Industrial Alcohol Market by Type (Ethyl Alcohol, Methyl Alcohol, Isopropyl Alcohol, and Isobutyl Alcohol), Source (Sugarcane & Bagasse, Corn, Grains, Molasses, and Fuels), Application, and Region - Global Forecast to 2025

To know about the assumptions considered for the study, Request for Free Sample Report

Industrial Alcohol Market Dynamics

Drivers: Increase in the use of alcohol in a wide spectrum of applications

Alcohols have been used in beverage and medical applications for decades. However, as technology developed, alcohol has found use in a wide range of applications. Among the various alcohols available commercially, ethyl alcohol is the most used and widely accepted industrial alcohol, globally. Currently, most of the ethyl alcohol produced goes into the fuel sector to be used as biofuel. Though ethyl alcohol is a commercialized biofuel used across the world, studies on the development of bio-butanol have also gained importance and are gradually paving the way toward commercialization.

Sectors other than biofuel where alcohols find applications are food, pharmaceuticals, home & personal care products, chemical industries, research laboratories, paints, inks, adhesives & coatings, and insecticides. Though ethyl alcohol is the main alcohol used in these industries, methyl alcohol, sorbitol, maltitol, benzyl alcohol, and isopropyl alcohol are also used in some applications. Ethyl alcohol, due to its properties of solubility, insect repellency, antimicrobial nature, preservation, and antifreezing properties, finds applications in all the above sectors.

Restraints: Fluctuating prices of raw material

Industrial alcohol is inelastic in terms of price demand. This means that the scarcity of the product causes a major increase in prices and vice versa. The alcohol industry is heavily dependent on raw materials such as sugar, corn, and wheat. The raw material prices depend on various factors such as cultivation yield, climatic conditions, and the quality of crops.

Additionally, the main crops used in ethyl alcohol production—sugarcane, corn, and wheat—are sensitive to adverse climatic conditions. Environmental deterioration has a direct effect on cultivation. All these factors result in volatility in the prices of these raw materials.

Opportunities: Emerging markets: new growth frontiers

The changing lifestyles, growing economy, and shift toward renewable resource utilization in developing economies have led to an increasing demand for alcohol in fuel and other applications. Developing countries, namely China, India, and countries in the Middle East & Africa, in the coming years, are expected to experience a strong upsurge in demand for alcohol such as ethyl alcohol and isobutyl alcohol. This demand is expected to be driven by an increase in the consumption of alcohol in various sectors and the growing trend of greener technology in the energy sector. In addition, these regions also provide a cost advantage in terms of production, labor cost, and processing. High demand, coupled with a low cost of production, is a key feature that is expected to aid alcohol suppliers.

Challenges: Approval from various regulatory bodies

According to European Union regulations, a firm must imply administrative regulations such as pre-market approval, especially in the case of alcohols being used in the food, pharmaceutical, and personal care sectors. The compliance burden is also an influencing factor, in which a company must cope with the changing regulations related to environment protection, pricing policy, immigration reform, and infrastructure improvements, among others. Firms that are not able to comply with these new and changing requirements may have to deal with the exit from the industrial alcohol market.

To know about the assumptions considered for the study, download the pdf brochure

By type, the ethyl alcohol segment remained the largest, while isobutyl alcohol segment is expected grow strongly during the forecast period

The ethyl alcohol segment accounted for the largest market share in the industrial alcohol market in terms of value, followed by methyl alcohol. The increase in demand for biofuel and the extensive research carried out on newer generations of biofuel drives the ethyl alcohol market. The market for isobutyl alcohol is projected to grow at the highest CAGR of 7.5% in the market, given their extensive application in the manufacture of chemical intermediates and solvents.

By source, the fossil fuels as feedstock account for the largest market share in the industrial alcohol market

The market for fossil fuels as feedstock remained the largest segment in the overall industrial alcohol market. It is also expected to be the fastest growing as fossil fuels are gaining increasing popularity as a source for the manufacturing of industrial alcohol, mainly ethyl alcohol and methyl alcohol. Ethyl alcohol and methyl alcohol manufactured by this process reduce pollution and cause less harm to the environment.

By application, chemical intermediates & solvents segment is projected to grow the fastest during the forecast period

The increased usage of alcohol in the fuel sector and as solvent/reactant in the production of chemical intermediates is fueling the market growth. There has been an increase in the demand for ethyl alcohol in the fuel industry, owing to its high-octane number and the ability to reduce emissions when blended with gasoline. Chemical intermediates & solvents will experience the highest growth during the forecast period owing to high alcohol usage as the main solvent in paints & inks, wood varnishes, polishes, and coatings etc.

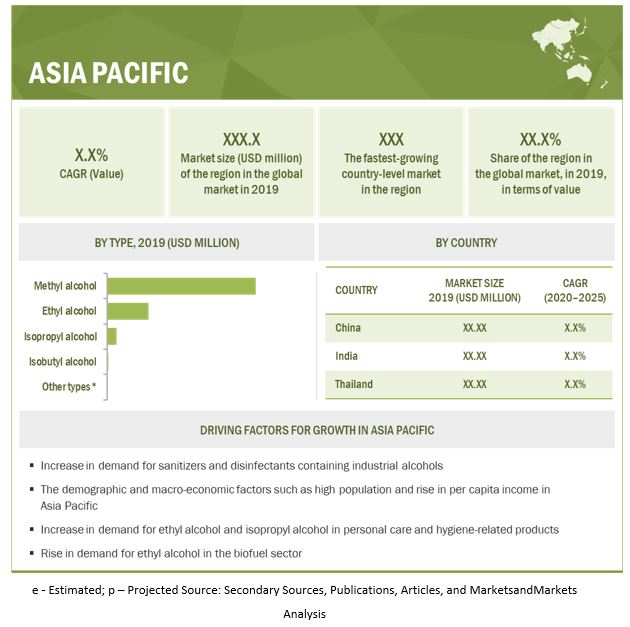

Asia Pacific has been the fastest-growing region that witnesses high ethanol consumption in the world. This is due to the increased emphasis on reducing GHG emissions globally and the low consumption of oil in the region. The regional market is further projected to witness high growth during the forecast period due to the increased demand from China and India. On the other hand, the growth of the market in Europe is due to the emission targets set by the EU since 1899.

