Hybrid System Market by System (Start-Stop, Regenerative Braking, EV Drive, eBoost), Component (Battery, DC/DC Converter, DC/AC Inverter, eMotor), Battery (Li-Ion, Lead Acid, NiMH), Vehicle (Mild Hybrid, HEV, PHEV, EV) - Global Forecast to 2022

The hybrid system market was valued at USD 18.88 billion in 2016 and is projected to grow at a CAGR of 10.79% during the forecast period. The base year considered for the study is 2016 and the forecast period is 2017–2022.Factors such as decreased tail-pipe emission limits, potential fuel savings with adoption of mild hybrids, and tax benefits & incentives/subsidies for adoption of electric vehicles are the key factors fueling the growth of the hybrid system market.

Objectives of the Study:

- To define, describe, and project the hybrid system market, by battery type (lead acid, Li-ion battery, and Nickel-based) during the forecast period, in terms of volume and value

- To identify and forecast the hybrid system market from 2017 to 2022 based on component (12V battery, high voltage battery, DC/AC inverter, DC/DC converter, DC/DC boost converter, E-motor, motor controller and AC/DC charger), in terms of volume and value at regional level

- To analyze and forecast the hybrid system market based on system type (start-stop, regenerative braking, EV drive, E-boost, sailing, and plug-in charging system) and vehicle type (mild hybrid, HEV, PHEV, and BEV) from 2017 to 2022, in terms of volume and value at country level

- To identify the market dynamics, including drivers, restraints, opportunities, and challenges, and analyze their impact on the hybrid system market

- To analyze the competitive leadership map for the key players based on their product offerings and business strategies to identify the dynamic differentiators, innovators, visionary leaders, and emerging companies in the hybrid system market

The research methodology uses secondary sources, which include associations such as International Organization of Motor Vehicle Manufacturers (OICA), Emission Controls Manufacturers Association (ECMA), European Automobile Manufacturers Association (EAMA), Environmental Protection Agency (EPA), and International Council on Clean Transportation (ICCT) and paid databases and directories such as Factiva and Bloomberg. In the primary research stage, experts from related industries, manufacturers, and suppliers have been interviewed to understand the present situation and future trends in the hybrid system market. The hybrid system market for OE has been derived from forecasting techniques based on electric & hybrid vehicle sales, hybrid system penetration, and electric vehicle regulations incentives.

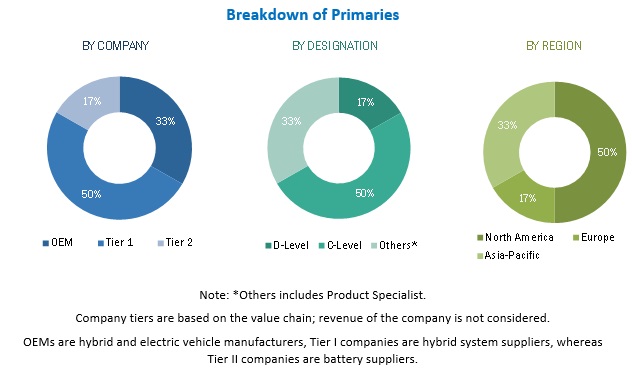

The figure below illustrates the break-up of the profile of industry experts who participated in primary discussions.

To know about the assumptions considered for the study, download the pdf brochure

The hybrid system market ecosystem consists of hybrid system manufacturers such as Bosch (Germany), Continental (Germany), Denso (Germany), ZF (Germany), and Johnson Controls (US). Hybrid system is supplied to major OEMs in the automotive industry including Nissan (Japan), General Motors (US), Toyota (Japan), and others.

Target Audience

- Hybrid System Component Manufacturers

- Distributors and Suppliers of Hybrid System Components

- Independent and Authorized Dealers Hybrid Components

- Hybrid System Manufacturers

- Electric Vehicle Manufacturers

- Industry Associations and Experts

Scope of the Report

Market, By Region

Market, By Component

Market, By Electric Vehicle Type

Market, By System Type

Market, By Battery Type

Mild Hybrid System Market, By System Type

-

- Asia Oceania

- Europe

- North America

- RoW

- 12V Battery

- High Voltage Battery

- DC/AC Inverter

- DC/DC Converter

- DC/DC Boost Converter

- E-Motor

- AC/DC Charger

- Motor controller

- BEV

- HEV

- PHEV

- Start-stop

- Regenerative Braking

- EV Drive

- E-booster

- Sailing

- Plug-in Charging System

- Lead Acid

- Li-ion Battery

- Nickel-Based

- Start-stop

- Regenerative Braking

- E-booster

Available Customizations

With the given market data, MarketsandMarkets offers customizations in accordance with the company’s specific needs.

