Hybrid Train Market by Battery Type (Lead Acid, Lithium-Ion, Sodium-Ion, Nickel Cadmium), Application (Passenger and Freight), Operating Speed (Below 100 KM/H, 100–200 KM/H, And Above 200 KM/H), Service Power, Propulsion Region - Global Forecast to 2030

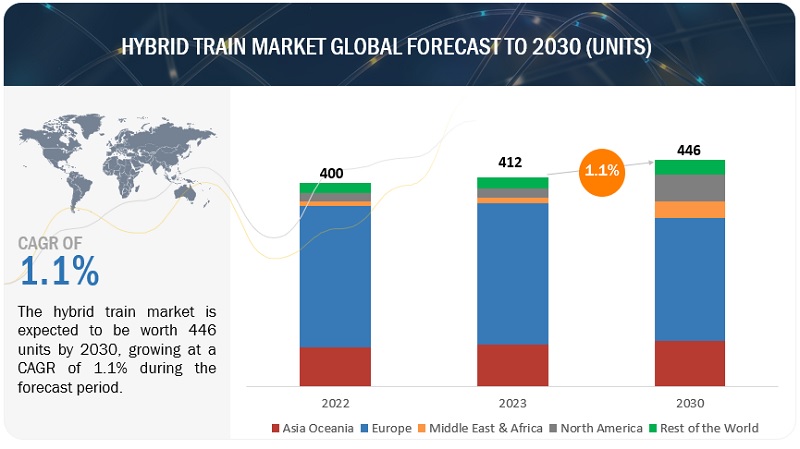

[285 Pages Report] The global hybrid train market is projected to grow from 412 units in 2023 to 446 units by 2030, registering a CAGR of 1.1%. Due to the rising demand for sustainable transportation solutions, the industry of railway systems is experiencing a transformative shift towards hybrid trains. These innovative locomotives seamlessly blend the power of battery-electric, hydroelectric, and diesel-electric propulsion systems, offering a multifaceted approach to addressing the growing need for efficient, eco-friendly, and versatile rail transport. As environmental concerns gain prominence and energy efficiency becomes paramount, the convergence of these propulsion technologies is paving the way for a sustainable mode of transportation, one that is characterized by reduced emissions, enhanced performance, and the promise of a greener future for rail travel.

To know about the assumptions considered for the study, Request for Free Sample Report

To know about the assumptions considered for the study, download the pdf brochure

Market Dynamics:

Driver: Demand for energy-efficient and less polluting train operations

Increasing stringency of emission norms by governments in several countries has compelled train manufacturers to adopt less pollution-causing trains. Thus, companies like Alstom, Bombardier, Siemens, and Wabtec Corporation are investing in alternative fuel-powered trains. For instance, Alstom was one of the first companies to unveil a hydrogen-powered train. In April 2022, Alstom and ENGIE signed a partnership agreement to offer the rail freight sector a solution for decarbonizing mainline operations by replacing diesel-powered locomotives with hydrogen versions. Various freight companies have started investing in hybrid trains to cut operating costs by eliminating fuel and maintenance costs. The total cost of ownership (TCO) plays a key role in the freight industry and affects profit margins. Fuel expenses are high while covering long distances using conventional diesel trains. However, the use of electrified, fuel cell, CNG, and LNG hybrid trains reduces these expenses by almost 50%. Increasing the modal share of railways is considered a cost-effective method of increasing the use of renewable energy in transport, thereby reducing greenhouse gas (GHG) emissions. These factors are expected to drive the growth of the hybrid train market.

Restraint: Refurbishment of existing trains

The need to provide increased vehicle capacity and upgrade old coaches, coupled with the growing demand for reduced travel costs, has boosted the market for train refurbishment. The existing fleet must be refurbished due to the rising passenger numbers and increase in demand for modern amenities. Refurbishments offer an opportunity to address reliability issues, improve train energy efficiency, and update the vehicles as per current requirements. There have been various refurbishment programs— In FY 2022, Swiss Federal Railways (SBB) is investing USD 2.1 Bn in the refurbishment of its railway infrastructure to make it more compatible with hybrid trains. The work includes upgrading the electrification system, installing charging stations, and improving the signaling system. The financial constraints in acquiring new trains also contribute to increasing train refurbishment programs. Refurbishing existing trains eliminates the need to purchase new vehicles and could restrict the hybrid train market.

Opportunity: Retrofitting of diesel-electric trains

According to Worldwiderail (website), diesel locomotives cost around USD 0.5-USD 2 million, and an electric locomotive costs more than USD 6 million. Hence, it is more viable to retrofit a diesel locomotive with battery systems than to buy a new one. For example, in the US, a large number of General Electric locomotives, currently owned by several North American railroads, are being rebuilt with cab upgrades, along with electrical and safety systems. Re-manufacturing locomotives cost about 40% less than purchasing a new locomotive. Indian Railways, for instance, has been able to reduce the cost incurred in diesel to electric conversion to as low as USD 0.3 million. The growing market for diesel retrofitting is driving the demand for energy storage systems, such as backups and power supply units. In addition to the above, replacing the diesel motor with an electric drive will also reduce the onboard weight and further improve the efficiency of railways. For instance, In 2022, the German railway company Deutsche Bahn (DB) announced that it would be retrofitting 100 diesel-electric trains with hybrid technology. The retrofitting is expected to be completed by 2025. The retrofitting will involve installing a battery pack and a hybrid control system on the trains. The battery pack will allow the trains to operate on electric power for short distances, while the hybrid control system will automatically switch between electric and diesel power depending on the operating conditions.

Challenge: Technical challenges related to lead-acid and lithium-ion batteries

Rail batteries must be long-lasting and fast-charging. Currently, the rail sector makes substantial use of lead-acid and nickel-cadmium (Ni-Cd) batteries. These batteries are hazardous to the environment and contain dangerous substances. In addition to these disadvantages, they have a high self-discharge rate and a short charge cycle. Despite the fact that Ni-Cd batteries may give 60% more energy than other varieties, they have a recharging issue known as the "memory effect." The memory effect is a condition in which the battery remembers its last discharge performance and only recharges to that level, diminishing its performance. While increasing cell capacity can improve battery performance, it can also jeopardize system safety. Furthermore, rail batteries are electrochemical batteries that use chemical reactions to generate an electric current. Temperature changes affect the performance of rail batteries since they affect all chemical reactions. Low-temperature conditions limit cell performance, lowering the battery's specific energy gradient. Lithium-ion batteries operate with better efficiency against temperature changes, but the heating can reduce the capacity of the batteries over time. Further, lithium-ion (Li-ion) batteries require lithium mining, which has brought forward many environmental challenges. The manufacturing cost of Li-ion batteries is also 40% higher than Ni-Cd batteries.

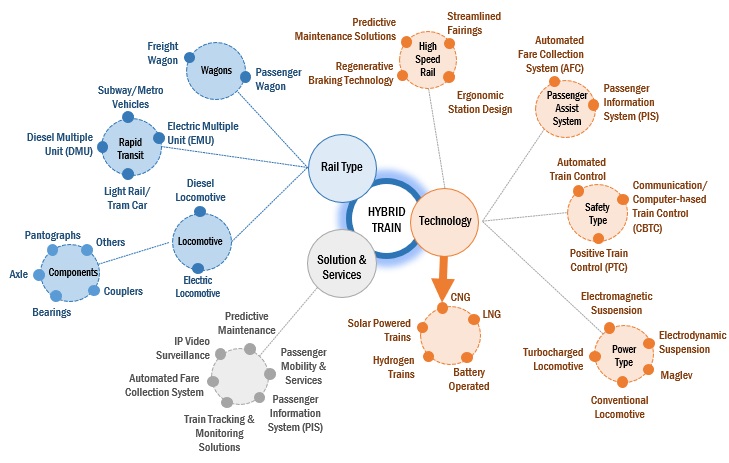

Market Ecosystem

Passenger hybrid trains are the largest segment during the forecast period

The benefit of cost-effective and efficient transportation of passenger accounts during the forecast period. A number of cities are placing new rail infrastructure projects into place to ease traffic and offer inexpensive intercity and intracity transportation options. The market for hybrid trains will rise in response to growing urbanization and rising consumer demands for greater connectivity, comfort, dependability, and safety. As of 2022, the majority of hybrid train projects or operations will be focused on the passenger market because freight transportation demands powerful trains. The development of hybrid train technologies is still in its early stages to meet the demand for freight transportation. In February 2022, SNCF Voyageurs and Alstom presented the first hybrid Régiolis trainset for France following one year of hybridization project and eight months of tests. In June 2023, Alstom successfully completed the first tests of a hybrid electric-diesel-battery train on the Toulouse-Mazamet and Toulouse-Rodez lines in the South of France. Considering these developments hybrid train market will provide growth opportunities in the near future. For passenger transportation, Europe is a significant market for hybrid trains. The main mode of transportation for passengers in Germany is rolling stock. The main element influencing the adoption of railroads for passenger transportation in Germany is the availability of reliable infrastructure for urban and intercity mass transit. The number of passengers using passenger trains, particularly those in Germany, has increased globally. Increasing awareness of the environmental impact of transportation has led to a growing demand for more eco-friendly modes of travel. Hybrid trains, which combine both electric and diesel power, offer reduced emissions compared to traditional diesel trains, making them a more sustainable option. In order to provide efficient and environmentally friendly passenger trains, railroad operators are collaborating with OEMs.

