Radio Frequency Components (RFC) Market for Consumer Electronics Global Forecast & Analysis (2012 2017) By Applications, Modules, Materials & Geography

Radio Frequency Components (RFC) Market (Antenna Switches, Filters, Power Amplifiers, Demodulators & Its Tunability Aspects) for Consumer Electronics Global Forecast & Analysis (2012 2017) By Applications [Cellular Phones, Tablets, E-Readers, GPS Devices, Laptops, Smart TVs, Set Top Boxes, Others], Modules, Materials & Geography

Radio frequency refers to the radio signals that vary from 3 KHz (1 KHz = 10^3 Hertz) to 300 GHz (1 GHz = 10^9 Hertz). In the field of consumer electronics, the area of interest is radio frequency ranging between 10 MHz and 10 GHz. The major components used in RF front communications in consumer electronics devices are mainly Receivers /Transmitters, Filters, Power Amplifiers, Duplexers, Antenna Switches, and Demodulators.

With RF developments, products that are enabled with internet protocols embark upon their existence and expansion all over the world. Developed regions such as Japan, China, and U.S had enabled this technology with changed architecture of communication devices five years back but developing nations such as India, Brazil, and South Africa have launched these technologies recently.

At present, most of the favorable frequency bands are occupied by cell phones or by government or unlicensed bands with limited transmission range. New devices such as tablets, head up displays, etc. have to rely on less favorable frequency bands, which have more noise distribution then the allotted lower frequencies.

This report refers to the RF components market, which caters to the wide range of applications, components, materials, and modules. RF components cover antenna switches, filters, power amplifiers and tuners; whereas RF components application areas cover cellular phones, tablets, e-readers, GPS devices, laptops, smart TVs, and others.

RF Components market is segmented into the following categories:-

- RFC Market- By Modules: Antenna Switch Module, Rx Module, Tx Module, Duplexer and Pa Module, Multi Duplexer Module, Rx and Duplexer Module

- RFC Market- By Applications: Cellular Phones, Tablets, E-Readers, GPS Devices, Laptops, Smart TVs, Others

- RFC Market- By Components: Antenna, filters, Power Amplifiers

- RFC Market- By Tunability: Antenna Tunability, Filters Tunability, Pas Tunability

- RFC Market- By Materials: Silicon, Silicon Germanium, Gallium arsenide, Indium Phosphide and Gallium Nitride

- RFC Market- By Geography: Americas divided into North America and South America; Europe divided into Italy, France, Germany, U.K., and others; APAC divided into China, Japan, Taiwan, South Korea & India, Others; ROW divided into Middle East and Africa

In addition, the report entails details of:

- Key growth drivers and restraints of the market

- Burning issues and opportunities

- Impact analysis of the market dynamics

- Analysis of different applications of the market

- Key trends shaping and influencing the market

- Identification of segments with high growth potential

- Region specific developments and peculiarities

- Key growth strategies for companies in the precision monitoring market

- The competitive landscape of the industry

The report also captures the market roadmap with market sizes, trend lines, revenue forecasts, value chain, market & product trends, socio-economic trends and regulations, competitive landscape.

Various secondary sources directories, e-magazines, and research projects, databases such as Factiva, OneSource, Bloomberg, Reuters, and universities blogs were used to identify and collect information useful for this extensive technical and commercial study of the global RF Components market. The primary sources selected experts from related industries and preferred suppliers - were interviewed to obtain and verify critical information as well as assess future prospects.

The key players in the RF Components Market were identified through secondary research while formulating for the industry value chain and their market revenue was determined through primary and secondary research.

Major players operating in the RF Components (RFC) market are Skyworks Inc. (U.S.), Murata Manufacturing (Japan), Triquint Semiconductors (U.S.), AVAGO Technologies (U.S.), RDA Microelectronics (China) and RF Micro devices (U.S.).

The key stakeholders identified for this report include:

- Manufacturers

- User end companies

- Integrators

- Foundries

- Researchers

- Raw material manufacturers

- RF components testing market players

- Private equity

- Investment bankers.

