In-Vehicle Computer System Market by Application (Safety, Performance, Convenience, and Diagnostic), Offering (Hardware and Software), Vehicle Type (PC and CV), Memory Size (Up to 8 GB, 16GB, 32 GB and above), and Region- Global Forecast to 2025

In-Vehicle Computer System Market

In-vehicle computer systems are designed to be used as network video recorder (NVR), in-vehicle gateways, and more, and offer high performance computing and reliable communication for various automotive applications. These computers are ruggedized to withstand harsh vehicular environments, including vibration, shock, temperature, and electromagnetic interference. They are primarily used in specialized vehicles such as police patrol cars, ambulances, fire trucks, and other emergency response vehicles.

Key Drivers:

- Increasing automation levels and intelligent cruise controls

- Focus on customized solutions for specialized vehicles

- Shift toward IoT-based smart transportation

Key Restraints:

- Increased complexity of vehicle electronics

- Threat of substitution by smartphones or compact handheld devices

Top Player

- S&T AG (Kontron) (Germany)

- Lanner Electronics Inc. (Taiwan)

- Axiomtek (Taiwan)

- SINTRONES Technology Corporation (Taiwan)

- NEXCOM International (Taiwan)

- IBASE Technology Inc. (Taiwan)

- Acrosser (Taiwan)

- Premio Inc (US)

- IEI Integration Corporation (Taiwan)

- SD-Omega (Hong Kong)

- S&T AG (Kontron) (Germany): Kontron is expertized in embedded computing technologies. It offers computer systems for several industries, including automation, avionics, energy, defence, and transportation. Kontron provides in-vehicle computer systems for fleet management, vehicle diagnostics, asset tracking, and video analytics. Its data logger systems and gateway computers come with wide CPU configurations. It developed EvoTRAC-S1901 high performance in-vehicle computer platform for artificial intelligence, deep learning, high performance embedded computing. In addition, it designed S2000 hardware platform for autonomous vehicles. The high performance scalable platform features Intel XEON processors and full size PCIe graphics processing units specially suitable for autonomous vehicle testing and development.

- NEXCOM International (Taiwan): NEXCOM is specialized in in-vehicle computers for railways. Apart from railway computers, it designs and manufactures modular vehicle computer systems, vehicle mount computers, and vehicle telematics computers for automotive applications. The modular vehicle computer systems are built with interchangeable modules and expansion modules that are suitable for easy service and upgrade. Systems such as MVS 2620-IP are designed for both first response vehicles and public transits, while MVS 5600 and MVS 5600-IP for first response vehicles under this category. The company launched ATC 8110 advanced telematics computer for autonomous driving and law enforcement. The system is specially designed to support graphics processing with a maximum of seven expansion slots, ideal for ANPR, facial recognition, and machine vision uses in law enforcement settings.

- SINTRONES Technology Corporation (Taiwan): SINTRONES offers a dedicated service of computing system products in several countries across the world. In-vehicle computing, embedded computing, AI GPU computing, and surveillance computing are the four major offerings of the company. SINTRONES introduced new ABOX-5200G4 in-vehicle computer specially designed for ADAS applications. The system can integrate cameras, LiDAR, and GPS sensors to facilitate ADAS features such as blind spot monitoring, lane departure warning, and forward collision warning. ABOX-5200G4 is targeted for implementation in the autonomous vehicles, mining trucks, and long-haul trucks.

In-vehicle Computer System Market and Key Technology:

- Can Bus Protocol - The CAN bus protocol is a peer-to-peer (P2P) network, and each individual node can freely read and write data on the network. Individual nodes use an attribution ID to identify a message and display priority of the message. If multiple nodes try to access the network, the message with lower attribution ID will be allowed first. Lower priority messages will have to wait for clearance. The CAN bus system drastically simplifies the communication process among components and sensors.

- In-Vehicle Gateway - A gateway acts as a central hub that securely connects and transfers data between the central hub and the vehicle. For instance, traditionally, an ambulance used one modem for vehicle tracking or navigation and another separate modem or laptop to access the patient’s health report. However, in-vehicle computers can be used as an in-vehicle gateway for a single point of communication. These embedded computers (hardware) are designed for higher bandwidth, reliability, and ability to integrate an increasing number of devices due to its wide variety of I/O selection.

- Network Video Recorder (NVR) - Mobile/remote surveillance and recording are some of the major applications of in-vehicle computers for public transit, school buses, cash in transits, and police patrol cars. Network video recording allows the central hub or headquarters to monitor real-time in-vehicle activity. In-vehicle computers offer many PoE (Power over Ethernet) ports to connect and record multiple IP (internet protocol) camera feed simultaneously, even with 1080p recording. They are connected to LTE radio modems to transmit multiple H.264 video streams to a central station, making them a preferred choice for transportation video surveillance.

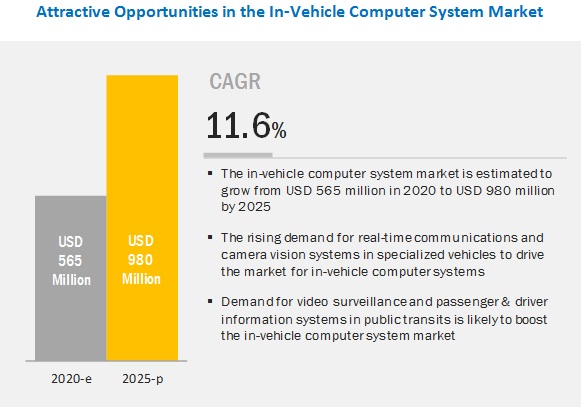

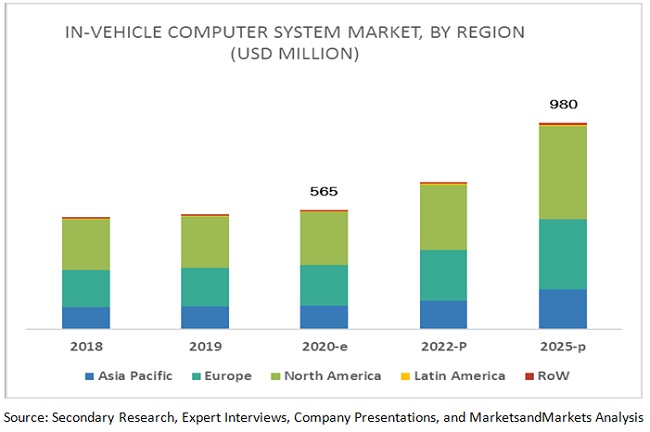

The global in-vehicle computer system market is projected to grow from USD 565 million in 2020 to USD 980 million by 2025, at a CAGR of 11.6%. Growing consumer demand for vehicle telematics and camera-based surveillance systems would drive the market for in-vehicle computer systems.

