Infrared Thermometer Market Size, Share and Industry Growth Analysis Report by Type (Fixed, Portable), Component (Optical, Display & Interface Units), Application (Medical, Non-Medical), End-Use (Residential, Commercial, Industrial), and Global Growth Driver and Industry Forecast To 2025

Updated on : October 22, 2024

The Infrared Thermometer Market is experiencing significant growth, driven by an increasing demand for non-contact temperature measurement across various sectors, including healthcare, automotive, and food safety. Key trends shaping the market include the rising awareness of personal health monitoring and the need for quick and accurate temperature assessments, especially in the wake of global health crises. Moreover, advancements in technology, such as the integration of smart features and enhanced imaging capabilities, are expected to propel future growth. As industries continue to prioritize safety and efficiency, the infrared thermometer market is poised for expansion, offering innovative solutions that meet the evolving needs of both consumers and professionals in diverse applications.

Infrared Thermometer Market Size

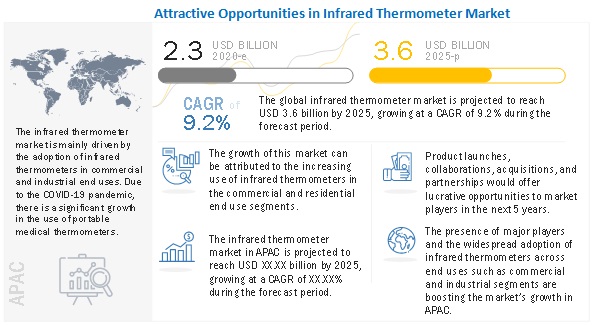

The global Infrared thermometer market size is projected to reach USD 3.6 billion by 2025, growing at a CAGR of 9.2%.The major factors driving the market's growth include the increasing number of COVID-19 patients and the rising adoption of infrared thermometers across the manufacturing sector and construction applications.

To know about the assumptions considered for the study, Request for Free Sample Report

The infrared thermometer industry will continue to generate revenue in 2020, faster than the one estimated before the pandemic. The growth is expected to be shoot for to a certain extent through the revenue generated in the second half of the year or, in some end-uses, by the end of 2021.

Infrared thermometer Market Dynamics

Driver : Increasing number of COVID-19 cases

COVID-19 is thought to spread mainly through close contact from person to person, including between people who are physically near each other (within 6 feet). People who are infected but do not show symptoms can also spread the virus to others. Cases of reinfection with COVID-19 has also been reported, though such cases are rare. Infrared thermometers can measure thermal radiation (infrared) emitted from the ear and forehead to infer body temperature. For in-ear thermometers, a new ear-probe jacket should be used for each person, and the ear canal must be pulled straight when measuring. Forehead thermometers are used for screening instead of diagnostic purposes. Thus, in most public places, there has been a significant rise in the use of infrared thermometers in residential and commercial end uses. It is expected that with the rise in the number of COVID-19 cases, there will be a significant increase in the use of infrared thermometers in residential and public areas, such as airports, stadiums, malls, and banking and financial institutions.

Restraint: Accuracy issues with infrared thermometers

The first-generation forehead thermometer guns were launched in a hurry to control the spread of COVID-19. They were not built for use in extreme temperatures and humidity; hence, when they were shipped mainly from China to all parts of the world, many problems occurred, including instability and unreliability in terms of measurement accuracy. To meet the global demand for low-cost IR thermometers, some Chinese OEMs supply low-cost infrared thermometers, which lack in terms of accuracy and quality of the thermopile sensor, ADC accuracy, and temperature compensation algorithm. These thermometers were returned by the overseas clients, mainly from the Russian and European countries, due to their unreliable performance in extreme temperatures and high humidity environments. Their sensor sensitivity was not enough and resulted in inaccuracy when the temperatures reached 38° C to 42° C mainly because of thermal noise suppression measures and different thermal refractive indexes caused by different skin colors and races.

Opportunities : Opportunities for 2nd generation infrared thermometers

During the early days of the COVID-19 pandemic, it was believed that the rise in temperature during the summer could eliminate the virus. However, this did not turn out to be true, and there has been a significant rise in COVID-19 patients, mainly in the US, India, Russia, and Brazil. Apart from the “temperature rise” strategy, the “herd immunity” strategy in Sweden and the UK has also been ineffective. However, in countries such as China, Taiwan, and South Korea, national control measures have proven to be effective, in which temperature screening played an important role. Therefore, the second wave of epidemic prevention and control is about to start in countries such as the US, the UK, Germany, India, and Canada, which will lead to an increased demand for second-generation forehead thermometer guns in overseas markets.

Challenges: Limitation of infrared thermometer in crowd screening

As the lockdown restrictions have been lifted and various public places are being reopened, non-contact temperature assessment devices are being used as part of an initial check at entry points to identify people who may have elevated temperatures. An elevated temperature is one way to identify a person who may have a COVID-19 infection.

Thermal scanning systems can quickly screen for high-temperature fever caused by pneumonia and influenza in crowded areas. These systems provide high-speed sensitive measurements for highly populated pedestrian transit areas. A few of the important features of these systems include large area detection, non-contact rapid screening of body temperature, fast response, intelligent alarms, and high-temperature measuring accuracy. Since areas such as airports, banks, retail, and educational institutes have a high footfall, it would be practically difficult to monitor each individual using infrared thermometers

Based on type, the portable segment is projected to account for the largest size of the infrared thermometer market from 2020 to 2025.