Hybrid Trains with speeds above 200 KM/H to be one of the largest markets during the forecast period

Hybrid Trains with speeds above 200 KM/H to be one of the largest markets during the forecast period. The improvement of hybrid technologies and the evolution of train traction systems have accelerated improvements in the operating speed range of trains. This aspect has caused hybrid trains' operational speeds to rise rapidly and surpass 200 km/h. Due to hybrid trains' early development, improvements in their running speeds are not occurring as quickly as with conventional trains. Due to the need to cut down on commuting times and traffic on rail lines, this speed range of high-speed trains is anticipated to experience exponential expansion. Diesel electric propulsion is the most common type of propulsion for hybrid trains operating in this range of speeds. CRRC Qingdao Sifang Locomotive & Rolling Stock Co., Ltd (Sifang) is developing a hybrid train with an operating speed of 250 km/h. The train is currently undergoing testing and is expected to enter commercial service in 2024. The launch of a hybrid train with an operating speed of 200 km/h is a significant development in the railway industry. It is a sign that the industry is moving towards more sustainable and efficient modes of transportation. The success of this train could lead to the development of hybrid trains with even higher speeds and better performance in the future.

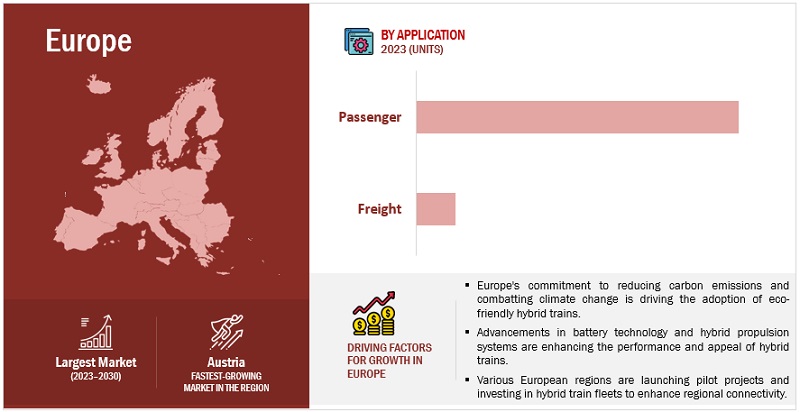

Europe is the largest market for Hybrid trains during the forecast period

Europe is home to many leading railway manufacturers such as Alstom (France), Siemens (Germany), Hitachi Rail (Italy), and CAF (Spain). The railway industry is one of the key contributors to the European economy. The region for this study is segmented into Germany, France, Spain, Austria, and the UK. Europe has stringent environmental regulations and ambitious sustainability targets. Hybrid trains, which combine electric and alternative power sources, help rail operators reduce greenhouse gas emissions, meet emissions standards, and contribute to a cleaner environment. Many European governments offer incentives, subsidies, and grants to promote the adoption of hybrid and electric trains. These financial incentives encourage rail operators to invest in greener transportation options. For instance, the UK government has announced that it will be phasing out all the trains running solely on diesel by 2040. Many of the top train manufacturers from the region, such as Alstom, Siemens, Hitachi Rail STS, and CAF, have incorporated hybrid technologies in their trains. In August 2023, Alstom and the Central Saxony transport authority, Verkehrsverbund Mittelsachsen (VMS), presented in Chemnitz, Germany, a new battery-powered train developed by Alstom. A total of eleven Coradia Continental battery-electric trains have been ordered by VMS. These trains will enter service in 2024 on the Chemnitz-Leipzig line. In January 2022, Alstom and Deutsche Bahn tested the first battery train in passenger operation in Germany. UK and Germany are planning to complete the electrification of railway lines to control or reduce emissions through diesel trains, which will present a big opportunity for all hybrid train manufacturers, resulting in the overall European hybrid train market growth.

Key Market Players

The hybrid train market is dominated by CRRC (China), Alstom (France), Siemens (Germany), Wabtec Corporation (US), and Stadler Rail AG (Switzerland), among others. These companies manufacture trains and develop new technologies. These companies have set up R&D facilities and offer best-in-class products to their customers.

Scope of the Report

|

Report Metric |

Details |

|

Market size available for years |

2019–2030 |

|

Base year considered |

2022 |

|

Forecast period |

2023-2030 |

|

Forecast units |

Volume (Units) |

|

Segments Covered |

Battery Type, Application, Operating Speed, Service Power, Propulsion Type, and Region |

|

Geographies covered |

Asia Oceania, Europe, North America, the Middle East & Africa, and the Rest of the World |

|

Companies Covered |

CRRC (China), Alstom (France), Siemens (Germany), Wabtec Corporation (US), and Stadler Rail AG (Switzerland). |

This research report categorizes the Hybrid Train market based on Battery Type, Application, Operating Speed, Service Power, Propulsion Type, and Region.

Based on Battery Type:

- Lead acid

- Lithium-ion

- Sodium-Ion

- Nickel Cadmium

- Others

Based on Application:

- Passenger

- Freight

Based on Operating Speed:

- Below 100 KM/H

- 100–200 KM/H

- Above 200 KM/H

Based on Service Power:

- Less than 2000 kW

- Between 2000 to 4000 kW

- Above 4000 kW

Based on Propulsion Type:

- Electro Diesel

- Battery Electric

- Hydrogen Battery

Based on the region:

-

Asia Oceania

- Australia

- China

- India

- Japan

- New Zealand

- South Korea

-

North America

- Canada

- Mexico

- US

-

Europe

- Austria

- France

- Germany

- Italy

- Spain

- UK

Recent Developments

- In August 2023, Alstom and the Verkehrsverbund Mittelsachsen (VMS) of Central Saxony unveiled a new battery-powered train in Chemnitz, Germany. VMS has ordered a total of eleven Coradia Continental battery-electric trains. These trains will begin service on the Chemnitz-Leipzig route in 2024.

- In June 2023, The CRRC unveiled the "world's most powerful" hydrogen train. The new Ningdong engine apparently has a 270kg liquefied hydrogen capacity and can run for up to 190 hours.

- In May 2023, Alstom and Export Development Canada (EDC), Canada’s export credit agency, signed a Sustainable Global Corporate Partnership agreement to promote investments in clean mobility worldwide.

- In May 2023, Siemens Mobility and Niederbarnimer Eisenbahn (NEB) unveiled the final design of the Mireo Plus, which will enter operation on the Heidekrautbahn and East Brandenburg train networks in December 2024.

- In June 2022, the 3000 HP permanent magnet hybrid shunting locomotive developed by CRRC reached about 2000 km of safe operation. Compared with the traditional shunting diesel locomotive, the locomotive was highly praised by customers for its outstanding energy efficiency and environmental protection effect.

Frequently Asked Questions (FAQ):

What is the current size of the hybrid train market by volume?

The current size of the hybrid train market is estimated at 412 units in 2023.

Who are the winners in the hybrid train market?

The hybrid train market is dominated by CRRC (China), Alstom (France), Siemens (Germany), Wabtec Corporation (US), and Stadler Rail AG (Switzerland), among others. These companies manufacture trains and develop new technologies. These companies have set up R&D facilities and offer best-in-class products to their customers.

Which region will have the fastest-growing market for hybrid train market?

North America will be the fastest-growing hybrid train market region due to the increasing awareness of environmental sustainability, supportive government initiatives, and surging need for public transportation systems to avoid traffic congestion.

What are the key technologies affecting the hybrid train market?

The key technologies affecting the hybrid train market are regenerative braking, autonomous trains, fuel cells for heavy load transportation and the development of tri mode hybrid trains.