The commercial vehicle segment is expected to be the largest in-vehicle computer system market during the forecast period

The commercial vehicle segment is still dominated by ICEs. However, the demand for sustainable transportation has impacted ICE adoption in recent years. In addition, governments have also raised the standard of emission control tests due to increasing pollution levels. Thus, the demand for regular periodic maintenance has become a standard for commercial vehicles. In addition, availability of faster communication networks has helped fleet operators introduce connected commercial vehicles for optimized fleet management. The introduction of new-age connectivity services is expected to be a boon for commercial vehicles. Services such as accurate traffic data, weather forecasts, real-time GPS, and predictive maintenance alerts have already contributed to more profitable fleet operations. The increasing demand for efficient, connected commercial vehicles would drive the market for in-vehicle computer systems.

Safety computers will have a major share in the in-vehicle computer system market during the forecast period

Governments of several countries have mandated safety features in upcoming vehicles to minimize incidents of over speeding and fatal accidents. For example, India has proposed a mandate to incorporate advanced safety features, including electronic stability control (ESC) and autonomous emergency braking (AEB), in new vehicles between 2022 and 2023. The authority has also stressed that advanced safety features are required in all vehicles in India and cannot be confined to luxury vehicles only. In Europe, the new eCall system has been mandated since April 2018. This system dials an emergency number and communicates the vehicle location in the event of serious road accidents. According to the European Commission, it can reduce emergency response time by 40% in urban areas. All these mandates will have a serious impact on vehicle safety in the coming years. OEM initiatives to implement these features early would create the demand for in-vehicle computer systems.

Increasing connectivity services and advanced safety features would be major drivers for the in-vehicle computer system market. Premium automakers have already started testing 5G connectivity services. 5G connectivity offers several advantages compared to LTE, including a reduction in operational costs and data transfer time. Such advantages would allow OEMs to deploy V2V and V2I communications. Seamless connectivity also presents major service-based revenue from on-demand entertainment and convenience features.

The North American in-vehicle computer system market is expected to hold the largest share during the forecast period.

North America is expected to be the largest market for in-vehicle computer systems during the forecast period. The emergence of autonomous driving in the US would play a major role. High Performance Embedded Computing (HPEC) platforms are high margin products compared to in-vehicle computer systems deployed in fleet management or passenger information systems. Increasing demand for such systems in the US would impact the market North American market positively. In addition, emergency response vehicles such as fire trucks and rescue vehicles could directly stream scenarios for additional instructions and communicate with the central hub for guidance in case of national disasters because lawmakers are investing in superior disaster and rescue management solutions to reduce casualties.

Key Market Players

The global in-vehicle computer system market is dominated by major players such as S&T AG (Kontron) (Germany), Lanner Electronics Inc. (Taiwan), Axiomtek (Taiwan), NEXCOM International (Taiwan), and IBASE Technology Inc. (Taiwan). These companies have secure distribution networks at a global level. Also, these manufacturers offer a wide range of in-vehicle computer systems with an array of configurations tailored for different automotive applications. The key strategies adopted by these companies to sustain their market position are new product developments, collaborations, and contracts & agreements.

Scope of the Report

|

Report Metric |

Details |

|

Market size available for years |

2018–2025 |

|

Base year considered |

2019 |

|

Forecast period |

2020–2025 |

|

Forecast units |

Volume (units) and Value (USD Million) |

|

Segments covered |

Offering, Memory Size, Application, Vehicle Type, and Region |

|

Geographies covered |

North America, Asia Pacific, Europe, Latin America, and Rest of the World |

|

Companies Covered |

S&T AG (Kontron) (Germany), Lanner Electronics Inc. (Taiwan), Axiomtek (Taiwan), SINTRONES Technology Corporation (Taiwan), NEXCOM International (Taiwan), and IBASE Technology Inc. (Taiwan) |

This research report categorizes the in-vehicle computer system market based on application, offering, memory size, vehicle type, and region.

Based on Application:

- Safety Computers

- Performance Computers

- Convenience Computers

- Diagnostic Computers

Based on Offering:

- Hardware

- Software

Based on Memory Size:

- Up To 8 GB

- 16 GB

- 32 GB and above

Based on Vehicle Type:

- Passenger Car

- Commercial Vehicle

Based on Region:

-

Asia Pacific

- China

- India

- Japan

- South Korea

- Thailand

- Rest of Asia Pacific

-

North America

- US

- Canada

- Mexico

-

Europe

- France

- Germany

- Russia

- Italy

- Spain

- Turkey

- UK

- Rest of Europe

-

Latin America

- Brazil

- Argentina

- Rest of LATAM

-

Rest of the World

- Iran

- South Africa

- Rest of RoW

Critical Questions:

- Where will the introduction of intelligent transportation systems (ITS) take the industry in the long term?

- What will be the impact on the market with respect to the increasing adoption of in-vehicle computer systems in specialized vehicles?

- What is the impact of developments in autonomous driving on the in-vehicle computer system market?

- What are the upcoming trends in the in-vehicle computer system market? What impact would they make post-2022?

