Digital Radio Frequency Memory Market by Platform (Defense, Commercial & Civil), Application (Electronic Warfare, Radar Test & Evaluation, Electronic Warfare Training), Architecture (Processor, Modulator, Converter, Memory) - Global Forecast to 2022

[136 Pages Report] The Digital Radio Frequency Memory (DRFM) market is projected to grow from USD 613.9 Million in 2016 to USD 1,222.2 Million by 2022, at a CAGR of 12.16% during the forecast period. The base year considered for the study is 2015 and the forecast period is from 2016 to 2022.

Objectives of the Study:

The report analyzes the Digital Radio Frequency Memory (DRFM) market on the basis of application (electronic warfare, radar test & evaluation, electronic warfare training, and radio & cellular network jamming), platform (defense and commercial & civil), and architecture (processor, modulator, converter, memory, and others), as well as maps these segments and subsegments across major regions worldwide, namely, North America, Europe, Asia-Pacific, and rest of the world.

The report provides in-depth market intelligence regarding the Digital Radio Frequency Memory (DRFM) market dynamics and major factors that influence the growth of the market such as drivers, restraints, opportunities, and industry-specific challenges, along with an analysis of micromarkets with respect to individual growth trends, future prospects, and their contribution to the DRFM market.

The Digital Radio Frequency Memory (DRFM) market was valued at USD 613.9 Million in 2016, and is projected to reach USD 1,222.2 Million by 2022, at a CAGR of 12.16% from 2016 to 2022. Advancements in military technology have led to the development of superior air defense systems. These systems have posed a serious challenge for airborne units operating in enemy airspace leading to severe damage, attrition of units, and loss of personnel. Electronic warfare technologies are focused on reducing the instances of detection by enemy radars and providing the necessary time to evade them.

DRFM-based electronic warfare systems are installed in various defense platforms, such as ground-based military units, Unmanned Aerial Systems (UAS), and navy ships. The growth of the airborne electronic warfare systems and the upgrade of older air platforms are significant factors driving the demand for DRFM-based jammers. Other applications of DRFM-based jammers include Radar Environment Simulation (RES) testing. The RES testing procedure involves evaluation of radar systems in an anechoic environment during their designing phase. The shortcomings of radar systems are eliminated by incorporating design changes during radar development.

Based on platform, the Digital Radio Frequency Memory (DRFM) market has been segmented into commercial & civil and defense. The defense segment includes air, naval, land, and unmanned platforms. Naval DRFM systems are mostly used for Electronic Support Measures (ESM). Prominent players involved in the manufacturing of naval DRFM systems provide a wide range of Naval Laser Warning (NLW) systems, and ESM and ELINT systems for submarine and surface vessels. These naval DRFM systems provide capabilities for early detection, analysis, threat warning, and protection from Anti-Ship Cruise Missiles (ASCMs).

The report also covers competitive developments such as long-term contracts, joint ventures, mergers, new product launches and developments, and research & development activities in the Digital Radio Frequency Memory (DRFM) market, in addition to business and corporate strategies adopted by key players.

On the basis of application, the Digital Radio Frequency Memory (DRFM) market has been segmented into electronic warfare, radar test & evaluation, electronic warfare testing, and radio & cellular network jamming, among others. The electronic warfare segment is the largest application segment of the DRFM market. The electronic warfare systems are installed at both, air and naval platforms. Electronic warfare uses control over electromagnetic spectrum to disrupt enemy electronic systems. The use of DRFM systems in jammers has improved the capability of electronic warfare technologies. The DRFM systems encompass the ability to store and modify signals, before transmitting them to the enemy radar. These systems use various deception techniques such as multiple false target generation, range gate pull-off, and velocity gate pull-off, among others, to deceive the enemy radar. DRFM-based systems are also used for Signals Intelligence (SIGINT) and Communications Intelligence (COMINT) missions to capture the electromagnetic signatures of enemy aircraft, ships, and other units. These electromagnetic signatures provide intelligence about the capabilities of enemy ships and types of electronic systems in operation.

On the basis of architecture, the Digital Radio Frequency Memory (DRFM) market has been segmented into processor, modulator, converter, memory, and others. The memory stores the digital waveform of the incoming radar signal. DRFM processes this signal to be sent back to the target radar for deception jamming. Based on architecture, the processor segment accounted for the largest share of the DRFM market in 2016.