Market, By Battery Type & Country, 2015-2025

-

- Lithium-Ion

- Nickel-Based

- Lead Acid

- Solid State Battery

(The Countries to be Studied are China, Japan, India, South Korea, Germany, France, Italy, the Netherlands, Norway, UK, US, Canada, Mexico, Brazil, Russia, and South Africa)

Market, By Voltage Architecture, System Type & Region

-

48V (Mild Hybrid)

- Start-stop system

- Regenerative braking

- E-booster

60V–299V

- Start-stop system

- Regenerative braking

- E-booster

- Sailing/coating

300V–349V

- Start-stop system

- Regenerative braking

- E-booster

- Sailing/coating

- Plug-in charging

>349V

- Start-stop system

- Regenerative braking

- E-booster

- Sailing/coating

- Plug-in charging

(Regions to be considered are Asia Pacific, Europe, North America, and RoW)

Mild Hybrid System Market, By System Type & Country

- Start-stop system

- Regenerative braking system

- E-Booster system

(The countries to be studied are China, Japan, India, South Korea, Germany, France, Italy, the Netherlands, Norway, UK, US, Canada, Mexico, Brazil, Russia, and South Africa)

The hybrid system market is projected to grow at a CAGR of 10.79% during the forecast period and is projected to reach USD 40.99 billion by 2022. Owing to the benefits offered by hybrid system, such as elimination of mechanical linkages, improved fuel efficiency and, thereby, decreased tail-pipe emissions, the demand for these systems is projected to grow in near future. Also, secondary factors such as increase in demand for electric & hybrid vehicles, government subsidies for BEVs, and investments in charging infrastructure will fuel the demand for hybrid systems in the coming years.

Regenerative braking system is projected to be the largest segment of the mild hybrid system market, by value. The major factor contributing to the large demand for regenerative braking system in the mild hybrid cars is the fact that it can reduce fuel consumption of a car by 10–25% according to the International Council on Clean Transportation (ICCT). Asia Pacific is the region with the highest growth of regenerative braking system market size in terms of volume and value because of the increasing elctric cars sales volume in the region, followed by North America where the sales of electric vehicles are growing significantly.

The EV drive system is leading the hybrid system market in terms of value because of the high cost of EV drive, which includes key components such as high voltage battery, E-motor, and DC/DC Converter. The cost of high voltage battery, which includes mainly lithium-ion and nickel-based battery, is expected to decline tremendously in the future. According to ICCT (The International Council of Clean Transportation), the cost of battery packs for battery electric vehicle has declined to USD 295 per kWh in 2015. Further, it is anticipated that the cost will come down to USD 154-212 per kWh by 2020. This is impacting the overall EV drive cost, as the key component is high voltage battery.

The high voltage battery is expected to hold the largest market size in hybrid system components market during the forecast period. The high voltage battery is the one of the most important and costly components in a plug-in hybrid or fully electric vehicle. The cost of battery module is up to 30–45% of the total cost of a fully electric vehicle. Although the manufacturers are trying to reduce the cost of battery packs used in EVs so as to make the overall price of the electric vehicle cheaper and reachable to mass market. The market for high voltage battery is projected to remain the largest among the market for other components of the hybrid system.

The lithium-ion battery type is estimated to hold the largest market size during the forecast period mainly because of its popularity in high voltage battery market and its high power-to-weight ratio, good high-temperature performance, high energy efficiency, and low self-discharge. Most of today's plug-in hybrid electric vehicles and full electric vehicles use lithium-ion batteries, though the cost of the battery is high. Nickel-based batteries were having the second major market as of 2016 after lithium-ion battery technology.

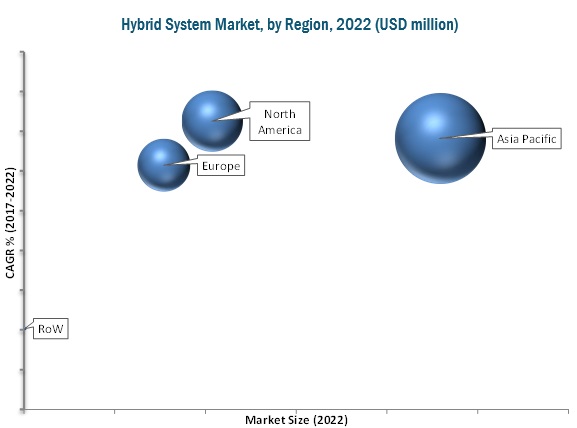

Asia Pacifc is estimated to be the largest hybrid system market owing to the increasing electric vehicle sales in countries such as China and Japan. The electric vehicle sales in China and Japan is expected to increase from 0.49 million units and 1.09 million units in 2016 to 2.17 million units and 2.1 million units in 2022, respectively. The Chinese government’s move towards working on a time table to end the production and sales of gasoline as well as diesel cars and Japanese government’s “Next-Generation Vehicle Strategy 2010”, which targets the market share of electric vehicles sales is 50% of total vehicle sales by the end of year 2020, are expected to increase the market of electric vehicles in the Asia Pacific region. Thus, the market for hybrid sytems is also slated to increase with the increasing electric vehicles in the region.

