Pyrometer Market Size, Share, Industry Growth, Trends & Analysis by Type (Fixed, Handheld), Technology (Optical, Infrared), Wavelength (Single Wavelength, Multiwavelength), End-user Industry (Ceramics, Glass, Metal Processing), and Geography

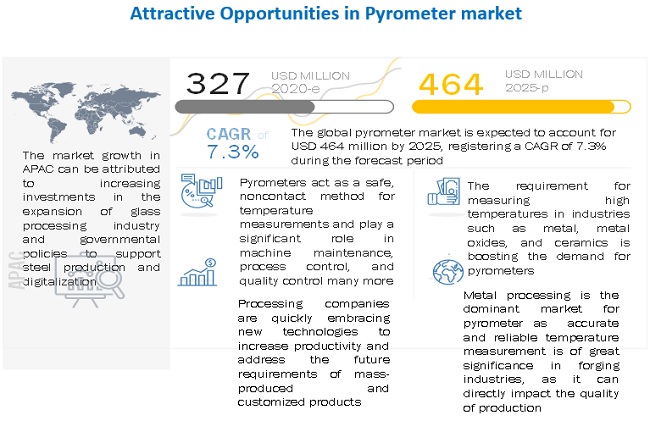

[180 Pages Report] The pyrometer market Size, Share, Industry Growth, Trends & Analysis is projected to reach USD 464 million by 2025, growing at a CAGR of 7.3% during the forecast period.

A few key factors driving the growth of this market are increased importance of non-contact temperature measurements, emphasis of end-user industries on rugged temperature measurement devices, Industry 4.0 pushed demand for pyrometers, and surged popularity of application-specific pyrometers.

To know about the assumptions considered for the study, Request for Free Sample Report

Pyrometer Market Sees Steady Growth Across Key Industries: Ceramics, Glass, and Metal Processing Lead the Way

Impact of COVID-19 on pyrometer market

The outbreak and the spread of COVID-19 have affected the pyrometer industry. Several industry experts believe that this pandemic will subside by the end of the first quarter of FY2021. Considering the inputs from various industry experts from different stages of the pyrometer value chain (which include OEMs, suppliers, end users, and distributors) as well as after consulting financial releases of different companies in the pyrometer ecosystem for the year 2020, it has been estimated that the size of the pyrometer market is expected to witness a decline of 4% to 6% from 2019 to 2020.

Pyrometer Market by Type

“The pyrometer market for fixed type is expected to grow at a higher CAGR from 2020 to 2025.”

The pyrometer market for fixed type is expected to grow at higher CAGR from 2020 to 2025. The key factor driving the growth of this segment is the increased demand for high-precision temperature measurements in industries with harsh environments. Ongoing digitalization and automation of various industries have led to the rise in demand for continuous temperature measurement devices, thereby stimulating the growth in demand for fixed pyrometers across the world.

Pyrometer Market by Share

“Infrared pyrometers expected to hold larger share of the market during forecast period.”

Infrared pyrometers expected to hold larger share of the market during forecast period. Infrared pyrometers have extremely fast data acquisition rates catering to applications of a wide range of industries, including glass temperature measurement, measurements on thin plastic films, and measurements through flames, among others. These types of pyrometers are available in diverse designs, from handheld to integrated process control systems.

Pyrometer Market by Multiwavelength

“Multiwavelength segment expected to hold larger share of pyrometer market during forecast period.”

Multiwavelength segment is expected to hold larger share of pyrometer market during forecast period. Multiwavelength pyrometers are ideal for high-temperature measurements for all low-emissivity materials, offer the real-time measurement of temperature. They can simultaneously measure single-wavelength and dual or multi-wavelength temperature values. This growth is also driven by the wide range of applications of multiwavelength pyrometers in metal processing industries such as galvanized/gal annealed steel, aluminum extrusion, quench, and strip, among others.

Pyrometer Market by Industry

“Metal processing end-user industry expected to grow at the highest CAGR during forecast period.”

Metal processing end-user industry expected to grow at the highest CAGR during forecast period. Pyrometers are used in different stages of the diverse process of metal processing industries such as forging, rolling, extrusion, and others. Also, metal companies are seeking more pyrometer devices than other temperature measurement solutions such as thermocouples owing to their robust, accurate, and standalone temperature measurement capabilities.

To know about the assumptions considered for the study, download the pdf brochure

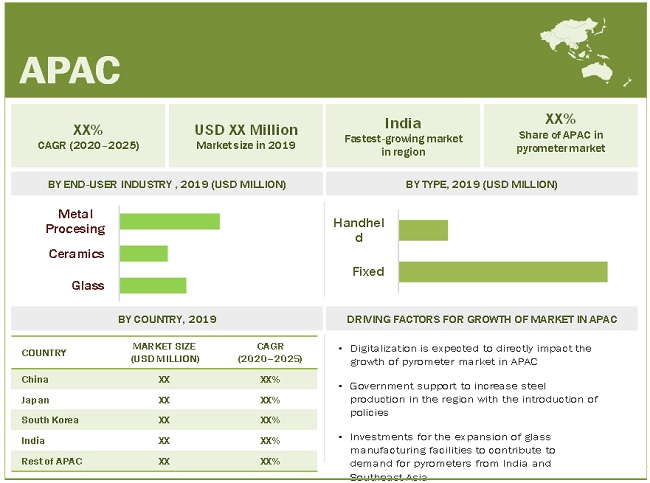

Pyrometer Market by APAC Region

“Pyrometer market in APAC to grow at highest CAGR during forecast period.”

The pyrometer market in APAC is expected to grow at the highest CAGR from 2020 to 2025. This market will be driven by the growing demand for metals such as steel for complex industrial applications. China, Japan, South Korea, and India are expected to drive the pyrometer market in APAC. China remains the largest market for pyrometers and is anticipated to remain dominant throughout the forecast period. Investments for the expansion of glass manufacturing and government support for steel production are set to offer huge opportunities for the pyrometer market in APAC.

