Industrial Maintenance Coatings Market by Technology (Solvent-based, Water-based, Powder & Others), Resin Type (Epoxy, PU, Acrylic, Alkyd & Others), End-use Industry and Region (North America, Europe, Asia Pacific, South America & Middle East & Africa) - Global Forecast to 2025

Updated on : June 18, 2024

Industrial Maintenance Coatings Market

Industrial Maintenance Coatings Market was valued at USD 4.0 billion in 2020 and is projected to reach USD 4.9 billion by 2025, growing at 4.0% cagr from 2020 to 2025. Need for an efficient process and durable coatings with better aesthetics, increasing demand for environmentally-friendly coatings, and growing demand from the Asia Pacific region are the major factors driving the industrial coatings market.

To know about the assumptions considered for the study, Request for Free Sample Report

Impact of COVID-19 on Global Industrial Maintenance Coatings Market

COVID-19 has exposed many challenges for the industrial maintenance coatings market by impacting both the automotive and general industrial sectors. Major economies of each region are affected due to pandemic and resulted in slowdown in activities across the industries that use industrial coatings. Industries such as packaging will gain while others are expected to be negatively impacted in 2020 and 2021. The market is expected to recover from 2021 onwards, with industrial and transportation activities getting back on track and functioning with full capacities.

Industrial Maintenance Coatings Market Dynamics

Driver: Need for efficient process and durable coatings with better aesthetics

Nowadays, industrial maintenance coating products are sold with a multi-year guarantee against corrosion, mostly as a result of improvements in the performance of coatings. In addition to improved performance, manufacturers are continuously introducing new products in the market that have environmentally-friendly characteristics. The technologies that are currently used to manufacture coatings differ from solvent-based technology used previously. The introduction of new technologies has increased the performance of coatings rapidly. Furthermore, the industrial maintenance coatings offer several benefits, such as crack-bridging ability, high flexibility, waterproofing & weatherproofing, resistance to dirt, mildew, and chemicals.

Restraint: Difficulty in obtaining thin films in powder coatings

Powder coatings offer excellent flow properties, reduced edge build-ups, and consistent distribution of the raw materials throughout the powder mixtures. They can be used in decorative, protective, and optical coatings. However, powder coatings produce a thick finish on metal products. It is difficult to produce thin finishes using conventional powder coatings as the thickening of the polymer can lead to the formation of an uneven texture. A successful thin-film application involves the correlation between color and opacity of pigmentation of powder coatings. Polyurethane resin is preferable for obtaining thin films because of its flow and physical properties and lower costs. Substrate smoothness and wetting are important issues faced in the thin-film powder coating applications. It is difficult to obtain thin films similar to the ones formed using wet paint systems.

Opportunity: Increasing use of nano-coatings

Nano-coatings provide weather resistance to protect coated surfaces from getting degraded. Nano-coatings offer excellent properties, such as high-temperature resistance, waterproofness, UV-stability, high-abrasion resistance, and corrosion resistance. They are also environmentally-friendly and non-toxic and are easy to clean. They are considered as sustainable protective coatings. Owing to these properties, nano-coatings find applications in automotive, aerospace, electronics, food & packaging, and marine industries. Nano-coatings also enhance the properties of display screens of electronic devices and extend their useful life. They enable easy cleaning, disinfection, and sterilization of these devices.

Challenge: Stringent regulatory policies

Owing to an increasing number of government’s regulatory policies, industrial coatings producers have to improve their processes to comply with new policies. Products who fail to meet the legal requirements are not allowed in countries that have stringent environment regulations, especially in Western Europe and North America.

The industrial maintenance coatings industry also faces many environmental challenges with the increasing focus on meeting state and local regulations for wastewater discharge. The powder coating operations have a considerable amount of metals, oil & grease, and suspended solids in their wastewater streams generated during cleaning and pretreatment phases.

The polyurethane segment is expected to account for the larger share of the industrial coatings market.

The polyurethane resin-based coatings are used where high performance is expected, such as oil-rig towers, warehouses, industrial plants, heat-resistant coatings, and bridges. These resins have properties, such as high durability, toughness, ease of cleaning, and high gloss. These properties make them preferable in a wide range of applications. They are also used in the wood, aircraft, and construction industries. Apart from these, the coatings are preferred for heavy-duty exterior and interior structural applications, paper mills, power plants, offshore structures, oil field machinery, exterior surfaces of steel tanks, handrails, conveyors, and chemical processing equipment.

The powder-based technology segment is expected to grow with the highest CAGR in the industrial coatings market during the forecast period.

Powder coating is a dry finishing process in which the finely ground particles of pigment and resin are electrostatically charged and sprayed onto electrically grounded parts. The powder-based industrial coatings offer low VOC emission, providing superior performance, and cost efficiency for applications that require maximum abrasion resistance and hardness. The powder-based industrial coating technology is a highly efficient process with over 98% powder overspray recoverability, higher resistance to chipping, scratching, fading, and wearing than other finishes. This process releases negligible VOCs into the environment and takes less cure time beyond the cool-down period.

The automotive OEM segment to grow at the fastest rate during the forecast period.

Automotive OEM is an integral part of automotive manufacturing. Coatings offer excellent quality and durability to automotive equipment. Automotive OEM coatings possess excellent mechanical properties that protect automobiles from scratches, environment, and chemical exposure. Coating done on the interior parts of an automotive, improve the surface area of the automotive body. Increasing automobile production majorly in the Asia Pacific region is expected to drive the demand for industrial coatings during the forecast period.

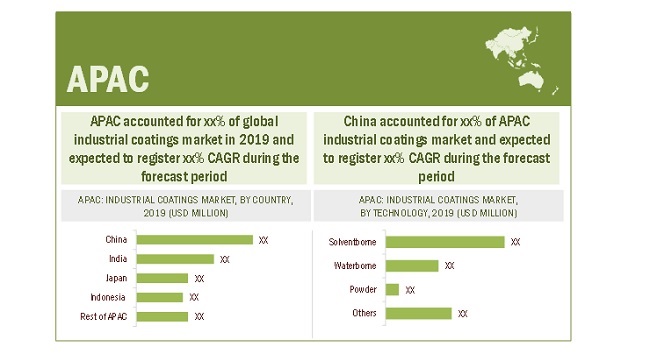

Asia Pacific is expected to account for the largest market share during the forecast period.

ASIA PACIFIC has emerged as the leading consumer and producer of industrial coatings. The region is a huge manufacturing hub which has resulted in attracting foreign investment and the booming industrial sectors primarily due to the low-cost labor and easily accessible raw materials. There is an increase in the demand for industrial coatings owing to the growing industrial, aerospace, transportation, marine, and automotive industries in the region.