RF Components in correct combinations are the basic components desired by any communication devices for their functioning. Today, with certain technological changes in environment, RF components demand is also increasing. The other factor that affects this market is its capability to fit in very small sizes in the mentioned applications. With increasing network of universal mobile telecommunications system (3G), the market has witnessed high demand for switches and tuners due to their supporting feature to provide precise functionality to the other main RF devices such as power amplifiers, demodulators, etc.

Scope for massive research and development over the past few years had also helped in the evolution of new technologies according to Moores Law. This had introduced different materials such as silicon germanium, gallium arsenide, and others in the past, required for smooth functioning of the communication devices at different specified ranges. Different modules are enabled by embedding the components on a chip known as system-on-chip (SOC). Previously, components used to take more spaces on board. The effectiveness of this can be seen from the current launch of HTC handsets for LTE or the launch of Google TV set top boxes.

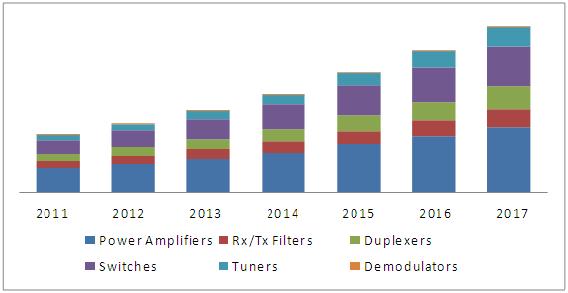

RF components market for consumer electronics was valued at $5,933 million in 2011 and is expected to reach $17,123 million by 2017 at an estimated CAGR of 19.4% from 2012 to 2017. The demand of RF components is due to the launch of new devices which contains advance features such as virtual communication, haptics reorganization from a distance and so on.

Although radio frequencyis a rate of oscillation, the term "radio frequency" or its acronym "RF" are also used as a synonym for radio i.e. to describe the use of wireless communication, as opposed to communication via an electrical connector.

The major players operating in the RF Components (RFC) market are Skyworks Inc. (U.S.), Murata Manufacturing (Japan), Triquint Semiconductors (U.S.), AVAGO Technologies (U.S.), RDA Microelectronics (China) and RF Micro devices (U.S.).