- What are the key strategies adopted by top market players to increase their revenue?

Frequently Asked Questions (FAQ):

What is the market size of the in-vehicle computer system?

The in-vehicle computer system market size is estimated to be USD 565 million in 2020 and is projected to reach USD 980 million by 2025, growing at a CAGR of 11.6% during the forecast period.

Who are the key players in the in-vehicle computer system market?

The in-vehicle computer system market is led by globally established players such as S&T AG (Kontron) (Germany), Lanner Electronics Inc. (Taiwan), Axiomtek (Taiwan), NEXCOM International (Taiwan), and IBASE Technology Inc. (Taiwan). The key strategies adopted by these companies to sustain their market position are new product developments, collaborations, and contracts & agreements.

Which applications are included in the in-vehicle computer system market?

The study includes key applications such as safety computers, performance computers, convenience computers, and diagnostic computers.

What is the impact of COVID-19 on the in-vehicle computer system market?

The COVID-19 severely impacted the in-vehicle computer system market due to the shortage of necessary components. As major players are based of Taiwan, production continued as normal. However, lack of components such as power supply and SSD became prominent as the crisis depended further in March and hindered the production schedule for major manufacturers. However, post pandemic, investment towards modernisation of medical infrastructure would boost the demand for in-vehicle computers in ambulances.

Which is the largest market for in-vehicle computer systems?

The North America is estimated to be the largest market for in-vehicle computer systems. Apart from the applications of in-vehicle computer systems in the emergency response vehicles, development and testing of autonomous driving systems would prevail major revenue opportunity for the manufacturers in the region. The High Performance Embedded Computing (HPEC) platforms which are specially designed for autonomous driving systems, are expensive among in-vehicle computer systems.

Which is the most promising vehicle type for in-vehicle computer system manufacturers?

The commercial vehicle segment would hold largest market for in-vehicle computer systems. Demand for in-vehicle computer systems from fleet operators to introduce connected commercial vehicles for optimized fleet management would be a major growth driver for the commercial vehicle segment. In addition, incorporation of in-vehicle computer systems in the smart public transit applications such as passenger surveillance and driver & passenger information systems are major revenue opportunity for in-vehicle computer system manufacturers. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 21)