The factor that is restraining the market is the lack of standardization of hybrid technologies such as high voltage battery. There is no such specific industry standards or specification available. The components such as electric motors, starter generators, and energy storage systems can be standardized in order to decrease the R&D cost of developing the hybrid systems. Standardizing the system components is difficult for the manufacturers, and this restrains the market growth. The hybrid system market comprises several regional players and is dominated by a few global players. Some of the key manufacturers operating in the market are Bosch (Germany), Continental (Germany), Denso (Germany), ZF (Germany), and Johnson Controls (US).

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 17)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Years Considered for the Study

1.4 Currency

1.5 Package Size

1.6 Limitations

1.7 Stakeholders

2 Research Methodology (Page No. - 21)

2.1 Research Data

2.2 Secondary Data

2.2.1 Key Secondary Sources

2.2.2 Key Data From Secondary Sources

2.3 Primary Data

2.3.1 Sampling Techniques & Data Collection Methods

2.3.2 Primary Participants

2.4 Factor Analysis

2.4.1 Demand-Side Analysis

2.4.1.1 Rise in the Demand for Hybrid System to Reduce Fuel Consumption

2.4.1.2 Stringent Emission Regulations Driving Sales of Electric and Hybrid Vehicles

2.4.1.3 Supporting Government Policies for Electric and Hybrid Vehicles

2.4.2 Supply-Side Analysis

2.4.2.1 Opportunity for Hybrid System Component and Battery Pack Suppliers

2.4.2.2 Battery Cost

2.5 Market Size Estimation

2.5.1 Bottom-Up Approach

2.5.2 Data Triangulation

2.5.3 Assumptions

3 Executive Summary (Page No. - 34)

4 Premium Insights (Page No. - 41)

4.1 Attractive Opportunities in the Hybrid System Market

4.2 Market, By Region

4.3 Market, By System Type

4.4 Market, By Vehicle Type

4.5 Mild Hybrid System Market, By System Type

4.6 Market, By Component

4.7 Market, By Battery Type

4.8 Hybrid System Supplier Analysis, By Component

5 Market Overview (Page No. - 53)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Rising Demand for Mild Hybrid Vehicles