What are different countries covered in Asia Oceania region for hybrid train market?

The countries covered in report for hybrid train market are China, Japan, India, South Korea, Australia, New Zealand.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Increasing stringency in emission norms- Rising demand for less polluting train operations and energy-efficient transport- Benefits of hybrid trains over conventional diesel trains- Increasing preference for railway-based public transport to reduce traffic congestionRESTRAINTS- High development costs and complexities in technologies and related infrastructure- Refurbishment of existing trainsOPPORTUNITIES- Development of hydrogen fuel cell locomotives- Development of battery-operated trains- Retrofitting of diesel-electric trainsCHALLENGES- Technical challenges related to lead-acid and lithium-ion batteries- High cost of charging infrastructure development

-

5.3 PRICING ANALYSISAVERAGE SELLING PRICE TRENDS OF KEY PLAYERS, BY PROPULSION, 2023AVERAGE SELLING PRICE TRENDS, BY ELECTRO-DIESEL PROPULSION, BY REGIONAVERAGE SELLING PRICE OF TRAIN BATTERIESAVERAGE SELLING PRICE OF HVAC SYSTEMS

-

5.4 ECOSYSTEM ANALYSIS

-

5.5 MACROECONOMIC INDICATORSGDP TRENDS AND FORECASTS FOR MAJOR ECONOMIES

-

5.6 VALUE CHAIN ANALYSISRESEARCH & DEVELOPMENTPROCUREMENT OF RAW MATERIALSPRODUCTION DEPARTMENTFINAL ASSEMBLY AND TESTINGMAINTENANCE AND OVERHAUL

- 5.7 VALUE STREAM MAPPING

-

5.8 AVERAGE LIFESPAN OF HYBRID TRAINS, BY REGIONELECTRO-DIESEL TRAINSBATTERY ELECTRIC TRAINSHYDROGEN BATTERY TRAINS

-

5.9 CASE STUDY ANALYSISDEVELOPMENT OF CLIMATE-NEUTRAL DRIVE SYSTEM FOR BRIDGING NON-ELECTRIFIED SUBSECTIONS OF LINEGOLINC-M MODULESENVIRONMENTALLY FRIENDLY MONORAIL SYSTEM USED BY 70,000 RIDERS/DAY IN KOREAN METROPOLISSCOTTISH HYDROGEN TRAIN ON TRACK TO DELIVER CLIMATE TARGETSFREIGHTLINER TO PROGRESS TOWARD LOW-EMISSION FUEL

-

5.10 PATENT ANALYSIS

-

5.11 TECHNOLOGY ANALYSISINTRODUCTIONREGENERATIVE BRAKING IN TRAINSAUTONOMOUS TRAINSUSE OF FUEL CELLS FOR HEAVY-LOAD TRANSPORTATIONRAPID CHARGING TRAIN OPERATIONAL CONCEPTS FOR HYBRID HEAVY HAUL LOCOMOTIVESDEVELOPMENT OF TRI-MODE HYBRID TRAINSMITRAC PULSE TRACTION BATTERYMRX NICKEL TECHNOLOGY BATTERY

-

5.12 KEY TRENDS IN ALTERNATE FUELS (PROPULSION/AUXILIARY)CNGLNGHYDROGENSOLAR

-

5.13 TARIFF AND REGULATORY LANDSCAPEUSEUROPEINDIASOUTH KOREACHINACANADAUKSPAINREGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

-

5.14 TRADE ANALYSISUSCHINAGERMANYUKFRANCEINDIAITALYAUSTRIASWITZERLANDJAPAN

- 5.15 KEY CONFERENCES AND EVENTS IN 2023–2024

- 5.16 TRENDS AND DISRUPTIONS IMPACTING MARKET

-

5.17 KEY STAKEHOLDERS AND BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

-

5.18 HYBRID TRAIN MARKET SCENARIO ANALYSISMOST LIKELY SCENARIOOPTIMISTIC SCENARIOPESSIMISTIC SCENARIO

- 5.19 DETAILS OF HYBRID TRAIN RAILWAY PROJECTS WORLDWIDE

- 6.1 INTRODUCTION

-

6.2 PASSENGERLONG DISTANCE TRAIN- Increasing investment in high-speed rail infrastructure to drive growthURBAN TRANSIT TRAIN- Rising urbanization and traffic congestion to drive growth

-

6.3 FREIGHTDEVELOPMENT OF HYBRID TECHNOLOGIES TO DRIVE GROWTH

- 6.4 KEY PRIMARY INSIGHTS

- 7.1 INTRODUCTION

-

7.2 LESS THAN 2000 KWRISE IN DEMAND FOR URBAN TRANSIT TO DRIVE GROWTH

-

7.3 BETWEEN 2000 TO 4000 KWINCREASING DEMAND FOR HIGH-SPEED RAIL TO DRIVE GROWTH

-

7.4 ABOVE 4000 KWADVANCEMENT IN PROPULSION TECHNOLOGY TO DRIVE GROWTH

- 7.5 KEY PRIMARY INSIGHTS

- 8.1 INTRODUCTION

-

8.2 BELOW 100 KM/HDEVELOPMENT IN PROPULSION TECHNOLOGIES TO DRIVE GROWTH

-

8.3 100–200 KM/HADVANCEMENTS IN HYDROGEN FUEL CELL AND BATTERY-OPERATED TRAINS TO DRIVE GROWTH

-

8.4 ABOVE 200 KM/HINCREASE IN INVESTMENT FOR HIGH-SPEED RAIL TO DRIVE GROWTH

- 8.5 KEY PRIMARY INSIGHTS

- 9.1 INTRODUCTION

-

9.2 ELECTRO DIESELRISING DEMAND FOR ENERGY-EFFICIENT LOCOMOTIVES TO DRIVE GROWTH

-

9.3 BATTERY ELECTRICCONTINUOUS DEVELOPMENTS IN BATTERY TECHNOLOGIES TO DRIVE GROWTH

-

9.4 HYDROGEN BATTERYDEMAND FOR CLEAN TRANSPORTATION TO DRIVE GROWTH

- 9.5 KEY PRIMARY INSIGHTS

- 10.1 INTRODUCTION

- 10.2 LEAD-ACID

-

10.3 LITHIUM-IONLITHIUM-TITANATE OXIDE (LTO)LITHIUM IRON PHOSPHATE (LFP)LITHIUM-NICKEL-MANGANESE-COBALT-OXIDE (NMC)

- 10.4 SODIUM-ION

- 10.5 NICKEL-CADMIUM

- 10.6 OTHERS

- 11.1 INTRODUCTION

-

11.2 ASIA OCEANIARECESSION IMPACT ANALYSISCHINA- Increase in demand for high-speed hybrid trains to drive growthJAPAN- Presence of leading hybrid train manufacturers to drive growthINDIA- Increasing railway electrification to drive growthSOUTH KOREA- Increase in infrastructure investments for hybrid trains to drive growthNEW ZEALAND- Rising number of railway projects to drive growthAUSTRALIA- Rise in government investment in railways sector to drive growth

-

11.3 EUROPERECESSION IMPACT ANALYSISFRANCE- Rising demand for less polluting trains to drive growthGERMANY- Increase in investment for upgrading railway infrastructure to drive growthITALY- Increasing modernization and expansion of existing railway network to drive growthSPAIN- Increasing high-speed railway network and presence of reputed hybrid train manufacturers to drive growthAUSTRIA- Replacement of current diesel trains with electro-diesel trains to drive growthUK- Rise in government investment in emission-free transportation to drive growth

-

11.4 NORTH AMERICARECESSION IMPACT ANALYSISUS- Rising demand for hybrid freight trains to drive growthCANADA- Increasing passenger and freight transportation to drive growthMEXICO- Rising concerns about reduction in carbon emissions to drive growth

-

11.5 MIDDLE EAST & AFRICARECESSION IMPACT ANALYSISSOUTH AFRICA- Rise in government spending on greener trains to drive growthUAE- Development in railway technologies to drive growthEGYPT- Government plans to invest in hybrid train lines for tourism to drive growth

-

11.6 REST OF THE WORLDBRAZIL- Rising electrification of existing networks to drive growthRUSSIA- Increasing demand for electro-diesel trains to drive growthARGENTINA- Modernization of railway network to drive growth

