Fire Protection Materials Market for Construction by Type (Coatings, Sealants & Fillers, Mortar, Sheets/Boards, Spray, Preformed Device, Putty, Cast-in Devices), Application (Commercial, Industrial, and Residential) - Global Forecast to 2024

Updated on : March 27, 2023

Fire Protection Materials Market

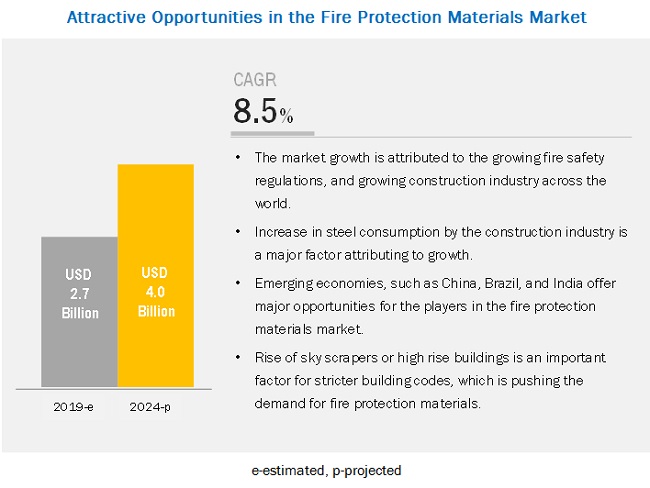

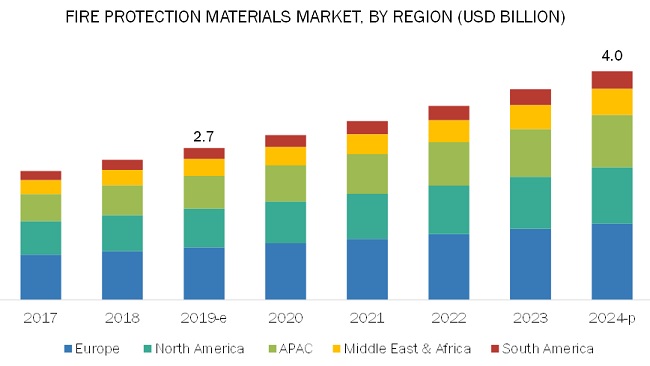

The fire protection materials market was valued at USD 2.7 billion in 2019 and is projected to reach USD 4.0 billion by 2024, growing at a cagr 8.5% from 2019 to 2024. Increasing demand for passive fire protection systems fueled by stringent building codes and fire safety policies are driving the market. North America is the key market for fire protection materials globally, followed by Europe and APAC.

Coatings are expected to lead the market during the forecast period.

Based on type, the fire protection materials market is segmented into coatings, mortar, sealants & fillers, sheets\boards, spray, preformed device, putty, and cast-in devices, and others (ablative and perlite). Coatings is estimated to lead the market. This is due to its fire proofing application in the construction industry. The growth of steel consumption plays a huge role in the demand for coatings in the construction industry. The market by type is greatly affected by the growing construction industry globally.

Commercial construction is projected to be the largest application of fire protection materials market during the forecast period.

Commercial construction is projected to dominate the fire protection materials market during the forecast period. The growing demand for a passive fire protection system and increased emphasis on fire safety codes and regulations are driving its application. Increased commercial construction activities are a result of increased capital expenditure on all types of commercial centers which include, hospitals, institutions, education centers, and offices. The growth of the retail industry plays a vital role in commercial expansion; thus, it will also have a significant impact on the commercial application of this market.

North America is expected to account for the largest share of the fire protection materials market during the forecast period.

North America is expected to account for the largest market share in the fire protection materials market during the forecast period. The presence of various key fire-stopping and fire protection market players, such as Hilti Group (Liechtenstein), 3M (US), Specified Technologies Inc. (US), and Morgan Advanced Materials (UK), along with the strict implementation of NFPA codes has a positive impact on the market. Additionally, the growing emphasis on passive fire protection systems influenced by fire-stop contractors and regulatory organizations has a huge impact on this market.

