Land Survey Equipment Market by End User (Commercial, Defense, Service Providers), Application (Inspection, Monitoring, Volumetric Calculations, layout Points), Solution (Hardware, Software, Services), Industry, and Region - Global Forecast to 2028

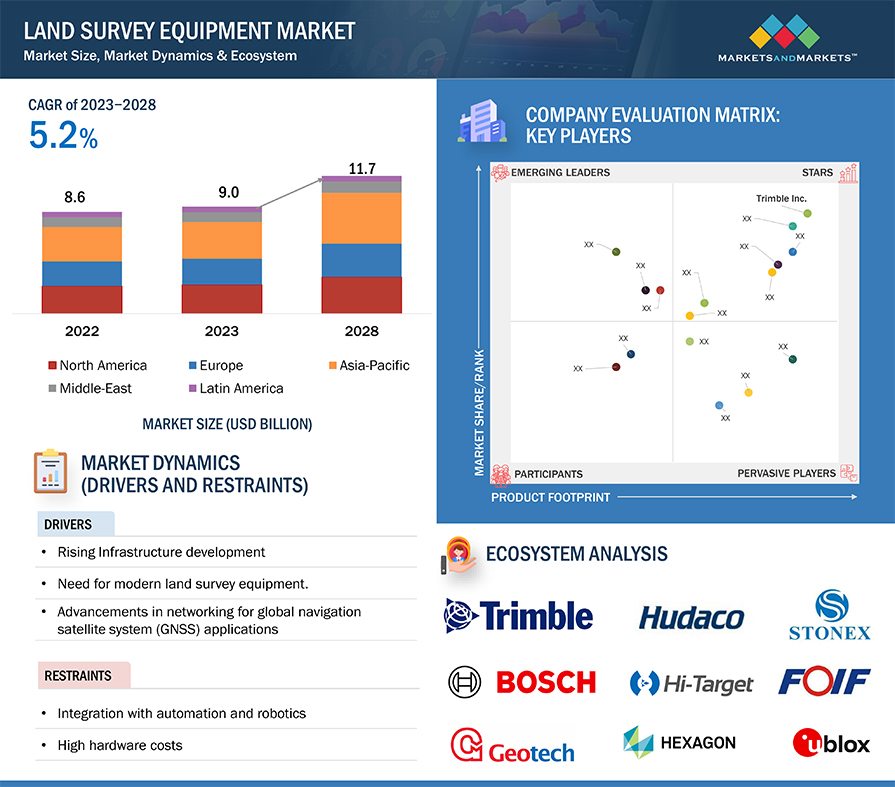

[340 Pages Report] The global Land Survey Equipment Market was valued at USD 9.0 billion in 2023 and is projected to grow from USD 10.04 billion in 2025 to USD 11.71 billion by 2028, at a CAGR of 5.2% during the forecast period. This growth is primarily driven by rising infrastructure development, the need for modern land survey equipment, and advancements in networking for global navigation satellite system (GNSS) applications. The integration of GPS/GNSS technology with survey equipment has notably enhanced field data collection, enabling real-time positioning and increased productivity. As urban areas expand and infrastructure projects proliferate, the demand for precise land surveying solutions continues to rise.

Key Takeaways:

• The global Land Survey Equipment Market was valued at USD 9.0 billion in 2023 and is projected to grow from USD 10.04 billion in 2025 to USD 11.71 billion by 2028, at a CAGR of 5.2% during the forecast period.

• By Product: Advancements in automation, robotics, and sensor technologies are expected to drive market growth, particularly through innovations in GNSS, total stations, and 3D laser scanners.

• By Application: The emphasis on preventive maintenance and asset management in inspection applications is boosting market demand, while compliance with regulations in volumetric calculations supports growth.

• By Technology: Integration of terrestrial laser scanners and advancements in digital mapping and data analytics are enhancing land survey processes, offering increased accuracy and operational efficiency.

• By End User: Rapid urbanization and population expansion in the commercial sector are key growth drivers, alongside increasing investments by defense agencies.

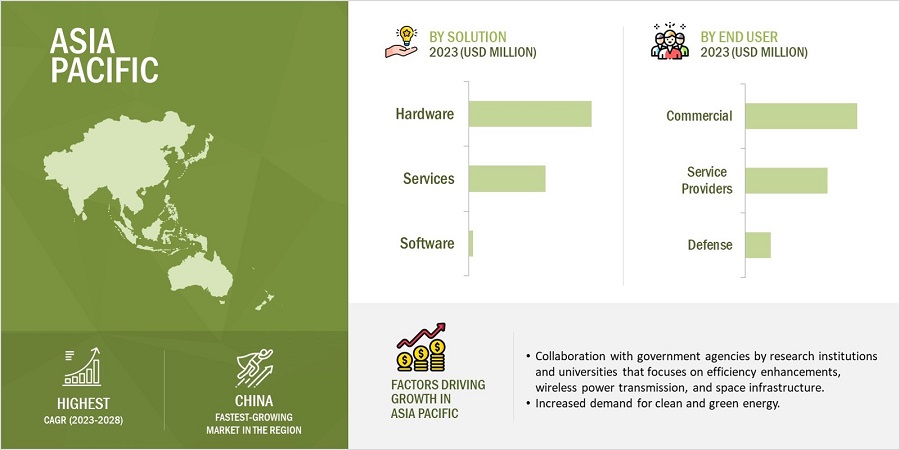

• By Region: ASIA PACIFIC is expected to grow fastest at a 6.8% CAGR, driven by large-scale infrastructure projects and economic expansion in countries like India and China.

The Land Survey Equipment Market is poised for significant growth, driven by technological advancements and the increasing complexity of infrastructure projects worldwide. Long-term projections indicate sustained demand for innovative surveying solutions, particularly as urbanization trends and renewable energy projects continue to evolve. The integration of advanced technologies such as unmanned aerial vehicles (UAVs) and cloud-based data management systems will further facilitate efficient and accurate land surveying operations, presenting numerous growth opportunities for market participants.

Land Survey Equipment Market Forecast to 2028

To know about the assumptions considered for the study, Request for Free Sample Report

Land Survey Equipment Market Dynamics

Driver: Rising Infrastructure Development

Infrastructure development, driven by rapid urbanization, improved transportation networks, and renewable energy projects, significantly propels the land survey equipment market. As urban areas expand, new infrastructure projects emerge, necessitating precise land surveying. Land survey equipment are pivotal in accurately mapping terrain, determining property boundaries, and assessing environmental factors for infrastructure development. This equipment helps in city planning, land zoning, and real estate. Similarly, transportation networks, including roads, highways, railways, and airports, require precise land surveying to ensure proper alignment, grading, and construction. Land survey equipment enables engineers to assess terrain characteristics, identify potential obstacles, and plan optimal routes for transportation infrastructure projects. Renewable energy projects, such as wind farms, solar parks, and hydroelectric facilities, also rely on land survey equipment to assess site suitability, optimize layout design, and ensure regulatory compliance. Accurate land surveys help renewable energy developers maximize energy production while minimizing environmental impact.

As infrastructure development continues to accelerate globally, the land survey equipment market is expected to experience sustained growth to meet the growing demand for precise surveying solutions. For Instance, India’s economic growth target of reaching USD 5 trillion by 2025 necessitates significant enhancements to its infrastructure. Partnerships and agreements with other countries, such as the contract signed with the Dubai government in October 2021, play a crucial role in achieving this goal. This agreement focuses on developing infrastructure in Jammu and Kashmir.

Restraints: Integration With Automation and Robotics

Integration with automation and robotics, while promising in enhancing efficiency and productivity in land surveying, also presents a significant restraint for the land survey equipment market due to the associated costs and complexities. While automation and robotics offer the potential for streamlined workflows and reduced manpower requirements, the initial investment and ongoing maintenance costs can be prohibitive for smaller companies and infrequent users. Additionally, integrating automation and robotics requires specialized expertise and training, which may pose challenges for organizations with limited resources or technical capabilities. Furthermore, the rapid pace of technological advancement in automation and robotics necessitates continuous upgrades and updates to remain competitive, further adding to the financial strain burden. As a result, while automation and robotics hold promise for revolutionizing the land surveying industry, the high costs and complexities associated with integration serve as significant restraints, particularly for smaller players and occasional users.

Opportunity: Subscription and Rental Models for Land Survey Equipment

Subscription and rental models present lucrative significant opportunities for the land survey equipment market by offering flexibility, cost-effectiveness, and access to cutting-edge technology. These models Subscription and rental models allow customers to access equipment as needed, without the need for a large significant upfront investment. This flexibility enables businesses to scale their operations according to project requirements, whether it's a short-term surveying project or a long-term infrastructure development initiative. Instead of purchasing expensive equipment outright, subscription and rental models offer a more cost-effective alternative. Customers can spread the cost of equipment usage over time, reducing financial strain and improving cash flow management.

Additionally, subscription models often include maintenance, upgrades, and support services, further enhancing their value proposition. With this, Subscription and rental models enable businesses to access the latest and most advanced surveying equipment without the burden of ownership. This allows smaller companies firms and start-ups to compete on a level playing field with larger competitors, driving innovation and technological advancements within the industry. By opting for subscription or rental agreements, businesses can mitigate the risks associated with equipment ownership, such as depreciation, obsolescence, and maintenance costs. Instead, they can focus on their core competencies while leaving equipment management to the rental provider.

Challenges: Lack of Skilled Workforce and Technical Knowledge of Latest Equipment

The surge in demand for land survey equipment over the past decade necessitates a proficient workforce capable of operating such tools. Manpower development is paramount for fostering a robust, streamlined industrial foundation. Proficient manpower facilitates the advancement of cutting-edge technologies, offers policy backing for expanded market penetration, and cultivates markets for spatial applications and services. However, the integration of sophisticated land survey equipment poses notable challenges in operator training. Mastery of these tools demands operators to acclimate to novel construction methodologies. Despite the rapid comprehension of the advantages of modern instruments, their implementation in construction projects often encounters resistance. Thorough comprehension of the capabilities of contemporary land survey equipment is crucial to optimizing operator productivity, especially for sizable projects mandating a considerable workforce. Thus, comprehensive operator training on state-of-the-art land survey equipment is indispensable to ensure the requisite precision and accuracy essential for project advancement at construction sites.