1.1 Objectives of Study

1.2 Product Definition

1.2.1 Inclusions & Exclusions

1.3 In-Vehicle Computer System Market Scope

1.3.1 Years Considered for the Study

1.4 Limitations

1.5 Stakeholders

2 Research Methodology (Page No. - 25)

2.1 Research Data

2.2 Secondary Data

2.2.1 Key Data From Secondary Sources

2.3 Primary Data

2.3.1 Sampling Techniques & Data Collection Methods

2.3.2 Primary Participants

2.4 Market Size Estimation

2.4.1 In-Vehicle Computer System Market: Bottom-Up Approach

2.4.2 Market: Top-Down Approach

2.5 Market Breakdown and Data Triangulation

2.6 Assumptions & Associated Risks

3 Executive Summary (Page No. - 35)

4 Premium Insights (Page No. - 39)

4.1 In-Vehicle Computer System Market to Grow at A Significant Rate During the Forecast Period (2020–2025)

4.2 North America is Estimated to Lead the Global Market in 2020

4.3 Global Market, By Vehicle Type and Offering

4.4 Market, By Application

4.5 InMarket, By Offering

4.6 Market, By Memory Size

4.7 Market, By Vehicle Type

5 In-Vehicle Computer System Market Overview (Page No. - 45)

5.1 Introduction

5.2 Operational Data

5.3 Market Dynamics

5.3.1 Drivers

5.3.1.1 Increasing Automation Levels and Intelligent Cruise Controls

5.3.1.2 Focus on Customized Solutions for Specialized Vehicles

5.3.1.3 Shift Toward IoT-Based Smart Transportation

5.3.2 Restraints

5.3.2.1 Increased Complexity of Vehicle Electronics

5.3.2.2 Threat of Substitution By Smartphones Or Compact Handheld Devices

5.3.3 Opportunities

5.3.3.1 Advanced Telematics-Based Services Such as Usage-Based Insurance and Predictive Vehicle Maintenance

5.3.3.2 Initiatives for Smart Public Transit

5.3.4 Challenges

5.3.4.1 Risk of Data Privacy and Cyber Threats

5.3.4.2 Higher Installation and Maintenance Costs

5.3.5 Impact of Market Dynamics

5.4 Revenue Shift Driving Market Growth

5.5 Revenue Missed: Opportunities for In-Vehicle Computer System Manufacturers and Component Providers

5.6 In-Vehicle Computer System Market, Scenarios

5.6.1 Market, Most Likely Scenario

5.6.2 Market, Optimistic Scenario

5.6.3 Market, Pessimistic Scenario

6 Industry Trends (Page No. - 55)

6.1 Introduction

6.2 Technological Overview

6.2.1 Can Bus Protocol

6.2.1.1 Components of A Can Bus Message

6.2.1.2 Advantages of Can Bus Communication

6.2.2 In-Vehicle Gateway

6.2.2.1 WAN Connection

6.2.2.2 VAN Or In-Vehicle Wi-Fi

6.2.3 Network Video Recorder (NVR)

6.3 Porter’s Five Forces

6.4 In-Vehicle Computer System: Applications

6.4.1 Autonomous Driving

6.4.2 Preventive Maintenance

6.4.3 Emergency Response Vehicles

6.4.4 Fleet Management

7 Global In-Vehicle Computer System Market, By Application (Page No. - 64)

7.1 Introduction

7.2 Research Methodology

7.3 Assumptions

7.4 Safety Computers

7.4.1 Advanced Safety Features Will Drive the Market

7.5 Performance Computers

7.5.1 Autonomous Driving Would Initialize Adoption of In-Vehicle Performance Computers

7.6 Convenience Computers

7.6.1 Smart Infotainment Systems Would Drive the Demand for In-Vehicle Convenience Computers

7.7 Diagnostic Computers

7.7.1 Predictive Maintenance Would Boost the Market for In-Vehicle Diagnostic Computers

7.8 Market Leaders

8 Global In-Vehicle Computer System Market, By Memory Size (Page No. - 73)

8.1 Introduction

8.2 Research Methodology

8.3 Assumptions

8.4 Up to 8 GB

8.4.1 Up to 8 GB RAM Systems are Suitable for Vehicle Tracking and Diagnostics

8.5 16 GB

8.5.1 Public Transit Applications Would Benefit From 16 GB RAM Configurations

8.6 32 GB and Above

8.6.1 Autonomous Driving and Cruise Controls Would Require 32 GB and Above RAM Configuration

8.7 Market Leaders

9 Global In-Vehicle Computer System Market, By Offering (Page No. - 81)

9.1 Introduction

9.2 Research Methodology

9.3 Assumptions

9.4 Hardware

9.4.1 Low Power Processing Units Will Be Helpful for Specific Automotive Applications Such as Vehicle Tracking

9.4.2 Display Screen

9.4.3 Processing Unit

9.4.4 Others

9.5 Software

9.5.1 Free and Open Source Features of Linux Give It the Edge Over Windows Os

9.5.2 Windows

9.5.3 Linux

9.6 Market Leaders

10 Global In-Vehicle Computer System Market, By Vehicle Type (Page No. - 89)

10.1 Introduction

10.2 Research Methodology

10.3 Assumptions

10.4 Passenger Car

10.4.1 Advancements in the Self Driving Systems Would Require High Performance In-Vehicle Computers

10.5 Commercial Vehicle

10.5.1 Demand for Real-Time Telematics Will Drive the Demand for In-Vehicle Computers in Commercial Vehicles

10.6 Market Leaders

11 Global In-Vehicle Computer System Market, By Region (Page No. - 95)

11.1 Introduction

11.2 Asia Pacific

11.2.1 China

11.2.1.1 Stringent Emission Norms Would Drive the Demand for Diagnostics Computers in China

11.2.2 India

11.2.2.1 Increasing Demand for Trucks Will Fuel the Demand for Camera-Based Vision Systems in India

11.2.3 Japan

11.2.3.1 Increasing Specialized Vehicles Will Drive the Japanese Market

11.2.4 South Korea

11.2.4.1 Developments By Domestic SPV Manufacturers Such as Kia and Hyundai Will Drive the South Korean Market

11.2.5 Thailand

11.2.5.1 Favorable Government Policies Would Drive the Thai Market

11.2.6 Rest of Asia Pacific

11.2.6.1 OEM Focus on Expansions Will Fuel Demand in This Region

11.3 Europe

11.3.1 Germany

11.3.1.1 Initiatives for Intelligent Transportation Systems Will Drive the German Market

11.3.2 France

11.3.2.1 Shift Toward High Performance Engines By Premium Automakers Will Drive the French Market

11.3.3 Italy

11.3.3.1 Government Collaborations and Strategies Will Drive the Italian Market

11.3.4 Russia

11.3.4.1 Increasing Innovations and Developments in Trucking Will Fuel the Russian Market

11.3.5 Spain

11.3.5.1 Growing Vehicle Production and Exports Will Fuel the Spanish Market

11.3.6 Turkey

11.3.6.1 Developments By Component Manufacturers Will Drive the Turkish Market

11.3.7 UK

11.3.7.1 R&D in Automotive Industry Would Fuel Demand for In-Vehicle Computer Systems in UK

11.3.8 Rest of Europe

11.3.8.1 Public Transit Improvements Will Drive the Rest of Europe Market

11.4 North America

11.4.1 Canada

11.4.1.1 Upcoming Fuel Efficiency Regulations Will Drive the Canadian Market

11.4.2 Mexico

11.4.2.1 Increasing Focus on Trucking Industry Will Drive the Mexican Market

11.4.3 US

11.4.3.1 Huge Logistics Demand Would Fuel the US Market

11.5 Latam

11.5.1 Brazil

11.5.1.1 Increasing Truck Sales Will Drive the Brazilian Market

11.5.2 Argentina

11.5.2.1 Increasing Production of Passenger Cars Will Drive the Argentinian Market

11.5.3 Rest of Latam

11.5.3.1 Presence of Leading Automotive Players Will Drive the Rest of Latam Market

11.6 Rest of the World (RoW)

11.6.1 Iran

11.6.1.1 Demand for Trucks in Agriculture and Highway Construction Would Fuel the Demand for Telematics Applications in Iran

