Thermal Scanners Market by Wavelength (LWIR, MWIR, SWIR), Application (Thermography, Security & Surveillance, Search & Rescue), Vertical (Industrial, Commercial, Aerospace & Defense, Automotive, Healthcare), Technology, Region - Global Forecast to 2025

Thermal Scanners Market

Thermal Scanners Market and Top Companies

- FLIR Systems Inc. (US) – The Company is a global leading technology company focused on intelligent sensing solutions for defense, industrial, and commercial applications. The company designs, develops, markets, and distributes technologies used to enhance the user’s perception and awareness. It offers thermal imaging systems, threat detection systems, locator systems, and measurement and diagnostic systems to cater to the demand from its customers from verticals, such as military and defense, energy and utilities, construction, transportation, and industrial manufacturing. The company has a geographic presence worldwide, including North and South (Latin) America, APAC, Europe, and RoW. FLIR has manufacturing and R&D facilities in more than 94 countries

- Fluke Corporation (US) −The Company operates as a wholly-owned subsidiary of Fortive Corporation. The company is involved in the manufacturing, distributing, and servicing of electronic test tools and software. It has more than 70 years of experience in developing and manufacturing thermal imaging cameras and modules for various applications, including industrial/electronic service installation and maintenance, indoor air quality, calibration, and biomedical.

- Leonardo SPA (Italy) − The Company is one of the major players in the aerospace & defense and security markets. The company is involved in the designing and manufacturing of defense & security electronics, helicopters, aeronautics, and aerospace & defense solutions for various end users, such as governments, aerial & terrestrial, institutions, naval & maritime, and space & cyberspace. The thermal product portfolio offered by the company includes thermal cameras for MWIR and LWIR wavelengths, thermal modules, sights, and navigation systems. In addition, the company offers thermal core products through one of its subsidiary— Leonardo DRS

- L3 HARRIS TECHNOLOGIES (US) − The Company operates through its L3 Space & Sensors (formerly known as L3 Cincinnati Electronics (L3 CE)) subsidiary, which is a manufacturer of IR imaging systems and surveillance products. The company designs, develops, and incorporates IR thermal imaging products mainly for military and commercial verticals. The company has expertise in cooled thermal imagers, which enables the user to view a clear picture of actual and potential threats. Moreover, the company holds patented InSb focal plane array architecture on which the cooled MWIR imaging systems are based. These products are mainly adopted for classification, detection, and identification.

- Opgal (Israel) – The Company is one of the major providers of innovative thermal camera solutions and near-infrared illumination camera solutions for wide-ranging aviation, defense, industrial, and security applications. The company offers a wide range of high-performance and versatile visualization hardware, as well as software products that are designed using thermal and active imaging technologies and created using advanced electrooptics and image processing expertise.

- Axis Communications AB (Sweden) – The Company is one of the major providers of innovative thermal camera solutions and near-infrared illumination camera solutions for wide-ranging aviation, defense, industrial, and security applications. The company offers a wide range of high-performance and versatile visualization hardware, as well as software products that are designed using thermal and active imaging technologies and created using advanced electrooptics and image processing expertise.

- Optotherm Inc. (US) – The Company is a US-based company that manufactures and supplies photographic equipment. The company primarily performs software development, design engineering, and the manufacturing of thermal imaging microscopes and radiometric infrared cameras. The company develops cameras and microscopes based on uncooled, long-wavelength infrared detector technology. The company develops system software in-house, which can be integrated with all its cameras and other system components to provide a modern user interface.

Thermal Scanner Market and Top End-user Industries

- Industrial−The industrial vertical includes electronics & semiconductors, manufacturing and process, steel, metallurgical, and energy & utility industries. In the industrial segment, thermal scanners are used as preventive maintenance tools for monitoring, inspection, detection, and measurement applications. They enable the continuous monitoring and inspection of electricity grids in power plants, pipelines in process industries, and steel ladle in the steel industry to detect haphazard events and avoid accidents. Thermal scanners are non-invasive tools that are mounted in any place or area, enabling easy detection and providing sharp and clear thermal images of the targeted object.

- Automotive −Thermal imaging and scanning systems are used in the automotive industry to perform the continuous monitoring, inspection, and detection of the heat generated by abnormal friction in vehicles so that proper maintenance can be performed before a problem escalates. Currently, numerous automotive manufacturing companies such as Audi, Mercedes, BMW, and General Motors (GM) are deploying thermal imaging solutions in advanced driver-assistance systems (ADAS). These solutions provide day and night driver assistance, pedestrian and obstacle alerts, and respond rapidly to potential danger. Moreover, in luxurious cars, thermal cameras are deployed in the driver cabin to detect drowsy drivers.

- Aerospace & Defense − Thermal scanning products including thermal cameras and modules are mainly used by the aerospace & defense industry as they are effective in temperature measurement. Over a period of time, there is an increase in the utilization of unique and advanced thermal scanning products in this industry. Due to increasing conflicts between nations wars have increased. Well-equipped military forces and technologically advanced methods are required in such situations. In order to cope with these distinctly asymmetric, multidimensional, and highly lethal needs of the battlefield, global armies are modernizing their military arsenal and equipping soldiers with the latest combat and surveillance technology.

- Oil & Gas− In the oil & gas sector, process handling equipment work in an environment of high pressure, temperature, and oxidization. Any malfunction such as gas leakage can cause huge loss. Many oil & gas production industries release chemical compounds and gases that are invisible to the naked eye and can be detected accurately using thermal scanning systems.