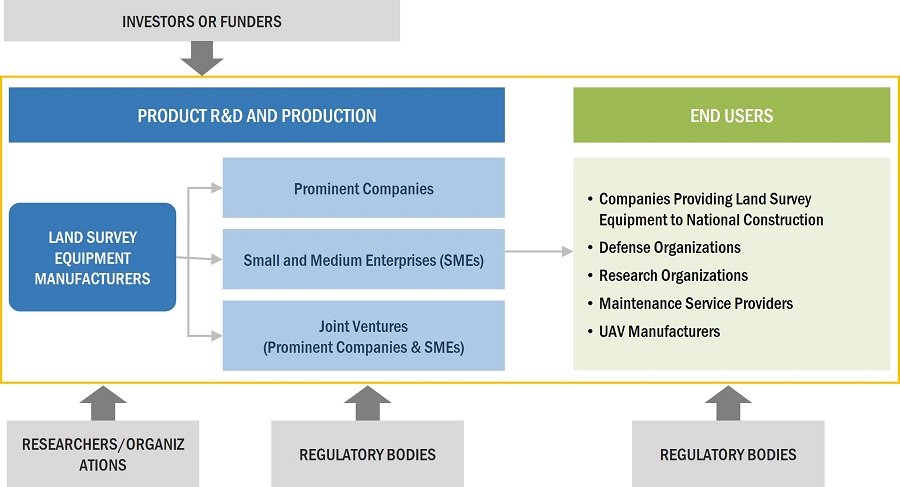

Land Survey Equipment Market Ecosystem

In the Land Survey Equipment market ecosystem, key stakeholders range from major Land Survey Equipment providers to private enterprises, distributors, suppliers, retailers, and end users. Influential forces shaping the industry include investors, funders, academic researchers, distributors, service providers, and defense procurement authorities. This intricate network of participants collaboratively drives market dynamics, innovation, and strategic decisions, highlighting the complexity and vitality of the Land Survey Equipment sector.

Land Survey Equipment Market Segmentation

Based on the Solution, the Hardware Segment is Estimated to Lead the Land Survey Equipment Market in 2023

Based on the solution, the Land Survey Equipment market has been segmented broadly into hardware, software, and services. Here hardware is leading this segment in 2023. The hardware components of land surveying equipment comprise a diverse range of instruments including GNSS systems, total stations, theodolites, levels, lasers, 3D laser scanners, UAVs, and machine control systems. Among these, Unmanned Aerial Vehicles (UAVs) are anticipated to emerge as the dominant force in the foreseeable future. UAVs, also known as remote aerial vehicles, play crucial roles in both commercial and defense sectors. In commercial applications, they are indispensable for tasks such as mapping, surveying, aerial imaging, and photogrammetry. Their adaptability and continuous advancements, driven by significant investments in research and development, broaden their usefulness across industries like mining, 3D mapping, and oil & gas exploration. Particularly in agriculture, UAVs support precision farming by enabling crop monitoring, disease identification, and optimized harvesting schedules, utilizing technologies such as infrared imagery and sensors. The increasing demand for UAVs underscores their rapid growth trajectory within the realm of land surveying equipment.

Based on the Industry, the Mining & Construction Segment is Estimated to Lead the Land Survey Equipment Market in 2023

Based on the industry, the Land Survey Equipment market has been segmented broadly into transportation, energy & power, mining & construction, forestry, scientific & geological research, precision farming, disaster management, and others. Here mining & construction is leading this segment in 2023. Land survey equipment plays a crucial role in the mining and construction sectors for precise measurement, mapping, and monitoring of sites. The market's growth is propelled by the expanding construction industry, primarily fueled by urbanization in emerging Asian and African economies. In mining, these tools aid in mineral exploration, mine planning, and infrastructure development, utilizing instruments such as total stations, GNSS receivers, levels, and UAVs. Total stations, for example, are integral for geodetic and engineering survey measurements, facilitating accurate data analysis for geological mapping and mineral deposit assessment.

Based on the Application, the Layout Points Segment is Estimated to Lead the Land Survey Equipment Market in 2023

Based on the application, the Land Survey Equipment market has been segmented broadly into inspection, monitoring, volumetric calculations, layout points, and others. Here layout points is leading this segment in 2023. Within the domain of land survey equipment, layout points refer to the pivotal procedure of converting construction blueprints into actionable coordinates for upcoming structures. This process is vital for maintaining alignment with design specifications and streamlining the advancement of ongoing projects, thus ensuring their punctual finalization. Recent research endeavors have shown a growing interest in harnessing IT solutions like 4D simulations, artificial intelligence, virtual reality, and Building Information Modeling (BIM) to amplify the effectiveness of layout planning across different construction stages.

Based on the End User, the Commercial, Defense, Service Providers Segment is Estimated to Lead the Land Survey Equipment Market in 2023

Based on the end user, the Land Survey Equipment market has been segmented broadly into commercial, defense, service providers. Here commercial is leading this segment in 2023. Land surveying equipment is widely utilized in various industries such as construction, agriculture, mining, oil & gas, forestry, telecommunications, electricity, and water utilities. Manufacturers are continuously improving equipment capabilities to meet the increasing demands of surveyors and service providers. Technological advancements like GNSS integration are driving adoption rates, especially in commercial applications, thereby expanding the market. With heightened construction activities in Asia Pacific, Africa, and North America, coupled with a rise in global mining operations and precision agriculture initiatives, the market for advanced land survey equipment in the commercial sector is experiencing significant growth. These trends underscore a growing demand for cutting-edge land survey equipment in commercial applications.

The Asia Pacific is the Fastest Growing During the Forecast Period in the Land Survey Equipment Market

Land Survey Equipment Market by Region

To know about the assumptions considered for the study, download the pdf brochure

Based on region, the Land Survey Equipment market has been segmented into North America, Europe, Asia Pacific, the Middle East and Rest of the World (RoW). Asia Pacific Land Survey Equipment sector is thriving due to a combination of factors. The expansion of the land survey equipment market in Asia Pacific is predominantly fueled by swift urbanization, rising allocations towards infrastructure enhancements, and the uptake of cutting-edge technologies. With the construction industry in the region experiencing significant growth, driven by governmental endeavors aimed at developing smart cities and improving transportation infrastructure, there is a heightened need for precise land surveying instruments to streamline planning and execution processes. Additionally, the integration of advanced technologies such as GNSS, 3D scanning, and UAVs into land surveying methodologies is becoming increasingly prevalent, bolstering accuracy while reducing time investments. Furthermore, the burgeoning real estate sector and reforms in agriculture further bolster demand, solidifying Asia Pacific's position as a key market for land survey equipment.

Land Survey Equipment Industry Companies: Top Key Market Players

Major players in the Land Survey Equipment Companies include Hexagon AB (Sweden), Trimble Inc. (US), Topcon Corporation (Japan), CHC-Navigation (China), Hi-Target (China), U-Blox Holdings AG (Switzerland), and Hudaco Industries (South Africa) to enhance their presence in the market. The report covers various industry trends and new technological innovations in the Land Survey Equipment market.

Scope of the Report

|

Report Metric |

Details |

|

Estimated Market Size |

USD 9.0 Billion in 2023 |

|

Projected Market Size |

USD 11.7 Billion by 2028 |

|

Growth Rate |

5.2% |

|

Market Size Available for Years |

2019-2028 |

|

Base Year Considered |

2022 |

|

Forecast Period |

2023-2028 |

|

Forecast Units |

Value (USD) |

|

Segments Covered |

By Solution, Application, End User, and Industry |

|

Geographies Covered |

North America, Europe, Asia Pacific, the Middle East & ROW (Africa, and Latin America) |

|

Companies Covered |

Hexagon AB (Sweden), Trimble Inc. (US), Topcon (Japan), CHC-Navigation (China), and Hi-Target (China) |

Land Survey Equipment Market Highlights

This research report categorizes the Land Survey Equipment markets based on Application, Industry, Solution and End User.

|

Segment |

Subsegment |

|

By Application |

|

|

By Industry |

|

|

By Solution |

|

|

By End-User |

|

|

By Region |

|

Recent Developments

- In August 2023, Hexagon AB announced its new Leica BLK2FLY Indoor empowering indoor scanning for comprehensive digital twin creation. The enhanced BLK2FLY now delivers unparalleled autonomy, enabling seamless scanning of entire structures both indoors and outdoors. This breakthrough feature extends the BLK2FLY's utility in diverse environments, including GNSS-deprived areas like nuclear facilities. Leveraging Hexagon's cutting-edge visual SLAM technology, the system achieves real-time spherical imaging with a remarkable operational range of up to 1.5 meters.

- In February 2024, John Deere unveiled a groundbreaking collaboration with Leica Geosystems, a Hexagon subsidiary, aimed at revolutionizing the digitalization of the heavy construction sector. This synergistic partnership capitalizes on the core competencies of both entities, ushering in a new era of technological advancement and service delivery for construction practitioners globally. The integration of SmartGrade™ with Leica solution epitomizes the pinnacle of innovation, empowering John Deere and its network of dealers to cater to diverse job sites while addressing the evolving technological demands of clientele. Leveraging Leica Geosystems' cutting-edge technological prowess alongside the robust performance capabilities inherent in the John Deere construction equipment portfolio ensures unparalleled productivity, efficiency, and seamlessness across construction sites for end-users.

Frequently Asked Questions (FAQs) Addressed by the Report:

What are your views on the growth prospect of the Land Survey Equipment market?

Response: The Land Survey Equipment market due to advancements in compact missile design technology. This development is poised to enhance surveying capabilities, fostering demand for innovative equipment. Technological progress in missile design is set to drive the expansion of the Land Survey Equipment market.