- 12.1 OVERVIEW

- 12.2 KEY PLAYERS’ STRATEGIES/RIGHT TO WIN

-

12.3 MARKET SHARE ANALYSIS FOR KEY PLAYERS, 2022CRRCALSTOMSIEMENSWABTEC CORPORATIONSTADLER RAIL AGMARKET SHARE ANALYSIS FOR TRAIN BATTERY MARKET, 2022- EnerSys- Saft- Exide Industries Ltd.- Amara Raja Energy & Mobility Limited- GS Yuasa International Ltd.MARKET SHARE ANALYSIS FOR TRAIN HVAC SYSTEM MARKET, 2022- Knorr-Bremse AG- Liebherr Group- Wabtec Corporation- Mitsubishi Electric Corporation- Trane Technologies plc

- 12.4 REVENUE ANALYSIS OF KEY PLAYERS, 2018–2022

-

12.5 COMPETITIVE SCENARIOPRODUCT LAUNCHES/DEVELOPMENTSDEALSOTHERS

-

12.6 COMPANY EVALUATION MATRIXSTARSPERVASIVE PLAYERSEMERGING LEADERSPARTICIPANTS

-

12.7 STARTUP/SME EVALUATION MATRIXPROGRESSIVE COMPANIESRESPONSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKS

-

13.1 KEY PLAYERSCRRC CORPORATION LIMITED (CRRC)- Business overview- Products offered- Recent developments- MnM viewALSTOM- Business overview- Recent developments- MnM viewSIEMENS- Business overview- Recent developments- MnM viewWABTEC CORPORATION- Business overview- Recent developments- MnM viewSTADLER RAIL AG- Business overview- Recent developments- MnM viewHYUNDAI ROTEM COMPANY- Business overview- Recent developmentsHITACHI, LTD.- Business overview- Recent developmentsCONSTRUCCIONES Y AUXILIAR DE FERROCARRILES (CAF)- Business overview- Recent developmentsTOSHIBA- Business overview- Recent developmentsCUMMINS INC.- Business overview- Products offered- Recent developmentsABB- Business overview- Recent developmentsMITSUBISHI ELECTRIC CORPORATION- Business overview- Recent developmentsTALGO- Business overview- Recent developments

-

13.2 OTHER KEY PLAYERSBNSFBALLARD POWER SYSTEMSCHART INDUSTRIESRENFE OPERADORASKODA TRANSPORTATIONDB CARGOSNCFROLLS-ROYCETHE KINKI SHARYO CO., LTD.KAWASAKI HEAVY INDUSTRIESETIHAD RAILSINARA TRANSPORT MACHINESTRANSMASHHOLDINGINTAMIN BAHNTECHNIK UND BETRIEBS-MBH & CO. KG

- 14.1 NORTH AMERICA TO BE FASTEST-GROWING MARKET DURING FORECAST PERIOD

- 14.2 INCREASING RAILWAY ELECTRIFICATION NETWORK TO DRIVE DEMAND FOR ELECTRO-DIESEL TRAINS

- 14.3 UPCOMING TRI-MODE TRAIN TECHNOLOGY TO OFFER MARKET GROWTH OPPORTUNITIES

- 14.4 CONCLUSION

- 15.1 KEY INSIGHTS FROM INDUSTRY EXPERTS

- 15.2 DISCUSSION GUIDE

- 15.3 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 15.4 CUSTOMIZATION OPTIONS

- 15.5 RELATED REPORTS

- 15.6 AUTHOR DETAILS

- TABLE 1 HYBRID TRAIN MARKET DEFINITION, BY BATTERY TYPE

- TABLE 2 MARKET DEFINITION, BY APPLICATION

- TABLE 3 MARKET DEFINITION, BY PROPULSION

- TABLE 4 MARKET DEFINITION, BY OPERATING SPEED

- TABLE 5 MARKET DEFINITION, BY SERVICE POWER

- TABLE 6 MARKET: INCLUSIONS AND EXCLUSIONS

- TABLE 7 CURRENCY EXCHANGE RATES

- TABLE 8 EMISSIONS STANDARD, UIC 624-1

- TABLE 9 EMISSIONS STANDARD, UIC 624-2

- TABLE 10 MARKET: IMPACT OF MARKET DYNAMICS

- TABLE 11 AVERAGE SELLING PRICE OF TRAIN BATTERIES, BY TYPE

- TABLE 12 AVERAGE SELLING PRICE OF HVAC SYSTEMS, BY APPLICATION

- TABLE 13 MARKET: ROLE OF COMPANIES IN ECOSYSTEM

- TABLE 14 LIST OF KEY TRAIN BATTERY SUPPLIERS

- TABLE 15 LIST OF KEY TRAIN HVAC SYSTEM SUPPLIERS

- TABLE 16 LIST OF KEY ELECTRONICS PART SUPPLIERS

- TABLE 17 GDP TRENDS AND FORECASTS, BY MAJOR ECONOMIES, 2018–2026 (USD BILLION)

- TABLE 18 REAL GDP GROWTH RATE (ANNUAL PERCENTAGE CHANGE AND FORECAST), BY MAJOR ECONOMIES, 2022–2026

- TABLE 19 GDP PER CAPITA TRENDS AND FORECASTS, BY MAJOR ECONOMIES, 2022–2026 (USD BILLION)

- TABLE 20 VALUE STREAM MAPPING FOR TRAIN BATTERY MARKET

- TABLE 21 VALUE STREAM MAPPING FOR TRAIN HVAC SYSTEM MARKET

- TABLE 22 AVERAGE AGE OF ELECTRO-DIESEL TRAINS, BY REGION

- TABLE 23 AVERAGE AGE OF BATTERY ELECTRIC TRAINS, BY REGION

- TABLE 24 AVERAGE AGE OF HYDROGEN BATTERY TRAINS, BY REGION

- TABLE 25 IMPORTANT PATENT REGISTRATIONS RELATED TO MARKET

- TABLE 26 LEVEL OF AUTONOMY FOR AUTONOMOUS TRAINS

- TABLE 27 STANDARDS: RAIL TRACTION ENGINES (STAGE III A)

- TABLE 28 STANDARDS: RAIL TRACTION ENGINES (STAGE III B)

- TABLE 29 DESIGN OF EQUIPMENT, SYSTEM, AND SUB-SYSTEMS TO COMPLY WITH FOLLOWING STANDARDS

- TABLE 30 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 31 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 32 ASIA OCEANIA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 33 REST OF THE WORLD: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 34 MARKET: KEY CONFERENCES AND EVENTS

- TABLE 35 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR HYBRID TRAINS, BY PROPULSION (%)

- TABLE 36 KEY BUYING CRITERIA

- TABLE 37 MOST LIKELY SCENARIO, BY REGION, 2023–2030 (USD MILLION)

- TABLE 38 OPTIMISTIC SCENARIO, BY REGION, 2023–2030 (USD MILLION)

- TABLE 39 PESSIMISTIC SCENARIO, BY REGION, 2023–2030 (USD MILLION)

- TABLE 40 EUROPE: RAILWAY PROJECTS

- TABLE 41 NORTH AMERICA: RAILWAY PROJECTS

- TABLE 42 ASIA OCEANIA: RAILWAY PROJECTS

- TABLE 43 REST OF THE WORLD: RAILWAY PROJECTS

- TABLE 44 MARKET, BY APPLICATION, 2018–2022 (UNITS)

- TABLE 45 MARKET, BY APPLICATION, 2023–2030 (UNITS)

- TABLE 46 OEMS IN MARKET, BY APPLICATION

- TABLE 47 PASSENGER: MARKET, BY TRAIN TYPE, 2018–2022 (UNITS)

- TABLE 48 PASSENGER: MARKET, BY TRAIN TYPE, 2023–2030 (UNITS)

- TABLE 49 LONG DISTANCE MARKET, BY REGION, 2018–2022 (UNITS)

- TABLE 50 LONG DISTANCE MARKET, BY REGION, 2023–2030 (UNITS)

- TABLE 51 URBAN TRANSIT MARKET, BY REGION, 2018–2022 (UNITS)

- TABLE 52 URBAN TRANSIT MARKET, BY REGION, 2023–2030 (UNITS)

- TABLE 53 FREIGHT: MARKET, BY REGION, 2018–2022 (UNITS)

- TABLE 54 FREIGHT: MARKET, BY REGION, 2023–2030 (UNITS)

- TABLE 55 MARKET, BY SERVICE POWER, 2018–2022 (UNITS)

- TABLE 56 MARKET, BY SERVICE POWER, 2023–2030 (UNITS)

- TABLE 57 LESS THAN 2000 KW: MARKET, BY REGION, 2018–2022 (UNITS)