- Commercial − In the commercial segment, thermal imaging solutions are used for security and surveillance monitoring, inspection, and the detection of commercial buildings and public places that include airports, stadiums, and others. The security and surveillance of building infrastructures are of prime importance in commercial buildings. This can be achieved by using thermal scanners and imaging systems as they comprise onboard video analytics capable of sorting human or vehicular intrusions, which significantly reduces false alarms.

Thermal Scanners Market and Top Technologies

- Cooled− Cooled thermal scanning systems have imaging sensors, interfacing and image processing electronics, cryocoolers, and an optional zoom lens. The cryocooler is used to lower the imaging sensor temperature to cryogenic temperature, which is essential to reduce thermally induced noise and support the image formation. The image produced by the cooled thermal scanning system is clear, has high spectral filtering, and improved magnification performance.

- Uncooled− Uncooled thermal cameras are based on the microbolometer design. They do not use cryocoolers or thermoelectric coolers for cooling the imaging sensor temperature, whereas they operate at room temperature. Thermal scanners based on uncooled technology function on the long-wave infrared (LWIR) band in which most of the targeted terrestrial temperature is emitted by the infrared energy.

Updated on : April 04, 2024

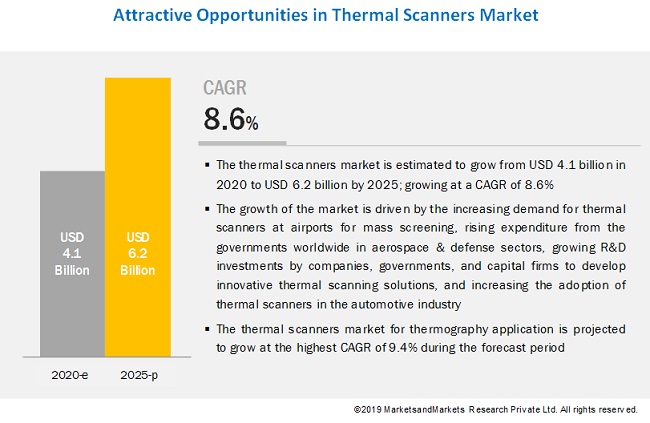

The global thermal scanners market size is expected to reach USD 6.2 billion by 2025 from USD 4.1 billion in 2020, growing at a CAGR of 8.6% during the forecast period.

Thermal Scanners Market Size & Growth Drivers

The growth of the Thermal Scanners Market is propelled by increasing demand for advanced temperature monitoring solutions across sectors such as healthcare, defense, and industrial automation. The rising focus on public safety, especially during pandemics, has driven the adoption of thermal scanners for contactless temperature screening in airports, workplaces, and public spaces. In the defense and aerospace sectors, these devices are critical for surveillance and target detection. Additionally, advancements in thermal imaging technology, coupled with growing adoption in applications like predictive maintenance and building diagnostics, further fuel market expansion. The integration of AI and IoT in thermal scanning systems enhances efficiency, making them indispensable in diverse industries.

The key factors fueling the growth of this market are the increasing demand for thermal scanners at airports for mass screening, rising expenditure from the governments worldwide in aerospace & defense sectors, growing R&D investments by companies, governments, and capital firms to develop innovative thermal scanning solutions, and increasing the adoption of thermal scanners in the automotive industry.

Impact of AI Thermal Scanners Market

The integration of artificial intelligence (AI) into the thermal scanners market is revolutionizing temperature monitoring and surveillance across various sectors. AI-enhanced thermal scanners offer real-time data analysis, anomaly detection, and predictive maintenance capabilities, significantly improving accuracy and operational efficiency. In healthcare, these scanners enable precise fever detection in large crowds, streamlining screening processes and reducing false positives. Industrial applications benefit from continuous equipment monitoring, where AI algorithms analyze thermal data to predict potential failures, thereby preventing costly downtime. The amalgamation of AI with Internet of Things (IoT) technologies facilitates remote monitoring and data sharing, enhancing decision-making processes. Advancements in infrared and thermopile technologies have also made thermal scanners more accessible and cost-effective, broadening their application scope. As AI continues to evolve, its integration with thermal scanning technology is expected to drive further innovation, expanding the market's reach into emerging areas such as smart infrastructure and environmental monitoring.

Thermal scanners market for uncooled technology segment accounted for a larger share of market in 2019

The uncooled technology segment accounted for a larger share of the thermal scanners industry in 2019. The larger share is due to several advantages, such as better penetration in weak environmental conditions including dust, fog, and smoke and fewer mobile parts, providing long operating life with low maintenance.

The Thermal scanners market for LWIR wavelength accounted for the largest share of market in 2019

The market for LWIR wavelength accounted for the largest share of the thermal scanners industry in 2019. The growth is attributed to the increasing demand for thermal scanners operating in LWIR wavelengths in automotive, civil infrastructure, food & beverages, and medical for monitoring and inspection as well as detection and measurement applications.

The Thermal scanners market for fixed devices accounted for the largest share of thermal scanners industry in 2019

In 2019, the fixed-type segment held the largest share of the thermal scanners market. The growth of this market is attributed to the increasing adoption of thermal scanners in industrial and commercial sectors. The recent outbreak of coronavirus in China and other parts of South East Asia have caused significant demand in fixed-mounted thermal scanners at airports and other crowded areas such as train stations, factories, and commercial buildings.

The Thermal scanners market for thermography expected to grow at the highest CAGR during the forecast period

The demand for thermography is mainly for monitoring and detection purpose which is likely to grow at the highest CAGR during the forecast period. The growth is attributed to the increasing adoption of thermal scanners in commercial and industrial sectors.