What are the key sustainability strategies adopted by leading players operating in the Land Survey Equipment market?

Response: Key players have adopted various organic and inorganic strategies to strengthen their position in the Land Survey Equipment market. Major players Hexagon AB (Sweden), Trimble Inc. (US), Topcon (Japan), CHC-Navigation (China), Hi-Target (China), U-Blox Holdings AG (Switzerland), and Hudaco Industries (South Africa have adopted various strategies, such as contracts and agreements, to expand their presence in the market further.

What are the new emerging technologies and use cases disrupting the Land Survey Equipment market?

Response: Some of the major emerging technologies are digitalization and artificial intelligence that will disrupt the Land Survey Equipment market.

Who are the key players and innovators in the ecosystem of the Land Survey Equipment market?

Response: Major players in the Land Survey Equipment market include Hexagon AB (Sweden), Trimble Inc. (US), Topcon (Japan), CHC-Navigation (China), Hi-Target (China), U-Blox Holdings AG (Switzerland), and Hudaco Industries (South Africa).

Which region is expected to hold the highest market share in the Land Survey Equipment market?

Response: Land Survey Equipment market in the Asia Pacific region is estimated to account for the largest share of 34.2% of the market in 2023.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Rising infrastructure development- Need for modern land survey equipment- Advancements in networking for global navigation satellite system (GNSS) applicationsRESTRAINTS- Integration with automation and robotics- High hardware costsOPPORTUNITIES- Technological advancements in data management systems- Integration of terrestrial laser scanners into land survey equipment- Subscription and rental models for land survey equipment- Benefits of electronic devices in land surveysCHALLENGES- Lack of skilled workforce and technical knowledge of latest equipment

- 5.3 IMPACT OF RECESSION

- 5.4 TRENDS AND DISRUPTIONS IMPACTING CUSTOMERS’ BUSINESSES

-

5.5 ECOSYSTEM MAPPINGPROMINENT COMPANIESPRIVATE AND SMALL ENTERPRISESEND USERS

- 5.6 PRICING ANALYSIS

- 5.7 OPERATIONAL DATA

- 5.8 TRADE DATA

-

5.9 KEY STAKEHOLDERS AND BUYING CRITERIASTAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

- 5.10 VALUE CHAIN ANALYSIS

- 5.11 TECHNOLOGY ROADMAP

- 5.12 BILL OF MATERIALS FOR TOTAL STATIONS

- 5.13 TOTAL COST OF OWNERSHIP FOR TOTAL STATIONS

-

5.14 USE CASE ANALYSISWINGTRAONE FIXED-WING DRONESOIL EROSION TRACKING WITH MOBILE MAPPING, GNSS, AND LIDAR

- 5.15 TARIFF AND REGULATORY LANDSCAPE

- 5.16 KEY CONFERENCES AND EVENTS, 2024

- 5.17 INVESTMENT AND FUNDING SCENARIO

- 6.1 INTRODUCTION

-

6.2 SUPPLY CHAIN ANALYSISMAJOR COMPANIESSMALL AND MEDIUM ENTERPRISESEND USERS/CUSTOMERS

-

6.3 TECHNOLOGY TRENDSROBOTIC TOTAL STATIONS AND MOBILE MAPPING SYSTEMSDIGITALIZATIONUNMANNED AERIAL VEHICLESLIDAR

-

6.4 IMPACT OF MEGATRENDSELECTRONIFICATION OF LAND SURVEY EQUIPMENT COMPONENTS- Electronic distance measurement (EDM) devices- Electronic theodolites- Microprocessors- Storage units- Other componentsCLOUD-BASED DATA MANAGEMENT

-

6.5 PATENT ANALYSIS

- 7.1 INTRODUCTION

-

7.2 HARDWAREADVANCEMENTS IN AUTOMATION, ROBOTICS, AND SENSOR TECHNOLOGIES TO DRIVE GROWTHGNSS- Integrated smart antennas- Modular GNSS- GNSS network solutionsTOTAL STATIONS & THEODOLITES- Standard/Manual total stations- Robotic total stations- Multi-stationsLEVELS- Digital levels- Automatic levels3D LASER SCANNERSLASERS- Leveling lasers- Dual-grade lasers- Pipe lasersUNMANNED AERIAL VEHICLES (UAVS)MACHINE CONTROL SYSTEMS

-

7.3 SOFTWAREADVANCEMENTS IN DIGITAL MAPPING AND DATA ANALYTICS TO DRIVE GROWTHDESKTOP APPLICATIONSMOBILE APPLICATIONSREMOTE SENSING APPLICATIONSDEVELOPER APPLICATIONS

-

7.4 SERVICESADVANCED SOFTWARE INTEGRATION TO DRIVE GROWTHTECHNICAL SERVICESCALIBRATION SERVICESSOFTWARE DEVELOPMENT SERVICES

- 8.1 INTRODUCTION

-

8.2 INSPECTIONEMPHASIS ON PREVENTIVE MAINTENANCE AND ASSET MANAGEMENT TO DRIVE GROWTH

-

8.3 MONITORINGGROWING AWARENESS OF SAFETY AND RISK MANAGEMENT TO DRIVE GROWTH

-

8.4 VOLUMETRIC CALCULATIONSCOMPLIANCE WITH REGULATIONS REGARDING LAND USE AND ENVIRONMENTAL IMPACT TO DRIVE GROWTH

-

8.5 LAYOUT POINTSEMPHASIS ON SUSTAINABILITY AND RESOURCE OPTIMIZATION TO DRIVE GROWTH

- 8.6 OTHER APPLICATIONS

- 9.1 INTRODUCTION

-

9.2 COMMERCIALRAPID URBANIZATION AND POPULATION EXPANSION TO DRIVE GROWTH

-

9.3 DEFENSEINCREASING INVESTMENTS BY DEFENSE AGENCIES TO DRIVE GROWTH

-

9.4 SERVICE PROVIDERSAVAILABILITY OF DIVERSE SURVEYING SOLUTIONS TO DRIVE GROWTH

- 10.1 INTRODUCTION

- 10.2 TRANSPORTATION

-

10.3 ENERGY & POWEROIL & GASUTILITIESRENEWABLE ENERGY

- 10.4 MINING & CONSTRUCTION

- 10.5 FORESTRY

- 10.6 SCIENTIFIC & GEOLOGICAL RESEARCH

- 10.7 PRECISION FARMING

- 10.8 DISASTER MANAGEMENT

- 10.9 OTHER INDUSTRIES

- 11.1 INTRODUCTION

- 11.2 REGIONAL RECESSION IMPACT ANALYSIS

-

11.3 NORTH AMERICARECESSION IMPACT ANALYSISPESTLE ANALYSISUS- Rising investments in infrastructure renewal and urban development projects to drive growthCANADA- Need for advanced surveying equipment to ensure regulatory compliance to drive growth

-

11.4 ASIA PACIFICRECESSION IMPACT ANALYSISPESTLE ANALYSISCHINA- Focus on smart city development and digital economy to drive growthINDIA- Extensive infrastructure development programs to drive growthJAPAN- Integration of IoT technologies into infrastructure projects to drive growthSOUTH KOREA- Emphasis on green infrastructure and urban renewal projects to drive growthAUSTRALIA- Rapidly expanding tourism industry to drive growthREST OF ASIA PACIFIC

-

11.5 EUROPERECESSION IMPACT ANALYSISPESTLE ANALYSISUK- Advancements in scientific & geological surveying techniques to drive growthRUSSIA- Need for comprehensive surveying services in construction planning to drive growthFRANCE- Government investments in urban development to drive growthITALY- Focus on archaeological preservation to drive growthGERMANY- Surge in renewable energy projects to drive growthREST OF EUROPE

-

11.6 MIDDLE EASTRECESSION IMPACT ANALYSISPESTLE ANALYSISGCC- Focus on economic diversification to drive growthTURKEY- Ongoing developments in construction industry to drive growthISRAEL- Adoption of land survey equipment in real estate development projects to drive growthREST OF MIDDLE EAST

-

11.7 REST OF THE WORLDRECESSION IMPACT ANALYSISPESTLE ANALYSISLATIN AMERICA- Deployment of modern surveying techniques to drive growthAFRICA- Fast-improving tourism infrastructure to drive growth

- 12.1 INTRODUCTION

- 12.2 STRATEGIES ADOPTED BY KEY PLAYERS

- 12.3 REVENUE ANALYSIS, 2018–2022

- 12.4 MARKET SHARE ANALYSIS, 2022

- 12.5 RANKING ANALYSIS, 2022

-

12.6 COMPETITIVE EVALUATION MATRIX, 2022STARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTSCOMPANY FOOTPRINT

-

12.7 START-UP/SME EVALUATION MATRIX, 2022PROGRESSIVE COMPANIESRESPONSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKSCOMPETITIVE BENCHMARKING

- 12.8 COMPANY FINANCIAL METRICS, 2022

- 12.9 BRAND/PRODUCT COMPARISON

-

12.10 COMPETITIVE SCENARIOMARKET EVALUATION FRAMEWORKPRODUCT LAUNCHES/DEVELOPMENTSDEALSOTHERS

-

13.1 KEY PLAYERSHEXAGON AB- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewTOPCON CORPORATION- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewTRIMBLE INC.- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewU-BLOX- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewSHANGHAI HUACE NAVIGATION TECHNOLOGY LTD.- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewHI-TARGET- Business overview- Products/Solutions/Services offered- Recent developmentsHUDACO INDUSTRIES LTD.- Business overview- Products/Solutions/Services offeredSUZHOU FOIF CO., LTD.- Business overview- Products/Solutions/Services offeredSTONEX SRL- Business overview- Products/Solutions/Services offered- Recent developmentsSOUTH SURVEYING & MAPPING TECHNOLOGY CO., LTD.- Business overview- Products/Solutions/Services offered- Recent developmentsCST/BERGER- Business overview- Products/Solutions/Services offeredCHANGZHOU DADI SURVEYING SCIENCE & TECHNOLOGY CO., LTD.- Business overview- Products/Solutions/Services offeredGUANGDONG KOLIDA INSTRUMENT CO., LTD.- Business overview- Products/Solutions/Services offered- Recent developmentsUNISTRONG- Business overview- Products/Solutions/Services offered- Recent developmentsGEOTECH- Business overview- Products/Solutions/Services offeredROBERT BOSCH GMBH- Business overview- Products/Solutions/Services offered- Recent developments

-

13.2 OTHER PLAYERSHEMISPHERE GNSS, INC.ENTEK INSTRUMENTS INDIA PVT. LTD.SAMAH AERIAL SURVEY CO., LTD.EOS POSITIONING SYSTEMS, INC.TI ASAHI CO., LTD.GEOSOLUTION I GOTEBORG ABTHEIS FEINWERKTECHNIKEMLID TECH KFTTIANJIN XING OU SURVEYING INSTRUMENT MANUFACTURE CO., LTD.