To know about the assumptions considered for the study, download the pdf brochure

Industrial Maintenance Coatings Market Players

PPG Industries, Inc. (US), Akzo Nobel N.V. (the Netherlands), The Sherwin-Williams Company (US), Axalta Coating Systems, LLC (US), Kansai Paint Co., Ltd. (Japan) are some of the leading players in the industrial maintenance coatings market.

Industrial Maintenance Coatings Market Report Scope

|

Report Metric |

Details |

|

Years considered for the study |

2018–2025 |

|

Base year |

2019 |

|

Forecast period |

2020–2025 |

|

Units considered |

Value (USD Million) and Volume (Kiloton) |

|

Segments covered |

Resin Type, Technology, End-use Industry, and Region |

|

Geographies covered |

Asia Pacific, Europe, North America, Middle East & Africa, and South America |

|

Companies profiled |

PPG Industries, Inc. (US), Akzo Nobel N.V. (Netherlands), Axalta Coating Systems (US), The Sherwin-Williams Company (US). |

This research report categorizes the industrial maintenance coatngs market based on resin type, technology, end-use industry, and region.

Based on Resin Type, the industrial maintenance coatings market has been segmented as follows:

- Polyurethane

- Epoxy

- Acrylic

- Alkyd

- Others (Polyphenylene sulfide (PPS), polyethersulfone (PES), polyester, fluoropolymers, silicone, polyurea, polyolefin, hybrids, and polysiloxane coatings)

Based on Technology, the industrial maintenance coatings market has been segmented as follows:

- Solvent-based

- Water-based

- Powder

- 100% Solids

- Others (UV- and EB-cured technology)

Based on End-use Industry, the industrial maintenance coatings market has been segmented as follows:

- Energy & Power

- Transportation

- Metal Processing

- Construction

- Chemical

- Other (Pulp and Paper, Cement, Mining, Water and Wastewater, and Machine Tool)

Based on the Region, the industrial maintenance coatings market has been segmented as follows:

- Asia Pacific

- Europe

- North America

- Middle East & Africa

- South America

Recent Developments

- In September 2020, Hempel A/S entered into a strategic partnership with Vestas. The purpose of the partnership is to cooperate in developing innovative solutions for the surface protection of wind turbines.

- In December 2019, Axalta announced the completion of the acquisition of Capital Paints, a UAE-based thermosetting powder coatings manufacturer. Capital Paints is expected to operate as one of three Axalta powder manufacturing facilities in the emerging market regions, with the others located in Malaysia and Indonesia.

Frequently Asked Questions (FAQ):

Does this report covers the upcoming technologies used in the industrial coatings industry?

Yes it covers the upcoming technologies in the industrial coatings market.

Does this report covers the volume tables in addition to value tables?

Yes the report covers the market both in terms of volume as well as value

What is the current competitive landscape in the industrial coatings market in terms of new technologies, production, and sales?

The market has various large, medium, and small scale players operating across the globe. Many players are constantly innovating and developing new products and expanding to developing countries where the demand is constantly growing; thereby boosting sales.

Which countries are considered in the Asia Pacific region?

China, India, Japan, Malaysia, and Indonesia have been considered in Asia Pacific region. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 26)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 MARKET SCOPE

1.3.1 MARKET SEGMENTATION

1.3.2 YEARS CONSIDERED FOR THE STUDY

1.4 CURRENCY

1.5 UNIT CONSIDERED

1.6 STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 29)

2.1 MARKET DEFINITION AND SCOPE

2.2 BASE NUMBER CALCULATION

FIGURE 1 BASE NUMBER CALCULATION APPROACH 1

FIGURE 2 BASE NUMBER CALCULATION APPROACH 2

2.3 FORECAST NUMBER CALCULATION

2.4 MARKET ENGINEERING PROCESS

2.4.1 TOP-DOWN APPROACH

FIGURE 3 MARKET SIZE ESTIMATION: TOP-DOWN APPROACH

2.4.2 BOTTOM-UP APPROACH

FIGURE 4 MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

2.5 RESEARCH DATA

FIGURE 5 INDUSTRIAL MAINTENANCE COATINGS MARKET: RESEARCH DESIGN

2.5.1 SECONDARY DATA

2.5.1.1 Key data from secondary sources

2.5.2 PRIMARY DATA

2.5.2.1 Key data from primary sources

2.5.2.2 Key industry insights

2.5.2.3 Breakdown of primary interviews

2.6 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 6 DATA TRIANGULATION

2.7 ASSUMPTIONS & LIMITATIONS

2.7.1 RESEARCH ASSUMPTIONS

2.7.2 RESEARCH LIMITATIONS

3 EXECUTIVE SUMMARY (Page No. - 38)

TABLE 1 INDUSTRIAL COATINGS MARKET SNAPSHOT, 2020 VS. 2025

FIGURE 7 EPOXY WAS THE LARGEST SEGMENT, BY RESIN TYPE, OF THE INDUSTRIAL MAINTENANCE COATINGS MARKET IN 2019

FIGURE 8 SOLVENT-BASED TO BE THE LARGEST TECHNOLOGY SEGMENT DURING THE FORECAST PERIOD 40

FIGURE 9 ASIA PACIFIC TO LEAD THE INDUSTRIAL COATINGS MARKET

4 PREMIUM INSIGHTS (Page No. - 42)

4.1 ATTRACTIVE OPPORTUNITIES IN THE INDUSTRIAL MAINTENANCE COATINGS MARKET

FIGURE 10 EMERGING ECONOMIES TO OFFER LUCRATIVE GROWTH OPPORTUNITIES FOR MARKET PLAYERS

4.2 INDUSTRIAL COATINGS MARKET, BY RESIN TYPE

FIGURE 11 ACRYLIC RESIN TO REGISTER THE HIGHEST CAGR OVER THE FORECAST PERIOD

4.3 INDUSTRIAL MAINTENANCE COATINGS MARKET, DEVELOPED VS. DEVELOPING COUNTRIES

FIGURE 12 DEVELOPING COUNTRIES TO GROW FASTER THAN THE DEVELOPED COUNTRIES

4.4 INDUSTRIAL MAINTENANCE COATINGS MARKET, BY END-USE INDUSTRY AND KEY COUNTRY

FIGURE 13 ENERGY & POWER SEGMENT TO ACCOUNT FOR THE LARGEST MARKET SHARE

4.5 INDUSTRIAL MAINTENANCE COATINGS MARKET, BY MAJOR COUNTRIES

FIGURE 14 CHINA TO REGISTER THE HIGHEST CAGR IN THE MARKET

5 MARKET OVERVIEW (Page No. - 45)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 15 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN THE INDUSTRIAL MAINTENANCE COATINGS MARKET

