High Temperature Sealants Market by Chemistry (Silicone, Epoxy), Application (Electrical & Electronics, Transportation, Industrial, Construction), and Region (Asia Pacific, Europe, North America, Middle East & Africa) - Global Forecast to 2022

[157 Pages Report] on High Temperature Sealants Market was valued at USD 2.71 Billion in 2016 and is projected to reach USD 3.56 Billion by 2022, at a CAGR of 4.6% from 2017 to 2022. In this study, 2016 has been considered the base year and 2017 to 2022 the forecast period to project the market size of high temperature sealants.

Objectives of the study:

- To define, describe, and project the global high temperature sealants market based on chemistry, application, and region

- To forecast the market size, in terms of value and volume, of five main regional markets, namely, Asia Pacific, Europe, North America, Middle East & Africa, and South America

- To provide detailed information on the key factors influencing market growth, such as drivers, restraints, opportunities, and industry-specific challenges

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and contribution to the total market

- To analyze competitive developments, such as, mergers & acquisitions, expansions, new product developments/ launches, and partnerships/agreements & collaborations, in the high temperature sealants market

- To strategically profile the key players and comprehensively analyze their market strategies and core competencies as well as provide competitive benchmarking for various players

Research Methodology:

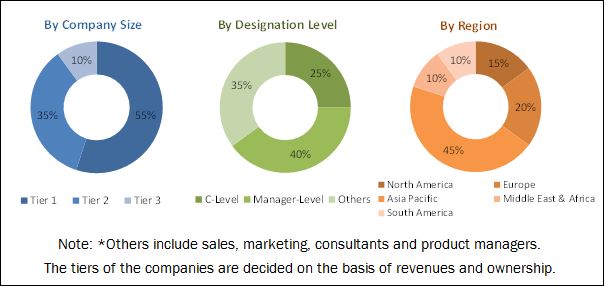

The research methodology used to estimate and forecast the market size included both, top-down and bottom-up approaches. The total market size for high temperature sealants is identified through both, primary and secondary research. The overall high temperature sealants market was further segmented, based on chemistries and applications. Percentages were allotted to the different sectors in each of the segments. These allotments and calculations were arrived at on the basis of extensive primary interviews and secondary research. The secondary resources include annual reports, press releases, and investor presentations of companies; white papers; certified publications; articles from recognized authors; and gold standard & silver standard websites such as, Factiva, ICIS, Bloomberg, and so on. Findings of this study were verified through primary research by conducting extensive interviews with key officials such as, CEOs, VPs, directors, and other executives. The breakdown of profiles of the primary interviewees is illustrated in the figure below:

To know about the assumptions considered for the study, download the pdf brochure

The global market for high temperature sealants is led by players such as Dow Corning Corporation (US), Wacker Chemie AG (Germany), Henkel AG & Co. KGaA (Germany), Sika AG (Switzerland), 3M Company (US), Bostik SA (France), H.B. Fuller (US), PPG Industries, Inc. (US), CSW Industrials, Inc. (US), Illinois Tool Works Company (US), and Soudal N.V. (Belgium).

Target Audience:

- Manufacturers of High Temperature Sealants

- Manufacturers in End-Use Industries such as Electrical & Electronics, Transportation, Industrial, Construction, and Others

- Traders, Distributors, and Suppliers of High Temperature Sealants

- Regional Manufacturers’ Associations and General Sealants Associations

- Government and Regional Agencies and Research Organizations

Scope of the Report:

This report categorizes the global high temperature sealants market based on chemistry, application, and region.

Market Segmentation, by Chemistry:

- Silicone

- Epoxy

- Others

Market Segmentation, by Application:

- Electrical & Electronics

- Transportation

- Industrial

- Construction

- Others

Market Segmentation, by Region:

- Asia Pacific

- Europe

- North America

- Middle East & Africa

- South America

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to the customer’s specific needs. The following customization options are available for the report:

Regional Analysis

- Further breakdown of the Rest of Asia Pacific high temperature sealants market into Singapore, Philippines, Australia, and others

- Further breakdown of the Rest of Europe high temperature sealants market into Poland, Netherlands, Belgium, and others

Company Information

- Detailed analysis and profiles of additional market players (Up to five)

The high temperature sealants market is projected to reach USD 3.56 Billion by 2022, at a CAGR of 4.6% from 2017 to 2022. The high temperature sealants market is driven by its wide application areas and excellent temperature resistance properties. The high temperature sealants market is witnessing moderate growth owing to increasing end-use applications such as electrical & electronics, transportation, industrial, construction, and the increasing demand from emerging economies.