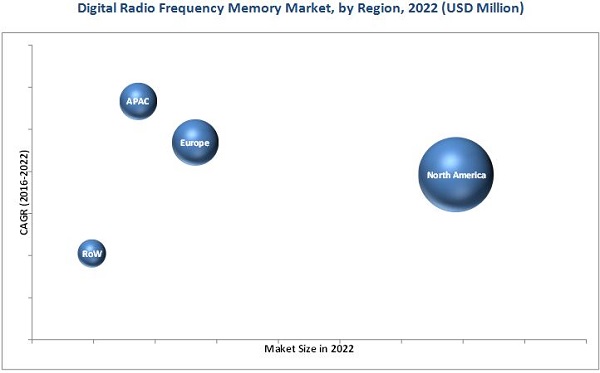

North America accounted for the largest share of the DRFM market in 2016. The defense forces in North America are increasingly investing in the development of technologically advanced DRFM systems. Northrop Grumman Corporation (U.S.) and BAE Systems plc (U.K.) are among the well-established and prominent DRFM manufacturers in this region.

Reduction in defense expenditure in developed nations and ban on the usage of jammers for civilian application are some of the key factors restraining the growth of the Digital Radio Frequency Memory (DRFM) market during the forecast period.

Major players operating in the Digital Radio Frequency Memory (DRFM) market include Airbus Group (France), Northrop Grumman Corporation (U.S.), Thales Group (France), Raytheon Company (U.S.), and BAE Systems plc (U.K.), among others.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 13)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Study Scope