By type, the portable segment is expected to dominate the infrared thermometer market . One factor for the high adoption of portable infrared thermometers is their use in industrial and commercial end uses. Handheld infrared thermometers are noncontact, inexpensive, easy to use devices that help in rapid temperature measurement. Due to COVID-19, handheld infrared thermometers are being widely used for temperature screening at various commercial places, as high body temperature is one of the symptoms of 73 COVID-19. Governments in various countries have made it compulsory to use handheld infrared thermometers at public places and offices to check the spread of COVID-19. Governments in various countries have made it compulsory to use handheld infrared thermometers at public places and offices to check the spread of COVID-19.

Governments in various countries have made it compulsory to use handheld infrared thermometers at public places and offices to check the spread of COVID-19.

Based on component, the display and electronics is projected to account for the largest size of the infrared thermometer market from 2020 to 2025.

The display & interface unit segment is expected to hold the largest size during the forecast period. A display has a backlight and a screen, which can be either an LED display or LCD. Some infrared thermometers simulate a thermocouple output, while others have a 0–20 mA or 4–20 mA current loop or voltage output. Depending on the type of infrared thermometer, the Display and Control Units vary.

Based on application, the non-medical segment is projected to account for the largest size of the infrared thermometer market from 2020 to 2025.

The non-medical application is expected to hold a larger market share, in terms of both value and volume, while the medical application is expected to grow at a higher CAGR, in terms of value, during the forecast period. The major factors for the growth of the medical application are the lower cost, higher accuracy, and rising adoption of infrared thermometers for temperature screening due to COVID-19. The infrared thermometers employed for the non-medical application mainly use a mica or germanium lens and thus are more expensive. An infrared thermometer measures both infrared radiation and the emissivity value of a surface. In the non-medical application, infrared thermometers are used to measure surface temperatures over an extensive temperature range to suit a multitude of industrial applications.

Based on end-use, the industrial segment is projected to account for the largest size of the infrared thermometer market from 2020 to 2025.

By end use, the industrial segment is expected to hold the largest share, while the commercial segment is expected to grow at the highest rate. The growth of the industrial segment is attributed to the higher adoption of infrared thermometers in industrial manufacturing, industrial processing, and other such industrial segments.

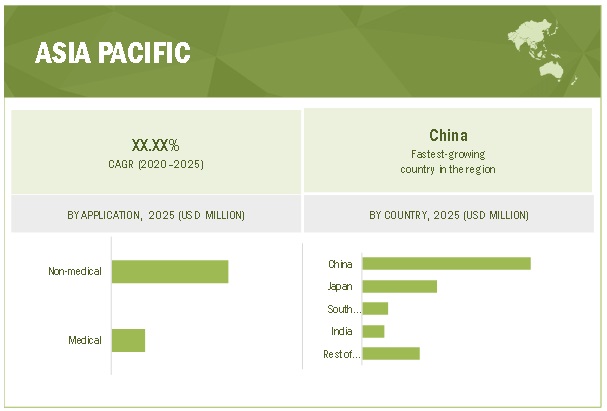

APAC is projected to hold the largest size of the infrared thermometer market during the forecast period.

APAC held the largest share of the infrared thermometer market in 2020 due to technological advancements and the high adoption of technology in a vast range of industries. The infrared thermometer market in APAC is expected to grow at the highest CAGR from 2020 to 2025, driven by the increasing adoption of infrared thermometers in several sectors, such as commercial and industrial.

To know about the assumptions considered for the study, download the pdf brochure

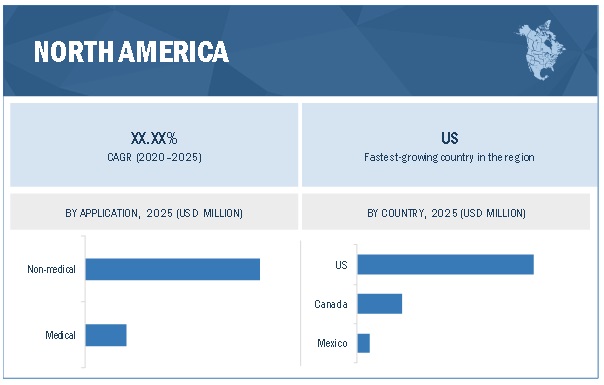

The market in North America mainly includes the US, Canada, and Mexico. North America is a mature market for infrared thermometers. The growth of the infrared thermometers market in this region is attributed to the presence of a large number of infrared thermometer product manufacturers in the US and significant use of infrared thermometers in industrial and commercial end use segments.

To know about the assumptions considered for the study, download the pdf brochure

Top Infrared Thermometer Companies - Key Market Players

Fluke (US), FLIR (US), Testo (Germany), Omron (Japan), Microlife (Taiwan), Hill-Rom (US), Omega Engineering (US), PCE Instruments (UK), Chino Corporation (Japan), and AMETEK Land (UK) are some of the key players operating in the infrared thermometer market.

Infrared Thermometer Market Report Scope :

|

Report Metric |

Detail |

| Estimated Market Size | USD 2.3 Billion |

| Projected Market Size | USD 3.6 Billion |

| Growth Rate | 9.2% CAGR |

|

Historical Data Available for Years |

2016–2025 |

|

Base Year Considered |

2019 |

|

Forecast period |

2020–2025 |

|

Segments covered |

|

|

Region Covered |

|

|

Market Leaders |

|

| Top Companies in North America |

|

| Key Market Driver | Increasing number of COVID-19 cases |

| Key Market Opportunity | Opportunities for 2nd generation infrared thermometers |

| Largest Growing Region | Asia Pacific |

| Largest Market Share Segment | Display & Interface unit |

| Largest Application Market Share | Non-medical Application |

This research report categorizes the infrared thermometer market based on Technology, type, monitoring type, Trends, end-user, and region.