The high temperature sealants market is segmented on the basis of chemistries into silicone, epoxy, and others. Silicone chemistry accounted for the largest share in the high temperature sealants market in 2016 and is expected to continue to lead during the forecast period 2017-2022. The growth of the silicone based high temperature sealants segment is backed by the wide acceptance of silicone based products due to their extreme temperature & chemical resistance, and excellent electrical properties.

The high temperature sealants market is further segregated on the basis of application including electrical & electronics, transportation, industrial, construction, and others. Electrical & electronics is projected to be the largest as well as fastest-growing application of high temperature sealants. The electrical & electronics segment is projected to drive the high temperature sealants market from 2017 to 2022 due to the indispensability of electrical & electronics products in modern life, increasing disposable incomes of the middle class population, and the increasing usage of electrical components in automobiles. The transportation application is also projected to grow at a high rate due to the wide applications of high temperature sealants in the automobile and marine industries. High temperature sealants offer excellent temperature & chemical resistance and adhesion to a range of substrates.

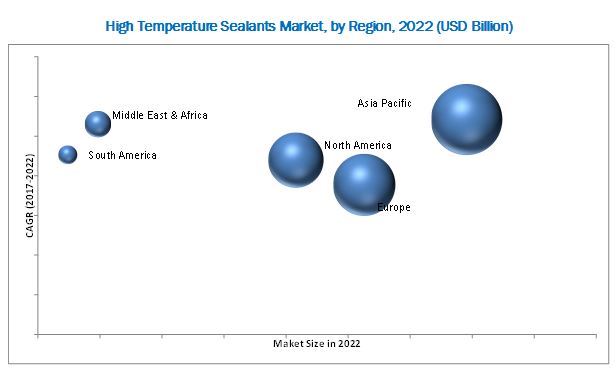

The Asia Pacific region high temperature sealants market is expected to grow at the highest CAGR in terms of value and volume. Infrastructure development, backed by rapid industrialization and favorable government policies have offered significant growth opportunities in the high temperature sealants market in the Asia Pacific region. The growing electrical & electronics industry, increasing production of automobiles, investments in construction activities, and rising disposable incomes are expected to drive the high temperature sealants market in the region.

Stringent government regulations and standards is the key factor restraining the growth of the high temperature sealants market.

Expansions, mergers & acquisitions, as well as new product developments were the major strategies adopted by a majority of the players in the market during 2015-2017. Companies such as Dow Corning Corporation (US), Henkel AG & Co. KGaA (Germany), Sika AG (Switzerland), H.B. Fuller (US), 3M Company (US), CSW Industrials Inc. (US), and PPG Industries Inc. (US) adopted these strategies to expand their customer base, increase product offerings, and stay ahead of their competitors.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 17)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Scope of the Study

1.3.1 Markets Covered

1.3.2 Years Considered for the Study

1.4 Currency

1.5 Limitations

1.6 Stakeholders

2 Research Methodology (Page No. - 20)

2.1 Research Data

2.1.1 Key Data From Secondary Sources

2.1.2 Key Data From Primary Sources

2.2 Market Size Estimation

2.3 Market Breakdown and Data Triangulation

2.4 Research Assumptions and Limitations

2.4.1 Assumptions

2.4.2 Limitations

3 Executive Summary (Page No. - 29)

4 Premium Insights (Page No. - 33)

4.1 Attractive Opportunities in the High Temeperature Sealant Market

4.2 High Temperature Sealant Market, By Region

4.3 High Temperature Sealant Market, By Chemistry and Country

4.4 High Temperature Sealant Market Growth

4.5 High Temperature Sealant Market, By Application

5 Market Overview (Page No. - 37)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Wide Range of Application Areas Across Industries