Source: MarketsandMarkets Analysis

TABLE OF CONTENTS

1 INTRODUCTION

1.1 KEY TAKE-AWAYS

1.2 REPORT DESCRIPTION

1.3 MARKETS COVERED

1.4 STAKEHOLDERS

1.5 RESEARCH METHODOLOGY

1.5.1 MARKET SIZE

1.5.2 MARKET CRACKDOWN

1.5.3 MARKET MODEL

1.5.3.1 Components of market model

1.5.4 KEY DATA POINTS FROM SECONDARY SOURCES

1.5.5 KEY DATA POINTS FROM PRIMARY SOURCES

1.5.6 ASSUMPTIONS MADE FOR THIS REPORT

1.5.7 LIST OF COMPANIES COVERED DURING THE RESEARCH

2 EXECUTIVE SUMMARY

3 MARKET OVERVIEW

3.1 MARKET DEFINITION

3.2 ROADMAP TO RF TECHNOLOGY

3.3 MARKET DYNAMICS

3.3.1 DRIVERS

3.3.1.1 High end requirement in communication devices

3.3.1.2 Expansion of new technology in untapped regions

3.3.1.3 Introduction on new materials to be compatible with all types of devices

3.3.2 RESTRAINT

3.3.2.1 Highly fragmented market cause less price margin

3.3.3 OPPORTUNITIES

3.3.3.1 Rapid technological transitions

3.4 VALUE CHAIN ANALYSIS

3.5 BURNING ISSUES

3.5.1 LOCAL MANUFACTURERS EXISTENCE LEADS TO DUPLICITY

3.5.2 ENVIRONMENTAL ISSUES MAY AFFECT THE OVERALL BUSINESS

3.6 WINNING IMPERATIVES

3.6.1 CHANGE IN ARCHITECTURE DESIGN OF COMMUNICATION DEVICES

3.7 PORTER FIVE FORCES

3.7.1 BARGAINING POWER OF SUPPLIER

3.7.2 BARGAINING POWER OF BUYER

3.7.3 THREAT FROM NEW ENTRANTS

3.7.4 THREAT FROM SUBSTITUTES

3.7.5 DEGREE OF COMPETITION

4 RFC GLOBAL FORECAST & ANALYSIS, BY COMPONENTS

4.1 INTRODUCTION

4.2 RF FILTER (RX/TX FILTERS)

4.2.1 SURFACE ACOUSTIC WAVE (SAW) FILTERS

4.2.2 BULK ACOUSTIC WAVE (BAW) FILTERS

4.3 DUPLEXERS

4.4 POWER AMPLIFIERS

4.5 ANTENNA SWITCHES

4.5.1 TYPES OF ANTENNA SWITCHES

4.5.1.1 Gallium Arsenide (GaAs) HBT switches

4.5.1.2 High Resistive-Silicon on Insulator (HR-SOI) switches

4.5.1.3 Silicon on Sapphire(SOS) switches

4.6 DEMODULATORS

5 RFC GLOBAL FORECAST & ANALYSIS, BY TUNABILITY

5.1 INTRODUCTION

5.1.1 ANTENNA TUNING

5.1.2 POWER AMPLIFIERS TUNING

5.1.3 FILTER/DUPLEXERS TUNING

6 RFC GLOBAL FORECAST & ANALYSIS, BY MODULES

6.1 INTRODUCTION

6.2 ANTENNA SWITCH MODULE

6.3 RX MODULE

6.4 TX MODULE

6.5 DUPLEXER + PA MODULE

6.6 MULTI DUPLEXER MODULE (ANTENNA SWITCH MODULE/RX MODULE + DUPLEXERS)

6.7 RX + DUPLEXER MODULE (RX MODULE + SINGLE DUPLEXER)

7 RFC GLOBAL FORECAST & ANALYSIS, BY APPLICATIONS

7.1 INTRODUCTION

7.2 CELLULAR PHONES

7.2.1 FEATURE PHONES

7.2.2 SMART PHONES

7.3 TABLETS

7.4 E-READERS

7.5 GPS DEVICES

7.6 NOTEBOOKS

7.7 SMART TVS

7.8 SET TOP BOXES

8 RFC GLOBAL FORECAST & ANALYSIS, BY MATERIALS

8.1 INTRODUCTION

8.2 SILICON

8.3 GALLIUM ARSENIDE

8.4 SILICON-GERMANIUM

8.5 COMPARISON OF VARIOUS COMPOUNDS USED IN RF COMPONENTS MANUFACTURING

8.6 FUTURE MATERIALS USED IN RF DEVICES MANUFACTURING

8.6.1 GALLIUM NITRIDE

8.6.2 INDIUM PHOSPHIDE

9 RFC GLOBAL FORECAST & ANALYSIS, BY GEOGRAPHY

9.1 INTRODUCTION

9.2 AMERICAS

9.2.1 NORTH AMERICA

9.2.2 SOUTH AMERICA

9.3 EUROPE

9.4 APAC

9.5 ROW