Fire Protection Materials Market Players

The key market players profiled in the report include as Hilti Group (Liechtenstein), 3M (US), Specified Technologies Inc. (US), ETEX (Belgium), Morgan Advanced Materials (UK), Akzo Nobel NV (Netherlands), Jotun (Norway), Sika AG (Switzerland), and Rolf Kuhn GmbH (Germany).

Hilti is the largest player in the fire protection materials market. The company is developing its business via expansion in countries such as APAC and North America. It mainly focuses on direct selling and expansion to strengthen its position in the market. The company is also focusing on new product developments and product listing via UL documents to strengthen its product portfolio.

ETEX is one of the major manufacturers of fire protection materials. The company is one of the leading innovators in this market. It is expected to have the highest number of UL listed products according to experts. During the forecast period, the company is expected to compete for the leading position in the global market.

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Fire Protection Materials Market Report Scope

|

Report Metric |

Details |

|

Years considered for the study |

2017-2024 |

|

Base year considered |

2018 |

|

Forecast period |

2019–2024 |

|

Unit considered |

Value (USD Billion) |

|

Segments covered |

Type, application, and region |

|

Regions covered |

Europe, North America, APAC, Middle East & Africa and South America |

|

Companies profiled |

Hilti Group (Liechtenstein), 3M (US), Specified Technologies Inc. (US), ETEX (Belgium), Morgan Advanced Materials (UK), Akzo Nobel NV (Netherlands), BASF (Germany) and Isolatek International (US) Top 20 major players covered |

This report categorizes the global fire protection materials market based on type, application, and region.

On the basis of Type, the fire protection materials market has been segmented as follows:

- Coatings

- Mortar

- Sealants & Fillers

- Sheets/Boards

- Spray

- Preformed Device

- Putty

- Cast-In Devices

- Others (ablative and perlite)

On the basis of Application, the fire protection materials market has been segmented as follows:

- Commercial

- Industrial

- Residential

On the basis of Region, the fire protection materials market has been segmented as follows:

- North America

- Europe

- Asia Pacific

- Middle East & Africa

- South America

Key Questions addressed by the report

- What are the major changes impacting market development?

- How will all the developments shape the industry in the mid to long term?

- What are the upcoming products of the fire protection materials market?

- What are the emerging markets for fire protection materials?

- What initiatives are companies undertaking to tap into the potential of the industry?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 16)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Regions Covered