Thermal scanners are used as a maintenance tool for monitoring and inspection application in various buildings, historical monuments, and industrial equipment. Furthermore, thermal scanners are majorly in demand from these sectors to monitor the structural health of buildings and equipment. Also, these scanners find massive applications in mass screening of people to detect human temperatures. With the outbreak of coronavirus, it is expected that there would be higher adoption of thermal scanners at various airports across the globe.

Thermal scanners market in Aerospace & defense sector dominated market in 2019

In 2019, the aerospace & defense vertical dominated the thermal scanners industry. The dominance is due to the capability of thermal scanner products to work in all weather conditions irrespective of the time. Also, they are used for border surveillance, law enforcement, in ship collision avoidance and guidance systems, and structural health monitoring of aircraft. Moreover, they help soldiers in identifying, locating, and targeting the enemy forces.

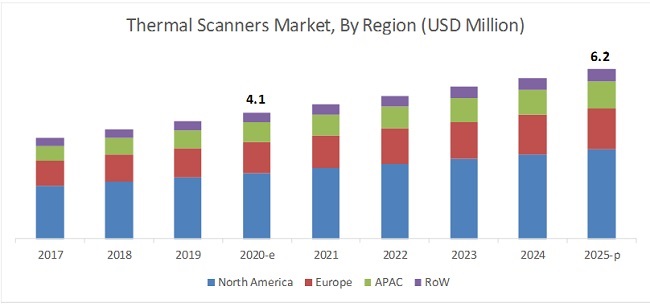

Thermal scanners market in North America held a major share of market in 2019

Maintenance operators use thermal scanners for monitoring and inspection of commercial and residential buildings. North America is home to numerous historical monuments, commercial as well as residential buildings, and different process and manufacturing industries. Owing to this, North America held the major share of the thermal scanners market in 2019.

Top Key Players in Thermal Scanners Market:

-

FLIR Systems, Inc. (US),

-

Fluke Corporation (US),

-

Leonardo S.p.A. (Italy),

-

L3HARRIS TECHNOLOGIES, INC. (US),

-

Opgal (Israel),

Few major companies operating in the thermal scanners market. These companies have adopted both organic and inorganic growth strategies such as product launches and developments, partnerships, agreements, contracts, and mergers & acquisitions to strengthen their position in the market.

Thermal Scanners Market Size and Scope

|

Report Metric |

Details |

|

Estimated Market Size |

USD 4.1 Billion |

|

Projected Market Size |

USD 6.2 Billion |

|

Growth Rate |

8.6% |

|

Market size available for years |

2017–2025 |

|

Forecast Period |

2020–2025 |

|

Forecast Units |

Value (USD million/billion) |

|

Segments Covered |

Technology, wavelengths, type, application, vertical, and region |

|

Base Year considered |

2019 |

This report categorizes the thermal scanners market based on technology, wavelengths, product type, application, vertical, and region.

Thermal Scanners Market By Technology

- Cooled

- Uncooled

Thermal Scanners Market By Wavelength

- Short-wave Infrared (SWIR)

- Mid-Wave Infrared (MWIR)

- Long-Wave Infrared (LWIR)

Thermal Scanners Market By Type

- Fixed

- Portable

Thermal Scanners Market By Application

- Thermography

- Security & Surveillance

- Search & Rescue

- Other Applications

Thermal Scanners Market By Vertical:

- Industrial

- Commercial

- Aerospace & Defense

- Automotive

- Healthcare & Life Sciences

- Oil & Gas

- Other Verticals

Thermal Scanners Market By Geography

-

North America

- US

- Canada

- Mexico

-

Europe

- UK

- Germany

- France

- Rest of Europe

-

APAC

- China

- Japan

- India

- Rest of APAC

-

RoW

- Middle East & Africa

- South America

Key Questions Addressed by the Report

- Where will all these developments take the industry in the mid-to-long term?

- What are the upcoming trends in the thermal scanner market?

- What are the opportunities for the existing players, and for those who are planning to enter various stages of the thermal scanners value chain?

- How the adoption of inorganic growth strategies, such as acquisitions and partnerships, will have a positive impact on the growth of the thermal scanner market? Which players are likely to adopt these strategies in the near future to create a position or increase share in this market?

- What are the emerging applications of thermal scanners products?

Frequently Asked Questions (FAQ):

Which are the major technologies used in thermal scanners? How huge is the opportunity for their growth in the next five years?

The major technologies in thermal scanners are cooled and uncooled. The global market for thermal scanners is expected to reach at more than USD 6 billion and at a CAGR of more than 8%. The growth is mainly due to the high adoption of thermal scanners at airport due to Covid-19.

Which are the major companies in the thermal scanners market? What are their major strategies to strengthen their market presence?

The major companies operating in this market are FLIR Systems, Inc. (US), Fluke Corporation (US), Leonardo S.p.A. (Italy), L3HARRIS TECHNOLOGIES, INC. (US), Opgal (Israel), Axis Communications AB (Sweden), Optotherm, Inc. (US), Seek Thermal (California, US), Thermoteknix Systems Ltd. (UK), and among others. These players are indulging in various new product developments, partnerships, and collaborations to expand its presence in the market.

Which region is expected to witness significant demand for thermal scanners in the coming years?

The North American region is expected to hold the largest share. The growth in the market in the North American region is attributted to the rising use of thermal scanners at the airports to monitor the humans for Covid-19. Apart from this, thermal scanners are widely adopted in the military and defense vertical, which is expected to drive the market further.

What are the driving factors for the thermal scanners market?