Key Market Players

Key players in this market include Cargill (US), Raizen Energia (Brazil), Sigma-Aldrich (US), Univar Solutions (US), and MGP Ingredients (US). Other players include Green Plains Inc. (US), Cristalco (France), The Andersons Inc. (US), Grain Processing Corporation (US), Greenfield Global Inc., etc.

Industrial Alcohol Market Report Scope

|

Report Metric |

Details |

|

Market size available for years |

2020-2025 |

|

Base year considered |

2020 |

|

Forecast period |

2020-2025 |

|

Forecast units |

Value (USD Billion) |

|

Segments covered |

Type, Source, Application and Region |

|

Geographies covered |

North America, Europe, Asia Pacific, South America, and RoW |

|

Companies covered |

Cargill (US), Raizen Energia (Brazil), Sigma-Aldrich (US), Univar Solutions (US), MGP Ingredients (US), Green Plains Inc. (US), Cristalco (France), The Andersons Inc. (US), Grain Processing Corporation (US), Greenfield Global Inc. |

Recent Developments

- In July 2020, Green Plains has expanded its facility at its subsidiary, Green Plain Wood River LLC, for the production of FCC-grade and USP-grade alcohol meeting FDA specifications. This strategy would allow the company to cater to the demand for alcohol and serve a larger consumer base.

- In March 2020, MGP Ingredients acquired New Columbia Distilleries LLC (US). This acquisition improved the company’s hold in the US and allowed it to serve a larger consumer base.

- In May 2020, Procter & Gamble and Cargill entered into a collaboration to bring nature-powered innovative technology to convert lactic acid into bio-based acrylic acid to manufacture more sustainable products. P&G granted Cargill an exclusive license, allowing Cargill to further develop and commercialize this technology, to ultimately be incorporated in a range of applications from superabsorbent polymers in absorbent hygiene products to thickeners in household paints and more.

Frequently Asked Questions (FAQ):

What is the projected market value of the global Industrial Alcohol Market?

The global industrial alcohol market size is projected to reach USD 112.0 billion by 2025.

What is the estimated growth rate (CAGR) of the global Industrial Alcohol Market for the next five years?

The global industrial alcohol market is expected to grow at a compound annual growth rate (CAGR) of 3.7% from 2020 to 2025.

What are the major revenue pockets in the Industrial Alcohol Market currently?

Asia Pacific has been the fastest-growing region that witnesses high ethanol consumption in the world. This is due to the increased emphasis on reducing GHG emissions globally and the low consumption of oil in the region. The regional market is further projected to witness high growth during the forecast period due to the increased demand from China and India. On the other hand, the growth of the market in Europe is due to the emission targets set by the EU since 1899.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 20)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 STUDY SCOPE

FIGURE 1 INDUSTRIAL ALCOHOL MARKET SEGMENTATION

FIGURE 2 REGIONAL SEGMENTATION

1.4 PERIODIZATION CONSIDERED

1.5 CURRENCY CONSIDERED

TABLE 1 USD EXCHANGE RATE, 2017-2019

1.6 STAKEHOLDERS

1.7 INCLUSIONS & EXCLUSIONS

1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 25)

