Specialty Malt Market by Type (Roasted, Crystal, and Dark), Application (Brewing, Distilling, Non-alcoholic Malt Beverages, Bakery), Source (Barley, Wheat, and Rye), Form (Dry & Liquid), and Region - Global Forecast to 2022

[133 Pages Report] The specialty malts market is estimated at USD 2.36 billion in 2017 and is projected to reach USD 3.01 billion by 2022, at a CAGR of 5.0% from 2017. Specialty malts can be defined as malts that consist of a larger percentage of lighter malts and a smaller percentage of flavored or colored malts. Specialty malts are uniquely steeped and kilned to achieve the desired sweetness, taste, color, and effect. Specialty malts can be classified into three main categories, namely, crystal or caramel malt, roasted malt, and dark malt. Roasted malts are usually kilned to a very high degree to achieve the desired result and are the most commonly used specialty malts in brewing. The base year considered for the study is 2016, and the forecast has been provided for the period between 2017 and 2022.

Market Dynamics

Drivers

- Malternatives to drive the specialty malt market

- Craft beer becoming popular with the increasing beer consumption

- Specialty malts play a crucial role in defining the taste & texture of craft beers

Restraints

- Uncertain environment conditions

Opportunities

- Emerging markets offers potential for specialty malts

- Evolving demand of malt based RTDS/high strength premixes offering opportunities in APAC region

Challenges

- Distribution network facing challenges

- Fluctuations in raw materials prices

Increase in popularity of craft beer

Increase in demand for beer is encouraging the use of specialty malt in local breweries. The usage of specialty malt in the brewing industry is expected to boost the consumption of the craft beer, globally. The usage of specialty malt is expected to increase, owing to the increasing demand of flavored malt in brewing. The growing popularity of craft beer and domestic beer are likely to further raise the demand for specialty malt over the next few years.

To know about the assumptions considered for the study, Request for Free Sample Report

The following are the major objectives of the study.

- To describe and forecast the specialty malt market, in terms of value, by application, type, source form and region

- To describe and forecast the market, in terms of volume, by application, type, source form and region

- To describe and forecast the specialty malt market, in terms of value, by region–Asia Pacific (APAC), Europe, North America, and Rest of the World (RoW) along with their respective countries

- To provide detailed information regarding major factors influencing market growth (drivers, restraints, opportunities, and challenges)

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and contributions to the overall market

- To study the complete value chain of specialty malt

- To analyze opportunities in the market for stakeholders by identifying the high-growth segments of the specialty malt

- To strategically profile key players and comprehensively analyze their market position in terms of ranking and core competencies, along with detailing competitive landscape for market leaders

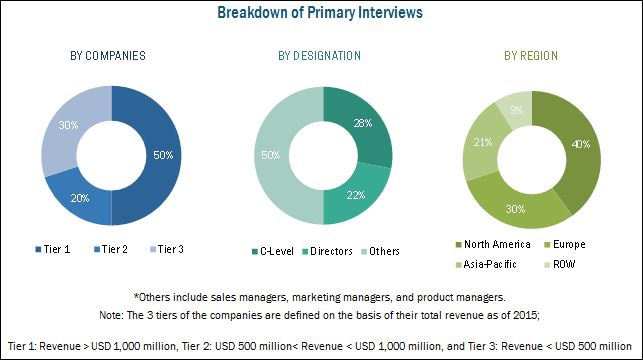

During this research study, major players operating in the specialty malt market in various regions have been identified, and their offerings, regional presence, and distribution channels have been analyzed through in-depth discussions. Top-down and bottom-up approaches have been used to determine the overall market size. Sizes of the other individual markets have been estimated using the percentage splits obtained through secondary sources such as Hoovers, Bloomberg BusinessWeek, and Factiva, along with primary respondents. The entire procedure includes the study of the annual and financial reports of the top market players and extensive interviews with industry experts such as CEOs, VPs, directors, and marketing executives for key insights (both qualitative and quantitative) pertaining to the market. The figure below shows the breakdown of the primaries on the basis of the company type, designation, and region considered during the research study.