- 14.1 DISCUSSION GUIDE

- 14.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 14.3 CUSTOMIZATION OPTIONS

- 14.4 RELATED REPORTS

- 14.5 AUTHOR DETAILS

- TABLE 1 INCLUSIONS AND EXCLUSIONS

- TABLE 2 USD EXCHANGE RATES

- TABLE 3 MARKET SIZE ESTIMATION PROCESS

- TABLE 4 ROLE OF COMPANIES IN ECOSYSTEM

- TABLE 5 AVERAGE SELLING PRICE OF LAND SURVEY EQUIPMENT, BY SOLUTION (USD THOUSAND)

- TABLE 6 AVERAGE SELLING PRICE OF LAND SURVEY EQUIPMENT, BY REGION (USD THOUSAND)

- TABLE 7 LAND SURVEY EQUIPMENT VOLUME, BY TYPE, 2019–2022 (UNITS)

- TABLE 8 IMPORT DATA (HS CODE: 901520), BY COUNTRY, 2018–2022 (USD THOUSAND)

- TABLE 9 EXPORT DATA (HS CODE: 901520), BY COUNTRY, 2018–2022 (USD THOUSAND)

- TABLE 10 IMPORT DATA (HS CODE: 901530), BY COUNTRY, 2018–2022 (USD THOUSAND)

- TABLE 11 EXPORT DATA (HS CODE: 901530), BY COUNTRY, 2018–2022 (USD THOUSAND)

- TABLE 12 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS OF LAND SURVEY EQUIPMENT, BY END USER (%)

- TABLE 13 KEY BUYING CRITERIA FOR LAND SURVEY EQUIPMENT, BY END USER

- TABLE 14 NORTH AMERICA: TARIFFS

- TABLE 15 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 16 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 17 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 18 KEY CONFERENCES AND EVENTS, 2024

- TABLE 19 VENTURE CAPITAL AND DEALS, 2019−2022

- TABLE 20 PATENT ANALYSIS, 2022–2024

- TABLE 21 LAND SURVEY EQUIPMENT MARKET, BY SOLUTION, 2019–2022 (USD MILLION)

- TABLE 22 LAND SURVEY EQUIPMENT MARKET, BY SOLUTION, 2023–2028 (USD MILLION)

- TABLE 23 LAND SURVEY EQUIPMENT MARKET, BY HARDWARE, 2019–2022 (USD MILLION)

- TABLE 24 LAND SURVEY EQUIPMENT MARKET, BY HARDWARE, 2023–2028 (USD MILLION)

- TABLE 25 LAND SURVEY EQUIPMENT MARKET, BY SOFTWARE, 2019–2022 (USD MILLION)

- TABLE 26 LAND SURVEY EQUIPMENT MARKET, BY SOFTWARE, 2023–2028 (USD MILLION)

- TABLE 27 LAND SURVEY EQUIPMENT MARKET, BY SERVICE, 2019–2022 (USD MILLION)

- TABLE 28 LAND SURVEY EQUIPMENT MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 29 LAND SURVEY EQUIPMENT MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 30 LAND SURVEY EQUIPMENT MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 31 LAND SURVEY EQUIPMENT MARKET, BY END USER, 2019–2022 (USD MILLION)

- TABLE 32 LAND SURVEY EQUIPMENT MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 33 LAND SURVEY EQUIPMENT MARKET, BY INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 34 LAND SURVEY EQUIPMENT MARKET, BY INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 35 LAND SURVEY EQUIPMENT MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 36 LAND SURVEY EQUIPMENT MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 37 NORTH AMERICA: LAND SURVEY EQUIPMENT MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 38 NORTH AMERICA: LAND SURVEY EQUIPMENT MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 39 NORTH AMERICA: LAND SURVEY EQUIPMENT MARKET, BY SOLUTION, 2019–2022 (USD MILLION)

- TABLE 40 NORTH AMERICA: LAND SURVEY EQUIPMENT MARKET, BY SOLUTION, 2023–2028 (USD MILLION)

- TABLE 41 NORTH AMERICA: LAND SURVEY EQUIPMENT MARKET, BY HARDWARE, 2019–2022 (USD MILLION)

- TABLE 42 NORTH AMERICA: LAND SURVEY EQUIPMENT MARKET, BY HARDWARE, 2023–2028 (USD MILLION)

- TABLE 43 NORTH AMERICA: LAND SURVEY EQUIPMENT MARKET, BY SOFTWARE, 2019–2022 (USD MILLION)

- TABLE 44 NORTH AMERICA: LAND SURVEY EQUIPMENT MARKET, BY SOFTWARE, 2023–2028 (USD MILLION)

- TABLE 45 NORTH AMERICA: LAND SURVEY EQUIPMENT MARKET, BY SERVICE, 2019–2022 (USD MILLION)

- TABLE 46 NORTH AMERICA: LAND SURVEY EQUIPMENT MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 47 NORTH AMERICA: LAND SURVEY EQUIPMENT MARKET, BY INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 48 NORTH AMERICA: LAND SURVEY EQUIPMENT MARKET, BY INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 49 NORTH AMERICA: LAND SURVEY EQUIPMENT MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 50 NORTH AMERICA: LAND SURVEY EQUIPMENT MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 51 NORTH AMERICA: LAND SURVEY EQUIPMENT MARKET, BY END USER, 2019–2022 (USD MILLION)

- TABLE 52 NORTH AMERICA: LAND SURVEY EQUIPMENT MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 53 US: LAND SURVEY EQUIPMENT MARKET, BY SOLUTION, 2019–2022 (USD MILLION)

- TABLE 54 US: LAND SURVEY EQUIPMENT MARKET, BY SOLUTION, 2023–2028 (USD MILLION)

- TABLE 55 US: LAND SURVEY EQUIPMENT MARKET, BY INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 56 US: LAND SURVEY EQUIPMENT MARKET, BY INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 57 US: LAND SURVEY EQUIPMENT MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 58 US: LAND SURVEY EQUIPMENT MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 59 US: LAND SURVEY EQUIPMENT MARKET, BY END USER, 2019–2022 (USD MILLION)

- TABLE 60 US: LAND SURVEY EQUIPMENT MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 61 CANADA: LAND SURVEY EQUIPMENT MARKET, BY SOLUTION, 2019–2022 (USD MILLION))

- TABLE 62 CANADA: LAND SURVEY EQUIPMENT MARKET, BY SOLUTION, 2023–2028 (USD MILLION)

- TABLE 63 CANADA: LAND SURVEY EQUIPMENT MARKET, BY INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 64 CANADA: LAND SURVEY EQUIPMENT MARKET, BY INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 65 CANADA: LAND SURVEY EQUIPMENT MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 66 CANADA: LAND SURVEY EQUIPMENT MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 67 CANADA: LAND SURVEY EQUIPMENT MARKET, BY END USER, 2019–2022 (USD MILLION)

- TABLE 68 CANADA: LAND SURVEY EQUIPMENT MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 69 ASIA PACIFIC: LAND SURVEY EQUIPMENT MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 70 ASIA PACIFIC: LAND SURVEY EQUIPMENT MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 71 ASIA PACIFIC: LAND SURVEY EQUIPMENT MARKET, BY SOLUTION, 2019–2022 (USD MILLION)

- TABLE 72 ASIA PACIFIC: LAND SURVEY EQUIPMENT MARKET, BY SOLUTION, 2023–2028 (USD MILLION)

- TABLE 73 ASIA PACIFIC: LAND SURVEY EQUIPMENT MARKET, BY HARDWARE, 2019–2022 (USD MILLION)

- TABLE 74 ASIA PACIFIC: LAND SURVEY EQUIPMENT MARKET, BY HARDWARE, 2023–2028 (USD MILLION)

- TABLE 75 ASIA PACIFIC: LAND SURVEY EQUIPMENT MARKET, BY SOFTWARE, 2019–2022 (USD MILLION)

- TABLE 76 ASIA PACIFIC: LAND SURVEY EQUIPMENT MARKET, BY SOFTWARE, 2023–2028 (USD MILLION)

- TABLE 77 ASIA PACIFIC: LAND SURVEY EQUIPMENT MARKET, BY SERVICE, 2019–2022 (USD MILLION)

- TABLE 78 ASIA PACIFIC: LAND SURVEY EQUIPMENT MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 79 ASIA PACIFIC: LAND SURVEY EQUIPMENT MARKET, BY INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 80 ASIA PACIFIC: LAND SURVEY EQUIPMENT MARKET, BY INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 81 ASIA PACIFIC: LAND SURVEY EQUIPMENT MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 82 ASIA PACIFIC: LAND SURVEY EQUIPMENT MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 83 ASIA PACIFIC: LAND SURVEY EQUIPMENT MARKET, BY END USER, 2019–2022 (USD MILLION)