2.1 RESEARCH DATA

FIGURE 3 RESEARCH DESIGN

2.1.1 SECONDARY RESEARCH

2.1.2 PRIMARY RESEARCH

2.1.2.1 Key industry insights

2.1.2.2 Data from primary sources

2.1.2.3 Market data from primary sources

2.1.2.4 Breakdown of primaries

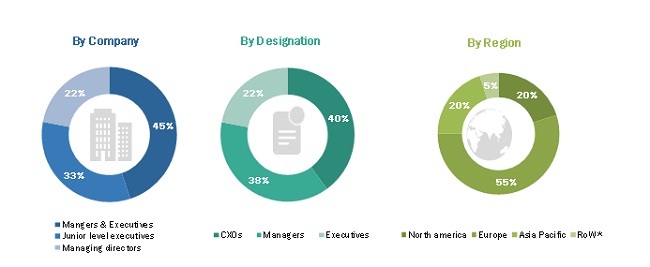

FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

2.2 MACROECONOMIC INDICATORS

2.2.1 INTRODUCTION

2.2.2 DEMAND-SIDE ANALYSIS

2.2.2.1 Rise in demand for ethanol globally

FIGURE 5 GROWTH IN DEMAND FOR ETHANOL IS PROJECTED TO RISE BY 2025

2.2.2.2 Growth in demand for automotive vehicles

FIGURE 6 US: GRADUAL INCREASE IN THE SALES OF LIGHT VEHICLES, 2017-2030

2.3 MARKET SIZE ESTIMATION

FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY: TOP-UP APPROACH

FIGURE 8 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-DOWN APPROACH

2.4 MARKET BREAKDOWN & DATA TRIANGULATION

FIGURE 9 DATA TRIANGULATION METHODOLOGY

2.5 RESEARCH ASSUMPTIONS

2.6 LIMITATIONS

3 EXECUTIVE SUMMARY (Page No. - 35)

FIGURE 10 INCREASED DEMAND FOR FUEL TO DRIVE THE MARKET FOR INDUSTRIAL ALCOHOL IN 2020

FIGURE 11 INCREASED DEMAND FOR ETHYL ALCOHOL TO DRIVE THE MARKET FOR INDUSTRIAL ALCOHOL IN 2020 AND 2025

FIGURE 12 ASIA PACIFIC MARKET TO GROW AT THE HIGHEST RATE FOR INDUSTRIAL ALCOHOL THROUGH 2025

FIGURE 13 ASIA PACIFIC DOMINATED THE MARKET IN 2019

4 PREMIUM INSIGHTS (Page No. - 39)

4.1 BRIEF OVERVIEW OF THE INDUSTRIAL ALCOHOL MARKET

FIGURE 14 ASIA PACIFIC TO OFFER HIGH GROWTH OPPORTUNITIES FOR MARKET PLAYERS

4.2 ASIA PACIFIC: INDUSTRIAL ALCOHOL MARKET, BY KEY APPLICATION & COUNTRY

FIGURE 15 ASIA PACIFIC: CHINA WAS THE LARGEST MARKET FOR INDUSTRIAL ALCOHOL

4.3 MARKET FOR INDUSTRIAL ALCOHOL, BY APPLICATION

FIGURE 16 INDUSTRIAL ALCOHOL IS TO BE WIDELY USED IN FUEL APPLICATIONS

4.4 MARKET FOR INDUSTRIAL ALCOHOL, BY COUNTRY

FIGURE 17 INDIA IS PROJECTED TO GROW AT THE HIGHEST CAGR IN THE MARKET BETWEEN 2020 & 2025

5 MARKET OVERVIEW (Page No. - 42)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 18 INDUSTRIAL ALCOHOL MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.2.1 DRIVERS

5.2.1.1 Growth in demand for bioethanol

FIGURE 19 WORLD FUEL ETHANOL PRODUCTION SHARE, 2019

5.2.1.2 Rise in demand for methanol from end-use industries

5.2.1.3 Increase in the use of alcohol in a wide spectrum of applications

5.2.1.4 Rise in global trade in alcohol

5.2.2 RESTRAINTS

5.2.2.1 Fluctuating prices of raw material

FIGURE 20 MONTHLY PRICE TREND FOR CORN, 2019 (USD/METRIC TON)

FIGURE 21 MONTHLY PRICE TREND FOR SUGARCANE, 2019 (USD/METRIC TON)

FIGURE 22 MONTHLY PRICE TREND FOR WHEAT, (USD/METRIC TON)

5.2.2.2 The use of fuel-grade ethanol in comparison to methanol

5.2.3 OPPORTUNITIES

5.2.3.1 Emerging markets: new growth frontiers

5.2.3.2 Advent of greener ethyl alcohol sources

5.2.3.3 Use of methanol as a marine fuel

5.2.4 CHALLENGES

5.2.4.1 Approval from various regulatory bodies

5.2.4.2 Adverse environmental impact of bioethanol production

5.2.4.3 A challenging capital cost environment

5.3 IMPACT OF COVID-19 ON THE INDUSTRIAL ALCOHOL MARKET

5.4 PRICING ANALYSIS

FIGURE 23 PRICE TREND FOR ETHANOL, 2019 (USD/METRIC TON)

FIGURE 24 PRICE TREND FOR METHANOL, 2017-2020 (USD/METRIC TON)

5.5 TRADE ANALYSIS

5.5.1 EXPORT DATA ANALYSIS

FIGURE 25 INDUSTRIAL ALCOHOL MARKET EXPORT ANALYSIS, 2019: US WAS THE MAJOR EXPORTER OF ETHYL ALCOHOL

5.5.2 IMPORT DATA ANALYSIS

FIGURE 26 INDUSTRIAL ALCOHOL MARKET IMPORT ANALYSIS, 2019: US WAS THE MAJOR IMPORTER OF ETHYL ALCOHOL

5.5.3 VALUE CHAIN ANALYSIS

FIGURE 27 VALUE CHAIN ANALYSIS OF THE MARKET, 2017: A MAJOR CONTRIBUTION IS WITNESSED FROM PROCESSING

5.6 SUPPLY CHAIN

FIGURE 28 SUPPLY CHAIN: INDUSTRIAL ALCOHOL MARKET

5.7 REGULATORY ENVIRONMENT

TABLE 2 LEGAL PERMISSIBLE LIMIT OF ETHYL ALCOHOL BLENDS, BY COUNTRY

5.8 CASE STUDIES

5.8.1 MNM HELPED FOR A LEADING INDUSTRIAL ALCOHOL PROVIDER PARTNER WITH A PROMINENT CHEMICAL INTERMEDIATES & SOLVENTS COMPANY, TARGETING A PROJECTED REVENUE OF USD 200 MILLION OVER 3 YEARS

5.8.2 MNM HELPED A LEADING CHEMICAL MANUFACTURER ACQUIRE AN METHYL ALCOHOL PROVIDER, TO MEET THE RISING CONSUMER DEMAND

5.9 MARKET ECOSYSTEM

FIGURE 29 INDUSTRIAL ALCOHOL: MARKET ECOSYSTEM

6 INDUSTRIAL ALCOHOL MARKET, BY TYPE (Page No. - 59)

6.1 INTRODUCTION

FIGURE 30 INDUSTRIAL ALCOHOL MARKET SIZE, BY TYPE, 2020 VS. 2025 (USD MILLION)

TABLE 3 INDUSTRIAL ALCOHOL MARKET SIZE, BY TYPE, 2018-2025 (USD MILLION)

TABLE 4 INDUSTRIAL ALCOHOL MARKET SIZE, BY TYPE, 2018-2025 (KT)

6.2 ETHYL ALCOHOL

6.2.1 ETHANOL IS THE MOST PREFERRED TYPE OF INDUSTRIAL ALCOHOL WITH A VAST RANGE OF APPLICATIONS

TABLE 5 INDUSTRIAL ETHYL ALCOHOL MARKET SIZE, BY REGION, 2018-2025 (USD MILLION)

TABLE 6 INDUSTRIAL ETHYL ALCOHOL MARKET SIZE, BY REGION, 2018-2025 (KT)

6.3 METHYL ALCOHOL

6.3.1 METHYL ALCOHOL IS A TOXIC ALCOHOL, USED MOSTLY AS SOLVENTS, DEICERS, AND FUEL

TABLE 7 INDUSTRIAL METHYL ALCOHOL MARKET SIZE, BY REGION, 2018-2025 (USD MILLION)