To know about the assumptions considered for the study, download the pdf brochure

Key participants in the specialty malt market are the malt manufacturers, suppliers, and regulatory bodies. The key players that are profiled in the report include Cargill (U.S.), Malteurop Groupe (France), GrainCorp Ltd. (Australia), Soufflet Group (France), and Axereal Group (France).

Major Market Developments

- In May 2016, Viking Malt acquired Carlsberg’s subsidiary—Danish Malting Group A/S (DMG). DMG had three malting plants (one in Denmark and two in Poland) with a combined annual capacity of 220,000 tons.

- In May 2015, GrainCorp significantly expanded the malt production capacity at its Great Western Malting facility in Pocatello, Idaho, U.S. The project would increase the capacity at Pocatello by 120,000 tons, bringing the total annual malting capacity of the facility to 220,000 tons.

- In April 2015, Malteurop launched a new line of premium quality kiln-dried specialty malts. This extended Malteurop North America’s offering to satisfy the distinctive malt needs of craft brewers throughout the region.

- In November 2014, Axereal (France) and Tereos SA (France) France’s major sugar group, entered into long-term strategic partnership to develop an innovative range of solutions for their brewery and distillery customers. This partnership enabled Axereal to add value to the malting and glucose production activities.

- In October 2013, Cargill acquired Joe White Maltings (Australia) from Glencore International (Switzerland); this provided Cargill with a global footprint in all key global barley production areas, particularly in the Australian continent.

Target Audience

- Malt manufacturers

- Regulatory bodies

- Intermediary suppliers

- End Users

Report Scope

By Application

- Brewing

- Distilling

- Non-Alcoholic Malt beverages

- Baking

By Source:

- Rye

- Barley

- Wheat

By Form:

- Liquid Specialty Malts

- Dry Specialty Malts

By Geography

- North America

- Europe

- Asia Pacific

- RoW (Ecuador, South Africa)

Critical questions which the report answers

- What are new application areas which the specialty malt companies are exploring?

- Which are the key players in the market and how intense is the competition?

Available Customizations

Based on the given market data, MarketsandMarkets offers customizations in the reports as per the client’s specific requirements. The available customization options are as follows:

Geographic Analysis

- Further country-wise breakdown of the market in APAC based on application

Company Information

- Detailed analysis and profiling of additional market players (Up to 5)

The specialty malts market is estimated at USD 2.36 billion in 2017 and is projected to reach USD 3.01 billion by 2022, at a CAGR of 5.0% from 2017. The demand for specialty malts in various brewing applications and the growing usage of specialty malts in several food products have led to the growth of the specialty malts market. However, uncertain environmental conditions and seasonal variations of raw materials such as barley, wheat, and rye used to derive malt restrain the growth of this market.

The brewing segment is estimated to account for the largest share in the specialty malt market. The major factor contributing to the growth of the brewing segment for specialty malts is the growing popularity and demand for craft beer across the globe. Roasted malt, being the most popular flavored malt used for brewing, dominates the market for specialty malts. The ease of availability of a variety of roasted malts such as Vienna malt, Munich malt, and Belgian malt for craft beers is another driving factor for the specialty malts market.

Increasing consumption of alcoholic beverages resulted in an increase in demand from this industry for specialty malt. The beer industry is one of the major contributors, responsible for the increase in demand for specialty malts. Domestically brewed beer and popularity of craft beer are also fueling the market growth. Global players are investing substantially in technology and innovation for providing high-quality malt to the brewing, distilling, and food industries. Modern methods are used for stepping, germination, kilning, and deculming for getting better quality specialty malts. The global market for specialty malt ingredients is witnessing newer product innovations and various applications in different industries, signifying the progressive demand for specialty malts.