- TABLE 58 LESS THAN 2000 KW: MARKET, BY REGION, 2023–2030 (UNITS)

- TABLE 59 BETWEEN 2000 TO 4000 KW: MARKET, BY REGION, 2018–2022 (UNITS)

- TABLE 60 BETWEEN 2000 TO 4000 KW: MARKET, BY REGION, 2023–2030 (UNITS)

- TABLE 61 ABOVE 4000 KW: MARKET, BY REGION, 2018–2022 (UNITS)

- TABLE 62 ABOVE 4000 KW: MARKET, BY REGION, 2023–2030 (UNITS)

- TABLE 63 MARKET, BY OPERATING SPEED, 2018–2022 (UNITS)

- TABLE 64 MARKET, BY OPERATING SPEED, 2023–2030 (UNITS)

- TABLE 65 BELOW 100 KM/H HYBRID TRAIN MARKET, BY REGION, 2018–2022 (UNITS)

- TABLE 66 BELOW 100 KM/H MARKET, BY REGION, 2023–2030 (UNITS)

- TABLE 67 100–200 KM/H MARKET, BY REGION, 2018–2022 (UNITS)

- TABLE 68 100–200 KM/H MARKET, BY REGION, 2023–2030 (UNITS)

- TABLE 69 ABOVE 200 KM/H MARKET, BY REGION, 2018–2022 (UNITS)

- TABLE 70 ABOVE 200 KM/H MARKET, BY REGION, 2023–2030 (UNITS)

- TABLE 71 DIFFERENCE BETWEEN ELECTRO-DIESEL, BATTERY-ELECTRIC, AND HYDROGEN-BATTERY HYBRID TRAINS

- TABLE 72 MARKET, BY PROPULSION, 2018–2022 (UNITS)

- TABLE 73 MARKET, BY PROPULSION, 2023–2030 (UNITS)

- TABLE 74 MARKET, BY PROPULSION, 2018–2022 (USD MILLION)

- TABLE 75 MARKET, BY PROPULSION, 2023–2030 (USD MILLION)

- TABLE 76 HYBRID TRAIN MODELS, BY PROPULSION

- TABLE 77 ELECTRO DIESEL-PROPELLED MARKET, BY REGION, 2018–2022 (UNITS)

- TABLE 78 ELECTRO DIESEL-PROPELLED MARKET, BY REGION, 2023–2030 (UNITS)

- TABLE 79 ELECTRO DIESEL-PROPELLED MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 80 ELECTRO DIESEL-PROPELLED MARKET, BY REGION, 2023–2030 (USD MILLION)

- TABLE 81 MARKET, BY REGION, 2018–2022 (UNITS)

- TABLE 82 MARKET, BY REGION, 2023–2030 (UNITS)

- TABLE 83 MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 84 MARKET, BY REGION, 2023–2030 (USD MILLION)

- TABLE 85 ASIA OCEANIA: MARKET, BY COUNTRY, 2018–2022 (UNITS)

- TABLE 86 ASIA OCEANIA: MARKET, BY COUNTRY, 2023–2030 (UNITS)

- TABLE 87 ASIA OCEANIA: MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 88 ASIA OCEANIA: MARKET, BY COUNTRY, 2023–2030 (USD MILLION)

- TABLE 89 CHINA: HYBRID TRAIN MARKET, BY PROPULSION, 2018–2022 (UNITS)

- TABLE 90 CHINA: MARKET, BY PROPULSION, 2023–2030 (UNITS)

- TABLE 91 CHINA: MARKET, BY PROPULSION, 2018–2022 (USD MILLION)

- TABLE 92 CHINA: MARKET, BY PROPULSION, 2023–2030 (USD MILLION)

- TABLE 93 JAPAN: MARKET, BY PROPULSION, 2018–2022 (UNITS)

- TABLE 94 JAPAN: MARKET, BY PROPULSION, 2023–2030 (UNITS)

- TABLE 95 JAPAN: MARKET, BY PROPULSION, 2018–2022 (USD MILLION)

- TABLE 96 JAPAN: MARKET, BY PROPULSION, 2023–2030 (USD MILLION)

- TABLE 97 INDIA: MARKET, BY PROPULSION, 2018–2022 (UNITS)

- TABLE 98 INDIA: MARKET, BY PROPULSION, 2023–2030 (UNITS)

- TABLE 99 INDIA: MARKET, BY PROPULSION, 2018–2022 (USD MILLION)

- TABLE 100 INDIA: MARKET, BY PROPULSION, 2023–2030 (USD MILLION)

- TABLE 101 SOUTH KOREA: MARKET, BY PROPULSION, 2018–2022 (UNITS)

- TABLE 102 SOUTH KOREA: MARKET, BY PROPULSION, 2023–2030 (UNITS)

- TABLE 103 SOUTH KOREA: MARKET, BY PROPULSION, 2018–2022 (USD MILLION)

- TABLE 104 SOUTH KOREA: MARKET, BY PROPULSION, 2023–2030 (USD MILLION)

- TABLE 105 NEW ZEALAND: MARKET, BY PROPULSION, 2018–2022 (UNITS)

- TABLE 106 NEW ZEALAND: MARKET, BY PROPULSION, 2023–2030 (UNITS)

- TABLE 107 NEW ZEALAND: MARKET, BY PROPULSION, 2018–2022 (USD MILLION)

- TABLE 108 NEW ZEALAND: MARKET, BY PROPULSION, 2023–2030 (USD MILLION)

- TABLE 109 AUSTRALIA: MARKET, BY PROPULSION, 2018–2022 (UNITS)

- TABLE 110 AUSTRALIA: MARKET, BY PROPULSION, 2023–2030 (UNITS)

- TABLE 111 AUSTRALIA: MARKET, BY PROPULSION, 2018–2022 (USD MILLION)

- TABLE 112 AUSTRALIA: MARKET, BY PROPULSION, 2023–2030 (USD MILLION)

- TABLE 113 EUROPE: MARKET, BY COUNTRY, 2018–2022 (UNITS)

- TABLE 114 EUROPE: MARKET, BY COUNTRY, 2023–2030 (UNITS)

- TABLE 115 EUROPE: MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 116 EUROPE: MARKET, BY COUNTRY, 2023–2030 (USD MILLION)

- TABLE 117 FRANCE: MARKET, BY PROPULSION, 2018–2022 (UNITS)

- TABLE 118 FRANCE: MARKET, BY PROPULSION, 2023–2030 (UNITS)

- TABLE 119 FRANCE: MARKET, BY PROPULSION, 2018–2022 (USD MILLION)

- TABLE 120 FRANCE: MARKET, BY PROPULSION, 2023–2030 (USD MILLION)

- TABLE 121 GERMANY: HYBRID TRAIN MARKET, BY PROPULSION, 2018–2022 (UNITS)

- TABLE 122 GERMANY: MARKET, BY PROPULSION, 2023–2030 (UNITS)

- TABLE 123 GERMANY: MARKET, BY PROPULSION, 2018–2022 (USD MILLION)

- TABLE 124 GERMANY: MARKET, BY PROPULSION, 2023–2030 (USD MILLION)

- TABLE 125 ITALY: MARKET, BY PROPULSION, 2018–2022 (UNITS)

- TABLE 126 ITALY: MARKET, BY PROPULSION, 2023–2030 (UNITS)

- TABLE 127 ITALY: MARKET, BY PROPULSION, 2018–2022 (USD MILLION)

- TABLE 128 ITALY: MARKET, BY PROPULSION, 2023–2030 (USD MILLION)

- TABLE 129 SPAIN: MARKET, BY PROPULSION, 2018–2022 (UNITS)

- TABLE 130 SPAIN: MARKET, BY PROPULSION, 2023–2030 (UNITS)

- TABLE 131 SPAIN: MARKET, BY PROPULSION, 2018–2022 (USD MILLION)

- TABLE 132 SPAIN: MARKET, BY PROPULSION, 2023–2030 (USD MILLION)

- TABLE 133 AUSTRIA: MARKET, BY PROPULSION, 2018–2022 (UNITS)

- TABLE 134 AUSTRIA: MARKET, BY PROPULSION, 2023–2030 (UNITS)

- TABLE 135 AUSTRIA: MARKET, BY PROPULSION, 2018–2022 (USD MILLION)

- TABLE 136 AUSTRIA: MARKET, BY PROPULSION, 2023–2030 (USD MILLION)

- TABLE 137 UK: MARKET, BY PROPULSION, 2018–2022 (UNITS)