5.2.1.1.1 Increased Fuel Efficiency With the Adoption of Mild Hybrids

5.2.1.1.2 Rising Government Incentives for the Adoption of Mild Hybrids

5.2.1.2 Increasing Demand for Higher Voltage Systems to Increase Hybridization

5.2.2 Restraints

5.2.2.1 Lack of Standardization of Hybrid Technologies

5.2.3 Opportunities

5.2.3.1 Growing Electric Vehicle Infrastructure

5.2.3.1.1 Government Policies and Incentives for Electric Vehicle Charging Stations

5.2.3.1.2 Developing Charging Technologies and Infrastructure for Electric Vehicles

5.2.3.2 Electrification and Hybridization in the Commercial Vehicles

5.2.4 Challenges

5.2.4.1 Cost Reduction and High-Energy Density Ev Batteries

5.2.5 Macro Indicator Analysis

5.2.5.1 Introduction

5.2.5.1.1 Full Electric Vehicle Sales as A Percentage of Total Electric Vehicle Sales

5.2.5.1.2 GDP (USD Billion)

5.2.5.1.3 GNP Per Capita, Atlas Method (USD)

5.2.5.1.4 GDP Per Capita PPP (USD)

5.2.6 Macro Indicators Influencing the Hybrid System Market for Top 3 Countries

5.2.6.1 Japan

5.2.6.2 China

5.2.6.3 US

6 Hybrid System Market, By Battery Type and Region (Page No. - 67)

6.1 Introduction

6.2 Lead Acid Battery Market, By Region

6.3 Lithium Ion Battery Market, By Region

6.4 Nickel Based Battery Market, By Region

7 Mild Hybrid System Market, By System Type and Region (Page No. - 73)

7.1 Introduction

7.2 Start-Stop System Market Size for Mild Hybrids, By Region

7.3 Regenerative Braking System Market Size for Mild Hybrids, By Region

7.4 E-Booster Market Size for Mild Hybrids, By Region

8 Market, By Component & Region (Page No. - 79)

8.1 Introduction

8.2 12v Battery Market, By Region

8.3 High Voltage Battery Market, By Region

8.4 DC/AC Inverter Market, By Region

8.5 DC/DC Converter Market, By Region

8.6 DC/DC Boost Converter, By Region

8.7 E-Motor Market, By Region

8.8 AC/DC Charger Market, By Region

8.9 Motor Controller Market, By Region

9 Hybrid System Market, By Region, Vehicle Type & System Type (Page No. - 91)

9.1 Introduction

9.1.1 E-Booster System Market, By Region

9.1.2 Ev Drive System Market, By Region

9.1.3 Plug-In Charging System Market, By Region

9.1.4 Regenerative Braking System, By Region

9.1.5 Sailing System Market, By Region

9.1.6 Start-Stop System Market, By Region

9.2 Asia Pacific: Market, By Country, Vehicle Type & System Type

9.2.1 Asia Pacific: Market, By Vehicle Type

9.2.2 Asia Pacific: Market, By System Type

9.2.2.1 Asia Pacific: E-Booster Market, By Country and Vehicle Type

9.2.2.2 Asia Pacific: Ev Drive System Market, By Country and Vehicle Type

9.2.2.3 Asia Pacific: Plug-In Charging System Market, By Country and Vehicle Type

9.2.2.4 Asia Pacific: Regenerative Braking System Market, By Country and Vehicle Type

9.2.2.5 Asia Pacific: Sailing System Market, By Country and Vehicle Type

9.2.2.6 Asia Pacific: Start-Stop System Market, By Country and Vehicle Type

9.3 Europe: Market, By Country, Vehicle Type & System Type

9.3.1.1 Europe: E-Booster System Market, By Country and Vehicle Type

9.3.1.2 Europe: Ev Drive System Market, By Country and Vehicle Type

9.3.1.3 Europe: Plug In-Charging System Market, By Country and Vehicle Type

9.3.1.4 Europe: Regenerative Braking System Market, By Country and Vehicle Type

9.3.1.5 Europe: Sailing System Market, By Country and Vehicle Type

9.3.1.6 Europe: Start-Stop System Market, By Country and Vehicle Type

9.4 North America: Market, By Country, Vehicle Type & System Type

9.4.1 North America: Market, By Vehicle Type

9.4.2 North America Market, By System Type

9.4.2.1 North America: E-Booster System Market, By Country and Vehicle Type

9.4.2.2 North America: Ev Drive System Market, By Country and Vehicle Type

9.4.2.3 North America: Plug-In Charging System Market, By Country and Vehicle Type

9.4.2.4 North America: Regenerative Braking System Market, By Country and Vehicle Type

9.4.2.5 North America: Sailing System Market, By Country and Vehicle Type

9.4.2.6 North America: Start-Stop System Market, By Country and Vehicle Type

9.5 Rest of the World: Market, By Country, Vehicle Type & System Type

9.5.1 RoW: Market, By Vehicle Type

9.5.1.1 RoW: E-Booster System Market, By Country and Vehicle Type

9.5.1.2 RoW: Ev Drive System Market, By Country and Vehicle Type

9.5.1.3 RoW: Plug-In Charging System Market, By Country and Vehicle Type

9.5.1.4 RoW: Regenerative Braking System Market, By Country and Vehicle Type

9.5.1.5 RoW: Sailing System Market, By Country and Vehicle Type

9.5.1.6 RoW: Start-Stop System Market, By Country and Vehicle Type

10 Competitive Landscape (Page No. - 158)

10.1 Hybrid System Market: Company Ranking Analysis

11 Company Profiles (Page No. - 159)

(Business Overview, Services Offered, Strength of Service Portfolio, Business Strategy Excellence, Recent Developments)*

11.1 Bosch

11.2 Continental

11.3 Denso

11.4 Delphi

11.5 Johnson Controls

11.6 ZF

11.7 Valeo

11.8 Hitachi Automotive

11.9 Magna

11.10 Infineon

11.11 Schaeffler

11.12 GKN

*Details on Business Overview, Services Offered, Strength of Service Portfolio, Business Strategy Excellence, Recent Developments Might Not Be Captured in Case of Unlisted Companies.