The key factors fueling the growth of this market are the increasing demand for thermal scanners at airports for mass screening, rising expenditure from the governments worldwide in aerospace & defense sectors, growing R&D investments by companies, governments, and capital firms to develop innovative thermal scanning solutions, and increasing the adoption of thermal scanners in the automotive industry.

Which are the various types of thermal scanners? Can you elaborate or provide some factors for the growth of a particular type?

The thermal scanners market has beed segmented into fixed and portable. In 2019, the fixed-type segment held the largest share of the thermal scanners market. The growth of this market is attributed to the increasing adoption of thermal scanners in industrial and commercial sectors. The recent outbreak of Covid-19 worldwide, have caused significant demand in fixed-mounted thermal scanners at airports and other crowded areas such as train stations, factories, and commercial buildings. However, it is expected that there would be significant adoption of portable thermal scanners in coming years at various public places for screening purposes. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 18)

1.1 Study Objectives

1.2 Market Definition

1.3 Scope

1.3.1 Markets Covered

1.3.2 Years Considered

1.4 Currency

1.5 Limitations

1.6 Market Stakeholders

2 Research Methodology (Page No. - 21)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Secondary Sources

2.1.2 Primary Data

2.1.2.1 Primary Sources

2.1.2.2 Key Industry Insights

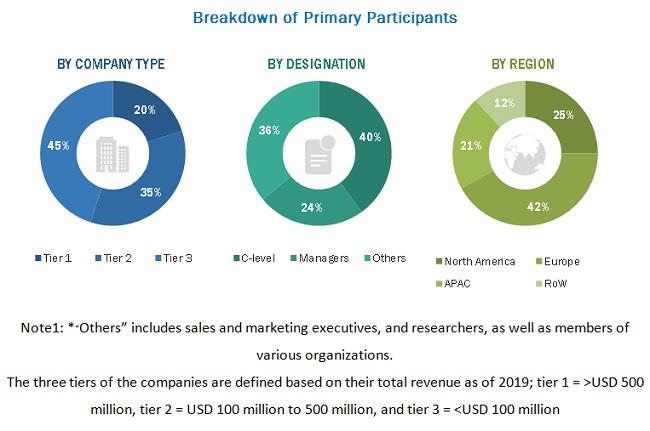

2.1.2.3 Breakdown of Primaries

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.1.1 Approach for Capturing Market Size By Bottom-Up Analysis (Demand Side)

2.2.2 Top-Down Approach

2.2.2.1 Approach for Capturing Market Share By Top-Down Analysis (Supply Side)

2.3 Market Breakdown and Data Triangulation

2.3.1 Research Assumptions

3 Executive Summary (Page No. - 30)

4 Premium Insights (Page No. - 34)

4.1 Attractive Opportunities in Thermal Scanners Market

4.2 Thermal Scanner Market, By Application and Country

4.3 Country-Wise Thermal Scanner Market

5 Market Overview (Page No. - 37)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Increasing Demand for Thermal Scanners at Airports for Coronavirus Detection

5.2.1.2 Rising Expenditure in Aerospace and Defense Sector From Governments Worldwide

5.2.1.3 Growing Adoption of Thermal Scanners in Automotive Industry

5.2.1.4 Rising R&D Investments By Companies, Governments, and Capital Firms to Develop Innovative Thermal Scanning Solutions

5.2.2 Restraints

5.2.2.1 Export Restrictions Imposed on Thermal Imaging Products

5.2.3 Opportunities

5.2.3.1 Increase in Adoption of Thermal Scanners in Healthcare Applications

5.2.3.2 Use of Thermal Scanners to Diagnose Defects in Building Structures

5.2.4 Challenges

5.2.4.1 Inapplicable for Glass and Water

5.2.4.2 Impractical for See-Through Wall Applications

6 Thermal Scanners Market, By Type (Page No. - 45)

6.1 Introduction

6.2 Portable

6.2.1 Firefighters and Law Enforcement Personnel Benefit From Using Handheld Thermal Scanners

6.3 Fixed

6.3.1 High Adoption of Fixed-Mounted Thermal Scanners in Fever Scanning Application Accelerates Market Growth

7 Thermal Scanners Market, By Technology (Page No. - 49)

7.1 Introduction

7.2 Cooled

7.2.1 Highly Sensitive Cooled Thermal Cameras are Used to Monitor Minute Temperature Differences

7.3 Uncooled

7.3.1 Uncooled Thermal Scanners are Being Used to Screen Large Groups of People for Fever

8 Thermal Scanners Market, By Wavelength (Page No. - 52)

8.1 Introduction

8.2 Short-Wave Infrared

8.2.1 SWIR Thermal Scanners are Capable of Producing Detailed Images With High Resolution

8.3 Mid-Wave Infrared

8.3.1 MWIR Thermal Scanners are Used to Provide High-Contrast Thermal Images

8.4 Long-Wave Infrared

8.4.1 LWIR Thermal Scanners are Used to Monitor Human Activities and Vehicles

9 Thermal Scanners Market, By Application (Page No. - 57)

9.1 Introduction

9.2 Thermography

9.2.1 Process Industry

9.2.1.1 Rising Deployment of Thermal Cameras in Process Industry is Fueling Market Growth

9.2.2 Discrete Industry

9.2.2.1 Requirement of Monitoring and Inspection to Assess Quality of Manufactured Device Drives Adoption of Thermal Scanners