Infrared thermometer Market Size, by Type

- Fixed Infrared Thermometer

- Portable Infrared Thermometer

Infrared thermometer Market, by Component

- Optical Components

- Electronics

- Display and Control Units

- Others

Infrared thermometer Industry, by Application

- Non-medical

- Medical

Infrared thermometer Market, by End-use

- Residential

- Commercial

- Industrial

Infrared thermometer Market, by Region

- North America

- Europe

- Asia Pacific (APAC)

- RoW

Recent Developments in Infrared Thermometer Industry

- In November 2020, FLIR launched FLIR SV87-KIT, which offers a low-cost and easy to configure remote vibration and temperature sensing solution that can be used for industrial applications.

- In October 2020, CHINO Corporation launched the IR-CZ radiation thermometer. It can be used for the measurement of middle-to-high temperature ranges.

- In September 2020, Fluke launched Endurance pyrometers. These can be used as dedicated calibration instruments in temperatures ranging from 50° to 3200° C.

- In June 2020, Hill-Rom entered into a partnership with Aiva, a provider of voice-enabling systems in areas such as clinical communications and patient engagement. The acquisition enabled the company to offer hands-free communication for both patients and staff utilizing an in-room voice assistant and Hill-Rom's Voalte Mobile solution.

- In November 2019, Omega launched SP-001—a smart infrared probe for noncontact temperature monitoring applications, including moving material, corrosive material, and high-temperature measurement.

Frequently Asked Questions (FAQ):

Why is there an increasing need of infrared thermometers?

Infrared thermometers are used across end-uses such commercial and residential. The growth in the commercial sector is attributed to the rising adoption in public places such as airports, retail stores, banks, and government institutions.

Which are the major companies in the market? What are their major strategies to strengthen their market presence?

Fluke, FLIR, Testo, Omron, and Hill-rom, are some of the major companies providing infrared thermometers. Product launches is one of the key strategies adopted by these players.

Which region is expected to witness significant demand for infrared thermometer in the coming years?

APAC accounted for the largest share of the infrared thermometers market in 2019. The ongoing urbanization and increasing investments by global healthcare solutions providers in this region are the major factors contributing to the high demand for infrared thermometers..

Which are the major end-uses of this market?

Industrial and commercial is one of the major end uses of the infrared thermometer market. The commercial areas mainly include hospitals and healthcare facilities, banks and financial institutions, retail stores, government offices and buildings, sports and entertainment venues, research and educational institutes, and airports and transport hubs. Infrared thermometers are widely used in various industrial manufacturing applications. The thermometer is selected depending on the type of application.

Which are the major opportunities in the infrared thermometer market?

Opportunities in 2nd generation of IR thermometers and rising adoption of IR thermometers for HVAC and refrigeration are the important opportunities in the infrared thermometer market. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 22)

1.1 STUDY OBJECTIVES

1.2 DEFINITION

1.2.1 INCLUSIONS AND EXCLUSIONS

1.3 STUDY SCOPE

1.3.1 MARKET COVERED

1.3.2 GEOGRAPHIC SCOPE

1.3.3 YEARS CONSIDERED

1.4 CURRENCY

1.5 STAKEHOLDERS

1.6 LIMITATIONS

2 RESEARCH METHODOLOGY (Page No. - 27)

2.1 RESEARCH DATA

FIGURE 1 INFRARED THERMOMETER MARKET: RESEARCH DESIGN

2.1.1 SECONDARY AND PRIMARY RESEARCH

2.1.2 SECONDARY DATA

2.1.2.1 Key data from secondary sources

2.1.3 PRIMARY DATA

2.1.3.1 Key data from primary sources

2.1.3.2 Key industry insights

2.1.3.3 Breakdown of primary sources

2.1.3.4 Primary interviews with key players

2.2 MARKET SIZE ESTIMATION

2.2.1 BOTTOM-UP APPROACH

2.2.1.1 Approach to arrive at the market size using the bottom-up approach (demand side)

FIGURE 2 MARKET: BOTTOM-UP APPROACH

2.2.2 TOP-DOWN APPROACH (SUPPLY SIDE)

2.2.2.1 Approach for arriving at the market share by top-down analysis (supply side)

FIGURE 3 MARKET: TOP-DOWN APPROACH

FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY FOR MARKET THROUGH SUPPLY-SIDE ANALYSIS

FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 1 (SUPPLY SIDE)— IDENTIFICATION OF REVENUE GENERATED BY COMPANIES FROM INFRARED THERMOMETERS

FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP MARKET ESTIMATION APPROACH FOR MARKET, BY TYPE

2.3 DATA TRIANGULATION

FIGURE 7 DATA TRIANGULATION

2.4 RESEARCH ASSUMPTIONS

TABLE 1 ASSUMPTIONS FOR RESEARCH STUDY

TABLE 2 RISKS

3 EXECUTIVE SUMMARY (Page No. - 38)

FIGURE 8 IMPACT OF COVID-19 ON INFRARED THERMOMETER MARKET

3.1 PRE-COVID-19 SCENARIO

TABLE 3 PRE-COVID-19 SCENARIO: INFRARED THERMOMETER MARKET

3.2 POST-COVID-19 SCENARIO

TABLE 4 POST-COVID-19 SCENARIO: INFRARED THERMOMETER MARKET

3.3 OPTIMISTIC SCENARIO (POST-COVID-19)

TABLE 5 OPTIMISTIC SCENARIO (POST-COVID-19): MARKET

3.4 PESSIMISTIC SCENARIO (POST-COVID-19)

TABLE 6 PESSIMISTIC SCENARIO (POST-COVID-19): MARKET

FIGURE 9 PORTABLE SEGMENT IS EXPECTED TO WITNESS A HIGHER GROWTH RATE DURING FORECAST PERIOD

FIGURE 10 OPTICAL COMPONENTS SEGMENT IS EXPECTED TO GROW AT HIGHEST RATE DURING FORECAST PERIOD

FIGURE 11 COMMERCIAL SEGMENT IS EXPECTED TO GROW AT HIGHEST RATE DURING FORECAST PERIOD

FIGURE 12 APAC TO HOLD LARGEST SHARE OF MARKET IN 2020

4 PREMIUM INSIGHTS (Page No. - 43)

4.1 ATTRACTIVE GROWTH OPPORTUNITIES IN MARKET

FIGURE 13 ADOPTION OF INFRARED THERMOMETERS DUE TO COVID-19 PANDEMIC WOULD DRIVE MARKET GROWTH

4.2 INFRARED THERMOMETER MARKET, BY TYPE

FIGURE 14 PORTABLE SEGMENT TO HOLD LARGER SHARE OF INFRARED THERMOMETER FROM 2020 TO 2025

4.3 MARKET, BY END USE

FIGURE 15 INDUSTRIAL SEGMENT TO HOLD LARGEST MARKET SHARE DURING FORECAST PERIOD

4.4 INFRARED MARKET IN APAC, BY COUNTRY AND END USE

FIGURE 16 CHINA AND INDUSTRIAL SEGMENT ARE LIKELY TO HOLD LARGEST SHARE OF INFRARED THERMOMETER MARKET IN APAC BY 2025

5 MARKET OVERVIEW (Page No. - 45)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 17 MARKET DYNAMICS

5.2.1 DRIVERS

FIGURE 18 MARKET DRIVERS AND THEIR IMPACT

5.2.1.1 Increasing number of COVID-19 patients

FIGURE 19 COVID-19 CASES, JANUARY TO DECEMBER* 2020

5.2.1.2 Rising adoption of infrared thermometers across manufacturing sector

TABLE 7 MAJOR PROVIDERS OF INFRARED THERMOMETERS FOR INDUSTRIAL APPLICATIONS

5.2.1.3 Rising adoption of infrared thermometers in construction applications

5.2.2 RESTRAINTS

5.2.2.1 Accuracy issues with infrared thermometers

5.2.3 OPPORTUNITIES

FIGURE 20 MARKET OPPORTUNITIES AND THEIR IMPACT

5.2.3.1 Opportunities for second generation of infrared thermometers

5.2.3.2 Rising R&D investments by companies, governments, and capital firms to develop innovative thermal scanning solutions and infrared thermometers

5.2.3.3 Rising adoption of infrared thermometers in HVAC and refrigeration applications

FIGURE 21 HVAC SYSTEMS MARKET, 2016–2025 (USD BILLION)

5.2.4 CHALLENGES

5.2.4.1 Limitation of infrared thermometers in crowd screening

FIGURE 22 MARKET RESTRAINTS AND CHALLENGES, AND THEIR IMPACT

5.3 VALUE CHAIN ANALYSIS

FIGURE 23 VALUE CHAIN ANALYSIS: INFRARED THERMOMETER MARKET

5.4 ECOSYSTEM

FIGURE 24 MARKET: ECOSYSTEM

TABLE 8 GLOBAL MARKET: ECOSYSTEM

5.5 PORTER’S FIVE FORCE ANALYSIS

TABLE 9 IMPACT OF EACH FORCE ON MARKET, 2019 VS. 2025

5.6 USE CASES

5.6.1 OPTIMIZING FURNACE OPERATION USING INFRARED THERMAL IMAGING

5.6.2 DEVELOPMENT OF INFRARED THERMOMETER THAT CAN MEASURE TEMPERATURE IN EXTRUSION AND HOT-ROLLING ALUMINUM ALLOYS

5.6.3 HOT AXLE DETECTION USING INFRARED THERMOMETER

5.6.4 FEVER SCREENING KIT USING INFRARED THERMOMETER TO SCREEN PEOPLE

5.6.5 INFRARED THERMOMETER FOR INDUSTRIAL PROCESSES

5.7 TECHNOLOGY TRENDS

5.7.1 CHANGE-OF-STATE SENSORS

5.7.2 THERMOCOUPLES

5.7.3 INFRARED NIGHT VISION CAMERAS

5.7.4 THERMAL SCANNERS

5.7.5 DISPLAYS FOR INFRARED THERMOMETERS

5.7.6 SENSORS FOR INFRARED THERMOMETERS

5.8 PRICING ANALYSIS

FIGURE 25 PRICE OF INFRARED THERMOMETERS, BY TYPE, 2016–2025

FIGURE 26 PRICE OF FIXED INFRARED THERMOMETERS, BY APPLICATION, 2016–2025

FIGURE 27 PRICE OF PORTABLE INFRARED THERMOMETERS, BY APPLICATION, 2016–2025

5.9 TRADE ANALYSIS

5.9.1 THERMOMETERS: GLOBAL IMPORT DATA, 2019 (USD MILLION)

5.9.2 THERMOMETERS: GLOBAL EXPORT DATA, 2019 (IN USD MILLION)

5.10 PATENT ANALYSIS

5.11 MARKET REGULATIONS

6 INFRARED THERMOMETER MARKET, BY TYPE (Page No. - 75)

6.1 INTRODUCTION

FIGURE 28 MARKET, BY TYPE

FIGURE 29 PORTABLE THERMOMETERS TO HOLD A LARGER SHARE OF IMARKET DURING FORECAST PERIOD

TABLE 10 MARKET, BY TYPE, 2016–2019 (USD MILLION)