1.3.1 Markets Covered

1.3.2 Geographic Scope

1.3.3 Years Considered

1.4 Currency & Pricing

1.5 Distribution Channel Participants

2 Research Methodology (Page No. - 17)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

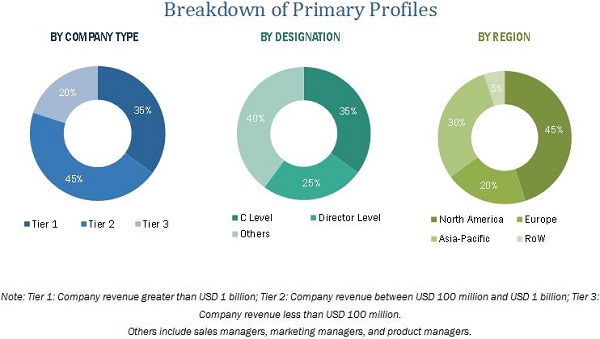

2.1.2.2 Breakdown of Primaries

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

2.3 Market Breakdown & Data Triangulation

2.4 Research Assumptions

3 Executive Summary (Page No. - 26)

4 Premium Insights (Page No. - 32)

4.1 Attractive Market Opportunities in the DRFM Market

4.2 DRFM Market, By Platform, 2014-2022

4.3 DRFM Market Share in the Asia-Pacific Region

4.4 DRFM Market, By Application

4.5 DRFM Market, By Architecture

4.6 DRFM Market, By Region

5 Market Overview (Page No. - 35)

5.1 Introduction

5.2 Market Segmentation

5.2.1 By Platform

5.2.2 By Architecture

5.2.3 By Application

5.3 Market Dynamics

5.3.1 Drivers

5.3.1.1 Technological Advancements in Military Radars

5.3.1.2 Increasing Transnational Disputes Leading to Increase in Usage of Military Ew Systems

5.3.1.3 Advent of Cognitive Electronic Warfare Technology

5.3.2 Restraints

5.3.2.1 Reduction in Defense Expenditure of Developed Nations

5.3.2.2 Prohibition on the Usage of Jammers for Civilian Applications

5.3.3 Opportunities

5.3.3.1 Development of DRFM-Based Jammers for UAV Applications

5.3.3.2 Development of Advanced Electronic Warfare Systems to Detect and Counter Complicated Sensors

5.3.3.3 Deployment of Ew Capabilities in Civil Aviation

5.3.4 Challenges

5.3.4.1 Development of Eccm Systems

5.3.4.2 Development of Aesa Radar

6 Industry Trends (Page No. - 42)

6.1 Introduction

6.2 Technology Trends

6.2.1 Next-Generation Jammer

6.2.2 Quantum-Enhanced Radar

6.2.3 Self-Protection Jamming System for Unmanned Aerial Vehicle System (UAV)

6.2.4 Adaptive Jamming Technology

6.2.5 DRFM-Based Active Decoy Systems

6.2.6 Fpga Usage in DRFM

6.3 Key Technological Innovations By Leading Players (2012-2015)

6.4 Innovation and Patent Registration

7 Digital Radio Frequency Memory Market, By Platform (Page No. - 45)

7.1 Introduction

7.2 Defense

7.2.1 Air

7.2.2 Naval

7.2.3 Land

7.2.4 Unmanned

7.3 Commercial & Civil

8 Digital Radio Frequency Memory Market, By Architecture (Page No. - 50)

8.1 Introduction

8.2 Processors

8.3 Modulators

8.4 Converters

8.5 Memory

8.6 Others

9 Digital Radio Frequency Memory Market, By Application (Page No. - 56)

9.1 Introduction

9.2 Electronic Warfare

9.3 Radar Test and Evaluation

9.4 Electronic Warfare Training

9.5 Radio and Cellular Network Jamming

10 Regional Analysis (Page No. - 62)

10.1 Introduction

10.2 North America

10.2.1 By Architecture

10.2.2 By Application

10.2.3 By Platform

10.2.4 By Country

10.2.4.1 U.S.

10.2.4.1.1 By Architecture

10.2.4.1.2 By Platform

10.2.4.2 Canada

10.2.4.2.1 By Platform

10.2.4.2.2 By Architecture

10.3 Europe

10.3.1 By Application

10.3.2 By Platform

10.3.3 By Architecture

10.3.4 By Country

10.3.4.1 U.K.

10.3.4.1.1 By Platform

10.3.4.1.2 By Architecture

10.3.4.2 Germany

10.3.4.2.1 By Platform

10.3.4.2.2 By Architecture

10.3.4.3 France

10.3.4.3.1 By Platform

10.3.4.3.2 By Architecture

10.3.4.4 Russia

10.3.4.4.1 By Platform

10.3.4.5 Turkey

10.3.4.5.1 By Platform

10.3.4.5.2 By Architecture

10.3.4.6 Rest of Europe

10.3.4.6.1 By Platform

10.3.4.6.2 By Architecture

10.4 Asia-Pacific

10.4.1 By Platform

10.4.2 By Architecture

10.4.3 By Application

10.4.4 By Country

10.4.4.1 China

10.4.4.1.1 By Platform

10.4.4.1.2 By Architecture

10.4.4.2 Japan

10.4.4.2.1 By Platform

10.4.4.2.2 By Architecture

10.4.4.3 South Korea

10.4.4.3.1 By Platform

10.4.4.3.2 By Architecture

10.4.4.4 India

10.4.4.4.1 By Platform

10.4.4.4.2 By Architecture

10.4.4.5 Rest of Asia-Pacific

10.4.4.5.1 By Platform

10.4.4.5.2 By Architecture

10.5 Rest of the World

10.5.1 By Platform

10.5.2 By Architecture

10.5.3 By Application

10.5.4 By Region

10.5.4.1 Middle East

10.5.4.1.1 By Platform

10.5.4.1.2 By Architecture

10.5.4.2 Africa

10.5.4.2.1 By Platform

10.5.4.2.2 By Architecture

10.5.4.3 Latin America

10.5.4.3.1 By Platform

10.5.4.3.2 By Architecture

11 Competitive Landscape (Page No. - 92)

11.1 Introduction

11.2 Brand Analysis

11.3 Product Mapping

11.4 Market Share Analysis of DRFM Market

11.5 Competitive Situation and Trends

11.5.1 Contracts

11.5.2 New Product Developments

12 Company Profiles (Page No. - 102)

(Overview, Financial*, Products & Services, Strategy, and Developments)

12.1 Introduction

12.2 Airbus Group

12.3 Northrop Grumman Corporation

12.4 Raytheon Company

12.5 Bae Systems PLC

12.6 Elbit Systems Ltd.

12.7 Thales Group

12.8 Leonardo S.P.A

12.9 Curtiss-Wright Corporation

12.10 Israel Aerospace Industries

12.11 Rohde & Schwarz

*Details Might Not Be Captured in Case of Unlisted Companies.