1.3.2 Years Considered for the Study

1.3.3 Currency

1.3.4 Limitations

1.4 Stakeholders

2 Research Methodology (Page No. - 19)

2.1 Research Data

2.1.1 Primary and Secondary Research

2.1.2 Secondary Data

2.1.2.1 Key Data From Secondary Sources

2.1.3 Primary Data

2.1.3.1 Key Data From Primary Sources

2.1.3.2 Breakdown of Primary Interviews

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

2.3 Data Triangulation

2.4 Research Assumption

3 Executive Summary (Page No. - 25)

4 Premium Insights (Page No. - 29)

4.1 Attractive Market Opportunities for Fire Protection Materials Manufacturers

4.2 Fire Protection Materials Market, By Region

4.3 Fire Protection Materials Market Share, By Application

4.4 North America: Fire Protection Materials Market, By Type and Country

4.5 Fire Protection Materials Market Attractiveness

5 Market Overview (Page No. - 32)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Increasing Fire Safety Regulations

5.2.1.2 Growing Incentives and Construction Activities Globally

5.2.1.3 Rising Number of Fire Incidents

5.2.2 Restraints

5.2.2.1 Rising Environmental and Health Concerns Due to the Use of Conventional Fire Protection Materials

5.2.2.2 Price Sensitivity in the Emerging Regions

5.2.3 Opportunities

5.2.3.1 Development of More Effective Synergist Compounds

5.2.4 Challenges

5.2.4.1 Lack of Awareness and Non-Compliance to the Regulations in the Emerging Markets

5.3 Porter’s Five Forces Analysis

5.3.1 Threat of New Entrants

5.3.2 Bargaining Power of Suppliers

5.3.3 Threat of Substitutes

5.3.4 Bargaining Power of Buyers

5.3.5 Intensity of Competitive Rivalry

6 Fire Protection Materials Market, By Type (Page No. - 39)

6.1 Introduction

6.2 Coatings

6.2.1 Intumescent Coatings

6.2.2 Cementitious Coatings

6.3 Mortar

6.4 Sealants & Fillers

6.5 Sheets/Boards

6.6 Spray

6.7 Preformed Device

6.7.1 Pillow

6.7.2 Wrap-Strips

6.7.3 Collars

6.7.4 Pu-Brick

6.8 Putty

6.9 Cast-In Devices

6.10 Others

7 Fire Protection Fire Protection Materials Market, By Application (Page No. - 50)

7.1 Introduction

7.2 Commercial

7.3 Industrial

7.4 Residential

8 Fire Protection Fire Protection Materials Market, By Region (Page No. - 55)

8.1 Introduction

8.2 North America

8.2.1 US

8.2.2 Canada

8.2.3 Mexico

8.3 Europe

8.3.1 Germany

8.3.2 UK

8.3.3 France

8.3.4 Italy

8.3.5 Russia

8.3.6 Spain

8.4 APAC

8.4.1 China

8.4.2 Japan

8.4.3 India

8.4.4 South Korea

8.4.5 Indonesia

8.5 Middle East & Africa

8.5.1 Middle East

8.5.2 Africa

8.6 South America

8.6.1 Brazil

8.6.2 Argentina

9 Competitive Landscape (Page No. - 105)

9.1 Overview

9.2 Competitive Leadership Mapping (Overall Market)

9.2.1 Visionary Leaders

9.2.2 Innovators

9.2.3 Dynamic Differentiators

9.2.4 Emerging Companies

9.3 Key Market Players

9.3.1 New Product Launches

9.3.2 Expansions

10 Company Profiles (Page No. - 110)

10.1 Hilti Group

10.1.1 Business Overview

10.1.2 Products Offered

10.1.3 Winning Imperatives

10.1.4 Current Focus and Strategies

10.1.5 Threat From Competition

10.1.6 Hilti's Right to Win

10.2 3M

10.2.1 Business Overview

10.2.2 Products Offered

10.2.3 Winning Imperatives

10.2.4 Current Focus and Strategies

10.2.5 Threat From Competition

10.2.6 3M’s Right to Win

10.3 Akzo Nobel N.V.

10.3.1 Business Overview

10.3.2 Products Offered

10.3.3 Recent Developments

10.3.4 Winning Imperatives

10.3.5 Current Focus and Strategies

10.3.6 Threat From Competition

10.3.7 Akzo Nobel N.V.'S Right to Win

10.4 Morgan Advanced Materials

10.4.1 Business Overview

10.4.2 Products Offered

10.4.3 Winning Imperatives

10.4.4 Current Focus and Strategies

10.4.5 Threat From Competition

10.4.6 Morgan Advanced Material's Right to Win

10.5 Specified Technologies Inc.

10.5.1 Business Overview