TABLE 11MARKET, BY TYPE, 2020–2025 (USD MILLION)

TABLE 12 MARKET, BY TYPE, 2016–2019 (MILLION UNITS)

TABLE 13 MARKET, BY TYPE, 2020–2025 (MILLION UNITS)

6.2 FIXED INFRARED THERMOMETERS

6.2.1 FIXED INFRARED THERMOMETERS ARE PERMANENTLY MOUNTED AND ARE USED TO MONITOR TEMPERATURE OF PROCESSES

TABLE 14 FIXED INFRARED THERMOMETER MARKET, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 15 FIXED INFRARED THERMOMETER , BY APPLICATION, 2020–2025 (USD MILLION)

6.3 PORTABLE INFRARED THERMOMETERS

6.3.1 RISING DEMAND FOR PORTABLE INFRARED THERMOMETERS DUE TO COVID-19

TABLE 16 PORTABLE INFRARED THERMOMETER MARKET, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 17 PORTABLE INFRARED THERMOMETER , BY APPLICATION, 2020–2025 (USD MILLION)

7 INFRARED THERMOMETER MARKET, BY COMPONENT (Page No. - 81)

7.1 INTRODUCTION

FIGURE 30 MARKET, BY TYPE

FIGURE 31 GENERAL MECHANISM OF INFRARED THERMOMETERS

FIGURE 32 DISPLAY & INTERFACE UNIT TO HOLD LARGEST SHARE OF MARKET DURING FORECAST PERIOD

TABLE 18 MARKET, BY COMPONENT, 2016–2019 (USD MILLION)

TABLE 19 MARKET, BY COMPONENT, 2020–2025 (USD MILLION)

7.2 OPTICAL COMPONENTS

7.2.1 OPTICAL COMPONENTS FOCUS RADIATION ENERGY ONTO THE IR DETECTOR AND FILTER OUT UNWANTED RADIATION

7.3 ELECTRONICS

7.3.1 ELECTRONICS CONSIST OF A CONTROLLER, AN AMPLIFIER, A SIGNAL CONDITIONING MODULE, AND AN ANALOG-TO-DIGITAL CONVERTER

7.4 DISPLAY AND CONTROL UNITS

7.4.1 DISPLAYS SHOW WARNINGS AND READINGS WHEREAS INTERFACE UNITS PROVIDE DATA TO OTHER MODULES

7.5 OTHERS

8 INFRARED THERMOMETER MARKET, BY APPLICATION (Page No. - 86)

8.1 INTRODUCTION

FIGURE 33 MARKET, BY APPLICATION

FIGURE 34 NON-MEDICAL APPLICATION TO HOLD A LARGER SHARE OF MARKET DURING FORECAST PERIOD

TABLE 20 MARKET, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 21 MARKET, BY APPLICATION, 2020–2025 (USD MILLION)

TABLE 22 MARKET, BY APPLICATION, 2016–2019 (MILLION UNITS)

TABLE 23 MARKET, BY APPLICATION, 2020–2025 (MILLION UNITS)

8.2 NON-MEDICAL

8.2.1 INFRARED THERMOMETERS ARE USED IN NON-MEDICAL APPLICATION FOR INDUSTRIAL END USE

TABLE 24 IMARKET FOR NON-MEDICAL APPLICATION, BY END USE, 2016–2019 (USD MILLION)

TABLE 25 MARKET FOR NON-MEDICAL APPLICATION, BY END USE, 2020–2025 (USD MILLION)

TABLE 26MARKET FOR NON-MEDICAL APPLICATION, BY END USE, 2016–2019 (MILLION UNITS)

TABLE 27 MARKET FOR NON-MEDICAL APPLICATION, BY END USE, 2020–2025 (MILLION UNITS)

TABLE 28 MARKET FOR NON-MEDICAL APPLICATION, BY TYPE, 2016–2019 (USD MILLION)

TABLE 29 MARKET FOR NON-MEDICAL APPLICATION, BY TYPE, 2020–2025 (USD MILLION)

TABLE 30 MARKET FOR NON-MEDICAL APPLICATION, BY TYPE, 2016–2019 (MILLION UNITS)

TABLE 31 MARKET FOR NON-MEDICAL APPLICATION, BY TYPE, 2020–2025 (MILLION UNITS)

FIGURE 35 NORTH AMERICA TO LEAD INFRARED THERMOMETERS MARKET FOR NON-MEDICAL APPLICATION DURING FORECAST PERIOD

TABLE 32 MARKET FOR NON-MEDICAL APPLICATION, BY REGION, 2016–2019 (USD MILLION)

TABLE 33 MARKET FOR NON-MEDICAL APPLICATION, BY REGION, 2020–2025 (USD MILLION)

TABLE 34 MARKET FOR NON-MEDICAL APPLICATION, BY REGION, 2016–2019 (MILLION UNITS)

TABLE 35 MARKET FOR NON-MEDICAL APPLICATION, BY REGION, 2020–2025 (MILLION UNITS)

8.3 MEDICAL INFRARED THERMOMETERS

8.3.1 MEDICAL INFRARED THERMOMETERS ARE MAINLY USED IN COMMERCIAL APPLICATIONS

TABLE 36 MARKET FOR MEDICAL APPLICATION, BY END USE, 2016–2019 (USD MILLION)