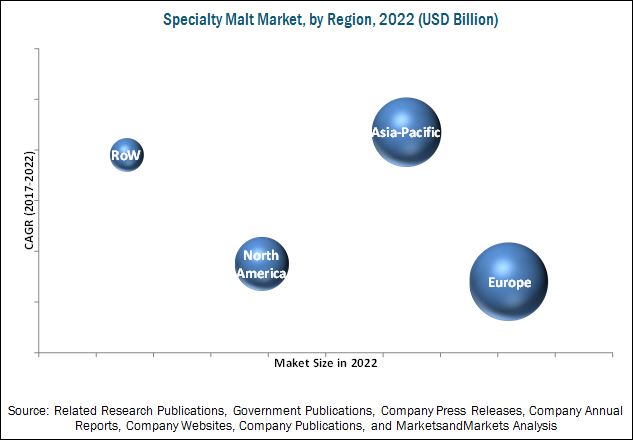

The Asia Pacific region dominated the specialty malt market in 2015. The region has a large youth population with high disposable income, and has been witnessing rising demand for alcohol with the growing popularity of craft beers. The region also has large-scale production facilities and immense potential to fulfil market demand, and is therefore projected to witness a high growth rate during the forecast period.

Specialty malt applications in brewing, distilling, non-alcoholic malt beverages, and baking drive the growth of specialty malt market

Brewing

Malt is an essential component for making beer. The production of beer by steeping malt in hot water and fermenting the resulting mixture using yeast is called brewing. The process of brewing using specialty malt can take place in a commercial brewery, a home brewery, or by a variety of traditional methods used by industrial brewers. Beer is usually fermented with a brewer's yeast and flavored with malt. Malt sources that are not often used include sorghum, millet, and cassava.

Distilling

One of the major uses of malts is in distilleries whiskey, spirits, and other alcoholic preparations. The main reason behind the growth of the alcoholic beverages segment is the increasing use of malt in breweries and distilleries coupled with the rising demand for flavored whiskeys across the globe.

Non-alcoholic malt beverages

Non-alcoholic malt beverages are generally ready-to-drink beverages with added natural or artificial flavors to achieve the desired taste. Barley is the most commonly used grain in malt beverages; however, some of these beverages may also be based from corn or wheat. The fermentation process involved for malt based soft drinks is similar to that used in beer production. Fermentation also helps to add flavor and texture to the final product. Malt-based drinks have developed a reputation over the centuries for their nutritional value leading to increased demand from developed regions.

Bakery

Specialty malts have been finding increasing applications in the baking industry being incorporated in several varieties of flavored bread, biscuits, cookies, and other preparations. The constantly changing tastes and preferences of customers for baked goods has forced manufacturers to experiment with different kinds of raw materials, including malt, in their preparations. Bread is a staple household food in most regions; several varieties of malt-infused breads are gaining popularity in developed regions.

Critical questions the report answers:

- Where will all these developments take the industry in the mid to long term?

- What are the upcoming industry applications for specialty malt?

The specialty malt manufacturers faces challenges such as distribution network. The foremost challenge is pressure on the manufacturers’ profit margins as retail stores deliver products with lower profit margins even when they are not offering discounts. At the same time, retailers are putting higher demands on local manufacturers for more frequent deliveries in order to reduce their cost of warehousing.

The specialty malt market is diversified and competitive with a large number of players. The key players in this market are Cargill (US), Malteurop Groupe (France), GrainCorp Ltd. (Australia), Soufflet Group (France), and Axereal Group (France). These companies use strategies such as mergers & acquisitions, expansions & investments, and new product launches to strengthen their position in the market. Several players adopted the expansion strategy to capture market share, globally, by investing in upgrading their production facilities, adding research laboratories and innovation centers in various regions.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 13)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Scope of the Study