11.6.2 South Africa

11.6.2.1 Increasing Production of Commercial Vehicles Will Drive the South African Market

11.6.3 Rest of RoW

11.6.3.1 New Investments and Presence of Major Automotive Players to Drive the Rest of RoW Market

12 Recommendations By Marketsandmarkets (Page No. - 130)

12.1 North America Will Be the Key Market for In-Vehicle Computer Systems

12.2 Specialized Vehicle Applications Can Be A Key Focus for Manufacturers

12.3 Conclusion

13 Competitive Landscape (Page No. - 132)

13.1 Overview

13.2 In-Vehicle Computer System Market Ranking Analysis

13.3 Competitive Leadership Mapping

13.3.1 Visionary Leaders

13.3.2 Innovators

13.3.3 Dynamic Differentiators

13.3.4 Emerging Companies

13.4 Strength of Product Portfolio

13.5 Business Strategy Excellence

13.6 Winners vs Tail-Enders

13.7 Competitive Scenario

13.7.1 New Product Developments

13.7.2 Partnerships/Contracts

14 Company Profiles (Page No. - 144)

14.1 S&T AG (Kontron)

14.1.1 Business Overview

14.1.2 Products and Services Offered

14.1.3 SWOT Analysis

14.1.4 MnM View

14.2 Lanner Electronics Inc.

14.2.1 Business Overview

14.2.2 Products and Services Offered

14.2.3 Recent Developments

14.2.4 SWOT Analysis

14.2.5 MnM View

14.3 Axiomtek

14.3.1 Business Overview

14.3.2 Products and Services Offered

14.3.3 SWOT Analysis

14.3.4 MnM View

14.4 Ibase Technology Inc.

14.4.1 Business Overview

14.4.2 Products and Services Offered

14.4.3 SWOT Analysis

14.4.4 Recent Developments

14.5 Sintrones Technology Corporation

14.5.1 Business Overview

14.5.2 Products and Services Offered

14.5.3 Recent Developments

14.5.4 SWOT Analysis

14.5.5 MnM View

14.6 Acrosser

14.6.1 Business Overview

14.6.2 Products and Services Offered

14.6.3 Recent Developments

14.7 Premio Inc.

14.7.1 Business Overview

14.7.2 Products and Services Offered

14.7.3 Recent Developments

14.8 IEI Integration Corporation

14.8.1 Business Overview

14.8.2 Products and Services Offered

14.8.3 Recent Developments

14.9 JLT Mobile Computers

14.9.1 Business Overview

14.9.2 Products and Services Offered

14.9.3 Recent Developments

14.10 SD-Omega

14.10.1 Business Overview

14.10.2 Products and Services Offered

14.11 Onlogic

14.11.1 Business Overview

14.11.2 Products and Services Offered

14.11.3 Recent Developments

14.12 Nexcom International Co., LTD.

14.12.1 Business Overview

14.12.2 Products and Services Offered

14.12.3 Recent Developments

14.13 Other Key Players

14.13.1 Asia Pacific

14.13.1.1 Avalue Technology Inc.

14.13.1.2 Neousys Technology

14.13.1.3 Adlink Technology Inc.

14.13.1.4 Winsonic

14.13.1.5 Aaeon

14.13.2 Europe

14.13.2.1 Roda Computer GmbH

14.13.2.2 Men Mikro Elektronik GmbH

14.13.2.3 Mpl AG Elektronik-Unternehmen

14.13.2.4 Syslogic Datentechnik AG

14.13.3 North America

14.13.3.1 American Portwell Technology

15 Appendix (Page No. - 180)

15.1 Discussion Guide – In-Vehicle Computer System

15.2 Knowledge Store: Marketsandmarkets Subscription Portal

15.3 Available Customizations

15.4 Related Reports

15.5 Author Details

List of Tables (166 Tables)

Table 1 Inclusions & Exclusions for In-Vehicle Computer System Market

Table 2 Market: Configuration for Different Applications

Table 3 Market: Impact of Market Dynamics

Table 4 Market (Most Likely), By Region, 2018–2025 (USD Thousand)

Table 5 Market (Optimistic), By Region, 2021–2025 (USD Thousand)

Table 6 Market (Pessimistic), By Region, 2021–2025 (USD Thousand)

Table 7 Market, By Application, 2018–2025 (‘000 Units)

Table 8 Market, By Application, 2018–2025 (USD Million)

Table 9 Major Assumptions, By Application

Table 10 Safety Computers: Market, By Region, 2018–2025 (Units)

Table 11 Safety Computers: Market, By Region, 2018–2025 (USD Thousand)

Table 12 Performance Computers: Market, By Region, 2018–2025 (Units)

Table 13 Performance Computers: Market, By Region, 2018–2025 (USD Thousand)

Table 14 Convenience Computers: Market, By Region, 2018–2025 (Units)

Table 15 Convenience Computers: Market, By Region, 2018–2025 (USD Thousand)

Table 16 Diagnostic Computers: Market, By Region, 2018–2025 (Units)

Table 17 Diagnostic Computers: Market, By Region, 2018–2025 (USD Thousand)

Table 18 Recent Developments, By Application

Table 19 In-Vehicle Computer System Market, By Memory Size, 2018–2025 (‘000 Units)

Table 20 Market, By Memory Size, 2018–2025 (USD Million)

Table 21 Major Assumptions, By Memory Size

Table 22 Up to 8 GB: Market, By Region, 2018–2025 (Units)

Table 23 Up to 8 GB: Market, By Region, 2018–2025 (USD Thousand)

Table 24 16 GB: Market, By Region, 2018–2025 (Units)

Table 25 16 GB: Market, By Region, 2018–2025 (USD Thousand)

Table 26 32 GB and Above: Market, By Region, 2018–2025 (Units)

Table 27 32 GB and Above: Market, By Region, 2018–2025 (USD Thousand)

Table 28 Recent Developments, By Memory Size

Table 29 Market, By Offering, 2018–2025 (USD Million)

Table 30 Major Assumptions, By Offering

Table 31 Hardware: Market, By Component, 2018–2025 (USD Thousand)

Table 32 Display Screen: Market, By Region, 2018–2025 (USD Thousand)

Table 33 Processing Unit: Market, By Region, 2018–2025 (USD Thousand)

Table 34 Others: Market, By Region, 2018–2025 (USD Thousand)

Table 35 Software: Market, By Operating System, 2018–2028 (USD Thousand)

Table 36 Windows: Market, By Region, 2018–2028 (USD Thousand)

Table 37 Linux: Market, By Region, 2018–2028 (USD Thousand)

Table 38 Recent Developments, By Offering

Table 39 In-Vehicle Computer System Market, By Vehicle Type, 2018–2025 (‘000 Units)

Table 40 Market, By Vehicle Type, 2018–2025 (USD Million)

Table 41 Major Assumptions, By Vehicle Type

Table 42 Passenger Car: Market, By Region, 2018–2025 (Units)

Table 43 Passenger Car: Market, By Region, 2018–2025 (USD Thousand)

Table 44 Commercial Vehicle: Market, By Region, 2018–2025 (Units)

Table 45 Commercial Vehicle: Market, By Region, 2018–2025 (USD Thousand)