Market Dynamics

Driver: Emphasis of end-user industries on rugged temperature measurement devices

The requirement for measuring high temperatures in industries such as metals, metal oxides, and ceramics is boosting the demand for pyrometers. For instance, in a steel factory, the measurement of the temperature of raw steel, slabs, and wires in processing stages is essential to ensure the quality of product and safety at the workplace. This drives the demand for pyrometers for improved process monitoring and greater efficiency in the production process. Advanced pyrometers have stainless steel housing, making them suitable for harsh environments.

Restraint: Clear view path of pyrometers into surfaces/objects for accurate measurements

Pyrometers should be installed in a specific manner to obtain an accurate result. Any form of optical interference might deflect from the actual temperature measurements. While opting for pyrometers to measure temperature, it is important to have a clearer view path into the thermal surface/objects. Unable to have a clearer view path can result in much lower temperature output than the actual temperature of the surface/objects.

Opportunity: New measurement opportunities from forging applications

Accurate and reliable temperature measurement is of great significance in forging industries, as it can directly impact the quality of production. Iron, steel, aluminum, and alloys remain the major metals that require temperature measurement during forging applications. According to the Association of Indian Forging Industry, the Indian forging industry caters to USD 57 billion Indian automotive industry and accounts for 60–70% of forging production. The adoption of pyrometers in the measurement of numerous forging applications is paving new avenues for the pyrometer market.

Challenge: Requirement of awareness regarding technical details of surfaces/objects

Emissivity is the measurement of a surface’s/object’s ability to emit infrared radiation. This radiation indicates the temperature of the surface/object. The emissivity and emissivity values are different for different materials, and the end user should have a clear idea about the application, optimum technology, wavelength, and emissivity of surfaces to achieve accurate temperature measurements. Lack of awareness regarding these factors might create confusion regarding the selection of the right kind of pyrometer for the application. This might hinder the sales of pyrometers in short to medium term.

Key Market Players

The pyrometers companies such as AMETEK Land (US), Fluke Corporation (US), CHINO Corporation (Japan), Advanced Energy Industries, Inc. (US), OMEGA Engineering (US), PCE Instruments (Germany), Optris GmbH (Germany), Sensortherm GmbH (Germany), CI Systems (US), DIAS Infrared GmbH (Germany), Williamson Corporation (US), and Micro-Epsilon (Germany) are few major players in pyrometer market.

Pyrometer Market cope:

|

Report Metric |

Details |

|

Estimated Market Size |

USD 327 million |

|

Projected Market Size |

USD 464 million |

|

Growth Rate |

CAGR of 7.36% |

|

Largest Share Region |

APAC |

|

Years considered |

2018–2025 |

|

Base year considered |

2019 |

|

Forecast period |

2020–2025 |

|

Forecast units |

Value (USD million/billion) |

|

Segments covered |

Type, Technology, Wavelength, End-user Industry, Glass Manufacturing Type, and Metal Processing Manufacturing Type |

|

Regions covered |

North America, APAC, Europe, and RoW |

|

Companies covered |

AMETEK Land (US), Fluke Corporation (US), CHINO Corporation (Japan), Advanced Energy Industries, Inc. (US), OMEGA Engineering (US), PCE Instruments (Germany), Optris GmbH (Germany), Sensortherm GmbH (Germany), CI Systems (US), DIAS Infrared GmbH (Germany), Williamson Corporation (US), and Micro-Epsilon (Germany)- Total 25 companies covered |

This report categorizes the pyrometer market based on Type, Technology, Wavelength, End-user Industry, Glass Manufacturing Type, and Metal Processing Manufacturing Type.

Pyrometer Market, by Type

- Fixed

- Handheld

Market, by technology

- Infrared

- Optical

Market, by Wavelength

- Single Wavelength

- Multiwavelength

Market, by End-user Industry

- Glass

- Ceramics

- Metal Processing

Market, by Glass Manufacturing Type

- Forehearth

- Melt Tank

- Lehr

- Tin Bath

- Others

Market, by Metal Processing Manufacturing Type

- Forging

- Others

Pyrometer Market, by Geography

-

North America

- US

- Canada

- Mexico

-

Europe

- Germany

- UK

- France

- Italy

- Rest of Europe

-

APAC

- China

- Japan

- India

- South Korea

- Rest of APAC

-

RoW

- Middle East & Africa

- South America

Recent Developments in Pyrometer Industry

- In October 2020, CHINO Corporation launched IR-CZS/CZI/CZP as a high-performance model of IR-CZ series pyrometers for improving the accuracy for mid-to-high temperature ranges, targeting iron, steel, and semiconductor manufacturing applications.

- In October 2020, AMETEK Land innovated its Popular SPOT AL EQS Range pyrometers by introducing two new modes for forging and forming applications.

- In September 2020, Fluke Process Instruments, a subsidiary of Fluke Corporation, launched one- and two-color Endurance pyrometers, which are ideal as dedicated calibration instruments for applications demanding high precision and high-temperature reference.

- In September 2020, Advanced Energy Industries introduced an innovative new pyrometry platform, the Impac series 600, for production monitoring and temperature measurement of non-metallic or coated metallic surfaces in industrial manufacturing applications.

Frequently Asked Questions (FAQ):

How big Pyrometer Market?

Pyrometer market Size is expected to reach USD 464 million by 2025 from USD 327 million in 2020 to grow at a CAGR of 7.3% from 2020 to 2025.

Which are the major companies in the market? What are their major strategies to strengthen their market presence?