12 Appendix (Page No. - 203)

12.1 Insights of Industry Experts

12.2 Discussion Guide

12.3 Knowledge Store: Marketsandmarkets’ Subscription Portal

12.4 Introducing RT: Real Time Market Intelligence

12.5 Available Customizations

12.5.1 Hybrid System Market, By Battery Type & Country, 2015-2025

12.5.1.1 Lithium-Ion

12.5.1.2 Nickel Based

12.5.1.3 Lead Acid

12.5.1.4 Solid State Battery

12.5.2 Hybrid System Market, By Voltage Architecture, System Type & Region

12.5.2.1 48v (Mild Hybrid)

12.5.2.1.1 Start-Stop System

12.5.2.1.2 Regenerative Braking

12.5.2.1.3 E-Booster

12.5.2.2 60v-299v

12.5.2.2.1 Start Stop System

12.5.2.2.2 Regenerative Braking

12.5.2.2.3 E-Booster

12.5.2.2.4 Sailing/Coating

12.5.2.3 300v-349v

12.5.2.3.1 Start-Stop System

12.5.2.3.2 Regenerative Braking

12.5.2.3.3 E-Booster

12.5.2.3.4 Sailing/Coating

12.5.2.3.5 Plug-In Charging

12.5.2.4 >349v

12.5.2.4.1 Start-Stop System

12.5.2.4.2 Regenerative Braking

12.5.2.4.3 E-Booster

12.5.2.4.4 Sailing/Coating

12.5.2.4.5 Plug-In Charging

12.5.3 Mild Hybrid System Market, By System Type & Country

12.5.3.1 Start-Stop System

12.5.3.2 Regenerative Braking System

12.5.3.3 E-Booster System

12.6 Related Reports

12.7 Author Details

List of Tables (138 Tables)

Table 1 Currency Exchange Rates (W.R.T. USD)

Table 2 Impact of Degree of Hybridization on Fuel Consumption

Table 3 Country-Wise Emission Regulations (2010-2020), Enacted & Proposed

Table 4 Taxation Schemes for Electric Vehicles, 2014

Table 5 DC-DC Converter: Key Suppliers

Table 6 Traction Motor: Key Suppliers

Table 7 Battery: Key Suppliers

Table 8 Invertor: Key Suppliers

Table 9 On-Board Charger: Key Suppliers

Table 10 Components and Outlay Covered Under the Fame Scheme (Million USD)

Table 11 Range of Demand Incentives for Mild Hybrid Under the Fame Scheme (USD)

Table 12 High Voltage Systems in Hybrid and Electric Vehicles

Table 13 Voltage Levels Required to Power Various Systems in Passenger Cars

Table 14 Electric Charging Points in Major European Countries, 2011 & 2020

Table 15 Publicly Accessible Fast Charger Stock, By Country, 2014–2016 (Number of Units)

Table 16 Potential Co2 Saving for Hybrid Bus & Truck Configuration

Table 17 Technical Performance of Different Ev Batteries

Table 18 Japan: Rising Debt-GDP Ratio to Be the Most Crucial Indicator Given Its Excessively Weak Performance in the Recent Past

Table 19 China: Domestic Demand Expected to Play A Crucial Role Owing to A Host of Chinese Domestic Carmakers

Table 20 U.S.: Rising Gni Per Capita Expected to Drive the Sales of Luxury Vehicles During the Forecast Period

Table 21 Hybrid System Market Size, By Battery Type, 2015-2022 (‘000 Units)

Table 22 Hybrid System Market Size, By Battery Type, 2015-2022 (USD Million)

Table 23 Lead Acid Battery Market Size, By Region, 2015-2022 (‘000 Units)

Table 24 Lead Acid Battery Market Size, By Region, 2015-2022 (USD Million)

Table 25 Lithium Ion Battery Market Size, By Region, 2015-2022 (‘000 Units)

Table 26 Lithium Ion Battery Market Size, By Region, 2015-2022 (USD Million)

Table 27 Nickel Based Battery Market Size, By Region, 2015-2022 (‘000 Units)

Table 28 Nickel Based Battery Market Size, By Region, 2015-2022 (USD Million)

Table 29 Mild Hybrid System Market Size, By System Type, 2015-2022 (‘000 Units)

Table 30 Mild Hybrid System Market Size, By System Type, 2015-2022 (USD Million)

Table 31 Start-Stop System Market Size for Mild Hybrids, By Region, 2015-2022 (‘000 Units)

Table 32 Start-Stop System Market Size for Mild Hybrids, By Region, 2015-2022 (USD Million)

Table 33 Regenerative Braking System Market Size for Mild Hybrids, By Region, 2015-2022 (‘000 Units)

Table 34 Regenerative Braking System Market Size for Mild Hybrids, By Region, 2015-2022 (USD Million)

Table 35 E-Booster Market Size for Mild Hybrids, By Region, 2015-2022 (‘000 Units)

Table 36 E-Booster Market Size for Mild Hybrids, By Region, 2015-2022 (USD Million)