5.2.1 DRIVERS

5.2.1.1 High demand for extended product lifetime and reduced maintenance

5.2.1.2 Inclination of facility managers in having an effective coating maintenance plan

5.2.1.3 Increasing demand for environment-friendly coatings

5.2.1.4 Need for efficient processes and durable coatings with enhanced esthetics

5.2.2 RESTRAINTS

5.2.2.1 Difficulty in obtaining thin films in powder coatings

5.2.2.2 Requirement of higher drying period for water-based coatings

5.2.3 OPPORTUNITIES

5.2.3.1 Attractive opportunities for powder coatings in shipbuilding and pipeline sectors

5.2.3.2 Increasing use of nano-coatings

5.2.4 CHALLENGES

5.2.4.1 Stringent regulatory policies

TABLE 2 ALLOWABLE VOC CONTENT BY THE OZONE TRANSPORT COMMISSION (OTC), (GRAMS/LITER)

5.2.4.2 Meeting performance standards set by conventional solvent-borne technologies

5.2.4.3 Susceptibility of end users in the adoption of new technologies

5.3 PORTER'S FIVE FORCES ANALYSIS

FIGURE 16 LOW THREAT OF BACKWARD INTEGRATION FROM BUYERS IN THE INDUSTRIAL MAINTENANCE COATINGS MARKET

5.3.1 THREAT OF SUBSTITUTES

5.3.2 BARGAINING POWER OF BUYERS

5.3.3 THREAT OF NEW ENTRANTS

5.3.4 BARGAINING POWER OF SUPPLIERS

5.3.5 INTENSITY OF COMPETITIVE RIVALRY

5.4 PATENT ANALYSIS

6 COVID-19 IMPACT ON THE INDUSTRIAL MAINTENANCE COATINGS MARKET (Page No. - 55)

6.1 VALUE CHAIN OF THE INDUSTRIAL MAINTENANCE COATINGS INDUSTRY

FIGURE 17 INDUSTRIAL MAINTENANCE COATINGS VALUE CHAIN

FIGURE 18 INDUSTRIAL MAINTENANCE COATINGS VALUE CHAIN: PLAYERS AT EACH NODE

6.2 IMPACT ON VALUE CHAIN

6.2.1 RAW MATERIALS/SUPPLIERS

6.2.1.1 Impact of COVID-19 on Raw Materials and Suppliers

6.2.1.1.1 Resins

6.2.1.1.2 Pigments

6.2.1.1.3 Solvents

6.2.2 INDUSTRIAL MAINTENANCE COATINGS FORMULATORS

6.2.2.1 Impact of COVID-19 on Formulators

6.2.3 DISTRIBUTORS

TABLE 3 DISTRIBUTORS: OFFERINGS AND SERVICES

6.2.3.1 Impact of COVID-19 on Distributors

6.2.4 END-USE INDUSTRIES

6.2.4.1 Impact of COVID-19 on End-Use Industries

6.3 CUSTOMER ANALYSIS

6.3.1 SHIFT IN THE AUTOMOTIVE INDUSTRY

6.3.1.1 Most-impacted regions

6.3.1.2 Customers' perspective on the growth outlook

6.4 SHIFT IN THE AEROSPACE INDUSTRY

6.4.1 DISRUPTION IN THE INDUSTRY

6.4.2 IMPACT ON CUSTOMERS' OUTPUT AND STRATEGIES TO RESUME/IMPROVE PRODUCTION

6.4.3 IMPACT ON CUSTOMERS' REVENUES

6.4.3.1 Most-impacted regions

6.4.4 NEW MARKET OPPORTUNITIES/GROWTH OPPORTUNITIES

6.4.4.1 Measures taken by customers

6.4.4.2 Customers' perspective on the growth outlook

7 INDUSTRIAL MAINTENANCE COATINGS MARKET, BY TECHNOLOGY (Page No. - 65)

7.1 INTRODUCTION

FIGURE 19 SOLVENT-BASED TO BE THE LARGEST TECHNOLOGY IN 2019

TABLE 4 INDUSTRIAL MAINTENANCE COATINGS MARKET SIZE, BY TECHNOLOGY, 2018-2025 (KILOTON)

TABLE 5 INDUSTRIAL MAINTENANCE COATINGS MARKET SIZE, BY TECHNOLOGY, 2018-2025 (USD MILLION)

7.2 SOLVENT-BASED

7.2.1 OUTSTANDING PHYSICAL PROPERTIES EXPECTED TO DRIVE THE DEMAND FOR SOLVENT-BASED TECHNOLOGY

TABLE 6 SOLVENT-BASED INDUSTRIAL MAINTENANCE COATINGS MARKET SIZE, BY REGION 2018-2025 (KILOTON)

TABLE 7 SOLVENT-BASED INDUSTRIAL MAINTENANCE COATINGS MARKET SIZE, BY REGION, 2018-2025 (USD MILLION)

7.3 WATER-BASED

7.3.1 LOW TOXICITY AND FLAMMABILITY DUE TO LOW VOC LEVELS BOOSTING THE DEMAND FOR WATER-BASED INDUSTRIAL MAINTENANCE COATINGS

TABLE 8 WATER-BASED INDUSTRIAL MAINTENANCE COATINGS MARKET SIZE, BY REGION, 2018-2025 (KILOTON)

TABLE 9 WATER-BASED INDUSTRIAL MAINTENANCE COATINGS MARKET SIZE, BY REGION, 2018-2025 (USD MILLION)

7.4 POWDER

7.4.1 SUPERIOR PERFORMANCE AND EXCELLENT PROPERTIES OF POWDER TECHNOLOGY DRIVING DEMAND

TABLE 10 POWDER INDUSTRIAL MAINTENANCE COATINGS MARKET SIZE, BY REGION, 2018-2025 (KILOTON)

TABLE 11 POWDER INDUSTRIAL COATINGS MARKET SIZE, BY REGION, 2018-2025 (USD MILLION)

7.5 100% SOLIDS

7.5.1 LACK OF VOC MAKES 100% SOLIDS IDEAL FOR USE IN RAILROAD TANK CARS

TABLE 12 100% SOLIDS INDUSTRIAL MAINTENANCE COATINGS MARKET SIZE, BY REGION, 2018-2025 (KILOTON)

TABLE 13 100% SOLIDS INDUSTRIAL MAINTENANCE COATINGS MARKET SIZE, BY REGION, 2018-2025 (USD MILLION)

7.6 OTHERS

TABLE 14 INDUSTRIAL MAINTENANCE COATINGS MARKET SIZE, IN OTHER TECHNOLOGIES, BY REGION, 2018-2025 (KILOTON)