TABLE 8 INDUSTRIAL METHYL ALCOHOL MARKET SIZE, BY REGION, 2018-2025 (KT)

6.4 ISOPROPYL ALCOHOL

6.4.1 ISOPROPYL ALCOHOL IS THE MOST SUITABLE FOR SANITIZATION PURPOSES

TABLE 9 INDUSTRIAL ISOPROPYL ALCOHOL MARKET SIZE, BY REGION, 2018-2025 (USD MILLION)

TABLE 10 INDUSTRIAL ISOPROPYL ALCOHOL MARKET SIZE, BY REGION, 2018-2025 (KT)

6.5 ISOBUTYL ALCOHOL

6.5.1 ISOBUTYL ALCOHOL IS LARGELY USED IN CHEMICALS AND CHEMICAL INTERMEDIATES

TABLE 11 INDUSTRIAL ISOBUTYL ALCOHOL MARKET SIZE, BY REGION, 2018-2025 (USD MILLION)

TABLE 12 INDUSTRIAL ISOBUTYL ALCOHOL MARKET SIZE, BY REGION, 2018-2025 (KT)

6.6 OTHER TYPES

TABLE 13 OTHER INDUSTRIAL ALCOHOL TYPES MARKET SIZE, BY REGION, 2018-2025 (USD MILLION)

TABLE 14 OTHER TYPES: MARKET SIZE FOR INDUSTRIAL ALCOHOL, BY REGION, 2018-2025 (KT)

7 INDUSTRIAL ALCOHOL MARKET, BY SOURCE (Page No. - 69)

7.1 INTRODUCTION

FIGURE 31 MARKET SIZE FOR INDUSTRIAL ALCOHOL, BY SOURCE, 2020 VS. 2025 (USD MILLION)

TABLE 15 MARKET SIZE FOR INDUSTRIAL ALCOHOL, BY SOURCE, 2018-2025 (USD MILLION)

TABLE 16 MARKET SIZE FOR INDUSTRIAL ALCOHOL, BY SOURCE, 2018-2025 (KT)

7.2 SUGARCANE & BAGASSE

7.2.1 SUGARCANE AND BAGASSE ARE AMONG THE MAJOR SOURCES OF ETHYL AND METHYL ALCOHOL

TABLE 17 SUGARCANE & BAGASSE: MARKET SIZE FOR INDUSTRIAL SIZE, BY REGION, 2018-2025 (USD MILLION)

TABLE 18 SUGARCANE- & BAGASSE: MARKET SIZE FOR INDUSTRIAL ALCOHOL, BY REGION, 2018-2025 (KT)

7.3 CORN

7.3.1 CORN IS A GRAIN PRODUCED EXTENSIVELY IN NORTH AMERICA AND IS COST-EFFECTIVE

TABLE 19 CORN: MARKET SIZE FOR INDUSTRIAL SIZE, BY REGION, 2018-2025 (USD MILLION)

TABLE 20 CORN: MARKET SIZE FOR INDUSTRIAL ALCOHOL, BY REGION, 2018-2025 (KT)

7.4 GRAINS

7.4.1 GRAINS APART FROM CORN ARE USED FOR PRODUCTION OF ISOBUTYL ALCOHOL AND ETHYL ALCOHOL

TABLE 21 GRAINS: MARKET SIZE FOR INDUSTRIAL ALCOHOL, BY REGION, 2018-2025 (USD MILLION)

TABLE 22 GRAINS: MARKET SIZE FOR INDUSTRIAL ALCOHOL, BY REGION, 2018-2025 (KT)

7.5 MOLASSES

7.5.1 SOYBEAN MOLASSES IS WIDELY USED AS A SUBSTRATE IN MANUFACTURING INDUSTRIAL ALCOHOL

TABLE 23 MOLASSES: MARKET SIZE FOR INDUSTRIAL ALCOHOL, BY REGION, 2018-2025 (USD MILLION)

TABLE 24 MOLASSES: MARKET SIZE FOR INDUSTRIAL ALCOHOL, BY REGION, 2018-2025 (KT)

7.6 FOSSIL FUELS

7.6.1 INDUSTRIAL ALCOHOL EXTRACTED FROM PETROLEUM PRODUCTS IS USED AS A BLEND IN FUELS A SUCH AS GASOLINE

TABLE 25 FOSSIL FUEL: MARKET SIZE FOR INDUSTRIAL ALCOHOL, BY REGION, 2018-2025 (USD MILLION)

TABLE 26 FOSSIL FUEL: MARKET SIZE FOR INDUSTRIAL ALCOHOL, BY REGION, 2018-2025 (KT)

7.7 OTHER SOURCES

TABLE 27 OTHER SOURCES: MARKET SIZE FOR INDUSTRIAL ALCOHOL, BY REGION, 2018-2025 (USD MILLION)

TABLE 28 OTHER SOURCES: MARKET SIZE FOR INDUSTRIAL ALCOHOL, BY REGION, 2018-2025 (KT)

8 INDUSTRIAL ALCOHOL MARKET, BY APPLICATION (Page No. - 79)

8.1 INTRODUCTION

FIGURE 32 THE FUEL SEGMENT IS PROJECTED TO ACCOUNT FOR THE LARGEST SHARE AMONG ALL APPLICATIONS OF INDUSTRIAL ALCOHOL THROUGH 2025 (USD BILLION)

TABLE 29 MARKET SIZE FOR INDUSTRIAL ALCOHOL, BY APPLICATION, 2018-2025 (USD MILLION)

TABLE 30 MARKET SIZE FOR INDUSTRIAL ALCOHOL, BY APPLICATION, 2018-2025 (KT)

8.2 FUEL

8.2.1 MANDATE TO USE ETHYL ALCOHOL BLENDS INSTEAD OF COMMERCIAL GASOLINE FUELS IN COUNTRIES SUCH AS THE US

TABLE 31 FUEL: MARKET SIZE FOR INDUSTRIAL ALCOHOL, BY REGION, 2018-2025 (USD MILLION)