- TABLE 84 ASIA PACIFIC: LAND SURVEY EQUIPMENT MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 85 CHINA: LAND SURVEY EQUIPMENT MARKET, BY SOLUTION, 2019–2022 (USD MILLION)

- TABLE 86 CHINA: LAND SURVEY EQUIPMENT MARKET, BY SOLUTION, 2023–2028 (USD MILLION)

- TABLE 87 CHINA: LAND SURVEY EQUIPMENT MARKET, BY INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 88 CHINA: LAND SURVEY EQUIPMENT MARKET, BY INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 89 CHINA: LAND SURVEY EQUIPMENT MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 90 CHINA: LAND SURVEY EQUIPMENT MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 91 CHINA: LAND SURVEY EQUIPMENT MARKET, BY END USER, 2019–2022 (USD MILLION)

- TABLE 92 CHINA: LAND SURVEY EQUIPMENT MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 93 INDIA: LAND SURVEY EQUIPMENT MARKET, BY SOLUTION, 2019–2022 (USD MILLION))

- TABLE 94 INDIA: LAND SURVEY EQUIPMENT MARKET, BY SOLUTION, 2023–2028 (USD MILLION)

- TABLE 95 INDIA: LAND SURVEY EQUIPMENT MARKET, BY INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 96 INDIA: LAND SURVEY EQUIPMENT MARKET, BY INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 97 INDIA: LAND SURVEY EQUIPMENT MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 98 INDIA: LAND SURVEY EQUIPMENT MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 99 INDIA: LAND SURVEY EQUIPMENT MARKET, BY END USER, 2019–2022 (USD MILLION)

- TABLE 100 INDIA: LAND SURVEY EQUIPMENT MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 101 JAPAN: LAND SURVEY EQUIPMENT MARKET, BY SOLUTION, 2019–2022 (USD MILLION))

- TABLE 102 JAPAN: LAND SURVEY EQUIPMENT MARKET, BY SOLUTION, 2023–2028 (USD MILLION)

- TABLE 103 JAPAN: LAND SURVEY EQUIPMENT MARKET, BY INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 104 JAPAN: LAND SURVEY EQUIPMENT MARKET, BY INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 105 JAPAN: LAND SURVEY EQUIPMENT MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 106 JAPAN: LAND SURVEY EQUIPMENT MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 107 JAPAN: LAND SURVEY EQUIPMENT MARKET, BY END USER, 2019–2022 (USD MILLION)

- TABLE 108 JAPAN: LAND SURVEY EQUIPMENT MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 109 SOUTH KOREA: LAND SURVEY EQUIPMENT MARKET, BY SOLUTION, 2019–2022 (USD MILLION)

- TABLE 110 SOUTH KOREA: LAND SURVEY EQUIPMENT MARKET, BY SOLUTION, 2023–2028 (USD MILLION)

- TABLE 111 SOUTH KOREA: LAND SURVEY EQUIPMENT MARKET, BY INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 112 SOUTH KOREA: LAND SURVEY EQUIPMENT MARKET, BY INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 113 SOUTH KOREA: LAND SURVEY EQUIPMENT MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 114 SOUTH KOREA: LAND SURVEY EQUIPMENT MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 115 SOUTH KOREA: LAND SURVEY EQUIPMENT MARKET, BY END USER, 2019–2022 (USD MILLION)

- TABLE 116 SOUTH KOREA: LAND SURVEY EQUIPMENT MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 117 AUSTRALIA: LAND SURVEY EQUIPMENT MARKET, BY SOLUTION, 2019–2022 (USD MILLION))

- TABLE 118 AUSTRALIA: LAND SURVEY EQUIPMENT MARKET, BY SOLUTION, 2023–2028 (USD MILLION)

- TABLE 119 AUSTRALIA: LAND SURVEY EQUIPMENT MARKET, BY INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 120 AUSTRALIA: LAND SURVEY EQUIPMENT MARKET, BY INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 121 AUSTRALIA: LAND SURVEY EQUIPMENT MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 122 AUSTRALIA: LAND SURVEY EQUIPMENT MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 123 AUSTRALIA: LAND SURVEY EQUIPMENT MARKET, BY END USER, 2019–2022 (USD MILLION)

- TABLE 124 AUSTRALIA: LAND SURVEY EQUIPMENT MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 125 REST OF ASIA PACIFIC: LAND SURVEY EQUIPMENT MARKET, BY SOLUTION, 2019–2022 (USD MILLION))

- TABLE 126 REST OF ASIA PACIFIC: LAND SURVEY EQUIPMENT MARKET, BY SOLUTION, 2023–2028 (USD MILLION)

- TABLE 127 REST OF ASIA PACIFIC: LAND SURVEY EQUIPMENT MARKET, BY INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 128 REST OF ASIA PACIFIC: LAND SURVEY EQUIPMENT MARKET, BY INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 129 REST OF ASIA PACIFIC: LAND SURVEY EQUIPMENT MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 130 REST OF ASIA PACIFIC: LAND SURVEY EQUIPMENT MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 131 REST OF ASIA PACIFIC: LAND SURVEY EQUIPMENT MARKET, BY END USER, 2019–2022 (USD MILLION)

- TABLE 132 REST OF ASIA PACIFIC: LAND SURVEY EQUIPMENT MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 133 EUROPE: LAND SURVEY EQUIPMENT MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 134 EUROPE: LAND SURVEY EQUIPMENT MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 135 EUROPE: LAND SURVEY EQUIPMENT MARKET, BY SOLUTION, 2019–2022 (USD MILLION)

- TABLE 136 EUROPE: LAND SURVEY EQUIPMENT MARKET, BY SOLUTION, 2023–2028 (USD MILLION)

- TABLE 137 EUROPE: LAND SURVEY EQUIPMENT MARKET, BY HARDWARE, 2019–2022 (USD MILLION)

- TABLE 138 EUROPE: LAND SURVEY EQUIPMENT MARKET, BY HARDWARE, 2023–2028 (USD MILLION)

- TABLE 139 EUROPE: LAND SURVEY EQUIPMENT MARKET, BY SOFTWARE, 2019–2022 (USD MILLION)

- TABLE 140 EUROPE: LAND SURVEY EQUIPMENT MARKET, BY SOFTWARE, 2023–2028 (USD MILLION)

- TABLE 141 EUROPE: LAND SURVEY EQUIPMENT MARKET, BY SERVICE, 2019–2022 (USD MILLION)

- TABLE 142 EUROPE: LAND SURVEY EQUIPMENT MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 143 EUROPE: LAND SURVEY EQUIPMENT MARKET, BY INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 144 EUROPE: LAND SURVEY EQUIPMENT MARKET, BY INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 145 EUROPE: LAND SURVEY EQUIPMENT MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 146 EUROPE: LAND SURVEY EQUIPMENT MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 147 EUROPE: LAND SURVEY EQUIPMENT MARKET, BY END USER, 2019–2022 (USD MILLION)

- TABLE 148 EUROPE: LAND SURVEY EQUIPMENT MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 149 UK: LAND SURVEY EQUIPMENT MARKET, BY SOLUTION, 2019–2022 (USD MILLION)

- TABLE 150 UK: LAND SURVEY EQUIPMENT MARKET, BY SOLUTION, 2023–2028 (USD MILLION)

- TABLE 151 UK: LAND SURVEY EQUIPMENT MARKET, BY INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 152 UK: LAND SURVEY EQUIPMENT MARKET, BY INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 153 UK: LAND SURVEY EQUIPMENT MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 154 UK: LAND SURVEY EQUIPMENT MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 155 UK: LAND SURVEY EQUIPMENT MARKET, BY END USER, 2019–2022 (USD MILLION)

- TABLE 156 UK: LAND SURVEY EQUIPMENT MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 157 RUSSIA: LAND SURVEY EQUIPMENT MARKET, BY SOLUTION, 2019–2022 (USD MILLION)

- TABLE 158 RUSSIA: LAND SURVEY EQUIPMENT MARKET, BY SOLUTION, 2023–2028 (USD MILLION)

- TABLE 159 RUSSIA: LAND SURVEY EQUIPMENT MARKET, BY INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 160 RUSSIA: LAND SURVEY EQUIPMENT MARKET, BY INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 161 RUSSIA: LAND SURVEY EQUIPMENT MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 162 RUSSIA: LAND SURVEY EQUIPMENT MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 163 RUSSIA: LAND SURVEY EQUIPMENT MARKET, BY END USER, 2019–2022 (USD MILLION)

- TABLE 164 RUSSIA: LAND SURVEY EQUIPMENT MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 165 FRANCE: LAND SURVEY EQUIPMENT MARKET, BY SOLUTION, 2019–2022 (USD MILLION)

- TABLE 166 FRANCE: LAND SURVEY EQUIPMENT MARKET, BY SOLUTION, 2023–2028 (USD MILLION)

- TABLE 167 FRANCE: LAND SURVEY EQUIPMENT MARKET, BY INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 168 FRANCE: LAND SURVEY EQUIPMENT MARKET, BY INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 169 FRANCE: LAND SURVEY EQUIPMENT MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 170 FRANCE: LAND SURVEY EQUIPMENT MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 171 FRANCE LAND SURVEY EQUIPMENT MARKET, BY END USER, 2019–2022 (USD MILLION)

- TABLE 172 FRANCE: LAND SURVEY EQUIPMENT MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 173 ITALY: LAND SURVEY EQUIPMENT MARKET, BY SOLUTION, 2019–2022 (USD MILLION)

- TABLE 174 ITALY: LAND SURVEY EQUIPMENT MARKET, BY SOLUTION, 2023–2028 (USD MILLION)

- TABLE 175 ITALY: LAND SURVEY EQUIPMENT MARKET, BY INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 176 ITALY: LAND SURVEY EQUIPMENT MARKET, BY INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 177 ITALY: LAND SURVEY EQUIPMENT MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 178 ITALY: LAND SURVEY EQUIPMENT MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 179 ITALY: LAND SURVEY EQUIPMENT MARKET, BY END USER, 2019–2022 (USD MILLION)