TABLE 15 INDUSTRIAL MAINTENANCE COATINGS MARKET SIZE, IN OTHER TECHNOLOGIES, BY REGION, 2018-2025 (USD MILLION)

8 INDUSTRIAL MAINTENANCE COATINGS MARKET, BY RESIN TYPE (Page No. - 76)

8.1 INTRODUCTION

FIGURE 20 EPOXY-BASED RESIN TO BE THE LARGEST SEGMENT IN 2020

TABLE 16 INDUSTRIAL MAINTENANCE COATINGS MARKET SIZE, BY RESIN TYPE, 2018-2025 (KILOTON)

TABLE 17 INDUSTRIAL MAINTENANCE COATINGS MARKET SIZE, BY RESIN TYPE, 2018-2025 (USD MILLION)

8.2 EPOXY

8.2.1 GOOD DIMENSIONAL STABILITY ALONG WITH EXCELLENT ELECTRICAL CONDUCTIVITY BOOSTING THE DEMAND FOR EPOXY RESINS

TABLE 18 EPOXY INDUSTRIAL MAINTENANCE COATINGS MARKET SIZE, BY REGION, 2018-2025 (KILOTON)

TABLE 19 EPOXY INDUSTRIAL MAINTENANCE COATINGS MARKET SIZE, BY REGION, 2018-2025 (USD MILLION)

8.3 POLYURETHANE

8.3.1 HIGH DEMAND FOR POLYURETHANE RESINS IN HIGH-PERFORMANCE APPLICATION

TABLE 20 POLYURETHANE INDUSTRIAL MAINTENANCE COATINGS MARKET SIZE, BY REGION, 2018-2025 (KILOTON)

TABLE 21 POLYURETHANE INDUSTRIAL MAINTENANCE COATINGS MARKET SIZE, BY REGION, 2018-2025 (USD MILLION)

8.4 ACRYLIC

8.4.1 OUTSTANDING PHYSICAL PROPERTIES ARE EXPECTED TO DRIVE THE DEMAND FOR ACRYLIC RESINS

TABLE 22 ACRYLIC INDUSTRIAL MAINTENANCE COATINGS MARKET SIZE, BY REGION, 2018-2025 (KILOTON)

TABLE 23 ACRYLIC INDUSTRIAL COATINGS MARKET SIZE, BY REGION, 2018-2025 (USD MILLION)

8.5 ALKYD

8.5.1 HIGH DURABILITY AND GOOD DRYING CHARACTERISTICS ARE THE REASONS FOR THE GROWTH OF ALKYD RESINS

TABLE 24 ALKYD INDUSTRIAL MAINTENANCE COATINGS MARKET SIZE, BY REGION, 2018-2025 (KILOTON)

TABLE 25 ALKYD INDUSTRIAL MAINTENANCE COATINGS MARKET SIZE, BY REGION, 2018-2025 (USD MILLION)

8.6 OTHERS

TABLE 26 INDUSTRIAL MAINTENANCE COATINGS MARKET SIZE FOR OTHER RESIN TYPES, BY REGION, 2018-2025 (KILOTON)

TABLE 27 INDUSTRIAL MAINTENANCE COATINGS MARKET SIZE FOR OTHER RESIN TYPES, BY REGION, 2018-2025 (USD MILLION)

9 INDUSTRIAL MAINTENANCE COATINGS MARKET, BY END-USE INDUSTRY (Page No. - 87)

9.1 INTRODUCTION

FIGURE 21 ENERGY AND POWER WAS THE LARGEST END-USER INDUSTRY IN 2019

TABLE 28 INDUSTRIAL MAINTENANCE COATINGS MARKET SIZE, BY END-USE INDUSTRY, 2018-2025 (KILOTON)

TABLE 29 INDUSTRIAL MAINTENANCE COATINGS MARKET SIZE, BY END-USE INDUSTRY, 2018-2025 (USD MILLION)

9.2 ENERGY & POWER

9.2.1 CHALLENGING CONDITIONS IN THE ENERGY AND POWER SECTOR MANDATING THE USE OF INDUSTRIAL MAINTENANCE COATINGS

9.2.1.1 Properties of industrial maintenance coatings used in the energy and power sector

9.2.1.2 Applications of industrial maintenance coatings used in the energy and power sector

TABLE 30 INDUSTRIAL MAINTENANCE COATINGS MARKET SIZE FOR ENERGY AND POWER, BY REGION, 2018-2025 (KILOTON)

TABLE 31 INDUSTRIAL MAINTENANCE COATINGS MARKET SIZE FOR ENERGY AND POWER, BY REGION, 2018-2025 (USD MILLION)

9.3 TRANSPORTATION

9.3.1 USE OF INDUSTRIAL MAINTENANCE COATINGS TO DRIVE THE OVERALL TRANSPORTATION SEGMENT

9.3.1.1 Marine

9.3.1.2 Aerospace

9.3.1.3 Rail

9.3.1.4 Automotive refinish

TABLE 32 INDUSTRIAL MAINTENANCE COATINGS MARKET SIZE FOR TRANSPORTATION, BY REGION, 2018-2025 (KILOTON)

TABLE 33 INDUSTRIAL MAINTENANCE COATINGS MARKET SIZE FOR TRANSPORTATION, BY REGION, 2018-2025 (USD MILLION)

9.4 CHEMICAL

9.4.1 SUPERIOR PERFORMANCE AND EXCELLENT PROPERTIES OF POWDER TECHNOLOGY DRIVING DEMAND

TABLE 34 INDUSTRIAL MAINTENANCE COATINGS MARKET SIZE FOR CHEMICALS, BY REGION, 2018-2025 (KILOTON)

TABLE 35 INDUSTRIAL COATINGS MARKET SIZE FOR CHEMICALS, BY REGION, 2018-2025 (USD MILLION)

9.5 METAL PROCESSING

9.5.1 STEEL PLANTS DUE TO EXTREME OPERATING CONDITIONS TO DRIVE DEMAND

TABLE 36 INDUSTRIAL MAINTENANCE COATINGS MARKET SIZE FOR METAL PROCESSING, BY REGION, 2018-2025 (KILOTON)

TABLE 37 INDUSTRIAL MAINTENANCE COATINGS MARKET SIZE IN METAL PROCESSING, BY REGION, 2018-2025 (USD MILLION)

9.6 CONSTRUCTION

TABLE 38 INDUSTRIAL MAINTENANCE COATINGS MARKET SIZE FOR CONSTRUCTION, BY REGION, 2018-2025 (KILOTON)

TABLE 39 INDUSTRIAL MAINTENANCE COATINGS MARKET SIZE FOR CONSTRUCTION, BY REGION, 2018-2025 (USD MILLION)