1.4 Years Considered for the Study

1.5 Currency

1.6 Stakeholders

2 Research Methodology (Page No. - 17)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

2.1.2.3 Breakdown of Primaries

2.2 Factor Analysis

2.2.1 Introduction

2.2.2 Demand-Side Analysis

2.2.2.1 Increasing Beer Consumption to Fuel the Market for Specialty Malts

2.2.2.2 Emerging Economies to Play A Key Role in Increasing Demand for Consumer Products Incorporating Specialty Malt

2.2.3 Supply-Side Analysis

2.2.3.1 Barley Production

2.3 Market Size Estimation

2.4 Market Breakdown & Data Triangulation

2.5 Research Assumptions & Limitations

3 Executive Summary (Page No. - 28)

4 Premium Insights (Page No. - 32)

4.1 Attractive Opportunities in the Specialty Malts Market

4.2 Specialty Malts Market, By Application

4.3 Asia Pacific Specialty Malts Market, By Country and Type

4.4 Specialty Malts Market: Major Countries

4.5 Specialty Malts Market: Developed vs Developing Nations, 2017 vs 2022

4.6 Life Cycle Analysis, By Region

5 Market Overview (Page No. - 36)

5.1 Introduction

5.2 Market Segmentation

5.2.1 Type

5.2.2 Application

5.2.3 Source

5.2.4 By Form

5.3 Market Dynamics

5.3.1 Drivers

5.3.1.1 Malternatives to Drive the Specialty Malts Market

5.3.1.2 Increase in Popularity of Craft Beer

5.3.1.3 Specialty Malts Play A Crucial Role in Defining the Taste & Texture of Craft Beers

5.3.2 Restraints

5.3.2.1 Changes in Climatic Conditions

5.3.3 Opportunities

5.3.3.1 Emerging Markets Offers Potential for Specialty Malts

5.3.3.2 Evolving Demand for Malt-Based Rtd Cocktails/High-Strength Premixes Offering Opportunities in APAC

5.3.4 Challenges

5.3.4.1 Distribution Network Facing Challenges

5.3.4.2 Fluctuations in Raw Material Prices

6 Specialty Malt Market, By Type (Page No. - 42)

6.1 Introduction

6.2 Crystal

6.3 Roasted

6.3.1 Munich Malt

6.3.2 Vienna Malt

6.3.3 Belgian Malt

6.4 Dark

6.5 Other Types

7 Specialty Malts Market, By Application (Page No. - 49)

7.1 Introduction

7.2 Brewing

7.3 Distilling

7.4 Non-Alcoholic Malt Beverages

7.5 Baking

7.6 Others

8 Specialty Malts Market, By Source (Page No. - 58)

8.1 Introduction

8.2 Rye

8.3 Barley

8.4 Wheat

8.5 Others

9 Specialty Malts Market, By Form (Page No. - 65)

9.1 Introduction

9.2 Liquid Specialty Malts

9.3 Dry Specialty Malts

10 Specialty Malts Market, By Brand (Page No. - 70)

10.1 Weyermann Specialty Malts

10.1.1 Abbey Malt

10.1.2 Carahell

10.2 Cargill, Incorporated

10.2.1 Dingemans Biscuit (Mout Roost 50)

10.2.2 Gambrinus Honey

10.3 Malteurop Groupe Sa

10.3.1 Malteurop Germany

10.3.1.1 Munich Malt

10.4 Graincorp Limited

10.4.1 Canada Malting Co.

10.4.1.1 Cmc White Wheat Malt

10.4.1.2 Cmc Munich Malt

10.5 Ireks GmbH

10.5.1 Ireks Mela Red Alder

10.5.2 Ireks Mela Beech

11 Specialty Malts Market, By Flavor (Page No. - 72)

11.1 Introduction

11.2 Coffee Flavor

11.3 Chocolate

11.4 Caramel

11.4.1 Biscuit

11.4.2 Honey

11.5 Smoked

11.6 Aromatic Malts

12 Specialty Malts Market, By Region (Page No. - 74)

12.1 Introduction

12.2 North America

12.3 Europe

12.4 Asia-Pacific

12.5 Rest of the World (RoW)

13 Competitive Landscape (Page No. - 99)

13.1 Overview

13.2 Market Share Analysis

13.3 Competitive Situation & Trends

13.4 Acquisitions

13.5 Expansions

13.6 New Product Launches

13.7 Partnerships

14 Company Profiles (Page No. - 104)

14.1 Introduction

(Business Overview, Products Offered, Recent Developments, SWOT Analysis, and MNM View)*

14.2 Cargill, Incorporated

14.3 Graincorp Ltd.

14.4 Axereal

14.5 Soufflet Group

14.6 Malteurop

14.7 Agrária

14.8 Viking Malt AB

14.9 Ireks GmbH

14.10 Simpsons Malt Limited.

14.11 Barmalt Malting India Pvt. Ltd.

*Details on Business Overview, Products Offered, Recent Developments, SWOT Analysis, and MNM View might not be captured in case of unlisted companies.

