elosol GmbH

18.14 Hibond Adhesives

18.15 Scigrip

18.16 Beacon Adhesives Inc.

18.17 Polytec PT GmbH

18.18 Parson Adhesives Inc.

18.19 Chemence Inc.

18.20 ITW Devcon

18.21 KIWO Inc.

18.22 Electro-Lite Corporation

18.23 Flint Group

18.24 Sadechaf

18.25 Electronic Materials Inc.

18.26 Loxeal Engineering Adhesives

18.27 Fielco Adhesives

18.28 Bohle Ltd.

18.29 Royal Adhesives & Sealants LLC

18.30 Micro-Lite Technology

18.31 Hernon Manufacturing, Inc.

19 Appendix

19.1 Discussion Guide

19.2 Related Reports

19.3 Authors

19.4 Knowledge Store: Marketsandmarkets Subscription Portal

19.5 Marketsandmarkets Knowledge Store: Chemical Industry Snapshot

List of Tables (69 Tables)

Table 1 UV Adhesives Market Snapshot 2016 vs 2021

Table 2 UV Adhesives Market Size, By Resin Type, 20142021 (USD Million)

Table 3 UV Adhesives Market Size, By Resin Type, 20142021 (Ton)

Table 4 UV Adhesives Market, By Resin Type: 2015 (USD Million)

Table 5 Acrylic UV Adhesives Market Size, By Region, 20142021 (USD Million)

Table 6 Acrylic UV Adhesives Market Size, By Region, 20142021 (Ton)

Table 7 Cyanoacrylate UV Adhesives Market Size, By Region, 20142021 (USD Million)

Table 8 Cyanoacrylate UV Adhesives Market Size, By Region, 20142021 (Ton)

Table 9 Epoxy UV Adhesives Market Size, By Region, 20142021 (USD Million)

Table 10 Epoxy UV Adhesives Market Size, By Region, 20142021 (Ton)

Table 11 Silicone UV Adhesives Market Size, By Region, 20142021 (USD Million)

Table 12 Silicone UV Adhesives Market Size, By Region, 20142021 (Ton)

Table 13 Polyurethane UV Adhesives Market Size, By Region, 20142021 (USD Million)

Table 14 Polyurethane UV Adhesives Market Size, By Region, 20142021 (Ton)

Table 15 Other UV Adhesives Market Size, By Region, 20142021 (USD Million)

Table 16 Other UV Adhesives Market Size, By Region, 20142021 (Ton)

Table 17 UV Adhesives Market Size, By Application, 2014-2021 (USD Million)

Table 18 UV Adhesives Market Size, By Application, 2014-2021 (Ton)

Table 19 UV Adhesives Market Size in Medical Application, By Region, 2014-2021 (USD Million)

Table 20 UV Adhesives Market Size in Medical Application, By Region, 2014-2021 (Ton)

Table 21 UV Adhesives Market Size in Electronics Application, By Region, 2014-2021 (USD Million)

Table 22 UV Adhesives Market Size in Electronics Application, By Region, 2014-2021 (Ton)

Table 23 UV Adhesives Market Size in Glass Bonding Application, By Region, 2014-2021 (USD Million)

Table 24 UV Adhesives Market Size in Glass Bonding Application, By Region, 2014-2021 (Ton)

Table 25 UV Adhesives Market Size in Packaging Application, By Region, 2014-2021 (USD Million)

Table 26 UV Adhesives Market Size in Packaging Application, By Region, 2014-2021 (Ton)

Table 27 UV Adhesives Market Size in Industrial Assembly Application, By Region, 2014-2021 (USD Million)

Table 28 UV Adhesives Market Size in Industrial Assembly Application, By Region, 2014-2021 (Ton)

Table 29 UV Adhesives Market Size in Transportation Application, By Region, 2014-2021 (USD Million)

Table 30 UV Adhesives Market Size in Transportation Application, By Region, 2014-2021 (Ton)

Table 31 UV Adhesives Market Size in Other Applications, By Region, 2014-2021 (USD Million)

Table 32 UV Adhesives Market Size in Other Applications, By Region, 2014-2021 (Ton)

Table 33 UV Adhesives Market, By Region, 20142021 (USD Million)

Table 34 UV Adhesives Market, By Region, 20142021 (Ton)

Table 35 North America: UV Adhesives Market Size, By Country, 20142021 (USD Million)