9.7 OTHERS

TABLE 40 INDUSTRIAL MAINTENANCE COATINGS MARKET SIZE FOR OTHER INDUSTRIES, BY REGION, 2018-2025 (KILOTON)

TABLE 41 INDUSTRIAL MAINTENANCE COATINGS MARKET SIZE FOR OTHER INDUSTRIES, BY REGION, 2018-2025 (USD MILLION)

10 INDUSTRIAL MAINTENANCE COATINGS MARKET, BY REGION (Page No. - 98)

10.1 INTRODUCTION

FIGURE 22 GEOGRAPHIC SNAPSHOT

TABLE 42 INDUSTRIAL MAINTENANCE COATINGS MARKET SIZE, BY REGION, 2018-2025 (USD MILLION)

TABLE 43 INDUSTRIAL MAINTENANCE COATINGS MARKET SIZE, BY REGION, 2018-2025 (KILOTON)

TABLE 44 INDUSTRIAL MAINTENANCE COATINGS MARKET SIZE, BY TECHNOLOGY, 2018-2025 (USD MILLION)

TABLE 45 INDUSTRIAL MAINTENANCE COATINGS MARKET SIZE, BY TECHNOLOGY, 2018-2025 (KILOTON)

TABLE 46 INDUSTRIAL MAINTENANCE COATINGS MARKET SIZE, BY RESIN TYPE, 2018-2025 (USD MILLION)

TABLE 47 INDUSTRIAL MAINTENANCE COATINGS MARKET SIZE, BY RESIN TYPE, 2018-2025 (KILOTON)

TABLE 48 INDUSTRIAL MAINTENANCE COATINGS MARKET SIZE, BY END-USE INDUSTRY, 2018-2025 (USD MILLION)

TABLE 49 INDUSTRIAL MAINTENANCE COATINGS MARKET SIZE, BY END-USE INDUSTRY, 2018-2025 (KILOTON)

10.2 ASIA PACIFIC

10.2.1 IMPACT OF COVID-19 ON ASIA PACIFIC

FIGURE 23 ASIA PACIFIC: INDUSTRIAL MAINTENANCE COATINGS MARKET SNAPSHOT

TABLE 50 ASIA PACIFIC: INDUSTRIAL MAINTENANCE COATINGS MARKET SIZE, BY COUNTRY, 2018-2025 (USD MILLION)

TABLE 51 ASIA PACIFIC: INDUSTRIAL MAINTENANCE COATINGS MARKET SIZE, BY COUNTRY, 2018-2025 (KILOTON)

TABLE 52 ASIA PACIFIC: INDUSTRIAL MAINTENANCE COATINGS MARKET SIZE, BY TECHNOLOGY, 2018-2025 (USD MILLION)

TABLE 53 ASIA PACIFIC: INDUSTRIAL MAINTENANCE COATINGS MARKET SIZE, BY TECHNOLOGY, 2018-2025 (KILOTON)

TABLE 54 ASIA PACIFIC: INDUSTRIAL MAINTENANCE COATINGS MARKET SIZE, BY RESIN TYPE, 2018-2025 (USD MILLION)

TABLE 55 ASIA PACIFIC: INDUSTRIAL MAINTENANCE COATINGS MARKET SIZE, BY RESIN TYPE, 2018-2025 (KILOTON)

TABLE 56 ASIA PACIFIC: INDUSTRIAL MAINTENANCE COATINGS MARKET SIZE, BY END-USE INDUSTRY, 2018-2025 (USD MILLION)

TABLE 57 ASIA PACIFIC: INDUSTRIAL MAINTENANCE COATINGS MARKET SIZE, BY END-USE INDUSTRY, 2018-2025 (KILOTON)

10.2.2 CHINA

10.2.2.1 High civil infrastructural activities to drive the industrial maintenance coatings market in China

TABLE 58 CHINA: INDUSTRIAL MAINTENANCE COATINGS MARKET SIZE, BY UNIT, 2018-2025 (USD MILLION) (KILOTON)

10.2.3 JAPAN

10.2.3.1 Japan, as a major automotive hub, expected to spur the demand for industrial maintenance coatings

TABLE 59 JAPAN: INDUSTRIAL MAINTENANCE COATINGS MARKET SIZE, BY UNIT, 2018-2025 (USD MILLION) (KILOTON)

10.2.4 INDIA

10.2.4.1 Enhanced infrastructural activities to fuel the industrial maintenance coatings market growth

TABLE 60 INDIA: INDUSTRIAL MAINTENANCE COATINGS MARKET SIZE, BY UNIT, 2018-2025 (USD MILLION) (KILOTON)

10.2.5 SOUTH KOREA

10.2.5.1 Increasing penetration of Japanese carmakers to benefit the industrial maintenance coatings market

TABLE 61 SOUTH KOREA: INDUSTRIAL MAINTENANCE COATINGS MARKET SIZE, BY UNIT, 2018-2025 (USD MILLION) (KILOTON)

10.2.6 REST OF ASIA PACIFIC

TABLE 62 REST OF ASIA PACIFIC: INDUSTRIAL MAINTENANCE COATINGS MARKET SIZE, BY UNIT, 2018-2025 (USD MILLION) (KILOTON)

10.3 EUROPE

10.3.1 IMPACT OF COVID-19 ON EUROPE

FIGURE 24 EUROPE: INDUSTRIAL MAINTENANCE COATINGS MARKET SNAPSHOT

TABLE 63 EUROPE: INDUSTRIAL MAINTENANCE COATINGS MARKET SIZE, BY COUNTRY, 2018-2025 (USD MILLION)

TABLE 64 EUROPE: INDUSTRIAL MAINTENANCE COATINGS MARKET SIZE, BY COUNTRY, 2018-2025 (KILOTON)

TABLE 65 EUROPE: INDUSTRIAL MAINTENANCE COATINGS MARKET SIZE, BY TECHNOLOGY, 2018-2025 (USD MILLION)

TABLE 66 EUROPE: INDUSTRIAL MAINTENANCE COATINGS MARKET SIZE, BY TECHNOLOGY, 2018-2025 (KILOTON)

TABLE 67 EUROPE: INDUSTRIAL MAINTENANCE COATINGS MARKET SIZE, BY RESIN TYPE, 2018-2025 (USD MILLION)

TABLE 68 EUROPE: INDUSTRIAL MAINTENANCE COATINGS MARKET SIZE, BY RESIN TYPE, 2018-2025 (KILOTON)

TABLE 69 EUROPE: INDUSTRIAL MAINTENANCE COATINGS MARKET SIZE, BY END-USE INDUSTRY, 2018-2025 (USD MILLION)

TABLE 70 EUROPE: INDUSTRIAL MAINTENANCE COATINGS MARKET SIZE, BY END-USE INDUSTRY, 2018-2025 (KILOTON)