TABLE 32 FUEL: MARKET SIZE FOR INDUSTRIAL ALCOHOL, BY REGION, 2018-2025 (KT)

8.3 CHEMICAL INTERMEDIATES & SOLVENTS

8.3.1 ALCOHOL IS USED AS THE MAIN SOLVENT IN PAINTS & INKS, WOOD VARNISHES, POLISHES, AND COATINGS

TABLE 33 CHEMICAL INTERMEDIATES & SOLVENTS: MARKET SIZE FOR INDUSTRIAL ALCOHOL, BY REGION, 2018-2025 (USD MILLION)

TABLE 34 CHEMICAL INTERMEDIATES & SOLVENTS: MARKET SIZE FOR INDUSTRIAL ALCOHOL, BY REGION, 2018-2025 (KT)

8.4 PHARMACEUTICALS

8.4.1 ETHANOL MANUFACTURERS IN THE US AND EUROPE ARE PRODUCING BIOETHANOL IN BULK TO MEET THE DEMAND FOR HAND SANITIZERS

TABLE 35 PHARMACEUTICALS: MARKET SIZE FOR INDUSTRIAL SIZE, BY REGION, 2018-2025 (USD MILLION)

TABLE 36 PHARMACEUTICALS: MARKET SIZE FOR INDUSTRIAL ALCOHOL, BY REGION, 2018-2025 (KT)

8.5 PERSONAL CARE PRODUCTS

8.5.1 ETHANOL IS SKIN FRIENDLY AND ODORLESS

TABLE 37 PERSONAL CARE PRODUCTS: MARKET SIZE FOR INDUSTRIAL ALCOHOL, BY REGION, 2018-2025 (USD MILLION)

TABLE 38 PERSONAL CARE PRODUCTS: MARKET SIZE FOR INDUSTRIAL ALCOHOL, BY REGION, 2018-2025 (KT)

8.6 FOOD

8.6.1 ETHYL ALCOHOL, ISOBUTYL ALCOHOL, AND BENZYL ALCOHOL ARE WIDELY USED IN THE FOOD INDUSTRY FOR FLAVORING PURPOSES

TABLE 39 FOOD: MARKET SIZE FOR INDUSTRIAL ALCOHOL, BY REGION, 2018-2025 (USD MILLION)

TABLE 40 FOOD: MARKET SIZE FOR INDUSTRIAL ALCOHOL, BY REGION, 2018-2025 (KT)

8.7 OTHER APPLICATIONS

TABLE 41 OTHER APPLICATIONS: MARKET SIZE FOR INDUSTRIAL ALCOHOL, BY REGION, 2018-2025 (USD MILLION)

TABLE 42 OTHER APPLICATIONS: MARKET SIZE FOR INDUSTRIAL ALCOHOL, BY REGION, 2018-2025 (KT)

9 INDUSTRIAL ALCOHOL MARKET, BY PURITY (Page No. - 89)

9.1 INTRODUCTION

9.2 DENATURED ALCOHOL

9.3 UNDENATURED ALCOHOL

10 INDUSTRIAL ALCOHOL MARKET, BY FUNCTIONALITY (Page No. - 91)

10.1 INTRODUCTION

10.2 ANTIMICROBIAL ACTIVITY

10.3 FRAGRANT/FLAVORING AGENTS

10.4 SOLUBILITY

10.5 ANTIFREEZE

10.6 FLAMMABILITY & VOLATILITY

11 INDUSTRIAL ALCOHOL MARKET, BY PROCESS TECHNOLOGY (Page No. - 94)

11.1 INTRODUCTION

11.2 FERMENTATION METHOD

11.3 SYNTHETIC METHOD

12 INDUSTRIAL ALCOHOL MARKET, BY REGION (Page No. - 96)

12.1 INTRODUCTION

FIGURE 33 MARKET SHARE (VALUE), BY KEY COUNTRY, 2020

TABLE 43 MARKET SIZE, BY REGION, 2018-2025 (USD MILLION)

TABLE 44 MARKET SIZE, BY REGION, 2018-2025 (KT)

12.2 ASIA PACIFIC

FIGURE 34 ASIA PACIFIC: MARKET SNAPSHOT

TABLE 45 ASIA PACIFIC: INDUSTRIAL ALCOHOL MARKET SIZE, BY COUNTRY, 2018-2025 (USD MILLION)

TABLE 46 ASIA PACIFIC: MARKET SIZE FOR INDUSTRIAL ALCOHOL, BY COUNTRY, 2018-2025 (KT)

TABLE 47 ASIA PACIFIC: MARKET SIZE FOR INDUSTRIAL ALCOHOL, BY TYPE, 2018-2025 (USD MILLION)

TABLE 48 ASIA PACIFIC: MARKET SIZE FOR INDUSTRIAL ALCOHOL, BY TYPE, 2018-2025 (KT) 101

TABLE 49 ASIA PACIFIC: MARKET SIZE FOR INDUSTRIAL ALCOHOL, BY SOURCE, 2018-2025 (USD MILLION)

TABLE 50 ASIA PACIFIC: MARKET SIZE FOR INDUSTRIAL ALCOHOL, BY SOURCE, 2018-2025 (KT)

TABLE 51 ASIA PACIFIC: MARKET SIZE FOR INDUSTRIAL ALCOHOL, BY APPLICATION, 2018-2025 (USD MILLION)

TABLE 52 ASIA PACIFIC: MARKET SIZE FOR INDUSTRIAL ALCOHOL, BY APPLICATION, 2018-2025 (KT)

12.2.1 CHINA

12.2.1.1 Methyl alcohol offers an ideal solution for companies in China to cater to the increasing demand for fuel

TABLE 53 CHINA: MARKET SIZE FOR INDUSTRIAL ALCOHOL, BY TYPE, 2018-2025 (USD MILLION)

