High Performance Computing as a Service Market by Verticals (BFSI, Healthcare and Life Sciences, Manufacturing), Deployment Type (Colocation, Hosted Private Cloud, Public Cloud), Component, Region - Global Forecast to 2023

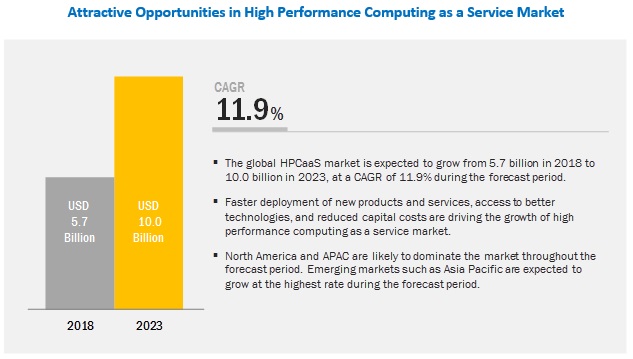

[107 Pages Report] The high performance computing as a service market projected to reach USD 10.0 billion by 2023 from USD 5.7 billion in 2018, at a CAGR of 11.9%. Growth in this HPC as a service market is driven by the deployment of new products and services, access to better technologies, and reduced capital costs.

To know about the assumptions considered for the study, Request for Free Sample Report

The healthcare and life sciences segment is expected to grow at the highest CAGR from 2018 to 2023

The number of life science applications are expected to increase in the future, thus leading to an increase in data storage requirements. Data-intensive applications such as genomics, protein modeling, personalized medicine, and data mining that require real-time data processing will drive the adoption of HPC as a service.

Platform as a service is expected to grow at the highest CAGR during the forecast period.

Majority of Independent Software Vendors (ISV’s) are delivering or are planning to deliver cloud-based versions of their offerings for HPC. Major roadblocks for “as a service” adoption is the cost of the licensed or commercial products. Furthermore, they are bulky to run on the cloud and are expensive too.

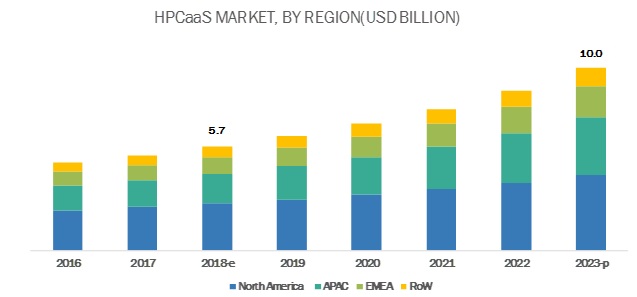

Asia Pacific is expected to experience the highest growth in the High Performance Computing as a Service market

By Region, APAC is dominating the HPC as a service market as China is emphasizing on enhancing its supercomputing capabilities. Recently, China topped with 202 supercomputers in the world’s top 500 supercomputers survey.

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

The major High Performance Computing as a service market vendors are IBM (US), AWS (US), Microsoft (US), Cray (US), Sabalcore Computing (US), Google (US), Penguin Computing (US), Adaptive Computing (US), Nimbix (US), Uber Cloud (US), HPE (US), and Dell (US).

Microsoft Corporation is a global vendor in providing a diverse set of software, licensing, hardware products and solutions across different industrial verticals for over three decades. The company is focused on expanding its expertise in the mobile, cloud, and security domain. It also emphasizes on driving innovations in all of its product offerings. It focuses on strategic partnerships with industry co-leaders to enhance its global reach and offerings. It partnered with companies such as AT&T and CA Technologies to expand its customer base and reach. The company primarily aims to enrich the technological usage experience for all its clients, both in personal and business-related functioning by providing its customers with highly valued, economical, and convenient product offerings integrated with the latest technological solutions and services. Considering the current market scenario, the company’s strategic focus is to create new market opportunities for its range of cloud solutions and to increase customer satisfaction with service enhancement.

Scope of the Report

|

Report Metric |

Details |

|

Market size available for years |

2017–2023 |

|

Base year considered |

2017 |

|

Forecast period |

2018–2023 |

|

Forecast units |

Values (USD Billion), |

|

Segments covered |

By vertical, deployment type, component, and region |

|

Geographies covered |

North America, Europe, APAC, and RoW |

|

Companies covered |

|

This research report categorizes the high performance computing as a service market based on the type of vertical, deployment type, component, and region.

On the basis of Vertical, the high performance computing as a service market is segmented as follows:

- BFSI

- Healthcare and Life Sciences

- Manufacturing

- Electronic Devices and Automation

- Weather

- Others (Military and Defense, Media, and Entertainment, Academia and Research, Online Gaming, and Government)

On the basis of Deployment type, the market is segmented as follows:

- Colocation

- Hosted Private Cloud

- Public Cloud

On the basis of Component, the market is segmented as follows:

- SaaS

- PaaS

- IaaS

On the basis of region, the market is segmented as follows:

- North America

- Asia Pacific

- Europe, Middle East, and Africa

- Latin America

Key questions addressed by the report:

- Who are the major players in the high performance computing as a service market?