Table 36 North America: UV Adhesives Market Size, By Country, 20142021 (Ton)

Table 37 North America: UV Adhesives Market Size, By Resin Type, 20142021 (USD Million)

Table 38 North America: UV Adhesives Market Size, By Resin Type, 20142021 (Ton)

Table 39 North America: UV Adhesives Market Size, By Application, 20142021 (USD Million)

Table 40 North America: UV Adhesives Market Size, By Application, 20142021 (Ton)

Table 41 Europe: UV Adhesives Market Size, By Country, 20142021 (USD Million)

Table 42 Europe: UV Adhesives Market Size, By Country, 20142021 (Ton)

Table 43 Europe: UV Adhesives Market Size, By Resin Type, 20142021 (USD Million)

Table 44 Europe: UV Adhesives Market Size, By Resin Type, 20142021 (Ton)

Table 45 Europe: UV Adhesives Market Size, By Application, 20142021 (USD Million)

Table 46 Europe: UV Adhesives Market Size, By Application, 20142021 (Ton)

Table 47 Asia-Pacific: UV Adhesives Market Size, By Country, 20142021 (USD Million)

Table 48 Asia-Pacific: UV Adhesives Market Size, By Country, 20142021 (Ton)

Table 49 Asia-Pacific: UV Adhesives Market Size, By Resin Type, 20142021 (USD Million)

Table 50 Asia-Pacific: UV Adhesives Market Size, By Resin Type, 20142021 (Ton)

Table 51 Asia-Pacific: UV Adhesives Market Size, By Application, 20142021 (USD Million)

Table 52 Asia-Pacific: UV Adhesives Market Size, By Application, 20142021 (Ton)

Table 53 Middle East & Africa: UV Adhesives Market Size, By Country, 20142021 (USD Million)

Table 54 Middle East & Africa: UV Adhesives Market Size, By Country, 20142021 (Ton)

Table 55 Middle East & Africa: UV Adhesives Market Size, By Resin Type, 20142021 (USD Million)

Table 56 Middle East & Africa: UV Adhesives Market Size, By Resin Type, 20142021 (Ton)

Table 57 Middle East & Africa: UV Adhesives Market Size, By Application, 20142021 (USD Million)

Table 58 Middle East & Africa: UV Adhesives Market Size, By Application, 20142021 (Ton)

Table 59 RoW: UV Adhesives Market Size, By Country, 20142021 (USD Million)

Table 60 RoW: UV Adhesives Market Size, By Country, 20142021 (Ton)

Table 61 RoW: UV Adhesives Market Size, By Resin Type, 20142021 (USD Million)

Table 62 RoW: UV Adhesives Market Size, By Resin Type, 20142021 (Ton)

Table 63 RoW: UV Adhesives Market Size, By Application, 20142021 (USD Million)

Table 64 RoW: UV Adhesives Market Size, By Application, 20142021 (Ton)

Table 65 UV Adhesives Market: Key Developments, By Company (20122016)

Table 66 New Product Launches, 20122016

Table 67 Mergers & Acquisitions, 20122016

Table 68 Joint Ventures, Partnerships, and Contracts & Agreements, 20122016

Table 69 Investments & Expansions, 20122016

List of Figures (82 Figures)

Figure 1 UV Adhesives Market, By Application

Figure 2 Years Considered for the Study

Figure 3 UV Adhesives Market: Research Design

Figure 4 Breakdown of Primary Interviews

Figure 5 Market Size Estimation: Top-Down Approach

Figure 6 Market Size Estimation: Bottom Up Approach

Figure 7 Cyanoacrylate Segment to Dominate the Market During the Forecast Period

Figure 8 Medical to Be the Fastest-Growing Segment Between 2016 and 2021

Figure 9 Asia-Pacific to Register Highest CAGR During the Forecast Period

Figure 10 High Growth in UV Adhesives Market

Figure 11 Cyanoacrylate to Dominate UV Adhesives Market, 20162021

Figure 12 UV Adhesives Market to Register CAGR in Developing Countries Between 2016 and 2021

Figure 13 Market in Developing Countries to Register Rapid Growth During Forecast Period

Figure 14 Developing Economies to Register High CAGR By 2021

Figure 15 Market Dynamics: DROC

Figure 16 UV Adhesive Manufacturing Process

Figure 17 Average Price - By Region (2015)

Figure 18 Average Price - By Application (2015)