12.2.2 INDIA

12.2.2.1 India witnesses a high demand for convenience and secondary packaging

TABLE 54 INDIA: MARKET SIZE FOR INDUSTRIAL ALCOHOL, BY TYPE, 2018-2025 (USD MILLION)

12.2.3 THAILAND

12.2.3.1 Thai market driven by the Increase in consumer awareness about hygiene

TABLE 55 THAILAND: INDUSTRIAL ALCOHOL MARKET SIZE, BY TYPE, 2018-2025 (USD MILLION)

12.2.4 REST OF ASIA PACIFIC

TABLE 56 REST OF ASIA PACIFIC: MARKET SIZE FOR INDUSTRIAL ALCOHOL, BY TYPE, 2018-2025 (USD MILLION)

12.3 NORTH AMERICA

FIGURE 35 NORTH AMERICAN INDUSTRIAL ALCOHOL MARKET SNAPSHOT

TABLE 57 NORTH AMERICA: INDUSTRIAL ALCOHOL MARKET SIZE, BY TYPE, 2018-2025 (USD MILLION)

TABLE 58 NORTH AMERICA: MARKET SIZE FOR INDUSTRIAL ALCOHOL, BY TYPE, 2018-2025 (KT)

TABLE 59 NORTH AMERICA: MARKET SIZE FOR INDUSTRIAL ALCOHOL, BY COUNTRY, 2018-2025 (USD MILLION)

TABLE 60 NORTH AMERICA: MARKET SIZE FOR INDUSTRIAL ALCOHOL, BY COUNTRY, 2018-2025 (KT)

TABLE 61 NORTH AMERICA: MARKET SIZE FOR INDUSTRIAL ALCOHOL, BY SOURCE, 2018-2025 (USD MILLION)

TABLE 62 NORTH AMERICA: MARKET SIZE FOR INDUSTRIAL ALCOHOL, BY SOURCE, 2017-2019 (KT)

TABLE 63 NORTH AMERICA: MARKET SIZE FOR INDUSTRIAL ALCOHOL, BY APPLICATION, 2018-2025 (USD MILLION)

TABLE 64 NORTH AMERICA: MARKET SIZE FOR INDUSTRIAL ALCOHOL, BY APPLICATION, 2018-2025 (KT)

12.3.1 US

12.3.1.1 There is a high demand for ethyl alcohol produced in the US in the export market

TABLE 65 US: MARKET SIZE FOR INDUSTRIAL ALCOHOL, BY TYPE, 2018-2025 (USD MILLION)

12.3.2 CANADA

12.3.2.1 To improve fuel efficiency and decrease environmental impact, the government is encouraging the use of ethanol in fuel

TABLE 66 CANADA: MARKET SIZE FOR INDUSTRIAL ALCOHOL, BY TYPE, 2018-2025 (USD MILLION)

12.3.3 MEXICO

12.3.3.1 Sugarcane is a major source of industrial alcohol produced in Mexico

TABLE 67 MEXICO: INDUSTRIAL ALCOHOL MARKET SIZE, BY TYPE, 2018-2025 (USD MILLION)

12.4 EUROPE

TABLE 68 EUROPE: INDUSTRIAL ALCOHOL MARKET SIZE, BY TYPE, 2018-2025 (USD MILLION)

TABLE 69 EUROPE: MARKET SIZE FOR INDUSTRIAL ALCOHOL, BY TYPE, 2018-2025 (KT)

TABLE 70 EUROPE: MARKET SIZE FOR INDUSTRIAL ALCOHOL, BY COUNTRY, 2018-2025 (USD MILLION)

TABLE 71 EUROPE: MARKET SIZE FOR INDUSTRIAL ALCOHOL, BY COUNTRY, 2018-2025 (KT)

TABLE 72 EUROPE: MARKET SIZE FOR INDUSTRIAL ALCOHOL, BY SOURCE, 2018-2025 (USD MILLION)

TABLE 73 EUROPE: MARKET SIZE FOR INDUSTRIAL ALCOHOL, BY SOURCE, 2018-2025 (KT)

TABLE 74 EUROPE: MARKET SIZE FOR INDUSTRIAL ALCOHOL, BY APPLICATION, 2018-2025 (USD MILLION)

TABLE 75 EUROPE: MARKET SIZE FOR INDUSTRIAL ALCOHOL, BY APPLICATION, 2018-2025 (KT)

12.4.1 GERMANY

12.4.1.1 Easy availability of cheap feedstocks in Germany for methyl production

TABLE 76 GERMANY: MARKET SIZE FOR INDUSTRIAL ALCOHOL, BY TYPE, 2018-2025 (USD MILLION)

12.4.2 UK

12.4.2.1 Increase in consumption of methyl alcohol in the UK due to new technological advancements

TABLE 77 UK: MARKET SIZE FOR INDUSTRIAL ALCOHOL, BY TYPE, 2020-2025 (USD MILLION)

12.4.3 FRANCE

12.4.3.1 France among the largest producers of fuel ethyl alcohol among European countries

TABLE 78 FRANCE: MARKET SIZE FOR INDUSTRIAL ALCOHOL, BY TYPE, 2018-2025 (USD MILLION)

12.4.4 SPAIN

12.4.4.1 Spain witnessed the introduction of mandatory regulatory changes for bioethanol

TABLE 79 SPAIN: MARKET SIZE FOR INDUSTRIAL ALCOHOL, BY TYPE, 2018-2025 (USD MILLION)

12.4.5 SWEDEN

12.4.5.1 Introduction of national policies in Sweden encourage the production and use of renewable fuels

TABLE 80 SWEDEN: MARKET SIZE FOR INDUSTRIAL ALCOHOL, BY TYPE, 2018-2025 (USD MILLION)

12.4.6 POLAND

12.4.6.1 Poland is expected to roll out an e10 mandate by 2022

TABLE 81 POLAND: MARKET SIZE FOR INDUSTRIAL ALCOHOL, BY TYPE, 2018-2025 (USD MILLION)

12.4.7 REST OF EUROPE

TABLE 82 REST OF EUROPE: INDUSTRIAL ALCOHOL MARKET SIZE, BY TYPE, 2018-2025 (USD MILLION)