10 COMPETITIVE LANDSCAPE

10.1 INTRODUCTION

10.2 MARKET SHARE ANALYSIS

10.3 KEY GROWTH STRATEGIES

10.4 MERGERS & ACQUISITIONS

10.5 NEW PRODUCT LAUNCH/ DEVELOPMENT

10.6 AGREEMENTS

10.7 OTHER STRATEGIES

11 COMPANY PROFILES

11.1 FAB AND FABLESS COMPANIES

11.1.1 AVAGO TECHNOLOGIES LIMITED

11.1.1.1 Overview

11.1.1.2 Products & services

11.1.1.3 Financials

11.1.1.4 Strategy

11.1.1.5 Developments

11.1.2 EPCOS

11.1.2.1 Overview

11.1.2.2 Products & services

11.1.2.3 Financials

11.1.2.4 Strategy

11.1.2.5 Developments

11.1.3 MURATA MANUFACTURING CO., LIMITED

11.1.3.1 Overview

11.1.3.2 Products & services

11.1.3.3 Financials

11.1.3.4 Strategy

11.1.3.5 Developments

11.1.4 SKYWORKS INC.

11.1.4.1 Overview

11.1.4.2 Products & services

11.1.4.3 Financials

11.1.4.4 Strategy

11.1.4.5 Developments

11.1.5 FREESCALE SEMICONDUCTOR INC.

11.1.5.1 Overview

11.1.5.2 Products & services

11.1.5.3 Financials

11.1.5.4 Strategy

11.1.5.5 Developments

11.1.6 FUJITSU LIMITED

11.1.6.1 Overview

11.1.6.2 Products & services

11.1.6.3 Financials

11.1.6.4 Strategy

11.1.6.5 Developments

11.1.7 NXP SEMICONDUCTORS N.V

11.1.7.1 Overview

11.1.7.2 Products & services

11.1.7.3 Financials

11.1.7.4 Strategy

11.1.7.5 Developments

11.1.8 RENESAS ELECTRONICS CORPORATION

11.1.8.1 Overview

11.1.8.2 Products & services

11.1.8.3 Financials

11.1.8.4 Strategy

11.1.9 RF MICRO DEVICES INC.

11.1.9.1 Overview

11.1.9.2 Products & services

11.1.9.3 Financials

11.1.9.4 Strategy

11.1.9.5 Developments

11.1.10 ROHM COMPANY LIMITED

11.1.10.1 Overview

11.1.10.2 Products & services

11.1.10.3 Financials

11.1.10.4 Strategy

11.1.10.5 Developments

11.1.11 STMICROELECTRONICS N.V

11.1.11.1 Overview

11.1.11.2 Products & services

11.1.11.3 Financials

11.1.11.4 Strategy

11.1.11.5 Developments

11.1.12 TRIQUINT SEMICONDUCTOR INC.

11.1.12.1 Overview

11.1.12.2 Products & services

11.1.12.3 Financials

11.1.12.4 Strategy

11.1.12.5 Developments

11.1.13 CREE INC.

11.1.13.1 Overview

11.1.13.2 Products & services

11.1.13.3 Financials

11.1.13.4 Strategy

11.1.13.5 Developments

11.1.14 AIXTRON SE

11.1.14.1 Overview

11.1.14.2 Products & services

11.1.14.3 Financials

11.1.14.4 Strategy

11.1.14.5 Developments

11.1.15 INTERNATIONAL QUANTUM EPITAXY PLC

11.1.15.1 Overview

11.1.15.2 Products & services

11.1.15.3 Financials

11.1.15.4 Strategy

11.1.15.5 Developments

11.1.16 TEXAS INSTRUMENTS INC.

11.1.16.1 Overview

11.1.16.2 Products & services

11.1.16.3 Financials

11.1.16.4 Strategy

11.1.16.5 Developments

11.1.17 TOSHIBA CORPORATION

11.1.17.1 Overview

11.1.17.2 Products & services

11.1.17.3 Financials

11.1.17.4 Strategy

11.1.17.5 Developments

11.1.18 TAIWAN SEMICONDUCTOR MANUFACTURING CO. LIMITED

11.1.18.1 Overview

11.1.18.2 Products & services

11.1.18.3 Financials

11.1.18.4 Strategy

11.1.18.5 Developments

11.1.19 RDA MICROELECTRONICS, INC.

11.1.19.1 Overview