- What are the growth trends and the largest revenue-generating regions for market?

- How is high performance computing as a service is catered to customers?

- What are the major types of high performance computing services?

- Which verticals are major adaptors in market?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 12)

1.1 Objectives of the Study

1.2 Market Scope&

1.3 Market Definition

1.4 Currency

1.5 Limitation

1.6 Stakeholders

2 Research Methodology (Page No. - 16)

2.1 Research Data

2.1.1 Key Data From Secondary Data

2.1.2 Key Data From Primary Data

2.2 High Performance Computing as a Service Market Size Estimation: Bottom-Up and Top-Down Approach

2.3 Vendor Analysis Matrix Methodology

2.3.1 Vendor Inclusion Criteria

2.4 Research Assumptions

3 Premium Insights (Page No. - 24)

3.1 Premium Insights

4 High Performance Computing as a Service Market Overview (Page No. - 26)

4.1 Market Drivers

4.2 Market Restraints

4.3 Market Opportunity & Challenges

5 Global Market Opportunity (Page No. - 32)

5.1 Global HPC as a service Market Opportunity

5.2 Global Market Opportunity, By Vertical

5.3 Global Market Opportunity, By Deployment Type

5.4 Global Market Opportunity, By Component

5.5 Global Market Opportunity, By Region

6 End User Analysis (Page No. - 42)

6.1 End User Analysis, Adoption Trend

6.2 End User Analysis, By Spending

6.3 End User Analysis, By Deployment

6.4 End User Analysis, By Workload

6.5 End User Analysis, High Performance Computing as a Service Market Share

6.5.1 End User Analysis: Software By Manufacturing Application

6.5.2 End User Analysis: Software By BFSI Application

6.5.3 End User Analysis: Software By Healthcare and Life science Application

6.5.4 End User Analysis: Software By Electronic Design Automation Application

6.5.5 End User Analysis: Software By Weather Application

7 Competitive Landscape (Page No. - 53)

7.1 Ecosystem

7.2 Vendor Strategy

7.3 Growth Strategy

7.4 Vendor Offerings: Market Snapshot

7.4.1 Vendor Offerings Comparison – Tier I

7.4.2 Vendor Offerings Comparison – Tier II

8 Company Profile (Page No. - 70)

8.1 IBM

8.2 AWS

8.3 Microsoft

8.4 Penguin Computing

8.5 Sabalcore Computing

8.6 Adaptive Computing

8.7 Nimbix

8.8 Google

8.9 Cray

8.10 Ubercloud

8.11 HPE

8.12 Dell

9 Appendix (Page No. - 100)

9.1 MarketsandMarkets Knowledge Store: Snapshot

9.2 Our Custom Research and Consulting

9.3 List of Abbreviations

9.4 Related Reports

9.5 Disclaimer

List of Tables (21 Tables)

Table 1 Key Data From Secondary Sources

Table 2 Key Data From Primary Sources

Table 3 Research Assumptions

Table 4 Global High Performance Computing as a Service Market Size, 2018–2023 (USD Billion)

Table 5 Global HPC as a service Market Size, By Verticals, 2018–2023 (USD Billion)

Table 6 Global Market Size, By Deployment Type, 2018–2023 (USD Billion)

Table 7 Global Market Size, By Component, 2018–2023 (USD Billion)

Table 8 Global Market Size, By Region, 2018–2023 (USD Billion))

Table 9 Top ISV Software, 2018

Table 10 Top Open Source Software, 2018

Table 11 End User Analysis: Manufacturing Applications

Table 12 End User Analysis: BFSI Applications

Table 13 End User Analysis: Healthcare & Life Science Applications

Table 14 End User Analysis: EDA Applications

Table 15 End User Analysis: Weather Applications

Table 16 Partnerships, Agreements, and Collaborations

Table 17 New Product Launches and Upgradations

Table 18 High Performance Computing as a Service Market: Mergers and Acquisitions

Table 19 HPC as a service Vendor Offerings Snapshot

Table 20 Vendor Offerings Comparison - Tier I

Table 21 Vendor Offerings Comparison - Tier II

List of Figures (31 Figures)

Figure 1 High Performance Computing as a Service Market Covered

Figure 2 Years Considered in the Report

Figure 3 Global Open Source Service Market: Research Design

Figure 4 Market Size Estimation Methodology: Bottom-Up Approach

Figure 5 Market Size Estimation Methodology: Top-Down Approach

Figure 6 Vendor Analysis: Criteria Weightage

Figure 7 Market Drivers: Regional

Figure 8 Market Drivers: Vertical

Figure 9 Market Restraints: Regional

Figure 10 Market Restraints: Vertical

Figure 11 Global HPC as a service Market, 2018–2023 (USD Billion)