Table 46 Recent Developments, By Vehicle Type

Table 47 Market, By Region, 2018–2025 (‘000 Units)

Table 48 InMarket, By Region, 2018–2025 (USD Million)

Table 49 Asia Pacific: Market, By Country, 2018–2025 (Units)

Table 50 Asia Pacific: Market, By Country, 2018–2025 (USD Thousand)

Table 51 China: Vehicle Production Data (Units)

Table 52 China: Market, By Vehicle Type, 2018–2025 (Units)

Table 53 China: Market, By Vehicle Type, 2018–2025 (USD Thousand)

Table 54 India: Vehicle Production Data (Units)

Table 55 India: Market, By Vehicle Type, 2018–2025 (Units)

Table 56 India: Market, By Vehicle Type, 2018–2025 (USD Thousand)

Table 57 Japan: Vehicle Production Data (Units)

Table 58 Japan: Market, By Vehicle Type, 2018–2025 (Units)

Table 59 Japan: Market, By Vehicle Type, 2018–2025 (USD Thousand)

Table 60 South Korea: Vehicle Production Data (Units)

Table 61 South Korea: Market, By Vehicle Type, 2018–2025 (Units)

Table 62 South Korea: Market, By Vehicle Type, 2018–2025 (USD Thousand)

Table 63 Thailand: Market, By Vehicle Type, 2018–2025 (Units)

Table 64 Thailand: Market, By Vehicle Type, 2018–2025 (USD Thousand)

Table 65 Rest of Asia Pacific: In-Vehicle Computer System Market, By Vehicle Type, 2018–2025 (Units)

Table 66 Rest of Asia Pacific: Market, By Vehicle Type, 2018–2025 (USD Thousand)

Table 67 Europe: Market, By Country, 2018–2025 (Units)

Table 68 Europe: Market, By Country, 2018–2025 (USD Thousand)

Table 69 Germany: Vehicle Production Data (Units)

Table 70 Germany: Market, By Vehicle Type, 2018–2025 (Units)

Table 71 Germany: Market, By Vehicle Type, 2018–2025 (USD Thousand)

Table 72 France: Vehicle Production Data (Units)

Table 73 France: Market, By Vehicle Type, 2018–2025 (Units)

Table 74 France: Market, By Vehicle Type, 2018–2025 (USD Thousand)

Table 75 Italy: Vehicle Production Data (Units)

Table 76 Italy: Market, By Vehicle Type, 2018–2025 (Units)

Table 77 Italy: Market, By Vehicle Type, 2018–2025 (USD Thousand)

Table 78 Russia: Vehicle Production Data (Units)

Table 79 Russia: Market, By Vehicle Type, 2018–2025 (Units)

Table 80 Russia: Market, By Vehicle Type, 2018–2025 (USD Thousand)

Table 81 Spain: Vehicle Production Data (Units)

Table 82 Spain: Market, By Vehicle Type, 2018–2025 (Units)

Table 83 Spain: Market, By Vehicle Type, 2018–2025 (USD Thousand)

Table 84 Turkey: Vehicle Production Data (Units)

Table 85 Turkey: Market, By Vehicle Type, 2018–2025 (Units)

Table 86 Turkey: Market, By Vehicle Type, 2018–2025 (USD Thousand)

Table 87 UK: Vehicle Production Data (Units)

Table 88 UK: Market, By Vehicle Type, 2018–2025 (Units)

Table 89 UK: Market, By Vehicle Type, 2018–2025 (USD Thousand)

Table 90 Rest of Europe: Market, By Vehicle Type, 2018–2025 (Units)

Table 91 Rest of Europe: Market, By Vehicle Type, 2018–2025 (USD Thousand)

Table 92 North America: Market, By Country, 2018–2025 (Units)

Table 93 North America: Market, By Country, 2018–2025 (USD Thousand)

Table 94 Canada: Vehicle Production Data (Units)

Table 95 Canada: Market, By Vehicle Type, 2018–2025 (Units)

Table 96 Canada: Market, By Vehicle Type, 2018–2025 (USD Thousand)

Table 97 Mexico: Vehicle Production Data (Units)

Table 98 Mexico: Market, By Vehicle Type, 2018–2025 (Units)

Table 99 Mexico: Market, By Vehicle Type, 2018–2025 (USD Thousand)

Table 100 US: Vehicle Production Data (Units)

Table 101 US: In-Vehicle Computer System Market, By Vehicle Type, 2018–2025 (Units)

Table 102 US: Market, By Vehicle Type, 2018–2025 (USD Thousand)

Table 103 Latin America: Market, By Country, 2018–2025 (Units)

Table 104 Latin America: Market, 2018–2025 (USD Thousand)

Table 105 Brazil Production Data (Units)

Table 106 Brazil: Market, By Vehicle, 2018–2025 (Units)

Table 107 Brazil: Market, By Vehicle, 2018–2025 (USD Thousand)

Table 108 Argentina Production Data (Units)

Table 109 Argentina: Market, By Vehicle, 2018–2025 (Units)

Table 110 Argentina: Market, By Vehicle, 2018–2025 (USD Thousand)

Table 111 Rest of Latam: Market, By Vehicle, 2018–2025 (Units)

Table 112 Rest of Latam: Market, By Vehicle, 2018–2025 (USD Thousand)

Table 113 Rest of the World: Market, By Country, 2018–2025 (Units)

Table 114 Rest of the World: Market, By Country, 2018–2025 (USD Thousand)

Table 115 Iran: Vehicle Production Data (Units)

Table 116 Iran: Market, By Vehicle Type, 2018–2025 (Units)

Table 117 Iran: Market, By Vehicle Type, 2018–2025 (USD Thousand)

Table 118 South Africa: Vehicle Production Data (Units)

Table 119 South Africa: Market, By Vehicle Type, 2018–2025 (Units)

Table 120 South Africa: Market, By Vehicle Type, 2018–2025 (USD Thousand)

Table 121 Egypt: Vehicle Production Data (Units)