Table 37 Hybrid System Market Size, By Component, 2015-2022 (‘000 Units)

Table 38 Hybrid System Market Size, By Component, 2015-2022 (USD Million)

Table 39 12v Battery Market Size, By Region, 2015-2022 (‘000 Units)

Table 40 12v Battery Market Size, By Region, 2015-2022 (USD Million)

Table 41 Various Battery Technologies Used in Vehicles

Table 42 High Voltage Battery Market Size, By Region, 2015-2022 (‘000 Units)

Table 43 High Voltage Battery Market Size, By Region, 2015-2022 (USD Million)

Table 44 DC/AC Inverter Market Size, By Region, 2015-2022 (‘000 Units)

Table 45 DC/AC Inverter Market Size, By Region, 2015-2022 (USD Million)

Table 46 DC/DC Converter Market Size, By Region, 2015-2022 (‘000 Units)

Table 47 DC/DC Converter Market Size, By Region, 2015-2022 (USD Million)

Table 48 DC/DC Boost Converter Market Size, By Region, 2015-2022 (‘000 Units)

Table 49 DC/DC Boost Converter Market Size, By Region, 2015-2022 (USD Million)

Table 50 E-Motor Market Size, By Region, 2015-2022 (‘000 Units)

Table 51 E-Motor Market Size, By Region, 2015-2022 (USD Million)

Table 52 AC/DC Charger Market Size, By Region, 2015-2022 (‘000 Units)

Table 53 AC/DC Charger Market Size, By Region, 2015-2022 (USD Million)

Table 54 Motor Controller Market Size, By Region, 2015-2022 (‘000 Units)

Table 55 Motor Controller Market Size, By Region, 2015-2022 (USD Million)

Table 56 Hybrid System Market Size, By Region, 2015-2022 (‘000 Units)

Table 57 Hybrid System Market Size, By Region, 2015-2022 (USD Million)

Table 58 Hybrid System Market Size, By System Type, 2015-2022 (‘000 Units)

Table 59 Hybrid System Market Size, By System Type, 2015-2022 (USD Million)

Table 60 Hybrid System Market Size, By Vehicle Type, 2015-2022 (‘000 Units)

Table 61 Hybrid System Market Size, By Vehicle Type, 2015-2022 (USD Million)

Table 62 E-Booster System Market Size, By Region, 2015-2022 (‘000 Units)

Table 63 E-Booster System Market Size, By Region, 2015-2022 (USD Million)

Table 64 Ev Drive Market Size, By Region, 2015-2022 (‘000 Units)

Table 65 Ev Drive Market Size, By Region, 2015-2022 (USD Million)

Table 66 Plug-In Charging System Market Size, By Region, 2015-2022 (‘000 Units)

Table 67 Plug-In Charging System Market Size, By Region, 2015-2022 (USD Million)

Table 68 Regenerative Braking System Market Size, By Region, 2015-2022 (‘000 Units)

Table 69 Regenerative Braking System Market Size, By Region, 2015-2022 (USD Million)

Table 70 Sailing System Market Size, By Region, 2015-2022 (‘000 Units)

Table 71 Sailing System Market Size, By Region, 2015-2022 (USD Million)

Table 72 Start-Stop System Market Size, By Region, 2015-2022 (‘000 Units)

Table 73 Start-Stop System Market Size, By Region, 2015-2022 (USD Thousand)

Table 74 Asia Pacific: Hybrid System Market Size, By Vehicle Type, 2015-2022 (‘000 Units)

Table 75 Asia Pacific: Hybrid System Market Size, By Vehicle Type, 2015-2022 (USD Million)

Table 76 Asia Pacific: Hybrid System Market Size, By System Type, 2015-2022 (‘000 Units)

Table 77 Asia Pacific: Hybrid System Market Size, By System Type, 2015-2022 (USD Million)

Table 78 Asia Pacific: E-Booster System Market Size, By Country and Vehicle Type, 2015-2022 (Units)

Table 79 Asia Pacific: E-Booster System Market Size, By Country and Vehicle Type, 2015-2022 (USD Thousand)

Table 80 Asia Pacific: Ev Drive System Market Size, By Country and Vehicle Type, 2015-2022 (Units)

Table 81 Asia Pacific: Ev Drive System Market Size, By Country and Vehicle Type, 2015-2022 (USD Thousand)

Table 82 Asia Pacific: Plug-In Charging System Market Size, By Country and Vehicle Type, 2015-2022 (Units)

Table 83 Asia Pacific: Plug-In Charging System Market Size, By Country and Vehicle Type, 2015-2022 (USD Thousand)