AMETEK Land (US), Fluke Corporation (US), CHINO Corporation (Japan), Advanced Energy Industries, Inc. (US), OMEGA Engineering (US), Sensortherm GmbH (Germany), CI Systems (US), DIAS Infrared GmbH (Germany), and Micro-Epsilon (Germany) are few major players in pyrometer market. Most of the leading companies have used product launches and product development as key strategies to boost their revenues.

Which regions are expected to pose significant demand from 2020 to 2025?

Europe and APAC are expected to pose significant demand from 2020 to 2025. Investments for the expansion of glass manufacturing and government support for steel production are set to offer huge opportunities for the pyrometer market in APAC. Europe’s continuous technological developments, coupled with the increasing usage of temperature measurement devices to ensure safety, will push the demand for the pyrometer market in the coming years.

Which are the major end-user industries of the pyrometer market?

Glass, ceramics, and metal processing are the key industries that deploy pyrometers. In these industries, temperature measurement devices should be effective and robust to perform precise temperature measurements despite harsh environments. Technological advancements in these manufacturing industries, including most processes and systems being automated, coupled with capacity expansions in emerging economies, are likely to offer huge growth opportunities for the pyrometer market. The metal processing segment is projected to account for the largest size of the pyrometer market from 2020 to 2025. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 22)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION

1.2.1 INCLUSIONS AND EXCLUSIONS

1.3 MARKETS COVERED

FIGURE 1 MARKET SEGMENTATION

1.3.1 YEARS CONSIDERED

1.4 CURRENCY

1.5 LIMITATIONS

1.6 STAKEHOLDERS

1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 26)

2.1 RESEARCH DATA

FIGURE 2 PYROMETER MARKET: PROCESS FLOW OF MARKET SIZE ESTIMATION

FIGURE 3 PYROMETER MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 List of key secondary sources

2.1.1.2 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Breakdown of primaries

2.1.2.2 Key data from primary sources

2.1.2.3 Key industry insights

2.1.3 SECONDARY AND PRIMARY RESEARCH

2.2 MARKET SIZE ESTIMATION

FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 1 (SUPPLY SIDE)—REVENUES GENERATED BY COMPANIES IN PYROMETER MARKET

FIGURE 5 PYROMETER MARKET: RESEARCH METHODOLOGY – ILLUSTRATION OF COMPANY (FLUKE CORPORATION) REVENUE ESTIMATION

FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 2— DEMAND SIDE ANALYSIS

FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 2— DEMAND SIDE ANALYSIS

2.2.1 BOTTOM-UP APPROACH

2.2.1.1 Approach for calculating market size using bottom-up analysis

FIGURE 8 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

2.2.2 TOP-DOWN APPROACH

2.2.2.1 Approach for calculating market size using top-down analysis

FIGURE 9 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 10 DATA TRIANGULATION METHODOLOGY

2.4 RESEARCH ASSUMPTIONS

3 EXECUTIVE SUMMARY (Page No. - 39)

3.1 COVID-19 IMPACT ON PYROMETER MARKET

TABLE 1 REVENUES OF LEADING COMPANIES OPERATING IN PYROMETER MARKET FROM 2019 TO 2020

3.1.1 PRE-COVID-19 SCENARIO: PYROMETER MARKET

TABLE 2 PYROMETER MARKET SIZE IN PRE-COVID SCENARIO, 2018–2025 (USD MILLION)

3.1.2 POST-COVID-19 PESSIMISTIC SCENARIO: PYROMETER MARKET

TABLE 3 PYROMETER MARKET SIZE IN PESSIMISTIC SCENARIO, 2018–2025 (USD MILLION)

FIGURE 11 PROJECTED YEAR-0N-YEAR (YOY) GROWTH RATE OF PYROMETER MARKET IN PESSIMISTIC SCENARIO FROM 2019 TO 2025

3.1.3 POST-COVID-19 REALISTIC SCENARIO: PYROMETER MARKET

TABLE 4 PYROMETER MARKET SIZE IN REALISTIC SCENARIO, 2018–2025 (USD MILLION)

FIGURE 12 PROJECTED YEAR-0N-YEAR (YOY) GROWTH RATE OF PYROMETER MARKET IN REALISTIC SCENARIO FROM 2019 TO 2025

3.1.4 POST-COVID-19 OPTIMISTIC SCENARIO: PYROMETER MARKET

TABLE 5 PYROMETER MARKET SIZE IN OPTIMISTIC SCENARIO, 2018–2025 (USD MILLION)

FIGURE 13 PROJECTED YEAR-0N-YEAR (YOY) GROWTH RATE OF PYROMETER MARKET IN OPTIMISTIC SCENARIO FROM 2019 TO 2025

FIGURE 14 FIXED PYROMETERS SEGMENT ACCOUNTED FOR LARGE SHARE OF PYROMETER MARKET IN 2019

FIGURE 15 INFRARED SEGMENT TO ACCOUNT FOR LARGER SHARE OF PYROMETER MARKET FROM 2019 TO 2025

FIGURE 16 MULTIWAVELENGTH PYROMETER MARKET TO GROW AT HIGH CAGR FROM 2020 TO 2025

FIGURE 17 METAL PROCESSING SEGMENT TO ACCOUNT FOR LARGEST SIZE OF PYROMETER MARKET IN 2025

FIGURE 18 PYROMETER MARKET, BY REGION, 2019

4 PREMIUM INSIGHTS (Page No. - 47)

4.1 ATTRACTIVE OPPORTUNITIES IN PYROMETER MARKET

FIGURE 19 GROWING ADOPTION OF RUGGED AND ACCURATE TEMPERATURE MEASUREMENT PRODUCTS TO FUEL DEMAND FOR PYROMETERS

4.2 PYROMETER MARKET, BY GLASS MANUFACTURING TYPE

FIGURE 20 FOREHEARTH SEGMENT TO ACCOUNT FOR LARGEST SIZE OF PYROMETER MARKET FOR GLASS MANUFACTURING TYPE FROM 2020 TO 2025