TABLE 37 MARKET FOR MEDICAL APPLICATION, BY END USE, 2020–2025 (USD MILLION)

TABLE 38 MARKET FOR MEDICAL APPLICATION, BY END USE, 2016–2019 (MILLION UNITS)

TABLE 39 MARKET FOR MEDICAL APPLICATION, BY END USE, 2020–2025 (MILLION UNITS)

TABLE 40 MARKET FOR MEDICAL APPLICATION, BY TYPE, 2016–2019 (USD MILLION)

TABLE 41 MARKET FOR MEDICAL APPLICATION, BY TYPE, 2020–2025 (USD MILLION)

TABLE 42 MARKET FOR MEDICAL APPLICATION, BY TYPE, 2016–2019 (MILLION UNITS)

TABLE 43 MARKET FOR MEDICAL APPLICATION, BY TYPE, 2020–2025 (MILLION UNITS)

FIGURE 36 MARKET FOR MEDICAL APPLICATION TO GROW AT HIGHEST RATE IN APAC DURING FORECAST PERIOD

TABLE 44 MARKET FOR MEDICAL APPLICATION, BY REGION, 2016–2019 (USD MILLION)

TABLE 45 MARKET FOR MEDICAL APPLICATION, BY REGION, 2020–2025 (USD MILLION)

TABLE 46 MARKET FOR MEDICAL APPLICATION, BY REGION, 2016–2019 (MILLION UNITS)

TABLE 47 MARKET FOR MEDICAL APPLICATION, BY REGION, 2020–2025 (MILLION UNITS)

8.4 FACTORS TO CONSIDER WHILE SELECTING AN INFRARED THERMOMETER

8.4.1 ACCURACY

8.4.2 EMISSIVITY

8.4.3 TEMPERATURE RANGE

8.4.4 READING SPEED OR RESPONSE TIME

8.4.5 DESIGN

8.4.6 BACKLIT DISPLAY

8.4.7 WARRANTY

9 INFRARED THERMOMETER MARKET, BY END USE (Page No. - 101)

9.1 INTRODUCTION

FIGURE 37 MARKET, BY END USE

FIGURE 38 INDUSTRIAL SEGMENT TO HOLD LARGEST SHARE OF MARKET DURING FORECAST PERIOD

TABLE 48 MARKET, BY END USE, 2016–2019 (USD MILLION)

TABLE 49 MARKET, BY END USE, 2020–2025 (USD MILLION)

TABLE 50 MARKET, BY END USE, 2016–2019 (MILLION UNITS)

TABLE 51 MARKET, BY END USE, 2020–2025 (MILLION UNITS)

9.2 RESIDENTIAL

9.2.1 COVID-19 PANDEMIC HAS LED TO A RISE IN USE OF INFRARED THERMOMETERS IN RESIDENTIAL AREAS

TABLE 52 MARKET FOR RESIDENTIAL, BY REGION, 2016–2019 (USD MILLION)

TABLE 53 MARKET FOR RESIDENTIAL, BY REGION, 2020–2025 (USD MILLION)

9.3 COMMERCIAL

9.3.1 COMMERCIAL USE OF INFRARED THERMOMETERS IS MAINLY IN HEALTHCARE, GOVERNMENT, AND RETAIL SECTORS

TABLE 54 MARKET FOR COMMERCIAL, BY REGION, 2016–2019 (USD MILLION)

TABLE 55 MARKET FOR COMMERCIAL, BY REGION, 2020–2025 (USD MILLION)

9.4 INDUSTRIAL

9.4.1 SIGNIFICANT ADOPTION OF INFRARED THERMOMETERS IN INDUSTRIAL MANUFACTURING TO SPUR THE MARKET GROWTH

TABLE 56 MARKET FOR INDUSTRIAL, BY REGION, 2016–2019 (USD MILLION)

TABLE 57 MARKET FOR INDUSTRIAL, BY REGION, 2020–2025 (USD MILLION)

10 GEOGRAPHIC ANALYSIS (Page No. - 110)

10.1 INTRODUCTION

FIGURE 39 MARKET IN APAC TO WITNESS HIGHEST GROWTH DURING FORECAST PERIOD

TABLE 58 MARKET, BY REGION, 2016–2019 (USD MILLION)

TABLE 59 MARKET, BY REGION, 2020–2025 (USD MILLION)

TABLE 60 MARKET, BY REGION, 2016–2019 (MILLION UNITS)

TABLE 61 MARKET, BY REGION, 2020–2025 (MILLION UNITS)

10.2 NORTH AMERICA

FIGURE 40 MARKET SNAPSHOT: NORTH AMERICA

FIGURE 41 US TO WITNESS HIGHEST GROWTH IN NORTH AMERICAN ARKET DURING FORECAST PERIOD

TABLE 62 MARKET IN NORTH AMERICA, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 63 MARKET IN NORTH AMERICA, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 64 MARKET IN NORTH AMERICA, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 65 MARKET IN NORTH AMERICA, BY APPLICATION, 2020–2025 (USD MILLION)

TABLE 66 MARKET IN NORTH AMERICA, BY APPLICATION, 2016–2019 (MILLION UNITS)

TABLE 67 MARKET IN NORTH AMERICA, BY APPLICATION, 2020–2025 (MILLION UNITS)