11.1.19.2 Products & services

11.1.19.3 Financials

11.1.19.4 Strategy

11.1.19.5 Developments

11.1.20 SILICON LABORATORIES INC.

11.1.20.1 Overview

11.1.20.2 Products & services

11.1.20.3 Financials

11.1.20.4 Strategy

11.1.20.5 Developments

11.2 APPLICATION COMPANIES

11.2.1 APPLE INC

11.2.1.1 Overview

11.2.1.2 Products & services

11.2.1.3 Financials

11.2.1.4 Strategy

11.2.1.5 Developments

11.2.2 MICROSOFT CORPORATION

11.2.2.1 Overview

11.2.2.2 Products & services

11.2.2.3 Financials

11.2.2.4 Strategy

11.2.2.5 Developments

11.2.3 HEWLETT-PACKARD COMPANY

11.2.3.1 Overview

11.2.3.2 Products & services

11.2.3.3 Financials

11.2.3.4 Strategy

11.2.3.5 Developments

11.2.4 PANASONIC CORPORATION

11.2.4.1 Overview

11.2.4.2 Products & services

11.2.4.3 Financials

11.2.4.4 Developments

11.2.5 SAMSUNG ELECTRONICS CO. LIMITED

11.2.5.1 Overview

11.2.5.2 Products & services

11.2.5.3 Financials

11.2.5.4 Strategy

11.2.5.5 Developments

APPENDIX

RECOMMENDED READINGS

LIST OF TABLES

TABLE 1 FORECAST COMPONENTS OF MARKET MODEL

TABLE 2 INFLUENTIAL COMPONENTS OF MARKET MODEL

TABLE 3 RF COMPONENTS MARKET, 2012 2017 ($MILLION)

TABLE 4 RF COMPONENTS MARKET, BY APPLICATIONS, 2012 2017 ($MILLION)

TABLE 5 RX/TX MARKET REVENUE, BY GEOGRAPHY, 2012 2017 ($MILLION)

TABLE 6 RX/TX MARKET REVENUE, BY TYPES, 2012 2017 ($MILLION)

TABLE 7 RX/TX FILTERS FOR CONSUMER ELECTRONICS, 2012 2017 (MILLION UNITS)

TABLE 8 DUPLEXERS MARKET REVENUE, BY GEOGRAPHY, 2012 2017 ($MILLION)

TABLE 9 DUPLEXERS FOR CONSUMER ELECTRONICS, 2012 2017 (MILLION UNITS)

TABLE 10 POWER AMPLIFIERS MARKET, BY GEOGRAPHY, 2012 2017 ($MILLION)

TABLE 11 POWER AMPLIFIERS FOR CONSUMER ELECTRONICS, 2012 2017 (MILLION UNITS)

TABLE 12 ANTENNA SWITCHES MARKET REVENUE, BY GEOGRAPHY, 2012 2017 ($MILLION)

TABLE 13 ANTENNA SWITCHES FOR CONSUMER ELECTRONICS, 2012 2017 (MILLION UNITS)

TABLE 14 ANTENNA SWITCHES MARKET REVENUE, BY TYPES, 2012 2017 ($MILLION)

TABLE 15 DEMODULATORS MARKET, BY GEOGRAPHY, 2012 2017 ($MILLION)

TABLE 16 TUNERS MARKET REVENUE, BY TYPES, 2012 2017 ($MILLION)

TABLE 17 TUNERS FOR CONSUMER ELECTRONICS, 2012 2017 (MILLION UNITS)

TABLE 18 RF FRONT END MODULES MARKET, 2012 2017 ($MILLION)

TABLE 19 RF COMPONENTS ENABLED APPLICATIONS SEGMENT, 2012 2017 (MILLION UNITS)

TABLE 20 RF COMPONENTS MARKET, IN CELLULAR PHONES, BY TYPES, 2012 2017 ($MILLION)

TABLE 21 RF COMPONENTS IN CELLULAR PHONES, 2012 2017 (MILLION UNITS)

TABLE 22 MOBILE PHONES, BY TYPES, 2012 2017 (MILLION UNITS)

TABLE 23 RF COMPONENTS IN FEATURE PHONES, 2012 2017 (MILLION UNITS)

TABLE 24 FEATURE PHONES, RF COMPONENTS ASP, 2012 2017 ($)

TABLE 25 RF COMPONENTS MARKET, IN FEATURE PHONES, BY TYPES, 2012 2017 ($MILLION)

TABLE 26 RF COMPONENTS IN SMARTPHONES, 2012 2017 (MILLION UNITS)

TABLE 27 SMARTPHONES, RF COMPONENTS ASP, 2012 2017 ($)

TABLE 28 RF COMPONENTS MARKET, IN SMART PHONES, BY TYPES, 2012 2017 ($MILLION)