5.2.1.2 Increasing Automobile Production

5.2.1.3 Extreme Temperature Resistance Properties

5.2.2 Restraints

5.2.2.1 Stringent Government Regulations and Standards

5.2.3 Opportunities

5.2.3.1 Rising Demand From Emerging Economies

5.2.3.2 Development of Sealant With Adhesive Properties

6 Industry Trends (Page No. - 44)

6.1 Porter’s Five Forces Analysis

6.1.1 Threat of New Entrants

6.1.2 Threat of Substitutes

6.1.3 Bargaining Power of Suppliers

6.1.4 Bargaining Power of Buyers

6.1.5 Intensity of Competitive Rivalry

6.2 Macroeconomic Indicators

6.2.1 Introduction

6.2.2 GDP and Forecasts of Major Economies

6.2.3 Trends and Forecast of Electronics Industry and Its Impact on High Temperature Sealants

6.2.4 Trends and Forecast of Automotive Industry and Its Impact on High Temperature Sealants

7 High Temperature Sealants Market, By Chemistry (Page No. - 55)

7.1 Introduction

7.2 High Temperature Sealant Market, By Chemistry

7.3 Silicone

7.4 Epoxy

7.5 Others

8 High Temperature Sealants Market, By Application (Page No. - 60)

8.1 Introduction

8.2 High Temperature Sealant Market, By Application

8.3 Electrical & Electronics

8.4 Transportation

8.5 Industrial

8.6 Construction

8.7 Others

9 High Temperature Sealants Market, By Region (Page No. - 65)

9.1 Introduction

9.1.1 High Temperature Sealants Market Size, By Region

9.2 Asia-Pacific

9.2.1 China

9.2.2 India

9.2.3 Japan

9.2.4 South Korea

9.2.5 Indonesia

9.2.6 Taiwan

9.2.7 Thailand

9.2.8 Malaysia

9.2.9 Rest of Asia-Pacific

9.3 Europe

9.3.1 Germany

9.3.2 France

9.3.3 U.K.

9.3.4 Italy

9.3.5 Spain

9.3.6 Russia

9.3.7 Turkey

9.3.8 Rest of Europe

9.4 North America

9.4.1 U.S.

9.4.2 Canada

9.4.3 Mexico

9.5 Middle East & Africa

9.5.1 Saudi Arabia

9.5.2 UAE

9.5.3 South Africa

9.5.4 Israel

9.5.5 Rest of Middle East & Africa

9.6 South America

9.6.1 Brazil

9.6.2 Argentina

9.6.3 Rest of South America

10 Competitive Landscape (Page No. - 114)

10.1 Market Ranking

10.2 Competitive Leadership Mapping, 2016

10.2.1 Dynamic Differentiators

10.2.2 Innovators

10.2.3 Visionary Leaders

10.2.4 Emerging Companies

10.3 Competitive Benchmarking

10.3.1 Strength of Product Offerings (For All 25 Players)

10.3.2 Business Strategy Excellence (For All 25 Players)

11 Company Profiles (Page No. - 122)

11.1 DOW Corning Corporation

11.1.1 Business Overview

11.1.2 Strength of Product Portfolio

11.1.3 Business Strategy Excellence

11.1.4 Recent Developments

11.2 Wacker Chemie AG

11.2.1 Business Overview

11.2.2 Strength of Product Portfolio

11.2.3 Business Strategy Excellence

11.2.4 Recent Developments

11.3 Henkel AG & Co. KGaA

11.3.1 Business Overview

11.3.2 Strength of Product Portfolio

11.3.3 Business Strategy Excellence

11.3.4 Recent Developments

11.4 Sika AG

11.4.1 Business Overview

11.4.2 Strength of Product Portfolio

11.4.3 Business Strategy Excellence

11.4.4 Recent Developments

11.5 3M Company

11.5.1 Business Overview

11.5.2 Strength of Product Portfolio

11.5.3 Business Strategy Excellence

11.5.4 Recent Developments

11.6 Bostik SA (Arkema)

11.6.1 Business Overview

11.6.2 Strength of Product Portfolio

11.6.3 Business Strategy Excellence

11.6.4 Recent Developments

11.7 H.B. Fuller

11.7.1 Business Overview

11.7.2 Strength of Product Portfolio

11.7.3 Business Strategy Excellence

11.7.4 Recent Developments

11.8 PPG Industries Inc.

11.8.1 Business Overview

11.8.2 Strength of Product Portfolio

11.8.3 Business Strategy Excellence

11.8.4 Recent Developments

11.9 CSW Industrials Inc.

11.9.1 Business Overview

11.9.2 Strength of Product Portfolio

11.9.3 Business Strategy Excellence

11.9.4 Recent Developments

11.10 Illinois Tool Works (ITW) Inc.

11.10.1 Business Overview