10.3.2 GERMANY

10.3.2.1 High energy consumption in Germany to enhance industrial maintenance coatings market during the forecast period

TABLE 71 GERMANY: INDUSTRIAL MAINTENANCE COATINGS MARKET SIZE, BY UNIT, 2018-2025 (USD MILLION) (KILOTON)

10.3.3 RUSSIA

10.3.3.1 Increased requirement for power generation in the country expected to boost the industrial maintenance coatings market

TABLE 72 RUSSIA: INDUSTRIAL MAINTENANCE COATINGS MARKET SIZE, BY UNIT, 2018-2025 (USD MILLION) (KILOTON)

10.3.4 ITALY

10.3.4.1 The manufacturing industry is expected to fuel the growth of the industrial maintenance coatings market

TABLE 73 ITALY: INDUSTRIAL MAINTENANCE COATINGS MARKET SIZE, BY UNIT, 2018-2025 (USD MILLION) (KILOTON)

10.3.5 TURKEY

10.3.5.1 Country's dependence on natural gas supply impacting the market growth of industrial maintenance coatings

TABLE 74 TURKEY: INDUSTRIAL MAINTENANCE COATINGS MARKET SIZE, BY UNIT, 2018-2025 (USD MILLION) (KILOTON)

10.3.6 FRANCE

10.3.6.1 Strong chemical industry expected to drive the demand for industrial maintenance coatings

TABLE 75 FRANCE: INDUSTRIAL MAINTENANCE COATINGS MARKET SIZE, BY UNIT, 2018-2025 (USD MILLION) (KILOTON)

10.3.7 UK

10.3.7.1 Established automotive sector to enhance the demand for industrial maintenance coatings in the UK

TABLE 76 UK: INDUSTRIAL MAINTENANCE COATINGS MARKET SIZE, BY UNIT, 2018-2025 (USD MILLION) (KILOTON)

10.3.8 SPAIN

10.3.8.1 Strong power generation and automotive sectors are expected to drive the industrial maintenance coatings market

TABLE 77 SPAIN: INDUSTRIAL MAINTENANCE COATINGS MARKET SIZE, BY UNIT, 2018-2025 (USD MILLION) (KILOTON)

10.3.9 REST OF EUROPE

TABLE 78 REST OF EUROPE: INDUSTRIAL MAINTENANCE COATINGS MARKET SIZE, BY UNIT, 2018-2025 (USD MILLION) (KILOTON)

10.4 NORTH AMERICA

10.4.1 IMPACT OF COVID-19 ON NORTH AMERICA

FIGURE 25 NORTH AMERICA: INDUSTRIAL MAINTENANCE COATINGS MARKET SNAPSHOT

TABLE 79 NORTH AMERICA: INDUSTRIAL MAINTENANCE COATINGS MARKET SIZE, BY COUNTRY, 2018-2025 (USD MILLION)

TABLE 80 NORTH AMERICA: INDUSTRIAL MAINTENANCE COATINGS MARKET SIZE, BY COUNTRY, 2018-2025 (KILOTON)

TABLE 81 NORTH AMERICA: INDUSTRIAL MAINTENANCE COATINGS MARKET SIZE, BY TECHNOLOGY, 2018-2025 (USD MILLION)

TABLE 82 NORTH AMERICA: INDUSTRIAL MAINTENANCE COATINGS MARKET SIZE, BY TECHNOLOGY, 2018-2025 (KILOTON)

TABLE 83 NORTH AMERICA: INDUSTRIAL MAINTENANCE COATINGS MARKET SIZE, BY RESIN TYPE, 2018-2025 (USD MILLION)

TABLE 84 NORTH AMERICA: INDUSTRIAL MAINTENANCE COATINGS MARKET SIZE, BY RESIN TYPE, 2018-2025 (KILOTON)

TABLE 85 NORTH AMERICA: INDUSTRIAL MAINTENANCE COATINGS MARKET SIZE, BY END-USE INDUSTRY, 2018-2025 (USD MILLION)

TABLE 86 NORTH AMERICA: INDUSTRIAL MAINTENANCE COATINGS MARKET SIZE, BY END-USE INDUSTRY, 2018-2025 (KILOTON)

10.4.2 US

10.4.2.1 Presence of major manufacturers in the oil& gas sector fueling the growth of the industrial maintenance coatings market

TABLE 87 US: INDUSTRIAL MAINTENANCE COATINGS MARKET SIZE, BY UNIT, 2018-2025 (USD MILLION) (KILOTON)

10.4.3 MEXICO

10.4.3.1 Major expansion plans in the oil & gas sector expected to boost the industrial maintenance coatings market

TABLE 88 MEXICO: INDUSTRIAL MAINTENANCE COATINGS MARKET SIZE, BY UNIT, 2018-2025 (USD MILLION) (KILOTON)

10.4.4 CANADA

10.4.4.1 Strong automotive sector boosting the demand for industrial maintenance coatings

TABLE 89 CANADA: INDUSTRIAL MAINTENANCE COATINGS MARKET SIZE, BY UNIT, 2018-2025 (USD MILLION) (KILOTON)

10.5 MIDDLE EAST & AFRICA

10.5.1 IMPACT OF COVID-19 ON THE MIDDLE EAST & AFRICA

TABLE 90 MIDDLE EAST & AFRICA: INDUSTRIAL MAINTENANCE COATINGS MARKET SIZE, BY COUNTRY, 2018-2025 (USD MILLION)

TABLE 91 MIDDLE EAST & AFRICA: INDUSTRIAL MAINTENANCE COATINGS MARKET SIZE, BY COUNTRY, 2018-2025 (KILOTON)

TABLE 92 MIDDLE EAST & AFRICA: INDUSTRIAL MAINTENANCE COATINGS MARKET SIZE, BY TECHNOLOGY, 2018-2025 (USD MILLION)

TABLE 93 MIDDLE EAST & AFRICA: INDUSTRIAL MAINTENANCE COATINGS MARKET SIZE, BY TECHNOLOGY, 2018-2025 (KILOTON)

TABLE 94 MIDDLE EAST & AFRICA: INDUSTRIAL MAINTENANCE COATINGS MARKET SIZE, BY RESIN TYPE, 2018-2025 (USD MILLION)

TABLE 95 MIDDLE EAST & AFRICA: INDUSTRIAL MAINTENANCE COATINGS MARKET SIZE, BY RESIN TYPE, 2018-2025 (KILOTON)

TABLE 96 MIDDLE EAST & AFRICA: INDUSTRIAL MAINTENANCE COATINGS MARKET SIZE, BY END-USE INDUSTRY, 2018-2025 (USD MILLION)