- TABLE 180 ITALY: LAND SURVEY EQUIPMENT MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 181 GERMANY: LAND SURVEY EQUIPMENT MARKET, BY SOLUTION, 2019–2022 (USD MILLION)

- TABLE 182 GERMANY: LAND SURVEY EQUIPMENT MARKET, BY SOLUTION, 2023–2028 (USD MILLION)

- TABLE 183 GERMANY: LAND SURVEY EQUIPMENT MARKET, BY INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 184 GERMANY: LAND SURVEY EQUIPMENT MARKET, BY INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 185 GERMANY: LAND SURVEY EQUIPMENT MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 186 GERMANY: LAND SURVEY EQUIPMENT MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 187 GERMANY: LAND SURVEY EQUIPMENT MARKET, BY END USER, 2019–2022 (USD MILLION)

- TABLE 188 GERMANY: LAND SURVEY EQUIPMENT MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 189 REST OF EUROPE: LAND SURVEY EQUIPMENT MARKET, BY SOLUTION, 2019–2022 (USD MILLION)

- TABLE 190 REST OF EUROPE: LAND SURVEY EQUIPMENT MARKET, BY SOLUTION, 2023–2028 (USD MILLION)

- TABLE 191 REST OF EUROPE: LAND SURVEY EQUIPMENT MARKET, BY INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 192 REST OF EUROPE: LAND SURVEY EQUIPMENT MARKET, BY INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 193 REST OF EUROPE: LAND SURVEY EQUIPMENT MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 194 REST OF EUROPE: LAND SURVEY EQUIPMENT MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 195 REST OF EUROPE: LAND SURVEY EQUIPMENT MARKET, BY END USER, 2019–2022 (USD MILLION)

- TABLE 196 REST OF EUROPE: LAND SURVEY EQUIPMENT MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 197 MIDDLE EAST: LAND SURVEY EQUIPMENT MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 198 MIDDLE EAST: LAND SURVEY EQUIPMENT MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 199 MIDDLE EAST: LAND SURVEY EQUIPMENT MARKET, BY SOLUTION, 2019–2022 (USD MILLION)

- TABLE 200 MIDDLE EAST: LAND SURVEY EQUIPMENT MARKET, BY SOLUTION, 2023–2028 (USD MILLION)

- TABLE 201 MIDDLE EAST: LAND SURVEY EQUIPMENT MARKET, BY HARDWARE, 2019–2022 (USD MILLION)

- TABLE 202 MIDDLE EAST: LAND SURVEY EQUIPMENT MARKET, BY HARDWARE, 2023–2028 (USD MILLION)

- TABLE 203 MIDDLE EAST: LAND SURVEY EQUIPMENT MARKET, BY SOFTWARE, 2019–2022 (USD MILLION)

- TABLE 204 MIDDLE EAST: LAND SURVEY EQUIPMENT MARKET, BY SOFTWARE, 2023–2028 (USD MILLION)

- TABLE 205 MIDDLE EAST: LAND SURVEY EQUIPMENT MARKET, BY SERVICE, 2019–2022 (USD MILLION)

- TABLE 206 MIDDLE EAST: LAND SURVEY EQUIPMENT MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 207 MIDDLE EAST: LAND SURVEY EQUIPMENT MARKET, BY INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 208 MIDDLE EAST: LAND SURVEY EQUIPMENT MARKET, BY INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 209 MIDDLE EAST: LAND SURVEY EQUIPMENT MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 210 MIDDLE EAST: LAND SURVEY EQUIPMENT MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 211 MIDDLE EAST: LAND SURVEY EQUIPMENT MARKET, BY END USER, 2019–2022 (USD MILLION)

- TABLE 212 MIDDLE EAST: LAND SURVEY EQUIPMENT MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 213 GCC: LAND SURVEY EQUIPMENT MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 214 GCC: LAND SURVEY EQUIPMENT MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 215 GCC: LAND SURVEY EQUIPMENT MARKET, BY SOLUTION, 2019–2022 (USD MILLION))

- TABLE 216 GCC: LAND SURVEY EQUIPMENT MARKET, BY SOLUTION, 2023–2028 (USD MILLION)

- TABLE 217 GCC: LAND SURVEY EQUIPMENT MARKET, BY INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 218 GCC: LAND SURVEY EQUIPMENT MARKET, BY INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 219 GCC: LAND SURVEY EQUIPMENT MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 220 GCC: LAND SURVEY EQUIPMENT MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 221 GCC: LAND SURVEY EQUIPMENT MARKET, BY END USER, 2019–2022 (USD MILLION)

- TABLE 222 GCC: LAND SURVEY EQUIPMENT MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 223 TURKEY: LAND SURVEY EQUIPMENT MARKET, BY SOLUTION, 2019–2022 (USD MILLION))

- TABLE 224 TURKEY: LAND SURVEY EQUIPMENT MARKET, BY SOLUTION, 2023–2028 (USD MILLION)

- TABLE 225 TURKEY: LAND SURVEY EQUIPMENT MARKET, BY INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 226 TURKEY: LAND SURVEY EQUIPMENT MARKET, BY INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 227 TURKEY: LAND SURVEY EQUIPMENT MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 228 TURKEY: LAND SURVEY EQUIPMENT MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 229 TURKEY: LAND SURVEY EQUIPMENT MARKET, BY END USER, 2019–2022 (USD MILLION)

- TABLE 230 TURKEY: LAND SURVEY EQUIPMENT MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 231 ISRAEL: LAND SURVEY EQUIPMENT MARKET, BY SOLUTION, 2019–2022 (USD MILLION))

- TABLE 232 ISRAEL: LAND SURVEY EQUIPMENT MARKET, BY SOLUTION, 2023–2028 (USD MILLION)

- TABLE 233 ISRAEL: LAND SURVEY EQUIPMENT MARKET, BY INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 234 ISRAEL: LAND SURVEY EQUIPMENT MARKET, BY INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 235 ISRAEL: LAND SURVEY EQUIPMENT MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 236 ISRAEL: LAND SURVEY EQUIPMENT MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 237 ISRAEL: LAND SURVEY EQUIPMENT MARKET, BY END USER, 2019–2022 (USD MILLION)

- TABLE 238 ISRAEL: LAND SURVEY EQUIPMENT MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 239 REST OF MIDDLE EAST: LAND SURVEY EQUIPMENT MARKET, BY SOLUTION, 2019–2022 (USD MILLION))

- TABLE 240 REST OF MIDDLE EAST: LAND SURVEY EQUIPMENT MARKET, BY SOLUTION, 2023–2028 (USD MILLION)

- TABLE 241 REST OF MIDDLE EAST: LAND SURVEY EQUIPMENT MARKET, BY INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 242 REST OF MIDDLE EAST: LAND SURVEY EQUIPMENT MARKET, BY INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 243 REST OF MIDDLE EAST: LAND SURVEY EQUIPMENT MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 244 REST OF MIDDLE EAST: LAND SURVEY EQUIPMENT MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 245 REST OF MIDDLE EAST: LAND SURVEY EQUIPMENT MARKET, BY END USER, 2019–2022 (USD MILLION)

- TABLE 246 REST OF MIDDLE EAST: LAND SURVEY EQUIPMENT MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 247 REST OF THE WORLD: LAND SURVEY EQUIPMENT MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 248 REST OF THE WORLD: LAND SURVEY EQUIPMENT MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 249 REST OF THE WORLD: LAND SURVEY EQUIPMENT MARKET, BY SOLUTION, 2019–2022 (USD MILLION)

- TABLE 250 REST OF THE WORLD: LAND SURVEY EQUIPMENT MARKET, BY SOLUTION, 2023–2028 (USD MILLION)

- TABLE 251 REST OF THE WORLD: LAND SURVEY EQUIPMENT MARKET, BY HARDWARE, 2019–2022 (USD MILLION)

- TABLE 252 REST OF THE WORLD: LAND SURVEY EQUIPMENT MARKET, BY HARDWARE, 2023–2028 (USD MILLION)

- TABLE 253 REST OF THE WORLD: LAND SURVEY EQUIPMENT MARKET, BY SOFTWARE, 2019–2022 (USD MILLION)

- TABLE 254 REST OF THE WORLD: LAND SURVEY EQUIPMENT MARKET, BY SOFTWARE, 2023–2028 (USD MILLION)

- TABLE 255 REST OF THE WORLD: LAND SURVEY EQUIPMENT MARKET, BY SERVICE, 2019–2022 (USD MILLION)

- TABLE 256 REST OF THE WORLD: LAND SURVEY EQUIPMENT MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 257 REST OF THE WORLD: LAND SURVEY EQUIPMENT MARKET, BY INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 258 REST OF THE WORLD: LAND SURVEY EQUIPMENT MARKET, BY INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 259 REST OF THE WORLD: LAND SURVEY EQUIPMENT MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 260 REST OF THE WORLD: LAND SURVEY EQUIPMENT MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 261 REST OF THE WORLD: LAND SURVEY EQUIPMENT MARKET, BY END USER, 2019–2022 (USD MILLION)

- TABLE 262 REST OF THE WORLD: LAND SURVEY EQUIPMENT MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 263 LATIN AMERICA: LAND SURVEY EQUIPMENT MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 264 LATIN AMERICA: LAND SURVEY EQUIPMENT MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 265 LATIN AMERICA: LAND SURVEY EQUIPMENT MARKET, BY SOLUTION, 2019–2022 (USD MILLION)

- TABLE 266 LATIN AMERICA: LAND SURVEY EQUIPMENT MARKET, BY SOLUTION, 2023–2028 (USD MILLION)

- TABLE 267 LATIN AMERICA: LAND SURVEY EQUIPMENT MARKET, BY INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 268 LATIN AMERICA: LAND SURVEY EQUIPMENT MARKET, BY INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 269 LATIN AMERICA: LAND SURVEY EQUIPMENT MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 270 LATIN AMERICA: LAND SURVEY EQUIPMENT MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 271 LATIN AMERICA: LAND SURVEY EQUIPMENT MARKET, BY END USER, 2019–2022 (USD MILLION)