9.2.3 Building Inspection

9.2.3.1 Thermal Scanners Enable Detection of Building Defects By Screening Temperature Distribution of Surfaces

9.2.4 Inspection & Quarantine

9.2.4.1 Thermal Scanners have Emerged as Widely Used Tool to Detect Fever in Response to Covid-19

9.2.5 Medical Diagnosis

9.2.5.1 Panoramic Thermal Imaging System Enables Tracking in Wide Areas

9.3 Security & Surveillance

9.3.1 City Monitoring

9.3.1.1 Increasing Awareness Regarding Safety of Chief Areas in Cities Helps in Deployment of Thermal Scanners

9.3.2 Border & Coastal Surveillance

9.3.2.1 Rising Adoption of Thermal Cameras to Safeguard Building Structures is Propelling Thermal Scanner Market

9.3.3 Ports and Wharfs Monitoring

9.3.3.1 Need for Human Safety Increases Demand for Thermal Imaging Technology

9.3.4 Key Infrastructure Monitoring

9.3.4.1 Thermal Scanners Play Important Role in Safeguarding Key Infrastructure Areas

9.4 Search and Rescue

9.4.1 Law Enforcement

9.4.1.1 Thermal Scanners Can Provide Better Execution of Tasks in Poor Vision Situations in Law Enforcement Activities

9.4.2 Firefighting and First Response

9.4.2.1 Deployment of Thermal Cameras to Reduce Human, Material, and Property Losses is Expected to Boost Market Growth

9.4.3 Forest Protection

9.4.3.1 Increase in Use of Thermal Cameras for Detection of Animals and Humans Using Body Temperatures

9.4.4 Maritime Rescue

9.4.4.1 Thermal Cameras Help Maritime Rescue Operators to Find Humans in Case of Any Accidents

9.5 Others

10 Thermal Scanners Market, By Vertical (Page No. - 69)

10.1 Introduction

10.2 Industrial

10.2.1 Rise in Adoption of Thermal Scanners in Industrial Vertical for Safety of Industrial Assets and Human Lives

10.3 Commercial

10.3.1 High Adoption of Thermal Scanners in Fever Scanning at Airports Accelerates Market Growth

10.4 Aerospace & Defense

10.4.1 High Adoption of Thermal Scanners Across Aerospace & Defense Industry is Fueling Market Growth

10.5 Automotive

10.5.1 High Adoption of Thermal Scanners in Automotive Industry for Monitoring, Inspection, and Detection

10.6 Healthcare & Lifesciences

10.6.1 Simple, Non-Invasive, and Less Expensive Thermal Imaging Technique Increases Demand for Thermal Cameras in Healthcare & Life Sciences

10.7 Oil & Gas

10.7.1 Use of Thermal Scanners for Predictive Maintenance to Fuel Market Growth

10.8 Others

11 Geographic Analysis of Thermal Scanners Market (Page No. - 76)

11.1 Introduction

11.2 North America

11.2.1 US

11.2.1.1 Presence of Thermal Scanner Manufacturing Companies to Boost Market Growth in US

11.2.2 Canada

11.2.2.1 Investment in R&D of Thermal Imaging By Government and Non-Government to Spur Growth of Market in Canada

11.2.3 Mexico

11.2.3.1 Wide Distribution Network in Mexico to Propel Market Growth

11.3 Europe

11.3.1 UK

11.3.1.1 Increasing Use of Thermal Scanners for Diagnosing Diseases in Healthcare Sector

11.3.2 Germany

11.3.2.1 Market for Thermal Scanners in Germany to Grow at Highest CAGR During Forecast Period

11.3.3 France

11.3.3.1 Presence of Automobile Manufacturers in France to Spur Growth of Thermal Scanners Market

11.3.4 Rest of Europe

11.3.4.1 Emerging Economy, Increasing Infrastructure Facilities, and Funding Contributes to Growth of Market in Rest of Europe (RoE)

11.4 APAC

11.4.1 China

11.4.1.1 China is Experiencing High Demand for Thermal Scanners Due to the Outbreak of Coronavirus

11.4.2 Japan

11.4.2.1 Increase in Use of Thermal Cameras in Healthcare Industry LED to Increase in Demand for Thermal Scanners in Japan

11.4.3 India

11.4.3.1 Airport Measures Against Coronavirus in India Drives the Market

11.4.4 Rest of APAC

11.4.4.1 Increasing Implementation of Thermal Scanners at Airports Across the Region is Driving the Market in Rest of APAC

11.5 RoW

11.5.1 Middle East & Africa

11.5.1.1 Ongoing Investments in Oil & Gas and Aerospace & Defense Industry Support Growth of Market

11.5.2 South America

11.5.2.1 Increasing Demand for Monitoring & Inspection in Healthcare & Life Sciences, Aerospace & Defense, and Industrial Sectors Creates Growth Opportunity

12 Competitive Landscape (Page No. - 110)

12.1 Overview

12.2 Market Ranking Analysis

12.2.1 Product Launches

12.2.2 Mergers & Acquisitions

12.2.3 Expansions

12.3 Competitive Leadership Mapping

12.3.1 Visionary Leaders

12.3.2 Innovators

12.3.3 Dynamic Differentiators

12.3.4 Emerging Players

13 Company Profiles (Page No. - 116)

13.1 Introduction

(Business Overview, Products/Solutions/Services Offered, Recent Developments, SWOT Analysis, MnM View)*

13.2 Key Players

13.2.1 FLIR Systems, Inc.

13.2.2 Fluke Corporation

13.2.3 Leonardo S.P.A.

13.2.4 L3HARRIS TECHNOLOGIES, Inc.

13.2.5 Opgal

13.2.6 Axis Communications Ab

13.2.7 Optotherm, Inc.

13.2.8 Seek Thermal Inc.

13.2.9 Thermoteknix Systems LTD.

13.2.10 3M (3M Scott)

13.3 Other Key Players

13.3.1 COX

13.3.2 C-THERMAL

13.3.3 HGH Infrared Systems

13.3.4 Tonbo Imaging

13.3.5 Terabee

13.3.6 Xenics

13.3.7 Vumii Imaging

13.3.8 Infratec GmbH

13.3.9 AMETEK Land

13.3.10 Testo Se & Co. KGaA

*Details on Business Overview, Products/Solutions/Services Offered, Recent Developments, SWOT Analysis, MnM View Might Not Be Captured in Case of Unlisted Companies.