Figure 19 UV Adhesives Market Share, By Resin Type, 2015

Figure 20 Acrylic UV Adhesives Market Share, By Region, 2015

Figure 21 Cyanoacrylate UV Adhesives Market Share, By Region, 2015

Figure 22 Epoxy UV Adhesives Market Share, By Region, 2015

Figure 23 Silicone UV Adhesives Market Share, By Region, 2015

Figure 24 Polyurethane UV Adhesives Market Share, By Region, 2015

Figure 25 Other UV Adhesives Market Share, By Region, 2015

Figure 26 UV Adhesives Market Share, By Application, 2015

Figure 27 UV Adhesives Market Size in Medical Application, By Region, 2015

Figure 28 Growth in Medical Device & Equipment Adhesives Market

Figure 29 UV Adhesives Market Size in Electronics Application, By Region, 2015

Figure 30 Growth in Electronics Industry

Figure 31 UV Adhesives Market Size in Glass Bonding Application, By Region, 2015

Figure 32 UV Adhesives Market Size in Packaging Application, By Region, 2015

Figure 33 UV Adhesives Market Size in Industrial Assembly Application, By Region, 2015

Figure 34 UV Adhesives Market Size in Transportation Application, By Region, 2015

Figure 35 Global Production of Vehicles*, 2014 and 2015

Figure 36 UV Adhesives Market Size in Other Applications, By Region, 2015

Figure 37 UV Adhesives Market Share, By Region, 2015

Figure 38 UV Adhesives Market Size, By Region, 2015

Figure 39 North America Country Split, By Value, 2015

Figure 40 UV Adhesives Market in North America, By Country, 2015

Figure 41 Europe Country Split, By Value, 2015

Figure 42 UV Adhesives Market in Europe, By Country, 2015

Figure 43 Asia-Pacific Country Split, By Value, 2015

Figure 44 UV Adhesives Market in Asia-Pacific, By Country, 2015

Figure 45 Middle East & Africa Country Split, By Value, 2015

Figure 46 UV Adhesives Market in Middle East & Africa, By Country, 2015

Figure 47 RoW Country Split, By Value, 2015

Figure 48 UV Adhesives Market in RoW, By Country, 2015

Figure 49 Market Share of Top Players in UV Adhesives Market

Figure 50 UV Adhesives Market, By Growth Strategies (20122016)

Figure 51 UV Adhesives Market, Major Developments (20122016)

Figure 52 Henkel AG & Co. KGAA: Company Snapshot

Figure 53 HB Fuller: Company Snapshot

Figure 54 3M Company: Company Snapshot

Figure 55 Ashland Inc.: Company Snapshot

Figure 56 Dymax Corporation: Company Snapshot

Figure 57 Permabond Engineering Adhesives: Company Snapshot

Figure 58 Threebond Holdings Co., Ltd.: Company Snapshot

Figure 59 Masterbond Inc.: Company Snapshot

Figure 60 Epoxy Technology Inc.: Company Snapshot

Figure 61 Microcoat Technology: Company Snapshot

Figure 62 Norland Products Inc.: Company Snapshot

Figure 63 Delo Industrial Adhesives LLC: Company Snapshot

Figure 64 Panacol-Elosol GmbH: Company Snapshot

Figure 65 Hibond Adhesives: Company Snapshot

Figure 66 Scigrip: Company Snapshot

Figure 67 Beacon Adhesives Inc.: Company Snapshot

Figure 68 Polytec PT GmbH: Company Snapshot

Figure 69 Parson Adhesives Inc.: Company Snapshot

Figure 70 Chemence Inc.: Company Snapshot

Figure 71 ITW Devcon Inc.: Company Snapshot

Figure 72 KIWO Inc.: Company Snapshot

Figure 73 Electro-Lite Corporation: Company Snapshot

Figure 74 Flint Group: Company Snapshot

Figure 75 Sadechaf: Company Snapshot

Figure 76 Hernon Manufacturing, Inc.: Company Snapshot

Figure 77 Electronic Materials Inc.: Company Snapshot"

Figure 78 Loxeal Engineering Adhesives: Company Snapshot

Figure 79 Fielco Adhesives: Company Snapshot

Figure 80 Bohle Ltd.: Company Snapshot

Figure 81 Royal Adhesives & Sealants LLC: Company Snapshot

Figure 82 Micro-Lite Technology: Company Snapshot

Growth opportunities and latent adjacency in UV Adhesives Market