15 Appendix (Page No. - 123)

15.1 Key Industry Insights

15.2 Discussion Guide

15.3 More Company Developments

15.3.1 Acquisitions

15.3.2 Expansions

15.3.3 New Product Launches

15.4 Knowledge Store: Marketsandmarkets’ Subscription Portal

15.5 Introducing RT: Real Time Market Intelligence

15.6 Available Customizations

15.7 Related Reports

15.8 Author Details

List of Tables (88 Tables)

Table 1 Specialty Malts Market Size, By Type, 2015–2022 (USD Million)

Table 2 Specialty Malts Market Size, By Type, 2015–2022 (KT)

Table 3 Crystal Malts Market Size, By Region, 2015–2022 (USD Million)

Table 4 Crystal Malts Market Size, By Region, 2015–2022 (KT)

Table 5 Roasted Malts Market Size, By Region, 2015–2022 (USD Million)

Table 6 Roasted Malts Market Size, By Region, 2015–2022 (KT)

Table 7 Dark Malts Market Size, By Region, 2015–2022 (USD Million)

Table 8 Dark Malts Market Size, By Region, 2015–2022 (KT)

Table 9 Other Types Market Size, By Region, 2015–2022 (USD Million)

Table 10 Other Types Market Size, By Region, 2015–2022 (KT)

Table 11 Specialty Malts Market, By Application, 2015–2022 (USD Million)

Table 12 Specialty Malts Market, By Application, 2015–2022 (KT)

Table 13 Specialty Malts for Brewing Market Size, By Region, 2015–2022 (USD Million)

Table 14 Specialty Malts for Brewing Market Size, By Region, 2015–2022 (KT)

Table 15 Specialty Malts for Distilling Market Size, By Region, 2015–2022 (USD Million)

Table 16 Specialty Malts for Distilling Market Size, By Region, 2015–2022 (KT)

Table 17 Specialty Malts for Non-Alcoholic Malt Beverages Market Size, By Region, 2015–2022 (USD Million)

Table 18 Specialty Malts for Non-Alcoholic Malt Beverages Market Size, By Region, 2015–2022 (KT)

Table 19 Specialty Malts for Bakery Market Size, By Region, 2015–2022 (USD Million)

Table 20 Specialty Malts for Bakery Market Size, By Region, 2015–2022 (KT)

Table 21 Specialty Malt for Other Applications Market Size, By Region, 2015–2022 (USD Million)

Table 22 Specialty Malt: Other Applications Market Size, By Region, 2015–2022 (KT)

Table 23 Specialty Malts Market Size, By Source, 2015–2022 (USD Million)

Table 24 Specialty Malt Market Size, By Source, 2015–2022 (KT)

Table 25 Rye Malt Market Size, By Region, 2015–2022 (USD Million)

Table 26 Rye Malt Market Size, By Region, 2015–2022 (KT)

Table 27 Barley Malt Market Size, By Region, 2015–2022 (USD Million)

Table 28 Barley Malt Market Size, By Region, 2015–2022 (KT)

Table 29 Wheat Malt Market Size, By Region, 2015–2022 (USD Million)

Table 30 Wheat Malt Market Size, By Region, 2015–2022 (KT)

Table 31 Other Sources Market Size, By Region, 2015–2022 (USD Million)

Table 32 Other Sources Market Size, By Region, 2015–2022 (KT)

Table 33 Specialty Malts Market Size, By Form, 2015–2022 (USD Million)

Table 34 Specialty Malts Market Size, By Form, 2015–2022 (KT)

Table 35 Liquid Specialty Malts Market Size, By Region, 2015–2022 (USD Million)

Table 36 Liquid Specialty Malts Market Size, By Region, 2015–2022 (KT)

Table 37 Dry Specialty Malts Market Size, By Region, 2015–2022 (USD Million)

Table 38 Dry Specialty Malts Market Size, By Region, 2015–2022 (KT)