14 Appendix (Page No. - 150)

14.1 Discussion Guide

14.2 Knowledge Store: Marketsandmarkets’ Subscription Portal

14.3 Available Customizations

14.4 Related Reports

14.5 Author Details

List of Tables (104 Tables)

Table 1 Thermal Scanners Market, By Type, 2017–2025 (USD Million)

Table 2 Portable Thermal Scanner Market, By Application, 2017–2025 (USD Million)

Table 3 Fixed Thermal Scanner Market, By Application, 2017–2025 (USD Million)

Table 4 Thermal Scanner Market, By Technology, 2017–2025 (USD Million)

Table 5 Thermal Scanner Market, By Wavelength, 2017–2025 (USD Million)

Table 6 Thermal Scanner Market for SWIR Wavelength, By Application, 2017–2025 (USD Million)

Table 7 Thermal Scanner Market for MWIR Wavelength, By Application, 2017–2025 (USD Million)

Table 8 Thermal Scanner Market for LWIR Wavelength, By Application, 2017–2025 (USD Million)

Table 9 Thermal Scanner Market, By Application, 2017–2025 (USD Million)

Table 10 Thermal Scanner Market for Thermography, By Application Type, 2017–2025 (USD Million)

Table 11 Thermal Scanner Market for Thermography, By Region, 2017–2025 (USD Million)

Table 12 Thermal Scanner Market for Thermography, By Wavelength, 2017–2025 (USD Million)

Table 13 Thermal Scanner Market for Thermography, By Type, 2017–2025 (USD Million)

Table 14 Thermal Scanner Market for Security & Surveillance, By Application Type, 2017–2025 (USD Million)

Table 15 Thermal Scanner Market for Security & Surveillance, By Region, 2017–2025 (USD Million)

Table 16 Thermal Scanner Market for Security & Surveillance, By Wavelength, 2017–2025 (USD Million)

Table 17 Thermal Scanner Market for Security & Surveillance, By Type, 2017–2025 (USD Million)

Table 18 Thermal Scanner Market for Search & Rescue, By Application Type, 2017–2025 (USD Million)

Table 19 Thermal Scanner Market for Search & Rescue, By Region, 2017–2025 (USD Million)

Table 20 Thermal Scanner Market for Search & Rescue, By Wavelength, 2017–2025 (USD Million)

Table 21 Thermal Scanner Market for Search & Rescue, By Type, 2017–2025 (USD Million)

Table 22 Thermal Scanner Market for Other Applications, By Region, 2017–2025 (USD Million)

Table 23 Thermal Scanner Market for Other Applications, By Wavelength, 2017–2025 (USD Million)

Table 24 Thermal Scanner Market for Other Applications, By Type, 2017–2025 (USD Million)

Table 25 Thermal Scanner Market, By Vertical, 2017–2025 (USD Million)

Table 26 Thermal Scanner Market for Industrial Vertical, By Region, 2017–2025 (USD Million)

Table 27 Thermal Scanner Market for Commercial Vertical, By Region, 2017–2025 (USD Million)

Table 28 Thermal Scanner Market for Aerospace & Defense Vertical, By Region, 2017–2025 (USD Million)

Table 29 Thermal Scanner Market for Automotive Vertical, By Region, 2017–2025 (USD Million)

Table 30 Thermal Scanner Market for Healthcare & Lifesciences Vertical, By Region, 2017–2025 (USD Million)

Table 31 Thermal Scanner Market for Oil & Gas Vertical, By Region, 2017–2025 (USD Million)

Table 32 Thermal Scanner Market for Other Verticals, By Region, 2017–2025 (USD Million)

Table 33 Thermal Scanners Market, By Region, 2017–2025 (USD Million)

Table 34 Market in North America, By Country, 2017–2025 (USD Million)

Table 35 Market in North America, By Application, 2017–2025 (USD Million)

Table 36 Market in North America, By Vertical, 2017–2025 (USD Million)

Table 37 Market for Industrial Vertical in North America, By Country, 2017–2025 (USD Million)

Table 38 Market for Commercial Vertical in North America, By Country, 2017–2025 (USD Million)

Table 39 Market for Aerospace & Defense Vertical in North America, By Country, 2017–2025 (USD Million)

Table 40 Market for Automotive Vertical in North America, By Country, 2017–2025 (USD Million)

Table 41 Market for Healthcare & Lifesciences Vertical in North America, By Country, 2017–2025 (USD Million)

Table 42 Market for Oil & Gas Vertical in North America, By Country, 2017–2025 (USD Million)

Table 43 Market for Other Verticals in North America, By Country, 2017–2025 (USD Million)

Table 44 Market in US, By Application, 2017–2025 (USD Million)

Table 45 Market in US, By Vertical, 2017–2025 (USD Million)

Table 46 Market in Canada, By Application, 2017–2025 (USD Million)