4.3 PYROMETER MARKET IN APAC, BY END-USER INDUSTRY AND COUNTRY

FIGURE 21 METAL PROCESSING INDUSTRY SEGMENT AND CHINA TO ACCOUNT FOR LARGEST SHARES OF PYROMETER MARKET IN APAC IN 2020

4.4 PYROMETER MARKET, BY GEOGRAPHY

FIGURE 22 PYROMETER MARKET IN INDIA TO GROW AT HIGHEST CAGR FROM 2020 TO 2025

5 MARKET OVERVIEW (Page No. - 49)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 23 PYROMETER MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.2.1 DRIVERS

5.2.1.1 Increased importance of noncontact temperature measurements

5.2.1.2 Emphasis of end-user industries on rugged temperature measurement devices

5.2.1.3 Industry 4.0 to push demand for pyrometers

5.2.1.4 Surged popularity of application-specific pyrometers

FIGURE 24 IMPACT ANALYSIS OF DRIVERS ON PYROMETER MARKET

5.2.2 RESTRAINTS

5.2.2.1 Higher cost of pyrometers than other temperature measurement solutions

5.2.2.2 Clear view path of pyrometers into surfaces/objects for accurate measurements

FIGURE 25 IMPACT ANALYSIS OF RESTRAINTS ON PYROMETER MARKET

5.2.3 OPPORTUNITIES

5.2.3.1 New measurement opportunities from forging applications

5.2.3.2 Replacement of thermocouples with pyrometers

5.2.3.3 Expansion of glass manufacturing plants in India and Southeast Asia

FIGURE 26 IMPACT ANALYSIS OF OPPORTUNITIES ON PYROMETER MARKET

5.2.4 CHALLENGES

5.2.4.1 Industrial environments might affect pyrometer temperature measurements

5.2.4.2 Requirement of awareness regarding technical details of surfaces/objects

FIGURE 27 IMPACT ANALYSIS OF CHALLENGES ON PYROMETER MARKET

5.3 VALUE CHAIN ANALYSIS

FIGURE 28 VALUE CHAIN ANALYSIS: PYROMETER MARKET

5.3.1 RESEARCH AND DEVELOPMENT

5.3.2 COMPONENT MANUFACTURERS

5.3.3 ORIGINAL EQUIPMENT MANUFACTURERS

5.3.4 SOFTWARE/SERVICES

5.3.5 DISTRIBUTORS/SALES

5.3.6 END-USER INDUSTRIES

5.4 ECOSYSTEM ANALYSIS

TABLE 6 PYROMETER MARKET: ECOSYSTEM

5.5 YC-YCC SHIFT

FIGURE 29 YC-YCC SHIFT: PYROMETER MARKET

5.6 TECHNOLOGY TRENDS

5.6.1 COMBINATION OF PYROMETERS WITH OTHER INDUSTRIAL AUTOMATION PRODUCTS FOR IMPROVED OUTPUTS

5.6.2 INCREASED ADOPTION OF RAPID-RESPONSE TIME PYROMETERS

5.6.3 HIGH ACCURACY OF HIGH-TEMPERATURE PYROMETER PRODUCTS

5.6.4 ADVANTAGES OF FIBER-OPTIC PYROMETERS OVER TRADITIONAL PYROMETERS

5.7 CASE STUDIES

5.7.1 HYDRO EXTRUSIONS HUNGARY

TABLE 7 AMETEK HELPED HYDRO EXTRUSIONS HUNGARY IN ASSURED QUALITY CONTROL

5.7.2 SAPA PROFILES UK

TABLE 8 AMETEK HELPED SAPA PROFILES UK SECURE ADVANTAGES OF NEW TEMPERATURE MEASUREMENT SOLUTIONS

5.8 PYROMETER MARKET POTENTIAL

TABLE 9 PYROMETER MARKET REVENUE WITH COVID-19 IMPACT, 2018–2025 (USD MILLION)

TABLE 10 MARKET FORECASTING METHODOLOGY ADOPTED FROM 2019 TO 2025

FIGURE 30 PYROMETER MARKET-YEAR-0N-YEAR (YOY) GROWTH RATE

5.9 PRICING ANALYSIS

TABLE 11 INDICATIVE PRICES OF PYROMETERS

5.10 PATENT ANALYSIS

TABLE 12 KEY PATENTS RELATED TO PYROMETERS

5.11 PRODUCTION, EXPORT, AND IMPORT DATA OF END-USE INDUSTRIES

5.11.1 STEEL INDUSTRY

FIGURE 31 GLOBAL CRUDE STEEL PRODUCTION, 2010–2019 (MILLION TONNES)

TABLE 13 STEEL PRODUCTION, BY GEOGRAPHY, 2018–2019 (MILLION TONNES)

TABLE 14 TOP STEEL EXPORTING AND IMPORTING COUNTRIES, 2018

5.11.2 GLASS PROCESSING INDUSTRY

FIGURE 32 EUROPEAN UNION GLASS PRODUCTION, BY COUNTRY, 2010–2019 (MILLION TONNES)

5.11.3 ALUMINUM PRODUCTION INDUSTRY

FIGURE 33 GLOBAL ALUMINUM PRODUCTION, 2010–2019 (THOUSAND METRIC TONNES)

TABLE 15 ALUMINUM PRODUCTION, BY GEOGRAPHY, 2019 (THOUSAND METRIC TONNES)