Table 84 Asia Pacific: Regenerative Braking System Market Size, By Country and Vehicle Type, 2015-2022 (Units)

Table 85 Asia Pacific: Regenerative Braking System Market Size, By Country and Vehicle Type, 2015-2022 (USD Thousand)

Table 86 Asia Pacific: Sailing System Market Size, By Country and Vehicle Type, 2015-2022 (Units)

Table 87 Asia Pacific: Sailing System Market Size, By Country and Vehicle Type, 2015-2022 (USD Thousand)

Table 88 Asia Pacific: Start Stop System Market Size, By Country and Vehicle Type, 2015-2022 (Units)

Table 89 Asia Pacific: Start-Stop System Market Size, By Country and Vehicle Type, 2015-2022 (USD Thousand)

Table 90 Europe: Market Size, By Vehicle Type, 2015-2022 (‘000 Units)

Table 91 Europe: Market Size, By Vehicle Type, 2015-2022 (USD Million)

Table 92 Europe: Market Size, By System Type, 2015-2022 (‘000 Units)

Table 93 Europe: Market, By System Type, 2015-2022 (USD Million)

Table 94 Europe: E-Booster System Market Size, By Country and Vehicle Type, 2015-2022 (Units)

Table 95 Europe: E-Booster System Market Size, By Country and Vehicle Type, 2015-2022 (USD Thousand)

Table 96 Europe: Ev Drive System Market Size, By Country and Vehicle Type, 2015-2022 (Units)

Table 97 Europe: Ev Drive System Market Size, By Country and Vehicle Type, 2015-2022 (USD Thousand)

Table 98 Europe: Plug in Charging System Market Size, By Country and Vehicle Type, 2015-2022 (Units)

Table 99 Europe: Plug-In Charging System Market Size, By Country and Vehicle Type, 2015-2022 (USD Thousand)

Table 100 Europe: Regenerative Braking System Market Size, By Country and Vehicle Type, 2015-2022 (Units)

Table 101 Europe: Regenerative Braking System Market Size, By Country and Vehicle Type, 2015-2022 (USD Thousand)

Table 102 Europe: Sailing System Market Size, By Country and Vehicle Type, 2015-2022 (Units)

Table 103 Europe: Sailing System Market Size, By Country and Vehicle Type, 2015-2022 (USD Thousand)

Table 104 Europe: Start Stop System Market Size, By Country and Vehicle Type, 2015-2022 (Units)

Table 105 Europe: Start-Stop System Market Size, By Country and Vehicle Type, 2015-2022 (USD Thousand)

Table 106 North America: Market Size, By Vehicle Type, 2015-2022 (‘000 Units)

Table 107 North America: Market Size, By Vehicle Type, 2015-2022 (USD Million)

Table 108 North America: Market Size, By System Type, 2015-2022 (‘000 Units)

Table 109 North America: Market Size, By System Type, 2015-2022 (USD Million)

Table 110 North America: E-Booster System Market Size, By Country and Vehicle Type, 2015-2022 (Units)

Table 111 North America: E-Booster System Market Size, By Country and Vehicle Type, 2015-2022 (USD Thousand)

Table 112 North America: Ev Drive System Market Size, By Country and Vehicle Type, 2015-2022 (Units)

Table 113 North America: Ev Drive System Market Size, By Country and Vehicle Type, 2015-2022 (USD Thousand)

Table 114 North America: Plug in Charging System Market Size, By Country and Vehicle Type, 2015-2022 (Units)

Table 115 North America: Plug in Charging System Market Size, By Country and Vehicle Type, 2015-2022 (USD Thousand)

Table 116 North America: Regenerative Braking System Market Size, By Country and Vehicle Type, 2015-2022 (Units)

Table 117 North America: Regenerative Braking System Market Size, By Country and Vehicle Type, 2015-2022 (USD Thousand)

Table 118 North America: Sailing System Market Size, By Country and Vehicle Type, 2015-2022 (Units)

Table 119 North America: Sailing System Market Size, By Country and Vehicle Type, 2015-2022 (USD Thousand)

Table 120 North America: Start Stop System Market Size, By Country and Vehicle Type, 2015-2022 (Units)

Table 121 North America: Start Stop System Market Size, By Country and Vehicle Type, 2015-2022 (USD Thousand)

Table 122 RoW: Market Size, By Vehicle Type, 2015-2022 (‘000 Units)

Table 123 RoW: Market Size, By Vehicle Type, 2015-2022 (USD Million)

Table 124 RoW: Market Size, By System Type, Volume (‘000 Units)

Table 125 RoW: Market Size, By System Type,Value (USD Million)

Table 126 RoW: E-Booster System Market Size, By Country and Vehicle Type, 2015-2022 (Units)