Table 47 Market in Canada, By Vertical, 2017–2025 (USD Million)

Table 48 Market in Mexico, By Application, 2017–2025 (USD Million)

Table 49 Market in Mexico, By Vertical, 2017–2025 (USD Million)

Table 50 Market in Europe, By Country, 2017–2025 (USD Million)

Table 51 Market in Europe, By Application, 2017–2025 (USD Million)

Table 52 Market in Europe, By Vertical, 2017–2025 (USD Million)

Table 53 Market for Industrial Vertical in Europe, By Country, 2017–2025 (USD Million)

Table 54 Market for Commercial Vertical in Europe, By Country, 2017–2025 (USD Million)

Table 55 Market for Aerospace & Defense Vertical in Europe, By Country, 2017–2025 (USD Million)

Table 56 Market for Automotive Vertical in Europe, By Country, 2017–2025 (USD Million)

Table 57 Market for Healthcare & Lifesciences Vertical in Europe, By Country, 2017–2025 (USD Million)

Table 58 Market for Oil & Gas Vertical in Europe, By Country, 2017–2025 (USD Million)

Table 59 Market for Other Verticals in Europe, By Country, 2017–2025 (USD Million)

Table 60 Market in UK, By Application, 2017–2025 (USD Million)

Table 61 Market in UK, By Vertical, 2017–2025 (USD Million)

Table 62 Market in Germany, By Application, 2017–2025 (USD Million)

Table 63 Market in Germany, By Vertical, 2017–2025 (USD Million)

Table 64 Market in France, By Application, 2017–2025 (USD Million)

Table 65 Market in France, By Vertical, 2017–2025 (USD Million)

Table 66 Thermal Scanners Market in Rest of Europe, By Application, 2017–2025 (USD Million)

Table 67 Market in Rest of Europe, By Vertical, 2017–2025 (USD Million)

Table 68 Market in APAC, By Country, 2017–2025 (USD Million)

Table 69 Market in APAC, By Application, 2017–2025 (USD Million)

Table 70 Market in APAC, By Vertical, 2017–2025 (USD Million)

Table 71 Market for Industrial Vertical in APAC, By Country, 2017–2025 (USD Million)

Table 72 Market for Commercial Vertical in APAC, By Country, 2017–2025 (USD Million)

Table 73 Market for Aerospace & Defense Vertical in APAC, By Country, 2017–2025 (USD Million)

Table 74 Market for Automotive Vertical in APAC, By Country, 2017–2025 (USD Million)

Table 75 Market for Healthcare & Lifesciences Vertical in APAC, By Country, 2017–2025 (USD Million)

Table 76 Market for Oil & Gas Vertical in APAC, By Country, 2017–2025 (USD Million)

Table 77 Market for Other Verticals in APAC, By Country, 2017–2025 (USD Million)

Table 78 Market in China, By Application, 2017–2025 (USD Million)

Table 79 Market in China, By Vertical, 2017–2025 (USD Million)

Table 80 Market in Japan, By Application, 2017–2025 (USD Million)

Table 81 Market in Japan, By Vertical, 2017–2025 (USD Million)

Table 82 Market in India, By Application, 2017–2025 (USD Million)

Table 83 Market in India, By Vertical, 2017–2025 (USD Million)

Table 84 Market in Rest of APAC, By Application, 2017–2025 (USD Million)

Table 85 Market in Rest of APAC, By Vertical, 2017–2025 (USD Million)

Table 86 Market in RoW, By Region, 2017–2025 (USD Million)

Table 87 Market in RoW, By Application, 2017–2025 (USD Million)

Table 88 Market in RoW, By Vertical, 2017–2025 (USD Million)

Table 89 Market for Industrial Vertical in RoW, By Region, 2017–2025 (USD Million)

Table 90 Market for Commercial Vertical in RoW, By Region, 2017–2025 (USD Million)

Table 91 Market for Aerospace & Defense Vertical in RoW, By Region, 2017–2025 (USD Million)

Table 92 Market for Automotive Vertical in RoW, By Region, 2017–2025 (USD Million)

Table 93 Market for Healthcare & Lifesciences Vertical in RoW, By Region, 2017–2025 (USD Million)

Table 94 Market for Oil & Gas Vertical in RoW, By Region, 2017–2025 (USD Million)

Table 95 Market for Other Verticals in RoW, By Region, 2017–2025 (USD Million)

Table 96 Market in Middle East & Africa, By Application, 2017–2025 (USD Million)

Table 97 Market in Middle East & Africa, By Vertical, 2017–2025 (USD Million)

Table 98 Market in South America, By Application, 2017–2025 (USD Million)

Table 99 Thermal Scanners Market in South America, By Vertical, 2017–2025 (USD Million)

Table 100 Market Player Ranking, 2019

Table 101 Product Launches, 2019

Table 102 Agreements/Collaborations/Partnerships/Contracts, 2019

Table 103 Mergers & Acquisitions, 2019

Table 104 Expansions, 2019

List of Figures (40 Figures)

Figure 1 Thermal Scanners Market: Research Design

Figure 2 Market Size Estimation Methodology: Bottom-Up Approach

Figure 3 Market Size Estimation Methodology: Top-Down Approach

Figure 4 Data Triangulation

Figure 5 Portable Thermal Scanner Market to Grow at Higher CAGR During Forecast Period

Figure 6 Thermal Scanner Market for LWIR Wavelength Segment to Hold Largest Share in 2025

Figure 7 Thermography Application to Dominate Thermal Scanner Market During Forecast Period