5.12 IMPACT OF THIN-FILM BATTERIES

5.12.1 VALUE CHAIN ANALYSIS

5.12.2 TOP PLAYERS IN THIN-FILM BATTERY MARKET

TABLE 16 THIN-FILM BATTERY MARKET SHARE ANALYSIS, 2019

5.12.3 POTENTIAL FOR PYROMETERS IN THIN-FILM BATTERIES:

5.13 DISTRIBUTION ANALYSIS

TABLE 17 KEY PYROMETER DISTRIBUTORS/SALES REPRESENTATIVES IN NORTH AMERICA

TABLE 18 KEY PYROMETER DISTRIBUTORS/SALES REPRESENTATIVES IN EUROPE

TABLE 19 KEY PYROMETER DISTRIBUTORS/SALES REPRESENTATIVES IN APAC

TABLE 20 KEY PYROMETER DISTRIBUTORS/SALES REPRESENTATIVES IN ROW

5.14 PORTER’S FIVE FORCE ANALYSIS

TABLE 21 IMPACT OF PORTER’S FIVE FORCES ON PYROMETER MARKET, 2019

TABLE 22 IMPACT OF EACH FORCE ON MARKET, 2020–2025

5.14.1 BARGAINING POWER OF SUPPLIERS

5.14.2 BARGAINING POWER OF BUYERS

5.14.3 THREAT FROM NEW ENTRANTS

5.14.4 THREAT OF SUBSTITUTES

5.14.5 INTENSITY OF COMPETITIVE RIVALRY

5.15 TRADE AND TARIFF ANALYSIS

5.15.1 TRADE ANALYSIS

TABLE 23 THERMOMETERS/PYROMETERS: GLOBAL IMPORT DATA, 2015–2019 (USD MILLION)

TABLE 24 THERMOMETERS/PYROMETERS: GLOBAL EXPORT DATA, 2015–2019 (USD MILLION)

5.15.2 TARIFF ANALYSIS

TABLE 25 TARIFFS ON PYROMETERS EXPORTED BY US

TABLE 26 TARIFFS ON PYROMETERS EXPORTED BY CHINA

TABLE 27 TARIFFS ON PYROMETERS EXPORTED BY UK

TABLE 28 TARIFFS ON PYROMETERS EXPORTED BY GERMANY

TABLE 29 TARIFFS ON PYROMETERS EXPORTED BY SWEDEN

5.16 MARKET REGULATIONS

6 PYROMETER MARKET, BY TYPE (Page No. - 78)

6.1 INTRODUCTION

FIGURE 34 FIXED PYROMETER MARKET TO GROW AT A HIGHER CAGR FROM 2020 TO 2025

TABLE 30 PYROMETER MARKET, BY TYPE, 2018–2025 (USD MILLION)

6.2 FIXED

6.2.1 RISEN USE OF FIXED PYROMETERS FOR HIGH-PRECISION TEMPERATURE MEASUREMENTS IN INDUSTRIES WITH HARSH ENVIRONMENTS

TABLE 31 FIXED PYROMETER MARKET, BY END-USER INDUSTRY, 2018–2025 (USD MILLION)

TABLE 32 FIXED PYROMETER MARKET, BY REGION, 2018–2025 (USD MILLION)

6.3 HANDHELD

6.3.1 SURGED DEMAND FOR HANDHELD PYROMETERS FOR USE IN ROUTE MANAGEMENT APPLICATIONS FOR REGULAR MONITORING OF MANUFACTURING/PROCESSING SITES

TABLE 33 HANDHELD PYROMETER MARKET, BY END-USER INDUSTRY, 2018–2025 (USD MILLION)

TABLE 34 HANDHELD PYROMETER MARKET, BY REGION, 2018–2025 (USD MILLION)

7 PYROMETER MARKET, BY TECHNOLOGY (Page No. - 82)

7.1 INTRODUCTION

FIGURE 35 INFRARED SEGMENT TO ACCOUNT FOR LARGE SIZE OF PYROMETER MARKET IN 2025

TABLE 35 PYROMETER MARKET, BY TECHNOLOGY, 2018–2025 (USD MILLION)

7.2 OPTICAL

7.2.1 EFFICIENT AND EFFECTIVE SOLUTIONS FOR PERIODIC MONITORING APPLICATIONS

TABLE 36 PYROMETER MARKET FOR OPTICAL TECHNOLOGY, BY WAVELENGTH, 2018–2025 (USD MILLION)

TABLE 37 PYROMETER MARKET FOR OPTICAL TECHNOLOGY, BY END-USER INDUSTRY, 2018–2025 (USD MILLION)

7.3 INFRARED

7.3.1 ADAPTABLE TO DEMANDING INDUSTRIAL TEMPERATURE MEASUREMENT APPLICATIONS

TABLE 38 PYROMETER MARKET FOR INFRARED TECHNOLOGY, BY WAVELENGTH, 2018–2025 (USD MILLION)

TABLE 39 PYROMETER MARKET FOR INFRARED TECHNOLOGY, BY END-USER INDUSTRY, 2018–2025 (USD MILLION)

8 PYROMETER MARKET, BY WAVELENGTH (Page No. - 86)

8.1 INTRODUCTION

FIGURE 36 MULTIWAVELENGTH SEGMENT TO ACCOUNT FOR A LARGER SIZE OF PYROMETER MARKET IN 2025

TABLE 40 PYROMETER MARKET, BY WAVELENGTH, 2018–2025 (USD MILLION)

8.2 SINGLE WAVELENGTH

8.2.1 USE OF SINGLE WAVELENGTH PYROMETERS IN CONSTANT EMISSIVITY TARGET MEASUREMENT APPLICATIONS

8.3 MULTIWAVELENGTH

8.3.1 ADOPTION OF MULTIWAVELENGTH PYROMETERS OWING TO THEIR APPLICATION-SPECIFIC ALGORITHMS

9 PYROMETER MARKET, BY END-USER INDUSTRY (Page No. - 89)

9.1 INTRODUCTION

FIGURE 37 METAL PROCESSING END-USER INDUSTRY TO HOLD LARGEST SIZE OF PYROMETER MARKET FROM 2020 TO 2025

TABLE 41 PYROMETER MARKET, BY END-USER INDUSTRY, 2018–2025 (USD MILLION)