10.2.1 US

10.2.1.1 Presence of infrared thermometer manufacturing companies to boost market growth in US

10.2.2 CANADA

10.2.2.1 Health Canada has laid regulations to maintain quality of infrared thermometers

10.2.3 MEXICO

10.2.3.1 Proximity to US and government policies to propel market growth

10.3 EUROPE

FIGURE 42 MARKET SNAPSHOT: EUROPE

FIGURE 43 GERMAN INFRARED THERMOMETER MARKET TO WITNESS HIGHEST GROWTH IN EUROPE DURING FORECAST PERIOD

TABLE 68 MARKET IN EUROPE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 69 MARKET IN EUROPE, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 70 MARKET IN EUROPE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 71 MARKET IN EUROPE, BY APPLICATION, 2020–2025 (USD MILLION)

TABLE 72 MARKET IN EUROPE, BY APPLICATION, 2016–2019 (MILLION UNITS)

TABLE 73 MARKET IN EUROPE, BY APPLICATION, 2020–2025 (MILLION UNITS)

10.3.1 UK

10.3.1.1 Increasing use of infrared thermometers for diagnosing diseases in healthcare sector

10.3.2 GERMANY

10.3.2.1 Market growth for infrared thermometers in Germany is attributed to its industrial sector

10.3.3 FRANCE

10.3.3.1 Presence of industrial manufacturing companies in France to spur market growth

10.3.4 ITALY

10.3.4.1 Adoption of infrared thermometers in healthcare sector to spur market growth in Italy

10.3.5 REST OF EUROPE

10.3.5.1 Emerging economies and increasing number of infrastructure facilities to drive market growth in Rest of Europe (RoE)

10.4 APAC

FIGURE 44 MARKET SNAPSHOT: APAC

FIGURE 45 CHINESE MARKET TO WITNESS HIGHEST GROWTH IN APAC DURING FORECAST PERIOD

TABLE 74 MARKET IN APAC, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 75 MARKET IN APAC, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 76 MARKET IN APAC, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 77 MARKET IN APAC, BY APPLICATION, 2020–2025 (USD MILLION)

TABLE 78 MARKET IN APAC, BY APPLICATION, 2016–2019 (MILLION UNITS)

TABLE 79 MARKET IN APAC, BY APPLICATION, 2020–2025 (MILLION UNITS)

10.4.1 CHINA

10.4.1.1 China is experiencing high demand for infrared thermometers, mainly for industrial and commercial end use segments

10.4.2 JAPAN

10.4.2.1 Growing use in healthcare industry has led to increased demand for infrared thermometers in Japan

10.4.3 INDIA

10.4.3.1 Preventative measures by airports against COVID-19 in India to drive market growth

&nnbsp; 10.4.4 SOUTH KOREA

10.4.4.1 Surged use of infrared thermometers in residential and commercial applications in South Korea

10.4.5 REST OF APAC

10.4.5.1 Increasing implementation in commercial applications is driving Rest of APAC infrared thermometer market

10.5 ROW

FIGURE 46 SOUTH AMERICAN INFRARED THERMOMETER MARKET TO WITNESS HIGHEST GROWTH IN ROW DURING FORECAST PERIOD

TABLE 80 MARKET IN ROW, BY REGION, 2016–2019 (USD MILLION)

TABLE 81 MARKET IN ROW, BY REGION, 2020–2025 (USD MILLION)

TABLE 82 MARKET IN ROW, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 83 MARKET IN ROW, BY APPLICATION, 2020–2025 (USD MILLION)

TABLE 84 MARKET IN ROW, BY APPLICATION, 2016–2019 (MILLION UNITS)

TABLE 85 MARKET IN ROW, BY APPLICATION, 2020–2025 (MILLION UNITS)

10.5.1 MIDDLE EAST & AFRICA

10.5.1.1 Ongoing investments in manufacturing industry support market growth

10.5.2 SOUTH AMERICA

10.5.2.1 Increasing demand for infrared thermometers in healthcare & life sciences

11 COMPETITIVE LANDSCAPE (Page No. - 132)

11.1 INTRODUCTION

11.2 MARKET SHARE ANALYSIS, 2019

FIGURE 47 MARKET SHARE OF KEY PLAYERS IN MARKET, 2019

11.3 COMPETITIVE EVALUATION ANALYSIS

11.3.1 STAR

11.3.2 PERVASIVE

11.3.3 EMERGING LEADERS

11.3.4 PARTICIPANT

FIGURE 48 MARKET (GLOBAL) COMPANY EVALUATION MATRIX, 2019

11.4 SMALL AND MEDIUM-SIZED ENTERPRISES (SME) EVALUATION QUADRANT, 2019

11.4.1 PROGRESSIVE COMPANIES

11.4.2 RESPONSIVE COMPANIES

11.4.3 DYNAMIC COMPANIES

11.4.4 STARTING BLOCKS

FIGURE 49 MARKET (GLOBAL) SME EVALUATION QUADRANT, 2019

11.5 COMPETITIVE SITUATIONS AND TRENDS

11.6 MARKET: APPLICATION AND REGIONAL FOOTPRINT

TABLE 86 PRODUCT FOOTPRINT OF COMPANIES

TABLE 87 END-USE FOOTPRINT OF COMPANIES

TABLE 88 REGIONAL FOOTPRINT OF COMPANIES

TABLE 89 MARKET: PRODUCT LAUNCHES

TABLE 90 INFRARED THERMOMETER MARKET: DEALS

12 COMPANY PROFILES (Page No. - 142)

(Business Overview, Products Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats))*