Table 122 Rest of RoW: Market, By Vehicle Type, 2018–2025 (Units)

Table 123 Rest of RoW: Market, By Vehicle Type, 2018–2025 (USD Thousand)

Table 124 New Product Developments, 2017–2020

Table 125 Partnerships/Contracts, 2017–2020

Table 126 S&T AG (Kontron): Products and Services Offered

Table 127 S&T AG (Kontron): Total Sales, 2014–2018 (USD Million)

Table 128 S&T AG (Kontron): Net Profit, 2014–2018 (USD Million)

Table 129 Lanner Electronics Inc.: Products and Services Offered

Table 130 Lanner Electronics Inc.: Total Sales, 2014–2018 (USD Million)

Table 131 Lanner Electronics Inc.: Net Profit, 2014–2018 (USD Million)

Table 132 Lanner Electronics Inc.: New Product Developments

Table 133 Lanner Electronics Inc.: Partnerships

Table 134 Axiomtek: Products and Services Offered

Table 135 Axiomtek: Total Sales, 2014–2018 (USD Million)

Table 136 Axiomtek: Net Profit, 2014–2018 (USD Million)

Table 137 Ibase Technology Inc.: Products and Services Offered

Table 138 Ibase Technology Inc.: Total Sales, 2014–2018 (USD Million)

Table 139 Ibase Technology Inc.: Net Profit, 2014–2018 (USD Million)

Table 140 Ibase Technology Inc: New Product Developments

Table 141 Sintrones Technology Corporation: Products and Services Offered

Table 142 Sintrones Technology Corporation: Total Sales, 2014–2018 (USD Million)

Table 143 Sintrones Technology Corporation: Net Profit, 2014–2018 (USD Million)

Table 144 Sintrones Technology Corporation: New Product Developments

Table 145 Acrosser: Products and Services Offered

Table 146 Acrosser: New Product Developments

Table 147 Premio Inc.: Products and Services Offered

Table 148 Premio Inc.: New Product Developments

Table 149 Premio Inc.: Collaborations

Table 150 IEI Integration Corporation: Products and Services Offered

Table 151 IEI Integration Corporation: Total Sales, 2014–2018 (USD Million)

Table 152 IEI Integration Corporation: Net Profit, 2014–2018 (USD Million)

Table 153 IEI Integration Corporation: New Product Developments

Table 154 JLT Mobile Computers: Products and Services Offered

Table 155 JLT Mobile Computers: Total Sales, 2014–2018 (USD Million)

Table 156 JLT Mobile Computers: Net Profit, 2014–2018 (USD Million)

Table 157 JLT Mobile Computers: New Product Developments

Table 158 SD-Omega: Products and Services Offered

Table 159 Onlogic: Products and Services Offered

Table 160 Onlogic: New Product Developments

Table 161 Onlogic: Collaborations

Table 162 Nexcom International Co., LTD: Products and Services Offered

Table 163 Nexcom International Co., LTD: Total Sales, 2014–2018 (USD Million)

Table 164 Nexcom International Co., LTD: Net Profit, 2014–2018 (USD Million)

Table 165 Nexcom International Co., LTD: New Product Developments

Table 166 Currency Exchange Rates (Per USD)

List of Figures (52 Figures)

Figure 1 In-Vehicle Computer System: Market Segmentation

Figure 2 In-Vehicle Computer System Market: Research Design

Figure 3 Research Design Model

Figure 4 Breakdown of Primary Interviews

Figure 5 Market: Research Design & Methodology

Figure 6 Market: Research Methodology Illustration of Delphi Revenue Estimation

Figure 7 Data Triangulation

Figure 8 In-Vehicle Computer System: Market Outlook

Figure 9 Market, By Application, 2020 vs 2025 (USD Million)

Figure 10 Increasing Demand for Efficient Fleet Management Solutions is Likely to Boost Growth

Figure 11 Market Share, By Region, 2020

Figure 12 Commercial Vehicle and Hardware Account for the Largest Shares of the Market in 2020

Figure 13 Safety Computers is Expected to Hold the Largest Market Share, 2020 vs 2025 (USD Million)

Figure 14 Hardware is Expected to Hold the Largest Market Share, 2020 vs 2025 (USD Million)

Figure 15 Up to 8 GB is Estimated to Hold the Largest Market Share, 2020 vs 2025 (USD Million)

Figure 16 Commercial Vehicle is Estimated to Hold the Largest Market Share, 2020 vs 2025 (USD Million)

Figure 17 In-Vehicle Computer System: Market Dynamics

Figure 18 Market – Future Trends & Scenario, 2021–2025 (USD Million)

Figure 19 In-Vehicle Computer System: Components of A Can Message

Figure 20 In-Vehicle Computer System: Wide Area Network

Figure 21 In-Vehicle Computer System: Vehicle Area Network

Figure 22 In-Vehicle Computer System: Network Video Recorder

Figure 23 Porter’s Five Forces: Market

Figure 24 In-Vehicle Computer System: Autonomous Driving

Figure 25 In-Vehicle Computer System: Preventive Maintenance

Figure 26 In-Vehicle Computer System: First Response Vehicles

Figure 27 In-Vehicle Computer System: Fleet Management

Figure 28 Market, By Application, 2020 vs 2025 (USD Million)

Figure 29 Key Primary Insights

Figure 30 Market, By Memory Size, 2020 vs 2025 (USD Million)

Figure 31 Key Primary Insights

Figure 32 Market, By Offering, 2020 vs 2025 (USD Million)

Figure 33 Key Primary Insights

Figure 34 Market, By Vehicle Type, 2020 vs 2025 (USD Million)

Figure 35 Key Primary Insights

Figure 36 Market, By Region, 2022 vs 2025 (USD Million)

Figure 37 Europe: Market Snapshot

Figure 38 In-Vehicle Computer System Market (Global): Competitive Leadership Mapping, 2020