9.2 GLASS

9.2.1 CONSTANT TEMPERATURE MEASUREMENT REQUIREMENTS FOR ENSURING HIGH-QUALITY GLASS

TABLE 42 PYROMETER MARKET FOR GLASS, BY TYPE, 2018–2025 (USD MILLION)

TABLE 43 PYROMETER MARKET FOR GLASS, BY TECHNOLOGY, 2018–2025 (USD MILLION)

TABLE 44 PYROMETER MARKET FOR GLASS, BY REGION, 2018–2025 (USD MILLION)

9.3 CERAMICS

9.3.1 GROWTH IN CERAMICS INDUSTRY TO BE DRIVEN BY DEMAND FOR SANITARY WARE, TILES, CEMENT, ETC.

TABLE 45 PYROMETER MARKET FOR CERAMICS, BY TYPE, 2018–2025 (USD MILLION)

TABLE 46 PYROMETER MARKET FOR CERAMICS, BY TECHNOLOGY, 2018–2025 (USD MILLION)

TABLE 47 PYROMETER MARKET FOR CERAMICS, BY REGION, 2018–2025 (USD MILLION)

TABLE 48 PYROMETER MARKET FOR CERAMICS, BY CERAMICS TYPE, 2018–2025 (USD MILLION)

9.3.1.1 Silicon carbide

9.3.1.2 Silicon

9.3.1.3 Sapphire

9.3.1.4 Others

9.4 METAL PROCESSING

9.4.1 EMPHASIS ON INCREASING QUALITY STANDARDS OF FINISHED PRODUCTS WILL REQUIRE MEASUREMENTS DEVICES

TABLE 49 PYROMETER MARKET FOR METAL PROCESSING, BY TYPE, 2018–2025 (USD MILLION)

TABLE 50 PYROMETER MARKET FOR METAL PROCESSING, BY TECHNOLOGY, 2018–2025 (USD MILLION)

TABLE 51 PYROMETER MARKET FOR METAL PROCESSING, BY REGION, 2018–2025 (USD MILLION)

10 PYROMETER MARKET, BY GLASS MANUFACTURING TYPE (Page No. - 96)

10.1 INTRODUCTION

FIGURE 38 FOREHEARTH SEGMENT TO ACCOUNT FOR LARGEST SIZE OF PYROMETER MARKET FOR GLASS MANUFACTURING TYPE FROM 2020 TO 2025

TABLE 52 PYROMETER MARKET FOR GLASS, BY MANUFACTURING TYPE, 2018–2025 (USD MILLION)

10.2 FOREHEARTH

10.3 MELT TANK

10.4 TIN BATH

10.5 LEHR (COOLING)

10.6 OTHERS

11 PYROMETER MARKET, BY METAL PROCESSING MANUFACTURING TYPE (Page No. - 99)

11.1 INTRODUCTION

FIGURE 39 FORGING SEGMENT OF MARKET TO GROW AT HIGHEST CAGR FROM 2020 TO 2025

TABLE 53 PYROMETER MARKET, BY METAL PROCESSING MANUFACTURING TYPE, 2018–2025 (USD MILLION)

TABLE 54 PYROMETER MARKET FOR METAL PROCESSING, BY METAL TYPE, 2018–2025 (USD MILLION)

11.2 FORGING

11.2.1 OPENING OF NEW PLANTS AND CAPACITY EXPANSIONS OF EXISTING FORGING PLANTS TO OFFER AMPLE OPPORTUNITIES FOR PYROMETERS

11.3 OTHERS

12 GEOGRAPHIC ANALYSIS (Page No. - 103)

12.1 INTRODUCTION

TABLE 55 PYROMETER MARKET, BY REGION, 2018–2025 (USD MILLION)

12.2 NORTH AMERICA

FIGURE 40 SNAPSHOT: PYROMETER MARKET IN NORTH AMERICA

TABLE 56 PYROMETER MARKET IN NORTH AMERICA, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 57 PYROMETER MARKET IN NORTH AMERICA, BY TECHNOLOGY, 2018–2025 (USD MILLION)

TABLE 58 PYROMETER MARKET IN NORTH AMERICA, BY END-USER INDUSTRY, 2018–2025 (USD MILLION)

TABLE 59 PYROMETER MARKET IN NORTH AMERICA, BY TYPE, 2018–2025 (USD MILLION)

12.2.1 US

12.2.1.1 US to remain largest market for pyrometers in North America

12.2.2 CANADA

12.2.2.1 Steel production and its interdependence on other end-user industries to boost steel production in Canada

12.2.3 MEXICO

12.2.3.1 Strategic location and low operational cost to increase production of glasses and metal processing in Mexico

12.3 EUROPE

FIGURE 41 SNAPSHOT: PYROMETER MARKET IN EUROPE

TABLE 60 PYROMETER MARKET IN EUROPE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 61 PYROMETER MARKET IN EUROPE, BY TECHNOLOGY, 2018–2025 (USD MILLION)

TABLE 62 PYROMETER MARKET IN EUROPE, BY END-USER INDUSTRY, 2018–2025 (USD MILLION)

TABLE 63 PYROMETER MARKET IN EUROPE, BY TYPE, 2018–2025 (USD MILLION)

12.3.1 GERMANY

12.3.1.1 New investments in glass manufacturing industry in Germany to offer opportunities for installations of temperature measurement solutions

12.3.2 ITALY

12.3.2.1 Strong production base of steel and ceramics sector to drive growth for temperature measurement solutions in Italy