- TABLE 272 LATIN AMERICA: LAND SURVEY EQUIPMENT MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 273 AFRICA: LAND SURVEY EQUIPMENT MARKET, BY SOLUTION, 2019–2022 (USD MILLION)

- TABLE 274 AFRICA: LAND SURVEY EQUIPMENT MARKET, BY SOLUTION, 2023–2028 (USD MILLION)

- TABLE 275 AFRICA: LAND SURVEY EQUIPMENT MARKET, BY INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 276 AFRICA: LAND SURVEY EQUIPMENT MARKET, BY INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 277 AFRICA: LAND SURVEY EQUIPMENT MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 278 AFRICA: LAND SURVEY EQUIPMENT MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 279 AFRICA: LAND SURVEY EQUIPMENT MARKET, BY END USER, 2019–2022 (USD MILLION)

- TABLE 280 AFRICA: LAND SURVEY EQUIPMENT MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 281 STRATEGIES ADOPTED BY KEY PLAYERS, 2019–2022

- TABLE 282 LAND SURVEY EQUIPMENT MARKET: DEGREE OF COMPETITION

- TABLE 283 COMPANY FOOTPRINT

- TABLE 284 SOLUTION FOOTPRINT

- TABLE 285 APPLICATION FOOTPRINT

- TABLE 286 REGION FOOTPRINT

- TABLE 287 KEY START-UPS/SMES

- TABLE 288 COMPETITIVE BENCHMARKING OF KEY START-UPS/SMES

- TABLE 289 PRODUCT COMPARISON, BY TOTAL STATION

- TABLE 290 PRODUCT COMPARISON, BY LEVEL

- TABLE 291 PRODUCT COMPARISON, BY GNSS

- TABLE 292 LAND SURVEY EQUIPMENT MARKET: PRODUCT LAUNCHES/DEVELOPMENTS, 2020–2023

- TABLE 293 LAND SURVEY EQUIPMENT MARKET: DEALS, 2020–2023

- TABLE 294 LAND SURVEY EQUIPMENT MARKET: OTHERS, 2020–2023

- TABLE 295 HEXAGON AB: COMPANY OVERVIEW

- TABLE 296 HEXAGON AB: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 297 HEXAGON AB: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 298 HEXAGON AB: DEALS

- TABLE 299 TOPCON CORPORATION: COMPANY OVERVIEW

- TABLE 300 TOPCON CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 301 TOPCON CORPORATION: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 302 TOPCON CORPORATION: DEALS

- TABLE 303 TRIMBLE INC.: COMPANY OVERVIEW

- TABLE 304 TRIMBLE INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 305 TRIMBLE INC.: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 306 TRIMBLE INC.: DEALS

- TABLE 307 TRIMBLE INC.: OTHERS

- TABLE 308 U-BLOX: COMPANY OVERVIEW

- TABLE 309 U-BLOX.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 310 U-BLOX: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 311 U-BLOX: DEALS

- TABLE 312 U-BLOX: OTHERS

- TABLE 313 SHANGHAI HUACE NAVIGATION TECHNOLOGY LTD.: COMPANY OVERVIEW

- TABLE 314 SHANGHAI HUACE NAVIGATION TECHNOLOGY LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 315 SHANGHAI HUACE NAVIGATION TECHNOLOGY LTD.: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 316 SHANGHAI HUACE NAVIGATION TECHNOLOGY LTD.: DEALS

- TABLE 317 SHANGHAI HUACE NAVIGATION TECHNOLOGY LTD.: OTHERS

- TABLE 318 HI-TARGET: COMPANY OVERVIEW

- TABLE 319 HI-TARGET: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 320 HI-TARGET: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 321 HUDACO INDUSTRIES LTD.: COMPANY OVERVIEW

- TABLE 322 HUDACO INDUSTRIES LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 323 SUZHOU FOIF CO., LTD.: COMPANY OVERVIEW

- TABLE 324 SUZHOU FOIF CO., LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 325 STONEX SRL: COMPANY OVERVIEW

- TABLE 326 STONEX SRL: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 327 STONEX SRL: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 328 SOUTH SURVEYING & MAPPING TECHNOLOGY CO., LTD.: COMPANY OVERVIEW

- TABLE 329 SOUTH SURVEYING & MAPPING TECHNOLOGY CO., LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 330 SOUTH SURVEYING & MAPPING TECHNOLOGY CO., LTD.: OTHERS

- TABLE 331 CST/BERGER: COMPANY OVERVIEW

- TABLE 332 CST/BERGER: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 333 CHANGZHOU DADI SURVEYING SCIENCE & TECHNOLOGY CO., LTD.: COMPANY OVERVIEW

- TABLE 334 CHANGZHOU DADI SURVEYING SCIENCE & TECHNOLOGY CO., LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 335 GUANGDONG KOLIDA INSTRUMENT CO., LTD.: COMPANY OVERVIEW

- TABLE 336 GUANGDONG KOLIDA INSTRUMENT CO., LTD.: PRODUCTS/SOLUTIONS/ SERVICES OFFERED

- TABLE 337 GUANGDONG KOLIDA INSTRUMENT CO., LTD.: OTHERS

- TABLE 338 UNISTRONG: COMPANY OVERVIEW

- TABLE 339 UNISTRONG: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 340 UNISTRONG: PRODUCT LAUNCHES/ DEVELOPMENTS

- TABLE 341 GEOTECH: COMPANY OVERVIEW

- TABLE 342 GEOTECH: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 343 ROBERT BOSCH GMBH: COMPANY OVERVIEW

- TABLE 344 ROBERT BOSCH GMBH: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 345 ROBERT BOSCH GMBH: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 346 HEMISPHERE GNSS, INC.: COMPANY OVERVIEW

- TABLE 347 ENTEK INSTRUMENTS INDIA PVT. LTD.: COMPANY OVERVIEW

- TABLE 348 SAMAH AERIAL SURVEY CO., LTD.: COMPANY OVERVIEW

- TABLE 349 EOS POSITIONING SYSTEMS, INC.: COMPANY OVERVIEW

- TABLE 350 TI ASAHI CO., LTD.: COMPANY OVERVIEW

- TABLE 351 GEOSOLUTION I GOTEBORG AB: COMPANY OVERVIEW

- TABLE 352 THEIS FEINWERKTECHNIK: COMPANY OVERVIEW

- TABLE 353 EMLID TECH KFT: COMPANY OVERVIEW

- TABLE 354 TIANJIN XING OU SURVEYING INSTRUMENT MANUFACTURE CO., LTD.: COMPANY OVERVIEW

- FIGURE 1 LAND SURVEY EQUIPMENT MARKET SEGMENTATION

- FIGURE 2 RESEARCH PROCESS FLOW

- FIGURE 3 RESEARCH DESIGN

- FIGURE 4 BOTTOM-UP APPROACH

- FIGURE 5 TOP-DOWN APPROACH

- FIGURE 6 DATA TRIANGULATION

- FIGURE 7 HARDWARE SEGMENT TO HOLD MAXIMUM SHARE IN 2028

- FIGURE 8 LAYOUT POINTS SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 9 MINING & CONSTRUCTION TO BE LARGEST SEGMENT IN 2028

- FIGURE 10 COMMERCIAL SEGMENT TO EXHIBIT HIGHEST GROWTH DURING FORECAST PERIOD

- FIGURE 11 ASIA PACIFIC TO BE LARGEST MARKET FOR LAND SURVEY EQUIPMENT DURING FORECAST PERIOD

- FIGURE 12 INCREASE IN CONSTRUCTION PROJECTS TO DRIVE GROWTH

- FIGURE 13 HARDWARE TO SURPASS OTHER SEGMENTS DURING FORECAST PERIOD

- FIGURE 14 LAYOUT POINTS SEGMENT TO BE DOMINANT DURING FORECAST PERIOD

- FIGURE 15 MINING & CONSTRUCTION TO SECURE LEADING MARKET POSITION DURING FORECAST PERIOD

- FIGURE 16 COMMERCIAL SEGMENT TO ACCOUNT FOR LARGEST SHARE IN 2028

- FIGURE 17 GERMANY TO BE FASTEST-GROWING MARKET DURING FORECAST PERIOD

- FIGURE 18 LAND SURVEY EQUIPMENT MARKET DYNAMICS

- FIGURE 19 GDP GENERATED FROM CONSTRUCTION IN ASIA PACIFIC, 2022

- FIGURE 20 GNSS DEVICE INSTALLATION, 2012–2023

- FIGURE 21 TRENDS AND DISRUPTIONS IMPACTING CUSTOMERS’ BUSINESSES

- FIGURE 22 ECOSYSTEM MAPPING

- FIGURE 23 AVERAGE SELLING PRICE OF LAND SURVEY EQUIPMENT, BY SOLUTION (USD THOUSAND)

- FIGURE 24 AVERAGE SELLING PRICE OF LAND SURVEY EQUIPMENT, BY REGION (USD THOUSAND)

- FIGURE 25 IMPORT DATA (HS CODE: 901520), BY COUNTRY, 2018–2022 (USD THOUSAND)

- FIGURE 26 EXPORT DATA (HS CODE: 901520), BY COUNTRY, 2018–2022 (USD THOUSAND)

- FIGURE 27 IMPORT DATA (HS CODE: 901530), BY COUNTRY, 2018–2022 (USD THOUSAND)

- FIGURE 28 EXPORT DATA (HS CODE: 901530), BY COUNTRY, 2018–2022 (USD THOUSAND)