TABLE 97 MIDDLE EAST & AFRICA: INDUSTRIAL MAINTENANCE COATINGS MARKET SIZE, BY END-USE INDUSTRY, 2018-2025 (KILOTON)

10.5.2 SAUDI ARABIA

10.5.2.1 Upgrading infrastructure fueling the growth of the industrial maintenance coatings market

TABLE 98 SAUDI ARABIA: INDUSTRIAL MAINTENANCE COATINGS MARKET SIZE, BY UNIT, 2018-2025 (USD MILLION) (KILOTON)

10.5.3 UAE

10.5.3.1 Presence of major manufacturers in industrial maintenance coatings market to drive growth

TABLE 99 UAE: INDUSTRIAL MAINTENANCE COATINGS MARKET SIZE, BY UNIT, 2018-2025 (USD MILLION) (KILOTON)

10.5.4 SOUTH AFRICA

10.5.4.1 The surge in demand for industrial coated products is expected to drive the market

TABLE 100 SOUTH AFRICA: INDUSTRIAL MAINTENANCE COATINGS MARKET SIZE, BY UNIT, 2018- 2025 (USD MILLION) (KILOTON)

10.5.5 REST OF THE MIDDLE EAST & AFRICA

TABLE 101 REST OF THE MIDDLE EAST & AFRICA: INDUSTRIAL MAINTENANCE COATINGS MARKET SIZE, BY UNIT, 2018-2025 (USD MILLION) (KILOTON)

?

10.6 SOUTH AMERICA

10.6.1 IMPACT OF COVID-19 ON SOUTH AMERICA

TABLE 102 SOUTH AMERICA: INDUSTRIAL MAINTENANCE COATINGS MARKET SIZE, BY COUNTRY, 2018-2025 (USD MILLION)

TABLE 103 SOUTH AMERICA: INDUSTRIAL MAINTENANCE COATINGS MARKET SIZE, BY COUNTRY, 2018-2025 (KILOTON)

TABLE 104 SOUTH AMERICA: INDUSTRIAL MAINTENANCE COATINGS MARKET SIZE, BY TECHNOLOGY, 2018-2025 (USD MILLION)

TABLE 105 SOUTH AMERICA: INDUSTRIAL MAINTENANCE COATINGS MARKET SIZE, BY TECHNOLOGY, 2018-2025 (KILOTON)

TABLE 106 SOUTH AMERICA: INDUSTRIAL MAINTENANCE COATINGS MARKET SIZE, BY RESIN TYPE, 2018-2025 (USD MILLION)

TABLE 107 SOUTH AMERICA: INDUSTRIAL MAINTENANCE COATINGS MARKET SIZE, BY RESIN TYPE, 2018-2025 (KILOTON)

TABLE 108 SOUTH AMERICA: INDUSTRIAL MAINTENANCE COATINGS MARKET SIZE, BY END-USE INDUSTRY, 2018-2025 (USD MILLION)

TABLE 109 SOUTH AMERICA: INDUSTRIAL MAINTENANCE COATINGS MARKET SIZE, BY END-USE INDUSTRY, 2018-2025 (KILOTON)

10.6.2 BRAZIL

10.6.2.1 Presence of a major oil & gas manufacturer driving the growth of the industrial maintenance coatings market

TABLE 110 BRAZIL: INDUSTRIAL MAINTENANCE COATINGS MARKET SIZE, BY UNIT, 2018-2025 (USD MILLION) (KILOTON)

10.6.3 ARGENTINA

10.6.3.1 The favorable automotive industry outlook is facilitating the growth of the industrial maintenance coatings market

TABLE 111 ARGENTINA: INDUSTRIAL MAINTENANCE COATINGS MARKET SIZE, BY UNIT, 2018-2025 (USD MILLION) (KILOTON)

10.6.4 REST OF SOUTH AMERICA

TABLE 112 REST OF SOUTH AMERICA: INDUSTRIAL MAINTENANCE COATINGS MARKET SIZE, BY UNIT, 2018-2025 (USD MILLION) (KILOTON)

11 COMPETITIVE LANDSCAPE (Page No. - 135)

11.1 OVERVIEW

FIGURE 26 COMPANIES ADOPTED ORGANIC AND INORGANIC GROWTH STRATEGIES BETWEEN JANUARY 2017 AND SEPTEMBER 2020

11.2 MARKET EVALUATION FRAMEWORK

FIGURE 27 MARKET EVALUATION FRAMEWORK: 2020 SAW CAPACITY EXPANSIONS LEADING THIS SPACE

11.3 MARKET SHARE ANALYSIS

11.3.1 MARKET SHARE ANALYSIS OF TOP PLAYERS IN THE INDUSTRIAL MAINTENANCE COATINGS MARKET

FIGURE 28 RANKING OF KEY MARKET PLAYERS

FIGURE 29 REVENUE ANALYSIS OF LEADING COMPANIES IN THE INDUSTRIAL MAINTENANCE COATINGS MARKET, 2015-2019

11.4 COMPANY EVALUATION QUADRANT MATRIX DEFINITIONS AND METHODOLOGY, 2019

11.4.1 STAR

11.4.2 EMERGING LEADERS

11.4.3 PERVASIVE

11.4.4 PARTICIPANTS

FIGURE 30 INDUSTRIAL MAINTENANCE COATINGS MARKET (GLOBAL) COMPETITIVE LANDSCAPE MAPPING, 2019

11.5 STRENGTH OF PRODUCT PORTFOLIOS

FIGURE 31 PRODUCT PORTFOLIO ANALYSIS OF TOP PLAYERS IN INDUSTRIAL MAINTENANCE COATINGS MARKET

11.6 BUSINESS STRATEGY EXCELLENCE

FIGURE 32 BUSINESS STRATEGY EXCELLENCE OF TOP PLAYERS IN INDUSTRIAL MAINTENANCE COATINGS MARKET

11.7 SME MATRIX, 2019

11.7.1 STAR

11.7.2 EMERGING COMPANIES

11.7.3 PERVASIVE

11.7.4 EMERGING LEADERS

FIGURE 33 INDUSTRIAL MAINTENANCE COATINGS MARKET: EMERGING COMPANIES COMPETITIVE LEADERSHIP MAPPING, 2019

11.8 KEY MARKET DEVELOPMENTS

TABLE 113 DEALS, 2017-2020

TABLE 114 PRODUCT LAUNCHES, 2018-2020

TABLE 115 OTHERS, 2017-2020

12 COMPANY PROFILES (Page No. - 151)

(Business Overview, Products Offered, Recent Developments, MnM View, and Impact of COVID-19)*