- TABLE 138 UK: MARKET, BY PROPULSION, 2023–2030 (UNITS)

- TABLE 139 UK: MARKET, BY PROPULSION, 2018–2022 (USD MILLION)

- TABLE 140 UK: MARKET, BY PROPULSION, 2023–2030 (USD MILLION)

- TABLE 141 NORTH AMERICA: MARKET, BY COUNTRY, 2018–2022 (UNITS)

- TABLE 142 NORTH AMERICA: MARKET, BY COUNTRY, 2023–2030 (UNITS)

- TABLE 143 NORTH AMERICA: MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 144 NORTH AMERICA: MARKET, BY COUNTRY, 2023–2030 (USD MILLION)

- TABLE 145 US: MARKET, BY PROPULSION, 2018–2022 (UNITS)

- TABLE 146 US: MARKET, BY PROPULSION, 2023–2030 (UNITS)

- TABLE 147 US: MARKET, BY PROPULSION, 2018–2022 (USD MILLION)

- TABLE 148 US: MARKET, BY PROPULSION, 2023–2030 (USD MILLION)

- TABLE 149 CANADA: HYBRID TRAIN MARKET, BY PROPULSION, 2018–2022 (UNITS)

- TABLE 150 CANADA: MARKET, BY PROPULSION, 2023–2030 (UNITS)

- TABLE 151 CANADA: MARKET, BY PROPULSION, 2018–2022 (USD MILLION)

- TABLE 152 CANADA: MARKET, BY PROPULSION, 2023–2030 (USD MILLION)

- TABLE 153 MEXICO: MARKET, BY PROPULSION, 2018–2022 (UNITS)

- TABLE 154 MEXICO: MARKET, BY PROPULSION, 2023–2030 (UNITS)

- TABLE 155 MEXICO: MARKET, BY PROPULSION, 2018–2022 (USD MILLION)

- TABLE 156 MEXICO: MARKET, BY PROPULSION, 2023–2030 (USD MILLION)

- TABLE 157 MIDDLE EAST & AFRICA: MARKET, BY COUNTRY, 2018–2022 (UNITS)

- TABLE 158 MIDDLE EAST & AFRICA: MARKET, BY COUNTRY, 2023–2030 (UNITS)

- TABLE 159 MIDDLE EAST & AFRICA: MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 160 MIDDLE EAST & AFRICA: MARKET, BY COUNTRY, 2023–2030 (USD MILLION)

- TABLE 161 SOUTH AFRICA: MARKET, BY PROPULSION, 2018–2022 (UNITS)

- TABLE 162 SOUTH AFRICA: MARKET, BY PROPULSION, 2023–2030 (UNITS)

- TABLE 163 SOUTH AFRICA: MARKET, BY PROPULSION, 2018–2022 (USD MILLION)

- TABLE 164 SOUTH AFRICA: MARKET, BY PROPULSION, 2023–2030 (USD MILLION)

- TABLE 165 UAE: HYBRID TRAIN MARKET, BY PROPULSION, 2018–2022 (UNITS)

- TABLE 166 UAE: MARKET, BY PROPULSION, 2023–2030 (UNITS)

- TABLE 167 UAE: MARKET, BY PROPULSION, 2018–2022 (USD MILLION)

- TABLE 168 UAE: MARKET, BY PROPULSION, 2023–2030 (USD MILLION)

- TABLE 169 EGYPT: MARKET, BY PROPULSION, 2018–2022 (UNITS)

- TABLE 170 EGYPT: MARKET, BY PROPULSION, 2023–2030 (UNITS)

- TABLE 171 EGYPT: MARKET, BY PROPULSION, 2018–2022 (USD MILLION)

- TABLE 172 EGYPT: MARKET, BY PROPULSION, 2023–2030 (USD MILLION)

- TABLE 173 REST OF THE WORLD: MARKET, BY COUNTRY, 2018–2022 (UNITS)

- TABLE 174 REST OF THE WORLD: MARKET, BY COUNTRY, 2023–2030 (UNITS)

- TABLE 175 REST OF THE WORLD: MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 176 REST OF THE WORLD: MARKET, BY COUNTRY, 2023–2030 (USD MILLION)

- TABLE 177 BRAZIL: HYBRID TRAIN MARKET, BY PROPULSION, 2018–2022 (UNITS)

- TABLE 178 BRAZIL: MARKET, BY PROPULSION, 2023–2030 (UNITS)

- TABLE 179 BRAZIL: MARKET, BY PROPULSION, 2018–2022 (USD MILLION)

- TABLE 180 BRAZIL: MARKET, BY PROPULSION, 2023–2030 (USD MILLION)

- TABLE 181 RUSSIA: MARKET, BY PROPULSION, 2018–2022 (UNITS)

- TABLE 182 RUSSIA: MARKET, BY PROPULSION, 2023–2030 (UNITS)

- TABLE 183 RUSSIA: MARKET, BY PROPULSION, 2018–2022 (USD MILLION)

- TABLE 184 RUSSIA: MARKET, BY PROPULSION, 2023–2030 (USD MILLION)

- TABLE 185 ARGENTINA: MARKET, BY PROPULSION, 2018–2022 (UNITS)

- TABLE 186 ARGENTINA: MARKET, BY PROPULSION, 2023–2030 (UNITS)

- TABLE 187 ARGENTINA: MARKET, BY PROPULSION, 2018–2022 (USD MILLION)

- TABLE 188 ARGENTINA: MARKET, BY PROPULSION, 2023–2030 (USD MILLION)

- TABLE 189 OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS IN HYBRID TRAIN MARKET