12.5 SOUTH AMERICA

TABLE 83 SOUTH AMERICA: MARKET SIZE FOR INDUSTRIAL ALCOHOL, BY COUNTRY, 2018-2025 (USD MILLION)

TABLE 84 SOUTH AMERICA: MARKET SIZE FOR INDUSTRIAL ALCOHOL, BY COUNTRY, 2018-2025 (KT)

TABLE 85 SOUTH AMERICA: MARKET SIZE FOR INDUSTRIAL ALCOHOL, BY TYPE, 2018-2025 (USD MILLION)

TABLE 86 SOUTH AMERICA: MARKET SIZE FOR INDUSTRIAL ALCOHOL, BY TYPE, 2018-2025 (KT)

TABLE 87 SOUTH AMERICA: MARKET SIZE FOR INDUSTRIAL ALCOHOL, BY SOURCE, 2018-2025 (USD MILLION)

TABLE 88 SOUTH AMERICA: MARKET SIZE FOR INDUSTRIAL ALCOHOL, BY SOURCE, 2018-2025 (KT)

TABLE 89 SOUTH AMERICA: MARKET SIZE FOR INDUSTRIAL ALCOHOL, BY APPLICATION, 2018-2025 (USD MILLION)

TABLE 90 SOUTH AMERICA: MARKET SIZE FOR INDUSTRIAL ALCOHOL, BY APPLICATION, 2018-2025 (KT)

12.5.1 BRAZIL

12.5.1.1 Brazil is the second-largest producer and exporter of ethyl alcohol, following the US

TABLE 91 BRAZIL: INDUSTRIAL ALCOHOL MARKET SIZE, BY TYPE, 2018-2025 (USD MILLION)

12.5.2 REST OF SOUTH AMERICA

TABLE 92 REST OF SOUTH AMERICA: INDUSTRIAL ALCOHOL MARKET SIZE, BY TYPE, 2018-2025 (USD MILLION)

12.6 ROW

TABLE 93 ROW: INDUSTRIAL ALCOHOL MARKET SIZE, BY REGION, 2018-2025 (USD MILLION)

TABLE 94 ROW: MARKET SIZE FOR INDUSTRIAL ALCOHOL, BY REGION, 2018-2025 (KT)

TABLE 95 ROW: MARKET SIZE, BY TYPE, 2018-2025 (USD MILLION)

TABLE 96 ROW: MARKET SIZE, BY TYPE, 2018-2025 (KT)

TABLE 97 ROW: MARKET SIZE, BY SOURCE, 2018-2025 (USD MILLION)

TABLE 98 ROW: MARKET SIZE, BY SOURCE, 2018-2025 (KT)

TABLE 99 ROW: MARKET SIZE, BY APPLICATION, 2018-2025 (USD MILLION)

TABLE 100 ROW: MARKET SIZE, BY APPLICATION, 2019-2025 (KT)

12.6.1 MIDDLE EAST

12.6.1.1 In the Middle East, Oman, the UAE, and KSA are the key markets

TABLE 101 MIDDLE EAST: MARKET SIZE FOR INDUSTRIAL ALCOHOL, BY TYPE, 2018-2025 (USD MILLION)

12.6.2 AFRICA

12.6.2.1 Sub-Saharan Africa is projected to offer high growth potential for bioethanol

TABLE 102 AFRICA: MARKET SIZE FOR INDUSTRIAL ALCOHOL, BY TYPE, 2018-2025 (USD MILLION)

13 COMPETITIVE LANDSCAPE (Page No. - 136)

13.1 OVERVIEW

FIGURE 36 KEY DEVELOPMENTS OF THE LEADING PLAYERS IN THE INDUSTRIAL ALCOHOL MARKET, 2018-2020

13.2 COMPETITIVE SCENARIO (MARKET EVALUATION FRAMEWORK)

FIGURE 37 MARKET EVALUATION FRAMEWORK, 2018-2020

13.3 MARKET SHARE, 2019

FIGURE 38 SIGMA-ALDRICH LED THE INDUSTRIAL ALCOHOL MARKET, 2019

13.4 RANKING OF KEY PLAYERS, 2019

FIGURE 39 PLAYER RANKING, 2019

13.5 KEY MARKET DEVELOPMENTS

13.5.1 EXPANSIONS & INVESTMENTS

TABLE 103 EXPANSIONS & INVESTMENTS, 2019-2020

13.5.2 MERGERS & ACQUISITIONS

TABLE 104 MERGERS & ACQUISITIONS, 2018-2020

13.5.3 AGREEMENTS, COLLABORATIONS, AND PARTNERSHIPS

TABLE 105 AGREEMENTS, COLLABORATIONS, AND PARTNERSHIPS, 2018-2020

14 COMPANY EVALUATION MATRIX AND COMPANY PROFILES (Page No. - 143)

14.1 COMPETITIVE LEADERSHIP MAPPING

14.1.1 STARS

14.1.2 EMERGING LEADERS

14.1.3 PERVASIVE PLAYERS

14.1.4 EMERGING COMPANIES

FIGURE 40 INDUSTRIAL ALCOHOL MARKET COMPETITIVE LEADERSHIP MAPPING, 2018 (OVERALL MARKET)

14.2 COMPETITIVE LEADERSHIP MAPPING (START-UP/SME)

14.2.1 PROGRESSIVE COMPANIES

14.2.2 STARTING BLOCKS

14.2.3 RESPONSIVE COMPANIES

14.2.4 DYNAMIC COMPANIES

FIGURE 41 INDUSTRIAL ALCOHOL MARKET: COMPETITIVE LEADERSHIP MAPPING, 2018 (START-UP/SME)

14.3 COMPANY PROFILES

14.3.1 INTRODUCTION

(Business overview, Products offered, Recent developments, SWOT analysis, MnM View & Right to win)*