12.1 AKZO NOBEL N.V.

FIGURE 34 AKZO NOBEL N.V.: COMPANY SNAPSHOT

FIGURE 35 AKZO NOBEL N.V.: SWOT ANALYSIS

12.2 JOTUN A/S

FIGURE 36 JOTUN A/S: COMPANY SNAPSHOT

FIGURE 37 JOTUN A/S: SWOT ANALYSIS

12.3 PPG INDUSTRIES INC.

FIGURE 38 PPG INDUSTRIES INC.: COMPANY SNAPSHOT

FIGURE 39 PPG INDUSTRIES, INC.: SWOT ANALYSIS

12.4 THE SHERWIN-WILLIAMS COMPANY

FIGURE 40 THE SHERWIN-WILLIAMS COMPANY: COMPANY SNAPSHOT

FIGURE 41 THE SHERWIN-WILLIAMS COMPANY: SWOT ANALYSIS

12.5 NIPPON PAINT HOLDINGS CO., LTD.

FIGURE 42 NIPPON PAINT HOLDINGS CO., LTD.: COMPANY SNAPSHOT

12.6 KANSAI PAINT CO., LTD.

FIGURE 43 KANSAI PAINT CO., LTD.: COMPANY SNAPSHOT

12.7 RPM INTERNATIONAL INC.

FIGURE 44 RPM INTERNATIONAL INC.: COMPANY SNAPSHOT

12.8 TIKKURILA OYJ

FIGURE 45 TIKKURILA OYJ: COMPANY SNAPSHOT

12.9 HEMPEL A/S

FIGURE 46 HEMPEL A/S: COMPANY SNAPSHOT

12.10 AXALTA COATING SYSTEMS, LLC

FIGURE 47 AXALTA COATING SYSTEMS, LLC: COMPANY SNAPSHOT

FIGURE 48 AXALTA COATING SYSTEMS, LLC: SWOT ANALYSIS

12.11 AREMCO PRODUCTS INC.

12.12 MONARCH INDUSTRIAL PRODUCTS (I) PVT. LTD.

12.13 GOA PAINTS

12.14 CONTINENTAL COATINGS INC.

*(Business Overview, Products Offered, Recent Developments, MnM View, and Impact of COVID-19 might not be captured in case of unlisted companies.

12.15 OTHER PLAYERS

12.15.1 TEKNOS GROUP

12.15.2 NOROO PAINT & COATINGS

12.15.3 WEILBURGER

12.15.4 THE CHEMOURS COMPANY

12.15.5 THE VALSPAR CORPORATION

12.15.6 WHITFORD CORPORATION

12.15.7 BELZONA INTERNATIONAL LTD.

12.15.8 CHEMCO INTERNATIONAL LTD.

12.15.9 GENERAL MAGNAPLATE CORPORATION

12.15.10 SIKA AG

13 APPENDIX (Page No. - 191)

13.1 DISCUSSION GUIDE

13.2 KNOWLEDGE STORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

13.3 AVAILABLE CUSTOMIZATIONS

13.4 RELATED REPORTS

13.5 AUTHOR DETAILS

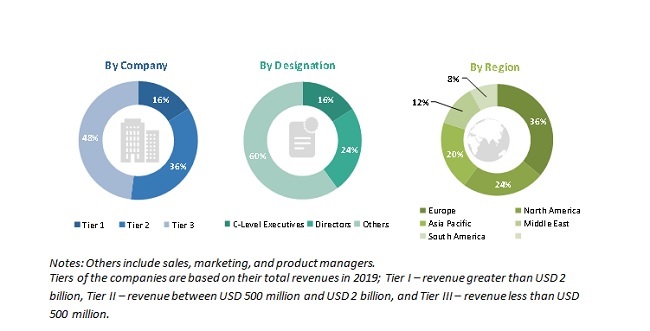

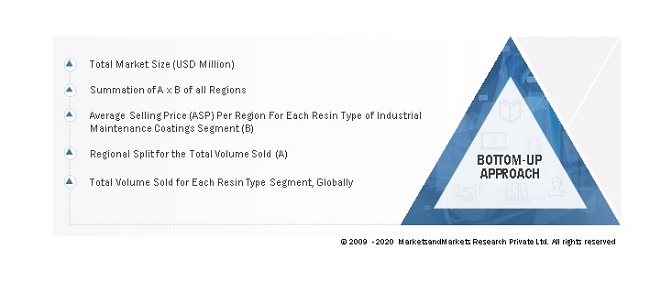

The study involved four major activities in estimating the current market size for industrial maintenance coatings. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation were used to estimate the market size of the segments and the subsegments.

Secondary Research

In the secondary research process, various secondary sources such as Hoovers, Bloomberg BusinessWeek were referred to for identifying and collecting information for this study. These secondary sources included annual reports, press releases & investor presentations of companies; white papers; certified publications; articles by recognized authors; gold standard & silver standard websites; regulatory bodies; trade directories; and databases.

Primary Research

The industrial maintenance coatings market comprises several stakeholders, such as raw material suppliers, processors, end-product manufacturers, and regulatory organizations. The demand side for this market is characterized by the development of automotive OEM, automotive refinish, general industrial, marine, protective, industrial wood, coil, packaging, aerospace, and rail industries as well as the growth in population. Advancements in diverse end-use industries characterize the supply side. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information.

Breakdown of the Primary Interviews

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the overall size of the industrial maintenance coatings market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry were identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, were determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

- All possible parameters that affect the market covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

- The research included the study of reports, reviews, and newsletters of top market players, along with extensive interviews for opinions from key leaders, such as CEOs, directors, and marketing executives.

Global Industrial MaintenanceCoatings Market Size: Bottom-Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall market size—using the market size estimation processes as explained above—the market was split into several segments and subsegments. To complete the total market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides of the end-user industries such as automotive OEM, automotive refinish, general industrial, energy & power, marine, industrial wood, coil, aerospace, and rail.

Report Objectives

- To define, describe, and forecast the global market size of industrial maintenance coatings

- To provide detailed information about the key factors influencing the growth of the market (drivers, restraints, opportunities, and challenges)

- To analyze the micro-markets with respect to individual growth trends, future opportunities, and their contribution to the overall market

- To understand the structure of the industrial maintenance coatings market by identifying its various subsegments

- To project the size of the market and its submarkets, in terms of value, with respect to the five regions (along with their respective key countries)

- To profile key players and comprehensively analyze their core competencies

- To understand the competitive landscape and identify major growth strategies adopted by players across the key regions

- To analyze the competitive developments such as expansion, acquisition, new product launch, and joint venture in the industrial coatings market

Available Customizations

MarketsandMarkets offers the following customizations for this market report:

- A further breakdown of a country with respect to end-use industries in the industrial maintenance coatings market

- Detailed analysis and profiling of additional market players

Growth opportunities and latent adjacency in Industrial Maintenance Coatings Market