13 Appendix (Page No. - 128)

13.1 Discussion Guide

13.2 Knowledge Store: Marketsandmarkets’ Subscription Portal

13.3 Introducing RT: Real Time Market Intelligence

13.4 Available Customizations

13.5 Related Reports

13.6 Author Details

List of Tables (70 Tables)

Table 1 Defence Budget Cuts of Developed Countries, 2011-2015 (USD Billion)

Table 2 Advanced Ew Systems Developed By Various Market Players for Unmanned Platform

Table 3 Key Technological Innovations By Leading Players

Table 4 Innovation & Patent Registration ( 2011- 2016)

Table 5 Digital Radio Frequency Memory Market Size, By Platform, 2014-2022 (USD Million)

Table 6 DRFM Market Size for Defense, By Region, 2014-2022 (USD Million)

Table 7 DRFM Market Size for Defense, By Platform, 2014-2022 (USD Million)

Table 8 DRFM Market Size for Commercial & Civil Segment, By Region, 2014-2022 (USD Million)

Table 9 DRFM Market Size, By Architecture, 2014-2022 (USD Million)

Table 10 DRFM Market Size for Processors, By Region, 2014-2022 (USD Million)

Table 11 DRFM Market Size for Modulators, By Region, 2014-2022 (USD Million)

Table 12 DRFM Market Size for Converters, By Region, 2014-2022 (USD Million)

Table 13 DRFM Market Size for Memory, By Region, 2014-2022 (USD Million)

Table 14 DRFM Market Size for Others, By Region, 2014-2022 (USD Million)

Table 15 DRFM Market Size, By Application, 2014-2022 (USD Million)

Table 16 DRFM Market Size for Electronic Warfare, By Region, 2014-2022 (USD Million)

Table 17 DRFM Market Size for Radar Test and Evaluation, By Region, 2014-2022 (USD Million)

Table 18 DRFM Market Size for Electronic Warfare Training, By Region, 2014-2022 (USD Million)

Table 19 DRFM Market Size for Radio and Cellular Network Jamming, By Region, 2014-2022 (USD Million)

Table 20 DRFM Market Size, By Region, 2014-2022 (USD Million)

Table 21 North America DRFM Market Size, By Architecture, 2014-2022 (USD Million)

Table 22 North America DRFM Market Size, By Application, 2014-2022 (USD Million)

Table 23 North America DRFM Market Size, By Platform, 2014-2022 (USD Million)

Table 24 North America DRFM Market Size, By Country, 2014-2022 (USD Million)

Table 25 U.S. DRFM Market Size, By Architecture, 2014-2022 (USD Million)

Table 26 U.S. DRFM Market Size, By Platform, 2014-2022 (USD Million)

Table 27 Canada DRFM Market Size, By Platform, 2014-2022 (USD Million)

Table 28 Canada DRFM Market Size, By Architecture, 2014-2022 (USD Million)

Table 29 Europe DRFM Market Size, By Application, 2014-2022 (USD Million)

Table 30 Europe DRFM Market Size, By Platform, 2014-2022 (USD Million)

Table 31 Europe DRFM Market Size, By Architecture, 2014-2022 (USD Million)

Table 32 Europe DRFM Market Size, By Country, 2014-2022 (USD Million)

Table 33 U.K. DRFM Market Size, By Platform, 2014-2022 (USD Million)

Table 34 U.K. DRFM Market Size, By Architecture, 2014-2022 (USD Million)

Table 35 Germany DRFM Market Size, By Platform, 2014-2022 (USD Million)

Table 36 Germany DRFM Market Size, By Architecture, 2014-2022 (USD Million)

Table 37 France DRFM Market Size, By Platform, 2014-2022 (USD Million)

Table 38 France DRFM Market Size, By Architecture, 2014-2022 (USD Million)

Table 39 Russia DRFM Market Size, By Platform, 2014-2022 (USD Million)

Table 40 Russia DRFM Market Size, By Architecture, 2014-2022 (USD Million)

Table 41 Turkey DRFM Market Size, By Platform, 2014-2022 (USD Million)

Table 42 Turkey : DRFM Market Size, By Architecture, 2014-2022 (USD Million)

Table 43 Rest of Europe DRFM Memory Market Size, By Platform, 2014-2022 (USD Million)

Table 44 Rest of Europe DRFM Memory Market Size, By Architecture, 2014-2022 (USD Million)