12.1 KEY PLAYERS

12.1.1 FLUKE

12.1.2 FLIR

FIGURE 50 FLIR: COMPANY SNAPSHOT

12.1.3 TESTO

12.1.4 OMRON

FIGURE 51 OMRON: COMPANY SNAPSHOT

12.1.5 MICROLIFE

12.1.6 HILL-ROM

FIGURE 52 HILL-ROM: COMPANY SNAPSHOT

12.1.7 OMEGA ENGINEERING

12.1.8 PCE INSTRUMENTS

12.1.9 CHINO CORPORATION

FIGURE 53 CHINO CORPORATION: COMPANY SNAPSHOT

12.1.10 AMETEK LAND

12.2 OTHER KEY PLAYERS

12.2.1 ROBERT BOSCH

12.2.2 OPTRIS GMBH

12.2.3 CONTEC MEDICAL SYSTEMS COMPANY LTD

12.2.4 NURECA

12.2.5 TRUMETER

12.2.6 DOUBLE KING INDUSTRIAL HOLDINGS (CHINA VICTOR)

12.2.7 YUWELL-JIANGSU YUYUE MEDICAL EQUIPMENT & SUPPLY CO., LTD.

12.2.8 WIKA GROUP

12.2.9 EMERSON

12.2.10 HORIBA

12.2.11 KEYENCE

12.2.12 ZEBRONICS

12.2.13 AMPHENOL

12.2.14 MELEXIS

12.2.15 CALEX ELECTRONICS

12.2.16 DETEL

*Details on Business Overview, Products Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats) might not be captured in case of unlisted companies.

13 APPENDIX (Page No. - 174)

13.1 DISCUSSION GUIDE

13.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

13.3 AVAILABLE CUSTOMIZATIONS

13.4 RELATED REPORTS

13.5 AUTHOR DETAILS

The study involved the estimation of the size of the infrared thermometer market. Exhaustive secondary research was carried out to collect information on the market, its peer markets, and its parent market. Both top-down and bottom-up approaches were employed to estimate the overall size of the infrared thermometer market. The market breakdown and data triangulation methods were used to estimate the size of different segments and subsegments of the market.

Secondary Research

In the secondary research process, various secondary sources such as Hoovers, Bloomberg BusinessWeek, and Factiva were referred to identify and collect information for this study on the infrared thermometer market. The secondary research involved the collection of data from various organizations, corporate filings (such as annual reports, investor presentations, and financial statements); and trade, business, and infrared thermometer and IR associations, white papers, certified publications, articles by recognized authors, gold-standard and silver-standard websites, regulatory bodies, trade directories, and databases.

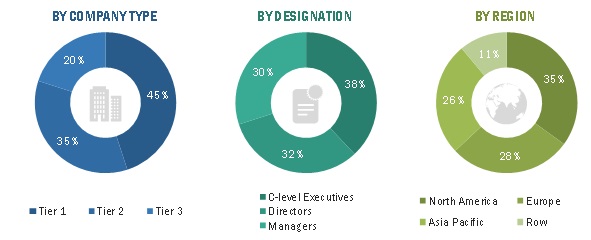

Primary Research

In the primary research process, various primary sources from both supply and demand sides have been interviewed to obtain qualitative and quantitative information about the market. Primary sources from the supply side include various industry experts, such as chief experience officers (CXOs); vice presidents (VPs); directors from business development, marketing, product development/innovation teams; and key executives from major players in the infrared thermometer market; industry associations; distributors; and key opinion leaders. Extensive primary research was conducted after acquiring an understanding of the prevailing scenario of the infrared thermometer market through secondary research. Several primary interviews were conducted with the market experts from demand side (OEM) and supply side (manufacturers and distributors of IR sensors) players across 4 major regions—North America, Europe, Asia Pacific (APAC), and the Rest of the World (RoW). RoW includes South America, the Middle East, and Africa. Various primary sources from both supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. The breakdown of primary respondents is as follows:

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the overall size of the infrared thermometer market. These approaches were also used to determine the size of various segments and subsegments of the market. The research methodology used to estimate the market size is as follows:

- Key players in the infrared thermometer market were identified through extensive secondary research.

- The supply chain of the infrared thermometer was identified and the market size, in terms of value and volume, determined through primary and secondary research processes.

- Players offering various types of infrared thermometer types were considered, their revenues were analyzed to arrive at the global numbers.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size—using the market size estimation processes explained above—the market was split into several segments and subsegments. Data triangulation and market breakdown procedures were employed, wherever applicable, to complete the entire market engineering process and arrive at the exact statistics of each market segment and subsegment. The data was triangulated by studying various factors and trends from both demand and supply sides in the infrared thermometer market.

Report Objectives

- To estimate and forecast the size of the infrared thermometer market based on type, component, application, end-use, and region, in terms of value and volume

- To estimate and forecast the size of the market in North America, Europe, Asia Pacific (APAC), and the Rest of the World (RoW), in terms of value and volume

- To provide detailed information regarding drivers, restraints, opportunities, and challenges influencing the growth of the infrared thermometer market

- To strategically analyze micromarkets1 with respect to individual growth trends, future market prospects, and contributions to the total market

- To strategically profile key players and comprehensively analyze their market ranking in 2019 according to their revenues and core competencies2, along with a detailed competitive landscape of the market

- To analyze competitive developments such as product launches, partnerships, collaborations, acquisitions, and expansions in the infrared thermometer market

- To benchmark players within the market using the proprietary competitive leadership mapping framework, which analyzes the market players on various parameters within broad categories of business and product strategies

1. Micromarkets are defined as the further segments and subsegments of the infrared thermometer market included in the report.

2. The core competencies of the companies are captured in terms of their key developments and key strategies adopted by them to sustain their position in the infrared thermometer market.

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for the report:

Company information:

- Detailed analysis and profiling of additional market players

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Infrared Thermometer Market