TABLE 29 RF COMPONENTS IN TABLETS, 2012 2017 (MILLION UNITS)

TABLE 30 TABLETS, RF COMPONENTS ASP, 2012 2017 ($)

TABLE 31 RF COMPONENTS MARKET, IN TABLETS, BY TYPES, 2012 2017 ($MILLION)

TABLE 32 RF COMPONENTS IN EREADERS, 2012 2017 (MILLION UNITS)

TABLE 33 EREADERS, RF COMPONENTS ASP, 2012 2017 ($)

TABLE 34 RF COMPONENTS MARKET, IN EREADERS, BY TYPES, 2012 2017 ($MILLION)

TABLE 35 RF COMPONENTS IN GPS DEVICES, 2012 2017 (MILLION UNITS)

TABLE 36 GPS DEVICES, RF COMPONENTS ASP, 2012 2017 ($)

TABLE 37 RF COMPONENTS MARKET, IN GPS DEVICES, BY TYPES, 2012 2017 ($MILLION)

TABLE 38 RF COMPONENTS IN NOTEBOOKS, 2012 2017 (MILLION UNITS)

TABLE 39 NOTEBOOK, RF COMPONENTS ASP, 2012 2017 ($)

TABLE 40 RF COMPONENTS MARKET, IN NOTEBOOKS, BY TYPES, 2012 2017 ($MILLION)

TABLE 41 RF COMPONENTS IN SMART TVS, 2012 2017 (MILLION UNITS)

TABLE 42 SMART TVS, RF COMPONENTS ASP, 2012 2017 ($)

TABLE 43 RF COMPONENTS MARKET, IN SMART TVS, BY TYPES, 2012 2017 ($MILLION)

TABLE 44 RF COMPONENTS IN SET TOP BOXES, 2012 2017 (MILLION UNITS)

TABLE 45 SET TOP BOXES, RF COMPONENTS ASP, 2012 2017 ($)

TABLE 46 RF COMPONENTS MARKET, IN SMART TVS, BY TYPES, 2012 2017 ($MILLION)

TABLE 47 COMPETITIVE INDEX OF MATERIALS USED IN MAKING MATERIALS (%)

TABLE 48 PROPERTIES OF VARIOUS RF COMPONENT MATERIALS

TABLE 49 RF COMPONENTS MARKET, AMERICAS, BY REGIONS, 2012 2017 ($MILLION)

TABLE 50 RF COMPONENTS MARKET, AMERICAS, BY COMPONENTS, 2012 2017 ($MILLION)

TABLE 51 RF COMPONENTS MARKET, NORTH AMERICA, BY COUNTRIES, 2012 2017 ($MILLION)

TABLE 52 RF COMPONENTS MARKET, NORTH AMERICA, BY COMPONENTS, 2012 2017 ($MILLION)

TABLE 53 RF COMPONENTS MARKET, SOUTH AMERICA, BY COUNTRIES, 2012 2017 ($MILLION)

TABLE 54 RF COMPONENTS MARKET, SOUTH AMERICA, BY COMPONENTS, 2012 2017 ($MILLION)

TABLE 55 RF COMPONENTS MARKET, EUROPE, BY COUNTRIES, 2012 2017 ($MILLION)

TABLE 56 RF COMPONENTS MARKET, EUROPE, BY COMPONENTS, 2012 2017 ($MILLION)

TABLE 57 RF COMPONENTS MARKET, APAC, BY COUNTRIES, 2012 2017 ($MILLION)

TABLE 58 RF COMPONENTS MARKET, EUROPE, BY COMPONENTS, 2012 2017 ($MILLION)

TABLE 59 RF COMPONENTS MARKET, ROW, BY REGIONS, 2012 2017 ($MILLION)

TABLE 60 RF COMPONENTS MARKET, EUROPE, BY COMPONENTS, 2012 2017 ($MILLION)

TABLE 61 MAJOR PLAYERS RANK, REVENUE ($BILLION & MARKET SHARE), 2011 (%)