Figure 39 Key Developments By Leading Players in the Market, 2017–2020

Figure 40 S&T AG (Kontron): Company Snapshot

Figure 41 S&T AG (Kontron): SWOT Analysis

Figure 42 Lanner Electronics Inc.: Company Snapshot

Figure 43 Lanner Electronics Inc.: SWOT Analysis

Figure 44 Axiomtek: Company Snapshot

Figure 45 Axiomtek: SWOT Analysis

Figure 46 Ibase Technology Inc.: Company Snapshot

Figure 47 Ibase Technology Inc.: SWOT Analysis

Figure 48 Sintrones Technology Corporation: Company Snapshot

Figure 49 Sintrones Technology Corporation: SWOT Analysis

Figure 50 IEI Integration Corporation: Company Snapshot

Figure 51 JLT Mobile Computers: Company Snapshot

Figure 52 Nexcom International Co., LTD: Company Snapshot

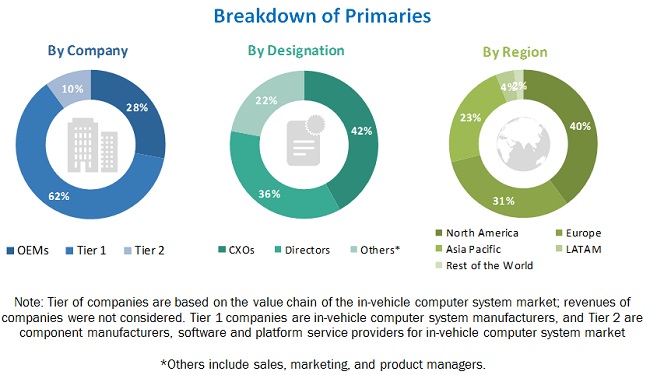

The research study involved extensive use of secondary sources, such as company annual reports/presentations, industry association publications, magazine articles, directories, technical handbooks, World Economic Outlook, trade websites, technical articles, and databases, to identify and collect information on the in-vehicle computer system market. The primary sources—experts from related industries, automobile OEMs, and suppliers—have been interviewed to obtain and verify critical information, as well as assess the growth prospects and market estimations.

Secondary Research

The secondary sources referred for this research study include corporate filings (such as annual reports, investor presentations, and financial statements), trade, business, and professional associations, whitepapers and in-vehicle computer-related journals, certified publications, articles from recognized authors, directories, and databases. Secondary data has been collected and analyzed to arrive at the overall market size, which is further validated by primary research.

Primary Research

Extensive primary research has been conducted after acquiring an understanding of the in-vehicle computer system market scenario through secondary research. Several primary interviews have been conducted with market experts from both the demand- (OEMs) and supply-side (in-vehicle computer system manufacturers, system integrators, and technology providers) across major regions, namely, North America, Europe, Asia Pacific, Latin America, and the Rest of the World. Approximately 25% and 75% of primary interviews have been conducted from the demand- and supply-side, respectively. Primary data has been collected through questionnaires, emails, and telephonic interviews. In the canvassing of primaries, we have strived to cover various departments within organizations, such as sales, operations, and marketing, to provide a holistic viewpoint in our report.

After interacting with industry experts, we have also conducted brief sessions with highly experienced independent consultants to reinforce the findings from our primaries. This, along with the in-house subject matter experts’ opinions, has led us to the findings as described in the remainder of this report.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The bottom-up and top-down approaches have been used to estimate and validate the size of this market. The market size, by vehicle type, in terms of volume and value, is derived by estimating the penetration of vehicles equipped with an in-vehicle computer system in the total production of passenger cars in a country. This gives the volume of the in-vehicle computer system market in a country. The summation of market size in all countries provides the regional-level market in terms of volume. The market size, by volume, is then multiplied with the average selling price (ASP) of the in-vehicle computer system to derive the global market by value.

The top-down methodology has been followed to estimate in-vehicle computer system market by memory size, application, and offering. To derive this market, by application, in terms of volume and value, the total volume of market is multiplied with the penetration percentage of each application (safety, performance, diagnostic, and convenience) at regional level. The summation of market size in all regions provides the global-level market, in terms of volume. The market size of in-vehicle computer system, by application, in terms of value, is derived by multiplying the cost break-up percentage of the market with total value at regional level by value. A similar approach is used to derive the market for memory size and offering segments.

Data Triangulation

After arriving at the overall market size—using the market size estimation processes explained above—the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Report Objectives

- To segment and forecast the global market, in terms of volume (units) and value (USD million)

- To define, describe, and forecast the global market based on offering, memory size, application, vehicle type, and region

- To analyze the regional markets for growth trends, prospects, and their contribution to the overall market

- To segment and forecast the market size, by offering (hardware and software)

- To segment and forecast the market size, by memory size (up to 8 GB, 16 GB, and 32 GB and above)

- To segment and forecast the market size, by vehicle type (passenger car and commercial vehicle)

- To segment and forecast the market size, by application (safety computers, performance computers, convenience computers, and diagnostic computers)

- To forecast the market size with respect to key regions, namely, North America, Europe, Asia Pacific, Latin America, and the Rest of the World (RoW)

- To provide detailed information regarding the major factors influencing market growth (drivers, challenges, restraints, and opportunities)

- To analyze opportunities for stakeholders and the competitive landscape for market leaders

- To strategically profile key players and comprehensively analyze their market shares and core competencies

- To analyze recent developments, alliances, joint ventures, product innovations, and mergers & acquisitions in this market

Available Customizations

With the given market data, MarketsandMarkets offers customizations in accordance to the company’s specific needs.

- In-vehicle computer system market, by autonomous vehicle at regional level

- In-vehicle computer system market, by electric vehicle at regional level

- In-vehicle computer system market, by vehicle at country level (for countries not covered in the report)

Company Information

- Profiling of Additional Market Players (Up to 3)

Growth opportunities and latent adjacency in In-Vehicle Computer System Market