Table 45 Asia-Pacific DRFM Market Size, By Platform, 2014-2022 (USD Million)

Table 46 Asia-Pacific DRFM Market Size, By Architecture, 2014-2022 (USD Million)

Table 47 Asia-Pacific DRFM Market Size, By Application, 2014-2022 (USD Million)

Table 48 Asia-Pacific DRFM Market Size, By Country, 2014-2022 (USD Million)

Table 49 China DRFM Market Size, By Platform, 2014-2022 (USD Million)

Table 50 China DRFM Market Size, By Architecture, 2014-2022 (USD Million)

Table 51 Japan DRFM Market Size, By Platform, 2014-2022 (USD Million)

Table 52 Japan DRFM Market Size, By Architecture, 2014-2022 (USD Million)

Table 53 South Korea DRFM Market Size, By Platform, 2014-2022 (USD Million)

Table 54 South Korea DRFM Market Size, By Architecture, 2014-2022 (USD Million)

Table 55 India DRFM Market Size, By Platform, 2014-2022 (USD Million)

Table 56 India DRFM Market Size, By Architecture, 2014-2022 (USD Million)

Table 57 Rest of Asia-Pacific DRFM Market Size, By Platform, 2014-2022 (USD Million)

Table 58 Rest of Asia-Pacific DRFM Market Size, By Architecture, 2014-2022 (USD Million)

Table 59 Rest of the World DRFM Market Size, By Platform, 2014-2022 (USD Million)

Table 60 Rest of the World DRFM Market Size, By Architecture, 2014-2022 (USD Million)

Table 61 Rest of the World DRFM Market Size, By Application, 2014-2022 (USD Million)

Table 62 Rest of the World DRFM Market Size, By Region, 2014-2021 (USD Million)

Table 63 Middle East DRFM Market Size, By Platform, 2014-2022 (USD Million)

Table 64 Middle East DRFM Market Size, By Application, 2014-2022 (USD Million)

Table 65 Africa DRFM Market Size, By Platform, 2014-2022 (USD Million)

Table 66 Africa DRFM Market Size, By Architecture, 2014-2022 (USD Million)

Table 67 Latin America DRFM Market Size, By Platform, 2014-2022 (USD Million)

Table 68 Latin America DRFM Market Size, By Architecture, 2014-2022 (USD Million)

Table 69 Contracts, February 2012-September 2016

Table 70 New Product Launches: October 2012-October 2016

List of Figures (48 Figures)

Figure 1 Markets Covered: Digital Radio Frequency Memory Market

Figure 2 Years Considered for The Study

Figure 3 Report Process Flow

Figure 4 DRFM Market: Research Design

Figure 5 Breakdown of Primary Interviews: By Company Type, Designation, and Region

Figure 6 Market Size Estimation Methodology: Bottom-Up Approach

Figure 7 Market Size Estimation Methodology: Top-Down Approach

Figure 8 Data Triangulation

Figure 9 The DRFM Market in The Asia-Pacific Region Projected to Grow at The Highest CAGR During The Forecast Period

Figure 10 The Defense Segment Projected to Lead The DRFM Market During The Forecast Period

Figure 11 The Processors Segment Projected to Lead The DRFM Market During The Forecast Period

Figure 12 Electronic Warfare Segment Projected to Grow at The Highest CAGR During The Forecast Period

Figure 13 Contracts Were The Key Growth Strategy Adopted By Market Players From February 2012 to October 2016

Figure 14 DRFM Market Growth and Its Influencing Factors (2016-2022)

Figure 15 Defense Segment Projected to Grow at The Highest CAGR During The Forecast Period

Figure 16 China Accounted for The Largest Share of The Asia-Pacific DRFM Market in 2016

Figure 17 The Electronic Warfare Segment Expected to Lead The DRFM Market During The Forecast Period

Figure 18 The Processor Segment Projected to Lead The DRFM Market During The Forecast Period

Figure 19 North America Accounted for The Largest Share of The DRFM Market in 2016

Figure 20 DRFM Market: Drivers, Restraints, Opportunities, and Challenges

Figure 21 The Commercial and Civil Platform Expected to Grow at The Highest CAGR During The Forecast Period

Figure 22 Processors Accounted for The Largest Share of The DRFM Market, By Architecture in 2016