Figure 8 Thermal Scanner Market for Commercial Vertical to Grow at Highest CAGR During Forecast Period

Figure 9 North America to Hold Largest Share of Thermal Scanner Market in 2025

Figure 10 Growing Demand for Thermal Scanners at Airports for Coronavirus Detection to Drive Market Growth

Figure 11 Thermography and US to Be Largest Shareholders of Thermal Scanner Market in 2025

Figure 12 Thermal Scanner Market in China to Grow at Highest CAGR During Forecast Period

Figure 13 Thermal Scanner Market: Drivers, Restraints, Opportunities, and Challenges

Figure 14 Thermal Scanner Market Drivers and Their Impact

Figure 15 Thermal Scanner Market Restraint and Its Impact

Figure 16 Thermal Scanner Market Opportunities and Their Impact

Figure 17 Thermal Scanner Market Challenge and Its Impact

Figure 18 Thermal Scanners Market, By Type

Figure 19 Portable Thermal Scanners to Exhibit Higher CAGR From 2020 to 2025

Figure 20 Thermal Scanner Market, By Technology

Figure 21 Uncooled Thermal Scanner Market is Expected to Grow at Higher CAGR From 2020 to 2025

Figure 22 Thermal Scanner Market, By Wavelength

Figure 23 Thermal Scanner Market for SWIR Segment is Expected to Grow at Highest CAGR From 2020 to 2025

Figure 24 Thermal Scanner Market, By Application

Figure 25 Thermal Scanner Market for Thermography is Expected to Grow at Highest CAGR From 2020 to 2025

Figure 26 Thermal Scanner Market for Commercial Vertical is Expected to Grow at Highest CAGR From 2020 to 2025

Figure 27 Geographic Segmentation of Thermal Scanners Market

Figure 28 APAC to Witness Highest Growth During Forecast Period (USD Million)

Figure 29 North America: Thermal Scanner Market Snapshot

Figure 30 Europe: Thermal Scanner Market Snapshot

Figure 31 Germany to Witness the Highest CAGR During Forecast Period

Figure 32 APAC: Thermal Scanners Market Snapshot

Figure 33 China to Dominate the Thermal Scanner Market in APAC During the Forecast Period

Figure 34 Middle East and Africa to Hold the Largest Share of the Thermal Scanner Market in RoW

Figure 35 Organic and Inorganic Strategies Adopted By Companies Operating in Thermal Scanner Market

Figure 36 Thermal Scanner (Global) Competitive Leadership Mapping

Figure 37 FLIR Systems, Inc.: Company Snapshot

Figure 38 Leonardo S.P.A.: Company Snapshot

Figure 39 L3HARRIS TECHNOLOGIES, Inc.: Company Snapshot

Figure 40 3M: Company Snapshot

The study involved four major activities for estimating the size of the global thermal scanners market. Exhaustive secondary research has been carried out to collect information relevant to the market, the peer market, and the parent market. Primary research has been undertaken to validate these findings, assumptions, and sizing with the industry experts across the value chain of the thermal scanners market. Both top-down and bottom-up approaches have been employed to estimate the complete market size. After that, the market breakdown and data triangulation methods have been used to estimate the size of different segments and subsegments of the market.

Secondary Research

The research methodology used to estimate and forecast the size of the thermal scanners market began by capturing data related to the revenues of key vendors in the market through secondary research. This study involved the extensive use of secondary sources, directories, and databases (such as Hoovers, Bloomberg Businessweek, Factiva, and OneSource) to identify and collect information useful for a technical, market-oriented, and commercial study of the thermal scanners market. Vendor offerings have been taken into consideration to determine the market segmentation. The entire research methodology included the study of annual reports, press releases, and investor presentations of companies; white papers; and certified publications and articles by recognized authors, directories, and databases.

Primary Research

The thermal scanners market comprises several stakeholders, such as suppliers of standard components and original equipment manufacturers (OEMs). The demand side of this market is characterized by the development and manufacture of thermal scanning applications as well as by different verticals. Various primary sources from both the supply and demand sides of the market have been interviewed to obtain qualitative and quantitative information. Following is the breakdown of primary respondents.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches have been used to estimate and validate the size of the thermal scanners market and its segments. The research methodology used to estimate the market size included the following:

- Key players in the market have been identified through extensive secondary research.

- The supply chain of the manufacturing industry and the size of the thermal scanners market, in terms of value, have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size—using the market size estimation process explained above—the total market has been split into several segments and subsegments. Data triangulation and market breakdown procedures have been employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment. The data has been triangulated by studying various factors and trends from both the demand and supply sides of the thermal scanners market.

Research Objectives

- To describe and forecast the overall size of the thermal scanners market by technology, wavelength, type, application, and vertical, in terms of value

- To describe and forecast the size of the market, by regions—North America, Europe, Asia Pacific (APAC), and the Rest of the World (RoW) in terms of value

- To provide detailed information regarding the major factors such as drivers, restraints, opportunities, and challenges influencing the market growth

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and contributions to the overall market

- To strategically profile the key players and comprehensively analyze their position in the thermal scanners market in terms of their ranking and core competencies as well as provide detailed information on the competitive landscape of the market

- To analyze competitive developments such as product launches and developments, expansions, partnerships, agreements, contracts, and mergers & acquisitions undertaken in the thermal scanners market

Available Customizations

Along with the market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for the report:

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Critical Questions

- What are new application areas being explored by the providers of thermal scanning products?

- Who are the key players in the thermal scanning market, and how intense is the competition in this market?

Growth opportunities and latent adjacency in Thermal Scanners Market