TABLE 62 MAJOR PLAYERS REVENUE & Y-O-Y % CHANGE

TABLE 63 MERGERS & ACQUISITIONS

TABLE 64 NEW PRODUCT LAUNCH/ DEVELOPMENT

TABLE 65 AGREEMENTS

TABLE 66 OTHER STRATEGIES

TABLE 67 AVAGO REVENUE, 2009 2011 ($MILLION)

TABLE 68 RELATIVE ANALYSIS OF AVAGO TECHNOLOGIES, 2009 2011

TABLE 69 RELATIVE ANALYSIS OF SKYWORKS INC., 2009 2011

TABLE 70 FREESCALE SEMICONDUCTOR: MARKET REVENUE, BY PRODUCTS, 2009 2011 ($MILLION)

TABLE 71 FREESCALE SEMICONDUCTOR: MARKET REVENUE, BY GEOGRAPHY, 2009 2011 ($MILLION)

TABLE 72 FUJITSU LTD.: MARKET REVENUE, BY PRODUCTS, 2009 2011 ($MILLION)

TABLE 73 FUJITSU LTD.: MARKET REVENUE, BY GEOGRAPHY, 2009 2011 ($MILLION)

TABLE 74 NXP SEMICONDUCTORS N.V: REVENUE & MARKET SHARE, 2010 2011 ($MILLION)

TABLE 75 NXP SEMICONDUCTORS N.V: MARKET REVENUE BY PRODUCT SEGMENTS, 2010 2011 ($MILLION)

TABLE 76 NXP SEMICONDUCTOR N.V: MARKET REVENUE, BY GEOGRAPHY, 2010 2011 ($MILLION)

TABLE 77 RENESAS ELECTRONICS CORP.: MARKET REVENUE, BY PRODUCT SEGMENTS, 2009 2011 ($MILLION)

TABLE 78 RENESAS ELECTRONICS CORP.: MARKET REVENUE, BY GEOGRAPHY, 2010 2011 ($MILLION)

TABLE 79 RF MICRO DEVICES, INC.: REVENUE & MARKET SHARE, 2010 2011 ($MILLION)

TABLE 80 RF MICRO DEVICES, INC.: MARKET REVENUE, BY PRODUCTS, 2010 2011 ($MILLION)

TABLE 81 RF MICRO DEVICES, INC.: MARKET REVENUE, BY GEOGRAPHY, 2010 2011 ($MILLION)

TABLE 82 ROHM CO., LTD.: MARKET REVENUE, BY PRODUCT SEGMENTS, 2010 2011 ($MILLION)

TABLE 83 ROHM CO., LTD.: MARKET REVENUE BY GEOGRAPHY, 2010 2011 ($MILLION)

TABLE 84 STMICROELECTRONICS: MARKET REVENUE BY PRODUCTS, 2009 2011 ($MILLION)

TABLE 85 STMICROELECTRONICS: MARKET REVENUE, BY GEOGRAPHY, 2009 2011 ($MILLION)

TABLE 86 TRIQUINT SEMICONDUCTOR, INC.: REVENUE & MARKET SHARE, 2010 2011 ($MILLION)

TABLE 87 TRIQUINT SEMICONDUCTOR, INC.: MARKET REVENUE, BY PRODUCTS, 2010 2011 ($MILLION)

TABLE 88 CREE INC: MARKET REVENUE BY PRODUCTS, 2010 2011 ($MILLION)

TABLE 89 CREE INC: MARKET REVENUE, BY GEOGRAPHY, 2010 2011 ($MILLION)

TABLE 90 AIXTRON SE: MARKET REVENUE, BY GEOGRAPHY, 2009 2011 ($MILLION)

TABLE 91 AIXTRON SE: MARKET REVENUE, BY PRODUCTS, 2009 2011 ($MILLION)

TABLE 92 INTERNATIONAL QUANTUM EPITAXY PLC: MARKET REVENUE, BY GEOGRAPHY, 2010 2011 ($MILLION)

TABLE 93 INTERNATIONAL QUANTUM EPITAXY PLC: MARKET REVENUE, BY PRODUCTS, 2010 2011 ($MILLION)