10.5.2 Products Offered

10.5.3 Recent Developments

10.5.4 Winning Imperatives

10.5.5 Current Focus and Strategies

10.5.6 Threat From Competition

10.5.7 Specified Technologies Inc.'S Right to Win

10.6 ETEX

10.6.1 Business Overview

10.6.2 Products Offered

10.6.3 Recent Developments

10.6.4 Winning Imperatives

10.6.5 Current Focus and Strategies

10.6.6 Threat From Competition

10.6.7 ETEX's Right to Win

10.7 Tremco Incorporated

10.7.1 Business Overview

10.7.2 Products Offered

10.7.3 Current Focus and Strategies

10.7.4 Tremco's Right to Win

10.8 BASF SE

10.8.1 Business Overview

10.8.2 Products Offered

10.8.3 Current Focus and Strategies

10.8.4 Threat From Competition

10.8.5 BASF's Right to Win

10.9 Isolatek International

10.9.1 Business Overview

10.9.2 Products Offered

10.9.3 Current Focus and Strategies

10.9.4 Threat From Competition

10.9.5 Isolatek International's Right to Win

10.10 USG Corporation

10.10.1 Business Overview

10.10.2 Product Offering: Scorecard

10.10.3 Products Offered

10.10.4 Current Focus and Strategies

10.10.5 Threat From Competition

10.10.6 USG's Right to Win

10.11 Other Key Market Players

10.11.1 Hempel Group (Denmark)

10.11.2 PPG Industries Inc. (US)

10.11.3 W. R. Grace & Co. (US)

10.11.4 Rolf Kuhn GmbH.(Germany)

10.11.5 Fire Protection Coatings Limited (UK)

10.11.6 No-Burn Inc.(US)

10.11.7 The Sherwin-Williams Company (US)

10.11.8 Contego International Inc. (US)

10.11.9 Sika Group (Switzerland)

10.11.10 Supremex Equipments (India)

10.11.11 Den Braven (The Netherlands)

10.11.12 Walraven (The Netherlands)

10.11.13 Tenmat LTD. (UK)

10.11.14 Dufaylite Developments LTD (UK)

10.11.15 Rectorseal (US)

11 Appendix (Page No. - 138)

11.1 Insights of Industry Experts

11.2 Discussion Guide

11.3 Knowledge Store: Marketsandmarkets Subscription Portal

11.4 Available Customizations

11.5 Related Reports

11.6 Author Details

List of Tables (104 Tables)

Table 1 List of Major Secondary Sources

Table 2 Fire Protection Materials Market Size, By Type, 2017–2024 (USD Million)

Table 3 Fire Protection Coatings Market Size, By Region, 2017-2024 (USD Million)

Table 4 Fire Protection Intumescent Coatings Market Size, By Region, 2017–2024 (USD Million)

Table 5 Fire Protection Cementitious Coatings Market Size, By Region, 2017–2024 (USD Million)

Table 6 Fire Protection Mortar Market Size, By Region, 2017–2024 (USD Million)

Table 7 Fire Protection Sealants & Fillers Market Size, By Region, 2017–2024 (USD Million)

Table 8 Fire Protection Sheets/Boards Market Size, By Region, 2017–2024 (USD Million)

Table 9 Fire Protection Spray Market Size, By Region, 2017–2024 (USD Million)

Table 10 Fire Protection Preformed Devices Market Size, By Region, 2017–2024 (USD Million)

Table 11 Fire Protection Pillows Market Size, By Region, 2017–2024 (USD Million)

Table 12 Fire Protection Wrap Strips Market Size, By Region, 2017-2024 (USD Million)

Table 13 Fire Protection Collars Market Size, By Region, 2017–2024 (USD Million)

Table 14 Fire Protection Pu-Bricks Market Size, By Region, 2017–2024 (USD Million)

Table 15 Fire Protection Putty Market Size, By Region, 2017–2024 (USD Million)

Table 16 Fire Protection Cast-In Devices Market Size, By Region, 2017–2024 (USD Million)

Table 17 Other Fire Protection Materials Market Size, By Region, 2017–2024 (USD Million)

Table 18 Fire Protection Fire Protection Materials Market Size, By Application, 2017–2024 (USD Million)

Table 19 Fire Protection Fire Protection Materials Market Size in Commercial Application, By Region, 2017–2024 (USD Million)

Table 20 Fire Protection Materials Market Size in Industrial Application, By Region, 2017–2024 (USD Million)

Table 21 Fire Protection Materials Market Size in Residential Application, By Region, 2017–2024 (USD Million)