Table 39 Specialty Malts Market Size, By Region, 2015–2022 (USD Million)

Table 40 Specialty Malts Market Size, By Region, 2015–2022(KT)

Table 41 North America: Specialty Malts Market Size, By Country, 2015–2022 (USD Million)

Table 42 North America: Specialty Malts Market Size, By Country, 2015–2022 (KT)

Table 43 North America: Specialty Malts Market Size, By Source, 2015–2022 (USD Million)

Table 44 North America: Specialty Malts Market Size, By Source, 2015–2022 (KT)

Table 45 North America: Specialty Malts Market Size, By Form, 2015–2022 (USD Million)

Table 46 North America: Specialty Malts Market Size, By Form, 2015–2022 (KT)

Table 47 North America: Specialty Malts Market Size, By Application, 2015–2022 (USD Million)

Table 48 North America: Specialty Malts Market Size, By Application, 2015–2022 (KT)

Table 49 North America: Specialty Malts Market Size, By Type, 2015–2022 (USD Million)

Table 50 North America: Specialty Malts Market Size, By Type, 2015–2022 (KT)

Table 51 Europe: Specialty Malts Market Size, By Country, 2015–2022 (USD Million)

Table 52 Europe: Specialty Malts Market Size, By Country, 2015–2022 (KT)

Table 53 Europe: Specialty Malts Market Size, By Source, 2015–2022 (USD Million)

Table 54 Europe: Specialty Malts Market Size, By Source, 2015–2022 (KT)

Table 55 Europe: Specialty Malts Market Size, By Form, 2015–2022 (USD Million)

Table 56 Europe: Specialty Malts Market Size, By Form, 2015–2022 (KT)

Table 57 Europe: Specialty Malts Market Size, By Application, 2015–2022 (USD Million)

Table 58 Europe: Specialty Malts Market Size, By Application, 2015–2022 (KT)

Table 59 Europe: Specialty Malts Market Size, By Type, 2015–2022 (USD Million)

Table 60 Europe: Specialty Malts Market Size, By Type, 2015–2022 (KT)

Table 61 Asia-Pacific: Specialty Malts Market Size, By Country, 2015-2022 (USD Million)

Table 62 Asia-Pacific: Specialty Malts Market Size, By Country, 2015-2022 (KT)

Table 63 Asia-Pacific: Specialty Malts Market Size, By Source, 2015-2022 (USD Million)

Table 64 Asia-Pacific: Specialty Malt Market Size, By Source, 2015-2022 (KT)

Table 65 Asia-Pacific: Specialty Malts Market Size, By Form, 2015-2022 (USD Million)

Table 66 Asia-Pacific: Specialty Malts Market Size, By Form, 2015-2022 (KT)

Table 67 Asia-Pacific: Specialty Malts Market Size, By Application, 2015-2022 (USD Million)

Table 68 Asia-Pacific: Specialty Malts Market Size, By Application, 2015-2022 (KT)

Table 69 Asia-Pacific: Specialty Malts Market Size, By Type, 2015-2022 (USD Million)

Table 70 Asia-Pacific: Specialty Malts Market Size, By Type, 2015-2022 (USD Million)

Table 71 RoW: Specialty Malts Market Size, By Region, 2015–2022 (USD Million)

Table 72 RoW: Specialty Malts Market Size, By Country, 2015–2022 (KT)

Table 73 RoW: Specialty Malts Market Size, By Source, 2015–2022 (USD Million)

Table 74 RoW: Specialty Malts Market Size, By Source, 2015–2022 (KT)

Table 75 RoW: Specialty Malts Market Size, By Form, 2015–2022 (USD Million)

Table 76 RoW: Specialty Malts Market Size, By Form, 2015–2022 (KT)

Table 77 RoW: Specialty Malts Market Size, By Application, 2015–2022 (USD Million)

Table 78 RoW: Specialty Malts Market Size, By Application, 2015–2022 (KT)

Table 79 RoW: Specialty Malts Market Size, By Type, 2015–2022 (USD Million)

Table 80 RoW: Specialty Malts Market Size, By Type, 2015–2022 (KT)

Table 81 Market Share for the Top Five Players in the Specialty Malts Market, 2015