Figure 23 Electronic Warfare Segment Accounted for The Largest Share of The DRFM Market, By Application in 2016

Figure 24 North America DRFM Market Snapshot

Figure 25 Europe DRFM Market Snapshot

Figure 26 Asia-Pacific DRFM Market Snapshot

Figure 27 Companies Adopted Contracts and New Product Launches as Key Growth Strategies From February 2012 to October 2016

Figure 28 Brand Analysis of Top Players in The DRFM Market

Figure 29 Product Mapping of Top Players in The DRFM Market

Figure 30 Market Share Analysis of Key Players in The DRFM Market (2015)

Figure 31 Influencing Factors and Their Impact on Regions Considered in The DRFM Market, 2015

Figure 32 Contracts: The Key Growth Strategy Adopted By Companies in The DRFM Market From February 2012 to October 2016

Figure 33 Regional Revenue Mix of Top Five Market Players

Figure 34 The Airbus Group: Company Snapshot

Figure 35 Airbus Group: SWOT Analysis

Figure 36 Northrop Grumman Corporation: Company Snapshot

Figure 37 Northrop Grumman Corporation: SWOT Analysis

Figure 38 Raytheon Company: Company Snapshot

Figure 39 Raytheon Company: SWOT Analysis

Figure 40 Bae Systems PLC: Company Snapshot

Figure 41 Bae Systems PLC.: SWOT Analysis

Figure 42 Elbit Systems Ltd.: Company Snapshot

Figure 43 Elbit Systems Ltd: SWOT Analysis

Figure 44 Thales Group: Company Snapshot

Figure 45 Thales Group: SWOT Analysis

Figure 46 Leonardo S.P.A: Company Snapshot

Figure 47 Curtiss-Wright Corporation: Company Snapshot

Figure 48 Israel Aerospace Industries: Company Snapshot

Research Methodology:

Market size estimations for various segments and subsegments of this market were done by referring to various secondary sources, such as the Association of Old Crows; company websites; corporate filings that include annual reports, investor presentations, and financial statements; and trade, business, and professional associations; among others. Corroboration with primaries and market triangulation with the help of statistical techniques using econometric tools were carried out. All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources. All possible parameters that affect the market covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to acquire the final quantitative and qualitative data. This data is consolidated and added with detailed inputs and analysis from MarketsandMarkets, and presented in this report.

To know about the assumptions considered for the study, download the pdf brochure

The ecosystem of the Digital Radio Frequency Memory (DRFM) market comprises manufacturers, distributors, and end users. Key end users of DRFM systems are the defense and commercial & civil sectors. Major DRFM system providers that include Airbus Group (France), Northrop Grumman Corporation (U.S.), Raytheon Company (U.S.), BAE Systems plc (U.K.), Elbit Systems Ltd. (Israel), Thales Group (France), Leonardo S.p.A. (Italy), Curtiss-Wright Corporation (U.S.), Israel Aerospace Industries (Israel), and Rohde & Schwarz (Germany) are offering advanced technology systems, products, and services. These players are adopting strategies such as agreements & partnerships, new product developments, contracts, and business expansions to strengthen their positions in the DRFM market.

Target Audience

- Armed Forces (Air Force, Army, and Navy)

- Defense Research Institutes

- Government Telecommunication Authorities

- Manufacturers of Electronic Jammers

- Original Equipment Manufacturers (OEMs)

- System-on-Chip Electronic Component Suppliers

Scope of the Report

This research report categorizes the DRFM market into the following segments and subsegments:

Digital Radio Frequency Memory Market, By Platform

- Defense

- Commercial & Civil

Digital Radio Frequency Memory Market, By Application

- Electronic Warfare

- Radar Test & Evaluation

- Electronic Warfare Training

- Radio & Cellular Network Jamming

Digital Radio Frequency Memory Market, By Architecture

- Processor

- Modulator

- Convertor

- Memory

- Others

Digital Radio Frequency Memory Market, By Region

- North America

- Europe

- Asia-Pacific

- Rest of the World

Customizations available for the report:

With the given market data, MarketsandMarkets offers customizations as per specific needs of the company. The following customization options are available for the report:

Company Information

- Detailed analysis and profiles of additional market players (up to five)

- Geographic Analysis: Further breakdown of the rest of the world DRFM market

Growth opportunities and latent adjacency in Digital Radio Frequency Memory Market