Table 127 RoW: E-Booster System Market Size, By Country and Vehicle Type, 2015-2022 (USD Thousand)

Table 128 RoW: Ev Drive System Market Size, By Country and Vehicle Type, 2015-2022 (Units)

Table 129 RoW: Ev Drive System Market Size, By Country and Vehicle Type, 2015-2022 (USD Thousand)

Table 130 RoW: Plug in Charging System Market Size, By Country and Vehicle Type, 2015-2022 (Units)

Table 131 RoW: Plug-In Charging System Market Size, By Country and Vehicle Type, 2015-2022 (USD Thousand)

Table 132 RoW: Regenerative Braking System Market Size, By Country and Vehicle Type, 2015-2022 (Units)

Table 133 RoW: Regenerative Braking System Market Size, By Country and Vehicle Type, 2015-2022 (USD Thousand)

Table 134 RoW: Sailing System Market Size, By Country and Vehicle Type, 2015-2022 (Units)

Table 135 RoW: Sailing System Market Size, By Country and Vehicle Type, 2015-2022 (USD Thousand)

Table 136 RoW: Start-Stop System Market Size, By Country and Vehicle Type, 2015-2022 (Units)

Table 137 RoW: Start-Stop System Market Size, By Country and Vehicle Type, 2015-2022 (USD Thousand)

Table 138 Hybrid System Market: Company Ranking, 2016

List of Figures (44 Figures)

Figure 1 Hybrid System Market: Research Design

Figure 2 Research Design Model

Figure 3 Breakdown of Primary Interviews

Figure 4 Supply Chain Contributors

Figure 5 Lithium Ion Battery Cost Reduction

Figure 6 Hybrid System Market: Bottom-Up Approach

Figure 7 Data Triangulation

Figure 8 Market, By Region, 2017 vs 2022 (USD Million)

Figure 9 Market, By System Type, 2017 vs 2022 (USD Million)

Figure 10 Market, By Country, 2017-2022 (USD Million)

Figure 11 Market, By Component, 2017 vs 2022 (USD Million)

Figure 12 Market, By Battery Type, 2017 vs 2022 (USD Million)

Figure 13 Mild Hybrid System Market, By System Type, 2017 vs 2022 (USD Million)

Figure 14 Increasing Hybridization & Demand for Higher Fuel Economy to Drive the Hybrid System Market During the Forecast Period

Figure 15 Asia Pacific Estimated to Lead the Hybrid System Market in 2017

Figure 16 The Ev Drive System Segment is Estimated to Lead this Market

Figure 17 The HEV Segment is Estimated to Lead the Hybrid System Market

Figure 18 The Regenerative Braking System Segment is Estimated to Lead the Mild Hybrid System Market

Figure 19 The High Voltage Battery Segment is Estimated to Lead the Market

Figure 20 The Lithium Ion Battery Segment Estimated to Lead the Hybrid System Battery Market

Figure 21 Drivers, Restraints, Opportunities, and Challenges in the Hybrid System Market

Figure 22 Vehicle Electrification vs Fuel Efficiency

Figure 23 Projected Cost of Lithium-Ion Batteries, 2015-2030 (USD Per Kwh)

Figure 24 Li-Ion Battery With Improved Energy Density

Figure 25 Lithium Ion Segment is Estimated to Be the Largest in the Hybrid System Market During the Forecast Period

Figure 26 Regenerative Braking System Market Size is Estimated to Be the Largest in the Mild Hybrid System Market During the Forecast Period

Figure 27 High Voltage Battery Estimated to Be the Largest Component Segment of the Hybrid System Market During the Forecast Period

Figure 28 North America to Be the Fastest-Growing Market for the Hybrid System, 2017–2022 (USD Million)

Figure 29 Asia Pacific: Market Snapshot

Figure 30 Europe: Market, By Country, 2017 vs 2022 (USD Million)

Figure 31 North America: Market Snapshot

Figure 32 RoW: Market, By Country, 2017 vs 2022 (USD Million)

Figure 33 Bosch: Company Snapshot

Figure 34 Continental: Company Snapshot

Figure 35 Denso: Company Snapshot

Figure 36 Delphi: Company Snapshot

Figure 37 Johnson Controls: Company Snapshot

Figure 38 ZF: Company Snapshot

Figure 39 Valeo: Company Snapshot

Figure 40 Hitachi Automotive: Company Snapshot

Figure 41 Magna: Company Snapshot

Figure 42 Infineon: Company Snapshot

Figure 43 Schaeffler: Company Snapshot

Figure 44 GKN: Company Snapshot

Growth opportunities and latent adjacency in Hybrid System Market