12.3.3 UK

12.3.3.1 Digitalization in steel manufacturing sector to fuel demand for fixed pyrometers in UK

12.3.4 FRANCE

12.3.4.1 French pyrometer market driven by the production of metal processing and glass industries

12.3.5 REST OF EUROPE

12.4 APAC

FIGURE 42 SNAPSHOT: PYROMETER MARKET IN APAC

TABLE 64 PYROMETER MARKET IN APAC, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 65 PYROMETER MARKET IN APAC, BY TECHNOLOGY, 2018–2025 (USD MILLION)

TABLE 66 PYROMETER MARKET IN APAC, BY END-USER INDUSTRY, 2018–2025 (USD MILLION)

TABLE 67 PYROMETER MARKET IN APAC, BY TYPE, 2018–2025 (USD MILLION)

12.4.1 CHINA

12.4.1.1 China expected to hold largest share of pyrometer market in APAC

12.4.2 JAPAN

12.4.2.1 Economic partnerships of Japan with other countries for alternative and reliable supply chain for steel industry

12.4.3 SOUTH KOREA

12.4.3.1 Demand for steel from end-user industries in domestic market to fuel growth

12.4.4 INDIA

12.4.4.1 Energy-intensive industries in India leading to adoption of digitalization to increase profits

12.4.5 REST OF APAC

12.5 REST OF THE WORLD (ROW)

FIGURE 43 SNAPSHOT: PYROMETER MARKET IN ROW

TABLE 68 PYROMETER MARKET IN ROW, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 69 PYROMETER MARKET IN ROW, BY TECHNOLOGY, 2018–2025 (USD MILLION)

TABLE 70 PYROMETER MARKET IN ROW, BY END-USER INDUSTRY, 2018–2025 (USD MILLION)

TABLE 71 PYROMETER MARKET IN ROW, BY TYPE, 2018–2025 (USD MILLION)

12.5.1 MIDDLE EAST AND AFRICA

12.5.1.1 Capacity expansions and new investment projects to fuel demand for temperature measurement solutions in Middle East and Africa

12.5.2 SOUTH AMERICA

12.5.2.1 Investments in glass manufacturing to contribute to demand for pyrometers from pharmaceutical industry in South America

13 COMPETITIVE LANDSCAPE (Page No. - 119)

13.1 OVERVIEW

FIGURE 44 COMPANIES ADOPTED PRODUCT LAUNCHES AS KEY GROWTH STRATEGY FROM 2018 TO 2020

TABLE 72 OVERVIEW OF STRATEGIES DEPLOYED BY KEY PYROMETER COMPANIES

13.2 FIVE-YEAR COMPANY REVENUE ANALYSIS

FIGURE 45 FIVE-YEAR REVENUE ANALYSIS OF TOP PLAYERS IN PYROMETER MARKET

13.3 MARKET SHARE ANALYSIS, 2019

TABLE 73 PYROMETER MARKET: DEGREE OF COMPETITION

FIGURE 46 PYROMETER MARKET SHARE ANALYSIS, 2019 (%)

13.4 COMPANY EVALUATION QUADRANT

13.4.1 STAR

13.4.2 EMERGING LEADER

13.4.3 PERVASIVE

13.4.4 PARTICIPANT

FIGURE 47 PYROMETER MARKET (GLOBAL): COMPANY EVALUATION QUADRANT, 2019

13.5 PYROMETER MARKET: COMPANY PRODUCT FOOTPRINT

TABLE 74 PRODUCT FOOTPRINT OF COMPANIES

TABLE 75 END-USER INDUSTRY FOOTPRINT OF COMPANIES

TABLE 76 REGIONAL FOOTPRINT OF COMPANIES

13.6 STARTUP/SME EVALUATION QUADRANT, 2019

13.6.1 PROGRESSIVE COMPANY

13.6.2 RESPONSIVE COMPANY

13.6.3 DYNAMIC COMPANY

13.6.4 STARTING BLOCK

FIGURE 48 PYROMETER MARKET: STARTUP/SME EVALUATION QUADRANT, 2019

13.7 COMPETITIVE SCENARIO

13.7.1 PRODUCT LAUNCHES

TABLE 77 TOP FIVE PRODUCT LAUNCHES, 2018–2020

13.7.2 PRODUCT DEVELOPMENTS

TABLE 78 TOP FIVE PRODUCT DEVELOPMENTS, 2018–2020

13.7.3 COLLABORATIONS AND ACQUISITIONS

TABLE 79 COLLABORATIONS AND ACQUISITIONS, 2018–2020

14 COMPANY PROFILES (Page No. - 134)

(Business Overview, Products Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats))*