Table 22 Fire Protection Materials Market Size, By Region, 2017–2024 (USD Million)

Table 23 North America: Fire Protection Materials Market Size, By Country, 2017–2024 (USD Million)

Table 24 North America: Fire Protection Materials Market Size, By Type, 2017–2024 (USD Million)

Table 25 North America: Fire Protection Coatings Market Size, By Sub-Type, 2017–2024 (USD Million)

Table 26 North America: Fire Protection Preformed Devices Market Size, By Sub-Type, 2017–2024 (USD Million)

Table 27 North America: Fire Protection Materials Market Size, By Application, 2017–2024 (USD Million)

Table 28 US: Fire Protection Materials Market Size, By Type, 2017–2024 (USD Million)

Table 29 US: Fire Protection Preformed Devices Market Size, By Sub-Type, 2017–2024 (USD Million)

Table 30 US: Fire Protection Materials Market Size, By Application, 2017–2024 (USD Million)

Table 31 Canada: Fire Protection Materials Market Size, By Type, 2017–2024 (USD Million)

Table 32 Canada: Fire Protection Preformed Device Market Size, By Sub-Type, 2017–2024 (USD Million)

Table 33 Canada: Fire Protection Materials Market Size, By Application, 2017–2024 (USD Million)

Table 34 Mexico: Fire Protection Materials Market Size, By Type, 2017–2024 (USD Million)

Table 35 Mexico: Fire Protection Preformed Device Market Size, By Sub-Type, 2017–2024 (USD Million)

Table 36 Mexico: Fire Protection Materials Market Size, By Application, 2017–2024 (USD Million)

Table 37 Europe: Fire Protection Materials Market Size, By Country, 2017–2024 (USD Million)

Table 38 Europe: Fire Protection Materials Market Size, By Type, 2017–2024 (USD Million)

Table 39 Europe: Fire Protection Coatings Market Size, By Sub-Type, 2017–2024 (USD Million)

Table 40 Europe: Fire Protection Preformed Device Market Size, By Sub-Type, 2017–2024 (USD Million)

Table 41 Europe: Fire Protection Materials Market Size, By Application, 2017–2024 (USD Million)

Table 42 Germany: Fire Protection Materials Market Size, By Type, 2017–2024 (USD Million)

Table 43 Germany: Fire Protection Preformed Device Market Size, By Sub-Type, 2017–2024 (USD Million)

Table 44 Germany: Fire Protection Materials Market Size, By Application, 2017–2024 (USD Million)

Table 45 UK: Fire Protection Materials Market Size, By Type, 2017–2024 (USD Million)

Table 46 UK: Fire Protection Preformed Device Market Size, By Sub-Type, 2017–2024 (USD Million)

Table 47 UK: Fire Protection Materials Market Size, By Application, 2017–2024 (USD Million)

Table 48 France: Fire Protection Materials Market Size, By Type, 2017–2024 (USD Million)

Table 49 France: Fire Protection Preformed Device Market Size, By Sub-Type, 2017–2024 (USD Million)

Table 50 France: Fire Protection Materials Market Size, By Application, 2017–2024 (USD Million)

Table 51 Italy: Fire Protection Materials Market Size, By Type, 2017–2024 (USD Million)

Table 52 Italy: Fire Protection Preformed Device Market Size, By Sub-Type, 2017–2024 (USD Million)

Table 53 Italy: Fire Protection Materials Market Size, By Application, 2017–2024 (USD Million)

Table 54 Russia: Fire Protection Materials Market Size, By Type, 2017–2024 (USD Million)

Table 55 Russia: Fire Protection Preformed Device Market Size, By Sub-Type, 2017–2024 (USD Million)

Table 56 Russia: Fire Protection Materials Market Size, By Application, 2017–2024 (USD Million)

Table 57 Spain: Fire Protection Materials Market Size, By Type, 2017–2024 (USD Million)

Table 58 Spain: Fire Protection Preformed Device Market Size, By Sub-Type, 2017–2024 (USD Million)