- TABLE 190 MARKET SHARE ANALYSIS, 2022

- TABLE 191 MARKET SHARE ANALYSIS FOR TRAIN BATTERY MARKET, 2022

- TABLE 192 MARKET SHARE ANALYSIS FOR TRAIN HVAC SYSTEM MARKET, 2022

- TABLE 193 PRODUCT LAUNCHES/DEVELOPMENTS, 2021–2023

- TABLE 194 DEALS, 2021–2023

- TABLE 195 OTHERS, 2021–2023

- TABLE 196 MARKET: COMPANY REGION FOOTPRINT, 2022

- TABLE 197 MARKET: COMPANY APPLICATION FOOTPRINT, 2022

- TABLE 198 MARKET: COMPANY BATTERY TYPE FOOTPRINT, 2022

- TABLE 199 MARKET: COMPANY PRODUCT, APPLICATION, AND REGION FOOTPRINT, 2022

- TABLE 200 MARKET: STARTUP/SME REGION FOOTPRINT, 2022

- TABLE 201 MARKET: STARTUP/SME APPLICATION FOOTPRINT, 2022

- TABLE 202 MARKET: STARTUP/SME APPLICATION AND REGION FOOTPRINT, 2022

- TABLE 203 CRRC: COMPANY OVERVIEW

- TABLE 204 CRRC: PRODUCTS OFFERED

- TABLE 205 CRRC: PRODUCT DEVELOPMENTS

- TABLE 206 CRRC: DEALS

- TABLE 207 ALSTOM: COMPANY OVERVIEW

- TABLE 208 ALSTOM: PRODUCTS OFFERED

- TABLE 209 ALSTOM: PRODUCT DEVELOPMENTS

- TABLE 210 ALSTOM: DEALS

- TABLE 211 ALSTOM: OTHERS

- TABLE 212 SIEMENS: COMPANY OVERVIEW

- TABLE 213 SIEMENS: PRODUCTS OFFERED

- TABLE 214 SIEMENS: PRODUCT DEVELOPMENTS

- TABLE 215 SIEMENS: DEALS

- TABLE 216 SIEMENS: OTHERS

- TABLE 217 WABTEC CORPORATION: COMPANY OVERVIEW

- TABLE 218 WABTEC CORPORATION: PRODUCTS OFFERED

- TABLE 219 WABTEC CORPORATION: DEALS

- TABLE 220 WABTEC CORPORATION: OTHERS

- TABLE 221 STADLER RAIL AG: COMPANY OVERVIEW

- TABLE 222 STADLER RAIL AG: PRODUCTS OFFERED

- TABLE 223 STADLER RAIL AG: PRODUCT DEVELOPMENTS

- TABLE 224 STADLER RAIL AG: DEALS

- TABLE 225 STADLER RAIL AG: OTHERS

- TABLE 226 HYUNDAI ROTEM COMPANY: COMPANY OVERVIEW

- TABLE 227 HYUNDAI ROTEM COMPANY: PRODUCTS OFFERED

- TABLE 228 HYUNDAI ROTEM COMPANY: PRODUCT DEVELOPMENTS

- TABLE 229 HYUNDAI ROTEM COMPANY: DEALS

- TABLE 230 HITACHI, LTD.: COMPANY OVERVIEW

- TABLE 231 HITACHI, LTD.: PRODUCTS OFFERED

- TABLE 232 HITACHI, LTD.: PRODUCT DEVELOPMENTS

- TABLE 233 HITACHI, LTD.: DEALS

- TABLE 234 CAF: COMPANY OVERVIEW

- TABLE 235 CAF: PRODUCTS OFFERED

- TABLE 236 CAF: DEALS

- TABLE 237 TOSHIBA: COMPANY OVERVIEW

- TABLE 238 TOSHIBA: PRODUCTS OFFERED

- TABLE 239 TOSHIBA: PRODUCT DEVELOPMENTS

- TABLE 240 TOSHIBA: DEALS

- TABLE 241 CUMMINS INC.: COMPANY OVERVIEW

- TABLE 242 CUMMINS INC.: PRODUCTS OFFERED

- TABLE 243 CUMMINS INC.: DEALS

- TABLE 244 ABB: COMPANY OVERVIEW

- TABLE 245 ABB: PRODUCTS OFFERED

- TABLE 246 ABB: DEALS

- TABLE 247 ABB: OTHERS

- TABLE 248 MITSUBISHI ELECTRIC CORPORATION: COMPANY OVERVIEW

- TABLE 249 MITSUBISHI ELECTRIC CORPORATION: PRODUCTS OFFERED

- TABLE 250 MITSUBISHI ELECTRIC CORPORATION: DEALS

- TABLE 251 TALGO: COMPANY OVERVIEW

- TABLE 252 TALGO: PRODUCTS OFFERED

- TABLE 253 TALGO: DEALS

- TABLE 254 BNSF: COMPANY OVERVIEW

- TABLE 255 BALLARD POWER SYSTEMS: COMPANY OVERVIEW

- TABLE 256 CHART INDUSTRIES: COMPANY OVERVIEW

- TABLE 257 RENFE OPERADORA: COMPANY OVERVIEW

- TABLE 258 SKODA TRANSPORTATION: COMPANY OVERVIEW

- TABLE 259 DB CARGO: COMPANY OVERVIEW

- TABLE 260 SNCF: COMPANY OVERVIEW

- TABLE 261 ROLLS-ROYCE: COMPANY OVERVIEW

- TABLE 262 THE KINKI SHARYO CO., LTD.: COMPANY OVERVIEW

- TABLE 263 KAWASAKI HEAVY INDUSTRIES: COMPANY OVERVIEW

- TABLE 264 ETIHAD RAIL: COMPANY OVERVIEW

- TABLE 265 SINARA TRANSPORT MACHINES: COMPANY OVERVIEW

- TABLE 266 TRANSMASHHOLDING: COMPANY OVERVIEW

- TABLE 267 INTAMIN BAHNTECHNIK UND BETRIEBS-MBH & CO. KG: COMPANY OVERVIEW

- FIGURE 1 MARKET SEGMENTATION

- FIGURE 2 HYBRID TRAIN MARKET: RESEARCH DESIGN

- FIGURE 3 RESEARCH DESIGN MODEL

- FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY, DESIGNATION, AND REGION

- FIGURE 5 RESEARCH METHODOLOGY: HYPOTHESIS BUILDING

- FIGURE 6 MARKET SIZE ESTIMATION

- FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- FIGURE 8 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- FIGURE 9 MARKET: RESEARCH DESIGN AND METHODOLOGY

- FIGURE 10 MARKET: DATA TRIANGULATION

- FIGURE 11 FACTORS IMPACTING MARKET

- FIGURE 12 MARKET OVERVIEW

- FIGURE 13 MARKET, BY REGION, 2023–2030

- FIGURE 14 MARKET PERFORMANCE IN 2023

- FIGURE 15 PASSENGER SEGMENT TO LEAD MARKET IN 2023

- FIGURE 16 ADVANCEMENTS IN BATTERY TECHNOLOGY AND HYBRID PROPULSION SYSTEMS TO DRIVE MARKET

- FIGURE 17 PASSENGER SEGMENT TO HOLD LARGER MARKET SHARE IN 2023

- FIGURE 18 HYBRID TRAINS WITH 100-200 KM/H OPERATING SPEED TO CAPTURE LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 19 ABOVE 4000 KW SEGMENT TO GROW AT HIGHEST RATE DURING FORECAST PERIOD

- FIGURE 20 EUROPE TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 21 MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 22 RAIL OPERATORS TO ADDRESS EMISSIONS WITH 5 LEVELS

- FIGURE 23 GLOBAL CO2 EMISSIONS FROM DIFFERENT TRANSPORT SEGMENTS, 2000–2030

- FIGURE 24 CURRENT AND FUTURE EMISSION TECHNOLOGIES

- FIGURE 25 DRIVING TIME SPENT IN TRAFFIC CONGESTION IN US, 2022

- FIGURE 26 PROTOTYPE OF HYDROGEN TRAIN

- FIGURE 27 BENEFITS OF USING BATTERIES IN RAIL FOR MAXIMUM OPERATIONAL FLEXIBILITY

- FIGURE 28 COMPARISON OF BATTERY RECYCLING: LEAD-ACID VS. LITHIUM-ION

- FIGURE 29 AVERAGE SELLING PRICE TRENDS, BY ELECTRO-DIESEL PROPULSION, BY REGION, 2018–2023

- FIGURE 30 MARKET: ECOSYSTEM ANALYSIS

- FIGURE 31 MARKET: VALUE CHAIN ANALYSIS

- FIGURE 32 TRAIN BATTERY MARKET: VALUE CHAIN ANALYSIS

- FIGURE 33 TRAIN HVAC SYSTEM MARKET: VALUE CHAIN ANALYSIS

- FIGURE 34 REGENERATIVE BRAKING SYSTEM IN TRAINS

- FIGURE 35 TIMELINE OF FUEL CELL MASS MARKET ACCEPTABILITY IN TRANSPORTATION SECTOR, 2016–2050

- FIGURE 36 SPECIFICATIONS OF TRI-MODE BATTERY TRAIN

- FIGURE 37 US: IMPORT AND EXPORT DATA FOR RAILWAYS AND TRAMWAYS, LOCOMOTIVES, ROLLING STOCK, AND PARTS, 2018–2022 (USD MILLION)

- FIGURE 38 CHINA: IMPORT AND EXPORT DATA FOR RAILWAYS AND TRAMWAYS, LOCOMOTIVES, ROLLING STOCK, AND PARTS, 2018–2022 (USD MILLION)

- FIGURE 39 GERMANY: IMPORT AND EXPORT DATA FOR RAILWAYS AND TRAMWAYS, LOCOMOTIVES, ROLLING STOCK, AND PARTS, 2018–2022 (USD MILLION)

- FIGURE 40 UK: IMPORT AND EXPORT DATA FOR RAILWAYS AND TRAMWAYS, LOCOMOTIVES, ROLLING STOCK, AND PARTS, 2018–2022 (USD MILLION)

- FIGURE 41 FRANCE: IMPORT AND EXPORT DATA FOR RAILWAYS AND TRAMWAYS, LOCOMOTIVES, ROLLING STOCK, AND PARTS, 2018–2022 (USD MILLION)

- FIGURE 42 INDIA: IMPORT AND EXPORT DATA FOR RAILWAYS AND TRAMWAYS, LOCOMOTIVES, ROLLING STOCK, AND PARTS, 2018–2022 (USD MILLION)

- FIGURE 43 ITALY: IMPORT AND EXPORT DATA FOR RAILWAYS AND TRAMWAYS, LOCOMOTIVES, ROLLING STOCK, AND PARTS, 2018–2022 (USD MILLION)

- FIGURE 44 AUSTRIA: IMPORT AND EXPORT DATA FOR RAILWAYS AND TRAMWAYS, LOCOMOTIVES, ROLLING STOCK, AND PARTS, 2018–2022 (USD MILLION)

- FIGURE 45 SWITZERLAND: IMPORT AND EXPORT DATA FOR RAILWAYS AND TRAMWAYS, LOCOMOTIVES, ROLLING STOCK, AND PARTS, 2018–2022 (USD MILLION)