14.1 KEY PLAYERS

14.1.1 AMETEK LAND

TABLE 80 AMETEK LAND: COMPANY OVERVIEW

FIGURE 49 AMETEK LAND: COMPANY SNAPSHOT

14.1.2 FLUKE CORPORATION

TABLE 81 FORTIVE CORPORATION: COMPANY OVERVIEW

FIGURE 50 FORTIVE CORPORATION: COMPANY SNAPSHOT

14.1.3 CHINO CORPORATION

TABLE 82 CHINO CORPORATION: COMPANY OVERVIEW

FIGURE 51 CHINO CORPORATION: COMPANY SNAPSHOT

14.1.4 ADVANCED ENERGY INDUSTRIES, INC.

TABLE 83 ADVANCED ENERGY INDUSTRIES, INC.: COMPANY OVERVIEW

FIGURE 52 ADVANCED ENERGY INDUSTRIES, INC.: COMPANY SNAPSHOT

14.1.5 OMEGA ENGINEERING

TABLE 84 SPECTRIS PLC: COMPANY OVERVIEW

FIGURE 53 SPECTRIS PLC: COMPANY SNAPSHOT

14.1.6 PCE INSTRUMENTS

TABLE 85 PCE INSTRUMENTS: COMPANY OVERVIEW

14.1.7 OPTRIS GMBH

TABLE 86 OPTRIS GMBH: COMPANY OVERVIEW

14.1.8 SENSORTHERM GMBH

TABLE 87 SENSOTHERM: COMPANY OVERVIEW

14.1.9 CI SYSTEMS

TABLE 88 CI SYSTEMS: COMPANY OVERVIEW

14.1.10 DIAS INFRARED GMBH

TABLE 89 DIAS INFRARED GMBH: COMPANY OVERVIEW

14.2 OTHER KEY PLAYERS

14.2.1 PROXITRON GMBH

14.2.2 WILLIAMSON CORPORATION

14.2.3 BARTEC GROUP

14.2.4 AOIP

14.2.5 CALEX ELECTRONICS LTD.

14.2.6 MICRO-EPSILON

14.2.7 PYROMETER INSTRUMENT COMPANY

14.2.8 CRESS MANUFACTURING COMPANY INC.

14.2.9 K-SPACE ASSOCIATES, INC.

14.2.10 PROCESS SENSORS CORP.

14.2.11 PALMER WAHL INSTRUMENTS, INC.

14.2.12 KELLER HCW GMBH

14.2.13 TEMPSENS INSTRUMENTS PVT. LTD.

14.2.14 ALUTAL

14.2.15 MANYYEAR TECHNOLOGY

*Details on Business Overview, Products Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats) might not be captured in case of unlisted companies.

15 APPENDIX (Page No. - 172)

15.1 INSIGHTS OF INDUSTRY EXPERTS

15.2 QUESTIONNAIRE FOR PYROMETER MARKET

15.2.1 MARKET SIZING AND FORECAST

15.2.2 STAKEHOLDER ANALYSIS

15.3 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

15.4 AVAILABLE CUSTOMIZATIONS

15.5 RELATED REPORTS

15.6 AUTHOR DETAILS

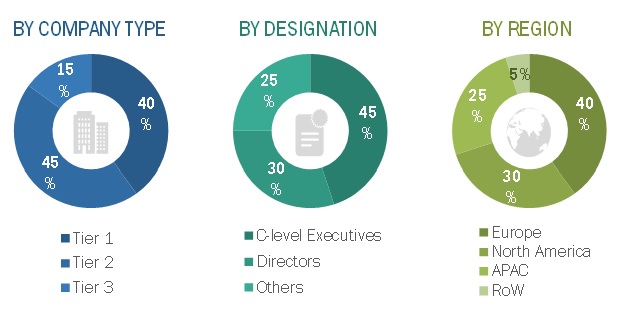

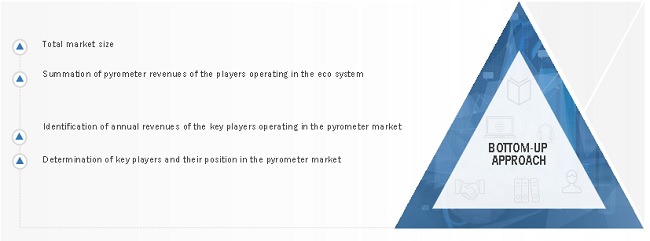

The study involved 4 major activities to estimate the size of the pyrometer market. Exhaustive secondary research has been conducted to collect information on the pyrometer. Validation of these findings, assumptions, and sizing with industry experts across value chain through primary research has been the next step. Both, top-down and bottom-up approaches have been employed to estimate the complete market size. After that, market breakdown and data triangulation have been used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research, various secondary sources have been referred to for identifying and collecting information important for this study. Secondary sources include corporate filings (such as annual reports, investor presentations, and financial statements); trade, business, and professional associations; white papers, machine condition monitoring related journals, and certified publications; articles from recognized authors; gold and silver standard websites; directories; and databases. World Steel Organization, Glass Manufacturing Industry Council, American Ceramics Society, UK Metric Association, and Institute of Electrical and Electronics Engineers are a few examples of secondary sources.

Primary Research

In the primary research, various primary sources from both the supply and demand sides have been interviewed with to obtain the qualitative and quantitative information for this report. Primary sources from the supply side include industry experts such as CEOs, VPs, marketing directors, technology and innovation directors, and related key executives from major companies and organizations operating in the pyrometer market. Following is the breakdown of primary respondents.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both, top-down and bottom-up approaches have been used to estimate and validate the size of the overall pyrometer market and the market based on subsegments. The research methodology used to estimate the market size has been given below:

- Key players in the market have been identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall market size—using the estimation processes explained above—the market has been split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation and market breakdown procedures have been employed, wherever applicable. The data has been triangulated by studying various factors and trends in both demand and supply sides of the pyrometer market.

Report Objectives

- To describe and forecast the pyrometer market, in terms of value, based on type, technology, wavelength, end-user industry, manufacturing type in glass and metal processing industry, and region

- To describe and forecast the pyrometer market, in terms of value, for various segments with respect to four key regions, namely, North America, Europe, Asia Pacific (APAC), and the Rest of the World (RoW)

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and contributions to the overall market

- To provide a detailed overview of the pyrometer value chain

- To strategically profile the key players and comprehensively analyze their market ranking in terms of revenue and core competencies

- To provide detailed information regarding drivers, restraints, opportunities, and challenges pertaining to the pyrometer market

- To map competitive intelligence based on company profiles, strategies of key players, and game-changing developments such as product launches, partnerships, collaborations, and agreements undertaken in the pyrometer market

- To analyze the impact of COVID-19 on the growth of the pyrometer market

Available Customizations

Along with the market data, MarketsandMarkets offers customizations according to a company’s specific needs. The following customization options are available for the report:

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Pyrometer Market