14.3.2 CARGILL

FIGURE 42 CARGILL: COMPANY SNAPSHOT

FIGURE 43 CARGILL: SWOT ANALYSIS

14.3.3 RAÍZEN ENERGIA

FIGURE 44 RAIZEN ENERGIA: COMPANY SNAPSHOT

FIGURE 45 RAIZEN ENERGIA: SWOT ANALYSIS

14.3.4 GREEN PLAINS INC.

FIGURE 46 GREEN PLAINS INC.: COMPANY SNAPSHOT

FIGURE 47 GREEN PLAINS INC.: SWOT ANALYSIS

14.3.5 CRISTALCO

FIGURE 48 CRISTALCO: SWOT ANALYSIS

14.3.6 MGP INGREDIENTS

FIGURE 49 MGP INGREDIENTS: COMPANY SNAPSHOT

FIGURE 50 MGP INGREDIENTS: SWOT ANALYSIS

14.3.7 THE ANDERSONS INC.

FIGURE 51 THE ANDERSONS INC.: COMPANY SNAPSHOT

14.3.8 GRAIN PROCESSING CORPORATION

14.3.9 GREENFIELD GLOBAL, INC.

14.3.10 FLINT HILLS RESOURCES

14.3.11 SIGMA-ALDRICH

FIGURE 52 SIGMA-ALDRICH: COMPANY SNAPSHOT

14.3.12 EXXON MOBIL CORPORATION

FIGURE 53 EXXON MOBIL CORPORATION: COMPANY SNAPSHOT

14.3.13 EASTMAN CHEMICALS COMPANY

FIGURE 54 EASTMAN CHEMICALS COMPANY: COMPANY SNAPSHOT

14.3.14 DOW CHEMICAL COMPANY

FIGURE 55 DOW CHEMICALS COMPANY: COMPANY SNAPSHOT

14.3.15 LYONDELLBASELL INDUSTRIES N.V.

FIGURE 56 LYONDELLBASELL INDUSTRIES N.V.: COMPANY SNAPSHOT

14.3.16 LINDE

FIGURE 57 LINDE: COMPANY SNAPSHOT

14.3.17 ROYAL DUTCH SHELL

FIGURE 58 ROYAL DUTCH SHELL PLC: COMPANY SNAPSHOT

14.3.18 ECOLAB

FIGURE 59 ECOLAB: COMPANY SNAPSHOT

14.3.19 UNIVAR SOLUTIONS

FIGURE 60 UNIVAR SOLUTIONS INC.: COMPANY SNAPSHOT

14.3.20 ARCHER DANIELS MIDLAND

FIGURE 61 ADM: COMPANY SNAPSHOT

14.3.21 WILMAR INTERNATIONAL LIMITED

FIGURE 62 WILMAR INTERNATIONAL: COMPANY SNAPSHOT

*Details on Business overview, Products offered, Recent developments, SWOT analysis, MnM View & Right to win might not be captured in case of unlisted companies.

15 APPENDIX (Page No. - 197)

15.1 DISCUSSION GUIDE

15.2 KNOWLEDGE STORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

15.3 AVAILABLE CUSTOMIZATIONS

15.4 RELATED REPORTS

15.5 AUTHOR DETAILS

The study involves four major activities to estimate the current size for industrial alcohol market. Exhaustive secondary research was conducted to collect information on the market, peer market, and parent market. These findings, assumptions, and market size were validated with industry experts across the value chain through primary research. Both the top-down and bottom-up approaches were employed to estimate the complete market size. After that, the market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources such as Hoovers, Bloomberg BusinessWeek, and Dun & Bradstreet were referred to, to identify and collect information for this study. These secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, gold standard & silver standard websites, food safety organizations, regulatory bodies, trade directories, and databases.

Primary Research

The industrial alcohol market comprises several stakeholders such as manufacturers of agricultural industrial alcohol, manufacturers of silage industrial alcohol, and suppliers of raw materials. The demand-side of this market is characterized by the rising demand from various end-use industries, such as automotive, aerospace & defense, electrical & electronics, industrial machinery, medical device, and construction. The supply-side is characterized by advancements in technology and diverse application industries. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. Following is the breakdown of the primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

*Others include sales managers, marketing managers, and product managers.

**RoW includes the Middle East and Africa.

Note: The three tiers of the companies are defined based on their total revenues in 2017 or 2018, as per the availability of financial data. Tier 1: Revenue > USD 1 billion; Tier 2: USD 100 million <= Revenue < =USD 1 billion; Tier 3: Revenue < USD 100 million.

Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the total size of the market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and markets were identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value and volume, were determined through primary and secondary research processes.

- All percentage shares splits, and breakdowns were determined using secondary sources and verified through primary respondents

Industrial Alcohol Market Size: Bottom-Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall market size—using the market size estimation processes, as explained above—the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation and market breakdown procedures were employed. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Report Objectives

- To define, segment, and project the global market size for the market

- To understand the structure of the market by identifying its various subsegments

- To provide detailed information about the key factors influencing the growth of the market (drivers, restraints, opportunities, and industry-specific challenges)

- To analyze the micro-markets, with respect to individual growth trends, future prospects, and their contribution to the total industrial alcohol market

- To project the size of the market and its submarkets, in terms of value and volume, with respect to the regions (along with their respective key countries)

- To profile the key players and comprehensively analyze their core competencies

- To understand the competitive landscape and identify the major growth strategies adopted by the players across key regions

- To analyze the competitive developments, such as expansions & investments, mergers & acquisitions, new product launches, partnerships, joint ventures, and agreements

1 Core competencies of companies include their key developments and strategies adopted by them to sustain their position in the market

AVAILABLE CUSTOMIZATIONS

With the given market data, MarketsandMarkets offers customizations according to the company’s specific scientific needs. The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Geographic Analysis

- Further breakdown of the Rest of Europe market by country

- Further breakdown of the Rest of Asia Pacific market by country

- Further breakdown of the Rest of South America market by country

Growth opportunities and latent adjacency in Industrial Alcohol Market