- FIGURE 46 JAPAN: IMPORT AND EXPORT DATA FOR RAILWAYS AND TRAMWAYS, LOCOMOTIVES, ROLLING STOCK, AND PARTS, 2018–2022 (USD MILLION)

- FIGURE 47 REVENUE SOURCES FOR MARKET

- FIGURE 48 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR HYBRID TRAINS, BY PROPULSION

- FIGURE 49 KEY BUYING CRITERIA

- FIGURE 50 FREIGHT SEGMENT TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 51 BETWEEN 2000 TO 4000 KW SEGMENT TO HAVE LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 52 100-200 KM/H SEGMENT TO HAVE LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 53 TYPES OF LITHIUM-ION BATTERIES

- FIGURE 54 LITHIUM-ION BATTERY USED IN REGIONAL BATTERY TRAIN

- FIGURE 55 EUROPE TO HOLD LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 56 ASIA OCEANIA: MARKET SNAPSHOT

- FIGURE 57 GERMANY TO HOLD LARGEST MARKET SHARE IN EUROPE DURING FORECAST PERIOD

- FIGURE 58 NORTH AMERICA: MARKET SNAPSHOT

- FIGURE 59 EGYPT TO HOLD LARGEST MARKET SHARE IN MIDDLE EAST & AFRICA DURING FORECAST PERIOD

- FIGURE 60 RUSSIA TO HOLD LARGEST MARKET SHARE IN REST OF THE WORLD DURING FORECAST PERIOD

- FIGURE 61 HYBRID TRAIN MARKET SHARE ANALYSIS, 2022

- FIGURE 62 TOP PUBLIC/LISTED PLAYERS IN HYBRID TRAIN MARKET IN LAST 5 YEARS

- FIGURE 63 HYBRID TRAIN MARKET: COMPANY EVALUATION MATRIX, 2022

- FIGURE 64 HYBRID TRAIN MARKET: STARTUP/SME EVALUATION MATRIX, 2022

- FIGURE 65 CRRC: COMPANY SNAPSHOT

- FIGURE 66 ALSTOM: COMPANY SNAPSHOT

- FIGURE 67 ALSTOM: NEW BUSINESS OPPORTUNITY SPACES

- FIGURE 68 SIEMENS: COMPANY SNAPSHOT

- FIGURE 69 WABTEC CORPORATION: COMPANY SNAPSHOT

- FIGURE 70 STADLER RAIL AG: COMPANY SNAPSHOT

- FIGURE 71 HYUNDAI ROTEM COMPANY: COMPANY SNAPSHOT

- FIGURE 72 HITACHI, LTD.: COMPANY SNAPSHOT

- FIGURE 73 CAF: COMPANY SNAPSHOT

- FIGURE 74 TOSHIBA: COMPANY SNAPSHOT

- FIGURE 75 CUMMINS INC.: COMPANY SNAPSHOT

- FIGURE 76 ABB: COMPANY SNAPSHOT

- FIGURE 77 MITSUBISHI ELECTRIC CORPORATION: COMPANY SNAPSHOT

- FIGURE 78 TALGO: COMPANY SNAPSHOT

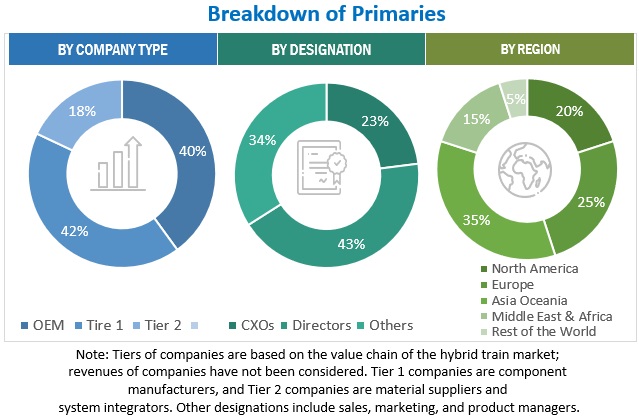

The study involved four major activities in estimating the current size of the Hybrid Train market. Exhaustive secondary research was done to collect information on the market, the peer market, and the child markets. The next step was to validate these findings, assumptions, and sizing with the industry experts across value chains through primary research. The top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation processes were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources were used to identify and collect information for this study. The secondary sources include annual reports, press releases, and investor presentations of companies; whitepapers, certified publications; articles from recognized authors, directories, and databases; and articles from recognized associations and government publishing sources. Secondary research has been used to obtain key information about the industry’s value chain, the overall pool of key players, market classification and segmentation according to industry trends to the bottom-most level, regional markets, and key developments from the market- and technology-oriented perspectives.

Primary Research

Extensive primary research has been conducted after acquiring an understanding of this market scenario through secondary research. Several primary interviews have been conducted with market experts from the demand- and supply-side OEMs (in terms of component supply, country-level government associations, and trade associations) and component manufacturers across four major regions, namely, Asia Pacific, Europe, North America, Middle East and Africa and Rest of the World. Approximately 25% and 75% of primary interviews have been conducted from the demand and supply side, respectively. Primary data has been collected through questionnaires, emails, LinkedIn, and telephonic interviews. In the canvassing of primaries, we have strived to cover various departments within organizations, such as sales, operations, and administration, to provide a holistic viewpoint in our report.

After interacting with industry experts, we conducted brief sessions with highly experienced independent consultants to reinforce the findings from our primaries. This, along with the in-house subject matter experts’ opinions, has led us to the findings as described in the remainder of this report. Following is the breakdown of primary respondents.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The bottom-up approach was used to estimate and validate the total market size. This method was also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and markets have been identified through extensive secondary research

- The industry’s supply chain and market size, in terms of volume, have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall market size—using the market size estimation processes as explained above—the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Market Definition

The hybrid train market refers to the segment of the transportation industry focused on the development, manufacturing, distribution, and operation of trains that utilize a combination of multiple power sources for propulsion. These trains typically integrate traditional diesel or gas propulsion with electric, battery, or alternative energy sources to enhance efficiency, reduce emissions, and offer flexible and sustainable rail transportation solutions. The market encompasses various stakeholders, including train manufacturers, rail operators, government agencies, and technology providers, all working together to meet the growing demand for environmentally friendly, energy-efficient, and technologically advanced train systems.

List of Key Stakeholders

- Train Manufacturers

- Rail Operators

- Government Authorities

- Technology Providers

- Infrastructure Providers

- Battery Manufacturers

- Energy Suppliers

- Passenger and Freight Transport Companies

- Maintenance and Service Providers

- Research and Development Institutions

- Environmental Organizations

- Investors and Financiers

- Local Communities

- Passengers and Commuters

- Supply Chain Partners

- Standards Organizations

Report Objectives

- To define, describe, and forecast the size of the hybrid trains market in terms of volume (units)

- To define, describe, and forecast the size of the hybrid trains market based on battery type (qualitative), application, operating speed, service power, propulsion type, and region

- To segment and qualitatively cover the following battery types (Lead acid, lithium-ion, Sodium-Ion, Nickel Cadmium and Others)

- To segment and forecast the market size by application (passenger and freight)

- To segment and forecast the market size operating speed (below 100 KM/H, 100–200 KM/H, and above 200 KM/H).

- To segment and forecast the market size service power (less than 2000 kW, between 2000 to 4000 kW and above 4000 kW).

- To cover the hybrid train market by propulsion (Electro Diesel, Battery Electric, and Hydrogen Battery)

- To segment and forecast the market size, by region (Asia Oceania, Europe, North America, Middle East & Africa, and the Rest of the World)

- To understand the market dynamics (drivers, restraints, opportunities, and challenges) of the hybrid train market

- To understand the dynamics of competitors in the hybrid train market and distinguish them into visionary leaders, innovators, emerging companies, and dynamic differentiators according to their product portfolio strength and business strategies

- To analyze opportunities for stakeholders and the competitive landscape for market leaders

- To strategically profile key players and comprehensively analyze their market share and core competencies

- To track and analyze competitive developments, such as new product launches, deals, and other developments by key players

- To analyze the opportunities offered by various segments of the market to its stakeholders

- To analyze and forecast the trends and orientation for the hybrid market in the global industry

Available Customizations

With the given market data, MarketsandMarkets offers customizations in accordance with company-specific needs.

- Hybrid Train Market, By Operating Speed Type, at the country level (For countries covered in the report)

- Hybrid Train Market, By Application Type, at the country level (For countries covered in the report)

Company Information

- Profiling of Additional Market Players (Up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Hybrid Train Market

I need few data points with simple tweaks for Electric Diesel Trains.