TABLE 94 TEXAS INSTRUMENTS, INC.: MARKET REVENUE BY PRODUCT SEGMENTS, 2009 2011 ($MILLION)

TABLE 95 TEXAS INSTRUMENTS, INC.: MARKET REVENUE, BY GEOGRAPHY, 2009 2011 ($MILLION)

TABLE 96 TOSHIBA CORP.: MARKET REVENUE, BY BUSINESS SEGMENTS, 2009 2011 ($MILLION)

TABLE 97 TOSHIBA CORP.: MARKET REVENUE, BY GEOGRAPHY, 2009 2011 ($MILLION)

TABLE 98 FINANCIAL ANALYSIS OF TSMC

TABLE 99 RDA MICROELECTRONICS REVENUE, BY SEGMENTS

TABLE 100 RELATIVE ANALYSIS OF RDA MICROELECTRONICS, 2009 2011

TABLE 101 RELATIVE ANALYSIS OF SILICON LABS, 2009 2011

LIST OF FIGURES

FIGURE 1 RF COMPONENTS MARKET RESEARCH STRATEGY

FIGURE 2 RF COMPONENTS MARKET CRACKDOWN STRATEGY

FIGURE 3 ARCHITECTURE OF MARKET MODEL

FIGURE 4 OVERVIEW OF RF COMPONENTS MARKET

FIGURE 5 ROADMAP OF RF TECHNOLOGY

FIGURE 6 IMPACT ANALYSIS OF DRIVERS

FIGURE 7 IMPACT ANALYSIS OF RESTRAINTS

FIGURE 8 VALUE CHAIN OF RFC MARKET

FIGURE 9 PORTER FIVE FORCES ANALYSIS

FIGURE 10 RF COMPONENTS MARKET, 2012 2017 ($MILLION)

FIGURE 11 APPLICATION SPACE OF RF FILTERS

FIGURE 12 GAAS SWITCHES MARKET SHARE (2012 2017)

FIGURE 13 HR-SOI SWITCHES MARKET SHARE (2012 2017)

FIGURE 14 SOS SWITCHES MARKET SHARE (2012 2017)

FIGURE 15 COMPARISON OF RF DISCRETE AND MODULE MARKET, 2012 2017 ($MILLION)

FIGURE 16 MODULES USED IN DIFFERENT TECHNOLOGIES, 2012

FIGURE 17 CELLULAR PHONES (MILLION UNITS) & Y-0-Y CHANGE(%), 2012 2017

FIGURE 18 E-READERS (MILLION UNITS) & Y-0-Y CHANGE (%), 2012 2017

FIGURE 19 GPS DEVICES (MILLION UNITS) & Y-0-Y CHANGE (%),2012 2017

FIGURE 20 NOTEBOOK (MILLION UNITS) & Y-0-Y CHANGE (%),2012 2017

FIGURE 21 SMART TVS (MILLION UNITS) & Y-0-Y CHANGE (%),2012 2017

FIGURE 22 SET TOP BOXES (MILLION UNITS) & Y-0-Y CHANGE (%), 2012 2017

FIGURE 23 MATRIX DIAGRAM OF MATERIALS AND FREQUENCY

FIGURE 24 RF COMPONENTS MARKET, BY GEOGRAPHY, 2012 2017 ($MILLION)

FIGURE 25 RF COMPONENTS MARKET, AMERICAS, 2012 2017 ($MILLION)

FIGURE 26 KEY GROWTH STRATEGIES, 2009 2012

FIGURE 27 FREESCALE SEMICONDUCTOR INC.: BUSINESS SEGMENTS

FIGURE 28 FUJITSU LTD.: PRODUCT APPLICATIONS

FIGURE 29 RENESAS ELECTRONICS CORP.: PRODUCTS & SERVICES

FIGURE 30 RENESAS ELECTRONICS CORP.: PERCENTAGE SHARE OF RENESASS MCU BUSINESS, BY GEOGRAPHY, 2011

FIGURE 31 RENESAS ELECTRONICS CORP.: RENESASS BUSINESS UNITS REVENUE SEGMENTATION

Growth opportunities and latent adjacency in Radio Frequency Components (RFC) Market