11.10.2 Strength of Product Portfolio

11.10.3 Business Strategy Excellence

11.11 Soudal N.V.

11.11.1 Business Overview

11.11.2 Strength of Product Portfolio

11.11.3 Business Strategy Excellence

11.11.4 Recent Developments

11.12 Other Market Players

11.12.1 CSL Silicones Inc.

11.12.2 Mcgill Airseal LLC

11.12.3 Momentive Performance Materials Inc.

11.12.4 Pidilite Industries

11.12.5 Bond It

11.12.6 Premier Building Solutions Inc.

11.12.7 Alstone

11.12.8 NUCO Inc.

11.12.9 G.F. Thompson Co. Ltd.

11.12.10 American Sealants, Inc.

11.12.11 Mapei S.P.A

11.12.12 Hylomar Limited

11.12.13 Sashco, Inc.

11.12.14 National Engineering Products, Incorporated

12 Appendix (Page No. - 152)

12.1 Insights From Industry Experts

12.2 Discussion Guide

12.3 Introducing RT: Real Time Market Intelligence

12.4 Available Customizations

12.5 Related Reports

List of Tables (86 Tables)

Table 1 Temperature Range Need of End-User Industries

Table 2 Regulations & Standards Related to VoC Content in Sealants

Table 3 Trend and Forecast of GDP, 2015-2022 (USD Billion)

Table 4 High Temperature Sealants Market, By Chemistry, 2015–2022 (USD Million)

Table 5 High Temperature Sealant Market Size, By Chemistry, 2015-2022 (KT)

Table 6 High Temperature Sealants Market Size, By Application, 2015-2022 (USD Million)

Table 7 High Temperature Sealant Market Size, By Application, 2015-2022 (KT)

Table 8 High Temperature Sealant Market Size, By Region, 2015-2022 (USD Million)

Table 9 High Temperature Sealant Market, By Region, 2015-2022 (KT)

Table 10 Asia-Pacific: High Temperature Sealant Market Size, By Country, 2015-2022 (USD Million)

Table 11 Asia-Pacific: High Temperature Sealant Market Size, By Country, 2015-2022 (Kiloton)

Table 12 Asia-Pacific: High Temperature Sealant Market Size, By Application, 2015-2022 (USD Million)

Table 13 Asia-Pacific: High Temperature Sealant Market Size, By Application, 2015-2022 (Kiloton)

Table 14 China: High Temperature Sealant Market Size, By Application, 2015-2022 (USD Million)

Table 15 China: High Temperature Sealant Market Size, By Application, 2015-2022 (Kiloton)

Table 16 India: High Temperature Sealant Market Size, By Application, 2015-2022 (USD Million)

Table 17 India: High Temperature Sealant Market Size, By Application, 2015-2022 (Kiloton)

Table 18 Japan: High Temperature Sealant Market Size, By Application, 2015-2022 (USD Million)

Table 19 Japan: High Temperature Sealant Market Size, By Application, 2015-2022 (Kiloton)

Table 20 South Korea: High Temperature Sealant Market Size, By Application, 2015-2022 (USD Million)

Table 21 South Korea: High Temperature Sealant Market Size, By Application, 2015-2022 (Kiloton)

Table 22 Indonesia: High Temperature Sealant Market Size, By Application, 2015-2022 (USD Million)

Table 23 Indonesia: High Temperature Sealant Market Size, By Application, 2015-2022 (Kiloton)

Table 24 Taiwan: High Temperature Sealant Market Size, By Application, 2015-2022 (USD Million)

Table 25 Taiwan: High Temperature Sealant Market Size, By Application, 2015-2022 (Kiloton)

Table 26 Thailand: High Temperature Sealant Market Size, By Application, 2015-2022 (USD Million)

Table 27 Thailand: High Temperature Sealant Market Size, By Application, 2015-2022 (Kiloton)

Table 28 Malaysia: High Temperature Sealant Market Size, By Application, 2015-2022 (USD Million)

Table 29 Malaysia: High Temperature Sealant Market Size, By Application, 2015-2022 (Kiloton)

Table 30 Rest of Asia-Pacific: High Temperature Sealant Market Size, By Application, 2015-2022 (USD Million)

Table 31 Rest of Asia-Pacific: High Temperature Sealant Market Size, By Application, 2015-2022 (Kiloton)

Table 32 Europe: High Temperature Sealants Market Size, By Country, 2015-2022 (USD Million)