Figure 12 Global Market Size, By Vertical, 2018–2023 (USD Billion)

Figure 13 Global Market, By Deployment Type, 2018–2023 (USD Billion)

Figure 14 Global Market, By Component, 2018–2023 (USD Billion)

Figure 15 Global Market Size, By Region, 2018–2023 (USD Billion)

Figure 16 Current Status of Adoption

Figure 17 Spending Evaluation

Figure 18 Deployment Preferences

Figure 19 HPC as a service Usage Evaluation

Figure 20 HPC as a service Software Market Share, By Type, 2018

Figure 21 Ecosystem Vendor Classification

Figure 22 Vendor Strategy – Tier I

Figure 23 Vendor Strategy – Tier II

Figure 24 Companies Adopted the Strategy of New Product Launches and Upgradations as the Key Growth Strategy During the Period 2016–2018

Figure 25 High Performance Computing as a Service Market Evaluation Framework

Figure 26 Battle for Market Share: Partnerships, Agreements, and Collaborations has Been the Key Strategy Adopted By Key Players in the Global Open Source Software Market

Figure 27 IBM: Company Snapshot

Figure 28 Microsoft: Company Snapshot

Figure 29 Google: Company Snapshot

Figure 30 Cray: Company Snapshot

Figure 31 HPE: Company Snapshot

The study involved 4 major activities in estimating the current size of the HPC as a service market. Exhaustive secondary research was done to collect information on the market as well as its peer and parent markets. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both the top-down and bottom-up approaches were employed to estimate complete market size. Thereafter, market breakdown and data triangulation procedures were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources such as Hoovers, Bloomberg BusinessWeek, Forbes, and Dun & Bradstreet have been referred to so as to identify and collect information useful for a technical, market-oriented, and commercial study of HPC as a service market. These secondary sources included annual reports, press releases and investor presentations of companies, white papers, World Bank (US), and the Organization for Economic Co-operation and Development (OECD).

Secondary data was collected and analyzed to arrive at the overall market splits, which were further validated using primary research. Secondary research was mainly used to obtain key information about the industry’s supply chain, the total pool of key players, market classification, and segmentation, according to the industry trends to the bottom-most level and regional markets. It was also used to obtain information about the key developments from a market-oriented perspective.

Primary Research

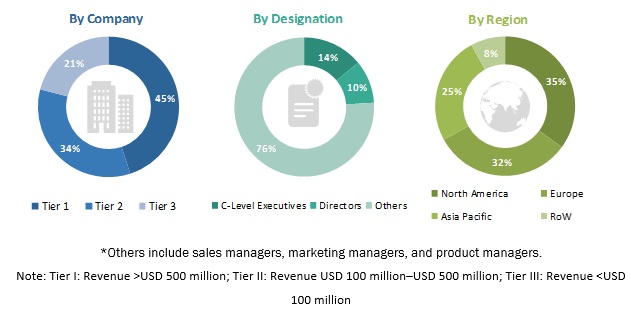

Extensive primary research was conducted after acquiring extensive knowledge about the HPC as a service market through secondary research. Primary interviews were conducted with market experts from both the demand-side across all four major geographies. Approximately 30% and 70% of primary interviews were conducted with both the demand and supply sides, respectively. This primary data was collected through questionnaires, e-mails, online surveys, and telephonic interviews. Given below is the breakdown of the primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the total size of the HPC as a service market. These approaches were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- Key players were identified through extensive secondary research

- Software product portfolios were studied for each player

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources

- All the possible parameters that affect the market covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data

Data Triangulation

After deriving the overall HPC as a service market, data, the total market value data was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all the segments, data triangulation and market breakdown procedures were employed wherever applicable. The data was triangulated by studying various qualitative & quantitative variables as well as by analyzing regional trends for both the demand- and supply-side macro indicators.

Report Objectives

- To define, describe, segment, and forecast the HPC as a service market by vertical, deployment type, component, and region

- To provide detailed information about the factors influencing market growth (drivers, restraints, opportunities, and challenges)

- To strategically analyze micro markets with respect to individual growth trends, prospects, and contributions to the overall market

- To analyze market opportunities for stakeholders and provide details of the competitive landscape for key players

- To forecast the size of market segments in North America, Europe, Asia Pacific (APAC), and the Rest of the World (RoW)

- To profile the key players and comprehensively analyze their core competencies in terms of key market developments, product portfolios, and financials

- To track and analyze competitive developments such as acquisitions, product developments, partnerships, agreements, collaborations, and expansions in the HPC as a service market

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to company-specific needs.

Growth opportunities and latent adjacency in High Performance Computing as a Service Market