- FIGURE 29 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS OF LAND SURVEY EQUIPMENT, BY END USER

- FIGURE 30 KEY BUYING CRITERIA FOR LAND SURVEY EQUIPMENT, BY END USER

- FIGURE 31 VALUE CHAIN ANALYSIS

- FIGURE 32 TECHNOLOGY ROADMAP OF LAND SURVEY EQUIPMENT MARKET, 2000–2030

- FIGURE 33 BILL OF MATERIALS FOR TOTAL STATIONS

- FIGURE 34 TOTAL COST OF OWNERSHIP FOR TOTAL STATIONS

- FIGURE 35 VENTURE CAPITAL AND DEALS, 2019−2022

- FIGURE 36 SUPPLY CHAIN ANALYSIS

- FIGURE 37 PATENTS ANALYSIS

- FIGURE 38 LAND SURVEY EQUIPMENT MARKET, BY SOLUTION, 2023–2028

- FIGURE 39 UAVS TO BE LARGEST SEGMENT DURING FORECAST PERIOD

- FIGURE 40 LAND SURVEY EQUIPMENT VOLUME, BY HARDWARE, 2019–2022 (UNITS)

- FIGURE 41 LAND SURVEY EQUIPMENT VOLUME, BY HARDWARE, 2023–2028 (UNITS)

- FIGURE 42 DESKTOP APPLICATIONS TO BE LARGEST SEGMENT DURING FORECAST PERIOD

- FIGURE 43 TECHNICAL SERVICES TO BE LARGEST SEGMENT DURING FORECAST PERIOD

- FIGURE 44 LAND SURVEY EQUIPMENT MARKET, BY APPLICATION, 2023–2028

- FIGURE 45 LAND SURVEY EQUIPMENT MARKET, BY END USER, 2023–2028

- FIGURE 46 LAND SURVEY EQUIPMENT MARKET, BY INDUSTRY, 2023–2028

- FIGURE 47 LAND SURVEY EQUIPMENT MARKET, BY REGION, 2023–2028

- FIGURE 48 NORTH AMERICA: LAND SURVEY EQUIPMENT VOLUME, BY HARDWARE (UNITS)

- FIGURE 49 NORTH AMERICA: LAND SURVEY EQUIPMENT MARKET SNAPSHOT

- FIGURE 50 ASIA PACIFIC: LAND SURVEY EQUIPMENT VOLUME, BY HARDWARE (UNITS)

- FIGURE 51 ASIA PACIFIC: LAND SURVEY EQUIPMENT MARKET SNAPSHOT

- FIGURE 52 EUROPE: LAND SURVEY EQUIPMENT VOLUME, BY HARDWARE (UNITS)

- FIGURE 53 EUROPE: LAND SURVEY EQUIPMENT MARKET SNAPSHOT

- FIGURE 54 MIDDLE EAST: LAND SURVEY EQUIPMENT VOLUME, BY HARDWARE (UNITS)

- FIGURE 55 MIDDLE EAST: LAND SURVEY EQUIPMENT MARKET SNAPSHOT

- FIGURE 56 REST OF THE WORLD: LAND SURVEY EQUIPMENT VOLUME, BY HARDWARE (UNITS)

- FIGURE 57 REST OF THE WORLD: LAND SURVEY EQUIPMENT MARKET SNAPSHOT

- FIGURE 58 REVENUE ANALYSIS OF TOP FIVE PLAYERS, 2018–2022

- FIGURE 59 MARKET SHARE ANALYSIS OF KEY PLAYERS, 2022

- FIGURE 60 MARKET RANKING OF KEY PLAYERS, 2022

- FIGURE 61 COMPANY EVALUATION MATRIX, 2022

- FIGURE 62 START-UP/SME EVALUATION MATRIX, 2022

- FIGURE 63 COMPANY FINANCIAL METRICS, 2022

- FIGURE 64 HEXAGON AB: COMPANY SNAPSHOT

- FIGURE 65 TOPCON CORPORATION: COMPANY SNAPSHOT

- FIGURE 66 TRIMBLE INC.: COMPANY SNAPSHOT

- FIGURE 67 U-BLOX: COMPANY SNAPSHOT

- FIGURE 68 SHANGHAI HUACE NAVIGATION TECHNOLOGY LTD.: COMPANY SNAPSHOT

- FIGURE 69 HI-TARGET: COMPANY SNAPSHOT

- FIGURE 70 HUDACO INDUSTRIES LTD.: COMPANY SNAPSHOT

- FIGURE 71 UNISTRONG: COMPANY SNAPSHOT

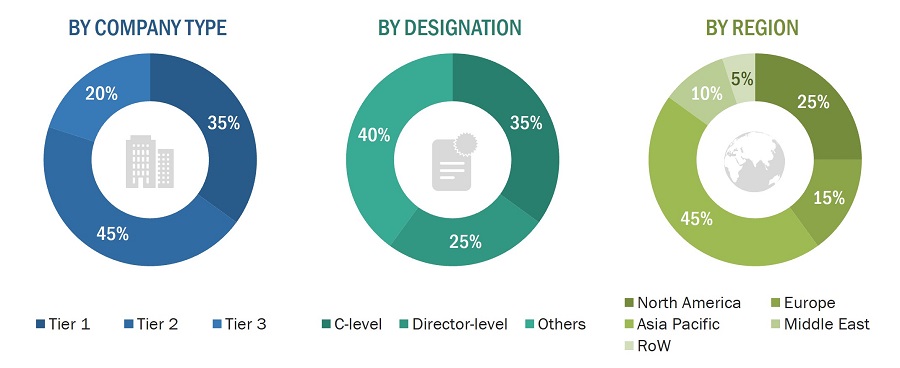

This research study on the Land Survey Equipment market involved the extensive use of secondary sources, directories, and databases such as Hoovers, Bloomberg BusinessWeek, and Factiva to identify and collect information relevant to the market. Primary sources included industry experts, service providers, manufacturers, solution providers, technology developers, alliances, and organizations related to all segments of this industry's value chain. In-depth interviews with primary respondents, including key industry participants, subject matter experts, industry consultants, and C-level executives, were conducted to obtain and verify critical qualitative and quantitative information about the Land Survey Equipment market and assess the market's growth prospects.

Secondary Research

The market size of companies offering land survey equipment was arrived at based on the secondary data available through paid and unpaid sources and by analyzing the product portfolios of major companies and rating them based on their performance and quality.

In the secondary research process, various sources were referred to for identifying and collecting information for this study. These sources included government sources; corporate filings, such as annual reports, press releases, and investor presentations of companies; white papers, journals, and certified publications; and articles by recognized authors, directories, and databases.

The secondary research was used to obtain key information about the industry’s value and supply chain and identify key players by various products, market classifications, and segmentation according to their offerings and industry trends related to solution, industry, application, end user, and region, and key developments from both market and technology-oriented perspectives.

Primary Research

Extensive primary research was conducted after acquiring information regarding the Land Survey Equipment market scenario through secondary research. Several primary interviews were conducted with market experts from both the demand and supply sides across major countries of North America, Europe, Asia Pacific, the Middle East, and ROW, which includes Africa and Latin America. Primary data was collected through questionnaires, emails, and telephonic interviews.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

- Both top-down and bottom-up approaches were used to estimate and validate the size of the Land Survey Equipment market.

- Key players were identified through secondary research, and their market ranking was determined through primary and secondary research. This included a study of annual and financial reports of the top market players and extensive interviews of leaders, including CEOs, directors, and marketing executives.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources. All possible parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data. This data was consolidated, enhanced with detailed inputs, analyzed by MarketsandMarkets, and presented in this report.

Market size estimation methodology: Bottom-Up Approach

Market size estimation methodology: Top-Down Approach

Data Triangulation

After arriving at the overall size of the Land Survey Equipment market from the market size estimation process explained above, the total market was split into several segments and subsegments. Wherever applicable, data triangulation and market breakdown procedures explained below were implemented to complete the overall market engineering process and arrive at the exact statistics for various market segments and subsegments. The data was triangulated by studying various factors and trends from both the demand and supply sides. Additionally, the market size was validated using both top-down and bottom-up approaches.

Market Definition

Land survey equipment are instruments used in various surveys, such as including terrestrial surveys, cadastral or boundary surveys, construction surveys, deformation surveys, leveling, mining surveys, monitoring, as well as other in various applications such as construction, transportation, utilities, mining, agriculture, oil & gas, and research, among others. These tools include total stations, GPS receivers, and laser scanners, enabling accurate determination of positions, distances, and elevations crucial for mapping, construction, and boundary delineation in civil engineering and land management. UAVs are also considered under land survey equipment as they these are increasingly being deployed for the purposes of surveying, inspecting, and collecting aerial images.

Stakeholders

Various stakeholders of the market are listed below:

- Land survey equipment suppliers.

- Land survey equipment manufacturers.

- Software and solution providers

- Construction & mining companies

- Defense procurement agencies

- Software/Hardware/Service and solution providers

- OEMs

Report Objectives

- To define, describe, and forecast the size of the Land Survey Equipment market based on solution, industry, application, end user, and region from 2023 to 2028.

- To forecast the size of market segments with respect to five major regions, namely North America, Europe, Asia Pacific, the Middle East, and the Rest of the world

- To identify and analyze key drivers, restraints, opportunities, and challenges influencing the growth of the market.

- To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and their contribution to the market

- To analyze opportunities for stakeholders in the market by identifying key market trends

- To analyze competitive developments such as contracts, acquisitions, expansions, agreements, joint ventures and partnerships, product developments, and research and development (R&D) activities in the market

- To provide a detailed competitive landscape of the -market, in addition to an analysis of business and corporate strategies adopted by leading market players.

- To strategically profile key market players and comprehensively analyze their core competencies2

1Micromarkets are referred to as the segments and subsegments of the Land Survey Equipment markets considered in the scope of the report.

2Core competencies of companies were captured in terms of their key developments and key strategies adopted to sustain their positions in the market.

Available customizations

Along with the market data, MarketsandMarkets offers customizations as per the specific needs of companies. The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company.

Regional Analysis

- Further breakdown of the market segments at the country level

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Land Survey Equipment Market

Data on the growth of geo surveying in developing countries?