Table 59 Spain: Fire Protection Materials Market Size, By Application, 2017–2024 (USD Million)

Table 60 APAC: Fire Protection Materials Market Size, By Country, 2017–2024 (USD Million)

Table 61 APAC: Fire Protection Materials Market Size, By Type, 2017–2024 (USD Million)

Table 62 APAC: Fire Protection Coatings Market Size, By Sub-Type, 2017–2024 (USD Million)

Table 63 APAC: Fire Protection Preformed Device Market Size, By Sub-Type, 2017–2024 (USD Million)

Table 64 APAC: Fire Protection Materials Market Size, By Application, 2017–2024 (USD Million)

Table 65 China: Fire Protection Materials Market Size, By Type, 2017–2024 (USD Million)

Table 66 China: Fire Protection Preformed Device Market Size, By Sub-Type, 2017–2024 (USD Million)

Table 67 China: Fire Protection Materials Market Size, By Application, 2017–2024 (USD Million)

Table 68 Japan: Fire Protection Materials Market Size, By Type, 2017–2024(USD Million)

Table 69 Japan: Fire Protection Preformed Device Market Size, By Sub-Type, 2017–2024 (USD Million)

Table 70 Japan: Fire Protection Materials Market Size, By Application, 2017–2024 (USD Million)

Table 71 India: Fire Protection Materials Market Size, By Type, 2017–2024 (USD Million)

Table 72 India: Fire Protection Preformed Device Market Size, By Sub-Type, 2017–2024 (USD Million)

Table 73 India: Fire Protection Materials Market Size, By Application, 2017–2024 (USD Million)

Table 74 South Korea: Fire Protection Materials Market Size, By Type, 2017–2024 (USD Million)

Table 75 South Korea: Fire Protection Preformed Device Market Size, By Sub-Type, 2017–2024 (USD Million)

Table 76 South Korea: Fire Protection Materials Market Size, By Application, 2017–2024 (USD Million)

Table 77 Indonesia: Fire Protection Materials Market Size, By Type, 2017–2024 (USD Million)

Table 78 Indonesia: Fire Protection Preformed Device Market Size, By Sub-Type, 2017–2024 (USD Million)

Table 79 Indonesia: Fire Protection Materials Market Size, By Application, 2017–2024 (USD Million)

Table 80 Middle East & Africa: Fire Protection Materials Market Size, By Region, 2017–2024 (USD Million)

Table 81 Middle East & Africa: Fire Protection Materials Market Size, By Type, 2017–2024 (USD Million)

Table 82 Middle East & Africa: Fire Protection Coatings Market Size, By Sub-Type, 2017–2024 (USD Million)

Table 83 Middle East & Africa: Fire Protection Preformed Device Market Size, By Sub-Type, 2017–2024 (USD Million)

Table 84 Middle East & Africa: Fire Protection Materials Market Size, By Application, 2017–2024 (USD Million)

Table 85 Middle East: Fire Protection Materials Market Size, By Type, 2017–2024 (USD Million)

Table 86 Middle East: Fire Protection Preformed Device Market Size, By Sub-Type, 2017–2024 (USD Million)

Table 87 Middle East: Fire Protection Materials Market Size, By Application, 2017–2024 (USD Million)

Table 88 Africa: Fire Protection Materials Market Size, By Type, 2017–2024 (USD Million)

Table 89 Africa: Fire Protection Preformed Device Market Size, By Sub-Type, 2017–2024 (USD Million)

Table 90 Africa: Fire Protection Materials Market Size, By Application, 2017–2024 (USD Million)

Table 91 South America: Fire Protection Materials Market Size, By Country, 2017–2024 (USD Million)

Table 92 South America: Fire Protection Materials Market Size, By Type, 2017–2024 (USD Million)

Table 93 South America: Fire Protection Coatings Market Size, By Sub-Type, 2017–2024 (USD Million)

Table 94 South America: Fire Protection Preformed Device Market Size, By Sub-Type, 2017–2024 (USD Million)