Table 33 Europe: High Temperature Sealant Market Size, By Country, 2015-2022 (KT)

Table 34 Europe: High Temperature Sealant Market Size, By Application, 2015-2022 (USD Million)

Table 35 Europe: High Temperature Sealant Market Size, By Application, 2015-2022 (KT)

Table 36 Germany, High Temperature Sealant Market Size, By Application, 2015-2022 (USD Million)

Table 37 Germany: High Temperature Sealant Market Size, By Application 2015-2022 (KT)

Table 38 France: High Temperature Sealants Market Size, By Application, 2015-2022 (USD Million)

Table 39 France: High Temperature Sealant Market Size, By Application, 2015-2022 (KT)

Table 40 UK: High Temperature Sealant Market Size, By Application, 2015-2022 (USD Million)

Table 41 UK: High Temperature Sealant Market Size, By Application, 2015-2022 (KT)

Table 42 Italy: High Temperature Sealants Market Size, By Application, 2015-2022 (USD Million)

Table 43 Italy: High Temperature Sealant Market Size, By Application, 2015-2022 (KT)

Table 44 Spain: High Temperature Sealant Market Size, By Application, 2015-2022 (USD Million)

Table 45 Spain: High Temperature Sealant Market Size, By Application, 2015-2022 (KT)

Table 46 Russia: High Temperature Sealants Market Size, By Application, 2015-2022 (USD Million)

Table 47 Russia: High Temperature Sealant Market Size, By Application, 2015-2022 (KT)

Table 48 Turkey: High Temperature Sealant Market Size, By Application, 2015-2022 (USD Million)

Table 49 Turkey: High Temperature Sealant Market Size, By Application, 2015-2022 (KT)

Table 50 Rest of Europe: High Temperature Sealants Market Size, By Application, 2015-2022 (USD Million)

Table 51 Rest of Europe: High Temperature Sealant Market Size, By Application, 2015-2022 (KT)

Table 52 North America: High Temperature Sealants Market Size, By Country, 2015-2022 (USD Million)

Table 53 North America: High Temperature Sealant Market Size, By Country, 2015-2022 (KT)

Table 54 North America: High Temperature Sealant Market Size, By Application, 2015-2022 (USD Million)

Table 55 North America: High Temperature Sealant Market Size, By Application, 2015-2022 (KT)

Table 56 U.S.: High Temperature Sealants Market Size, By Application, 2015-2022 (USD Million)

Table 57 U.S.: High Temperature Sealant Market Size, By Application, 2015-2022 (KT)

Table 58 Canada: High Temperature Sealants Market Size, By Application, 2015-2022 (USD Million)

Table 59 Canada: High Temperature Sealant Market Size, By Application, 2015-2022 (KT)

Table 60 Mexico: High Temperature Sealant Market Size, By Application, 2015-2022 (USD Million)

Table 61 Mexico: High Temperature Sealant Market Size, By Application, 2015-2022 (KT)

Table 62 Middle East & Africa: Moisture Cure Adhesives Market Size, By Country, 2015-2022 (USD Million)

Table 63 Middle East & Africa: High Temperature Sealants Market Size, By Country, 2015-2022 (KT)

Table 64 Middle East & Africa: High Temperature Sealant Market, By Application, 2015-2022 (USD Million)

Table 65 Middle East & Africa: High Temperature Sealant Market Size, By Application, 2015-2022 (KT)

Table 66 Saudi Arabia’s Automotive Investment Projects

Table 67 Saudi Arabia: High Temperature Sealants Market, By Application, 2015-2022 (USD Million)

Table 68 Saudi Arabia: High Temperature Sealant Market Size, By Application, 2015-2022 (KT)

Table 69 UAE: High Temperature Sealants Market Size, By Application, 2015-2022 (USD Million)

Table 70 UAE: High Temperature Sealant Market Size, By Application, 2015-2022 (KT)

Table 71 South Africa: High Temperature Sealants Market Size, By Application, 2015-2022 (USD Million)

Table 72 South Africa: High Temperature Sealant Market Size, By Application, 2015-2022 (KT)

Table 73 Israel: High Temperature Sealant Market Size, By Application, 2015-2022 (USD Million)

Table 74 Israel: High Temperature Sealant Market Size, By Application, 2015-2022 (KT)