Table 82 Acquisition, 2011–May, 2016

Table 83 Expansions, 2011–2015

Table 84 New Product Launches, 2011–2015

Table 85 Partnerships, 2011–2015

Table 86 Acquisitions, 2011–2016

Table 87 Expansions, 2011–2016

Table 88 New Service Launches, 2011–2016

List of Figures (44 Figures)

Figure 1 Specialty Malts Market Segmentation

Figure 2 Specialty Malt Market: Research Design

Figure 3 Rising Beer Consumption, Fuelling the Specialty Malts Market in Top Countries, 2014 (Thousand Kilo Liters)

Figure 4 Key Economies Based on GDP 2011-2015 (USD Trillion)

Figure 5 World Barley Production, 2008-2016 (Million Metric Tons)

Figure 6 Market Size Estimation Methodology: Bottom-Up Approach

Figure 7 Market Size Estimation Methodology: Top-Down Approach

Figure 8 Data Triangulation Methodology

Figure 9 Assumptions of the Research Study

Figure 10 Limitations of the Research Study

Figure 11 Specialty Malts Market Growth Trend, 2017 vs 2022

Figure 12 Brewing Segment to Dominate the Global Specialty Malts Market, By Application, 2017–2022

Figure 13 Specialty Malts Market, By Type, 2017 vs 2022

Figure 14 Asia-Pacific is Projected to Be the Fastest-Growing Market for Specialty Malts From 2017 to 2022

Figure 15 Increasing Demand for Craft Beer & Flavored Malt Beverages Would Fuel the Growth of the Market During the Forecast Period

Figure 16 Brewing Segment to Dominate the Market for Specialty Malts During the Forecast Period

Figure 17 Roasted Segment Accounted for the Largest Share in the Asia-Pacific Specialty Malts Market in 2016

Figure 18 India to Grow at the Highest CAGR in the Specialty Malts Market During the Forecast Period

Figure 19 Developing Markets Show Strong Growth Opportunities During the Forecast Period

Figure 20 Specialty Malts Market is Projected to Experience Strong Growth in the Asia-Pacific Region

Figure 21 By Type

Figure 22 By Application

Figure 23 By Source

Figure 24 Market Dynamics: Specialty Malts Market

Figure 25 Specialty Malts Market Size, By Type, 2017 vs 2022 (USD Million)

Figure 26 Specialty Malts Market Size, By Application, 2017 vs 2022 (USD Million)

Figure 27 Specialty Malts Market, By Source, 2015–2022 (USD Million)

Figure 28 Specialty Malts Market Size, By Application, 2017 vs 2022 (USD Million)

Figure 29 Geographical Snapshot (2015–2022): Asia-Pacific Emerging as A New Hotspot for Specialty Malts

Figure 30 North American Market Snapshot: the U.S. to Be Largest Market for Specialty Malt in 2016

Figure 31 Barley to Lead the North American Specialty Malts Market (USD Million)

Figure 32 Geographical Snapshot: Germany is Estimated to Be the Largest Market for Specialty Malts in 2016

Figure 33 Barley is Projected to Lead the European Specialty Malts Market Through 2022

Figure 34 Asia-Pacific: Specialty Malts Market Snapshot: China & ANZ are the Most Lucrative Markets From 2015 to 2022

Figure 35 Barley to Lead the Asia-Pacific Specialty Malts Market in 2016

Figure 36 New Product Launches, Expansions, Acquisitions, and Partnerships: Leading Approaches of Key Companies, 2011–2015

Figure 37 Expansions and Acquisitions: Key Strategies, 2011–May, 2016

Figure 38 Geographic Revenue Mix of Top Market Players

Figure 39 Cargill, Incorporated: Company Snapshot

Figure 40 Cargill, Inc.: SWOT Analysis

Figure 41 Graincorp Ltd.: Company Snapshot

Figure 42 Graincorp Ltd.: SWOT Analysis

Figure 43 Soufflet Group: SWOT Analysis

Figure 44 Malteurop: SWOT Analysis

Growth opportunities and latent adjacency in Specialty Malt Market