Table 95 South America: Fire Protection Materials Market Size, By Application, 2017–2024 (USD Million)

Table 96 Brazil: Fire Protection Materials Market Size, By Type, 2017–2024 (USD Million)

Table 97 Brazil: Fire Protection Preformed Device Market Size, By Sub-Type, 2017–2024 (USD Million)

Table 98 Brazil: Fire Protection Materials Market Size, By Application, 2017–2024 (USD Million)

Table 99 Argentina: Fire Protection Materials Market Size, By Type, 2017–2024 (USD Million)

Table 100 Argentina: Fire Protection Preformed Device Market Size, By Sub-Type, 2017–2024 (USD Million)

Table 101 Argentina: Fire Protection Materials Market Size, By Application, 2017–2024 (USD Million)

Table 102 Major Fire Protection Material Producers

Table 103 New Product Launches, 2018–2019

Table 104 Expansions, 2019

List of Figures (53 Figures)

Figure 1 Market Segmentation

Figure 2 Global Market Calculation

Figure 3 Market Calculation, By Application

Figure 4 Market Calculation, By Type

Figure 5 Market Calculation, By Region

Figure 6 Fire Protection Fire Protection Materials Market: Bottom-Up Approach

Figure 7 Fire Protection Fire Protection Materials Market: Top-Down Approach

Figure 8 Fire Protection Fire Protection Materials Market: Data Triangulation

Figure 9 Commercial Application to Dominate the Market During the Forecast Period

Figure 10 Coatings to Be the Largest Type of Fire Protection Materials During the Forecast Period

Figure 11 North America to Be the Largest Market Between 2019 and 2024

Figure 12 Growth in Global Construction Activities is Propelling the Market for Fire Protection Materials

Figure 13 North America to Be the Largest Fire Protection Materials Market Between 2019 and 2024

Figure 14 Commercial Application Dominated the Fire Protection Materials Market in 2018

Figure 15 US Was the Largest Market for Fire Protection Materials in North America

Figure 16 China to Witness High Demand for Fire Protection Materials Between 2019 and 2024

Figure 17 Drivers, Restraints, Opportunities, and Challenges in the Fire Protection Materials Market

Figure 18 APAC Accounts for the Largest in the Construction Industry.

Figure 19 Number of Structural Fire Incident as Reported By International Association of Fire and Rescue Services for 2016?

Figure 20 Porter’s Five Forces Analysis: Fire Protection Materials Market

Figure 21 Coatings to Dominate the Market During the Forecast Period

Figure 22 Commercial to Be the Largest Application of Fire Protection Materials

Figure 23 APAC is the Leading Region in Number of 200 Meter Or Taller Buildings Completed in 2018

Figure 24 North America to Be the Largest Fire Protection Materials Market

Figure 25 North America: Fire Protection Materials Market Snapshot

Figure 26 US to Be the Largest Market for Fire Protection Materials in North America

Figure 27 Coatings to Be the Largest Type in the Market

Figure 28 Europe: Fire Protection Materials Market Snapshot

Figure 29 Germany to Be the Largest Market for Fire Protection Materials in Europe

Figure 30 Coatings Segment to Capture the Largest Share in Germany’s Fire Protection Materials Market

Figure 31 Coatings Account for Largest Share of UK Fire Protection Materials Market

Figure 32 APAC: Fire Protection Materials Market Snapshot

Figure 33 China to Be the Largest Fire Protection Materials Market in APAC

Figure 34 China Accounts for the Largest Number of Buildings Completed, Taller Than 200 Meters

Figure 35 Mortar to Be the Second-Largest Type in the Country During the Forecast Period

Figure 36 Middle East Dominates Fire Protection Materials Market in the Middle East & Africa Region

Figure 37 Coatings Segment Accounts for Largest Share of Overall Protection Materials Market in Africa

Figure 38 Brazil is Largest Fire Protection Materials Market in South America

Figure 39 Fire Protection Materials Market for Construction (Global) Competitive Leadership Mapping, 2018