Table 75 Rest of Middle East & Africa: High Temperature Sealants Market Size, By Application, 2015-2022 (USD Million)

Table 76 Rest of Middle East & Africa: High Temperature Sealant Market Size, By Application, 2015-2022 (KT)

Table 77 South America: High Temperature Sealants Market Size, By Country, 2015-2022 (USD Million)

Table 78 South America: High Temperature Sealant Market Size, By Country, 2015-2022 (KT)

Table 79 South America: High Temperature Sealant Market Size, By Application, 2015-2022 (USD Million)

Table 80 South America: High Temperature Sealant Market Size, By Application, 2015-2022 (KT)

Table 81 Brazil: High Temperature Sealants Market Size, By Application, 2015-2022 (USD Million)

Table 82 Brazil: High Temperature Sealant Market Size, By Application, 2015-2022 (KT)

Table 83 Argentina: High Temperature Sealant Market Size, By Application, 2015-2022 (USD Million)

Table 84 Argentina: High Temperature Sealant Market Size, By Application, 2015-2022 (KT)

Table 85 Rest of South America: High Temperature Sealant Market Size, By Application, 2015-2022 (USD Million)

Table 86 Rest of South America: High Temperature Sealant Market Size, By Application, 2015-2022 (KT)

List of Figures (41 Figures)

Figure 1 Market Segmentation

Figure 2 High Temperature Sealants: Research Design

Figure 3 Breakdown of Primary Interviews

Figure 4 Bottom-Up Approach

Figure 5 Top-Down Approach

Figure 6 Research Methodology: Data Triangulation

Figure 7 Silicone to Lead the High Temperature Sealant Market During the Forecast Period

Figure 8 Electrical & Electronics Application to Lead the High Temperature Sealant Market During the Forecast Period

Figure 9 Asia Pacific to Lead the High Temperature Sealant Market in 2016

Figure 10 China to Be the Fastest-Growing High Temperature Sealant Market During the Forecast Period

Figure 11 The Growing Demand Across Applications is Expected to Drive the High Temperature Sealant Market Between 2017 and 2022

Figure 12 Asia Pacific is Expected to Be the Fastest-Growing Market for High Temperature Sealant During the Forecast Period

Figure 13 China Accounted for the Largest Share of the High Temperature Sealant Market in 2016, in Terms of Value

Figure 14 Asia Pacific and Middle East & Africa High Temperature Sealant Markets are Expected to Witness Significant Growth Between 2017 and 2022

Figure 15 The Electrical & Electronics Segment is Estimated to Be the Largest Segment of the High Temperature Sealant Market During the Forecast Period

Figure 16 High Temperature Sealants Market Dynamics

Figure 17 Automobile Production 2014-2016 (Million Units)

Figure 18 Porter’s Five Forces Analysis

Figure 19 Production By the Global Electronics and It Industries

Figure 20 China Was the Largest Automobile Producer in 2016

Figure 21 Automotive (Car) Sales Outlook (Million Unit)

Figure 22 Silicone Chemistry is Expected to Dominate the High Temperature Sealants Market, 2017-2022

Figure 23 Electrical & Electronics Segment is Projected to Dominate the Application Segment in Terms of Demand, 2017- 2022

Figure 24 Regional Snapshot (2017-2022)

Figure 25 Asia-Pacific Market Snapshot: Electrical & Electronics to Be the Largest Application of High Temperature Sealant

Figure 26 European Market Snapshot

Figure 27 Automobile Production in Germany, 2012-2016 (Thousand Units)

Figure 28 North America Market Snapshot

Figure 29 Automobile Production in the U.S. 2012-2016 (Million Units)

Figure 30 Cars and Commercial Vehicles Production in Mexico (Thousand Units)

Figure 31 Dive Chart

Figure 32 DOW Corning Corporation: Business Overview

Figure 33 Wacker Chemie AG : Company Snapshot

Figure 34 Henkel AG & Co. KGaA: Company Snapshot

Figure 35 Sika AG : Company Snapshot

Figure 36 3M Company: Company Snapshot

Figure 37 Bostik SA: Company Snapshot

Figure 38 H.B. Fuller: Company Snapshot

Figure 39 PPG Industries Inc.: Company Snapshot

Figure 40 CSW Industrials Inc. : Company Snapshot

Figure 41 ITW Inc. : Company Snapshot

Growth opportunities and latent adjacency in High Temperature Sealants Market