Figure 40 Top 4 Players Accounted for the Major Market Share in 2015

Figure 41 Hilti Group: Company Snapshot

Figure 42 Hilti Group: Winning Imperatives

Figure 43 3M: Company Snapshot

Figure 44 3M: Winning Imperatives

Figure 45 Akzo Nobel N.V.: Company Snapshot

Figure 46 Akzo Nobel N.V.: Winning Imperatives

Figure 47 Morgan Advanced Materials: Company Snapshot

Figure 48 Morgan Advanced Material: Winning Imperatives

Figure 49 Specified Technologies Inc.: Winning Imperatives

Figure 50 ETEX: Company Snapshot

Figure 51 ETEX: Winning Imperatives

Figure 52 BASF SE: Company Snapshot

Figure 53 USG Corporation: Company Snapshot

The study involved four major activities in estimating the market size for fire protection materials. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, the market breakdown and data triangulation procedures were used to estimate the market size of the segments and sub segments.

Secondary Research

Secondary sources used in this study included annual reports, press releases, and investor presentations of companies; white papers; certified publications; articles from recognized authors; and gold standard & silver standard websites, such as Factiva, ICIS, and Bloomberg. Findings of this study were verified through primary research by conducting extensive interviews with key officials, such as CEOs, VPs, directors, and other executives.

Primary Research

The fire protection market comprises several stakeholders, such as raw material suppliers, end-product manufacturers, and regulatory organizations in the supply chain. The demand side of this market is characterized by the development of the applications, such as commercial construction, industrial construction and residential construction. The supply side is characterized by type of products and width of the product portfolio. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information.

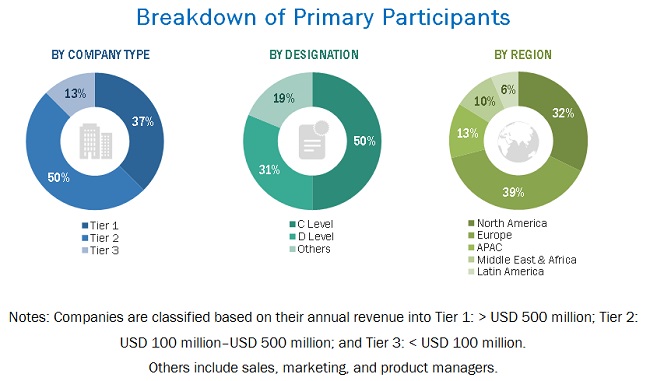

The breakdown of profiles of the primary interviewees is illustrated in the figure below:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the fire protection materials market. These methods were also used extensively to estimate the size of various sub-segments in the market. The research methodology used to estimate the market size includes the following:

The key players in the industry were identified through extensive secondary research.

- The industry’s supply chain and market size in terms of value were determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size using the market size estimation processes as explained above—the market was split into several segments and sub-segments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and sub-segments, the data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides in the construction applications

Report Objectives

- To estimate and forecast the market size of fire protection materials in terms of value

- To provide detailed information regarding the important factors (drivers, restraints, opportunities, and challenges) influencing the growth of the market

- To define, describe, and forecast the global fire protection materials market by type and application

- To forecast the market size based on five key regions, namely, Asia Pacific (APAC), Europe, North America, the Middle East & Africa, and South America

- To strategically analyze the market with respect to individual growth trends, prospects, and their contribution to the overall market

- To analyze opportunities for stakeholders in the market and provide a competitive landscape for the market leaders

- To strategically profile the key players and comprehensively analyze their core competencies

Available Customizations

Along with the given market data, MarketsandMarkets offers customizations according to the company’s specific needs. The following customization options are available for the report:

Regional Analysis

- Further breakdown of a region with respect to a particular country or application

Company Information

- Detailed analysis and profiles of additional market players (up to five)

Growth opportunities and latent adjacency in Fire Protection Materials Market